Tree Service Invoice Template for Easy and Professional Billing

Managing payments and keeping track of completed tasks is essential for any business, particularly in industries that require specialized work. Ensuring your customers receive clear and professional documentation for the services provided helps maintain a smooth workflow and encourages timely payment. Having an organized method for invoicing can save valuable time and reduce confusion over billing details.

Efficiency in your financial processes is critical. By creating detailed records and offering clients easy-to-read statements, you can enhance customer satisfaction and avoid disputes. An effective billing system is a reflection of your business’s credibility and commitment to transparency.

Whether you are just starting out or looking to improve your existing practices, having a reliable system in place allows you to focus more on delivering quality work while ensuring that payments are handled seamlessly. Customizable solutions are widely available, providing you with the flexibility to match your specific needs.

Tree Service Invoice Template Overview

When it comes to documenting completed work and ensuring smooth financial transactions, having a well-organized system is crucial for any professional business. An efficient document helps not only in tracking payments but also in presenting a polished and reliable image to clients. It serves as an official record, outlining the tasks completed, the costs involved, and the terms of payment in a clear and straightforward manner.

Why a Structured Document is Important

Adopting a standardized format for your financial documentation offers several advantages:

- Clarity: Clients can easily understand the breakdown of costs and the nature of the work performed.

- Professionalism: A neat, consistent format helps build trust and credibility with your clients.

- Efficiency: A pre-designed system saves time by eliminating the need to create each document from scratch.

- Compliance: Detailed records help maintain proper business documentation for tax or audit purposes.

What to Expect from an Effective Document

An ideal document includes several key elements that help ensure clarity and professionalism:

- Contact Information: Clear details about both the business and the client for easy reference.

- Job Description: A detailed list of the work completed, including dates and specifics of the tasks performed.

- Cost Breakdown: Transparent pricing with itemized charges for labor, materials, or other fees.

- Payment Terms: Clear instructions on how and when payments are due, including any late fees or discounts.

By implementing a customizable solution for your financial documentation, you can streamline your workflow while maintaining a professional relationship with your clients.

Why Use an Invoice Template

Adopting a pre-designed document for financial transactions offers several key benefits for businesses of all sizes. Instead of manually creating each billing statement from scratch, a ready-made format simplifies the process, saving both time and effort. Using a consistent structure helps ensure that all essential details are included, reducing the risk of errors and miscommunication.

Efficiency is one of the primary reasons to use a standardized document. With a customizable framework, you can quickly adjust details for each client while maintaining a professional and uniform appearance. This helps streamline your workflow, making the task of generating invoices quicker and more reliable.

Accuracy is another critical advantage. When all necessary sections, such as client information, service description, and payment terms, are pre-set in the document, you are less likely to miss important data. This leads to clearer communication with clients and fewer billing disputes.

Additionally, using a pre-built structure enhances professionalism. A well-organized document presents a polished image to clients, reflecting your business’s attention to detail and commitment to providing a smooth experience. It also helps maintain consistency across all financial communications, further solidifying your credibility in the industry.

