Top Invoice Template iPad App for Simple and Efficient Invoicing

Efficient billing solutions are essential for businesses of all sizes. The process of generating professional, accurate, and easily shareable financial documents can be time-consuming, especially for those constantly on the move. With the right tools, managing invoices, receipts, and other payment-related documents becomes simpler and faster. Today, there are many solutions that offer powerful features to automate this process, saving you valuable time and effort.

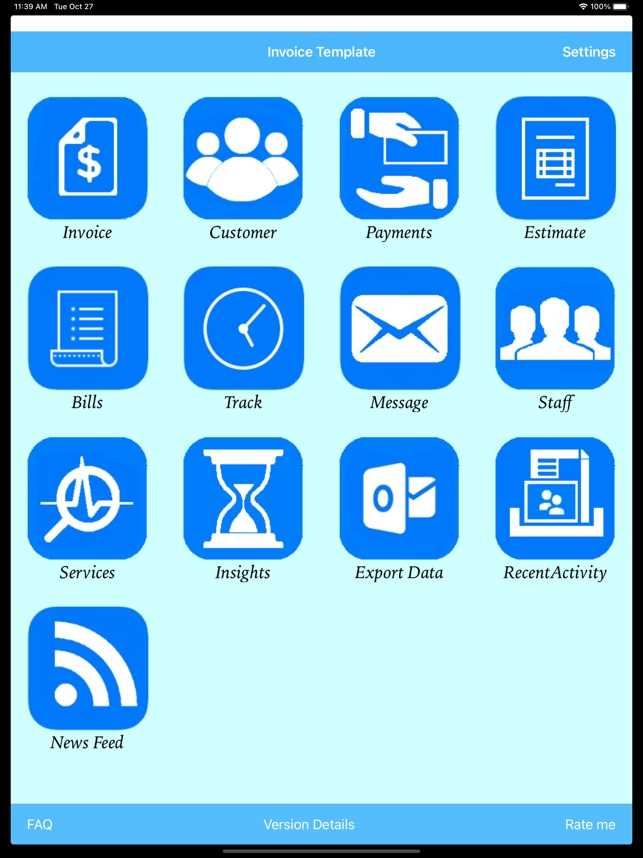

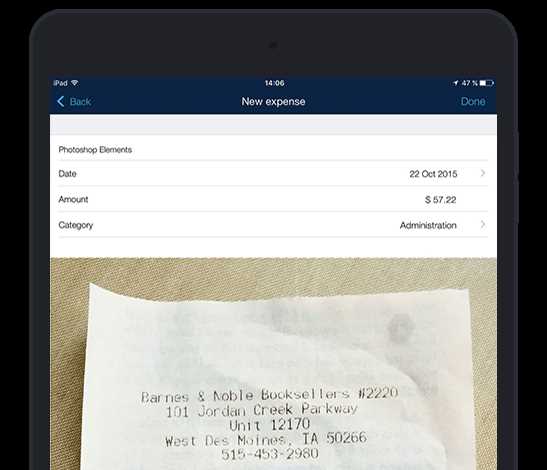

In particular, mobile tools have revolutionized the way we handle business transactions. With just a few taps, you can create, customize, and send payment requests directly from your device. These mobile solutions offer a wide range of templates, customization options, and integrations with other systems, all designed to make your financial management smoother and more professional. Whether you are a freelancer, a small business owner, or a large enterprise, the right tool can greatly enhance your efficiency.

Choosing the best mobile solution for managing financial documents depends on your specific needs. Features such as ease of use, customization flexibility, and compatibility with accounting software are key factors to consider. Whether you’re invoicing clients on the go or organizing your payments, there are numerous options available to suit various business requirements. The following guide will explore some of the top choices and key features to help you select the right solution for your business.

Best Billing Solutions for 2024

In 2024, the demand for efficient and mobile-friendly tools to manage financial documents is greater than ever. Professionals, freelancers, and small business owners are constantly looking for solutions that simplify the process of creating, customizing, and sending financial requests. With a wide variety of options available, choosing the right tool can be overwhelming. Below are some of the best solutions for managing business documents in 2024, offering robust features and user-friendly interfaces that make financial management easier and more efficient.

- QuickBooks – A well-known solution offering an intuitive interface, seamless integration with accounting systems, and customizable document options to streamline your financial workflow.

- Zoho Billing – Ideal for small businesses, this tool offers advanced features like automated reminders, recurring billing, and easy integration with other Zoho products.

- Invoice2go – A simple and easy-to-use option for freelancers and small businesses, this solution provides customizable designs and options for tracking payments and sending reminders.

- FreshBooks – Popular for its user-friendly design and professional-looking outputs, this platform offers invoicing, expense tracking, and time management features all in one place.

