Freelancer Invoice Template in Word for Easy Professional Billing

Managing financial transactions is a crucial aspect of working independently, yet it can often be overwhelming without the proper tools. Clear and organized documents for requesting payment help ensure both professionalism and efficiency in your operations. Using structured templates can save time, reduce errors, and improve client relationships by presenting a clean and consistent format every time you submit a payment request.

For those navigating the world of freelance work, having a reliable document format to outline services, fees, and terms is essential. With the right format, you can easily keep track of completed tasks, agreed-upon amounts, and payment timelines. The goal is to streamline the process, avoid confusion, and create a seamless experience for both you and your clients.

In this guide, we explore how to utilize editable document formats that help simplify billing. Whether you’re new to independent work or an experienced professional, mastering this aspect of your business will free up more time to focus on what you do best.

Professional Billing Documents for Independent Workers

Creating organized and clear payment requests is essential for any independent worker. These documents not only serve as a record of services rendered but also reflect your professionalism and attention to detail. Having a predefined structure for your payment requests helps ensure accuracy and consistency, allowing you to manage your finances effectively.

Why Structured Payment Requests Matter

Having a well-organized document that outlines your services, rates, and payment terms ensures that there is no confusion between you and your clients. It also helps streamline your workflow by eliminating the need to manually design each new request. By using a flexible, editable format, you can easily adjust details as necessary while maintaining a professional appearance.

Key Benefits of Using Editable Documents

Editable files offer flexibility and convenience, allowing you to personalize your payment requests without starting from scratch every time. Customization options allow you to match the document to your specific needs and style, while ensuring all required information is clearly presented. Additionally, they can be reused across multiple clients and projects, saving you valuable time and effort.

Why You Need a Structured Billing Document

For anyone running an independent business, having a consistent system for requesting payments is vital. A structured document that outlines your services, terms, and amounts owed not only ensures clarity but also establishes trust with your clients. It eliminates confusion, minimizes the risk of errors, and makes tracking payments much easier.

Ensuring Professionalism and Accuracy

By using a predefined structure for your payment requests, you can avoid overlooking critical details. A well-designed document provides a professional appearance and assures your clients that they will receive all the necessary information to process payments promptly. Consistency is key–using the same format every time reduces the likelihood of mistakes.

Saving Time and Reducing Stress

Creating a document from scratch for each client or project can be time-consuming. Having a ready-to-use format saves you from having to start over each time, allowing you to focus on other important tasks. Additionally, it helps you stay organized and ensures that all necessary components–such as payment amounts, deadlines, and contact details–are included automatically, reducing stress and last-minute corrections.

How to Use a Document for Billing

Using a structured file for payment requests is a straightforward way to ensure that all necessary details are consistently included in your documents. These editable files allow you to quickly personalize your payment forms for each client while maintaining a professional appearance. With a few simple steps, you can create an accurate and organized request every time you need to request compensation.

