Attorney Invoice Template Excel for Efficient Legal Billing

For legal professionals, managing client payments and keeping track of services rendered can become a time-consuming task. Properly documenting hours worked, expenses incurred, and the total amount due requires a reliable method to ensure accuracy and transparency. A well-structured financial document is key to maintaining professional relationships and streamlining administrative processes.

Using digital tools to organize these records can make the billing process much simpler and more efficient. By relying on customizable documents that are easy to update, lawyers can save valuable time while ensuring they provide clients with clear, professional, and detailed accounts of their charges.

Modern software solutions offer practical features that allow customization to suit the specific needs of legal services. These tools provide essential fields for capturing detailed information, such as hourly rates, disbursements, and additional fees, all in a format that is easy to read and understand. Implementing such systems can greatly reduce the likelihood of errors, improve client satisfaction, and enhance overall business management.

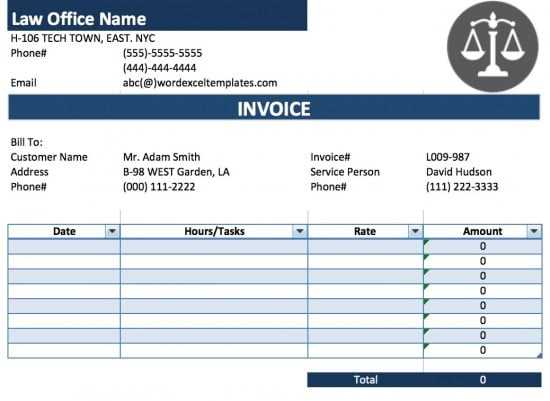

Attorney Invoice Template Excel Overview

A well-designed billing document can greatly simplify the process of charging clients for legal services. These digital solutions are customizable, enabling professionals to accurately capture hours worked, expenses, and various fees associated with a case. By streamlining the billing process, these documents improve efficiency and ensure consistency in the way charges are presented to clients.

The core idea behind such a solution is to create an easy-to-update file that automatically calculates totals, tracks time, and organizes detailed records. This can be particularly helpful for legal professionals who need to manage multiple clients and cases simultaneously. Instead of creating a new document from scratch each time, users can modify an existing structure to fit their needs, reducing time spent on administrative tasks.

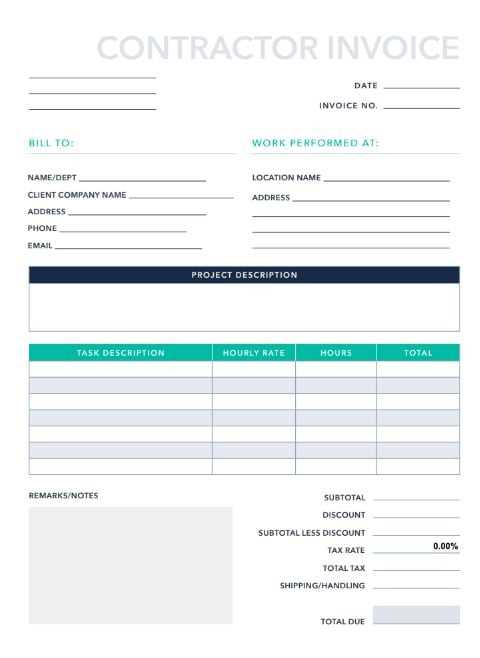

The following table outlines the common components you might find in a typical billing document for legal services:

| Section | Description |

|---|---|

| Client Information | Contains fields for the client’s name, address, and contact details. |

| Service Description | Detailed breakdown of the legal services provided, including hourly rates and services rendered. |

| Time Tracking | Fields for logging the amount of time spent on each task or service. |

| Expenses | Area to list any out-of-pocket costs, such as filing fees or court costs. |

| Total Amount Due | Automatically calculated total based on the time worked, rates, and any additional costs. |

This structure helps legal professionals maintain organized, accurate records and provides clients with a clear and professional summary of the charges. Customization options allow for flexibility in adapting the document to various billing scenarios and personal preferences.