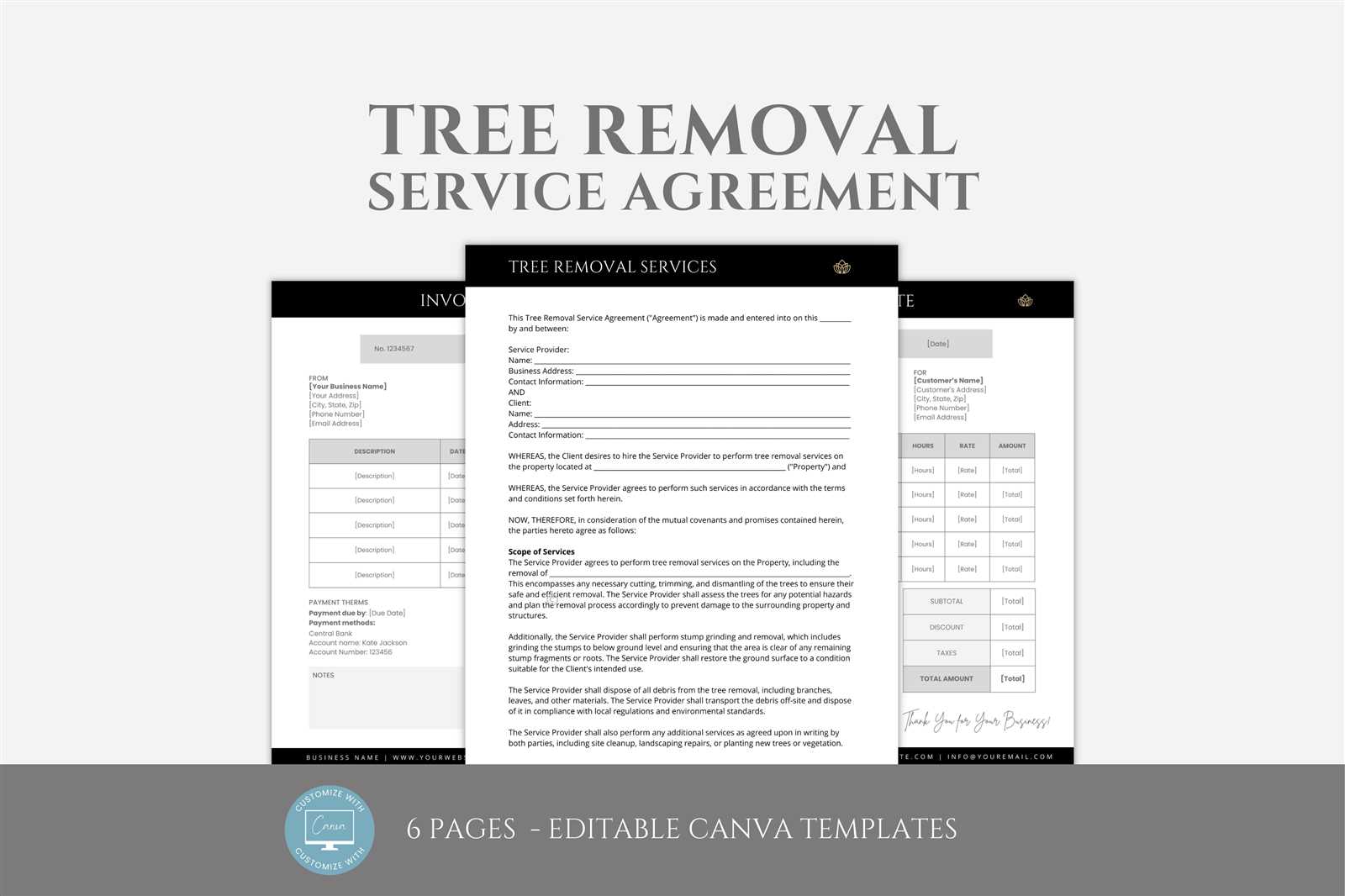

Key Features of a Tree Service Invoice

A well-crafted financial document serves as a comprehensive record of the work completed, outlining the tasks performed and the corresponding costs. It plays a crucial role in ensuring transparency between the business and the client, providing clear details of charges, payment terms, and other essential information. An effective document not only facilitates prompt payment but also helps maintain a professional relationship with clients.

Essential Information to Include

Every financial record should contain key components that make it easy for both parties to understand the transaction:

- Business and Client Details: Accurate contact information for both the service provider and the client, including names, addresses, and phone numbers.

- Job Description: A detailed breakdown of the work completed, including specific tasks, locations, and the time spent on each aspect.

- Cost Breakdown: Clear itemization of the charges, such as labor, materials, and additional fees, with transparent pricing for each category.

- Payment Terms: Clear guidelines on how and when the payment is expected, including due dates, accepted payment methods, and any applicable late fees or discounts.

Additional Features for Clarity and Professionalism

To further enhance the document’s usefulness and appearance, consider including:

- Unique Identifier: An invoice or reference number for easy tracking and record-keeping.

- Tax Information: Include any applicable taxes or fees, ensuring compliance with local regulations.

- Payment Instructions: Specific steps or details on how the client can complete the payment process, such as bank account details or online payment options.

By incorporating these features, you ensure a streamlined and professional experience for both your clients and your business.

