Free Invoice Template Wave for Effortless Billing and Professional Invoices

Managing financial transactions efficiently is a key part of any successful business. Whether you’re a freelancer, a small business owner, or a large company, having the right tools to create and send documents that track payments and services can save valuable time and improve overall organization. With the right resources, you can simplify the process of requesting payments while ensuring your documents look professional and well-organized.

Simple yet effective solutions allow businesses to generate accurate, customizable documents quickly and without hassle. These tools not only ensure that all necessary information is included but also provide options for personalizing the look and feel of each record. This customization helps to build trust with clients, making your business appear more polished and reliable.

In the next sections, we’ll explore how you can leverage these tools to streamline your billing practices and enhance productivity. From easy-to-use features to seamless integrations, the right approach can make invoicing both simple and efficient.

Why Choose Wave for Invoicing

When it comes to managing payments and creating professional business documents, selecting the right platform can make a world of difference. A reliable and user-friendly solution can help streamline your workflow, ensure accuracy, and enhance client relationships. This is where Wave stands out, offering a versatile and efficient tool for handling financial tasks with ease.

Key Benefits of Using Wave

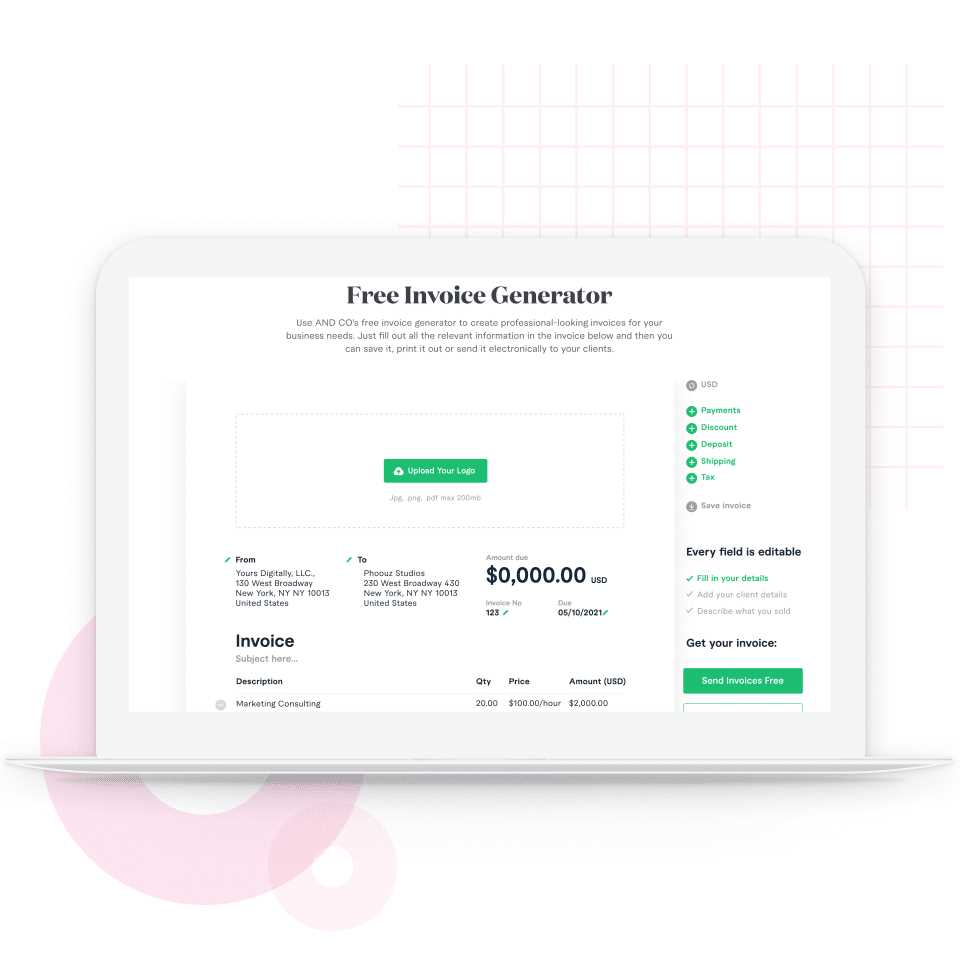

Wave provides a comprehensive suite of features designed to simplify the billing process and help businesses stay organized. Its intuitive interface, combined with powerful tools, ensures that even those with limited technical expertise can create polished, accurate documents quickly. Here are some of the main advantages:

- Ease of Use: The platform is designed with simplicity in mind, making it easy for anyone to start using right away.

- Customization Options: Tailor the look of your documents to fit your brand’s identity, from colors and logos to personalized text.

- Automatic Calculations: Automatically add taxes, discounts, and totals, reducing the chances for human error.