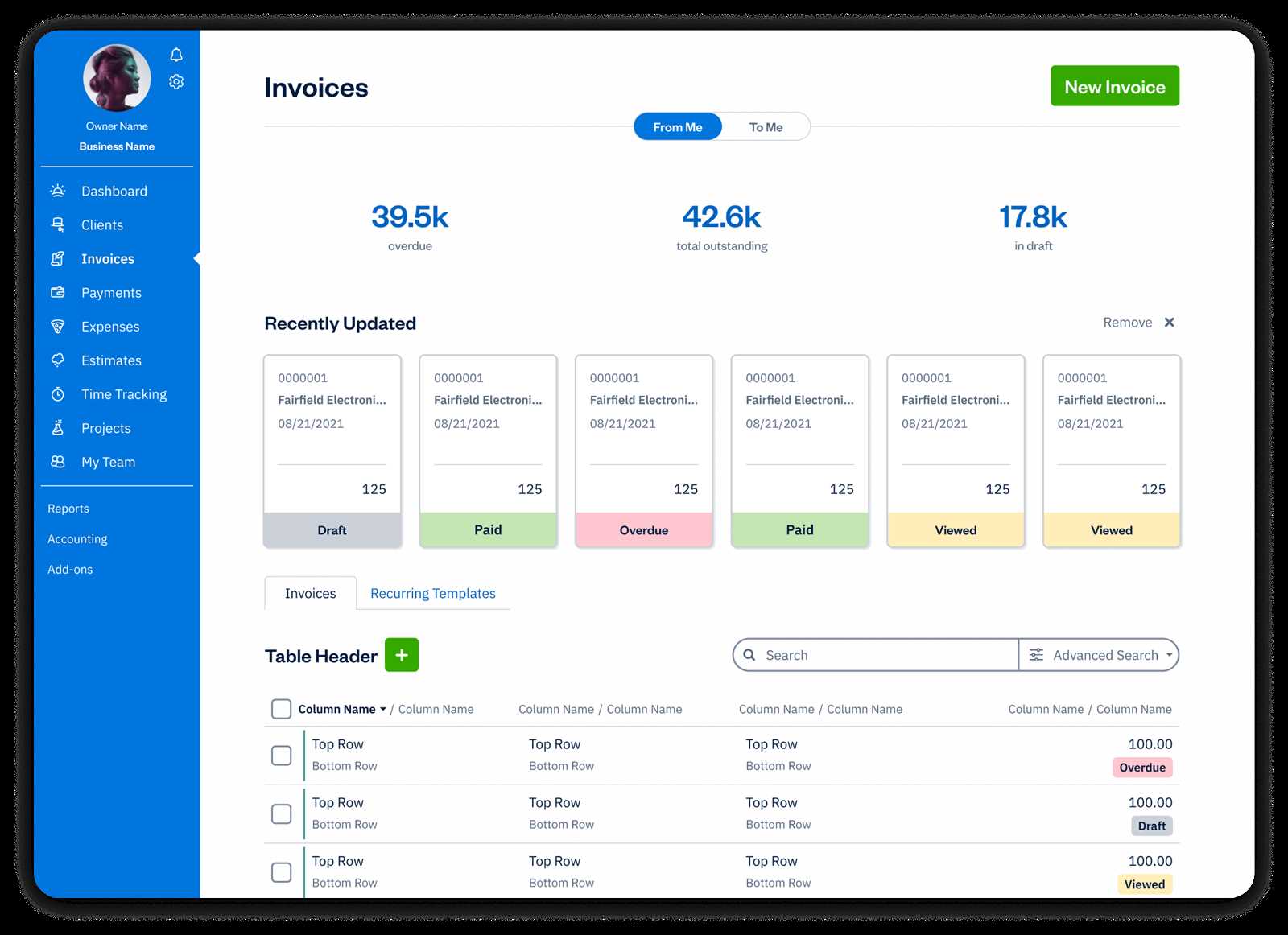

Why Use Excel for Legal Invoices

Choosing the right tool to manage billing and client payments is essential for legal professionals who need to maintain accurate and timely records. One of the most efficient solutions is to use a spreadsheet application, which offers both flexibility and ease of use for organizing financial data. These tools allow for automatic calculations, easy updates, and the ability to create detailed, customizable billing records that fit a variety of needs.

