Professional Business Invoice Templates in Word for Streamlined Billing

In today’s fast-paced work environment, having a reliable way to bill clients is crucial for maintaining smooth operations. A well-organized document not only provides a clear record of transactions but also communicates professionalism, enhancing trust between you and your clients. Establishing a system that allows you to quickly generate these documents can save time and streamline your workflow, leading to improved efficiency.

There are numerous pre-made layouts that can be customized to reflect your company’s unique brand and style. From adding logos to adjusting the structure, these layouts offer flexibility while maintaining essential elements for financial accuracy. By using these ready-made formats, you can focus on core tasks without spending excessive time designing each new document.

Customizing these drafts to fit specific needs enables you to adjust

Comprehensive Guide to Professional Billing Documents

For efficient management of financial transactions, utilizing organized, customizable layouts can significantly simplify the process of creating essential billing documents. These layouts provide a structured foundation, allowing companies to quickly prepare professional-looking files that contain all necessary details. The right approach to setting up these formats can reduce administrative work, ensure consistency, and enhance your overall workflow.

Core Elements of Effective Billing Documents

A well-designed document layout includes several key elements that contribute to its effectiveness. First and foremost, clear sections for contact details, including both the sender’s and recipient’s information, help avoid any confusion and ensure the document reaches the correct party. Additionally, dedicated sections for a detailed list of services provided or items delivered make it easy to verify each line of the transaction.

Another essential aspect is the inclusion of a well-defined payment section, specifying due dates and accepted methods

Benefits of Using Pre-Made Layouts for Billing Documents

Utilizing structured formats for creating financial documents offers numerous advantages, simplifying the process of generating professional billing statements. These ready-to-use layouts are particularly valuable for ensuring uniformity and efficiency in client communications. They save time and reduce the chance of errors, which is crucial for maintaining a smooth administrative workflow.

- Time Efficiency: Ready-made formats allow you to quickly fill in necessary information, eliminating the need to design each document from scratch. This speeds up the process, freeing up time for other tasks.

- Consistency and Accuracy: Using a standardized layout ensures that each document follows the same structure, minimizing the risk of missing important details or making errors in formatting. Consistent files enhance trust and reflect professionalism.

- Brand Recognition: Customizable formats enable you to incorporate your brand’s visual elements, such as logos

Choosing the Right Format for Your Billing Needs

Selecting the ideal layout for your financial documents is essential to ensure clarity, professionalism, and efficiency. The right format should not only represent your company’s image but also be functional and easy to use. With many design options available, it’s crucial to find a layout that meets both your operational and aesthetic requirements.

Identifying Key Features for Your Layout

The first step in choosing a suitable format is to assess the elements most relevant to your operations. For example, if you regularly provide detailed descriptions, look for a layout that includes ample space for itemization. Similarly, consider a design that highlights payment terms or contact information to ensure all essential details are easy to locate.

Another factor to consider is flexibility

Creating Customizable Formats for Billing Documents

Designing adaptable layouts for financial documents allows you to personalize each file to meet the unique needs of your company and clients. These flexible formats offer the freedom to adjust elements like branding, structure, and content, making it easier to produce professional, on-brand records for every transaction.

- Start with a Basic Layout: Begin by selecting a simple format that includes all essential sections. This foundation should cover key areas such as item descriptions, contact information, and payment terms, giving you a base to build upon.

- Add Branding Elements: Incorporate your logo, brand colors, and specific font choices to ensure each document reflects your company’s identity. These visual details create consistency across communications.

- Customize Fields for Flexibility: Add or remove fields depending on transaction requirements. For example, you may need sec

How to Edit Pre-Designed Formats in Word

Modifying pre-made layouts for billing documents allows you to tailor each file to better suit your needs and provide a more personalized experience for clients. By adjusting key elements, you can ensure that each document aligns with your brand and contains all necessary information for smooth processing.

Steps to Personalize Your Layout

- Open the Template File: Start by opening the selected layout file. Make sure it contains the essential sections you need, such as headers, itemized sections, and contact details.

- Edit Text Fields: Replace placeholder text with specific details relevant to each transaction. This includes adding the client’s information, your company’s name, and any specific terms.

