Free Online Invoice Template for Seamless Billing

Managing finances is an essential aspect of running a business, and having the right tools to streamline the process can make a world of difference. With the right resources, it’s possible to generate polished, accurate payment requests quickly and efficiently. This not only saves valuable time but also helps maintain a professional image when dealing with clients and customers.

Whether you are an independent contractor or part of a growing business, having access to customizable forms for payment requests is crucial. These documents are designed to be simple yet detailed, ensuring all necessary information is included while also being easy to use. With modern solutions, creating such forms has never been more accessible.

Efficiency and professionalism are at the heart of these tools, allowing businesses of all sizes to manage their transactions seamlessly. By using a carefully designed structure, you can ensure your requests are clear, reducing misunderstandings and improving your cash flow management.

Free Invoice Templates for Your Business

For any business, having an efficient method for managing financial transactions is essential. There are a variety of tools available that help you create detailed and professional billing documents at no cost. These resources are designed to simplify the process, allowing entrepreneurs and companies to focus on growing their operations instead of getting bogged down by administrative tasks.

Why Choose These Tools

Using well-structured resources ensures that you can generate documents that meet the required standards, presenting a polished and organized appearance. These materials are especially useful for small businesses or freelancers who need to manage payments regularly but do not want to invest in expensive software. They allow you to quickly input essential details such as payment terms, itemized charges, and client information.

Key Features to Look For

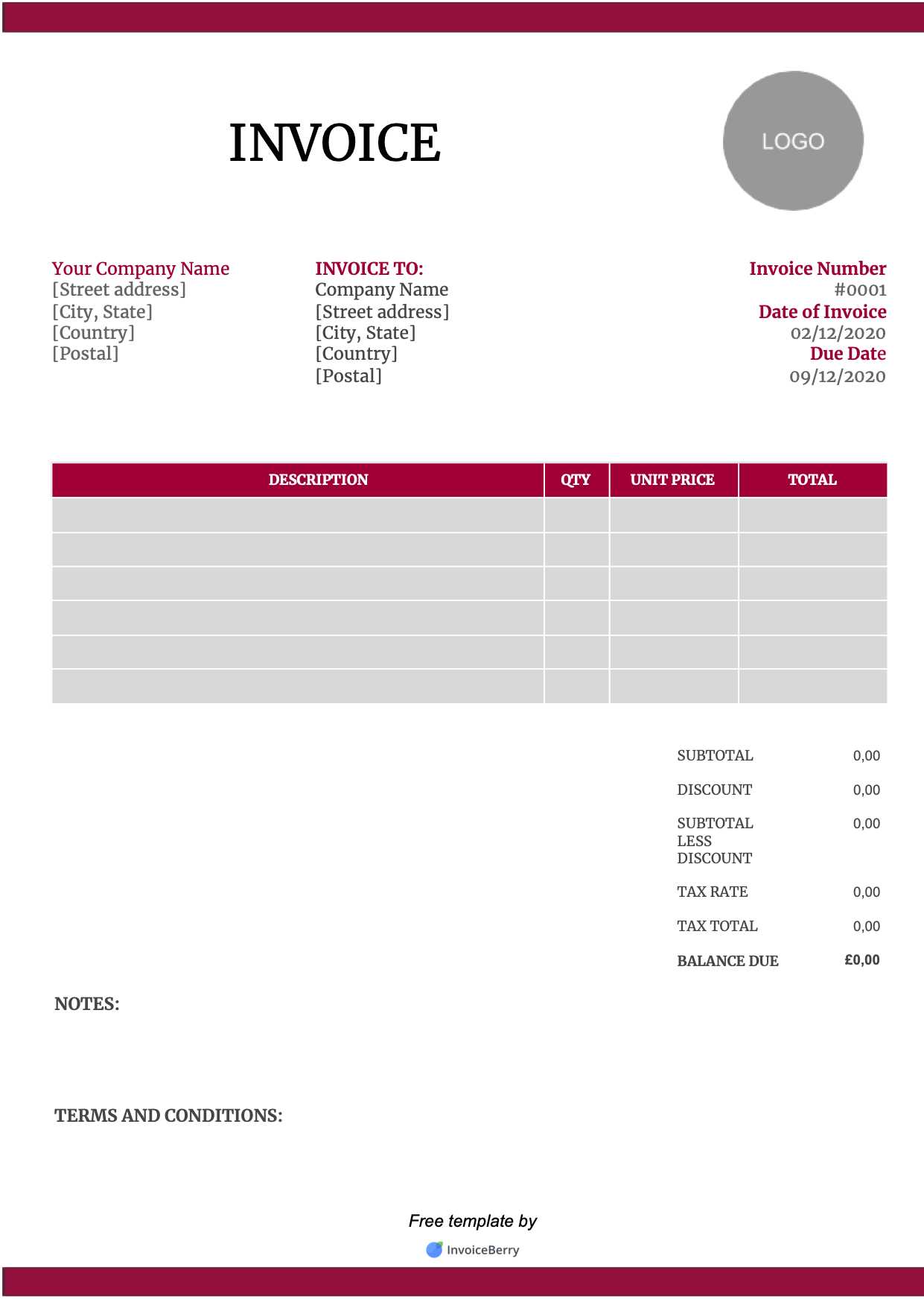

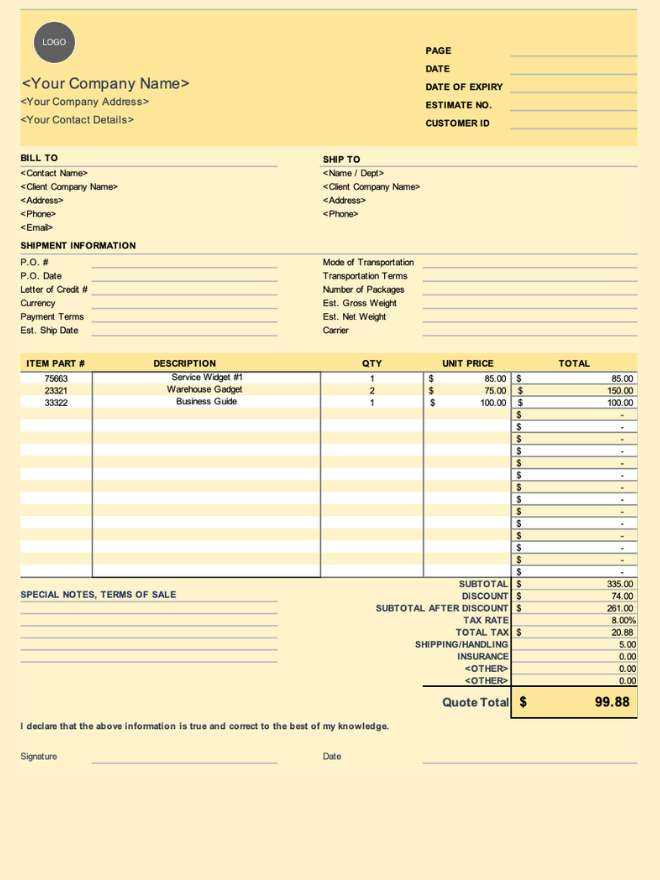

When selecting these resources, look for features that allow for customization and flexibility. Being able to adjust the design, layout, and content will help maintain consistency across your financial documents. Whether you need to add your company logo or modify payment terms, having an adaptable structure ensures that your documents always align with your brand.

