Landscaping Invoices Template for Easy Billing

Efficient financial management is a key element of any business, especially for service providers. Properly organized payment requests ensure smooth transactions and help maintain a professional image. This is where an organized system for creating billing documents becomes essential. It simplifies the task of tracking work performed and payment received, making both processes faster and more reliable.

Crafting accurate billing statements that reflect the services offered, payment terms, and other important details is crucial. An easy-to-use document format can significantly reduce errors and streamline communication between you and your clients. With the right tools, sending well-structured documents not only boosts your credibility but also helps maintain transparency.

By utilizing a customizable approach, service providers can ensure that each statement is tailored to their specific needs. This flexibility allows for the inclusion of any necessary charges, discounts, or additional services provided, making the process both efficient and professional.

Landscaping Invoices Template Guide

Creating professional billing documents is essential for any service provider. It ensures clarity, maintains transparency, and helps manage financial transactions effectively. Using a clear and organized format for payment requests makes the process more straightforward, ensuring both parties understand the terms and the work completed.

When constructing a billing document, it’s important to include all necessary details. This includes information about the services provided, payment terms, deadlines, and any additional fees or discounts that may apply. The layout should be simple, yet thorough, to avoid confusion and ensure smooth communication between the service provider and the client.

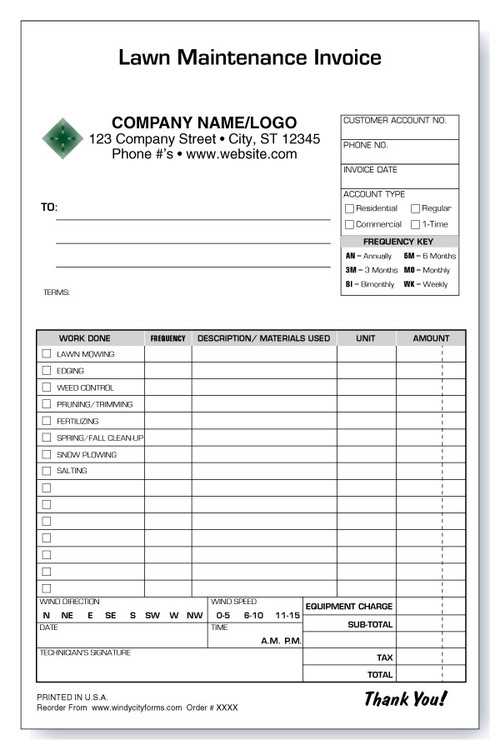

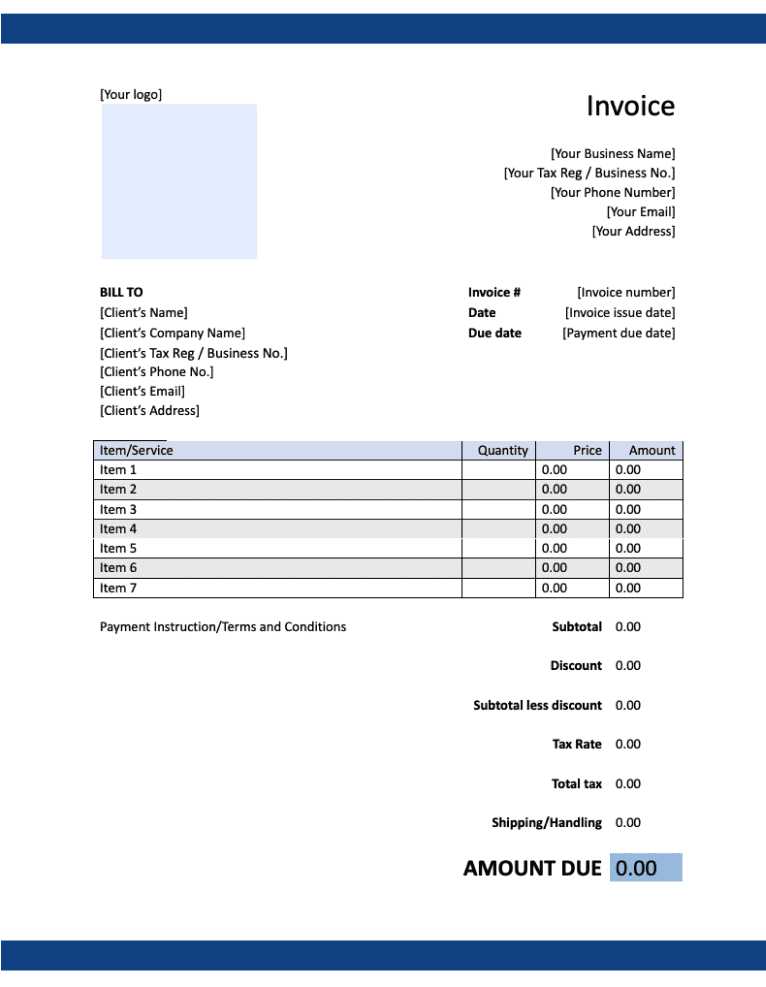

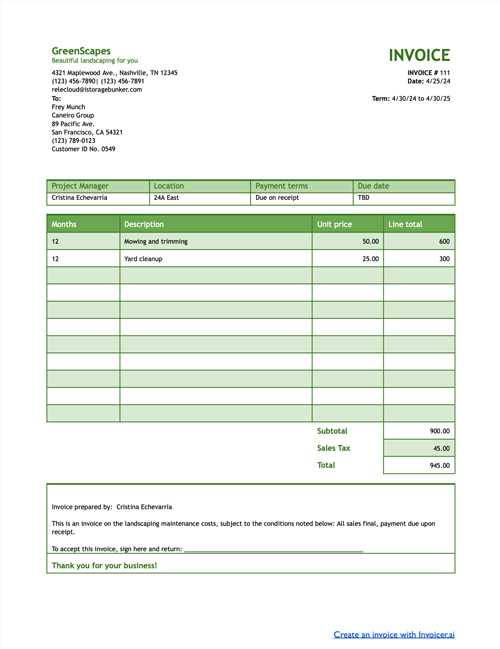

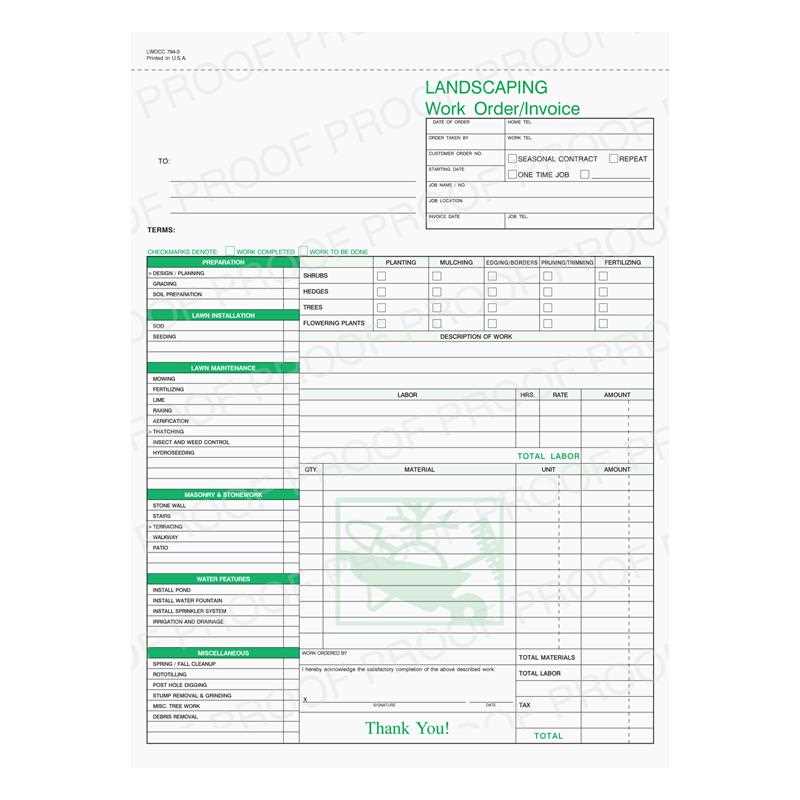

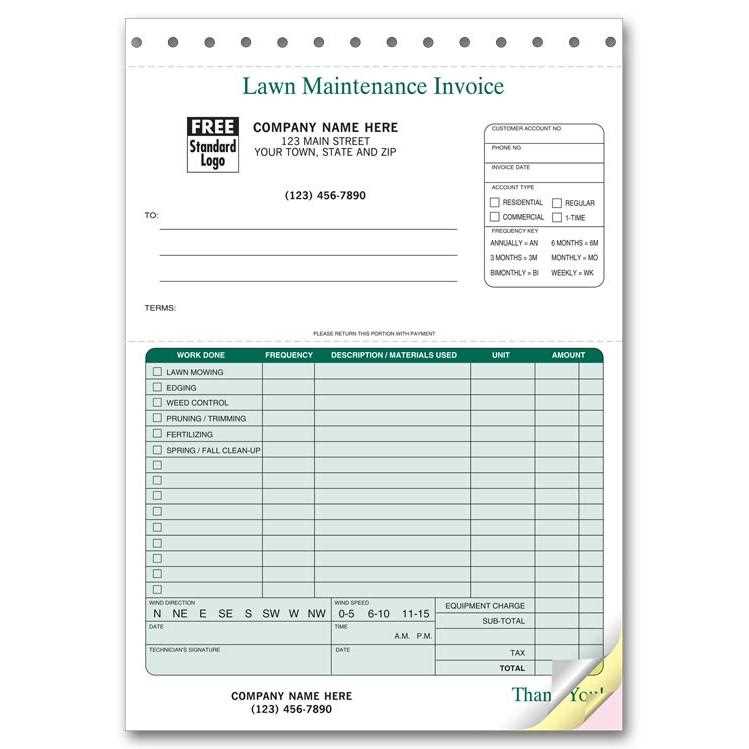

Below is a basic structure for an effective billing document:

| Section | Description |

|---|---|

| Service Description | Provide a clear breakdown of the tasks performed, including any materials used or specific details relevant to the work completed. |

