How to Use Microsoft Invoice Template 2007 for Your Business

For small business owners and freelancers, managing financial transactions efficiently is key to maintaining a smooth workflow. One of the simplest ways to streamline this process is by using pre-designed forms that help you create clear and professional records of payments and services. With these tools, you can save time, reduce errors, and focus more on growing your business.

These ready-made solutions provide a structured layout, allowing you to quickly input necessary information, including client details, payment amounts, and due dates. Not only does this ensure consistency in your paperwork, but it also enhances the professional appearance of your financial documents. Customization options make it easy to adjust the design to fit your unique business needs, making the process both effective and adaptable.

Whether you’re just starting out or managing an established business, leveraging these resources can simplify your accounting tasks. The following guide will help you understand how to efficiently use these tools to manage transactions and maintain an organized record-keeping system.

Microsoft Invoice Template 2007 Overview

For businesses of all sizes, maintaining clear and professional financial records is essential for smooth operations. The document creation tool available in older versions of Office software offers an easy way to generate detailed billing statements without needing specialized accounting software. This pre-built solution provides users with a straightforward method to record payments, track transactions, and communicate with clients in a professional manner.

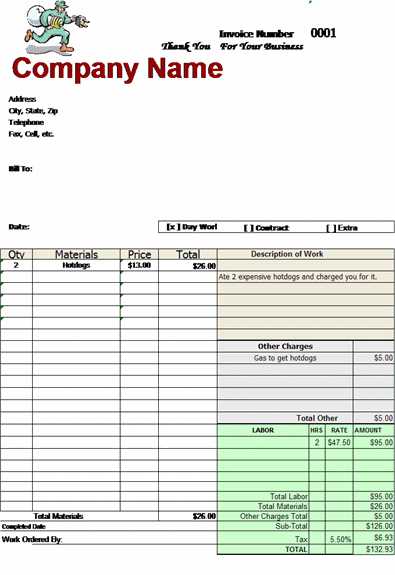

Key Features of the Billing Form

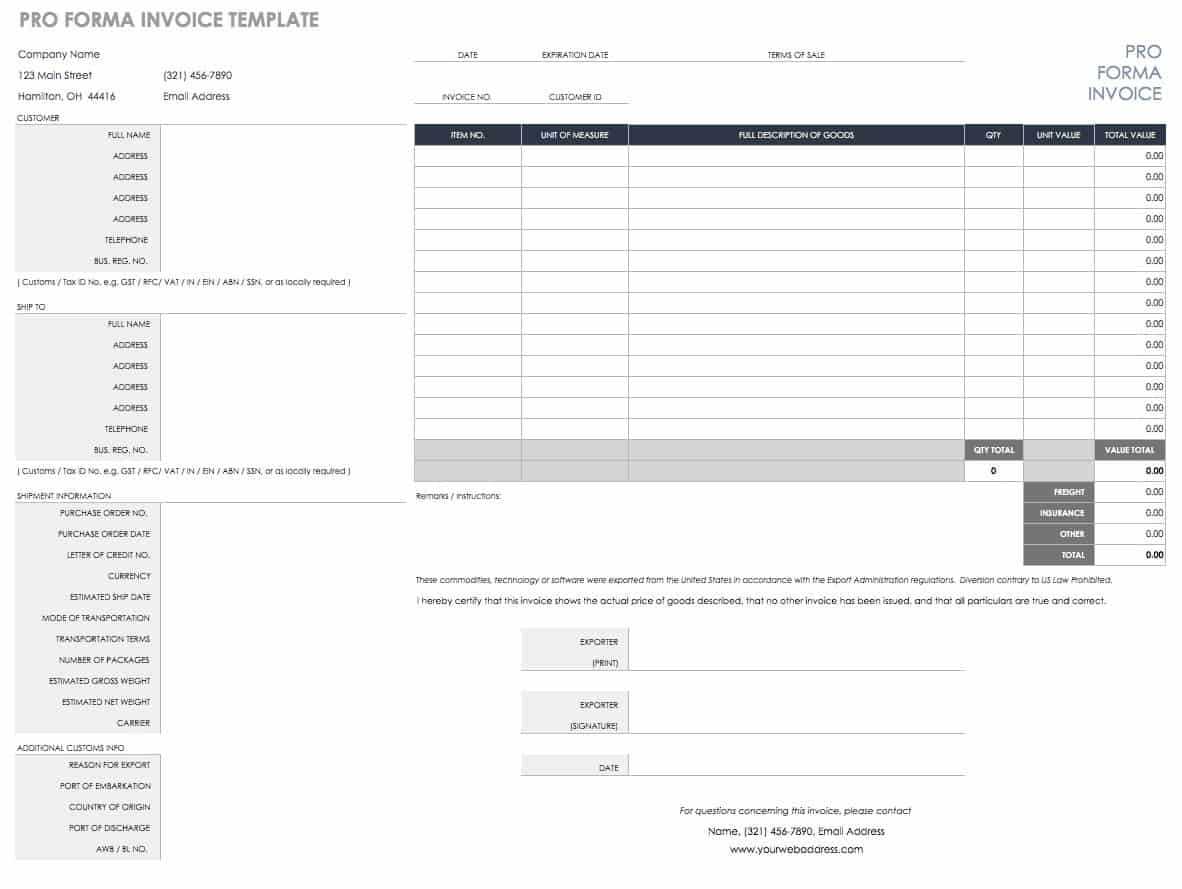