- PayPal Business – With built-in payment processing, this platform allows users to create professional financial documents and receive payments quickly and securely.

- Wave – A free, easy-to-use option for freelancers and small businesses that includes invoicing, expense tracking, and simple reporting features.

These solutions stand out due to their features, ease of use, and ability to integrate with other tools. Depending on your business needs, you can select one that best fits your requirements, whether you need advanced features like automatic payment reminders or a simple, straightforward system for generating professional documents on the go.

Why Use a Billing Solution App

Managing financial documentation efficiently is a critical task for businesses and freelancers alike. Without the right tools, creating and sending professional payment requests can become a time-consuming and error-prone process. Mobile solutions that offer ready-made formats for generating financial documents help save time and ensure consistency across all business communications. These tools simplify the workflow and provide the flexibility needed for professionals on the move.

Time and Efficiency

One of the primary benefits of using such a mobile solution is the significant time savings. By eliminating the need to manually design each document from scratch, you can quickly create professional records with just a few taps. Customization options allow you to include all necessary details while maintaining a consistent, branded look for your business. This allows you to focus on other important tasks while still keeping your finances organized.

Professional Appearance

For any business, maintaining a professional image is essential. These tools often come with a variety of sleek and polished designs that can be tailored to your specific needs. With clear, easy-to-read documents that follow best practices, clients are more likely to take your financial requests seriously. In turn, this can improve your reputation and help build trust with customers.

Additional features like automatic payment tracking, reminder notifications, and direct sharing options further enhance the benefits of using such mobile solutions. With these features, you can streamline your payment processes, minimize errors, and ensure a smoother financial workflow.

Top Features to Look for in Billing Solutions

When selecting a tool to manage financial documents, it’s essential to choose one that not only meets your needs but also improves your efficiency. The best solutions offer more than just basic functionality–they include features that simplify the process of creating, sending, and tracking payments. Here are some of the top features to consider when evaluating different options for managing your business transactions.

