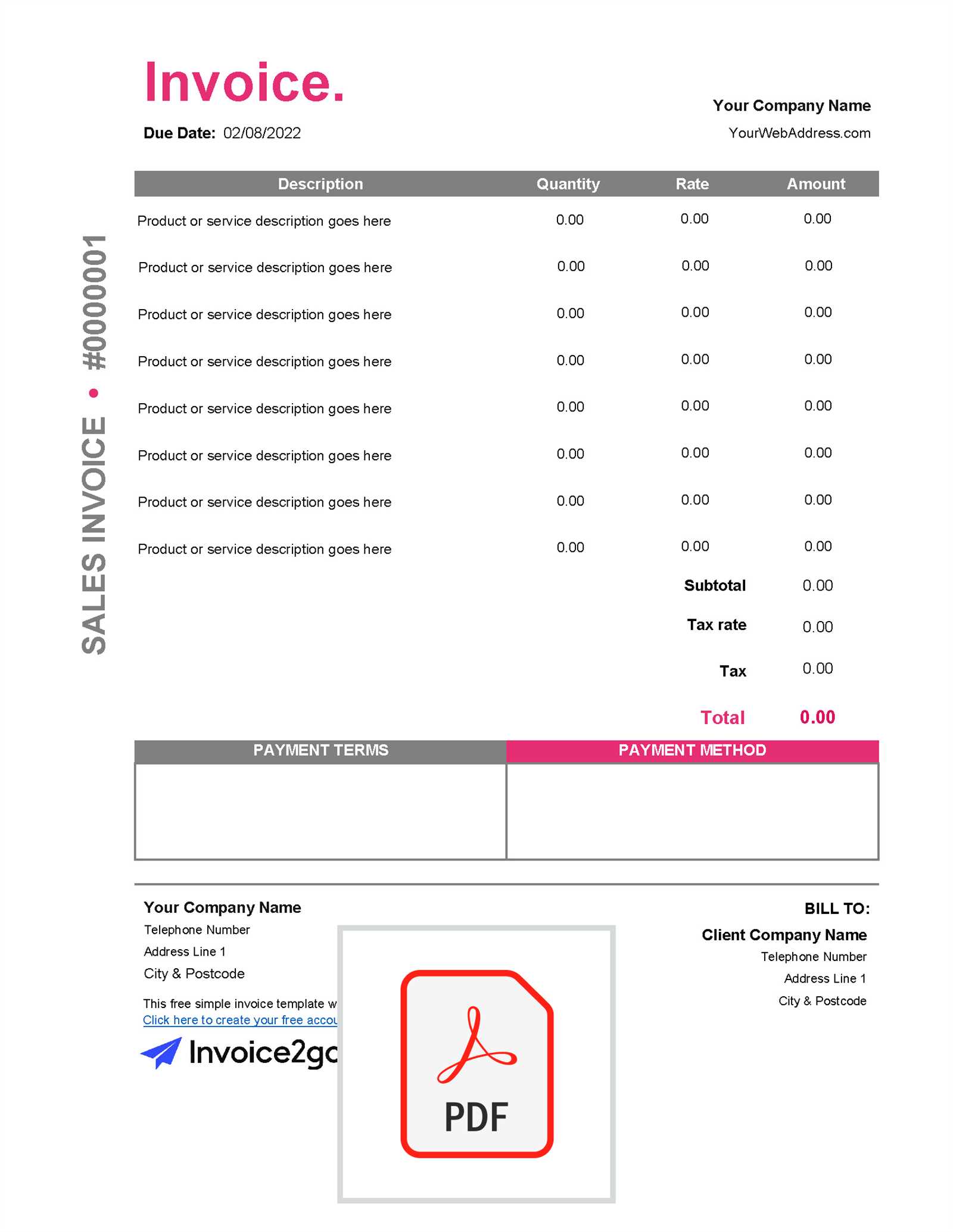

Download Free Sales Invoice Template for Easy Billing

Managing transactions efficiently is crucial for maintaining smooth business operations. Having the right tools to document payments and purchases helps ensure clarity between you and your clients. The right document can save time, prevent errors, and contribute to better financial tracking.

There are many options available when it comes to creating professional billing records. By using an easy-to-edit document format, businesses can customize their statements to reflect their unique needs. Whether you’re working with regular clients or processing one-time orders, an organized record is essential for tracking income and ensuring timely payments.

Accessing ready-made files allows you to focus on other areas of your work while ensuring your financial documents are accurate and compliant with standards. These tools can be adjusted to fit your brand’s style, offering both functionality and professionalism in one simple solution.

Free Sales Invoice Template Download

Efficient document management plays a key role in maintaining clear records of all financial transactions. Having access to editable forms allows businesses to create detailed and professional statements for clients quickly. These ready-made documents are designed to help you streamline the process of documenting payments, ensuring consistency and accuracy.

Using customizable files, you can easily input specific transaction details and adjust them to suit your business’s needs. Whether you are processing a simple sale or handling more complex transactions, these tools ensure that all necessary information is properly included. The ability to create tailored records helps businesses maintain a professional image while reducing the time spent on paperwork.

