Event Planner Invoice Template for Easy Billing and Management

Managing financial transactions smoothly is crucial for any business that offers services. Having a well-structured document to outline charges, terms, and payment details can simplify the billing process and ensure timely compensation. For those working in the event management industry, creating clear, professional documents is essential for maintaining client relationships and tracking earnings.

By using a standardized document, you can reduce errors, save time, and enhance the overall professionalism of your business. Whether you’re working on a large conference or an intimate gathering, a properly formatted statement not only communicates your charges but also reflects your attention to detail and organizational skills. A customized billing solution makes it easier to adjust for different types of services, from planning to coordination and execution.

Creating a streamlined document for your services helps ensure that all necessary information is included, such as itemized costs, payment instructions, and deadlines. This way, you can focus on delivering quality experiences while staying on top of your finances with minimal hassle. Having an easy-to-use structure in place will allow you to stay organized and ensure both you and your clients are clear on payment expectations.

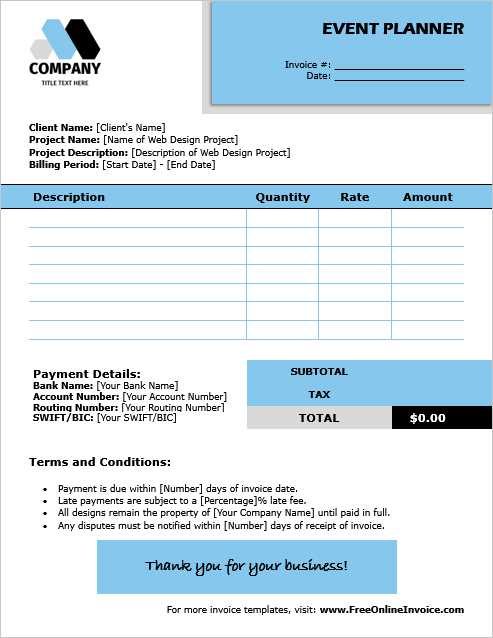

Event Planner Invoice Template Overview

When managing a service-based business, clear documentation of transactions is essential. A well-structured billing document helps you maintain professionalism, ensures timely payments, and provides clients with a clear breakdown of services rendered. By using a standard format, you can streamline the process, reduce errors, and save time on each project.

