Download and Customize Medical Records Invoice Template in Word Format

Managing financial transactions in healthcare can be a complex and time-consuming task, but using streamlined systems can make the process much more efficient. For healthcare professionals, generating accurate and clear documentation of services rendered is essential for both internal record-keeping and client communication. The ability to quickly create professional billing documents without the need for complex software can save time and reduce errors.

One effective way to simplify this process is by utilizing pre-designed formats that can be easily customized to fit the needs of any practice. These tools help ensure that all essential details are included in the documentation, allowing healthcare providers to focus more on patient care and less on administrative tasks. With simple edits, these documents can be adapted to specific requirements, reducing the burden of manual data entry.

In this article, we’ll explore the benefits of using easy-to-edit formats for creating billing statements, discuss key elements to include, and offer practical tips for making the most of these resources. Whether you’re a solo practitioner or part of a larger team, streamlining your financial documentation is a step towards improving overall efficiency in your practice.

Understanding Healthcare Billing Needs

Accurate financial documentation is crucial for healthcare practices to maintain smooth operations and ensure timely payments. Whether you’re a doctor, therapist, or clinic administrator, the ability to provide clear and organized statements for services rendered helps both the service provider and the patient understand financial obligations. The need for proper billing becomes even more critical when dealing with insurance claims, patient reimbursements, and compliance with healthcare regulations.

Key Considerations in Billing Practices

When it comes to preparing financial statements, several important elements must be included to guarantee clarity and avoid misunderstandings. These documents should be precise, detailed, and formatted in a way that both parties–provider and patient–can easily interpret. Common aspects to focus on include:

- Service Description: Clear identification of the treatments or consultations provided.

- Payment Terms: Clear instructions on payment deadlines, accepted methods, and penalties for late payment.

- Legal Compliance: Ensuring all necessary data is recorded to comply with healthcare standards and laws.

- Transparency: Detailed breakdown of costs for each service rendered, with no hidden charges.

Why Efficient Billing is Essential

Proper billing practices are vital for maintaining a professional relationship with patients and insurance providers. A lack of clarity can lead to delays in payment, disputes, or even legal issues. By using an effective approach to creating billing statements, practices can improve cash flow, reduce administrative overhead, and enhance patient satisfaction. Streamlining this process not only ensures compliance but also frees up valuable time for healthcare providers to focus on what matters most–patient care.

Benefits of Using Document Templates for Billing

Creating financial statements can be a tedious process, especially when done manually. However, utilizing pre-designed formats offers a simple solution for streamlining this task. By using ready-made layouts, healthcare professionals can save time, reduce errors, and maintain consistency across all documents. These customizable options not only simplify the preparation of billing records but also ensure a professional appearance and accuracy in every transaction.

Time Efficiency and Consistency

One of the biggest advantages of using pre-designed formats for billing is the significant amount of time saved. Instead of starting from scratch with each new statement, you can simply modify an existing document to reflect the necessary details. This consistency in format not only speeds up the process but also ensures that all essential elements are included every time, minimizing the risk of omission.

- Faster Creation: Modify a pre-made layout instead of designing from the ground up.

- Uniform Appearance: All documents follow a consistent structure, reinforcing professionalism.

- Reduced Human Error: With fewer manual steps, the likelihood of mistakes decreases.

Customization and Flexibility

Another key benefit is the level of customization these formats offer. While templates provide a structured framework, they also allow for easy modification to suit the specific needs of your practice. Whether you need to adjust for different types of services or add additional fields for patient information, these formats give you the flexibility to tailor each document as necessary without starting from scratch.

- Adapt to Specific Needs: Add or remove sections as per your practice’s requirements.

- Easy Updates: Modify information quickly as client or service details change.

- Professional Results: Ensure all documents maintain a polished, consistent layout.

Overall, using pre-built formats for billing helps streamline administrative processes, allowing you to focus on providing quality care while keeping financial documentation organized and accurate.

How to Create a Billing Statement in a Document Editor

Creating a clear and professional billing statement doesn’t have to be difficult. With the right tools, it can be a quick and straightforward process. Many document editors, such as popular text processing software, offer built-in features that allow you to design detailed statements with ease. By following a few simple steps, you can create a customized record that accurately reflects the services rendered and provides all necessary payment information.

Step-by-Step Process

Here’s how to create a professional billing statement from scratch in a document editor:

- Open a New Document: Start by opening a blank document to ensure there is no previous content interfering with your layout.

- Add Your Practice Details: At the top of the document, include your practice’s name, contact details, and address. This ensures the statement is clearly associated with your services.

- Insert Client Information: Below your practice’s details, include the client’s name, address, and any other relevant contact information.

- List Services Provided: Provide a detailed list of the services rendered, including descriptions, dates, and costs. Use a table format for better organization and clarity.

- Include Payment Terms: Clearly outline the payment instructions, due dates, and accepted payment methods. Be sure to specify any penalties for late payment if applicable.

- Finalize with Footer: In the footer, you can add any legal disclaimers or additional information that may be necessary, such as refund policies or tax details.