Why Use an Online Invoice Template

Having a streamlined system for generating professional payment documents can save time, reduce errors, and enhance the overall client experience. These ready-made solutions allow you to quickly create well-structured records that meet the necessary standards for business transactions. Rather than starting from scratch, you can leverage pre-designed formats that are customizable to your needs.

- Efficiency: With a pre-built format, the process of generating billing documents is simplified. You don’t need to worry about layout, structure, or missing information.

- Accuracy: These tools help ensure that all the necessary fields are included, reducing the risk of mistakes and providing a clear outline of charges and terms.

- Professionalism: A polished document reflects well on your business and builds trust with clients, presenting your company as organized and reliable.

- Cost-Effective: Many of these solutions are available at no charge, offering small businesses and freelancers an affordable way to create professional-grade documents without additional expenses.

Additionally, using a standardized format makes it easier to track payments, maintain financial records, and ensure consistency across all your transactions. By implementing these tools into your business operations, you can focus on what matters most: growth and customer satisfaction.

How to Customize Your Invoice

Personalizing your billing documents ensures that they reflect your brand’s identity and meet your specific needs. Customization allows you to modify the design, structure, and content, making your records not only professional but also tailored to your business. With the right approach, you can create documents that are both functional and aligned with your company’s image.

Adjusting the Layout: One of the first steps in personalizing your billing records is selecting a layout that suits your style. Choose a clean, organized structure that makes it easy for clients to read and understand. You can arrange sections for services, dates, and charges in a way that is most intuitive for your audience.

Adding Your Branding: Incorporating your logo, brand colors, and business details adds a personal touch to your documents. This helps reinforce your company’s image and ensures consistency across all communications. Include your contact information and website address to make it easy for clients to get in touch.

Customizing Payment Terms: Adapt the payment terms to suit your specific agreements with clients. You can modify the due date, apply discounts for early payments, or outline penalties for late payments. This flexibility ensures that your billing system works for you and your clients.

With these adjustments, you can create a unique and professional record that not only serves its purpose but also strengthens your brand’s presence in every transaction.

Advantages of Free Invoice Templates

Utilizing accessible and pre-designed resources for generating billing documents can provide numerous benefits to businesses of all sizes. These tools help simplify the process, ensuring that professionals can create high-quality records without investing in expensive software. By using such solutions, you can save both time and money while maintaining accuracy and professionalism in every transaction.

Cost-Effectiveness

One of the primary advantages of these tools is their zero cost. Small businesses, freelancers, and startups can create professional-looking payment requests without the financial burden of purchasing costly software. This allows them to allocate their budget to other areas of growth and development.

Ease of Use

Many of these resources are designed to be user-friendly, requiring no advanced skills to operate. They provide simple interfaces that allow users to input necessary information and generate well-structured documents in just a few steps.

| Benefit | Explanation |

|---|---|

| Time-Saving | Quickly generate documents without manual formatting or design work. |

| Customization | Modify the content to fit your business’s specific needs, from payment terms to layout. |

| Professional Quality | Produce clear and polished documents that reflect your brand’s identity. |

| Consistency | Ensure uniformity across all your financial documents, helping to establish trust with clients. |

These advantages allow businesses to manage their financial transactions more efficiently while projecting a professional image to clients and customers alike. By leveraging these accessible tools, you can simplify your administrative work and focus more on growing your business.

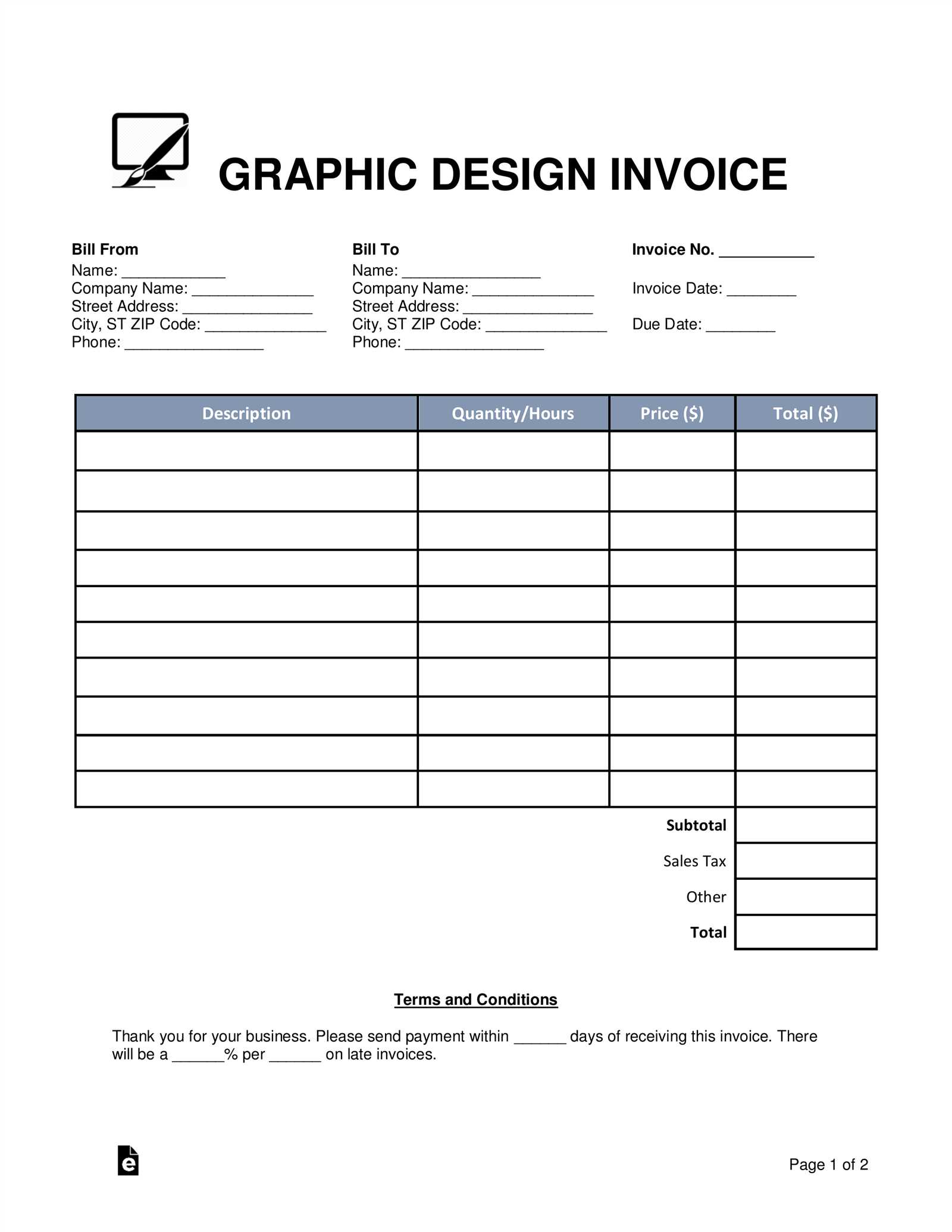

Best Free Invoice Templates Available

When it comes to generating billing documents, having access to high-quality resources can make the process faster and more efficient. Various tools are available that allow you to create professional, customized records without any cost, making them perfect for small businesses or freelancers. These solutions offer different styles and features to suit the needs of various industries and payment models.

