How to Use and Customize MYOB Invoice Template

Efficient financial management is essential for any business, whether you are a freelancer, a small startup, or an established company. One key aspect of managing finances is ensuring that your billing process is smooth, professional, and error-free. Using pre-designed documents can save time, reduce human error, and give your clients a polished experience. The right tools allow you to focus more on your core business while ensuring that all payments are tracked and processed accurately.

Customizable solutions are an excellent way to meet your specific business needs. By adopting a flexible format that can be tailored to fit different services, clients, and transactions, you can create a standardized approach to managing your finances. These solutions not only help you maintain consistency but also present a professional image that builds trust with your clients.

With the right set of features, creating a payment request document becomes a streamlined process that can be completed in just a few steps. From adjusting the layout to adding specific details about the transaction, the process of issuing a bill should feel effortless. In this article, we will explore various options to optimize your billing practices, helping you create clear, accurate, and effective financial records.

Why Choose MYOB for Invoicing

When it comes to managing payments and financial records, businesses need a tool that simplifies the process while offering flexibility and precision. The right software can help streamline your financial workflows, ensuring that every transaction is accurately recorded and professionally presented. With a variety of options available, selecting the most suitable platform for your billing needs can be a challenge. However, some systems stand out due to their comprehensive features, ease of use, and ability to integrate with other business operations.

Choosing the right platform for handling billing and financial documentation can offer several advantages, including time-saving automation, customizable features, and secure transaction tracking. Such solutions are designed to meet the needs of various industries, offering adaptable formats that cater to the unique requirements of different businesses.

| Feature | Benefit |

|---|---|

| Ease of Use | Simple and intuitive interface, reducing the learning curve for users. |

| Customization Options | Ability to tailor documents to suit specific business needs and branding. |

| Integration | Seamlessly integrates with accounting, inventory, and other business systems. |

| Automation | Automated reminders, recurring transactions, and report generation save time. |

| Security | Ensures that sensitive financial data is securely stored and protected. |

By opting for a comprehensive system, businesses can improve their financial operations, reduce administrative tasks, and focus on growing their enterprise. With robust features that cater to both small businesses and large enterprises, this software solution ensures that your billing process is both efficient and reliable.

Benefits of Using Invoice Templates

Using pre-designed billing documents can significantly enhance the efficiency of financial management for any business. These ready-made solutions offer a structured format that reduces the time spent on creating payment requests from scratch, allowing business owners to focus on other critical tasks. With consistent layout and content, these solutions ensure that all necessary information is included and formatted properly every time.

Time Efficiency

One of the primary advantages of utilizing pre-structured formats is the amount of time it saves. Rather than creating a new document for each transaction, users can quickly fill in the relevant details, streamlining the process of preparing and sending payment requests. This allows for quicker turnaround times and ensures that no details are overlooked.

Professional Appearance

Using a standardized format ensures that every payment request maintains a professional look. Whether you’re a freelancer or running a large corporation, maintaining consistency in your communication helps build trust with clients. These documents often include sections that help emphasize important information such as due dates and amounts, which enhances clarity and reduces misunderstandings.

| Benefit | Description |

|---|---|

| Consistency | Standardized format ensures uniformity across all billing documents, fostering a professional image. |

| Customization | Easy to adapt the layout to fit specific business needs, such as adding branding or unique service details. |

| Efficiency | Reduces time spent on creating documents, speeding up the process of generating and sending payment requests. |

| Accuracy | Helps prevent mistakes by providing predefined sections and fields, reducing human error. |

| Cost-Effective | Reduces the need for expensive software or manual document creation, saving resources. |

Incorporating these tools into your workflow not only improves the speed and consistency of your billing but also ensures that your financial documents are organized and error-free. This small yet impactful change can make a significant difference in the way you manage your business transactions.

How to Download a MYOB Template

Getting started with pre-designed financial documents is easy and convenient. With just a few simple steps, you can quickly download a professional layout that suits your business needs. These ready-made solutions are often available for free or as part of a subscription, giving you access to customizable formats that can be used right away. Below are the basic steps to download and start using these resources.

Step 1: Access the Download Portal

The first step is to visit the official website or a trusted platform that offers the document formats you need. Most platforms will have a dedicated section where you can browse and select various templates tailored for different business purposes. Look for the download options that align with your specific needs, whether it’s for client billing, service records, or general business transactions.

