Quebec Invoice Template for Easy and Professional Billing

Efficient and professional billing is a crucial aspect of any business, whether you’re a freelancer or running a large company. Having a standardized document for transactions ensures that both you and your clients are clear on payment terms, amounts, and deadlines. The right form can help eliminate confusion and minimize errors, making the entire process smoother for everyone involved.

Creating the perfect document for your financial exchanges can seem daunting, but with the right tools and knowledge, it becomes a simple task. The key is to use a structure that meets legal requirements while still being easy to customize and manage. By focusing on clarity, accuracy, and simplicity, you can make sure your documents are both effective and professional.

In this guide, we will explore how to design and use a document that fits the specific needs of your business and location. You’ll learn about essential components, tips for customization, and how to maintain consistency across all your transactions. Whether you’re looking to simplify your workflow or enhance your professionalism, a well-structured billing solution can make all the difference.

Quebec Invoice Template Overview

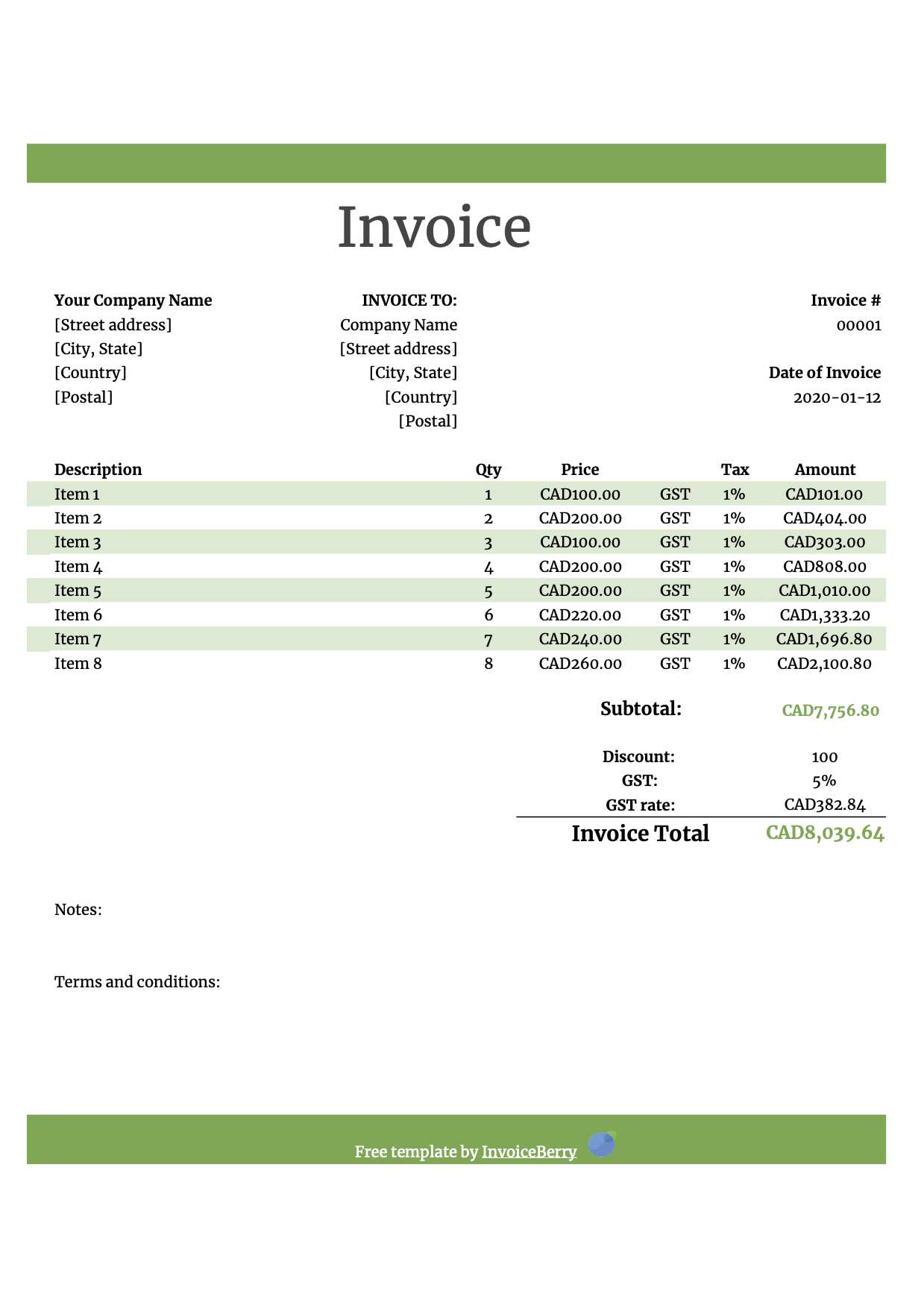

When managing financial transactions, having a well-organized document for requesting payments is essential. This type of document serves as a formal request for compensation, detailing the services rendered or products delivered, along with the amount due. A professional layout not only ensures clarity but also helps maintain legal compliance with local regulations, making it easier to track and manage payments.

Using a standardized format offers a range of benefits, from saving time to improving communication with clients. Customizable layouts allow businesses to adapt the structure to their specific needs while still following the required guidelines. This flexibility is crucial for maintaining consistency in your financial dealings.

Why Standardization Matters

Having a fixed structure ensures that all necessary details are included, such as contact information, payment terms, and tax rates. This reduces the likelihood of omissions or misunderstandings and helps maintain a professional image.

Key Features of a Professional Document

A good document typically includes fields for the date, transaction details, payment instructions, and any relevant terms or conditions. These elements are vital for keeping both parties informed and ensuring timely payment. By using a clear, consistent approach, businesses can streamline their entire billing process.

Why Use a Quebec Invoice Template

Utilizing a standardized billing format is essential for businesses looking to streamline their financial processes and ensure accuracy in every transaction. Having a pre-designed structure not only saves time but also enhances professionalism, making it easier to track payments and maintain consistency across all transactions. Whether you’re a freelancer, a small business owner, or managing a larger company, a well-organized form can significantly improve the billing experience for both you and your clients.

