Free Formal Invoice Template for Professional Billing

In any business, managing payments effectively is crucial to maintaining cash flow and ensuring smooth operations. One of the key components of this process is having a well-organized document that outlines the services or products provided, their costs, and the terms for payment. These documents help both businesses and clients stay on the same page, ensuring transparency and preventing misunderstandings.

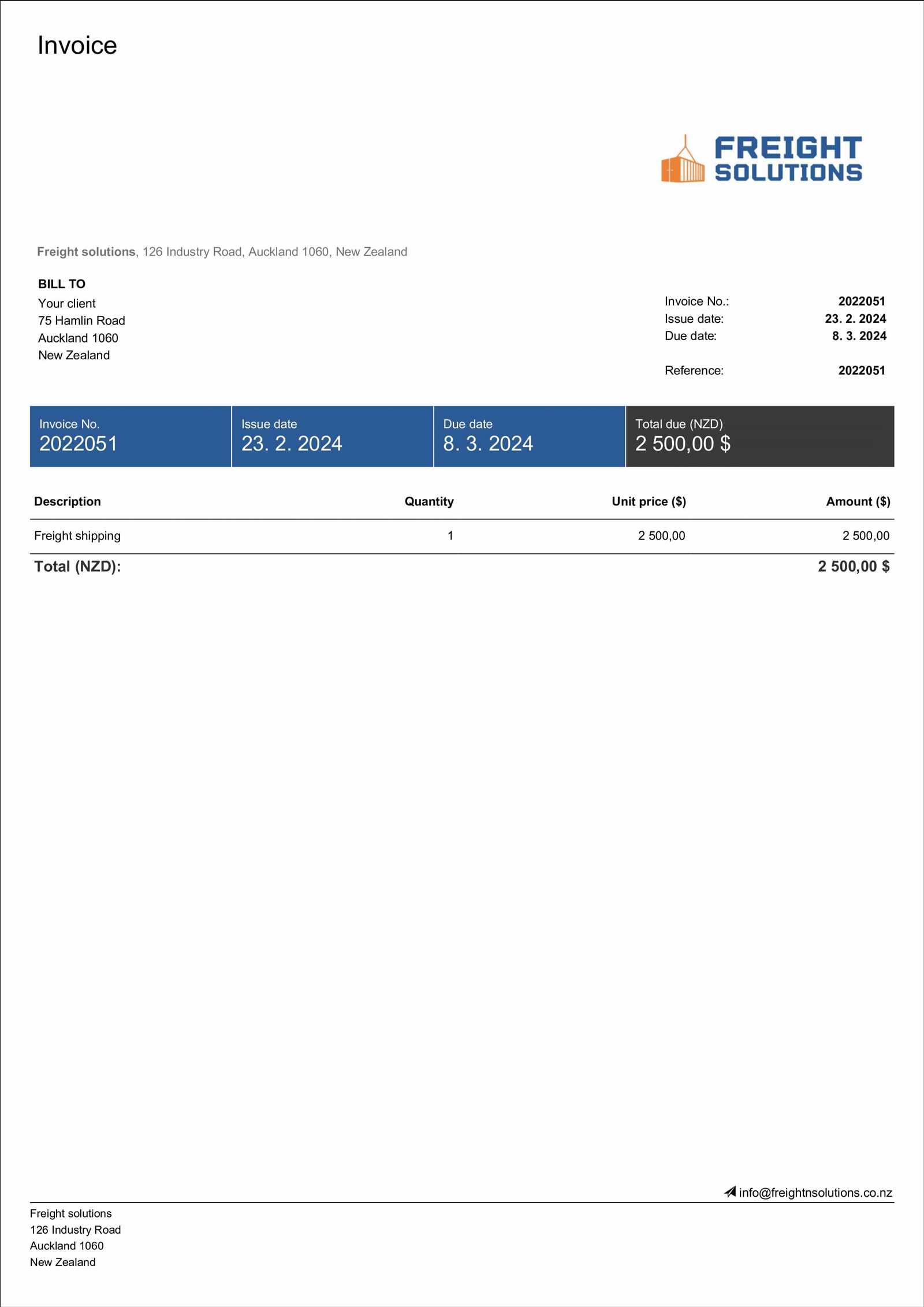

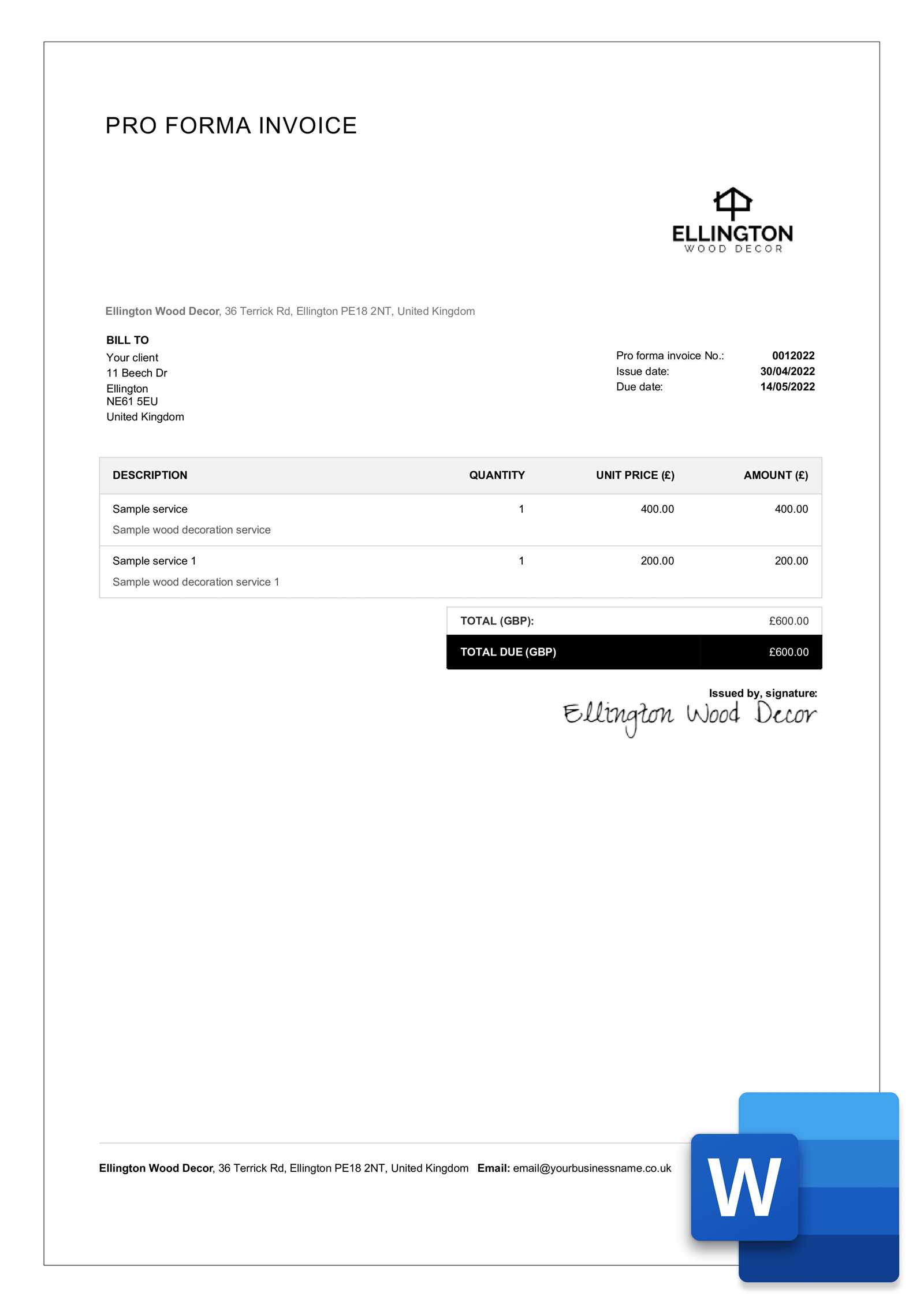

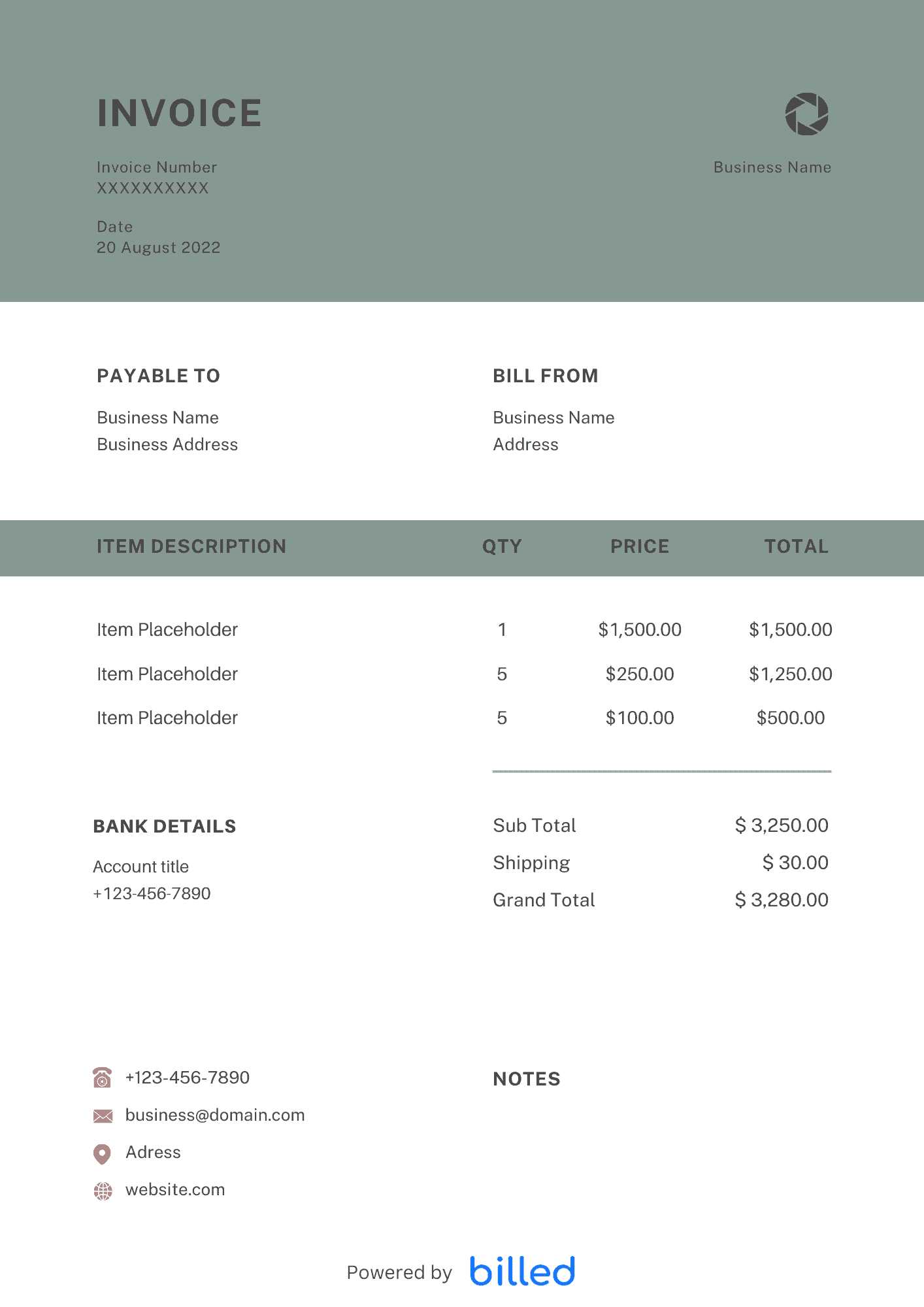

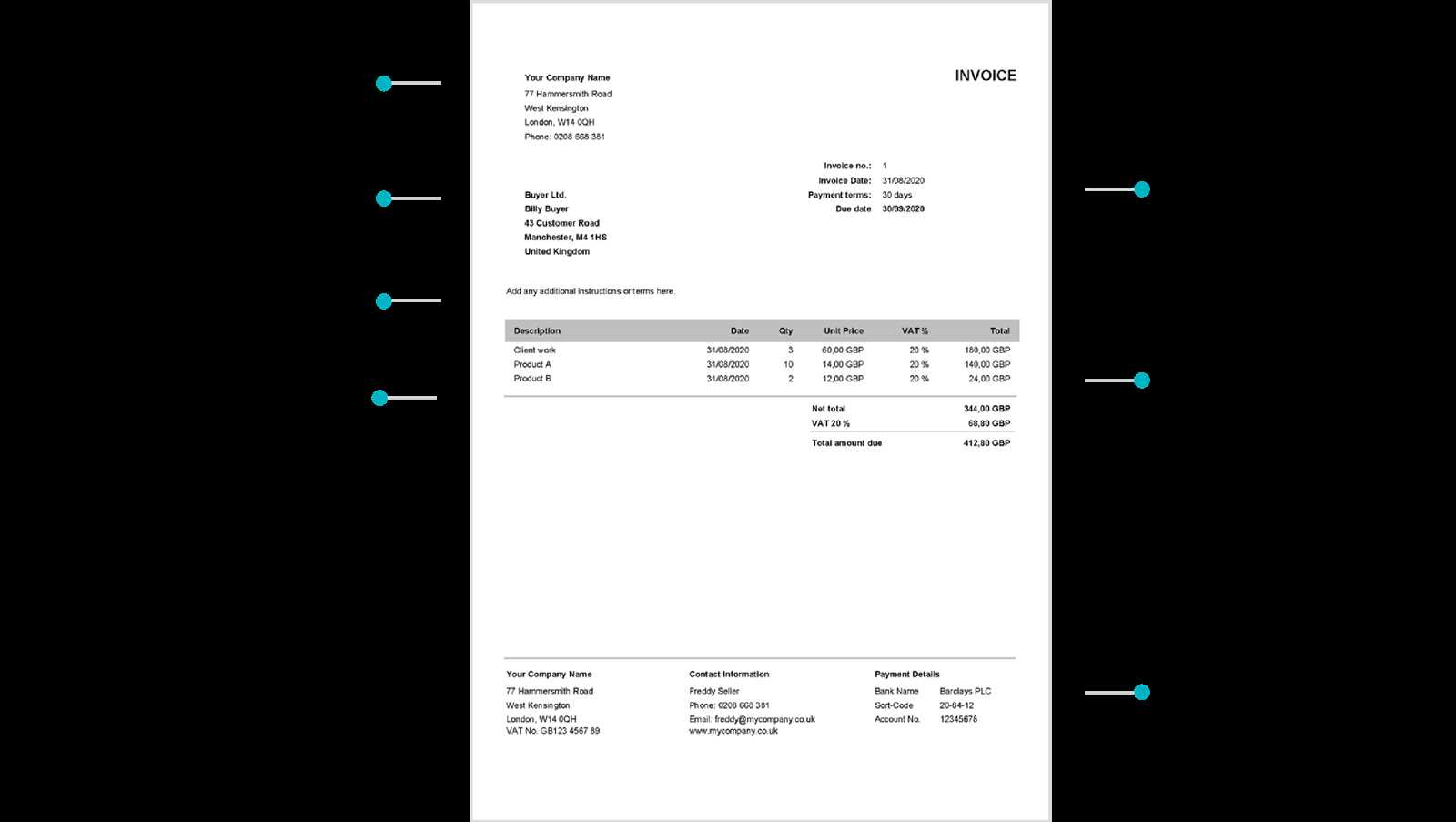

By using a well-structured form, you can streamline your financial transactions and present a polished, professional image to your clients. The right document should include all necessary details, such as the buyer’s and seller’s information, item descriptions, payment deadlines, and total amounts due. Customizing this tool to fit your specific needs can save time and reduce errors, allowing you to focus on growing your business.

Whether you are an independent freelancer, a small business owner, or part of a larger organization, having a consistent and reliable method for creating these documents is essential. With the right resources, you can produce these materials quickly and efficiently, ensuring they meet both your standards and those of your clients.