Key Benefits of Using a Spreadsheet for Billing

- Customizability: Users can tailor the document to fit specific needs, adjusting sections for different services, rates, and client preferences.

- Automation: Automatic calculations for total charges, taxes, and discounts reduce the risk of manual errors.

- Ease of Use: Familiar spreadsheet interfaces make it easy for professionals to create and modify records without requiring technical expertise.

- Cost-Effective: Many spreadsheet tools are available for free or at a low cost, making them accessible to professionals at any stage of their business.

How It Improves Billing Efficiency

When dealing with multiple clients and cases, efficiency is key. Spreadsheets simplify the process by allowing users to enter data once and have it automatically applied throughout the document. This eliminates the need to manually calculate totals, saving time and reducing errors. Additionally, having a digital format makes it easier to store, access, and share billing records with clients or other stakeholders.

- Quick updates: Modifications to rates or services can be made instantly, ensuring the document is always up to date.

- Easy tracking: With built-in formulas and organized structures, users can quickly track and review billing history for individual clients.

- Professional appearance: Clean, structured documents present a polished and professional image to clients, enhancing the overall client experience.

In summary, using a spreadsheet program for managing legal fees offers flexibility, efficiency, and cost-saving benefits, all while maintaining accuracy and professionalism in client billing.

Key Features of an Attorney Invoice Template

A well-structured billing document is essential for any legal professional seeking to maintain clear communication with clients about the services provided and the corresponding charges. A comprehensive billing record should not only detail the work completed but also offer a straightforward breakdown of costs, taxes, and other important information. Key features that ensure accuracy, professionalism, and clarity are essential for creating an effective financial document.

- Client Information Section: A dedicated area for recording client details such as name, address, and contact information helps ensure the document is personalized and easily traceable.

- Clear Service Descriptions: Detailed descriptions of services provided, including hourly rates or flat fees, help clients understand exactly what they are being charged for, enhancing transparency.

- Time Tracking: An organized section for logging hours worked allows for accurate tracking of billable time, which can then be multiplied by the respective rate to calculate fees automatically.

- Expense Tracking: A designated field for out-of-pocket costs such as filing fees, court costs, or travel expenses ensures all related expenses are accounted for and added to the total amount.

- Automatic Calculations: Built-in formulas that calculate totals, taxes, and discounts save time and reduce the possibility of errors when finalizing the payment amount.

- Tax and Discount Fields: The ability to include taxes, discounts, or other adjustments ensures that the document complies with local regulations and accommodates any client-specific agreements.

- Professional Design: A clean, organized layout with clearly defined sections and headings helps the document appear professional and easy to read, which in turn builds trust with clients.

- Payment Instructions: Clear instructions regarding payment methods and due dates give clients all the information they need to settle the bill promptly.

- Customizable Fields: The option to add or remove specific sections allows the document to be tailored to the needs of different clients or cases, making it flexible for a variety of situations.

These features not only make the billing process more efficient but also ensure a higher level of professionalism and organiz

How to Customize Your Invoice in Excel

Customizing a billing document allows legal professionals to adjust the layout and content to fit specific needs and preferences. By personalizing certain fields, users can make the document more tailored, relevant, and professional for each client. This process involves modifying sections like client details, payment terms, service descriptions, and even the appearance to align with a particular style or brand.

Steps to Personalize Your Billing Record

- Update Client Information: Ensure the client’s name, address, and contact details are accurate. Adding a section for the client’s reference number or case ID can help keep records organized.

