Create Professional Invoices with an Hourly Invoice Template

Managing time-based charges efficiently is essential for freelancers, consultants, and businesses that bill for services by the hour. Creating well-organized records of work performed not only ensures accuracy in payment collection but also builds trust with clients. A structured approach to documenting work hours allows professionals to maintain clarity and transparency throughout the billing process.

When setting up a system for time-based charges, the right tools can significantly simplify this task. A well-crafted document can help track the services provided, the duration spent on each task, and the agreed-upon rate. This makes it easier to calculate total amounts owed while reducing the potential for errors and misunderstandings.

In this article, we will explore how to create and utilize an effective system for billing clients based on time worked. From understanding the key components to optimizing your approach, we’ll cover practical strategies to help you manage your business operations smoothly and professionally.

Invoice Hourly Template Overview

When managing time-based billing, having an efficient way to document and calculate charges is crucial for both service providers and clients. A properly structured document ensures that work hours are clearly recorded and payment requests are transparent. This approach helps maintain professional relationships and avoids any confusion over rates or the work completed.

The main objective of such a system is to create a clear and standardized format that allows for easy tracking of the time spent on each task. This method not only simplifies the billing process but also ensures that all hours worked are accounted for and accurately billed, providing both parties with a straightforward reference point for the transaction.

Key Features of a Time-Based Billing Record

To create a reliable record, it is important to include essential details such as the service provided, the start and end times, and the agreed-upon rates. Organized documentation helps to prevent errors and ensures consistency across all projects. Additionally, a well-organized format can be adapted to various industries, making it a versatile tool for different professionals.

Benefits of Using a Standardized Format

One of the main advantages of using a standardized system is the ability to streamline both the tracking and invoicing process. With clear records, professionals can reduce administrative burden and focus more on their core tasks. Furthermore, a consistent method provides clients with a transparent view of the work performed, fostering trust and enhancing communication.

Why Use an Hourly Invoice Template

Utilizing a standardized approach to document work hours and corresponding charges brings clarity and consistency to billing processes. This method simplifies the calculation of costs for time-based services, ensuring that both clients and service providers have a transparent understanding of what is being billed and why. Having a well-organized system not only saves time but also reduces the likelihood of errors in calculations or misunderstandings.

One of the key reasons for adopting such a system is its ability to track work done efficiently. By using a structured format, it becomes easier to manage and report the time spent on various tasks, making sure that every minute is accounted for. This clarity leads to smoother transactions and more professional interactions between businesses and their clients.

| Benefit | Description |

|---|---|

| Improved Accuracy | Helps ensure all time is properly documented and billed, reducing human errors. |

| Time Efficiency | Standardized format saves time when preparing bills, allowing for quick generation and review. |

| Professional Appearance | Clear and consistent documentation projects a professional image to clients and builds trust. |

| Client Transparency | Clients can easily understand the breakdown of services and the time spent, fostering trust and reducing disputes. |

By using a reliable structure for tracking and billing, professionals can focus on their core tasks while ensuring that financial matters are handled smoothly. This system provides peace of mind for both parties, streamlining communication and ensuring prompt payment processing.

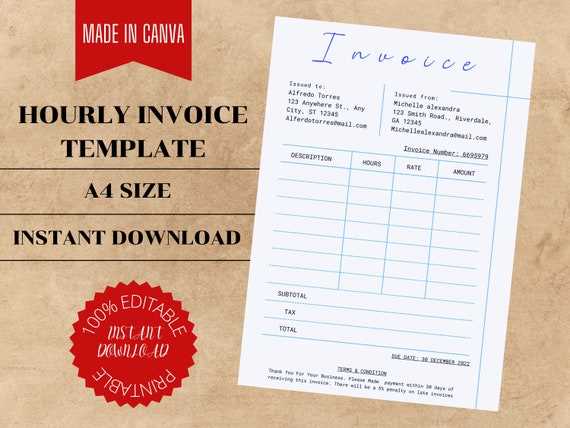

Benefits of Customizable Invoice Formats

Using adaptable billing documents can significantly enhance the efficiency and professionalism of any service-based business. The ability to tailor these documents to suit the specific needs of different clients, projects, or industries allows businesses to present clear and personalized payment requests. Customization ensures that each billing statement reflects the unique aspects of the work performed and meets the expectations of clients.

One of the key advantages of a customizable format is the flexibility it offers in adjusting to different business needs. Whether it’s adding specific terms, adjusting the layout, or including additional details, a personalized document can accommodate the unique requirements of each job, providing a more professional touch.

- Personalization: Adjust layouts, fonts, and content to match branding and style.

- Client-Specific Details: Include unique payment terms or project-specific information to make communication clear.

- Adaptability: Modify the structure to cater to different types of services or industries.

- Clearer Presentation: Organize details in a way that makes it easier for clients to understand the charges.

- Professionalism: Custom formats help businesses stand out by reflecting a polished, tailored image.

Furthermore, the ability to adjust these documents for different clients enhances transparency and communication, which can lead to faster payments and stronger client relationships. Whether it’s incorporating specific rates or defining payment deadlines, the customization process ensures every bill fits the context of the work done.

By using an adaptable format, businesses gain greater control over how they present their billing information, making it easier to manage client expectations and foster smoother transactions.

