Free Downloadable Invoice Template Excel for Easy Invoicing

Managing financial transactions and ensuring proper record-keeping is crucial for businesses of all sizes. One of the most effective ways to handle this task is by using digital tools that streamline the process and reduce errors. By utilizing user-friendly resources, you can maintain a professional approach while saving time on administrative duties.

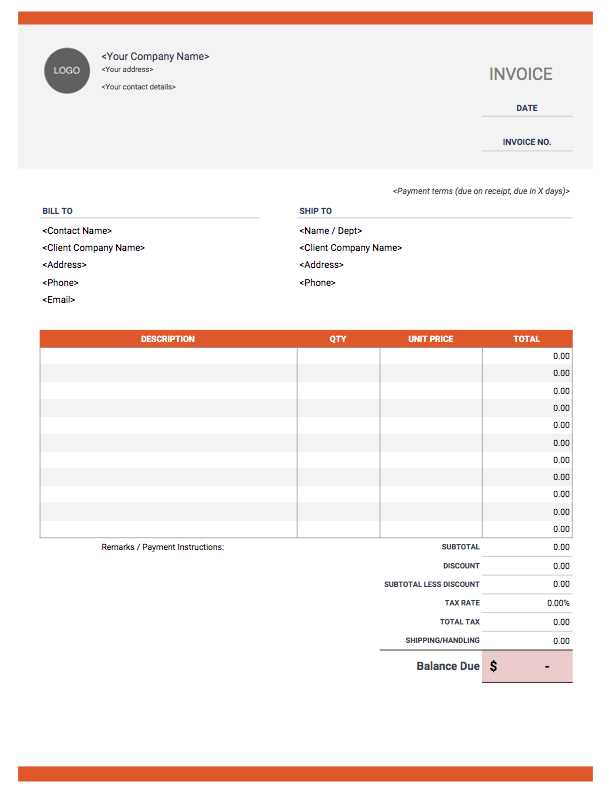

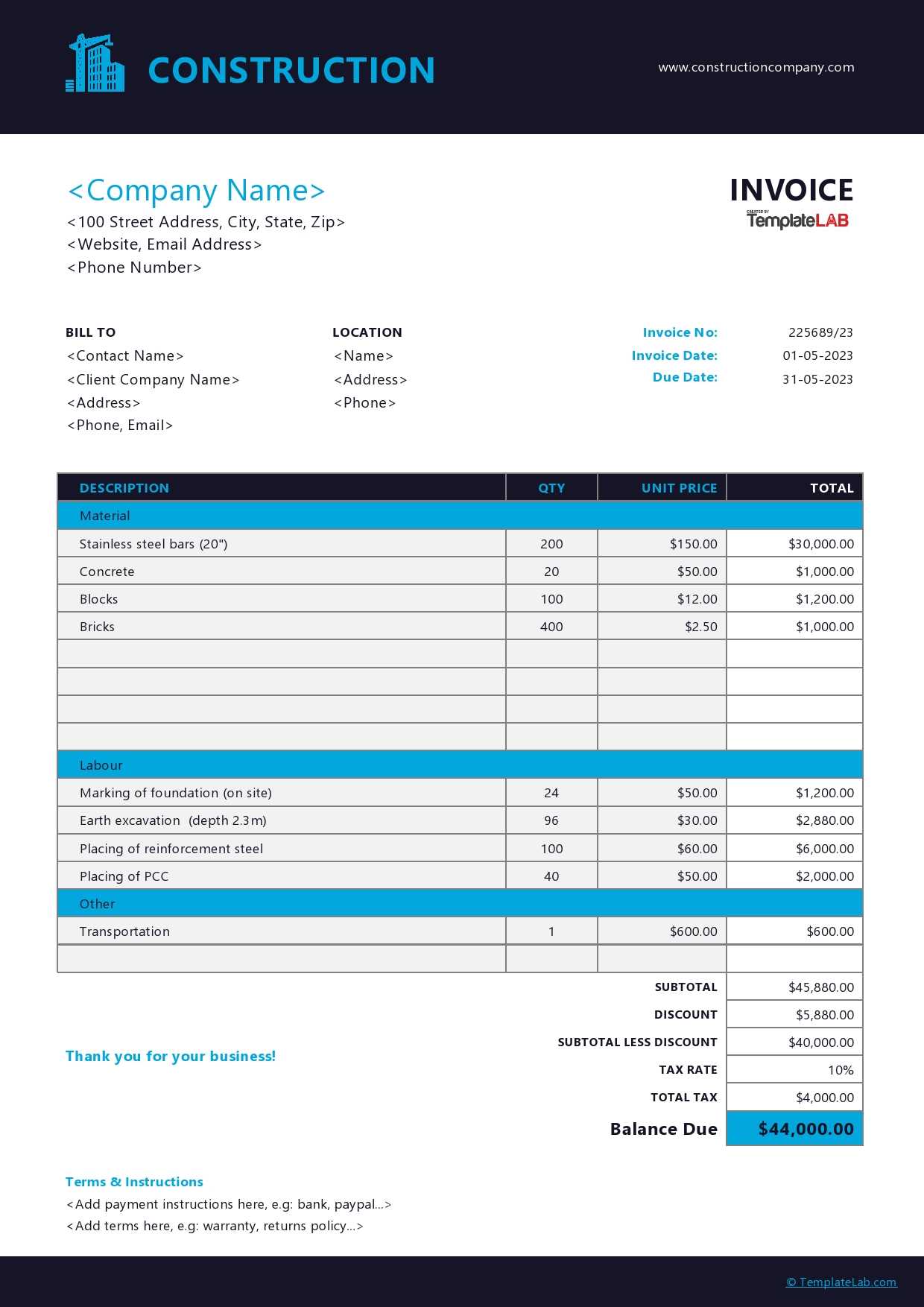

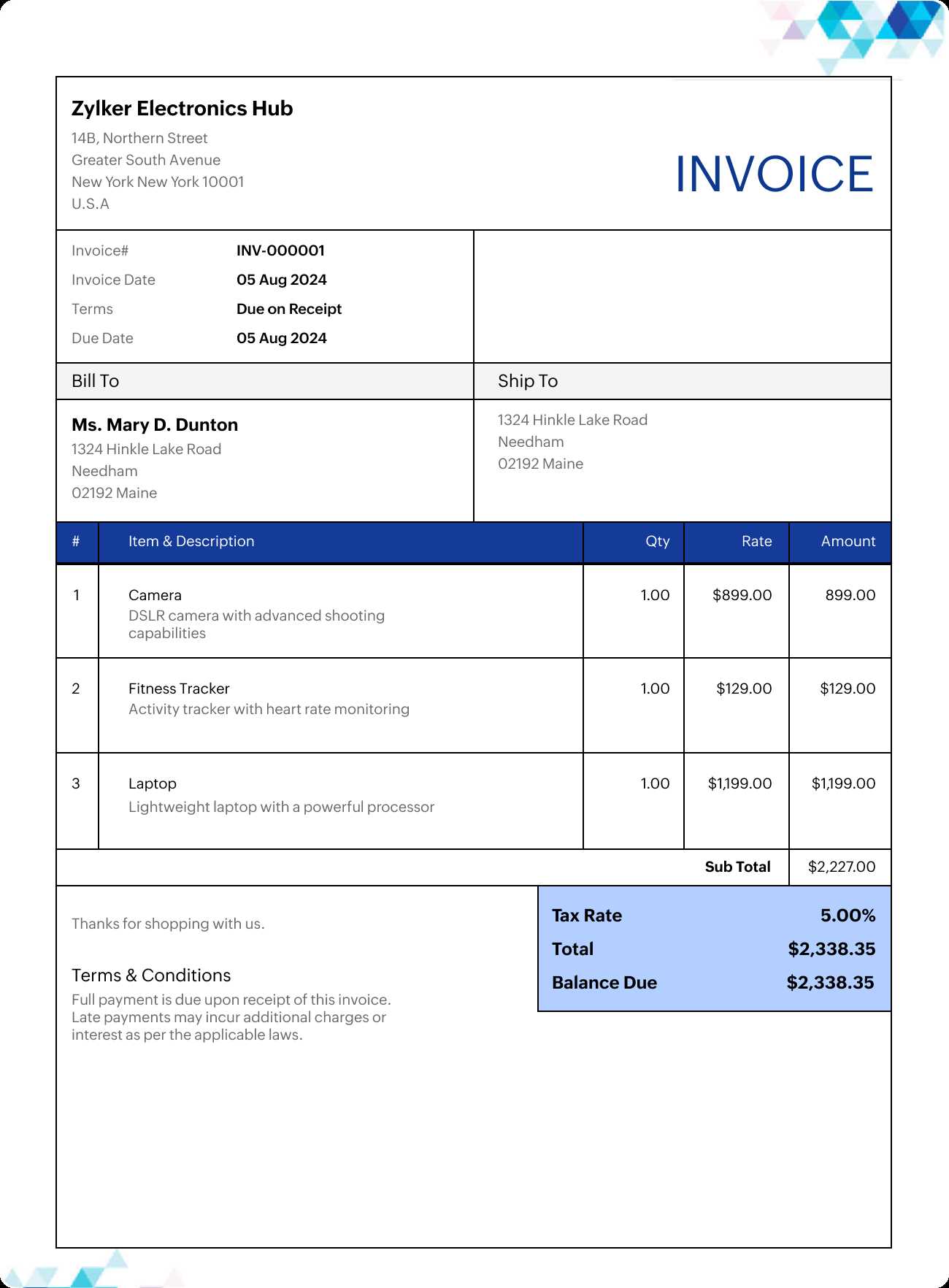

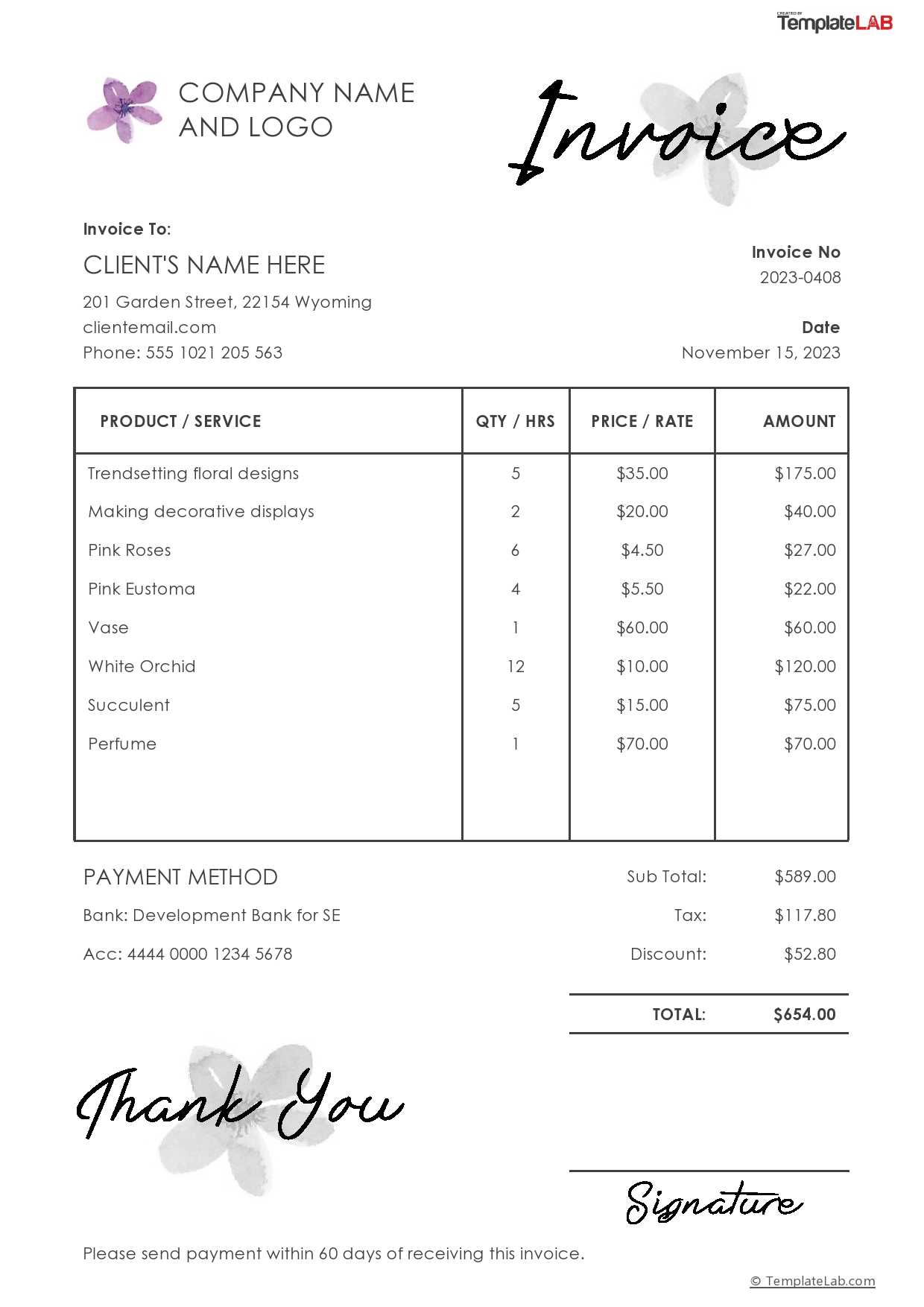

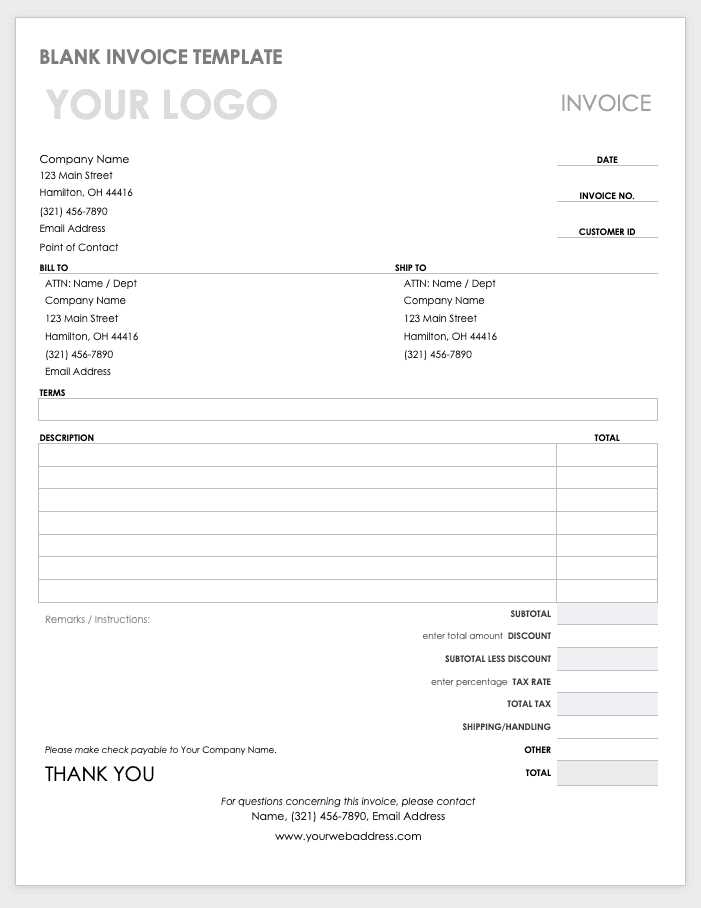

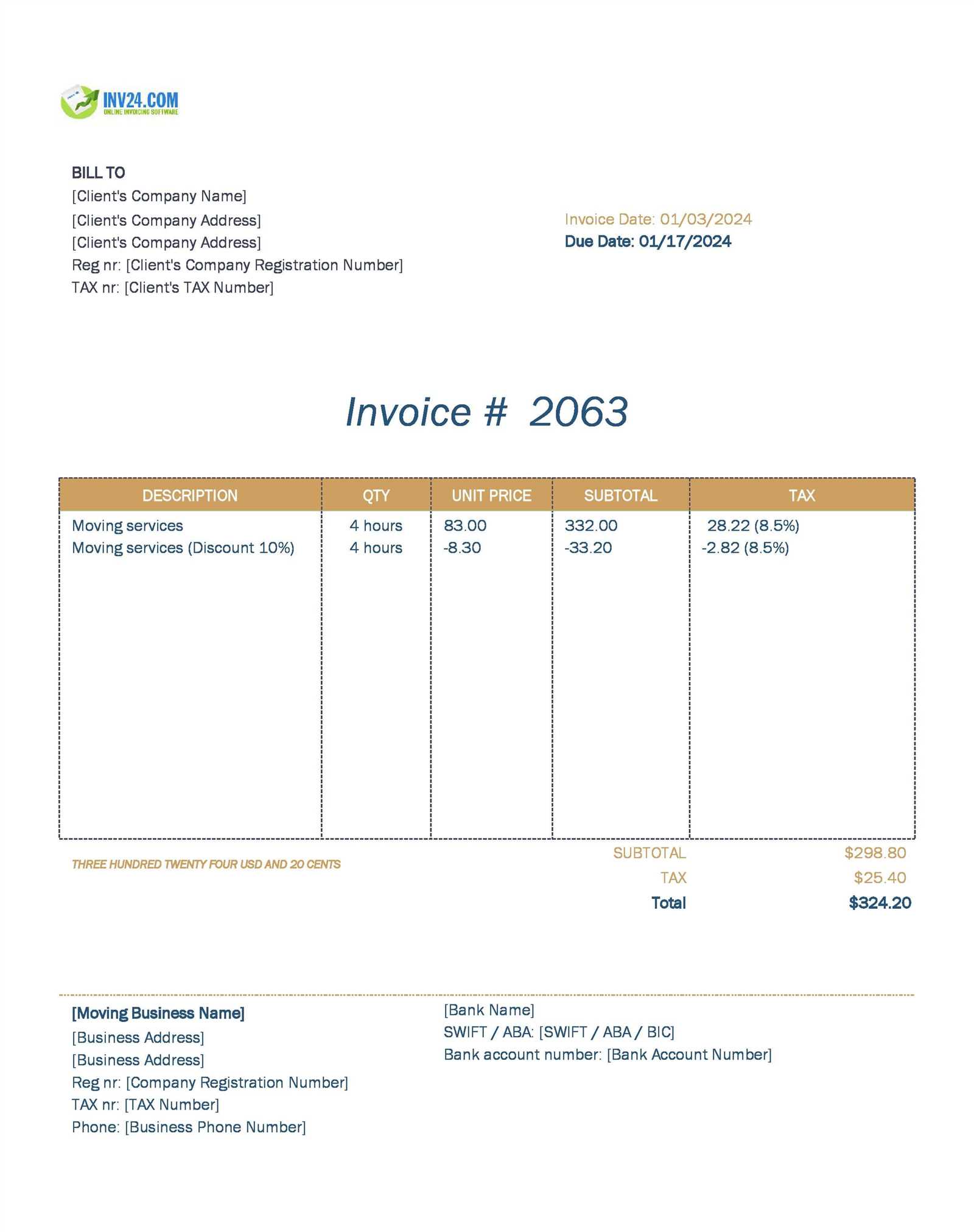

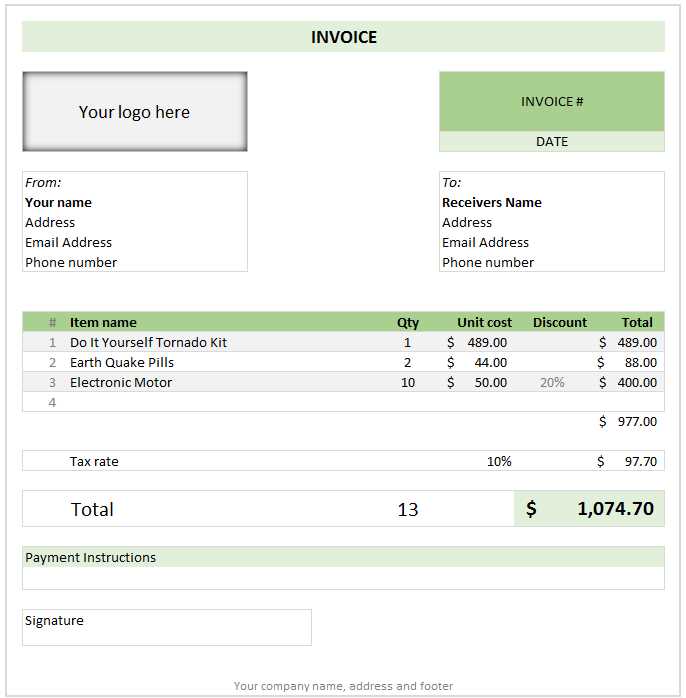

Customizable documents can greatly simplify the creation of payment requests, helping you present your charges clearly and concisely. These documents allow you to input necessary details, calculate totals automatically, and track important information, all in one place. Whether you’re working independently or as part of a team, such tools can be a valuable asset for efficient financial management.

