Car Garage Invoice Template for Auto Repair Services

Running an automotive repair business requires effective management of financial transactions. One of the most important aspects is ensuring that customers are provided with clear, accurate records for the work performed. Having a structured and professional document to detail services rendered can help streamline operations and enhance customer trust.

In today’s fast-paced world, using pre-designed forms can save time and effort. These documents can be easily customized to include necessary information, such as labor costs, parts used, and any applicable taxes or discounts. By doing so, you ensure that the billing process is transparent and organized, ultimately improving the customer experience.

Whether you’re managing a small workshop or a larger service center, adopting a standardized system can also help with tracking payments, improving financial reporting, and maintaining consistency. In this article, we’ll explore how utilizing these ready-made solutions can simplify your business operations while ensuring accuracy in every transaction.

Car Garage Invoice Template Overview

For any automotive service business, creating professional records of transactions is essential for maintaining transparency and ensuring smooth financial operations. A well-structured document provides a clear breakdown of all charges and services, helping both businesses and clients stay organized and informed. These documents are not only crucial for accurate billing but also serve as a tool for keeping track of past transactions and managing customer relationships.

There are several key features that make these documents effective and efficient. The ability to quickly customize fields, easily calculate totals, and ensure compliance with local tax regulations makes these tools invaluable. Furthermore, a standardized format helps maintain consistency across all customer interactions, saving time and reducing the risk of errors.

Key Elements to Include

- Service Description: A clear list of the work performed, detailing each task and part used.

- Cost Breakdown: An itemized list of charges, including labor, parts, and any additional fees.

- Payment Terms: Clear information on payment deadlines, methods, and penalties for late payments.

- Contact Details: The business’s name, address, and contact information for customer inquiries.

- Invoice Number: A unique identifier for record-keeping and tracking purposes.

Why Use a Pre-Designed Solution?

- Time Savings: A ready-made structure reduces the time spent creating each document from scratch.

- Accuracy: With built-in calculations and predefined fields, errors are minimized.

- Professional Appearance: Presenting customers with a clean, well-organized record enhances your business image.

- Easy Customization: Adjust the format to suit your specific business needs without complicated software.

Why Use an Invoice Template?

Managing financial documentation is crucial for any business. Without a consistent and structured method for generating transaction records, it’s easy to overlook details, leading to errors and confusion. Using a pre-designed solution for generating billing documents simplifies the process and ensures that everything is accounted for properly. It provides a reliable system that saves time, minimizes mistakes, and helps maintain professionalism in all customer interactions.

By adopting a standardized format, businesses can streamline their operations, from tracking payments to managing records. This approach not only boosts efficiency but also enhances customer trust, as clients can quickly review and understand the charges associated with the service provided. Below are several reasons why using a pre-designed system is a smart choice for any service-based business.

Benefits of Using a Pre-Formatted Document

- Time Efficiency: Pre-designed structures save you from the hassle of creating a new document for every transaction, allowing you to focus on other important aspects of your business.

- Consistency: Using the same format for all customer records helps maintain uniformity and ensures that no essential information is missed.

- Easy Customization: These systems allow quick adjustments for different services, tax rates, or pricing models, so they adapt easily to any situation.

- Professional Appearance: Presenting well-organized, clear documents improves your company’s image and fosters customer confidence.

- Accurate Record Keeping: A clear, itemized format ensures that all charges are correctly recorded and easily accessible for future reference.

Additional Advantages

- Legal Compliance: Pre-designed solutions often comply with legal and tax requirements, reducing the risk of mistakes that could lead to fines or disputes.

- Automation: Many platforms can automatically calculate totals, taxes, and discounts, further reducing manual errors and improving efficiency.

- Better Customer Communication: Transparent, easy-to-read documents help customers understand exactly what they’re paying for, making it easier to resolve disputes and enhance relationships.

Benefits of Customizable Invoice Formats

Having the flexibility to adjust billing documents to match specific business needs offers significant advantages for service providers. Customizable formats allow businesses to include or remove certain fields, adjust the layout, and incorporate branding elements, making the document truly unique to the company. This flexibility ensures that the records reflect the business’s particular operations and provide a clear, professional presentation to clients.