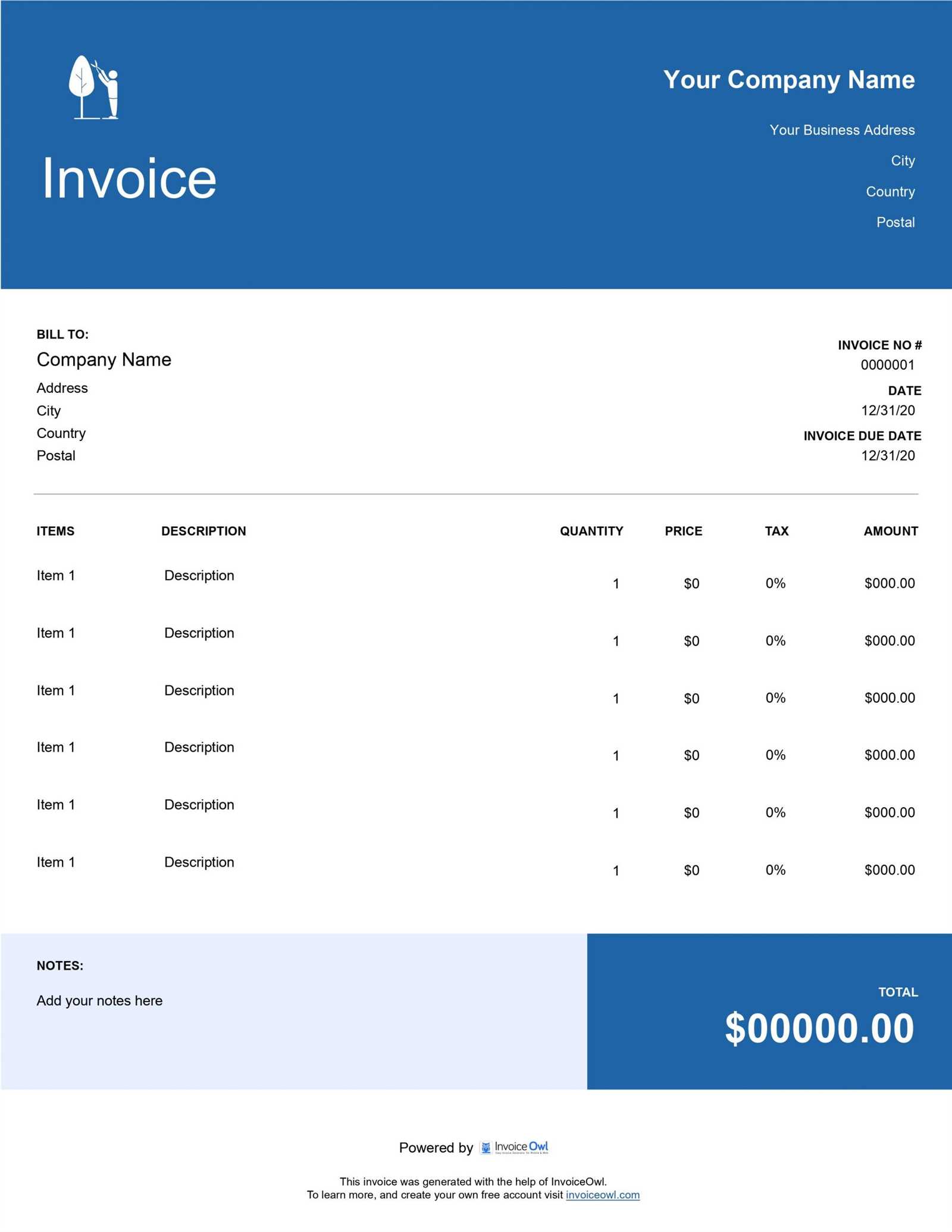

How to Customize Your Invoice Template

Personalizing your financial document is key to reflecting your brand and business needs while ensuring it serves its practical purpose. Customization allows you to create a clear, professional layout that highlights the most important details for both you and your client. By adjusting the structure, design, and content, you can make the document truly fit your business model and streamline your workflow.

Choosing a Layout and Design

The first step in customization is selecting an appropriate format and layout. Consider the following:

- Simple vs. Detailed: Decide if you need a basic, minimalist layout or a more detailed design with sections for additional information.

- Branding: Add your business logo, colors, and fonts to make the document visually align with your brand identity.

- Sections: Customize the sections to include only the relevant details you want to highlight, such as a payment reminder or service breakdown.

Updating Information and Fields

Next, personalize the content of your document:

- Business Details: Ensure that your contact information, including name, address, and phone number, is accurate and clearly visible.

- Client Information: Customize the section where client details are entered to make sure you can quickly reference important contact information.

- Service Breakdown: Adjust the fields where the description of completed tasks is listed, ensuring they reflect the specific work you perform. Add or remove any categories depending on your offerings.

- Payment Instructions: Ensure your payment terms are clear, and consider including multiple payment methods for client convenience.

Customizing these areas allows you to create a professional and user-friendly financial document that is tailored to your specific needs.

Essential Information to Include in Invoices

For any business, it’s crucial to provide complete and accurate documentation of work done and the corresponding charges. A well-structured financial document ensures clarity and helps both you and your clients avoid misunderstandings. Including all the necessary details ensures a smooth billing process and facilitates prompt payments.

Basic Details to Include

These fundamental elements form the backbone of your document and should always be present:

- Business and Client Information: The name, address, phone number, and email for both the company and the client should be clearly visible for easy reference.

- Unique Reference Number: Every document should have a distinct number for tracking purposes. This makes it easier to search and manage records.

- Date of Issue: Include the date when the document was generated, which helps establish a timeline for payment.