| Payment Terms | Outline when payment is due, acceptable payment methods, and any penalties for late payments. |

| Client Information | Include the client’s name, address, and contact details to ensure accurate communication and invoicing. |

| Company Information | Provide your company details, such as name, contact information, and any relevant registration numbers or licenses. |

| Pricing Breakdown | List the costs for each service or item provided, including taxes, fees, and any discounts. |

| Total Amount Due | Summarize the total amount due for the services rendered. |

Following a structured approach not only ensures completeness but also helps you maintain professionalism and efficiency in your billing practices.

Benefits of Using Invoice Templates

Using a pre-designed document for billing has numerous advantages, especially for service-based businesses. It streamlines the process of creating payment requests, saving both time and effort. With a standardized format, you can ensure that all essential details are included without missing any crucial information.

Some of the key benefits of using a structured document for billing include:

- Consistency: A pre-designed format ensures that all your payment requests are uniform, which enhances professionalism and reduces errors.

- Time Efficiency: Rather than starting from scratch each time, you can quickly fill in the necessary details, speeding up the billing process.

- Accuracy: A well-organized layout minimizes the risk of omitting important details, ensuring that your clients receive accurate payment information.

- Customization: Many templates offer customization options, allowing you to add your branding, adjust payment terms, and tailor the document to specific needs.

- Improved Cash Flow: By having a clear, professional billing document, clients are more likely to make prompt payments, improving your business’s cash flow.

- Professional Appearance: Using a polished, consistent format gives clients confidence in your services, reflecting positively on your business image.

- Easy Tracking: Standardized documents make it easier to track payments, monitor outstanding balances, and organize financial records.

By adopting a standardized system for billing, you not only save time and effort but also create a more organized and professional approach to managing payments.

