Download Free Sales Invoice Template Excel for Quick Billing

Managing business transactions efficiently is essential for smooth financial operations. Having the right tools can simplify the task of keeping track of payments, organizing client information, and ensuring accuracy in financial records. With the proper setup, creating professional documents for each transaction becomes quick and hassle-free.

Automating routine tasks not only saves time but also reduces human errors. By using easy-to-customize solutions, you can generate the necessary paperwork in minutes, giving you more time to focus on growing your business. The ability to tailor these tools to your specific needs makes them a valuable asset for any organization.

Whether you’re a small business owner or managing a larger company, having reliable and efficient tools at your disposal can streamline your financial processes significantly. The right approach ensures that you remain organized and consistent, keeping everything in order for both you and your clients.

Why Use an Excel Invoice Template

Effective financial management requires tools that are both flexible and easy to use. When creating essential documents for transactions, having an organized system allows businesses to save time and avoid mistakes. By using simple software solutions, it becomes possible to quickly generate professional documents tailored to your needs, ensuring consistency and clarity for both parties involved.

One of the main advantages of using such solutions is the ability to customize documents without requiring extensive technical knowledge. Most software includes predefined formats that are easy to modify and adapt. This allows businesses to create documents that reflect their brand while also meeting the necessary legal and professional standards.

Flexibility and Ease of Use

These systems provide a level of flexibility that allows adjustments in real time. Whether it’s adjusting the layout, updating pricing information, or adding custom details, you can easily make changes without starting from scratch. The simplicity of these tools helps you maintain control over your workflow and ensures that your documents are always up-to-date and accurate.

Time and Cost Efficiency

Using a streamlined approach for your financial paperwork can significantly reduce the time spent on repetitive tasks. These tools often come with built-in formulas, which help automate calculations like totals, taxes, and discounts. This not only speeds up the process but also reduces the risk of errors that could result in financial discrepancies or misunderstandings with clients.

| Benefit | Description | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Customization | Easily adjust documents to suit your business needs | ||||||||||||||||||||

| Accuracy | Automatic calculations reduce the risk of

Benefits of Downloading Free Invoice Templates

Accessing ready-made documents for your financial needs offers a variety of advantages, especially when you’re looking to save time and reduce manual work. Free solutions provide an excellent way to streamline processes without the need for expensive software or complicated setups. By using these pre-built solutions, businesses can maintain a high level of professionalism while ensuring accuracy in their financial records. Cost efficiency is one of the primary benefits. Many businesses, especially startups and freelancers, have limited budgets. Free options allow you to create polished documents without any financial investment. This accessibility makes it possible for anyone to maintain an organized and professional approach to business, no matter the size of the company. Another significant advantage is the time saved in document creation. Instead of designing a document from scratch, these tools provide pre-designed structures with the necessary fields, which can be filled in quickly. This feature helps businesses meet deadlines more effectively and ensures that all required information is included without omissions. Professional Design and Consistency