What is a Formal Invoice Template

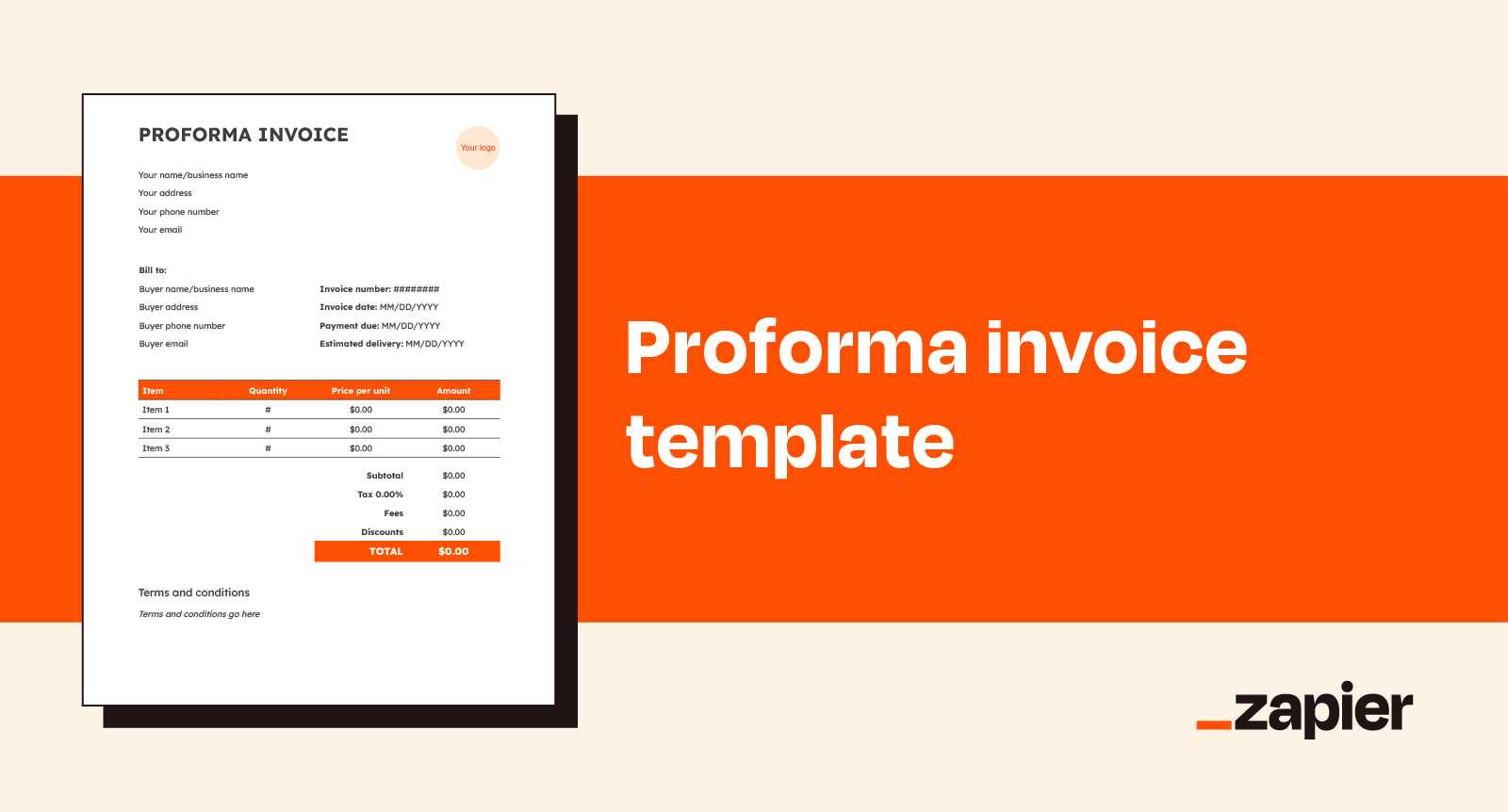

In business transactions, having a clear and organized document that specifies the details of a sale or service is essential for both the seller and the buyer. This document serves as a formal record, outlining the goods or services provided, the cost, and the terms for payment. It is a key part of maintaining transparency and professionalism in financial dealings.

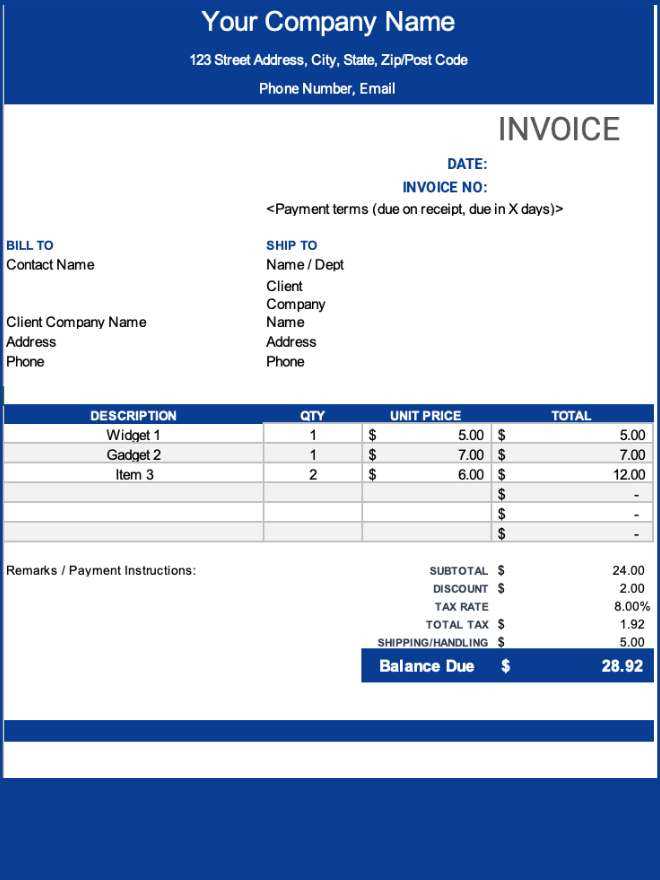

A well-designed billing document ensures that all necessary information is included, such as the names of the involved parties, dates, item descriptions, quantities, and payment instructions. By using a preformatted structure, businesses can reduce the chances of mistakes and ensure that their documents are both consistent and legally compliant.

Key Features of Such Documents

The most important elements of this type of document include clear sections for the client’s and business’s details, a breakdown of services or products, and the total amount due. It also typically includes payment terms, such as deadlines and accepted methods of payment. A proper structure ensures that both parties understand the terms of the transaction and what is expected from them.

Benefits of Using a Pre-designed Format

Using a standardized structure saves valuable time by eliminating the need to create a new document from scratch for each transaction. This approach also helps businesses present a professional image and ensures that all legal and financial requirements are met. Whether for a one-time project or ongoing work, this document is a vital tool for tracking payments and ensuring that agreements are clearly defined.

Benefits of Using a Formal Invoice Template

Utilizing a pre-designed structure for billing documents offers numerous advantages for businesses of all sizes. By relying on a consistent and efficient format, companies can streamline their financial processes, reduce the risk of errors, and ensure a professional appearance in every transaction. Below are some key benefits of using such a structured approach:

- Time-saving: With a ready-made format, businesses can quickly generate billing documents without needing to start from scratch each time.

- Consistency: A standardized layout ensures that all details are presented in the same manner across multiple transactions, making it easier to track and manage finances.

- Professionalism: Using a polished, well-organized document reflects positively on your business and builds trust with clients.

- Accuracy: A pre-built structure helps to minimize mistakes by including all necessary fields and eliminating the possibility of forgetting important information.

- Legal Compliance: Many billing documents include specific legal requirements, and using a format that incorporates these details helps ensure that your documents are compliant with industry standards.

Incorporating a structured approach not only simplifies the process but also improves communication with clients and partners, making it easier to manage and review financial records.

How to Create a Formal Invoice

Creating an organized and clear billing document is essential for any business transaction. This document should outline the services or products provided, their cost, and the terms of payment in a simple yet professional manner. Following a few key steps ensures that all necessary details are included and that the document meets both business and legal standards.

To create an effective billing document, start by including essential information such as:

- Seller and Buyer Information: Include the names, addresses, and contact details of both the service provider and the client.

- Unique Identification Number: Assign a unique reference number to the document for easy tracking and future reference.

- Description of Goods or Services: List the items or services provided along with their quantities and unit prices.

- Amount Due: Clearly display the total amount due, including taxes and any discounts, if applicable.