- Secure Storage: Keep all your financial records in one safe, digital location, easily accessible whenever needed.

- Seamless Integrations: Connect with other accounting tools and software to manage your finances effortlessly.

How Wave Enhances Productivity

By automating many aspects of financial documentation, Wave helps save time and reduce administrative burdens. You can create, track, and manage your records all in one place, ensuring that you never miss a deadline or important detail. This streamlined approach allows you to focus more on growing your business and serving your clients.

- Time-saving features: Automation and pre-built options reduce the time spent on manual entry.

- Real-time tracking: Monitor the status of your documents and payments with live updates.

- Access from anywhere: Wave is cloud-based, so you can manage your tasks from any device, at any time.

How to Use a Free Invoice Template

Creating accurate and professional business documents is a crucial task for any entrepreneur or freelancer. With the right tools, you can streamline the process and ensure that your records are both clear and well-organized. Using a ready-made format for generating payment requests allows you to save time and focus on other important tasks while still maintaining a high level of professionalism.

Step-by-Step Guide to Creating a Document

To get started with the document creation process, simply follow these steps. The platform offers an easy-to-navigate interface that makes it quick to generate a polished record. Here’s what you need to do:

- Choose a Layout: Select a structure that fits your needs, whether you prefer a minimalist or detailed design.

- Customize the Details: Enter your business name, contact information, and any other relevant data such as client details, product/service descriptions, and pricing.

- Set Payment Terms: Specify deadlines for payments, any applicable taxes, and payment methods available for your clients.

- Review and Save: Double-check the information for accuracy, then save the document in your preferred file format.