Customizing Your Billing Form

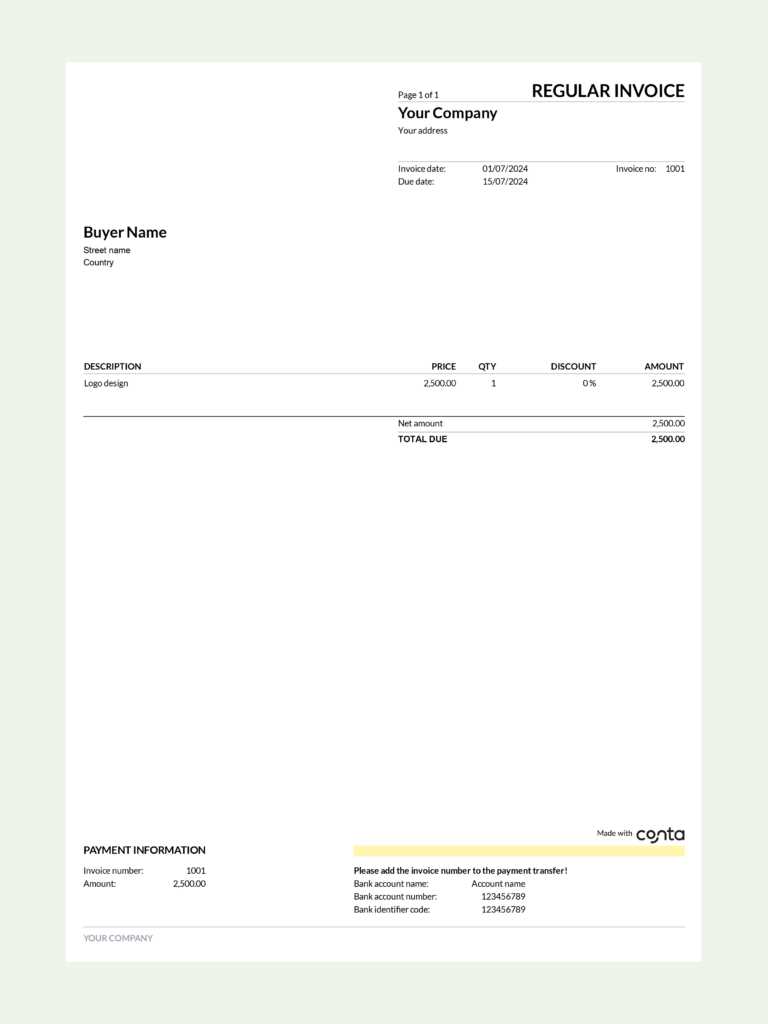

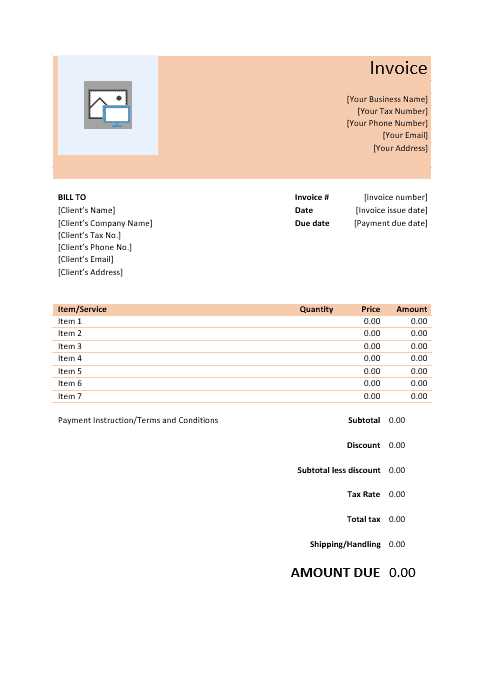

Start by opening your document and filling in the relevant details, such as your name, contact information, and the client’s details. Be sure to include a clear breakdown of the services provided, with corresponding amounts and dates. Customization options allow you to modify sections as needed, whether it’s adjusting the layout or adding specific payment instructions for your clients.

Saving and Sending Your Completed File

Once you’ve personalized the document, save it with an appropriate file name to keep everything organized. You can then send it electronically or print it for delivery. When sending via email, be sure to attach the finalized file and include any necessary instructions for payment, such as the due date or preferred payment methods. Consistency in delivery helps reinforce professionalism and makes the process smoother for both parties.

Key Features of a Billing Document

A well-organized payment request is essential for maintaining clear communication with clients and ensuring timely payments. The key to a successful billing document lies in its ability to clearly present all relevant information, making it easy for the client to understand what is owed and when it is due. A professional and comprehensive structure ensures that every necessary detail is included, leaving no room for confusion.