- Adjust Formatting: Customize font style, size, and color to match your brand’s aesthetic

Essential Elements of a Billing Document

Every financial document must include certain key components to ensure clarity, accuracy, and smooth processing. These crucial elements help both the issuer and the recipient easily understand the terms of the transaction, prevent misunderstandings, and facilitate payment. Knowing what details to include ensures that the document serves its purpose effectively.

First, the document should clearly present the contact information of both parties involved, such as the seller’s and buyer’s names, addresses, and other relevant details. Additionally, a unique reference number or code is essential to track the transaction and avoid confusion with other documents.

The document should also outline the specifics of the goods or services provided, including descriptions, quantities, unit prices, and totals. It’s important to specify the agreed payment terms, such as due dates, late fees, and acceptable payment methods. Finally, providing a clear breakdown of any applicable taxes ensures that all charges are transparent to the recipient.

Including these essential elements will help ensure that your financial records are complete, professional, and easy to process.

Tips for Organizing Billing Documents Professionally

Maintaining a well-organized system for managing financial records is key to ensuring smooth operations and avoiding unnecessary confusion. A professional approach to organizing these documents makes it easier to track payments, reference past transactions, and keep records accessible for future needs.

- Establish a Clear Naming System: Use descriptive file names that include important details such as the client’s name, document date, and reference number. This allows for easy searching and retrieval later.

- Categorize by Client or Project: Organize documents into separate folders for each client or project. This makes it simple to access all related records in one place and ensures consistency.

- Keep Track of Payment Status: Use a system to mark whether each document has been paid, is pending, or overdue. This can be done manually in a spreadsheet or with specialized software.

- Store Documents Securely: Always back up your financial records, whether digitally or physically. Make sure they are stored in a secure location to prevent unauthorized access and ensure they are easily accessible when needed.

- Regularly Review and Update Records: Set aside time to periodically review and update your records. This helps identify any missing or outdated documents and ensures everything is in order.

By following these simple steps, you can ensure your financial records are well-organized, making it easier to manage and reference your documentation whenever necessary.

Adding Your Branding to Billing Documents

Personalizing your financial documents with your company’s branding not only gives a professional appearance but also reinforces your brand identity. By incorporating key visual elements, you can ensure your documents are instantly recognizable and aligned with your overall marketing strategy. Customizing the layout and design adds a polished touch while keeping consistency across your communications.

- Include Your Logo: Placing your company logo at the top of the document makes it easily identifiable. Ensure that the logo is clear and properly sized to maintain a clean and professional look.

- Choose Consistent Colors: Use your brand’s color palette for borders, headings, and other key elements. This creates a cohesive look that aligns with your marketing materials.

- Utilize Custom Fonts: Select fonts that match your brand style. Be mindful of readability, especially for important details such as payment terms and contact information.

- Include Contact Information: Display your business address, phone number, email, and website in a prominent location. This provides recipients with easy access to contact you for any questions or clarifications.

- Use a Professional Layout: A clean and well-structured layout reflects professionalism. Ensure all sections are clearly defined, such as client details, product or service descriptions, and payment terms.

By adding these branding elements, you can make your financial documents not only functional but also an effective extension of your business’s image.

Top Free Billing Document Formats for Small Enterprises

For small enterprises, using free document formats can save time and money while maintaining a professional image. These resources provide ready-to-use layouts that are easy to personalize and can help streamline financial tasks. Below are some of the top free resources that cater to the needs of small businesses, ensuring simplicity and functionality.