Why Choose Editable Documents

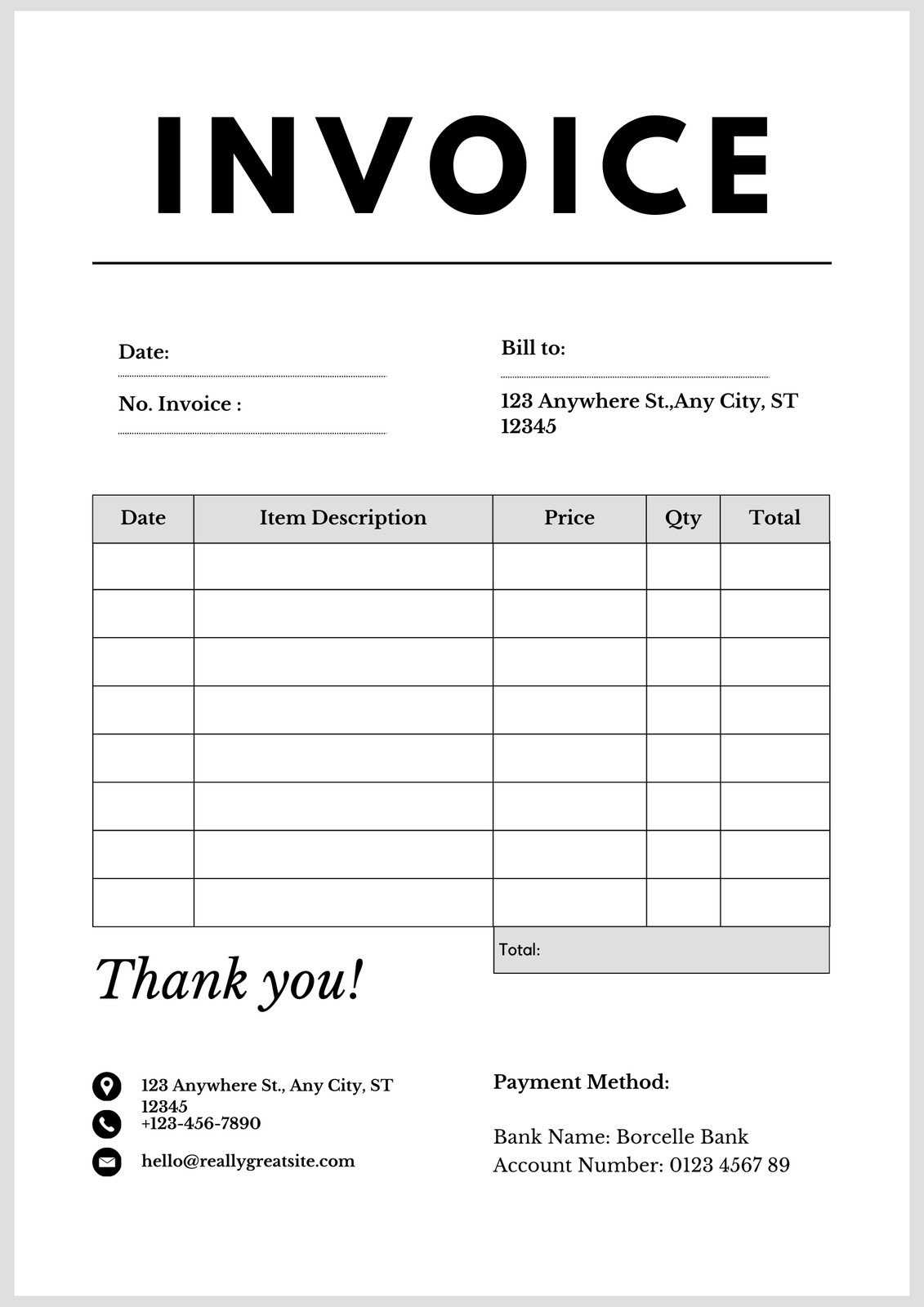

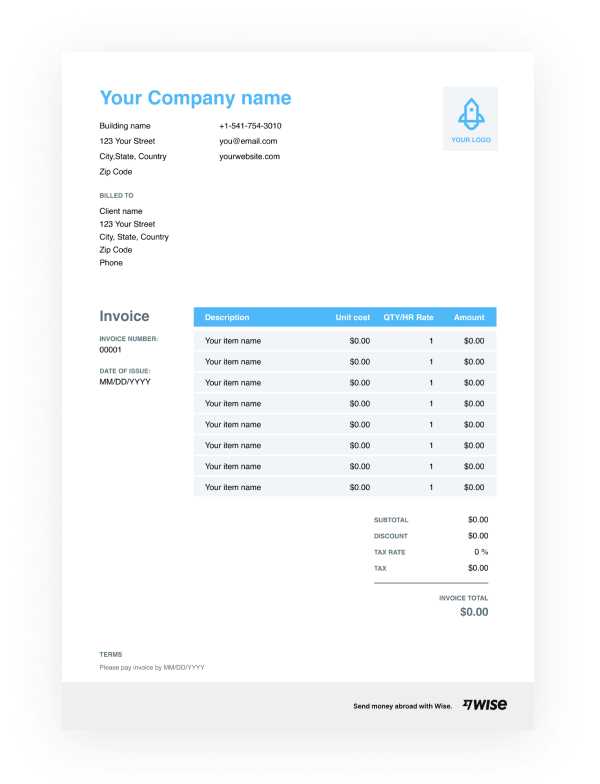

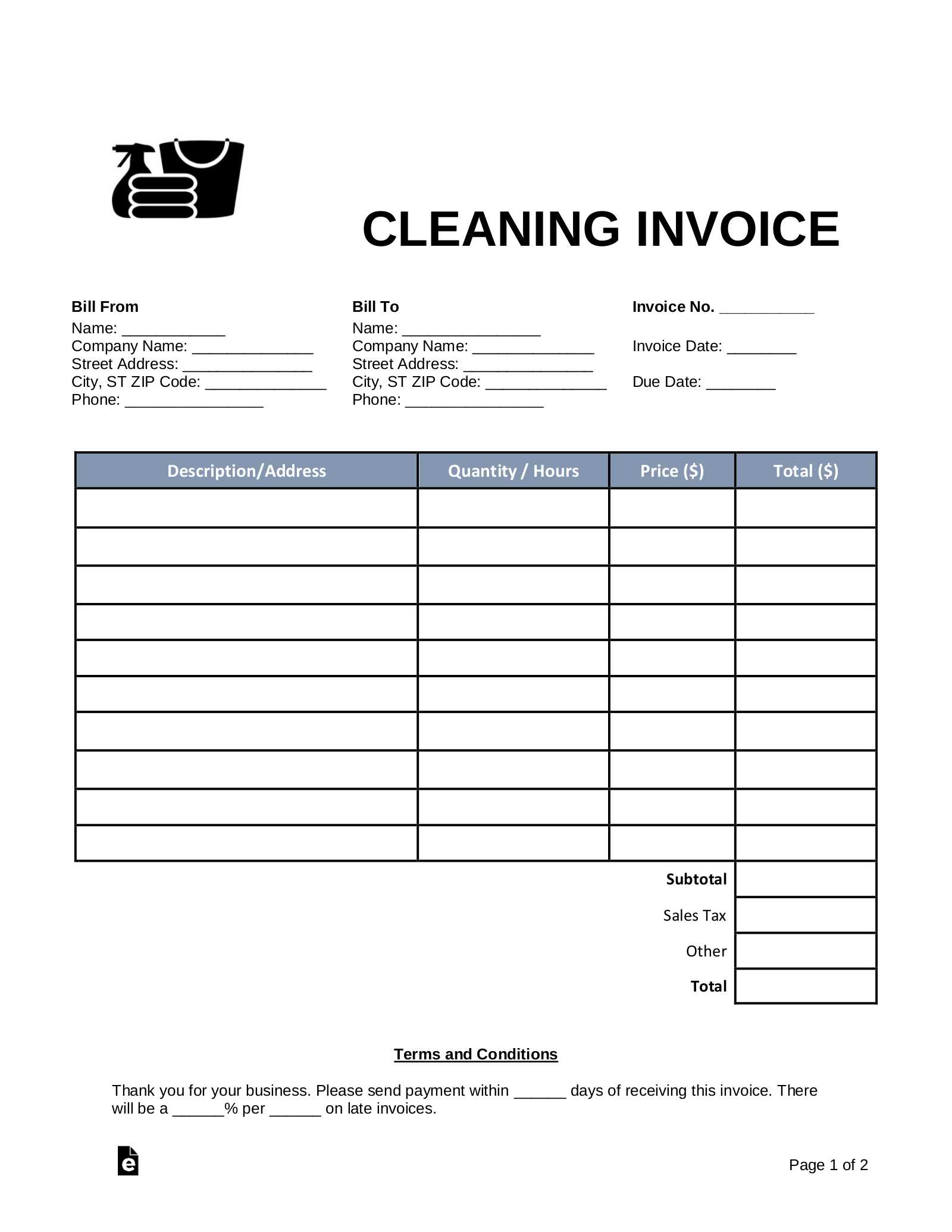

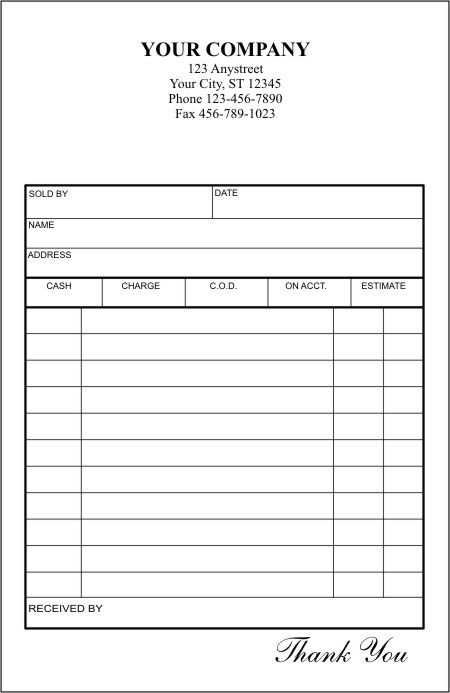

Editable forms provide flexibility in how you present transaction data. With a variety of styles and formats, you can select a layout that aligns with your business identity. Whether you prefer a minimalist design or a more detailed approach, these files can be adjusted to fit your preferences while maintaining clarity for clients and accountants alike.

How Customizable Formats Benefit Your Business

By choosing editable formats, businesses can ensure that every detail, from client names to transaction descriptions, is precisely included. This customization reduces the chances of errors, speeding up the billing process. Additionally, it provides a more polished and professional appearance that helps reinforce trust with clients.

Why Use a Billing Document Template

Efficient documentation is vital for any business looking to maintain accurate records and smooth financial operations. Using a pre-designed structure for payment records can significantly simplify the process, ensuring consistency and reducing the chances of errors. This approach helps businesses stay organized while saving valuable time.

These ready-made structures allow you to input all the necessary details without worrying about formatting or missing information. By following a consistent format, you ensure that all essential elements–such as dates, amounts, and client details–are included in every document, making it easier to track payments and resolve potential discrepancies.