Advantages of Using a Pre-Designed Document

There are several key benefits to using a pre-built format for your payment requests:

- Time-Saving: With a ready-made structure, you don’t need to start from scratch every time you create a payment request.

- Professional Appearance: A well-organized layout gives clients confidence and adds credibility to your business.

- Consistency: Standardizing your financial documents helps ensure that all necessary details are included, reducing the risk of errors.

- Legal Compliance: Pre-designed forms often include all required fields and legal disclaimers, ensuring you meet regional and industry-specific requirements.

How It Helps Maintain Accuracy

When you use a standardized structure, it’s easier to avoid common mistakes, such as missing tax information or incorrect pricing. The format typically includes all necessary fields for payment terms, client details, item descriptions, and total costs, ensuring that no critical information is overlooked.

Key Elements of Quebec Invoices

To create a clear and effective payment request, certain details must always be included. These essential components ensure that both the payer and payee have all the necessary information to complete the transaction smoothly and avoid confusion. Whether you are a small business owner or a large enterprise, structuring your billing document properly is crucial for maintaining professionalism and ensuring timely payments.

Essential Information to Include

There are several key pieces of information that should always appear on any billing document to ensure transparency and clarity:

- Contact Information: Both the sender’s and recipient’s names, addresses, and contact numbers should be clearly listed.

- Unique Reference Number: Each document should have a unique identifier to help both parties keep track of transactions.

- Date of Issue: The date the request is created is important for setting payment deadlines and understanding payment terms.

- Description of Services or Goods: A clear and detailed list of what was provided or sold, along with quantities and unit prices.

- Total Amount Due: The total payable amount should be prominently displayed, including any taxes or additional fees.

- Payment Terms: Specify the payment due date, accepted methods of payment, and any late fees if applicable.

Additional Legal Requirements

In certain regions, including required legal information is crucial. For example, some documents must contain specific tax registration numbers, or legal disclaimers depending on the jurisdiction. Ensuring that these elements are present can help avoid legal complications and ensure compliance with local regulations.

