Free VAT Invoice Template Download for Easy Invoice Creation

Managing business transactions requires accurate and well-organized records. One of the key documents in any business relationship is the formal record of a sale, which often needs to meet specific legal and financial standards. For businesses dealing with taxation and compliance, having a reliable format for these records is essential.

Creating customizable billing documents can simplify the process and save valuable time. Instead of starting from scratch, using pre-designed formats that allow for quick adjustments can make generating these records much more efficient. With the right tools, you can create detailed and professional documents in just a few minutes.

In this article, we will explore where you can access such formats, how to use them effectively, and what essential elements to include. Whether you’re a small business owner or a freelancer, understanding the best practices for these records will help you stay organized and compliant.

Free VAT Invoice Template Download Guide

When it comes to preparing professional billing documents, having a consistent and organized approach is key. There are various ways to access ready-made formats that help simplify the process, ensuring compliance and saving time. These resources can be easily customized to suit your specific business needs, allowing you to generate accurate records quickly and efficiently.

Where to Find Accessible Resources

Many online platforms offer ready-made options that can be accessed without any cost. These are often designed to meet industry standards, and with just a few modifications, they can be tailored for your specific business. Here are some common sources:

- Online marketplaces and resource hubs

- Accounting software platforms

- Business blogs or websites offering downloadable content

- Government or regulatory websites providing standard formats

Steps for Customizing and Using the Formats

Once you’ve located a suitable format, the next step is to adjust it for your business’s unique needs. This ensures the document meets both your internal requirements and legal obligations. Follow these simple steps:

- Choose a format that aligns with your

Why Use a VAT Invoice Template

Using a standardized document for recording business transactions can save time, reduce errors, and ensure consistency across all your financial records. Whether you are a small business owner or a freelancer, having a structured format allows you to focus on the important aspects of your work rather than worrying about formatting or compliance issues.

Efficiency is one of the main reasons to use pre-designed formats. Instead of creating a new document from scratch for each transaction, you can quickly fill in the necessary information. This speeds up the process and ensures that every document follows the same professional layout and includes all required details.

Accuracy is another key benefit. When using a proven format, you are less likely to miss important elements such as tax calculations, pricing, or contact details. This reduces the risk of making mistakes that could lead to misunderstandings with clients or issues with tax authorities.

Compliance is often a critical factor, especially for businesses dealing with tax regulations. A well-structured document can help ensure that all legal requirements are met, preventing potential fines or penalties. By using a consistent layout that adheres to relevant standards, you can stay confident that your business is always in line with the latest financial regulations.

Benefits of Free Invoice Templates

Using pre-made document formats for your business transactions provides several advantages, especially for those just starting or managing a small business. These ready-to-use resources help streamline the process of creating professional records while ensuring that all essential details are included. With these formats, you can save both time and effort, allowing you to focus on other aspects of your work.

Cost-Effective Solution

One of the most significant advantages is that these resources are typically available without charge. This makes them an ideal choice for businesses looking to cut down on operational expenses while maintaining a professional appearance in their financial dealings.

- Save money on expensive software or custom designs

- Access high-quality designs at no cost

- Reduce the need for hiring external help for document creation

Easy to Use and Customize

Another benefit is their ease of use. These formats are typically designed with simplicity in mind, allowing anyone with basic knowledge of word processors or spreadsheet software to make adjustments as needed. Customization is straightforward, whether you need to modify contact details, add line items, or change tax rates.

