Free Home Invoice Template for Easy Billing and Payment Management

When managing personal or small business transactions, maintaining clarity and organization in financial documents is essential. A well-structured billing system helps ensure that services are tracked, payments are processed smoothly, and clients remain satisfied. Proper documentation also protects both parties by providing clear records of agreed amounts, payment terms, and other critical details.

With the right tools, anyone can create professional, easy-to-read statements that make financial exchanges straightforward. Customizable options allow you to adjust content according to your specific needs, whether you’re providing one-time services or recurring tasks. This flexibility not only saves time but also promotes transparency in every transaction.

In this guide, we’ll explore how to craft the perfect document for your business, including tips on customization, layout, and essential components. By following these strategies, you’ll ensure that your billing process is as seamless and efficient as possible, building trust with your clients and contributing to long-term success.

Home Invoice Template Overview

Creating a clear and professional billing document is crucial for anyone offering services to clients. Whether you’re a freelancer, contractor, or small business owner, providing a detailed account of services rendered and payments due is essential for maintaining good financial records. These documents help both parties stay on the same page regarding payment terms, amounts, and deadlines, ensuring transparency and reducing misunderstandings.

Key Elements of an Effective Document

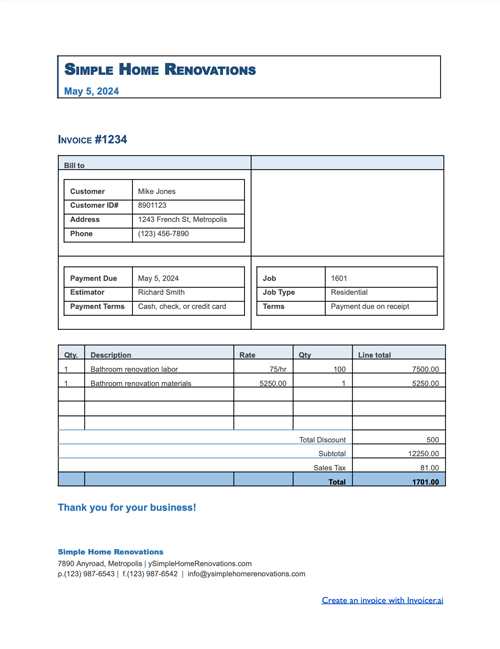

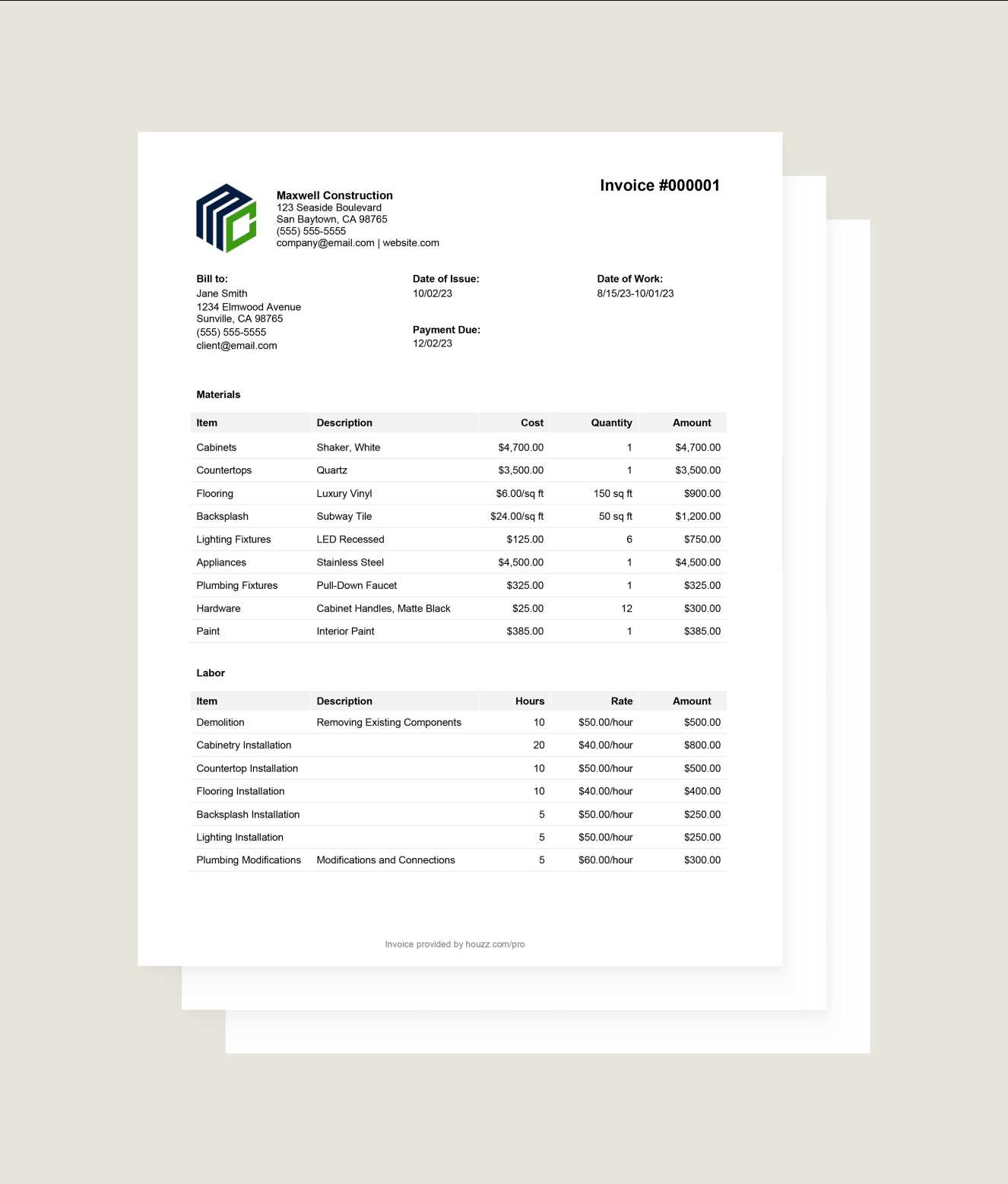

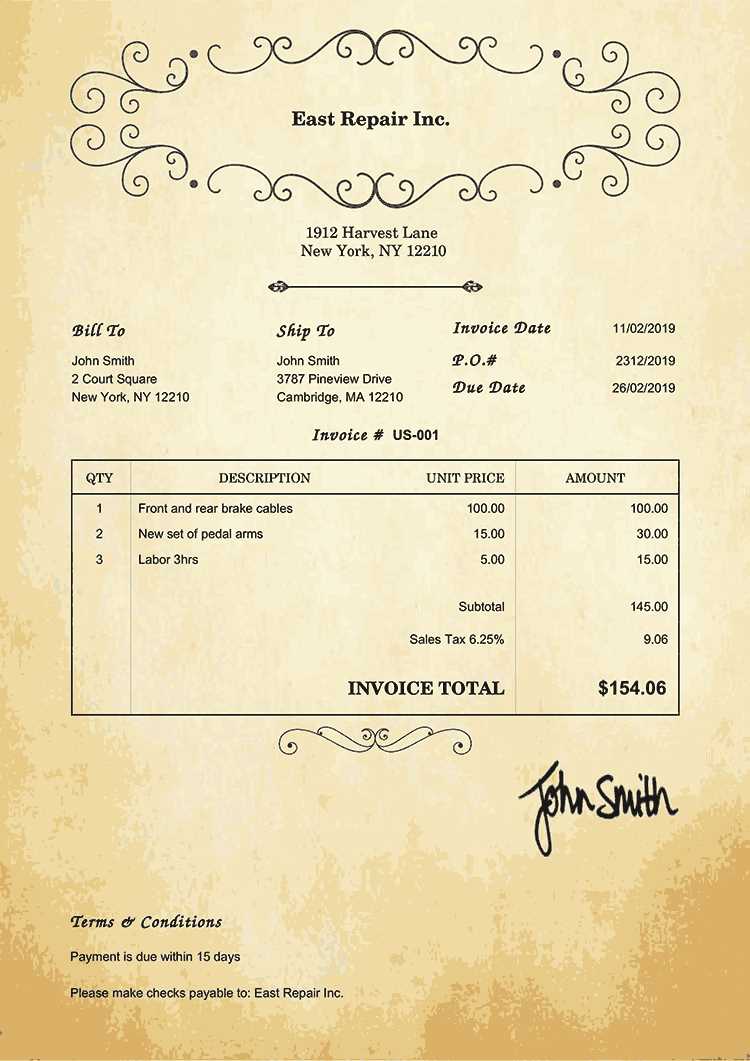

To make sure your billing documents are both functional and professional, they should include several key components. These typically consist of contact information, a breakdown of services provided, the amount due, payment terms, and due dates. By including these critical details, you provide your clients with everything they need to process the payment quickly and efficiently.

Customizing Your Document for Specific Needs

One of the main advantages of using a flexible billing system is the ability to tailor the document to suit the specifics of your services. You can adjust the layout, add or remove sections, and include personalized details such as discounts or payment plans. Customization makes it easier to maintain consistency in your communications while also accommodating unique client needs.

Why Use a Billing Document Format

Having a structured format for your billing records can greatly simplify the process of managing financial transactions. When you’re offering services, whether on a one-time or recurring basis, clear documentation is essential for ensuring prompt and accurate payments. Using a pre-designed structure helps both the service provider and client stay organized, reducing the risk of errors and misunderstandings.

Time Efficiency and Consistency

One of the main advantages of using a standardized billing format is the time saved. Instead of manually creating a new document each time you need to request payment, you can reuse a ready-made structure. This consistency not only streamlines your workflow but also ensures that all relevant details are included every time, without the need for rethinking the layout or content.

Professional Appearance

By adopting a polished, well-designed document, you enhance your professional image. A well-structured record shows clients that you take your work seriously and have systems in place to manage payments. This can build trust and encourage prompt payment, while also fostering positive relationships with your clients.