Whether you need to add extra details for a specific service or adjust the overall appearance to align with your brand, these adaptable solutions provide the tools to tailor each document as needed. This ensures that businesses can maintain consistency while also catering to any specific client or legal requirements. Below are several key benefits of using flexible, adjustable billing formats.

Enhanced Professionalism

- Branding Opportunities: Customization allows you to incorporate your company’s logo, color scheme, and contact information, presenting a polished and cohesive image to clients.

- Tailored Details: Adjust the layout to highlight important information, such as payment terms, service descriptions, or any additional charges, to meet the needs of your business.

- Unique Touch: Having a document that aligns with your company’s identity adds a personal touch, strengthening customer relationships.

Improved Efficiency and Accuracy

- Custom Fields: Add or remove specific fields based on the services offered, ensuring that the document only includes relevant information.

- Flexible Calculations: Adjust the format to include discounts, taxes, and other cost factors, reducing the need for manual input and minimizing errors.

- Scalability: As your business grows or services evolve, the ability to modify the document ensures it remains useful and up-to-date.

How to Create a Repair Bill

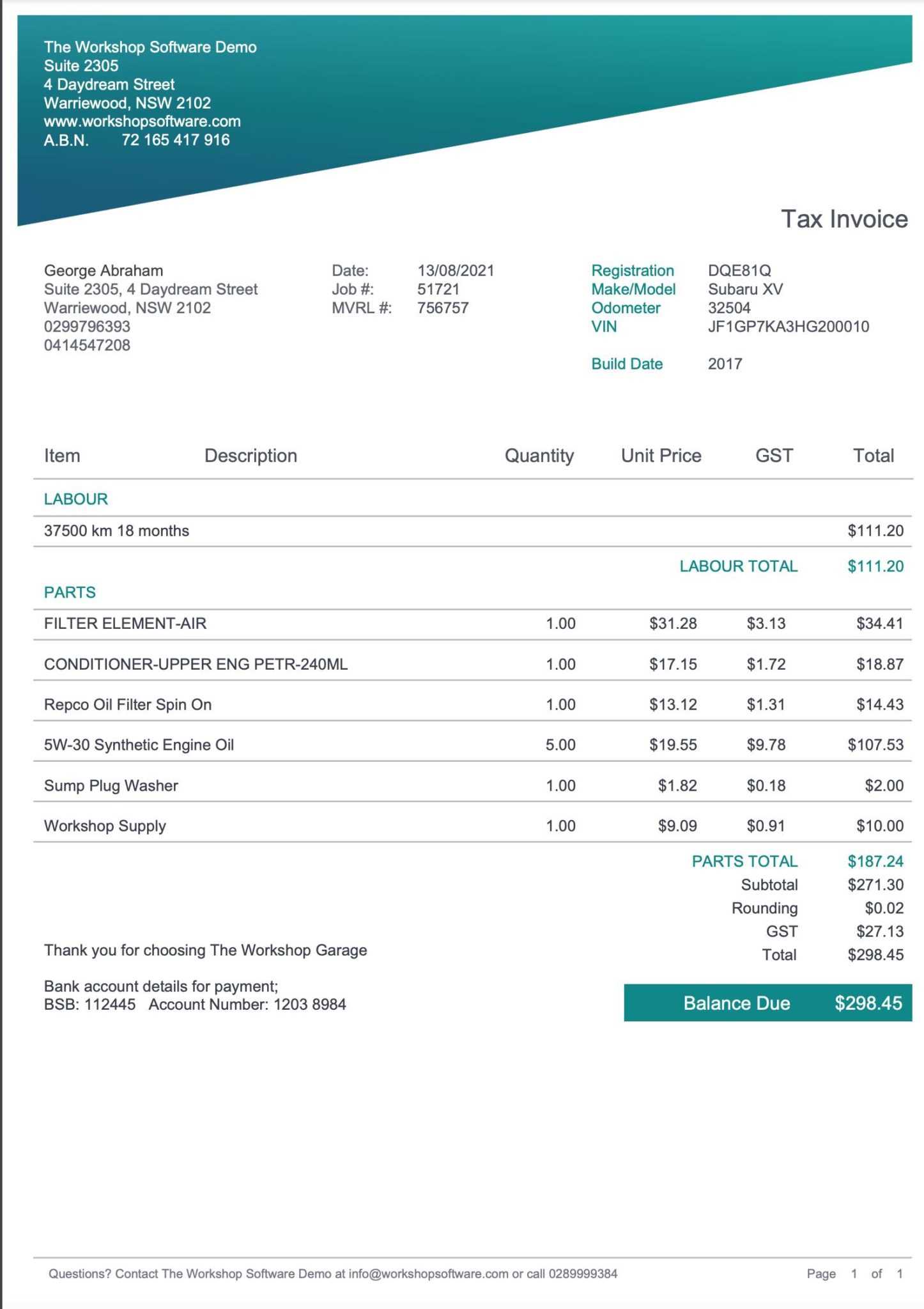

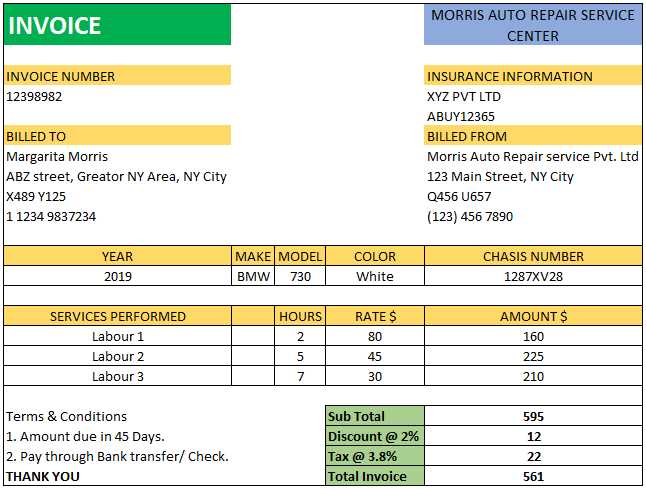

Generating a comprehensive record for services rendered is an essential task for any auto repair shop. A well-crafted document ensures that both the customer and business have a clear understanding of the charges and services provided. This step-by-step guide will walk you through the process of creating a professional billing statement that covers all necessary details and ensures accuracy in your transactions.

To begin with, it’s important to include all key components: client information, a breakdown of services, labor charges, and parts costs. Each section must be clearly laid out and easy to follow. Below is a simple structure to help you create an efficient and organized bill for your customers.