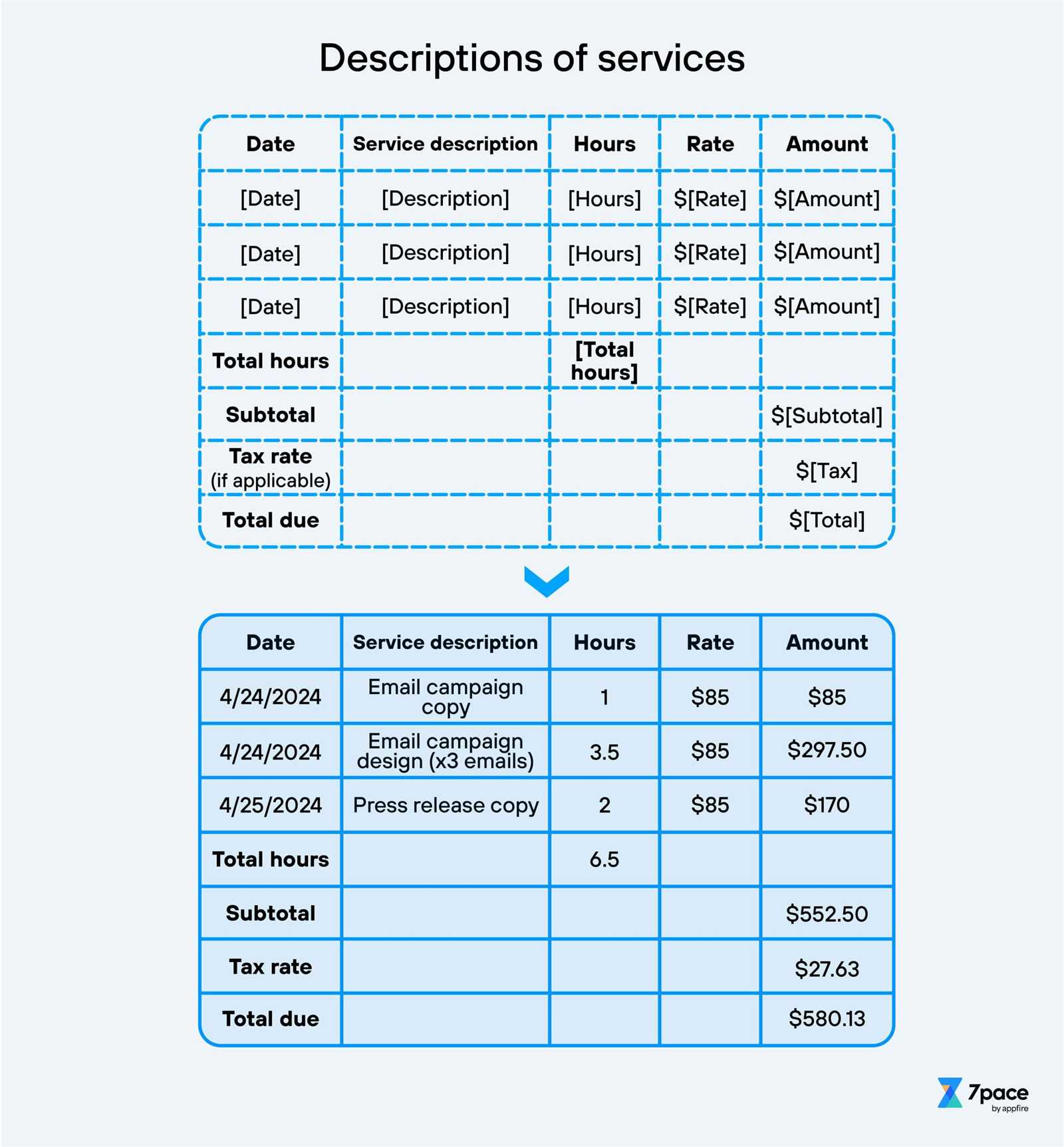

How to Track Billable Hours Effectively

Accurately recording the time spent on each project or task is crucial for ensuring that clients are charged fairly and that professionals are compensated for their work. Effective time tracking helps eliminate errors, prevents missed charges, and provides a clear breakdown of work completed. By using the right methods, you can maintain precise records and foster trust with clients.

One of the most effective strategies for tracking time is to break down each project into smaller, manageable tasks. This allows you to log the time spent on each specific activity, ensuring that no minutes are overlooked. Additionally, using automated tools can help streamline the process, allowing for real-time tracking and reducing the chance of forgetting important details.

Here are some tips for efficient time tracking:

- Use Time Tracking Tools: Leverage software or apps that automatically log time to prevent manual errors.

- Set Clear Start and End Times: Always mark the beginning and end of each task to ensure accuracy.

- Log Time Frequently: Record your hours as you go, rather than relying on memory at the end of the day.

- Group Similar Tasks: Categorize related tasks together for easier tracking and reporting.

- Review Time Entries Regularly: Check your logs regularly to make sure all hours are properly accounted for.

Additionally, it’s important to distinguish between billable and non-billable hours. Being clear on which activities are chargeable helps prevent confusion and ensures clients are billed accurately for the work done. Regularly reviewing and updating your system will also help you stay organized and make adjustments as your business grows.

By adopting these practices, you can track time effectively, ensuring that clients receive detailed and accurate reports while maintaining the integrity of your billing system.