Formatting Tips

To ensure your billing statement is professional and easy to read, consider these formatting tips:

- Use Clear Headings: Use bold or larger font sizes to separate different sections (e.g., services, payment terms) for easy navigation.

- Organize Data in Tables: Tables help break down information into digestible sections, making it easy to read and understand the breakdown of charges.

- Maintain Consistency: Stick to one font style and size throughout the document for a polished and uniform appearance.

By following these simple steps, you can create a professional, well-organized document that clearly communicates bi

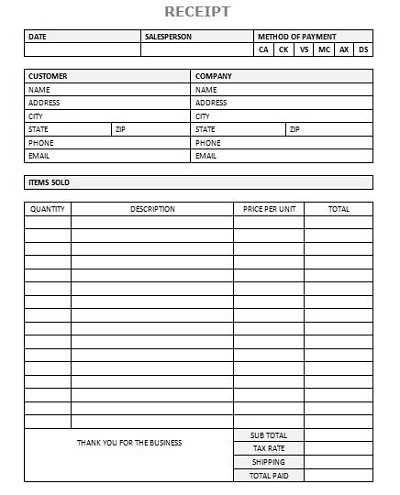

Key Elements of a Healthcare Billing Statement

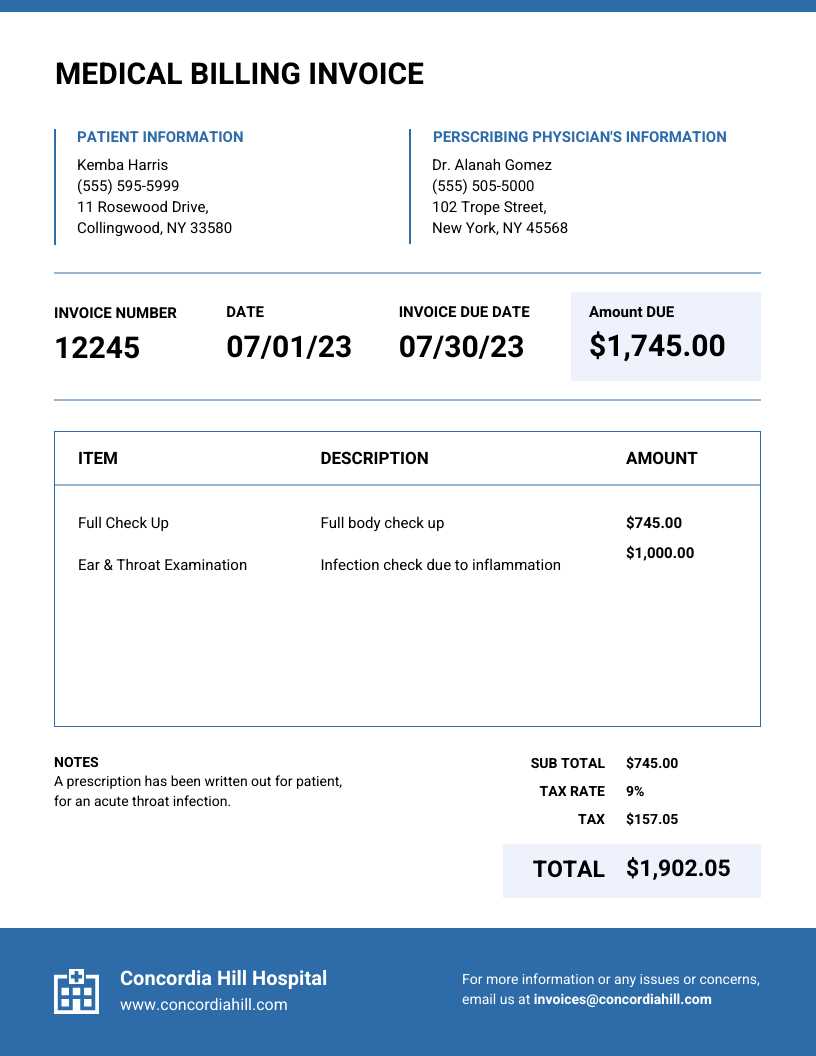

Creating a comprehensive and clear financial statement is essential for both healthcare providers and patients. A well-structured document helps avoid confusion and ensures timely payments. For a billing record to be effective, it must include several critical components that provide a complete and accurate overview of the services rendered, payment expectations, and any necessary legal information. Below are the key elements that should always be included in a well-organized billing document.

Important Components to Include

- Provider Information: This includes the name, address, contact details, and any professional identifiers of the healthcare provider or practice.

- Patient Information: Include the full name, address, and any relevant identification numbers of the patient receiving the service.

- Service Date: Clearly state the date(s) when the healthcare services were provided. This helps avoid confusion over which treatments are being billed.

- Detailed List of Services: List all treatments or consultations performed, along with brief descriptions and corresponding charges. This section provides transparency and clarity.

- Costs and Payment Breakdown: Include a detailed cost breakdown for each service rendered, showing the individual charge, any applicable discounts, and the total amount due.