Step-by-Step Breakdown

| Section | Description |

|---|---|

| Client Details | Include the customer’s name, address, and contact information for easy reference. |

| Service Description | List the work performed in detail, including any parts replaced or repaired. |

| Labor Charges | Break down the time spent on the job and the hourly rate, if applicable. |

| Parts and Materials | Include the parts used, along with their cost, ensuring full transparency. |

| Total Charges | Summarize the total cost of both labor and materials, adding any applicable taxes or fees. |

Additional Considerations

- Payment Terms: Clearly state the payment methods and any due dates for payment.

- Invoice Number: Assign a unique identifier for tracking purposes and future reference.

- Company Information: Make sure your business’s name, contact details, and legal information are included

Essential Information for Auto Service Invoices

When providing a detailed record of services rendered, it’s important to ensure that every necessary piece of information is included. A comprehensive and transparent document not only helps clients understand what they are being charged for but also enables businesses to maintain accurate records. There are several key elements that should always be included to ensure clarity and prevent confusion.

Each statement should contain basic client and service details, as well as a breakdown of the costs involved. This information makes it easier for both parties to track payments and understand exactly what was delivered, whether it’s a repair, maintenance, or a custom service. Below are the critical components to include in every document.

Key Elements to Include

- Client Information: The customer’s name, address, and contact details should be clearly visible for future reference.

- Service Description: A detailed description of the tasks performed, including parts replaced, labor hours, and any special procedures used.

- Itemized Costs: Break down the charges for both labor and materials, showing quantities, unit prices, and total costs for each line item.

- Payment Terms: Specify when payments are due, acceptable methods of payment, and any late fees that may apply.