Understanding the Key Sections of the Document

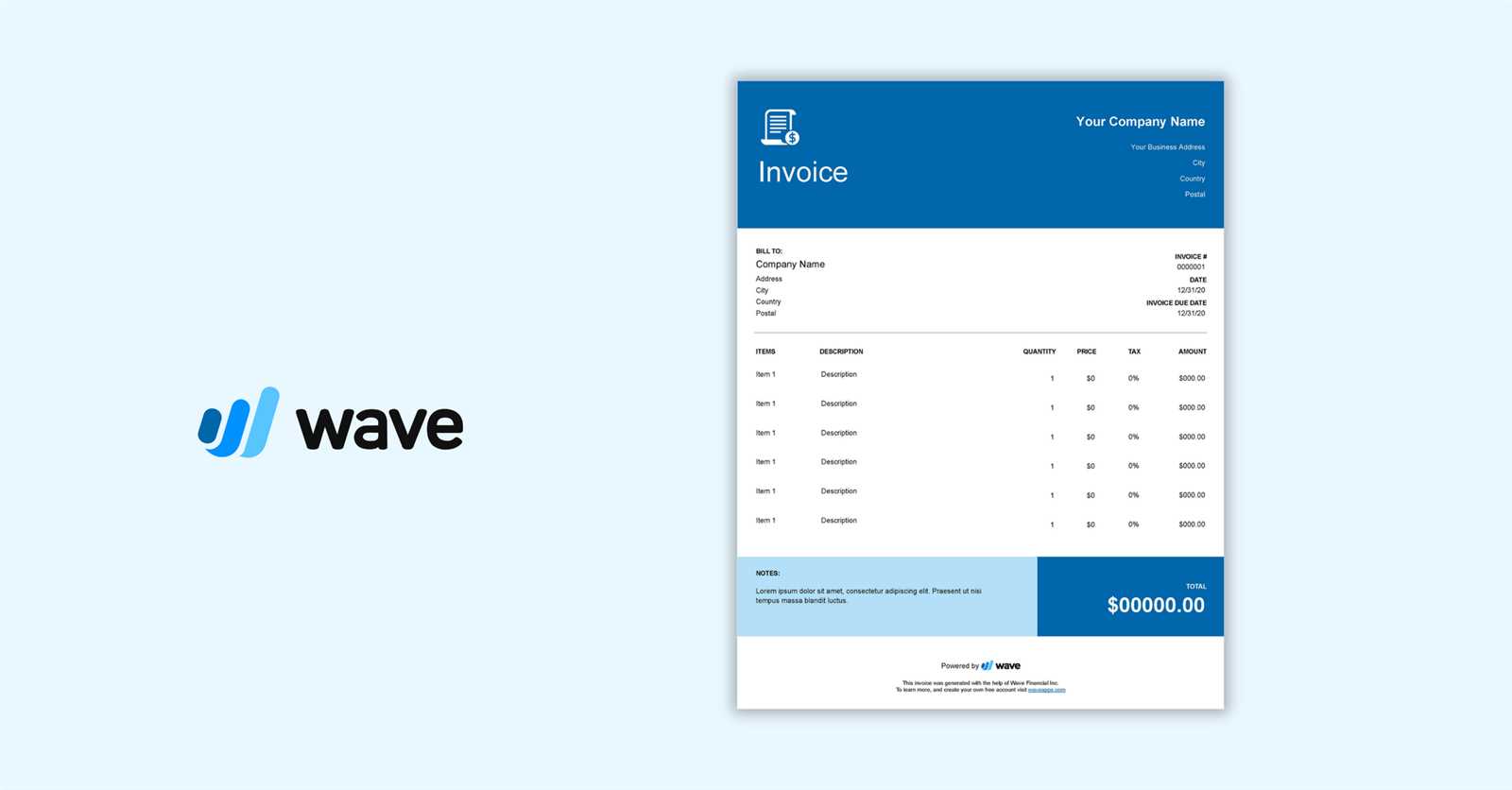

While the layout may vary depending on the platform or service, the essential components remain consistent across most options. Below is a simple example of the key sections you should expect to include in your document:

| Section | Description |

|---|---|

| Header | Includes your business name, logo, and contact information. |

| Client Information | Lists the client’s name, address, and contact details. |

| Service/Product Description | Outlines the products or services provided, with quantities and prices. |

| Payment Terms | Shows payment methods, due date, and any applicable taxes or discounts. |

| Footer | Includes additional notes, terms and conditions, or other relevant information. |

Once these sections are filled out, you

Benefits of Customizing Invoice Templates

Tailoring business documents to suit your brand can significantly enhance professionalism and improve client relations. Customization allows you to present a polished and cohesive image while also ensuring that all necessary information is clearly communicated. Whether it’s adjusting the layout, adding your logo, or modifying the content, the ability to make changes to the standard format offers several advantages for your business.

Why Personalization Matters

Customizing your payment request documents goes beyond aesthetics. It helps you align the document with your brand identity, making it instantly recognizable and building trust with clients. Customization also improves clarity and accuracy, as you can adjust fields according to your specific needs. Here are some of the key benefits:

- Brand Recognition: Adding your logo and company colors helps reinforce your brand’s identity with each transaction.

- Professional Appearance: A personalized design elevates the perception of your business, making you appear more established and reliable.

- Improved Client Trust: Clear, customized documents reflect attention to detail and care, which can increase client confidence.

- Efficiency: Adjusting the structure of the document allows you to highlight key information, making it easier for clients to understand payment terms.

Essential Customization Features

When customizing your documents, there are several key areas to focus on. Below is a table outlining the most important aspects that can be tailored:

| Customization Area | Benefit |

|---|---|

| Logo & Branding | Incorporating your logo and colors makes your documents consistent with your brand image. |

| Font Style & Size | Choosing a readable, professional font style enhances clarity and presentation. |

| Payment Terms & Instructions | Modify the layout to highlight payment methods, deadlines, and any special terms specific to each transaction. |

| Additional Notes | Include custom messages, such as thank-you notes or reminders about policies, which add a personal touch. |

These customization options allow you to create documents that not only look great but also serve the unique needs of your business and clients. Customization empowers you to present yourself in the best possible light while maintaining the efficiency and accuracy of your financial records.

Creating Professional Invoices with Wave

Generating well-crafted business documents is essential for maintaining professionalism and ensuring smooth transactions. With the right tools, you can easily create detailed, accurate records that reflect your business’s high standards. Whether you’re managing small projects or handling larger contracts, having the ability to generate polished, professional documents quickly is crucial for building trust and keeping everything organized.

Easy Steps to Generate Business Documents

Creating high-quality documents is simple and efficient with the right platform. By following a few straightforward steps, you can craft a clean, professional document ready for submission. Here’s how:

- Select a Layout: Choose from a variety of pre-designed formats to match the style that best suits your business needs.

- Fill in the Details: Add key information such as your business name, contact information, client data, services provided, and pricing structure.

- Set Payment Terms: Include specific details like due dates, payment methods, and any applicable taxes or discounts.

- Review and Send: Ensure all details are correct, then generate the document and send it directly to your client via email or download it for printing.

Key Features for Professional Documents

The platform provides several tools to help enhance the quality and appearance of your documents, ensuring they always reflect your brand’s professionalism. Some of the standout features include:

- Customizable Design: Personalize the look of your document by adding your logo, adjusting fonts, and choosing your brand colors.

- Automated Calculations: The platform automatically calculates totals, taxes, and any applicable discounts, reducing errors and saving you time.

- Payment Tracking: Keep track of outstanding amounts and monitor when payments are made, all in real time.

- Secure and Accessible: Your records are securely stored in the cloud, allowing easy access from any device, at any time.