- Payment Terms: Specify the payment due date, accepted payment methods, and any late fees or penalties that apply if the payment is not made on time.

- Insurance Information (if applicable): If the patient’s insurance is being billed, include the relevant policy or claim numbers and any amount covered by the insurance provider.

- Legal Disclaimers and Notes: This section can include any terms and conditions, refund policies, or other legal information that may be necessary to ensure compliance.

Why These Elements Matter

Each of these elements plays a crucial role in maintaining transparency and ensuring that both the service provider and the patient have a clear understanding of the financial obligations. By including all the necessary details in your billing statements, you not only ensure accuracy but also foster trust and professionalism in your practice.

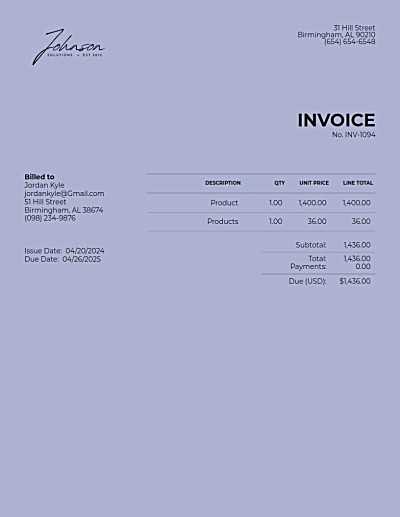

Customizing Your Billing Document for Practice

Tailoring your financial statement to fit the unique needs of your practice is crucial for both professionalism and efficiency. By adapting a pre-designed structure, you can ensure that all relevant information is presented in a way that aligns with the services you provide and the way your practice operates. Customization allows you to include specific details that are most important to your practice, from service descriptions to payment options, making the document more relevant and user-friendly for both your team and your patients.

Key Areas to Customize

When modifying your billing document, there are several key areas to focus on to ensure it meets the specific needs of your practice:

- Header Section: Include your practice’s name, logo, and contact details. This ensures that your documents are branded and easily identifiable by patients.

- Service Descriptions: Modify the sections detailing the services provided, ensuring that each treatment or consultation is accurately described and aligned with the terminology used in your practice.

- Payment Information: Customize payment terms based on your billing cycle, including due dates, late fees, and accepted payment methods.

- Client Details: Make sure that each patient’s contact information and any relevant identifiers are correct and formatted properly for easy reference.