Essential Details to Include

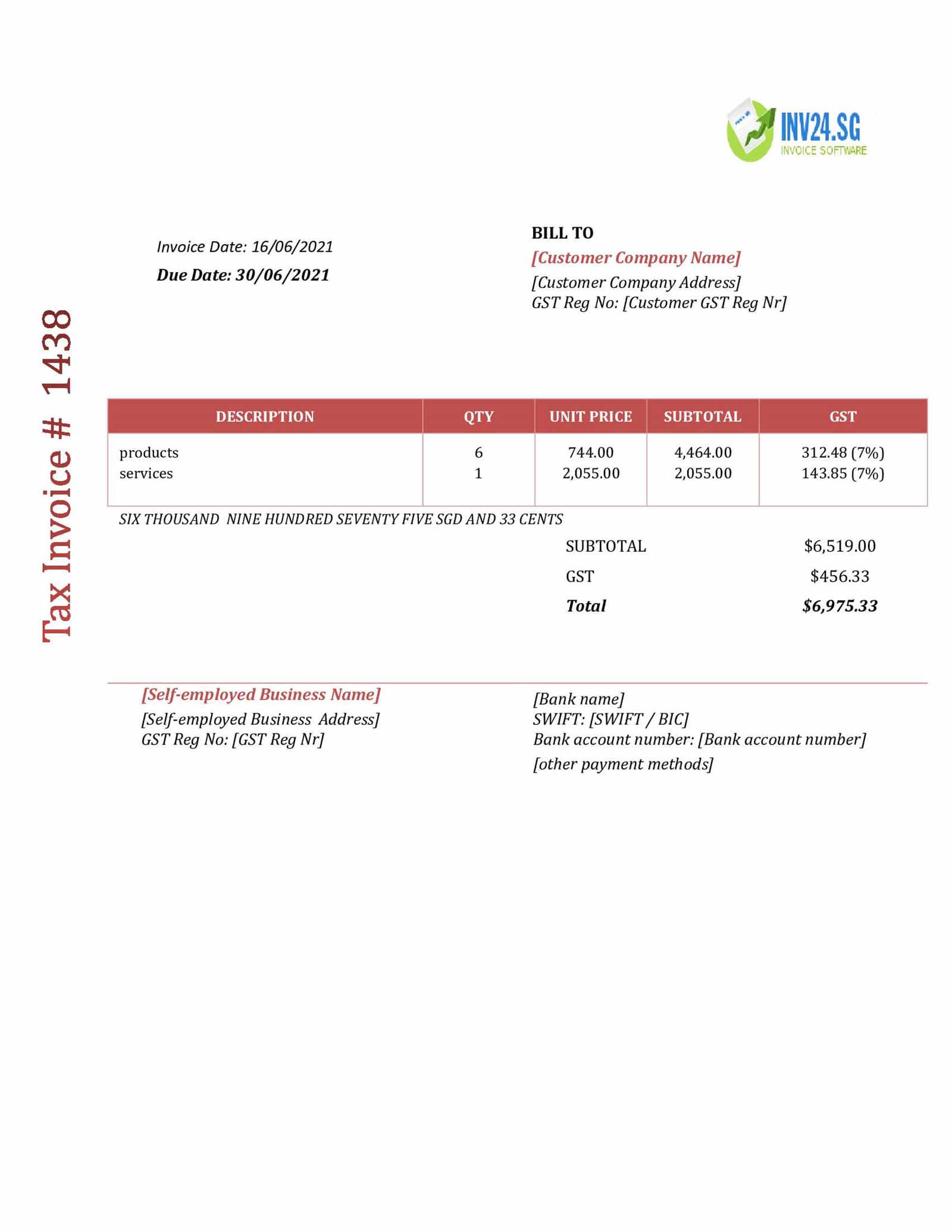

First and foremost, your document should include your full name or business name, contact information, and any relevant identification numbers, such as tax IDs. The client’s details should also be clearly stated, followed by an accurate list of services or products provided along with their corresponding costs. Clear descriptions ensure both parties are on the same page regarding the work completed and the agreed-upon terms.

Payment Terms and Due Dates

To avoid misunderstandings, it’s important to include clear payment instructions. This includes specifying the total amount due, the due date, and preferred payment methods. Including any applicable late fees or discounts for early payment helps set expectations. A professional document will also highlight the payment deadline in a prominent location, ensuring that it doesn’t go unnoticed. Clarity in terms helps facilitate a smoother transaction process.

Benefits of Customizing Your Payment Request

Personalizing your payment request offers several advantages, allowing you to tailor the document to your specific needs while maintaining a professional appearance. Customization not only enhances clarity but also provides a more polished and branded experience for your clients. By adjusting key details and presentation, you ensure that every aspect of the payment process aligns with your business style and requirements.

Improved Professionalism and Branding

When you customize your document, you can incorporate your company’s logo, colors, and branding elements. This helps create a cohesive look across all business communications, reinforcing your brand’s identity. A well-designed, personalized document signals professionalism and makes a lasting impression on your clients. Consistency in design builds trust and enhances your business reputation.

