How to Make a Free Invoice Template for Your Business

In the modern business world, clear and accurate financial records are essential for maintaining a smooth workflow. Whether you are a freelancer or run a large company, it’s crucial to have an efficient method for generating detailed billing documents. These records not only help you keep track of payments but also ensure that your clients have a clear understanding of the services provided.

Designing your own custom billing sheets can save time and money. By using simple tools and easy-to-understand formats, you can create professional-looking forms tailored to your business needs. Whether you prefer a minimalist design or a more elaborate layout, there are plenty of options available that allow you to craft the perfect document for your transactions.

Customizing these forms to fit the specifics of your industry can enhance your credibility and make your business appear more professional. From adding payment terms to adjusting currency formats, the right template can make a big difference in how your clients perceive your business.

In this guide, we will walk you through the process of creating a customized, efficient billing solution that suits both your style and your business needs.

How to Create a Free Invoice Template

Creating an effective billing document doesn’t require specialized software or expensive tools. By using simple design principles and available resources, anyone can build a functional and professional billing sheet. This process involves understanding key sections that should be included, ensuring clarity for both the business owner and the client.

Key Steps for Building Your Billing Document

Follow these essential steps to craft a custom form that fits your business needs:

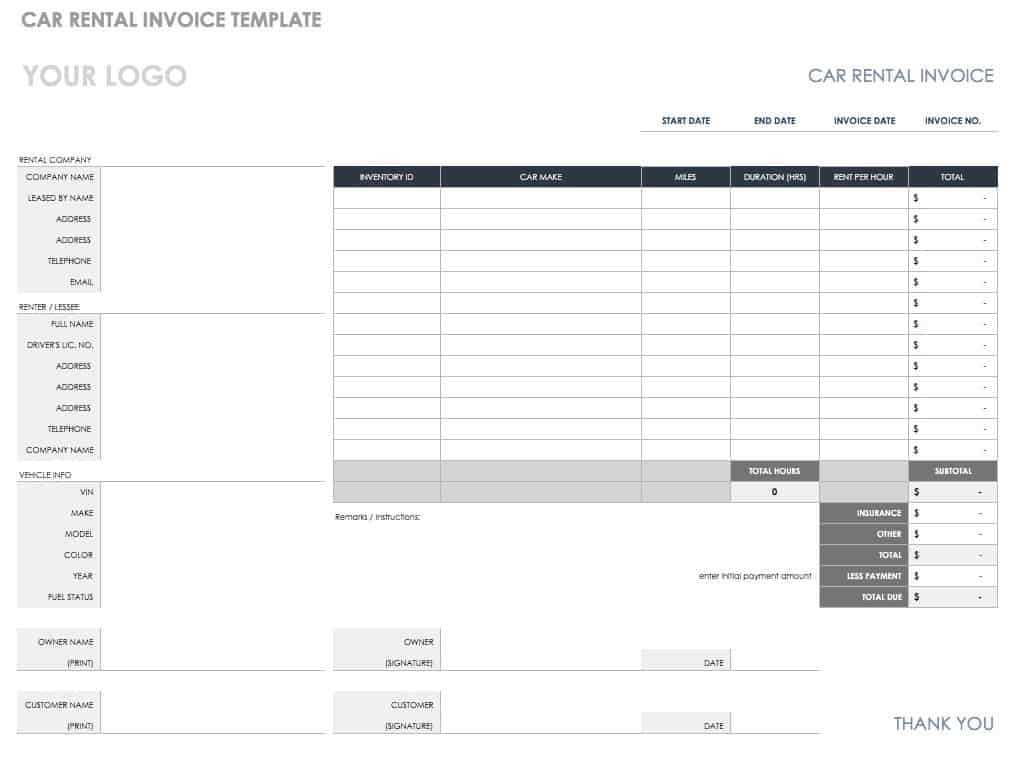

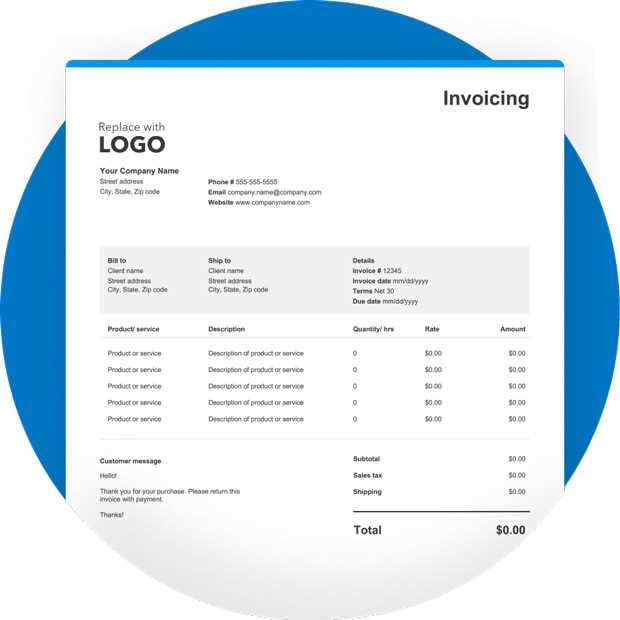

- Choose the Right Format: Decide on the structure of the document. You can opt for a minimalist style or a more detailed layout based on your preferences.

- Include Essential Information: Make sure to add fields such as your company name, contact details, and transaction specifics. This provides clarity and ensures that both parties have all necessary data.

- Add Payment Terms: Clearly define when payments are due, any late fees, and accepted methods of payment.

- Personalize the Design: Adjust colors, fonts, and logos to align with your brand identity.

Tools and Resources for Building Documents

There are many online platforms that offer templates, allowing you to customize them for your own needs. Some popular options include:

- Google Docs: A free and accessible tool that provides a variety of document formats for personal customization.

- Microsoft Excel or Google Sheets: Use spreadsheets to create easy-to-edit and calculate billing formats.

- Canva: Offers pre-designed forms that can be tailored with simple drag-and-drop features.

Once you’ve completed your design, save your file in a format that allows for easy sharing and printing. Common formats like PDF or Excel ensure your document remains accessible and professional for both you and your clients.

Why You Need a Professional Invoice

Having a well-structured and polished billing document is crucial for any business. It not only helps streamline financial processes but also plays a key role in shaping your company’s image. A clear and professional document ensures transparency and enhances trust between you and your clients, which can positively impact your business relationships and payment timelines.