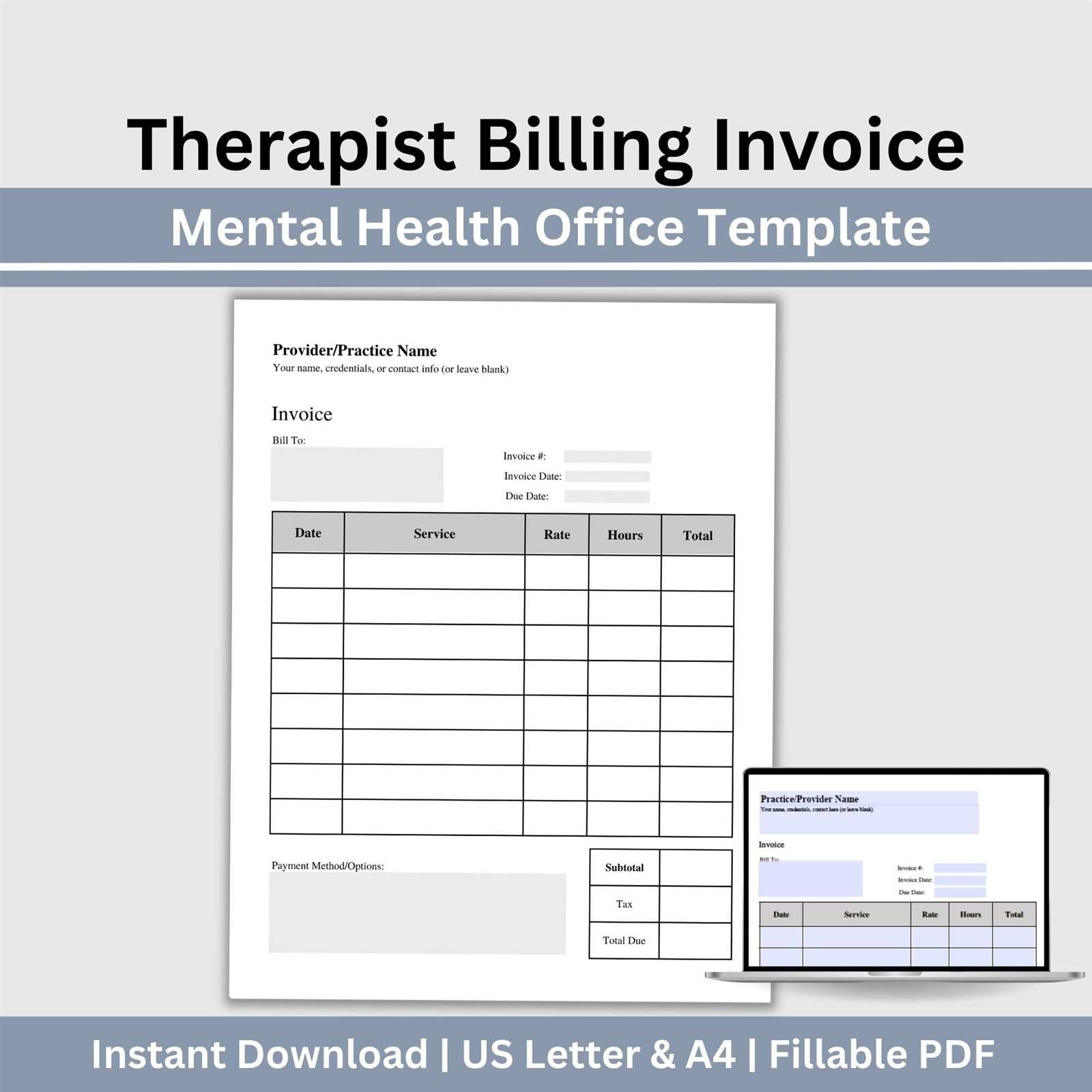

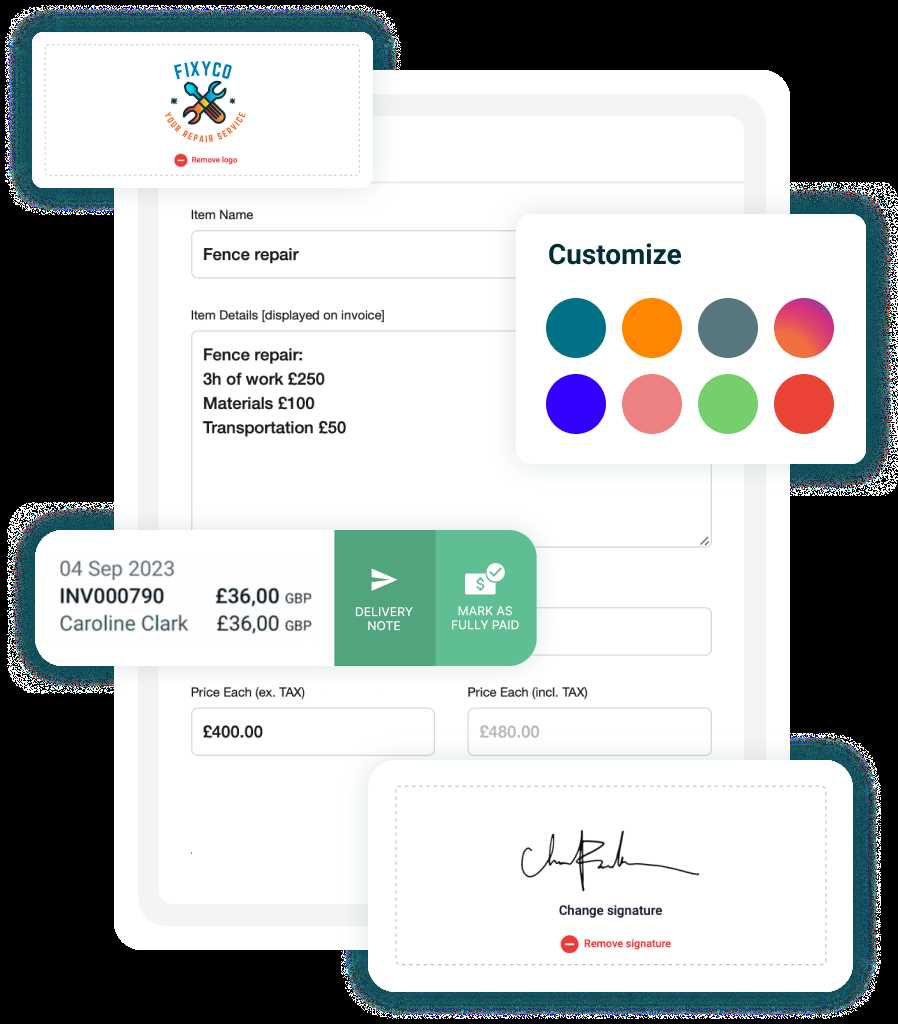

Customization Options

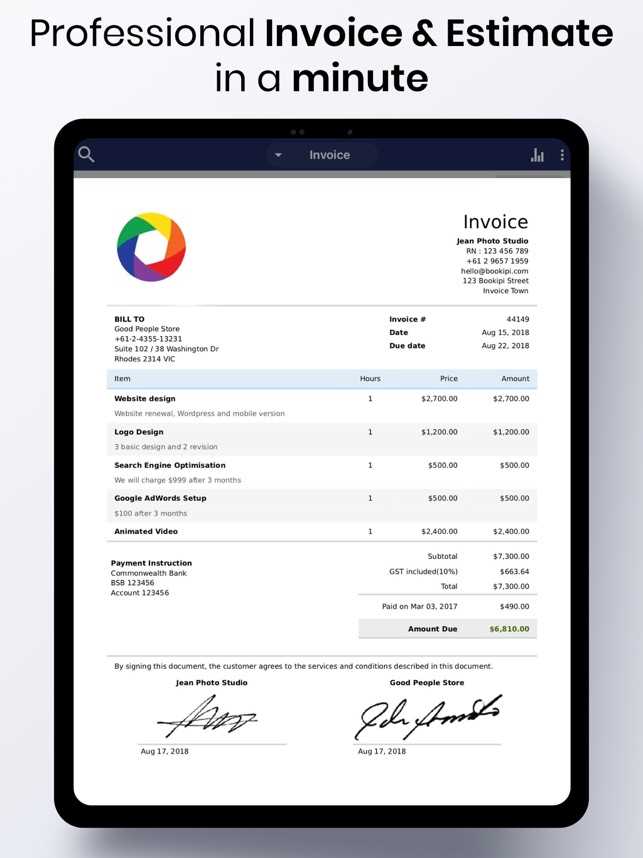

One of the key features to look for is the ability to tailor documents to suit your branding and business needs. Customization options such as adding your logo, choosing colors, and adjusting the layout can give your documents a professional and cohesive appearance. This helps create a consistent brand identity and ensures that your financial communications align with your company’s image.

Integration with Other Tools

Another critical feature is the ability to integrate with other business tools, such as accounting software, payment processors, or CRM systems. Integration streamlines the workflow, allowing data to flow seamlessly between platforms and reducing the chances of errors. This can help automate tasks such as payment tracking, reminders, and generating financial reports, ultimately saving you time and effort.

Other important features include automated reminders for overdue payments, the ability to create recurring charges, and the option to generate reports for financial tracking. These features enhance the functionality of your solution and contribute to a more efficient, error-free financial management process.