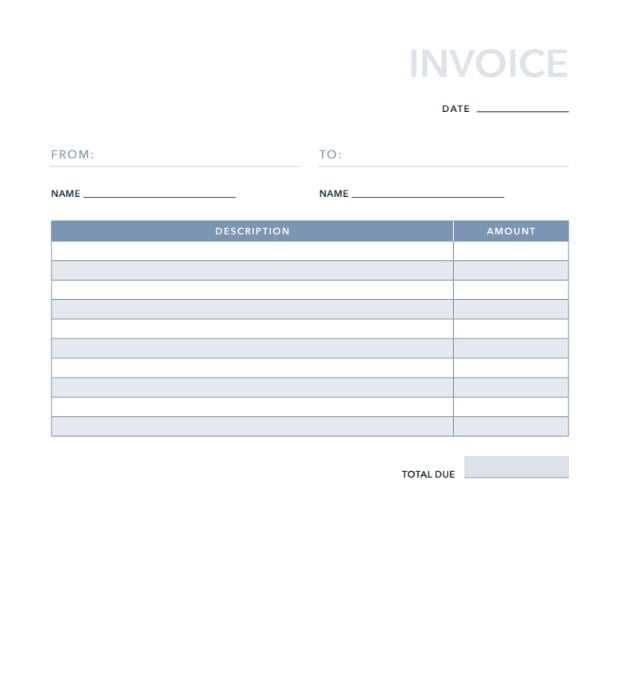

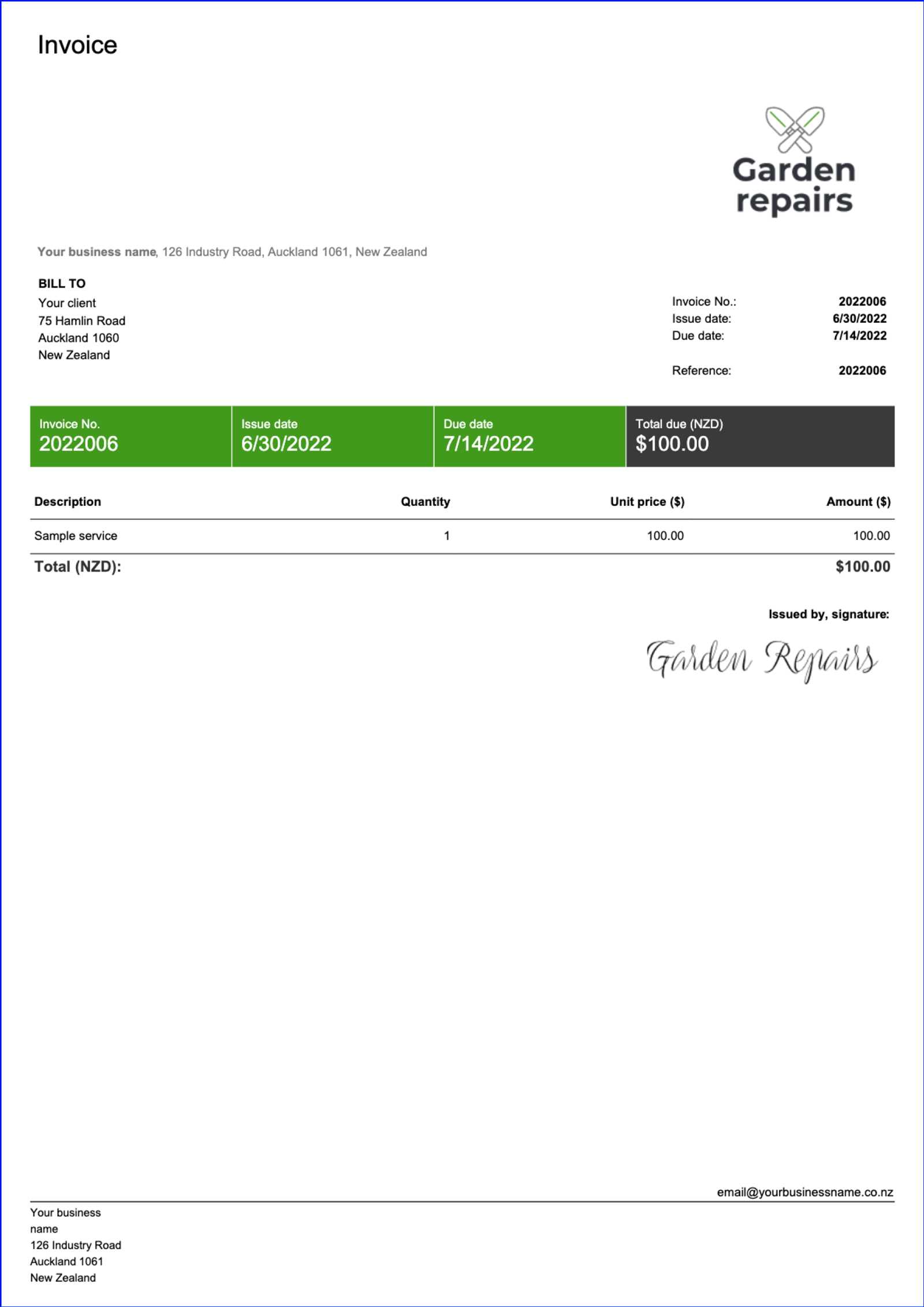

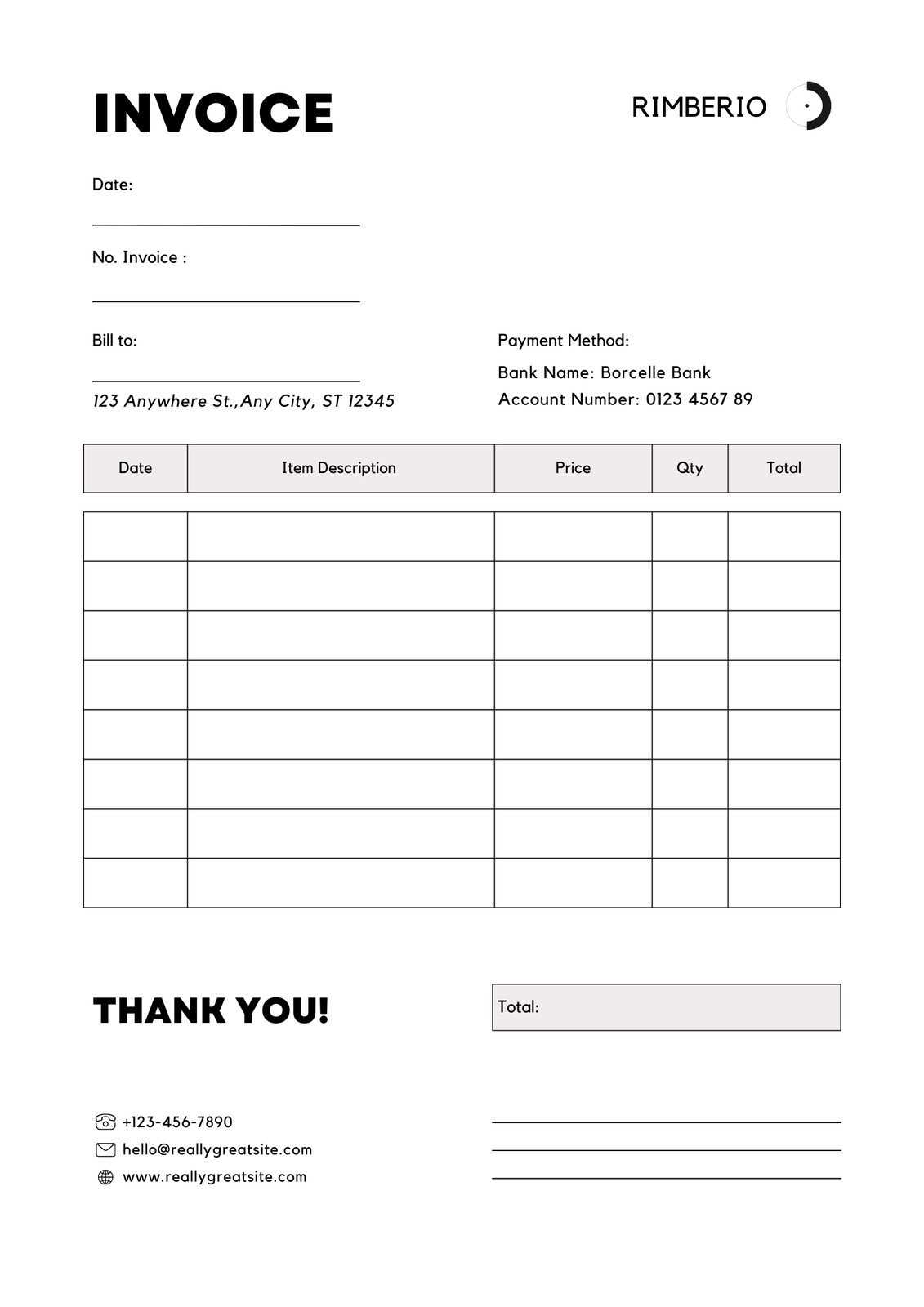

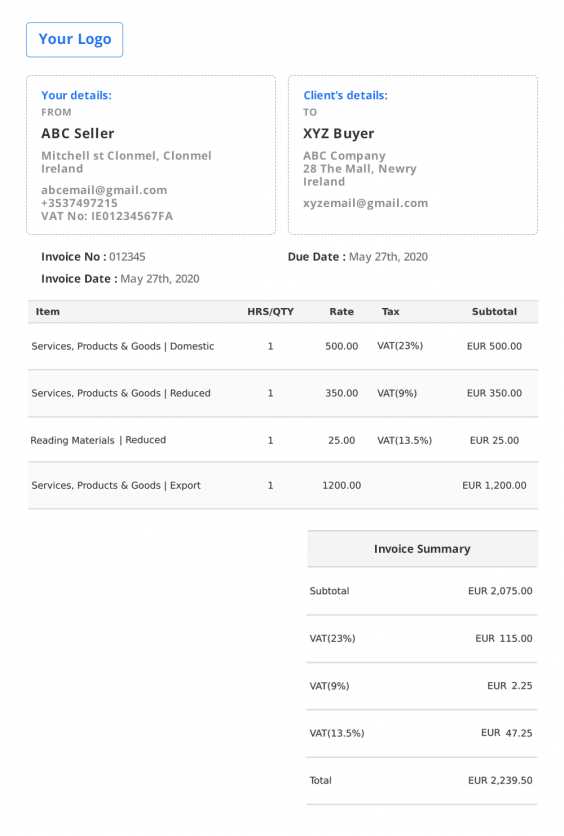

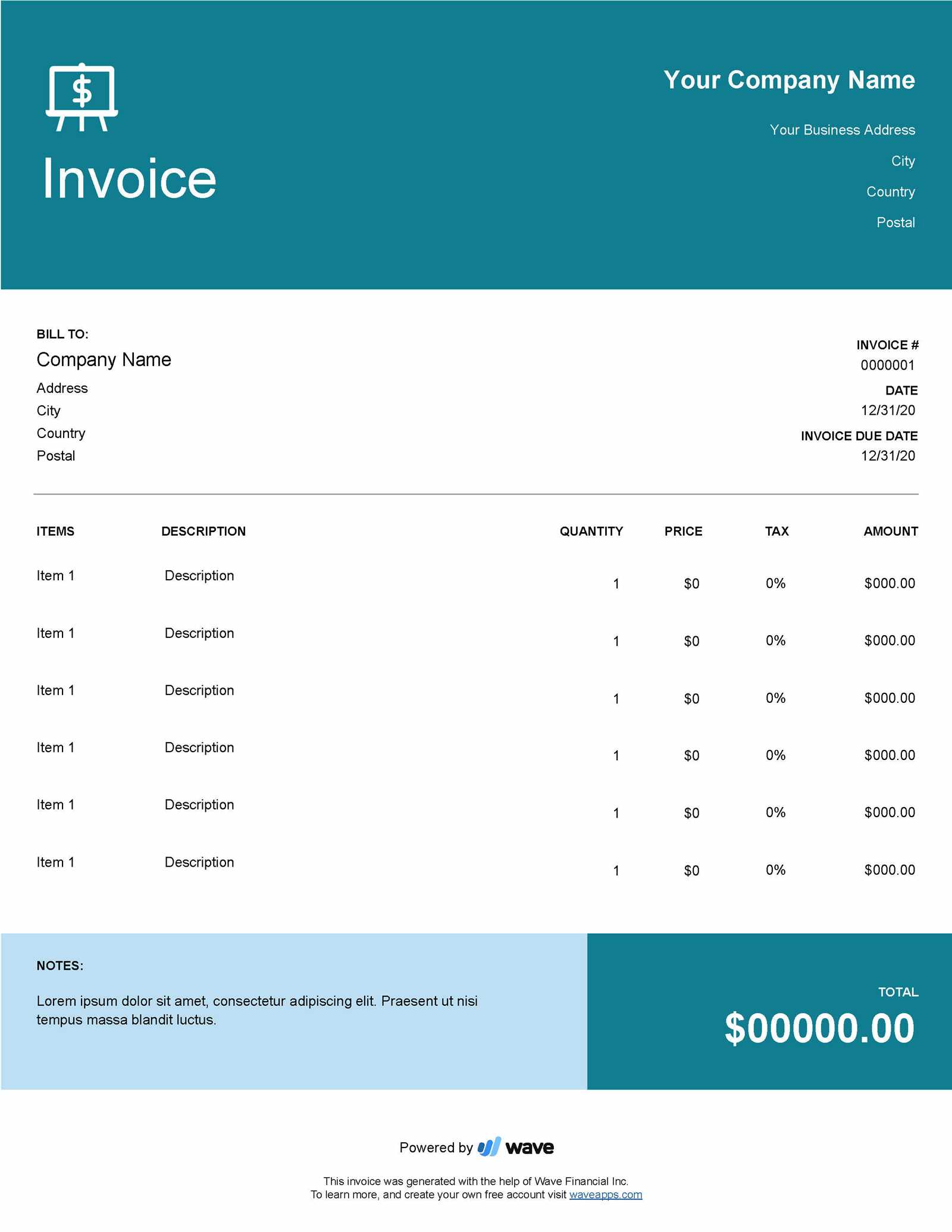

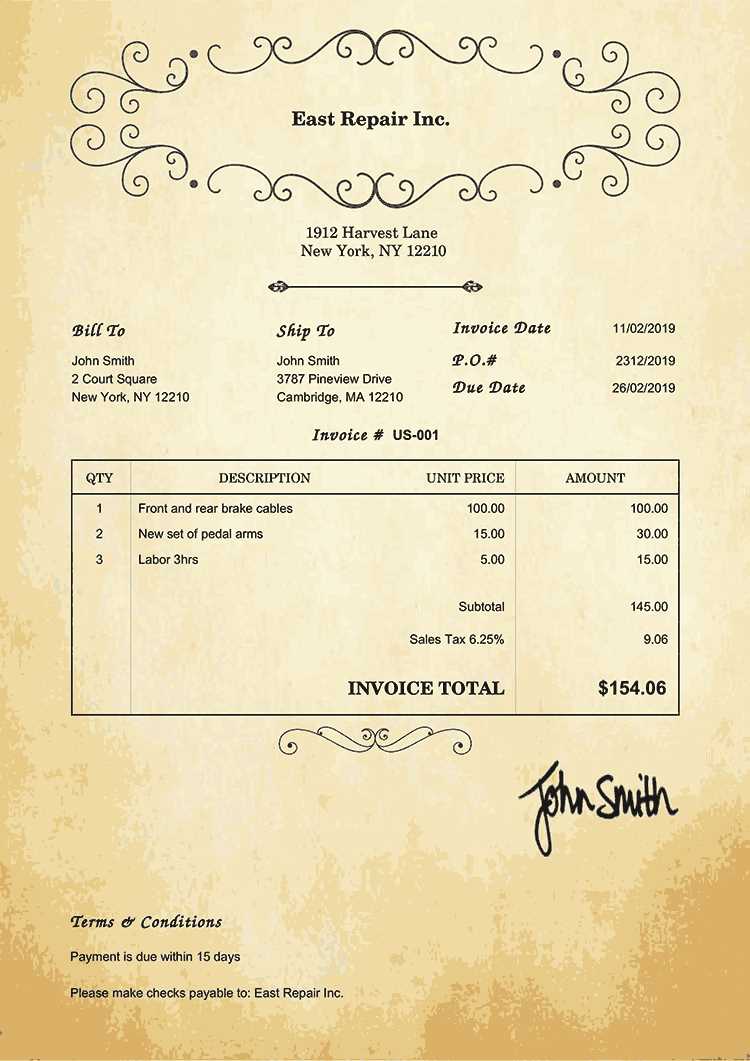

Simple and Professional Design: Some platforms offer minimalistic designs, ideal for those who prefer a straightforward, no-frills approach. These templates often focus on functionality, allowing you to input all the necessary details like client information, charges, and terms without overwhelming the reader with excess decoration.

Customizable Features: Many of these resources allow you to modify not only the content but also the design. You can add your company logo, change fonts and colors, and adjust the layout to reflect your brand’s identity. This flexibility ensures that your documents will always look polished and aligned with your business style.