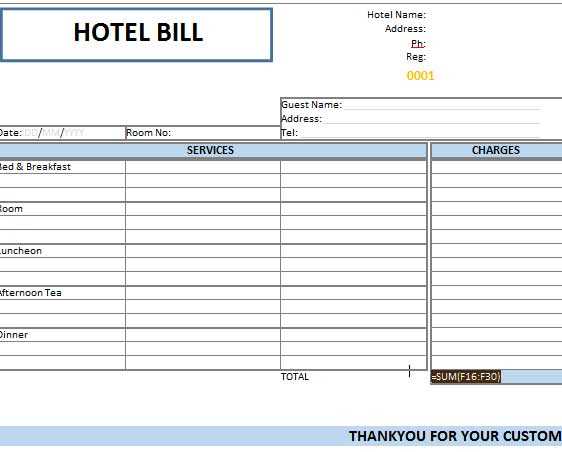

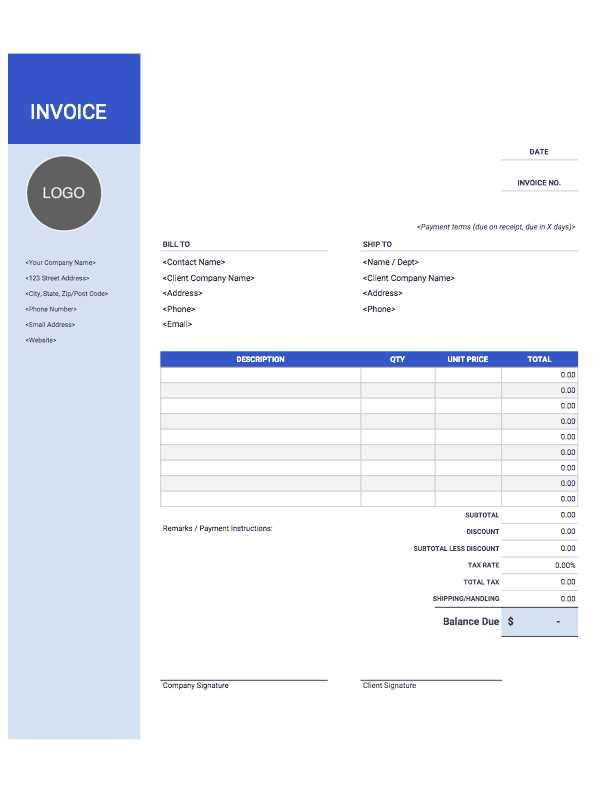

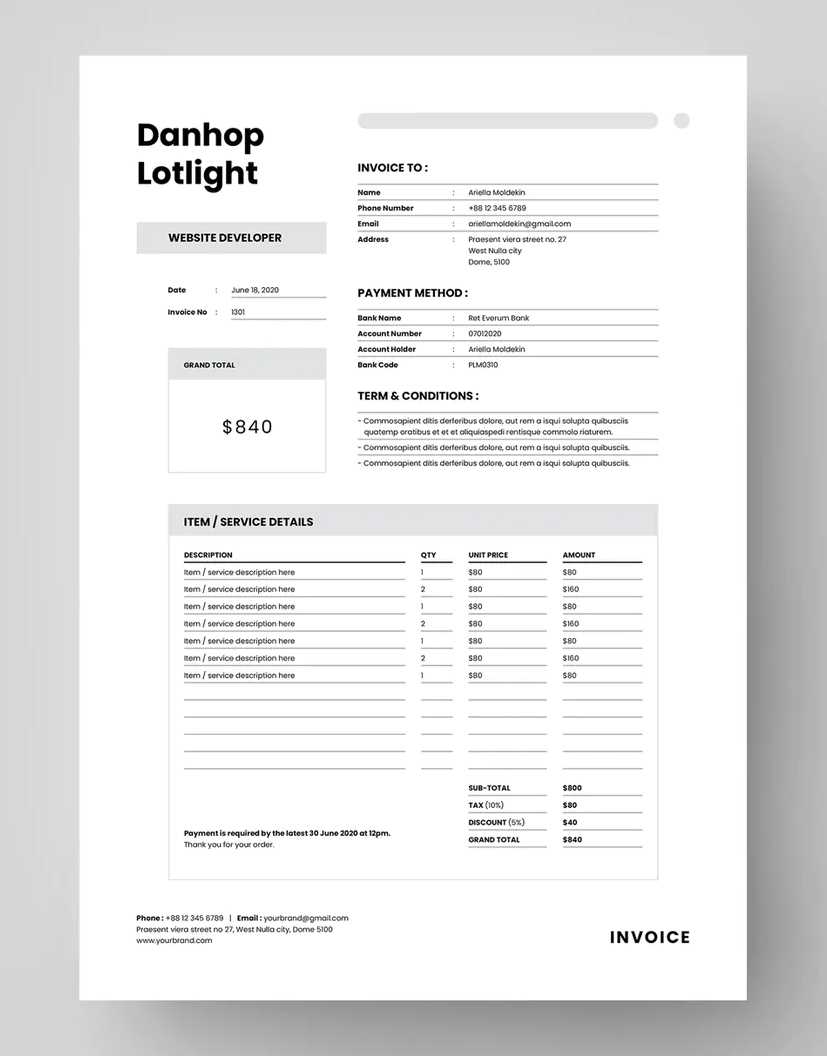

This form comes equipped with all the essential fields required to generate complete and accurate financial documents. You can input client information, list the services rendered, and specify payment terms. Fields for the total amount due, taxes, and due dates are included, ensuring all necessary details are present without extra effort. The layout is clean, easy to navigate, and allows for simple customization to suit individual business needs.

Customization and Flexibility

Despite being a pre-designed structure, the document offers flexibility for those who need to adjust the layout or add specific elements for their unique business requirements. You can modify fonts, colors, and field positions to match your branding or style. This customization helps ensure that the final product reflects your company’s professionalism while maintaining consistency across all your financial documents.

Why Choose Microsoft Invoice Templates

Using a pre-designed document for financial transactions offers numerous advantages, especially for those without extensive accounting experience. These ready-to-use solutions simplify the process of creating professional and accurate records, allowing businesses to save time and reduce errors. They provide a structured framework that ensures important details are consistently included, making the billing process more efficient and reliable.

One of the key benefits is ease of use. You don’t need to start from scratch or worry about formatting issues. The design is already set up, so all you need to do is input your specific data. Furthermore, these forms are customizable, allowing you to adjust certain elements to fit your business style or specific needs without complicated software. This level of flexibility makes it accessible for both newcomers and experienced professionals.

Another significant advantage is compatibility with common office software. These solutions integrate seamlessly with most systems, allowing for quick access and easy sharing across different devices or platforms. Whether you need to send a bill by email or print a physical copy, these documents are designed to work effortlessly in any environment, making them an ideal choice for businesses of all sizes.

Key Features of Microsoft Invoice Template 2007

This pre-designed billing document offers a range of features that make it ideal for businesses looking to manage their financial records quickly and efficiently. The layout is simple yet comprehensive, ensuring that all critical details are captured accurately without overwhelming the user. Whether you’re a freelancer or a small business owner, this tool can help streamline your payment process and enhance professionalism.

Essential Components

The layout is designed to cover all necessary information for generating a complete and accurate record. Here are some of the key elements:

- Client Information: Easily input client name, address, and contact details.

- Service or Product Details: List of services provided or items sold, with space for descriptions and quantities.

- Pricing: Fields to input unit prices, totals, and applicable discounts.

- Tax and Additional Fees: Pre-configured sections to add tax percentages and any extra charges.

- Due Date and Payment Terms: Clearly marked fields for payment deadlines and agreed-upon terms.

- Unique Reference Number: A section to assign a unique number to each transaction for easy tracking.