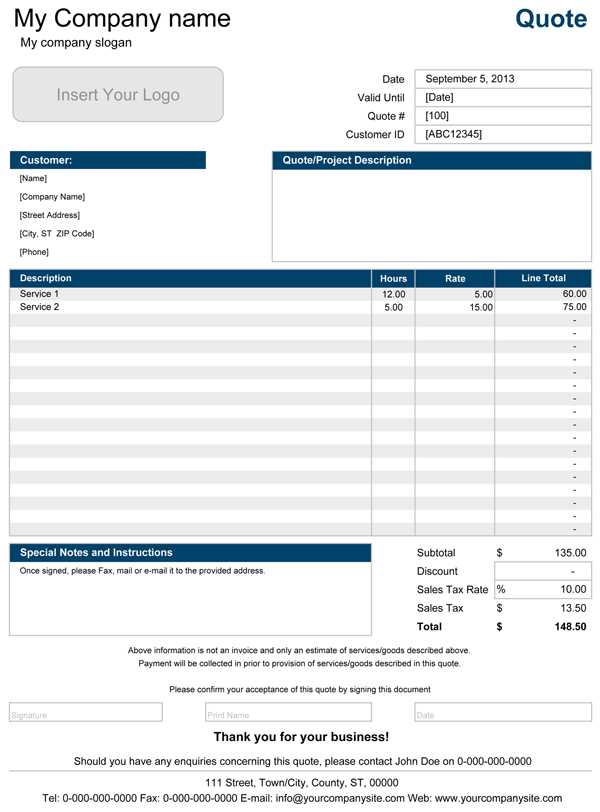

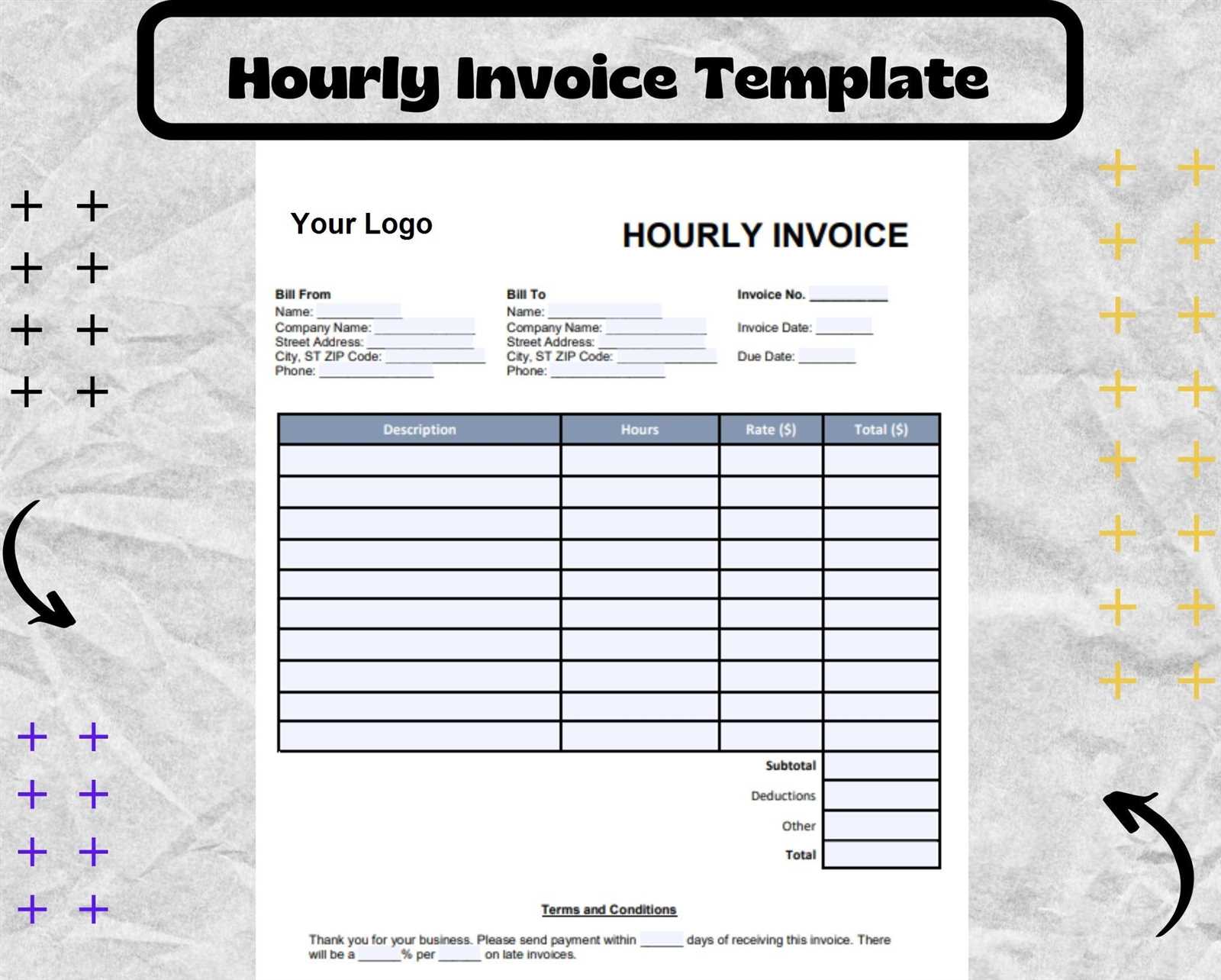

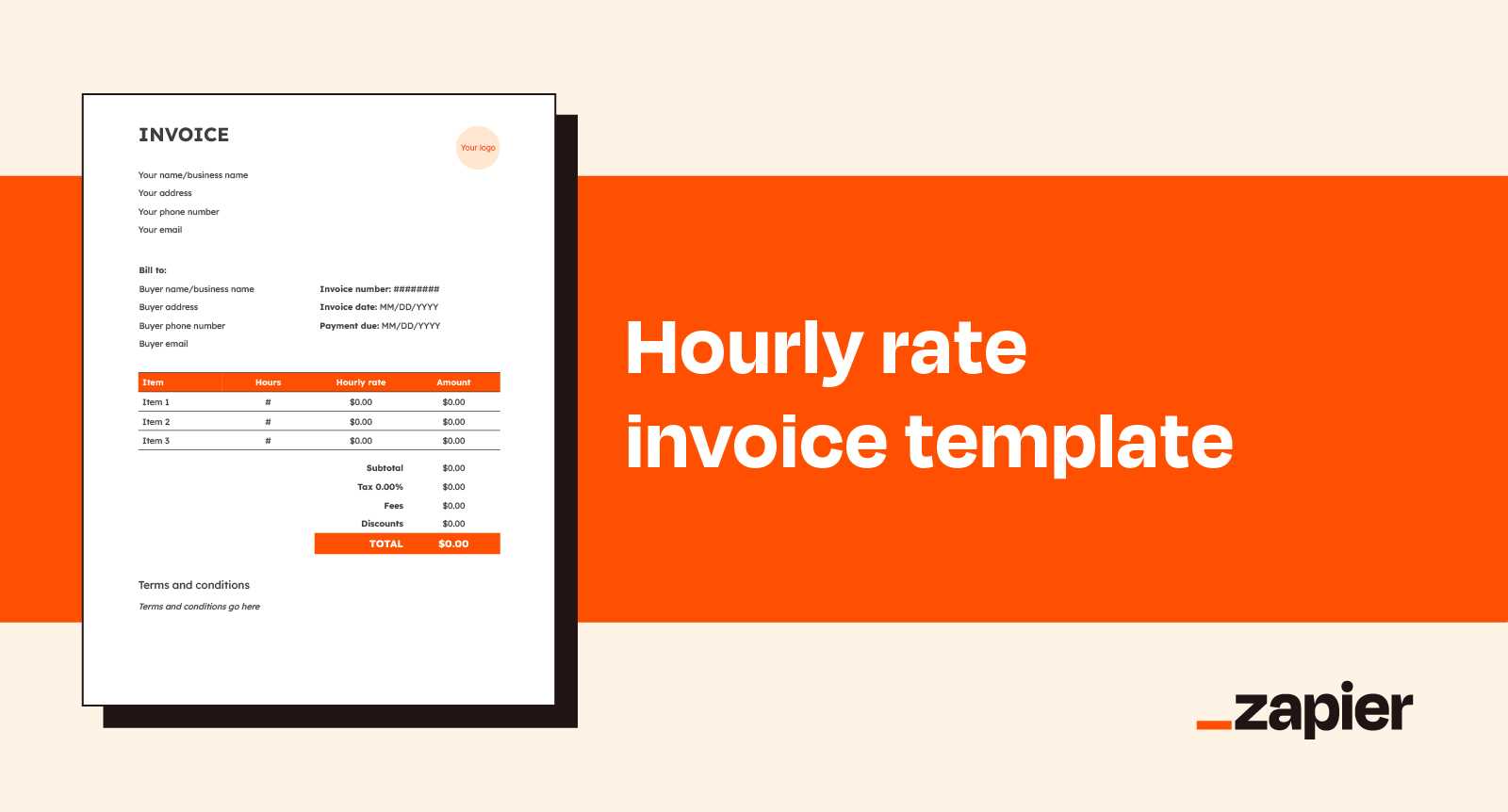

Choosing the Right Template for Your Business

Selecting the right document structure for billing is a crucial step in ensuring accurate and efficient payment requests. The format you choose should align with the nature of your business and provide clear, professional communication with your clients. A well-suited format not only simplifies the billing process but also enhances your company’s credibility and fosters better client relationships.