Enhanced Accuracy and Clarity

Customizing your document allows you to adjust sections to better fit the services provided, payment terms, and specific client requirements. You can highlight key information, such as discounts, special conditions, or preferred payment methods, making it easier for clients to understand. By customizing the layout, you can ensure that critical details are emphasized, reducing the likelihood of misunderstandings. Clear customization leads to smoother transactions and quicker payments.

Step-by-Step Guide to Creating Payment Requests

Creating a well-organized document for requesting payment doesn’t have to be a complicated process. By following a few simple steps, you can ensure that all the necessary information is included, making it easy for clients to understand what is owed and how to proceed with payment. This guide will walk you through the process, from start to finish, to help you create a clear and professional document every time.

Gather Necessary Information

Before you begin, make sure you have all the required details on hand. This includes your personal or business information, the client’s details, a breakdown of services or products provided, and agreed-upon amounts. Make sure you have accurate dates, any payment terms, and your preferred payment methods. Accuracy in data is crucial to prevent delays or misunderstandings.

Design and Format the Document

Once the necessary information is collected, it’s time to format your document. Begin by including your contact details at the top, followed by the client’s information. Then, list the services provided along with the corresponding costs. Make sure to clearly highlight the total amount due and the payment due date. You can also add any additional terms, such as late fees or discounts. Keep the layout simple and organized for easy readability.

Essential Information to Include in Payment Requests

To ensure smooth transactions and avoid any misunderstandings, it’s crucial to include all necessary details in your payment request document. A well-structured form will clearly communicate the amount due, the services provided, and any relevant terms, ensuring both parties are on the same page. Including the right information not only helps avoid confusion but also streamlines the payment process.

At a minimum, your document should include your name or business name, contact information, and a unique reference number for the request. You should also include the client’s name, address, and contact details. A clear breakdown of services or products rendered, along with the corresponding costs, is essential. Finally, specify the total amount due, payment terms, and the due date for payment. This basic information will ensure that both you and your client are aligned on the payment details and avoid any delays in processing.

Common Mistakes in Payment Requests

While creating a payment request may seem straightforward, there are several common mistakes that can cause delays or confusion. These errors can range from simple oversights to more significant issues that impact the clarity or accuracy of the document. Identifying and avoiding these mistakes ensures that your requests are professional and clear, minimizing the risk of payment delays.

Missing or Incorrect Client Information

One of the most common errors is failing to include the correct contact information for either you or your client. This can lead to confusion and payment delays. Always double-check that the client’s name, address, and contact details are accurate. Errors in this area can make the process unnecessarily complicated and affect your credibility.

Unclear Payment Terms

Another frequent mistake is not specifying clear payment terms. Failing to include the due date or acceptable payment methods can lead to misunderstandings. It’s also important to clarify any late fees or discounts for early payment to set proper expectations. Ambiguity in terms can cause frustration and result in delayed payments.

How to Organize Your Payment Request Files

Keeping your payment request files organized is essential for managing your business efficiently. Properly organizing these documents allows you to easily track payments, ensure timely follow-ups, and maintain a clear record for tax purposes. By implementing a consistent system, you can avoid confusion and streamline your workflow.

1. Create a Folder Structure

Start by setting up a clear folder system on your computer or cloud storage. This will help you easily find documents when needed. Consider organizing your folders by:

- Client Name: Store all documents related to a particular client in one folder for easy access.

- Project or Job: If you work on multiple projects for the same client, organize files by each project or job.

- Year or Month: For larger businesses, sorting files by year or month can help with archiving and filing taxes.

2. Name Your Files Consistently

Consistent naming conventions can save you a lot of time. Ensure that each document includes key details such as the client’s name, the project or job name, and the date. For example:

- ClientName_ProjectName_InvoiceDate

- JohnDoe_WebDesign_012023

This structure will allow you to quickly locate and identify files without needing to open them first.

How to Ensure Accurate Payment Terms

Clear and precise payment terms are essential for avoiding misunderstandings and ensuring timely transactions. By outlining the specifics of the payment process upfront, you set expectations for both yourself and your client. This reduces the risk of disputes and encourages faster payments. Here’s how to ensure that your payment terms are accurate and easily understood.

1. Be Specific with Due Dates

One of the most important elements of your payment terms is the due date. Clearly stating when payment is expected can help avoid delays. Make sure the due date is:

- Realistic: Consider the client’s payment cycles and ensure the date is achievable.