Detailed Work Description and Payment Breakdown

It’s important to provide a clear and comprehensive breakdown of the work performed and the charges incurred:

- Work Description: Detail the tasks completed, including locations and any special requirements. This ensures the client understands exactly what they are being billed for.

- Cost Breakdown: Itemize the charges, including labor, materials, or additional fees. Be transparent with the pricing to avoid confusion.

- Payment Terms: Clearly state the expected payment due date, accepted payment methods, and any late fees or discounts that may apply.

Including all this essential information guarantees that both you and your client are on the same page and facilitates smoother transactions.

Tree Service Invoice Design Best Practices

Designing an effective financial document is key to creating a professional impression and ensuring clarity in communication with clients. A well-structured layout enhances readability, highlights important details, and ensures the document serves its purpose without causing confusion. A clean, visually appealing design not only facilitates easy understanding but also boosts your business’s credibility.

Layout and Organization

The layout should be clean and simple, with enough white space to make the document easy to read. Important sections should be clearly marked, and the information should be logically arranged so the client can quickly find what they need.

| Section | Best Practice |

|---|---|

| Header | Include your business name, logo, and contact details at the top for easy recognition. |

| Client Information | Ensure that the client’s details are accurate and presented in a straightforward manner. |

| Work Description | Use clear, concise language to describe the work done, and break down tasks if necessary. |

| Cost Breakdown | Itemize costs and include taxes or other additional fees in a transparent manner. |

| Payment Terms | Clearly state payment methods, due dates, and any late fees in a separate, easy-to-read section. |

Design Aesthetics and Clarity

While functionality is key, the visual appeal of the document should not be overlooked. Use simple fonts that are easy to read, and avoid overcomplicating the design with excessive colors or images. Choose a professional color palette that reflects your brand, and make sure the font size is large enough for comfortable reading.

Incorporating these design best practices will ensure your documents are both functional and professional, leading to better client relationships and a smoother billing process.

How to Calculate Tree Service Costs

Accurately calculating the costs of work performed is essential for ensuring fair pricing and maintaining profitability. A well-thought-out pricing structure helps establish transparency with clients and ensures that you cover all your expenses while providing competitive rates. By factoring in various elements like labor, materials, and equipment, you can determine a precise cost for each task.

The first step in calculating costs is to assess the time required to complete the job. This includes not only the actual labor but also any preparatory work or follow-up tasks. Labor costs are typically charged by the hour or a flat rate, depending on the type of work. It is important to consider the skill level and experience of the workers when determining hourly rates.

Next, factor in the cost of materials and equipment. This could include tools, supplies, and other resources required to complete the task. For example, if a special tool or machinery is needed, the cost of renting or purchasing that equipment should be included in the final calculation. Additionally, you may need to account for the transportation costs to bring the necessary equipment and supplies to the job site.

Lastly, consider any overhead or additional expenses that may apply, such as permits, insurance, or disposal fees. These costs can vary depending on the job location and local regulations. Including these factors in your pricing ensures that you are not left covering unexpected expenses, and it helps maintain a sustainable business model.

By thoroughly calculating all these elements, you can set a fair and accurate price for the work performed, ensuring both client satisfaction and business profitability.

Common Payment Terms for Tree Services

Setting clear and straightforward payment terms is crucial for maintaining a healthy cash flow and ensuring timely compensation for the work completed. These terms define the expectations for both the business and the client, making the billing process more transparent and reducing the likelihood of payment delays or disputes. A well-structured agreement helps prevent misunderstandings and fosters a positive working relationship.

Typical Payment Structures

There are several common payment structures used in the industry, depending on the type of work and the agreement with the client:

- Hourly Rate: Clients are charged based on the number of hours worked. This is often used for tasks that are difficult to estimate in advance.

- Flat Fee: A fixed price is agreed upon before work begins. This is suitable for projects with well-defined scope and clear expectations.

- Per Unit Pricing: In some cases, businesses charge per unit of work, such as per tree removed or per cubic yard of debris hauled away.

- Retainer or Deposit: A deposit or retainer may be required upfront to secure the job, with the balance due upon completion. This can help cover initial costs and ensure commitment from the client.

Payment Terms and Conditions

In addition to the payment structure, certain conditions are often set to define the timing and method of payment:

- Due Date: Clearly specify when payment is due, whether it’s immediately upon completion or within a specific time frame, such as 30 days.

- Late Fees: Outline any fees that may apply if payment is not received on time, such as a percentage of the total amount or a flat late fee.

- Accepted Payment Methods: Make it clear what methods of payment are accepted, such as credit cards, bank transfers, or checks.

- Discounts for Early Payment: Some businesses offer discounts for clients who pay early. This can be an incentive to ensure quicker payments.