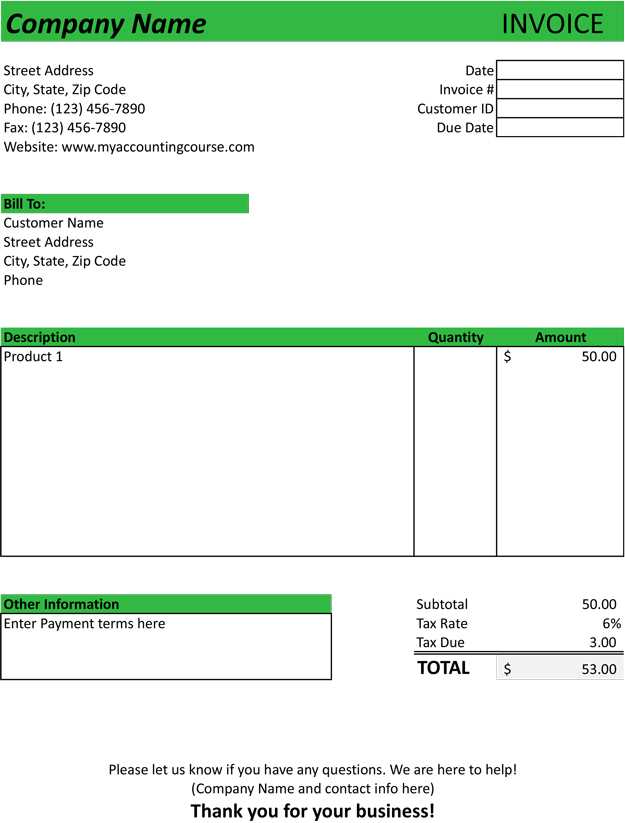

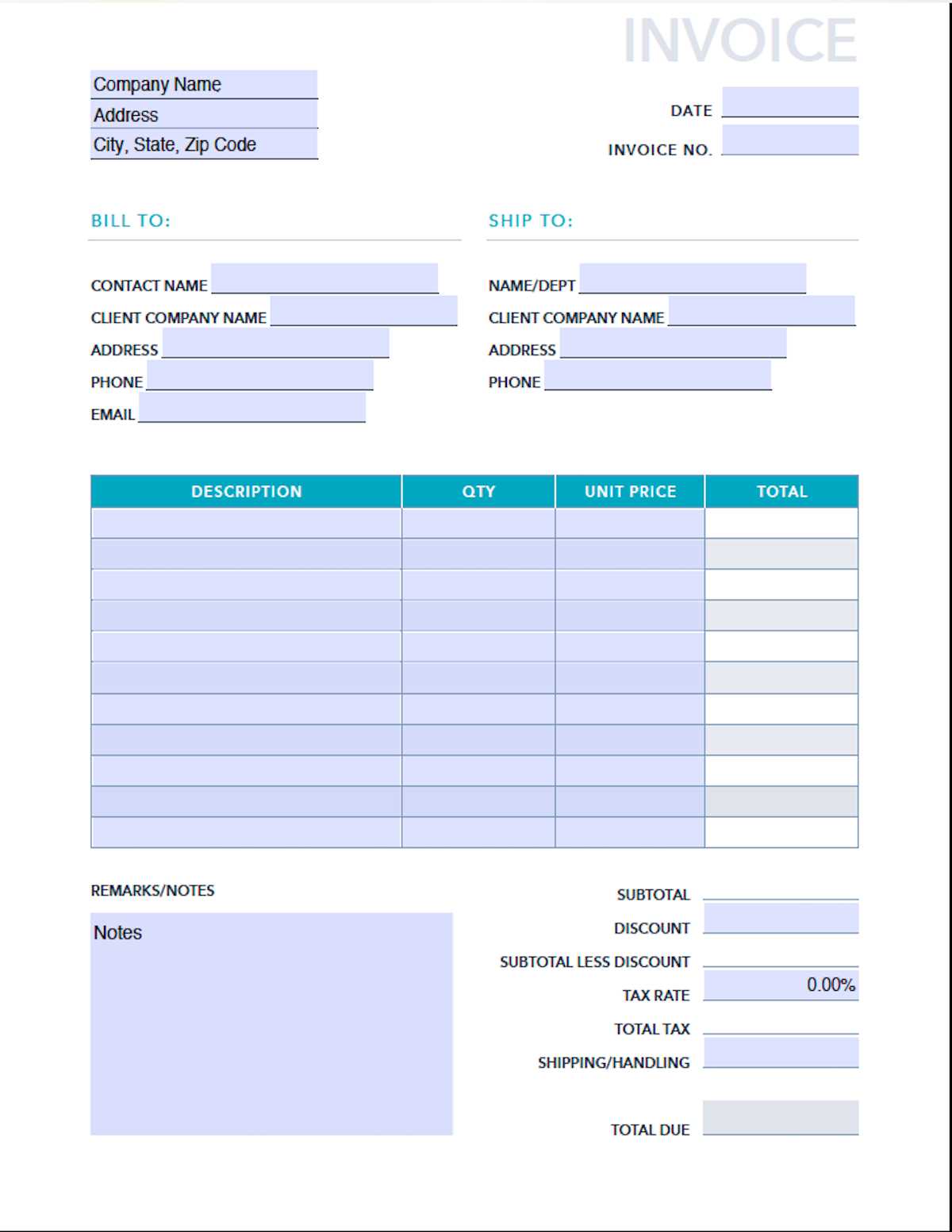

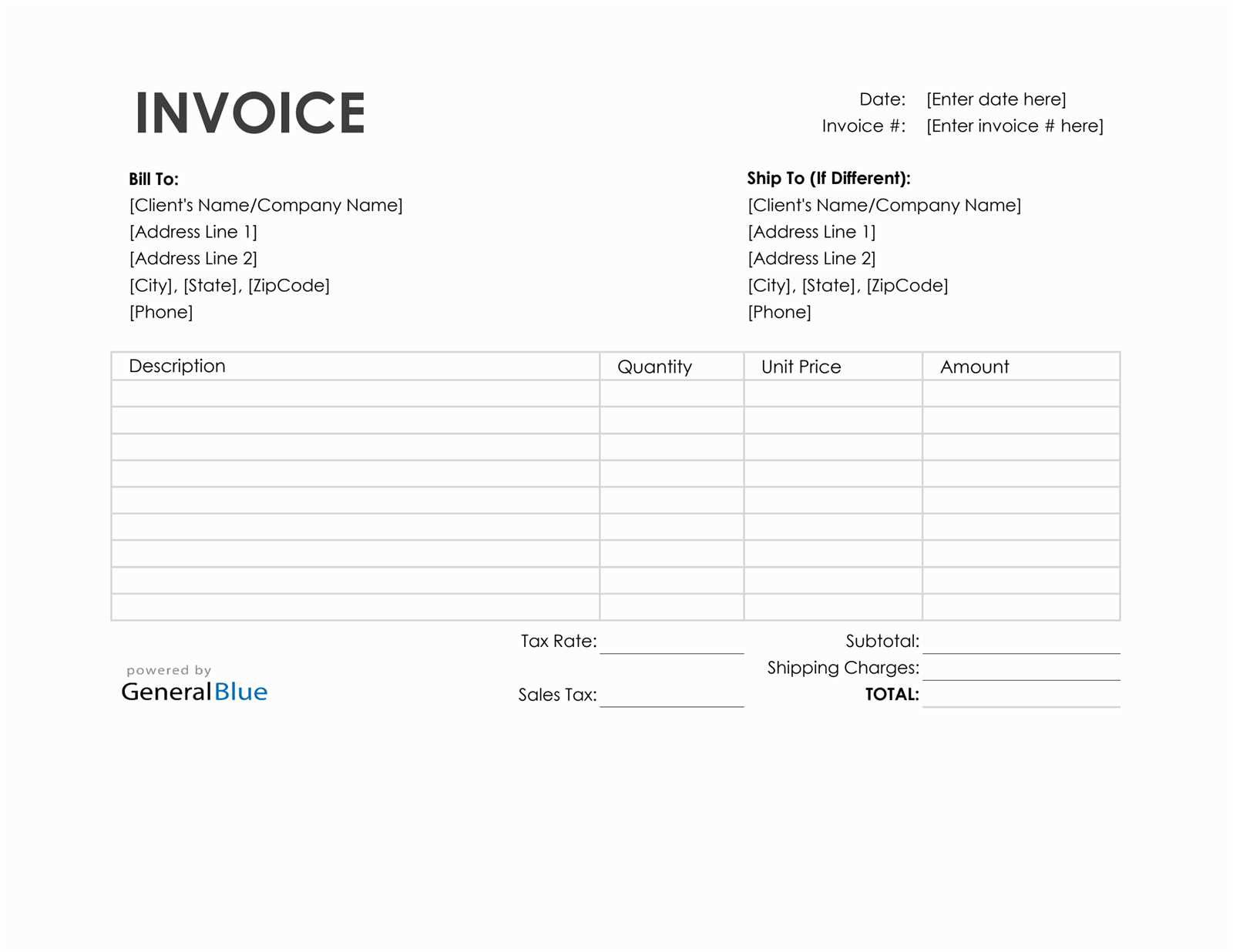

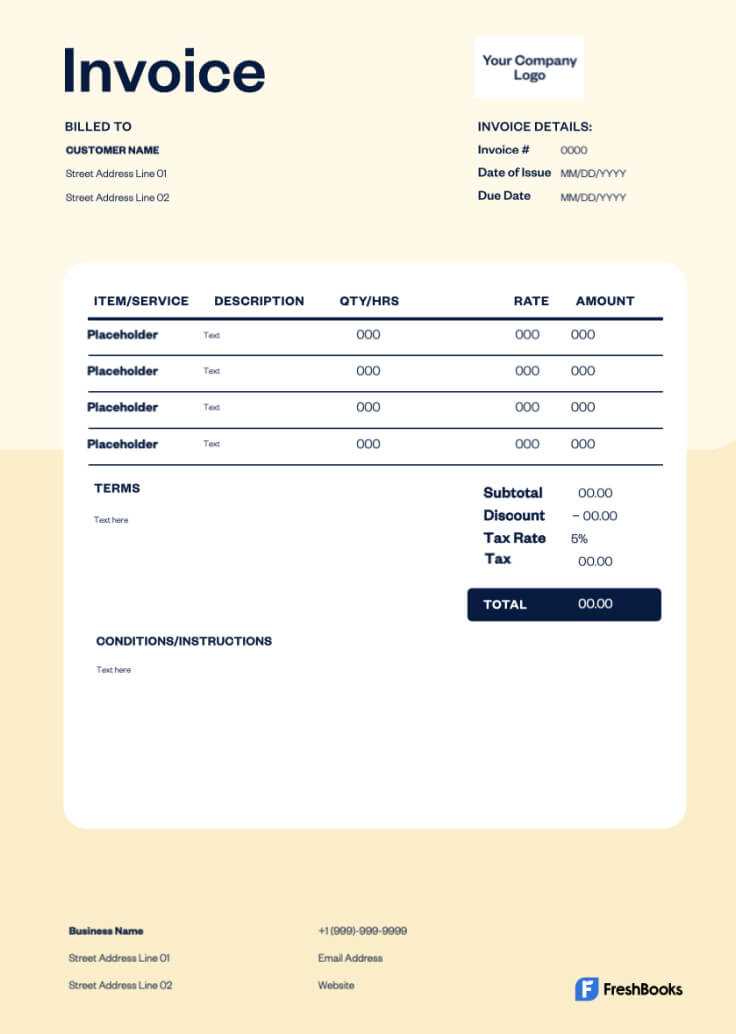

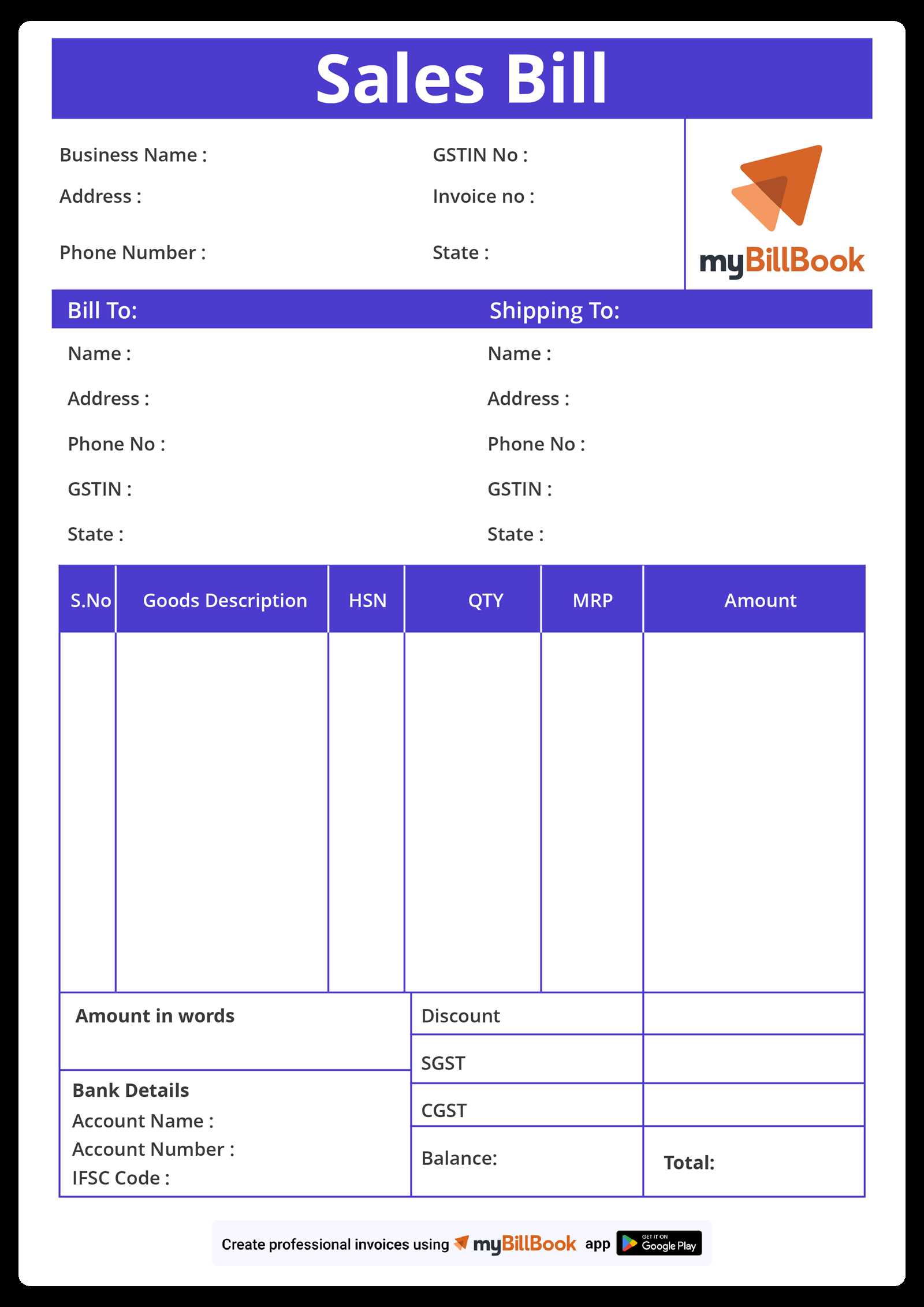

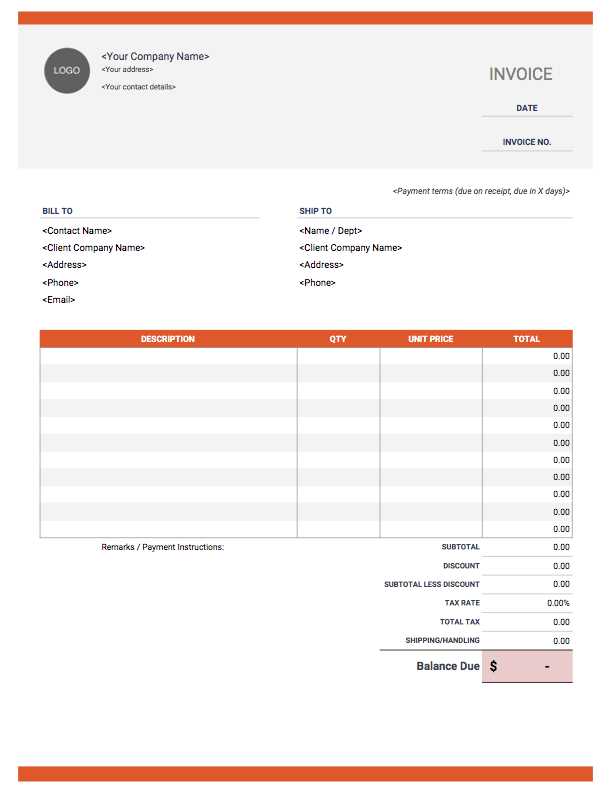

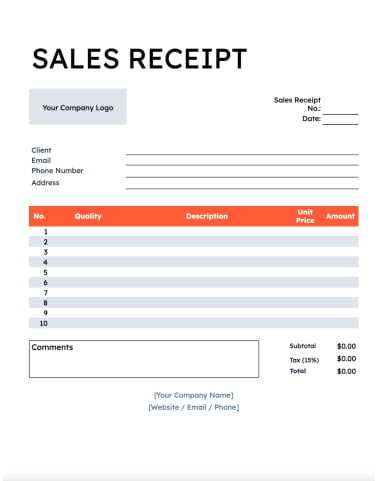

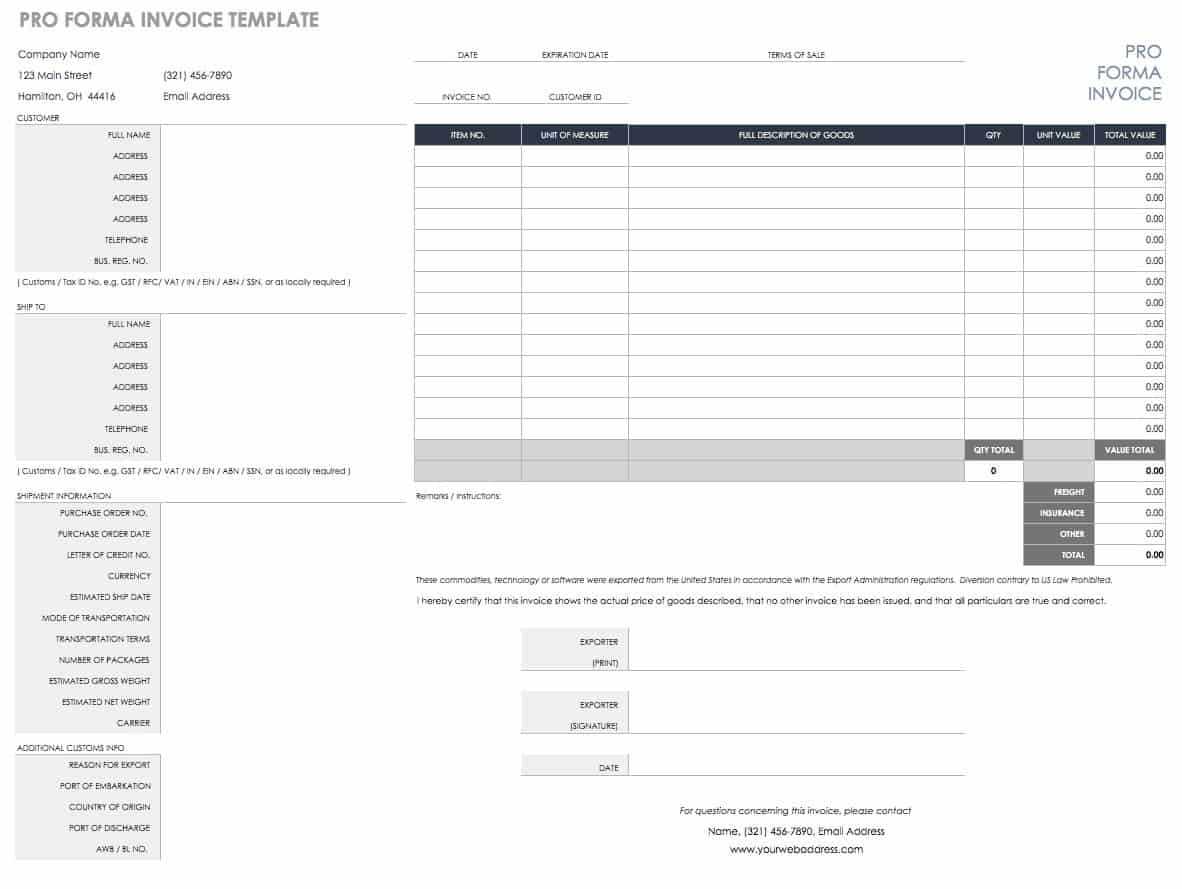

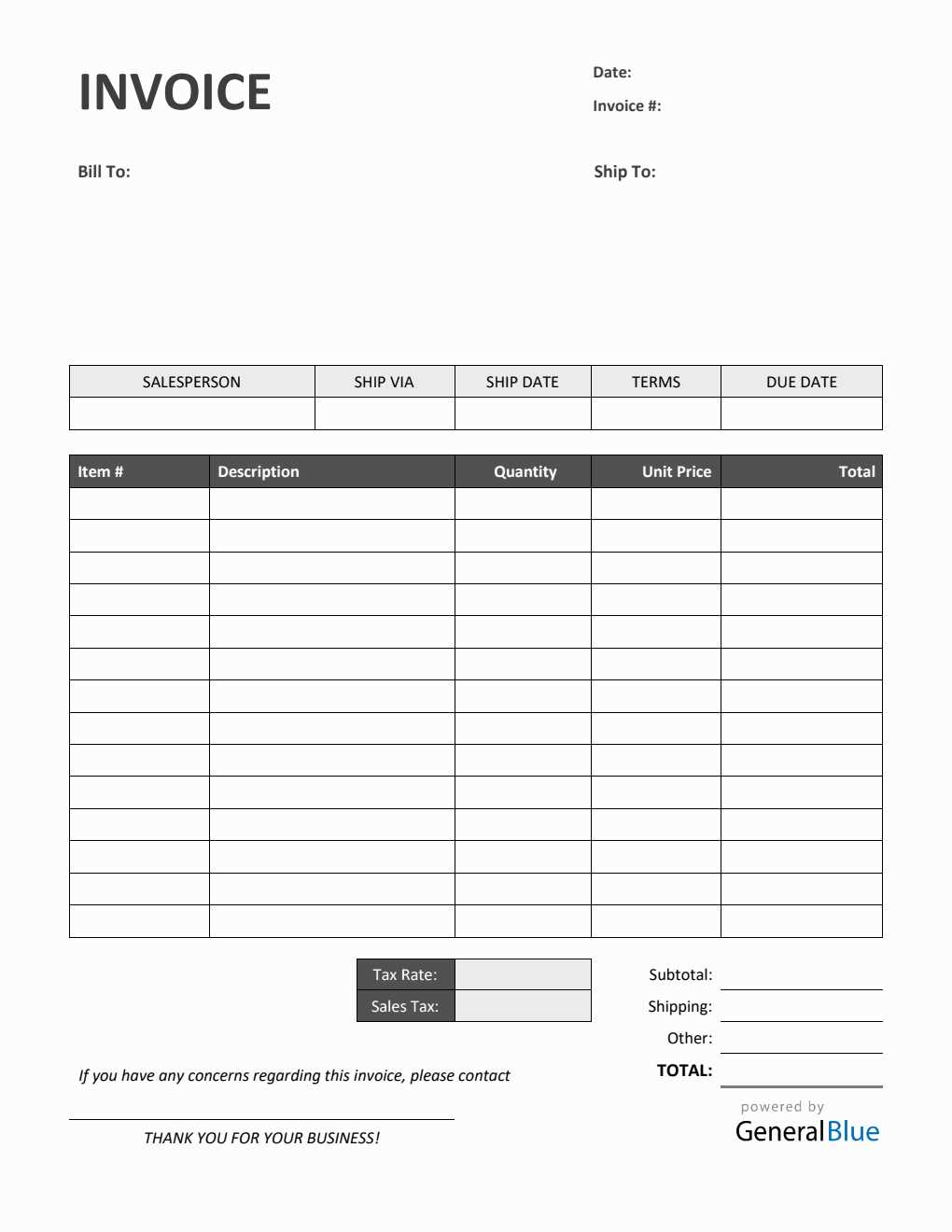

Pre-built documents often come with well-organized layouts that adhere to industry standards. This ensures that all important details–such as contact information, terms, and totals–are clearly presented and easy to read. Consistent presentation not only helps maintain a professional appearance but also reduces the chances of errors or misunderstandings between parties. Ease of CustomizationEven though these resources are free, they offer ample customization options. You can modify elements such as colors, fonts, and logos, allowing you to match the document to your brand identity. This flexibility makes it easy to personalize your paperwork while maintaining the core functionality and structure that is essential for effective financial management. How to Customize Sales Invoice in Excel

Customizing financial documents allows businesses to align their records with specific needs, ensuring both clarity and professionalism. Making adjustments to the structure, layout, and content ensures that all necessary information is included while reflecting your brand’s unique style. The ability to personalize these files helps you maintain consistency across all client interactions and financial reporting. Starting with a base layout is the easiest way to begin the customization process. Most solutions come with predefined structures that include essential fields like dates, totals, and client details. From there, you can modify specific sections such as payment terms, item descriptions, or contact information, tailoring each document to suit the transaction at hand. Adjusting Basic Elements