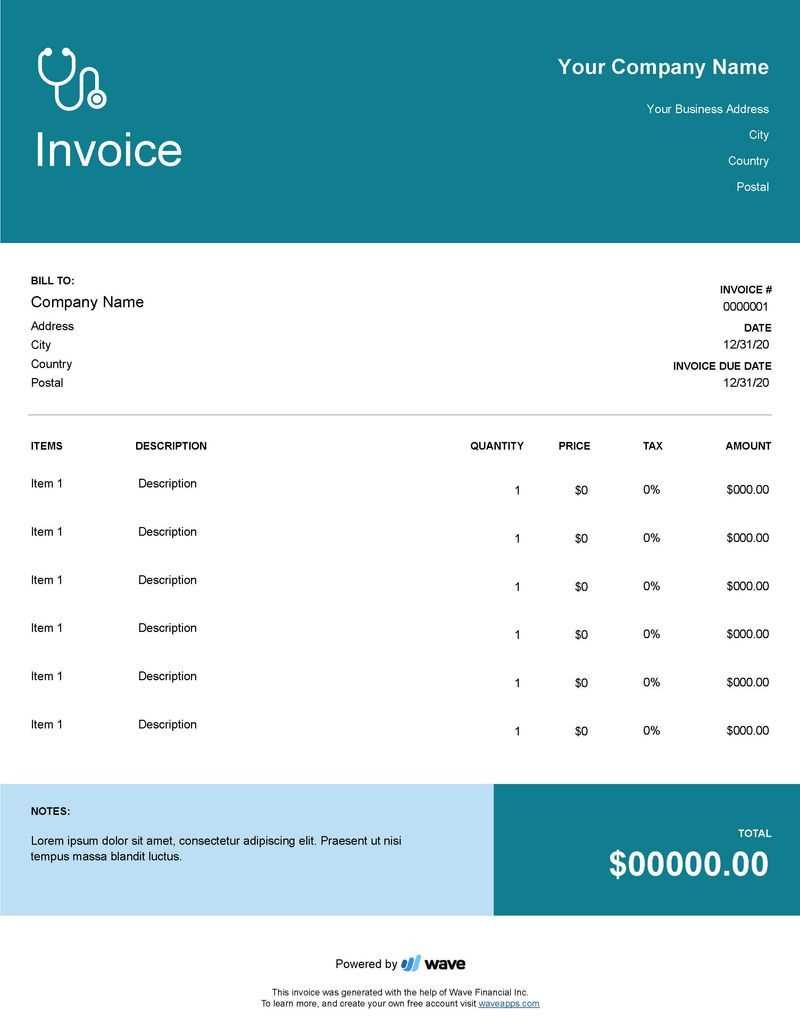

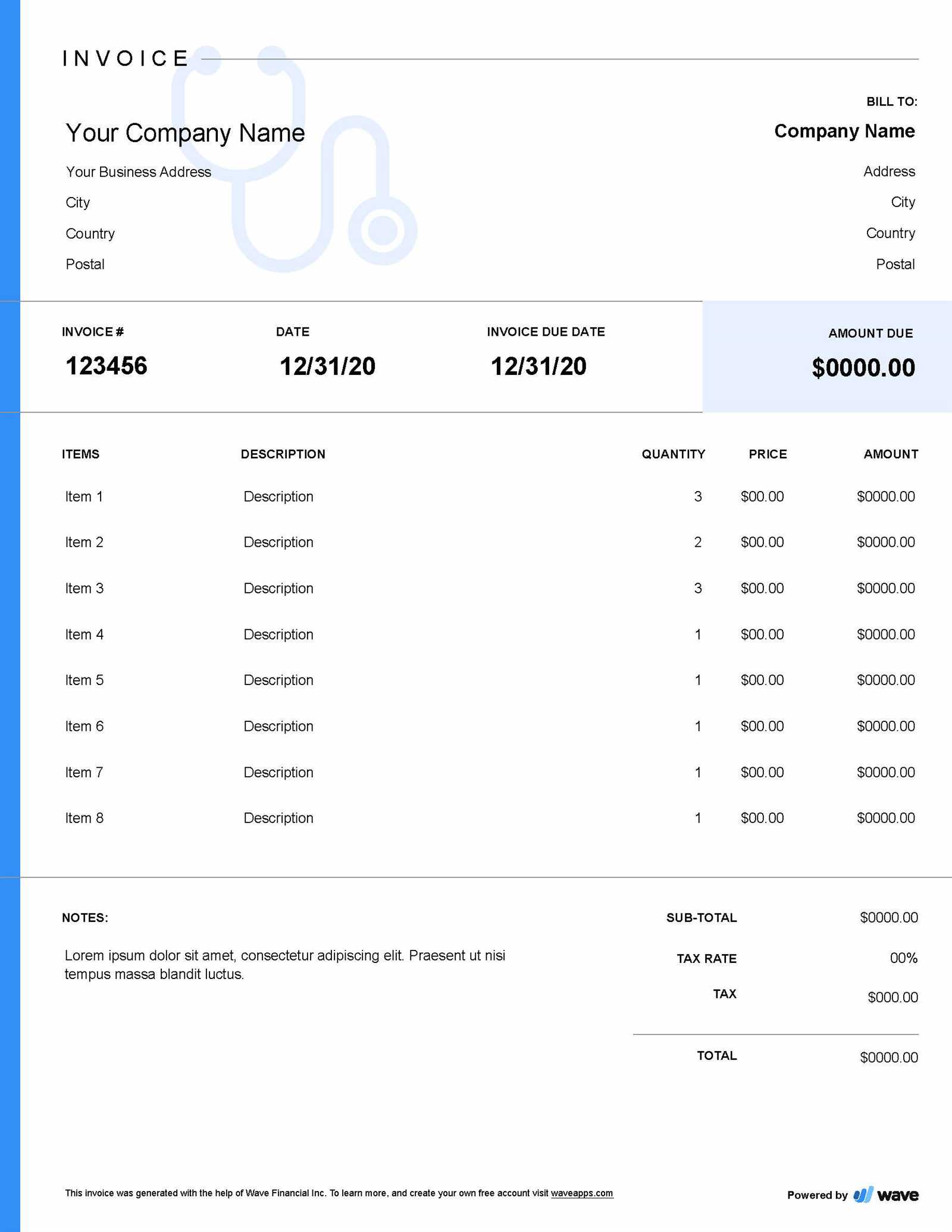

Key Features of a Good Template

A well-designed billing document should have clear, organized sections that present all necessary details in a logical order. A good format not only ensures that all required information is included, but it also makes the document easy to read and understand for both the provider and the client. Key features can range from basic contact information to advanced customization options, each contributing to a smooth transaction process.

One important feature is the inclusion of clearly defined sections for the description of services, the amount due, and payment terms. These sections help prevent any confusion and allow for easy reference. Additionally, customization options, such as the ability to add your company logo or client-specific details, can further personalize the document, making it appear more professional and tailored to each individual transaction.

Another essential characteristic is the document’s ability to display a payment summary, which can include taxes, discounts, and total amounts due. This helps both parties confirm that the terms are understood and agreed upon. Furthermore, an intuitive layout with sufficient space between each section reduces the risk of errors and enhances readability.

How to Customize Your Billing Document

Customizing your billing record allows you to create a more professional and personalized experience for your clients. Tailoring the layout and content to fit your specific needs ensures that all relevant information is clearly presented, improving the chances of timely payment. By making adjustments, you can reflect the unique aspects of your business, while still maintaining a structured and easily understandable document.

The first step in customization is adding your company logo or personal branding to the document. This helps establish your identity and adds a professional touch. Next, ensure that the contact information section is complete, including your business name, address, email, and phone number, as well as your client’s details. This not only makes the document look more organized but also ensures that both parties can reach each other if needed.

Another area to focus on is the service description. You should clearly outline each task or product provided, with a brief explanation if necessary. Additionally, adjusting the payment terms–such as the due date, late fees, or installment options–helps to prevent misunderstandings and sets clear expectations. Make sure that these details are easy to locate and read, as they are crucial for a smooth financial transaction.

Benefits of Digital Invoices for Home Services

Using digital billing records for services provides numerous advantages, especially in today’s fast-paced world. Digital documents streamline the entire process, making it easier for both service providers and clients to manage payments, track transactions, and maintain accurate financial records. The transition from paper to digital formats has revolutionized how businesses handle their accounting, offering greater efficiency and convenience.

- Speed and Efficiency: Digital records can be created, sent, and processed instantly, reducing delays and speeding up payment cycles.

- Cost-Effective: Eliminating the need for paper, printing, and postage helps save money in the long run.

- Easy Record Keeping: Storing digital documents is much more efficient than maintaining paper copies, allowing for quick access and retrieval when needed.

- Improved Accuracy: Automatic calculations reduce the chances of errors, ensuring the amounts and details are always correct.

- Environmental Impact: Going digital helps reduce paper waste, contributing to a more sustainable business practice.

- Enhanced Professionalism: Sending a well-designed digital document can impress clients and show that you are up-to-date with modern business practices.

Overall, digital billing systems help increase productivity, reduce costs, and improve client relationships, making them an essential tool for anyone offering services.

Step-by-Step Guide to Creating Invoices

Creating a clear and professional billing document doesn’t have to be complicated. With the right structure, you can easily generate a detailed record of services provided and amounts due, ensuring both you and your client are on the same page. This guide will walk you through the essential steps to create an accurate and effective billing statement, from gathering information to finalizing the document.

Step 1: Gather Information

Before starting, make sure you have all the necessary details. This includes your contact information, your client’s contact information, a description of the services rendered, and the agreed-upon payment amount. If applicable, be sure to include taxes, discounts, and any other charges.

Step 2: Choose a Format

You can either use an online tool, a software program, or create a document manually using a word processor or spreadsheet. Choose the format that best suits your workflow. Make sure it is easy to edit, professional, and customizable for future use.

Step 3: Fill in the Details

Include the service description, date of service, and total amount due. If you’re providing multiple services, list them separately with corresponding costs. Ensure that payment terms, such as due dates and late fees, are clearly outlined. Double-check for any additional charges or adjustments that need to be included.

Step 4: Review for Accuracy

Take a moment to check that all details are correct, including pricing, dates, and contact information. Mistakes in these areas can lead to confusion and delays in payment. Ensure that the document is organized in a way that’s easy to read and understand.

Step 5: Send the Document

Once you’ve completed the document, save it in a secure format such as PDF to preserve its integrity. Send it via email, or through an invoicing platform, depending on what’s most convenient for you and your client. Make sure to track when the document was sent and follow up if necessary.