Additional Key Details

- Invoice Number: Assign a unique identifier to each document for easy tracking and future reference.

- Business Information: Include the company’s name, address, phone number, and any necessary legal or tax identification numbers.

- Dates: Clearly state the service date, as well as the issue date of the document, to avoid any confusion about timelines.

- Terms and Conditions: Any applicable terms regarding warranties, returns, or service guarantees should be listed clearly for both parties to review.

Incorporating these elements ensures a clear, concise, and transparent record for both the service provider and the customer, fostering trust and professionalism in every transaction.

Free vs Premium Invoice Templates

When choosing a billing solution for your business, you may face the decision between using a free or a premium option. While both can provide the necessary structure for documenting services and charges, the features, customization options, and overall quality can vary significantly. Understanding the key differences between these two types of solutions will help you make an informed decision about which is best suited for your needs.

Free options are often appealing due to their accessibility, but they may lack some of the advanced features needed for more complex business operations. On the other hand, premium solutions typically offer enhanced functionality and better support, which can be worth the investment depending on the scale and specific needs of your business.

Advantages of Free Solutions

- Cost-Effective: As the name suggests, these solutions are free to use, making them ideal for startups or small businesses with limited budgets.

- Simple and Easy to Use: Most free options offer a basic, user-friendly interface that allows you to quickly create and send documents without much technical know-how.

- Ready to Use: These are often ready to go with minimal setup, offering a quick solution for businesses that need to get started fast.

Benefits of Premium Solutions

- Customization: Premium options provide greater flexibility in customizing your documents, allowing you to tailor them to your brand’s unique style and requirements.

- Advanced Features: Many paid solutions include features like automated calculations, customizable templates, and integration with accounting software, making them more suited for growing businesses.

- Support and Updates: With a premium solution, you typically gain access to customer support and regular updates, ensuring your system remains functional and secure.

- Professional Look: Paid platforms often provide more polished, modern designs that help improve your company’s professional image.

In summary, free options can be great for small businesses with simple needs, while premium solutions are better suited for those who require more advanced features, flexibility, and ongoing support. Your choice will depend on your business’s size, c

Invoice Templates for Small Auto Service Shops

For small service providers in the automotive industry, having a streamlined, efficient billing process is essential. A well-organized billing system helps ensure that all work is properly documented, payments are tracked, and clients receive a professional experience. Using a standardized document format tailored to small businesses can save time and reduce errors, allowing owners to focus on providing excellent service.

Small service shops often have unique needs when it comes to creating records for services rendered. These businesses usually deal with a diverse range of tasks, from basic maintenance to more complex repairs, which requires flexibility in the way information is presented. Below are key features that make an adaptable billing solution ideal for smaller businesses.

Key Features for Small Business Solutions

- Simple Layout: A straightforward, easy-to-read design ensures that clients can quickly understand the charges and services, reducing confusion.

- Customizable Fields: The ability to add specific service details, parts used, and labor costs provides flexibility to accommodate various types of work.

- Affordable Pricing: For small businesses with limited budgets, low-cost or free options can provide all the necessary features without a hefty investment.

- Efficient Record Keeping: An organized format allows for easy tracking of payments, simplifying the process for business owners and helping them maintain clear financial records.

Why Choose a Custom Solution?

- Branding: Small businesses can include their logo, contact details, and brand colors, ensuring that each document reflects their unique identity.

- Client-Friendly: Clear and concise records help build trust with clients by making it easy for them to see what they’re paying for and why.

- Time-Saving: Pre-designed documents that are ready to customize save valuable time, helping small businesses remain efficient while still providing high-quality service.

By using a tailored solution, small businesses can maintain professionalism, improve client communication, and keep their operations running smoothly. Whether opting for a free or premium option, these tools can help simplify billing and enhance business efficiency.

Automating Your Auto Service Billing System

For any service-oriented business, streamlining the billing process is crucial to improving efficiency and reducing administrative burdens. Automating this aspect of your operations can save time, minimize human error, and enhance customer experience by providing quick and accurate records. With the right tools, you can automate calculations, payment tracking, and even client communication, allowing you to focus more on service delivery than on paperwork.