Step 2: Choose Your Desired Format

Once you’ve accessed the correct section, you can filter or browse through the available options. Select the format that best matches your business style. Many platforms offer customizable features that allow you to adjust the layout, fields, and details. After selecting the desired format, click the download button to save the file to your computer or cloud storage.

| Step | Description |

|---|---|

| Visit the Website | Go to the official platform or trusted source offering pre-designed documents. |

| Select a Format | Choose the layout that suits your business needs from the available options. |

| Download the File | Click the download link to save the file, which may be in Excel, PDF, or other formats. |

| Customize the Document | Once downloaded, open the file and add your company details, services, and amounts. |

Once you’ve downloaded the necessary file, you can start personalizing it to fit your requirements. Add your business name, contact details, and any other necessary information before you start using it for client transactions.

Steps to Customize Your Invoice

Customizing your billing document allows you to tailor it specifically to your business needs, giving it a professional and personalized touch. Whether you’re adjusting the layout, adding your branding, or ensuring that all necessary information is included, the process is straightforward and can be completed in just a few steps. Here’s how you can easily adapt a pre-designed financial document to your requirements.

Step 1: Open the Document

Start by opening the downloaded file using the appropriate software, whether it’s a word processor or a spreadsheet program. Make sure that the document is in an editable format to allow full customization. Once opened, you can view the standard structure that has already been laid out for you.

