Download a Free Invoice Template for Word and Simplify Your Billing

Crafting an organized document that outlines billing details can be simple and efficient with the right tools. By using a familiar text editor, you can create a layout that clearly presents the necessary information for clients, making your business interactions smooth and professional. This approach provides flexibility, allowing you to adjust details and personalize the format to meet specific needs.

A well-organized billing document includes various elements to ensure clarity and consistency. From adding contact details to listing services and calculating totals, each section contributes to a polished final product. Not only does this give your document a professional look, but it also simplifies the process of sharing and storing these files.

Taking time to adjust and refine your layout can help streamline repetitive tasks, making it easier to handle ongoing client needs

How to Create an Invoice Using Word

Designing a document to outline billing details can be easily managed in a well-known text editor. With a few simple steps, you can establish a clear structure for recording services, products, and payment terms. This allows you to create a professional record that communicates your information effectively to clients.

Setting Up the Basic Layout

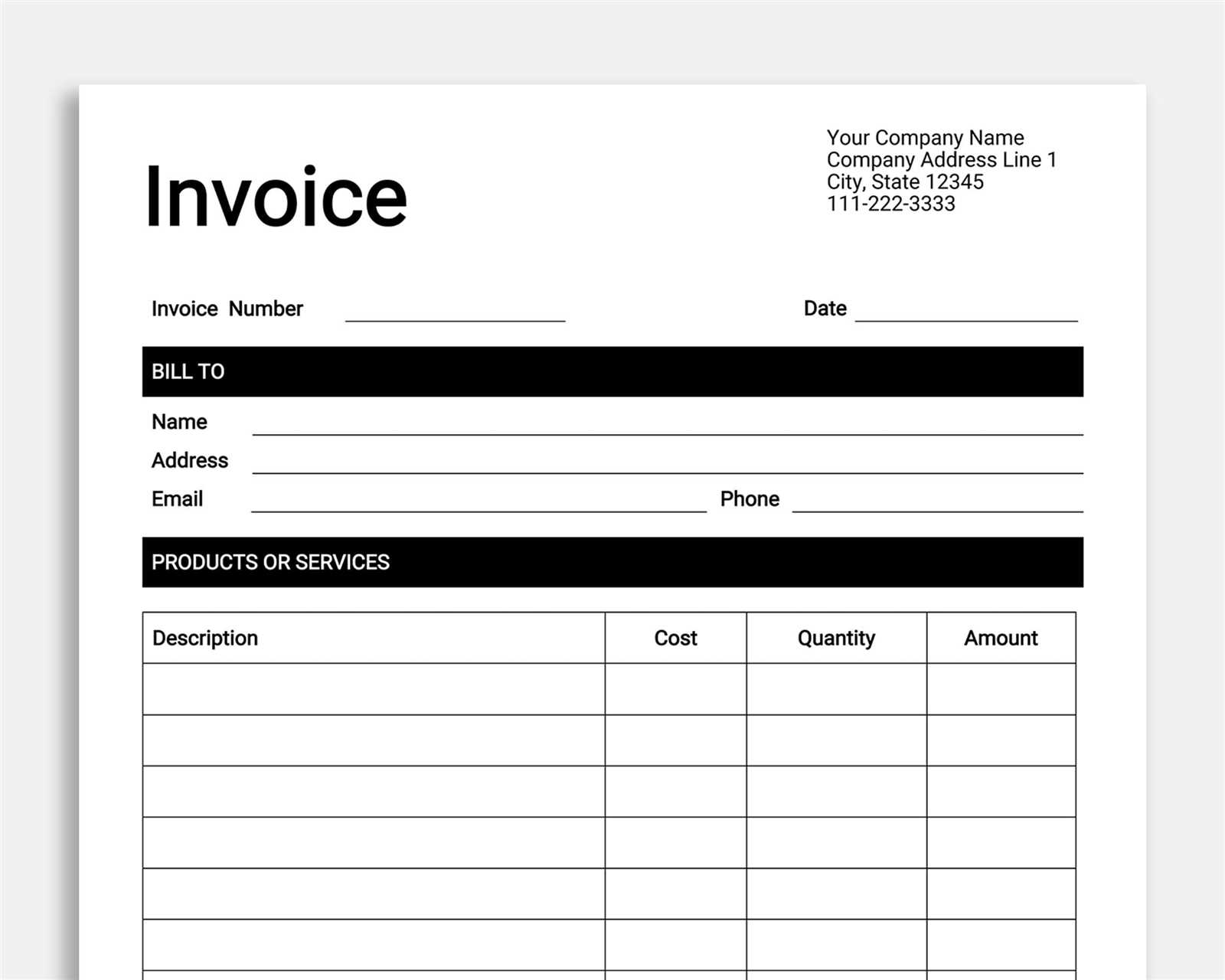

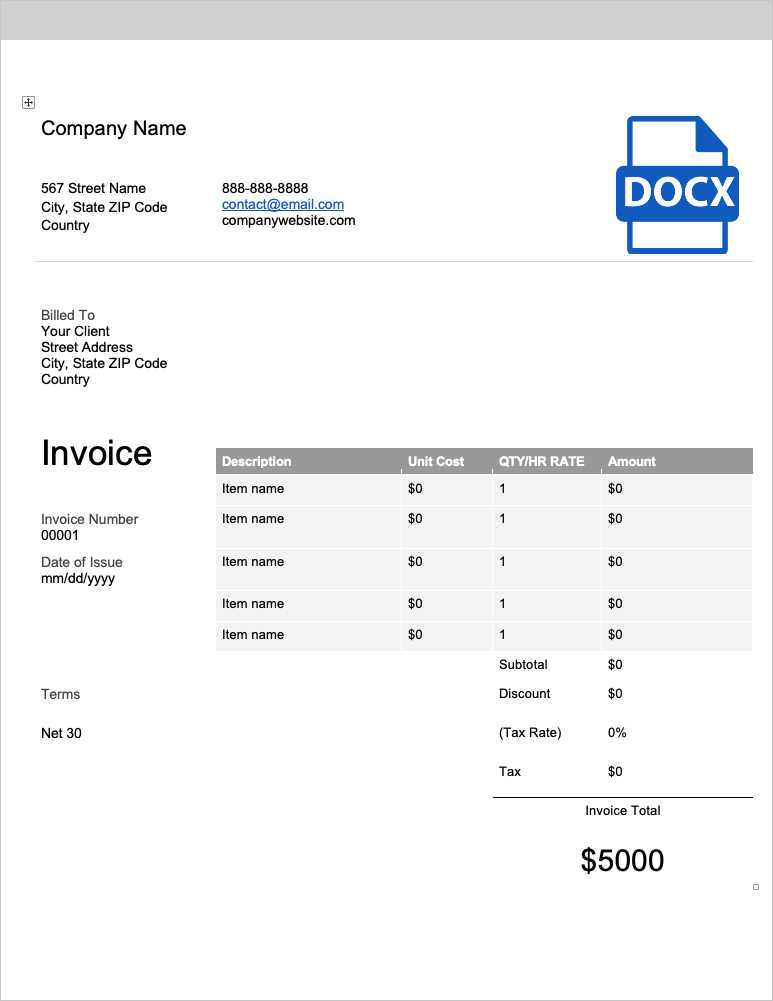

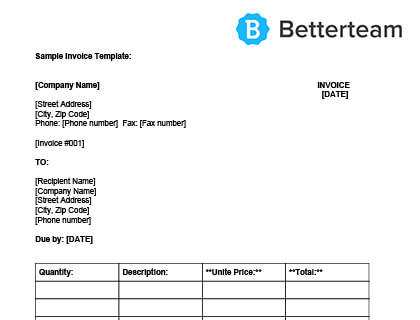

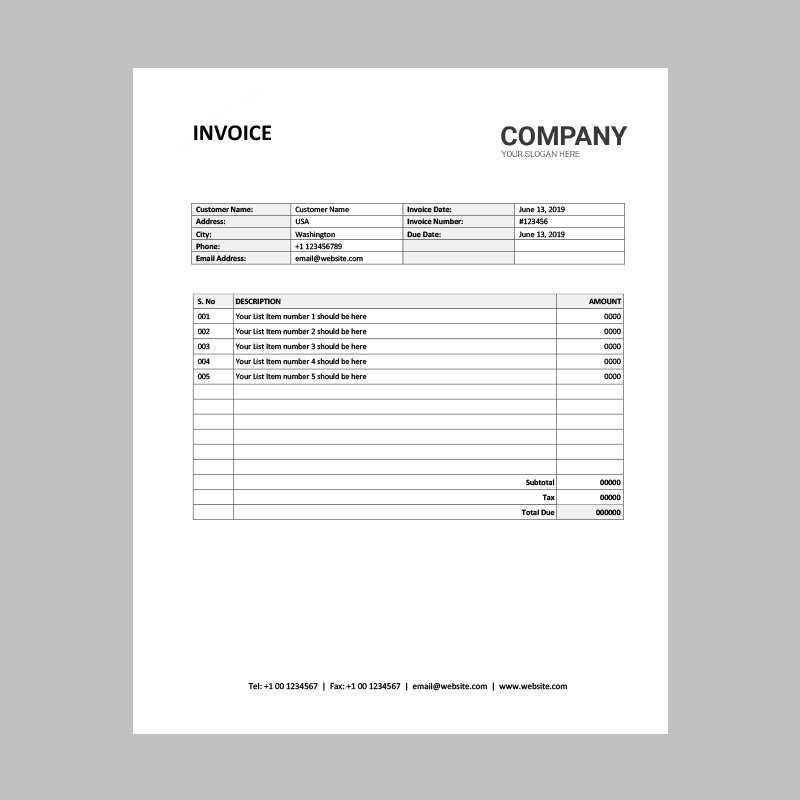

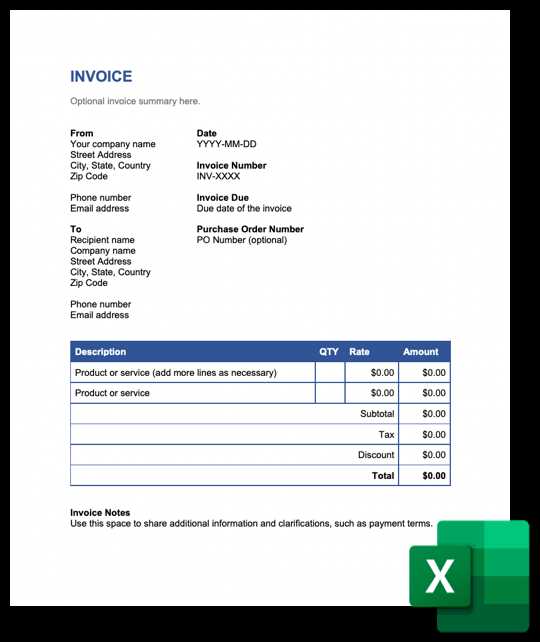

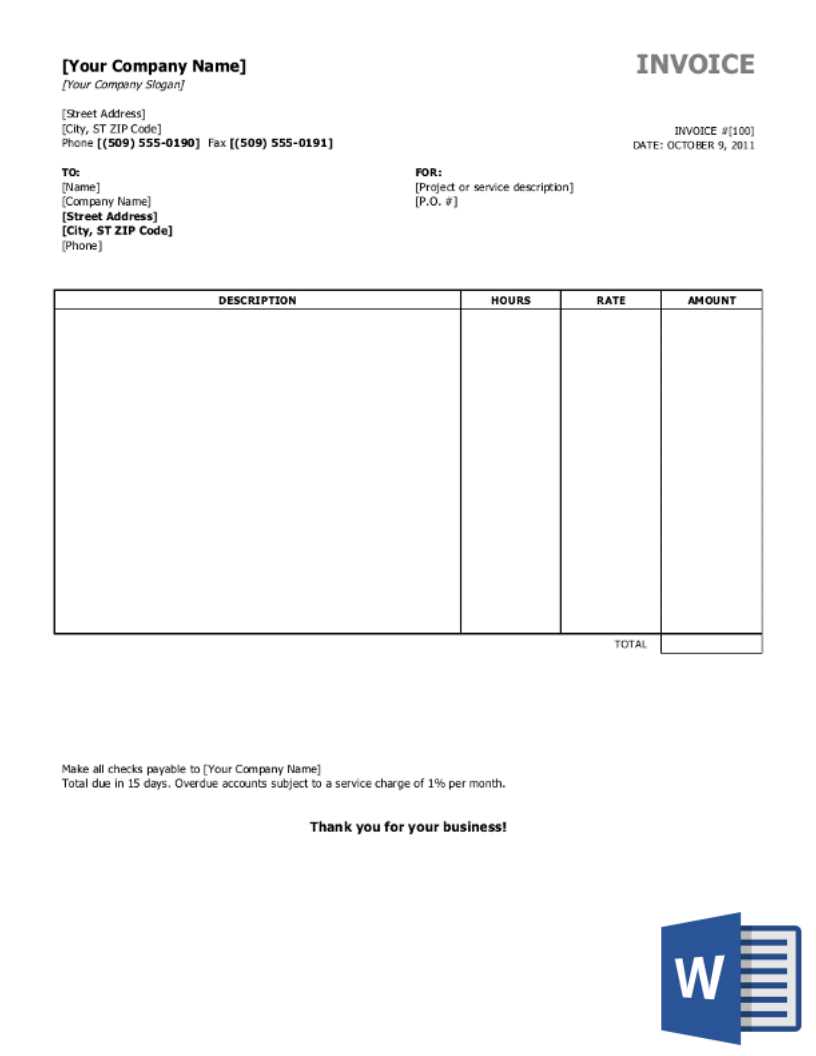

Begin by opening a new blank document in the editor and set up the page layout to suit your needs. You may want to adjust margins, add sections, and decide on the best font for readability. By dividing the page into logical parts, such as headers, client details, and item lists, you’ll have a straightforward foundation ready for further customization.

Adding Key Information

Once the layout is ready, include essential sections, such as your contact details and those of the recipient. Make sure to label each section clearly, so all parties understand what each part