With a little effort, you can find resources that cater to various needs, allowing you to adapt the structure to suit your particular requirements. By making the most of these readily available files, you can ensure a smooth billing experience and improve the accuracy of your financial records.

Why Use an Excel Invoice Template

Efficient billing is key to maintaining smooth business operations. Using a well-organized document to manage payment requests can save time, minimize mistakes, and present a professional image to clients. With the right tools, you can ensure that each transaction is clear, accurate, and easy to understand.

One of the most popular tools for creating financial documents is a spreadsheet program. These tools offer a variety of benefits for those who need to generate payment requests regularly. Below are some reasons why they are widely used:

- Customization: You can tailor the layout and design to suit your needs, ensuring all relevant details are included.

- Automatic Calculations: Built-in functions make it easy to calculate totals, taxes, and discounts without manual intervention.

- Efficiency: You can quickly input data and update information, speeding up the creation process.

- Consistency: Using the same format for all requests helps maintain professionalism and clarity.

- Tracking: Easily track and organize records for future reference or audits.

By using a spreadsheet tool, you can streamline the process and ensure your financial documents are both accurate and professional.

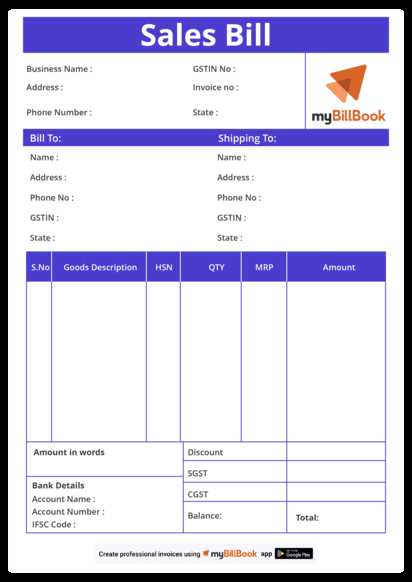

How to Customize Your Invoice Template

When creating a payment request, it’s important to adjust the layout and design to meet your specific needs. A customizable document allows you to add or remove sections, choose a preferred style, and ensure all necessary information is clearly presented. This flexibility makes it easy to create a document that fits your business and enhances professionalism.

Editing Key Details

Begin by adjusting the key sections of the document. You should include essential information such as:

| Field | Description |

|---|---|

| Business Name | Your company or individual name should be displayed prominently at the top. |

| Client Details | Include the client’s name, address, and contact information for easy identification. |

| Date | The date of the transaction or when the payment is due. |

| Description of Services | Provide a breakdown of the products or services you’ve provided to the client. |

| Total Amount | Ensure the total amount due is clearly displayed, including any taxes or discounts. |

Design and Formatting Adjustments

Once the content is in place, it’s time to focus on the appearance. Adjust fonts, colors, and spacing to create a clean, easy-to-read document. Consistent formatting helps convey professionalism and makes the document more user-friendly. Additionally, you can add your company logo or brand colors to make it personalized.

By customizing these elements, you create a payment request that not only meets your needs but also strengthens your business image.

Benefits of Using Excel for Invoices

When it comes to managing payment records, utilizing a spreadsheet application can provide significant advantages. With its wide range of features, it allows businesses to create and organize financial documents efficiently. From automatic calculations to seamless updates, this tool makes managing accounts straightforward and hassle-free.

One of the main benefits is the ability to quickly generate and modify financial documents as needed. Whether you’re handling a one-time transaction or recurring billing, a spreadsheet can adapt to your specific requirements. You can easily add or remove fields, adjust amounts, and update client information with minimal effort.

Another significant advantage is the automation of calculations. Built-in functions make it simple to calculate totals, taxes, discounts, and other fees, reducing the risk of errors. With just a few entries, the system can automatically update the final amounts, saving time and ensuring accuracy.

Additionally, spreadsheets offer great flexibility in organizing and storing data. You can create multiple sheets within a single file to track payments, monitor overdue amounts, and keep a comprehensive record of all transactions. This level of organization makes it easier to access historical data and prepare for audits or financial reviews.

Steps to Download an Invoice Template

Getting started with a financial document is simple when you know the right steps to follow. Many online resources offer ready-made files that can be easily accessed and customized to fit your needs. These steps will guide you through the process of obtaining and preparing your file for use in creating professional payment requests.

Locating the Right Resource

Start by identifying a reliable website or platform that offers the specific type of document you need. There are many options available, so take your time to find one that offers customizable features and a layout that suits your business style. Follow these steps to find the right one:

- Search for a platform that specializes in financial documents or business resources.

- Look for a file that can be easily edited to fit your business requirements.

- Check for additional features, such as automated calculations or pre-filled fields.

Downloading and Opening the File

Once you’ve located the right resource, the next step is to download it onto your device. The file is typically available in a format that can be easily opened and modified using popular spreadsheet software. Follow these steps to complete the process:

- Click on the “Download” button or link provided on the website.

- Save the file to a location on your computer or cloud storage for easy access.

- Open the file in your preferred spreadsheet program to start customizing it.

Now that you’ve successfully downloaded your document, you can begin filling in the necessary information and adjusting it to your needs.

Top Features of a Free Invoice Template

When choosing a document for billing, it’s important to select one that offers both functionality and ease of use. The ideal file should include features that make it easier to create accurate and professional payment requests. Below are some key aspects to look for in a useful billing document that will help you streamline the process.

Customization and Flexibility

One of the standout features of an effective financial document is its ability to be easily customized. You should be able to:

- Adjust the layout to fit your business’s branding and style.

- Add or remove fields according to the services or products provided.

- Change fonts, colors, and other design elements to make the document more visually appealing.

Automatic Calculations and Formulas

Another major benefit is the integration of built-in formulas that automatically calculate totals, taxes, and other important amounts. This feature:

- Eliminates the need for manual calculations, reducing errors.

- Ensures accurate totals, even when items, quantities, or rates change.

- Helps save time by instantly updating figures when adjustments are made.

These features enhance both efficiency and professionalism, ensuring that each billing document is accurate and easy to understand for clients.