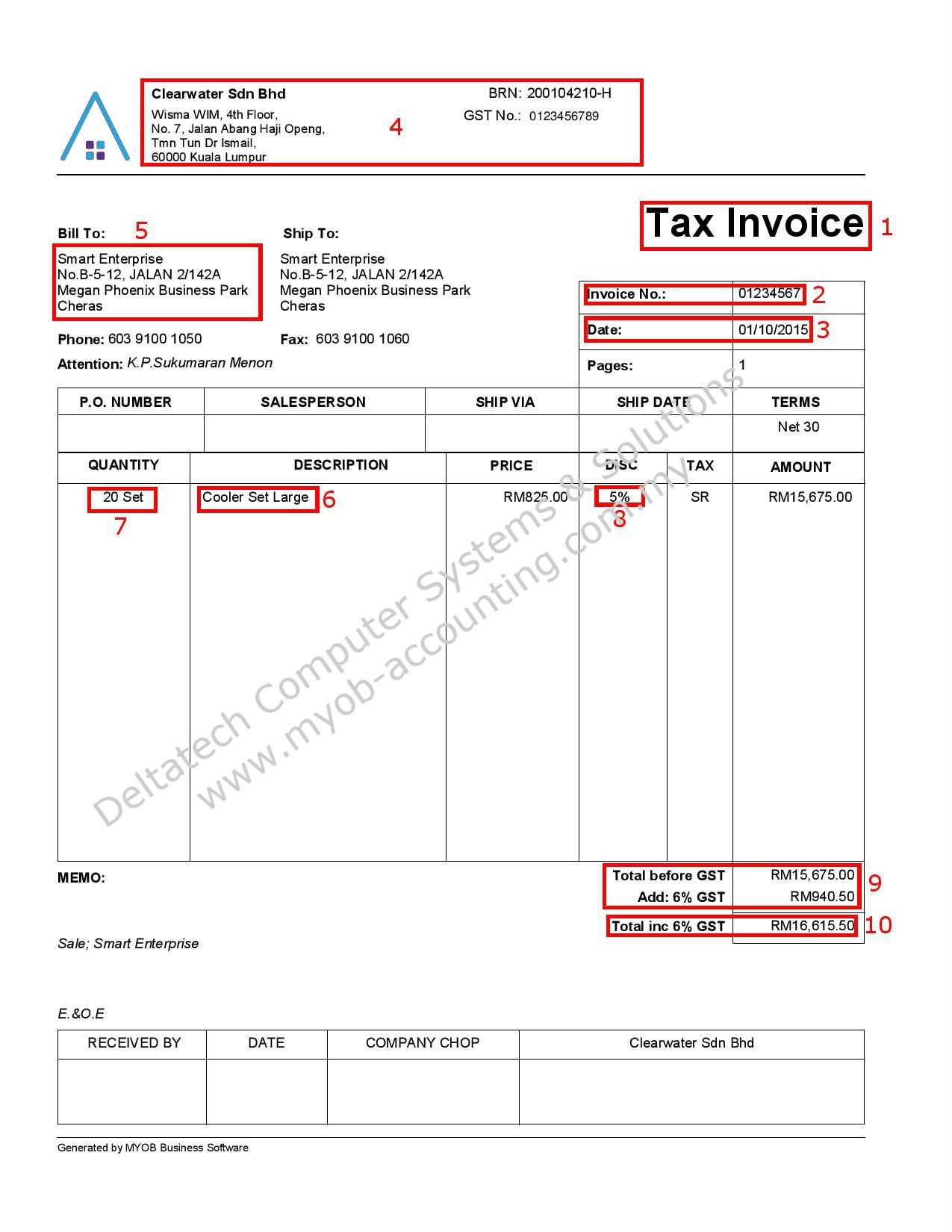

Step 2: Add Your Business Information

The first thing you should customize is your business details. This includes your company name, logo, address, contact information, and any other details that help identify your business. Placing this information at the top of the document ensures that clients can easily recognize who the document is coming from.

Step 3: Update Client Information

Next, replace the placeholder fields with the specific information for the client or customer. This includes the client’s name, address, and any other relevant contact details. Accurate and clear client information helps avoid confusion and ensures the document reaches the correct recipient.

Step 4: Adjust Payment Terms

Modify the payment terms based on the agreement you have with the client. This could include payment due dates, late fees, or discounts. Ensure that this section reflects the agreed-upon terms to avoid any miscommunication later.

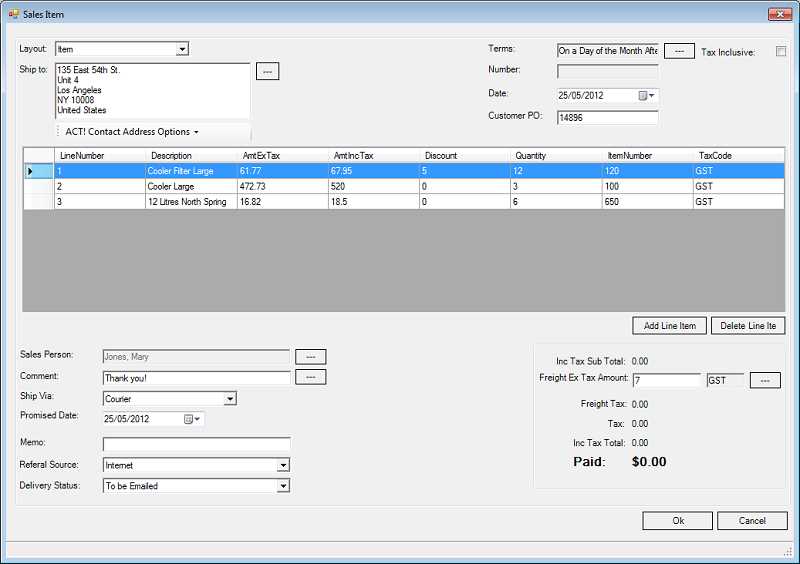

Step 5: Customize Line Items

Adjust the list of services or products provided. Make sure each item includes a description, quantity, unit price, and total cost. Be sure to include any taxes, discounts, or additional charges as necessary.

Step 6: Review and Save

Before finalizing the document, take the time to review all the information to ensure it is correct. Check for any spelling errors, discrepancies in numbers, or missing information. Once you’re confident that everything is accurate, save the document in your preferred format, such as PDF or Excel, for easy sharing with your client.

| Step | Description |

|---|---|

| Open the Document | Launch the editable file to begin making changes. |

| Add Business Details | Include your company name, logo, and contact information. |

| Update Client Info | Replace placeholders with the customer’s name and contact details. |

| Adjust Payment Terms | Set payment deadlines, late fees, and applicable discounts. |

| Modify Line Items | Update descriptions, quantities, prices, and total costs. |

| Review and Save | Double-check for errors, then save and share the completed document. |

By following these steps, you’ll create a professional and customized financial document that clearly reflects your business terms and s

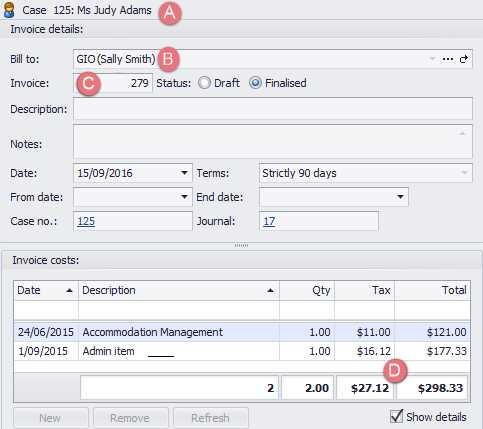

Key Fields in a MYOB Invoice

When creating a billing document, it’s essential to include certain key details to ensure clarity and professionalism. These fields help both the business and the client understand the specifics of the transaction, from the items or services provided to payment terms. By including these critical sections, you can avoid confusion and make sure that all necessary information is easily accessible for both parties.