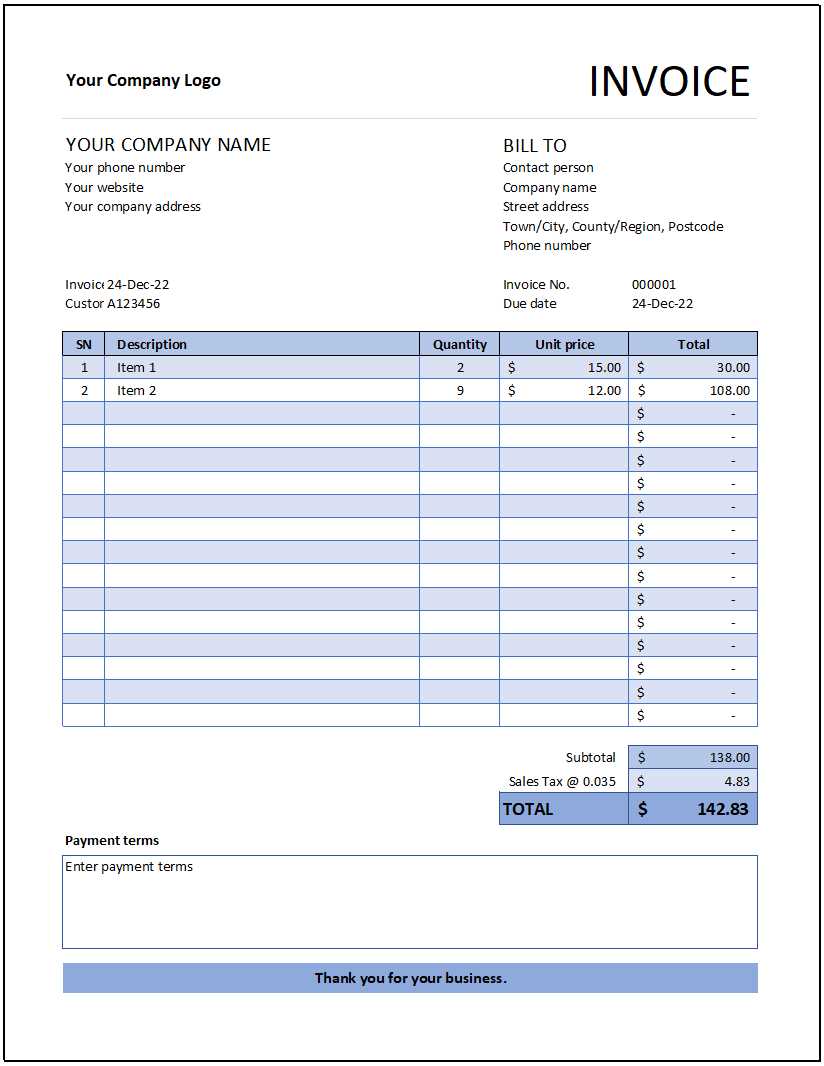

Customization and User-Friendly Design

Despite being a pre-made document, it offers significant flexibility in terms of design. Users can adjust:

- Fonts and Colors: Customize the appearance to align with your business branding.

- Layout Adjustments: Modify sections or add new fields to better suit your specific needs.

- Logo Integration: Easily add your company’s logo for a more personalized and professional touch.

These customizable features make the document adaptable for different types of businesses, whether you’re offering consulting services or selling physical goods.

How to Download the Template

Downloading a pre-designed billing form is a straightforward process that can be completed in just a few simple steps. By following the instructions below, you can access the document and start using it for your business transactions right away. The file is available through various online sources, and the process ensures you get the correct version compatible with your system.

Step-by-Step Instructions

Follow these steps to download the necessary document:

| Step | Action |

|---|---|

| 1 | Visit the official website or trusted online source where the document is hosted. |

| 2 | Navigate to the section or category dedicated to billing or business forms. |

| 3 | Search for the specific document by name or use filters to narrow down the results. |

| 4 | Click the download button or link to begin the download process. |

| 5 | Once downloaded, open the file using compatible office software to start editing. |

File Compatibility

Ensure that you have the necessary software to open and edit the file. Typically, these documents are available in popular formats like .docx or .xlsx, which can be accessed using commonly used office suites. If the file is in a different format, check that you have the appropriate software or viewer installed on your system before attempting to open it.

Setting Up Your Invoice Template

Once you have downloaded the billing document, the next step is to set it up for your business needs. This process involves configuring the form so that it accurately reflects your company’s branding, the services you provide, and the terms of each transaction. The layout is flexible, allowing you to customize various elements to fit your requirements.

Follow these simple steps to get started:

- Open the File: Launch the document in your preferred office software.

- Enter Business Details: Fill in your company name, address, contact information, and logo. Make sure these details are correct and consistent with your other business materials.

- Client Information: In the designated section, input the client’s name, address, and any other necessary contact details.

- List of Services: Include the services provided or items sold, with corresponding descriptions, quantities, and prices. Adjust the layout if more space is needed.

- Payment Terms: Specify the payment due date, any applicable taxes, and the terms of payment (e.g., net 30, upon receipt).

- Customize Design: Adjust fonts, colors, and the overall look to match your brand. This step is essential for a professional appearance.

- Review and Save: Double-check all fields for accuracy, ensure proper formatting, and then save the file in a convenient location for future use.

After completing these steps, your document will be ready for use in any billing or transaction scenario. Regularly update the template as needed to reflect changes in your pricing, terms, or business details.

Customizing the Template for Your Business

Personalizing a pre-designed billing document is essential for ensuring it aligns with your business’s unique needs and brand identity. Customization allows you to modify various elements, from company information to design and layout, ensuring the final product accurately represents your services and enhances your professional image. By adjusting key sections, you can tailor the document to match your specific requirements and maintain consistency across all financial records.

Here are some ways you can customize the document to suit your business:

- Branding: Add your company logo at the top of the document to ensure it is easily recognizable. You can also adjust the color scheme and font style to match your brand’s aesthetic.

- Business Information: Replace the default business details with your own. Include your address, phone number, email, and any other relevant contact information that clients may need.

- Service or Product Listings: Modify the description sections to fit the specific services or products you offer. You can also adjust the columns to reflect different pricing structures, such as hourly rates or bulk pricing.

- Payment Terms: Edit payment terms to reflect your business practices. Include information on late fees, discounts for early payments, or any special terms you may offer to clients.