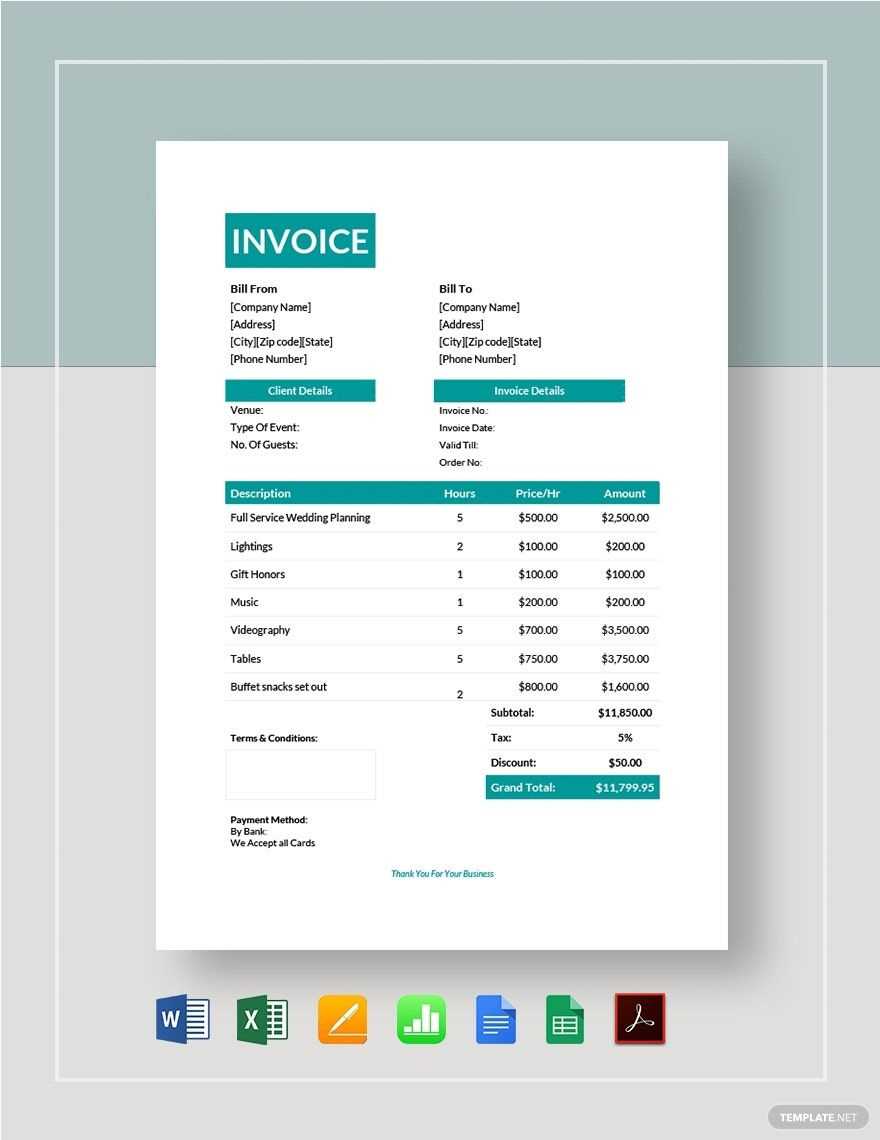

In essence, such a document serves as a comprehensive record that outlines the scope of work, the associated costs, and payment terms. For those offering event-related services, it is crucial to include all necessary details to avoid misunderstandings. Here are the main elements you should expect in a comprehensive billing document:

- Client Information: Name, contact details, and billing address.

- Service Description: A detailed breakdown of tasks performed or products provided.

- Dates and Timeline: Specific dates when services were rendered or milestones completed.

- Pricing Breakdown: A clear list of costs for each service, including taxes and additional charges.

- Payment Terms: Due dates, acceptable payment methods, and any late fees or discounts.

By having these elements clearly outlined, you ensure that both you and your clients are on the same page. Additionally, this type of document provides legal protection in case of disputes, as it offers an official record of the terms agreed upon by both parties.

Adopting a consistent and professional format for each project not only enhances your efficiency but also builds trust with clients. It shows that you are organized, transparent, and committed to delivering high-quality service.

Why You Need an Invoice Template

Having a standardized method for billing ensures that all transactions are clear, professional, and easy to manage. When you work in a service-oriented industry, keeping track of payments and providing accurate financial records is essential for smooth business operations. Using a predefined structure for documenting charges saves time, reduces errors, and helps maintain consistency across your projects.

Here are a few reasons why relying on a structured document for billing is crucial:

- Professionalism: A consistent format reflects your attention to detail and establishes trust with clients.

- Time-Saving: Pre-made formats reduce the need to create each document from scratch, allowing you to focus on delivering quality services.

- Accuracy: Ensures all relevant details are included, reducing the risk of missing critical information.

- Legal Protection: Acts as an official record of the agreed-upon terms and can protect you in case of disputes.

- Consistency: Maintains uniformity across all projects, making it easier to track payments and analyze your business performance.

By using a pre-designed structure, you can ensure that all the necessary components are included, leaving no room for confusion. This is especially important when managing multiple clients and various types of services. Having a clear, reliable system for documenting transactions helps you stay organized and ensures your business runs smoothly.

Key Elements of an Invoice Template

To create an effective document for billing, it’s important to include all the necessary details that provide a clear breakdown of services, costs, and terms. A well-structured document not only makes payment tracking easier but also enhances transparency and professionalism. Below are the essential components that should always be present in a billing record.

Client and Service Information

The first section should include the client’s contact details, including their name, address, and phone number. Additionally, include your own business information so clients can easily reach you. Clearly describe the services rendered, specifying what was provided, how long the services took, and any additional products or items involved in the transaction.

Payment Details and Terms

Next, include a detailed breakdown of costs. Each service should have its own price listed, along with any taxes or additional charges. The payment section should include the total amount due, payment methods accepted, and the due date. You should also specify any late fees or discounts for early payment to provide clear expectations for both parties.

Including these core elements ensures that the document is both comprehensive and easy to understand, which helps avoid any misunderstandings and ensures smoother transactions.

How to Create Your Own Invoice

Creating a customized document to record payments for your services can be a straightforward process when you know the essential components to include. A well-crafted document not only serves as a clear record for both you and your clients but also enhances your professional image. Here’s a step-by-step guide to help you create a personalized record of charges for any project.

First, start by organizing all the necessary details. This includes basic information such as the name of your business, your contact details, and the client’s information. Once these are in place, follow these simple steps:

- List the Services Provided: Describe each service or task you completed, along with the amount charged for each. Be as specific as possible to avoid confusion.