When choosing a structure for documenting time-based services, consider the specific needs of your industry. Whether you offer consulting, design services, or freelance work, the right layout can make all the difference in terms of clarity and professionalism.

Factors to Consider When Choosing a Format

- Business Type: The format should reflect the type of work you do and the complexity of your services.

- Client Expectations: Make sure the structure is easy to understand and suits your client’s preferences.

- Customization Options: Look for formats that allow you to add specific details such as terms, rates, and notes.

- Professional Appearance: Choose a format that aligns with your branding and conveys a polished image.

- Ease of Use: The structure should be simple to fill out and generate without requiring excessive time or effort.

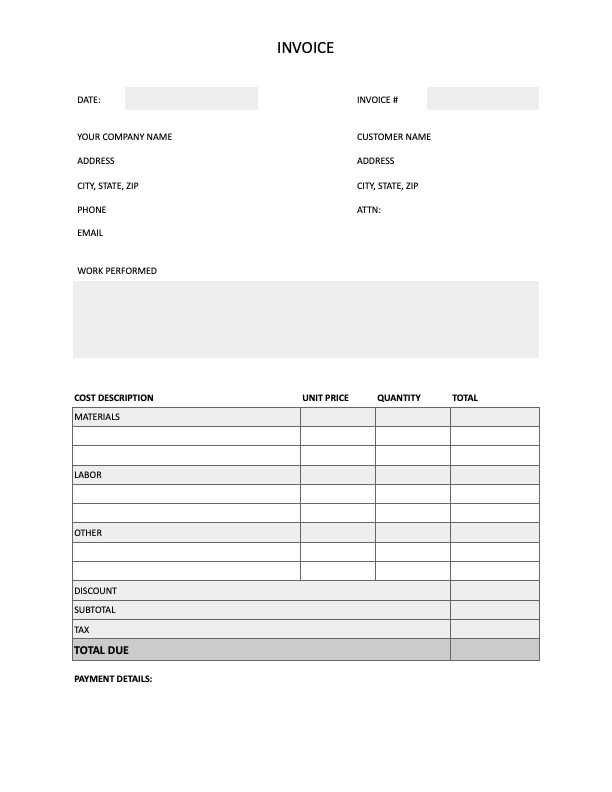

Common Layout Options

- Basic Format: Simple, easy-to-read designs for businesses that need quick and straightforward billing.

- Detailed Format: For businesses that require in-depth information, including multiple line items, descriptions, and taxes.

- Customizable Format: Ideal for businesses that need to frequently update billing details or have specific service requirements.

Once you identify the type of format that best fits your business, ensure that it allows for clear documentation of the work completed, time spent, and any agreed-upon rates. A well-organized structure helps to avoid misunderstandings and ensures prompt payment from clients.