- Layout Adjustments: Depending on your business needs, you can add or remove sections from the document, such as a space for customer signatures or additional notes. This flexibility allows you to create a document that fits your workflow.

By customizing these elements, you create a unique document that not only meets your business’s operational needs but also strengthens your professional image with clients.

How to Add Client Information

Including accurate client details in your billing document is crucial for maintaining clear and professional records. By adding the correct contact information, you ensure that both you and your clients can reference the transaction easily. It also helps to avoid any confusion related to payments or services provided. The process of entering client details is simple, and it ensures that all your communication remains organized and transparent.

Follow these steps to add client information to your document:

- Locate the Client Section: In the pre-designed form, find the designated area for entering client details. This is typically located near the top of the document, just below your own business information.

- Enter Client’s Name: Begin by inputting the full name of the client or the company. Be sure to spell it correctly and include any relevant titles, such as “Mr.” or “Dr.” if necessary.

- Provide Address Information: Include the client’s complete address, including street, city, state, and ZIP code. If applicable, you may also need to add a mailing address or different shipping address.

- Add Contact Details: Include the client’s phone number and email address. This will ensure that they can easily reach you if they have any questions regarding the transaction.

- Review for Accuracy: Double-check all the entered information to ensure it is correct and up to date. This is especially important for large transactions or long-term client relationships.

Once the client details are added, your document will be ready to send. By maintaining clear and accurate records, you can streamline communication and avoid delays or misunderstandings in the future.

Managing Invoice Numbers Effectively

Assigning and managing unique reference numbers to each billing document is essential for keeping track of transactions and ensuring proper record-keeping. A consistent numbering system helps both you and your clients easily identify and refer to specific records. It also plays a critical role in accounting and audits, where having organized and sequential numbers can simplify the reconciliation process.

Here are a few tips on how to manage reference numbers effectively:

- Use a Sequential Numbering System: Ensure that each new document gets a unique number that follows a clear and logical sequence. This makes it easier to track and locate past transactions.

- Include Date or Month in the Number: Adding the year or month to the reference number (e.g., 2023-001) can help organize records more efficiently and makes it easier to identify documents from a particular period.

- Avoid Gaps in the Sequence: Ensure that the numbering is continuous and doesn’t skip any numbers. This avoids confusion and ensures a complete set of records for future reference.

- Use Prefixes or Suffixes: If you manage different types of transactions or clients, consider adding prefixes or suffixes to differentiate between them. For example, you could use “S” for services and “P” for products, such as “S-001” and “P-001.”

- Keep a Record of Assigned Numbers: Maintain a log or spreadsheet where you can track all the numbers you’ve assigned. This will help prevent duplication and ensure that you always have a clear record of all transactions.

By managing reference numbers properly, you can create a more organized and efficient system for your business, making it easier to handle inquiries, audits, and payment tracking.

Using Date Fields in the Template

Including accurate date information in your billing document is crucial for both clarity and professionalism. Date fields help set clear expectations for payment timelines, as well as provide a record of when the transaction occurred. Properly managing date fields ensures that both you and your clients are on the same page when it comes to deadlines, payments, and due dates.

Here’s how to effectively use date fields in your document:

- Issue Date: The issue date marks the day the document is created. This date is essential as it helps both parties track the timeline for payments and agreements.

- Due Date: Clearly specify the due date for the payment. This helps set expectations for when the client is expected to pay and avoids any confusion about deadlines. Common formats include “Net 30” or a specific date.

- Payment Terms: If you offer flexible payment terms, include these details with the corresponding date fields. For example, “Payment due within 30 days of the issue date” can be indicated clearly using the date fields.

- Adjusting for Different Time Zones: If you are working with international clients, it’s important to specify the time zone of the due date to avoid confusion, especially for digital transactions or online payments.

- Custom Date Formats: Depending on your region or client preferences, you may need to adjust the date format. Common formats include MM/DD/YYYY or DD/MM/YYYY. Ensure that the format is clear to avoid any misinterpretation.

By correctly using and formatting date fields, you ensure that your financial documents are accurate, easy to understand, and professionally presented to your clients.

How to Include Tax Details

Including tax details in your billing document is essential for ensuring that both you and your clients understand the total cost of the transaction. Properly calculating and displaying tax amounts helps maintain transparency and compliance with local tax regulations. Whether you are charging sales tax, value-added tax (VAT), or any other type of tax, clearly outlining these amounts will help prevent misunderstandings and keep your financial records accurate.

Follow these steps to include tax details in your document:

- Identify Applicable Tax Rates: Before adding tax information, determine the correct tax rate based on your location or the client’s location. Different regions may have varying rates for different goods or services.

- Add a Tax Line: Create a line or section on the document specifically for tax charges. Clearly label this line with the applicable tax rate (e.g., “Sales Tax” or “VAT”) and ensure the client can easily identify it.