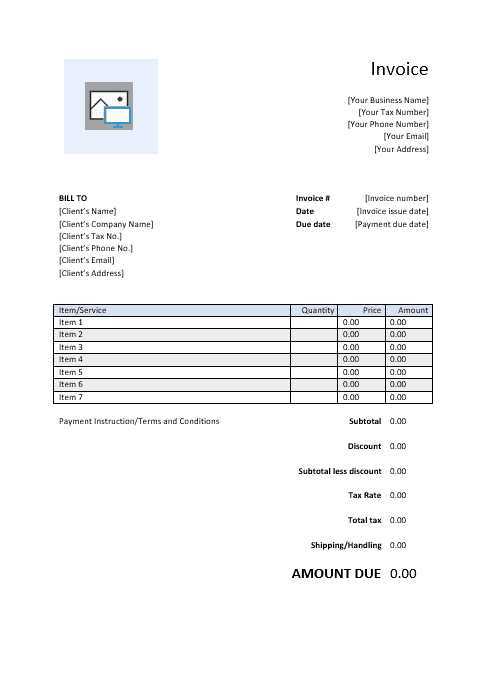

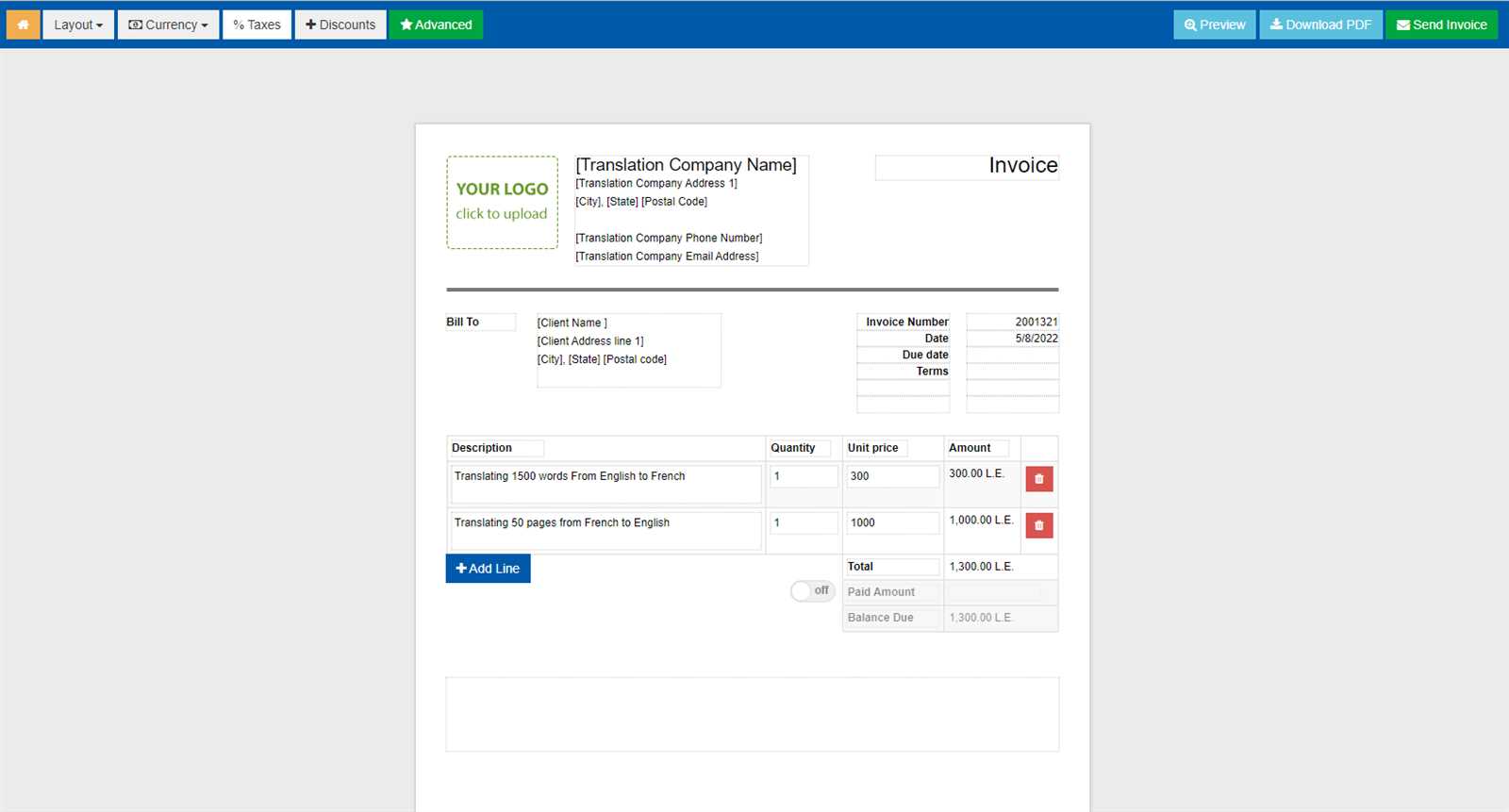

How to Edit Excel Invoice Templates

Once you’ve selected a suitable financial document, it’s time to customize it to meet your specific needs. Editing such a file is straightforward, thanks to the user-friendly features of spreadsheet programs. Below are the basic steps to help you modify and personalize the document quickly and effectively.

Editing Basic Information

The first step is to update the essential details in the document. These may include your business name, client information, and transaction specifics. Follow these steps:

- Click on the text fields you want to change, such as the company name or client contact details.

- Replace the placeholder text with accurate information for each section.

- Ensure that all fields are filled correctly before proceeding to the next step.

Adjusting Layout and Design

Once the core information is updated, focus on the design and layout of the document. This step helps ensure that your document looks polished and professional. You can:

- Change font styles and sizes to match your branding or preferences.

- Modify cell colors or borders to create a cleaner, more readable format.

- Move or resize columns and rows to make the information easier to follow.

Incorporating Automatic Calculations

If your file includes automatic calculation functions, make sure the formulas are working correctly. Check that:

- The totals, taxes, and other relevant amounts are updated automatically when changes are made.

- Formulas are applied to the correct fields to ensure accurate calculations.

- Each section is aligned with the correct calculation for a seamless billing experience.

By following these simple steps, you can easily adapt any document to your needs, ensuring that it’s ready for professional use.

Common Mistakes in Invoice Templates

When creating financial documents, errors can easily slip through, leading to confusion or delays in payments. Even with pre-designed files, common mistakes can undermine the accuracy and professionalism of your documents. Identifying and correcting these issues can help ensure that your billing is always clear, precise, and reliable.

One of the most frequent mistakes is not properly updating client or business details. If you leave outdated or incorrect information, it can create misunderstandings or cause clients to question the validity of the payment request.

Another common error involves failing to verify the accuracy of amounts. Whether it’s the total cost, taxes, or discounts, incorrect calculations can lead to disputes and delayed payments. Even if the document includes automated formulas, a minor mistake in data entry can throw everything off.

Additionally, it’s important not to overlook formatting issues. A poorly designed document can be difficult to read, leading to confusion. For example, misaligned text or cluttered sections can make it hard for clients to find critical information, such as the payment due date or the services provided.

By being aware of these mistakes, you can avoid unnecessary complications and ensure your financial documents are always accurate and professional.

