Proforma Invoice Template Excel for Easy Billing and Customization

Managing financial transactions efficiently is crucial for any business, especially when it comes to preparing documents for preliminary agreements. These records help establish the terms of a deal before final invoicing, providing both the seller and buyer with a clear understanding of the terms. Using the right tools can make this task simpler and faster, while maintaining professionalism.

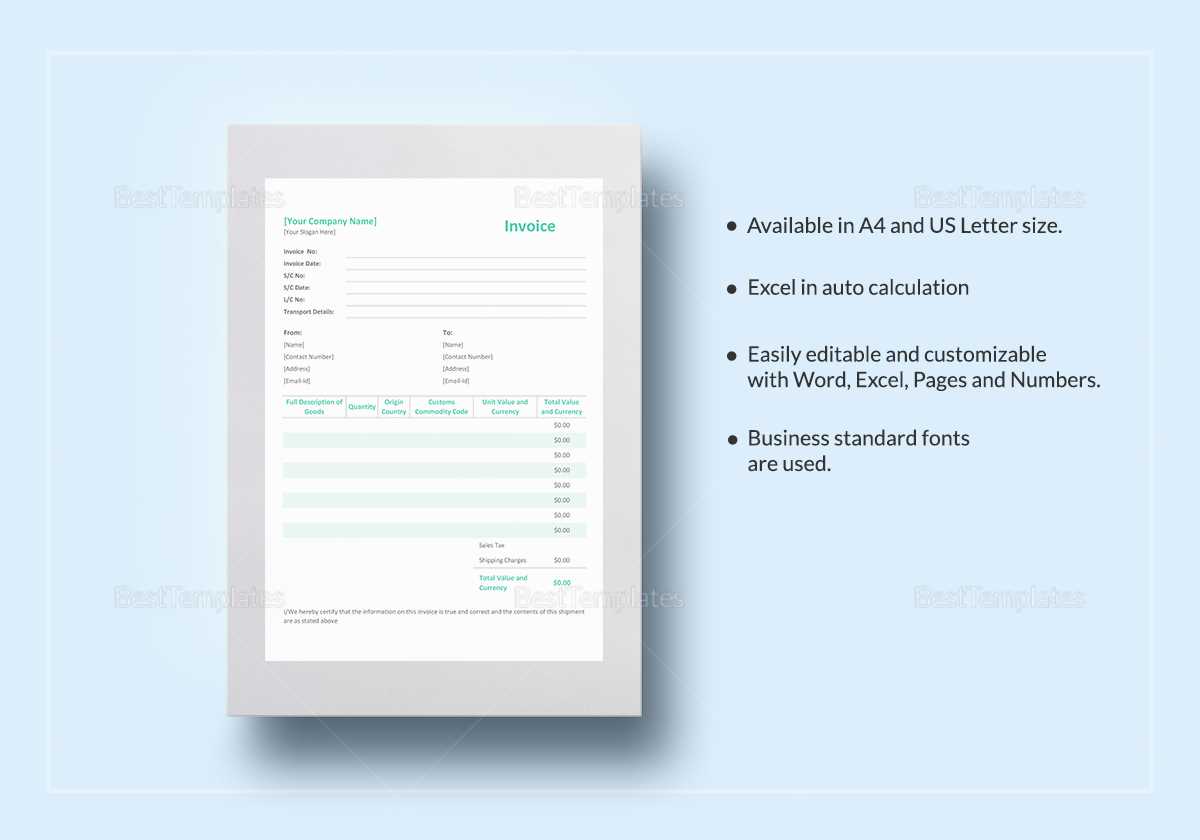

One of the most effective solutions involves utilizing readily available digital solutions that streamline the creation and customization of such records. With the help of spreadsheet software, businesses can design clean, organized documents that can be easily adjusted for different clients or projects. These tools offer flexibility, allowing you to add or remove information based on the specifics of each transaction.

Whether you are a freelancer, small business owner, or part of a larger company, having access to customizable templates ensures you can maintain consistency and accuracy. In this guide, we will explore how these tools can assist you in drafting clear and comprehensive preliminary records, enhancing both your workflow and your client interactions.