- Calculate the Tax Amount: Multiply the total amount of the services or goods provided by the tax rate to determine the correct tax amount. For example, if the subtotal is $100 and the tax rate is 10%, the tax amount would be $10.

- Show Tax as a Separate Line: List the tax amount as a separate line, distinct from the subtotal. This will help avoid confusion and make it clear that the tax is being added on top of the base price.

- Include Total Amount: After adding the tax, calculate the total amount due by adding the tax to the subtotal. Make sure the total reflects the complete cost, including both the goods or services and the tax.

- Clarify Tax Exemptions: If your business or the client qualifies for any tax exemptions, make sure to clearly note this in the document. Specify the exemption type and include a reference number or other necessary details for verification.

By clearly outlining tax details, you ensure that your clients are fully aware of the charges and can verify the accuracy of the transaction. This transparency is vital for maintaining professional and trustworthy business relationships.

Adding Payment Terms to Your Invoices

Clearly outlining payment terms in your billing document is essential for setting expectations and ensuring smooth financial transactions. Payment terms specify the conditions under which payment is expected, such as due dates, late fees, and any discounts for early payments. By providing these details up front, you help avoid misunderstandings and ensure both parties are aware of the agreed-upon conditions.

Here’s how to effectively add payment terms to your document:

| Payment Term | Description |

|---|---|

| Due Date | Specify the exact date by which the payment must be made. For example, “Due 30 days from the issue date” or a specific date like “March 15, 2024.” |

| Late Fees | If applicable, state any penalties for late payments. For example, “A late fee of 1.5% per month will be applied to overdue balances.” |

| Early Payment Discount | Provide a discount if the client pays ahead of the due date. For example, “A 5% discount is available for payments made within 10 days.” |

| Payment Method | Indicate the accepted payment methods (e.g., bank transfer, check, credit card, etc.) and any related instructions. |

By including these terms, you ensure that your client understands when and how to make payment, as well as any additional costs that may arise if payment is delayed. This clarity helps to avoid confusion and maintain a professional relationship.

Formatting Tips for Professional Invoices

Creating a polished and well-structured billing document is essential for presenting your business as organized and professional. A clean, easy-to-read layout not only enhances your credibility but also ensures that your client can quickly find and understand all the necessary details. Effective formatting makes a big difference in how your business is perceived and helps to avoid confusion or disputes regarding the transaction.

Key Formatting Considerations

Here are some formatting tips that will help you create a professional and visually appealing document:

- Use Clear Headings: Organize your document with clear headings for each section, such as “Business Details,” “Client Information,” “Items/Services Provided,” and “Payment Terms.” This helps the client navigate the document quickly.

- Maintain Consistent Fonts: Stick to one or two professional fonts throughout the document. Avoid using too many different font styles or sizes, as this can make the document look cluttered and unprofessional.

- Align Information Properly: Align the business and client details, as well as the list of items and prices, in a neat and structured way. Using tables or grids for this can help improve readability.

- Incorporate Your Brand: Add your logo and use brand colors or font styles to make the document consistent with your business’s identity. This adds a personal touch while maintaining a professional appearance.

- Keep It Simple: Avoid overloading the document with unnecessary information or complex designs. Keep the layout clean, focusing on the essential details, to make sure the document looks organized and easy to understand.

Spacing and Margins

Proper use of spacing and margins is vital for keeping the document visually appealing and easy to read:

- Use Adequate White Space: Leave enough space between sections and fields so the document doesn’t look crowded. White space enhances readability and makes the document more professional.

- Set Proper Margins: Ensure that there is consistent margin space around the edges of the document to avoid content being cut off when printing or viewed on different devices.

By following these formatting tips, you can create a professional billing document that leaves a lasting impression on your clients and helps ensure smooth business transactions.

How to Save and Print Your Invoice

After creating your billing document, it is important to know how to save and print it properly. Saving the document ensures that you have a backup copy for your records, while printing allows you to send a physical copy to your client if necessary. Properly saving and printing your document also helps maintain organization and efficiency in your business operations.

Saving Your Document

Follow these steps to save your document in a secure and accessible format:

- Choose the Right Format: Save your file in a format that is universally accessible, such as PDF or DOCX. PDFs are especially recommended as they preserve the layout and can be easily opened on any device.

- Use Descriptive File Names: Name your document in a way that helps you identify it easily. For example, use a format like “ClientName_Invoice_123” or “Date_Invoice_ClientName” to keep track of different documents.

- Save to a Secure Location: Store your file in a folder that is well-organized and easy to access. Consider saving it both locally on your computer and in cloud storage for added security.

- Backup Your Files: Make regular backups of important financial documents to avoid losing them due to system failures or accidental deletions.

Printing Your Document

Once your document is saved, follow these steps to print it properly:

- Check Document Layout: Before printing, review the document’s layout to ensure that all information is properly aligned and readable. Make sure there are no sections that are cut off or poorly formatted.

- Select the Right Printer: Choose a high-quality printer that ensures clear, professional prints. If you are printing multiple copies, consider a printer that supports bulk printing for efficiency.