Time-Saving and Efficient

One of the primary benefits of using a pre-structured document is the time it saves. Instead of creating a new record from scratch each time, you can fill in the relevant details in a few simple steps. This efficiency helps you focus on other tasks, knowing that the financial documentation is both accurate and professional.

Professional Appearance

Using a standardized format for your business records projects a professional image to clients. A consistent and clean presentation of financial details fosters trust and reliability, encouraging timely payments and positive business relationships. It ensures that your clients view your business as organized and dependable.

Benefits of Using a Pre-Made Billing Document

Accessing a ready-made structure for financial records offers a variety of advantages for businesses of all sizes. These pre-designed forms provide a streamlined approach to creating professional documents, ensuring accuracy and saving time. By utilizing such tools, companies can maintain consistency while focusing on more critical aspects of their operations.

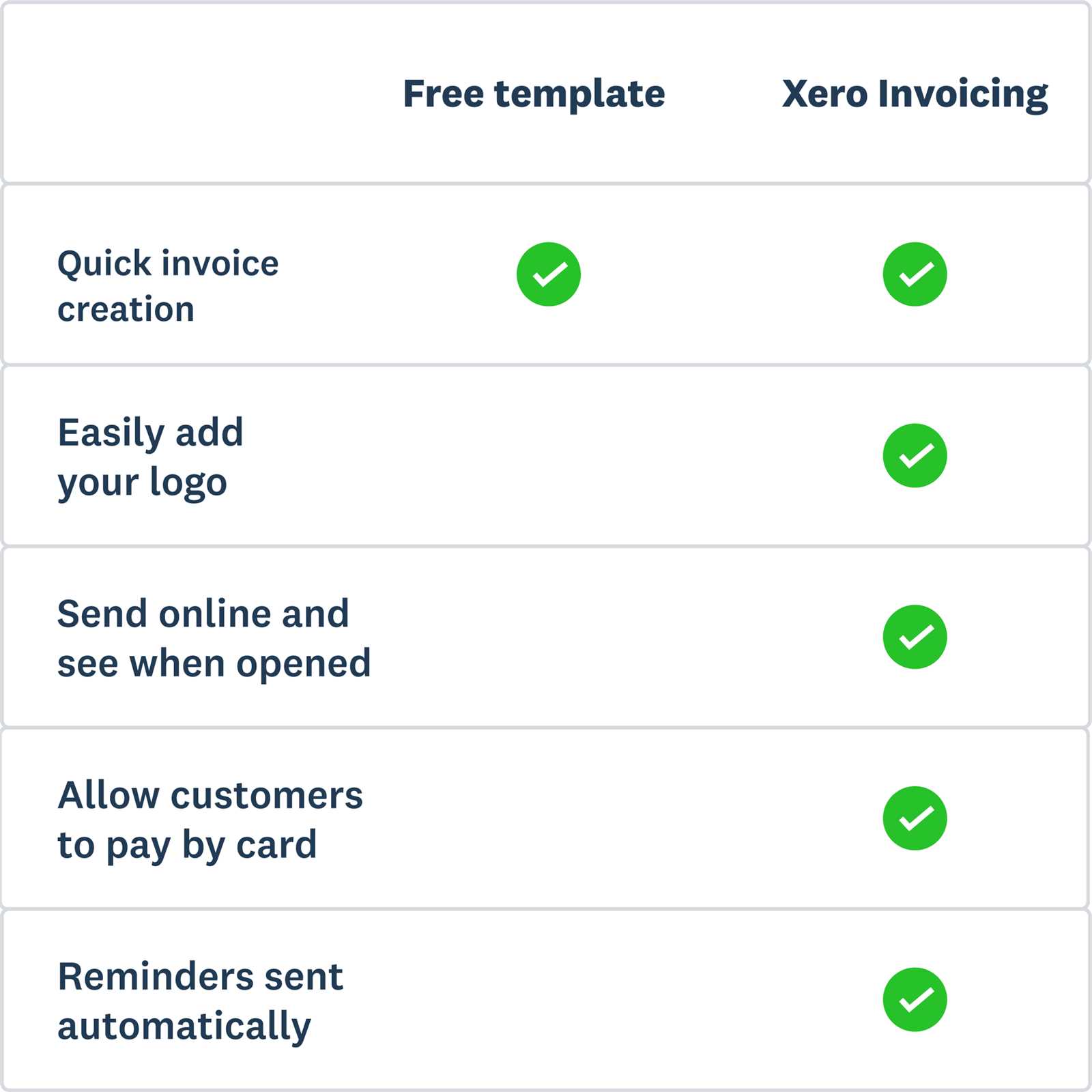

- Time Efficiency: With an established format, you can quickly fill in necessary details and generate documents without the hassle of starting from scratch.

- Cost Savings: Many pre-made forms are available at no charge, allowing businesses to avoid the expense of creating custom templates or hiring professionals to do so.

- Consistency and Accuracy: A standardized format reduces the risk of forgetting important information or making formatting errors, ensuring all records are uniform.

- Professional Appearance: These forms are designed to look polished and business-ready, which helps in building trust and presenting your company as organized and reliable.

- Easy Customization: Most formats can be easily adjusted to suit specific business needs, such as adding branding or modifying fields for specific types of transactions.

These benefits make it clear that using pre-structured documents not only simplifies the process of billing but also enhances overall business efficiency and professionalism.

How to Customize Your Billing Document

Customizing your financial records allows you to tailor them to meet the specific needs of your business and clients. Whether you’re adjusting the layout or adding personalized information, the ability to modify the document ensures that it reflects your brand’s identity while remaining functional. This flexibility helps you maintain professionalism and improve communication with clients.