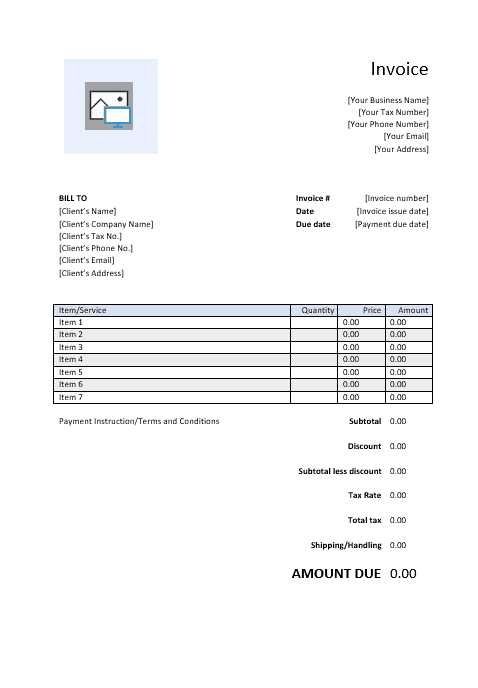

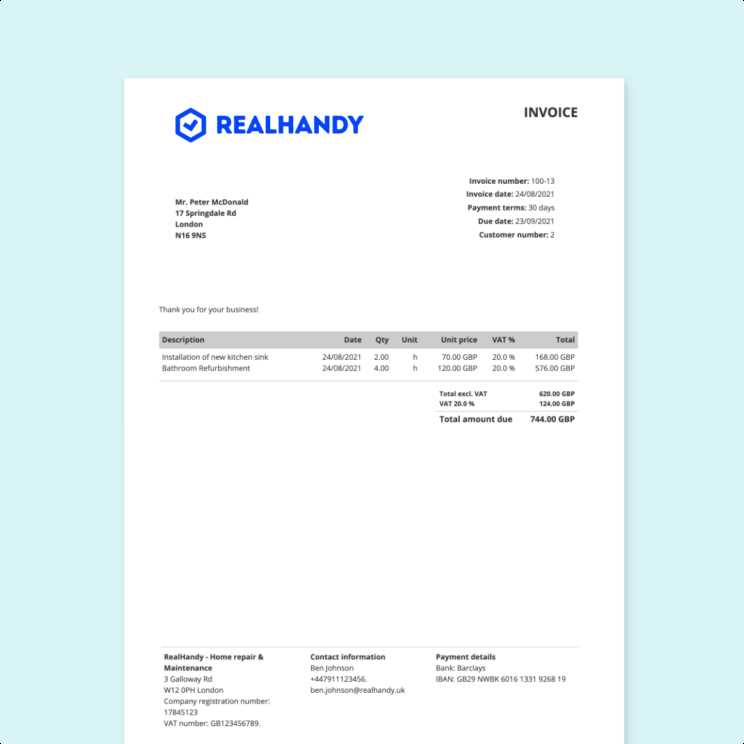

1. Classic Simple Format

This layout is ideal for businesses looking for a minimalist design. It focuses on key details such as product description, quantity, price, and total amount, providing a straightforward structure that’s easy to read.