By clearly defining these payment terms, you can help avoid misunderstandings, ensure a timely payment process, and maintain a professional relationship with your clients.

Creating Professional Invoices for Your Business

Creating a polished and professional financial document is essential for any business. A well-structured statement not only helps in tracking payments but also presents your business in a credible light. By focusing on clarity, accuracy, and a clean design, you can ensure your clients are confident in the legitimacy of your work and are more likely to make prompt payments.

To ensure your document meets these standards, it’s important to include several key elements and maintain a clean layout. Here are the most important components to consider when creating professional records for your business:

| Component | Description |

|---|---|

| Header | Include your business name, logo, and contact details at the top of the document for clear identification. |

| Client Information | Accurate details for the client, including their name, address, and contact information, should be clearly displayed. |

| Work Description | Provide a detailed account of the work performed, including dates, locations, and any special considerations. |

| Cost Breakdown | Clearly list all charges, including labor, materials, and any other applicable fees, to give the client a complete understanding of the total cost. |

| Payment Terms | State when payment is due, the accepted methods, and any late fees or discounts for early payment. |

By carefully considering these elements and ensuring your document is easy to read and understand, you can create a professional and reliable billing process that reflects well on your business and ensures timely payments.

Benefits of Digital Invoice Templates

In today’s digital world, using electronic documents for financial transactions offers several key advantages over traditional paper-based methods. Digital solutions streamline the entire process, from creation to delivery, making it easier to manage and track payments. These tools not only save time but also improve efficiency, accuracy, and professionalism in client communication.

Time-Saving and Efficiency

One of the primary benefits of digital documents is the amount of time saved in creating and sending them. With pre-designed formats, you can quickly fill in the necessary details, customize where needed, and send the document to clients with just a few clicks. This reduces the manual work involved and eliminates the need to print, sign, and mail physical copies, saving both time and effort.

Improved Accuracy and Organization

Another advantage is the reduction in errors. Automated fields and calculations ensure that all information is correct, eliminating the risks associated with manually entering data. Additionally, digital files are easier to store, categorize, and retrieve compared to paper records, helping you keep track of past transactions and stay organized.

Security is another important benefit. Digital documents are easier to protect with encryption, passwords, and secure cloud storage options. This ensures that sensitive information, such as client details and payment data, remains safe from unauthorized access.

Cost-Effective solutions are also a significant factor. By eliminating the need for paper, printing, and postage, businesses can save money while reducing their environmental footprint. Digital records also make it easier to comply with tax regulations and business audits, ensuring you have all necessary documents at your fingertips when required.

By transitioning to digital financial documents, businesses can experience greater efficiency, improved security, and enhanced client satisfaction, all while reducing operational costs and streamlining workflows.

Free Tree Service Invoice Templates Online

For small business owners or entrepreneurs looking to streamline their billing process, free digital templates are a great resource. These pre-designed formats provide a simple and professional way to document completed work, helping you save time and ensure that every necessary detail is included. Many online platforms offer free access to customizable layouts that can be tailored to fit your specific needs, all while maintaining a polished appearance for your clients.

These free resources often come with a variety of benefits, such as easy customization, quick access, and a wide range of formats that cater to different business types. Whether you need a basic design or something more detailed, these templates are typically user-friendly and compatible with various software tools.

| Platform | Features |

|---|---|

| Template Websites | Offer a variety of free and customizable layouts, often available in PDF, Word, or Excel format. |

| Online Software | Allow users to create, send, and track digital documents directly from the platform, with built-in customization options. |

| Google Docs/Sheets | Free templates available that can be edited in real-time and shared with clients easily. |

| Microsoft Office | Pre-made layouts that integrate seamlessly with Excel or Word, offering templates for multiple business purposes. |

By using free digital templates, you can easily maintain a professional image, reduce errors, and improve the efficiency of your billing process without any upfront costs. These tools make it simple to create clear and accurate records, ensuring you can focus more on the work at hand and less on administrative tasks.

Choosing the Right Invoice Software

Choosing the right software for generating and managing billing documents is an important decision for any business. The right tool can help streamline the billing process, improve accuracy, and enhance overall efficiency. With many options available on the market, it’s crucial to select software that not only fits your business needs but also integrates seamlessly with your existing systems. Key factors to consider include ease of use, customization options, and integration with other business tools.

When evaluating different software solutions, it’s essential to think about the features that will benefit your business the most. Some tools are designed to handle basic billing, while others offer more comprehensive functionality, including customer management, recurring billing, and detailed reporting.

| Software Feature | Considerations |

|---|---|

| Ease of Use | Look for user-friendly interfaces that make it simple to create and manage documents without requiring extensive training. |

| Customization | Ensure the software allows you to tailor documents to reflect your brand with custom logos, fonts, and color schemes. |

| Payment Integration | Consider software that integrates with popular payment gateways to make it easier for clients to pay online. |

| Reporting & Analytics | Choose software that provides detailed reports on payments, outstanding invoices, and overall cash flow. |

| Mobile Access | Opt for cloud-based solutions with mobile apps so you can create and manage documents on the go. |

By carefully evaluating these factors, you can choose software that best supports your business operations and helps ensure smooth, efficient transactions with your clients.