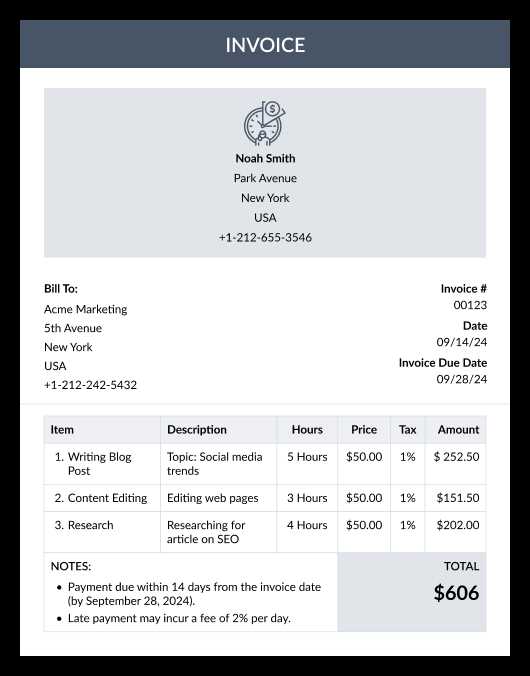

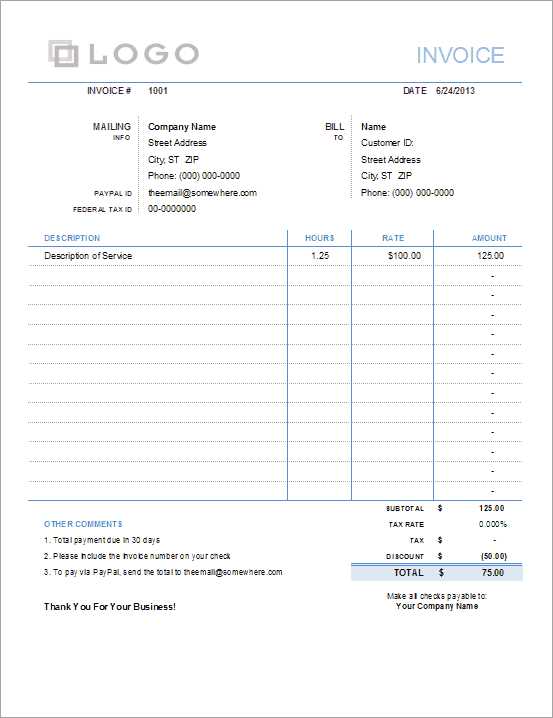

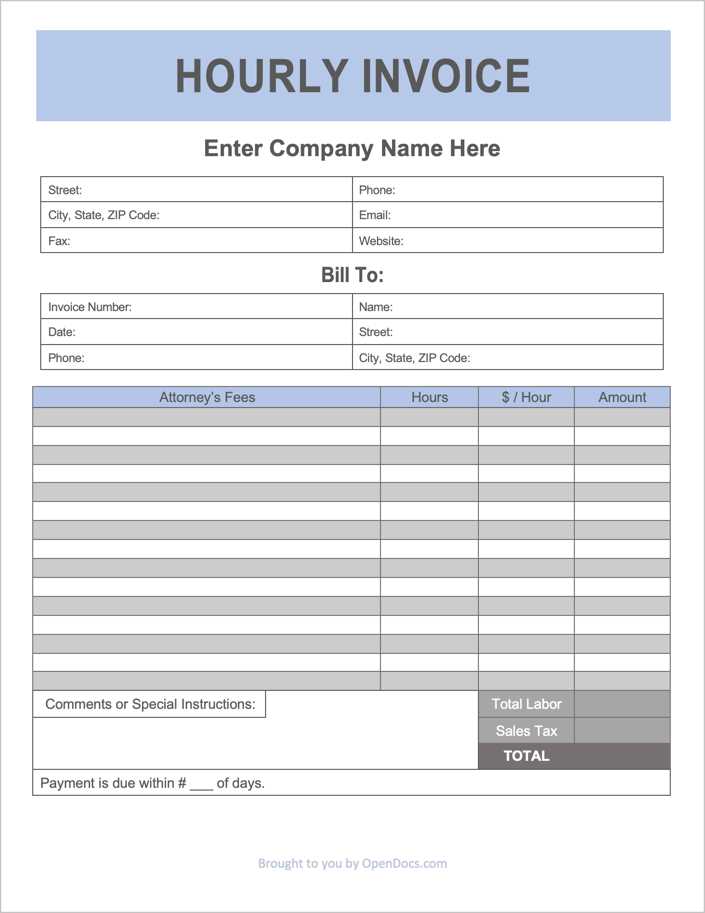

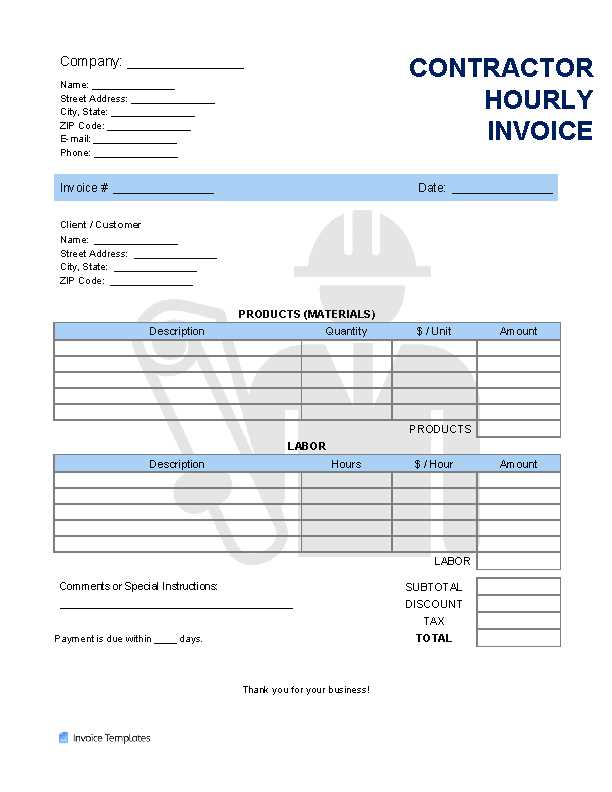

Key Elements of an Hourly Invoice

When documenting time-based services, it’s essential to include all the necessary details that ensure clear communication and accurate billing. A well-structured document should highlight specific information related to the work performed, the time spent, and the payment terms. Each element plays a crucial role in helping both the service provider and the client understand the terms of the transaction.

To create a comprehensive billing document, certain key elements must be included to ensure transparency and accuracy. These elements provide a clear breakdown of services rendered and the associated costs, preventing misunderstandings and disputes.

- Client Information: Include the name, address, and contact details of both the service provider and the client to ensure the document is clearly identifiable.

- Service Description: Provide a detailed breakdown of the tasks completed, including any relevant notes or clarifications about the services performed.

- Time Logged: Clearly state the time spent on each task, with start and end times for transparency.

- Rate Charged: Specify the agreed-upon rate for each unit of time worked, along with any applicable taxes or additional charges.

- Total Amount Due: Clearly list the total amount owed, calculated based on the time spent and the rate charged.

- Payment Terms: Outline any specific payment deadlines or terms, including late fees or discounts if applicable.

Including these elements in your documentation ensures both clarity and professionalism, helping to avoid confusion and ensuring prompt payment. A well-crafted billing document can also serve as a record for future reference, ensuring that all parties involved are on the same page regarding the work performed and the agreed-upon charges.

Setting Rates and Payment Terms

Establishing clear and fair pricing, along with well-defined payment terms, is essential to ensuring smooth financial transactions and maintaining professional relationships. By setting appropriate rates and outlining the payment structure, both the service provider and client will have a mutual understanding of the expected costs and timelines. This clarity helps prevent misunderstandings and ensures that all parties are on the same page throughout the working relationship.

To ensure transparency and fairness, it’s important to communicate your rates clearly and explain any factors that could affect pricing. Similarly, payment terms should be well-defined to avoid delays and ensure timely compensation for services rendered.

Factors to Consider When Setting Rates

- Industry Standards: Research the typical rates in your industry to ensure that your pricing is competitive yet fair.

- Experience and Expertise: Adjust your rates based on the level of skill and experience you bring to the table.

- Service Complexity: Higher rates may apply for more specialized or intricate tasks that require additional expertise or time.

- Geographic Location: Regional differences in cost of living can also influence the rates you set for your services.

Common Payment Terms

| Payment Term | Description |

|---|---|

| Due Upon Receipt | Full payment is expected immediately upon receipt of the billing document. |

| Net 30 | Payment is due 30 days from the date the bill is issued. |

| Installment Payments | Payments are divided into multiple installments, with specific due dates outlined in the agreement. |

| Late Fees | A fee is charged if payment is not received by the agreed-upon due date. |

Setting clear rates and payment terms upfront ensures that both the provider and the client are aligned in terms of expectations. By defining when payments are due, any discounts or penalties for late payments, and how rates are calculated, you help create a professional environment that encourages prompt and fair compensation for services.

Automating Hourly Invoice Generation

Automating the process of creating billing statements can significantly improve efficiency and reduce errors. By implementing automation tools, businesses can streamline the generation of payment documents, ensuring that all necessary details, such as time worked and rates applied, are accurately recorded. This not only saves time but also minimizes the chances of mistakes that could result in delayed payments or misunderstandings with clients.

Automation can be particularly useful for businesses that bill clients based on time spent on projects or tasks. With the right software, you can automate key steps such as tracking hours worked, calculating totals, and generating detailed statements. This leads to faster turnaround times and a more professional presentation of charges, which in turn enhances client trust and satisfaction.

Using automated systems also ensures consistency in your billing process. Once set up, these tools can generate standardized documents every time, keeping the format and details uniform. Additionally, automated systems can often integrate with other business tools, such as time tracking apps and accounting software, allowing for a seamless workflow across various business functions.

Best Software for Hourly Invoicing

Choosing the right software to handle time-based billing is essential for ensuring accuracy and efficiency in your business operations. With the right tools, you can automate many of the tedious aspects of generating payment statements, track time worked, and ensure that all the necessary details are correctly calculated. This not only saves valuable time but also helps maintain professionalism and consistency in your financial documentation.

The best software solutions for managing time-related charges offer a range of features that streamline the entire process, from tracking time to generating detailed statements. Many of these tools also provide customizable options that allow you to adjust billing formats, integrate with other business systems, and generate reports for easy tracking of finances.