By utilizing these tools, you can create documents that not only look professional but are also tailored to meet your business needs. Whether you are a freelancer, a small business owner, or a large corporation, this platform makes it easy to produce accurate and reliable documents for any transaction.

Wave Invoice Template Features Explained

When it comes to managing financial documents efficiently, having the right features at your disposal can make a significant difference. A comprehensive tool allows you to easily create, customize, and track your business records, providing everything you need in one place. The platform offers a variety of features designed to simplify the process while ensuring your documents maintain a professional appearance.

Key Features for Easy Document Creation

The platform is built with user-friendliness in mind, offering a wide range of features that make document creation fast, flexible, and efficient. Below are some of the key capabilities:

- Pre-built Layouts: Choose from a selection of professionally designed formats that can be easily tailored to fit your business needs.

- Customizable Fields: Adjust sections such as product descriptions, quantities, pricing, and payment terms to reflect the specifics of each transaction.

- Automatic Calculations: The system automatically calculates totals, taxes, and discounts, reducing the chances of human error and saving time.

- Save and Reuse: Once a document is created, save it for future use or create similar ones quickly by reusing the layout and information.

Additional Functionalities for Enhanced Productivity

In addition to document creation, the platform also offers powerful tools that help manage and track payments, ensuring that all financial activities are properly documented and monitored.

- Payment Tracking: Easily monitor the status of payments, see which records are paid or overdue, and set reminders for outstanding balances.

- Cloud Storage: Securely store your documents in the cloud, allowing you to access and manage them from any device, anytime, and from anywhere.

- Seamless Integration: Integrate with accounting software and other tools to ensure all your financial data is connected and up-to-date.

By using these features, you can quickly generate and manage your financial documents with accuracy and ease, helping you stay organized and professional in your business dealings.

Tips for Designing Effective Invoices

Creating clear and professional business documents is essential for ensuring smooth transactions and building trust with clients. A well-designed document not only conveys important information but also reinforces your brand’s identity. Whether you’re providing services or selling products, following a few design best practices can make your records more effective and easier to understand.

Key Design Principles for Professional Documents

When designing your business documents, there are several important aspects to keep in mind. A good layout helps your client easily find the most critical information, while a clean, organized design shows professionalism. Below are a few key principles to consider:

- Simplicity: Keep the design clean and uncluttered. Avoid using too many colors or fonts, as this can make the document difficult to read.

- Clear Structure: Organize your document in a logical flow, ensuring that all essential details, such as payment terms and contact information, are easy to locate.

- Brand Consistency: Use your company’s logo, colors, and fonts to ensure that your documents are consistent with your brand identity.

- Legible Fonts: Choose clear, readable fonts that are easy on the eyes. Stick to one or two font styles to maintain a professional look.

Essential Elements for Every Document

Including the right details in your document is critical to ensuring accuracy and transparency. Here are the core components that should always be present in your design:

| Section | Description |

|---|---|

| Header | Includes your business name, logo, and contact information for easy identification. |

| Client Information | Provides your client’s name, address, and contact details to ensure proper communication. |

| Transaction Details | Describes the products or services provided, including quantities, unit prices, and any applicable taxes. |

| Payment Terms | Clearly outlines payment methods, deadlines, and any discounts or late fees. |

| Footer | Can include additional notes, terms, or your business’s legal disclaimers. |

By following these design tips and ensuring that all the key elements are included, you can create business documents that are both functional and visually appealing, ultimately making your transaction processes smoother and more professional.

How to Download Free Wave Invoice Templates

Getting access to ready-made business documents can save you a lot of time and effort. Many platforms offer easy-to-use solutions for creating and managing these records, and with a few simple steps, you can download customizable formats that suit your specific needs. The process of obtaining these resources is quick and intuitive, allowing you to start generating documents almost immediately.

Steps to Download Your Business Document Format

Follow these easy instructions to access and download the necessary files for your business documentation needs. Once downloaded, you can begin customizing the format with your company details and client information.

- Create an Account: First, register for an account on the platform where the documents are offered. This will allow you to save your progress and access all features.

- Choose a Document Type: Select the format that best suits the type of transaction you are managing, such as a service request or product sale.

- Customize the Fields: Before downloading, personalize the format with your business name, logo, and specific transaction details.

- Download the Document: Once your document is ready, simply click the download button to save the file to your computer or device.

What You Can Do with Your Downloaded File

After downloading your business document, you have several options to manage and share it efficiently. You can store it in the cloud, print it for physical records, or email it directly to your clients for fast communication.

- Store Digitally: Save the file on your computer or cloud storage for easy access and future use.

- Make Modifications: Edit the document as necessary for future transactions by updating client names, payment terms, or product descriptions.

- Share with Clients: Send the file through email or via a link, ensuring that your clients have all the information they need.

