How to Use a Template for Invoice Receipt to Simplify Your Billing Process

Managing financial transactions efficiently is essential for any business, whether small or large. A well-structured document that confirms the completion of a transaction plays a crucial role in maintaining clarity between businesses and clients. Using an organized, easy-to-fill-out form can significantly improve this process, ensuring that all necessary details are captured and communicated effectively.

Automating the process through digital solutions not only saves time but also reduces the risk of human error. By relying on pre-designed formats, companies can streamline their operations and ensure consistency across all customer interactions. These structured documents help track payments, verify amounts, and provide proof of the transaction, which can be crucial for both businesses and clients alike.

Whether you run a freelance operation or manage a large corporation, customizing these forms to suit your specific needs can enhance the professionalism of your business. With the right design, they can reflect your brand’s identity while keeping the essential information easy to locate. The key is finding the right balance between simplicity and detail.

Invoice Receipt Template Overview

When managing business transactions, it is essential to have a standardized document that confirms the exchange of goods or services for payment. This form serves as a written acknowledgment that a client has completed their financial obligation. Using a pre-structured document to record these details ensures that all necessary information is captured and presented clearly.

Efficiency is a key advantage of using such documents. With the right design, businesses can quickly input essential details like the amount paid, the services or products provided, and the date of the transaction. This not only simplifies the process but also reduces the likelihood of errors or omissions that could cause confusion or disputes.