How to Handle Late Payments on Invoices

Dealing with delayed payments is a common challenge in business. Late payments can disrupt cash flow and create unnecessary stress, but handling them professionally and efficiently can help maintain good client relationships while ensuring timely compensation. It’s important to have a clear strategy in place for managing overdue balances, from clear terms to polite reminders.

The first step in preventing late payments is to set clear expectations upfront. Clearly outline payment terms, including due dates, late fees, and acceptable payment methods. Make sure these terms are included in all agreements and documents shared with clients.

Steps to Take When Payments Are Late

If a payment is overdue, it’s important to address the issue promptly. Here’s how you can handle late payments:

- Send a Friendly Reminder: A polite follow-up email or phone call is often enough to remind the client about the overdue payment. Keep the tone courteous and professional.

- Send a Formal Request: If the payment is significantly overdue, send a more formal reminder with specific details about the outstanding balance, including the original due date and any late fees that have been applied.

- Offer Payment Options: If the client is facing financial difficulties, consider offering flexible payment arrangements, such as installment plans or extensions on the due date, to help them fulfill their obligation.

- Charge Late Fees: If your payment terms include late fees, apply them consistently once the due date has passed. Be transparent about this process so the client understands the consequences of delayed payments.

- Escalate if Necessary: In cases where multiple reminders have been ignored, you may need to escalate the issue. This could involve using a collection agency or seeking legal advice, but it’s typically a last resort.

Communication is key throughout this process. Maintain a polite, professional tone and avoid becoming confrontational. By staying organized and consistent, you can improve the chances of receiving payment while maintaining a positive working relationship with your clients.

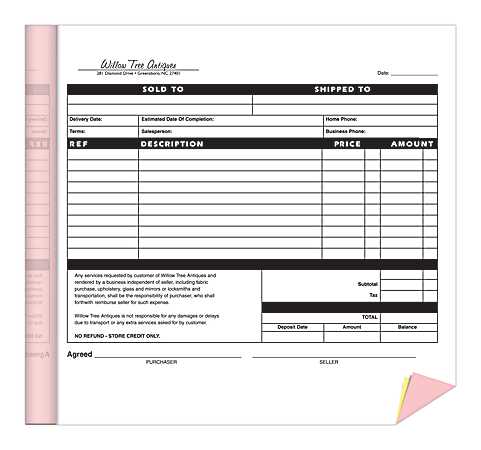

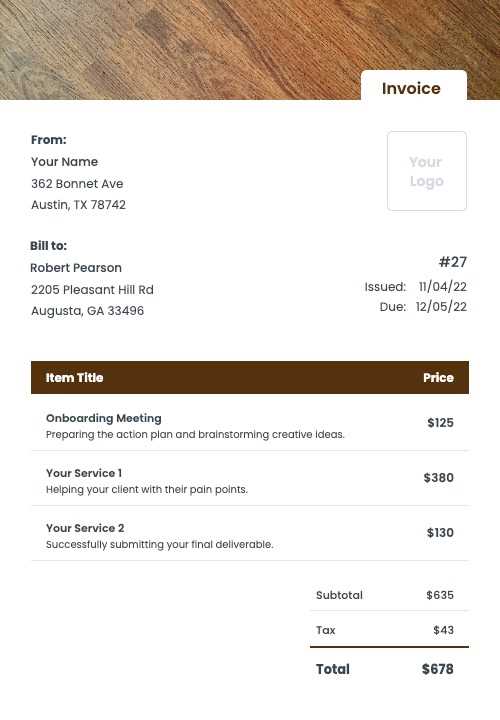

Tree Service Invoice Examples for Reference

Having well-designed examples of financial documents can serve as a valuable reference when creating your own. These samples provide a clear idea of what information needs to be included, as well as how to structure the content in a professional manner. By reviewing examples, you can gain insights into the best practices for detailing charges, taxes, and payment terms while ensuring clarity for your clients.

Basic Example

A simple and straightforward layout often works best for small projects or one-time clients. Here’s what a basic document might include:

- Header: Your business name, logo, and contact information.

- Client Details: The client’s name, address, and contact information.

- Work Description: A clear breakdown of services provided (e.g., trimming, stump removal, debris cleanup).

- Charges: A detailed cost breakdown, including labor, materials, and any additional fees.