- Payment Terms: Specify the payment due date, acceptable payment methods, and any late payment penalties.

Once these elements are included, review the document for accuracy before sending it to the client. A clear, well-organized billing document not only helps ensure timely payments but also builds trust and professionalism with your clients.

Essential Elements of a Formal Invoice

For any billing document to be effective, it must contain specific information that clearly outlines the transaction details. This ensures that both the service provider and the client have a clear understanding of the terms, payments, and expectations. A well-structured document not only aids in smoother financial processes but also helps to maintain a professional image and avoid potential disputes.

Here are the key elements that every billing document should include:

- Header Information: This includes the business name, logo, and contact information at the top of the document. It helps identify the sender clearly.

- Client Information: Include the name, address, and contact details of the client receiving the bill. This ensures that the document is directed to the correct party.

- Unique Reference Number: Assigning a unique number to each document helps with tracking and organizing past transactions.

- Description of Products or Services: Provide a detailed list of the goods or services provided, along with quantities, unit prices, and any relevant codes or identifiers.

- Amounts and Totals: Clearly show the cost of each item or service, any applicable taxes, and the final amount due. This helps both parties understand the payment expectations.

- Payment Terms: Define the payment due date, the method of payment accepted, and any penalties for late payments or early payment discounts.

- Footer Information: Include any additional information, such as bank account details, tax ID numbers, or business registration information, as required by law.

Including these critical elements ensures clarity and transparency, helping avoid any confusion and ensuring smooth and timely payments.

How to Customize Your Invoice Template

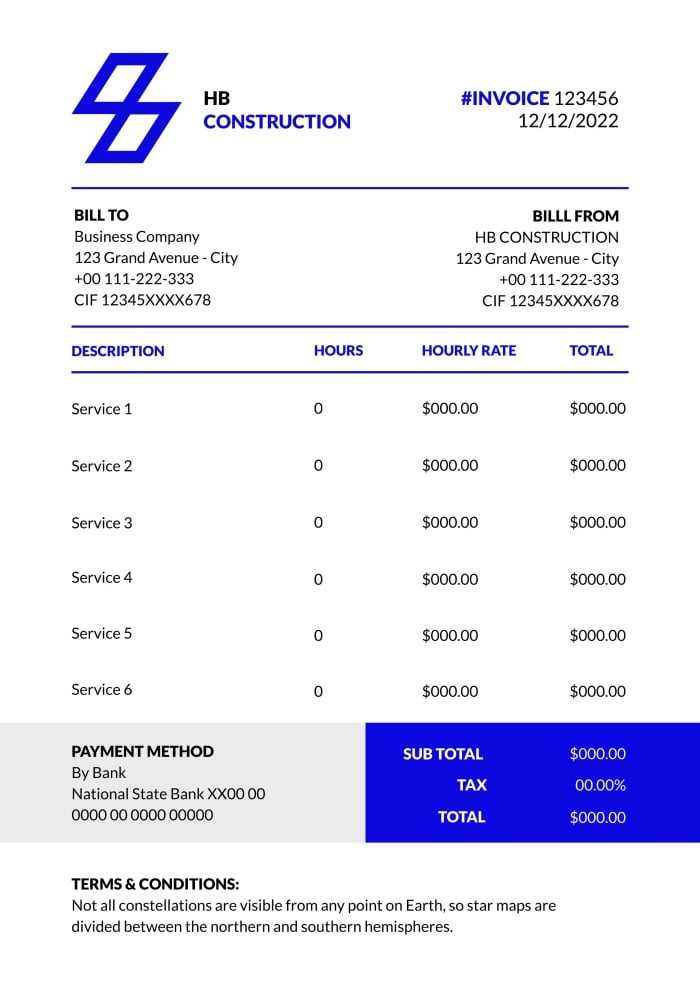

Tailoring your billing document to fit the unique needs of your business is crucial for maintaining consistency and professionalism. Customization not only makes your documents more personal but also ensures that all relevant details are accurately reflected. By adjusting various elements, you can create a document that aligns with your brand identity while meeting your specific financial and legal requirements.

Personalizing the Layout

One of the first steps in customization is adjusting the layout to suit your business style. You can choose colors, fonts, and logos that reflect your brand. This helps create a professional appearance that is instantly recognizable to clients. Most software allows for easy manipulation of the header, footer, and content sections, so you can position the details in a way that makes the document clear and easy to read.

Adding Business-Specific Information

While basic details like the client’s contact information and transaction specifics are necessary, you may also want to include additional business-related sections. This could include payment terms, discount offers, or specific notes about the project or service. Adding customized fields like your tax ID number or payment instructions can further enhance the document’s completeness and clarity.

By adjusting these elements, you ensure that every billing document you send out is fully aligned with your business processes, helping to build trust and professionalism with your clients.

Free Formal Invoice Templates Online

Finding the right resources to create billing documents doesn’t have to be expensive. There are many free tools and pre-designed formats available online that allow businesses to easily generate professional, accurate documents. These resources can save you time and effort, ensuring that your transactions are clearly outlined and easy to manage, without the need for costly software or design services.

Where to Find Free Resources

Many websites offer free downloadable or editable formats that can be customized for your business needs. Some popular platforms include:

- Online Accounting Tools: Many accounting platforms offer free billing document generators with customizable features.

- Document Creation Websites: Sites like Google Docs or Microsoft Word provide free, easy-to-use formats that can be modified to suit your style.

- Freelance Resource Websites: Websites targeting freelancers often offer a range of free templates tailored to different industries.

Advantages of Using Free Online Resources

Using free resources offers several key benefits, including:

- Cost-effective: No need to invest in expensive software or hire a designer.

- Time-saving: Pre-designed formats allow for quick creation without starting from scratch.

- Ease of Use: Most free resources are simple to edit and require no technical expertise.

By leveraging free online resources, businesses can streamline their financial processes while maintaining a professional appearance in every transaction.

Choosing the Right Invoice Template

Selecting the right document format for billing purposes is crucial for maintaining professionalism and ensuring clarity in financial transactions. The right structure not only makes the process easier for you but also improves the experience for your clients. Whether you’re working with a small or large business, it’s important to pick a format that suits your needs, is easy to customize, and aligns with your branding.