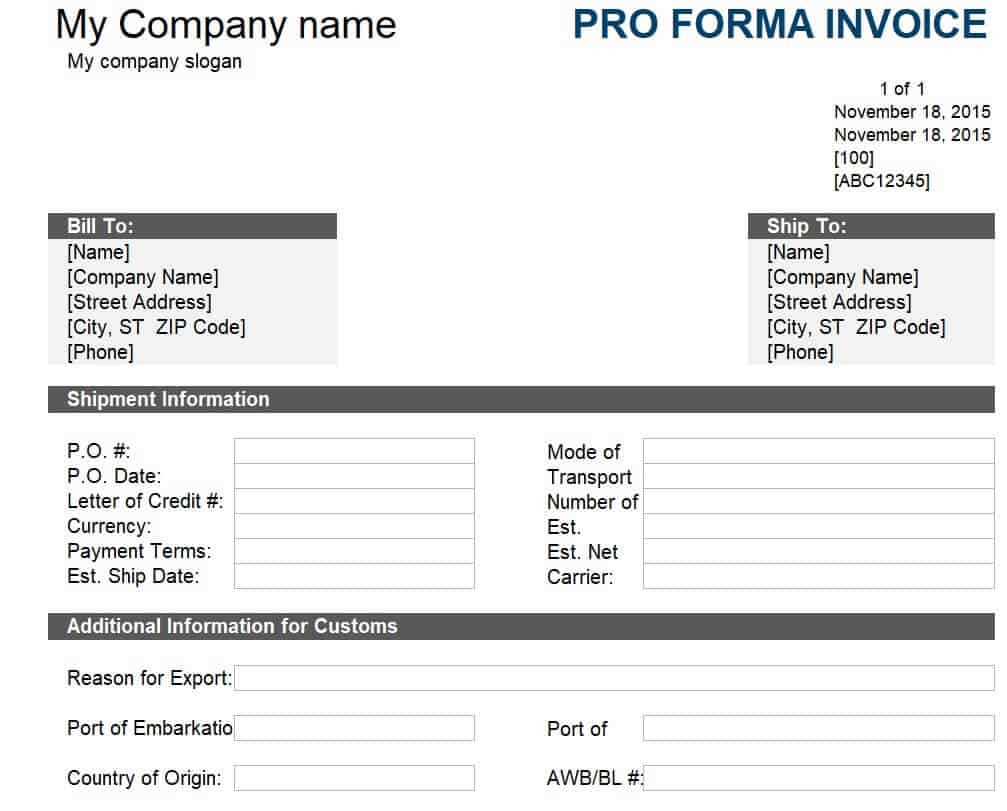

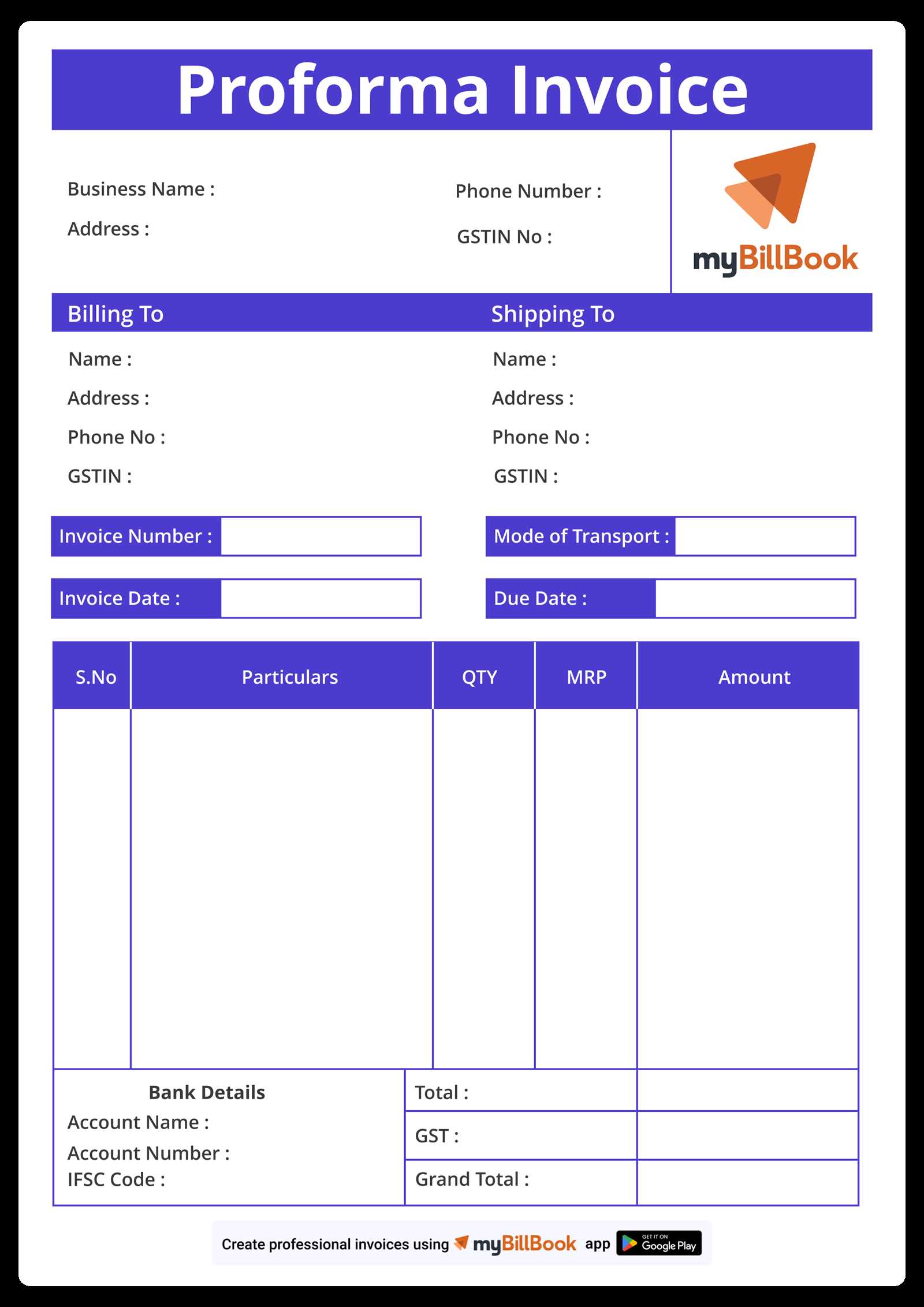

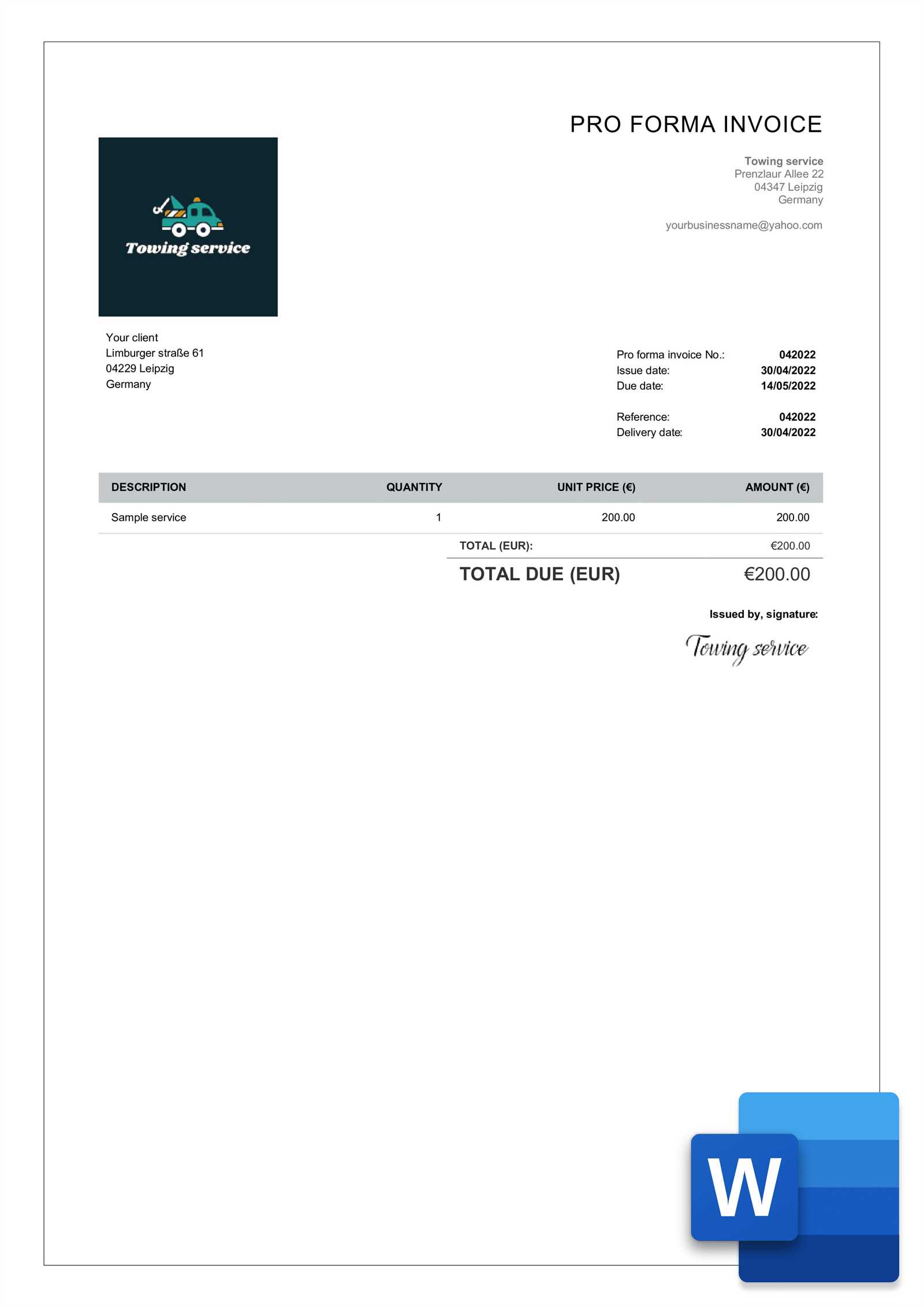

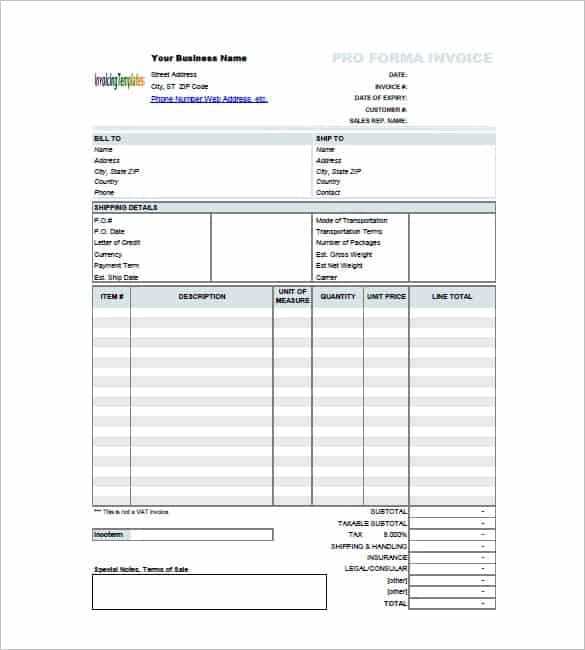

Proforma Invoice Template Excel Overview

Creating clear and structured documents for business transactions is essential for effective communication between sellers and buyers. These records help outline the details of a deal before the final payment request is made, ensuring both parties are aligned on terms and expectations. Utilizing digital solutions to generate such documents can significantly improve the efficiency and accuracy of the process.

