How to Create and Customize a Gucci Invoice Template

In today’s competitive business world, maintaining a polished and cohesive brand image is essential. One of the key elements in achieving this is the way you present financial documents to clients. A well-designed billing form can convey professionalism and attention to detail, reflecting the high standards of your company.

Whether you are an entrepreneur, a small business owner, or managing a larger organization, having a ready-made and customizable format for your transactions is crucial. This allows you to maintain consistency across all financial exchanges while saving time and effort. By using a premium, branded design, you can ensure that your documents stand out and leave a lasting impression on your clients.

In this guide, we will explore how to effectively create, customize, and use a premium billing form to suit your business needs. You will learn the best practices for including essential information, applying personal branding elements, and ensuring clarity in every document you send. The goal is to make financial transactions not only seamless but also aligned with your company’s image of quality and trustworthiness.

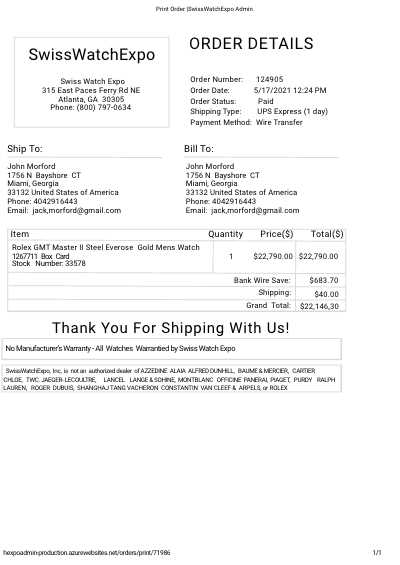

Gucci Invoice Template Overview

A well-structured billing document plays a crucial role in representing your brand’s professionalism. By choosing a sophisticated and sleek design, you ensure that every transaction with your clients reflects high standards and attention to detail. This type of document is not just a form for recording payments; it also serves as a tool to communicate your brand’s identity and build trust with your customers.

The design of a premium billing form typically includes a clean layout with the right balance of text and white space. It incorporates key elements such as the client’s information, itemized list of services or products, payment terms, and your business details. By customizing these forms to align with your brand, you enhance your business’s overall image and make the financial process smoother for both parties.

Having a customizable, elegant billing form is especially important for businesses aiming to convey exclusivity and high-end service. This kind of document allows you to leave a lasting impression and ensures that every client interaction is handled with the utmost care. Whether used for a one-time sale or ongoing transactions, a polished and professional format helps maintain consistency and organization in your financial dealings.

What Makes Gucci Invoices Unique

The distinction of high-end financial documents lies in their design and functionality. When it comes to luxury brands, every detail, no matter how small, contributes to the overall perception of quality. A premium billing form goes beyond simple calculations–it serves as a representation of your business’s values and commitment to excellence. In the case of renowned luxury brands, the documents used for transactions are crafted with precision to mirror the sophistication and prestige that the brand embodies.

Key Features of a Premium Billing Document

- Elegant Layout: The format is clean, organized, and visually appealing, with attention to detail that enhances readability.

- Brand Consistency: The design includes consistent use of logos, colors, and fonts that reflect the brand’s identity, ensuring that each document aligns with the overall aesthetic.

- Luxury Feel: High-quality materials, both digital and physical, are used to ensure that the document feels exclusive and premium.

- Personalization: Customizable sections allow businesses to add unique details, such as personalized notes or specific client preferences, further strengthening the customer relationship.

Why It Matters for Clients

- Professionalism: Clients instantly recognize the professionalism in a well-designed document, which helps to build trust and reinforce the brand’s credibility.

- Memorability: A beautifully crafted document leaves a lasting impression, making clients more likely to return or recommend the brand to others.

- Transparency: Clear and organized information reduces confusion, making the transaction process more straightforward for both parties.

By offering more than just a transaction receipt, these premium documents elevate the entire experience and align the business’s image with its high standards of quality. Whether digital or printed, the unique features of such a document ensure it stands out as both functional and luxurious.