- Modify Service Descriptions: Adjust the list of services provided, specifying hourly rates or flat fees for each task. You can also add extra fields for additional services that might be relevant to the client’s case.

- Add or Remove Sections: If you don’t need certain categories (such as travel expenses or consultation fees), you can delete them. Conversely, if your practice involves unique charges, like filing fees or research costs, you can add new sections as necessary.

- Adjust Calculation Formulas: Customizing formulas for totals, taxes, and discounts ensures that all calculations are accurate and meet your specific billing structure. You can change the rate of tax or apply specific discounts based on client agreements.

- Include Payment Instructions: Make sure to add clear payment terms, including accepted methods and deadlines. Specify any late fees or early payment discounts if applicable.

Design Customization Options

- Change Fonts and Colors: Customize fonts, font sizes, and colors to match your brand or desired aesthetic. Choose a professional, clean font for readability and use colors sparingly to maintain a polished appearance.

- Rearrange Layout: If you prefer a different order of information, you can easily move sections around to suit your preferences. This is especially useful for creating a more intuitive flow of information.

- Insert Logos and Branding: Add your firm’s logo or other branding elements to make the document uniquely yours and reinforce your professional identity.

By making these customizations, you can create a billing document that not only serves its practical purpose but also reflects your firm’s pro

Benefits of Using an Excel Invoice Template

Choosing a digital tool to manage billing can significantly streamline the process for legal professionals. A well-structured file not only saves time but also ensures that all necessary details are accurately captured, minimizing the risk of errors. By using a customizable, automated system, users can enjoy several advantages that enhance both efficiency and client satisfaction.

Time-Saving Features

- Automatic Calculations: Built-in formulas for totaling fees, calculating taxes, and applying discounts eliminate the need for manual math, ensuring accuracy and saving time during document preparation.

- Quick Adjustments: Changes in rates or services can be made instantly, updating the entire document automatically. This allows for fast modifications without disrupting the overall structure.

- Efficient Record Keeping: The ability to store and reuse a consistent billing structure makes managing multiple clients and cases easier, reducing the time spent recreating documents from scratch.

Improved Accuracy and Professionalism

- Consistency: Using a standardized document ensures uniformity in how services are billed, reducing the risk of missing important details or making inconsistent calculations.

- Clear and Transparent Layout: A clean, organized format makes it easy for clients to understand the breakdown of charges, which fosters trust and transparency in the billing process.

- Error Reduction: Automated calculations and structured fields decrease the likelihood of human error, which is especially critical when handling complex legal billing scenarios.

Overall, using a digital solution to manage financial records provides significant benefits in terms of efficiency, accuracy, and professionalism. By relying on a system that automates key aspects of billing, legal professionals can focus more on their work and less on administrative tasks, leading to a smoother experience for both clients and service providers.