Business Information

At the top of the document, include your business’s name, logo, and contact details. This helps clients quickly identify who the document is from and how to reach you for any questions or concerns. Including your business’s legal information, such as tax identification number, is also important in many regions.

Client Details

Similarly, the document should clearly list the client’s name, address, and contact information. This ensures that the document is correctly addressed and avoids any issues with payment processing or delivery of goods and services. This section can also include specific client account numbers or references for easy tracking.

Item or Service Descriptions

Clearly outline each product or service provided, including a description, quantity, and unit price. This is important for transparency and helps the client understand exactly what they are paying for. If applicable, this section should also include any serial numbers or model information for physical products.

Payment Terms

One of the most important sections is the payment terms. This includes the total amount due, payment due date, and any applicable late fees or early payment discounts. Clearly outlining the payment expectations helps avoid delays and misunderstandings about when payment is expected.

Tax Information

If applicable, include information about any taxes that apply to the transaction, such as sales tax or VAT. Clearly break down the tax amount and indicate the tax rate, so the client knows exactly what they are paying in taxes.

Additional Notes

It’s often useful to include a section for any special instructions or notes for the client. This could be information on how to make a payment, delivery schedules, or other specific details related to the transaction. This is also a good place to express appreciation or maintain a professional tone.

| Field | Description | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Business Information | Includes company name, logo, and contact details for easy identification. | |||||||||||||||||||||||||

| Client Information |

| Element | Description |

|---|---|

| Tax Rate | Indicate the applicable tax rate (e.g., 5%, 10%) and calculate the total tax based on the item prices or services rendered. |

| Tax Amount | Clearly state the total amount of tax applied, showing the calculation and breakdown if needed. |

| Discounts | If offering a discount, list the percentage or fixed amount deducted from the total cost. Include clear terms for the discount (e.g., 10% off for early payment). |

| Total After Discount and Tax | After applying the tax and discount, the final amount due should be displayed. This ensures transparency and prevents misunderstandings. |

Including this information not only helps clarify the financial breakdown for your clients but also ensures that your documents are professional and easy to understand. By clearly outlining taxes and discounts, you foster trust and provide a transparent pricing structure that benefits both parties.

Tracking Payments with MYOB Invoices

Tracking payments effectively is a critical component of financial management for any business. By monitoring outstanding payments and recording incoming funds, you can maintain a clear overview of your cash flow and ensure timely settlements. An organized approach to tracking payments helps avoid errors, delays, and misunderstandings with clients, ultimately contributing to smoother business operations.

Using a reliable system to track the status of each payment allows businesses to quickly identify overdue transactions, follow up with clients as needed, and maintain accurate financial records. Properly tracking payments also ensures that your records are updated in real-time, reducing the risk of discrepancies and allowing for efficient accounting.

Here are some key ways to track payments in your financial documents:

| Payment Status | Description |

|---|---|

| Unpaid | This status is assigned to transactions that are due but have not been paid yet. It helps identify pending payments that need attention. |

| Partially Paid | This status indicates that a partial payment has been received but the full amount is still outstanding. It allows you to track remaining balances. |

| Paid | The payment has been received in full. Marking the document as “Paid” helps keep your records updated and ensures that no further action is required. |

| Overdue | When the payment due date has passed without full payment, the status changes to “Overdue.” This helps you follow up with clients promptly. |

Additionally, integrating payment tracking into your workflow can help automate follow-up reminders and update your financial records instantly. This not only improves efficiency but also reduces the administrative burden of manually tracking payments, making your billing process seamless and accurate.

How to Create Recurring Invoices

For businesses that offer ongoing services or products, generating recurring payment requests saves time and ensures consistent revenue flow. Setting up a system to automatically generate and send these regular documents eliminates the need for manual creation each time. This process allows for smooth and reliable billing, helping businesses manage their cash flow while providing clients with predictable payment schedules.