represents. Next, add a list where you can detail services provided or products sold, along with pricing, quantities, and any applicable fees. This structured approach not only keeps the document organized

Benefits of Using Word for Invoices

Choosing a familiar word processor to create billing documents offers a flexible and efficient way to manage business interactions. This tool allows you to structure each document according to your needs, with the added convenience of customizable layouts and easy editing. It provides an accessible solution for small businesses and freelancers looking to maintain a professional appearance without specialized software.

Customization and Personalization

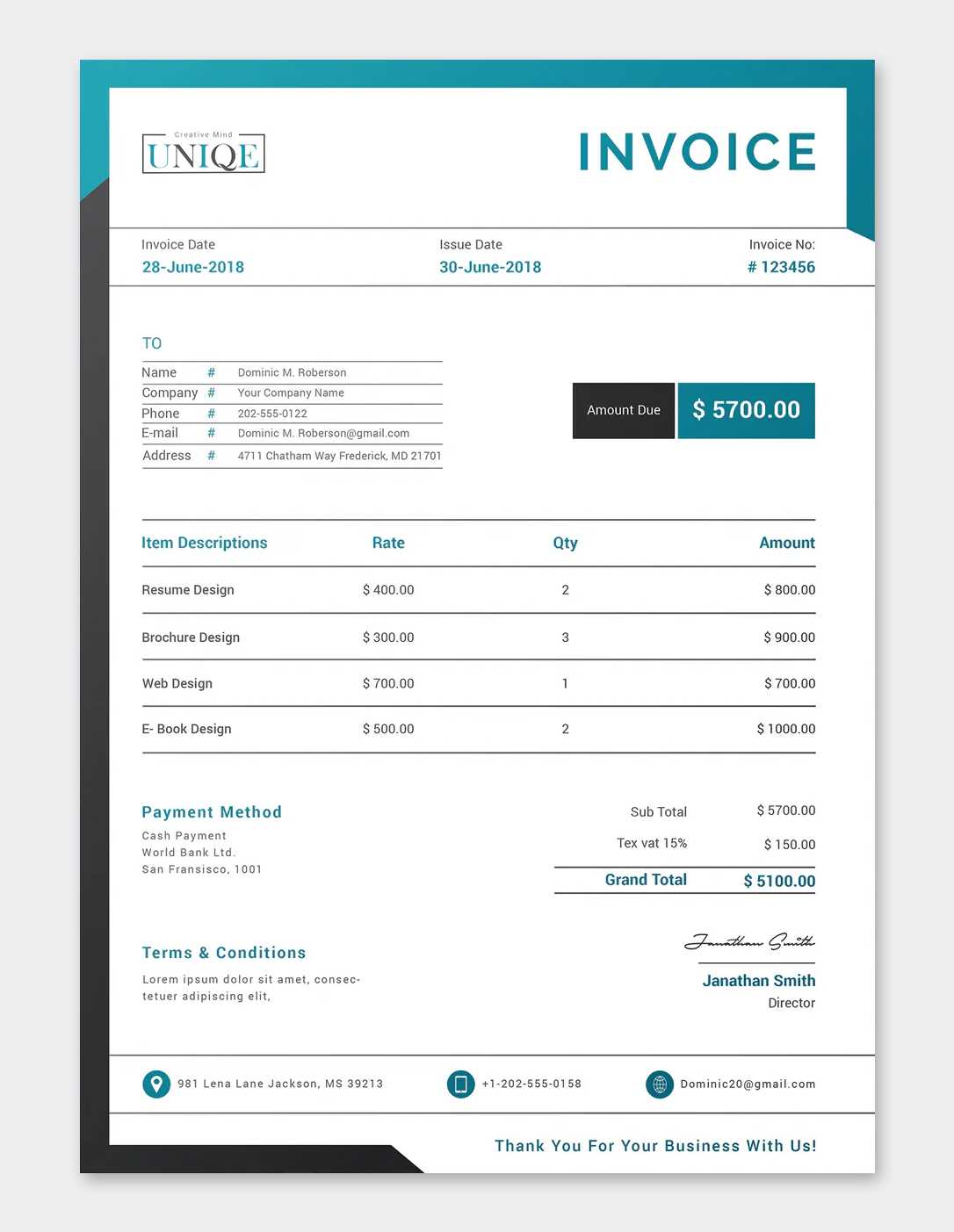

With a user-friendly text editor, you have the freedom to adjust every part of your document. From fonts and colors to logos and headers, you can design each section to reflect your brand. This level of personalization helps your document stand out and aligns it with your business’s identity, making each interaction more memorable and cohesive.