By implementing automated systems, you can ensure that each transaction is processed smoothly and consistently, without requiring manual input for every service provided. This technology allows for quicker turnaround times, better financial tracking, and increased professionalism. Below, we explore the key steps and benefits of automating your billing process.

Key Steps to Automation

- Choose the Right Software: Look for platforms that offer customizable features, easy integration with other business tools, and automation for key processes like tax calculations, payment reminders, and client invoicing.

- Set Up Automated Billing Cycles: Automate recurring charges or regular service fees, so customers are billed automatically based on predefined schedules, reducing the need for manual invoicing.

- Sync Payment Methods: Enable automatic payment processing through integrated payment gateways, allowing customers to pay online and eliminating manual data entry.

- Track and Report: Use automated tools to track payments, outstanding balances, and generate financial reports for easy monitoring and decision-making.

Benefits of Automation

- Efficiency: Automating the process reduces the time spent on administrative tasks, allowing your team to focus on providing high-quality service.

- Accuracy: Automated calculations and payment tracking minimize the risk of human error, ensuring every charge is correct.

- Professionalism: An automated system can generate clean, well-organized records that project a polished image to your clients.

- Improved Cash Flow: With automated payment reminders and easy payment processing, you reduce the chances of missed or delayed payments.

By automating your billing system, you simplify the financial aspects of your business, making it easier to manage day-to-day operations and scale as needed. The right tools can make all the difference, helping you stay ahead of the competition and provide exceptional service to your customers.

Best Practices for Clear Billing Statements

Creating a clear and effective document for services provided is key to maintaining smooth communication between a business and its customers. A well-organized record ensures that all details are understood, preventing confusion or disputes. Clear documentation not only reflects professionalism but also builds trust with clients, who can easily see what they are being charged for and why. Below are some best practices for ensuring that your service records are accurate, transparent, and easy to read.

Essential Tips for Clear Billing Documents

- Use Simple Language: Avoid jargon and complicated terms. Ensure that the descriptions of services are straightforward and easy for clients to understand.

- Provide Itemized Breakdowns: List each service, part, and charge separately. This helps clients see exactly what they are paying for, from labor costs to materials and taxes.

- Include Clear Dates: Always specify the date the service was provided and the date the document was generated. This helps with tracking and reference in case of any issues.

- Highlight Key Information: Make sure essential details like payment terms, due dates, and total costs are clearly visible, so clients can quickly locate this information.

- Consistent Formatting: Use a clean, uniform layout for each document. Consistency in fonts, headings, and spacing ensures that the document looks professional and is easy to follow.

Additional Considerations

- Double-Check for Accuracy: Before sending out any record, carefully review all details for accuracy, ensuring that quantities, prices, and calculations are correct.

- Provide Contact Information: Include your business’s contact details so clients can easily reach you if they have any questions or concerns about the charges.

- Clear Payment Instructions: Specify the payment methods accepted, due dates, and any late fees, so customers are aware of their obligations upfront.

By following these best practices, you can create billing statements that are not only clear

How to Include Labor and Parts Costs

When creating a detailed statement for services rendered, it is essential to clearly distinguish between the charges for labor and the cost of materials used. This transparency not only helps avoid confusion but also ensures that the client understands what they are paying for, fostering trust and improving communication. Properly documenting both labor and parts ensures accurate record-keeping and helps businesses maintain financial integrity.

To create a professional and comprehensive record, you need to break down these costs into clear, easily understandable sections. Below are some guidelines on how to effectively include labor and parts charges in your documents.

Including Labor Charges

- Hourly Rate: Clearly state the rate at which labor is charged, whether it’s an hourly fee or a flat rate for the task.

- Time Spent: Include the total hours or time spent on the job. If applicable, break it down into stages or different tasks performed.

- Labor Description: Provide a brief description of the work performed to help the client understand what they are paying for in terms of service time.

- Labor Total: Multiply the number of hours worked by the hourly rate to calculate the total labor cost, making sure the calculation is clear and easy to follow.

Including Parts Costs

- Itemized List: List each part or material used, including part numbers and brief descriptions, so the client can see exactly what was provided.

- Unit Price: For each item, provide the unit price, and if multiple parts were used, list the quantity purchased.