- Quickly modify fields to fit your specific needs

- Use simple tools to update branding and business information

- Easily adapt the format to various transaction types

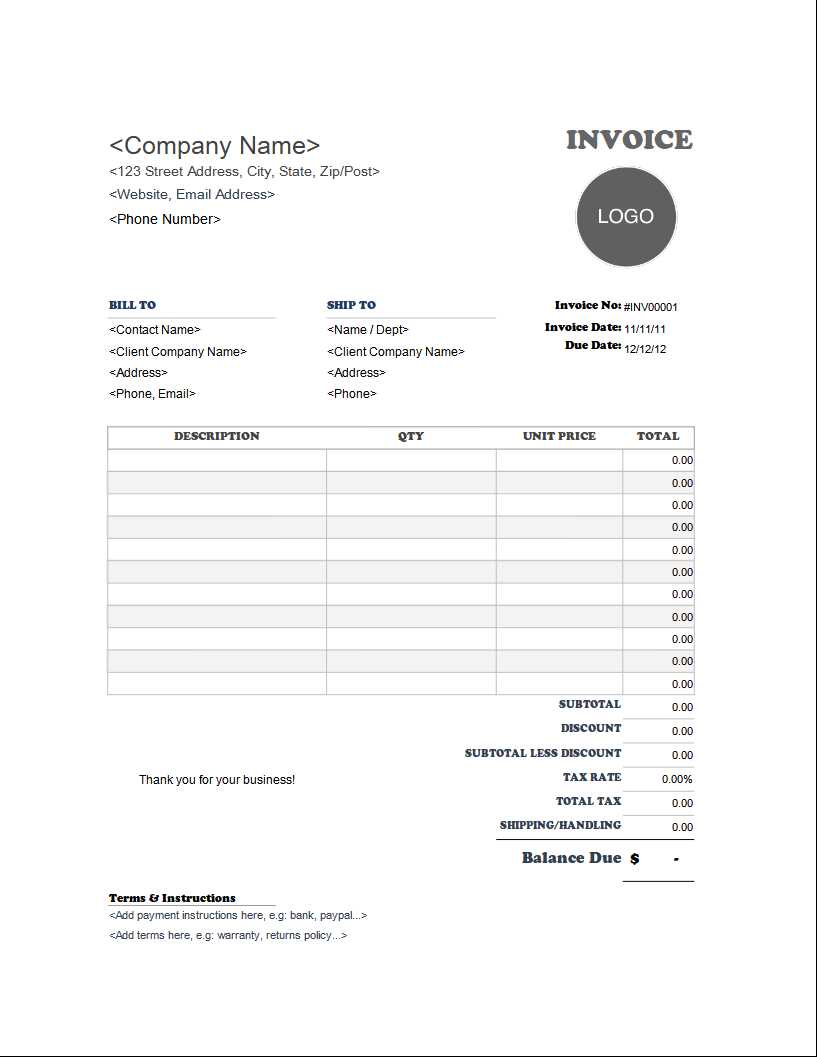

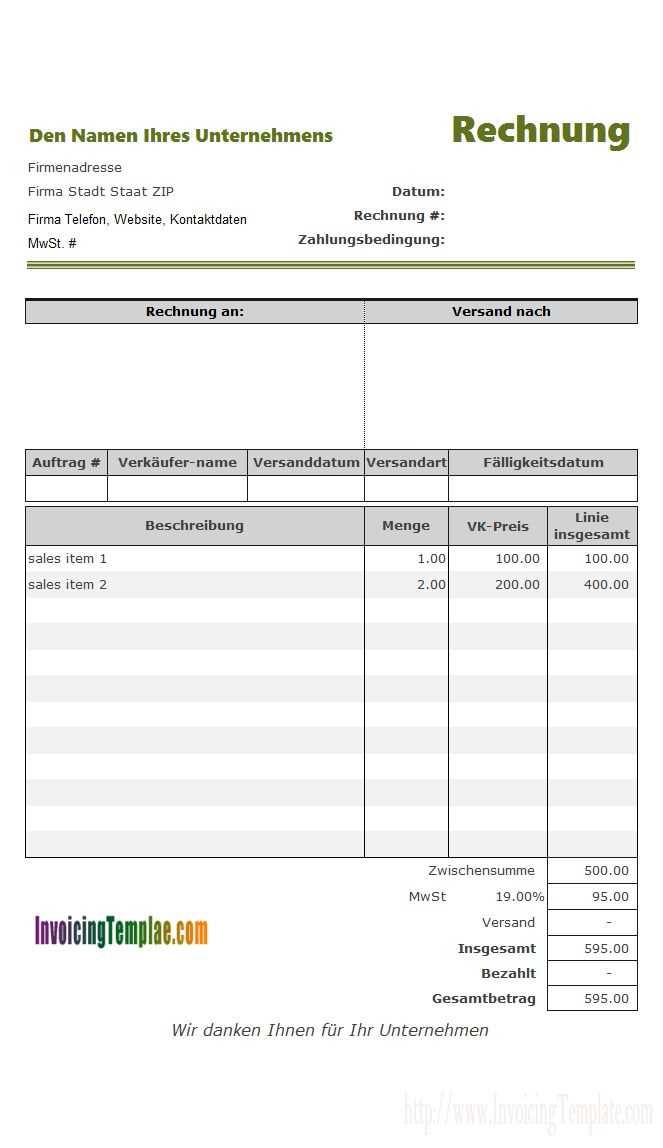

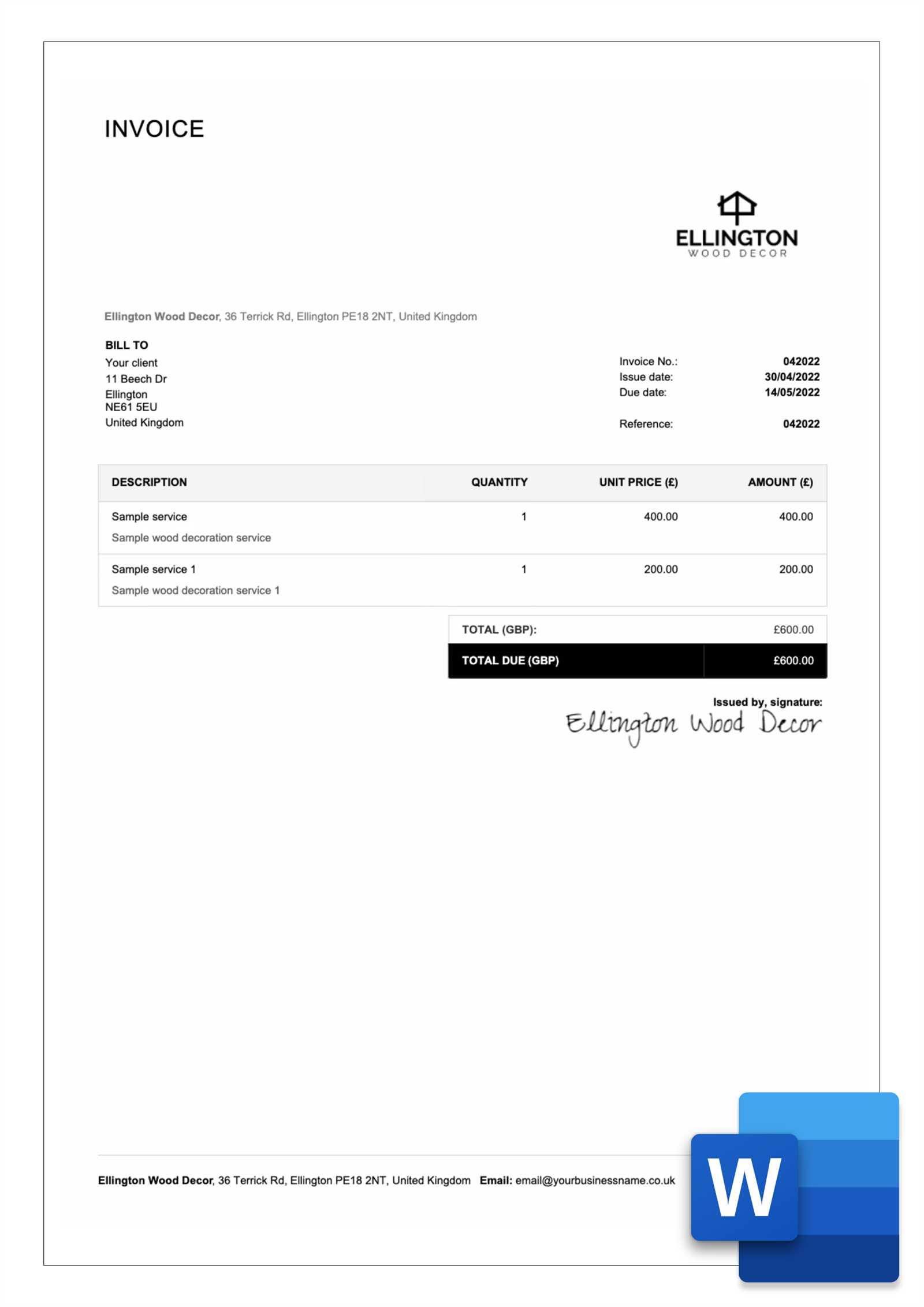

How to Customize VAT Invoice Templates

Customizing a pre-designed document for your business needs is an essential skill for creating professional records. With the right format, you can quickly adjust the layout and content to suit your specific transactions, branding, and legal requirements. This process ensures that your business documents are not only accurate but also aligned with your unique operational needs.

Steps for Adjusting the Layout

Once you’ve selected a suitable document, the first step is often to adjust the layout. This involves modifying the size, spacing, and alignment of various elements to create a clean, well-organized appearance.

- Ensure that key sections (e.g., contact information, date, and transaction details) are clearly visible

- Adjust column widths or rows for a balanced design that is easy to read

- Ensure the font size and style are professional and easy to interpret

Modifying Content for Your Needs

Next, focus on the specific content you need to include in your document. Each business has its own set of requirements, from the types of products or services offered to unique tax rates or payment terms. Make sure to fill in the relevant details for each section, such as:

- Your business name, address, and contact information

- A detailed list of goods or services provided, including quantities and prices

- Any applicable taxes, fees, or discounts

- Terms of payment, including due dates and accepted methods

Customizing these elements helps ensure the document accurately reflects your transaction while adhering to both business standards and legal obligations.

Where to Find Free VAT Templates

Finding reliable resources for creating professional business records is easier than ever. There are a variety of platforms that offer ready-made documents for businesses, often at no cost. These resources are designed to be easily accessible and customizable, allowing you to quickly adapt them for your specific needs. Here are some popular places where you can find high-quality formats for your business transactions.

Online Marketplaces and Resource Hubs

Many websites dedicated to business tools offer a wide range of downloadable formats. These platforms often host a variety of resources, from financial documents to project management tools, all available for immediate use.