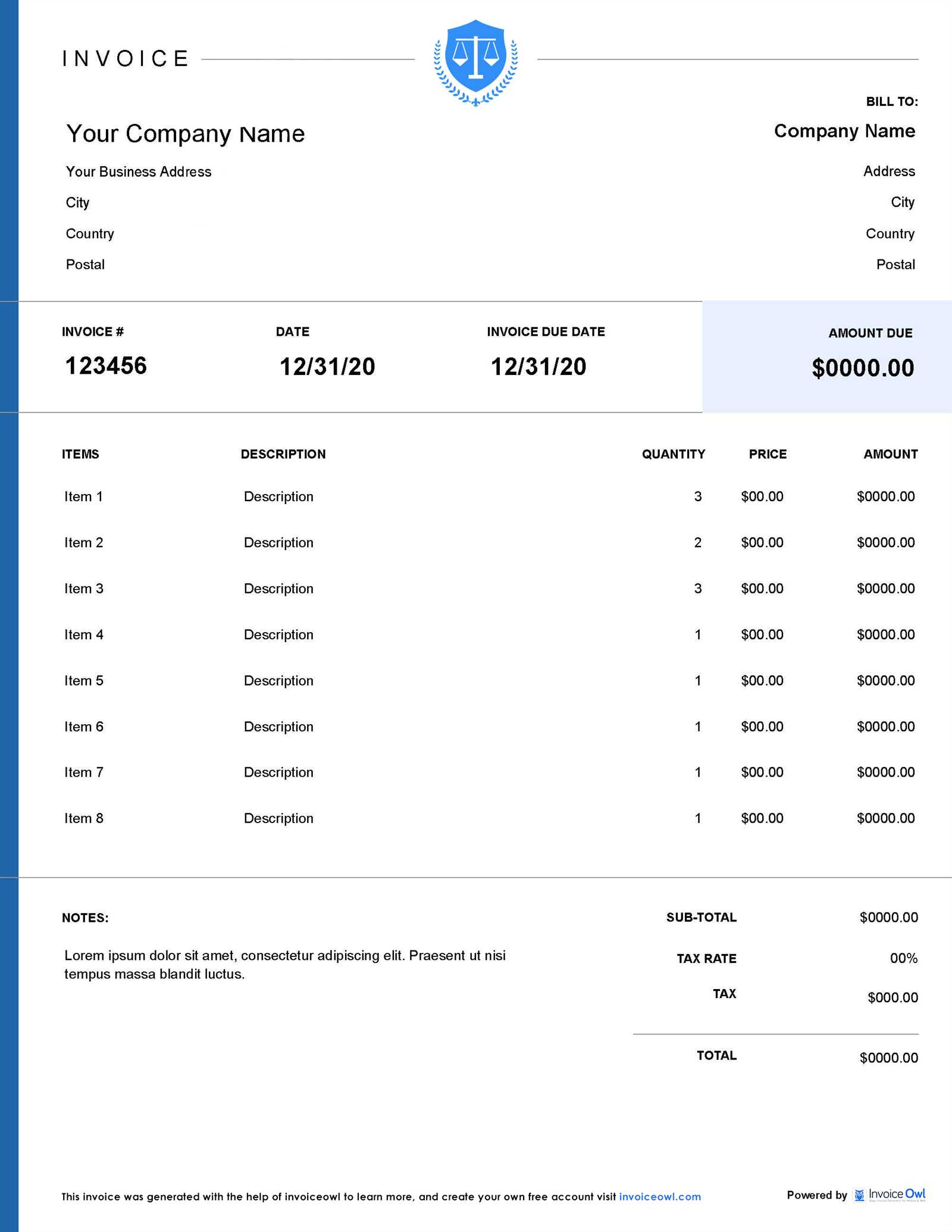

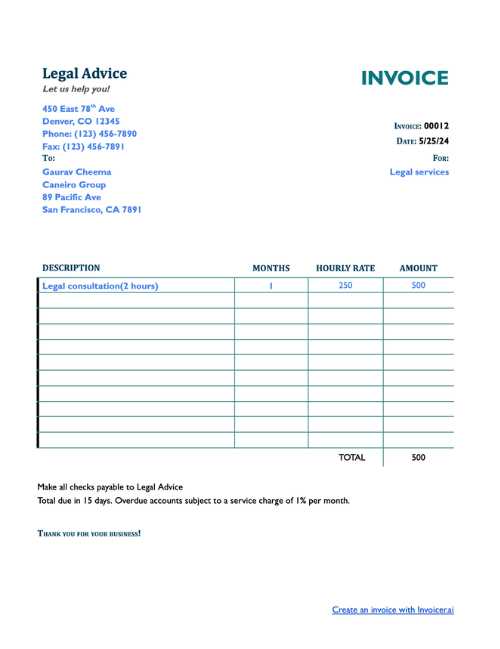

Creating a Simple Billing Template in Excel

Creating a basic billing document doesn’t have to be complicated. With the right structure, you can easily design a functional and professional record that captures all necessary details, from services rendered to total charges. A simple structure helps you stay organized and ensures that each bill is clear and accurate for your clients.