By following these steps, you’ll create a well-organized and professional billing document that sets clear expectations and helps ensure timely payments.

Common Mistakes to Avoid in Invoicing

While creating billing documents may seem straightforward, there are several common pitfalls that can lead to confusion, delayed payments, or misunderstandings. Ensuring that every detail is accurate and clear is key to maintaining a smooth financial process. Avoiding these errors will not only improve your workflow but also enhance your professionalism in the eyes of clients.

Missing or Incorrect Contact Information

One of the most basic yet crucial mistakes is failing to include the correct contact details. Ensure that both your information and the client’s are accurate. This includes full names, business addresses, phone numbers, and email addresses. Incorrect or missing details can delay communication and make it harder for clients to reach out for clarification or payment.

Unclear Payment Terms

Ambiguous payment terms can cause confusion and lead to delayed payments. Always state clearly when the payment is due, what methods are accepted, and any penalties for late payments. If you offer installment plans, specify the amounts and due dates. Clear payment terms ensure that both you and your client know what to expect and when.

Other common mistakes include:

- Forgetting to add taxes or discounts to the total amount

- Not providing enough detail in the service description

- Incorrectly calculating totals or applying the wrong rates

- Failure to include a unique reference number for easier tracking

By double-checking for these issues and taking the time to ensure clarity in every document, you reduce the chance of errors and foster a smoother business relationship.

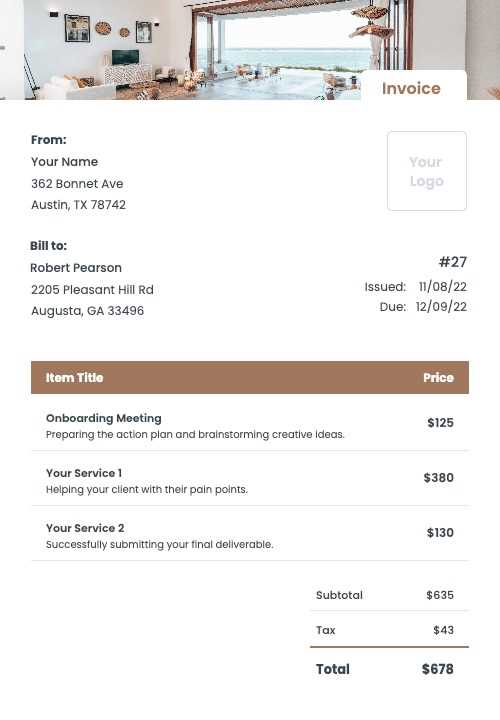

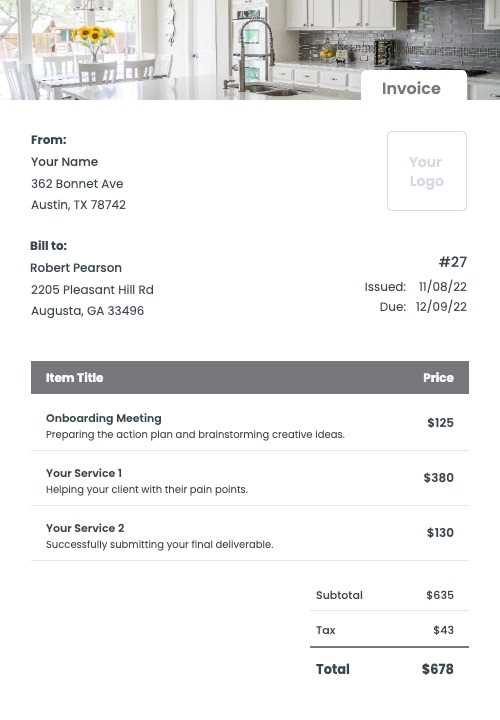

Best Practices for Invoice Design

When creating a billing document, design plays a crucial role in ensuring clarity and professionalism. A well-designed statement not only makes it easier for clients to understand the charges but also reinforces your brand image. The goal is to create a layout that is simple, structured, and easy to read, with all important information readily accessible. A clear, organized design can help avoid misunderstandings and ensure timely payments.

Prioritize Simplicity and Clarity

The design of your document should be clean and straightforward. Avoid cluttering the page with unnecessary information or decorative elements that might distract from the key details. Use headings and subheadings to organize the content logically, and ensure that there is enough white space between sections. This improves readability and helps clients quickly find what they need, such as service descriptions, amounts due, and payment terms.

Consistent Branding and Professional Appearance

Incorporating your company logo, brand colors, and a consistent font style can enhance the overall look of the document. It helps establish a professional image and makes your billing record easily recognizable. However, be careful not to overdo it–ensure that your branding elements do not overpower the core content of the document.

Other design tips to consider:

- Use a clean, professional font that is easy to read (e.g., Arial, Helvetica, or Times New Roman).

- Make sure that key sections (such as total amounts and due dates) stand out using bold or larger text.

- Incorporate a consistent color scheme that matches your business identity but doesn’t distract from the content.

- Ensure the document is optimized for both digital and printed formats to accommodate different client preferences.

By following these design best practices, you can create a billing record that is not only functional but also reflects the professionalism of your business, helping you maintain positive relationships with your clients.

How to Track Payments Efficiently

Tracking payments efficiently is key to maintaining smooth cash flow and ensuring that all financial transactions are properly recorded. By staying organized and using the right tools, you can easily monitor payments, identify overdue amounts, and reduce the risk of errors or missed payments. Proper tracking also helps you stay on top of outstanding balances and maintain a professional relationship with clients.

Utilize Digital Tools and Software

One of the most effective ways to track payments is by using accounting software or digital invoicing platforms. These tools can automate many aspects of the process, such as sending reminders for overdue payments, generating reports, and keeping a record of every transaction. Popular platforms like QuickBooks, Xero, or Zoho Invoice allow you to manage your payments in real-time and can integrate with your bank accounts for added convenience.

Set Up a Payment Tracking System

If you prefer a more manual approach, setting up a simple spreadsheet can help you track payments. A basic tracking system should include the following:

- Client Name: Who is making the payment?

- Invoice Number: This helps track specific transactions.

- Amount Due: The total amount that is expected.

- Payment Date: When the payment was made or is due.

- Payment Status: Mark whether the payment is pending, completed, or overdue.

Regularly updating this information will allow you to quickly identify which payments are still pending and take necessary actions if needed.

Send Payment Reminders

To prevent overdue payments from piling up, consider setting up automatic reminders for clients. Most invoicing software offers the ability to send follow-up emails or messages if a payment is not received by the due date. If you’re doing it manually, setting a reminder on your calendar to check on unpaid amounts will help keep you on track.

By using these strategies, you can streamline your payment tracking process, reduce administrative work, and ensure that your business operates smoothly and efficiently.