Efficient and Cost-Effective

Using a widely available text editor also means that you can avoid investing in complex billing software. You have everything you need to create, e

Essential Elements of a Professional Invoice

A well-structured billing document not only organizes key information but also establishes a professional impression with clients. Including the right components ensures that all parties clearly understand the transaction details, helping to maintain transparency and accuracy in business exchanges.

Header and Business Details

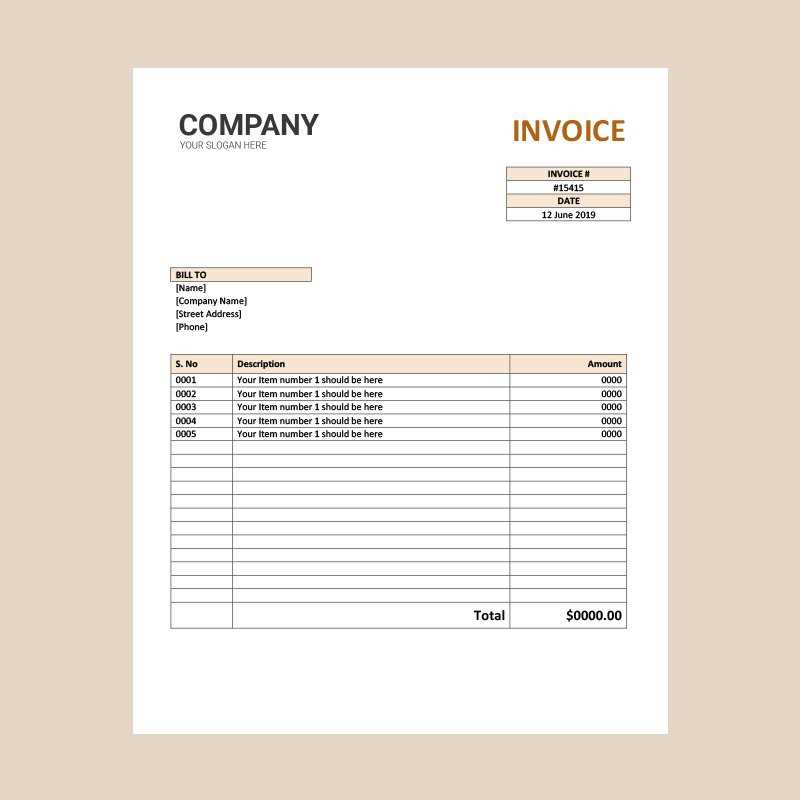

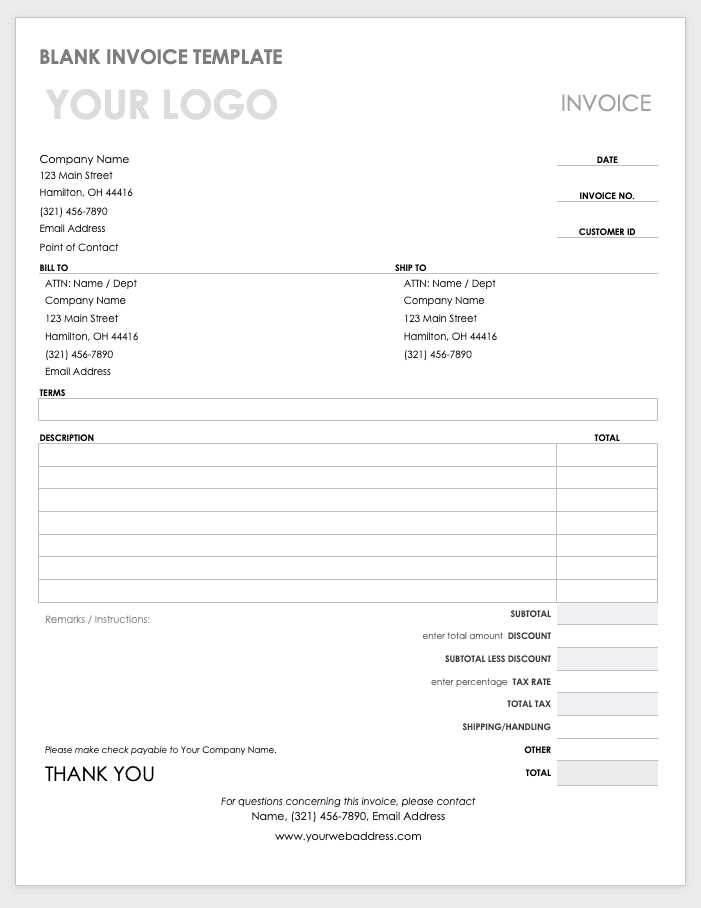

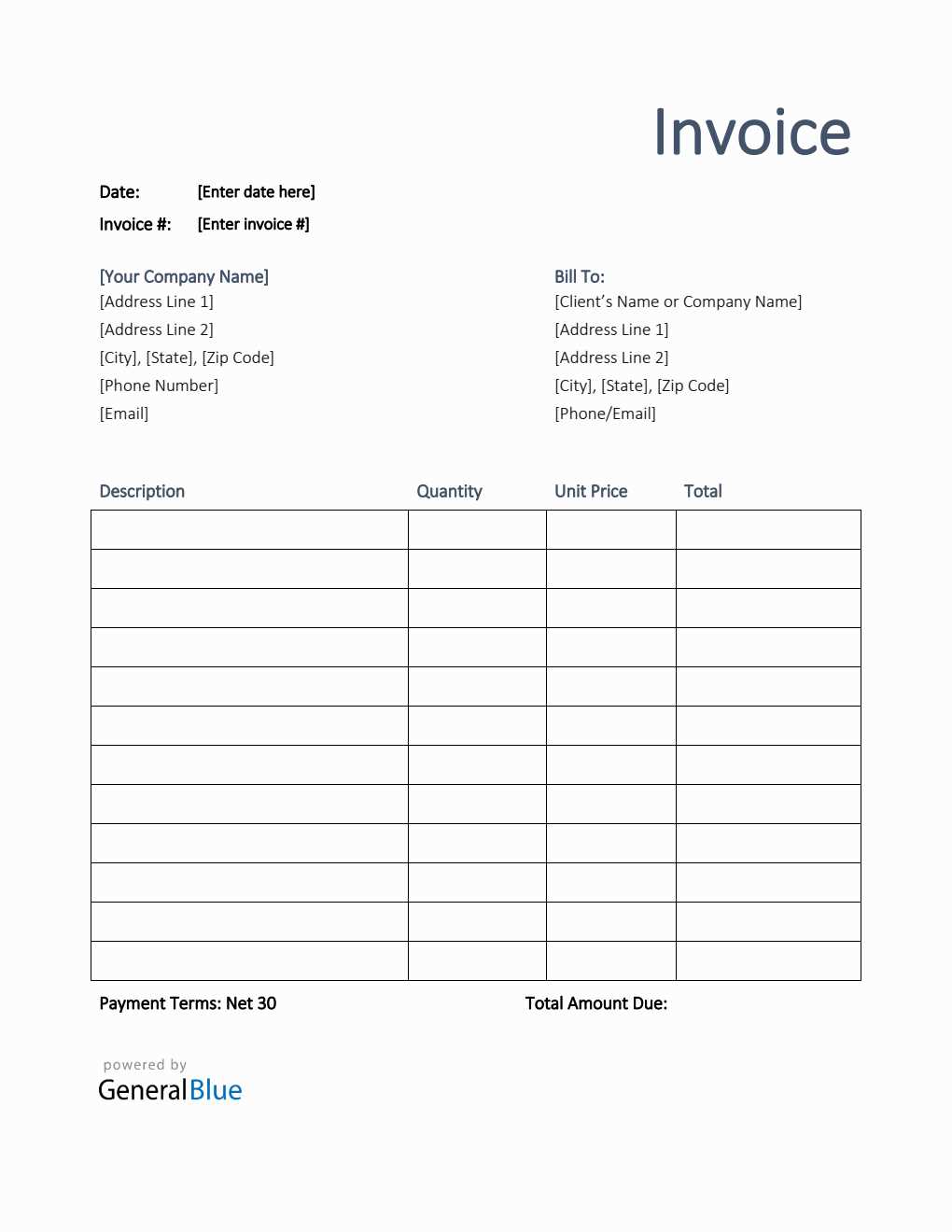

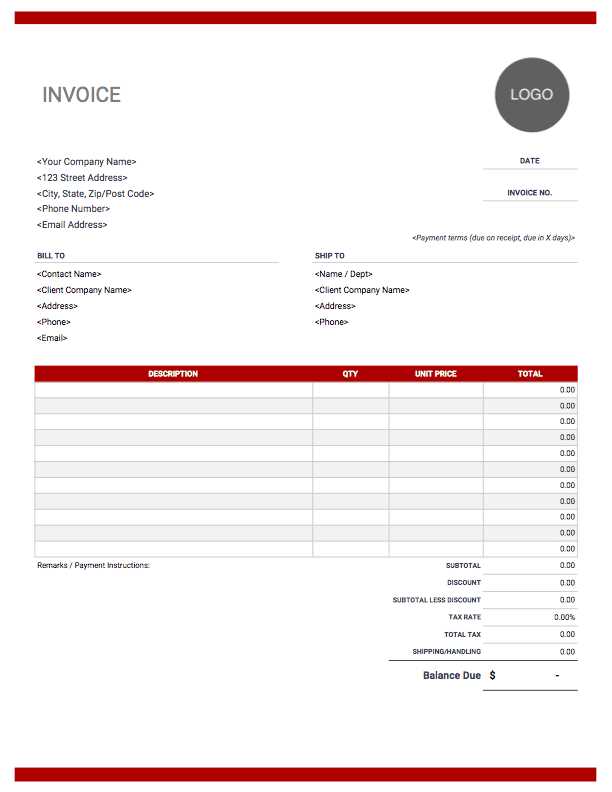

Begin with a clean header featuring your business name, logo, and contact information. Clearly display your company’s address, phone number, and email, as this reinforces credibility and provides clients with direct ways to reach out if needed. Adding a document number here also aids in tracking and organizing records.