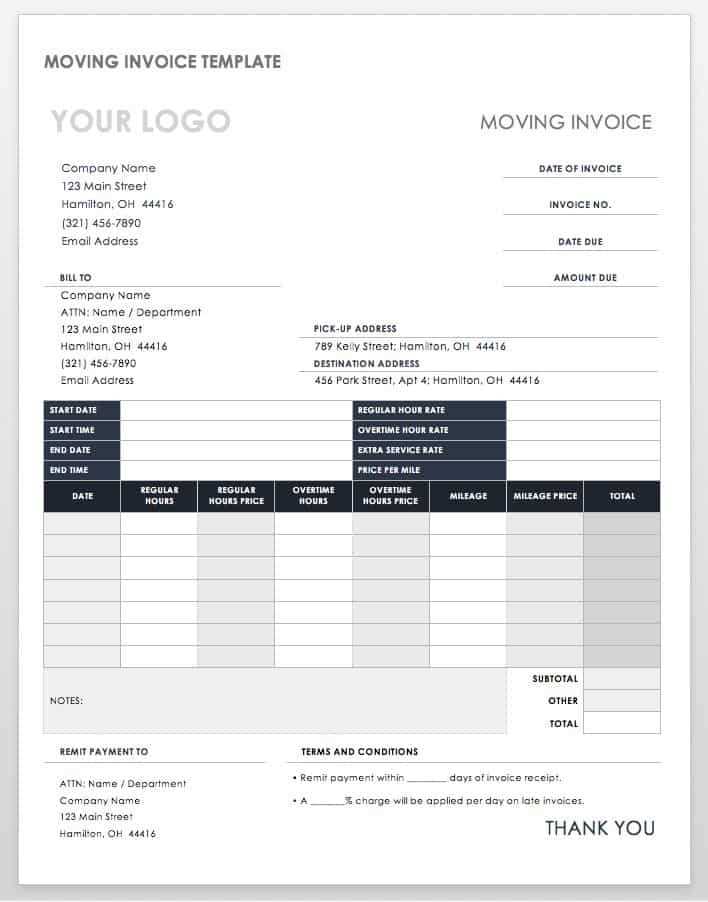

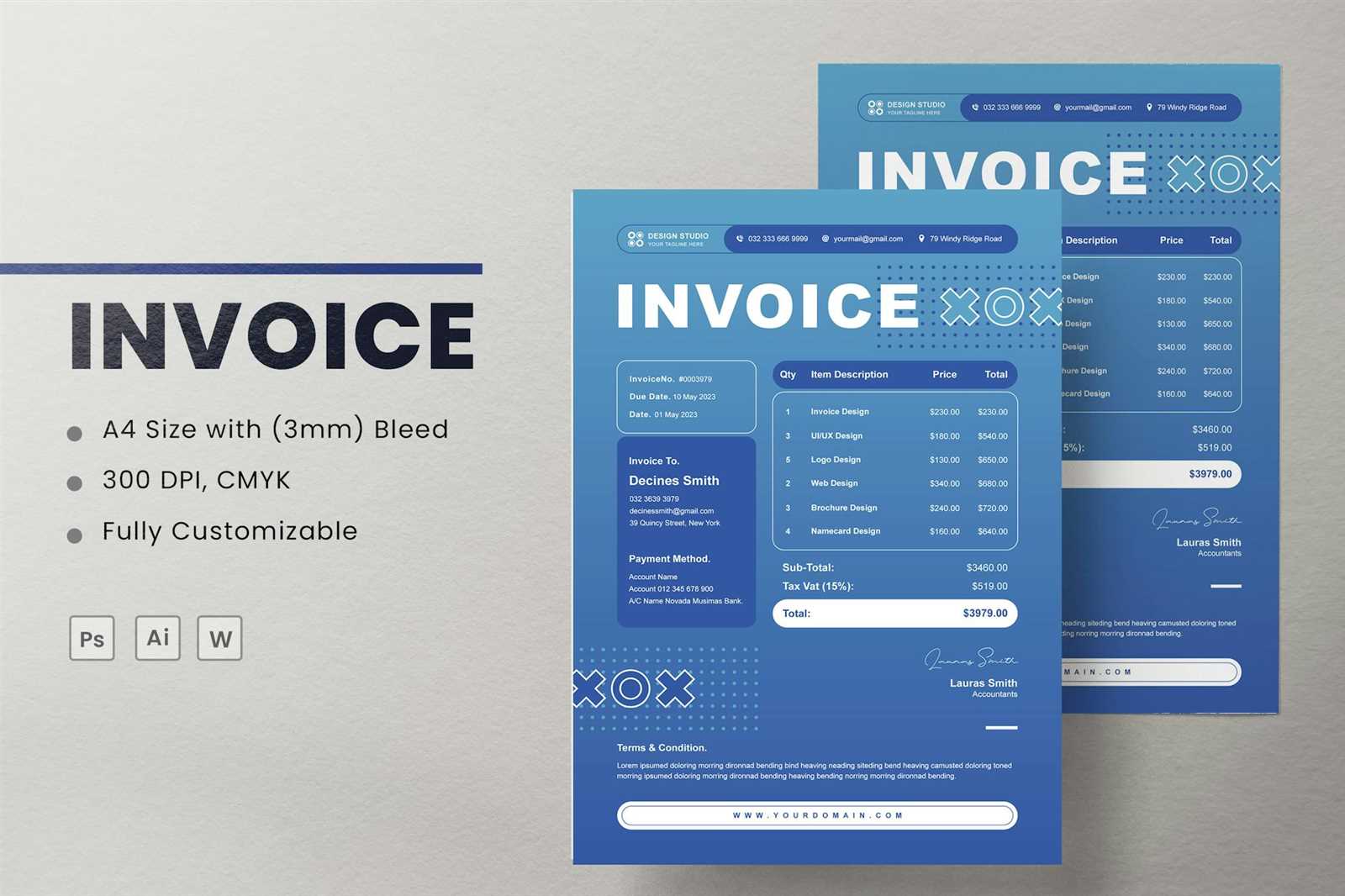

2. Modern Professional Format

A sleek, modern design that incorporates branding elements like logos, color schemes, and fonts. Perfect for businesses looking to add a more polished touch to their financial documents.