Benefits of Using a Professional Billing Document

A well-crafted billing sheet offers several advantages, including:

| Benefit | Description |

|---|---|

| Improved Clarity | Clearly itemized charges help clients understand exactly what they are paying for. |

| Faster Payments | Professional documents prompt quicker responses from clients due to clear payment terms and instructions. |

| Enhanced Credibility | A well-designed document reflects professionalism and attention to detail, boosting your business reputation. |

| Legal Protection | Accurate and detailed records serve as a legal safeguard in case of disputes or payment issues. |

How It Reflects Your Brand

Your billing document serves as a reflection of your brand identity. By customizing it to align with your business colors, fonts, and logos, you create a consistent, professional experience for your clients. This can contribute to a stronger brand presence and increase customer loyalty.

Best Tools for Making Invoices

When it comes to generating billing documents, there are several excellent tools available that can simplify the process. These resources provide a range of features that allow you to create and customize forms quickly, from basic details to more complex designs. Whether you’re a freelancer or managing a growing business, choosing the right tool can save you time and ensure accuracy in your financial records.

Top Online Tools for Creating Billing Documents

Here are some of the best platforms to consider when creating professional documents:

- FreshBooks: A cloud-based tool designed for small businesses and freelancers, offering easy-to-use billing and accounting features.

- Zoho Invoice: A versatile online tool with customizable templates, automated reminders, and multi-currency support.

- Wave: A free, user-friendly platform that provides customizable layouts and integration with accounting features.

- QuickBooks: A robust tool for managing finances that includes customizable document creation as part of its suite of services.

- PayPal: In addition to payment processing, PayPal offers easy-to-create billing forms with automated tracking and reporting tools.

Offline Tools for Creating Documents

If you prefer offline options, there are still several powerful tools available for creating structured billing records:

- Microsoft Excel: A popular spreadsheet tool that can be used to build custom forms with automatic calculation features.

- Google Sheets: Similar to Excel, this free tool offers online collaboration and flexibility in creating billing records.

- Canva: Though primarily a design tool, Canva also offers pre-designed document formats that are easy to personalize for business use.

Choosing the right tool largely depends on your specific needs. Whether you want a simple, quick solution or a more comprehensive system that integrates with other accounting processes, there’s a tool to suit your business style.

Step-by-Step Guide to Invoice Design

Designing an effective billing document is crucial for ensuring clarity and professionalism in your financial communications. A well-organized format not only helps present the necessary information but also leaves a positive impression on your clients. The following guide walks you through the essential steps to create a functional and visually appealing document.