- Include the Dates: Clearly mention the start and end dates for each service or project phase. This helps both you and the client keep track of timeframes.

- State the Payment Terms: Specify the total amount due, the payment due date, and any accepted payment methods. Don’t forget to include any late fees or discounts for early payment.

- Itemize Additional Costs: If there were any extra expenses (e.g., materials or travel), list them separately to avoid hidden charges.

Once you’ve included all the details, double-check for accuracy. Make sure all pricing is correct, and that all necessary contact information is clear. By following these simple steps, you can create a personalized document that ensures your business transactions are transparent and well-documented.

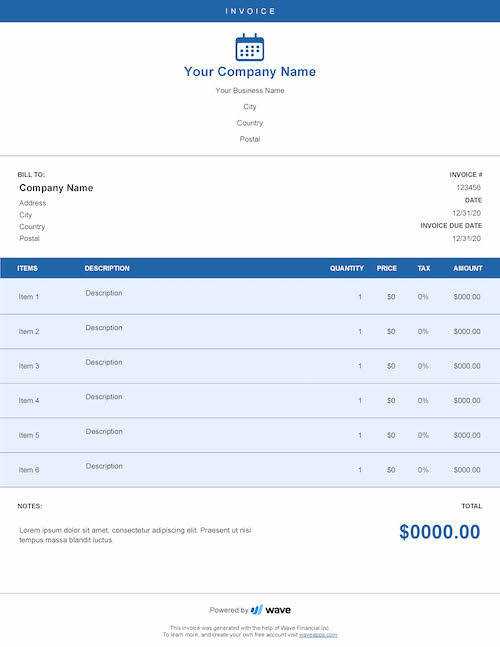

Customizing Your Invoice Template

Personalizing your billing document allows you to reflect your unique brand and better communicate with your clients. By adjusting certain elements, you can make the document more visually appealing, professional, and aligned with your business needs. Customization also helps ensure that all necessary details are clearly presented, while maintaining a consistent look for all transactions.

Design and Branding

One of the first things you can customize is the overall design. By adding your logo, choosing a professional font, and incorporating your brand colors, you can create a cohesive look that aligns with your business identity. A visually appealing document can make a lasting impression on your clients and enhance your professionalism.

- Logo and Branding: Include your business logo at the top to reinforce brand identity.

- Color Scheme: Use your brand’s color palette to highlight key sections, such as totals or payment terms.

- Font Style: Choose clear, professional fonts that are easy to read and match your brand’s tone.

Service and Payment Structure

Beyond design, the way you structure the details of each service can also be customized to fit the nature of your business. You may want to add or remove specific fields depending on the type of work you do, whether you’re offering flat-rate services, hourly charges, or special packages. Adjusting the layout can help emphasize important payment terms or deadlines, making it easier for clients to understand the overall costs.

- Detailed Descriptions: Customize how you list each service to be as specific as necessary for the client.

- Payment Methods: Clearly list acceptable payment options and preferred methods.

- Discounts and Promotions: Include any special offers or discounts, along with relevant terms and conditions.

Customizing your billing document ensures that it fits the needs of your business while making a professional impact. By focusing on both design and structure, you can create a tool that not only helps you manage your finances but also strengthens your brand’s presence.

Free Event Planner Invoice Templates

If you’re looking for a quick and easy way to manage your billing process, using a pre-made document can save you time and effort. Many websites offer free, customizable options that can help streamline your financial records. These ready-to-use formats are designed to suit various service-based businesses, and you can easily adjust them to fit your specific needs.

By downloading a free document, you can avoid the hassle of starting from scratch while still ensuring that all the necessary components are included. Here are some key benefits of using free pre-designed formats:

- Easy Customization: You can quickly modify the content to match your business, whether that’s adding your logo or adjusting the services and costs.

- Professional Appearance: These formats are designed by experts, ensuring your documents look polished and organized.

- Cost-effective: Free options provide all the essential features without the need for expensive software or services.

- Time-Saving: Pre-made formats save you time by eliminating the need to design a document from scratch.

Many free resources also provide multiple layout options, so you can choose the one that best fits your style and business requirements. Whether you prefer a minimalist design or something more detailed, there are plenty of choices to explore. These resources make it easier to create professional financial records without any additional cost.