Factors to Consider When Choosing

When deciding on a billing document format, consider the following factors to ensure it fits your business and operational needs:

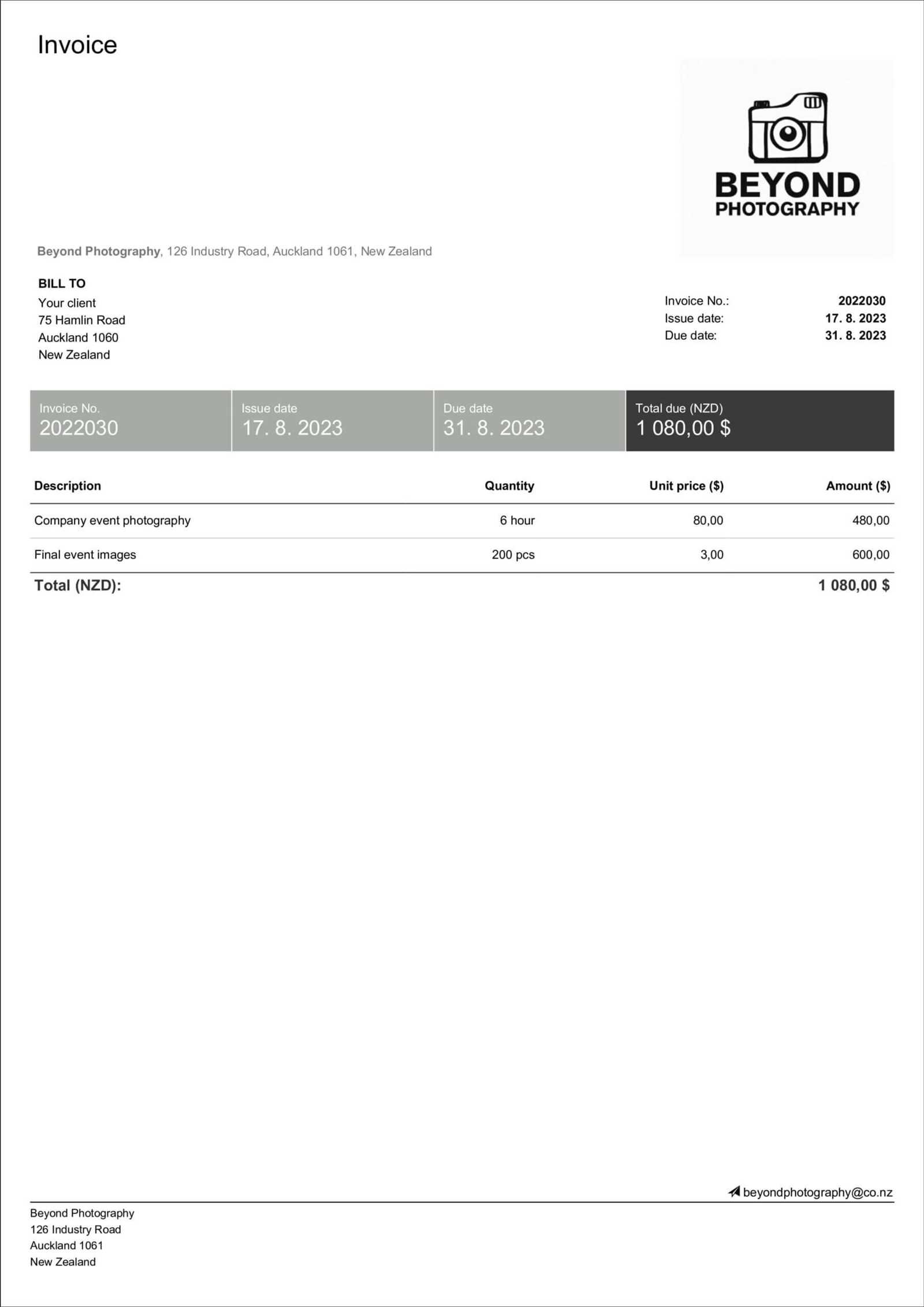

- Business Type: Depending on whether you’re a freelancer, a small business, or part of a larger corporation, the level of detail and complexity required in the document may vary.

- Design and Layout: Choose a layout that is clean, easy to read, and reflects your brand identity. A professional-looking document can leave a lasting impression on your clients.

- Customization Options: Ensure that the format you choose can be easily modified to fit different types of transactions, whether it’s a one-time service or a recurring contract.

- Legal and Tax Requirements: Depending on your location and industry, certain legal or tax details may need to be included, such as VAT numbers or payment terms. Make sure the format allows for these elements.

Choosing Based on Client Preferences

It’s also important to consider how your clients prefer to receive and process billing documents. Some clients may prefer a simple, straightforward format, while others might require a more detailed breakdown of charges. Offering a flexible structure that can cater to varying client needs will help foster better business relationships and ensure smooth payments.

By taking these factors into account, you can select the most suitable format that ensures efficient processing, meets legal requirements, and aligns with your branding and client expectations.

Tips for Professional Invoicing

Maintaining a high standard for your billing documents is key to ensuring smooth financial transactions and projecting a professional image to your clients. A well-crafted document not only helps ensure timely payments but also fosters trust and strengthens business relationships. By following a few simple practices, you can elevate your invoicing process and avoid common pitfalls.

Key Practices for Effective Billing

Here are some essential tips for creating professional and reliable billing documents:

- Be Clear and Concise: Ensure that all details are presented in a straightforward manner. Avoid using complex language or unnecessary jargon that might confuse your client.

- Include All Relevant Details: Double-check that all fields–such as client information, description of goods or services, amounts, and payment terms–are filled out accurately and completely.

- Set Clear Payment Terms: Specify the payment due date and acceptable methods of payment. Make sure to include any late fees or early payment discounts to avoid confusion later.

- Use Professional Design: A clean, well-organized format reflects professionalism. Choose simple layouts with clear headings and easy-to-read fonts to ensure your document looks polished.

- Maintain Consistency: Use the same structure for every document you send to clients. Consistency builds trust and helps you keep track of your transactions more easily.

Additional Tips for Streamlined Billing

To further enhance your invoicing process, consider these additional practices:

- Use Digital Tools: Online platforms and accounting software can automate and streamline the creation of billing documents, saving you time and reducing the risk of errors.