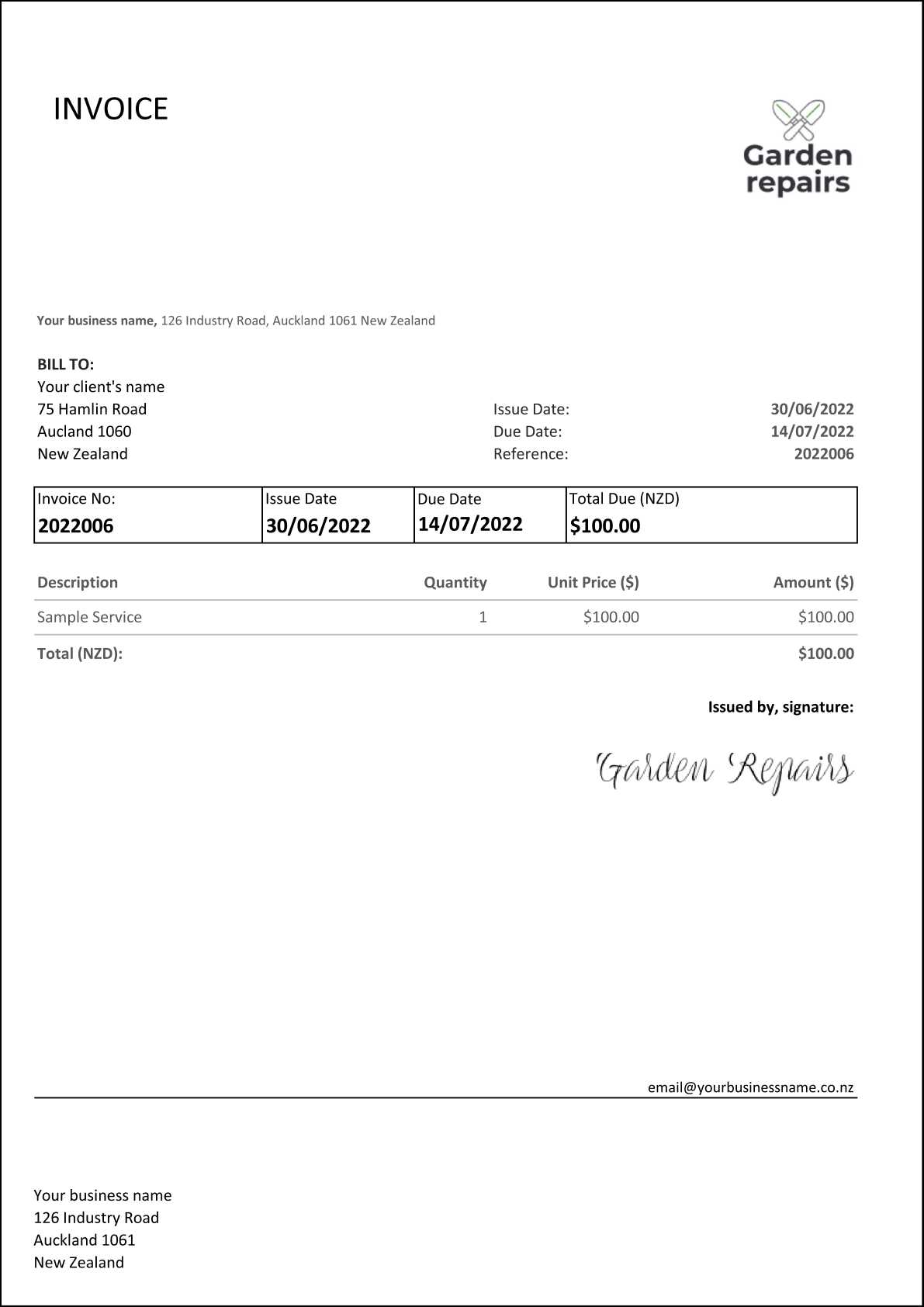

How to Choose the Right Billing Document Format

Choosing the right format for creating financial documents is a crucial step in streamlining your business operations. A well-designed structure not only enhances professionalism but also ensures that all necessary information is included clearly and accurately. The right format can save you time, reduce errors, and make managing payments more efficient. Here’s how to select the most suitable layout for your needs.

| Feature | Considerations |

|---|---|

| Customization | Look for options that allow you to add your business logo, contact details, and any specific branding elements. A personalized layout helps maintain a professional image. |

| Usability | The format should be easy to navigate and fill out. Make sure it’s user-friendly for both you and your clients to avoid confusion. |

| Clarity | Ensure the design is clear, with ample space for details such as product descriptions, quantities, and pricing. A clean, easy-to-read format reduces the risk of miscommunication. |

| Integration | If possible, select a format that can easily integrate with your accounting software or other business tools, making data entry and tracking simpler. |

| Payment Options | Choose a format that supports payment links or options for various payment methods, facilitating faster transactions and better cash flow management. |

By considering these factors, you can select the right format to meet your business needs, ensuring that your financial records are both professional and efficient.

Customizing Billing Documents on Your Mobile Device

Personalizing financial documents is an essential part of maintaining a professional appearance while ensuring that all necessary information is included. On mobile devices, customizing these documents is quick and easy, offering flexibility for businesses that require tailored formats. With the right tool, you can adjust the design and content of your documents to match your business branding and provide a consistent client experience.

Adjusting Layout and Design

Most solutions allow you to modify the layout of your document, providing options for text positioning, font styles, and overall structure. Customizing the design to align with your brand identity is simple–just add your business logo, choose your color scheme, and adjust the font size for clarity. This ensures that every document sent reflects your professional image.

Adding Essential Information

Customizing the content is just as important as the design. Make sure that all necessary fields, such as payment terms, itemized lists, and contact information, are clearly included. Many tools offer the ability to add custom fields, so you can tailor each document to suit the specific requirements of the transaction, whether you’re working with recurring payments, discounts, or special tax rates.

Advanced Features also allow for automatic calculations, such as taxes or discounts, which can be pre-programmed into your custom format. This reduces manual errors and speeds up the process of creating new documents.

Benefits of Using a Mobile Device for Billing

In the fast-paced world of business, the ability to manage financial documentation on the go is an essential advantage. Using a mobile device for handling payment records provides flexibility and efficiency, making it easier to stay organized and on top of financial tasks. Whether you’re in the office or on-site with a client, the convenience of managing transactions from a portable device helps you keep your workflow seamless and professional.

Portability is one of the key advantages. A mobile device allows you to create, edit, and send financial records anytime, anywhere. This mobility ensures that you never miss a deadline or forget to send important documents, even when you’re away from your desk or working remotely.

Ease of Use is another benefit. Mobile devices offer intuitive interfaces, making it simple to generate and customize documents quickly. With user-friendly tools, you can easily enter data, apply templates, and make adjustments without complicated steps, allowing you to focus more on the core aspects of your business.

Real-time Updates also make mobile solutions highly efficient. Changes made to documents can be saved and sent instantly, enabling you to keep clients informed and process payments faster. Additionally, many solutions integrate with cloud storage, ensuring that your records are always up-to-date and accessible from multiple devices.