Essential Elements to Include

When designing your billing sheet, ensure that it includes the following key elements to provide complete and accurate details:

| Element | Description |

|---|---|

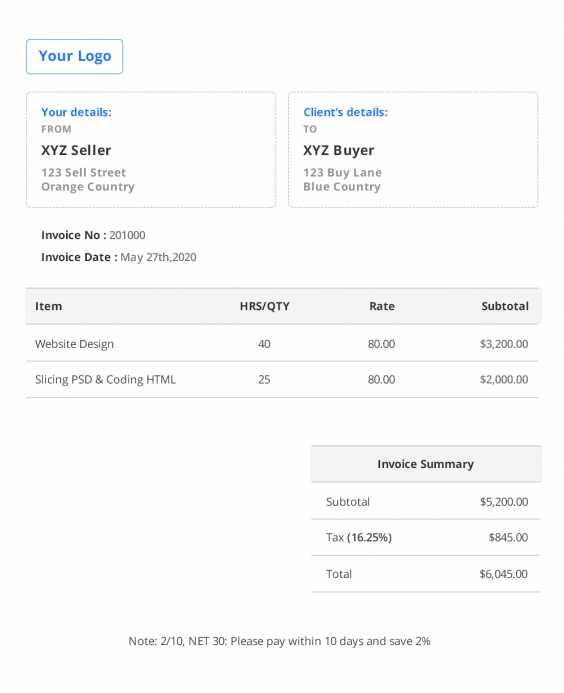

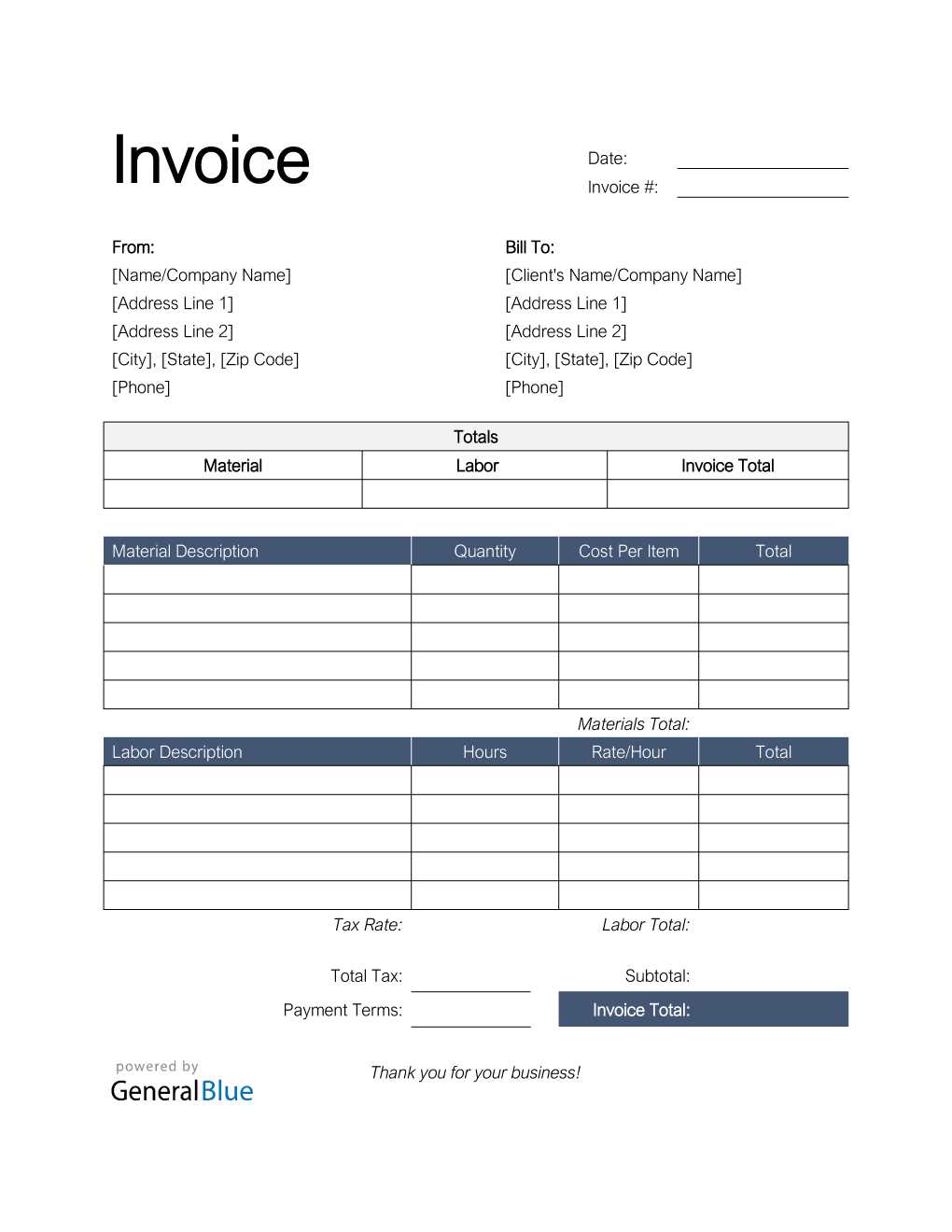

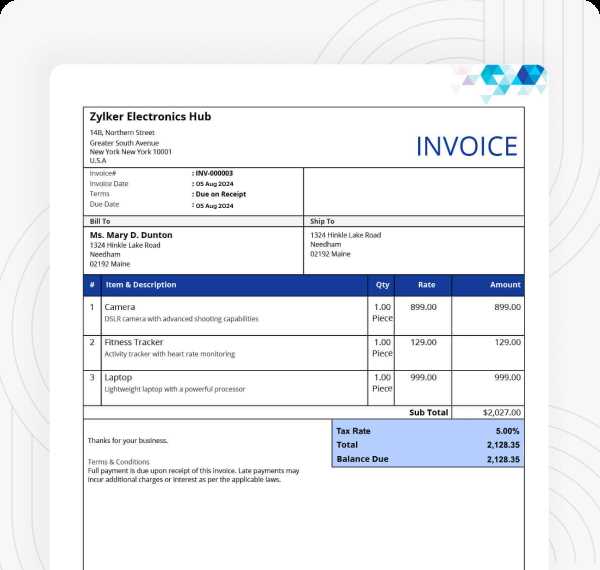

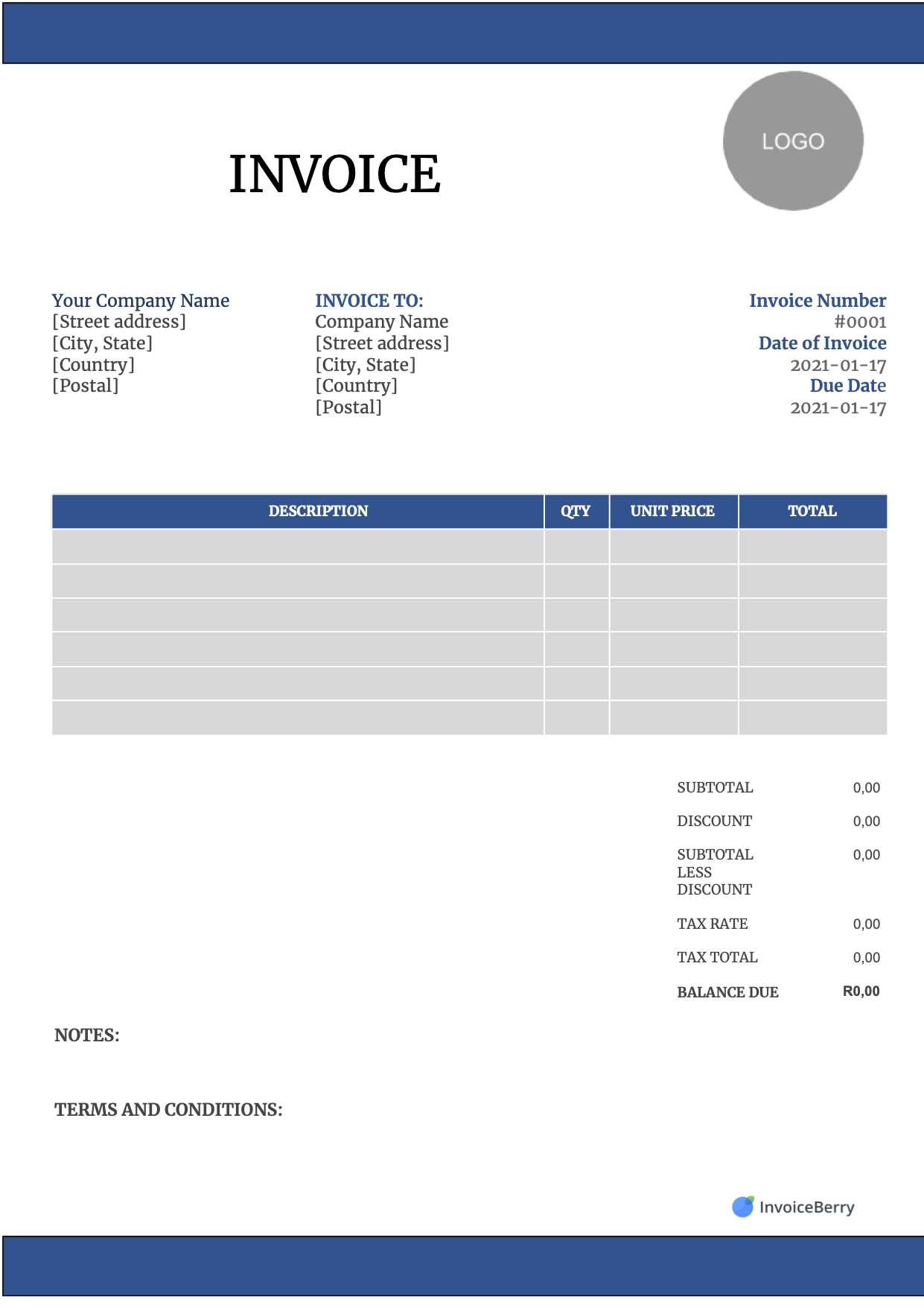

| Header | Include your business name, logo, and contact information at the top to make the document easily recognizable. |

| Client Details | Provide the recipient’s name, address, and contact information for clarity and record-keeping purposes. |

| Transaction Details | List the products or services provided along with their quantities, unit prices, and total amounts. |

| Payment Instructions | Specify payment terms, due date, and acceptable payment methods to ensure smooth transactions. |

| Footer | Include any necessary legal disclaimers, tax information, and business registration details. |