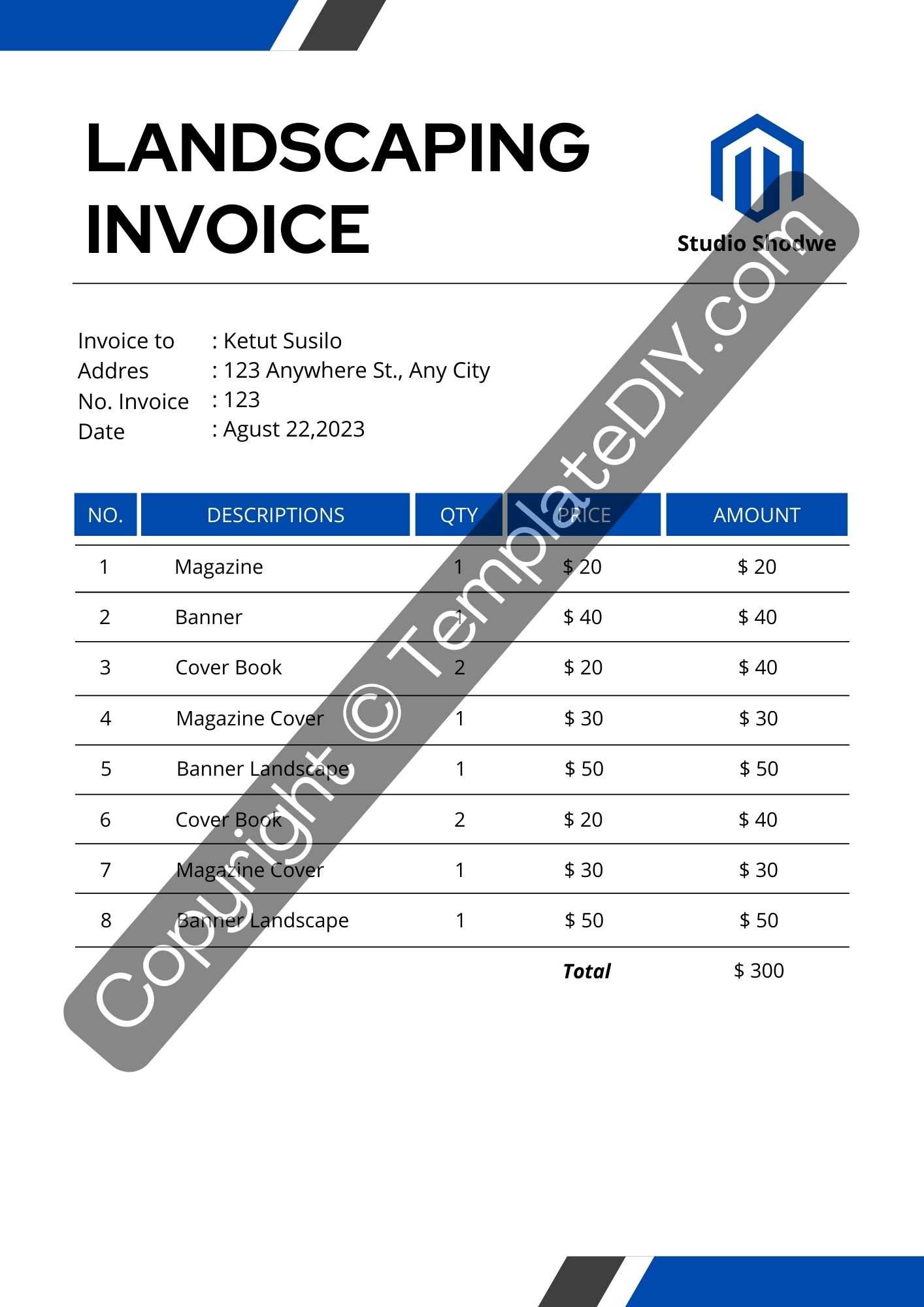

How to Customize Landscaping Invoices

Customizing your billing documents ensures they reflect your business’s unique branding and requirements. A personalized approach not only helps maintain professionalism but also allows you to include specific terms and details relevant to each job. Whether you’re adjusting the layout or adding extra information, customization helps make the document more relevant to both you and your clients.

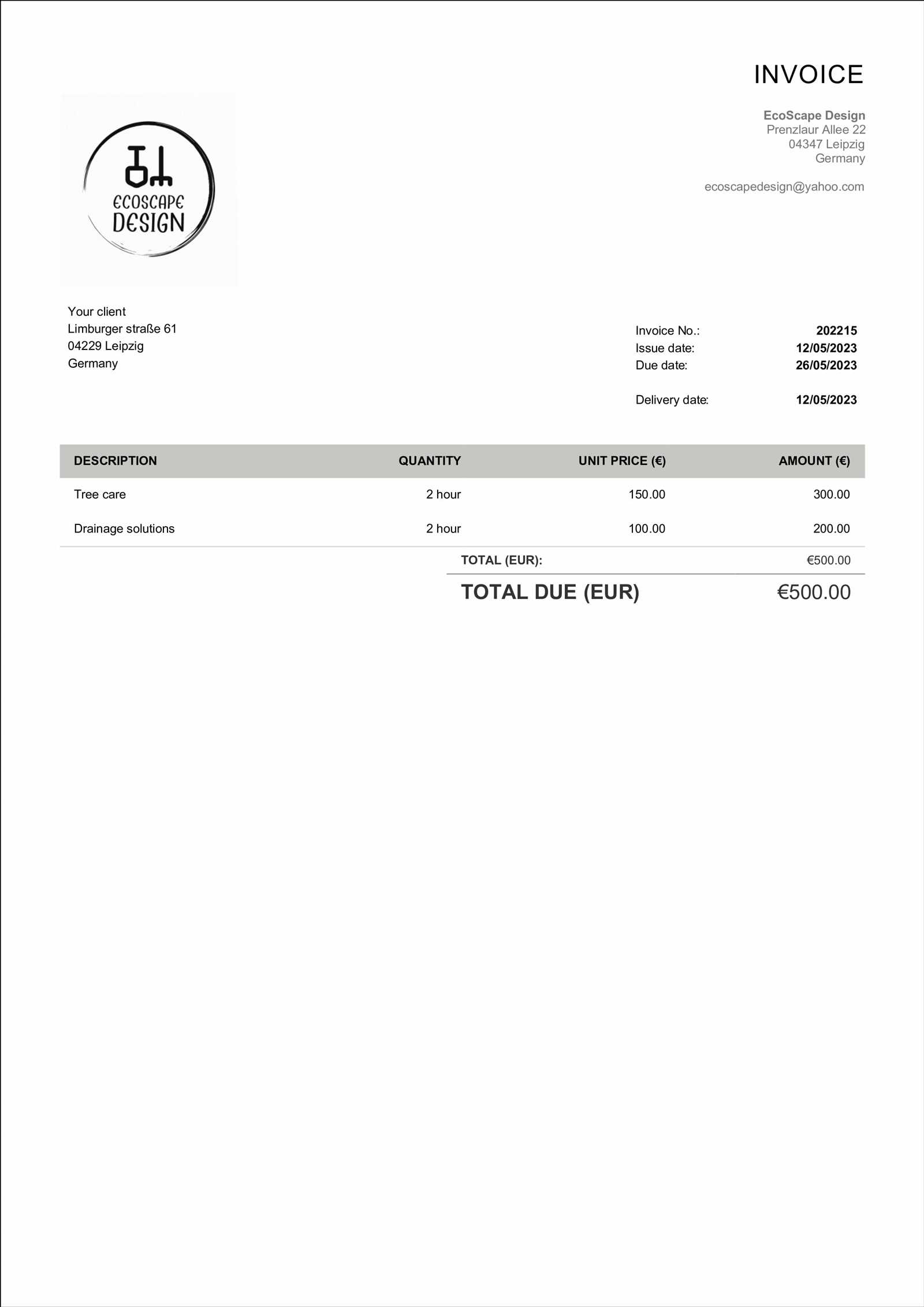

Adjusting the Layout and Design

When customizing a billing document, the first step is to choose a clean and easy-to-read layout. Make sure your business logo, contact details, and the client’s information are clearly visible. The design should be simple yet professional, using consistent fonts, colors, and spacing. You can adjust the placement of different sections like the service description, payment terms, and total due amount to create a logical flow that is easy to understand.

Adding Specific Terms and Conditions

Another crucial aspect of customization is including your specific terms and conditions. This can include details like payment deadlines, late fees, or specific instructions for the work completed. Tailoring these terms to the client or job ensures that all relevant information is communicated clearly, avoiding potential confusion or disputes. Always make sure these terms are easily noticeable within the document, ideally in a section that stands out.

By personalizing your billing documents, you make the process more efficient and ensure clarity for both you and your clients, fostering a smooth transaction every time.