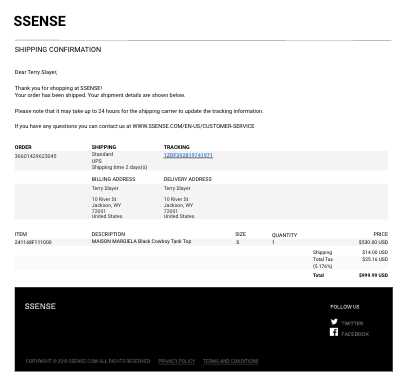

How to Download Gucci Invoice Template

Acquiring a professionally designed billing form is the first step in creating an elegant and consistent financial document for your business. The process is simple and straightforward, and it ensures you have access to a high-quality design that can be customized to your specific needs. Whether you’re looking for a digital version or a printable format, there are various methods for obtaining these premium documents online.

Step-by-Step Process to Obtain the Document

- Search for Trusted Sources: Begin by visiting reputable websites that specialize in offering high-end business resources. Many platforms provide free or paid options for downloading sophisticated forms.

- Select the Correct Format: Choose the version that best fits your business requirements, whether it’s for digital use, print, or both. Make sure the format is compatible with your software.

- Download and Save: Once you find the right document, click on the download link and save the file to your computer or cloud storage. Ensure the file is from a reliable source to avoid potential issues with formatting or security.

Customizing and Using the Document

- Open the Document: Use software like Microsoft Word, Google Docs, or Adobe PDF to open the downloaded file. These programs will allow you to easily edit and adjust the document to suit your brand’s needs.

- Edit Personal Details: Replace placeholders with your company’s name, logo, address, and other relevant information. Be sure to update client details and payment terms to reflect the specifics of each transaction.

- Save and Print: After making the necessary adjustments, save the customized version. You can either print physical copies or send them electronically to your clients, ensuring your brand’s professional image is always maintained.

Downloading and customizing a professional billing document is a quick way to enhance your business’s image and streamline financial transactions. By choosing a reliable source and making simple adjustments, you can have a high-quality document ready to use in no time.

Step-by-Step Guide to Customize Templates

Customizing a professional billing document is essential to ensure it aligns with your brand’s identity and meets specific business needs. Whether you’re adjusting the layout, adding your logo, or modifying the text, personalization is key to making the document unique and relevant. Below is a step-by-step guide to help you efficiently customize the document for your business.

1. Open the Document in Editing Software

Start by opening the downloaded billing form in a suitable editing program. Popular options include Microsoft Word, Google Docs, or Adobe PDF Editor. These tools allow you to modify both the layout and content easily.

2. Update Business Information

Replace all placeholder text with your company’s details. This includes your company name, address, contact number, and email address. Make sure this information is accurate and clear, as it will be crucial for communication with clients.

| Field | What to Include |

|---|---|

| Company Name | Your business name or brand |

| Business Address | Full physical address (street, city, ZIP code) |

| Contact Information | Phone number and email for client queries |

3. Add Branding Elements

Integrating your logo, brand colors, and fonts is vital for maintaining a consistent brand image. Insert your logo at the top of the document, and use your brand’s color palette for headings, borders, or accent details. Adjust the font to reflect your brand’s style, whether it’s elegant, modern, or classic.

4. Personalize Client Information

Fill in the client’s details, such as name, address, and contact information. If the document is for a specific transaction, include the purchase date, itemized list of products or services, and total amounts. This ensures the document is tailored to each individual case.

5. Review and Save

Before finalizing the document, carefully review all the information for accuracy. Ensure there are no spelling errors, incorrect details, or missing data. Once satisfied, save the document in your preferred format, such as PDF for electronic delivery or print-ready format for physical copies.

By following these steps, you can quickly customize a professional document that reflects your business’s identity and provides a seamless experience for your clients.