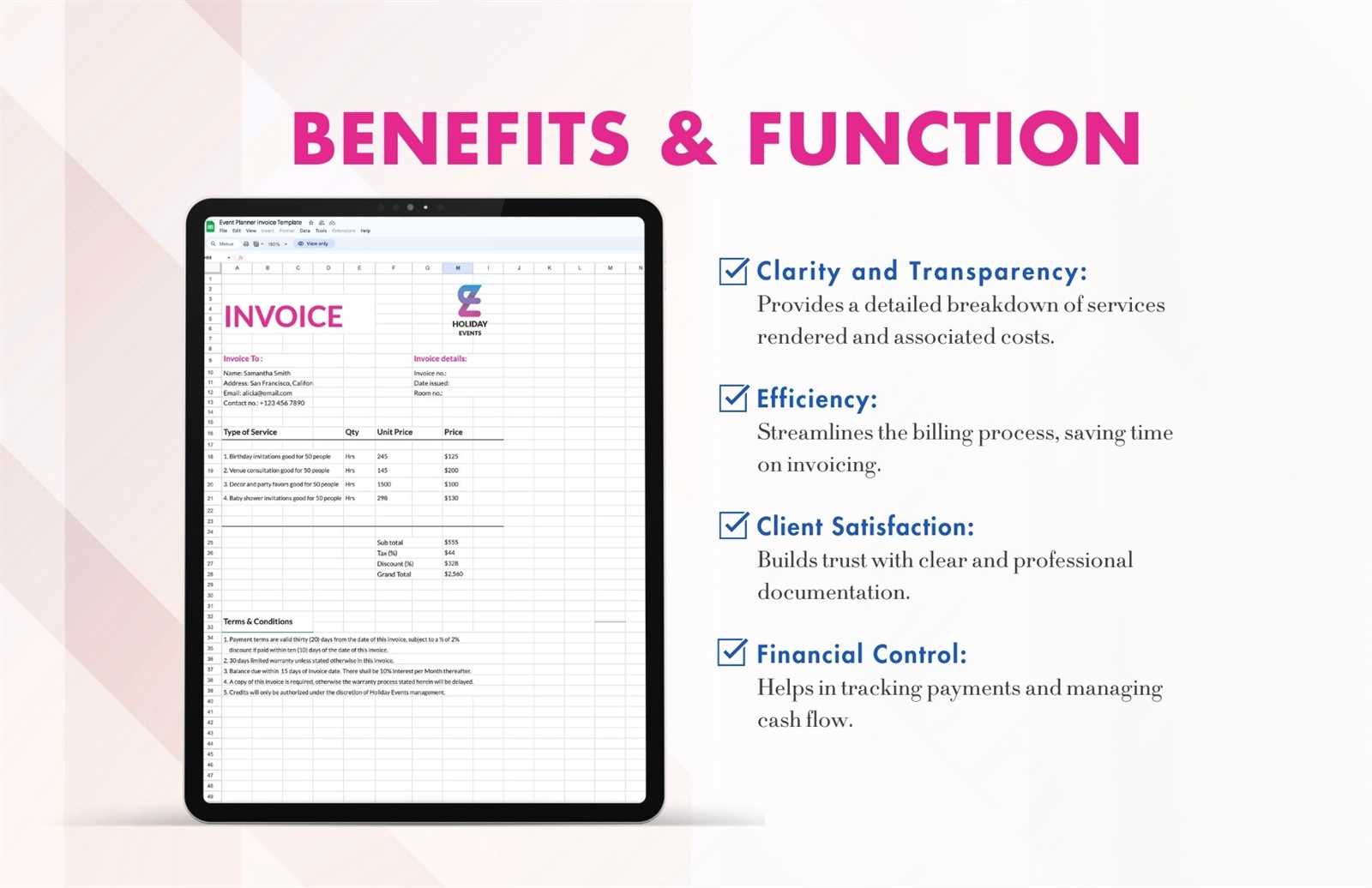

Benefits of Using Invoice Templates

Using a standardized structure for documenting transactions offers numerous advantages for service-based businesses. Whether you’re managing a small project or working with multiple clients, having a consistent format can streamline your workflow, improve accuracy, and present your business in a more professional light. This section outlines the key benefits of utilizing a ready-made billing solution.

Improved Efficiency

One of the main advantages of using a pre-designed structure is the time saved in creating documents from scratch. With all the key elements already laid out, you can simply input the necessary details and focus on other important tasks. This efficiency ensures that you meet deadlines while maintaining a high level of productivity.

- Faster Processing: Filling out a pre-built form takes far less time than creating one from the ground up.

- Reduced Errors: A consistent structure reduces the chances of overlooking key details or making mistakes in calculations.

- Easy Adjustments: You can quickly modify the document to fit each project without starting over each time.