- Adjust Print Settings: Set the print options to match your needs, including selecting the correct paper size and orientation (portrait or landscape). If you are printing on letterhead, ensure that the design is aligned correctly.

- Print a Test Copy: Before printing multiple copies, print a single test page to check the document for any issues with text size, alignment, or clarity.

- Print Multiple Copies: If you need to send physical copies to clients, print the required number of copies, ensuring each is clear and free of errors.

By following these steps, you ensure that your document is saved securely for future reference and printed clearly for professional presentation to your clients.

Common Errors When Using the Template

While creating and using a billing document, errors can occur that lead to confusion, delays in payment, or even disputes with clients. These mistakes often happen during the input process, especially when using pre-designed forms or layouts. Recognizing common errors and understanding how to avoid them can save time and ensure that the document is clear, accurate, and professional.

Common Mistakes to Watch Out For

Below are some of the most frequent issues users encounter when working with billing forms:

| Error | How to Avoid It |

|---|---|

| Incorrect or Missing Client Information | Always double-check client details such as name, address, and contact information. Ensure the client’s information is up-to-date and accurately entered to avoid delays or miscommunication. |

| Incorrect Calculations | Ensure all amounts are calculated correctly, including subtotals, taxes, and discounts. Use a calculator or built-in formula functions to prevent mathematical errors. |

| Omitting or Mislabeling Tax Information | Make sure to clearly list tax rates and amounts if applicable. Ensure the tax is calculated based on the correct percentage and is labeled as such to avoid confusion. |

| Using an Inconsistent Format | Stick to one consistent format throughout the document, especially with numbers, dates, and text. Consistent formatting helps improve readability and professionalism. |

| Leaving Out Payment Terms | Clearly state the payment terms, including due dates and late fees. Not including these details can lead to misunderstandings about payment deadlines. |

| Not Including a Unique Reference Number | Always assign a unique reference number to each document to make it easily identifiable for both you and your client. This helps with organization and future reference. |

How to Prevent Errors

To avoid the errors mentioned above, take time to thoroughly review the document before sending it to your client. Double-check all fields, ensure that all calculations are correct, and verify that all terms are clearly stated. Using a consistent format and organizing the document in a logical way will help prevent mistakes and make the billing process smoother for both you and your client.

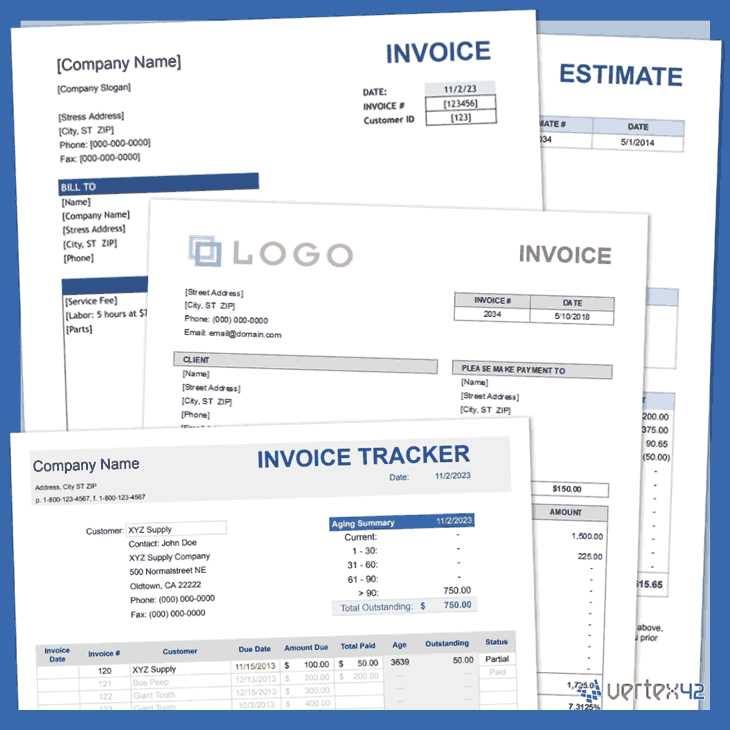

Integrating Invoice Templates with Excel

Integrating billing forms with spreadsheet software can significantly improve efficiency and accuracy in managing financial documents. Using a spreadsheet allows you to easily calculate totals, apply formulas, and automate repetitive tasks, making the process faster and reducing the risk of human error. By connecting your document to Excel, you can also streamline record-keeping and create detailed reports with ease.

Steps to Integrate Billing Forms with Excel

Here are the steps to integrate your document with spreadsheet software:

- Link Data Fields: If your billing form includes fields for item descriptions, quantities, or prices, you can link those fields to an Excel worksheet. This allows for automatic updates whenever changes are made to the data in the spreadsheet.

- Use Formulas for Calculations: Excel’s powerful formula capabilities can help automate calculations for subtotals, taxes, discounts, and totals. Set up the necessary formulas within your document to eliminate manual calculations.