Creating recurring billing requests can be done with a few simple steps, allowing you to automate much of the payment process. Below, you’ll find the basic steps to set up these documents efficiently.

Step 1: Choose the Frequency and Duration

First, determine how often the client will be charged. This could be weekly, monthly, quarterly, or annually, depending on the service agreement. You should also specify the duration of the recurring payment plan–whether it’s an ongoing contract or limited to a set number of payments. Having these details clearly defined helps both parties understand the terms of the arrangement.

Step 2: Set Up the Recurring Payment Document

Once the frequency and duration are decided, you can set up the recurring payment document. In most systems, you’ll enter the following information:

- The client’s name and contact details

- A description of the service or product being provided

- The recurring charge amount

- The payment schedule and due dates

- Applicable taxes or discounts

After entering these details, ensure that the system is configured to automatically generate the document on the agreed schedule. Some systems also allow you to set up automatic reminders or notifications to alert clients of upcoming payments.

Step 3: Review and Automate

Before finalizing the setup, review the document to ensure everything is correct, such as the charge amounts, payment intervals, and client details. Once you are satisfied, enable the automation settings to generate and send the document on the agreed schedule. This will streamline your billing process and reduce administrative effort, allowing you to focus on other areas of your business.

By following these steps, you can easily manage recurring billing, ensuring that clients are invoiced on time and that your business receives payments regularly, without the need for manual intervention each cycle.

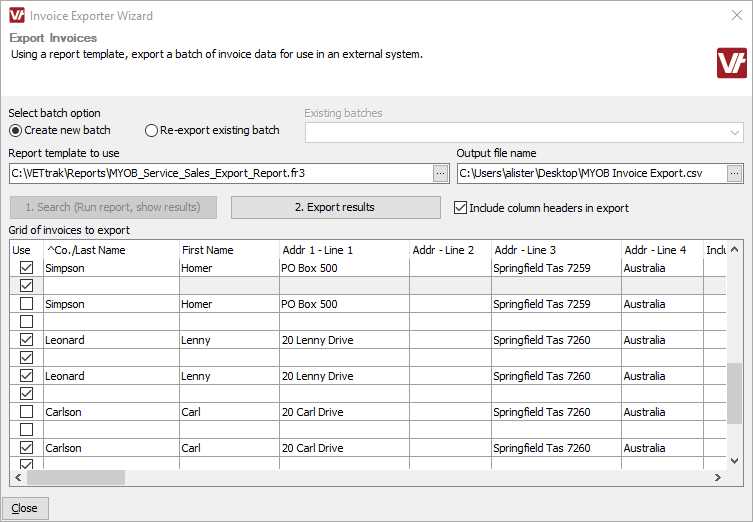

Saving and Exporting MYOB Invoices

Efficiently saving and exporting your financial documents is essential for maintaining accurate records and ensuring smooth communication with clients. Once you have created and customized your billing statements, it’s important to store them properly and export them in formats that are easy to share and archive. This process helps streamline accounting, reduces the risk of errors, and allows you to access documents quickly whenever needed.

Saving and exporting financial documents can be done in various formats depending on your needs. The most common formats include PDF, Excel, and Word, each serving different purposes. PDFs are ideal for sharing finalized documents, while Excel files are useful for further editing or tracking payments.

Step 1: Save Your Document Locally

Before exporting your document, make sure it is saved on your computer or cloud storage. Here’s how to do it:

- Click on the “Save” or “Save As” option in your document editor.

- Choose the location on your computer or cloud storage where you want to save the file.

- Name the file clearly (e.g., “ClientName_BillingDocument_March2024”) to easily identify it later.

- Select the desired file format (e.g., PDF, Word, Excel) and click “Save.”

Step 2: Export the Document for Sharing

Once the document is saved, you can export it in the appropriate format for sharing or archiving. Exporting is helpful when you need to send the document via email or upload it to a client portal. Follow these steps to export your file:

- Open the saved document in the program you used to create it (e.g., Word, Excel, or a specialized billing system).

- Click on “Export” or “Save As” from the menu options.

- Select the export format (PDF is usually preferred for sharing finalized documents).

- Choose the location where you want to store or send the exported file.

- If emailing, attach the exported file to an email and send it to the client.