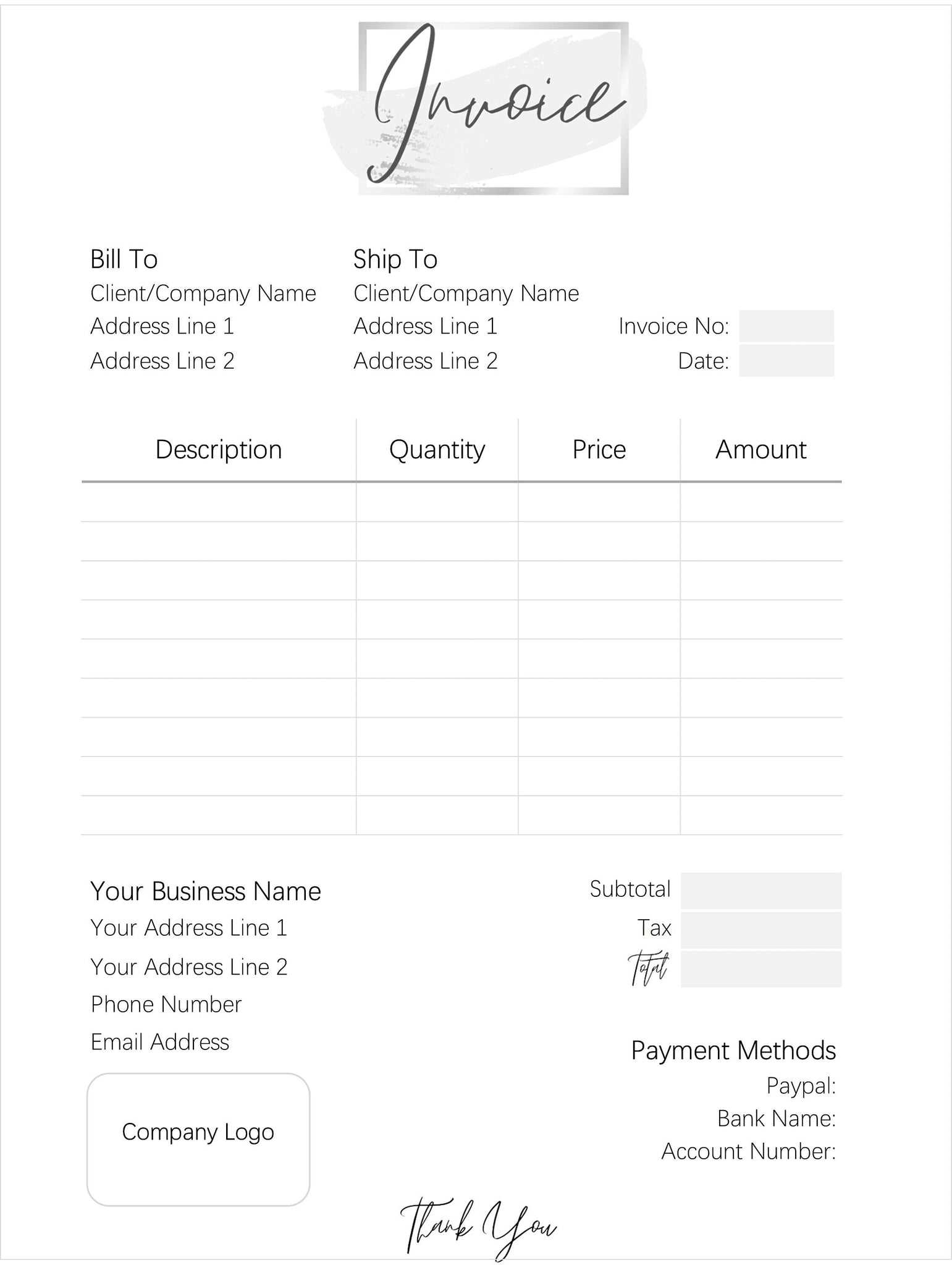

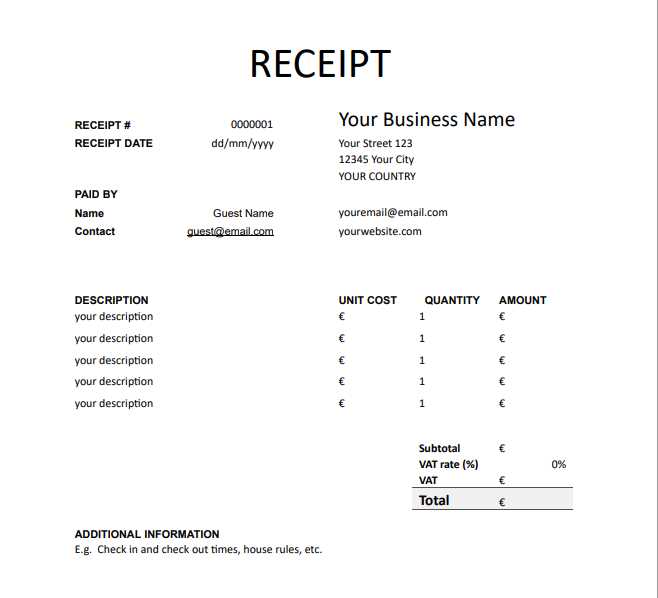

Additionally, incorporating customizable features into this form allows businesses to tailor the content to their specific needs, whether they require space for discounts, taxes, or multiple payment methods. Flexibility in layout and design ensures that the document fits seamlessly into a company’s operations and maintains a professional appearance, regardless of the industry.

Why You Need an Invoice Receipt

Having a formal record of each transaction is crucial for maintaining transparency and trust between businesses and their clients. This document serves as a proof of payment, providing both parties with a detailed summary of the agreed-upon exchange. Without such confirmation, misunderstandings or disputes may arise, which could negatively impact your business relationships.

Clarity is a primary reason for using these forms. They clearly outline the services or products delivered, the amount paid, and the terms of the agreement. This level of detail ensures that both the buyer and the seller have the same understanding of the transaction, reducing the chances of confusion.

Additionally, having a structured record can assist in financial tracking and tax reporting. These forms are often required when filing taxes, and they also help businesses monitor their cash flow. By maintaining a comprehensive archive of such documents, you create a valuable resource for audits or future reference.

Benefits of Using Invoice Templates

Utilizing structured forms for transaction records can significantly improve the efficiency and professionalism of your business. These pre-designed formats help streamline the billing process, saving both time and effort while ensuring consistency across all financial documentation. With a clear, organized layout, businesses can reduce errors and avoid unnecessary confusion with clients.

Time-Saving and Efficiency

One of the major advantages of using a ready-made format is the time saved during the billing process. Instead of starting from scratch with each new transaction, businesses can quickly fill in the necessary details, ensuring faster processing. This boosts productivity and allows teams to focus on more critical tasks while still maintaining a high level of accuracy.