Here are the key steps to build a straightforward billing document:

Step-by-Step Guide

- Set Up Basic Sections: Start by dividing the document into logical sections, such as client information, services, time spent, expenses, and total amount due. This helps maintain clarity and ensures that all necessary details are included.

- Input Client Information: Create fields for the client’s name, address, and contact details at the top of the document. This section ensures that the billing record is personalized and easily traceable.

- Describe the Services: Add a section where you can list the services provided. For each service, include a description, hours worked (if applicable), and the rate charged. This ensures transparency for your client.

- Include a Time Tracking Section: If you charge by the hour, create columns to track the time spent on each task. Multiply the hours by the rate to calculate the cost for each service automatically.

- List Additional Expenses: Add a section for any extra costs incurred, such as filing fees, transportation, or other out-of-pocket expenses. This ensures that all costs are accounted for and billed correctly.

- Calculate Total Amount Due: Use formulas to automatically calculate the total by adding up the charges for each service and expense. This reduces the risk of errors and saves time during the process.

- Set Payment Terms: Include a section at the bottom for payment instructions, such as due dates, accepted payment methods, and any late fee policies. This ensures clients know exactly how and when to pay.

Customization Tips

- Adjust Column Widths: Ensure that all columns are wide enough to fit the text, especially for long service descriptions or client names.

- Use Simple Formulas: Excel’s built-in functions, like SUM or multiplication, can automate calculations for you, saving time and ensuring accuracy.

- Design Consistency: Maintain a clean layout with consistent font choices and formatting to make the document easy to read and look professional.

By following these steps, you can create a simple yet effective billing record that meets your needs. This format is flexible enough to be adapted for different types of cases, while remaining easy to use for quick billing and clear communication with clients.

Managing Legal Fees with Excel Templates

Effectively managing client fees and associated charges is a critical task for legal professionals. Using a structured digital document to track billable hours, expenses, and other costs helps ensure transparency and accuracy. By leveraging automated systems, professionals can keep detailed records and stay organized while reducing the administrative burden of calculating and tracking fees manually.

Tracking Time and Expenses

One of the most important aspects of managing legal fees is accurately recording the time spent on client cases and any associated costs. A well-structured document allows users to enter the hours worked, multiply them by the appropriate hourly rate, and quickly calculate the corresponding charges. Similarly, out-of-pocket expenses, such as filing fees or transportation, can be easily tracked and added to the final amount due.

| Service Description | Time Spent (hrs) | Hourly Rate | Amount |

|---|---|---|---|

| Consultation | 2 | $150 | $300 |

| Research | 5 | $150 | $750 |

| Court Appearance | 3 | $200 | $600 |

| Total Amount | $1650 | ||

Managing Multiple Clients and Cases

For those managing multiple clients or ongoing cases, using a digital document allows for better organization. Multiple billing sheets can be created for different clients, each with unique rates, tasks, and expenses. Additionally, you can easily compare total charges across various cases, ensuring that all fees are accounted for and appropriately billed.

By utilizing such a system, legal professionals can efficiently manage their finances, reduce errors, and maintain transparency with clients. The ability to make quick updates and adjust charges as needed ensures tha

Step-by-Step Guide to Billing Clients

Accurate and efficient billing is essential for maintaining a professional relationship with clients. A structured approach to documenting the services provided and calculating the total charges helps ensure transparency and reduces misunderstandings. The following guide provides a clear, step-by-step process for creating a billing document that captures all necessary details while remaining straightforward for both the service provider and the client.

Step 1: Gather Client and Case Information

The first step in creating a billing record is to collect the client’s information, including their full name, address, and any relevant case or project details. This ensures that the document is tailored specifically to the client and can be easily identified for future reference.