A spreadsheet-based solution offers numerous advantages for businesses of all sizes. With its user-friendly interface, you can easily input information such as item descriptions, quantities, prices, and payment terms. The flexibility of these tools allows for quick customization, enabling you to create personalized documents for each client or project. Additionally, such solutions support automatic calculations, which reduces the likelihood of errors and saves time in document preparation.

Overall, adopting these tools not only simplifies the creation of transaction records but also enhances your professionalism. By maintaining consistent and accurate documents, businesses can foster trust and transparency with their clients, setting the foundation for smooth transactions.

Why Use a Proforma Invoice Template

Having a pre-designed structure for creating business documents can significantly improve the efficiency of your workflow. Instead of manually formatting each document from scratch, a structured format allows you to focus on the content rather than the design. This saves time and ensures that all necessary information is consistently included in every transaction record.

Time Efficiency and Consistency

One of the main advantages of using a structured solution is the time saved in document preparation. A pre-built format eliminates the need to re-enter basic information for each transaction. With a consistent format, you can quickly update values, such as quantities and prices, while keeping the rest of the layout intact. This consistency not only saves time but also helps avoid errors and ensures your documents meet professional standards every time.

Customizable for Different Transactions

Even though a template offers a set structure, it is highly customizable to suit various types of agreements. Whether you’re dealing with different clients, products, or services, a flexible layout allows you to make adjustments easily. This adaptability ensures that every transaction record accurately reflects the specific details of each deal, improving both accuracy and professionalism.

How to Create Proforma Invoices in Excel

Creating professional transaction records in a spreadsheet is a straightforward process that requires only basic knowledge of the software. The flexibility of spreadsheets allows you to easily organize and calculate the necessary information for each deal. By following a few simple steps, you can quickly create a clean and structured document that serves as a preliminary agreement for any transaction.

Step-by-Step Guide

Follow these steps to create your document:

- Open a new spreadsheet: Start by launching the software and creating a blank sheet.

- Define the header section: Add essential details such as your business name, contact information, and the recipient’s details.

- Add a table for items or services: Set up columns to list the description, quantity, unit price, and total cost for each item or service.

- Include payment terms: Clearly define payment methods, deadlines, and any special terms that apply.

- Calculate totals: Use formulas to automatically calculate the total cost based on the quantities and prices provided.

- Finalize the layout: Format the document to ensure it looks professional and is easy to read.

Additional Tips

- Use consistent formatting: Keep fonts and colors simple to ensure clarity and professionalism.

- Ensure accuracy: Double-check all calculations and ensure that no details are left out.

- Save as a template: If you plan to use the same format regularly, save it for future use to save time.

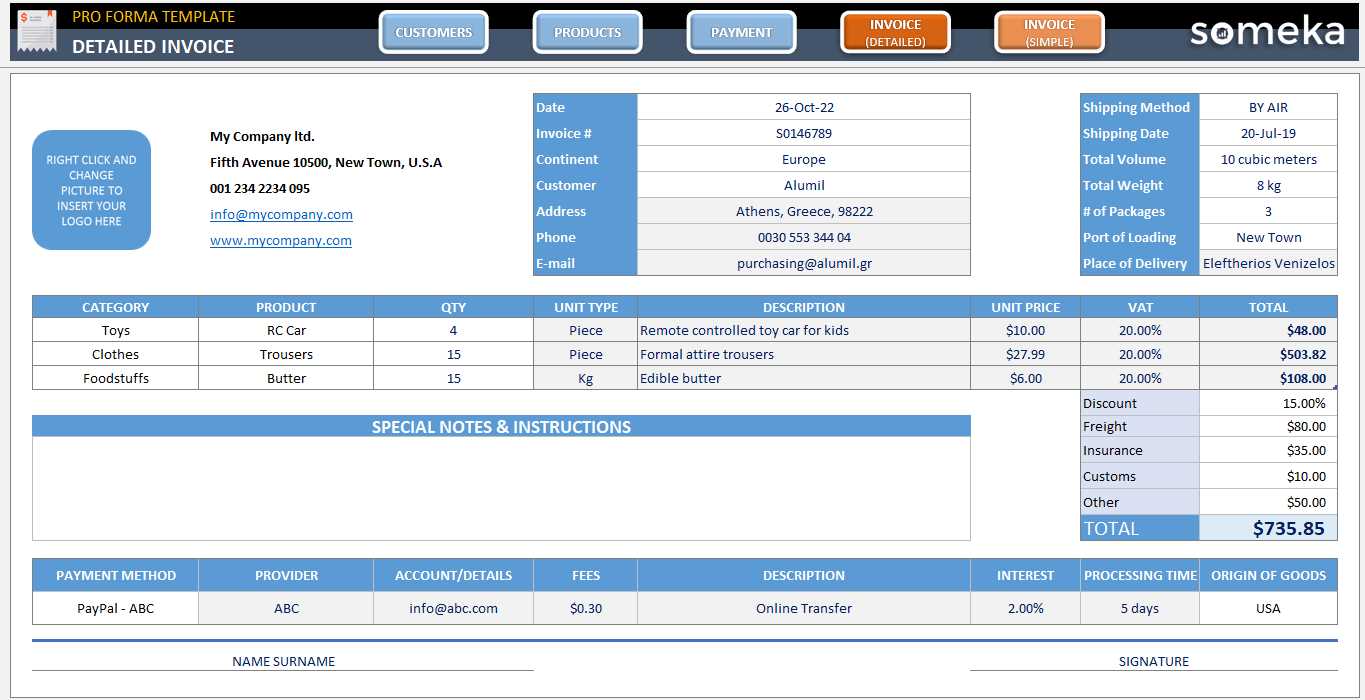

Top Features of Excel Invoice Templates

Digital solutions for creating transaction records offer a variety of useful features that simplify the process of preparing business documents. These features not only improve the accuracy and efficiency of your work but also ensure that your records maintain a high level of professionalism. Understanding these key features can help you take full advantage of the software’s capabilities, allowing you to create clear, organized, and customizable documents.

Automation and Calculations

One of the standout benefits of using a spreadsheet for creating business records is its ability to automate calculations. With built-in formulas, you can instantly calculate totals, taxes, and discounts based on the inputted data. This reduces the risk of human error and saves time, especially when dealing with large quantities of items or complex pricing structures.

Customizability and Flexibility

Customization is another essential feature that makes spreadsheets highly useful for creating business documents. You can easily adjust the layout, colors, and fonts to align with your brand identity or client preferences. Additionally, adding or removing fields is simple, allowing you to adapt the document to any specific needs, whether it’s adding a payment plan or including detailed product descriptions.

Flexibility extends beyond just the visual aspect. These solutions can be used for various types of transactions, from simple service agreements to complex product sales. The ability to tailor the document according to the specifics of each deal ensures that your records are accurate and fit for purpose, no matter the industry or situation.

Benefits of Using Excel for Invoicing

Using spreadsheet software for generating business documents offers a wide range of advantages, making the process of creating, customizing, and managing transaction records faster and more efficient. Whether you’re a freelancer, small business owner, or part of a larger company, the flexibility and features of these tools can significantly enhance your document management workflow, allowing you to streamline your operations and reduce the chance of errors.