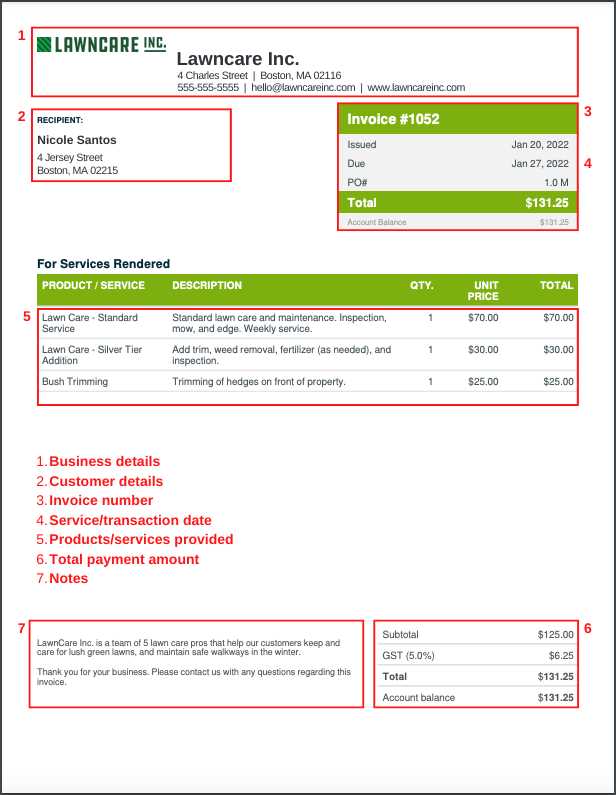

Essential Information for Landscaping Invoices

For any billing document, including the right details is crucial to ensure clarity and transparency. A well-structured statement helps both the service provider and the client understand the work performed and the amount due. Including the necessary information from the start can prevent confusion and ensure timely payments.

Key elements to include in your billing document are:

- Business Details: Include your company’s name, contact information, and any relevant registration numbers. This establishes credibility and ensures the client knows how to reach you.

- Client Information: Clearly list the client’s name, address, and contact information to avoid any mix-ups.

- Description of Services: Provide a detailed breakdown of the tasks performed. This helps justify the costs and gives the client a clear understanding of what they are paying for.

- Pricing Structure: List individual costs for each service or product provided, including any applicable taxes or fees. This transparency prevents misunderstandings regarding the amount due.

- Payment Terms: Outline when the payment is due, accepted payment methods, and any late fees or penalties for overdue payments. This ensures both parties are on the same page regarding deadlines and expectations.

- Total Amount Due: Clearly indicate the total sum the client needs to pay, ensuring there are no hidden costs.

By including these essential details, you ensure that your billing documents are comprehensive, transparent, and professional, leading to smoother transactions and fewer disputes.

Choosing the Right Invoice Format

Selecting the correct format for your billing documents is an important step in ensuring clarity and professionalism. A well-organized structure helps both the client and service provider easily understand the details of the transaction. The format should be simple to read, visually appealing, and comprehensive, providing all necessary information without overwhelming the reader.

Several factors come into play when choosing the right structure for your payment requests:

- Simplicity: Choose a design that is easy to navigate. Avoid unnecessary complexity in the layout, and make sure that key details, such as service descriptions, pricing, and payment terms, are clearly visible.

- Customization: Consider a flexible format that can be easily adjusted for different clients and jobs. This allows you to add unique terms, discounts, or specific service details as needed.

- Professional Appearance: Your document should reflect your business’s professionalism. A clean, polished layout builds trust with clients and creates a positive impression.

- Compatibility: Ensure the format is compatible with the tools you use for accounting or customer management. Many billing platforms offer predefined formats that can seamlessly integrate into your workflow.

- Clarity: Ensure that all critical information, such as service dates, pricing, and deadlines, is well-organized and easy to understand. Avoid cluttered designs that could confuse the client.

By selecting the right format, you can enhance communication, reduce misunderstandings, and create a smoother process for both you and your clients. A suitable format ensures that the document is not only functional but also reinforces your business’s professional image.