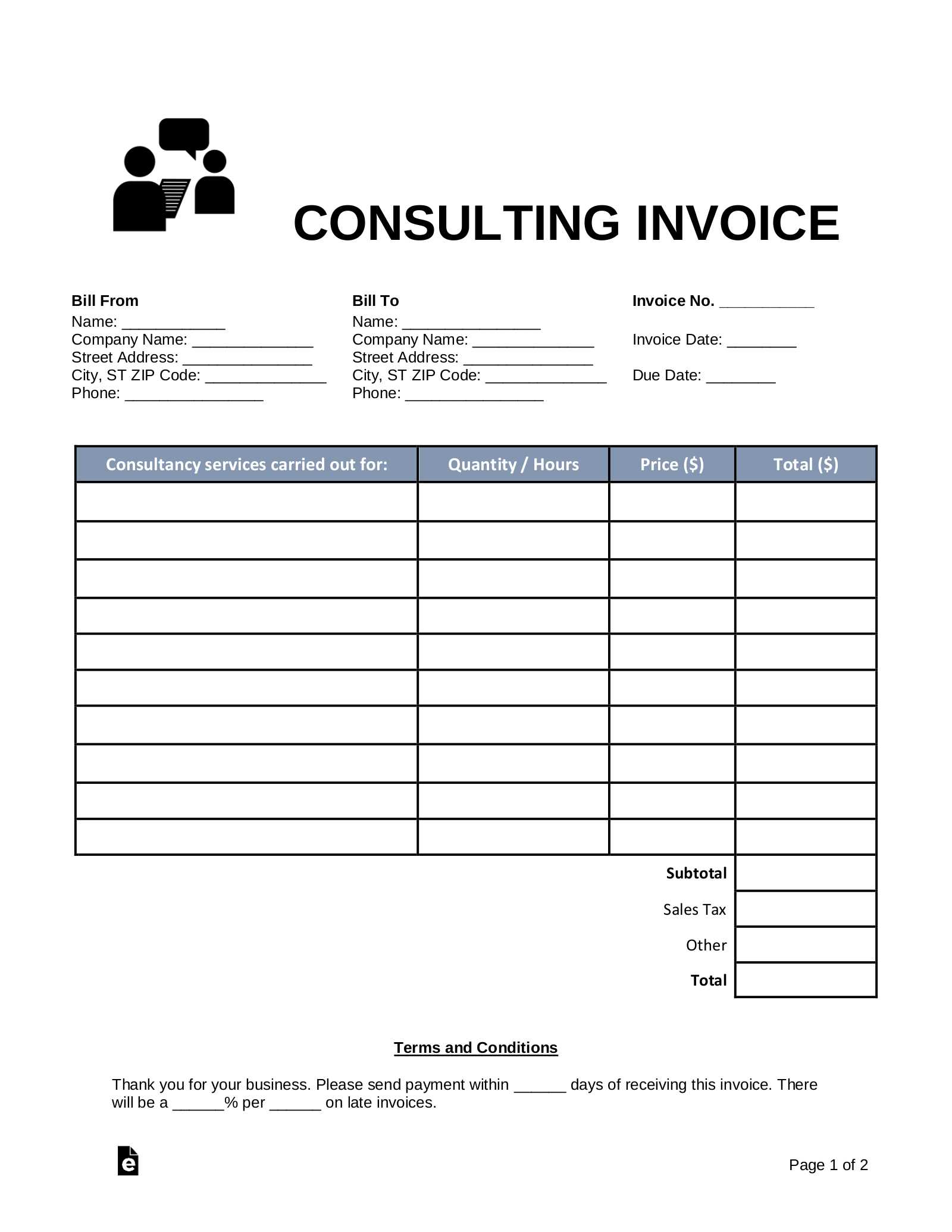

3. Service-Based Layout

Tailored for businesses offering services rather than products, this format emphasizes the hourly rate, services rendered, and payment terms. It allows for easy customization of service descriptions and rates.