Professional Appearance and Consistency

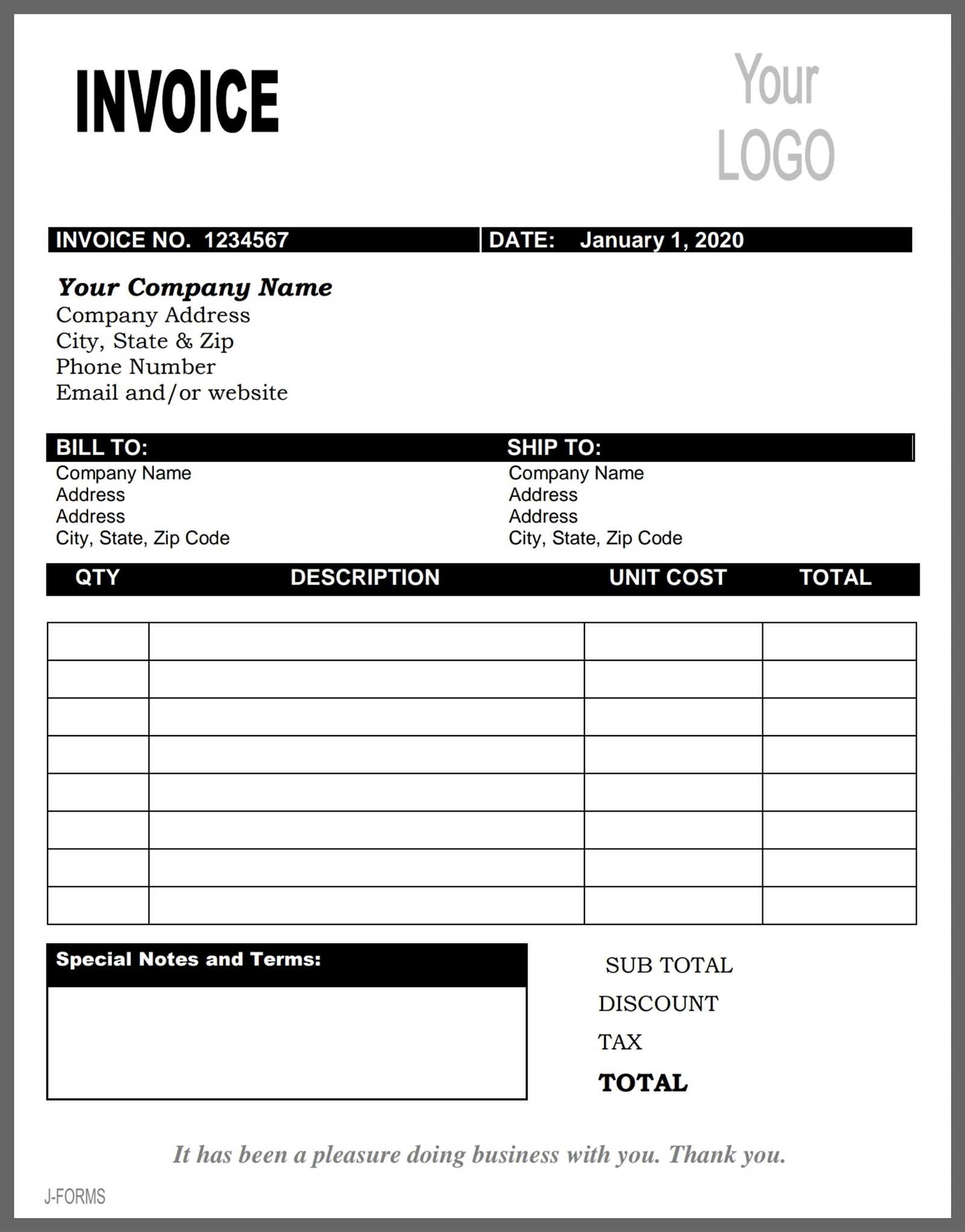

Another key benefit is the polished, uniform look these forms provide. A well-designed document conveys professionalism and builds trust with clients. By using a consistent layout for every transaction, businesses create a brand identity that is easily recognizable and reinforces credibility in all customer interactions.