By investing in quality software, businesses can improve the accuracy of their records, reduce administrative workload, and speed up the billing process, leading to quicker payments and better client relationships. Below are some top software solutions that cater specifically to businesses that need to manage time-based charges efficiently.

Incorporating Taxes in Hourly Invoices

When billing clients for time-based services, it’s important to account for taxes to ensure compliance with local laws and regulations. Incorporating taxes into billing statements not only ensures that your business operates within the legal framework, but it also provides clients with a clear breakdown of the total charges, including tax amounts. This transparency helps maintain trust and ensures that the financial expectations are well understood on both sides.

Understanding how to apply taxes correctly to the charges for services can be tricky, as tax rates and regulations vary by location and service type. Whether you’re dealing with state, federal, or VAT taxes, it’s crucial to factor in the correct rate and include it in the final amount. Here’s a general guideline for properly incorporating taxes into your billing:

Steps to Include Taxes in Billing

- Identify Taxable Services: Determine which services are taxable based on local tax laws. Some services may be exempt from taxes, while others require tax to be applied.

- Research Applicable Tax Rates: Tax rates vary by location and service. Be sure to check the local tax rate, whether it’s state, regional, or federal, and apply it to your charges.

- Calculate Tax Amount: Multiply the service cost by the tax rate to determine the tax amount. For example, if the service cost is $100 and the tax rate is 10%, the tax would be $10.

- Display Tax Breakdown: Make sure to clearly show the tax amount separately from the main service cost on the statement. This allows clients to see exactly how the total is calculated.

- Ensure Legal Compliance: Always ensure that your tax calculations comply with the latest local tax laws. It’s a good idea to consult a tax professional if you’re unsure about the correct rates or regulations.

By properly including taxes, businesses can avoid potential legal issues, prevent misunderstandings with clients, and ensure that both the service provider and client are fully aware of the total amount due. A well-structured billing document that includes a tax breakdown can also enhance the professional image of your business.

How to Add Discounts to Invoices

Offering discounts on services can be an effective way to incentivize clients, encourage timely payments, or reward long-term customers. When adding discounts to your billing statements, it’s important to apply them correctly to avoid confusion and ensure that both you and your clients have a clear understanding of the total amount due. Discounts should be presented transparently and clearly, so clients can see exactly how the price was reduced.

There are several ways to apply discounts depending on your pricing structure and business model. You can offer flat-rate discounts, percentage-based reductions, or even special promotions for specific services. Regardless of the method, making sure the discount is clearly itemized on the document is essential for clarity and professionalism.

Types of Discounts to Consider

- Percentage Discount: A common method where a certain percentage is taken off the total amount. For example, a 10% discount on a $500 service would result in a $50 discount, making the final total $450.

- Fixed Amount Discount: A set dollar amount is subtracted from the total charge. For instance, offering a $30 discount on a $200 service would reduce the final cost to $170.

- Volume-Based Discount: Discounts offered for larger quantities of services. For example, offering a discount on bulk service orders or repeat business.

- Seasonal or Promotional Discount: Discounts tied to special events, seasons, or sales promotions to encourage business during specific periods.

Best Practices for Adding Discounts

- Clearly Specify the Discount: Make sure to show both the original price and the discounted price, and clearly state the discount amount or percentage.

- State Discount Terms: Include any conditions related to the discount, such as limited-time offers, special eligibility, or required quantities.

- Use Itemized Listings: List the services, the original price, the discount applied, and the final amount to ensure full transparency.

- Track Discount Impact: Keep records of any discounts given, including reasons and the resulting financial impact, to assess profitability and future pricing strategies.

Adding discounts effectively not only helps attract clients but also builds trust by providing value. A clear and well-documented discount structure shows professionalism and helps maintain transparency in your business relationships.

Common Mistakes in Hourly Billing

When charging clients for services based on time spent, it’s easy to make mistakes that can affect both the accuracy of your records and your professional relationships. Errors in time tracking, pricing, or communication can lead to disputes, lost income, or damaged client trust. Avoiding these common pitfalls can help you maintain a smooth and efficient billing process, ensuring that both you and your clients are satisfied with the final agreement.

In this section, we will explore the most frequent mistakes that occur when charging for time-based services, and how to address them effectively. By understanding these common errors, you can streamline your billing practices and prevent misunderstandings that could hurt your business.

1. Inaccurate Time Tracking

One of the most common mistakes in time-based billing is not keeping accurate records of how much time was actually spent on each task. Without clear and precise time tracking, you risk undercharging or overcharging clients. This can lead to disputes or confusion about the final amount owed.

Best Practice: Use reliable time tracking tools or apps that allow you to track the start and end of each task. Always document time in real time to avoid forgetting details later.

2. Failing to Specify Billing Rates

Another frequent mistake is not clearly specifying your rates before starting a project. If a client is unaware of the cost per hour or the rate structure, they may be shocked by the final amount due. This lack of communication can damage your business relationships and lead to confusion or conflict.

Best Practice: Always clarify your rates upfront and get agreement from the client before proceeding. Ensure that the rates are itemized and easy to understand on your final statement.

3. Not Accounting for Overtime

If you don’t have a clear policy on overtime or additional hours outside of regular work, it can cause issues with billing. Failing to track and charge for extra hours beyond the standard agreement can lead to financial losses for your business.

Best Practice: Set clear guidelines for overtime or extra hours in your agreement. Ensure that your client is aware of the rate for overtime and get approval before charging for extra time.

4. Missing Out on Administrative Time

Many service providers forget to charge for administrative tasks like emails,

Integrating Hourly Invoices with Accounting Tools

Managing time-based billing alongside financial records can become complex without a seamless system. By integrating your billing process with accounting software, you can save time, reduce errors, and enhance the overall accuracy of your financial records. This integration allows for automatic synchronization between services rendered, payments received, and tax calculations, making your financial management more efficient and less prone to mistakes.

In this section, we’ll discuss how integrating time tracking and billing processes with accounting tools can streamline your workflow, simplify bookkeeping, and ensure that all your financial data is well-organized for tax and reporting purposes.

Benefits of Integration

Integrating your time tracking and billing system with an accounting tool offers several advantages:

- Time Savings: Automated data transfer from billing to accounting tools eliminates manual entries and reduces administrative workload.

- Improved Accuracy: By linking the two systems, you minimize the risk of errors that can occur when transferring information manually.

- Real-Time Insights: Integration provides a live overview of cash flow, allowing you to make better-informed decisions.

- Seamless Tax Calculation: With integrated systems, taxes can be calculated automatically based on the billing data, simplifying the tax filing process.