Professional Appearance

Another benefit is the professional image it creates for your business. A consistent and polished document shows your clients that you are organized and detail-oriented. It also provides transparency, which helps build trust. A clear, well-structured billing record can leave a lasting impression and demonstrate your commitment to quality service.

- Clear Communication: A well-formatted record helps avoid confusion by making all terms and charges easy to understand.

- Brand Consistency: Personalizing the design ensures your business identity remains consistent across all your documents.

- Legitimacy: A professional format adds an element of formality, ensuring that clients take the document seriously.

By adopting a standardized approach, you can save time, reduce mistakes, and elevate the professionalism of your business. This simple step has a big impact on both internal processes and client relationships.

How to Save Time with Templates

Using a predefined structure for creating billing documents can significantly reduce the amount of time spent on administrative tasks. Instead of manually designing each record from scratch, you can quickly adapt an existing framework, entering only the relevant details for each client or project. This streamlined approach allows you to focus more on your core work while ensuring consistency and accuracy in your financial records.

Here’s how using ready-made formats can help save valuable time:

- Quick Setup: Pre-made structures are already formatted with the essential sections, so you can simply fill in the blanks. No need to worry about layout or design every time.

- Reuse and Adapt: Once you’ve customized the structure to fit your business, you can reuse it across multiple projects, adjusting only the specifics. This minimizes the need to create a new document for each transaction.

- Consistency: A standardized approach ensures that all documents are consistent, reducing the need for constant revisions or updates. This also makes it easier for clients to understand the information presented.

By reducing the time spent on creating documents from scratch, you can allocate more resources toward growing your business and serving your clients. This simple yet effective method leads to greater productivity, allowing you to manage multiple clients or projects more efficiently.

Common Mistakes to Avoid

While creating financial documents, it’s easy to overlook small details that can cause confusion or delays in payments. These mistakes can lead to misunderstandings with clients, wasted time correcting errors, and even loss of revenue. Being mindful of common pitfalls when drafting your records can help ensure clarity, accuracy, and timely payments.

Here are some of the most frequent mistakes to watch out for:

- Missing Client Information: Failing to include the client’s full name, contact information, or billing address can cause delays or make it harder for clients to process payments.

- Unclear Service Descriptions: Not providing detailed explanations of the services rendered can create confusion, leading to disputes or clients not fully understanding what they are paying for.

- Incorrect Pricing or Calculations: Simple math errors or inconsistent pricing can damage your credibility. Always double-check totals, tax rates, and discounts before sending the document.

- Missing Payment Terms: Not clearly outlining payment deadlines, methods, or late fees can cause misunderstandings regarding when and how payments should be made.

- Omitting Dates: Without clear start and end dates for services rendered, it can be difficult to track project timelines, leading to confusion about when payments are due or what is being charged for.

By avoiding these common mistakes, you can ensure your financial records are clear, professional, and effective. Taking the time to review each document thoroughly before sending it will help maintain positive relationships with clients and streamline the payment process.

Essential Information for Event Invoices

For any service-based business, having all the necessary details clearly outlined in your billing documents is essential for maintaining professionalism and ensuring that payments are processed smoothly. A well-organized record not only helps you track your earnings but also provides your clients with transparency, reducing the chance of disputes or confusion.

Key Components to Include

To create a comprehensive and clear billing document, make sure to include the following elements:

- Client Details: Include the full name, address, and contact information of the client receiving the bill.

- Your Business Information: Provide your company name, logo, and contact information, ensuring that clients know how to reach you if needed.

- Description of Services: Detail each service provided, including dates, quantities, and individual costs for each item or task.

- Total Amount Due: Clearly display the total amount the client owes, including a breakdown of individual costs, taxes, and any applicable discounts.

- Payment Terms: Specify the due date for payment, acceptable payment methods, and any penalties for late payments.

- Invoice Number and Date: Assign a unique reference number to each document for easy tracking, along with the issue date of the bill.

Additional Information to Consider

While the core components listed above are essential, there are additional details you may want to include to enhance clarity and improve client relations:

- Payment Instructions: Clearly outline how clients can make payments, whether through bank transfers, credit card payments, or online platforms.

- Late Fee Policy: If applicable, provide details on late fees or interest charges that will apply if the payment is not received

How to Add Payment Terms Effectively

Clearly stating payment terms in your financial documents is essential for ensuring smooth transactions and avoiding misunderstandings with clients. Payment terms outline the expectations for both parties regarding when and how payments should be made. Setting clear terms helps you manage cash flow and gives clients a transparent understanding of their obligations.