Best Software for Editing Gucci Invoices

When it comes to customizing and editing professional business documents, choosing the right software is key to ensuring both functionality and ease of use. The right editing tool can help you make adjustments to the layout, content, and branding elements of your document efficiently. Below are some of the best software options available for editing high-quality billing documents, offering a range of features to suit different needs and skill levels.

Top Software Options for Customization

| Software | Key Features | Best For |

|---|---|---|

| Microsoft Word | Easy-to-use interface, customizable templates, and advanced formatting options. | Users who need a straightforward, widely-used tool for editing and printing documents. |

| Google Docs | Cloud-based access, real-time collaboration, and seamless sharing options. | Teams or individuals looking for a free, collaborative platform with cloud storage. |

| Adobe Acrobat Pro | Advanced editing tools for PDFs, custom branding, and high-quality design options. | Users needing professional-grade editing and PDF handling capabilities. |

| Canva | Intuitive drag-and-drop design, customizable layouts, and a wide range of templates. | Business owners who prefer an easy design tool with a focus on aesthetics. |

| Zoho Writer | Cloud-based platform, template options, and support for document automation. | Small businesses looking for a cost-effective, cloud-based editing tool with collaborative features. |

Choosing the Right Tool for Your Needs

Each software mentioned above has its strengths and is suited for different purposes. If you prefer a simple, easy-to-use solution, Microsoft Word or Google Docs may be sufficient for your needs. For those who need advanced features like PDF editing or professional design options, Adobe Acrobat Pro and Canva are ideal choices. Additionally, Zoho Writer is an excellent option for businesses looking for a cloud-based solution with team collaboration capabilities.

Ultimately, the best software for editing your documents depends on the complexity of your customization requirements, budget, and preferred features. By selecting the right tool, you can ensure your documents maintain a high level of professionalism while being easy to create and update.

Common Mistakes to Avoid in Invoices

When preparing professional billing documents, attention to detail is crucial. Even small errors can lead to confusion, payment delays, or a negative impression on clients. Understanding the most common mistakes that occur in these documents can help ensure that your transactions remain smooth and your brand stays professional. Below are some common pitfalls and tips for avoiding them.

Top Mistakes to Watch Out For

| Mistake | How to Avoid | Impact of Error |

|---|---|---|

| Incorrect Client Details | Double-check client information, including name, address, and contact details. | Confusion, delayed payments, and possible client frustration. |

| Missing or Incorrect Dates | Ensure transaction dates, due dates, and issue dates are accurate. | Payment delays, misunderstandings, and legal issues. |

| Unclear Payment Terms | Be specific about the payment methods, deadlines, and any late fees. | Payment disputes and delays. |

| Omitting Item Descriptions | Provide a detailed breakdown of services or products, including quantities and prices. | Confusion about charges, disputes over amounts owed. |

| Unprofessional Formatting | Maintain a clean, organized layout that’s easy to read and visually appealing. | Damaged brand image, clients may perceive the business as unprofessional. |

Why Accuracy Matters

Each section of a professional billing document must be carefully completed to avoid misunderstandings that can impact your cash flow and client relationships. For example, unclear payment terms or missing item details can cause confusion, which may lead to delays or disputes. Additionally, maintaining a clean and professional format reinforces your business’s image as competent and trustworthy.

By avoiding these com

How to Add Your Logo to Gucci Invoices

Including your brand’s logo on financial documents is an essential step in reinforcing your business identity. By adding a logo to your billing forms, you create a cohesive and professional look that helps to promote your brand and build trust with clients. This process can be easily done using various editing tools, allowing you to customize your documents to reflect your brand’s style. Below is a step-by-step guide on how to incorporate your logo into your business documents.

Steps to Add Your Logo

| Step | Action | Tips |

|---|---|---|

| 1 | Open the Document | Use editing software like Word, Google Docs, or Adobe Acrobat to open the billing form. |

| 2 | Select Logo Placement | Choose where you want your logo to appear–typically at the top of the document or near your business details. |

| 3 | Insert Logo Image | Click “Insert” or “Add Image” and upload your logo file (preferably in PNG or JPG format). |

| 4 | Resize and Position | Adjust the logo size to maintain balance. Ensure it’s not too large or too small for the document layout. |

| 5 | Finalize and Save | After positioning your logo, save the document in your preferred format (PDF, DOCX) for future use. |

Tips for Logo Integration

- Maintain Proportions: Make sure your logo is clear and legible by keeping the original aspect ratio intact when resizing.