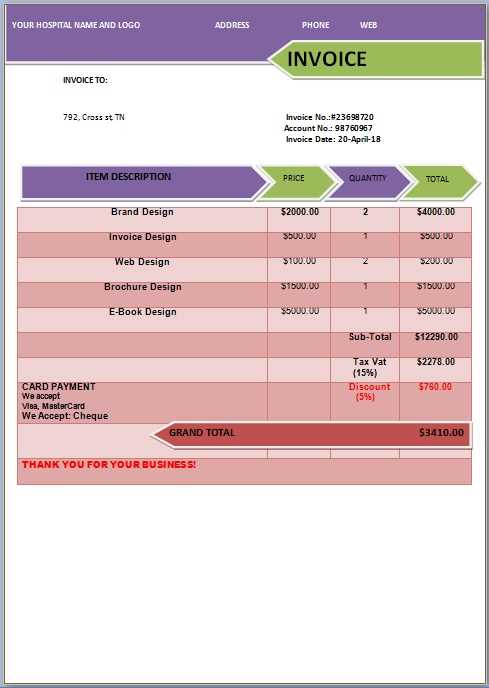

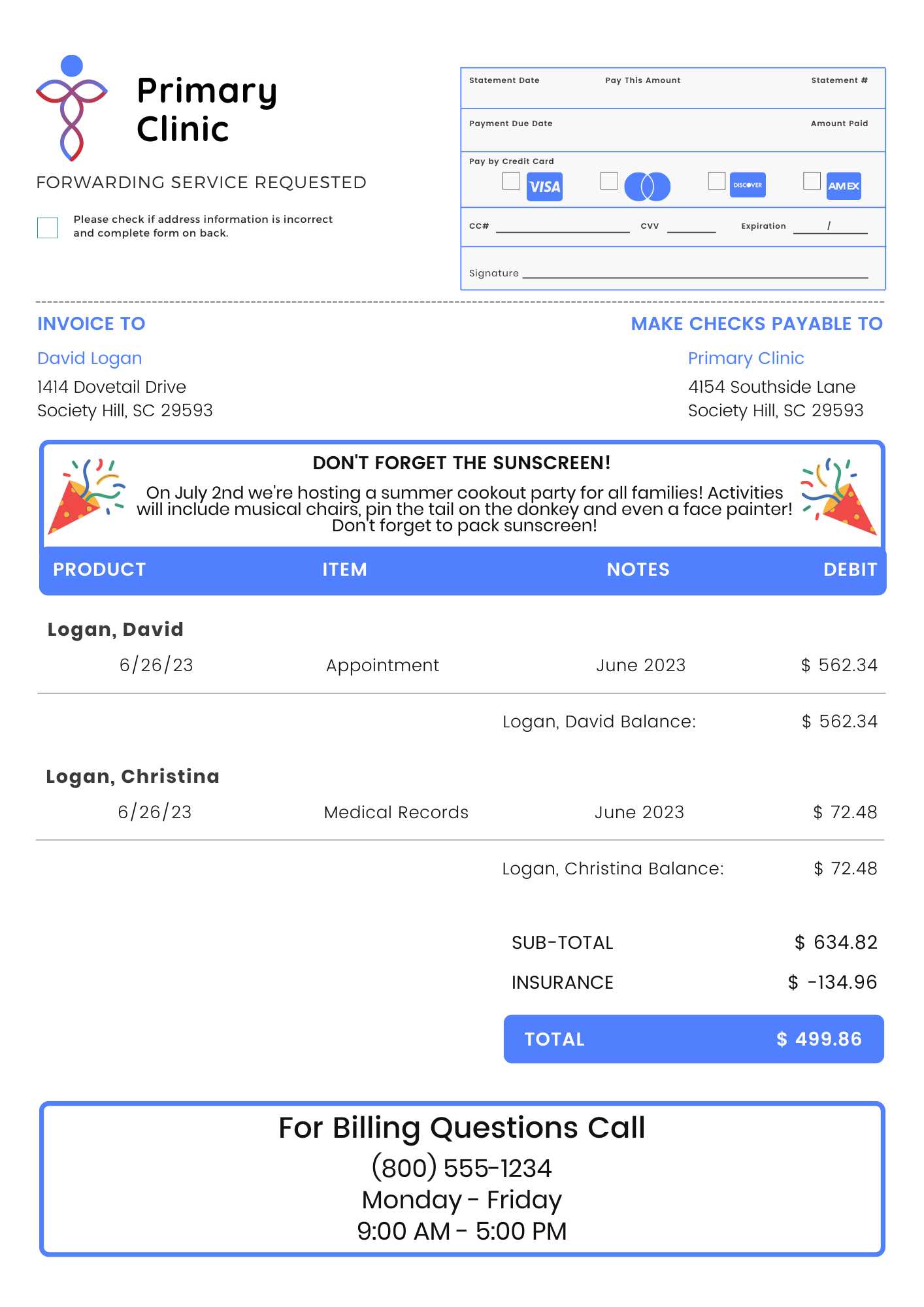

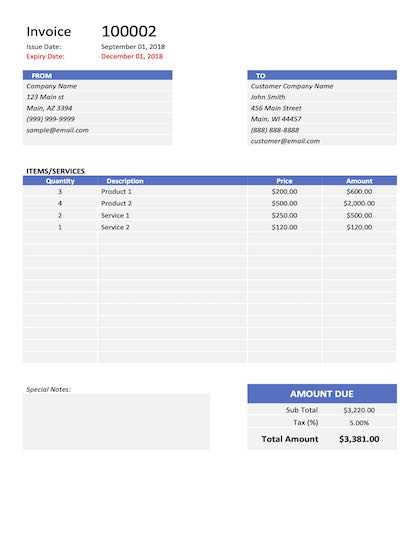

Example of a Customized Billing Layout

Here’s an example of a simple customized billing layout with the necessary sections filled in:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consultation with Dr. Smith | 1 | $150.00 | $150.00 |

| Follow-up Treatment | 2 | $75.00 | $150.00 |

| Total | $300.00 |

This example illustrates how a customized layout can help break down

Common Mistakes in Healthcare Billing Statements

Even with careful attention to detail, mistakes can sometimes slip through when creating financial records for healthcare services. These errors can lead to confusion, delayed payments, and even strained relationships with patients or insurance companies. Recognizing the most common pitfalls and understanding how to avoid them can help ensure that your billing documents are clear, accurate, and professional. Below are some of the frequent mistakes made when preparing these documents.

Frequent Errors in Billing Records

- Missing or Incorrect Patient Information: One of the most common mistakes is omitting essential patient details or entering incorrect contact or insurance information. This can delay processing and payments.

- Unclear Service Descriptions: Failing to clearly define the treatments or consultations provided can lead to confusion. Descriptions should be precise, with no ambiguity about what services were rendered.

- Calculation Errors: Simple math mistakes, such as incorrect totals or miscalculations of discounts, taxes, or fees, can make a document appear unprofessional and cause payment issues.

- Omitting Payment Terms: Not specifying due dates, payment methods, or late fees can create confusion for patients and lead to delayed payments.

- Inconsistent Formatting: Using inconsistent fonts, layouts, or styles can make the document harder to read and give an unprofessional impression. It’s important to maintain uniformity in the design for clarity and professionalism.

- Failure to Include Legal Information: Not including necessary legal disclaimers, such as refund policies or terms and conditions, can leave your practice vulnerable to disputes and non-compliance with regulations.