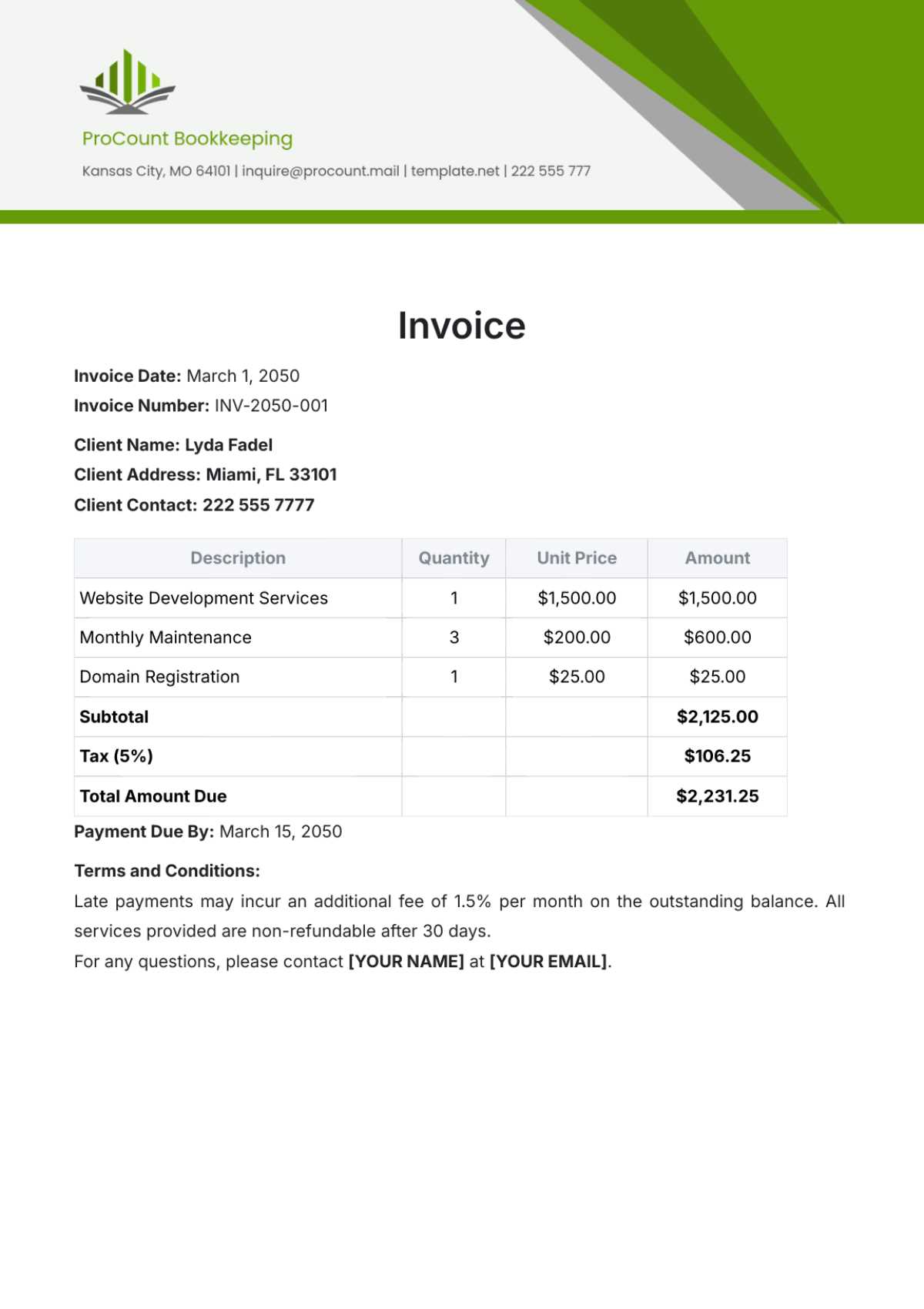

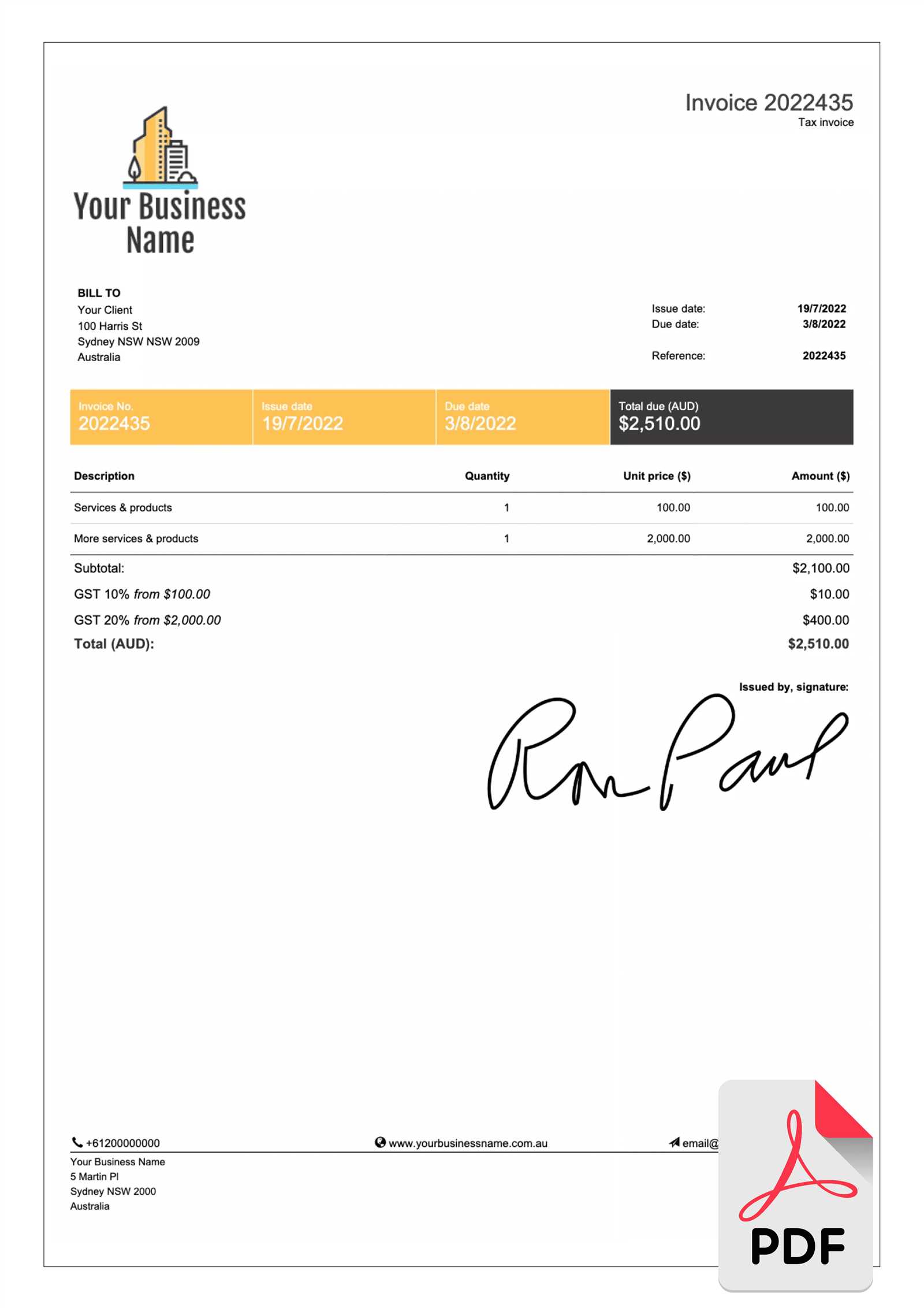

Detailed Layouts: Some tools provide more comprehensive structures, including sections for additional information such as taxes, discounts, or itemized services. These are perfect for businesses that need to break down complex charges and present detailed billing information clearly.

Ultimately, the best resource for you will depend on the type of business you run and the complexity of your billing process. With the variety of options available, you can easily find one that matches your needs and preferences, helping you maintain a professional approach in all your financial dealings.

Simple Steps to Create an Invoice

Creating clear and professional billing documents is an essential part of managing business transactions. The process is straightforward and can be completed in a few simple steps. By following these steps, you can ensure that your payment requests are accurate, easy to understand, and well-organized.

Step 1: Gather the Required Information

- Client Details: Include the name, address, and contact information of the recipient.

- Business Information: Make sure your own contact details

Invoice Templates for Freelancers

Freelancers often handle a wide range of projects, working with multiple clients and managing their own business finances. Having a reliable and easy-to-use tool for creating payment requests is essential for keeping things organized and professional. A well-structured billing document ensures that clients understand the services provided and the amount due, which ultimately helps maintain smooth transactions.

Tailored for Independent Professionals: Freelancers typically have unique billing needs, such as charging hourly rates, setting project milestones, or offering flexible payment terms. Many tools are specifically designed to cater to these variations, providing options for customizing your documents based on the type of work you do.

Simple and Clear Layouts: Clear and concise designs are essential for freelancers who may need to quickly generate multiple documents. Pre-designed structures can save you time while making sure that important information, like services rendered, dates, and total amounts due, are easy to find. These formats often focus on simplicity and readability, helping clients process payments without confusion.

Time-saving Features: For freelancers, time is precious, and the quicker you can generate professional records, the better. These resources streamline the process, allowing you to spend more time focusing on your work and less on administrative tasks.

With a properly customized system, freelancers can manage their billing efficiently, reducing the chances of errors, and ensuring that clients receive all the necessary details to make timely payments.

Online Invoice Templates vs Software

When choosing a method for creating payment requests, businesses often face the decision between using accessible tools available on the web or investing in specialized software. Both options offer unique advantages, and the choice depends on the specific needs of the business. Each approach provides a different level of customization, ease of use, and functionality, making it important to understand the benefits and limitations of each.

Accessibility and Cost: Web-based tools are typically more cost-effective, with many available at no charge. They allow you to generate billing documents quickly without the need for installation or ongoing costs. On the other hand, specialized software often comes with a price tag, but it may offer more advanced features for businesses with complex billing needs.