Common Mistakes in Invoice Templates

When creating financial documents, errors can easily slip through, leading to confusion or delays in payments. Even with pre-designed files, common mistakes can undermine the accuracy and professionalism of your documents. Identifying and correcting these issues can help ensure that your billing is always clear, precise, and reliable.

One of the most frequent mistakes is not properly updating client or business details. If you leave outdated or incorrect information, it can create misunderstandings or cause clients to question the validity of the payment request.

Another common error involves failing to verify the accuracy of amounts. Whether it’s the total cost, taxes, or discounts, incorrect calculations can lead to disputes and delayed payments. Even if the document includes automated formulas, a minor mistake in data entry can throw everything off.

Additionally, it’s important not to overlook formatting issues. A poorly designed document can be difficult to read, leading to confusion. For example, misaligned text or cluttered sections can make it hard for clients to find critical information, such as the payment due date or the services provided.

By being aware of these mistakes, you can avoid unnecessary complications and ensure your financial documents are always accurate and professional.

Invoice Templates for Small Businesses

For small businesses, managing financial documents efficiently is key to ensuring smooth operations and maintaining professional relationships with clients. A customizable billing document helps streamline the process, making it easier to track payments and avoid errors. Below, we discuss why small businesses benefit from having the right document layout and the features they should look for in a customizable file.

Benefits of Using a Billing Document for Small Businesses

Small businesses often need a simple yet effective solution for creating payment requests that can be tailored to their specific needs. Some key benefits include:

- Time savings: Pre-designed layouts allow for quick creation and easy adjustments, saving time for business owners.

- Professionalism: A well-structured document enhances the business’s image and assures clients that they are dealing with an organized company.

- Accuracy: Built-in formulas can automatically calculate totals, taxes, and discounts, reducing the risk of errors.

Key Features to Look For

When selecting a document layout for your business, consider the following features that will help keep your financial documents accurate and efficient:

- Editable fields: Ensure you can easily modify client details, services, and amounts.

- Clear structure: Look for a layout that clearly separates important sections, such as service descriptions and payment terms.

- Automatic calculations: Built-in formulas for taxes, totals, and discounts make financial management easier.

By choosing the right document format, small businesses can save time, reduce errors, and present themselves professionally to clients.

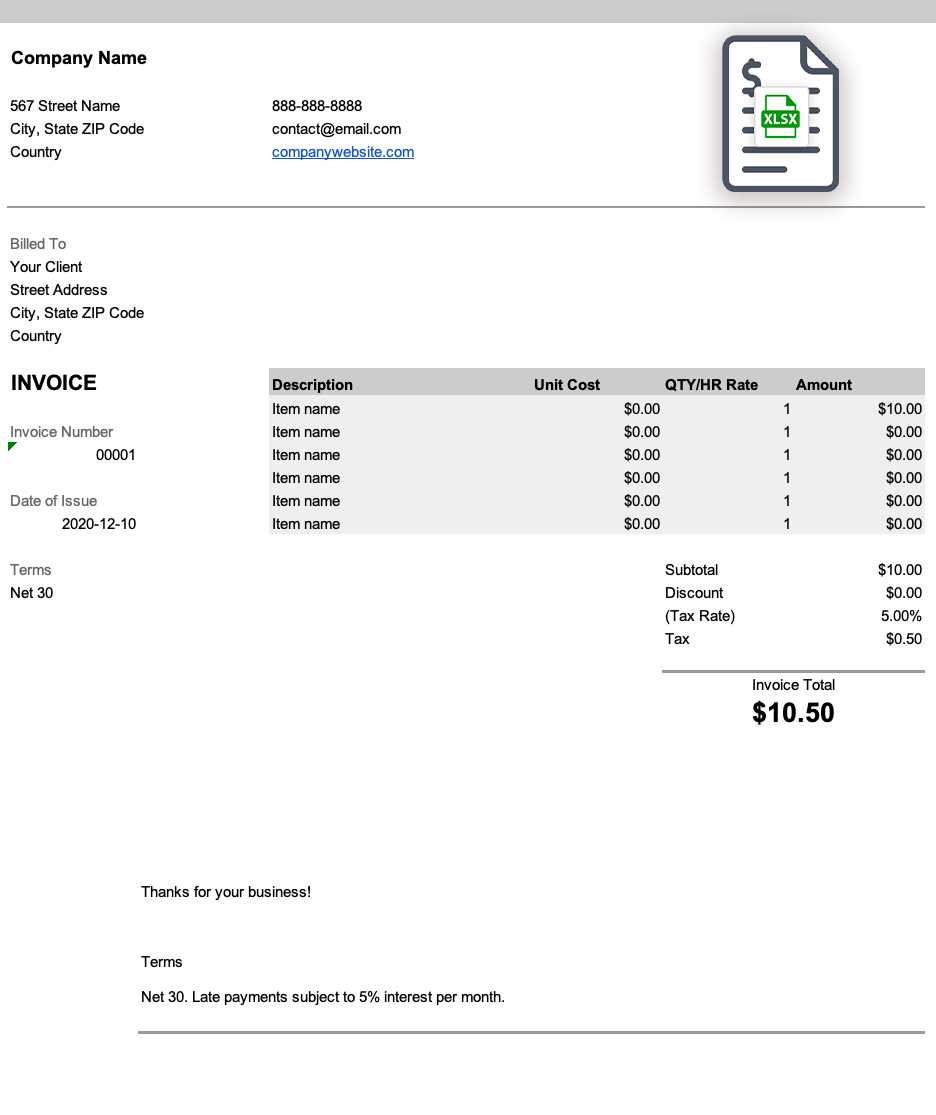

Using Excel for Accurate Billing

Accurate billing is essential for businesses to maintain healthy cash flow and strong client relationships. Using a spreadsheet program can help automate calculations, reduce human errors, and create professional-looking documents. Below are some of the key advantages of utilizing such a program for managing your financial records.

One of the primary reasons to use a spreadsheet for managing financial documents is the ability to set up automated calculations. This reduces the chances of making mistakes while performing manual math. The program allows for easy formula integration, which ensures that totals, taxes, and discounts are calculated instantly and accurately.

Key Advantages of Using a Spreadsheet

| Advantage | Explanation |

|---|---|

| Automated Calculations | Formulas automatically update totals, taxes, and discounts, ensuring accuracy without manual effort. |

| Customizable Layout | The program allows you to tailor the document layout, ensuring that all the necessary information is clearly presented. |

| Efficient Tracking | By using spreadsheets, you can easily track previous transactions, outstanding amounts, and payment histories. |

By using a spreadsheet for your financial documentation, businesses can increase efficiency, improve accuracy, and create professional-looking documents that enhance client trust.

How to Automate Calculations in Excel

Automating calculations within your financial documents helps eliminate human error and speeds up the process of creating accurate billing statements. By using built-in functions and formulas, you can set up calculations that update automatically when values are changed. This ensures consistency and accuracy, especially when dealing with large volumes of transactions.