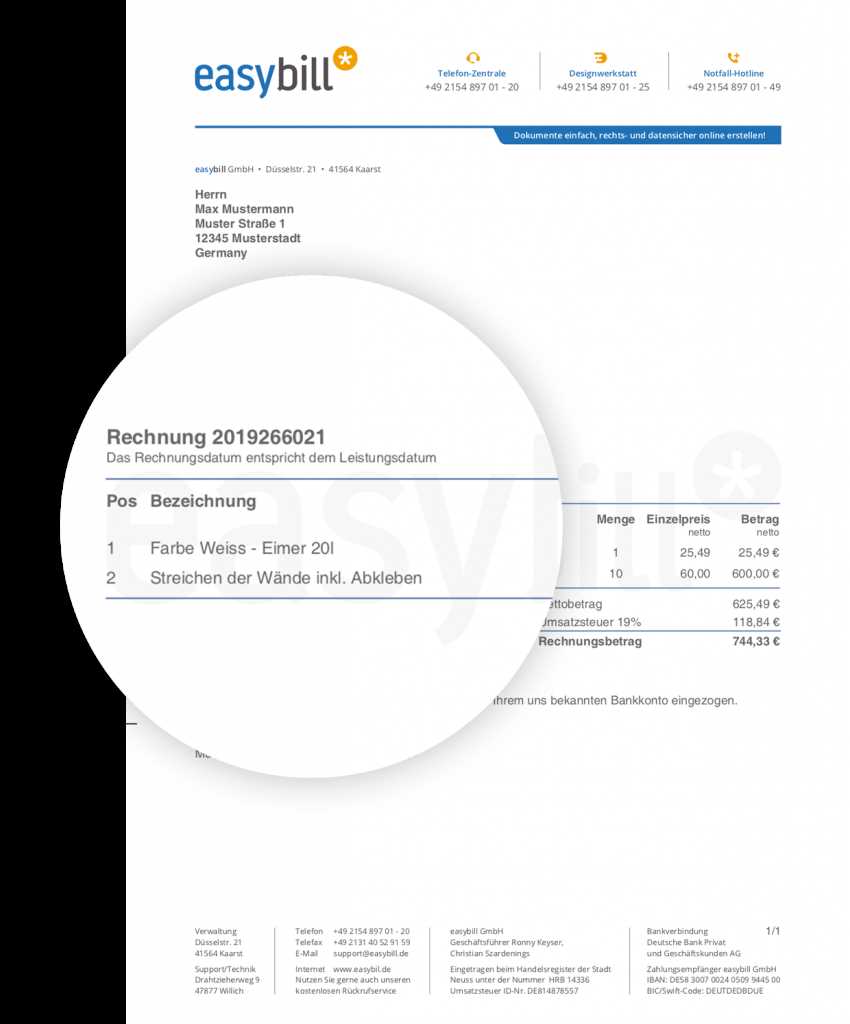

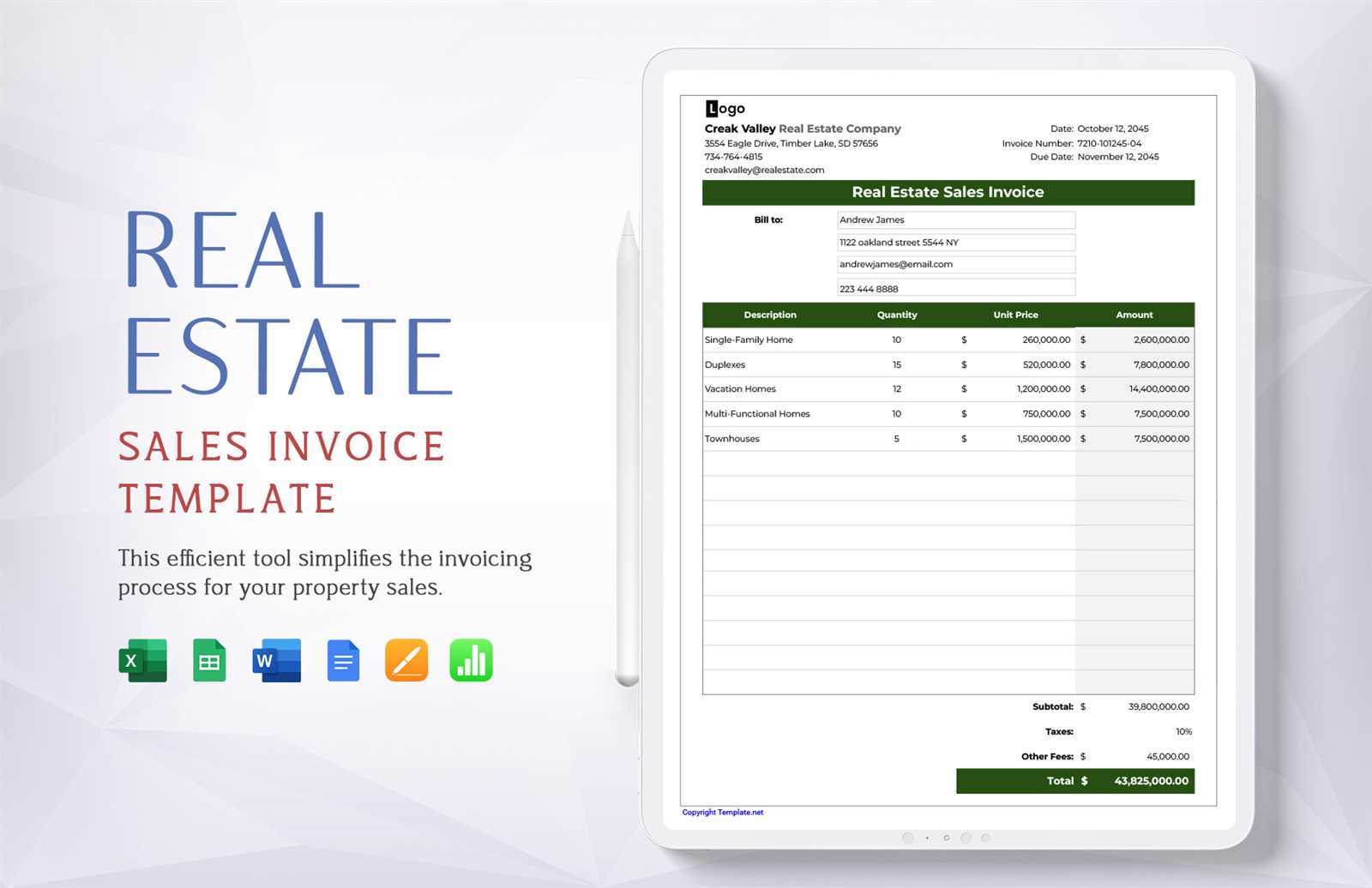

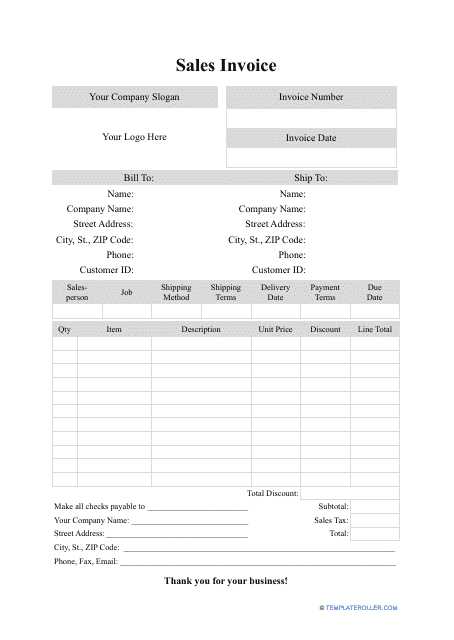

Adjusting Key Information

The most important aspect of customization is ensuring that all relevant details are included in each document. Common fields that may need to be adjusted include client names, product descriptions, dates, and payment terms. Depending on your business needs, you can also add sections for discounts, taxes, or shipping costs.