- Business-specific websites offering document libraries

- Marketplaces where templates are shared by community members

- Popular platforms with pre-designed formats for business use

Government and Regulatory Websites

For those needing standardized formats that meet legal and regulatory requirements, official government or regulatory bodies often provide templates. These resources are particularly helpful for ensuring that your records align with industry standards and local laws.

- Government websites offering tax or business-related documents

- Industry associations providing compliance-friendly formats

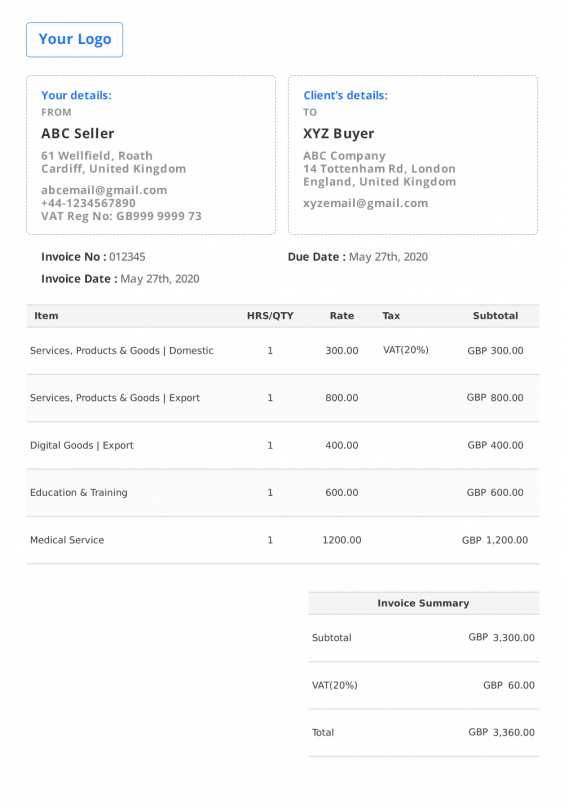

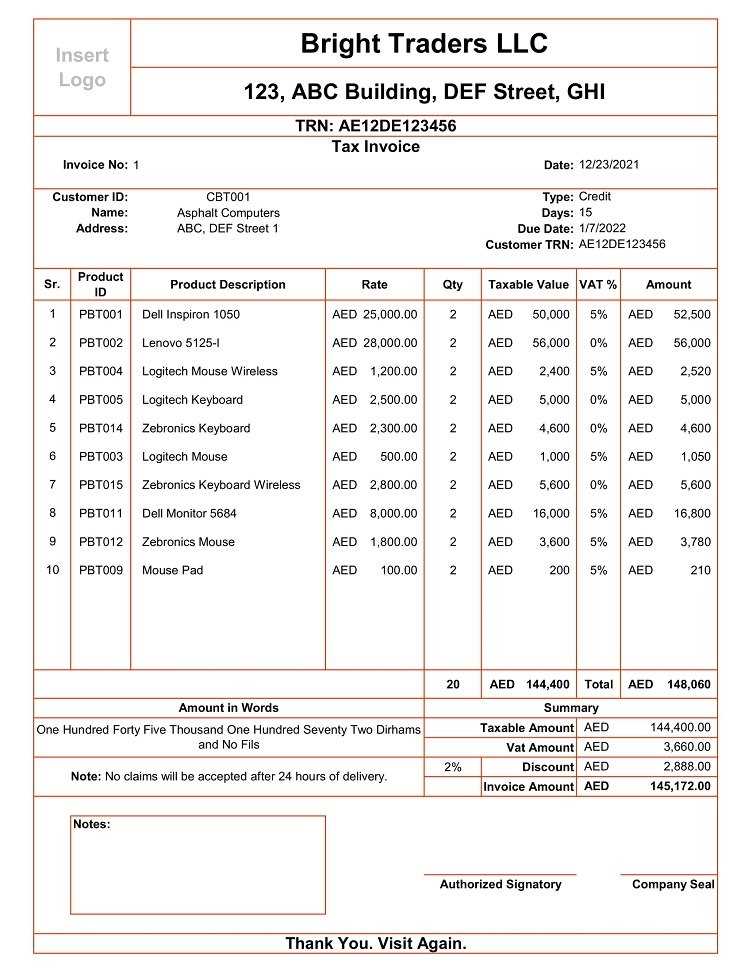

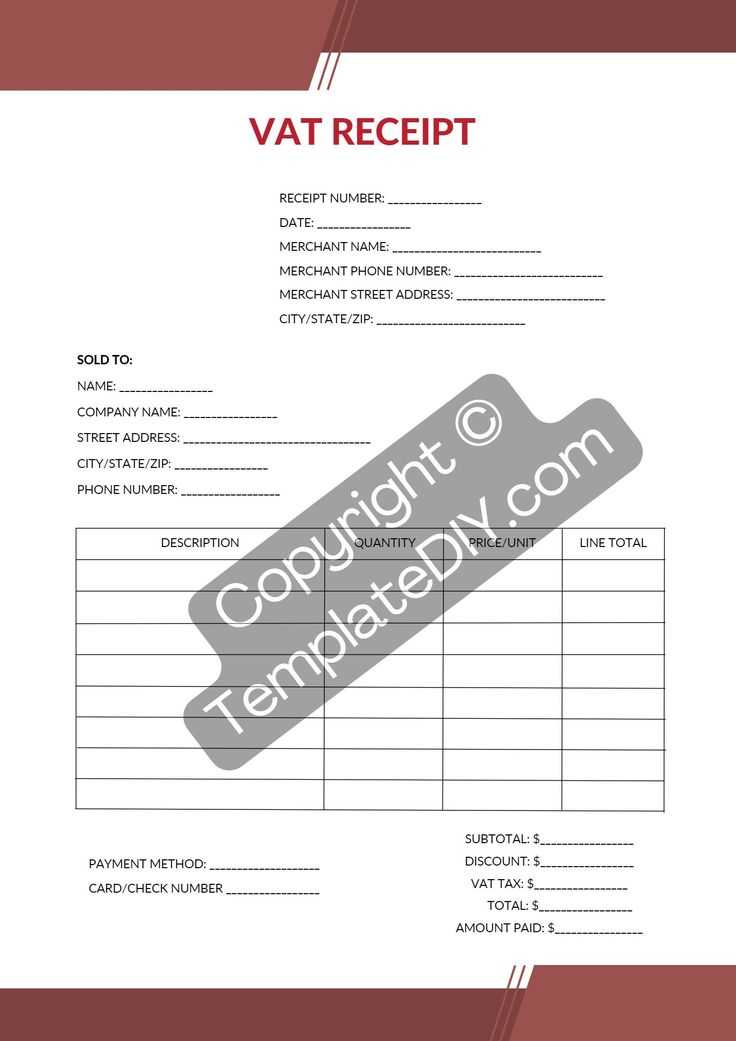

Essential Information for VAT Invoices

When creating a formal record of a transaction, it’s crucial to include certain key details that ensure the document is both professional and legally compliant. A well-structured document not only makes it easier to track sales and purchases but also helps maintain transparency between businesses and their clients. To avoid any confusion or legal issues, there are several important elements that must always be included.