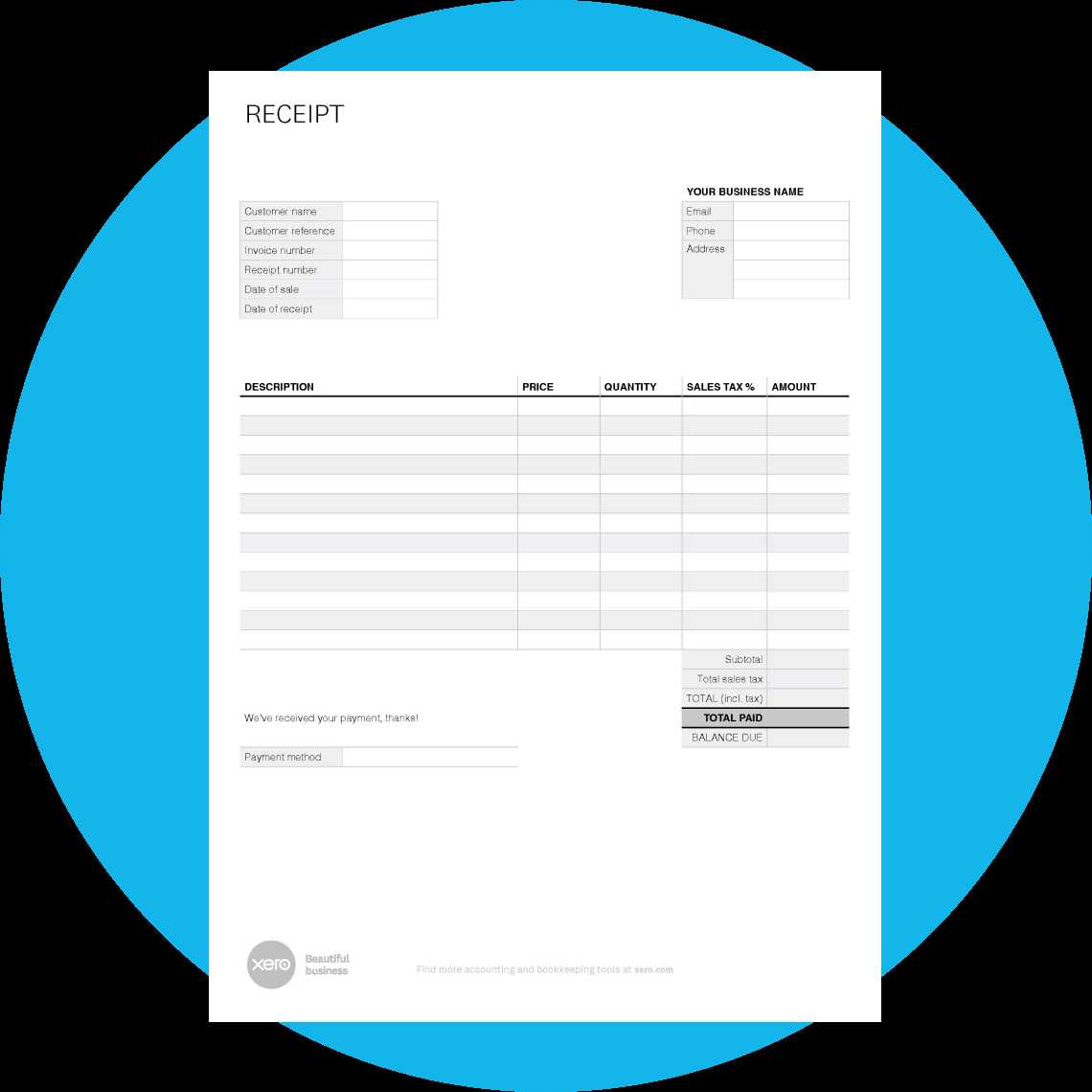

How to Customize Your Receipt Template

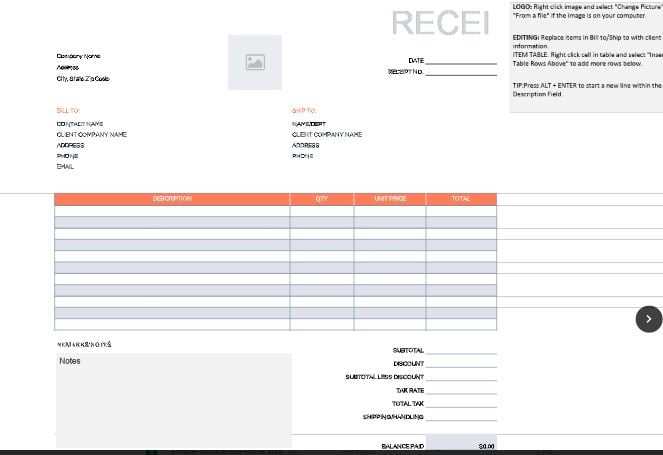

Personalizing a transaction document allows you to tailor it to your business’s specific needs, ensuring that it reflects both your brand and operational requirements. Customization provides flexibility in terms of layout, content, and design, giving you the ability to include all relevant details that are important for your clients and financial records.

Start with the basics–make sure that the essential information is always included, such as the amount paid, payment method, and services or products provided. You can also add optional fields such as discount codes, taxes, and additional notes. Customizing the format in this way ensures that every document accurately reflects the specifics of the transaction.

Brand identity is another key consideration. By adjusting the color scheme, font, and logo placement, you can create a consistent look that aligns with your company’s visual style. This not only enhances the professionalism of the document but also reinforces your brand’s presence in every transaction.

Top Features to Look for in Templates

When selecting a structured document for confirming transactions, it’s important to consider specific features that enhance both functionality and ease of use. A well-designed form should be intuitive, efficient, and customizable to fit the unique needs of your business. Ensuring the right elements are included can make the billing process smoother and more professional.

Clear Layout and Organization

A clean and well-organized structure is essential for any business document. The information should be easy to read and logically arranged, with clear sections for payment details, client information, and transaction specifics. This helps reduce confusion for both the business and the customer, ensuring that all essential data is easily accessible.

Customization Options

Flexibility is a key factor in choosing the right form. Look for options that allow you to adjust the layout, colors, and fonts to match your brand’s identity. Custom fields for taxes, discounts, or additional services can further tailor the document to your needs. These customizable features help create a personalized experience while maintaining consistency across all transactions.

Security features should not be overlooked either. Adding password protection or digital signatures can provide an extra layer of assurance, ensuring that the documents remain secure and tamper-proof.