Design Tips for Better Presentation

Beyond the functional elements, it’s important to focus on the overall layout and design to make your document easy to read and professional. Here are some tips:

- Consistency: Use consistent fonts, colors, and spacing throughout the document to create a clean and organized appearance.

- Clarity: Ensure that the text is easy to read, with clear headings, sec

Choosing the Right Invoice Layout

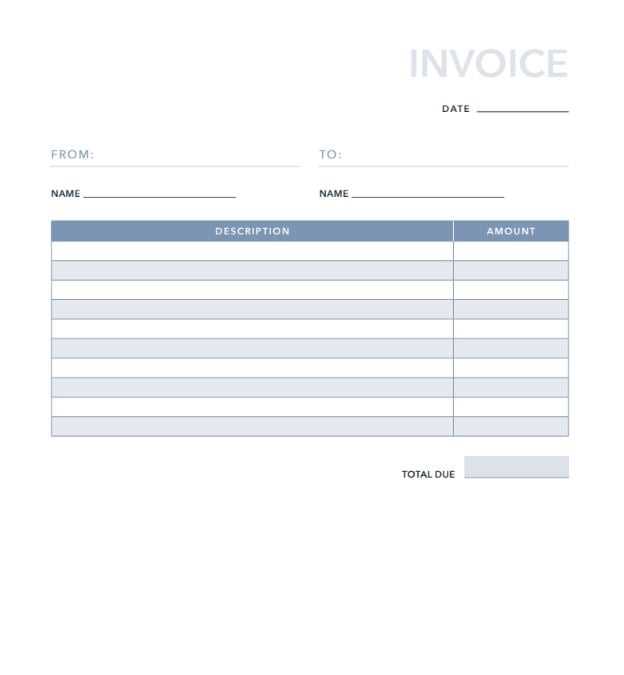

When it comes to managing financial documents, the design and structure play a crucial role in ensuring clarity and professionalism. The arrangement of essential details, such as payment terms, client information, and itemized costs, should be carefully considered to create a smooth and efficient process for both the sender and the recipient.

Clarity is key in selecting the right structure. A well-organized format allows the recipient to quickly understand the details of the transaction, reducing confusion and the potential for errors. Keep in mind that simplicity often leads to better results, especially when dealing with clients who may not be familiar with your business or industry-specific jargon.

Another important factor to consider is branding. The layout should reflect your business’s identity, reinforcing professionalism. Your logo, business colors, and font choices help set the tone for how your company is perceived. A polished, uniform design not only makes a strong impression but also boosts the credibility of your financial documents.

Lastly, consider the flexibility of the layout. Choose a structure that can easily be adapted for various situations, from one-time services to ongoing contracts. A versatile design ensures that it can accommodate different types of transactions while maintaining consistency in appearance.