By following these steps, you can ensure that your financial documents are properly saved, easily accessible, and ready for

Printing and Emailing Your Invoices

Once your financial documents are ready, it’s important to be able to distribute them efficiently to your clients. Whether you need to send a hard copy or an electronic version, having a streamlined process for printing and emailing your documents ensures timely delivery and smooth communication. This section will guide you through the steps to print and email your billing statements, making the process quick and easy.

Step 1: Printing Your Documents

Printing your billing statements is essential if you prefer to provide clients with physical copies. Follow these steps to print your documents clearly and professionally:

- Ensure the document is finalized and all details are correct.

- Click the “Print” button or use the “Ctrl + P” shortcut (on Windows) or “Cmd + P” (on Mac).

- Select the printer from the list of available devices.

- Check the printer settings to ensure the document will print in the correct size and orientation (usually A4 or Letter format).

- Click “Print” and verify that the document prints clearly with no errors.

Step 2: Emailing Your Documents

Emailing your billing documents is a quick and efficient way to send them to clients. Here’s how to email the documents securely:

- Save the document in an accessible format, such as PDF, which ensures that formatting remains intact.

- Open your email client (Gmail, Outlook, etc.) and create a new message to your client.

- Attach the saved document by clicking on the “Attach” button and selecting the file from your device.

- Write a brief, professional message in the email body, providing any relevant information, such as the payment due date or instructions.

- Double-check the recipient’s email address and ensure the attachment is included.

- Click “Send” to deliver the document to your client.

By following these steps, you can ensure that your financial documents are easily accessible to your clients, whether they prefer digital or physical copies. This flexibility helps improve customer satisfaction and ensures that your billing process remains efficient and professional.

Tips for Organizing Invoice Records

Maintaining an organized system for your financial records is essential for smooth business operations. Properly tracking and categorizing billing documents helps prevent confusion, ensures compliance, and allows you to quickly access important information when needed. A well-organized record-keeping system simplifies both internal management and client interactions, while also making tax time much easier. Below are some practical tips for keeping your financial documents orderly and accessible.

Whether you prefer digital or physical records, these strategies can help you stay on top of your documents and avoid unnecessary stress when searching for specific files.

1. Use a Consistent Naming System

Having a clear and consistent naming convention for your documents makes it easier to find and track specific records. For example, you might use a format like this:

| Format | Example |

|---|---|

| Client Name_Date_Type | ClientABC_03-2024_BillingStatement |

| Document Type_Date | BillingStatement_03-2024 |

This format allows you to instantly identify the client, the date, and the type of document, making it easier to locate files when necessary.

2. Organize by Client or Date

To further improve organization, categorize documents by client or by date. This ensures that all records related to a specific client or period are grouped together. Here are some options:

- Organize by client: Create separate folders for each client and place all relevant documents within those folders.

- Organize by date: Sort your documents by month or year to easily track when payments were made or documents were issued.

3. Use Cloud Storage or Accounting Software

Storing documents digitally provides the benefit of easy access and sharing. Cloud-based solutions like Google Drive, Dropbox, or specialized accounting software can securely store all your documents. Benefits include:

- Access from anywhere, on any device.

- Automatic backups to prevent data loss.

- Easy sharing with team members or clients.

- Search functionality to quic

Common Mistakes to Avoid with MYOB

When managing financial documents and records, it’s easy to make mistakes that can lead to confusion or errors in your accounting process. Whether you’re new to the system or a seasoned user, being aware of the most common pitfalls can help you avoid costly mistakes and streamline your operations. This section highlights some of the key issues to watch out for and how to avoid them for a more efficient and error-free experience.

1. Incorrect Client Information

One of the most common errors when creating financial documents is entering incorrect client details. This can result in sending documents to the wrong recipient, delays in payments, or misunderstandings with clients. To avoid this mistake, always double-check client names, contact details, and billing addresses before sending any documents. Ensure that the client’s information is updated regularly in the system to avoid outdated records.

2. Forgetting to Apply Taxes or Discounts

Another common issue is neglecting to apply taxes or discounts where necessary. This can lead to discrepancies between the amount the client expects to pay and what is actually owed. Always make sure that tax rates are correctly applied based on the service or product type, and that any agreed-upon discounts are included in the final amount. Here are a few tips to avoid this mistake:

- Verify the tax rates for each transaction, especially if they vary by region or product.