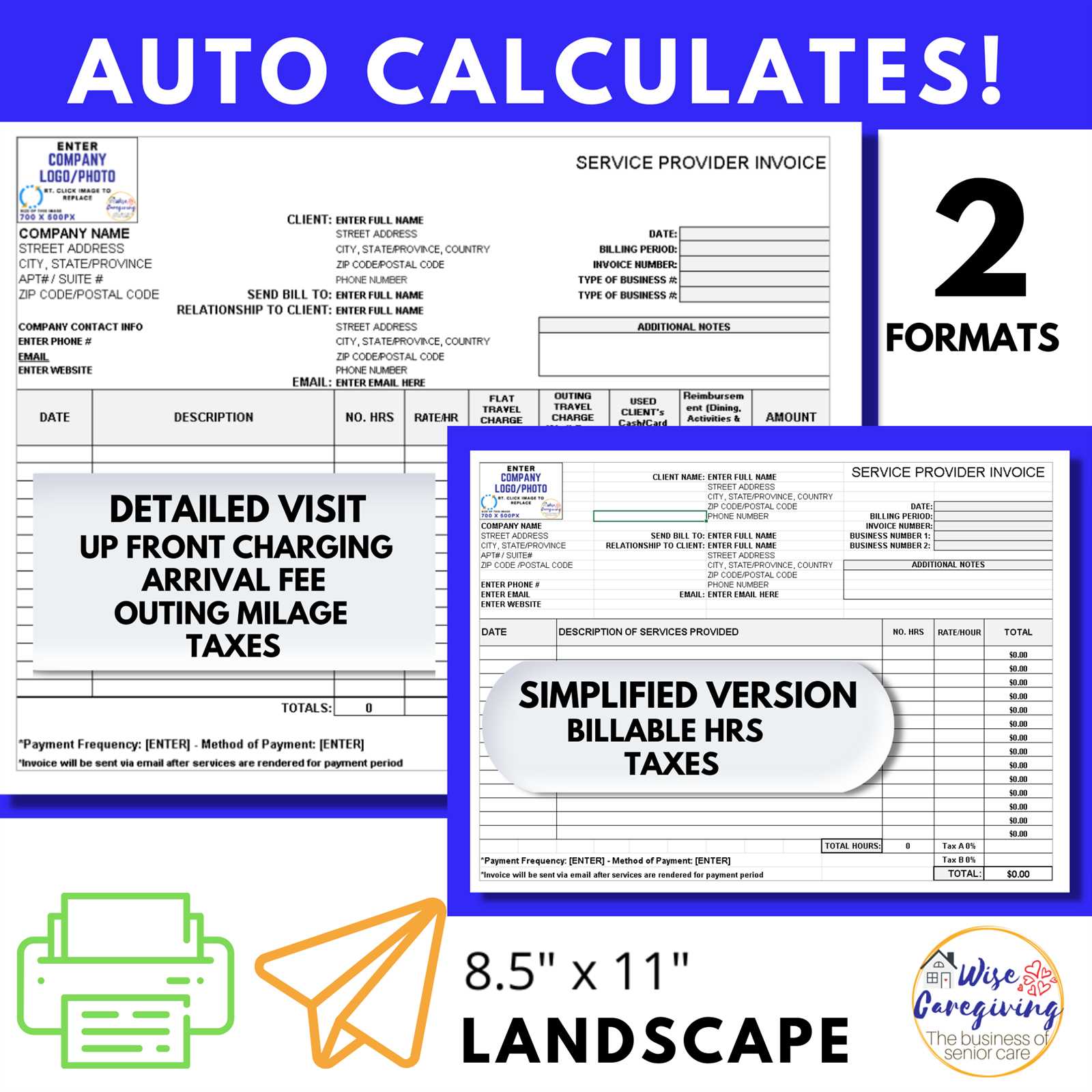

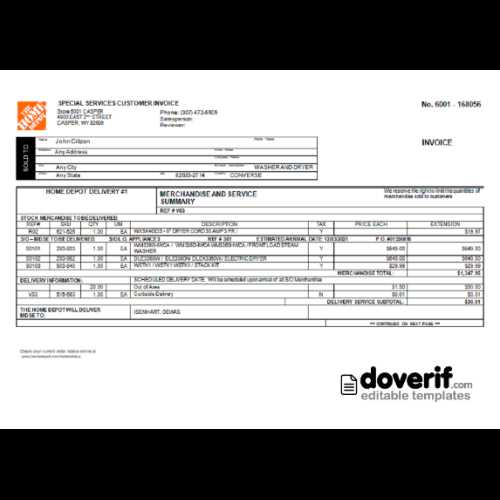

Choosing the Right Format for Invoices

Selecting the right format for your billing documents is essential for ensuring they are both professional and easy to manage. The format you choose will affect how clients perceive your business, as well as how efficiently you can manage payments and track records. Whether you opt for a digital, printable, or hybrid approach, it’s important to consider functionality, accessibility, and customization options when making your decision.

Consider Your Business Needs

The first step in choosing the right format is to assess your specific business needs. If you’re frequently handling large volumes of transactions, a digital solution may be best for automating and streamlining your billing process. For smaller-scale operations, a printable format might be sufficient. Below are some factors to consider:

- Volume of Transactions: High-volume businesses may benefit from automated digital platforms.

- Client Preferences: Some clients may prefer digital documents, while others might need a hard copy.

- Customization Needs: A format that allows for easy editing and personalization can be crucial for businesses offering unique or variable services.

Digital vs. Physical Formats

Both digital and physical formats come with their own set of advantages. Understanding these will help you decide which option is most appropriate for your workflow:

- Digital Formats: Digital documents (PDF, Word, Excel, or specialized invoicing software) are easily editable, shareable, and can be automatically tracked and stored. They can also integrate with accounting systems, reducing administrative tasks.

- Physical Formats: Printed bills may be necessary for clients who prefer hard copies or if you operate in a market where physical documentation is still required. However, they can be more time-consuming to send and track.

By considering these factors and selecting the right format, you can ensure that your billing process is efficient, streamlined, and meets both your business needs and your clients’ expectations.

Importance of Accurate Billing Information

Providing accurate billing details is crucial for both service providers and clients to ensure smooth financial transactions. Incorrect information can lead to delays, confusion, and even disputes that may affect the reputation of your business and strain client relationships. By ensuring that every detail is precise, you help maintain transparency and create trust, which is essential for long-term success.

Avoiding Payment Delays

One of the main consequences of incorrect billing information is delayed payments. If clients cannot easily verify the details of the charges or the total amount due, they may delay payment until the confusion is resolved. This not only disrupts your cash flow but may also create a negative client experience. Ensuring that all contact details, amounts, and service descriptions are accurate helps facilitate timely payments and minimizes misunderstandings.

Building Professional Trust

Accurate and clear billing fosters professionalism and reliability. By providing your clients with detailed and error-free documentation, you demonstrate your attention to detail and your commitment to transparent business practices. Clients are more likely to trust you with future projects and refer you to others when they see that you operate with honesty and integrity.