Essential Information to Include in Invoices

For any financial document to be effective and legally sound, it must contain certain key details that facilitate proper tracking and payment. Each section should be thoughtfully crafted to ensure transparency, reduce misunderstandings, and ensure timely processing. Including all necessary data not only supports your professionalism but also helps in maintaining smooth transactions between businesses and clients.

At the core of the document is the identification information, such as the names and contact details of both parties involved. This includes the full legal name, address, and, where applicable, tax identification numbers. This makes it clear who is issuing the document and who is responsible for the payment.

Transaction details are equally important. These encompass a clear description of the goods or services provided, along with the quantities and agreed-upon prices. A breakdown of any additional charges, such as taxes or discounts, should also be included to avoid confusion.

Payment terms are crucial for establishing expectations. These include the due date for payment, any late fees for overdue balances, and acceptable payment methods. This section serves to protect both parties by ensuring clarity about the financial agreement and the timeline for settlement.

Finally, including a unique reference number for each document helps both you and your client track the transaction easily. This is especially important for accounting purposes and can assist in resolving any future disputes or discrepancies.

Customizing Your Invoice Template for Business

Adapting your financial document layout to reflect your business’s unique needs and branding can significantly improve how clients perceive your professionalism and organization. Tailoring each aspect of the design–from the structure to the content–ensures that the document not only conveys essential information clearly but also reinforces your company’s identity. Customization goes beyond just aesthetic adjustments, influencing functionality and client experience as well.

When personalizing the document, consider incorporating your business logo and color scheme. These visual elements create a cohesive brand experience and increase recognition. Adjusting the font style and size can also help to align the document with your company’s overall aesthetic, ensuring consistency across all communication materials.

Furthermore, consider the nature of your products or services when organizing the content. For example, if your company specializes in project-based work, you might include a section to track milestones or phases of the project. For e-commerce businesses, a detailed product list with SKU numbers and shipping details may be essential.

Section Description Header Include your business name, logo, and contact information at the top for easy identification. Client Information Customize the client section to include any relevant details such as account numbers or client-specific terms. Product/Service Description Clearly list items with descriptions that are appropriate for your industry–this could include project stages, product models, or service types. Payment Terms Adjust payment instructions, such as due dates, accepted payment methods, or late fee policies, to match your business’s standard practices. By personalizing the structure and content, you create a document that aligns with your company’s values and streamlines communication with clients, ensuring smooth financial transactions every time.

How to Save and Print Your Invoice

Once you’ve completed the document, the next step is ensuring it’s properly saved and ready for distribution. Storing it correctly is crucial for easy access, future reference, and compliance with tax or accounting requirements. Printing the document should be straightforward, ensuring it maintains its integrity and clarity when presented to clients or for your records.

The first step in saving your document is selecting the right file format. Most commonly, documents are saved as PDFs, which preserve the layout and prevent unwanted edits. This format is universally accepted and ensures the recipient views the same version of the document that you created. If you’re using a software or platform, ensure it offers a “Save as PDF” option for the best compatibility.

Once saved, it’s important to use a naming convention that helps with organizing and locating the file easily. Include relevant details such as the client name, date, or a reference number in the filename. This ensures that you can quickly find the document later, especially when managing multiple transactions.

For printing, make sure your document is set up to fit standard paper sizes (such as A4 or Letter). Most modern printers allow you to preview the document before printing, giving you the opportunity to adjust margins, scale, or orientation if necessary. This helps ensure that the layout stays intact, and no information gets cut off.

Additionally, check the printer settings to confirm you’re printing in high quality, especially if you plan to send a physical copy. Clear text and crisp graphics make a strong impression, reinforcing the professionalism of your business.

Common Mistakes in Invoice Creation

When creating financial documents, it’s easy to overlook certain details that can lead to confusion, delayed payments, or even disputes. Small errors in the layout or missing information can create unnecessary complications for both the sender and the recipient. Identifying and avoiding these common mistakes ensures that your documents are clear, professional, and legally sound.

Incomplete or Missing Information

One of the most frequent errors is failing to include all necessary details. Missing information such as contact details, transaction descriptions, or payment terms can lead to misunderstandings or delays. Always ensure that key elements, such as the recipient’s name, business address, and specific itemized charges, are clearly listed. Additionally, neglecting to include a payment due date or the method of payment can create confusion about when and how the amount should be settled.