How to Customize Your Invoice

Personalizing your billing document is an important step to make sure it fits the specific needs of your business while maintaining a professional appearance. Customization allows you to reflect your brand’s identity, adapt to your industry’s requirements, and cater to the preferences of your clients. By adjusting key details, you can create a document that is both functional and visually appealing.

To tailor your request for payment to your unique business needs, focus on the following areas of customization:

- Branding Elements: Add your company’s logo, colors, and font styles to make the document visually consistent with your brand’s identity. This helps reinforce your professional image.

- Service or Product Descriptions: Modify the section that outlines the items or services provided. Make sure it accurately reflects your offerings, and be specific to avoid misunderstandings.

- Payment Methods: Customize the payment section to include the methods you accept, such as credit cards, bank transfers, or online payment platforms, depending on what’s convenient for your clients.

- Payment Terms and Deadlines: Adjust the payment terms, such as whether you offer discounts for early payments or have penalties for late payments. This flexibility allows you to cater to different client preferences.

When modifying your form, keep in mind that clarity is key. Overcomplicating the design with too many custom elements could reduce the document’s effectiveness. Stick to simple, professional changes that enhance the document’s functionality and your brand’s image.

Legal Requirements for Quebec Invoices

When preparing a billing document, it is important to ensure that it meets the legal standards set by local regulations. This is especially critical for businesses operating in specific regions where tax laws and business practices dictate the exact details that must be included. Adhering to these requirements helps protect both the business and the client, ensuring the document is legally valid and compliant with tax authorities.