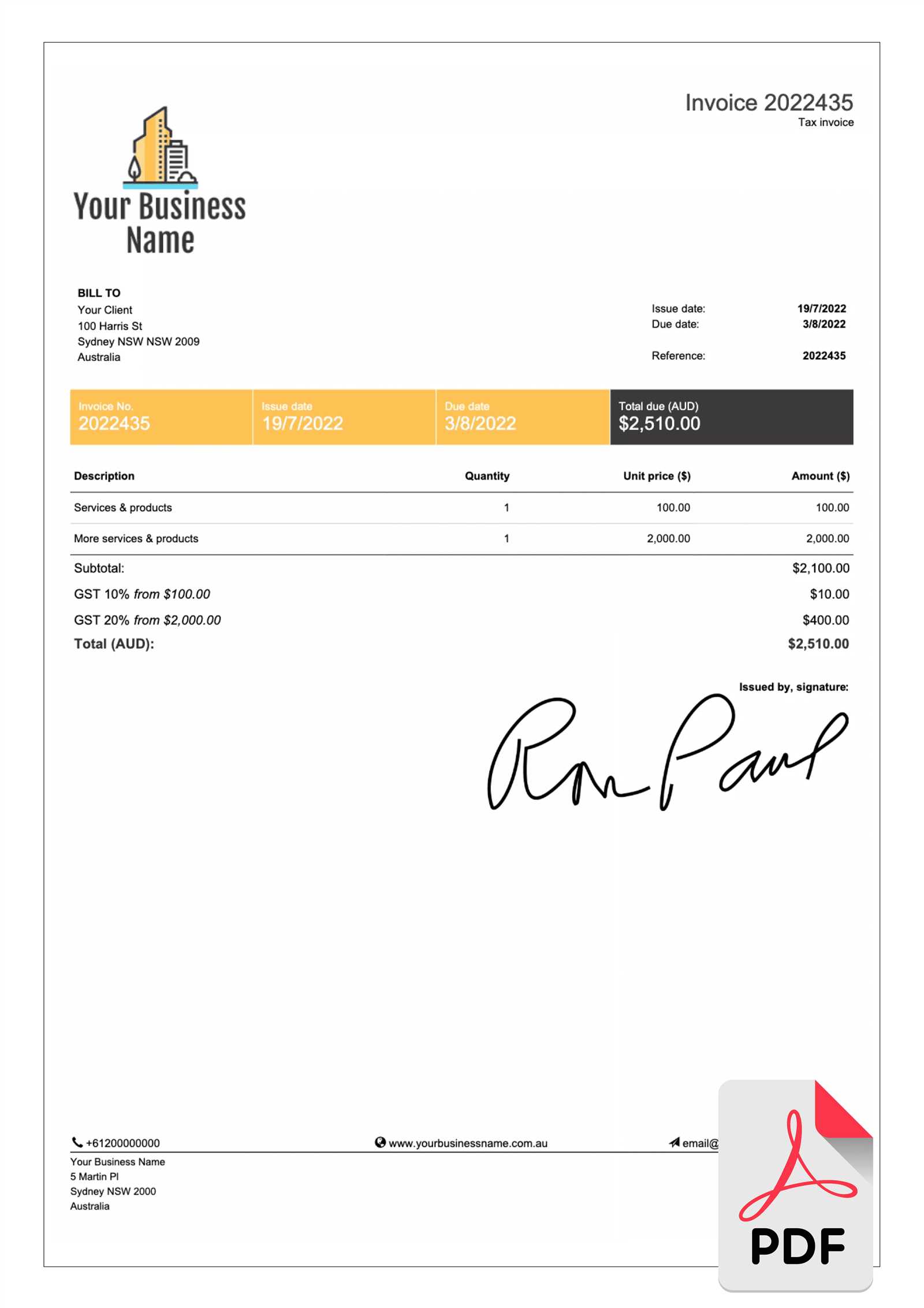

Design and Layout Changes

Beyond content, customizing the look of your document can make a big difference. Adjusting the layout to match your business’s visual identity helps create a more cohesive experience for your clients. Adding your company logo, changing the font, or tweaking the color scheme are all simple ways to make the document align with your brand.

| Field | Customization Options |

|---|---|

| Company Information | Add logo, change contact details, adjust business name formatting |

| Client Information | Modify fields for client names, addresses, or special notes |

| Itemized List | Adjust description, quantity, price columns, add custom fields |

| Payment Terms | Change due dates, add discounts or fees, modify payment instructions |

Customizing these elements ensures that each document serves its purpose efficiently while reflecting your business’s unique needs and image.

Top Features to Look for in Templates

When choosing a pre-made document structure for your billing needs, certain features can make the process smoother and more efficient. The right set of tools within the file can significantly reduce the time spent on customization and ensure that all essential information is included. Below are the key elements to look for when selecting a suitable format for your business.

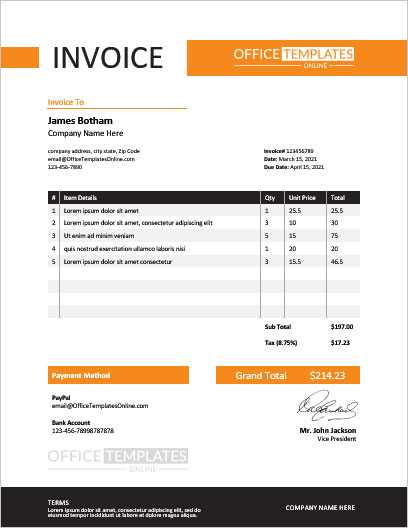

- Customizable Layout: Ensure that the format allows easy adjustments to suit your business needs, such as adding or removing sections, modifying text alignment, or resizing fields.

- Clear and Structured Design: A clean, organized layout helps clients quickly understand the details of the transaction. Look for a design that separates the sections clearly, making the document easy to read.

- Itemized Fields: Having separate areas for product descriptions, quantities, prices, and any additional fees allows for greater clarity and transparency in the billing process.

- Flexible Payment Terms: It’s important to be able to include specific payment instructions, due dates, or even installment options if applicable to your business model.

- Client and Company Information Sections: Make sure the document has space for both your business details and your client’s information, such as addresses, contact numbers, and email addresses.

- Tax and Discount Fields: Depending on the nature of your business, being able to apply taxes, discounts, or promotional offers can simplify calculations and prevent mistakes.

- Professional Appearance: A visually appealing document with a polished look enhances your business reputation and makes the billing process feel more official.

- Compatibility with Other Software: Some formats are designed to work well with accounting or payment processing software, which can make your workflow more efficient and automated.

By ensuring these features are present, you can create professional, accurate, and streamlined billing documents that benefit both your business and your clients.

How Billing Documents Improve Business Operations

Properly managing financial records is essential for any successful business. The use of organized and standardized documentation for transactions helps streamline operations, improve cash flow management, and ensure that all aspects of the billing process are transparent. When businesses implement a structured approach to recording sales and payments, they can better track revenue, avoid errors, and maintain positive relationships with clients.

Streamlined Payment Processing

Accurate and clear records make it easier for both businesses and clients to understand the terms of a transaction. With well-organized documents, customers can quickly review their purchases and know exactly what is owed. This clarity reduces delays in payment and fosters quicker processing, contributing to improved cash flow for the business.

Improved Financial Tracking and Reporting

Consistent use of structured documents allows businesses to track payments and outstanding balances with ease. By keeping a reliable record of every transaction, businesses can identify trends, monitor performance, and ensure that financial reports are accurate. This level of organization is critical when preparing tax filings or audits, helping businesses maintain compliance and avoid potential legal issues.

In summary, having a well-organized billing system in place provides operational efficiency, reduces administrative burdens, and strengthens customer relationships, ultimately contributing to the overall success of the business.

Where to Find Reliable Billing Documents

When looking for ready-made forms to streamline your financial records, it’s important to find sources that provide reliable, professional, and easy-to-use options. The right resources ensure that you have access to well-designed files that meet your business needs, and can be customized quickly without compromising quality. Whether you need a simple structure or something more detailed, choosing trustworthy providers is key to maintaining an organized and efficient workflow.

There are several places where you can find high-quality, customizable files for your business needs. Online platforms, such as reputable accounting websites or business resource hubs, offer a range of professional tools. Many of these platforms provide both free and premium options, allowing businesses of all sizes to choose a solution that fits their requirements.

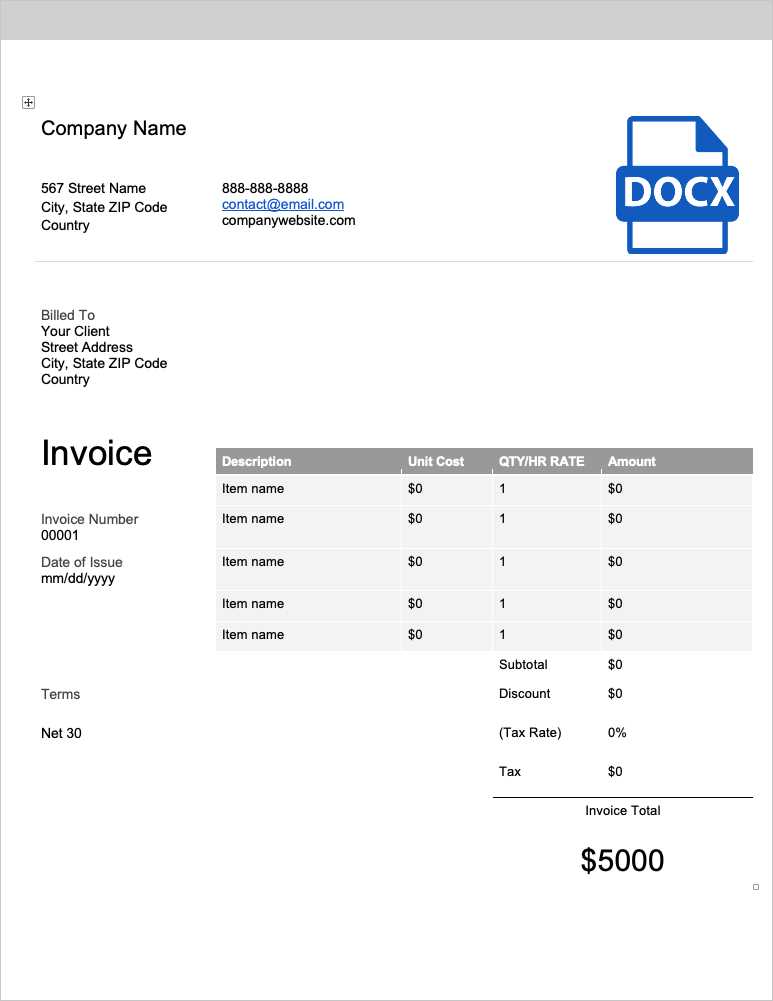

Additionally, some productivity software suites, such as word processors or spreadsheet programs, come with built-in templates that can be easily adjusted. These options often integrate seamlessly with other tools you may already use, making the process of managing records even more efficient.