How to Save Time with Templates

Using pre-designed documents can greatly reduce the time spent on administrative tasks. Instead of manually creating new forms from scratch for each transaction, you can streamline the process by utilizing a structured format that already contains the necessary fields. This allows you to focus on what matters most–serving your clients and running your business.

- Quick Data Entry: Pre-defined fields mean that you only need to enter essential details like customer information, payment amounts, and services rendered. This significantly speeds up the process compared to creating documents from the ground up.

- Consistency: With a standardized layout, every form will follow the same structure, eliminating the need to reformat or worry about missing information. This consistency saves time in both creation and review.

- Pre-filled Information: Some forms allow you to store common data, such as your business name, contact details, and payment terms, which can be automatically added to each new document. This feature eliminates repetitive tasks.

By adopting a pre-structured approach, businesses can reduce administrative overhead, minimize human error, and complete transactions faster, ultimately freeing up more time to focus on other key areas of the business.

Free vs Paid Invoice Receipt Templates

When choosing between no-cost and premium options for transaction confirmation forms, it’s important to weigh the benefits and drawbacks of each. Both free and paid solutions offer their own set of advantages, but they also come with limitations. Understanding these differences will help you make an informed decision based on your business’s needs and budget.

- Free Options: Free forms are easily accessible and can be a good starting point for small businesses or startups. They often offer basic features with minimal customization.

- Basic Design: While free forms can include essential fields, the layout and design may be more limited, making it harder to align with your brand identity.

- Limited Support: Free options typically come with little to no customer support, meaning you are on your own if issues arise.

On the other hand, paid options provide more advanced features and professional-level support.

- Customizable Designs: Premium forms offer greater flexibility, allowing you to modify layouts, logos, and colors to match your brand.