How to Avoid These Mistakes

To avoid these common errors, take the time to carefully review each billing statement before sending it out. Double-check patient details, verify that calculations are accurate, and ensure that all required information is included. Using a st

Why Choose Document Editors Over Other Formats

When creating financial statements, the choice of format can significantly impact both the ease of use and the effectiveness of your documentation. While there are various software options available, using a document editor such as a popular text processing program offers distinct advantages. These editors combine flexibility, simplicity, and compatibility, making them an ideal choice for creating customizable and professional billing records. Below are some of the key reasons why many professionals prefer document editors for their billing needs.

Advantages of Using Document Editors

- Ease of Customization: Document editors allow for straightforward customization, enabling you to easily adjust layouts, fonts, and sections to match your specific needs. This flexibility is especially valuable for practices that need to tailor their billing records to various patient needs.

- Compatibility: Files created in document editors are widely compatible with different operating systems and devices, ensuring that they can be easily shared and accessed by clients, staff, or other healthcare providers without any formatting issues.

- Simple Editing and Updates: It’s quick and easy to make changes to any part of the document, whether you need to correct an error, update information, or modify payment details. This adaptability ensures that you can maintain accurate and up-to-date records at all times.

- User-Friendly Interface: Document editors are typically designed with simplicity in mind, making them accessible even for individuals with limited technical knowledge. The intuitive interface allows you to create detailed records without the steep learning curve associated with more complex software.

Comparison of Formats

Let’s compare the features of a document editor with other common formats:

| Feature | Document Editor | Spreadsheet Software | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Customization Options | High | Medium | Low | ||||||||

| Ease of Editing | Very Easy | Moderate | Hard | ||||||||

| Strategy | Benefit | Example Tools |

|---|---|---|

| Centralized Billing System | All billing records are stored in one location, making it easier to track and manage. | QuickBooks, Xero |

| Regular Follow-Ups | Ensures timely payment by reminding patients of due payments. | MailChimp, FreshBooks |

| Reports and Analytics | Gain insight into trends and payment histories to spot issues early. | Zoho Analytics, Tableau |

By utilizing these tools and strategies, you can not only simplify your workflow but also improve your overall billing efficiency. Streamlining these processes will save time for both your team and your patients, leading to better financial outcomes and reduced administrative burdens.

How to Maintain Accurate Healthcare Billing Documentation

Keeping accurate financial documentation is critical for any healthcare practice. Well-maintained records not only ensure timely payments but also help to prevent disputes, errors, and regulatory issues. Maintaining consistency, attention to detail, and a systematic approach to record-keeping is essential for long-term efficiency. Here are several key strategies to help you maintain accuracy in your billing documentation.

1. Organize and Update Patient Information

Accurate billing starts with correct and up-to-date patient information. Make sure to collect all relevant data during every patient visit, and keep it updated. Here are some tips for managing patient information:

- Verify Patient Details: Always confirm patient contact information, insurance data, and billing preferences at the time of service.

- Maintain Consistent Records: Ensure patient information is entered into your system consistently, avoiding typos or misidentification of accounts.

- Regular Data Audits: Periodically check patient records for accuracy, especially before submitting claims to insurers or issuing billing statements.

2. Use Accurate Codes and Descriptions

Correctly coding each service is crucial for avoiding errors and claim denials. Whether you’re using CPT, HCPCS, or ICD-10 codes, ensure that each treatment or consultation is accurately described. Here’s how to stay accurate:

- Cross-Check Codes: Regularly update coding books or software to stay current with the latest guidelines and medical procedures.

- Detailed Descriptions: Always provide detailed, clear descriptions of services provided, including any follow-up care or additional charges.

- Double-Check Codes: Before submitting claims or generating financial documents, double-check the coding for accuracy to prevent errors that could lead to rejected claims.

3. Track All Payments and Adjustments

Accurately tracking all payments, adjustments, and write-offs ensures that your billing records reflect the correct balance due. Keep careful logs of all transactions and payments made by patients, insurance companies, or third parties. Consider the following best practices:

- Document Payments Promptly: Record payments as soon as they are received, whether through cash, check, or online payment platforms.

- Reconcile Payments: Regularly reconcile payments with the amounts billed to ensure accuracy in accounts receivable.

- Track Adjustments: If there are any write-offs or discounts, ensure they are properly documented and reflected in the final statements to avoid discrepancies.

By following these strategies, healthcare providers can ensure that their billing records are accurate, up-to-date, and compliant with industry standards. Consistently maintaining these practices will reduce the risk of financial errors, improve cash flow, and enhance trust with patients and insurance co

Ensuring Compliance in Healthcare Billing Statements

Maintaining compliance in billing procedures is essential for any healthcare provider to avoid legal issues, fines, or denials of payment. To ensure that your financial records align with both industry standards and regulatory requirements, it’s important to follow the correct guidelines for documentation, coding, and submission. Compliance helps prevent fraudulent activity, reduces errors, and builds trust with patients and insurance providers.

1. Stay Updated with Regulatory Requirements

Healthcare billing is governed by numerous regulations, including those set by government agencies and insurance companies. To ensure compliance, providers must stay informed about the latest rules and guidelines. Here are some key areas to focus on:

- Health Insurance Portability and Accountability Act (HIPAA): Protect patient privacy by ensuring that all financial documentation complies with HIPAA regulations regarding confidentiality and secure data transmission.