- Total Cost: Multiply the unit price by the quantity to calculate the total cost of the parts, and provide a subtotal for all materials used.

- Part Warranty: I

What to Avoid on Auto Service Billing Statements

When creating a billing document for services rendered, it’s important to ensure that the information provided is clear, accurate, and professional. Mistakes or omissions on such records can lead to confusion, disputes, and even damage to the business’s reputation. To avoid these issues, there are certain pitfalls that should be avoided when generating your statements. By being aware of what to leave out, you can ensure your records remain transparent and reliable.

Below are some common mistakes and things to avoid when preparing detailed billing statements for services in the automotive sector.

Common Mistakes to Avoid

- Vague Descriptions: Always provide specific details about the services performed and parts used. Avoid using generic terms like “work done” or “repairs completed.” This lack of clarity can confuse the client and make the document less professional.

- Omitting Important Details: Ensure you include essential information such as the service date, customer details, itemized breakdown, and payment terms. Missing any of these elements can make the document incomplete and difficult for clients to interpret.

- Incorrect or Unclear Pricing: Avoid rounding off or incorrectly calculating labor hours or parts costs. Clear and accurate pricing is essential, as any discrepancies can lead to disputes or payment delays.

- Overloading with Information: While clarity is important, overloading the statement with unnecessary details can make it hard to navigate. Stick to relevant information that directly pertains to the service provided.

- Not Including Payment Terms: Failing to specify when the payment is due, acceptable payment methods, or any late fees can create confusion about financial expectations. Make sure these details are clearly stated to avoid any misunderstandings.

Other Pitfalls to Avoid

- Unprofessional Formatting: A disorganized or cluttered layout can make your billing records appear unprofessional. Always maintain a consistent, clean format with clearly labeled sections and easy-to-read fonts.

- Not Tracking Payments: Be sure to track payments accurately and note the amounts received. Leaving this out can lead to missed payments and financial discrepancies.

- Failure to Include Company Information: Always include your business’s name, contact information, and any relevant legal or tax identification numbers. This ensures that the client can easily contact you if there are any questions or concerns.

Avoiding these common mistakes ensures that your records are clear, professional, and accurate. By maintaining high standards in your billing documents, you foster trust and reliability with your clients, helping to build long-term business relationships.

Tips for Easy Billing Customization

Customizing your billing documents allows you to better align them with your business’s branding and ensure they reflect the specific needs of each transaction. A flexible approach to document creation not only enhances professionalism but also improves the overall client experience. With the right tools and a few simple steps, personalizing these records can be straightforward, saving you time while adding a professional touch to every interaction.

Here are some effective tips to help you easily customize your billing statements and make them work for your business.

Key Customization Tips

- Use a Structured Layout: Keep your document layout simple and organized. Start with clear sections for customer information, service details, charges, and payment instructions to create a well-structured document that’s easy to understand.

- Brand Your Documents: Personalize your document by adding your company logo, brand colors, and contact information. This reinforces your identity and ensures your business is easily recognizable to clients.

- Adapt Service Descriptions: Customize service descriptions to be specific to the work done. Instead of generic terms, provide detailed explanations to give clients a clear understanding of what was performed and why they’re being charged.

- Adjust Payment Terms: Customize payment terms based on the job or client. Some clients may need longer payment periods, while others may prefer a quicker turnaround. Flexibility in this area can help you accommodate various customer preferences.

Creating Custom Fields

Adding specific fields can make your records more tailored to your business’s operations. Below is an example of what customized fields might look like in your document:

Service Description Hours Worked Parts Used Rate Total Cost Engine Diagnostics 2 hours Diagnostics Kit $50/hour $100 Brake Pad Replacement 3 hours Brake Pads $40/hour $120 Total $220 This table allows you to clearly display the services, time spent, parts used, and the corresponding costs. Custom fields like these provide a structured, client-friendly breakdown that ensures transparency and easy understanding.

By following these tips, you can create billing records that are not only easy to customize but also more professional and tailored to each unique service, helping you stand out in a competitive market.