- Additional Features: Paid solutions often include advanced tools like automatic calculations, multi-currency support, and integration with accounting software.

- Priority Support: With a paid option, you typically gain access to customer support, ensuring any issues are resolved quickly.

Ultimately, the choice between free and paid forms depends on your business’s specific requirements, such as the level of customization, support, and features you need.

Best Tools for Invoice Template Creation

Creating professional documents for tracking transactions is made easier with the right software tools. These platforms offer various features that help streamline the process, allowing businesses to design, customize, and manage their transaction records with ease. Choosing the right tool depends on factors like ease of use, functionality, and the level of customization required.

| Tool | Features | Best For |

|---|---|---|

| Microsoft Word | Simple editing, customization options, pre-built formats | Small businesses needing basic, customizable documents |

| Google Docs | Cloud-based, real-time collaboration, easy sharing | Remote teams and freelancers |

| Canva | Design-focused, customizable templates, drag-and-drop | Businesses seeking visually appealing designs |

| Zoho Invoice | Automated features, integration with accounting software | Medium to large businesses needing automation |

| FreshBooks | Customizable formats, time tracking, expense management | Freelancers and service-based businesses |

Each of these tools offers unique benefits, so selecting the right one depends on your business’s size, needs, and desired level of complexity. Whether you’re a freelancer or part of a larger company, there’s a solution available to help you create professional transaction records quickly and efficiently.

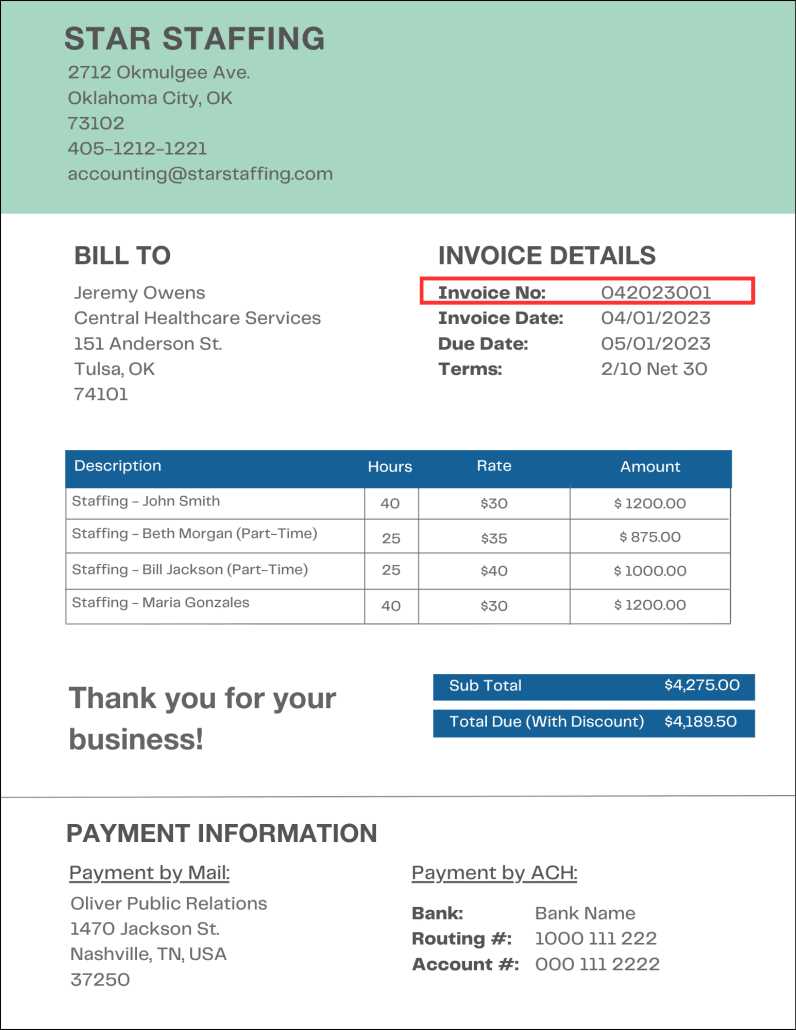

How to Add Payment Details to Your Template

Including payment information in your transaction forms is essential for clarity and record-keeping. Accurately capturing payment details ensures both parties understand the amount paid, the method of payment, and any additional terms or conditions related to the transaction. This section will guide you through the necessary steps to incorporate these important details into your document.