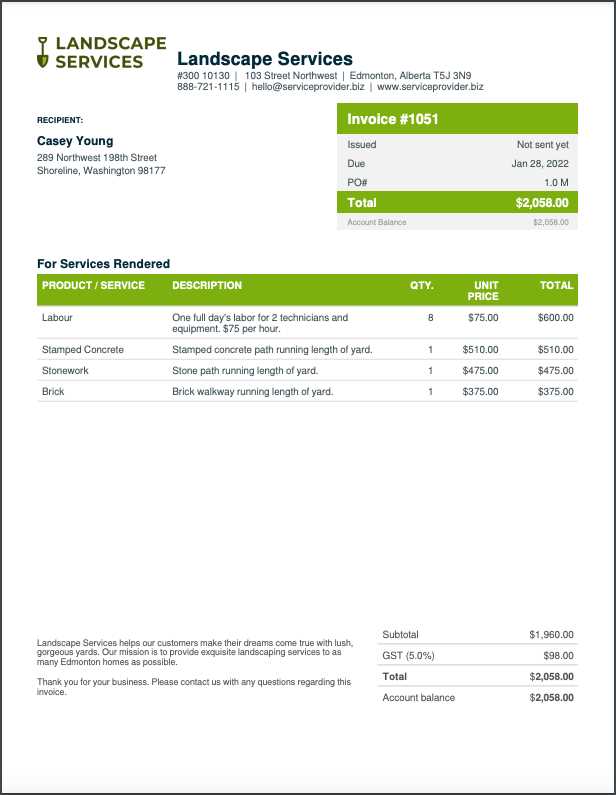

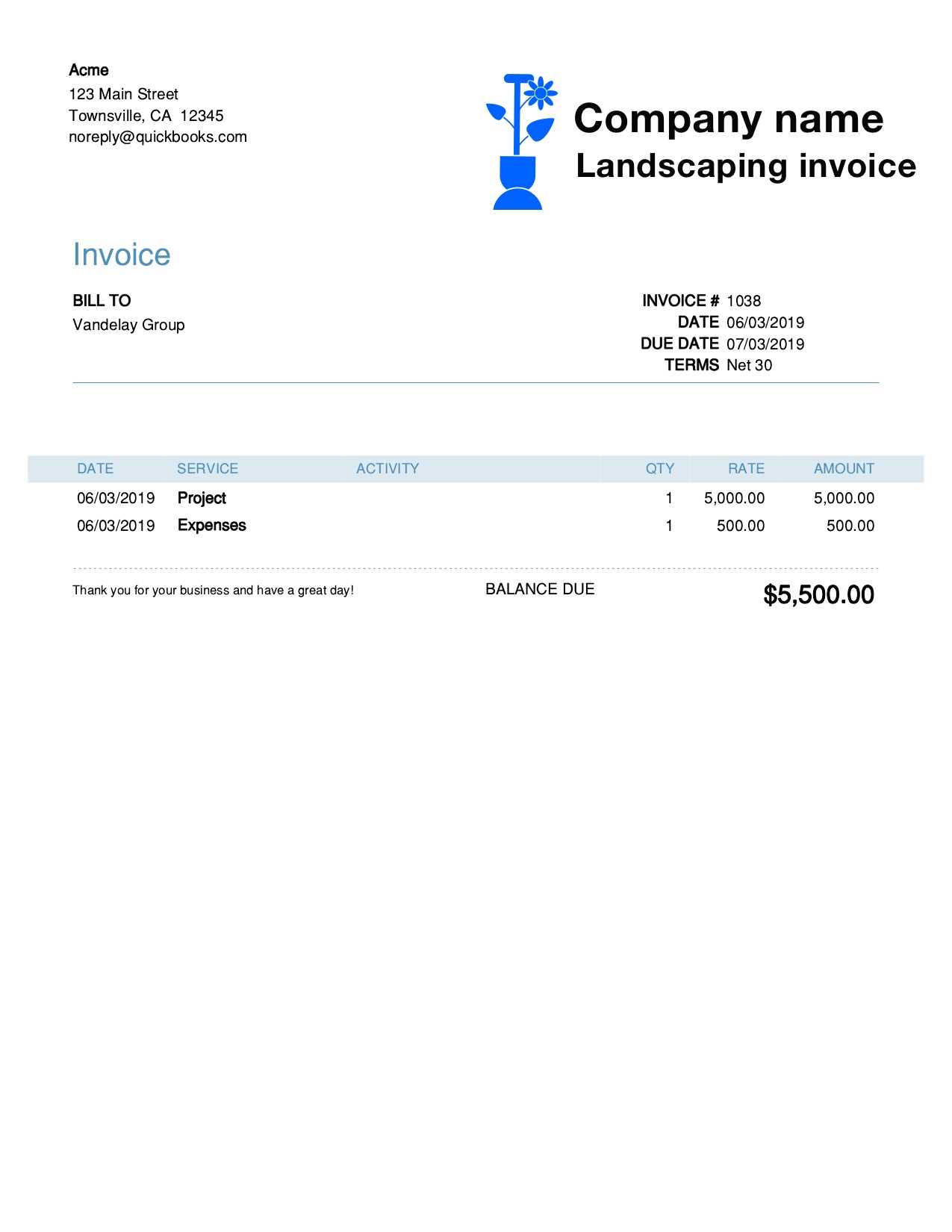

How to Add Services and Rates

Accurately listing the services provided and their corresponding rates is essential for clear communication and transparent billing. A detailed breakdown ensures that the client understands exactly what they are paying for and helps prevent disputes. The key is to be precise and thorough while maintaining a clean, organized format.

Here’s how to effectively add services and their associated costs to your payment document:

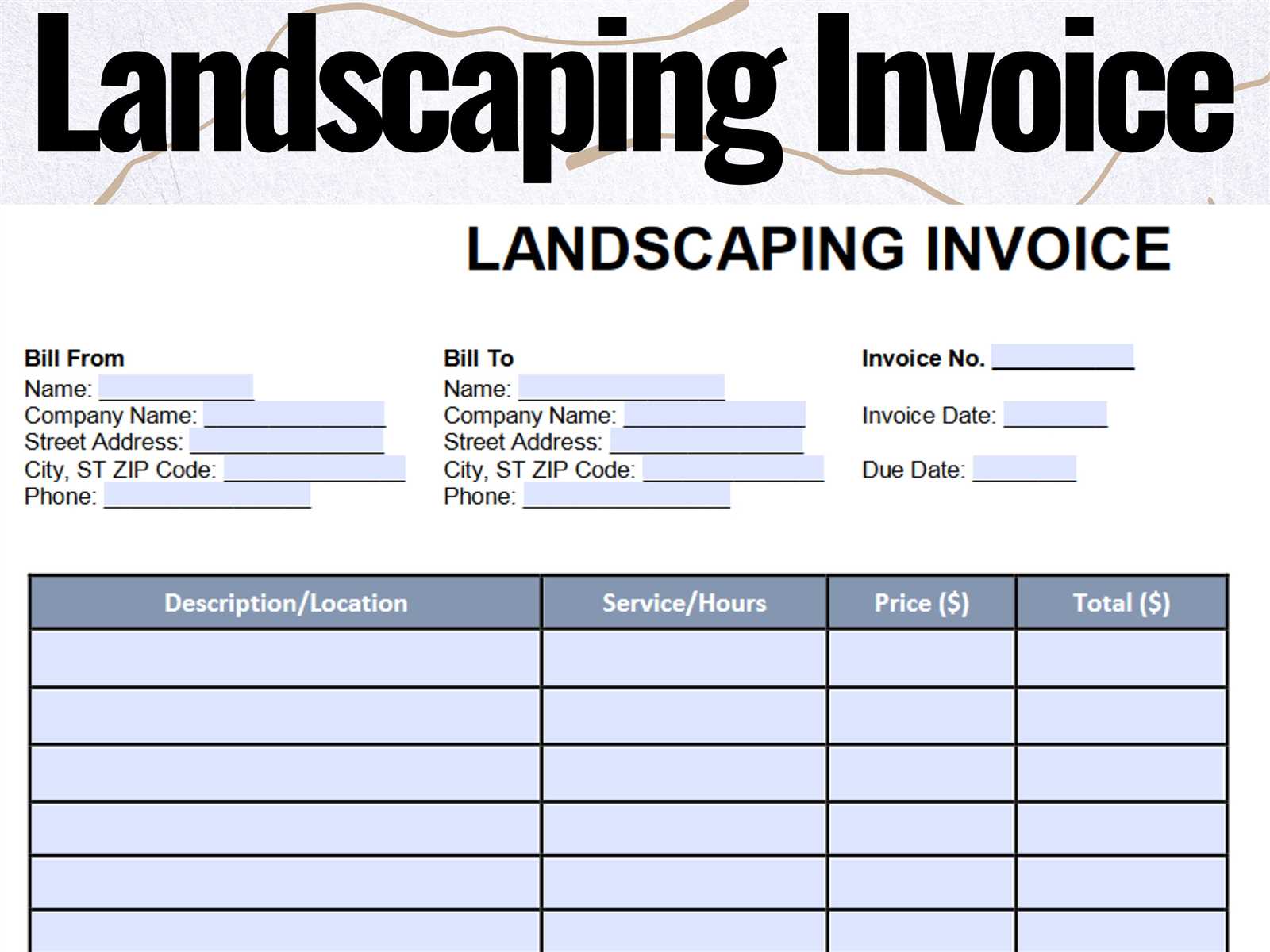

| Service | Description | Rate |

|---|---|---|

| Basic Lawn Care | Includes mowing, edging, and trimming. | $50 per session |

| Tree Pruning | Pruning of trees up to 15 feet. | $100 per hour |

| Garden Design | Custom design for garden layout and plant selection. | $200 flat fee |

Each service should be clearly described, including any specifics such as time frames, materials, or special requirements. Pricing should be straightforward, whether it is based on a per-hour rate, flat fee, or price per service. This transparency not only helps your client understand the charges but also simplifies your record-keeping.

Including Payment Terms in Invoices

Clearly defining payment terms in your billing document is crucial for setting expectations and ensuring timely compensation for services rendered. By outlining when payments are due, acceptable methods of payment, and any late fees, you provide a clear framework that helps avoid confusion and delays.

Here are some important aspects to consider when including payment terms in your billing document:

- Due Date: Specify the exact date by which payment should be made. This helps prevent any misunderstandings and ensures timely payments.

- Accepted Payment Methods: Clearly list the methods of payment you accept, such as credit card, bank transfer, or checks. This provides clients with options and avoids unnecessary delays.