- Use Transparent Background: If possible, use a logo with a transparent background (like a PNG file) to blend seamlessly with your document’s layout.

- Consistent Branding: Ensure the logo’s size and position align with your other business materials for consistent branding across all platforms.

By following these simple steps, you can easily add your logo to any financial document, giving

Formatting Tips for Professional Invoices

Presenting a clear, well-organized document is crucial for maintaining a professional image in your business transactions. The format of a billing document can greatly impact how clients perceive your business and how efficiently payments are processed. A clean and structured layout not only ensures easy readability but also reinforces your brand’s credibility. Below are some essential formatting tips to make your financial documents look polished and professional.

1. Use a Clean and Organized Layout

A well-structured layout is the foundation of any professional document. Divide the page into clearly defined sections with ample white space to prevent the content from feeling crowded. Use headings and subheadings to separate the different parts of the document, such as client details, itemized charges, and payment terms.

- Align content properly: Keep all text aligned to the left for easy reading and avoid placing important details too close to the edges.

- Use appropriate margins: Leave enough margin space around the document to ensure a clean and uncluttered look.

2. Consistency in Fonts and Colors

Choose one or two complementary fonts for the document–one for headings and another for the body text. Stick to professional and easy-to-read fonts like Arial, Times New Roman, or Calibri. Avoid using decorative or overly stylized fonts, as they can make the document difficult to read.

- Limit the color palette: Use your brand’s colors sparingly to highlight key elements, such as headings or totals, but ensure that the text remains legible against the background.

- Font size: Keep the body text size between 10-12 pt and the headings slightly larger to create a clear hierarchy of information.

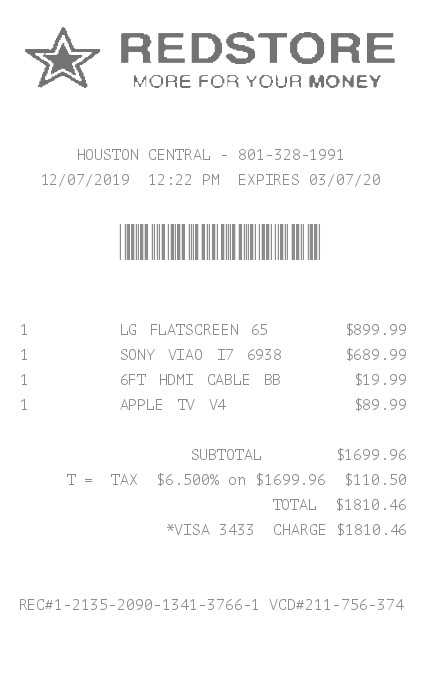

3. Organize Key Information in Tables

For itemized charges, services, or products, using a table is an effective way to organize and present information in a clean, easy-to-read format. Include columns for the description, quantity, price, and total for each item or service provided.

| Description | Quantity | Price | Total |

|---|---|---|---|

| Consulting Service | 1 | $500 | $500 |

| Product A | 3 | $30 | $90 |

Tables help clients easily review the charges and avoid confusion, especially for complex transactions with multiple items or services.

By following these formatting tips, you can create professional, well-organized documents that not only look great but also enhance the client experience. A consistent, polished appearance is a reflection of your business’s commitment to quality and professionalism.

Benefits of Using a Gucci Invoice Template

Utilizing a professionally designed billing document offers several advantages for businesses looking to maintain a high level of professionalism and streamline their financial processes. A well-crafted document helps ensure that all essential details are clearly presented, improving the clarity and efficiency of transactions. Below are some of the key benefits of using a pre-designed billing form for your business needs.