Step 2: List the Services Provided

Next, break down the services rendered. Each service should be listed with a brief description, including the time spent on the task (if applicable) and the corresponding fee. This transparency helps clients understand exactly what they are being charged for.

| Service Description | Hours Worked | Hourly Rate | Amount |

|---|---|---|---|

| Consultation | 2 | $150 | $300 |

| Research | 3 | $120 | $360 |

| Document Review | 1.5 | $100 | $150 |

| Total Amount | $810 | ||

Step 3: Add Additional Costs

After listing the services, b

Essential Fields in an Attorney Invoice

When creating a billing document for legal services, it is essential to include key fields that ensure both accuracy and transparency. These fields help outline the services provided, the costs associated with each, and the payment details necessary for clients to easily understand the charges. A comprehensive billing record ensures clarity, reduces misunderstandings, and promotes timely payments.

Key Information to Include

- Client Information: The top section of the document should feature the client’s name, address, and contact details. This ensures that the document is personalized and can be easily identified for future reference.

- Service Descriptions: A breakdown of the services provided, including a brief description, date, and the corresponding charge for each task. Clear and specific descriptions help the client understand exactly what they are being billed for.

- Hourly Rate or Flat Fee: If applicable, specify the hourly rate or any flat fees charged for each service. This ensures transparency about how the charges are calculated.

- Time Spent: When billing by the hour, it’s important to clearly state the amount of time spent on each service or task. This helps clients verify the charges and makes the billing process more transparent.

- Expenses: Any additional costs, such as court fees, travel expenses, or other out-of-pocket charges, should be itemized separately. This ensures that the client understands what additional costs were incurred during the case.

- Payment Terms: Clearly list payment instructions, including due dates, accepted payment methods, and any penalties for late payments. This section ensures both parties are on the same page regarding how and when the payment should be made.

Formatting Tips for Clarity

- Organized Layout: A clean, organized layout with clear headings and well-spaced sections makes it easier for clients to follow the document and understand the charges.

- Bold or Highlight Key Figures: Key figures, such as the total amount due, should be emphasized to make them stand out, ensuring that clients immediately notice the most important information.

- Use of Professional Language: The language used in the billing document should be formal, concise, and respectful, further reinforcing professionalism and clarity.

Including these essential fields ensures that your billing documents are both thorough and easy to understand. Clear and accurate records help foster trust between the legal professional and the client, promoting transparency and reducing the likelihood of payment delays.