Key elements to verify in your billing records:

- Correct client contact details (name, address, email, etc.)

- Accurate descriptions of services or products provided

- Proper application of taxes, discounts, or additional charges

- Clear payment terms (due date, late fees, etc.)

By paying close attention to these details, you can avoid costly errors and build stronger, more trusting relationships with your clients.

Legal Requirements for Billing Documents

When preparing billing documents, it is essential to comply with legal regulations to avoid disputes or penalties. Different countries and regions have specific requirements regarding the information that must be included in such documents. Understanding these legal obligations will ensure that your business remains in good standing and helps you avoid unnecessary legal complications.

Key Legal Information to Include

While requirements may vary, there are several elements that are generally required by law for any business transaction. These include:

- Business Information: Include your business name, registered address, and tax identification number (TIN). This helps identify your business in the event of an audit or dispute.

- Client Information: The full name or company name, address, and contact information of the client should be clearly listed. This ensures transparency and proper communication.

- Itemized List of Services or Products: A clear description of the services provided or products sold, including quantities, prices, and any applicable taxes.

- Unique Reference Number: Each document should have a unique identifier (e.g., invoice number) for tracking purposes.

- Date of Transaction: The date the service was provided or the product was delivered, along with the date the payment is due.

- Payment Terms: Clearly outline the agreed-upon payment terms, including due date and any penalties for late payment, if applicable.

Tax Considerations

Most countries require that businesses collect and report sales tax or value-added tax (VAT) on transactions. Depending on your location, you must ensure that your documents include the correct tax rates and amounts, as well as your business’s tax registration number. Failing to do so can result in fines or audits from tax authorities.

- VAT Number: If your business is VAT registered, include your VAT number on the document.

- Tax Breakdown: If applicable, break down the tax amount separately from the total, showing both the rate and the amount charged.

By ensuring that your billing records meet these legal requirements, you protect your business from potential legal issues and provide your clients with clear, transparent documentation that meets regulatory standards.