Incorrect Calculations and Discrepancies

Another common mistake is incorrect calculations, whether it’s the total amount due, taxes, or discounts. Even small discrepancies can cause significant issues when clients compare documents or make payments. Always double-check your calculations and ensure that all totals align with the individual line items, including any applicable taxes or additional charges. A quick review can save a lot of time and prevent issues later on.

How to Add Payment Terms to Your Invoice

Clearly outlining payment terms is essential for setting expectations and ensuring timely transactions. By specifying the due date, payment methods, and any penalties for late payments, you create transparency and avoid confusion. These terms not only protect your business but also help clients understand their obligations from the start, leading to smoother financial exchanges.

Specify the Due Date

The most basic element of any financial agreement is the due date. Clearly state when the payment should be made, whether it’s within a set number of days (e.g., 30 days from the issue date) or a specific calendar date. It’s crucial to be precise to prevent ambiguity. For example, instead of writing “Due in one month,” specify “Due by December 15, 2024.” This way, both parties have a clear understanding of the payment timeline.

Include Payment Methods and Late Fees

Next, specify the accepted payment methods, such as bank transfer, credit card, or online payment platforms. Clearly list any details required for payment, such as bank account numbers or links to payment portals. Additionally, you may want to include a clause regarding late payment fees. For example, you can note, “A late fee of 1.5% per month will be charged on overdue amounts.” This encourages timely payment and ensures your business is compensated for any delays.

Benefits of Using a Free Invoice Template

Utilizing a pre-designed document format for billing can offer numerous advantages, especially for small businesses or freelancers. These ready-made formats provide structure, saving time and reducing the risk of errors. With all necessary fields already laid out, they simplify the process of creating professional documents, allowing you to focus on running your business.

One of the main benefits is the time efficiency they provide. Rather than designing a layout from scratch, you can simply fill in the relevant details and generate a polished document in minutes. This streamlined process allows for faster billing cycles, which can help improve cash flow.

Another significant advantage is professionalism. Using a consistent and well-organized format for all your billing helps maintain a cohesive brand image. The design elements, such as logo placement and section headers, ensure that your documents look polished and credible, even if you don’t have a background in graphic design.

Additionally, these formats often include all the necessary fields, ensuring that important information like client details, payment terms, and total amounts are not overlooked. This reduces the chances of mistakes that could delay payments or lead to misunderstandings with clients.

How to Automate Invoice Generation

Automating the creation of billing documents can significantly reduce the time and effort involved in managing your business’s financial processes. With the right tools and software, you can generate professional records with minimal input, ensuring consistency and accuracy across all your transactions. Automation not only saves you time but also reduces the risk of errors and streamlines your workflow.

To get started with automating your billing process, follow these key steps:

- Choose the Right Software: Look for a tool or platform that suits your business’s needs. Many online services allow you to create and customize financial documents automatically.

- Integrate with Your Accounting System: Many software solutions can sync with your accounting tools, enabling data to flow directly into your billing documents. This eliminates the need for manual entry of transaction details.

- Set Up Recurring Billing: If you offer subscription-based services or regular payments, set up automatic generation for recurring charges. This will ensure that your clients are billed consistently and on time.

- Customize Your Document Settings: Pre-set fields for client information, payment terms, and product or service descriptions. This customization ensures that every document generated reflects your brand and is tailored to each transaction.

- Enable Notifications: Set up automatic email reminders or notifications for clients regarding upcoming payments or overdue balances. This can help ensure timely payment and maintain client relationships.

By automating these steps, you create a more efficient and reliable process for managing billing, allowing you to focus on growing your business rather than spending time on manual document creation.