1. Time-Saving and Efficiency

One of the biggest advantages of using a ready-made billing document is the time saved in preparing each transaction. These documents are structured with all the necessary fields already in place, allowing you to simply add specific details like customer information and transaction amounts. This reduces the time spent formatting and organizing each document from scratch.

- Predefined Structure: Quickly add client details, products, services, and totals without worrying about layout or design.

- Automated Fields: Some templates even include automated fields for taxes or discounts, further streamlining the process.

2. Consistency and Professionalism

Using a uniform design for all your billing documents ensures consistency across your transactions. A polished, branded document reflects your business’s professionalism and creates a cohesive image for clients. Consistent branding helps reinforce your identity, making your business more recognizable and trusted.

- Brand Alignment: Incorporating your company’s logo, colors, and fonts into the form makes every document feel cohesive with your other marketing materials.

- Clear Structure: A professionally designed document ensures that all information is organized and easy to navigate, leaving a positive impression on clients.

By using a pre-designed, customizable document, you not only save time but also enhance the overall efficiency and professionalism of your business operations. Whether you’re handling one transaction or many, these benefits will help ensure smooth, error-free billing every time.

Invoice Template Features You Should Know

When selecting or customizing a professional billing document, it’s essential to understand the features that can make it more functional, efficient, and aligned with your business needs. A well-designed document doesn’t just contain the necessary fields but also includes various features that help streamline the process, ensure accuracy, and provide a polished appearance. Below are some key features to look for in a billing document design.

1. Customizable Fields

A good billing form allows you to easily customize various fields to suit the specific needs of each transaction. You should be able to modify client details, product descriptions, and payment terms, ensuring that every document is tailored to the unique aspects of each job or sale.

2. Itemized Breakdown

Clear, itemized listings of goods or services provided are crucial for transparency. The ability to list individual items, including quantities, prices, and totals, helps clients understand exactly what they are being charged for. This feature is important for both small transactions and more complex, multi-item purchases.

3. Automatic Calculations

A professional billing form can automatically calculate totals, taxes, discounts, and other charges, minimizing the risk of errors. This feature ensures that calculations are accurate and consistent across all documents, saving you time and preventing mistakes in manual calculations.

4. Branding Integration

The option to incorporate your company’s logo, colors, and fonts is essential for maintaining a cohesive brand identity. A professional design should enable easy customization of these elements to make each document reflect your business style and tone.

5. Clear Payment Terms

Payment terms should be easy to find and understand. Including predefined sections for payment due dates, accepted payment methods, and late fees helps prevent confusion and ensures that both parties are on the same page regarding transaction expectations.

6. Multiple Format Options

A good billing document should be available in multiple formats, such as PDF, DOCX, or even editable online forms. This flexibility allows for easy sharing with clients and enables you to keep digital records for future reference.

7. Professional Layout

The overall design should be clean, with a clear hierarchy of information. Sections should be well-organized, and there should be adequate spacing to ensure the document is easy to read. A well-structured layout contributes to the document’s professional look and makes it more likely to be taken seriously by clients.

By understanding these features, you can choose or customize a billing document that not only meets the functional requirements of your business but also projects professionalism and efficiency. Whether you’re a freelancer, small business owner, or large corporation, these features will help streamline your billing process and create a positive experience for your clients.

How to Include Tax Information on Gucci Invoices

Including accurate tax information on business billing documents is a vital part of ensuring compliance and transparency. Tax rates can vary depending on the location of your business, the nature of the transaction, and the applicable tax laws. To maintain professionalism and avoid confusion, it is essential to clearly present tax-related details in your financial documents. Below are some essential steps and tips on how to properly include tax information in your billing forms.

1. Specify the Tax Rate and Type

It’s important to clearly indicate the applicable tax rate and type (e.g., sales tax, VAT) for the transaction. This information should be displayed in a prominent section of the document, usually next to the total amount due or within the itemized list of charges. Make sure the tax rate is correct and relevant to the product or service being provided.