Client Information

Include the client’s full name, business address, and other relevant details. Identifying both parties ensures that the document is personalized and specific to the transaction, which

Tips for Customizing Your Invoice Template

Making small adjustments to your billing document can give it a unique and professional look that reflects your brand. Customizing elements like colors, fonts, and layout details helps your document stand out, ensuring it leaves a lasting impression on clients.

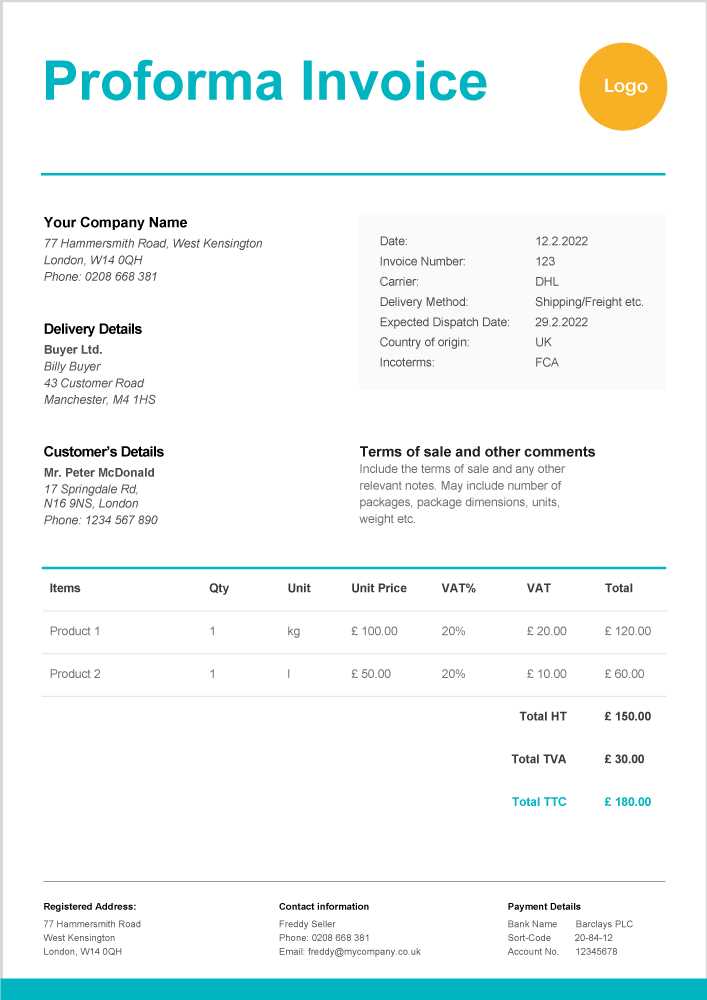

Incorporate Your Brand’s Identity

Start by adding your business logo and using your brand colors to create a cohesive appearance. This personal touch makes the document look polished and reinforces your business identity. Choose fonts that align with your brand’s style, balancing professionalism with readability. Keep consistency in these design choices to maintain a structured and recognizable format.