- Visible: Place the due date in a prominent location on your document to avoid confusion.

- Consistent: If you have ongoing projects with similar timelines, standardize your due dates to make future planning easier.

2. Specify Payment Methods

It’s important to specify the acceptable methods of payment. Whether you prefer bank transfers, online payment platforms, or checks, make sure to list the available options. This can prevent delays and complications by:

- Providing multiple options: Offer a range of methods to accommodate different client preferences.

- Clarifying any fees: If there are fees associated with certain payment methods, mention them upfront.

- Including your payment details: Ensure you provide accurate information such as bank account numbers, PayPal details, or other relevant data.

3. Outline Late Fees and Discounts

To encourage timely payments, include clear policies about late fees and discounts for early payments. This motivates clients to pay on time while also offering an incentive for early settlement. Be sure to:

- Specify Late Fees: State the percentage or flat fee that will be charged for late payments, and include how long after the due date the fee applies.

- Offer Early Payment Discounts: If applicable, mention any discounts available for payments made ahead of schedule.

- State Clear Terms: Clearly describe when and how these fees or discounts will apply to avoid any confusion.

Tips for Professional Payment Request Design

A well-designed payment request document not only helps communicate essential information clearly but also reflects your professionalism. The appearance of this document can influence how clients perceive you and may even impact the speed at which they process payments. By following a few simple design principles, you can ensure that your request is both functional and visually appealing.

1. Keep the Layout Clean and Organized

Ensure your payment request is easy to read by organizing the content in a clean, logical layout. Use clear headings, bullet points, and sections to break up information. A well-structured layout makes it easier for clients to quickly locate important details, such as the amount due or payment terms. Focus on:

- Whitespace: Use sufficient space between sections to avoid clutter and create a balanced design.

- Hierarchy: Highlight key details like total amount due and payment methods by making them larger or bold.

- Consistent Alignment: Ensure that all text is aligned properly for a polished, professional look.

2. Choose Professional Fonts and Colors

The typography and color scheme you use can impact the perception of your payment request. Stick to simple, professional fonts such as Arial or Times New Roman. Use dark colors for the text, such as black or dark gray, to enhance readability. If you’d like to incorporate color, use it sparingly to highlight specific sections or details, but avoid overuse. Focus on:

- Legibility: Ensure that your chosen fonts are easy to read on both screens and printed copies.

- Subtle Color Use: Choose neutral tones or a minimal color palette that conveys professionalism.

- Consistency: Stick to the same font styles and sizes throughout the document to maintain a cohesive appearance.

Using Payment Request Templates for Tax Purposes

Organizing payment documents is an important part of managing taxes. By using pre-designed formats for payment requests, you can ensure that all necessary details are included, making tax reporting easier and more accurate. These documents can serve as evidence of income and support tax deductions, saving you time during the filing process and helping you avoid costly mistakes.

1. Track and Categorize Your Income

Using a standardized payment request format allows you to track your earnings consistently. This is crucial when preparing for tax season, as you will need clear records of all payments received. By including specific details, such as the date of payment, client name, and amount, you can categorize your income more effectively.

2. Including Relevant Tax Information

Some payment documents may need to include tax-related information, such as VAT numbers or other tax identifiers, depending on your location and business type. Ensure that the design allows for easy inclusion of these details to avoid any confusion when submitting tax forms.

| Information to Include | Tax Purpose |

|---|---|

| Date of Transaction | To determine taxable periods and income |

| Amount Due | For calculating taxable income |

| Client’s Contact Information | For reference and to prove the legitimacy of the transaction |

| Tax ID or VAT Number | To comply with tax regulations |

By using a consistent format, you can streamline your record-keeping and tax preparation, ensuring that you meet all necessary legal requirements and avoid errors during filing.

Integrating Payment Request Formats with Accounting Software

Integrating your payment request documents with accounting software can significantly streamline your financial management. By linking these files with your accounting tools, you can automatically track and categorize your earnings, expenses, and taxes. This integration helps reduce the risk of human error and ensures that your records are always up to date.

1. Automating Data Entry

One of the biggest advantages of integrating payment request documents with accounting platforms is the automation of data entry. Instead of manually inputting transaction details, you can set up your accounting software to automatically extract information from your payment requests. This eliminates the time-consuming process of manual entry and reduces the likelihood of mistakes in your financial records.