- Sales Tax: For transactions within the same region, include the local sales tax rate (e.g., 10%).

- VAT: If applicable, specify the VAT rate (e.g., 20%) and indicate whether it is included or excluded in the price.

2. Clearly Break Down Tax Amounts

For transparency, always break down the tax amounts separately from the subtotal and total. This can be done either by adding a row in the itemized table or by listing the tax amount separately. This ensures your clients can clearly see how much they are paying for taxes, which helps avoid misunderstandings.

| Description | Amount |

|---|---|

| Subtotal | $100.00 |

| Sales Tax (10%) | $10.00 |

| Total | $110.00 |

This breakdown provides clarity and ensures that both parties are aware of the exact tax obligations. It is especially important in jurisdictions where tax rates fluctuate or if your client is tax-exempt.

3. Include Your Tax Identification Number

For compliance, include your business’s tax identification number (TIN) or VAT ID if required by law. This helps establish your legitimacy and ensures that your client can easily verify the authenticity of the tax charges. This informat

Creating Custom Fields in Your Invoice

Customizing your financial documents allows you to tailor them to your specific business needs, ensuring that all relevant information is included and clearly presented. Adding custom fields is an effective way to capture additional data that may not be covered by standard sections. These fields can help personalize the document for individual transactions, making it more relevant and organized. Below are some steps and considerations when creating custom fields in your billing forms.

1. Identify Necessary Custom Information

The first step in adding custom fields is identifying what additional information is required for your business or industry. Custom fields can include anything from client-specific details to project numbers or internal references. Think about the data you often need to track that isn’t included in the default structure, and determine where these fields should appear.

- Client Reference Number: Useful for tracking specific projects or agreements with clients.

- Discounts or Promotions: If you offer special pricing, a field to enter discount details can be helpful.

- Payment Method: Include a space for clients to indicate how they plan to pay (e.g., bank transfer, credit card).

2. Add Custom Fields to the Document Layout

Once you’ve identified the custom fields needed, you can incorporate them into the layout of your billing document. Most document editing software, such as Word, Google Docs, or specialized invoicing platforms, offer options to create new fields or sections that can be easily inserted into the template. Make sure these fields are logically placed to maintain the clarity and flow of the document.

- Positioning: Place the custom fields where they won’t clutter the main content. For example, payment method could go near the bottom, and project reference could appear near the itemized list.

- Clear Labels: Each custom field should have a label explaining what information should be entered. Use concise and simple language to avoid confusion.

3. Ensure Flexibility for Different Transactions

Keep in mind that different transactions may require different sets of information. When designing custom fields, consider leaving some sections optional or adjustable depending on the nature of the sale. For instance, certain fields like delivery date or purchase order numbers might not be needed for every transaction, but they can be essential in others.

Adding custom fields to your financial documents enhances their versatility and ensures that you have all the necessary details at hand. Th

How to Save and Print Gucci Invoices

Once you have completed and customized your billing document, the next crucial step is saving and printing it. Ensuring that your document is correctly saved in a preferred format allows you to store it for future reference, while printing it ensures that you can provide clients with a physical copy if necessary. Below are the steps you can follow to save and print your financial document efficiently.

1. Saving the Document for Future Use

When saving your completed document, it’s important to choose a file format that ensures both accessibility and preservation of formatting. Most document editing platforms, like Microsoft Word, Google Docs, or other specialized tools, offer a range of formats for saving your work. Here are a few tips for saving your file:

- Save as PDF: PDF is the most widely accepted format for billing documents. It preserves formatting and ensures that the document appears the same across all devices and platforms.

- Use Descriptive File Names: Name the file in a way that makes it easy to identify. Include key information like the client name and date (e.g., “Invoice_JohnDoe_2024-11-07.pdf”).

- Organize Files: Save your documents in clearly labeled folders, such as “Invoices” or “Client Billings,” to keep everything well-organized.