Ultimately, when searching for reliable resources, prioritize well-reviewed providers and ensure that the documents are compatible with your business’s operations. This ensures a smooth, professional experience for both you and your clients.

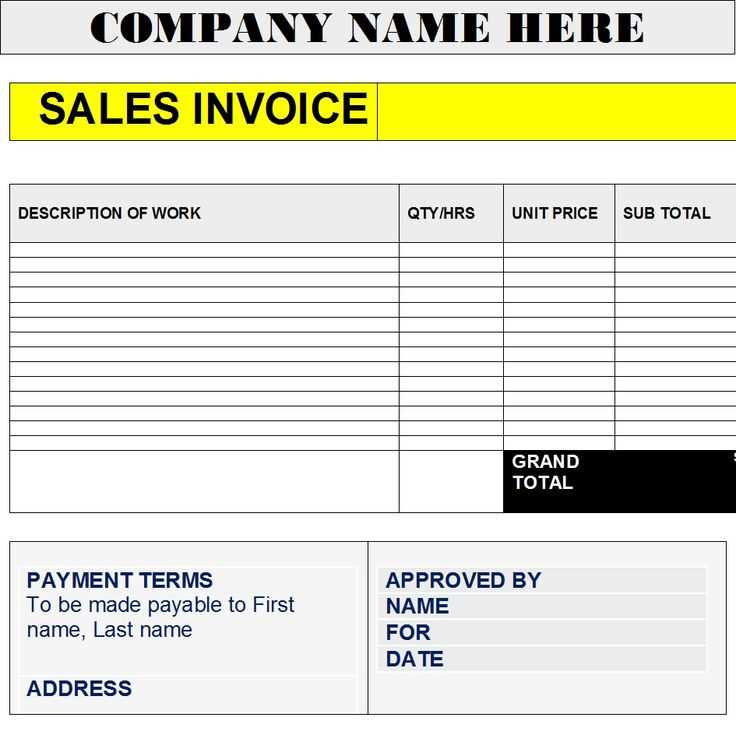

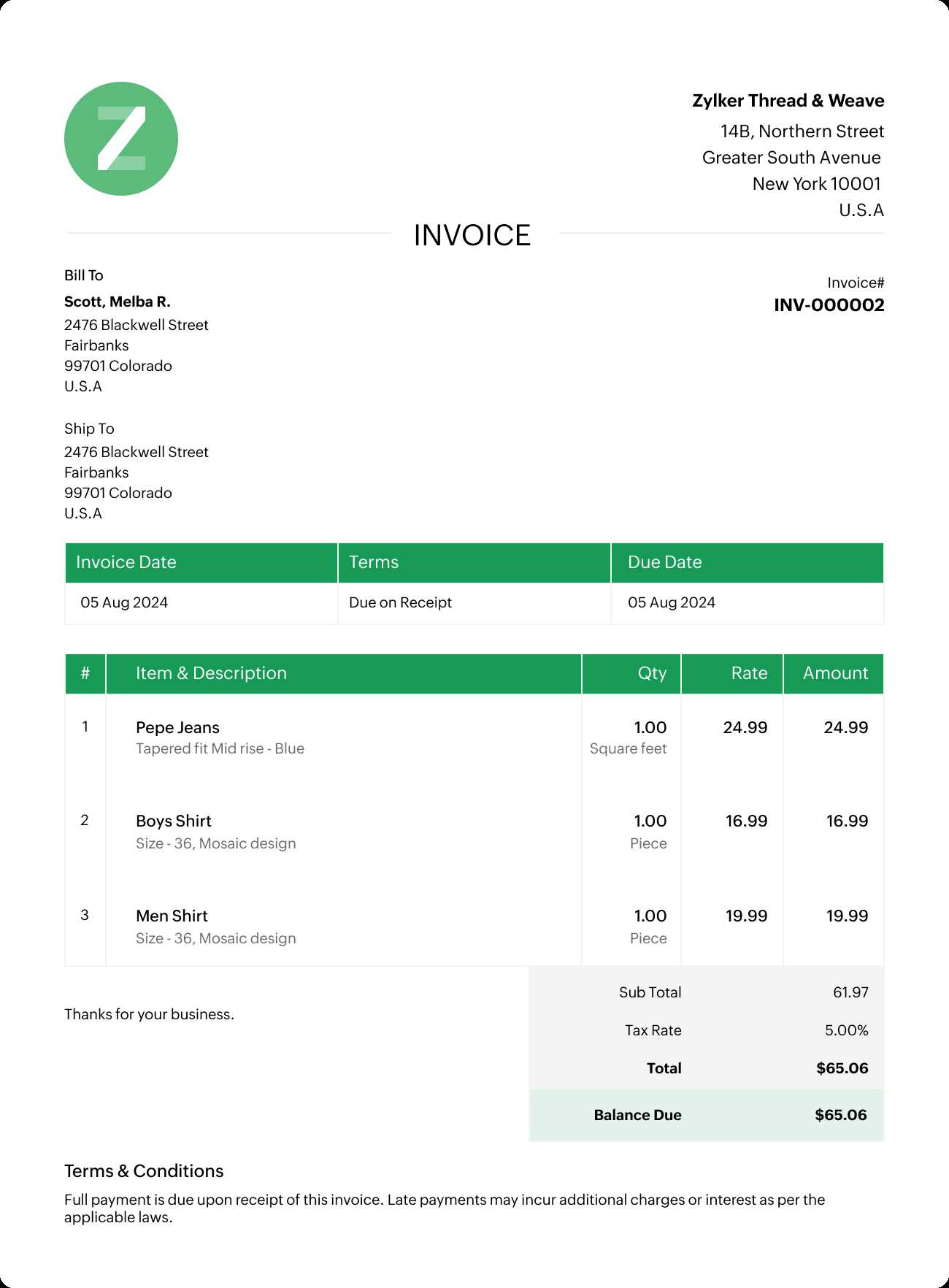

How to Choose the Right Billing Style

Selecting the appropriate design for your business’s financial records is crucial to ensuring that the documents are both functional and professional. The right style should align with your business type, branding, and the complexity of the transactions you handle. A well-chosen layout not only presents a polished image but also makes it easier for your clients to understand the details of each transaction.

When deciding on a style, consider the following factors:

| Factor | Considerations |

|---|---|

| Business Type | Choose a layout that fits your industry. A creative business may prefer a more visually dynamic design, while a consulting firm might opt for a simple, professional look. |

| Transaction Complexity | For simple transactions, a basic layout is sufficient. If your business involves more detailed billing (e.g., multiple items or services), consider a more structured format with separate sections for each component. |

| Brand Identity | Ensure that the design matches your brand’s color scheme, logo, and overall aesthetic. Consistency across all customer touchpoints helps reinforce your business’s identity. |

| Client Preferences | Consider whether your clients prefer more detailed, itemized statements or a summary format. Some clients may appreciate extra details, while others may prefer a simplified view. |

By considering these factors, you can select a style that enhances clarity, professionalism, and aligns with both your business needs and client expectations.

Step-by-Step Guide to Using Pre-Designed Forms

Using a pre-structured document for your billing process can significantly streamline your workflow. These ready-made formats are designed to simplify the process of creating professional records, allowing you to focus on the details without worrying about formatting. By following a simple, step-by-step approach, you can quickly create clear and accurate records for each transaction.