- Send Invoices Promptly: Aim to send your documents as soon as the work is completed or the product is delivered. Delaying the billing process can lead to delayed payments.

- Keep Records Organized: Keep track of all your sent documents and payments. An organized record system helps avoid confusion and makes it easier to follow up on overdue payments.

By following these tips, you can create billing documents that not only meet your business needs but also contribute to a more professional, efficient, and client-friendly experience.

Invoice Template for Small Businesses

For small businesses, having a reliable and easy-to-use billing document is essential for maintaining professional relationships and ensuring timely payments. A well-structured form helps you communicate clearly with your clients, provides a record of your transactions, and makes managing finances much simpler. Whether you’re just starting or have been in business for years, using a clear and efficient structure can save you time and reduce errors.

Why Small Businesses Need a Reliable Billing Format

As a small business owner, it’s important to streamline your billing process so you can focus on growing your business. A good billing document not only serves as proof of transaction but also helps you maintain a professional image, which is crucial for client retention. Additionally, consistent use of a structured format ensures that you don’t miss any important details, such as payment terms or taxes, which can lead to confusion or delays.

Key Features for Small Business Billing Documents

When choosing a format for your business, here are some key elements to include:

- Client and Business Information: Make sure both your details and your client’s contact information are clearly visible at the top of the document.

- Unique Reference Number: Assign a number to each document to keep track of all transactions and make future references easy.

- Clear Breakdown of Services: List the products or services provided, their quantities, unit prices, and any applicable taxes or discounts.

- Payment Terms: Clearly outline the payment due date and methods, as well as any penalties for late payments or incentives for early payment.

By creating a simple yet professional billing document, small businesses can improve their payment collection process, minimize errors, and present a polished image to clients.

Common Mistakes in Invoice Creation

Creating accurate and professional billing documents is crucial for businesses to maintain smooth cash flow and avoid misunderstandings with clients. However, mistakes in the document can lead to delays in payments, confusion, or even legal issues. Being aware of common errors can help businesses improve their invoicing process and ensure they meet all financial and legal requirements.

Frequently Encountered Errors

Here are some of the most common mistakes made when creating billing documents:

- Missing or Incorrect Contact Information: Not including the correct client or business details, such as addresses or contact numbers, can cause delays in communication and payment processing.

- Incorrect Payment Terms: Failure to specify payment due dates, late fees, or acceptable payment methods can lead to confusion and disputes about when and how payments should be made.

- Omitting Taxes or Discounts: Forgetting to include taxes or not applying agreed-upon discounts can result in discrepancies between what the client expects to pay and the total amount due.

- Unclear Descriptions of Goods or Services: Vague or incomplete descriptions of the products or services provided can create misunderstandings or disputes regarding the charges.

- Failure to Number Documents: Not assigning a unique reference number to each document can make it difficult to track transactions or resolve payment issues efficiently.

How to Avoid These Mistakes

To prevent these errors, always double-check your documents for accuracy and completeness before sending them to clients. Use a consistent format, clearly list all necessary details, and ensure that your payment terms are unambiguous. A careful and thorough approach to creating billing documents will help foster better relationships with clients and ensure timely payments.

How to Automate Invoice Generation

Automating the creation of billing documents can save businesses significant time and reduce the risk of human error. By using software tools and platforms, businesses can streamline the process, ensuring that all necessary details are included and calculations are accurate without manual intervention. Automation also ensures consistency across all transactions and improves efficiency in tracking payments and managing financial records.

Steps to Automate Your Billing Process

Here are the steps you can take to automate the generation of your billing documents:

- Choose the Right Software: Select a platform or tool that suits your business needs, whether it’s accounting software or a specific billing management system. Many tools offer customizable features that allow you to set up recurring billing, automatic calculations, and pre-defined templates.

- Set Up Client Profiles: Input your clients’ details into the system, such as their name, address, payment terms, and preferred payment methods. Once set up, these details will automatically populate in future documents, saving you time.

- Automate Calculations: Use software that can automatically calculate totals, apply discounts, and include taxes. This reduces the risk of errors and ensures that your calculations are consistent across all transactions.

- Establish Recurring Billing: If you provide services on a regular basis, set up recurring invoices that will be generated automatically on a set schedule. This is particularly useful for subscription-based businesses or ongoing contracts.

Benefits of Automation

By automating your billing process, you can:

- Save Time: Automation reduces the time spent on manual data entry and document creation, freeing up more time for other business activities.

- Minimize Errors: Automated tools reduce the likelihood of human error, ensuring that all details, such as amounts and dates, are correct.

- Improve Cash Flow: With automated reminders and recurring billing, you’re more likely to receive payments on time, improving your overall cash flow.

Automating the billing process can help businesses stay organized, maintain accuracy, and ultimately improve their financial management.

Digital vs. Paper Invoices

When it comes to billing, businesses have two main options: digital documents or traditional paper-based ones. Both methods have their pros and cons, and the choice often depends on factors such as the size of the business, client preferences, and available resources. Understanding the differences between the two options can help businesses make informed decisions about how they handle financial transactions.

Advantages of Digital Billing Documents

Digital billing offers numerous benefits that make it a popular choice for many businesses:

- Cost-Effective: Sending electronic documents eliminates printing and postage costs, which can add up over time, especially for small businesses.

- Speed and Efficiency: Digital documents can be generated, sent, and received almost instantly, speeding up the payment process and improving cash flow.

- Environmentally Friendly: Using digital formats reduces paper waste, making it a more sustainable option for businesses that want to reduce their environmental footprint.

- Easy Record-Keeping: Digital records are easier to store, organize, and search, which helps with financial tracking and reporting.

- Automation: Digital systems can automate repetitive tasks such as sending reminders or recurring billing, reducing administrative workload.

Benefits of Paper-Based Billing

While digital methods are becoming increasingly popular, paper-based documents still offer some advantages, particularly for certain businesses or clients:

- Personal Touch: For some clients, receiving a physical document may feel more personal or professional. This can be especially true in industries where traditional methods are still the norm.

- Universal Accessibility: Not all clients or businesses are comfortable with digital documents, and paper invoices ensure that clients without internet access or technical skills can still receive and process the documents.