- Total Amount: The final amount due, including applicable taxes.

- Payment Terms: A due date and any late fee policies.

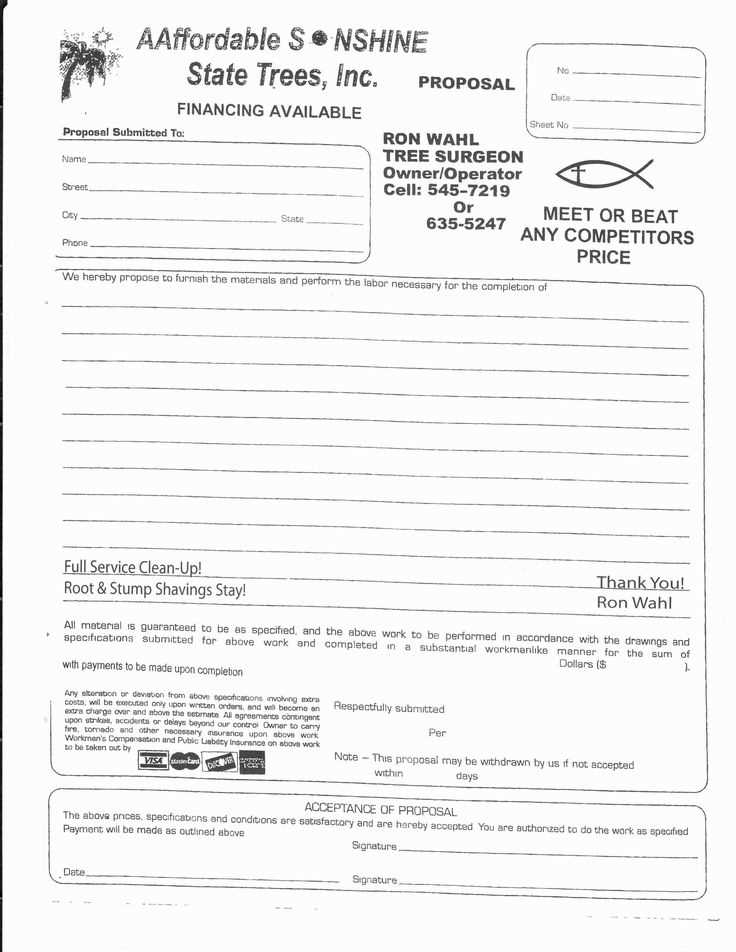

Comprehensive Example

For more complex projects or long-term clients, a more detailed version might be necessary. This example could include additional sections such as:

- Project Timeline: The duration of the work, including start and end dates.

- Detailed Labor Breakdown: Hourly rates and the number of hours worked for each specific task.

- Materials and Equipment: A separate line for any materials used or equipment rented during the job.

- Discounts or Adjustments: Any special offers or price changes based on agreements or negotiation.

- Payment Options: Different ways for clients to pay, such as credit card, bank transfer, or check.

These examples provide a solid foundation for creating accurate and professional documents that will help ensure smooth transactions with your clients.

Tips for Streamlining Billing Process

Efficiently managing the billing process is crucial for maintaining smooth cash flow and ensuring that payments are received on time. By implementing a few strategic practices, you can reduce errors, save time, and improve overall efficiency in how you handle financial transactions. Streamlining your approach can also enhance your professional image and improve client satisfaction.

1. Use Automation Tools

Automating certain aspects of the billing process can save time and minimize human error. There are numerous software tools available that can automatically generate financial documents, send reminders, and even track payments. Some benefits of automation include:

- Faster processing: Generate and send documents with a single click.

- Reduced errors: Pre-populated fields reduce the chances of making mistakes.

- Consistent follow-ups: Automated reminders ensure you never forget to contact clients about overdue payments.

2. Maintain Clear Payment Terms

It’s essential to set clear, concise payment terms from the start. By communicating expectations up front, you reduce the risk of confusion or delays later. Consider including the following in your agreements:

- Due dates: Clearly state when payments are expected, and outline any late fees or penalties.

- Payment methods: Offer multiple payment options, such as bank transfers, credit cards, and online payment platforms, to make it easier for clients to pay.

- Discounts for early payment: Providing an incentive for prompt payment can encourage faster processing.

3. Track and Follow Up on Payments

Keeping track of outstanding balances is essential for a streamlined process. Create a simple system for tracking who has paid and who hasn’t. If a payment is overdue, follow up promptly and professionally. Some tips include:

- Use spreadsheets or accounting software: Track all transactions and identify overdue payments quickly.

- Set reminders: Schedule follow-up emails or phone calls to ensure timely payments.

- Stay consistent: Send friendly but firm reminders as needed to maintain professionalism.