How to Add Discounts and Taxes

When creating a billing statement, it’s important to account for any discounts or taxes that may apply to the total charges. Including these elements not only helps ensure accuracy but also improves transparency for your customers. Whether you’re offering a promotional discount, applying a standard tax rate, or both, it’s essential to clearly show how these factors impact the final amount owed. Here are some straightforward steps for adding discounts and taxes to your records.

Applying Discounts

Discounts are a common way to incentivize clients or reward loyal customers. When applying discounts to a bill, be sure to include the following:

- Discount Type: Specify whether the discount is a percentage (e.g., 10% off) or a fixed amount (e.g., $20 off). This ensures the client understands the exact benefit they are receiving.

- Discount Conditions: If there are conditions attached to the discount, such as a minimum purchase amount or a time-limited offer, be sure to note these clearly.

- Show Discount Clearly: List the discount as a separate line item with a description like “Discount” or “Promotional Offer,” so the client can easily see how it was applied to the total.

Example of Discount Application:

Description Amount Service Total $300 Discount (10%) -$30 Total After Discount $270 Adding Taxes

Taxes can vary depending on the location or nature of the service. It’s essential to include the correct tax rate and ensure that your clients understand how it is calculated. Here are some tips:

- State the Tax Rate: Specify the tax percentage applied to the total. For example, “Sales Tax (8%)” or “VAT (15%).” This makes it clear how the tax is calculated.

- Apply Tax After Discounts: In most cases, taxes should be calculated on the subtotal after discounts are applied. Ensure that you follow the correct order of operations when calculating the final amo

Organizing Billing Numbers for Tracking

Proper organization of your billing records is essential for maintaining smooth operations and efficient financial tracking. A key component of this system is the use of unique identifiers for each transaction. These identifiers, typically referred to as billing numbers, help you keep track of all issued records, facilitate easy retrieval, and ensure that payments are properly allocated. By implementing a structured numbering system, you can avoid confusion, streamline your record-keeping process, and maintain a clear audit trail.

Creating a Structured Numbering System

A well-organized numbering system for your billing records provides clarity and consistency. Below are a few tips for designing a numbering scheme:

- Sequential Numbering: One of the simplest methods is to assign consecutive numbers to each record. For example, the first document would be numbered 001, the second 002, and so on. This method is easy to implement and provides a clear, chronological record of transactions.

- Incorporate Date Codes: Adding the date to the number can help identify when the transaction occurred, making it easier to reference in the future. For example, a record issued on January 1st, 2024, could be numbered as 2024-001, 2024-002, etc.

- Prefix with Client or Job Information: Including a client or job-specific code at the beginning of the number (e.g., “C123-001”) helps associate each record with the relevant customer or project. This is especially useful for businesses managing multiple clients or types of services.

Best Practices for Tracking Billing Numbers

- Keep Numbers Unique: Ensure that every identifier is unique to avoid duplicates. Duplicated numbers can lead to confusion and errors in your financial records.

- Use Software for Automation: Accounting and invoicing software often offer automatic number generation. This eliminates human error and ensures consistency across all documents.

- Maintain a Record of Issued Numbers: It’s essential to track which numbers have been assigned and ensure there are no gaps. This helps you avoid missing records or mismanagement of your billing documents.

By adopting a clear, systematic approach to billing number organization, you can

Ensuring Legal Compliance in Billing Records

Maintaining legal compliance in your billing documents is critical for avoiding disputes, penalties, and ensuring that your business operates smoothly within regulatory frameworks. Legal requirements can vary depending on your industry and location, but there are key elements that should always be included to ensure your documents meet legal standards. By adhering to these guidelines, you protect your business, build trust with clients, and reduce the risk of legal complications.

Key Legal Requirements for Billing Documents

To ensure that your records comply with the law, make sure to include the following elements:

- Business Information: Include your business’s legal name, address, and tax identification number. In some jurisdictions, a business registration or license number may also be required.

- Client Information: Ensure that the client’s full name, address, and contact details are accurately listed. This helps prevent disputes and ensures the proper party is being billed.

- Clear Breakdown of Charges: It is essential to provide a clear and itemized list of services provided, including any parts used. This helps avoid confusion and ensures that the client understands what they are paying for.