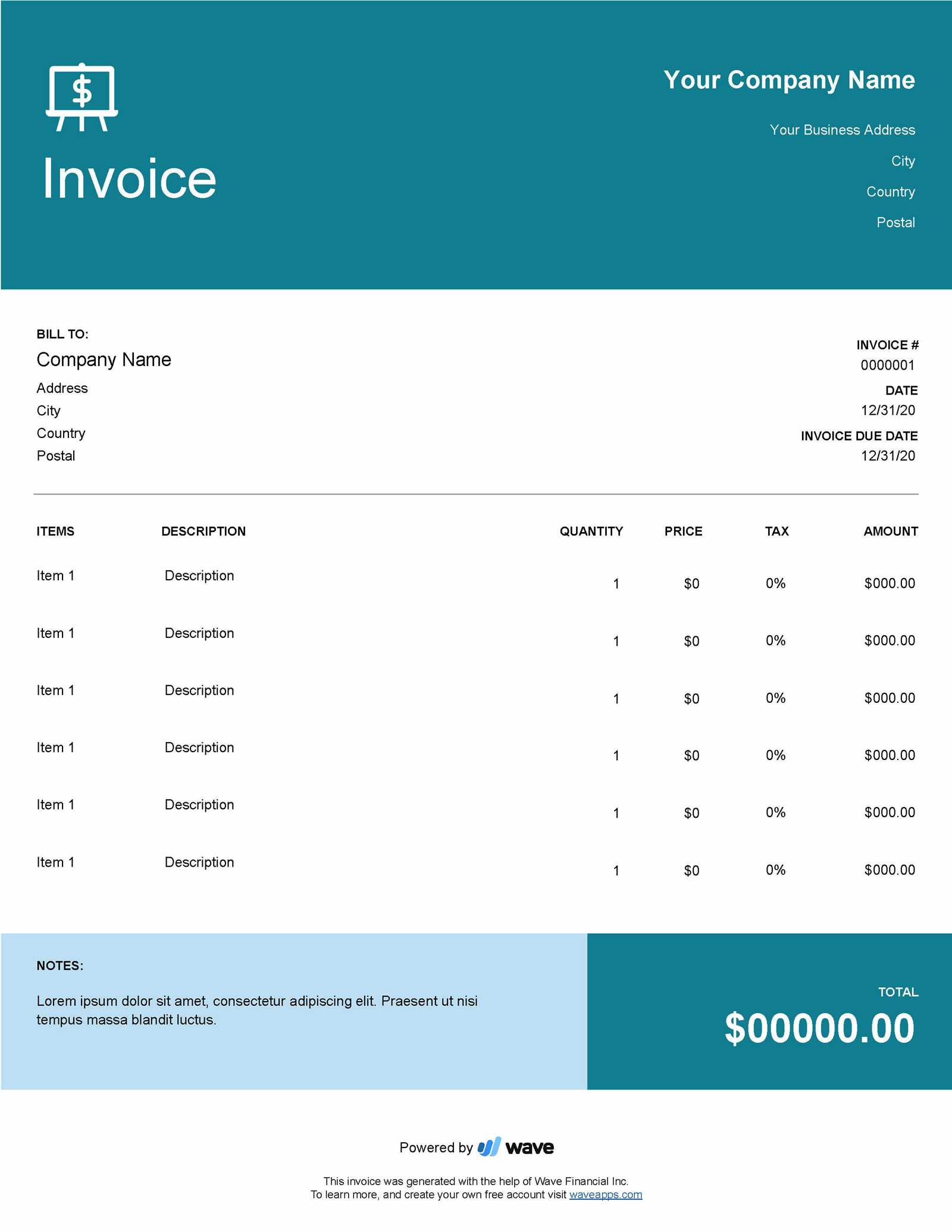

Step 1: Select the Right Format

The first step is to choose a format that fits the specific needs of your business. Consider whether you need a simple structure for one-time payments or a more detailed layout for ongoing transactions. Some forms are designed for single purchases, while others may include sections for taxes, discounts, and multiple items. Choose one that aligns with the complexity of your transactions.

Step 2: Input Your Details

Once you’ve selected the right layout, start filling in the required information. Typically, this includes your business name and contact details, client information, a breakdown of products or services, and payment terms. Be sure to include accurate and complete details, as this ensures clarity and avoids confusion later on. Double-check the numbers and make sure any discounts, taxes, or additional charges are correctly calculated.

Tip: Many of these documents allow you to easily add custom fields for specific needs, such as shipping information or special client instructions. Customize the document to suit your business requirements, but maintain a clean and professional design.

Once the details are entered, save the document and send it to your client. The ease of use and flexibility offered by pre-designed forms will help you stay organized and ensure you present a professional image in every transaction.

Common Mistakes in Billing Documents

While creating billing records may seem straightforward, many businesses overlook important details that can lead to confusion or delays in payments. Common errors in these documents can affect both the business’s reputation and the smooth flow of financial operations. Identifying and addressing these mistakes early on is crucial to maintaining accuracy and professionalism in your billing process.

Here are some of the most frequent issues that occur when generating financial records:

- Missing or Incorrect Client Information: Failing to include accurate details, such as the client’s name, address, or contact number, can lead to miscommunication and delayed payments. Always double-check that the client’s information is complete and accurate.

- Incorrect Payment Terms: Not specifying payment deadlines, late fees, or discounts clearly can cause confusion. Be sure to outline exactly when payment is due and what penalties may apply if the payment is late.

- Calculation Errors: Simple arithmetic mistakes in the total amount due can cause problems for both the business and the client. Ensure that all amounts–whether for individual products or taxes–are calculated correctly before sending the document.

- Missing Product/Service Descriptions: Failing to provide a detailed breakdown of the items or services rendered can lead to disputes or delays. It’s essential to describe each charge clearly so that both parties understand the transaction.

- Lack of Clear Payment Instructions: Not specifying the accepted methods of payment, such as bank transfer, credit card, or check, can create confusion. Always include clear, concise payment instructions to make the process easier for your clients.

By being aware of these common mistakes and taking extra care when preparing your records, you can prevent costly errors and ensure a smooth transaction process with your clients.

Best Practices for Professional Billing

Creating clear, accurate, and professional billing records is essential for maintaining positive client relationships and ensuring timely payments. Adhering to best practices in billing not only helps avoid mistakes but also presents your business as organized and trustworthy. By following a few key guidelines, you can enhance the effectiveness of your financial documents and streamline your payment processes.

1. Be Clear and Concise

Always ensure that your document is easy to read and understand. Use simple, straightforward language to describe products, services, and payment terms. Avoid jargon or complex terms that might confuse your client. A well-organized, clean layout makes it easy for the recipient to quickly assess what is owed and the terms of the transaction.

2. Include All Necessary Information

It’s important to provide complete and accurate details on every billing document. At a minimum, you should include:

- Your business name, contact information, and logo (if applicable)

- Your client’s name and contact details

- A breakdown of the products or services provided

- The total amount due, including any applicable taxes or discounts

- The payment due date and accepted payment methods

Including these details ensures that there is no ambiguity, reducing the chance of disputes and delays.

3. Set Clear Payment Terms

Clearly outline the terms of payment on your document. This includes specifying the payment deadline, applicable penalties for late payments, and accepted payment methods. By setting clear expectations, you help your clients understand exactly what is required and when, making the entire process more efficient.

Tip: If possible, offer different payment options (e.g., credit card, bank transfer, or online payment) to make it easier for your clients to settle their balances.

4. Keep a Professional Tone and Design

Your billing document should reflect the professionalism of your business. Maintain a consistent design that aligns with your brand’s identity, including logos, fonts, and colors. A polished appearance not only builds trust but also helps reinforce your brand image, making the document feel official and well-established.

By following these best practices, you can create billing documents that are clear, accurate, and professional, helping you build strong relationships with clients while ensuring timely payments.

Billing Document Structure for Small Businesses

For small businesses, having a clear and organized structure for financial records is essential to ensure smooth transactions and maintain professional relationships with clients. A well-designed billing record helps track payments, maintain cash flow, and avoid misunderstandings about transaction details. When starting out, it’s especially important to use a simple yet effective layout that allows for easy customization and quick generation.

For small businesses, the ideal structure should include all necessary details such as the business and client contact information, a breakdown of goods or services provided, and clear payment terms. The format should be flexible enough to accommodate a range of transaction types, from one-time purchases to recurring services. Keeping the layout straightforward ensures that even with limited resources, businesses can maintain a professional appearance and minimize errors.

Using a ready-made structure designed specifically for smaller companies can save valuable time, allowing entrepreneurs to focus on growing their business while ensuring that their financial records are accurate and consistent. Whether you’re selling products, offering services, or both, having a reliable system in place can help streamline the billing process and foster trust with your clients.

How to Track Payments with Billing Records

Tracking payments efficiently is critical for maintaining a healthy cash flow and ensuring that all transactions are accurately recorded. By using a clear and organized structure for each transaction, businesses can easily monitor outstanding balances, received payments, and due amounts. Implementing a consistent system helps avoid confusion, reduces administrative work, and ensures clients are billed appropriately for the services or products they have received.