2. Simplifying Tax Calculations and Reporting

With integrated software, tax calculations and reporting become more accurate and efficient. By linking your payment requests with accounting tools, all relevant financial data is collected in one place, making tax preparation simpler. The software can automatically calculate tax liabilities, deductions, and generate reports that are ready for submission to tax authorities.

Free vs Paid Payment Request Format Options

When choosing a design for your payment documents, you have the option to use either free or paid solutions. Both options offer benefits depending on your needs and the level of customization you require. Free formats are ideal for those just starting or with simpler requirements, while paid formats may provide more advanced features and support for complex invoicing needs.

1. Benefits of Free Formats

Free payment request designs are widely available and can be easily accessed without any upfront costs. These options typically offer basic layouts that cover the essential information needed for a payment record. They are a great choice for small businesses or individuals who have straightforward billing needs and do not require extensive customization.

2. Advantages of Paid Solutions

Paid formats, on the other hand, often come with more robust features such as advanced customization options, professional design elements, and integrations with accounting tools. These premium solutions are designed for businesses that require more flexibility and want to maintain a polished and professional appearance in their documentation. Additionally, paid options may include customer support and regular updates, ensuring your documents remain compliant and up-to-date.

Creating Recurring Payment Requests for Clients

Setting up recurring payment requests can save time and ensure consistent cash flow when working with clients on ongoing projects. By automating the process, you can avoid the need to manually create and send payment documents each month, while ensuring that your clients are billed on time for services rendered regularly. Below is a simple guide on how to structure and manage recurring payment records.

Recurring payments are especially useful for subscription-based services, maintenance contracts, or ongoing consulting engagements. These documents typically include the same set of information for each period, with only the date or amount being updated periodically. To make this process more efficient, it’s important to have a clear structure in place.

| Step | Action |

|---|---|

| 1. Define Billing Cycle | Choose how often the client should be billed, such as weekly, monthly, or quarterly. |

| 2. Set Fixed Amount | Decide on the fixed payment amount or pricing structure for each billing period. |

| 3. Include Payment Terms | Clearly specify the due date and any applicable late fees or discounts for early payments. |

| 4. Automate Reminders | Set up automated reminders to ensure clients receive timely notifications for upcoming payments. |

By automating recurring payments and ensuring consistency in your records, you can focus more on providing value to your clients rather than worrying about administrative tasks. Be sure to review your setup regularly to make sure everything remains aligned with your business goals and client agreements.

What to Do if Payments Are Delayed

When clients miss a payment deadline, it can cause unnecessary stress and disrupt cash flow. It’s important to address late payments promptly and professionally to maintain healthy business relationships while ensuring timely compensation for your services. Below are steps to follow if you encounter delayed payments.

1. Review the Payment Terms

Before taking any action, check the agreed-upon payment terms. Confirm the payment due date, the method, and any grace period. Sometimes, a delay could simply be a misunderstanding or a minor error in processing. Review your document or agreement to ensure everything aligns.

2. Contact the Client Politely

If the payment is still overdue after the deadline, it’s time to reach out. A polite reminder can go a long way. Here are some steps to follow:

- Send a friendly reminder email or message, clearly stating the overdue amount and the original payment date.

- Provide payment details again, making sure the client has all the necessary information to process the payment.

- Ask if there are any issues with the payment method or the billing process that need to be resolved.

3. Offer Flexible Payment Options

If the client is facing financial difficulties or challenges, consider offering an alternative payment plan. Allowing them to break up the payment into smaller installments could make it easier for both parties and prevent future delays.

4. Send a Formal Reminder

If there is still no response after your initial reminder, a more formal approach may be necessary. Draft a professional letter or email indicating that the payment is now officially overdue and include a new deadline for payment. Be sure to mention any late fees if they are outlined in your agreement.

5. Seek Legal Help if Necessary

If the payment continues to be delayed or ignored, you may need to consult legal assistance. Depending on the amount owed and your relationship with the client, a lawyer can provide options such as sending a demand letter or taking further legal action.

6. Prevent Future Delays

To prevent late payments in the future, consider revising your payment terms, offering upfront payments, or using an automated payment system. Establishing clear terms and communicating expectations early on can help reduce payment issues down the line.