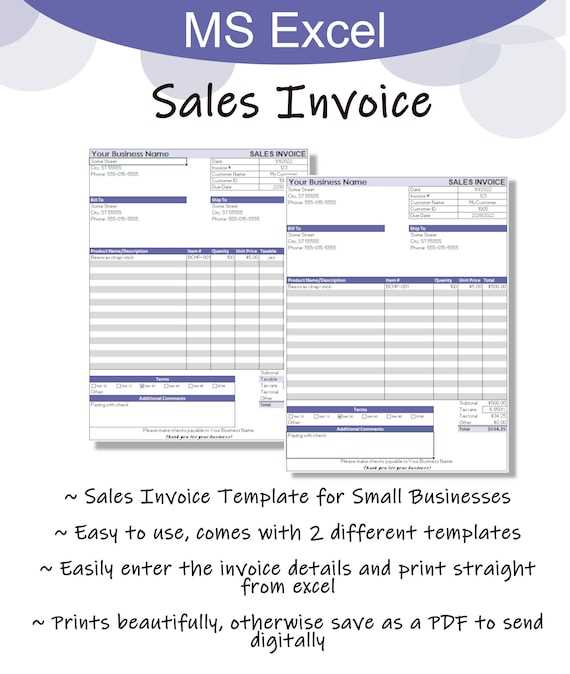

The first step in customization often involves adjusting basic elements like font size, style, and color. This makes the document more visually appealing and ensures that it fits with your company’s branding. Additionally, updating the company name, logo, and contact details in the header section is crucial for maintaining consistency across all your business communications. Adding or Removing FieldsEach business has unique needs when it comes to financial documentation. If there are specific details you want to include–such as a purchase order number, shipping instructions, or discount terms–you can easily add extra fields. Conversely, if a certain section isn’t relevant for a particular transaction, it can be removed to keep the document clean and focused on what matters most. Customizing these documents not only improves the efficiency of your workflow but also ensures that every interaction with clients and partners is both clear and professional. Tailoring these files to fit your business processes results in a more seamless experience for both your team and your customers. Key Features of Excel Invoice TemplatesEffective financial documentation requires a combination of functionality, clarity, and ease of use. Tools designed for creating business documents offer a range of features that can significantly improve the efficiency of your workflow. These essential elements ensure that your documents are not only professional but also easy to customize and manage, making them an indispensable asset for any business. Automatic Calculations are one of the most powerful features these solutions offer. By incorporating built-in formulas, you can instantly calculate totals, taxes, discounts, and other financial figures with accuracy. This reduces the risk of errors that might occur when doing manual calculations and helps you maintain consistency across all documents. Customizable FieldsEvery business is unique, and the ability to adjust the structure of your document to meet specific needs is essential. These tools typically allow you to modify text fields, add extra sections, and adjust the layout to reflect the specifics of each transaction. Whether you’re invoicing for different types of services or need to include custom notes, customization ensures that your documentation is as relevant and tailored as possible. Professional LayoutsA well-organized and clean design is crucial for making a positive impression on clients and partners. Most business document solutions come with professionally designed layouts that include sections for all relevant information. Clear organization of important details like contact info, payment terms, and line items ensures that the document is easy to read and understand, which builds trust and professionalism. How to Create Your Own Invoice TemplateDesigning your own document for financial transactions allows you to tailor it to your business’s specific needs. By creating a custom format, you can ensure that all necessary information is included, and the structure reflects your brand’s identity. This process can seem daunting, but with the right steps, you can develop a document that is both functional and professional. Here are the essential steps to creating your own document for billing purposes:

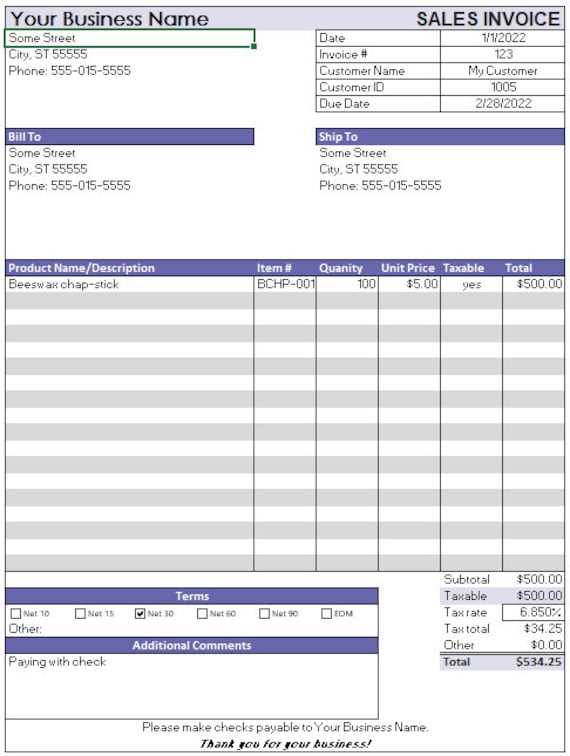

By following these steps, you can create a custom billing document that is both functional and aligned with your business needs. This approach gives you full control over how you present your financial records, ensuring a professional appearance every time. Top Free Excel Invoice Templates for BusinessesFinding the right tools to manage your business documentation is essential for maintaining efficiency and professionalism. Free solutions offer businesses an easy way to generate accurate and well-structured financial documents without the need for expensive software. Here are some of the best free resources available that provide customizable formats, suitable for any business size. Simple and Professional LayoutsMany free options come with minimalist and easy-to-read designs, making them ideal for businesses that prefer a straightforward approach to billing. These templates often include:

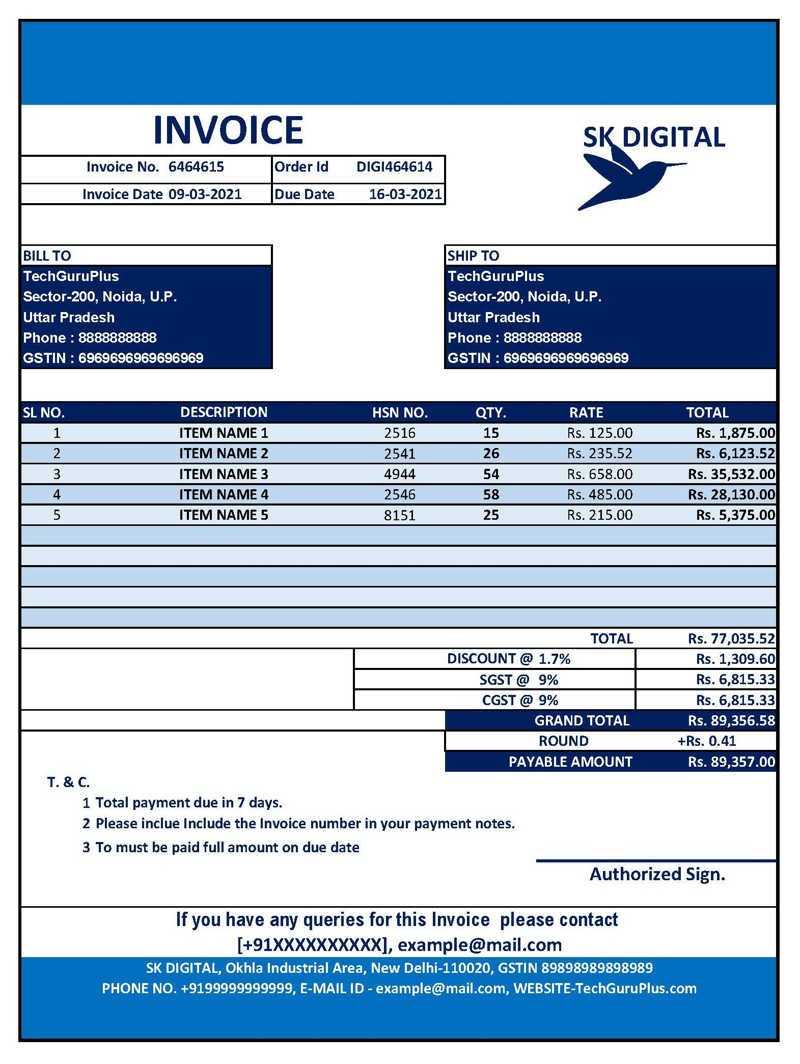

These designs are perfect for small businesses or freelancers looking for a simple yet professional way to send clients their bills. Comprehensive Formats with Itemized ListingsFor businesses that need to provide detailed descriptions of products or services, more complex solutions are available. These formats typically include:

These comprehensive layouts ensure that clients receive a clear breakdown of what they are being charged for, helping to avoid confusion and build trust. Industry-Specific Solutions

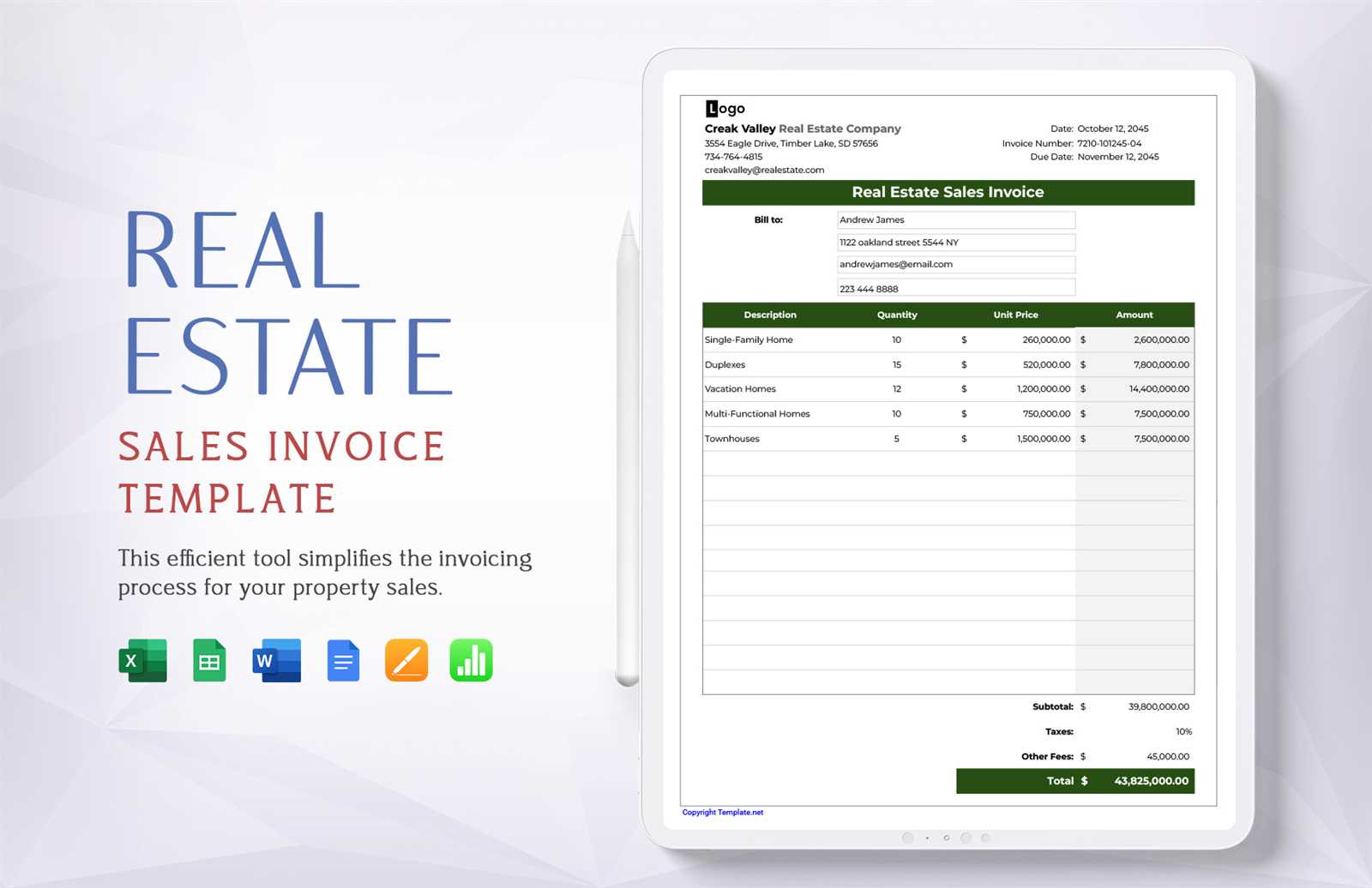

Some free tools are tailored to specific industries, offering features designed for particular types of businesses. Examples include:

Using an industry-specific layout ensures that your documents meet the expectations of your clients and clearly reflect the nature of your work. Improving Efficiency with Sales InvoicesIn any business, speed and accuracy in financial documentation are crucial. Streamlining the process of creating and sending bills not only saves time but also ensures that clients receive clear, error-free records. By optimizing the way these documents are generated, businesses can improve workflow, reduce mistakes, and foster better relationships with their clients. Automation plays a key role in enhancing efficiency. By using tools that automatically calculate totals, taxes, and discounts, you eliminate the need for manual input, which speeds up the entire process. With these systems in place, you can generate multiple documents in a fraction of the time it would take to create them manually. Standardization is another important factor. Using a consistent format for all business transactions helps eliminate confusion and ensures that all necessary information is included every time. Clients will appreciate the clear and professional presentation of your records, and your team will benefit from a more predictable process that requires less oversight and review. Finally, having the ability to quickly modify and customize documents when necessary increases flexibility. Whether you’re adding specific terms, updating pricing, or adjusting delivery details, the ability to make changes in real-time ensures that your documents are always current and accurate. Managing Multiple Clients with Excel Invoices

Handling a large number of clients can be a challenge, especially when it comes to organizing billing and tracking payments. By utilizing efficient systems for generating and managing transaction documents, businesses can streamline the process, making it easier to keep track of outstanding balances, due dates, and other important details. This approach reduces the risk of errors and ensures that all client accounts are handled promptly and professionally. Using well-organized systems helps manage multiple accounts simultaneously, without confusion or oversight. Here are a few strategies that can improve efficiency: Creating Client-Specific Documents

One of the simplest ways to manage a large client base is by creating individualized records for each client. This allows you to:

Automating Key Data EntryAutomating repetitive tasks can save valuable time. Using software that automatically populates client information or calculates totals for each transaction can make managing multiple clients much more manageable. This includes:

By utilizing these features, businesses can maintain a high level of accuracy while reducing manual effort, enabling them to focus more on client relationships and other c Excel Templates vs. Invoice SoftwareWhen it comes to creating business documents, there are two main options: using customizable spreadsheets or relying on specialized software designed for financial record-keeping. Each approach offers distinct advantages, depending on the complexity of your business needs and the resources available. Understanding the key differences between these two methods can help you make a more informed decision about which solution best suits your workflow. Flexibility and Customization

One of the main advantages of using customizable spreadsheets is their flexibility. You can easily modify the structure to fit your exact requirements, whether that means adding additional fields, adjusting formulas, or changing the design. This level of customization allows businesses to create personalized documents that align perfectly with their operations. On the other hand, while specialized software can offer pre-built templates, it often limits how much you can alter the layout or structure of documents. Ease of Use and AutomationSpecialized software typically excels in ease of use and automation. These tools are designed to streamline the billing process, offering features such as automatic calculations, integration with accounting systems, and built-in reminders for overdue payments. For businesses that require frequent, large-scale document creation, this type of software can save significant time and reduce human error. While spreadsheets can also incorporate formulas and automate certain tasks, they often require a higher level of manual input and expertise to set up effectively. Ultimately, the choice between spreadsheets and specialized software comes down to your business’s needs. Spreadsheets are ideal for smaller operations that require simplicity and flexibility, while specialized tools are better suited for businesses that need high automation and integrated financial management features. Best Practices for Using Invoice TemplatesCreating consistent and professional financial documents is essential for maintaining clear communication with clients and ensuring timely payments. Whether you’re using a spreadsheet or another tool, following best practices when creating these documents can help ensure accuracy, efficiency, and a professional appearance. Implementing a few key strategies can streamline the process, reduce errors, and improve the overall client experience. Consistency is KeyMaintaining a consistent format across all financial documents is crucial for building trust and presenting a professional image. Ensure that every document includes the same key details in the same layout, such as:

Standardizing your documents not only saves time but also makes it easier for clients to review and process the information, reducing the likelihood of misunderstandings or delays. Keep Information Accurate and Up-to-Date

Accuracy is paramount in financial documentation. Double-check all figures and details before sending any document to a client. This includes verifying the pricing, quantities, and any applicable taxes or discounts. Additionally, make sure that your contact details, payment terms, and due dates are current. Keeping your records up-to-date ensures that all clients receive the correct information, which in turn reduces disputes and fosters trust in your business practices. Regularly review and update your documents to reflect changes in pricing, tax rates, or business policies. By following these best practices, you can ensure that your business’s financial documentation remains accurate, professional, and easy to process for your clients. How to Automate Invoice Generation in ExcelAutomating the creation of financial documents can significantly improve efficiency and reduce the risk of human error. By utilizing built-in features within spreadsheet software, businesses can set up systems that automatically populate key information, calculate totals, and generate new documents with minimal effort. This not only saves time but also ensures that the documents are consistently formatted and accurate. Setting up automated calculations is one of the first steps toward streamlining the process. By incorporating formulas, you can automatically calculate the total cost, taxes, and any discounts for each transaction. For example, using basic multiplication and addition formulas, you can set up a system where entering quantities and unit prices will instantly produce the correct totals and overall cost. Using Data Entry Forms

Another way to speed up document creation is by utilizing data entry forms. This allows you to input the details of a transaction–such as client name, product or service provided, and price–into predefined fields. Once the data is entered, the system will automatically populate the necessary fields in your financial document, making it easier to generate new records without repetitive manual work. Creating Templates with Predefined FieldsDesigning a document layout with predefined fields is essential for automation. You can set up placeholders for client names, dates, and itemized lists. Once the form is filled out, these fields will be automatically populated with the correct information. This can save considerable time, especially for businesses that regularly create similar documents. By setting up a structured system that incorporates formulas, data entry forms, and predefined fields, you can automate the process of document creation in a way that is both efficient and reliable. This allows your team to focus on more critical tasks while ensuring that all financial documents are created with accuracy and consistency. Tips for Formatting Sales Invoices CorrectlyProperly formatting financial documents is essential for clear communication and ensuring that all necessary information is easily accessible. A well-structured document not only looks professional but also helps clients understand their obligations, reducing confusion and speeding up the payment process. Following a few key formatting guidelines can make a significant difference in the effectiveness and appearance of your records. 1. Include Essential InformationTo avoid any ambiguity, make sure your document includes the following details:

2. Organize Items ClearlyWhen listing the products or services provided, make sure to format the information in a clear and easy-to-follow table:

3. Maintain Consistency in DesignA clean and consistent design enhances the readability of your document. Here are some design tips to ensure clarity:

|