How to Set Up Integration

Setting up integration between your billing and accounting tools typically involves selecting compatible software that supports data syncing. Many modern time tracking and invoicing tools come with built-in integration features that work seamlessly with popular accounting software like QuickBooks, Xero, or FreshBooks. Follow these steps to integrate the systems:

- Choose Compatible Software: Ensure your billing and accounting tools are compatible. Most tools have a list of supported integrations.

- Connect Your Accounts: Link your billing system and accounting tool by logging into both platforms and following the setup instructions.

- Sync Data Regularly: Set up automated syncing for new time entries and billing details to keep your records up to date.

- Test the System: Run a few tests to ensure that the integration works as expected and that all data is transferred correctly.

By integrating your systems,

Tracking Client Payments on Invoices

Monitoring payments for the services rendered is a critical part of maintaining financial clarity. By properly tracking how much a client has paid and when, businesses can avoid misunderstandings and ensure timely follow-ups for any overdue balances. Accurate payment tracking helps maintain a smooth cash flow, facilitates better budgeting, and strengthens client relationships by providing transparent and organized financial records.

In this section, we will explore effective strategies for tracking client payments, the importance of maintaining detailed payment records, and the tools that can help simplify the process. Proper tracking ensures that no payment is overlooked and that any issues can be addressed quickly, helping businesses avoid unnecessary complications.

Methods for Tracking Client Payments

There are several methods to track payments effectively, ranging from manual logs to automated systems. Here are some common approaches:

- Manual Record Keeping: A basic method where payments are recorded by hand or in a spreadsheet. This is useful for small businesses but can be prone to errors.

- Payment Tracking Software: Specialized software helps automate payment tracking, providing real-time updates on paid and outstanding amounts.

- Integrated Systems: Linking billing systems with accounting or payment processing platforms can help track payments automatically and sync data across systems.

Key Information to Track

When tracking client payments, it is essential to record the following details to ensure full transparency and clarity:

- Payment Amount: The exact amount paid by the client, including any deposits or partial payments.

- Payment Date: The date the payment was received to monitor overdue payments accurately.

- Payment Method: Whether the payment was made via bank transfer, credit card, check, or another method.

- Outstanding Balance: The remaining amount to be paid after each transaction to keep track of balances due.

By maintaining a consistent system for tracking client payments, businesses can stay organized and ensure that all outstanding debts are addressed promptly,

Improving Accuracy and Efficiency in Billing

Ensuring the accuracy and efficiency of billing processes is crucial for maintaining a steady cash flow and avoiding disputes with clients. Small errors in calculations, missing details, or delays in issuing payment requests can lead to complications that affect business operations and customer trust. By streamlining your approach and implementing best practices, you can improve both the speed and precision of your financial documentation.

In this section, we will explore strategies to enhance the quality of your billing practices, minimize common errors, and make the entire process more efficient. The goal is to reduce administrative burdens while ensuring clients receive clear, accurate, and timely records of the services provided.

Key Strategies for Accuracy

To achieve error-free billing, it is important to pay attention to the following factors:

- Standardized Formats: Use consistent formats for all billing documents to avoid missing or confusing details. This includes consistent tax rates, service descriptions, and client information.

- Double-Check Calculations: Always verify calculations before sending out billing documents. Small arithmetic mistakes can lead to discrepancies and undermine credibility.

- Clear Service Descriptions: Provide detailed and easy-to-understand descriptions of the work performed, including dates, hours, and any other relevant specifics. This minimizes confusion for clients.

- Automated Tools: Utilize digital solutions that automatically calculate amounts based on hours worked or services rendered. Automation reduces human error and saves time.

Enhancing Efficiency

To streamline the billing process, the following practices can help you save time and resources:

- Batch Billing: Process multiple billing requests at once, especially when you have regular clients or recurring services. This allows for faster preparation and minimizes interruptions.

- Recurring Billing Setups: For clients on a subscription or retainer basis, automate recurring payment schedules to eliminate the need for manual billing each period.

- Cloud-Based Systems: Use cloud-based platforms that allow for quick access, easier document management, and faster sharing with clients, reducing the time spent on administrative tasks.

- Legal Considerations in Billing for Services

When providing services on a time-based or project-based agreement, it is essential to understand the legal aspects that govern your business transactions. Proper documentation, clear agreements, and compliance with local regulations are key components to ensuring that both parties–service providers and clients–are protected legally. This section will explore the most important legal considerations to keep in mind when billing for services rendered.

Having a solid legal foundation helps to avoid disputes, prevent misunderstandings, and ensure that payments are handled properly. In addition, adhering to legal requirements can protect you in case of audit or any issues related to non-payment or contract enforcement.

Contractual Clarity and Terms

Establishing clear terms and agreements with clients is crucial to avoid any confusion or disputes regarding payment. The following elements should always be included in any contract or agreement:

- Scope of Work: Clearly outline the services to be performed, including deliverables, expected timelines, and hourly or project rates. This helps to prevent disagreements about what was expected versus what was provided.

- Payment Terms: Clearly state when and how payments are due. This includes any late fees, payment methods, and whether deposits or installments are required.

- Termination Clause: Specify under what conditions the agreement can be terminated and any consequences for early termination. This ensures that both parties understand their rights and responsibilities in case of contract dissolution.

Compliance with Tax Regulations

Every business must comply with tax laws regarding the services they provide. Different regions or countries may have specific tax requirements, including the collection of sales tax, VAT, or other relevant taxes. When billing clients, it’s important to consider the following:

- Tax Rates: Ensure that you apply the correct tax rate based on the client’s location or jurisdiction. Failing to apply the correct tax can lead to fines and penalties.

- Record-Keeping: Maintain thorough records of all transactions. This includes keeping a detailed log of services rendered, payment receipts, and tax calculations. Proper documentation helps in case of audits or disputes.

- Tax Filing: Make sure that you file the appropriate tax returns on time, as required by local law. Failure to do so can lead to legal consequences.

By understanding these legal considerations and following the appropriate steps to ensure compliance, you can mitigate risks and maintain a smooth working relationship wi

How to Handle Late Payments

Delayed payments can be a common challenge for service providers, but addressing this issue in a structured and professional manner is crucial for maintaining cash flow and client relationships. When clients fail to meet payment deadlines, it’s important to have a clear strategy in place to handle the situation effectively and respectfully.

Managing late payments involves communication, setting expectations, and using proactive measures to ensure timely payment in the future. By establishing a consistent approach, you can avoid misunderstandings and reduce the likelihood of recurring delays.

Set Clear Payment Terms

The first step in preventing late payments is to clearly outline payment terms before beginning any work. Make sure to include:

- Due Dates: Specify the exact date by which payments should be made, whether it’s after the service is completed or according to a schedule.