Improved Accuracy and Automation

One of the most significant benefits of using a spreadsheet for financial records is its ability to automate calculations. The software can quickly calculate totals, taxes, and discounts based on the information you input, ensuring that every document is accurate and reducing the chance of human error. This is especially helpful when dealing with large volumes of transactions or complex pricing structures.

| Feature | Benefit |

|---|---|

| Automated Calculations | Instantly calculate totals, taxes, and discounts without manual input, reducing errors. |

| Customizable Layout | Adapt the design and structure to fit your brand or business needs with ease. |

| Data Organization | Easily store and organize transaction records for future reference or reporting. |

Time Efficiency and Cost-Effectiveness

Creating documents using a spreadsheet is far quicker than manually drafting them each time, saving valuable time in your day-to-day operations. The ability to reuse and modify pre-made formats reduces the need for repetitive tasks, while offering the flexibility to update or adjust records on the go. Moreover, spreadsheet software is often free or inexpensive, making it a cost-effective solution for businesses of all sizes.

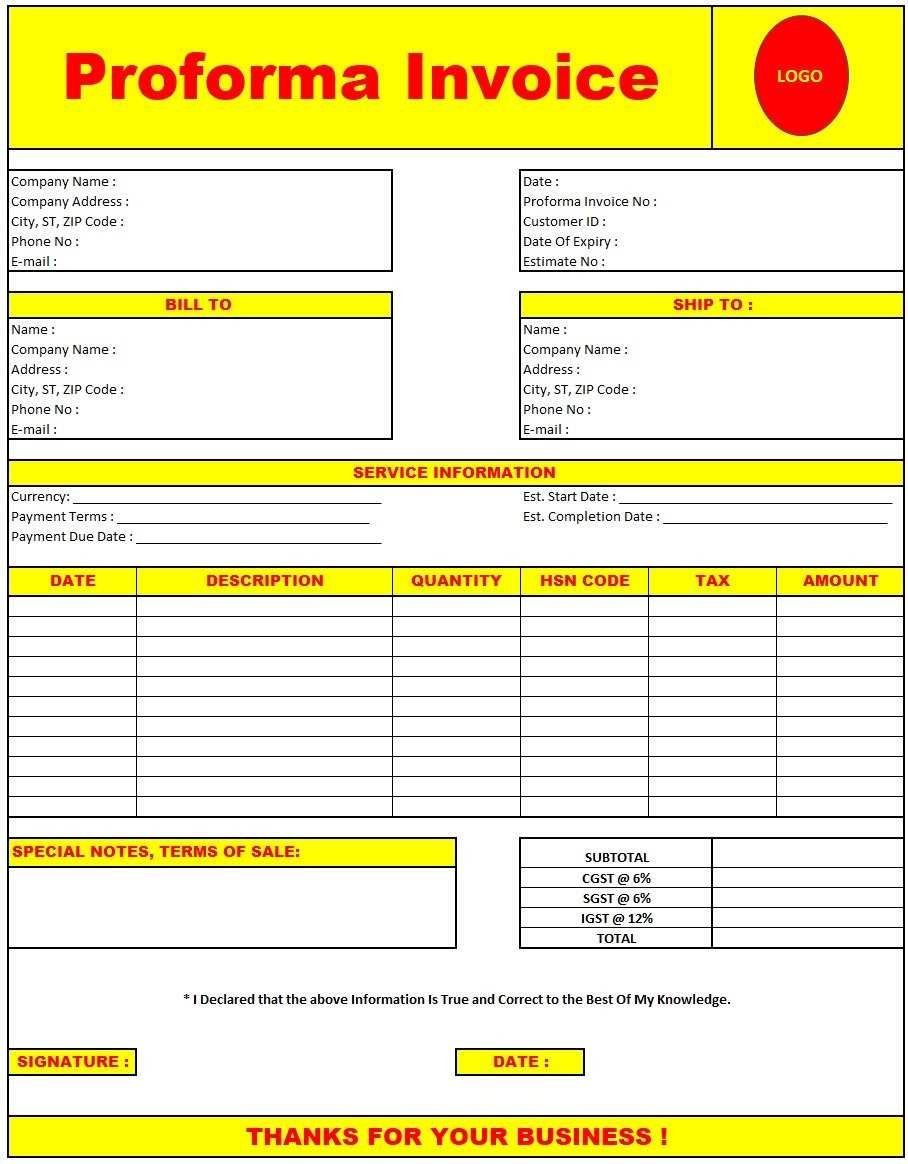

How to Customize Your Proforma Invoice

Customizing your transaction records allows you to tailor them to the specific needs of each client or project, ensuring that every detail is clear and relevant. Whether you need to adjust the layout, add additional fields, or modify the content, personalizing these documents can enhance professionalism and help maintain consistency across your business dealings. Here’s how to customize these documents effectively.

Steps for Customization

To personalize your transaction record, follow these steps:

- Adjust Header Information: Update the header to include your company name, logo, and contact information. You may also want to add the recipient’s details to make the document more personalized.

- Edit Product/Service Information: Modify the description, quantity, price, and any other relevant details for each item or service provided. Ensure all data is accurate and up to date.

- Change Payment Terms: Customize payment deadlines, methods, and any special conditions that apply to the specific agreement.

- Incorporate Additional Fields: Add custom fields for things like shipping costs, discounts, or taxes, depending on your business model.

- Format for Clarity: Adjust the font, alignment, and colors to ensure readability and a professional appearance. You can also adjust column widths to accommodate longer text if necessary.

Additional Customization Tips

- Use consistent branding: Ensure that your colors, fonts, and logo match your company’s branding for a unified look.