By incorporating these practices, you can streamline your financial management, reduce administrative burdens, and ensure a smoother, more efficient billing process that benefits both you and your clients.

How to Send and Track Invoices

Sending and tracking financial documents efficiently is key to ensuring that payments are received promptly and without confusion. By using the right tools and practices, you can improve the entire process from delivery to follow-up. Whether you are sending documents digitally or physically, establishing a clear system for tracking their status will help maintain a smooth cash flow and avoid overdue payments.

1. Sending Documents

There are various methods available for sending billing documents, and the best one depends on the preferences of both you and your client. Here are some tips for sending documents effectively:

- Use Digital Methods: Sending documents via email or through a secure online portal is fast, environmentally friendly, and provides a record of delivery.

- Include Clear Instructions: Make sure your client knows how to access, review, and pay for the work done. Include any necessary payment links or instructions in the document itself.

- Ensure Document Accessibility: Use formats like PDF or Word that are easy for clients to open and read, regardless of the device they are using.

- Use Professional Branding: Incorporate your business logo, contact information, and a consistent layout for a polished, professional appearance.

2. Tracking and Managing Payments

After sending the document, it’s important to keep track of its status to ensure timely payment. Here are some steps you can take to stay organized:

- Utilize Tracking Software: Many accounting or billing platforms offer tools that allow you to track when a document is opened and when payment is made. These features help keep you informed and prompt you to follow up if necessary.

- Create a Payment Calendar: Use a simple calendar or reminder system to mark due dates and send follow-up reminders as the deadline approaches.

- Set Payment Terms Clearly: Make sure the payment deadline and terms are clearly stated in the document to reduce confusion later. For overdue payments, send polite reminders before taking further action.

- Record Payments Promptly: As payments are made, record them immediately in your system to ensure you have an accurate overview of your outstanding balances.

By sending documents efficiently and tracking their progress, you can reduce delays and ensure that payments are processed smoothly and on time, ultimately improving the financial health of your business.

Tax Considerations for Tree Service Invoices

When handling financial documents for your business, it’s essential to ensure that tax obligations are accurately calculated and reflected. Including the correct tax information helps both you and your clients avoid potential legal issues and ensures compliance with tax regulations. Whether you’re charging sales tax, applying service tax, or dealing with exempt transactions, understanding how to properly manage tax considerations is crucial.

Understanding Sales Tax Requirements

One of the most common tax considerations when generating billing documents is sales tax. Depending on your location and the nature of the work provided, sales tax may apply to specific types of transactions. Here are key points to keep in mind:

- Sales Tax Jurisdictions: Sales tax rates can vary by state, county, or city. Make sure to research the appropriate rate for the area where the work is performed.

- Taxable Goods vs. Services: Some services may be exempt from sales tax, while others, such as materials or equipment rental, may require tax to be added to the total cost.

- Taxable Amount: Be sure to calculate tax based on the total amount for taxable goods or services, including any additional fees or charges that may apply.

Including Tax Information in Billing Documents

To ensure transparency and avoid confusion, it’s important to clearly state any tax-related information in the financial documents you send to clients:

- Separate Line for Tax: Always list the tax as a separate line item, distinct from the service charges, so the client can easily identify how much is being charged for tax purposes.

- Tax ID Number: Include your business’s tax identification number (TIN) if required by your local tax authority.

- Tax Rate: Specify the applicable tax rate for the jurisdiction in which the work was performed. This provides clarity and ensures both parties understand how the final amount was calculated.

Properly accounting for tax can help protect your business from penalties and improve your professional image. Make sure to stay updated with local tax laws and adjust your billing documents accordingly to remain compliant.

Improving Cash Flow with Efficient Invoicing

One of the most important factors in maintaining a healthy business is ensuring steady and timely cash flow. Efficiently managing the process of billing and collecting payments can significantly impact your financial stability. By streamlining the way you create and send financial documents, you can reduce delays, avoid errors, and encourage faster payments from your clients. This can help you stay on top of expenses and reinvest in the growth of your business.

To improve cash flow, it’s crucial to focus on creating clear, accurate, and timely documents. When clients receive well-organized and transparent statements, they are more likely to pay promptly, avoiding any misunderstandings or confusion. Additionally, providing convenient payment options and setting clear expectations around payment terms can help further speed up the collection process.

Efficient document management can also help reduce administrative costs and the time spent chasing overdue payments. With the right systems in place, you can automate reminders, track outstanding amounts, and maintain accurate financial records with minimal effort, freeing up your time to focus on other areas of the business.

By implementing these practices, you’ll not only improve the cash flow of your business but also build stronger relationships with your clients, who will appreciate your professionalism and the clarity of your billing process.