Key Elements of Payment Terms

When including payment terms, it’s important to be as specific as possible. Here are the key components you should cover:

- Due Date: Specify the exact date by which the payment must be made. This helps avoid confusion and ensures timely payment.

- Accepted Payment Methods: List the methods available for payment, such as bank transfer, credit card, PayPal, or checks. The more options you provide, the easier it will be for clients to pay.

- Late Fees: Clearly state any penalties or interest charges that will be applied if payment is not received by the due date. This encourages timely payments and protects your business financially.

- Early Payment Discounts: If you offer a discount for clients who pay early, outline the exact discount amount or percentage and the time frame in which it is applicable.

Best Practices for Clear Payment Terms

To make sure your payment terms are both effective and easy to understand, follow these best practices:

- Keep it Simple: Avoid overly complex language. Use clear, straightforward terms that leave no room for interpretation.

- Highlight Important Details: Use bold text or separate sections to make crucial information like due dates, fees, and payment methods stand out.

- Be Consistent: Ensure that the same terms are applied to all clients, or make it clear if specific terms differ for certain projects or agreements.

By setting clear payment terms and presenting them effectively in your financial records, you help ensure that both parties are on the same page, reducing the likelihood of disputes and promoting timely payments.

Formatting Tips for Event Invoices

Creating well-organized and easy-to-read financial documents is essential for smooth business transactions. A clear and professional layout not only enhances the client experience but also helps avoid confusion or delays in payment. Proper formatting ensures that all critical details are easily identifiable, making it easier for both you and your client to review the document.

Basic Formatting Guidelines

When designing your billing document, follow these basic formatting guidelines to maintain clarity and professionalism:

- Use a Clean Layout: Ensure the document is neatly organized with ample white space between sections. This makes it easier to navigate and understand at a glance.

- Prioritize Key Information: Place essential details like the client’s name, due date, and total amount at the top of the page or in a prominent position for quick reference.

- Group Similar Information: Organize your document into clear sections, such as “Client Details,” “Services Provided,” and “Total Amount Due.” This structure helps your client find the information they need without confusion.

- Use Clear Headings: Use bold or larger fonts for section headings to visually distinguish different parts of the document, such as “Payment Terms” or “Additional Charges.”

Visual Elements and Design Tips

While the content is essential, the visual design of your document can enhance its readability and overall professional appearance. Consider these design tips:

- Consistent Font Usage: Choose a professional font and maintain consistency throughout the document. Avoid using more than two font styles to prevent visual clutter.

- Highlight Important Numbers: Use bold or colored text to emphasize critical numbers like the total amount due, taxes, and payment deadlines.

- Avoid Overcrowding: Don’t overload the document with excessive text or small print. Ensure that the document doesn’t feel cramped, and that there is enough space between each section for easy reading.

- Incorporate Your Branding: Adding your company logo or colors can make the document feel more personalized and aligned with your brand identity. Keep the design professional and consistent with your other business materials.

By following these formatting tips, you create a document that is not only functional but also reflects your professionalism. A well-formatted billing document helps your clients quickly understand the payment details and improves the chances of timely payment.

Legal Considerations for Invoices

When creating financial documents for your business, it’s important to ensure they meet legal requirements to avoid potential issues with tax authorities or clients. Having the right legal elements included not only helps with compliance but also protects your business and establishes trust with clients. Being aware of the key legal aspects of your billing process is essential for maintaining professional standards and preventing disputes.

Key Legal Elements to Include

To ensure your financial records are legally sound, make sure to incorporate the following essential elements:

- Business Information: Include your registered business name, address, and tax identification number (TIN). This helps establish the legitimacy of your business and provides transparency to clients.

- Client Details: Always list the full name and address of the client receiving the bill. This ensures that the document is clearly attributed to the correct party.

- Tax Information: Include applicable tax rates, such as VAT or sales tax, and make sure to clearly show how they are applied to the total amount due. This is crucial for tax compliance.

- Payment Terms: Clearly outline the payment due date and the consequences for late payments, including any interest or penalties. This provides both clarity and legal backing in case of non-payment.

- Legal Jurisdiction: In case of disputes, it’s important to state the legal jurisdiction under which the terms of your agreement are governed. This helps resolve any conflicts if they arise.

Important Legal Considerations

Beyond the basic elements, there are additional legal considerations to be mindful of when preparing financial records:

- Contractual Agreement: Ensure that your terms align with any agreements or contracts made with the client. The document should reflect the terms that both parties have agreed upon.