How to Create a Billing Document on Your Mobile Device

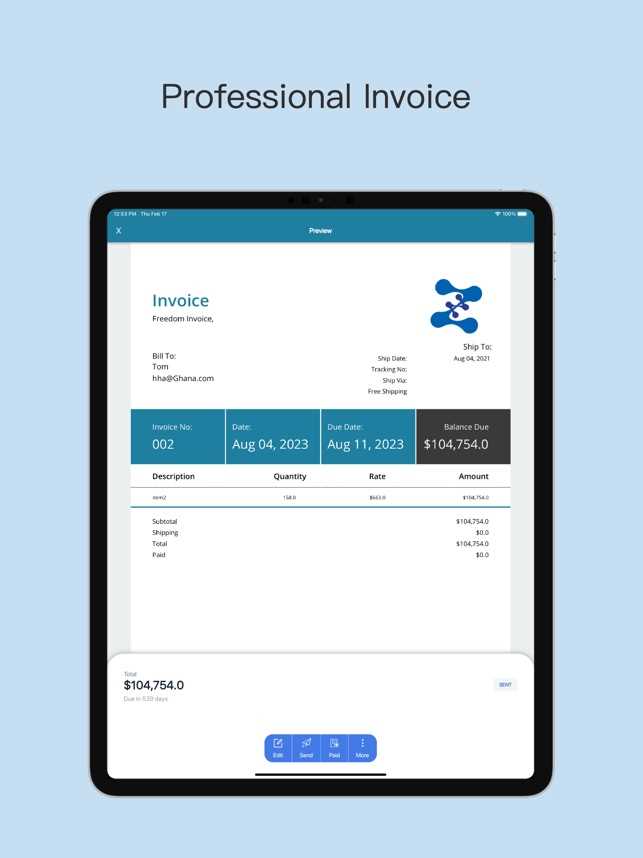

Creating a professional payment record on a mobile device is simple and efficient. Whether you’re a freelancer, small business owner, or part of a larger organization, the process can be done in just a few steps. With the right tools, you can generate a complete document in a matter of minutes, allowing you to send it to clients or save it for future reference.

Steps to Create a Billing Document

Follow these steps to easily create a financial document on your mobile device:

- Choose a Suitable Tool: Start by selecting a platform that offers the features you need for generating financial documents. Look for options that allow customization, tracking, and easy export.