- Late Fees: Include terms for late fees in the contract, specifying the amount or percentage charged after a payment becomes overdue. This creates a financial incentive for clients to pay on time.

- Accepted Payment Methods: Clarify the methods of payment you accept, such as bank transfers, credit cards, or checks, to avoid delays caused by payment issues.

Follow-Up on Overdue Payments

If a payment is missed, don’t hesitate to follow up. Politely remind your client of the outstanding balance. Here’s how you can approach this:

- Send a Reminder: If the payment deadline has passed, send a friendly reminder email or letter. Ensure it is courteous and professional, stating the amount due and the original due date.

- Give Grace Periods: Sometimes clients need a little extra time. Offer a short grace period for payment, but make sure to emphasize that further delays will result in late fees or suspension of services.

- Communicate Effectively: If delays persist, reach out personally by phone or email to discuss the issue and work out a payment plan if necessary. This shows flexibility while also reinforcing the importance of timely payments.

By setting expectations early, following up promptly, and offering solutions, you can ensure that late payments do not disrupt your business operations.

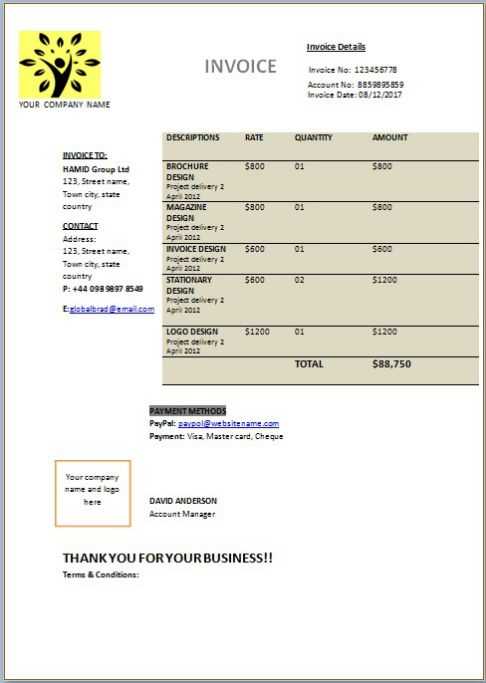

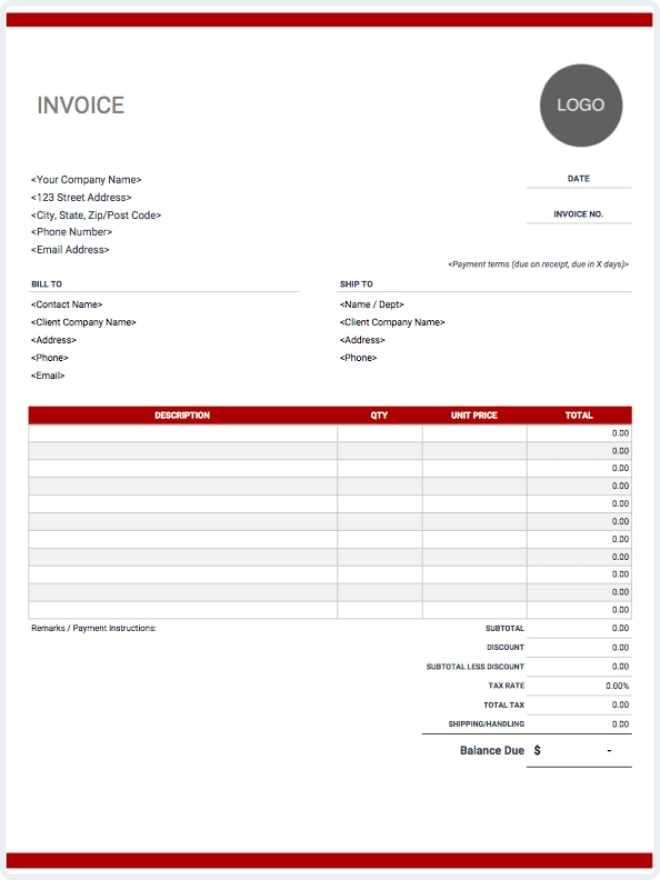

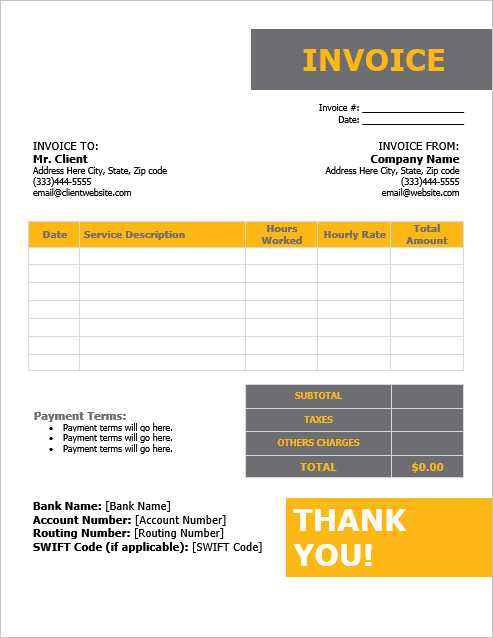

Tips for Professional Design

Creating a well-designed document for billing purposes is essential for presenting your business as professional and reliable. A clear, visually appealing layout not only helps clients easily understand the charges but also reinforces your brand’s image. Below are key design tips to enhance the clarity and effectiveness of your billing documents.

1. Keep It Simple and Clean

A cluttered design can confuse your clients and delay the payment process. Instead, focus on a minimalist approach that emphasizes key information. Consider the following:

- Use White Space: White space allows content to breathe, making it easier for clients to read and understand.

- Limit Fonts: Stick to one or two easy-to-read fonts. Using too many fonts can create visual chaos and reduce readability.

- Organized Layout: Ensure that your layout follows a logical flow, with sections clearly divided and each element placed in a consistent order.

2. Include All Essential Information

For the document to serve its purpose, it needs to include all the necessary details. Be sure to provide the following:

- Business Name and Contact Info: Include your company name, address, phone number, email, and website for easy reference.

- Client Details: Make sure to list the client’s name and contact details as well, so they know the document pertains to them.

- Payment Breakdown: Clearly outline each service or product provided, with a detailed breakdown of costs. Ensure the subtotal and any taxes are clearly visible.

- Due Date: Highlight the payment due date to set expectations and prompt timely payment.

3. Add Personalization and Branding

Personalizing your billing document with your brand’s logo and colors can add a professional touch. Here are a few ways to incorporate branding:

- Logo: Place your business logo at the top for instant recognition.

- Colors: Use your brand’s color scheme for headings or accents to maintain a cohesive look across your business materials.

- Consistent Tone: Ensure that the tone of your language matches your brand, whether it’s forma