4. Project-Based Format

This template is great for enterprises that work on projects with multiple phases. It allows for clear breakdowns of each project stage, with space for specific deliverables and deadlines.

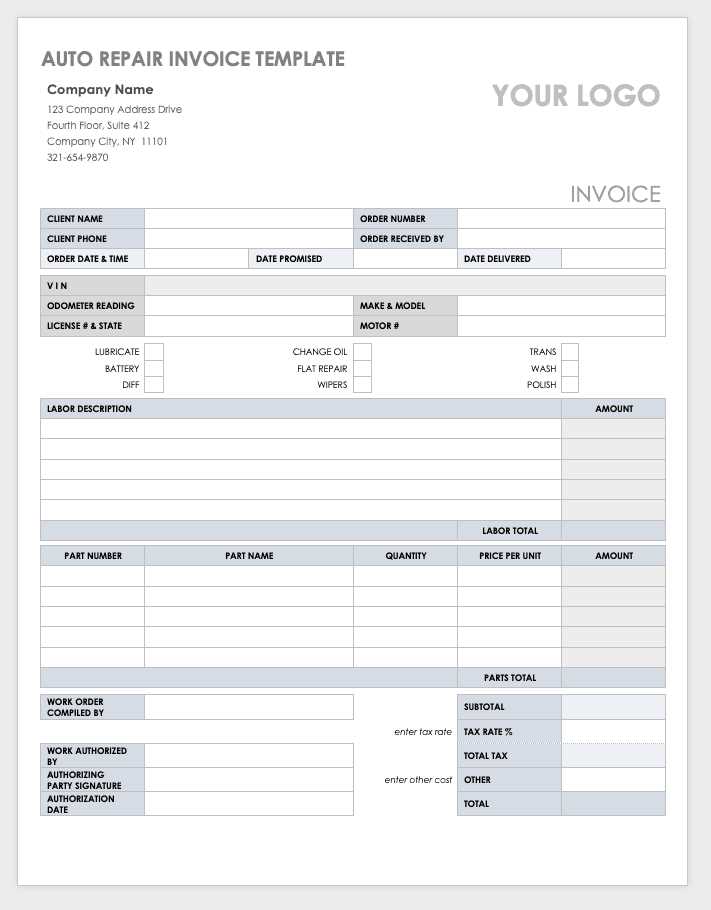

5. Itemized Format

An itemized format is ideal for businesses offering a range of products or services. It allows for a detailed breakdown of each item, including description, quantity, unit price, and total cost.

Template Name Best For Features Classic Simple Format Minimalist Designs Simple, easy-to-read layout Modern Professional Format Corporate Image Sleek design, customizable branding Service-Based Layout Service Providers Emphasizes services, hourly rates Project-Based Format Project-Based Work Clear breakdowns, project phases Itemized Format Product-Based Sales Item descriptions, pricing details These free options provide flexibility and can be customized to fit your company’s specific needs, ensuring a professional and organized approach to managing financial documents.

Best Practices for Billing Document Layouts

Creating well-organized and easy-to-read billing documents is essential for ensuring timely payments and maintaining professionalism. A clear layout helps recipients quickly find all the necessary information, reducing confusion and improving communication. Below are some best practices to follow when designing such documents to ensure clarity and efficiency.

1. Clear Hierarchy of Information

Organize your document by prioritizing essential details at the top, such as contact information and document numbers. Make sure there is a clear separation between different sections like payment terms, itemized lists, and totals. Use bold or larger font sizes for headings and section titles to enhance readability.

2. Keep the Design Simple and Clean

A cluttered layout can make the document difficult to read and may cause important details to be overlooked. Stick to a clean, minimalist design with ample white space. Avoid overusing colors and fonts, as this can distract from the primary purpose of the document.

Tip: Use tables to organize items or services and their prices clearly. This will make the billing document more structured and easier for clients to understand.

3. Include All Necessary Information

Ensure your document contains all the required details, such as the date, payment terms, and the correct contact information. Missing details can lead to delays in payment. Additionally, make sure to include a unique document number for tracking purposes.

Key Elements:

- Contact details for both parties

- Unique document identifier

- Detailed list of products or services

- Payment due date and terms

By following these best practices, you can ensure that your billing documents are both professional and effective, promoting timely payments and positive relationships with your clients.