- Save for future use: Once you’ve customized the do

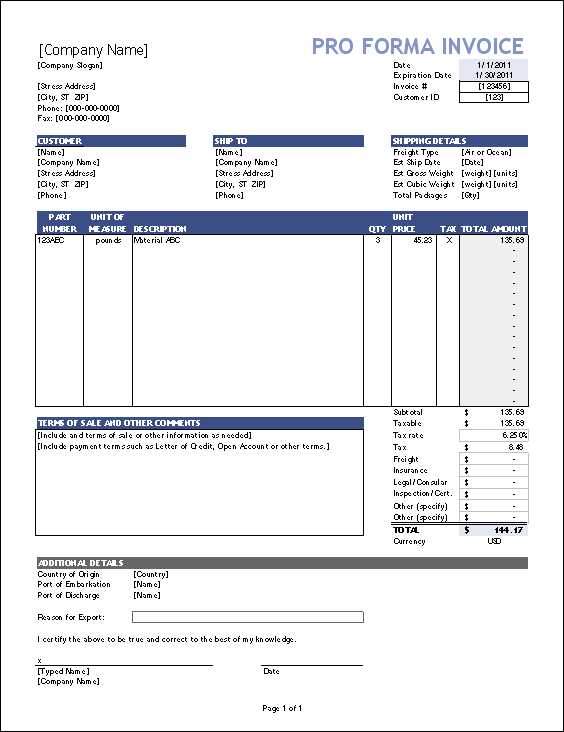

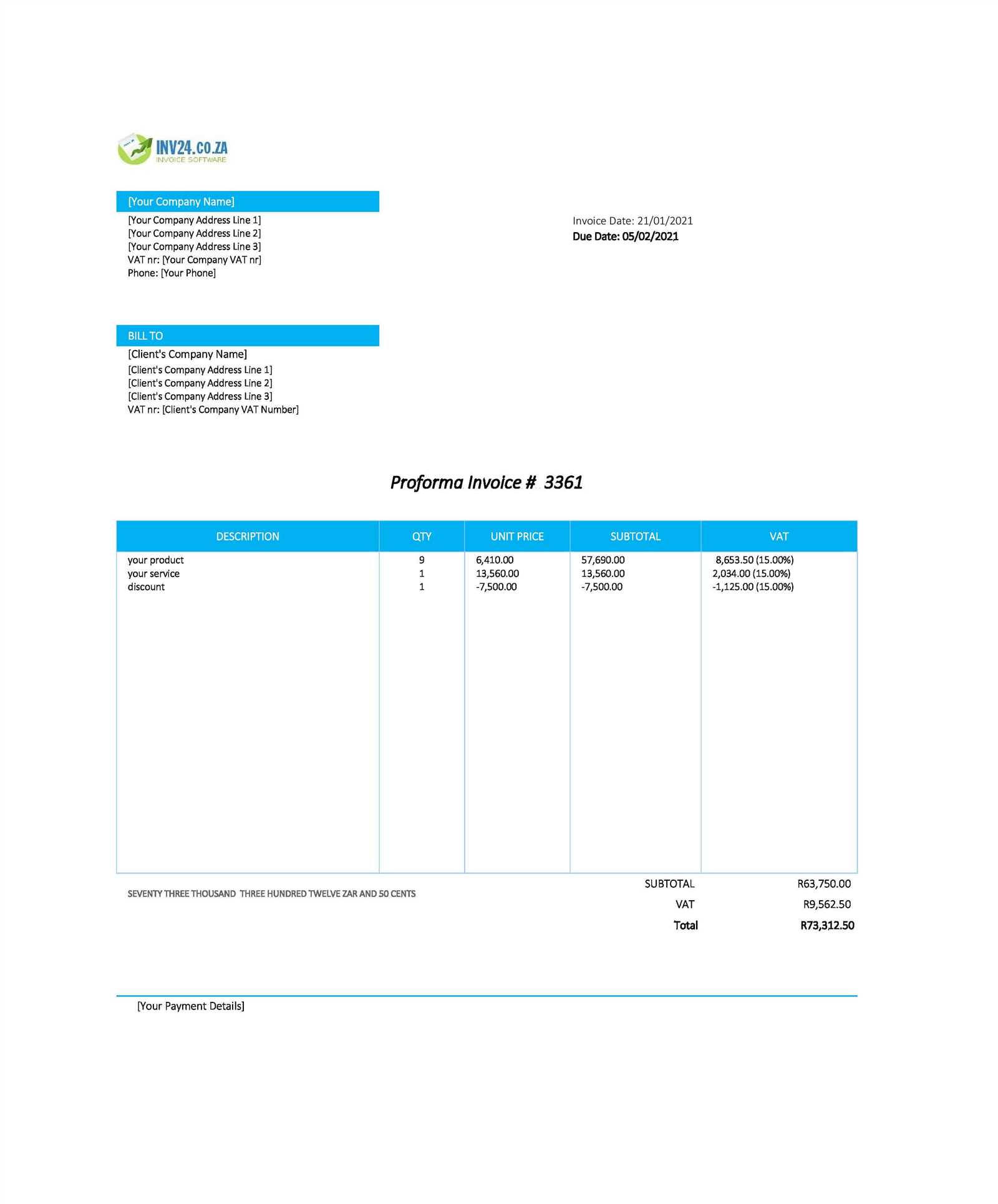

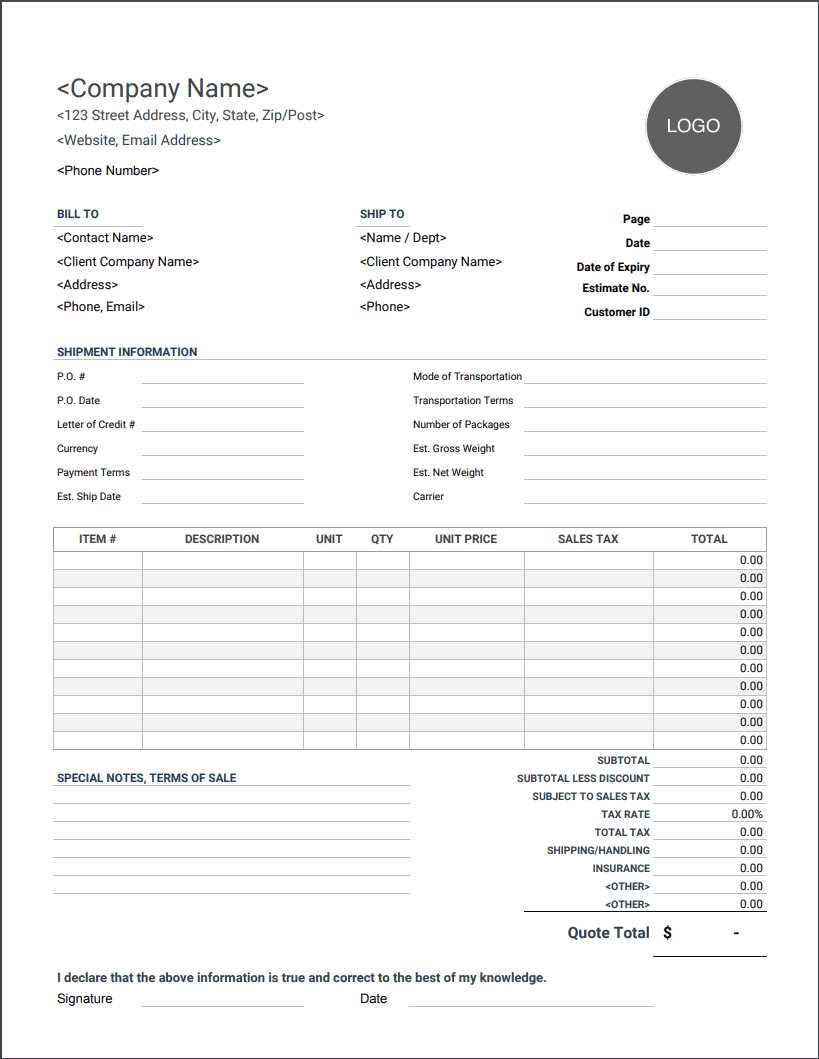

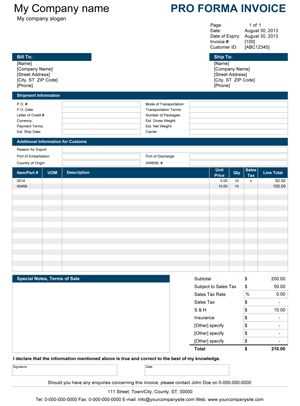

Key Information to Include in Proforma Invoices

When creating preliminary business documents, it’s important to include all necessary details to ensure clarity and transparency between the buyer and seller. These records serve as a summary of the transaction, outlining the terms, products, and services before the final payment is made. Properly structuring the information helps both parties avoid misunderstandings and ensures a smooth process once the final agreement is reached.

The following key elements should always be included to ensure that the document is complete and legally sound:

- Contact Information: Include your business name, address, phone number, and email, along with the recipient’s contact details. This makes the document easily traceable and helps both parties stay in touch.

- Document Number and Date: Assign a unique number to each record for easy reference. Include the date of creation, which helps track when the transaction is set to occur and establishes a clear timeline for both parties.

- Item Descriptions: Provide a detailed list of the goods or services being offered, including quantities, individual prices, and a brief description. This ensures the buyer understands what is being sold and at what price.

- Total Cost Breakdown: Clearly present the total cost, itemizing each charge, including taxes, discounts, and any other applicable fees. This allows for transparency in the pricing structure.

- Payment Terms: Specify the payment methods, due date, and any special conditions that apply to the transaction. This includes details such as payment deadlines, deposit requirements, or payment plans.