- Late Fees: State any penalties for overdue payments, such as a percentage added to the total amount due. This can encourage clients to pay on time and help protect your business’s cash flow.

- Discounts for Early Payments: If applicable, you may want to include an incentive for clients to pay ahead of schedule, such as a discount on the total amount due.

By being clear about payment expectations, you help your clients understand their responsibilities and ensure a smooth transaction process, benefiting both parties.

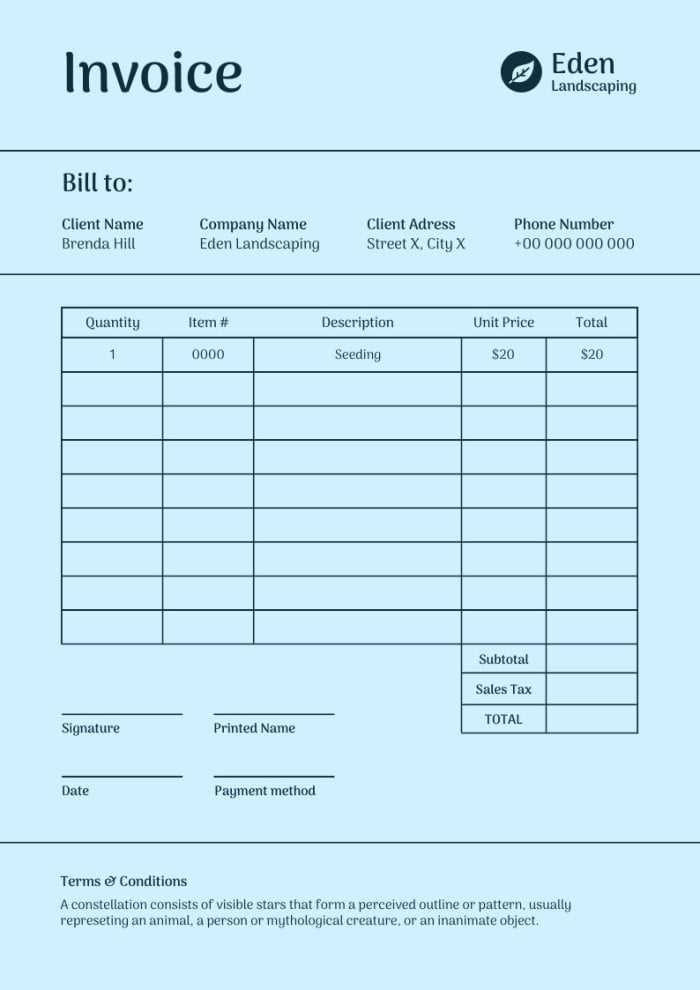

Designing a Professional Invoice Template

Creating a well-designed billing document not only enhances your business’s credibility but also ensures clarity and efficiency in communication with clients. A polished and organized layout communicates professionalism and helps clients easily understand the charges, payment methods, and terms. The right design can make a significant impact on how your business is perceived and can contribute to smoother transactions.

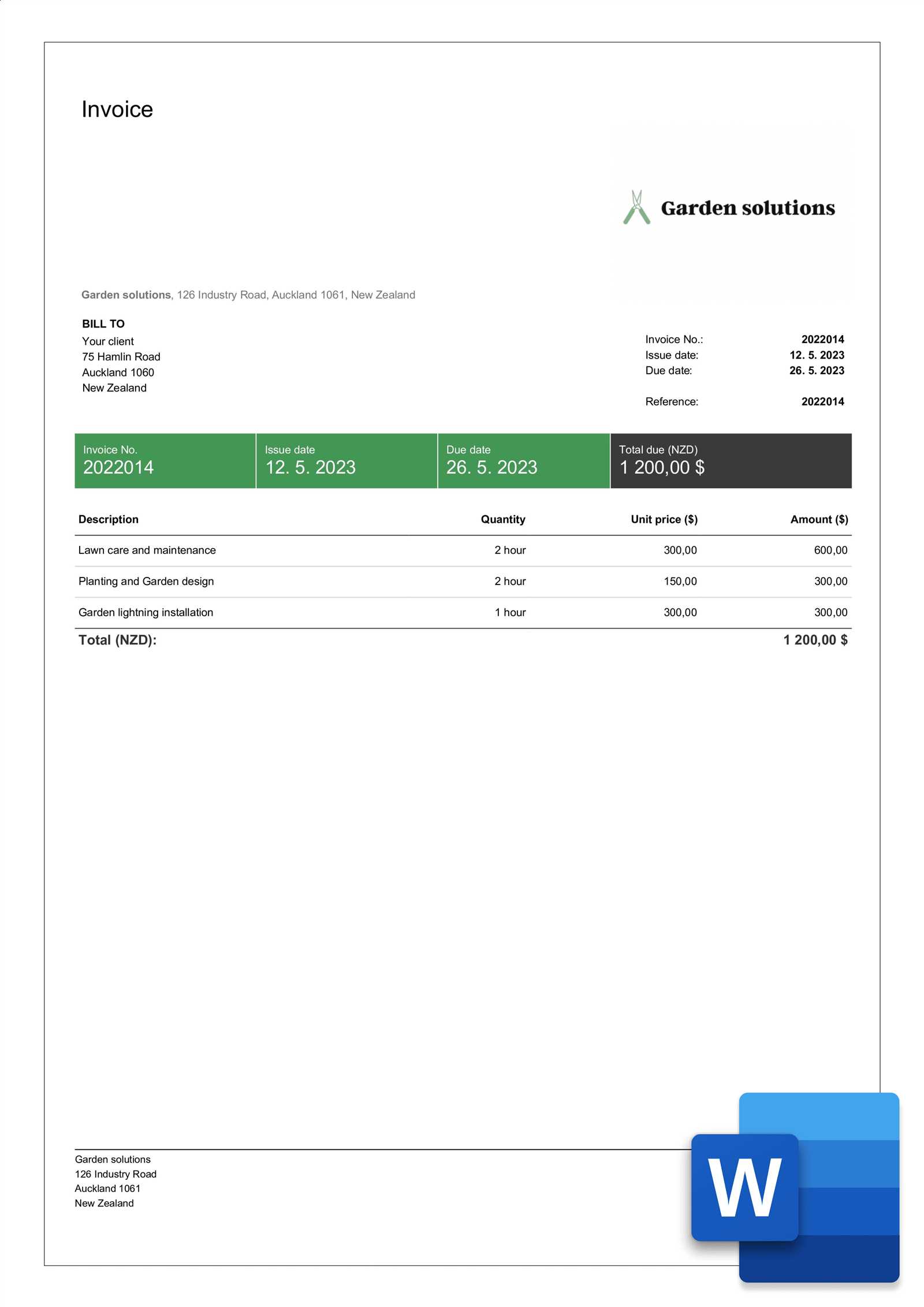

Choosing the Right Layout

The layout of your billing document should prioritize simplicity and clarity. Key information, such as the services provided, total amount due, and payment terms, should be easy to find. Organize these details in a logical flow, ensuring that each section is distinct and well-spaced. The use of headers and bold text can guide the reader’s eye to the most important parts of the document.