By following these simple steps, you can easily download and customize your business documents, saving time while maintaining a professional standard in your dealings.

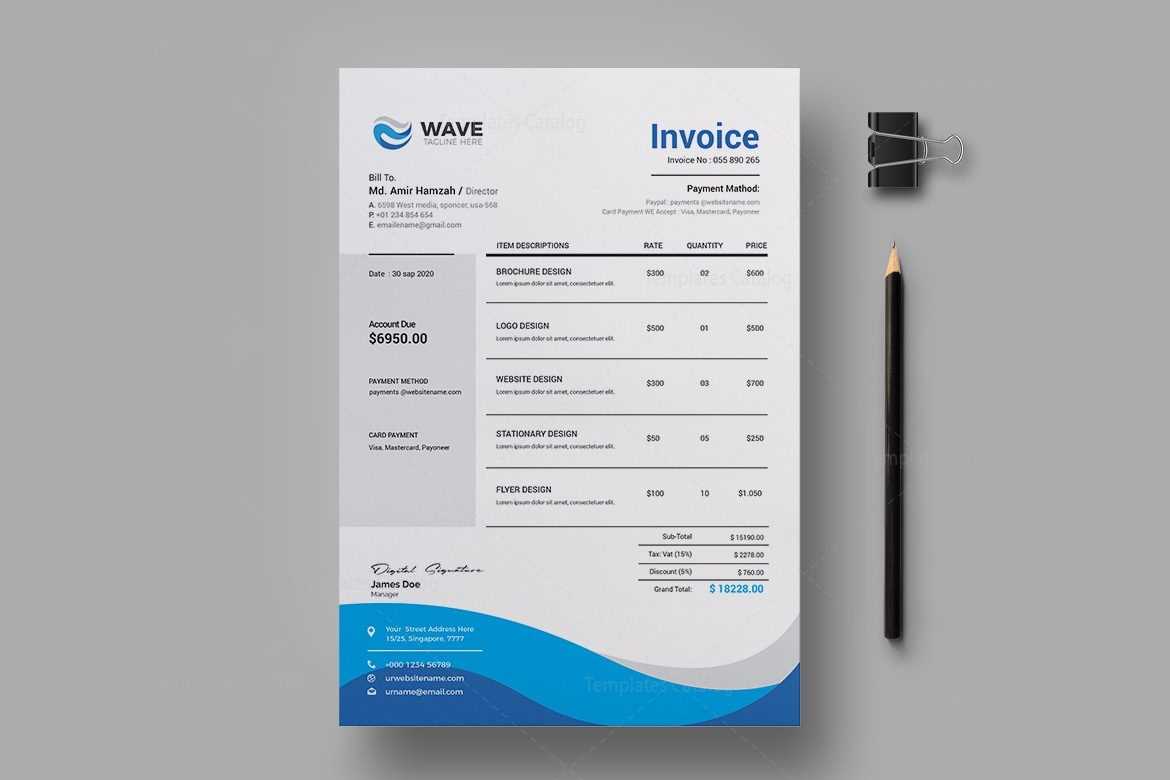

Step-by-Step Guide to Invoice Customization

Customizing business documents to fit your needs is an essential part of maintaining a professional appearance while ensuring clarity and accuracy in your transactions. Tailoring these documents allows you to personalize the design, include specific terms, and reflect your company’s branding, making the process more efficient and aligned with your business identity. Below is a step-by-step guide to help you customize your business documents with ease and precision.

1. Choose the Right Document Format

Before starting the customization process, it’s important to select a document layout that best suits your type of business. Choose a structure that’s clean, professional, and easy to understand. Make sure it contains all the essential fields required for your transactions, such as service descriptions, quantities, pricing, and payment details.

2. Personalize with Your Branding

Your business documents should reflect your company’s identity. Start by adding your logo and adjusting the colors and fonts to match your brand style. This helps reinforce brand recognition and makes your documents look polished and cohesive. Here’s how you can personalize:

- Add Your Logo: Position your company’s logo at the top of the document for instant recognition.

- Choose Your Colors: Adjust the color scheme to match your brand’s palette, giving the document a consistent and professional appearance.

- Select Fonts: Choose a font style that is both readable and aligns with your brand’s tone.

3. Fill in Essential Information

Now that you’ve selected the format and applied your branding, the next step is to add the necessary details. Ensure that all fields are accurately filled out to avoid any confusion or miscommunication. Some key sections to include are:

- Business Information: Include your company name, address, phone number, and email so that your client can easily reach you.

- Client Details: Clearly list the client’s name, address, and contact information to ensure proper identification and communication.

- Description of Services or Products: Provide a breakdown of what is being billed, including quantities, unit prices, and totals.

- Payment Terms: Define the payment due date, method, and any relevant instructions or late fees.