- Retention of Records: Many jurisdictions require businesses to keep financial records for a certain number of years for tax and legal purposes. Be sure to keep copies of all documents for your records.

- Consumer Protection Laws: Familiarize yourself with consumer protection laws in your region to make sure your documents are in compliance with any regulations regarding pricing, refunds, or returns.

By understanding these legal requirements and including the necessary details, you can ensure your financial records are both professional and legally compliant. This not only helps protect your business but also builds a trustworthy reputation with clients.

How to Deliver Your Event Invoice

Delivering your billing document in a timely and professional manner is just as important as creating an accurate and clear document. The way you send your record can influence how quickly your client processes the payment and reflects your business’s reliability. Choosing the right delivery method ensures that your document reaches your client promptly and securely, without any unnecessary delays.

Choosing the Right Delivery Method

There are several methods available to deliver your financial records to clients. Each has its benefits, so selecting the one that best fits your business model and client preferences is key:

- Email: Sending the document via email is one of the most common and efficient methods. Make sure to attach the file in a widely accepted format, such as PDF, and use a professional subject line and message body to ensure clarity.

- Postal Mail: For clients who prefer physical copies or in cases where email may not be suitable, mailing a hard copy of the document can be an option. Ensure you use secure mailing services that provide tracking to avoid any issues with delivery.

- Online Platforms: If you’re using an online payment or accounting platform, many of these services allow you to send your documents directly through their interface. This method can streamline the process and allow for faster processing of payments.

- In-Person Delivery: For certain clients or situations, you may want to hand-deliver the document. This method allows you to personally discuss the payment terms and answer any questions the client may have.

Best Practices for Delivery

Regardless of the method you choose, there are some best practices to follow when delivering your billing document:

- Confirm Receipt: Whether sending electronically or via mail, ensure you confirm that the client has received the document. This can help avoid any confusion or disputes about whether the document was delivered.

- Follow Up: If you haven’t received payment by the due date, send a polite reminder. Keeping communication lines open can help resolve any issues that may have arisen.

- Use Professional Language: When delivering your financial record, always maintain a professional tone. This not only reflects well on your business but also sets the tone for future communications.

By selecting the right delivery method and following

Tracking Payments with Invoices

Tracking payments effectively is crucial for maintaining accurate financial records and ensuring timely cash flow. Using a structured billing document allows you to monitor the status of payments and keep track of outstanding amounts. It also provides both you and your client with a clear reference for the agreed-upon payment terms, reducing the risk of missed payments or misunderstandings.

Key Steps for Tracking Payments

To keep your payment tracking organized and efficient, consider the following steps:

- Assign Unique Reference Numbers: Each billing document should have a unique number or reference code. This helps you easily track and refer to past transactions and ensures no documents are overlooked.

- Record Payment Dates: Keep a log of when payments are made. This allows you to track whether clients are paying on time and helps you identify any delays or issues early on.

- Track Outstanding Amounts: Make it easy to identify unpaid or partially paid balances by keeping detailed records of what has been paid and what is still due.

- Monitor Payment Methods: Track how payments are made, whether through credit cards, bank transfers, checks, or online platforms. This helps ensure that payments are processed correctly and gives you a clear record for accounting purposes.

Tools to Help with Payment Tracking

There are various tools and methods you can use to streamline payment tracking, making the process more efficient:

- Accounting Software: Many accounting tools and software offer built-in payment tracking features that automatically update the status of your documents and provide reports on outstanding balances.

- Spreadsheets: If you prefer a manual approach, creating a simple spreadsheet can help you track payments and keep a record of important dates and amounts due.

- Online Payment Platforms: Platforms like PayPal, Stripe, or Square often offer built-in payment tracking and reporting features, allowing you to track payments automatically and even send payment reminders to clients.

By staying organized and tracking payments carefully, you can ensure that your financial records are accurate and that your business remains financially stable. Regularly reviewing payment statuses also helps you stay on top of outstanding amounts, making it easier to follow up and maintain a steady cash flow.

Incorporating Branding into Your Invoice

Your billing documents serve as a reflection of your business’s identity and professionalism. Including branding elements not only makes your records more recognizable but also strengthens your brand image. Customizing your financial documents with your logo, colors, and font choices creates a cohesive and memorable experience for clients, further establishing your business’s presence.

Key Branding Elements to Include

To effectively incorporate your branding into your financial records, consider including the following elements:

- Company Logo: Displaying your logo at the top of the document makes it immediately recognizable to clients. It helps reinforce your brand and creates a professional look.