Ease of Use: Web-based solutions are generally simpler to use, with intuitive interfaces that allow users to quickly input information and create documents. These tools are ideal for small businesses or freelancers who need a quick and straightforward way to handle their billing. Software solutions, while more robust, can have a steeper learning curve and require more time to master.

Advanced Features: While web-based tools are great for basic documents, software often provides additional features like advanced reporting, integration with accounting systems, and the ability to manage a larger volume of transactions. Businesses that need these capabilities may find investing in software worthwhile.

Ultimately, the decision comes down to the specific requirements of your business. If you need a simple, budget-friendly solution for occasional use, web-based tools are often sufficient. However, if your business requires more sophisticated functionality and scalability, investing in dedicated software may be the better choice.

How to Download Invoice Templates

Downloading pre-designed billing documents is a simple and efficient way to streamline your business’s financial operations. By accessing these resources, you can avoid the time-consuming task of creating records from scratch. Most platforms offer various designs that can be quickly downloaded and customized to suit your needs, whether you’re a freelancer or a growing business.

Step-by-Step Guide to Downloading

- Choose a Reliable Source: Start by selecting a reputable platform that offers customizable billing formats. Ensure that the website provides secure downloads and up-to-date resources.

- Select the Design: Browse through the available options and choose a layout that fits your business style and needs. Look for one that’s easy to read and matches your brand’s identity.

- Click the Download Button: After selecting your preferred format, simply click the download link. Most resources are available in formats like PDF, Word, or Excel, allowing you to easily access and edit them on your device.

- Save to Your Device: Save the file in a folder that is easily accessible for future use. Make sure to name the file appropriately to avoid confusion later on.

Editing the Downloaded Document

- Customize the Fields: Open the file on your computer and begin filling in the necessary details, such as client information, services rendered, and payment terms.

- Modify the Layout: If desired, make adjustments to the layout to reflect your business’s branding, such as adding your logo or changing colors and fonts.

- Save and Send: After finalizing the document, save it again and send it to your client through email or your preferred method.

By following these simple steps, you can quickly download and personalize your billing documents, ensuring that every transaction is handled professionally and efficiently.

Creating Professional Invoices Quickly

Generating clear and professional billing documents doesn’t have to be a time-consuming task. With the right tools, you can quickly create well-organized records that reflect your brand and ensure smooth transactions. These resources provide pre-structured formats, making it easy to input your data and produce polished results in just a few minutes.

Essential Steps for Quick Billing

- Choose a Simple Format: Opt for a clear and clean design that is easy to read. Avoid over-complicating the layout, as simplicity often improves comprehension.

- Fill in the Key Information: Add the essential details such as the client’s name, services provided, and amounts due. Make sure everything is accurate to avoid any confusion or delays in payment.

- Double-Check for Accuracy: Verify that all the fields are filled out correctly. Mistakes can cause unnecessary delays, so it’s crucial to ensure that every detail is correct before sending.

Time-Saving Tools

Using pre-designed resources and digital tools allows you to save significant time compared to creating documents from scratch. The following table highlights some features that can help speed up the process:

Feature Benefit Pre-filled Sections Reduces the time spent entering repetitive information like business name and contact details. Automatic Calculations Automatically calculates totals, taxes, and discounts, minimizing errors and saving time. Customizable Layout Quickly adjust colors, fonts, and sections to match your brand identity without needing design skills. Save Templates Store frequently used documents for future reuse, avoiding the need to recreate them each time. By utilizing these tools and following a streamlined process, you can quickly produce professional billing documents that meet your business needs while saving valuable time. This efficiency allows you to focus on what matters most–growing your business.

Common Mistakes to Avoid in Invoices

Creating accurate billing documents is essential for maintaining professional relationships with clients and ensuring timely payments. However, even small mistakes can lead to confusion, delays, or even disputes. Understanding the most common errors and how to avoid them can save time and help maintain clear communication between businesses and clients.

Top Errors to Watch Out For

- Incorrect or Missing Contact Information: Always double-check that the recipient’s and your own contact details are correct. Missing or incorrect information can delay communication and payment.

- Ambiguous Descriptions: Provide clear, detailed descriptions of the products or services provided. Vague terms can lead to misunderstandings or disputes over what was delivered.

- Calculation Mistakes: Ensure that all amounts, including taxes, discounts, and totals, are accurately calculated. Simple math errors can cause significant confusion and payment delays.

- Omitting Payment Terms: Clearly state the payment due date, accepted methods, and any late fees. Not providing this information can lead to payment delays or confusion about the terms.

- Failure to Include an Invoice Number: Each billing document should have a unique reference number. This helps both you and your client track the payment and ensures there are no issues when referencing past transactions.

How to Prevent These Mistakes

- Use Pre-Designed Formats: Consider using a structured layout that already includes all necessary fields, reducing the chance of forgetting important details.

- Double-Check Before Sending: Always review the document for accuracy before submitting it. A quick review can help catch any mistakes early.

- Automate Calculations: Use digital tools that automatically calculate totals, taxes, and discounts to eliminate errors.

By paying attention to these details, you can create billing documents that are both professional and error-free, ensuring smooth and efficient transactions with your clients.

Legal Considerations for Invoices

When creating billing documents, it is essential to ensure compliance with relevant laws and regulations. These documents serve as legal records of transactions and can play a critical role in protecting your business interests in case of disputes or audits. Being aware of the legal requirements for generating such documents helps ensure that your financial dealings are transparent and legally sound.

Key Legal Elements to Include

- Accurate Client Information: Always ensure that the recipient’s name, address, and contact details are correct. Legal disputes often arise from mistakes in client details.

- Clear Payment Terms: State the agreed-upon payment deadline, penalties for late payments, and the accepted methods of payment. These terms help protect both parties and clarify expectations.

- Tax Information: If applicable, make sure that taxes are calculated correctly and stated clearly. Include your business’s tax identification number and any other legal information required by local or international tax laws.

- Legal Reference Number: Assign a unique identifier to each document. This reference helps track transactions and is crucial in case of disputes or for record-keeping purposes.

Legal Pitfalls to Avoid

- Failure to Include a Due Date: Without a clearly stated due date, payment deadlines may be unclear, leading to unnecessary delays or confusion.

- Ignoring Consumer Protection Laws: Be mindful of consumer protection regulations that apply to your industry. Failing to comply with these laws could result in legal action against your business.

- Missing Information on Refunds and Returns: If your business involves returns or refunds, it’s important to include the terms and conditions that govern these situations on the document to avoid future disputes.

By adhering to these legal guidelines, you can avoid potential legal issues and create professional records that protect your business while ensuring transparency and trust in your transactions.

How to Track Payments with Invoices

Tracking payments is a crucial part of maintaining financial health in any business. Properly managing and recording payment information helps ensure that you are paid on time and that there are no discrepancies in your financial records. By using clear, structured documents that capture the transaction details, you can easily monitor the status of payments and avoid errors.

Steps for Effective Payment Tracking

- Assign Unique Reference Numbers: Give each document a unique identifier to help track and match payments with the correct transactions.