Using Basic Formulas for Automated Calculations

To automate simple calculations, such as adding totals or applying percentages, you can use basic formulas. Some common functions include:

- SUM: Adds a range of numbers, useful for calculating totals.

- SUBTOTAL: Provides a subtotal for a range of data, which can be filtered for more accurate results.

- PERCENTAGE: Automatically calculates percentage amounts, such as tax or discount rates.

Advanced Functions for Complex Calculations

For more complex financial documents, you can use advanced functions to streamline calculations:

- IF: Used to create conditional statements that adjust calculations based on specific criteria.

- VLOOKUP: Helps look up values in a range, making it easier to reference data from other tables or sheets.

- ROUND: Automatically rounds numbers to a specific decimal point, ensuring your final calculations are consistent.

By mastering these functions, you can automate calculations in your documents, saving time and reducing the risk of errors. This makes it easier to maintain accuracy and improve the overall efficiency of your business’s financial management.

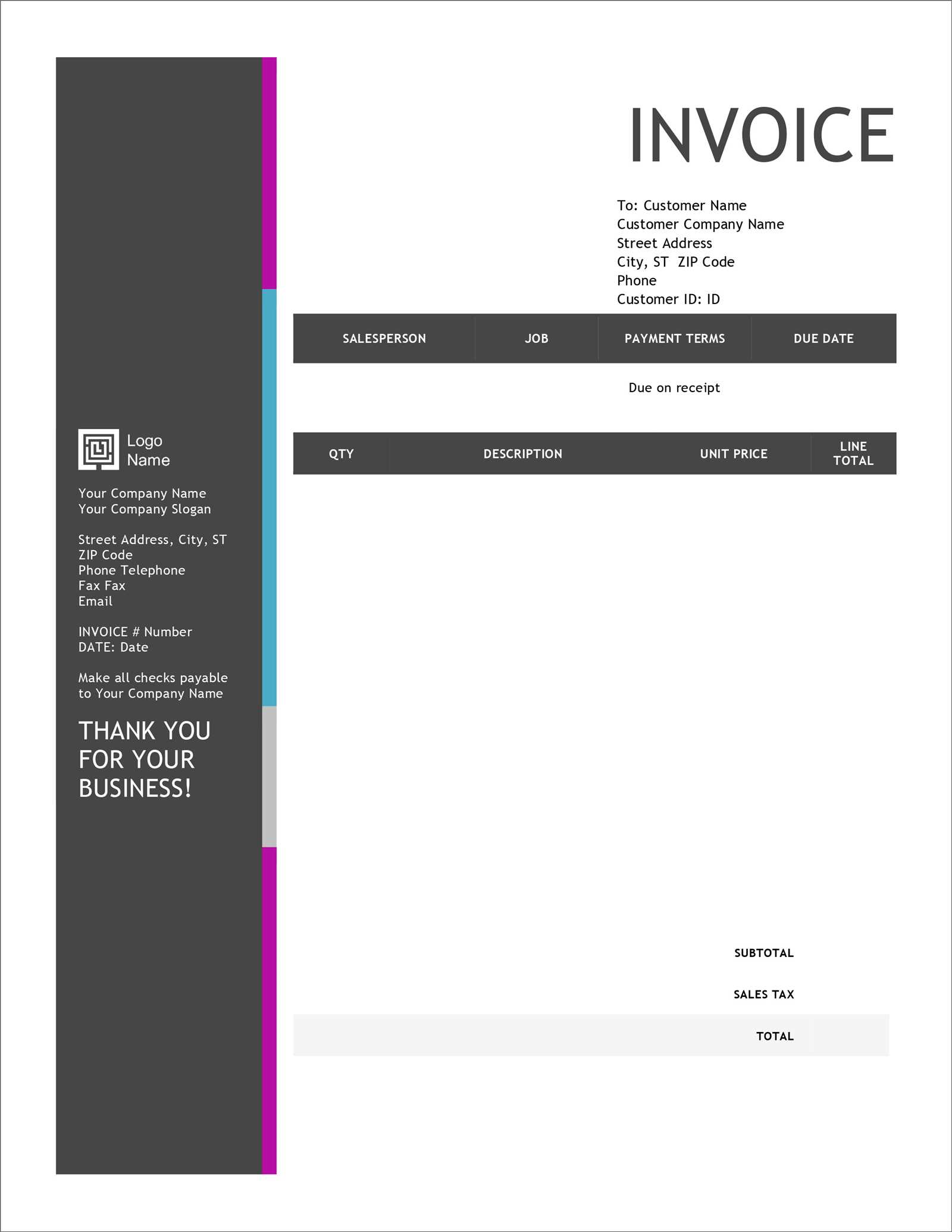

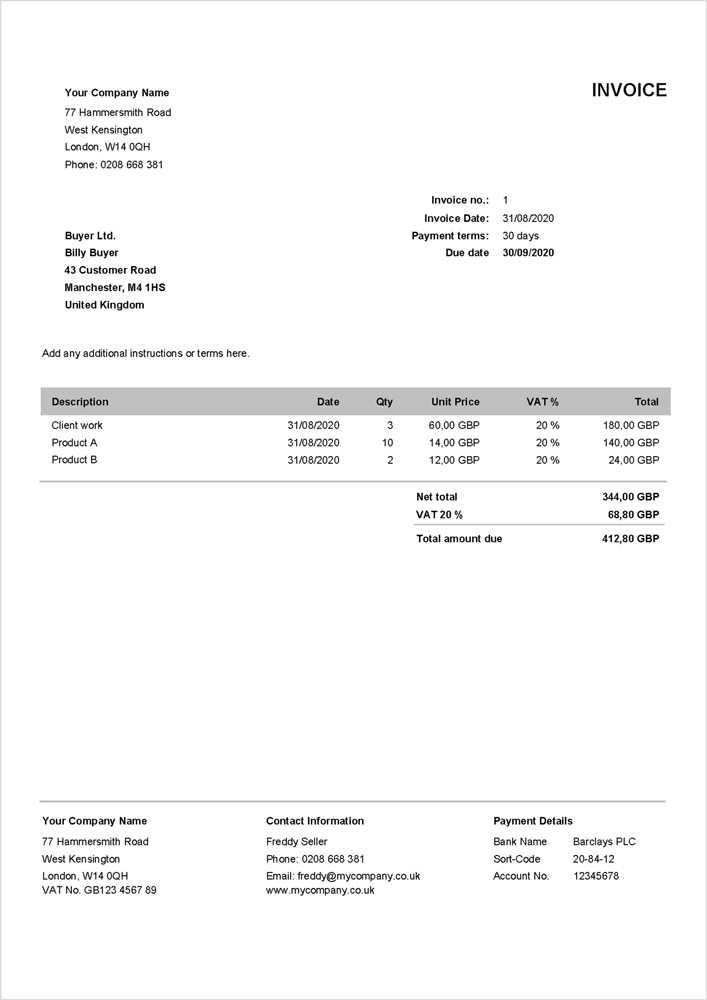

Tips for Clear Invoice Design

Creating a clean and well-structured billing document is essential for effective communication with clients. A clear layout ensures that all necessary details are easily accessible, reducing confusion and promoting professionalism. Here are some tips to help you design a document that is both functional and easy to understand.