Organize Key Information Effectively

Arrange sections logically, placing important details like your business information and contact details at the top. Use clear headings to separate each section, making it easy for clients to locate necessary information. Adding a unique identifier, such as a document number or date, can also improve organization and tracking.

Choosing the Right Invoice Format

Selecting an appropriate layout for your billing document can make a significant difference in how effectively it communicates details. With various design options available, it’s helpful to pick a structure that suits your business needs while ensuring clarity for your clients.

Common Formats and Their Uses

Each format offers unique advantages depending on the type of services or products provided. Whether you’re a freelancer, a small business, or a larger company, choosing the right style allows you to present your information in a way that is both organized and visually appealing. Below is a quick comparison of popular types and their typical applications.

| Format Type | Best Suited For | Advantages | ||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Simple Layout | Freelancers, Small Services | Easy to create, straightforward, ideal for basic transactions | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Itemized List | ||||||||||||||||||||||||||||||||||||||||||||||||||||

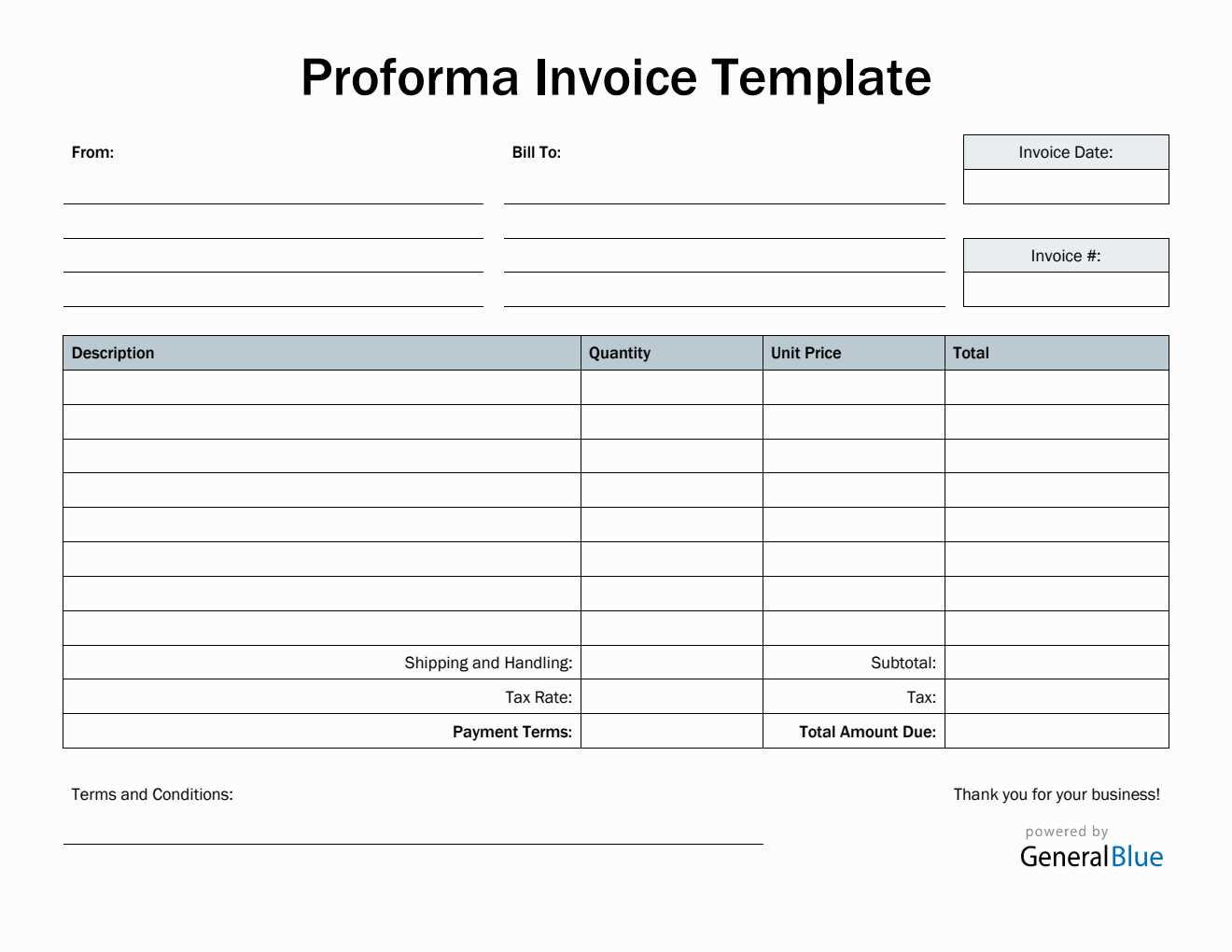

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Service or Product Name 1 | 1 | $100.00 | $100.00 |