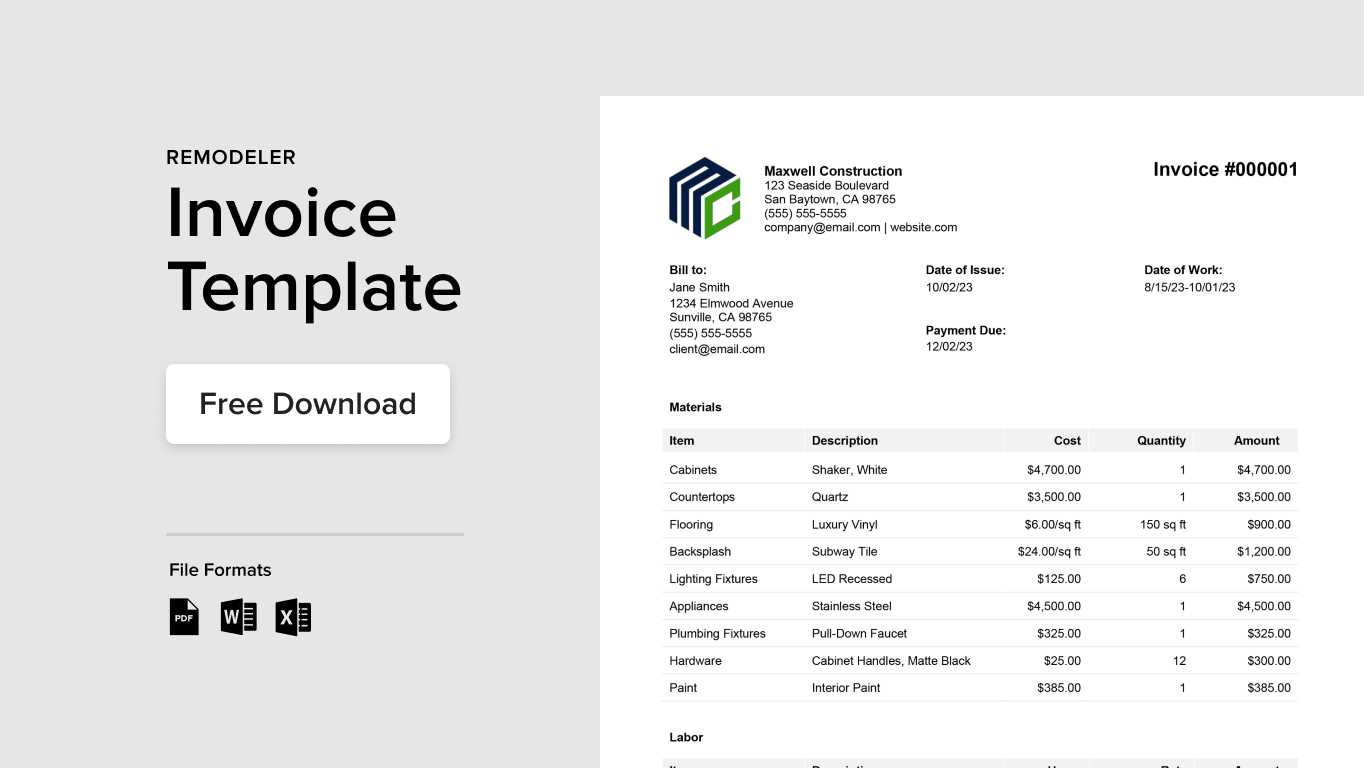

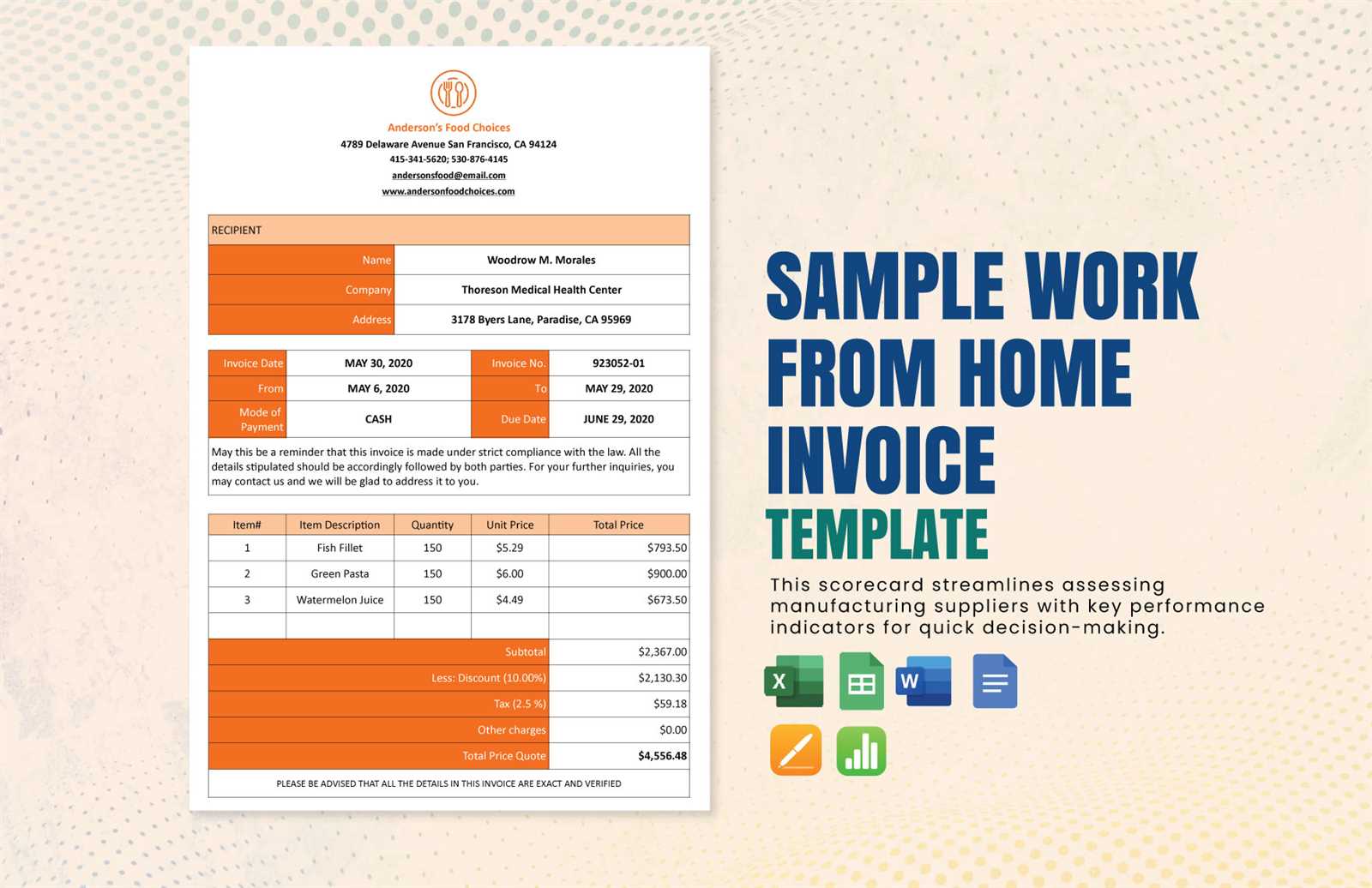

Free vs Paid Invoice Templates

When selecting a billing document format, one of the main choices you will face is whether to use a free or paid option. Both have their pros and cons, and the decision often depends on your business’s specific needs and the level of customization or functionality you require. Free options can work well for basic needs, but paid solutions often provide enhanced features, support, and design flexibility that may better suit growing businesses.

Advantages of Free Billing Formats

Free templates are a great option for small businesses, freelancers, or individuals just starting out. They offer an easy and cost-effective way to create professional-looking documents without any upfront investment. Here are some key benefits of using free formats:

- Zero Cost: The most obvious benefit is that there is no financial commitment involved, making it ideal for startups and those on a tight budget.

- Quick and Easy to Use: Free formats are generally simple to download and use. Many are available in popular file types such as Word, PDF, or Excel, and can be customized with minimal effort.

- Basic Functionality: For businesses with straightforward billing needs, a free format can cover essential features, such as service descriptions, amounts due, and payment terms.

Benefits of Paid Billing Formats

While free templates may suffice for basic use, paid options offer a range of advanced features that can enhance the billing process and improve efficiency. These templates are often designed with professional businesses in mind and include a higher level of customization. Key benefits of paid formats include:

- Advanced Customization: Paid options allow for more flexibility in design and layout, enabling you to create a personalized experience that reflects your brand.

- Integration with Accounting Systems: Many paid formats integrate with accounting or bookkeeping software, helping automate financial tracking and reporting.

- Customer Support: Paid solutions typically offer customer service or technical support, ensuring you get help if any issues arise during use.

- Automation Features: Some paid formats offer automation features such as recurring billing, automatic payment reminders, and direct payment links, making the billing process more efficient.

Ultimately, whether to choose a free or paid option depends on the scale of your business, your specific requirements, and your budget. Free templates can work well for individuals or small businesses with basic needs, but if you’re looking for advanced functionality, customization, and integration, a paid solution may be the better choice.

How to Handle Invoice Disputes

Disputes over billing can arise for various reasons, including unclear charges, errors in the document, or disagreements over the scope of services provided. When such situations occur, it’s important to address them promptly and professionally to maintain good client relationships and avoid unnecessary delays in payment. Handling disputes effectively requires clear communication, a calm approach, and a willingness to resolve issues fairly.