How to Save Billing Document Formats for Reuse

Creating reusable billing documents can save a lot of time and effort. By saving a format with the necessary sections and layout, you can easily update it for each new client or transaction. This ensures consistency and efficiency in your document management process. Below are some steps on how to save your billing layouts for future use.

1. Save as a Template File

Once you’ve created a billing format that works for you, it’s important to save it as a template file. This allows you to open the document and make adjustments without altering the original layout. Most programs offer the option to save as a “Template” or “Template Document” file.

- Choose “Save As” from the file menu

- Select “Template” or “.dotx” (depending on the program)

- Give the template a clear name for easy identification

2. Organize Templates in Folders

To ensure you can find your saved formats easily, organize them into clearly labeled folders. Group different types of documents by category, such as “Standard Format,” “Custom Format,” or “Recurring Clients,” for quick access when you need them.

- Create a specific folder for templates

- Use subfolders if you have various types of formats

- Ensure templates are named consistently for easy identification

3. Utilize Cloud Storage for Easy Access

By saving your billing formats to cloud storage, you can access them from any device at any time. This is particularly helpful if you need to manage documents across multiple devices or locations.

- Choose a reliable cloud storage provider

- Upload your saved templates to the cloud

- Access and update your templates from any device

By following these steps, you’ll be able to efficiently manage and reuse your billing formats, streamlining your workflow and maintaining consistency across all your documents.

Printing and Sharing Billing Documents from Word

Once your billing document is finalized, it’s time to print or share it with clients or business partners. There are multiple ways to ensure the document reaches the intended recipient, whether through physical copies or digital formats. Below are the steps to print or distribute your completed billing document.

1. Printing Your Document

Printing physical copies of your billing document can be important for those who prefer hard copies or require them for records. Here are the basic steps to print:

- Ensure that your document is fully prepared and correctly formatted.

- Click on the “File” menu and select “Print.”

- Choose your printer from the available options.

- Review the print settings (page range, number of copies) and click “Print.”

2. Sharing Your Document Digitally

If you prefer a digital distribution, there are various ways to share your billing document with clients. Here’s how you can do it:

- Email: Save the document as a PDF and attach it to an email for quick and easy sharing.

- Cloud Storage: Upload the file to a cloud service like Google Drive, Dropbox, or OneDrive, and share the link with your client.

- Direct Download: If you have an online platform or client portal, you can upload the document for your client to download directly.

By following these methods, you can ensure that your billing document is easily shared in the format that works best for you and your clients, whether physically or digitally.

Optimizing Billing Documents for Faster Payment

To ensure timely compensation, it’s essential that your billing documents are clear, concise, and easy to process. Optimizing these documents can help minimize delays and streamline payment procedures for both parties. Here are some strategies to improve the efficiency of your billing documents and encourage faster payments.

1. Clear Payment Terms

Specify the payment due date and any penalties for late payments right at the top of the document. Providing this information upfront reduces confusion and sets expectations from the start. Use straightforward terms like “Due within 30 days” and “Late fee of 2% per month after due date.”

2. Include Payment Methods

Offer multiple payment options for your clients, making it as easy as possible for them to pay. Clearly list available methods such as bank transfer, credit card, or online payment systems, along with relevant details like account numbers or payment links.

3. Itemized Breakdown

Provide a detailed breakdown of services or products rendered, including descriptions and quantities. This transparency helps clients understand exactly what they are paying for and can resolve any potential issues quickly.

4. Early Payment Discounts

Consider offering a discount for early payments. This can incentivize clients to pay sooner. For example, a 2% discount for payments made within 10 days can encourage faster processing and improve cash flow.

5. Automatic Reminders

Automating reminders for upcoming or overdue payments can significantly reduce delays. Set up a system to send polite reminders a few days before the due date and again if the payment is late.

By implementing these strategies, you can optimize your billing documents for quicker payments, improving your cash flow and maintaining positive relationships with your clients.

How to Track Payments with Billing Documents

Effectively managing payments is key to maintaining a smooth financial operation. By properly documenting and tracking each transaction, you can ensure that no payments are missed, and outstanding balances are easily managed. Here’s how you can track payments through your billing documents.