| Service or Product Name 2 | 2 | $50.00 | $100.00 |

| Service or Product Name 3 | 1 | $75.00 | $75.00 |

| Total Amount Due | $275.00 | ||

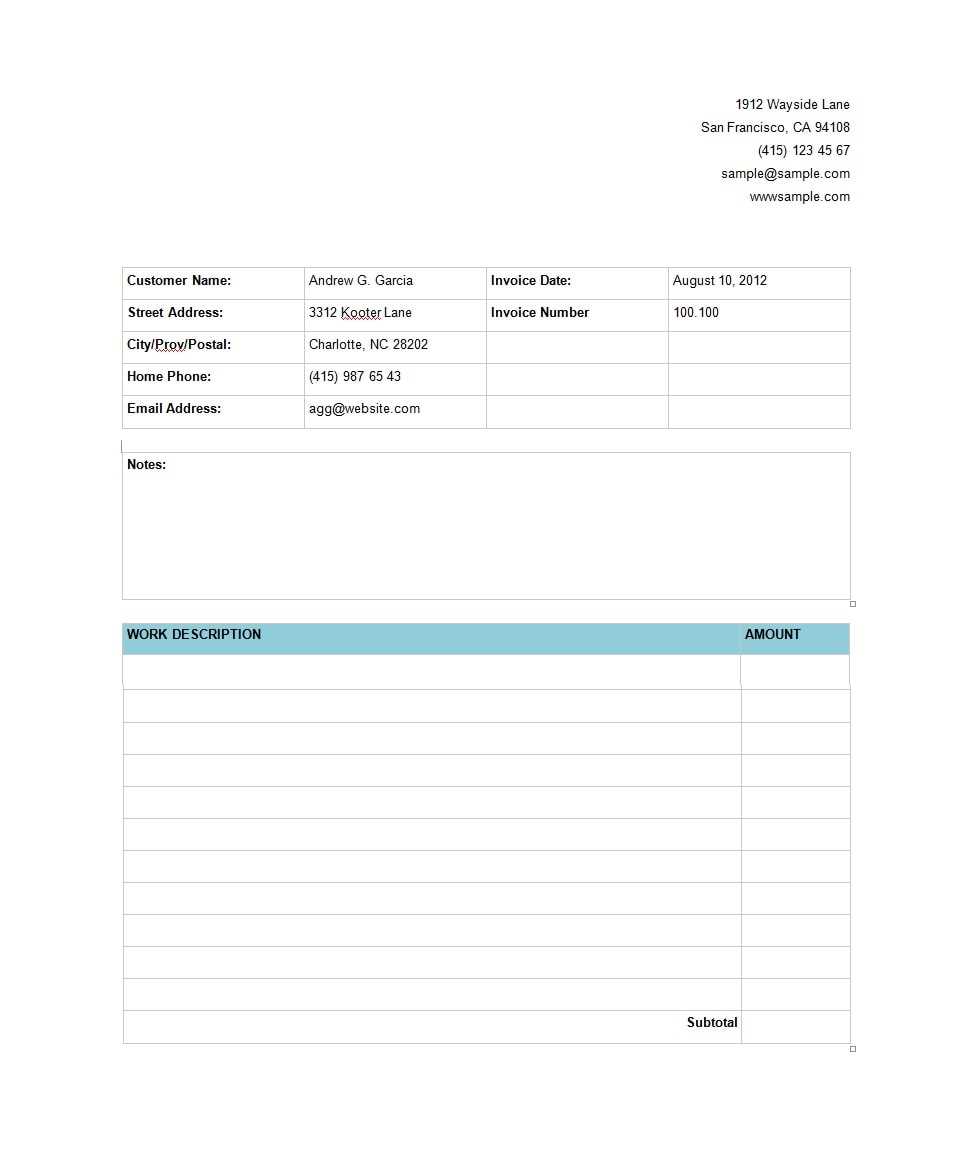

Best Practices for Listing Items

To enhance the effectiveness of your itemization, keep these tips in mind:

- Be Descriptive: Use clear and concise language to describe each service or product.

- Maintain Consistency: Use the same formatting style throughout the list for a professional appearance.

- Highlight Important Details: If applicable, include any relevant specifications or features that add value.

By carefully listing services or products, you provide a comprehensive overview that helps clients understand their charges and the value they receive.

Adding Payment Terms and Deadlines

Clearly defining the conditions for payment and associated deadlines is crucial in any billing document. This practice not only sets clear expectations for clients but also helps ensure timely compensation for services rendered or products delivered.

Establishing Clear Payment Conditions

When outlining payment terms, consider including the following elements:

| Payment Type | Description |

|---|---|

| Net 30 | Payment is due within 30 days from the date of issuance. |

| Due Upon Receipt | Payment should be made immediately upon receiving the document. |

| Installments | Payments can be made in scheduled installments as agreed upon. |

Setting Deadlines for Payment

In addition to defining payment types, it’s important to specify deadlines clearly:

- First Payment Due: Indicate when the initial payment should be received.

- Final Payment Date: Clearly state the date by which the total amount must be settled.

- Late Fees: Outline any penalties for overdue payments to encourage prompt action.

By incorporating detailed payment terms and deadlines, you enhance transparency and foster a professional relationship with your clients, reducing the likelihood of payment disputes.

Tips for Calculating Taxes and Fees

Accurate calculations of taxes and additional charges are essential for maintaining compliance and ensuring that your financial documents reflect true amounts owed. Being meticulous in this area not only prevents misunderstandings but also helps in maintaining a professional image.

Understanding Applicable Tax Rates

To ensure accurate tax calculations, keep these points in mind:

- Know Local Regulations: Familiarize yourself with the tax rates applicable in your area, as they can vary significantly.

- Product and Service Categories: Different categories might be taxed at different rates; make sure to check these specifics.

- Exemptions: Be aware of any exemptions that may apply to your offerings, which can help reduce the overall tax burden.

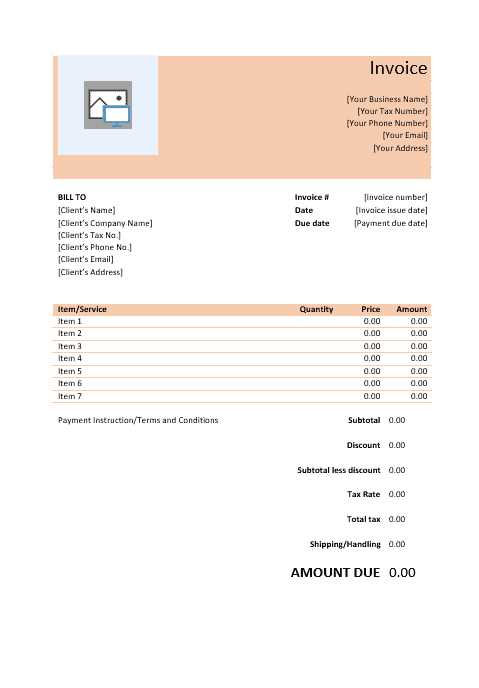

Incorporating Additional Charges

When calculating total costs, consider including other potential fees:

- Shipping Costs: If applicable, add any shipping or handling fees to the final amount.