- Insurance Billing Codes: Use up-to-date coding systems, such as ICD-10 and CPT codes, to accurately represent services rendered. Incorrect or outdated codes can lead to claim rejections or fraud allegations.

- State and Federal Laws: Familiarize yourself with state and federal healthcare billing laws to avoid violations related to pricing, patient rights, and reimbursement policies.

2. Implement Accurate and Transparent Billing Practices

Accurate billing practices are crucial for compliance. Errors or inconsistencies in billing can result in audits, fines, or disputes with insurance companies. To ensure your billing system is compliant:

- Provide Clear Documentation: Include all necessary details in the financial statements, such as patient information, service descriptions, billing codes, and payment terms. Transparency in your documentation helps avoid misunderstandings.

- Monitor Billing Deadlines: Submit claims within the specified time frames to avoid penalties. Insurance providers often have strict submission deadlines, and missing these deadlines could lead to delayed or denied payments.

- Avoid Upcoding and Downcoding: Ensure that all services are billed accurately according to the work performed. Upcoding (billing for a higher level of service) and downcoding (underreporting the level of service) are fraudulent practices that can lead to serious legal consequences.

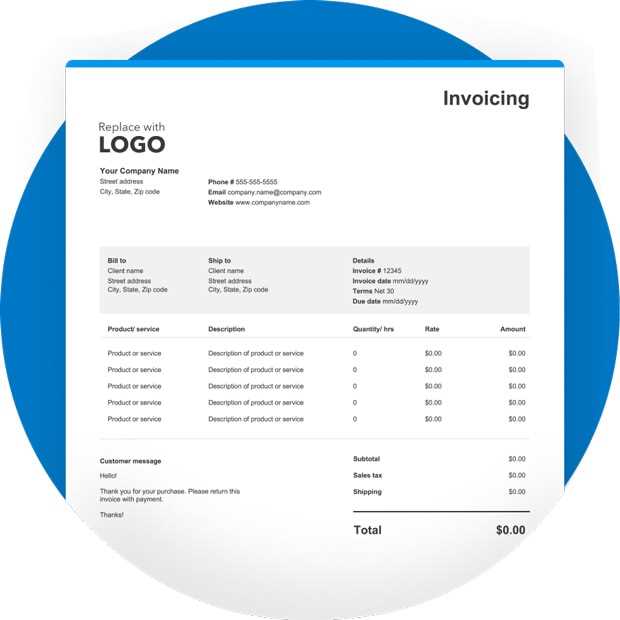

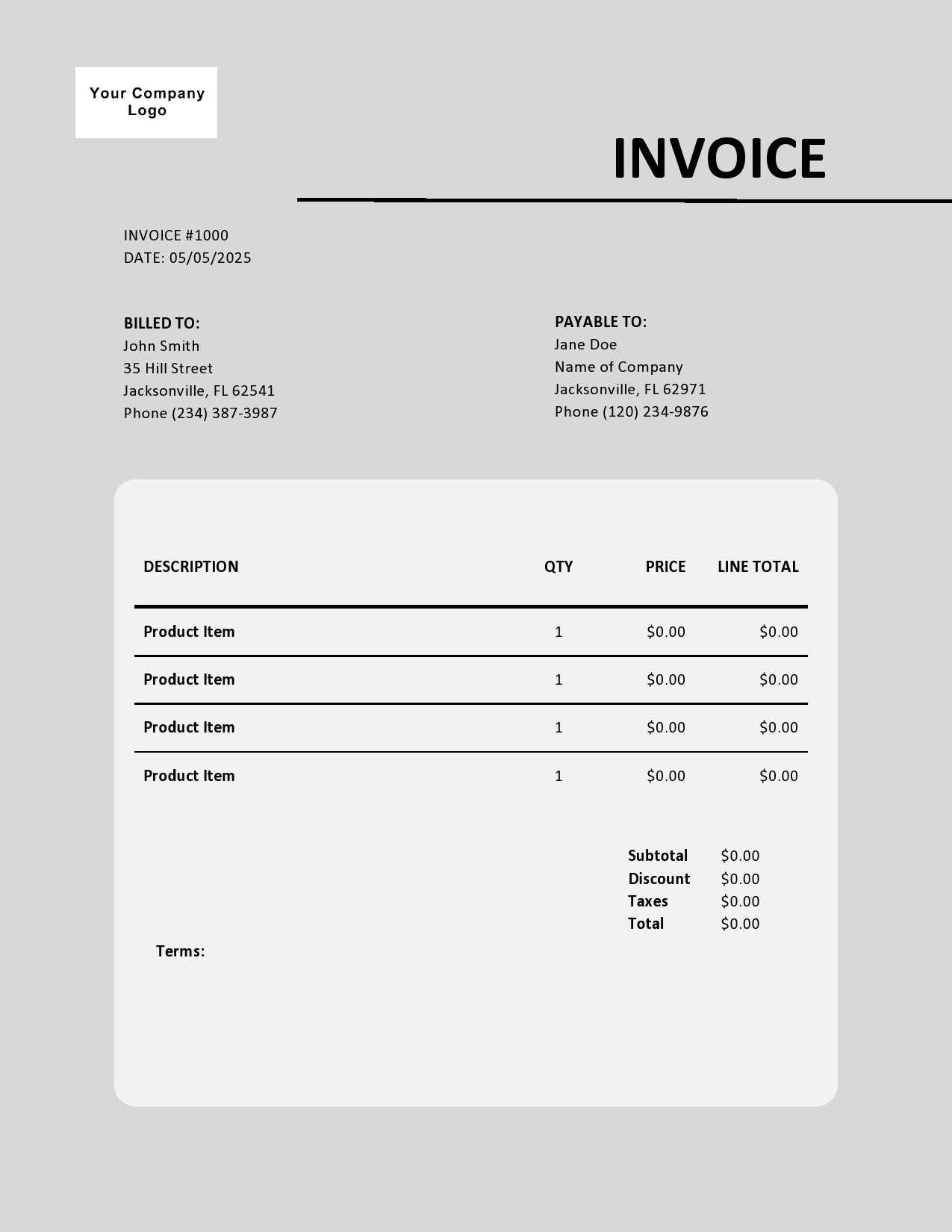

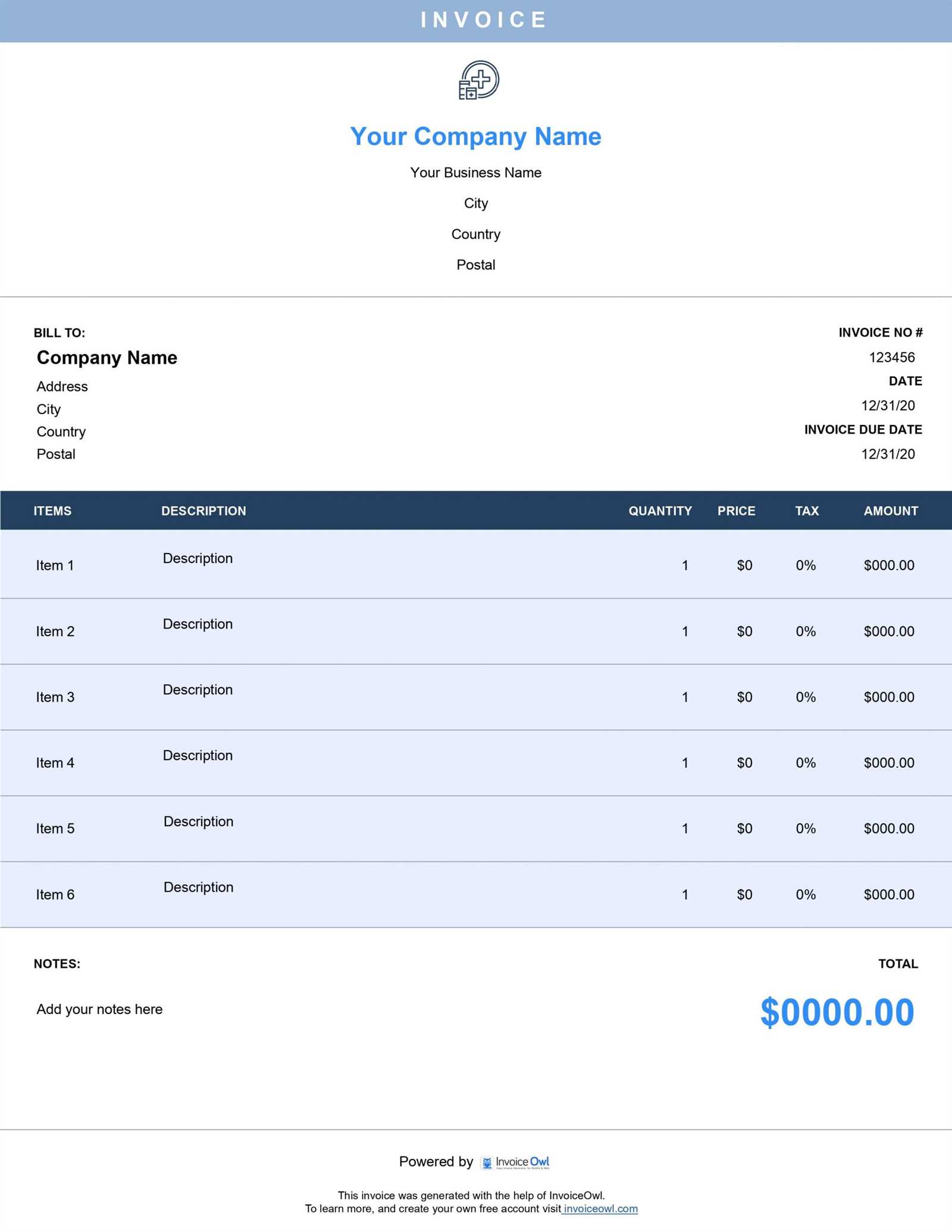

Free Healthcare Billing Document Templates for Word

Creating professional financial documents can be time-consuming, but with the right resources, the process becomes more efficient. Free billing document formats for popular word processing software allow healthcare providers to generate clear, accurate, and customizable statements quickly. These templates can help streamline the billing process, ensuring that all necessary details are included while maintaining a clean, professional appearance.