| Field | Description | Example |

|---|---|---|

| Payment Amount | The total sum paid for goods or services provided. | $500 |

| Payment Method | The method used to complete the transaction (e.g., credit card, bank transfer, PayPal). | Credit Card (Visa) |

| Transaction Date | The date on which the payment was made. | October 15, 2024 |

| Transaction Reference Number | A unique number assigned to the transaction, often provided by the payment processor. | TRX123456789 |

| Payment Status | The current status of the payment (e.g., Paid, Pending, Failed). | Paid |

These key payment details should be included in clear, easily identifiable sections of the document. By organizing and presenting this information effectively, you ensure both you and your client have a thorough record of the completed transaction.

Design Tips for Professional Invoice Receipts

Creating a visually appealing and professional document for transactions is crucial for making a positive impression on clients. A well-designed form not only conveys important information clearly but also enhances your brand’s credibility. Following a few key design principles can help ensure your forms look polished and communicate professionalism effectively.

Keep it Simple – Avoid cluttering the document with unnecessary elements. Focus on the essentials, such as transaction details, payment terms, and contact information. A clean, minimalist layout makes the document easier to read and more user-friendly.

Use Consistent Branding – Incorporate your logo, company colors, and fonts to create a consistent visual identity. This helps reinforce your brand’s image and makes the document feel aligned with your business’s overall style.

Prioritize Readability – Ensure the text is legible by choosing appropriate font sizes and contrasts. Use bold or highlighted text for important sections like the total amount due, payment methods, or due dates. Group similar information together to make it easy for clients to find what they need quickly.

Incorporate Clear Sections – Organize the document into clearly defined areas, such as customer details, product/services summary, payment information, and terms. This structure will make the document easier to navigate, reducing confusion and making it more professional in appearance.

By applying these design principles, you can create transaction forms that are not only functional but also reflect the professionalism and reliability of your business.

Common Mistakes When Using Templates

When using pre-designed forms for business transactions, it’s easy to make mistakes that can affect the clarity and accuracy of the information provided. These errors may seem minor, but they can lead to confusion, delays, or even disputes with clients. By understanding the most common pitfalls, you can avoid them and ensure your documents remain professional and effective.

Neglecting to Customize Key Information

One of the biggest mistakes is failing to personalize the document with essential details such as company name, client information, and payment terms. Using a generic form without adding specific data can lead to miscommunications and create a sense of impersonal service. Always ensure that the form reflects the exact details of the transaction and your business’s identity.

Overcomplicating the Design

While it’s tempting to add lots of design elements, cluttering the form with unnecessary graphics, fonts, or colors can make it look unprofessional and hard to read. Overcomplication can distract from the core details of the transaction, making it difficult for clients to quickly find the information they need. Stick to a clean, clear, and simple design that prioritizes functionality over decoration.

By being mindful of these common mistakes, you can improve the quality of your transaction documents, ensuring they serve their purpose without causing confusion or unnecessary complications.

How to Export and Print Invoice Receipts

Once a transaction document is completed, it’s often necessary to save and share it in various formats, or print it for physical records. Whether you need a digital copy for email or a hard copy for your files, knowing how to properly export and print your documents is crucial for smooth business operations. Here are a few steps to ensure the process goes smoothly.

Exporting Documents for Digital Use

Exporting transaction documents into a digital format allows you to easily store, share, or email them. Here’s how to do it efficiently:

- Select the appropriate format: Common formats for saving are PDF, Excel, or Word, depending on your needs. PDFs are ideal for sharing via email or for archiving as they preserve the document’s layout and content.

- Ensure file quality: Before exporting, check the document’s layout. Make sure all the text is readable and that no information is cut off.

- Use cloud storage: Save the document to a cloud service for easy access and sharing, or use an integrated system that automatically saves your records to a secure location.