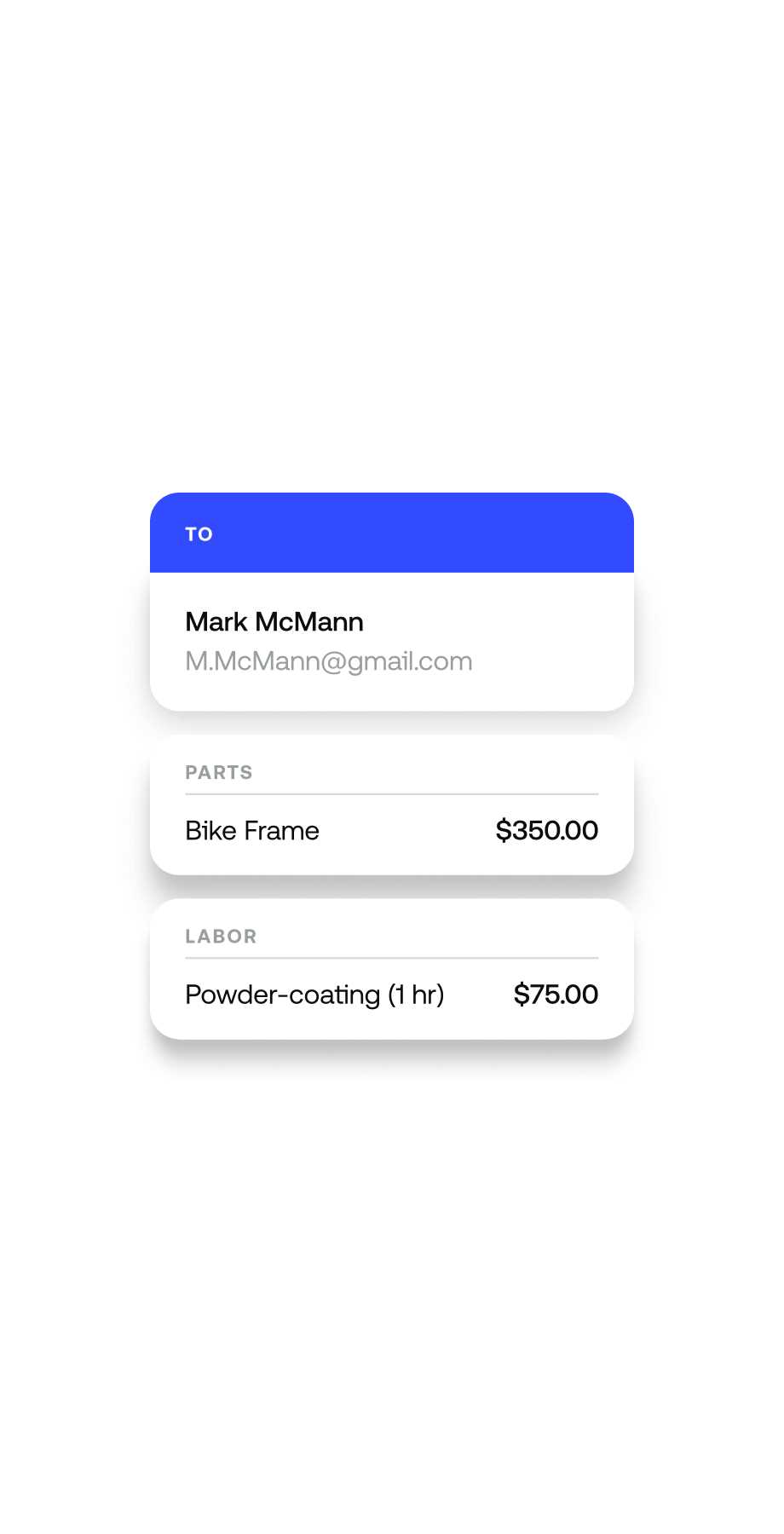

- Enter Client Information: Add the client’s name, contact details, and any relevant identifiers, such as a project number or order reference, to ensure accuracy.

- List Products or Services: Provide a detailed list of the services or products provided. Include descriptions, quantities, rates, and totals to make the document clear and transparent.

- Apply Payment Terms: Specify the terms of payment, including due dates, tax rates, and applicable discounts or late fees. This helps avoid any misunderstandings down the line.

- Review and Customize: Ensure all information is correct and customize the layout, if needed, to match your branding. Adjust the design, add your logo, and double-check the formatting.

- Send or Save: Once everything is set, send the document directly to the client via email or export it as a PDF for future reference.

Additional Tips for Creating Efficient Billing Documents

- Use Auto-Fill: Many tools offer the ability to save client information for future use, speeding up the creation process.

- Enable Payment Links: Some platforms allow you to add direct payment links, making it easier for clients to pay you immediately.

- Set Reminders: Set up automatic reminders to follow up with clients if payments are overdue.

By following these steps and tips, you can streamline the process of creating and managing financial records, saving you time and ensuring that all transactions are handled professionally.

How Billing Solutions Save Time and Money

Effective financial management tools are essential for saving both time and money. By automating repetitive tasks, streamlining processes, and reducing human error, these tools allow business owners to focus on growing their companies rather than spending valuable time on administrative work. Whether you’re managing a small business or working as a freelancer, the right solution can significantly improve your efficiency and bottom line.

Below are some of the key ways in which these solutions can help save resources:

| Benefit | How It Saves Time and Money | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Automation | By automating tasks such as sending reminders, calculating totals, and applying taxes, these tools eliminate manual work and reduce errors, helping you avoid costly mistakes. | |||||||||||||||||

| Instant Document Creation | Generating professional financial records is quick and easy, eliminating the need for time-consuming manual entry. This allows you to focus on other critical tasks while ensuring that documents are accurate and consistent. | |||||||||||||||||

| Streamlined Tracking | Integrated tracking features allow you to monitor payments and overdue balances in real-time, reducing the chances of missed payments and ensuring better cash flow management. | |||||||||||||||||

| Reduced Paperwork |

| Tool | Key Features | Best For |

|---|---|---|

| FreshBooks | Customizable documents, time tracking, automated reminders, and project management. | Service-based businesses and freelancers. |

| QuickBooks | Integration with accounting software, tax calculations, expense tracking, and invoicing. | Businesses needing full financial integration. |

| Zoho Invoice | Multiple currencies, payment reminders, customizable templates, and automated billing. | Small businesses with international clients. |

| Wave | Free solution with payment tracking, accounting integration, and receipt scanning. | Small businesses with a limited budget. |

| Invoicely | Recurring billing, multi-currency support, time tracking, and reports. | Business owners with recurring clients or projects. |

Choosing the Right Solution for Your Business

When selecting the best tool for your small business, consider factors like ease of use, required features, and the size of your client base. Some tools offer free basic versions, while others provide more robust features with paid plans. By carefully evaluating your needs, you can find a solution that

Can You Share Billing Documents Directly from Mobile Devices?

Sharing financial records with clients or team members is a crucial part of managing a business. Modern mobile solutions make it easy to send professional documents instantly, directly from your device. Whether you’re on the go or working remotely, these tools provide a fast and efficient way to share important details without the need for paper or additional software.

Methods to Share Documents Directly

Many mobile tools offer several options for sharing your financial documents directly. Here are the most common methods:

- Email: The most straightforward method is to send your document as an attachment via email. Most mobile solutions allow you to export the document in PDF or other standard formats, making it easy to share through email.