Steps to Resolve Billing Disputes

When faced with a dispute, it’s important to follow a structured process to ensure that the issue is resolved efficiently and without damaging your relationship with the client. Here are the key steps to take:

- Review the Document: Start by carefully reviewing the billing document in question. Double-check the details to ensure that there were no errors on your end, such as incorrect amounts or unlisted charges.

- Clarify the Discrepancy: Communicate with the client to understand the reason for the dispute. It’s essential to listen carefully to their concerns and ask for any supporting documentation they may have to back up their claims.

- Provide Documentation: If the dispute involves services or products that were provided, gather any supporting evidence, such as contracts, signed agreements, or delivery confirmations, that prove the validity of the charges.

- Negotiate a Solution: Once you have a clear understanding of the issue, propose a fair solution. If there was an error on your part, be prepared to correct it or offer a discount. If the charges are legitimate, explain why and offer to work with the client on a payment plan if needed.

Preventing Future Disputes

While disputes are inevitable at times, there are several steps you can take to minimize their occurrence in the future:

- Ensure Clarity: Always ensure that billing documents are clear, with detailed descriptions of services, amounts, taxes, and payment terms. A transparent document can prevent confusion down the line.

- Maintain Open Communication: Keep clients informed about the status of their payments, upcoming charges, and any changes to the scope of services. Clear communication helps prevent misunderstandings.

- Set Clear Terms: Include clear payment terms in all your billing records, specifying due dates, late fees, and any other conditions. Ensure that clients are aware of these terms before agreeing to services.

By following these steps and maintaining a professional attitude, you can resolve disputes effectively and prevent similar issues from arising in the future. The key is to stay calm, fair, and responsive to the client’s concerns while protecting your business interests.

Integrating Billing Documents with Accounting Software

Integrating your billing documents with accounting software can significantly streamline your business’s financial processes. By linking your billing records directly to your accounting system, you can automate tasks such as payment tracking, financial reporting, and tax calculations. This not only saves time but also reduces the risk of errors that can occur when handling these tasks manually.

When you integrate your billing system with accounting software, you create a seamless flow of information between the two systems. This allows you to track payments, issue reminders, and generate reports with ease, all while maintaining accurate and up-to-date financial data.