Printing Documents for Physical Use

If you need a hard copy, follow these steps to ensure high-quality prints:

- Choose the right printer: Ensure your printer is set up to print high-resolution documents. A good quality print ensures the details are legible and look professional.

- Check the layout: Before printing, use the “Print Preview” function to confirm the document fits properly on the page and that no important details are cut off.

- Print on quality paper: Opt for high-quality paper to give the printed document a professional feel. Standard printer paper may suffice, but heavier or textured paper can make a better impression.

By following these steps, you can easily export your transaction documents for digital storage or share them with clients, and ensure high-quality prints when needed for physical records.

Security Features in Invoice Templates

When handling financial documents, security is a top priority to prevent fraud, data theft, or unauthorized alterations. Transaction forms must include certain features to ensure that both the sender and recipient can trust the integrity of the document. Here are some essential security elements to consider when creating or using these documents.

- Password Protection: Protecting the document with a password ensures that only authorized individuals can view or edit the content. This adds a layer of security, particularly for sensitive payment details.

- Digital Signatures: Incorporating a digital signature helps verify the authenticity of the document and confirms that the content has not been tampered with since signing. It also proves the sender’s identity.

- Watermarks: Adding a watermark to your document is a simple yet effective way to deter unauthorized copying or modification. It also helps to identify original copies in case of disputes.

- Secure PDF Format: Saving your transaction record in a PDF file format is ideal because it preserves the layout and prevents editing. PDFs can also be encrypted, adding an extra layer of protection to the document.

- Tracking and Audit Logs: Some advanced tools offer tracking features that allow you to see who accessed the document and when. This can help monitor unauthorized attempts to view or edit the information.

Integrating these security features ensures that your transaction records remain safe, minimizing the risk of fraud or errors while maintaining trust and professionalism with clients.

Legal Requirements for Invoice Receipts

When issuing transaction records, it is crucial to ensure they comply with local and international laws. These documents not only serve as proof of payment but also must meet specific legal standards to be considered valid for tax and audit purposes. Understanding the essential information required by law helps prevent legal issues and ensures that both businesses and clients are protected.

| Required Information | Explanation |

|---|---|

| Business Identification | The legal name, address, and registration number of the business issuing the document. This ensures proper identification of the entity involved in the transaction. |

| Customer Information | The full name and contact details of the buyer or client. This helps to establish a clear transaction relationship and can be necessary for resolving disputes or for tax reporting. |

| Transaction Date | The date when the payment was made or the goods/services were delivered. This is crucial for record-keeping and tax compliance. |

| Unique Reference Number | A unique number assigned to each document for tracking and reference purposes. This ensures that each transaction can be individually identified and verified. |

| Amount Paid | The total amount paid for the goods or services, including any applicable taxes or discounts. It is important for financial reporting and tax filings. |

| Payment Method | Details on how the transaction was paid, such as credit card, bank transfer, or cash. This is useful for both parties in the case of any issues with the payment process. |

| Tax Information | Depending on the jurisdiction, this may include tax identification numbers, VAT, or other relevant tax information. This ensures compliance with tax laws and facilitates proper reporting. |

By ensuring these essential details are included in your transaction records, you comply with legal requirements, protect your business interests, and maintain transparency in all financial dealings.

Improving Customer Relations with Receipts

Transaction documents play a key role in building trust and strengthening relationships with customers. Beyond serving as a record of the sale, they can enhance the customer experience, show professionalism, and foster long-term loyalty. By paying attention to the details of these documents, businesses can make a lasting positive impression.

Providing Transparency and Clarity

Clear, well-organized documents help customers easily understand the breakdown of their purchase, including the costs, taxes, and payment method. Transparency builds confidence and ensures that there are no misunderstandings. Customers appreciate knowing exactly what they’re paying for and how the charges are calculated.

Personalizing the Experience

Including personalized messages or customer-specific information on transaction documents can help strengthen your connection with clients. Whether it’s a thank-you note or a reminder of upcoming deals, small personal touches can create a sense of value and appreciation. These gestures show customers that you care about their business and are committed to providing excellent service.

By offering clear, personalized, and professional transaction records, businesses can enhance their reputation, improve customer satisfaction, and ultimately foster stronger, more lasting relationships with their clients.