Key Business Details

Each document should clearly display both the seller’s and buyer’s information. This includes the legal name, address, and contact details of both parties. Additionally, be sure to provide the unique identification numbers, such as a business registration number or tax ID number, as these are often required for official records.

- Business name and address

- Contact details (phone, email)

- Registration or tax identification number

Transaction Information

Equally important is including the details of the transaction itself. This section should clearly describe the products or services exchanged, along with quantities, unit prices, and any applicable discounts. Including a unique reference number or order number is also recommended for easy tracking.

- Description of goods or services

- Quantity, unit price, and total price

- Any discounts, fees, or additional charges

- Unique transaction or reference number

Tax Details must also be specified, including the applicable tax rate and the amount charged. This is crucial for businesses operating in regions with specific tax regulations, as it ensures compliance with local laws and helps with tax reporting.

Remember, having all the necessary information in one place simplifies not only your internal accounting but also future audits or inspections by tax authorities.

VAT Invoices for Small Businesses

For small businesses, managing financial transactions efficiently and accurately is essential for growth and sustainability. Proper documentation not only helps maintain transparency with clients but also ensures that tax obligations are met. Whether you are a freelancer, a sole proprietor, or managing a small enterprise, understanding how to handle billing records correctly is key to keeping operations smooth and compliant.

Benefits of Proper Documentation

For small businesses, using a standardized format for financial documents can make a significant difference in ensuring both professionalism and compliance. By including all required details, you avoid costly mistakes that may arise from incomplete or incorrect documentation.

- Improved client relationships with clear and transparent records

- Minimized risk of errors or misunderstandings during audits

- Better organization for tax season and year-end reporting

How Small Businesses Can Simplify the Process

Small business owners can streamline their financial workflows by using pre-designed formats that are both easy to customize and meet industry standards. These formats allow businesses to generate clear and consistent documents with minimal effort. Additionally, automation tools can further reduce the time spent on creating these records, enabling entrepreneurs to focus on growing their businesses.