By following these steps, you can maintain professionalism and ensure that you are compensated for your work without compromising the relationship with your clients.

Improving Client Relations with Invoices

Maintaining strong relationships with clients goes beyond delivering quality services–it also involves clear communication regarding payments. One often-overlooked element in this process is the document that outlines the financial transaction. By ensuring that this document is professional, transparent, and easy to understand, you can improve your business relationships and encourage timely payments. Below are some strategies for leveraging your financial documentation to build better rapport with your clients.

1. Clear and Professional Communication

When you create a detailed and organized document, it shows your client that you are professional and serious about your business. Ensuring clarity in the payment terms, service details, and amounts owed builds trust and reduces confusion. Here’s how you can enhance communication:

- Use clear, concise language and avoid jargon that may confuse the client.

- Include a breakdown of services or products provided, ensuring full transparency on what the client is paying for.

- Ensure your document is visually organized, with easily identifiable sections such as payment terms, due dates, and contact information.

2. Timely and Consistent Documentation

Sending your document promptly and consistently shows clients that you value their time and business. Timely payment requests demonstrate your organization and efficiency, making the process smooth for both you and your client. To improve consistency:

- Set a schedule for when you will send your payment requests to avoid delays.

- Ensure that your records are consistent and match the agreed terms, keeping everything accurate and up-to-date.

- Send reminders ahead of due dates to keep the payment process at the forefront of the client’s mind.

3. Personalize and Show Appreciation

Clients appreciate when they feel valued, and a personalized approach in your payment requests can strengthen your professional relationship. By adding a note of appreciation for their business or offering a small gesture, such as a discount for early payment, you foster goodwill.

- Include a personalized thank-you note for the client’s continued business.

- Offer flexible payment options or early payment discounts as a token of appreciation.

- Customize the document with the client’s specific details to make it more personal and relevant.

4. Handling Disputes Professionally

If a dispute arises, handle it with professionalism and understanding. An open, non-confrontational dialogue can help resolve any issues quickly and efficiently. Addressing concerns promptly, whether about pricing or the scope of services, shows your willingness to collaborate with clients.

- Respond promptly to any concerns raised by the client.

- Offer to discuss the issue over a call to clarify any misunderstandings.

- Make necessary adjustments if the error lies with you, and ensure the client is satisfied with the resolution.

By using payment documents as a tool for transparency, appreciation, and open communication, you can enhance

Where to Download Professional Payment Documents

For individuals looking to streamline their financial transactions, accessing well-designed and easy-to-use payment request documents is crucial. These documents ensure that clients receive clear and concise information about amounts owed, due dates, and services rendered. Fortunately, there are several platforms where you can download professional, customizable options suited to your needs.

1. Online Document Repositories

There are several online platforms offering free and paid document designs for business transactions. These platforms provide a wide range of options for customizing your financial documents to fit your professional image. Some of the best-known repositories include:

- Template.net: A comprehensive site with various business document options, including payment request templates.

- Canva: Known for its user-friendly design interface, Canva offers customizable documents tailored to different industries.

- Google Docs: A reliable source for simple and clean designs that are easy to adapt for professional use.

- Microsoft Office Templates: A range of downloadable options that integrate seamlessly with Microsoft Office tools.

2. Accounting and Financial Software Providers

If you’re using accounting software, many providers offer pre-designed documents that can be directly downloaded or integrated into your system. These options are often built to work with your current workflow and can be updated automatically. Some of the popular providers include:

- QuickBooks: Offers customizable billing templates that can be exported for various purposes.

- Xero: Provides templates for creating professional payment requests within their accounting platform.

- FreshBooks: Known for its easy-to-use interface, it offers a variety of options to download for financial transactions.

3. Freelance Platforms

Many freelance service platforms provide payment document templates as part of their support services. These templates are specifically designed to meet the needs of independent professionals. Here are some platforms offering templates:

- Upwork: Offers invoice creation tools for freelancers to easily generate payment requests and send them to clients.

- Fiverr: Provides customizable payment documents that can be downloaded and used for client transactions.

Regardless of your needs, whether you’re an individual or a business, these platforms offer easy access to professional documents, helping you manage financial communications smoothly and effectively.