Keep Information Organized

One of the most important aspects of a well-designed document is organization. Group related information together in clearly marked sections. Key details like the recipient’s information, the services provided, and the payment terms should be easy to find. Consider dividing the document into distinct sections such as:

- Contact Information: Place your company’s and the client’s details in separate areas at the top.

- Description of Services: Provide a clear breakdown of products or services provided, with itemized lists where applicable.

- Payment Information: Include total amounts due, due date, and payment methods in a prominent section.

Use Consistent Formatting

Consistency in fonts, spacing, and alignment creates a visually appealing document. Choose a simple, professional font for readability, and maintain uniform spacing between sections to make the document look organized. Key tips include:

- Font Size: Use a larger font for headings and section titles to distinguish them from the rest of the text.

- Color Scheme: Use minimal colors–stick to black or dark blue for text, with occasional use of color to highlight headings or totals.

- Align Information: Keep text aligned properly (e.g., right-align totals, left-align descriptions) to improve readability.

A clear and structured design not only enhances the professionalism of your documents but also helps clients process the details quickly and without error.

How to Include Payment Terms in Invoices

Clearly stating payment terms in your financial documents is crucial for ensuring timely transactions. Payment terms outline when and how a client should pay, and they help avoid misunderstandings or delays. By including these details prominently in your document, you set clear expectations and encourage faster payments.

What to Include in Payment Terms

When specifying payment terms, it’s important to be detailed yet concise. Here are some key elements to include:

- Due Date: Always specify the exact date when payment is due, for example, “Due within 30 days of the issue date.”

- Accepted Payment Methods: List all the methods you accept, such as bank transfer, credit card, or online payment platforms.

- Late Fees: Clearly state any penalties for late payments, like “A 5% late fee will apply after 30 days.”

- Discounts for Early Payment: If you offer any discounts for early payments, such as “2% off if paid within 10 days,” be sure to mention them.

Where to Place Payment Terms

Positioning payment terms in the right place within the document is equally important. Typically, these details should be placed towards the bottom or in a prominent section before the total amount. This ensures clients see the terms before finalizing the payment. Including a clear, bold heading such as “Payment Terms” makes it easier for clients to identify the information.

By clearly outlining payment expectations, you not only reduce confusion but also improve your cash flow by encouraging timely settlements.

Best Practices for Invoice Formatting

Creating a well-organized and professional financial document is essential for ensuring smooth transactions and clear communication with clients. Proper formatting enhances readability and makes it easier for both parties to understand the details of the payment. Here are some best practices for formatting your billing document effectively.

1. Keep It Simple and Clean

A cluttered document can cause confusion and lead to mistakes. To maintain clarity, use a clean design with ample white space. Avoid unnecessary graphics and decorative elements that could distract from the important details. Key tips include:

- Minimal Design: Use simple fonts and avoid overly complex formatting.

- Clear Sectioning: Separate key information such as dates, totals, and contact details into distinct sections.

- Readable Fonts: Opt for easy-to-read fonts like Arial or Times New Roman, and make sure the font size is appropriate (usually 10-12 pt for body text).

2. Use Clear Headings and Labels

Headings help organize the document and make it easier to navigate. Use bold or larger fonts to highlight important sections like the total amount due, payment instructions, and the due date. This draws attention to the most critical information and reduces the risk of oversight.

- Bold Key Information: Use bold text for the total amount, payment methods, and any deadlines.

- Effective Use of Color: Stick to a limited color palette (black or dark blue for text) and reserve color for headings and totals.

- Consistent Alignment: Align text consistently–left-align descriptive items and right-align numbers for easier comparison.

By following these best practices, you ensure that your document looks professional and is easy for clients to read and understand. Well-formatted documents not only convey a sense of professionalism but also help prevent errors and disputes over payment.

Ensuring Invoice Consistency Across Clients

Maintaining uniformity in financial documents is essential for creating a professional image and ensuring smooth business operations. When the structure and information within these documents remain consistent, it improves efficiency, reduces errors, and fosters trust with clients. Here are some key strategies to ensure consistency across all your billing documents.

1. Standardize Layout and Sections

Having a uniform structure for all your documents makes it easier for both you and your clients to review the details. Ensure that every document follows the same format, with consistent section headings and placement of important details. This can include:

- Fixed Header: Always include essential information at the top, such as your company’s name, client details, and a unique reference number.

- Consistent Sectioning: Separate items, totals, and payment terms in the same order on every document, so clients know exactly where to find each piece of information.

- Uniform Font and Color: Stick to the same fonts, colors, and font sizes throughout all your billing documents for a cohesive look.

2. Automate and Use Tools for Accuracy

Using tools that automate calculations and offer pre-set fields for common data helps eliminate inconsistencies and human errors. This also saves time, as manual data entry becomes less necessary. Consider these tips:

- Use Predefined Fields: Include consistent fields like client names, product descriptions, and tax rates that populate automatically based on your settings.

- Leverage Software: Many software solutions help manage client information, making it easy to access the necessary details every time you generate a document.

- Set Payment Terms: Ensure that terms such as due dates and payment methods are clearly defined and appear in the same section for all clients.

By ensuring consistency in your billing documents, you not only make the process more efficient but also build a reputation for being organized and reliable. Clients appreciate clear, well-structured documents, and consistency makes it easier to track payments and manage records.

How to Save and Share Your Invoice

Once you’ve created a professional document for billing, it’s crucial to know how to save and distribute it effectively. A well-organized file that is easy to access and share ensures that clients receive timely and accurate details about the charges. Here’s how you can save and share your billing statements efficiently.

1. Save in a Common Format

To ensure your document is accessible to everyone, save it in a widely used format such as PDF or Word. These formats preserve the structure and layout, making it easier for clients to open and review the document without formatting issues. Most document editing software provides an option to “Save As” in these formats.

2. Organize Files Clearly

Maintaining an organized file system is key. Name your documents clearly using a consistent naming convention, such as “ClientName_ServiceMonth_Amount.” This way, you can easily locate past billing statements when needed. Store them in a dedicated folder for easy access and backup.

3. Share via Email or Cloud Storage

For quick and reliable delivery, email the document directly to your client. Attach the file as a PDF to ensure it’s opened without errors. If you prefer using cloud storage, upload the file to platforms like Google Drive, Dropbox, or OneDrive and send a shareable link. This method is especially useful for large documents or when collaborating with multiple clients.

4. Use Online Payment Platforms

Many online payment solutions allow you to upload and share documents directly with clients. These platforms can streamline the billing and payment process by providing a secure way for clients to view and settle their accounts. Examples include PayPal and Stripe, which often allow you to send detailed billing information alongside payment requests.

By following these simple steps, you can ensure your billing documents are saved properly and shared with clients in a professional and efficient manner, reducing confusion and ensuring smooth transactions.