- Import Client Data: By using Excel, you can store client information such as contact details and payment history in one location. This makes it easy to import or reference this data in your billing form, saving time when creating new documents.

- Automate Document Creation: With a combination of Excel and document templates, you can set up automated workflows to generate billing documents based on existing data. This minimizes repetitive tasks and ensures consistency across all your documents.

- Track Payment Status: Link your billing forms to an Excel file that tracks payment status, due dates, and outstanding balances. This makes it easier to stay on top of your receivables and helps with financial reporting.

Benefits of Integration

Integrating your billing forms with Excel offers several advantages:

- Increased Accuracy: Automated calculations and data entry reduce the risk of errors, ensuring that all amounts are correct.

- Time Efficiency: With automation and linked data, you can create and manage multiple documents quickly, saving valuable time.

- Better Financial Management: Having all your billing information in one place, alongside other financial records, improves organization and helps with managing cash flow.

- Customizable Reporting: Excel’s reporting capabilities allow you to easily create detailed reports about your sales, payments, and outstanding invoices, giving you better insight into your business’s financial health.

By integrating your billing forms with Excel, you streamline the invoicing process, reduce errors, and gain greater control over your financial data.

Benefits of Using Templates for Billing

Using pre-designed billing forms can offer significant advantages for businesses. These ready-to-use documents save time, ensure consistency, and help maintain professionalism when dealing with clients. By standardizing your billing process, you can streamline operations and reduce the likelihood of errors, leading to faster payments and improved customer relations.

Key Benefits of Pre-designed Billing Forms

Here are some of the most notable benefits of using pre-designed forms for managing payments and financial documents:

| Benefit | Description |

|---|---|

| Time Efficiency | Pre-designed forms eliminate the need to start from scratch every time you need to create a billing document. You can quickly input details and focus on more important tasks. |

| Consistency | Templates ensure that your documents have a consistent layout and formatting, improving professionalism and making it easier for clients to understand the information presented. |

| Reduced Errors | By using a pre-structured document, the risk of making mistakes with calculations, formatting, or missing important fields is significantly reduced. |

| Improved Organization | Billing forms keep all necessary information, such as client details, payment terms, and amounts, in one organized place, making it easier to track and manage your finances. |

| Professional Appearance | Ready-made documents are designed to look polished and clear, helping create a positive impression of your business with clients and partners. |

How Templates Help with Customization

Although templates provide a standardized format, they are also customizable. You can easily adapt pre-designed documents to fit your specific business needs, such as adjusting the layout, adding your company logo, or modifying payment terms. This flexibility allows you to maintain your unique branding while benefiting from the streamlined process that templates offer.

By using pre-designed forms for your billing process, you not only save time but also create a more organized, professional approach to managing financial transactions. This leads to smoother operations, clearer communication with clients, and ultimately, faster payments.

Alternatives to Microsoft Invoice Template 2007

While pre-designed documents can simplify the billing process, there are many other options available if you’re looking for alternatives. Whether you’re seeking more customization, cloud-based features, or integrations with other business tools, exploring different solutions can help you find the most effective method for managing financial transactions. Below, we explore some popular alternatives that offer various advantages over the standard pre-made forms.

Cloud-Based Solutions

Cloud-based platforms offer a variety of features that can simplify billing and financial management. These tools often include automatic calculation features, integration with other business software, and easy access from anywhere. Some top cloud alternatives include:

- FreshBooks: A user-friendly cloud platform tailored for small businesses and freelancers, providing templates, time tracking, and invoicing features.

- Zoho Books: Offers invoicing, financial tracking, and reporting capabilities. This platform also integrates with other business apps like CRM and inventory management.

- QuickBooks Online: A comprehensive accounting solution with customizable billing options, expense tracking, and cloud storage for easy access to records.

- Wave: A free, cloud-based option offering invoicing and financial reporting tools. Ideal for small businesses looking for a straightforward solution.

Spreadsheet-Based Options

If you prefer to stay within the realm of traditional software but need more flexibility than a standard document form, spreadsheet programs like Excel or Google Sheets can be excellent alternatives. These tools offer the ability to:

- Customize Billing Forms: Design your own forms with personalized fields, logos, and layouts.

- Automate Calculations: Use built-in formulas to automatically calculate totals, taxes, and discounts.

- Store Client Data: Create dedicated sheets to store customer information for easier data entry and tracking.

- Track Payments: Add columns for payment status and due dates to keep a record of outstanding amounts and overdue payments.

Other Software Alternatives

If you need more advanced features or integrations, consider the following specialized tools:

- Invoicely: A flexible invoicing platform with both free and premium plans. Offers recurring billing, multi-currency support, and integration with payment gateways.

- Invoice Ninja: A free, open-source invoicing tool with customizable templates, time tracking, and project management features.

- PayPal Invoicing: Ideal for businesses already using PayPal for payments. It allows you to send invoice