- Clearly list discounts, specifying any conditions or expiration dates.

- Double-check the final amount before sending or printing the document.

3. Overlooking Payment Terms

Clear payment terms are essential to avoid confusion and ensure timely payments. Failing to specify due dates, late fees, or payment methods can result in delayed or missed payments. Always ensure that payment terms are prominently displayed on the document and are agreed upon by both parties. Consider including reminders for clients about payment deadlines, as well as the penalties for late payments.

4. Failing to Back Up Records

It’s important to regularly back up your financial records to prevent data loss. Many businesses mak

Integrating MYOB with Other Tools

Integrating your accounting system with other business tools can significantly streamline your workflow and improve efficiency. By connecting your financial records management software with tools for project management, CRM, or payment processing, you can automate many processes, reduce errors, and save time. Proper integration ensures that all parts of your business are in sync, leading to better data management and enhanced productivity.

Here are some key benefits and steps to integrate your accounting platform with other commonly used business tools:

Benefits of Integration

- Improved Efficiency: Automated data synchronization reduces the need for manual entry and minimizes the risk of human error.

- Real-Time Data Access: Integration ensures that all teams, from accounting to sales, have access to the most up-to-date information.

- Streamlined Workflows: By linking your financial system with other tools, you can automate repetitive tasks like generating financial reports, sending reminders, or updating client information.

- Better Decision-Making: Integration allows you to gather data from different platforms in one place, providing comprehensive insights to make informed business decisions.

Steps to Integrate with Other Tools

- Identify the Tools You Use: List all the tools you currently use in your business, such as CRM systems, email marketing software, project management platforms, or payment gateways.

- Check Compatibility: Ensure that your accounting system is compatible with the tools you wish to integrate. Many modern systems offer built-in integration options with popular software, but some may require third-party connectors or plugins.

- Select an Integration Method: Choose between using native integrations, third-party platforms (such as Zapier), or custom API development based on your specific needs and technical capabilities.

- Set Up Automation: Once integrated, set up automated workflows such as automatically updating customer data, syncing transactions, or generating reports. This minimizes manual effort and reduces the risk of inconsistencies between systems.

- Test the Integration: Before fully implementing the integration, conduct thorough testing to ensure data flows seamlessly between systems and that no information is lost or corrupted.

By taking the time to integrate your financial management system with other tools, you can create a more cohesive and efficient workflow for your business, allowing for