Incorporating Branding and Contact Details

A professional design also incorporates your company’s branding, such as logos, colors, and fonts, creating a cohesive image for your business. Include your business’s contact information, like phone number, email, and address, in a prominent position. This not only makes it easier for clients to reach you but also reinforces the professionalism of your brand.

By focusing on simplicity, clarity, and branding, you can create a billing document that leaves a positive impression while ensuring all necessary details are clearly communicated to the client.

Common Mistakes in Landscaping Invoices

When creating billing documents, it’s easy to overlook certain details that can lead to confusion or delays in payment. Common errors, if left unaddressed, can create misunderstandings with clients and delay financial transactions. Identifying and correcting these mistakes can improve the professionalism of your business and ensure a smooth payment process.

Omitting Key Information

One of the most frequent mistakes is leaving out critical details such as the client’s contact information, service descriptions, or payment terms. Missing these can lead to confusion about what was provided, how much is owed, or when payment is due. Always double-check that every essential element is clearly listed and accurate.

Incorrect Pricing or Calculation Errors

Errors in pricing or calculations are another common issue. Double-check rates, quantities, and totals before finalizing the document. Inaccurate charges can lead to disputes, delayed payments, or lost trust with clients. To avoid this, use an automated system or software to help with accurate calculations.

By ensuring all essential details are included and double-checking pricing, you can prevent these common mistakes and create a clearer, more professional document that fosters better communication and trust with your clients.

Free vs Paid Invoice Templates

When it comes to creating billing documents, choosing between free and paid options is an important decision for many businesses. Each type offers distinct advantages and limitations, so understanding what you need can help you make the best choice. Whether you opt for a no-cost solution or invest in a premium option depends on your specific requirements and how much customization or functionality you need.

Advantages of Free Options

Free options are typically accessible and easy to use, making them a great starting point for small businesses or those just getting started. They often provide a simple structure that is easy to fill out and customize with your own details. Additionally, free billing documents are widely available online and can be downloaded quickly without any cost.

However, these free solutions may lack advanced features like integrated payment processing, personalized design, or ongoing support. For businesses with basic needs, free options can be a sufficient choice, offering the core functionality without additional costs.

Benefits of Paid Options

Paid solutions, on the other hand, typically offer greater customization, advanced features, and ongoing support. With a paid option, you can access more flexible designs, advanced calculations, and the ability to integrate with accounting software. Many premium options also offer cloud storage, automatic tax calculations, and customer support to assist with any issues.

While paid options involve an upfront investment, the additional features can save time, reduce errors, and enhance professionalism. For businesses looking for long-term solutions or those that require advanced capabilities, a paid service is often worth the investment.

Ultimately, the choice between free and paid options comes down to the scale of your business and the specific features you need. Consider your goals, budget, and how much time you can commit to customizing your billing documents when making your decision.

How to Handle Discounts and Fees

Effectively managing discounts and additional charges is crucial for maintaining clear communication with clients and ensuring fair compensation for your services. Whether offering a promotional discount or applying a fee for late payments, it is important to clearly outline these adjustments in your billing documents to avoid misunderstandings and to maintain professionalism.

Discounts can be a great way to incentivize early payments or reward loyal clients, but they should always be transparent. Clearly state the percentage or amount being deducted, along with any applicable conditions, such as early payment deadlines or special offers. Ensure that the discount is reflected in the total amount due, and always check that it’s accurately calculated.

Fees should also be explicitly mentioned. Late fees, service charges, or additional costs for special requests should be clearly listed and explained. Clients should know when these fees apply and the exact amount they will be charged. It’s best practice to include a brief note or explanation of why the fee is being applied, especially for things like late payment penalties or additional service requirements.

Handling discounts and fees with clarity not only prevents disputes but also enhances the trust and professionalism of your business. Make sure both discounts and fees are easy to understand and calculate, ensuring a smooth transaction for both parties.

Importance of Clear Invoice Layout

A well-organized billing document is essential for both the sender and the recipient. A clear and easy-to-read layout not only improves the professional image of your business but also ensures that the client can quickly understand the charges, payment terms, and other important details. A cluttered or confusing design can lead to misunderstandings, delayed payments, and unnecessary follow-ups.

Benefits of a Clear Layout

A streamlined and structured format helps clients easily navigate the document and find the information they need. Breaking down the charges, payment terms, and contact details into distinct sections allows for faster comprehension. The inclusion of headers, bullet points, and tables can also aid in organizing the content, making it visually appealing and simple to follow.

Key Components for a Clear Design

A well-organized layout should include the following key elements:

| Section | Details |

|---|---|

| Contact Information | Both the sender’s and the recipient’s contact details should be clearly listed. |

| Itemized List | List the services provided or products delivered with corresponding costs. |

| Total Amount | The total due should be clearly highlighted and easy to find. |

| Payment Terms | Provide clear instructions for payment deadlines, methods, and penalties for late payments. |

By ensuring that the key components are clearly marked and organized, you can avoid confusion and make the process smoother for both parties. A clear design reflects well on your professionalism and fosters positive relationships with your clients.

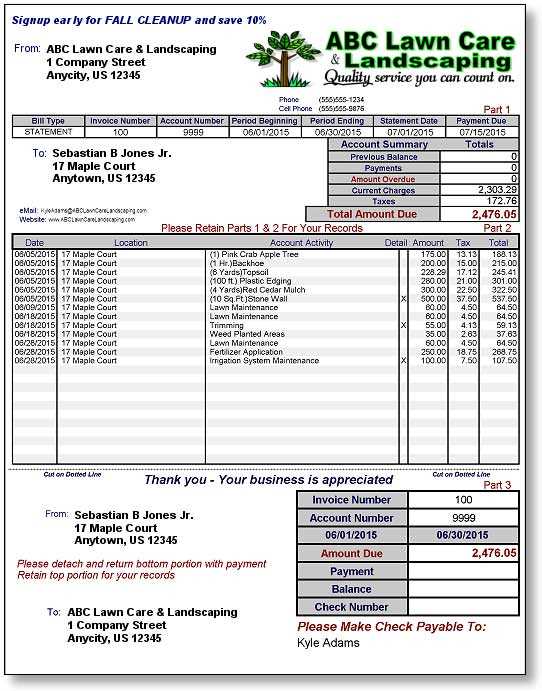

Tracking Payments with Invoice Templates

Efficiently tracking payments is crucial for maintaining cash flow and ensuring timely settlements. Using organized billing documents helps monitor the status of each payment, making it easier to follow up on overdue amounts and avoid confusion. Implementing a structured system for tracking payments not only keeps finances in order but also improves client relations by offering transparency in transactions.

There are several ways to track payments effectively, whether you are using manual records or automated systems. Here are some key practices to consider:

- Clear Payment Status Indicators: Always include a section in your documents to mark the payment status, such as “Paid,” “Pending,” or “Overdue.” This helps both you and the client track the current standing.

- Unique Invoice Numbers: Assign a unique reference number to each document to make it easier to track payments and match them with specific transactions.

- Due Dates and Payment Terms: Clearly state the payment deadline and any late fees that may apply, ensuring clients know when to make payments to avoid penalties.