4. Review and Finalize

Before sending your document, it’s crucial to review all the details for accuracy. Double-check the math for any calculations, e

Improving Cash Flow with Wave Invoices

Managing cash flow is critical for the health and growth of any business. One effective way to improve your financial liquidity is by streamlining how you send payment requests and track incoming funds. By utilizing the right tools, you can ensure that your clients receive timely and accurate records, reducing delays and minimizing errors that could disrupt your cash flow. The ability to send clear, professional documents quickly can have a significant impact on your business’s financial stability.

Streamlining Payment Requests

Clear and consistent communication with clients about payment expectations is vital for ensuring timely payments. With automated calculations and easy-to-use formats, you can quickly generate professional documents that clearly outline due amounts, payment terms, and deadlines. This not only saves you time but also reduces the chances of mistakes that can delay payment. By ensuring that all necessary information is included and presented in a professional manner, clients are more likely to pay promptly.

Key Features for Faster Payments

The platform offers several features that can help speed up the payment process, contributing to better cash flow management:

- Automatic Payment Reminders: Set up automatic reminders to notify clients of upcoming or overdue payments, encouraging faster action and reducing follow-up work.

- Multiple Payment Methods: Offer clients various ways to pay, such as credit cards, bank transfers, or online payment systems, making it easier for them to settle outstanding balances.

- Quick and Secure Delivery: Send payment requests instantly via email, ensuring your clients receive the document without delay, and reducing the time between sending and receiving payment.

Tracking Payments for Better Cash Flow

Once your documents are sent, tracking payments is equally important. With real-time updates, you can monitor the status of each payment, identify overdue amounts, and take action accordingly. By having access to organized and up-to-date records, you can make more informed decisions about when to follow up with clients or adjust your payment terms for future transactions.

- Payment Status Overview: Easily track whether payments are pending, completed, or overdue, giving you a clear picture of your business’s current financial situation.

- Integrated Accounting: Link your payment requests with your accounting system to automatically update records and provide an accurate snapshot of your cash flow.

By utilizing these tools, you can ensure that your payment requests are not only professional but also efficient, leading to quicker payments and improved cash flow for your business. With better tracking and automation, managing your finances becomes a simpler, m

Common Mistakes to Avoid in Invoices

Creating clear and accurate business records is crucial for maintaining a professional image and ensuring smooth transactions. However, small errors in these documents can lead to confusion, delays in payment, and unnecessary follow-up. By understanding the most common mistakes and taking steps to avoid them, you can streamline your processes and ensure your financial communication is both effective and professional.

1. Missing or Incorrect Contact Information

One of the most common errors is failing to include accurate contact information for either your business or your client. If any details such as names, addresses, or phone numbers are missing or incorrect, it could cause delays or confusion in the payment process. Ensure all contact details are verified and properly displayed.

- Double-check addresses and phone numbers: Incorrect details can make it difficult for clients to get in touch or process payments.

- Include both your and your client’s contact info: Having both sides’ information readily available promotes clear communication and avoids delays.

2. Failing to Specify Payment Terms

Unclear or missing payment terms can lead to misunderstandings or disputes. Make sure that your document clearly states the due date for payment, accepted payment methods, and any penalties for late payments. This helps set clear expectations and reduces the chances of late payments.

- Include payment deadlines: Clearly indicate when payment is due to avoid confusion.

- Specify payment methods: List the accepted ways for your clients to pay, whether through bank transfer, credit card, or online payment services.

- Outline late fees: If applicable, make sure your clients understand the consequences of not paying on time.

3. Lack of Itemized Details

Another common mistake is failing to provide enough detail about the products or services being billed. Vague descriptions can lead to confusion or disputes over charges. Be sure to include detailed descriptions, quantities, unit prices, and totals for each item or service.

- Be specific: Break down each product or service with a clear description, including quantity and pricing.

- Include applicable taxes and discounts: If there are any taxes, discounts, or special charges, list them separately to ensure full transparency.

4. Incorrect Calculation of Amounts

Math errors, whether in the total amount or tax calculations, can lead to significant issues with payment processing and damage your credibility. Always double-check the numbers and consider using automated calculation tools to minimize errors.

- Double-check totals: Always review the final amount and compare it with the individual amounts before finalizing the document.

- Use calculation tools: Take advantage of auto

Tracking Payments Using Wave Invoices

Effectively managing payments is key to maintaining a healthy cash flow and staying on top of your business finances. With the right tools, you can easily monitor the status of each payment, track outstanding balances, and ensure timely follow-ups. The ability to track payments in real time helps you identify issues early, improve communication with clients, and ensure your financial records remain accurate and up-to-date.