- Delivery and Shipping Information:

Common Mistakes in Proforma Invoices

Even with well-structured transaction records, mistakes can easily occur during creation, leading to confusion and potential disputes between businesses and their clients. These errors can range from minor formatting issues to significant inaccuracies that affect payment terms or product details. By understanding the most common mistakes and how to avoid them, you can ensure that your documents are clear, accurate, and professional.

Some of the most frequent mistakes include:

- Incorrect or Missing Contact Information: Failing to include up-to-date contact details for both parties can lead to confusion or delays in communication. Always ensure that your business and the recipient’s information are accurate and complete.

- Unclear or Inaccurate Item Descriptions: Vague or incorrect descriptions of goods or services can create misunderstandings. It’s essential to provide detailed, precise descriptions to avoid discrepancies later in the transaction.

- Errors in Pricing or Quantity: One of the most common mistakes is listing the wrong prices or quantities. Always double-check the unit price and the number of items to ensure the totals are calculated correctly.

- Missing or Incorrect Payment Terms: Failing to clearly outline payment methods, deadlines, or any other specific conditions can cause delays or disputes. Always specify how and when payments should be made and any penalties for late payment.

- Omitting Shipping or Delivery Information: Leaving out details about delivery timeframes or shipping costs can lead to confusion, especially if there are additional charges for transportation. Be sure to include all relevant shipping terms to set proper expectations.

- Not Using Unique Document Numbers: Each record should have a unique reference number to easily track the transaction. Failing to do so can cause issues when trying to retrieve or refer to past documents.

By paying attention to these details, you can avoid common errors that may lead to confusion or a lack of professionalism in your dealings. Always review the document thoroughly before sending it to ensure all necessary information is included and accurate.

How Excel Templates Save Time and Effort

Creating business records from scratch can be a time-consuming and repetitive process, especially when you need to produce them regularly. Using pre-designed structures in a spreadsheet simplifies this task by offering a ready-made format that can be customized with minimal effort. This efficiency not only saves time but also ensures consistency and reduces the chance of human error, which is crucial for maintaining professionalism in every transaction.

Streamlined Workflow

One of the key advantages of using pre-built structures is the significant reduction in the time spent formatting documents. Instead of manually organizing each section, you simply need to input the relevant details such as quantities, prices, and client information. The layout is already set up for you, allowing you to focus solely on customizing the content rather than worrying about the structure. This results in faster document creation and frees up valuable time for other important tasks.

Consistency and Accuracy

When you use a standardized structure, you ensure that every document follows the same format, which adds a layer of professionalism and consistency. This consistency eliminates the risk of missing important fields or forgetting key details, as everything is already laid out. Additionally, built-in features like automatic calculations for totals, taxes, and discounts further reduce errors, making the process quicker and more reliable.

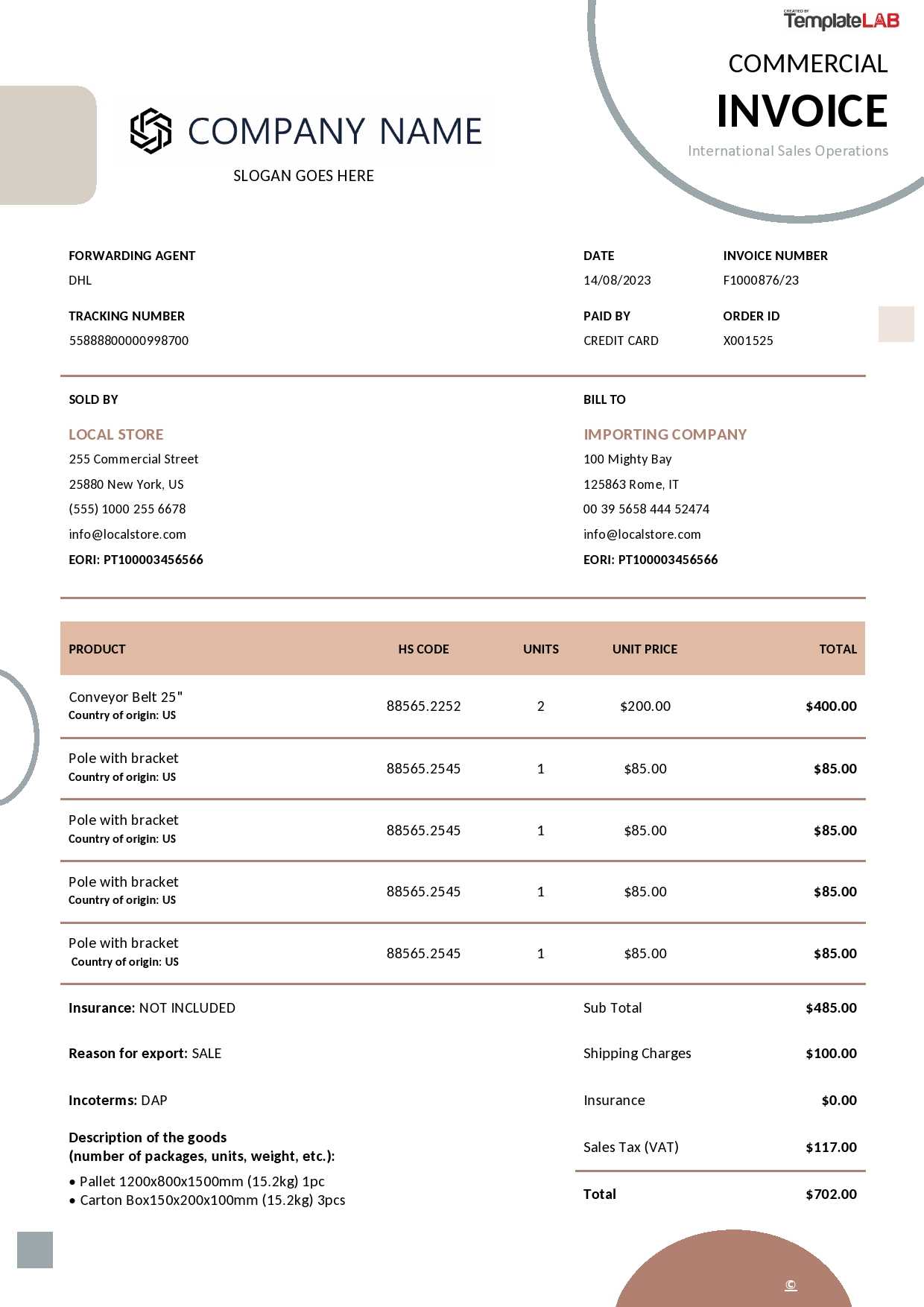

Proforma Invoice vs Commercial Invoice Differences

Although both documents are used in business transactions, they serve different purposes and contain distinct types of information. Understanding the differences between a preliminary record and a final bill is crucial for ensuring proper documentation and smooth business operations. While both documents outline the terms of the deal, the key distinctions lie in their intended use and the stage of the transaction they represent.

The primary difference between these two records is that one serves as an estimate or an outline of a transaction, while the other is a request for payment following the completion of the transaction. A preliminary document is typically issued before goods or services are delivered, offering the buyer a clear overview of what is being purchased and under what conditions. In contrast, a final document is issued after the goods or services have been provided, indicating the amount due for payment.

Another key distinction is the legal standing of each document. A final bill is a legally binding request for payment, while the preliminary document does not represent a demand for payment but rather a summary of the expected transaction. This difference can affect how the documents are treated by accounting departments, customs authorities, and other stakeholders involved in the transaction.