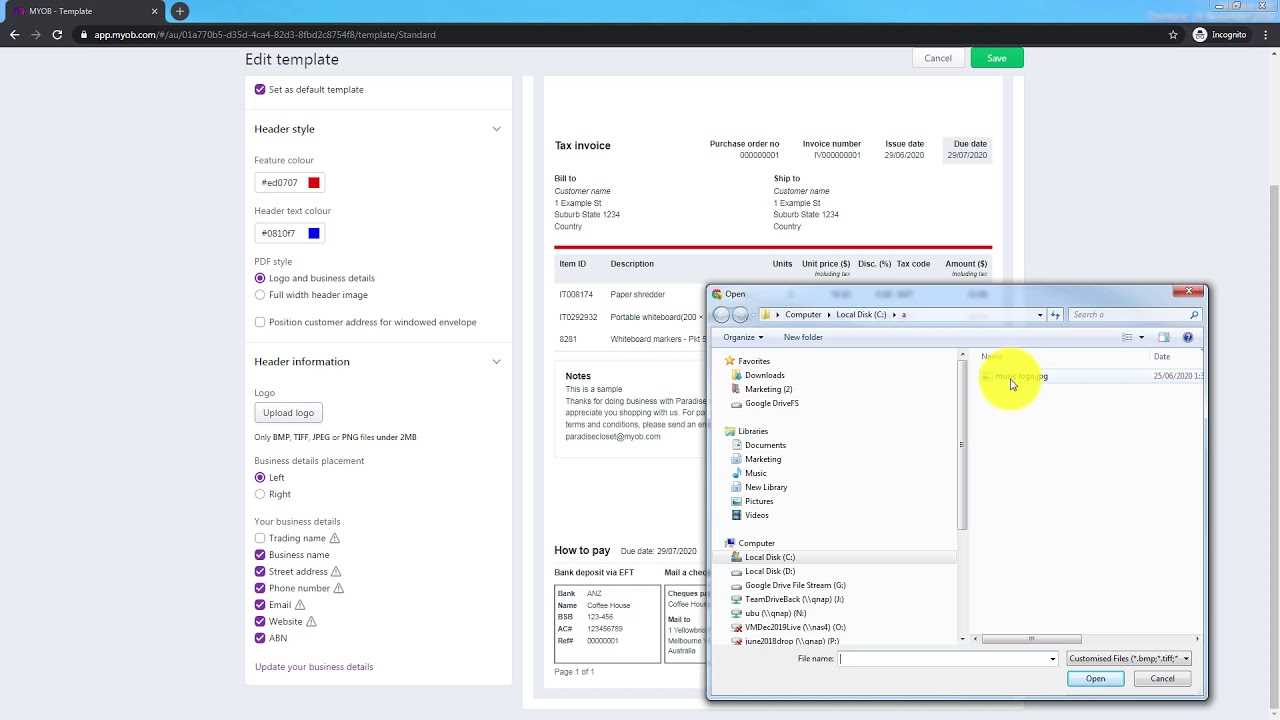

How to Update Your Invoice Template

Regularly updating your billing documents is crucial for maintaining professionalism and ensuring that they reflect any changes in your business or compliance requirements. Whether you’re adjusting for a new branding style, updating payment terms, or incorporating new tax rates, keeping your financial statements current is an important part of business management. This section will guide you through the steps to modify and improve your billing layouts to meet your business needs and ensure accuracy in every transaction.

Step 1: Access the Document Editor

The first step in updating your financial document design is to open the document editor. Whether you’re using specialized accounting software or a simple word processor, ensure that you have the right tool to make the changes. Here’s how to get started:

- Open the software or document editor where you create your billing statements.

- Select the document you wish to update or create a new one if necessary.

- Ensure that you have access to the specific sections that need to be modified (e.g., client details, pricing, payment terms).

Step 2: Modify the Layout and Content

Now that you have the document open, you can begin updating the layout, content, and any essential fields. Consider the following changes:

- Branding Update: If you’ve recently updated your logo, color scheme, or overall branding, be sure to apply these changes to the document header, footer, and any other relevant sections.

- Client and Payment Information: Update any fields that have changed, such as the client’s contact information, your payment terms, or payment methods.

- Tax Rates and Discounts: If there are any changes in applicable tax rates or discounts, update these in the relevant sections of the document to reflect the latest rates.

- Legal Requirements: Ensure that any mandatory information (e.g., business registration number, terms and conditions) is included as required by local laws.

Step 3: Save and Test the Updated Document

Once you’v

MYOB Invoice Template for Small Businesses

For small businesses, managing financial transactions efficiently is essential to maintain cash flow and ensure a smooth operation. A well-structured billing document not only reflects professionalism but also helps in keeping accurate records of payments and outstanding balances. Customizing your financial statements to meet the specific needs of your small business is a simple yet effective way to stay organized and minimize errors.

This section focuses on how small businesses can benefit from using a pre-designed billing document structure, streamlining their process while ensuring consistency and clarity in their financial communications. Below are some of the key advantages and customization options for small business owners to consider when selecting and using a professional billing format.

Key Features for Small Business Billing

Small businesses often face unique challenges when it comes to managing finances, such as keeping track of multiple clients, varying payment terms, and fluctuating service fees. A well-organized billing system can help you address these challenges effectively. Here are some key features that small businesses should look for:

- Customizable Fields: Ensure that your document allows for flexibility in adding or modifying fields like product/service descriptions, quantities, rates, and taxes.

- Client Management: Include areas to store essential client details such as contact information, address, and payment terms for easy reference.

- Clear Payment Terms: Clearly state payment deadlines, late fees, and accepted methods of payment to avoid confusion with clients.

- Professional Appearance: A clean, organized design reflects well on your brand and ensures that your clients have a positive experience.

How to Customize Your Billing Documents

Customizing your financial documents can make them more aligned with your business’s specific needs. Here’s how you can modify your existing document layout:

- Update Business Information: Ensure your business name, logo, and contact information are displayed prominently at the top of the document. This helps clients easily identify your brand.

- Adjust Payment Options: If you offer various payment methods (e.g., credit card, bank transfer, PayPal), make sure these are clearly stated on the document.

- Include Discounts or Special Terms: If you offer discounts or have special payment terms, ensure these are included in the relevant sections of your b