Benefits of Integration

Integrating billing with accounting software offers several advantages for businesses of all sizes:

- Automation: Automating the process of recording payments and updating financial records saves time and reduces manual errors. Payments and adjustments are recorded in real-time, keeping your accounting accurate without additional effort.

- Accurate Financial Reporting: With integrated systems, you can generate financial statements and reports that reflect the most current data, ensuring accurate insights into your business’s performance.

- Tax Compliance: Automated integration can help track tax rates and amounts, ensuring that you’re always in compliance with local tax regulations, minimizing the risk of errors during audits.

- Time Savings: Streamlining the entire process of billing and accounting reduces administrative workload, freeing up time to focus on other critical aspects of your business.

Choosing the Right Software

To take full advantage of these benefits, it’s important to choose the right accounting software that integrates smoothly with your billing system. Look for solutions that are compatible with your existing tools and offer features like invoicing, payment tracking, and tax management. Many popular accounting platforms, such as QuickBooks, Xero, and FreshBooks, offer built-in integrations or third-party apps to connect with your billing system.

By integrating your billing and accounting systems, you can reduce manual work, ensure accurate financial data, and improve the overall efficiency of your business operations. This integration is a valuable investment in maintaining streamlined and professional financial management.

Creating Recurring Billing Documents for Clients

For businesses that offer ongoing services or products, setting up recurring billing can greatly simplify financial management. Rather than manually generating documents each month or billing cycle, you can automate the process to ensure timely and consistent payments. This approach not only saves time but also improves cash flow by ensuring that clients are billed on a regular schedule.

Recurring billing is ideal for subscription-based services, maintenance contracts, or any agreement where clients are charged periodically for continuous service. By setting clear payment terms and automating the process, you can reduce the risk of late payments and maintain better relationships with clients.

Steps to Set Up Recurring Billing

Creating a recurring billing system requires careful setup to ensure accuracy and efficiency. Follow these steps to get started:

- Define Billing Frequency: Decide how often clients will be billed. Common options include monthly, quarterly, or annually. Choose a schedule that aligns with your service delivery and client expectations.

- Specify Payment Terms: Make sure to outline clear payment terms, such as the due date, late fees, and any discounts for early payment. This helps avoid confusion and ensures that both parties understand the expectations.

- Automate the Process: Use accounting software or online billing platforms that allow you to set up automated recurring billing. This ensures that each billing cycle is generated automatically based on your established schedule.

- Send Reminders: Set up automated reminders to notify clients about upcoming payments. This can help reduce late payments and encourage clients to pay on time.

Advantages of Recurring Billing

Recurring billing offers a variety of benefits, both for businesses and clients:

- Steady Cash Flow: By ensuring that payments are made regularly, you can maintain a more predictable and consistent cash flow for your business.

- Time Savings: Automating the billing process reduces administrative workload and allows you to focus on other aspects of the business.

- Improved Client Satisfaction: Clients appreciate the convenience of automated billing and the transparency of knowing exactly when payments will be due.

Setting up recurring billing is a practical way to streamline your business’s financial operations. By automating payments and clearly communicating terms, you can foster better relationships with your clients and ensure timely revenue collection.

Common Billing Terms Explained

Understanding the terminology used in billing documents is crucial for both businesses and clients. The language surrounding charges, payment terms, and conditions can sometimes be confusing, but becoming familiar with the most common terms helps to avoid misunderstandings. This section will break down some of the key terms that frequently appear on financial documents, providing clarity on their meaning and significance.

Key Billing Terms

Here are some of the most commonly used terms you may encounter when dealing with billing records:

- Due Date: The date by which payment must be made. Late payments after the due date may incur additional charges, such as late fees or interest.

- Net Terms: Refers to the amount of time a client has to pay after receiving a bill. Common net terms include “Net 30” (30 days) or “Net 60” (60 days).

- Payment Terms: The agreed-upon conditions of payment, including the due date, method of payment (e.g., bank transfer, credit card), and any discounts or late fees.

- Subtotal: The sum of all the charges before any taxes, discounts, or additional fees are applied.

- Tax Rate: The percentage of tax added to the total cost of services or goods provided. It varies depending on the location and type of product or service.

Other Important Terms

In addition to the basic terms above, you may encounter other key concepts that help clarify the details of a billing document:

- Discount: A reduction in the total price, often offered as an incentive for early payment or as part of a promotional offer.

- Balance Due: The amount that remains unpaid after subtracting any payments, credits, or discounts.

- Late Fee: An additional charge applied when payment is not received by the due date. Late fees are often a percentage of the outstanding balance.

- PO Number: Purchase Order number – a unique reference number used by the buyer to track and approve the purchase before payment is made.

By understanding these basic terms, businesses can create clear, transparent documents, and clients can better manage their payments. Familiarity with billing terminology ensures smoother transactions and avoids unnecessary confusion for both parties.

How Billing Documents Improve Cash Flow Management

Effective cash flow management is vital for the health of any business. One of the most important tools for ensuring steady cash flow is having a well-structured system for tracking payments and ensuring timely receipt of funds. Regular and accurate billing is a key aspect of this system, as it helps businesses maintain control over their income and expenses.

When billing is handled properly, businesses can forecast their revenue more accurately, avoid late payments, and ensure that clients pay within the specified timeframes. By automating and streamlining the billing process, companies can reduce the risk of cash flow problems that often arise from missed or delayed payments.

Benefits of Using Billing Systems for Cash Flow

Integrating billing systems into your financial workflow can bring several advantages that directly impact cash flow management:

- Faster Payment Collection: When billing documents are clear, timely, and automated, clients are more likely to pay on time. This results in quicker access to funds and a more predictable cash flow.

- Reduced Errors and Disputes: Clear and accurate documents help prevent misunderstandings and billing errors, reducing the likelihood of payment delays caused by disputes over charges.

- Improved Client Relationships: Consistently issuing professional, timely documents helps build trust with clients, leading to faster payments and long-term relationships.

- Better Financial Forecasting: Regular billing cycles allow businesses to predict their cash inflows more reliably, which helps with planning for operational costs, growth, and investment opportunities.

How Automated Billing Supports Cash Flow

Automating your billing process can make a significant impact on cash flow management. With automated systems, businesses can set up recurring billing, issue reminders for overdue payments, and track payment status in real-time. This reduces the administrative burden and helps ensure that all invoices are issued promptly and payments are collected efficiently.

- Recurring Billing: Setting up automatic recurring billing for ongoing services ensures consistent revenue flow without the need to manually generate each document.

- Automated Reminders: Automated payment reminders can be sent to clients before or after the due date, ensuring timely payments and reducing the likelihood of overdue balances.

- Real-time Tracking: With automated systems, businesses can instantly track the status of payments and follow up on any outstanding balances more efficiently.

By using a robust billing system, businesses can enhance their cash flow management, ensuring that funds are available when needed to cover expenses, invest in growth, and maintain financial stability.