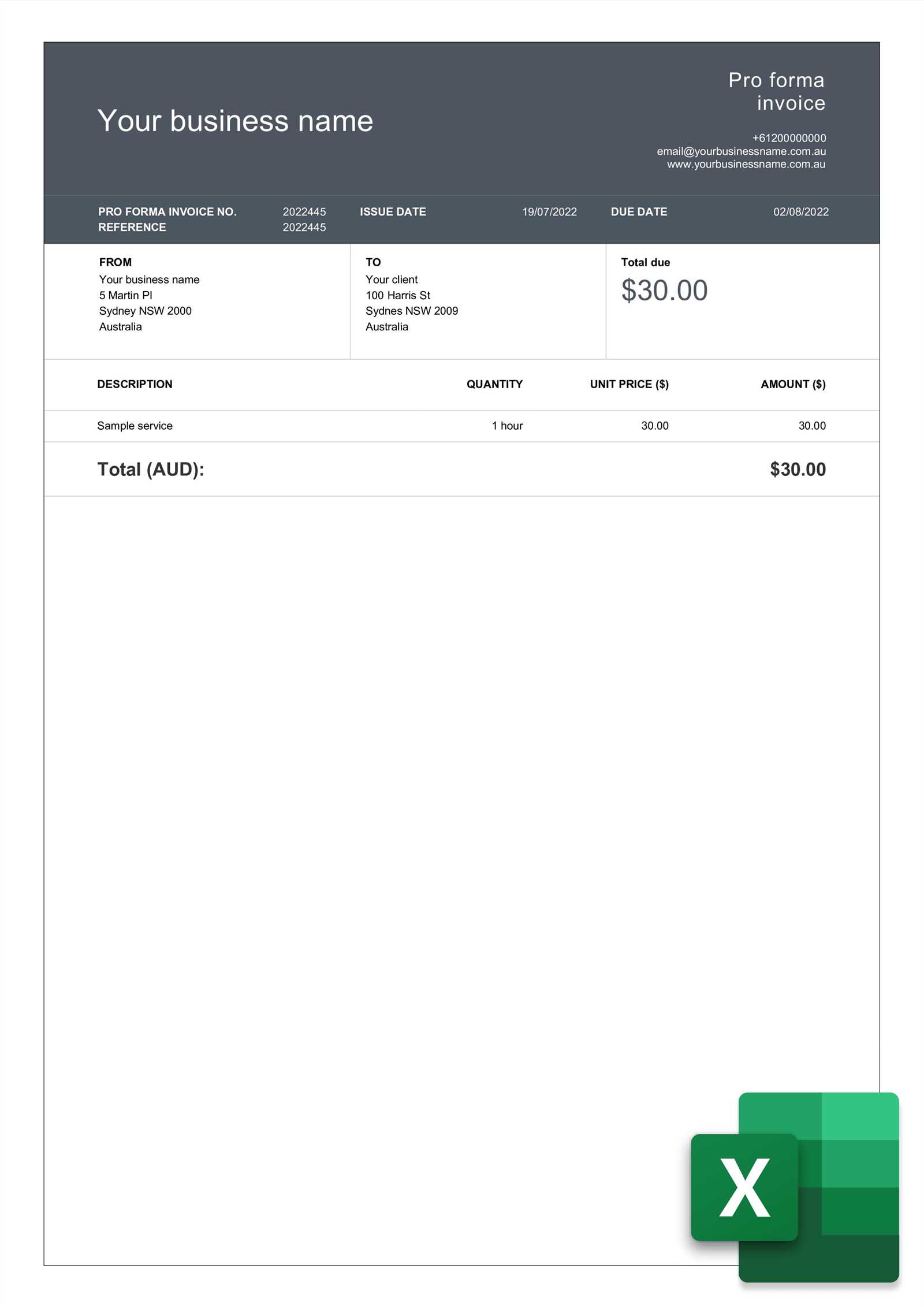

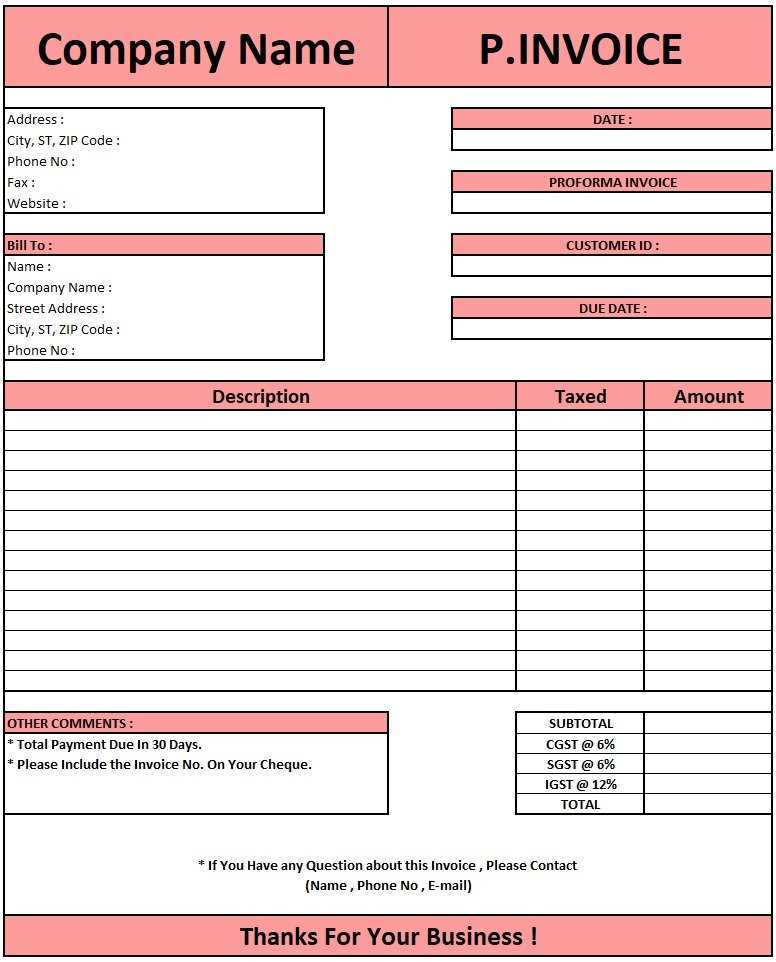

Best Practices for Proforma Invoice Design

When creating transaction records, it’s essential to ensure that the design is both functional and professional. A well-structured document not only improves readability but also makes it easier for both parties to understand the terms of the agreement. By following a few best practices in layout and design, you can create a document that is clear, easy to navigate, and visually appealing.

First and foremost, clarity should be your top priority. The document should have a clean, organized layout that makes important information easy to find. Use clear headings and subheadings to separate different sections, such as contact information, item details, payment terms, and delivery instructions. A cluttered or confusing layout can cause misunderstandings and delay the transaction process.

Consistency in design is equally important. Stick to one or two font types and sizes, and use consistent spacing throughout the document. Highlight critical information, such as totals or payment deadlines, with bold text or underlining, but avoid using too many different colors or font styles, as this can create a disorganized appearance. Additionally, make sure that the document aligns with your company’s branding, using your business’s logo, color scheme, and contact information consistently across all documents.

Lastly, legibility is key. Ensure that the font size is large enough for easy reading and that there is adequate contrast between the text and the background. If possible, allow for plenty of white space around each section to avoid visual clutter. A well-designed, readable document not only improves the client experience but also helps maintain a professional image for your business.

How to Track Payments with Excel Templates

Managing payments is an essential part of any business, and tracking them efficiently ensures that you maintain healthy cash flow and keep accurate financial records. Using structured tools, such as spreadsheets, simplifies the process of monitoring outstanding and received payments. With the right setup, you can track when payments are due, whether they’ve been made, and if any follow-up actions are necessary, all while keeping everything in one organized place.