- Use customizable tools to quickly create professional documents

- Set up automatic reminders for due payments or tax filings

- Integrate your document creation with accounting or invoicing software

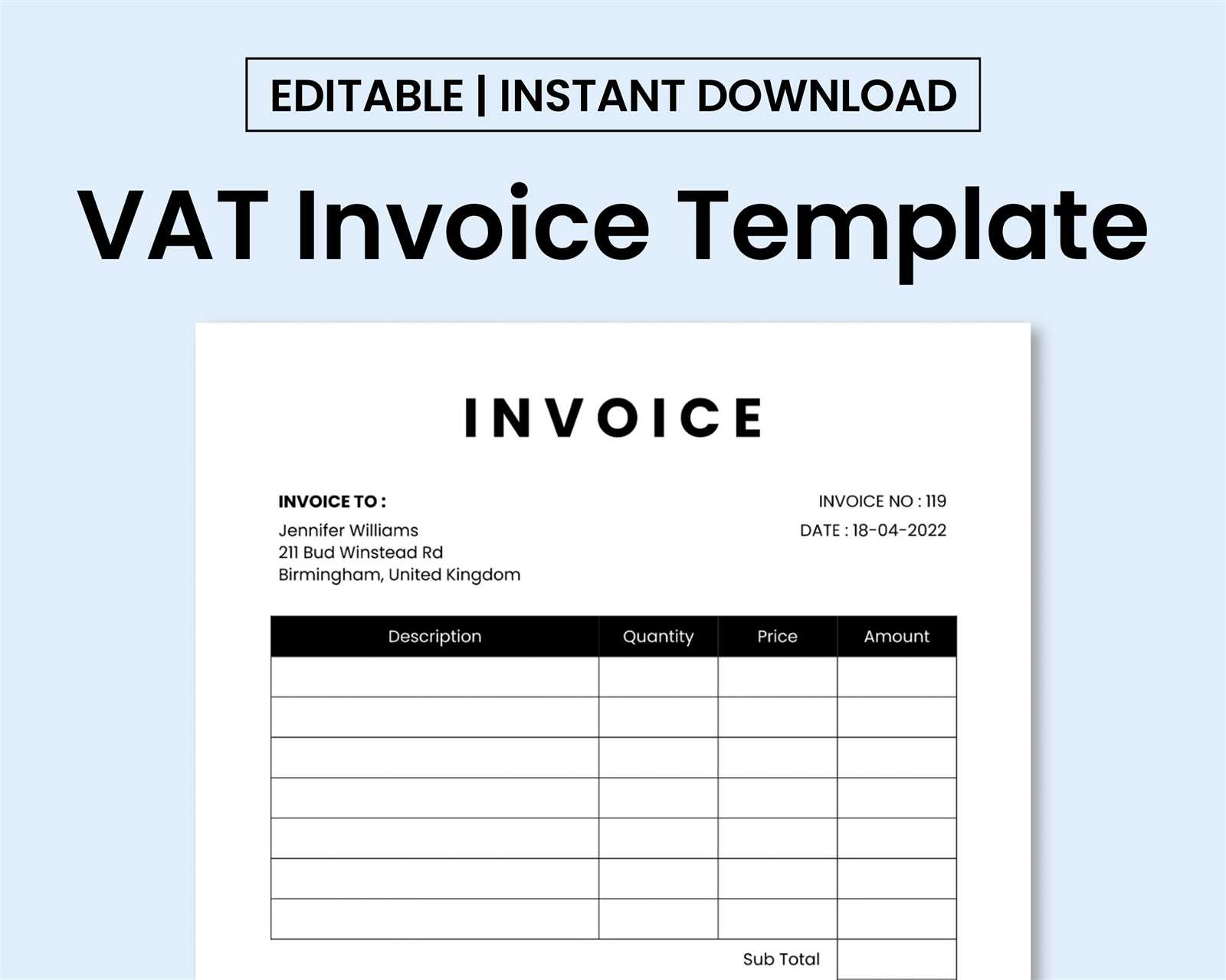

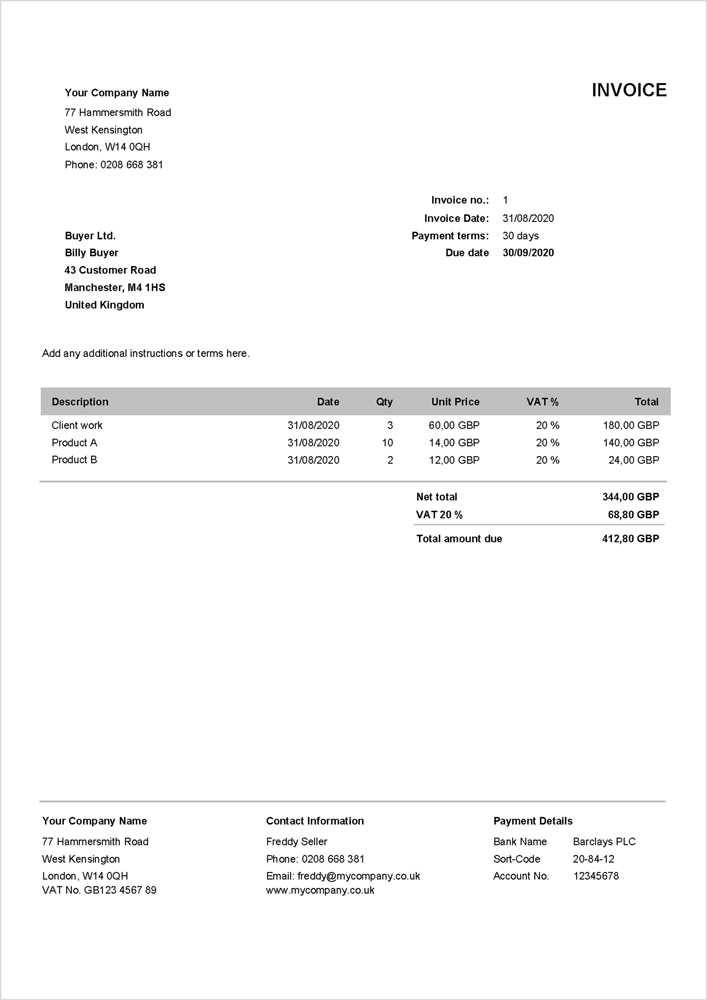

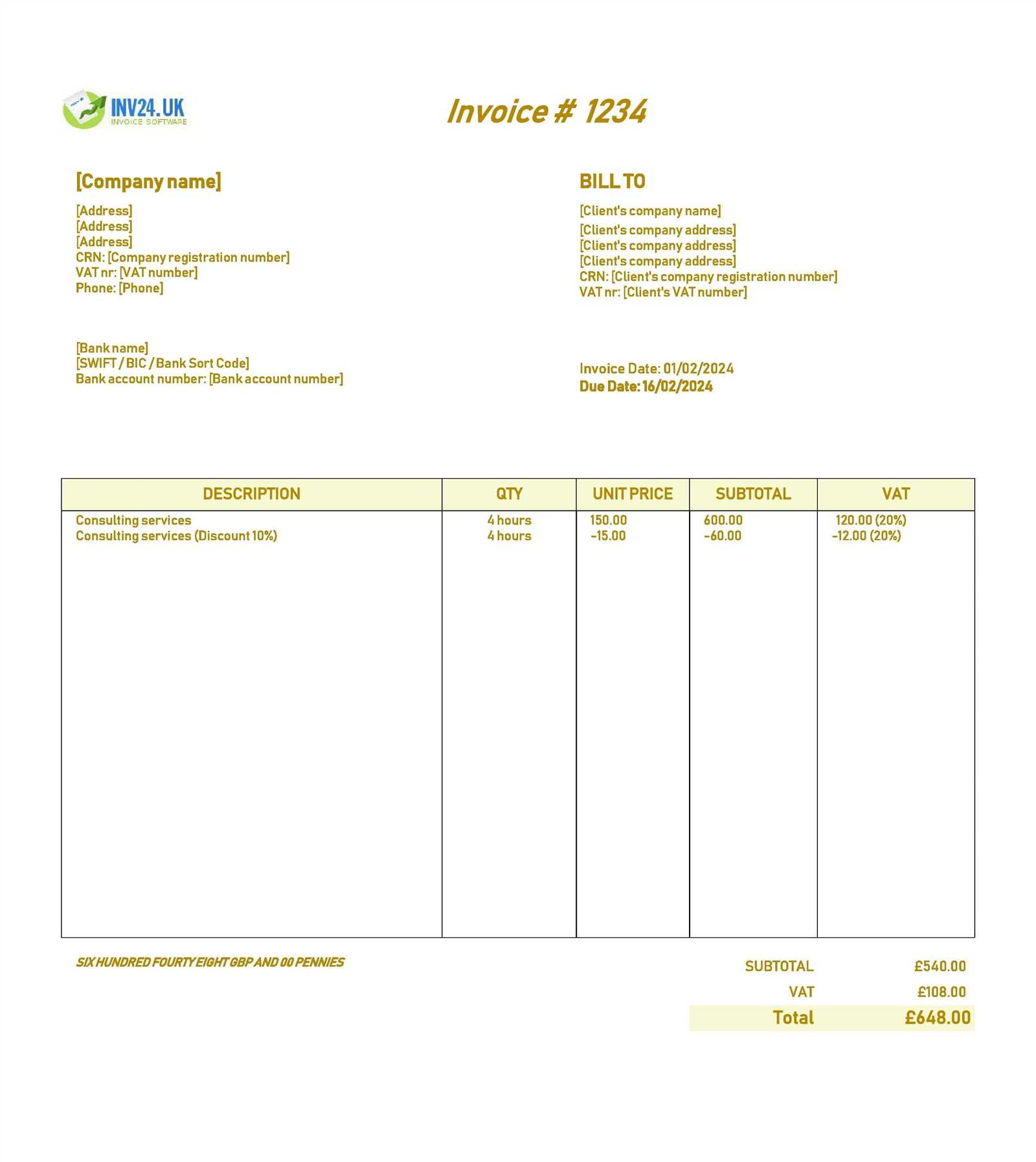

Creating Professional Invoices with Templates

For any business, presenting clear and professional documentation is essential. When it comes to billing clients, a well-structured document not only reflects your professionalism but also ensures that all essential details are included. Using pre-made formats can simplify this process, allowing you to create consistent and accurate records with minimal effort.

By customizing a pre-designed format, you can quickly adapt it to your needs, ensuring that each record is tailored to your transactions while maintaining a polished, businesslike appearance. The right format allows you to stay organized and compliant with industry standards without having to reinvent the wheel for each new transaction.

Steps to Creating a Professional Document

Follow these simple steps to create a polished and effective business document:

- Choose the Right Format: Select a document layout that suits your business style and meets any legal or industry requirements.

- Enter Key Information: Fill in the necessary fields, including your business details, client information, description of goods or services, pricing, and payment terms.

- Review for Accuracy: Ensure all data is correct, such as pricing, taxes, and due dates, to avoid any potential confusion with clients.

- Personalize the Design: Add your company logo, change the color scheme, or adjust the layout to align with your branding.

- Save and Share: Save the document in your preferred format (e.g., PDF or Word) and share it with your client via email or print it for physical delivery.

Tips for a Professional Finish

- Use clear, easy-to-read fonts and a simple layout to avoid clutter.

- Ensure that all sections are logically organized, making it easy for your client to follow.

- Include payment instructions or methods to reduce confusion on how to complete the transaction.

By following these steps and best practices, you can create professional documents that not only serve your business needs but also build trust and credibility with your clients.

Legal Requirements for VAT Invoices

When issuing official transaction documents, it’s crucial to adhere to legal standards set by tax authorities and regulatory bodies. These standards ensure that your records are compliant and that you meet the required obligations for both local and international business transactions. Failure to include all necessary details could result in fines or complications during audits.

There are several key elements that must always be included in your documents to ensure compliance with legal requirements. By including these essential details, you can avoid costly mistakes and ensure that your records are transparent, correct, and legally accepted by tax authorities.

Essential Legal Elements

Here are the key details that must be included in every formal document, depending on your jurisdiction and business structure:

- Business Identification: Your company name, address, and tax identification number (TIN) are typically required for all legal records.