By including these elements, you can maintain a streamlined system for monitoring payment progress and addressing any outstanding balances quickly and efficiently.

Legal Considerations for Invoices

When creating billing documents, it’s essential to understand the legal requirements that govern them. Properly structured billing statements ensure compliance with regulations and protect both your business and your clients in the event of disputes. It’s not just about including the right information but also adhering to legal standards that might vary by region or industry.

Key Legal Aspects to Include

There are several critical elements that must appear on your billing documents to meet legal requirements:

| Element | Legal Requirement |

|---|---|

| Business Identification | Include the full name and address of your business, as well as your tax identification number if applicable. |

| Client Details | Ensure the recipient’s name and contact information are listed accurately for clear identification. |

| Itemized Charges | Clearly describe the products or services provided, with dates, quantities, and costs to avoid confusion. |

| Payment Terms | Include the terms of payment, such as deadlines, accepted methods, and penalties for late payments. |

| Legal Disclaimers | Depending on your jurisdiction, include any necessary disclaimers related to taxes, penalties, or other legal obligations. |

Ensuring Compliance

By including these elements, you ensure that your billing practices are transparent and legally compliant. It’s always a good idea to stay informed about the specific regulations that may apply to your business type or location. Regularly reviewing your process and consulting with a legal professional when in doubt can help you avoid costly mistakes and protect your business interests.

How to Send Landscaping Invoices

Sending billing statements efficiently and professionally is essential for smooth transactions and timely payments. The method of delivery should be clear, secure, and convenient for both you and the recipient. Whether you’re delivering physical copies or opting for digital methods, choosing the right approach can significantly impact how quickly payments are processed and how professional your business appears.

There are several options for sending these documents, each with its own set of advantages:

- Physical Mail: For clients who prefer traditional communication, sending a printed copy via postal mail ensures the statement is delivered directly. Ensure the address is accurate and consider using certified mail for higher security and tracking.

- Email: Sending a digital copy via email is fast, eco-friendly, and provides a record of delivery. Make sure to include the document as an attachment in a professional format such as PDF and provide a brief explanation of the charges in the email body.

- Online Payment Platforms: Some businesses prefer using invoicing features within online payment platforms like PayPal or Stripe. This method often allows for easy tracking of payments, integrates with accounting systems, and simplifies the process for the client to settle the bill.

Choosing the right method depends on your client’s preferences and your business operations. Regardless of the method, always ensure that the statement is clear, accurate, and sent on time to avoid delays in payment.

Tips for Ensuring Timely Payments

Receiving payments promptly is crucial for maintaining cash flow and sustaining business operations. To help avoid delays and ensure that payments are made on time, there are a few best practices you can adopt when handling payment requests.

One of the most effective strategies is to clearly communicate the payment terms upfront. This includes specifying due dates, accepted payment methods, and any late fees or discounts for early payment. By setting expectations from the start, clients are more likely to adhere to deadlines.

Here are a few additional tips to help you receive payments quickly:

- Send Reminders: A gentle reminder a few days before the due date can prompt clients to make payments on time. A polite follow-up email or message helps keep the payment top of mind.

- Offer Multiple Payment Methods: Providing various ways for clients to pay, such as bank transfers, credit card payments, or online platforms, increases the likelihood of faster payments. Make it easy for them to settle their balance in the most convenient way.

- Invoice Promptly: The sooner you send your billing statement, the sooner the client can process it. Delays in issuing invoices can cause delays in payment, so it’s important to send them as soon as the work is completed.

- Be Clear and Detailed: Ensure that your payment request is straightforward and includes all the necessary information, such as the services provided, the total amount due, and any relevant reference numbers. A transparent document reduces the chances of confusion or disputes.

- Set Clear Late Fees: Specify in advance any penalties for late payments. This can motivate clients to pay on time to avoid extra charges, especially for those who may have a tendency to delay.

By being proactive and professional in your approach, you can significantly reduce the likelihood of delayed payments and improve your cash flow management.

Integrating Invoices with Accounting Software

Integrating billing records with accounting systems streamlines financial management and ensures accuracy in tracking payments, expenses, and overall business performance. By automating the process, you reduce the risk of manual errors and save valuable time that would otherwise be spent on reconciling data across different platforms.

There are several benefits to linking your payment records with accounting software:

- Improved Accuracy: Automatic data transfer between systems ensures that information is consistent, reducing the risk of mistakes in calculations and financial reports.

- Time Efficiency: By integrating the two, you eliminate the need to enter data manually in both platforms, saving time and reducing the workload.

- Real-Time Financial Overview: Integration provides up-to-date financial insights, allowing you to track income and expenses instantly and make informed business decisions.

- Automated Tax Calculations: Many accounting platforms can automatically calculate and apply taxes based on your billing records, ensuring compliance and saving time during tax season.

- Better Reporting: With all financial data in one place, it’s easier to generate comprehensive reports, analyze cash flow, and track outstanding payments.

How to Integrate Payment Records with Accounting Software

Integrating your billing system with accounting software is relatively simple and can be achieved in a few steps:

- Choose Compatible Software: Ensure that both your payment platform and accounting software can sync or integrate with each other, either through built-in features or third-party apps.

- Set Up Automatic Syncing: Once you’ve selected the right tools, enable automatic syncing so that your records are updated in real-time, reducing the need for manual input.

- Review and Adjust Settings: Make sure that all relevant fields, such as client names, amounts due, payment dates, and tax details, are correctly mapped in both systems.

- Monitor and Reconcile: Regularly check for any discrepancies and reconcile your accounts to ensure that everything matches up, and that both systems reflect the most current data.

Integrating your billing process with accounting tools not only simplifies your workflow but also helps you maintain a more organized, transparent, and efficient financial management system.

Maintaining Consistency in Billing Records

Ensuring uniformity in billing documents is essential for creating a professional appearance and simplifying the financial tracking process. Consistent records not only help with internal organization but also build trust with clients, as they know what to expect with each transaction. When your billing system follows a clear, repeatable structure, it minimizes confusion and errors while enhancing your overall business operations.

Here are key steps to help maintain consistency across all your billing documents:

1. Standardized Structure

Creating a standardized structure for your records is one of the first steps to ensuring consistency. This involves using the same format for all entries, including:

- Invoice Numbers: Ensure that each document follows a sequential numbering system, so both you and your clients can easily track them.

- Layout and Design: Use consistent fonts, headings, and spacing throughout all records to give them a professional and clean look.

- Common Information: Always include the same key details, such as client information, services provided, dates, and payment terms. This will make each record instantly recognizable.

2. Consistent Terminology

Using the same language and terminology in each document is crucial for maintaining clarity and reducing misunderstandings. Establish a list of terms and descriptions that you will use consistently across all your billing records. For example, if you refer to “labor fees” in one document, make sure to use the same phrasing in future records rather than switching to alternatives like “service charges” or “work costs.” This will keep everything aligned and help avoid confusion for your clients.

By following these guidelines and maintaining consistency in your billing process, you not only streamline your financial operations but also present a cohesive and professional image to your clients. Consistency is key to building long-term relationships and ensuring smooth, hassle-free transactions.