- Include Payment Terms: Clearly state the payment due date and any late fees or discounts offered for early payments. This sets clear expectations and helps clients know when to pay.

- Record Payments as They Come In: As soon as you receive a payment, mark it as paid in your records. Include the date and method of payment to ensure accuracy.

- Use a System for Follow-Ups: Set up a reminder or tracking system to follow up with clients who have not paid by the due date. Regular follow-ups reduce the risk of missed payments.

Helpful Tools for Payment Tracking

- Spreadsheets: Maintain a simple spreadsheet where you can input all transaction details and track outstanding payments. It allows for easy updates and quick reference.

- Accounting Software: Invest in accounting tools that automatically track payments and generate reminders for overdue balances. These systems also help generate financial reports and keep everything organized.

By using a systematic approach to record payments, businesses can ensure they stay organized and reduce the chances of payment issues, allowing for smoother financial operations and more efficient cash flow management.

Using Invoice Templates for Efficiency

Streamlining billing processes is essential for businesses looking to save time and reduce errors. By using pre-designed structures, businesses can quickly create professional-looking billing documents while ensuring consistency across all transactions. This approach minimizes the effort involved in manually crafting each document, allowing for faster invoicing and improved workflow.

Benefits of Using Pre-Designed Structures

- Time-saving: Pre-built formats eliminate the need to design each document from scratch, saving you time and effort with every transaction.

- Consistency: Using standardized layouts ensures that every billing document looks professional and follows the same structure, which promotes brand identity.

- Accuracy: Pre-designed structures often come with automatic fields for key information like tax rates and totals, reducing the chance of human error in calculations.

- Customizability: Many formats are customizable, allowing you to adjust the design and fields to match your business’s needs without losing the efficiency of a pre-made layout.

How Pre-Built Structures Improve Workflow

By integrating these structured designs into your billing routine, you ensure that your financial records are accurate, timely, and easy to manage. Below is an example of how a pre-structured document can help improve your billing process:

Step Process Time Saved 1. Enter Client Details Pre-filled fields for client contact information Reduced data entry time 2. List Products or Services Dropdown menus or auto-fill options for services or items Faster completion of the itemization process 3. Calculate Totals Automatic tax and total calculations Zero manual calculation errors 4. Final Review Easy-to-read format for quick review Faster verification and fewer mistakes By leveraging these efficient tools, you streamline your workflow and can focus more on other aspects

Free Invoice Templates for Small Businesses

For small businesses, efficient financial management is crucial for smooth operations and maintaining cash flow. Using pre-designed billing documents can greatly simplify the process of requesting payment for products or services, helping business owners stay organized and professional without spending too much time on document creation. These tools enable small business owners to focus more on their core activities rather than manual paperwork.

Benefits for Small Businesses

- Cost-Effective: Many templates are available at no cost, which makes them ideal for small businesses looking to minimize operational expenses while still maintaining a professional appearance.

- Professional Appearance: Using structured formats ensures that your documents look polished and uniform, which helps build trust with clients and partners.

- Ease of Use: These documents are simple to customize, allowing business owners to quickly input client details, services provided, and payment terms without complicated setups.

- Time-Saving: Pre-designed structures save you from the hassle of creating a new document from scratch for every transaction, allowing for quicker billing and faster payments.

Popular Features for Small Business Billing Documents

Feature Benefit Client Information Fields Pre-filled sections for easy entry of client name, address, and contact details. Automatic Calculations Automatically computes total amounts, taxes, and discounts to avoid errors. Customizable Sections Allows for easy adjustments to meet your business needs, from payment terms to service descriptions. Branding Options Option to include logos, business colors, and custom fonts for consistency with your branding. By using these readily available billing documents, small businesses can streamline their invoicing process, reduce errors, and create a more professional experience for their clients, all while saving time and money.

How to Share Invoices Online

Sharing payment requests electronically has become a fast and secure way to ensure that transactions are completed without delay. Whether you’re sending a bill to a client or managing multiple accounts, leveraging digital platforms can help streamline the process. It offers efficiency, quick delivery, and secure payment tracking, making it an essential part of modern business operations.

There are several methods to electronically send billing documents, and choosing the right one depends on factors such as client preferences, security, and ease of use. The following options are popular and effective for businesses looking to speed up payment collection and improve communication with clients.

Emailing the Document

One of the simplest and most common ways to send payment requests is by emailing them directly to clients. This method is fast, secure, and ensures that the recipient receives the document almost immediately. Here’s how to do it effectively:

- Attach the Document: Make sure the document is in a universally accessible format, such as PDF, so that clients can easily open it.

- Clear Subject Line: Include key details in the subject, like “Payment Request for [Service/Product Name]” to make the email easy to locate.

- Include a Message: Always add a polite and professional note in the body of the email explaining the attached bill, payment terms, and due dates.

Using Cloud Storage Platforms

If you frequently share payment requests or need to keep them organized, cloud storage services such as Google Drive, Dropbox, or OneDrive can be a great solution. These platforms allow you to store your documents securely and share them with clients through a simple link. Here’s how you can do it:

- Upload the Document: Save your completed document to your cloud storage account and ensure it’s set to “view-only” for security.

- Generate a Shareable Link: Create a shareable link that clients can use to view or download the document.

- Send the Link: Include the link in an email or message, ensuring clients understand how to access the document.

Whichever method you choose, ensure that you maintain professionalism in your communication and monitor payment statuses regularly to stay on top of your accounts.

Secure Your Invoices with Password Protection

When handling sensitive financial information, protecting your documents from unauthorized access is crucial. Adding an extra layer of security ensures that only the intended recipients can view or modify your billing documents. Password protection is one of the most effective methods to safeguard your files, especially when they contain personal, business, or payment details.

Using password protection allows you to share important files without worrying about them being intercepted or viewed by others. It’s a simple yet powerful way to ensure confidentiality while maintaining professionalism. Whether you’re sending an email attachment or storing your documents in the cloud, securing them with a password helps prevent any unwanted access.

How to Add Password Protection

Adding password protection to your documents is quick and easy, and can be done through various platforms and software. Here’s a basic guide on how to apply password protection:

- Using PDF Software: Most PDF readers, like Adobe Acrobat, offer an option to encrypt and set a password for documents. Simply choose the ‘Password Security’ option when saving your file, and create a strong password.

- Cloud Storage Options: Many cloud services such as Google Drive and Dropbox allow you to set permissions for sharing files. You can choose to protect access with a password before generating a shareable link.

- File Compression Tools: When compressing files into formats like ZIP, you can set a password for the compressed folder. Tools like WinRAR or 7-Zip offer this functionality.

Benefits of Password Protection

- Confidentiality: Passwords prevent unauthorized users from accessing sensitive business data.

- Control: You maintain full control over who can access the document, providing peace of mind when sending important files.

- Compliance: For businesses that handle private or regulated data, password protection helps meet security and privacy standards.

By taking simple steps like adding password protection, you can ensure that your files remain secure, and only authorized parties have access to them, protecting your business and your clients from potential threats.