Why Use Free Billing Document Templates?

Using pre-designed billing formats offers several advantages for healthcare providers, especially in fast-paced practices. Here are some reasons why utilizing these resources is beneficial:

- Time Savings: Templates are ready to use, requiring only the addition of specific patient and service details, which significantly reduces preparation time.

- Customization: These documents can be easily tailored to fit the needs of your practice, including logo placement, colors, and specific line items relevant to your services.

- Professional Look: Templates are designed with clean layouts that ensure your financial documents look polished and well-organized, helping to enhance your practice’s credibility.

- Cost-Effective: Many templates are available for free, making them a budget-friendly option for small practices and startups that do not want to invest in expensive software or hire third-party designers.

How to Choose the Right Template for Your Practice

When selecting a free billing document format, it’s important to consider several factors to ensure the template fits your practice’s needs. Here are a few things to keep in mind:

- Flexibility: Choose a template that allows for easy editing and customization, especially if your service offerings or pricing structures change over time.

- Compliance: Ensure that the template you select adheres to any industry regulations, such as including required patient information and billing codes.

- Clarity: Opt for a layout that presents information in a clear, concise manner, ensuring that patients can easily understand their charges and payment terms.

- Compatibility: Choose templates that are compatible with the software you are using. Most word processing softw

How to Automate Healthcare Billing in Word

Automating your billing process can save time and reduce errors, allowing healthcare providers to focus more on patient care. By utilizing the built-in features of popular word processing software, practices can automate many aspects of the billing cycle, from document creation to tracking payments. The key is to set up an efficient system that allows for quick data entry, consistent formatting, and easy customization. Here are a few strategies to help you automate billing tasks within a word processing program.

1. Use Fields and Data Entry Forms

One of the most effective ways to automate billing in word processors is by using fields and data entry forms. These features enable you to input data once, and have it automatically populate across various sections of the document. To set up fields for automation, follow these steps:

- Create Custom Fields: Define fields for frequently entered information like patient name, service description, and total charges. You can set these up to automatically update across multiple documents.

- Utilize Form Controls: Set up input fields that prompt users to enter specific data, which will automatically populate the relevant parts of the document.

- Link Fields Across Documents: Use hyperlinks or cross-references to connect information between different sections or related documents, ensuring consistency and reducing manual updates.

2. Build and Save Reusable Document Templates

Another way to automate your billing process is by creating reusable documents that can be quickly customized for each patient or service. Instead of starting from scratch with every bill, you can create a master document that includes the most common elements, such as payment terms and basic service descriptions. Here’s how:

- Design a Master Document: Set up a billing document with placeholders for all customizable fields, such as patient name, address, services rendered, and costs.

- Save as a Template: Save this document as a template so you can use it repeatedly without having to re-enter the same information every time.

- Quick Customization: Each time you create a new bill, simply fill in the patient-specific information, ensuring that the document is up-to-date and accurate.

3. Automate Billing Reports and Reminders

For

How to Save Time with Billing Document Formats

Creating billing documents from scratch for every patient can be time-consuming and repetitive. Using pre-designed, reusable document formats can drastically reduce the time spent on administrative tasks, allowing healthcare providers to focus more on patient care. By automating key aspects of document creation, practices can streamline the billing process and improve efficiency without sacrificing accuracy or professionalism.

1. Reduce Repetitive Data Entry

One of the primary advantages of using billing document formats is the ability to minimize repetitive data entry. Instead of manually creating each document from scratch, a reusable format allows you to input information once and have it automatically populate the necessary fields. Here’s how you can save time:

- Pre-fill Common Fields: Customize the format with placeholders for frequently used information like patient name, contact details, service descriptions, and prices.

- Save Standardized Data: Store commonly used data, such as procedure codes and payment terms, in the format so that they can be quickly accessed and inserted without re-entering them.

- Automate Calculations: Set up fields for automatic calculations like totals or taxes, which ensures accuracy and speeds up document creation.

2. Streamline Customization for Each Patient

Although billing formats are reusable, they can still be customized for each patient or service. The key is to make adjustments quickly without starting over. Here’s how to make the process more efficient:

- Use Consistent Layouts: Ensure that all documents follow a standardized layout, so there’s less time spent on adjusting the structure or design for each new billing cycle.

- Quickly Update Personal Details: Input patient-specific details like name, address, and treatment dates into pre-filled sections, saving time on customization.

- Save Multiple Versions: Keep different versions of the document format for various types of services, so you can easily select the one that matches the patient’s treatment.

By using a well-structured document format, healthcare providers can reduce the time spent on each individual billing task, ensuring that the administrative side of the practice runs smoothly and efficiently. This time-saving method helps improve the overall workflow and reduces the risk of errors or omissions in financial documentation.