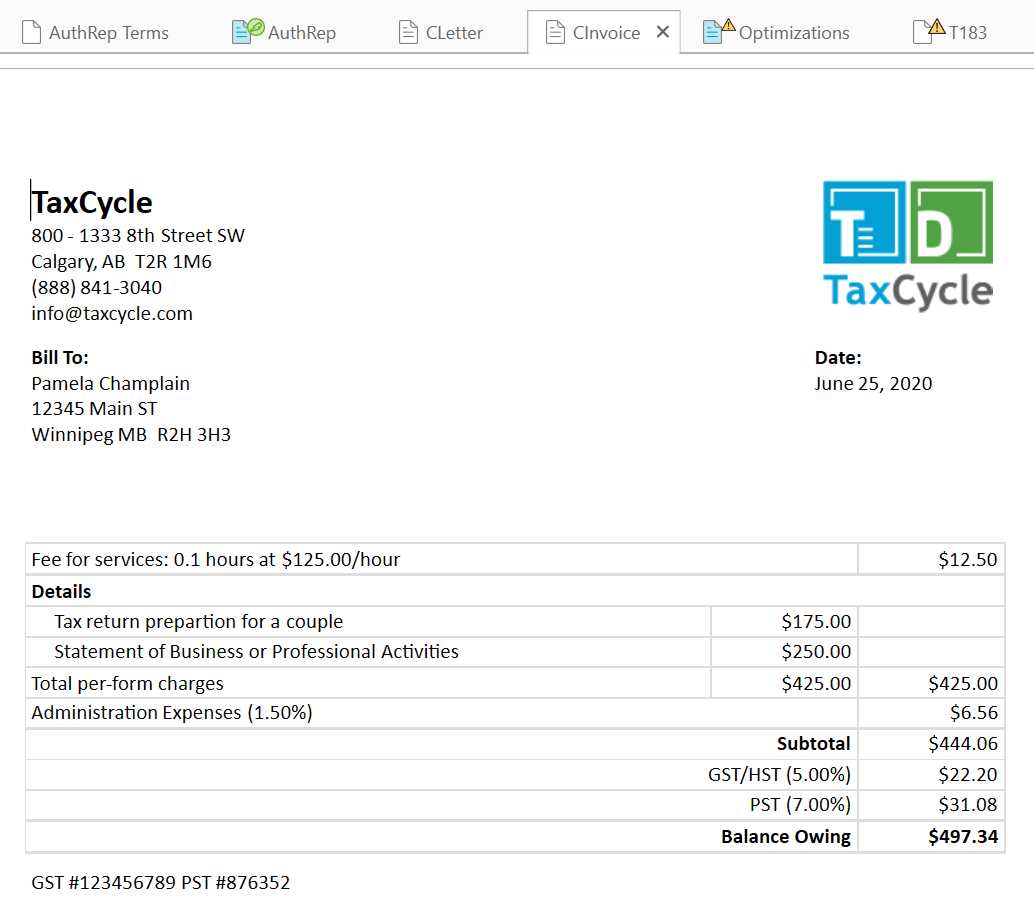

In order to avoid legal complications, certain elements must be included on every request for payment. These include:

- Tax Identification Number: Businesses must provide their tax registration number or business number to comply with government reporting requirements.

- Tax Breakdown: Clearly indicating the applicable sales taxes, including provincial and federal rates, is required. The tax amounts should be listed separately from the total sum due.

- Full Business Details: Including the business name, address, and contact information is necessary for legal recognition, especially for formal communication with clients and authorities.

- Client Information: The full name, address, and contact details of the recipient must also be included to ensure accurate record-keeping.

- Issue Date and Payment Due Date: The date the document is issued and the date by which payment is expected should be clearly stated to avoid disputes over timing.

Failure to include these legal elements can lead to delays in payment or even disputes with tax authorities. By ensuring that all required details are present, you can create a compliant and professional document that minimizes the risk of issues down the line.

Common Mistakes to Avoid in Invoices

When preparing a request for payment, even small mistakes can lead to misunderstandings, delayed payments, or legal issues. To ensure that your billing documents are clear and professional, it is important to avoid common pitfalls. By being aware of these errors, you can create more efficient and effective transactions, saving time and preventing complications.

Top Errors to Watch For

Here are some of the most common mistakes made when creating a payment request:

| Error | Consequence | Prevention |

|---|---|---|

| Missing or Incorrect Client Information | Delays in payment processing and confusion over who is responsible for the payment. | Double-check client details before sending the document. |

| Failure to Include Tax Information | Legal non-compliance and potential fines or penalties. | Ensure all taxes, including local and national rates, are clearly listed. |

| Unclear Payment Terms | Confusion about when payment is due and how it should be made. | Specify payment due dates, late fees, and accepted methods clearly. |

| Not Using a Unique Reference Number | Difficulty tracking payments and potential confusion over which transaction is being referenced. | Assign a unique reference number to every document. |

| Inaccurate or Missing Total Amount | Disputes over the amount due and delays in payment. | Double-check calculations and list the total due at the bottom of the document. |

Additional Tips for Accuracy

To further ensure that your document is error-free, always review the information before sending it out. Small mistakes like typos or missing dates can cause confusion and delay payments. Consistency in format and design will also help clients quickly navigate the document and understand the key details.

Creating Professional Invoices in Quebec

Designing a clear and professional billing document is essential for any business. Whether you’re a freelancer or a large corporation, having a polished and organized structure is key to maintaining strong client relationships and ensuring timely payments. A well-crafted payment request not only reflects your professionalism but also builds trust with your clients, reducing the chances of disputes or delays.

To create a professional payment document, it’s important to follow a few key principles. These principles will help you maintain consistency, avoid errors, and ensure that all necessary information is clearly communicated.

Key Aspects of a Professional Document

- Clarity: Ensure that all details are legible and easy to understand. Use a clean layout and avoid cluttering the document with unnecessary information.

- Brand Identity: Include your business logo, colors, and fonts to reinforce your brand’s image and create a cohesive look across all communications.

- Accurate Information: Double-check all figures, including amounts due and applicable taxes. Any mistakes can lead to confusion or payment delays.

- Clear Payment Terms: Clearly state the payment due date, acceptable payment methods, and any late fee policies to avoid any misunderstanding.

- Professional Tone: Use polite, neutral language that reflects your business’s professionalism and ensures your client feels respected and valued.

Tools and Resources for Creating Professional Documents

There are various tools available to help you create professional payment requests. These include online platforms, accounting software, or even downloadable files that can be easily customized to suit your needs. Choose the one that best fits your business size and the frequency of your transactions.