How Payment Tracking Works

By utilizing a system for monitoring payments, you gain visibility into the status of each transaction. Once you’ve sent a document to a client, you can easily track whether it has been paid, is still pending, or is overdue. This information allows you to take proactive steps to ensure timely collection and avoid unnecessary delays.

Key Features for Tracking Payments

Below are the essential features that make payment tracking straightforward and efficient:

- Real-Time Updates: Once a payment is made, your system can automatically update the status, allowing you to quickly see which transactions have been completed and which are still pending.

- Payment Status Notifications: Automated notifications can inform you when payments are received, or when they are overdue, ensuring that no transaction goes unnoticed.

- Client Communication: Directly communicate with clients about their payment status, reminding them of upcoming deadlines or overdue balances.

Tracking Payment History

In addition to tracking individual payments, maintaining a clear history of all transactions is essential for accurate financial management. You can easily view past records, identify trends in late payments, and assess how well your payment terms are working. This history can be accessed at any time for financial reporting, tax preparation, or auditing purposes.

Transaction Status Amount Due Date Payment Date Service A Paid $500 2024-10-01 2024-10-02 Product B Pending $300 2024-10-05 – Consulting C OverdueHow to Send Invoices via Email Sending business documents through email is a fast, efficient, and professional way to ensure your clients receive the necessary details for payments. This method not only saves time but also provides a convenient way to track when the document was sent and opened. By following a few simple steps, you can easily email your records to clients while maintaining clarity and professionalism.

Step 1: Prepare Your Document

Before sending, ensure your document is complete, accurate, and professionally formatted. Double-check all fields, including the client’s details, payment terms, item descriptions, and totals. Make sure the file is saved in a widely accessible format, such as PDF, to prevent issues with client accessibility and maintain the integrity of your layout.

- Use clear, concise language: Avoid jargon and make sure your terms are easy to understand.

- Check calculations: Ensure all amounts and taxes are correctly calculated to avoid confusion.

- Save in PDF format: PDFs are universally accessible and ensure the formatting remains intact.

Step 2: Compose a Professional Email

Your email should include a polite, clear message that provides context for the attached document. Briefly remind the client of the payment due date and any relevant instructions for submitting payment. Here is an example of an effective email message:

Subject: Payment Request for [Service/Product Name] Dear [Client Name], I hope this message finds you well. Attached, please find the payment details for [Service/Product Name] provided on [date]. Kindly review the attached document, and feel free to reach out if you have any questions regarding the details. The payment is due by [due date]. We accept payments via [payment methods]. Thank you for your prompt attention to this matter. Please let us know if you need any further assistance. Best regards, [Your Name] [Your Business Name] [Contact Information]

Step 3: Attach the Document

Once your email is composed, attach the document before sending it. Ensure the file is named clearly, using a format that is easy for your client to identify (e.g., “Invoice_001_CompanyName.pdf”). Avoid sending multiple attachments unless necessary, as this can cause confusion or cause clients to overlook important files.

- Use a descriptive file name: Name the file in a way that includes the date and client name, so it’s easily recognizable.

- Limit attachments: If yo

Integrating Wave Invoices with Accounting

Seamlessly integrating your billing system with accounting software can significantly streamline your financial processes, reduce manual data entry, and ensure accurate record-keeping. By syncing your payment requests with your accounting platform, you can automatically update your financial reports, track revenue, and monitor outstanding balances. This integration not only saves time but also helps maintain consistency and accuracy across all your financial documents.

Benefits of Integration

Integrating your payment request system with accounting tools offers several advantages:

- Automatic Financial Updates: When you send a request or receive a payment, your accounting records are updated in real time, reducing the need for manual data entry.

- Improved Accuracy: Syncing both systems ensures that the information in your billing and accounting records match, reducing the chances of errors and discrepancies.

- Time-Saving Automation: With automated synchronization, you no longer need to input payment information or manually update your books. This allows you to focus on other aspects of your business.

How to Set Up Integration

Setting up an integration between your payment request system and accounting software is a simple process, and many platforms offer easy-to-follow steps. Here’s a basic outline:

- Connect Your Accounts: Link your accounting software with your payment request system by following the platform’s integration instructions. This typically involves logging into both systems and allowing them to sync data.

- Configure Sync Preferences: Choose how often you want your systems to sync–whether in real time or at specific intervals. You can also specify which data you want to sync, such as payments, invoices, and client information.

- Test the Integration: Before fully implementing, conduct a test to ensure everything is syncing correctly. Create a test transaction to verify that the information appears accurately in both systems.

By connecting your billing and accounting platforms, you ensure smoother financial operations and minimize the risk of errors. Whether you’re sending payment requests or recording payments, the integration simplifies your workflow, making it easier to manage your business finances with confidence.