Steps to Track Payments Effectively

To track payments using a spreadsheet, follow these steps:

- Create a dedicated payment tracking sheet: Start by creating a new sheet where you can log all transactions. This should include columns for the transaction date, amount, payment method, client details, and status (paid or unpaid).

- List payment deadlines: For each transaction, make sure to note the payment deadline or the expected payment date. This will allow you to set reminders for overdue payments.

- Mark payment status: After a payment is received, update the status to “Paid” and include the payment date. For outstanding payments, leave the status as “Unpaid” or “Pending.”

- Use conditional formatting: Utilize the spreadsheet’s built-in tools to color-code or highlight overdue payments. This will help you quickly identify which payments require attention.

Additional Tips for Effective Tracking

- Automate totals: Use formulas to automatically calculate the total amount received and the outstanding balance. This will give you a clear view of your cash flow at any time.

- Set reminders: Create alerts or use reminders in the spreadsheet to notify you of upcoming due dates. This helps prevent missed payments.

- Keep detailed notes: Include a comments section where you can record any additional details, such as payment plans or special agreements with clients.

By following these simple steps, you can streamline the payment tracking process, reduce errors, and maintain an organized record of all transactions.

Free Excel Templates for Proforma Invoices

When creating business documents, having access to pre-designed structures can save you a lot of time and effort. Free tools offer a convenient way to generate these records without needing to start from scratch, while still allowing for customization. These ready-to-use formats are perfect for small business owners, freelancers, and anyone looking to streamline their document creation process.

Many online platforms offer free downloadable structures that help you quickly create professional-looking transaction summaries. By using these tools, you can ensure that all the necessary fields are included, and the design is clean and easy to read. Below are some of the key benefits of using free downloadable formats:

- Time-saving: Ready-made designs eliminate the need for manually formatting each document, allowing you to focus on inputting relevant information.

- Consistency: Pre-built layouts ensure that every document follows the same structure, maintaining consistency across all your records.

- Customization options: Most free formats allow for easy customization, enabling you to adapt them to your specific business needs, such as adding new fields or adjusting the layout.

- Professional design: Many free tools come with visually appealing designs, ensuring your records appear polished and organized, enhancing your business image.

Here are a few places where you can find free downloadable formats to use for your business:

- Microsoft Office Templates: A wide range of free downloadable files are available directly from Microsoft Office’s template gallery.

- Google Sheets: Google offers free, editable options that can be customized to suit your needs and saved directly to your Google Drive.

- Online Template Websites: Websites like Template.net and Vertex42 provide free options that are easy to download and adjust for your purposes.

- Business Blogs and Forums: Many small business-focused blogs offer free resources and downloadable tools, including transaction record formats.

By using these free tools, you can simplify the document creation process, maintain professional standards, and save valuable time on administrative tasks.

How to Add Taxes to Proforma Invoices

When preparing transaction records, it’s essential to account for any taxes that may apply to the sale of goods or services. Including tax calculations ensures that both parties are aware of the full cost of the transaction. Accurately adding taxes not only helps avoid misunderstandings but also ensures compliance with tax regulations.

To correctly add taxes to your transaction documents, follow these simple steps:

Steps for Adding Taxes

- Determine the applicable tax rate: Before adding taxes, check the tax rate for your region or industry. This could be a sales tax, VAT, or another type of tax. Make sure to apply the correct rate based on your location and the nature of the transaction.

- Include a dedicated tax section: In your document, create a separate section or line item specifically for taxes. This should list the tax rate and the total tax amount calculated on the goods or services provided.

- Calculate the tax amount: Multiply the total amount of goods or services by the applicable tax rate. For example, if the total amount is $500 and the tax rate is 10%, the tax amount would be $50. Add this value to the total cost of the transaction.

- Include both pre-tax and post-tax totals: It’s important to show both the pre-tax amount (before tax is added) and the total amount (after tax is added). This provides transparency for the client and helps them understand the breakdown of the final cost.

Example of Tax Calculation

- Total Amount: $500

- Tax Rate: 10%

- Tax Amount: $500 x 10% = $50

- Total Cost (with tax): $500 + $50 = $550

By following these steps, you can ensure that the correct tax is applied to each transaction, helping you maintain accuracy in your financial documentation. Additionally, clearly listing taxes will help your clients understand the full cost of the transaction and reduce potential confusion.

Using Excel for International Transactions

Handling international transactions requires special attention to detail, especially when dealing with multiple currencies, varying tax rates, and different regulations. Using a structured tool to organize this information ensures that cross-border payments and agreements are clear and accurate. A digital platform like a spreadsheet can streamline this process by allowing businesses to easily manage and track essential data across different markets.

Key Considerations for International Transactions

When managing international transactions, there are several factors to consider:

- Currency Conversion: Transactions involving multiple currencies require careful conversion. Make sure to use up-to-date exchange rates to ensure the amounts are accurately reflected. Many digital tools allow for automatic updates of exchange rates, simplifying this process.

- Tax and Duty Regulations: Different countries have different tax rules, import/export duties, and customs regulations. It’s important to calculate taxes and duties correctly based on the destination country, especially for goods that cross borders.

- Payment Methods and Terms: International payments often involve various payment methods, including bank transfers, credit cards, or payment platforms like PayPal. Specify the payment terms clearly, including due dates, early payment discounts, and late payment penalties.

How to Use Spreadsheets for International Transactions

Spreadsheets offer several advantages for managing cross-border transactions:

- Multiple Currency Support: You can create columns for different currencies and use formulas to convert between them using live exchange rate data.

- Customizable Payment Tracking: Track payment due dates, amounts paid, and outstanding balances, ensuring you can quickly follow up on overdue payments.

- Regulatory Compliance: Include sections for tax calculations, duties, and other compliance-related information, ensuring that your documents meet legal requirements in each country involved.

By using spreadsheets effectively, you can simplify the complexities of international trade, maintain accurate financial records, and reduce errors, all while ensuring smooth transactions across borders.

Updating Your Proforma Invoice Template in Excel

As your business evolves, so should the documents you use to manage transactions. Regular updates to your transaction record formats ensure that they remain aligned with changing business needs, industry standards, and legal requirements. Keeping your records current helps improve accuracy, reduce errors, and enhance the professional appearance of your documents.

Here are several steps to effectively update your document structure:

Steps to Update Your Transaction Records

- Review and Assess Changes: Start by reviewing your existing document format. Identify areas that need updating, whether it’s new fields, adjusted layouts, or more comprehensive tracking options. Make sure it aligns with your current business operations and customer needs.

- Incorporate New Fields: If there are additional details you now need to capture, such as new product/service categories, customer preferences, or new tax rules, add these fields to the layout. Ensure that the added information is clearly labeled and easy to understand.

- Adjust for Compliance: Legal requirements often change, especially regarding tax rates, international trade regulations, or payment terms. Be sure to incorporate any necessary updates that comply with local laws or industry standards.

- Optimize for Usability: Simplify the structure by removing unnecessary fields or sections. Ensure the layout is easy to navigate, especially if it will be used by employees or customers who may not be familiar with your business’s internal processes.

Advanced Tips for Streamlining Updates

- Use Dynamic Formulas: To reduce manual calculations, implement formulas that automatically adjust totals based on input data, such as calculating discounts, taxes, or payment balances.

- Template Versioning: Keep track of different versions of your document. This allows you to revert to a previous version if needed and helps you keep a history of changes made over time.

- Design for Mobile and Print: Ensure your document is easily readable both on screen and in print. If you’re sending records electronically, consider optimizing for mobile devices to ensure clients can view them on various platforms.

Updating your documents regularly ensures that you maintain control over your business processes, improve communication with clients, and stay compliant with any changing regulations. Regular adjustments allow you to continue running your business efficiently and professionally.