- Cloud Storage: Many tools integrate with cloud storage services like Google Drive, Dropbox, or iCloud. This allows you to store and share documents through secure links, providing easy access for clients and colleagues.

- Direct Link Generation: Some solutions offer the ability to generate a direct payment link, which can be shared via text, email, or social media for clients to make payments easily.

- Third-Party Integrations: Many billing tools integrate with third-party platforms like Slack or project management tools, making it easy to share documents within your business team or client network.

Why Direct Sharing Is Beneficial

Speed is one of the most significant advantages of sharing directly from your mobile device. You can quickly send documents without the delays of printing, scanning, or mailing. Additionally, sharing documents digitally helps ensure that your clients receive the information instantly, allowing them to take prompt action.

Convenience is another major benefit. Whether you are in the office, at a client meeting, or traveling, having the ability to share documents directly from your mobile device ensures that you can manage your business from virtually anywhere. No matter where you are, you can instantly provide your clients with the documents they need, improving customer service and operational efficiency.

With these capabilities, sharing documents has never been easier or more efficient. Modern tools streamline the process, ensuring that you can stay connected with your clients and manage your business wherever you are.

Securing Your Billing Documents on Mobile Devices

When it comes to managing financial records, security is paramount. Storing sensitive information on mobile devices requires careful attention to ensure that your documents are protected from unauthorized access, theft, or accidental loss. Fortunately, there are several steps and tools available to help secure your business records, ensuring that your data remains safe and confidential.

Best Practices for Securing Your Financial Documents

To safeguard your business documents, consider the following security measures:

- Use Strong Passwords: Set a strong password for your device to prevent unauthorized access. Make sure it is unique and difficult to guess, combining numbers, symbols, and both upper- and lowercase letters.

- Enable Two-Factor Authentication (2FA): Many mobile solutions offer two-factor authentication, which adds an extra layer of security by requiring a second form of verification (like a code sent to your phone) in addition to your password.

- Encrypt Your Documents: Use encryption tools to protect your files. Encrypting financial records ensures that even if someone gains access to your device, they will not be able to read the documents without the encryption key.

- Backup Your Data Regularly: Regularly back up your files to a secure cloud service or external storage. This protects your documents in case of device loss or failure, ensuring that you don’t lose any important records.

- Use Secure Cloud Services: Store your documents in secure cloud storage solutions with strong encryption and user authentication protocols, such as Google Drive or Dropbox. Ensure that your cloud storage provider has a good reputation for data security.

Additional Tips for Protecting Your Data

- Install Security Software: Consider using mobile security software that provides anti-malware protection, remote wipe capability, and device tracking in case it gets lost or stolen.

- Lock Specific Documents: Some tools allow you to lock individual documents with a password or PIN. This adds an extra layer of security, even if someone gains access to your device.

- Common Mistakes to Avoid with Billing Solutions

Using digital tools for managing financial records can significantly streamline your workflow, but it’s important to avoid common mistakes that can lead to inefficiencies, errors, or missed opportunities. Properly utilizing these solutions ensures that your transactions are accurate, your data remains secure, and your overall financial management remains organized. Below are some frequent missteps to be aware of and avoid.

Frequent Mistakes to Watch Out For

- Neglecting to Update Client Information: Failing to keep client details up to date can result in sending documents to incorrect addresses or using outdated contact information. Always verify and update your client list regularly to ensure accuracy.

- Overcomplicating Document Layouts: While customization options are often available, overly complicated or cluttered layouts can confuse clients. Keep your documents clear, professional, and easy to read.

- Forgetting to Set Payment Terms: Leaving out payment due dates or terms can cause confusion and delays. Always clearly state the payment deadline and any relevant conditions, such as late fees or discounts for early payments.

- Using Inconsistent Formats: Inconsistent formats across your documents can create confusion and look unprofessional. Stick to a standard format that is easy to read and ensures all necessary information is included consistently.

- Missing Follow-Up Reminders: Many tools offer automated reminders for overdue payments, but failing to activate or set them can result in late payments going unnoticed. Make sure your reminders are enabled and configured to send notifications automatically.

Additional Pitfalls to Avoid

- Not Backing Up Data: Relying solely on your mobile device for storing financial records without backing up can lead to data loss in case of hardware failure. Always back up your records to the cloud or external storage to protect them.

- Ignoring Security Features: Not taking full advantage of the security features offered by your solution, such as password protection or encryption, can expose your sensitive financial data to risks. Enable all available security options to protect your documents.

- Skipping Tax Calculations: Forgetting to account for tax rates or not setting up automated calculations can lead to errors in your financial documents. Ensure your system is configured to handle tax calculations correctly.

By staying aware of these common mistakes and actively avoiding them, you can make the most of your billing