2. Printing the Document for Physical Copy

If you need to provide a client with a physical copy, printing the document is simple, but you should ensure that the printout is clear and professional. Follow these steps for an optimal printout:

- Check the Page Layout: Before printing, make sure that the document is properly aligned, and no content is cut off. Ensure that the margins and page size are correct for printing.

- Use High-Quality Paper: For a professional look, print on clean, high-quality paper. White or off-white paper usually works best for official documents.

- Test Print: Consider doing a test print to ensure that the colors, fonts, and formatting appear as expected.

- Print Multiple Copies: If needed, print additional copies to keep for your records or to send to clients by mail.

By following these steps, you can easily save and print your billing documents, ensuring that you maintain proper records and provide your clients with the necessary paperwork for their own reference. Having both digital and physical copies helps streamline your workflow and guarantees that your business remains organized and professional.

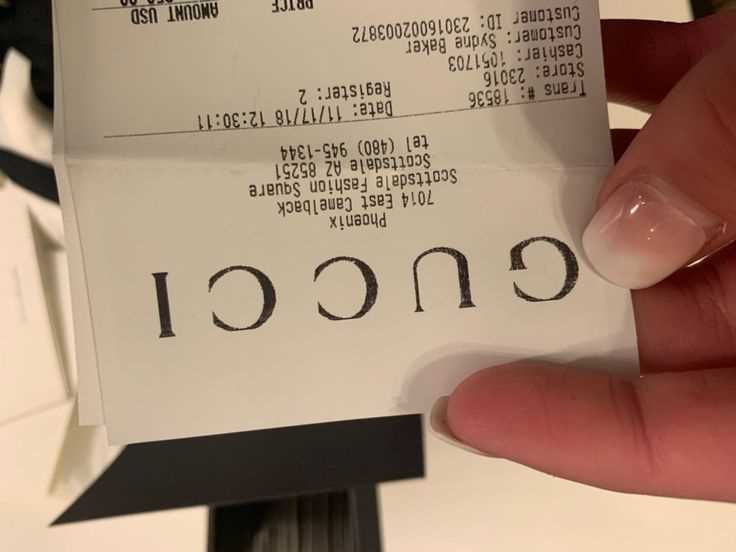

How Gucci Invoices Help Build Brand Image

Professional billing documents do more than just track payments; they also play a key role in shaping a company’s image and enhancing its reputation. For luxury brands, these documents serve as a direct reflection of the company’s values, attention to detail, and commitment to quality. By creating a seamless and visually appealing billing experience, brands can reinforce their identity and leave a lasting impression on clients. Below, we explore how well-crafted financial documents can contribute to the development of a strong brand image.

1. Reflecting Brand Values through Design

One of the primary ways billing documents help to build brand image is through design. A carefully designed form featuring consistent brand elements, such as logos, colors, and fonts, reinforces the company’s identity. These elements create a cohesive experience for the customer, making the document feel like an extension of the overall brand aesthetic.

- Logo and Branding: Including your company’s logo prominently on the document helps strengthen brand recognition.

- Color Palette: Using a color scheme that matches your brand’s visual identity promotes consistency and professionalism.

- Typography: The right choice of fonts can convey a sense of luxury, professionalism, or modernity, depending on the brand’s target audience.

2. Establishing Trust and Professionalism

High-quality, well-structured billing documents communicate trustworthiness and reliability. Clients are more likely to view a business as professional when they receive clear, easy-to-read documents that are free from errors and inconsistencies. A polished document can make all the difference in establishing a long-term, positive relationship with customers.

- Clarity and Transparency: Clear itemization of services, pricing, and terms demonstrates that the business is transparent and honest.

- Attention to Detail: A well-formatted document with correct information, such as accurate tax details and payment terms, shows that the company values precision.

- Consistency: Using the same design for every transaction reinforces the brand’s commitment to consistency in all aspects of its operations.

By thoughtfully designing and maintaining consistency in your business documents, you can ensure that they serve as an effective tool for building and reinforcing your brand’s image. When done correctly, these seemingly small details help create a cohesive and professional experience for your clients, fostering loyalty and trust in the brand.