- Legal Considerations: In some jurisdictions, paper billing may still be required for certain tax or legal purposes. It’s essential to be aware of local regulations before switching entirely to digital formats.

Both methods offer advantages, so the best approach depends on the specific needs of the business and its clients. Many businesses are now choosing a hybrid approach, offering both digital and paper options depending on client preference.

How to Handle Late Payments in Invoices

Late payments are a common challenge for many businesses and can significantly affect cash flow. When payments are delayed, it can lead to financial strain and disrupt your ability to meet your own obligations. Knowing how to handle these situations professionally is key to maintaining a healthy business relationship with your clients while ensuring that you are paid on time.

Steps to Address Late Payments

Here are some steps you can take to manage overdue payments effectively:

- Set Clear Payment Terms: From the outset, make sure your payment terms are clearly defined in every document. Specify the due date, accepted payment methods, and any applicable late fees. This will set expectations and provide a reference point if payments are delayed.

- Send Gentle Reminders: If a payment is overdue, send a friendly reminder email or message as soon as possible. Often, clients may have simply forgotten or missed the due date. A polite, professional reminder can prompt immediate payment.

- Establish a Late Fee Policy: Consider implementing a late fee structure for overdue payments. Clearly communicate this policy upfront, so clients are aware of the consequences for late payments. This provides an incentive for timely payments and compensates for any inconvenience caused by delays.

- Offer Payment Plans: If a client is facing financial difficulties, consider offering a payment plan. This can help ensure that you still receive payment, albeit in installments, while maintaining a positive relationship with the client.

How to Escalate When Necessary

If a payment remains unpaid despite reminders, there are additional steps you can take to resolve the situation:

- Follow Up with a Formal Letter: If informal reminders don’t work, consider sending a more formal letter or email outlining the overdue amount, payment terms, and any late fees. This communicates the seriousness of the situation and can often prompt action.

- Involve a Collection Agency: As a last resort, you may need to involve a collection agency or take legal action to recover the debt. However, this should be a final step after all other options have been exhausted.

Managing late payments is an essential part of maintaining a healthy business. By setting clear expectations

Legal Requirements for Invoices

Ensuring that your billing documents meet legal requirements is crucial for maintaining compliance and avoiding potential disputes. Depending on the country or jurisdiction, certain information must be included in all financial documents to be valid for tax, legal, and accounting purposes. Failing to include these mandatory details could lead to complications with tax authorities or clients.

Key Legal Information to Include

While requirements may vary based on your location, most jurisdictions require certain pieces of information in order to consider your document legally valid. Below is a general list of essential elements:

| Element | Description |

|---|---|

| Business Information | Include your business name, address, and registration number. This helps identify you as a legitimate business entity. |

| Client Details | The name, address, and contact information of your client must be present for identification purposes. |

| Unique Reference Number | Assign a distinct reference number to each document to ensure proper record-keeping and tracking of payments. |

| Description of Goods or Services | Clearly describe the products or services provided, including quantities, unit prices, and any applicable terms or conditions. |

| Total Amount Due | The total amount due, including taxes, fees, and any discounts applied, must be clearly stated. |

| Tax Information | Include applicable tax rates and the total tax amount. Some jurisdictions require a tax identification number for both the seller and the buyer. |

| Payment Terms | Specify the due date for payment, accepted payment methods, and any penalties for late payments. |

By ensuring these key elements are included, you can avoid complications with both your clients and tax authorities. Additionally, it’s essential to stay updated on any changes in local tax laws or regulations that could impact your documentation requirements.

How to Track Payments with Invoices

Keeping track of payments is an essential part of managing your business’s finances. Properly tracking each transaction ensures that all payments are accounted for, helps you stay on top of outstanding balances, and provides a clear record for future reference. By using an organized system to monitor payments, you can streamline your financial operations and reduce the risk of missed or delayed payments.

Methods for Tracking Payments

There are several effective ways to track payments against your billing documents. Here are some key strategies to help you stay organized:

- Use a Payment Log: Keep a detailed record of all incoming payments in a spreadsheet or accounting software. Note the payment date, amount, client name, and the corresponding reference number from the billing document to easily match it with the transaction.

- Set Up Payment Reminders: If a payment is overdue, set up reminders to follow up with clients. Automated reminders can be sent at regular intervals, ensuring that you don’t forget about outstanding payments.

- Monitor Payment Status: Maintain a system that clearly tracks the status of each transaction–whether it’s paid, pending, or overdue. This allows you to quickly identify any discrepancies and address them proactively.

Utilizing Accounting Software

For businesses looking to automate the tracking process, accounting software can be an invaluable tool. Most accounting platforms allow you to easily track payments, send invoices, and even generate financial reports. These tools can:

- Automatically update payment status: Once a payment is made, the software will update the status of your billing document.

- Send automated reminders: Set up automatic reminders for upcoming or overdue payments to keep clients informed.

- Generate payment reports: Accounting software can generate comprehensive reports on received payments, giving you a clear picture of your cash flow at any time.

By utilizing a combination of manual tracking or accounting tools, businesses can ensure that payments are properly monitored and that financial records remain accurate and up to date.

Design Considerations for Invoice Templates

The design of your billing documents plays a crucial role in ensuring clarity, professionalism, and ease of use for both you and your clients. A well-designed document not only makes it easier for clients to understand the details of the transaction but also reflects the quality and reliability of your business. When designing such documents, it’s important to consider layout, readability, and the inclusion of key information to avoid confusion and maintain a positive client relationship.

Here are some important factors to keep in mind when creating your documents:

- Clarity and Simplicity: A clean and simple layout ensures that all information is easy to find. Avoid cluttering the document with unnecessary graphics or excessive details that might distract from the essential content. Clear headings, well-organized sections, and ample white space can help improve readability.

- Branding and Customization: Incorporate your company logo, colors, and fonts to create a cohesive brand identity. This helps make the document instantly recognizable and reinforces your brand’s professionalism.

- Contact Information: Ensure that your business contact details are clearly visible, including your address, phone number, email, and website. Clients should be able to easily reach you if they have questions or need assistance.

- Consistency in Format: Using a consistent format across all your documents helps establish a professional image. This includes consistent fonts, spacing, and the way you present the pricing breakdown, payment terms, and other details.

- Mobile Compatibil