- Client Information: Include the name, address, and TIN of the recipient (if applicable).

- Description of Goods or Services: A clear, detailed list of the products or services provided, including quantities and unit prices.

- Dates: The date of issuance and the date of the transaction (if different) must be stated clearly.

- Tax Rate and Amount: Specify the applicable tax rate and the amount charged. This ensures that the transaction complies with local tax regulations.

- Unique Reference Number: A document or reference number helps track the transaction for future reference and audits.

Additional Considerations for Compliance

- Payment Terms: Clarify payment methods, due dates, and any penalties for late payment.

- Currency: The currency used for the transaction should be noted, especially for international trade.

- Discounts or Adjustments: Any discounts applied or adjustments made to the transaction should be clearly outlined.

By adhering to these legal requirements, you not only ensure compliance with tax laws but also create clear, professional records that can be easily referenced in the future.

How to Edit Your VAT Template

Once you’ve selected a pre-designed format for your business records, the next step is to customize it to suit your specific needs. Editing your document allows you to ensure that all the necessary information is included and that the layout aligns with your branding or preferences. Whether you need to update business details, modify the design, or adjust the content, editing can be done quickly and easily using common software tools.

Editing Key Information

The first step in editing any document is filling in the required information. This includes both your business and client details, as well as specific transaction data. Below is a table showing the essential fields you’ll need to modify:

Section Details to Modify Business Details Enter your company name, address, and tax identification number. Client Information Input the client’s name, address, and any applicable contact information. Transaction Data Update the list of products or services, along with quantities and prices. Tax Information Ensure the correct tax rate and total tax amount are listed, if applicable. Payment Details Specify the payment method and due date for the transaction. Design and Layout Adjustments

Once all the information is filled in, you can adjust the document’s appearance. This includes modifying fonts, changing colors, or adding your company logo to make the document look more professional and in line with your brand. Most editing tools allow for simple drag-and-drop functionality, making it easy to place your logo and adjust the layout to suit your needs.

- Adjust fonts for readability and consistency

- Change color schemes to match your business’s branding

- Insert your logo in the header or footer for a professional look

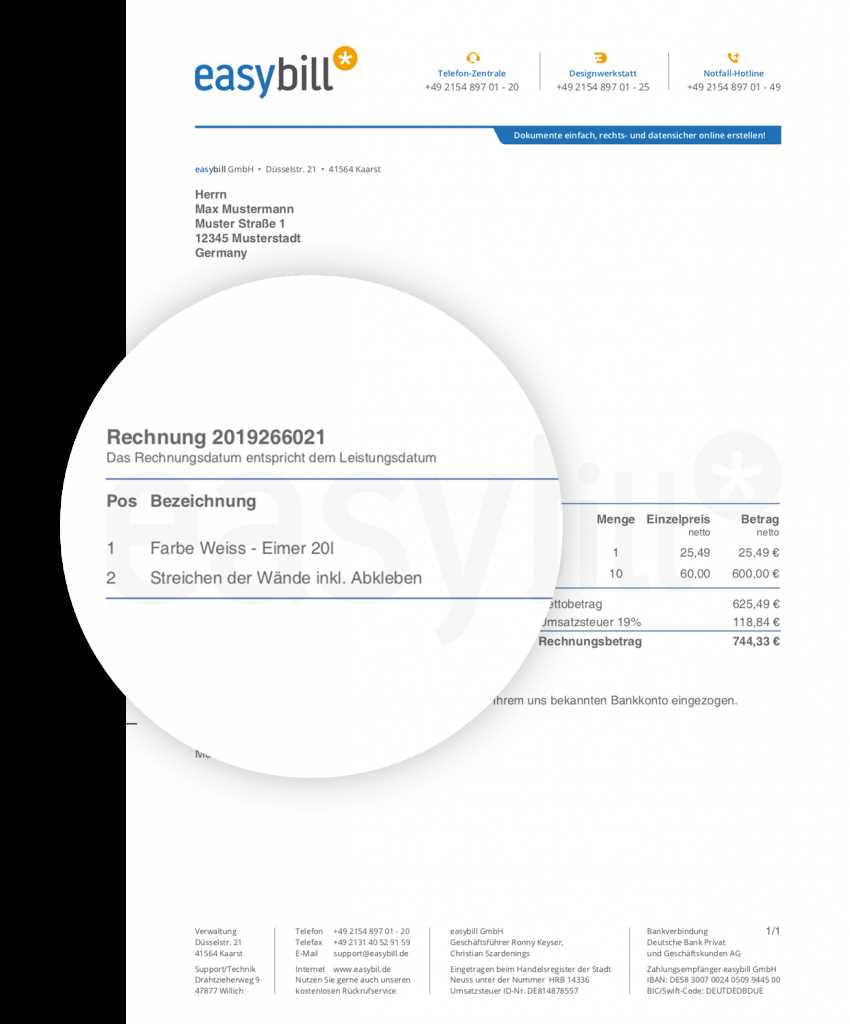

Automating VAT Invoice Creation

Automating the process of creating business transaction records can significantly reduce the time and effort required for manual document creation. By implementing software or systems that generate these documents automatically, businesses can streamline their workflows, improve accuracy, and ensure consistency across all their records. Automation helps eliminate errors caused by manual entry and speeds up the overall process, allowing business owners to focus on other critical tasks.

Benefits of Automation

Automating document creation offers several advantages that can enhance efficiency and reduce administrative burdens. Below is a table outlining some of the key benefits:

Benefit Description Time-Saving Automatically generated documents save time by eliminating the need for manual entry of data. Consistency Automation ensures that every document follows the same structure and format, reducing errors. Accuracy By linking to your accounting or CRM system, automated processes minimize the risk of data entry errors. Efficiency Automated systems can instantly generate multiple documents at once, speeding up invoicing and billing cycles. How to Implement Automation

To begin automating your document creation process, consider using accounting software or online tools that integrate with your business’s financial data. These tools typically allow you to customize the format and layout of your records while automatically pulling in the necessary details, such as client information, transaction dates, and amounts.

- Choose a software solution that fits your business needs and integrates with your existing systems.

- Set up templates within the software for various types of transactions.

- Connect the software to your database or CRM system to automatically populate client and transaction data.

- Schedule the creation of recurring documents or automate the process based on specific triggers (e.g., upon payment or delivery).