1. Include Payment Status Section

Make sure to include a dedicated section in your billing documents for payment status. This section should clearly indicate whether a payment has been made, is due, or is overdue. You can use labels such as “Paid”, “Pending”, or “Overdue” to keep everything organized.

2. Keep Record of Payment Dates

For every transaction, record the payment date. Having a specific field for the payment date within the document helps you keep track of when each payment was made, making it easier to identify any late payments and follow up accordingly.

3. Use a Unique Reference Number

Assign a unique reference number to each document. This allows you to track payments more efficiently by correlating the payment to its respective document. This is especially useful when dealing with multiple clients or transactions.

4. Update the Document After Each Payment

After each payment is made, update the billing document to reflect the current payment status. This might include noting the amount paid, the remaining balance, or any adjustments made. Keeping the document updated will help you quickly identify any outstanding amounts.

5. Create a Payment Log

In addition to the billing document itself, it’s helpful to maintain a separate payment log that tracks all payments received, including dates, amounts, and clients. This log can serve as a reference for easy tracking and reporting.

6. Set Up Automated Alerts

If possible, set up automated alerts to remind you of upcoming payments or overdue balances. This can be done using payment tracking software, or by setting reminders in a calendar or spreadsheet system.

By incorporating these practices, you can streamline the payment tracking process, stay organized, and reduce the likelihood of payment issues.

Formatting Tips for Readable Billing Documents

Creating clear and easily understandable documents is essential to ensure smooth communication with your clients. Proper formatting can make a big difference in how quickly your documents are processed and how professionally they are perceived. Below are some practical formatting tips to enhance the readability of your documents.

1. Use Clear and Simple Fonts

Choose fonts that are easy to read and professional in appearance. Avoid overly decorative or complex fonts. Simple fonts like Arial, Calibri, or Times New Roman are ideal for readability and clarity.

2. Organize Information with Tables

Tables are an excellent way to organize and present data in a clear and structured way. They help separate each section of the document, making it easy to read. For example, you can use tables to list item descriptions, quantities, rates, and totals. Here’s an example of how to structure this:

Item Description Quantity Rate Total Service A 2 $50 $100 Service B 1 $75 $75 Grand Total $175 3. Use Headings and Subheadings

Clearly label each section of your document using headings and subheadings. This helps clients easily navigate through the content. For example, use headings for sections like “Billing Information”, “Payment Terms”, and “Summary”.

4. Highlight Important Information

Use bold text or larger font sizes to emphasize critical information like the total amount due, due date, and payment instructions. This ensures that the most important details stand out and are easy to find.

5. Maintain Sufficient Spacing

Avoid cluttered documents by providing adequate spacing between sections. This not only improves readability but also makes your document appear more organized and professional.

By following these formatting tips, you can create well-structured and easily readable documents that will leave a positive impression on your clients and help them process your requests smoothly and quickly.

Legal Requirements for Billing Documents

When creating documents for financial transactions, it’s crucial to ensure compliance with legal standards. Various regulations govern the content and format of such documents to protect both the seller and the buyer. Understanding and following these requirements is essential to avoid legal disputes and ensure that your documentation is valid in the eyes of the law.

Key Legal Elements to Include

To ensure your financial documents meet legal standards, they should include the following elements:

- Contact Information: Include both the seller’s and buyer’s names, addresses, and contact details.

- Unique Identification Number: Every document should have a unique reference number for tracking purposes.

- Date: Clearly state the date of the transaction and the document creation date.

- Payment Terms: Specify the agreed-upon payment methods, due dates, and any late fees.

- Amount Due: State the total amount owed, including applicable taxes, discounts, and additional charges.

- Tax Information: Depending on your region, certain tax details like VAT numbers or other identification may be required.

Additional Legal Considerations

In addition to these essential elements, it’s important to be aware of other legal aspects:

- Consumer Protection Laws: Ensure your documents comply with any consumer protection laws regarding refunds, warranties, and returns.

- International Transactions: If dealing with international clients, ensure your documents adhere to the legal requirements of both countries.

- Data Protection: Always consider data privacy regulations when handling personal or financial information.

By ensuring that your documentation complies with these legal requirements, you not only protect your business but also foster trust and transparency with your clients.