- Accounting software: Integrates with your financial system and automates many aspects of the billing process.

- Online templates: Pre-designed documents that can be filled in quickly and tailored to your specifications.

- Custom designs: If you prefer a completely unique look, consider working with a graphic designer to create a personalized format.

Choosing the Right Invoice Format

Selecting the right format for your billing documents is crucial for efficiency, professionalism, and ease of use. The right format ensures that all essential information is included, clearly presented, and easy to process by both you and your clients. Depending on your business needs, the format you choose may vary, but it should always prioritize clarity and simplicity.

Choosing the appropriate structure can also help streamline your workflow, reduce errors, and create a better experience for your clients. There are several options available, each suited to different business types and client expectations.

Factors to Consider When Choosing a Format

- Industry Requirements: Some industries may have specific requirements for how billing documents should be structured. For example, a construction company may need to include additional project details, while a retailer may focus more on product descriptions.

- Business Size: Smaller businesses or freelancers might prefer simple, straightforward formats, while larger organizations may require more detailed and robust documents to handle multiple products or services.

- Client Preferences: Some clients may prefer digital documents over paper ones, while others may request a more formal, printed version. It’s important to tailor your format to your client’s needs.

- Ease of Customization: Select a format that allows easy modification. Whether you use a software tool or a pre-made layout, ensure that it can be easily adjusted to reflect different services, quantities, or pricing structures.

Common Formats and Their Uses

Here’s a table outlining the most common formats and their typical uses:

| Format | Best For | Advantages | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Simple/Basic Format | Freelancers, small businesses with few items or services | Quick to create, easy to read, minimal design | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Detailed Format | Companies offering multiple services or products | Comprehensive, includes detailed breakdowns and additional fields | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Top Benefits of Digital Invoicing

In the modern business landscape, using electronic documents for billing has become increasingly popular. Digital billing solutions offer numerous advantages over traditional paper methods, ranging from increased efficiency to improved accuracy. Adopting a digital approach can help streamline financial operations, reduce costs, and enhance client satisfaction. Here are some of the top benefits of switching to digital billing methods:

Adopting a digital approach not only simplifies your administrative work but al How to Include Taxes on Your InvoiceProperly calculating and displaying taxes on your billing documents is essential for legal compliance and clear communication with your clients. Whether you’re working with local, national, or international clients, including the correct tax information ensures transparency and helps avoid misunderstandings. There are several key points to consider when adding taxes to your payment requests, from tax rates to the structure of the document itself. Understanding the Tax StructureBefore including taxes on your document, it’s important to know which types of taxes apply to your transactions. This typically includes sales taxes, VAT, or other region-specific charges. Here’s how to approach this:

How to Structure Taxes on Your Payment RequestBelow is a simple breakdown of how taxes should be presented on your payment request:

By clearly listing the tax amount and breaking it down for each item or service, you ensure that your client understands how the taxes are calculated. This transparency also reduces the risk of disputes and keeps your transactions in line with legal standards. Invoice Templates for Different Industries

Each industry has its own unique needs when it comes to requesting payments. The structure and content of a payment document can vary depending on the products or services provided, as well as specific legal or regulatory requirements. Customizing your payment request according to industry standards ensures that all necessary details are included and helps maintain professionalism in every transaction. Below is an overview of how various industries can benefit from tailored payment documents:

By tailoring your payment documents to the specific needs of your industry, you ensure that all relevant information is clearly presented, making it easier for your clients to process payments and reducing the chances of misunderstandings. How to Handle Multiple PaymentsWhen a client makes multiple payments for a single transaction, it’s essential to keep accurate records and properly track each payment. Handling partial or segmented payments can be a challenge, especially when dealing with varying payment amounts, dates, and methods. Properly documenting these payments ensures that both you and your client remain on the same page and helps prevent confusion when reconciling balances. Steps for Managing Multiple PaymentsHere are a few best practices for effectively managing multiple payments from clients:

Example of Tracking Multiple PaymentsTo further illustrate, here’s how you can structure your payment records when handling multiple payments:

|