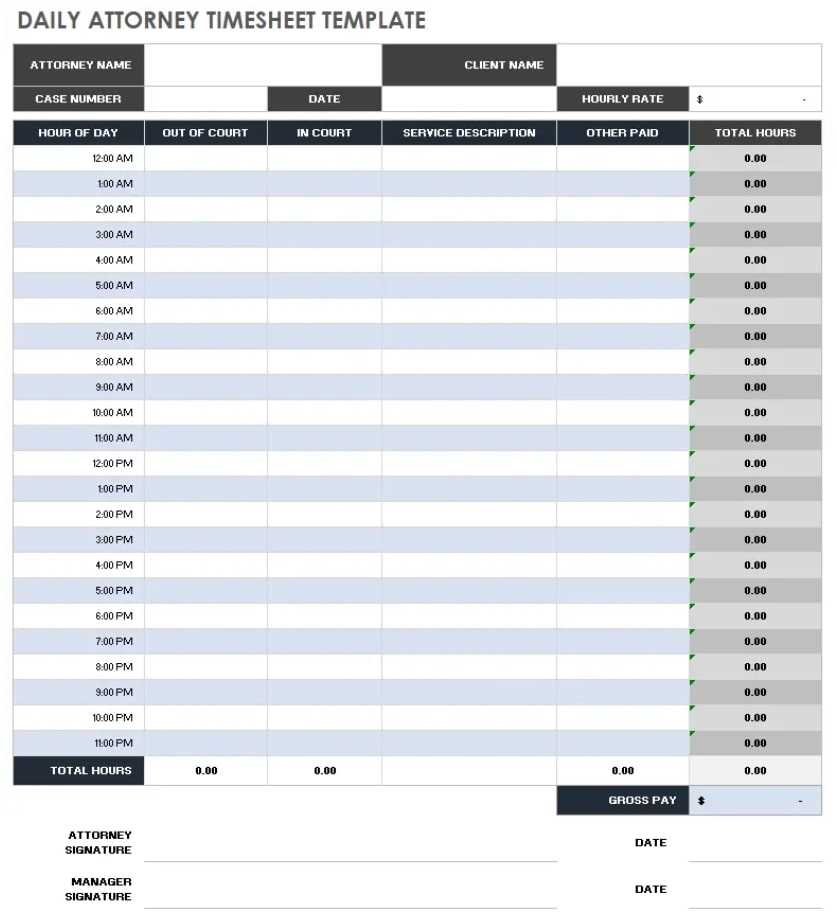

How to Track Hours in Excel Templates

Accurately tracking the time spent on various tasks is crucial for ensuring that clients are billed correctly. Using a structured digital document to record hours worked allows you to maintain clear and detailed records, automate calculations, and reduce the risk of errors. By setting up the right system, legal professionals can easily monitor time spent on each task and calculate the total amount due with minimal effort.

Step 1: Set Up Time Tracking Columns

Start by creating a clear layout with designated columns for recording hours worked. Typical columns might include:

- Date: The date the task was performed.

- Task Description: A brief description of the service or work completed.

- Start Time: The time the work began.

- End Time: The time the work concluded.

- Total Hours: A column where the total number of hours worked for each task is calculated automatically.

Once you’ve set up these columns, you can input the specific details for each task as you work. This provides a consistent method of recording time for multiple clients and cases.

Step 2: Use Formulas for Automatic Calculations

To streamline the process, use simple formulas to automatically calculate the number of hours worked for each task. In Excel, you can use the following formula to subtract start time from end time and calculate the duration:

=End Time - Start Time

Ensure the time cells are formatted in the correct time format (e.g., hh:mm), so the calculation is accurate. Once the hours are calculated, you can multiply the total hours by the rate for the task to generate the cost.

For example, if your hourly rate is $150, use this formula to calculate the total cost for the task:

=Total Hours * Hourly Rate

Step 3: Automate Totals for the Day or Project

To save time and ensure accuracy, you can use the SUM function to add up the total hours worked over a specific period, such as a day, week, or month. This can help track progress and bill clients for the total time spent on all tasks. For e

Invoice Formatting Tips for Lawyers

Creating a well-organized and professional billing document is essential for legal professionals. A clean, clear, and visually appealing layout helps clients easily understand the charges, which promotes transparency and timely payments. Proper formatting not only improves client relations but also minimizes errors in the billing process. Below are some practical tips for formatting your billing records effectively.

Key Formatting Principles

When designing your billing document, consider the following formatting principles to enhance readability and clarity:

- Simple and Clean Layout: Keep the design uncluttered, with enough white space around key sections. This will make the document easier to read and understand.

- Organized Sections: Divide the document into distinct sections such as client information, services provided, and total amount due. This creates a logical flow and allows clients to quickly find relevant details.

- Bold for Emphasis: Use bold text for critical items such as the total amount due, due dates, and important headings. This ensures that key information stands out.

- Consistent Font and Size: Choose a professional font (e.g., Arial, Times New Roman) and keep the font size consistent throughout. This ensures that the document looks polished and is easy to read.

Creating a Clear Summary Table

Including a detailed table helps break down the services rendered and the associated costs. This section should be well-organized to ensure the client can easily track the time, rate, and total for each service.

| Service Description | Hours/Units | Rate | Amount |

|---|---|---|---|

| Consultation | 2 hours | $150/hour | $300 |

| Document Preparation | 3 hours | $100/hour | $300 |

| Research | 5 hours | $120/hour |