Advantages of Using Digital Invoices

Switching from traditional paper-based billing to digital solutions offers numerous benefits for businesses. With digital documentation, you can streamline your workflow, reduce manual effort, and ensure greater accuracy in your financial records. This method also provides increased convenience, faster processing times, and easier storage, contributing to better overall efficiency in managing transactions and finances.

Key Benefits of Digital Documents

- Speed and Efficiency: Digital documents can be generated, sent, and received instantly, eliminating delays associated with traditional mail and reducing the time between service delivery and payment receipt.

- Cost Savings: Digital solutions reduce the need for printing, postage, and physical storage, leading to significant cost reductions over time.

- Improved Organization: Digital records are easier to categorize, search, and retrieve. They can be stored securely in the cloud, reducing the risk of losing important financial documents.

Accuracy and Tracking

By using digital solutions, businesses can reduce the likelihood of errors caused by manual entry. Automated tools can perform calculations and apply taxes or discounts, ensuring precision in every transaction. Additionally, tracking the status of each document is simplified, allowing for quicker follow-up and enhanced visibility into payment progress.

Benefit Description Efficiency Instant generation and transmission of documents, improving the speed of transactions. Cost Savings No need for paper, postage, or physical storage, reducing operational expenses. Organization Digital records can be easily stored, categorized, and searched for future reference. Accuracy Automated calculations reduce the chances of human errors in financial records. Tracking Easy monitoring of the status of each document, with options for follow-ups and reminders. Managing Multiple Clients with Wave

Managing multiple clients can be a complex task, especially when keeping track of transactions, payments, and communication. However, with the right tools, this process can be streamlined, making it easier to handle a growing client base. By organizing client information in one platform, you can efficiently manage billing, monitor payment status, and maintain professional relationships with each client.

Client Management Features

Using a comprehensive management system allows you to centralize all essential client data, providing quick access to details such as contact information, payment history, and current balances. This centralization helps eliminate confusion and ensures that no client is overlooked.

- Client Profiles: Create individual profiles for each client, storing their contact information, payment preferences, and billing history in one place. This makes it easy to access relevant details quickly.

- Transaction Tracking: Keep track of every transaction with each client, including payments, outstanding balances, and overdue amounts. This gives you a clear picture of the financial relationship at any given time.

- Automated Reminders: Set up automated reminders for upcoming payments or overdue balances, ensuring that clients are notified promptly and reducing the chance of missed payments.

Efficient Communication and Reporting

Maintaining clear communication with clients is essential for building trust and ensuring smooth business operations. Many platforms also provide tools that allow you to send customized messages, reminders, and payment receipts. Additionally, detailed reporting tools help you monitor your client relationships and business performance more effectively.

- Payment Reports: Generate reports that show the payment status of each client, including any pending or overdue amounts, to help you follow up in a timely manner.

- Custom Communication: Send personalized emails or messages directly from the platform, making communication seamless and professional.

By centralizing client data, automating tasks, and improving communication, you can efficiently manage multiple clients without losing track of important details. These tools allow you to focus on providing excellent service while ensuring that all financial matters are handled with precision.

How to Save Time with Invoice Automation

Automating your billing process can drastically reduce the time spent on administrative tasks, allowing you to focus more on growing your business. With automation, you can eliminate repetitive manual entries, reduce errors, and ensure that payment requests are sent on time, every time. This not only speeds up the overall process but also enhances accuracy and consistency in your financial records.

Key Benefits of Automation

Automation simplifies the entire process, from generating and sending documents to tracking payments. With the right tools, you can set up a system that works for you and your business needs.

- Streamlined Document Creation: By setting up pre-designed formats, you can create professional documents with just a few clicks. Automated systems can fill in client details and transaction data for you, saving you the time it would take to manually enter each field.

- Timely Dispatch: Automation ensures that your payment requests are sent automatically on scheduled dates, eliminating the risk of forgetting or delaying notifications.

- Error Reduction: With automated calculations and data population, you significantly reduce the chances of mistakes that can occur from manual entry, ensuring accurate financial records.

How to Set Up Automation

Setting up automation involves configuring your system to handle key aspects of the billing process, such as document generation, sending reminders, and tracking payment statuses.

- Customizing Templates: Choose or create a document layout that aligns with your business needs. Many platforms offer customizable formats that can automatically insert client names, addresses, and transaction details.

- Scheduling Reminders: Set up automatic reminders to notify clients of upcoming or overdue payments, ensuring that follow-ups are sent without requiring manual effort.

- Payment Tracking: Link your payment processing system to the automation tool to track payments in real time. This will allow you to instantly see when a client has paid and when you need to follow up.

By automating your billing process, you free up valuable time, reduce errors, and create a smoother experience for both you and your clients. The less time spent on manual tasks, the more time you have to focus o