The key to effective payment tracking is maintaining a well-documented record for each transaction. This allows you to match payments to the corresponding records and easily identify any discrepancies. Below is an example of how to structure your document to keep track of payments effectively:

| Transaction Date | Client Name | Amount Due | Amount Paid | Balance | Status |

|---|---|---|---|---|---|

| March 15, 2024 | John Doe | $500.00 | $500.00 | $0.00 | Paid |

| March 20, 2024 | Jane Smith | $200.00 | $100.00 | $100.00 | Partial Payment |

| March 25, 2024 | ABC Corp. | $1,000.00 | $0.00 | $1,000.00 | Unpaid |

In this table, you can see how important information such as the transaction date, client details, and amounts due and paid is organized in a way that allows for quick reference. The “Balance” column helps you see the remaining amount that is yet to be paid, while the “Status” column makes it easy to monitor the payment status–whether it’s fully paid, partially paid, or unpaid.

By keeping track of payments in this manner, businesses can easily follow up with clients regarding overdue balances and ensure that their financial records are always up to date.

Digital vs Printed Billing Documents

When managing financial transactions, businesses often face the decision of whether to send records electronically or in print. Both methods offer distinct advantages, and the choice depends on the needs of the business and its clients. Digital records provide convenience and speed, while printed records may be preferred for formal or legal purposes. Understanding the pros and cons of each can help businesses determine the best approach for their billing process.

Advantages of Digital Records

Digital billing documents have become increasingly popular due to their efficiency and ease of use. They allow businesses to send records instantly, reducing the time it takes for clients to receive and process payments. Digital records can also be stored securely in the cloud, making it easier to manage and retrieve financial information. Furthermore, electronic documents are easily customizable, enabling businesses to quickly adapt their records to meet client needs or update payment terms.

Advantages of Printed Records

Despite the growing popularity of digital options, printed records still hold value in many industries. For certain clients, receiving a physical document may feel more official or tangible. Printed records are also useful for businesses that require hard copies for legal reasons or for auditing purposes. Additionally, printed documents can be easily signed, making them a preferred option for transactions that require a physical signature.

Ultimately, the decision between digital and printed records depends on the nature of your business and your clients’ preferences. Many businesses opt for a hybrid approach, using digital records for quick transactions and printed ones for more formal or contractual dealings.

How to Create Recurring Billing Records

Recurring transactions are common for businesses that offer subscription-based services or long-term contracts. Setting up a system to generate recurring financial documents can save time, reduce errors, and ensure timely payments. By automating the process, businesses can ensure consistency and avoid missing any billing cycles.

Step 1: Set Clear Payment Terms

Before creating recurring billing records, it’s essential to define the payment terms clearly. This includes setting the frequency of payments, such as weekly, monthly, or annually, and specifying the amount due each time. It’s also important to outline any additional terms, such as late fees, discounts for early payment, or special billing adjustments. Clear terms will prevent misunderstandings with clients and provide transparency.

Step 2: Automate the Process

Many businesses use software to automate the creation and sending of recurring documents. By setting up a system where the same details are replicated for each cycle, you can ensure that the document is consistent and delivered on time. Most billing platforms allow you to input client details, transaction frequency, and amounts once, then automatically generate and send the document based on the agreed schedule.

Tip: Make sure that clients are notified in advance of upcoming payments and have an easy way to view or update their payment methods. This will help reduce payment delays and keep your process running smoothly.

By following these steps, you can streamline your recurring billing process, saving time and ensuring that payments are received on time without additional effort each cycle.

How to Protect Your Billing Data

Protecting your financial data is crucial for maintaining the trust of your clients and ensuring the security of your business operations. Billing records often contain sensitive information, such as client details, transaction amounts, and payment terms, which can be targeted by cybercriminals. Implementing strong security measures is necessary to safeguard this data from unauthorized access and potential breaches.

Here are some key strategies to help you protect your financial records:

- Use Strong Passwords: Ensure that all systems where billing records are stored are protected with strong, unique passwords. Avoid using simple or easily guessed passwords, and consider enabling two-factor authentication for added security.

- Encrypt Sensitive Data: If you’re storing or sending billing records electronically, use encryption to protect the data. This ensures that even if the information is intercepted, it will be unreadable without the proper decryption key.

- Regular Backups: Regularly back up your financial records to secure cloud storage or external drives. This protects against data loss due to hardware failure or cyberattacks like ransomware.

- Limit Access: Restrict access to financial data to authorized personnel only. Implement role-based access controls so that employees or contractors can only access the information necessary for their tasks.

- Monitor for Fraud: Regularly review your financial records for any signs of unauthorized activity. If you detect any unusual transactions or changes, investigate immediately to prevent further issues.

- Use Secure Payment Methods: When processing payments, ensure you’re using secure and trusted payment gateways. Look for systems that comply with industry standards, such as PCI-DSS, to ensure your clients’ payment details are handled securely.

By following these practices, you can greatly reduce the risk of data breaches and ensure that both your business and your clients’ information remains safe. Cybersecurity is an ongoing process, so regularly update your security measures to stay ahead of potential threats.

Legal Considerations for Billing Records

When issuing billing documents, it’s essential to be aware of the legal implications to ensure that both the business and its clients are protected. Billing records are not just administrative tools–they can be used as legal evidence in case of disputes or audits. As such, it is crucial to ensure that they comply with applicable laws and regulations. Understanding the legal requirements for these documents will help businesses avoid penalties and maintain professional integrity.

Here are some key legal aspects to consider when creating billing documents:

- Accurate and Transparent Information: It’s critical that all details on the billing document are accurate and clearly stated. This includes client information, payment terms, amounts due, and descriptions of the products or services provided. Inaccurate or vague documents could lead to legal issues or payment disputes.

- Comply with Tax Laws: Make sure your documents include all necessary tax information, such as tax rates, VAT numbers, or other required tax details, based on your jurisdiction. Failure to comply with tax laws can result in fines and penalties.

- Clear Payment Terms: Legal contracts are often tied to payment terms. Be sure that due dates, late payment penalties, and other conditions are clearly outlined. This will help you enforce the terms if payment is delayed or disputed.

- Retention Requirements: Some jurisdictions have laws that require businesses to retain billing records for a specific period, such as 3–7 years. Understanding your local legal retention requirements will ensure that you do not dispose of important documents prematurely.

- Electronic Billing Regulations: If you’re using electronic systems for creating and storing records, ensure that these practices comply with e-commerce and data protection laws. Certain countries have strict regulations on electronic contracts and digital signatures.

By ensuring that your billing records meet these legal considerations, you can mitigate the risk of disputes, penalties, or loss of client trust. Always consult with a legal professional to ensure your business is fully compliant with local laws and regulations regarding financial transactions.

Integrating Billing Records with Accounting Software

Integrating financial documents with accounting software is a crucial step for businesses seeking efficiency and accuracy in their financial management. By connecting your billing records directly to accounting tools, you can automate data entry, track transactions seamlessly, and generate reports with ease. This integration reduces manual errors, saves time, and ensures that financial data is up-to-date and aligned with your business operations.

Here’s how integrating billing records with accounting software can streamline your financial management:

| Benefit | Details |

|---|---|

| Reduced Data Entry Errors | By syncing billing data with accounting software, manual data entry is minimized, lowering the risk of errors in transactions, amounts, and calculations. |

| Improved Financial Tracking | Accounting software can automatically update your records every time a new billing entry is made, ensuring that your financial status is always current. |

| Time-Saving Automation | Once the system is set up, the software will automatically categorize and organize billing details, generating reports without requiring manual input for each transaction. |

| Better Financial Insights | Integration provides easy access to real-time financial data, helping businesses track revenue, expenses, and profits more effectively. |

| Streamlined Tax Reporting | By integrating billing and accounting, businesses can more easily compile tax reports, ensuring all required information is accurate and compliant with tax laws. |

When choosing accounting software, ensure that it offers seamless integration with your billing process. Many popular platforms offer tools that sync directly with your payment system, allowing for smooth data flow between the two. This will help you maintain accurate records while saving time on routine administrative tasks.