Invoices for Different Business Types

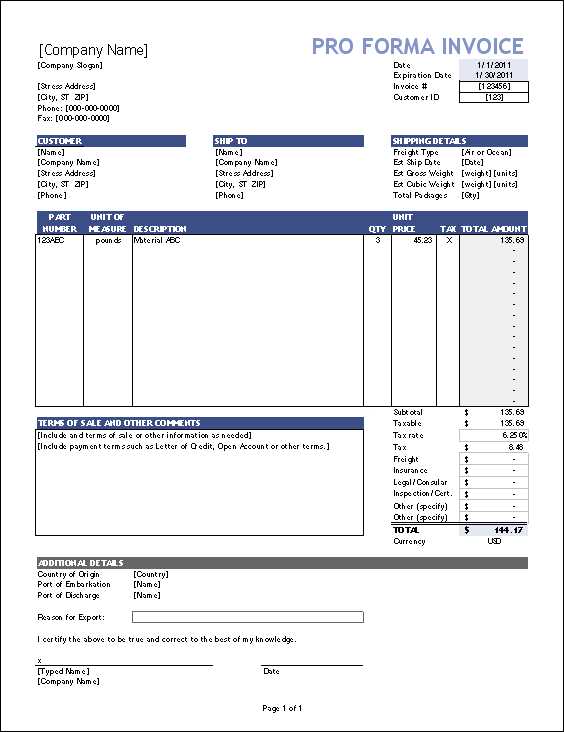

Different types of businesses often require unique approaches to creating billing documents. The structure, content, and details of each document can vary significantly depending on the nature of the product or service being offered. Understanding how to adapt the format to fit your business type helps ensure that all necessary information is included and that your documents meet industry standards and client expectations.

Service-Based Businesses

For service-oriented companies, such as consultants or contractors, it’s crucial to provide clear descriptions of the work performed. These documents often include hourly rates, project milestones, or service completion dates. Transparency in outlining services and charges reduces disputes and ensures clients are aware of what they are paying for.

Product-Based Businesses

Retailers or wholesalers typically need to include detailed itemized lists of products sold, quantities, and unit prices. Additionally, including SKU numbers or product codes helps clients verify their purchase. These documents often have additional fields for shipping costs and taxes based on the total purchase amount.

Business Type Key Details to Include Service Providers Service description, hourly rate, project milestones, due dates for payment Product Sellers Product names, SKUs, quantity, unit price, shipping fees, taxes Freelancers Detailed breakdown of tasks, agreed-upon rates, payment schedule Subscription-Based Businesses Recurring billing period, service included, payment cycles, renewal terms By adjusting the layout and content according to your business type, you ensure that the billing process is efficient, clear, and tailored to meet both your and your clients’ needs.

Design Tips for Professional Invoices

Creating a visually polished document helps establish credibility and ensures that clients take your work seriously. Attention to layout and aesthetics can enhance readability, making it easier for recipients to understand key details and payment instructions. Prioritizing clarity in design reflects positively on your business image and enhances trust.

Use Consistent Branding: Integrating your brand’s color palette, logo, and typography builds recognition and maintains a cohesive look across your communications. A consistent design style not only enhances professionalism but also reinforces brand identity with every transaction.

Organize Sections Clearly: Structuring the document with well-defined sections–such as header, itemized list, and payment terms–improves readability and ensures that all essential information is easy to find. Visual separators like lines or subtle color blocks can help break up sections without overwhelming the design.

Choose Readable Fonts: Select a font style that balances pro

Integrating Your Invoice Template with Accounting Software

Connecting your customized billing document with accounting platforms streamlines financial management, saves time, and reduces the risk of manual errors. Syncing these systems allows seamless tracking of payments, automates record-keeping, and simplifies overall financial workflows.

Benefits of Integration

Feature Description Automated Data Transfer Once linked, information such as client details, charges, and payment status flows directly into your accounting system, minimizing repetitive entry and ensuring accuracy. Real-Time Payment Tracking Integrated systems enable instant updates on incoming funds, helping you stay informed of payment statuses without needing to check multiple sources. How to Manage and Track Your Invoices Effective organization and tracking of billing documents are key for maintaining a steady cash flow and ensuring timely payments. By establishing a system to monitor each document’s status, you can minimize missed payments, reduce follow-up time, and keep financial records up-to-date.

Organize Your Records

Begin by creating a structured system to categorize documents based on status, such as pending, paid, or overdue. Digital folders or specialized software can help streamline this process, making it easier to locate documents quickly when needed. Consistent organization helps you stay informed of outstanding balances and prioritize follow-ups.

Use Tracking Tools

Tracking tools or software simpli

Improving Cash Flow with Invoices

Ensuring a steady cash flow is essential for financial stability, and well-structured billing practices can greatly assist in achieving this goal. By encouraging timely payments and reducing overdue accounts, you can keep funds moving consistently, which supports both daily operations and long-term growth.

Establish Clear Payment Terms: Set specific payment terms that outline due dates, late fees, and accepted payment methods. Transparent terms help clients understand expectations, encouraging them to complete transactions promptly and reducing delays.

Offer Multiple Payment Options: Providing various ways to pay, such as bank transfers, credit cards, or digital wallets, increases convenience for clients, which can lead to quicker payments. The easier the process, the more likely clients are to settle balances on time.

Incentivize Early Payments: Consider offering small discounts or other incentives for early payments. Such measures can motivate clients to settle balances before the due date, helping to speed