Using Gucci Invoices for International Transactions

When conducting business across borders, it is essential to adapt your financial documents to meet international standards. This includes considering the complexities of different currencies, tax regulations, and language preferences. By ensuring that your billing documents are optimized for global transactions, you not only facilitate smoother payments but also strengthen relationships with international clients. Below are key points to consider when tailoring your financial documents for international business.

1. Include Multi-Currency Options

One of the primary challenges in international transactions is dealing with multiple currencies. To make it easier for clients in different countries, your document should clearly indicate the currency in which the transaction is being made. You can also provide the option to display prices in multiple currencies, depending on your client’s preferences.

| Item Description | Amount (USD) | Amount (EUR) |

|---|---|---|

| Product A | $150.00 | €135.00 |

| Product B | $250.00 | €225.00 |

| Total | $400.00 | €360.00 |

By clearly listing amounts in both the local and international currencies, you avoid confusion and make the payment process smoother for global clients.

2. Account for Different Tax Regulations

Tax rates and structures vary widely across countries. When conducting international business, it is crucial to ensure that the correct tax rates are applied and that they align with the regulations of the buyer’s location. Some countries may require specific tax identification numbers, or exemptions may apply depending on the nature of the transaction. Always verify the local tax laws to avoid errors.

- VAT and Sales Tax: In some countries, VAT or sales tax may be applicable. Ensure the document reflects this correctly based on the location of the buyer.

- Tax ID Numbers: Include your company’s international tax identification number or VAT number where necessary, as well as any local tax requirements.

- Exemptions: Make sure to include any relevant tax exemptions or reduct

How to Track Payments with Gucci Templates

Managing and tracking payments is crucial for maintaining financial accuracy and ensuring timely cash flow. Billing documents can play an important role in this process, especially when they are designed to keep track of payment statuses and provide clear references for both businesses and clients. By incorporating key tracking features into your billing system, you can effectively monitor outstanding amounts and follow up on overdue payments. Below are several strategies for tracking payments using your financial documents.

1. Include Payment Status Fields

One of the easiest ways to track payments is to include a “Payment Status” field on your document. This allows you to mark each transaction as “Paid,” “Pending,” or “Overdue,” providing a quick visual reference for both you and your clients. Keeping this section updated will help you monitor the payment progress and ensure that no payments are missed.

- Paid: Mark the transaction as “Paid” once the payment has been successfully processed.

- Pending: Use “Pending” for transactions where the payment is still awaiting completion.

- Overdue: If the payment has not been received by the due date, mark it as “Overdue” to signal that action is required.

2. Set Clear Payment Due Dates

To effectively track payments, you need to establish a clear and concise payment timeline. Clearly indicating the due date on your billing document makes it easier to track whether the payment has been made on time or if further follow-up is needed. You can also include a “Date Received” field where payment dates are logged.

- Due Date: Display the payment due date prominently on the document, ensuring that clients are aware of the deadline.

- Date Received: Once a payment is received, update the “Date Received” field to document the exact date of the transaction.

- Payment Method: Specify how the payment was made (e.g., bank transfer, credit card) to keep detailed records for future reference.

3. Utilize Digital Tools for Payment Tracking

For a more efficient approach, many businesses integrate digital payment tracking tools with their billing documents. These tools can automatically update payment statuses and send reminders for overdue payments. By using accounting software or invoicing platforms that allow for real-time tracking, you can streamline your process and ensure that all transactions are documented accurately.

- Automated Reminders: Set up automated reminders to notify clients of upcoming due dates or overdue payments.

- Real-Time Updates: Link your billing system with payment processors to receive real-time updates about the payment status.

- Client Portal: Provide clients with access to a portal where they can view their payment history and outstanding balances.

By implementing these payment tracking techniques in your financial documents, you can stay organized, reduce the chances of missing payments, and ensure that all transactions are properly recorded. This not only helps improve cash flow but also builds credibility and trust with your clients.