- Service Fees: Include any service charges that may apply, especially for expedited processing.

- Discounts: Subtract any agreed-upon discounts before finalizing the total, ensuring clarity on the final figure.

By implementing these tips, you can ensure that your calculations are both accurate and compliant, fostering trust and professionalism in your financial dealings.

Saving Your Invoice as a PDF

Converting your financial document into a portable format is an essential step in ensuring that it can be easily shared and viewed across different platforms. This process not only secures the layout and design of your document but also enhances its professionalism.

Follow these simple steps to save your document in a widely accepted format:

| Step | Description |

|---|---|

| 1 | Click on the ‘File’ menu at the top left corner of your document editor. |

| 2 | Select ‘Save As’ from the dropdown options. |

| 3 | In the dialog box, choose the destination folder where you want to save the file. |

| 4 | From the ‘Save as type’ dropdown menu, select ‘PDF’. |

| 5 | Click ‘Save’ to convert and store your document in the chosen format. |

By saving your document in this format, you ensure that the recipient can view it as intended, regardless of the software they use. This step is crucial for maintaining a professional appearance in all your financial communications.

How to Duplicate an Invoice for Reuse

Creating a copy of a financial document can save time and effort, especially when you frequently issue similar statements. This process allows you to maintain consistency and accuracy while simplifying the preparation of new documents. Below are the steps to effectively duplicate your document for future use.

Steps to Duplicate Your Document

- Open the original financial document you wish to copy.

- Click on the ‘File’ menu located at the top of the screen.

- Select the ‘Save As’ option to create a new version.

- Choose a different name for the new file to avoid confusion.

- Select the desired file format, ensuring compatibility with your needs.

- Click ‘Save’ to complete the duplication process.

Tips for Efficient Reuse

- Always update client details before sending out the duplicate.

- Adjust any relevant dates or transaction information to reflect the current situation.

- Maintain a consistent format to enhance professionalism and clarity.

By following these steps, you can streamline your workflow and ensure that you have readily available documents that require minimal adjustments before being sent out.

Editing and Updating Templates Easily

Maintaining and modifying your documents should be a straightforward task, allowing for quick adjustments as your needs evolve. Streamlining this process enhances efficiency and ensures that your materials always reflect the latest information. Here are some effective strategies for making changes and keeping your documents up to date with minimal effort.

First, consider utilizing predefined styles to ensure consistency across your materials. By defining headings, body text, and other elements using styles, you can quickly alter the appearance of your document with just a few clicks. This approach not only saves time but also maintains a professional look.

Additionally, take advantage of built-in features such as find and replace to efficiently update specific terms or values throughout your document. This can be particularly useful when adjusting client details or revising numerical figures. By mastering these editing tools, you can ensure your materials are both accurate and visually appealing.

Lastly, save your modified documents with a new name or version number to keep track of changes and maintain an organized file system. This practice allows you to revert to previous versions if necessary while keeping your current documents streamlined and up to date.

Best Practices for Organizing Invoices

Effective organization of your financial documents is crucial for maintaining clarity and efficiency in your business operations. By implementing structured methods, you can ensure that all necessary records are easily accessible and up-to-date. Here are some recommended strategies to enhance your document management.

1. Create a Consistent Naming Convention: Use a clear and systematic approach for naming your documents. This could include details such as the client’s name, date, and a brief description. A consistent naming structure makes it easier to search for and identify specific records.

2. Utilize Folders and Subfolders: Organize your files into well-defined folders based on categories such as clients, dates, or projects. Within these folders, consider creating subfolders for different time periods or types of services. This hierarchical structure allows for efficient navigation and retrieval of documents.

3. Implement a Tracking System: Maintain a record of all issued documents in a spreadsheet or dedicated software. This should include details such as the document number, client information, and payment status. By tracking this information, you can easily monitor outstanding payments and identify any discrepancies.

4. Regularly Review and Archive: Periodically assess your records to remove outdated or unnecessary documents. Archiving older materials can help declutter your working space while retaining essential information for future reference.

By adopting these practices, you can enhance the efficiency of your financial management and ensure that all relevant documents are well-organized and easily accessible.

Benefits of Using Invoice Templates

Utilizing pre-designed formats for billing can significantly enhance your business processes. These structured documents streamline the preparation and delivery of financial statements, saving time and ensuring accuracy. Here are some key advantages of adopting these useful resources.

1. Time Efficiency: Pre-designed formats eliminate the need to create documents from scratch. This allows you to quickly input relevant details and generate professional-looking statements without extensive formatting efforts.

2. Consistency and Professionalism: Utilizing standardized formats helps maintain a uniform appearance across all documents. This consistency enhances your brand image and assures clients of your attention to detail, fostering trust and credibility.

3. Error Reduction: Having a structured layout minimizes the risk of mistakes. Fields for necessary information are clearly defined, reducing the likelihood of overlooking essential details or miscalculating amounts.

4. Customization Options: Many pre-designed formats offer flexibility, allowing you to modify them according to your specific needs. You can easily incorporate your branding elements, adjust layouts, or update information as required.

By integrating these formats into your financial operations, you can improve efficiency, accuracy, and professionalism, ultimately contributing to better client relationships and smoother business processes.

Common Mistakes

When creating billing documents, it’s essential to be aware of frequent errors that can undermine professionalism and lead to misunderstandings. Addressing these pitfalls can enhance the quality of your financial statements and improve client satisfaction. Below are some of the typical mistakes encountered during the preparation of these important documents.

| Common Mistake | Description |

|---|---|

| Incorrect Client Information | Failing to verify the recipient’s name and address can lead to miscommunication and delivery issues. |

| Omitting Payment Terms | Not clearly stating the payment deadline can cause confusion regarding when payments are expected. |

| Missing Item Descriptions | Providing insufficient details about services or products may lead to disputes or dissatisfaction. |

| Mathematical Errors | Miscalculating totals or tax amounts can result in financial discrepancies and erode trust. |

| Lack of Branding | Failing to include company logos or colors may diminish the professional appearance of your documents. |

By recognizing these common pitfalls, you can take proactive measures to ensure your financial statements are accurate, clear, and professionally presented. Regularly reviewing your processes can also help minimize these mistakes in future creations.