- Brand Colors: Use your brand’s color palette to accentuate key areas of the document, such as headings, borders, or the background. This adds a personalized touch while maintaining consistency across your business materials.

- Font Style: Choose fonts that are aligned with your brand’s aesthetic. Whether you opt for modern, bold fonts or a more traditional style, consistency in typography reinforces your visual identity.

Why Branding Matters in Financial Documents

Incorporating branding into your billing statements offers several advantages for your business:

- Professional Image: Branded documents enhance the overall perception of your business, giving clients the impression that you are organized and detail-oriented.

- Increased Recognition: Every interaction with your clients is an opportunity to reinforce your brand. By using consistent branding, your clients will easily recognize your business, even in financial documents.

- Improved Client Trust: A well-branded document shows that you are serious about your business. It also helps create a sense of reliability, making clients more likely to trust your services and pay on time.

By strategically using branding elements, you can create professional, memorable financial documents that make a lasting impression on your clients. A well-designed record not only serves as a functional tool for tracking payments but also reinforces your business’s identity and professionalism.

Software for Managing Event Invoices

Managing financial documents can be time-consuming, but using specialized software can significantly streamline the process. With the right tools, you can easily create, send, and track your financial records, reducing manual work and minimizing errors. Additionally, software solutions often offer features that help with organizing, automating, and integrating your accounting processes, making it easier to stay on top of payments and financial reporting.

Top Software Options to Consider

Here are some popular software tools that can help you manage your billing documents more effectively:

- QuickBooks: One of the most widely used accounting software, QuickBooks offers invoicing, payment tracking, and customizable reporting. It also integrates with other business tools for seamless financial management.

- FreshBooks: FreshBooks is known for its user-friendly interface and features like time tracking, expense management, and automated invoicing. It is ideal for small businesses looking for an easy-to-use solution.

- Wave: Wave offers free invoicing and accounting software with features such as automated billing, payment tracking, and receipt scanning. It’s perfect for small businesses or freelancers on a budget.

- Zoho Books: Zoho Books is a comprehensive accounting solution with features like recurring billing, client management, and tax calculations. It also provides integration with other Zoho business tools.

Benefits of Using Software for Financial Management

Choosing the right software can offer several advantages for managing your financial documents:

- Time Savings: Automating repetitive tasks, such as sending reminders or generating billing records, frees up time for other business activities.

- Accuracy: Accounting software reduces human error, ensuring that your financial documents are consistent and accurate every time.

- Data Security: Many software solutions offer secure cloud storage, protecting your financial records from data loss or unauthorized access.

- Comprehensive Reporting: These tools often include detailed reporting features that allow you to track revenue, expenses, and client payments, giving you better insights into your business’s financial health.

By using specialized software for managing your billing documents, you can improve efficiency, accuracy, and overall financial management. With the right tools, you can save time, stay organized, and ensure that your financial processes are streamlined and professional.

How to Handle Late Payments

Dealing with overdue payments is a common challenge for businesses, but addressing the issue in a professional and systematic manner can help maintain positive relationships with clients while ensuring you receive what you’re owed. Effective management of late payments not only improves cash flow but also reduces the likelihood of ongoing payment issues.

Steps to Take When Payments Are Late

When a payment becomes overdue, follow these steps to handle the situation efficiently and professionally:

- Review the Terms: Before taking any action, double-check the payment terms outlined in your agreement or billing document. Make sure the payment due date has passed and that no exceptions apply.

- Send a Reminder: Politely remind the client about the overdue payment. A friendly reminder can be sent via email or message, noting the payment amount, original due date, and any late fees that may apply.

- Offer Payment Options: If the client is having trouble making the full payment, consider offering flexible payment plans or alternative payment methods to ease the process.

- Contact Them Directly: If the payment is still not received after the reminder, follow up with a phone call. This personal touch can often resolve the issue more quickly and help maintain a professional relationship.

When to Take Further Action

If the payment remains unsettled despite reminders and direct communication, it may be time to consider stronger measures:

- Late Fees: If you have specified late fees in your contract, enforce them. This can encourage clients to pay promptly in the future and compensates you for any delays in receiving payment.

- Suspending Services: For clients with ongoing work, consider pausing services until the payment is received. Make sure to communicate this clearly in advance and be prepared for the potential impact on your relationship.

- Legal Action: In extreme cases, when a significant amount remains unpaid and all other options have been exhausted, it may be necessary to seek legal advice. This should be a last resort, as it can damage the business relationship.