- Tax Information: Include applicable tax rates and tax identification numbers, as required by law. If your business is subject to sales tax, VAT, or other taxes, the tax amount must be listed separately on the document.

- Payment Terms: Clearly state payment terms, including the due date and any penalties for late payment. This can help prevent misunderstandings and provide legal protection in case of non-payment.

- Authorization: Depending on the region, some jurisdictions require a signature or an acknowledgment to confirm that the transaction was authorized. This can protect your business in case of a dispute.

Additional Considerations for Compliance

- Currency and Language: Specify the currency used for the transaction, particularly for international clients. Additionally, ensure the document is in the language required by local law.

- Electronic Signatures:

Choosing the Right Billing Software

Selecting the right software for managing your billing records is a crucial decision that can improve efficiency, accuracy, and ease of use. With the right tool, you can automate many aspects of the billing process, ensure compliance, and reduce the risk of errors. There are numerous options available, each offering a variety of features tailored to different business needs. To make an informed choice, it’s important to consider the key factors that will impact your workflow and meet the demands of your specific industry.

Key Features to Consider

- Customization Options: Choose software that allows for easy customization of your documents. You should be able to adjust fields, layout, and branding to match your business’s unique needs.

- Automation and Templates: Look for software that offers automatic numbering, recurring billing features, and pre-built templates. This will save you time and ensure consistency across all records.

- Integrations: Make sure the software integrates with your existing tools, such as accounting software, payment processors, and customer relationship management (CRM) systems. This will allow for seamless data sharing and reduce manual entry.

- Reporting and Analytics: The ability to generate detailed reports and track payments is essential for financial oversight. Choose software that provides real-time insights into your billing status, overdue payments, and revenue trends.

- Compliance Features: Ensure that the software helps you meet legal and tax requirements, such as automatically calculating taxes and adhering to local regulations.

Evaluating Ease of Use and Support

In addition to functionality, consider the user interface and the level of customer support provided by the software. A clean, intuitive interface will make the billing process more efficient, while reliable customer service ensures you can resolve issues quickly.

- User-Friendly Interface: Look for a platform with a simple and clear layout. You don’t want to spend unnecessary time learning how to use the software or navigating through complex features.

- Customer Support: Ensure that the software provider offers robust customer support, whether through live chat, email, or phone. A responsive support team can help you troubleshoot issues

How to Send and Store Billing Records Efficiently

Efficiently sending and storing your billing records is essential for maintaining organized financial documentation and ensuring smooth business operations. Streamlining the process of issuing and archiving these documents can save time, reduce errors, and make it easier to track payments. By adopting the right practices and tools, you can ensure that your business maintains clear records, meets deadlines, and complies with legal requirements.

Sending Billing Records Effectively

There are several methods available for sending billing records to clients, and the right choice will depend on your business needs and client preferences:

- Email: The most common method for sending billing records is through email. Ensure that your documents are in a widely accepted format (such as PDF) to maintain a professional appearance and prevent formatting issues.

- Online Payment Platforms: Many businesses use online payment systems that allow for easy sharing of billing records along with payment options. These platforms often automate parts of the process, such as sending reminders or providing payment links.

- Postal Mail: For clients who prefer hard copies, ensure that documents are printed clearly and sent in a timely manner. This option is often necessary for larger or international clients who need physical records.

Storing and Organizing Billing Records

Proper storage of your billing records is just as important as sending them efficiently. A good storage system ensures that you can easily retrieve documents for future reference, audits, or tax purposes:

- Cloud Storage: Using a cloud-based storage system allows you to store and organize your records securely, with easy access from anywhere. Cloud storage services often include automatic backup and encryption for additional protection.

- Local Storage: If you prefer to store records locally, ensure that you have a well-organized filing system on your computer or external hard drive. Be sure to back up these files regularly to prevent data loss.

- Organized Folder Structure: Whether you use digital or physical storage, maintaining an organized folder structure is crucial. Create folders by client, date, or transaction type to ensure that documents are easy to find.

- Document Management Software: For larger businesses or those with high volumes of records, consider using document management software. These tools provide advanced search features and categorization, making it easier to manage, retrieve, and even edit documents when needed.