By automating the creation of these documents, businesses can ensure that they

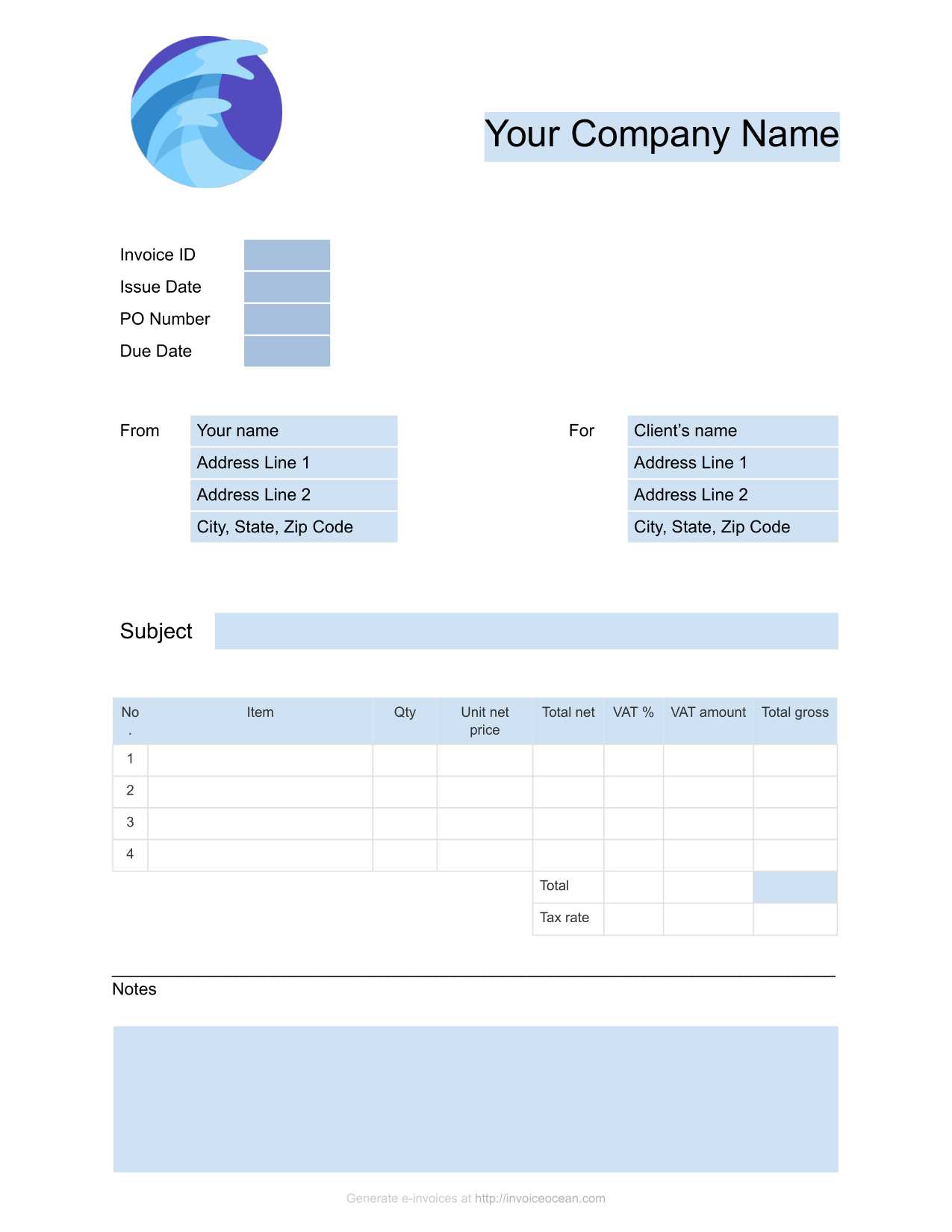

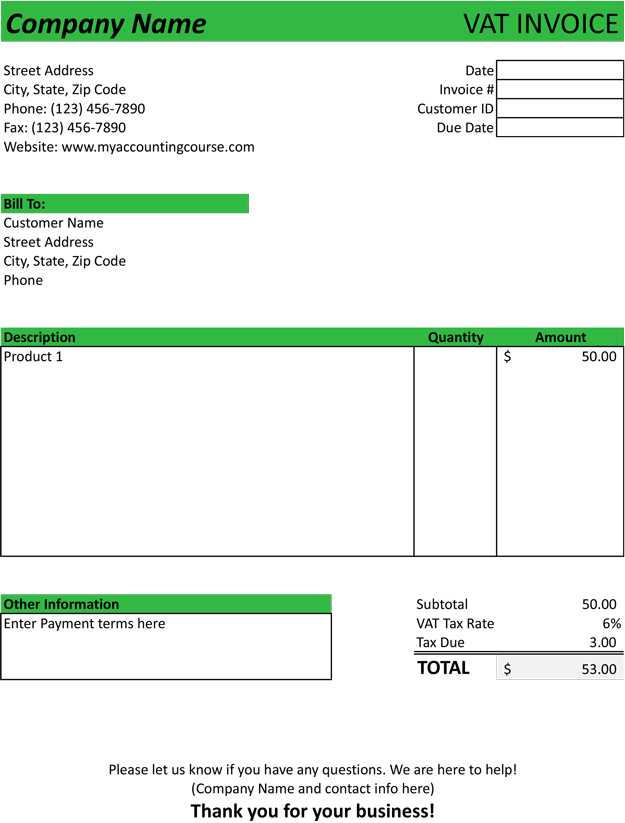

Choosing the Best Template for Your Business

Selecting the right document format for your business is a crucial decision that can affect both your efficiency and professional image. A well-designed document not only improves the overall experience for your clients but also ensures compliance with relevant regulations. The ideal format should match your business style, meet legal requirements, and be easy to use, helping you save time while ensuring that important details are included consistently.

Factors to Consider When Choosing a Format

When evaluating different formats, it’s essential to consider a few key factors that will influence how effective the document is for your needs:

- Business Type: Consider the nature of your business. A freelance consultant may require a simpler layout, while a large corporation might need a more detailed and structured design.

- Branding: Choose a format that allows you to personalize the document with your company’s logo, colors, and fonts to maintain a professional and consistent brand identity.

- Customization: Look for a format that can easily be customized to fit your specific transaction details, whether it’s adjusting pricing, payment terms, or adding multiple items.

- Compliance: Make sure the format adheres to local laws and industry regulations to avoid any legal issues down the line.

Types of Formats to Choose From

There are many options available, each suited for different business needs. Here are some common types of document formats that you can consider:

- Simple Layout: Best for small businesses or freelancers, offering a straightforward design that covers all essential details without overcomplicating the document.

- Detailed and Structured Layout: Ideal for larger businesses or industries requiring more complex records, such as multiple line items, tax breakdowns, and detailed payment schedules.

- Customizable and Automated Formats: Perfect for businesses looking to automate their record-keeping. These formats often integrate with accounting software and allow for easy customization and recurring use.

By evaluating these factors and understanding your business needs, you can choose a format that not only supports your daily operations but also enhances your professional image and ensures regulatory compliance.

Common Mistakes to Avoid with VAT Invoices

Creating accurate business transaction records is essential to maintaining smooth operations and ensuring compliance with legal requirements. However, even small errors can lead to serious consequences, such as delayed payments, customer dissatisfaction, or complications during audits. Being aware of common mistakes and learning how to avoid them is key to improving your process and maintaining professionalism.

Key Errors to Watch For

Here are some of the most frequent mistakes that businesses make when preparing their official documentation:

- Incomplete Information: Failing to include essential details such as business identification, client information, or transaction specifics can create confusion and lead to payment delays or legal issues.

- Incorrect Tax Calculations: Mistakes in calculating taxes or leaving out the applicable rates can result in financial discrepancies and may even trigger audits or fines from tax authorities.

- Missing or Incorrect Dates: Inaccurate transaction or issue dates can cause confusion regarding payment terms and can complicate future record-keeping or legal compliance.

- Not Including a Unique Reference Number: Without a reference number, tracking and verifying transactions becomes difficult, especially if you need to follow up on payments or resolve disputes.

- Overlooking Payment Terms: Not specifying the payment method, due date, or any applicable late fees can lead to misunderstandings and slow down the payment process.

- Inconsistent Layout: Using a disorganized or inconsistent format makes it harder for your clients to read and understand the document, reducing professionalism and increasing the chances of mistakes.

How to Avoid These Errors

To avoid these common pitfalls, ensure that your document is properly designed and thoroughly reviewed before being shared. Here are a few tips for maintaining accuracy:

- Double-check all details before finalizing any document to ensure that no critical information is missing.

- Use automated tools or software that can calculate taxes and generate accurate records for you, reducing human error.

- Always include a unique reference number for each transaction to make it easier to track payments.

- Be clear about payment terms and provide detailed instructions to avoid misunderstandings.

By paying attention to these common mistakes and taking steps to avoid them, you can maintain accurate, professional records that help build trust with clients and stay compliant with regulations.

Free vs Paid VAT Invoice Templates

When selecting a format for your business records, you’ll likely encounter two primary options: free solutions and paid ones. Each offers distinct advantages and drawbacks, and understanding these can help you make the right choice based on your business needs. While free formats may seem appealing, paid options often provide additional features, customization, and support that can enhance your operations. Weighing the pros and cons of each option can lead to a more informed decision that aligns with your goals.

Comparing Features

Below is a table comparing the key features of free and paid formats to help you decide which option works best for your business:

Feature Free Solutions Paid Solutions Customization Limited options for adjusting layout and design. Fully customizable to suit your specific branding and needs. Ease of Use Simple and straightforward, but may lack advanced options. Intuitive and feature-rich, often with user support and guides. Support Minimal or no support available. Customer service and technical support are usually included. Additional Features Basic features, with some limitations in functionality. Advanced features like integration with accounting software, recurring entries, etc. Legal Compliance May not include the latest legal updates or features specific to your location. Frequently updated to ensure compliance with changing laws and regulations. Which Option is Right for You?

Choosing between free and paid solutions depends on several factors, such as the size of your business, your budget, and your specific needs. Small businesses or startups may find free options sufficient for basic needs, while larger enterprises or those with more complex requirements might benefit from the features offered by paid solutions. Ultimately, the decision comes down to the level of funct

VAT Template Compatibility with Software

When selecting a document format for your business transactions, one of the most important factors to consider is how well it integrates with your existing software tools. Seamless compatibility ensures that you can easily manage, automate, and store these documents without manual data entry or the risk of errors. Whether you’re using accounting software, CRM systems, or other business tools, it’s essential that your format can work smoothly with these platforms to streamline your workflow and maintain accurate records.

Why Compatibility Matters

Integrating your document format with accounting or business management software can help you save time, reduce the chance of mistakes, and improve overall productivity. The ability to automatically populate fields with customer information, transaction data, and tax calculations can greatly enhance efficiency. Moreover, compatibility with software ensures that all the required fields and details are consistent with your business’s financial and regulatory requirements.

Key Considerations for Compatibility

To ensure that your format works effectively with the software you use, consider the following factors:

- File Format Support: Ensure that the format you choose is supported by your software, whether it’s a PDF, Word document, or another file type.

- Automation Features: Look for software that can automatically import data from your CRM or accounting system into your document layout, reducing the need for manual input.

- Customization Options: Ensure that your chosen format can be tailored to meet your specific business requirements, including tax rates, client details, and payment terms.

- Cloud Integration: If you use cloud-based software, check that your format can be accessed and shared across multiple devices and platforms, improving collaboration.

By carefully evaluating compatibility with the software you use, you can choose a format that will make document creation more efficient, reduce errors, and ensure that your business remains organized and compliant.

How to Save and Share VAT Invoices

Once your business transaction records are created, it’s essential to know how to properly save and share them with clients, partners, or accounting teams. Organizing these documents efficiently ensures quick access when needed, while sharing them securely maintains professionalism and compliance. The process involves selecting the right format, storage method, and distribution channels to ensure that your records are safe, easily retrievable, and ready for use in case of an audit or financial review.

Best Ways to Save Business Documents

There are various methods to store your documents, and choosing the right one depends on your business’s needs, volume of transactions, and available resources. Below are some commonly used options:

- Cloud Storage: Storing documents in cloud-based services such as Google Drive, Dropbox, or OneDrive offers easy access from multiple devices, secure backup, and the ability to share documents directly with others.

- Local Storage: If your business prefers offline solutions, saving documents on local drives (such as hard drives or servers) can offer more control. However, it’s essential to have backup systems in place to avoid data loss.

- Accounting Software: Many businesses use accounting software to automatically store and organize transaction records. These platforms often include additional features like search functionality, report generation, and integration with other business tools.

How to Share Your Business Documents

When it comes to sharing records with clients or team members, it’s crucial to choose secure and efficient methods. Below are the most popular ways to share business documents:

- Email: Sending documents via email remains one of the simplest methods. Ensure that you use a secure email service and, if needed, encrypt the files for additional protection.

- File Sharing Services: Using file-sharing services like Google Drive or Dropbox enables easy sharing of large documents while maintaining control over access permissions and version history.

- Direct Software Integration: If your business uses specialized software, many platforms allow you to send records directly from the system, streamlining the process and reducing the risk of errors.

- Physical Copies: In some cases, you may need to send printed copies. Ensure you keep a record of all mailings, including delivery tracking information and signed receipts, for your records.

By choosing the right methods to store and share your documents, you can ensure that your business transactions are handled smoothly and securely, cr

Updating VAT Templates for New Rates

Businesses must remain flexible and proactive when it comes to adapting their transaction records to reflect changes in applicable rates. As tax laws evolve, it becomes crucial to update your document structures to ensure compliance and avoid errors in financial reporting. Regularly reviewing and adjusting your formats ensures that your records reflect the most current tax rates, saving time and preventing potential issues with tax authorities.

Why It’s Important to Update Regularly

Tax rates can change frequently due to shifts in government policy, economic conditions, or industry-specific adjustments. When these changes occur, failing to update your records can lead to discrepancies, overcharging or undercharging clients, and legal complications. To avoid these risks, it’s essential to keep your documentation up to date and ensure that all new rates are properly applied to transactions.

Steps to Update Your Records

Updating your transaction document format for new rates can be simple if you follow these key steps:

- Review the Updated Tax Rates: Before making changes, ensure that you are fully aware of the new rates and any specific rules that may apply to your industry or region.

- Adjust the Fields for Calculations: Modify the calculation fields in your records to reflect the updated rates. This may involve changing formulas or adding new fields if necessary.

- Test the Changes: After updating, test the system to ensure that all calculations are correct and that no information is missing or miscalculated.

- Communicate with Clients: If the change affects your customers, it’s important to notify them in advance to avoid confusion or dissatisfaction.

- Backup Your Files: Always keep a backup of your previous version in case any issues arise. It’s good practice to keep historical records for audit purposes.

By following these steps, you ensure that your documentation remains accurate, compliant, and reflective of current tax regulations. This proactive approach not only saves time but also promotes a smooth, transparent relationship with your clients and partners.