Free Invoice Template for Australia

Managing financial transactions effectively is crucial for the success of any business. Whether you’re a freelancer or a small business owner, having a clear and organized method for documenting sales and services is essential. A reliable document for tracking payments helps maintain transparency and ensures a smooth cash flow.

With the right tools, you can create accurate records without spending unnecessary time on design or formatting. There are several options available to generate professional documents quickly, allowing you to focus more on your work rather than paperwork. Utilizing a customizable resource can save both time and effort while still adhering to local regulations.

In this guide, we will explore how you can easily access these useful tools, what features to look for, and how to customize them according to your needs. You’ll learn how to make the most out of the resources available, ensuring that every transaction is documented in a way that meets industry standards.

Free Invoice Template for Australian Businesses

For businesses in need of a streamlined approach to managing billing, having an accessible and simple solution can make all the difference. Many entrepreneurs and small companies require tools that help document payments accurately and professionally without unnecessary complexity. Fortunately, there are numerous options that enable you to generate and customize these documents without any cost.

Why Choose a Simple Billing Solution

Choosing an uncomplicated solution to handle your payment records can save valuable time. With minimal setup, these documents are ready to be customized to reflect your brand, services, and specific financial details. Not only do they help maintain professionalism, but they also ensure that all the required legal elements are included, such as tax information and business registration details.

Key Features to Look For

When selecting a tool for creating your billing records, ensure it offers flexibility in design. The best options allow you to add or remove sections based on your needs. Look for those that include fields for business contact information, payment terms, and transaction descriptions to ensure that your records are both complete and clear.

How to Create an Invoice in Australia

Creating accurate and professional billing documents is essential for businesses in order to maintain financial transparency and avoid misunderstandings. A well-structured bill outlines the transaction details clearly and ensures both parties are on the same page regarding the terms of payment. For those based in Australia, there are specific guidelines to follow to ensure compliance with local regulations.

To create a proper billing record, follow these essential steps:

- Include Your Business Information: Ensure that your business name, address, and contact details are clearly visible at the top of the document. This helps identify your company and makes it easier for clients to get in touch if needed.

- Provide Customer Information: Include the recipient’s name, company (if applicable), and contact details. This ensures that the right person or organization is billed for the services or products provided.

- List Products or Services Provided: Provide a detailed description of what was sold, including quantities, rates, and total costs. Clear itemization helps avoid disputes and ensures both parties understand the transaction.

- Specify Payment Terms: Clearly outline the due date, accepted payment methods, and any relevant terms, such as late fees or early payment discounts.

- Include Tax Information: In Australia, make sure to include the appropriate Goods and Services Tax (GST) if applicable. Indicate whether the amount is GST inclusive or exclusive, and calculate the tax accordingly.

Once all the necessary information is included, review the document for accuracy. Double-check all calculations, including totals, taxes, and discounts, to ensure there are no errors. A clear and correct record will facilitate smoother transactions and encourage prompt payments.

Benefits of Using a Free Invoice Template

Utilizing a pre-designed tool for creating billing records can offer numerous advantages, especially for small businesses and freelancers. These resources help simplify the process of documenting payments and maintaining professional standards, while also saving valuable time and effort. Whether you’re just starting or looking to streamline your workflow, adopting an efficient system can have a significant impact on your overall operations.

Time-Saving Convenience

One of the key benefits is the amount of time saved by avoiding manual formatting. Instead of starting from scratch, you can simply fill in the necessary details and generate a clean, professional document in minutes. This allows you to focus more on your core business activities, rather than spending time on administrative tasks.

Cost-Effective Solution

Using a pre-made solution is also cost-effective, as it eliminates the need to hire a designer or purchase expensive software. Many options are available at no cost and provide all the essential features needed to create high-quality records. This makes it an ideal choice for businesses operating on a tight budget.

- Professional Design: Pre-made documents are often designed with a polished and professional look, ensuring your records align with industry standards.

- Customization Options: These tools are easily customizable, allowing you to add your logo, adjust layout, and tailor the document to suit your brand’s style.

- Compliance Made Easy: Many resources automatically include the necessary fields for tax and legal requirements, ensuring you meet local business regulations.

By using an efficient system for generating billing records, you can save time, reduce costs, and maintain professionalism in your business dealings. This simple step can contribute to smoother financial management and improve overall client satisfaction.

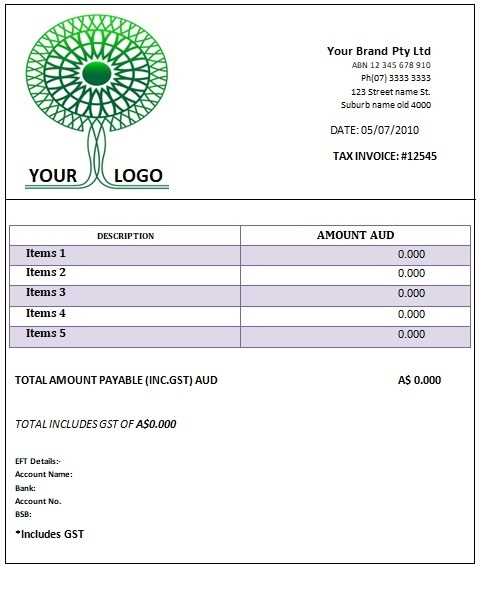

Key Elements of an Australian Invoice

For businesses operating in Australia, it’s crucial to include certain details in every billing document to ensure clarity and legal compliance. A well-structured document not only helps maintain professionalism but also serves as a reference for both the business and the customer. Understanding these essential components can help streamline the billing process and avoid potential errors or misunderstandings.

Here are the key elements that should be included:

- Business Information: Clearly display your company name, address, and contact details at the top of the document. This helps the recipient identify the source of the bill and easily reach out if needed.

- Client Details: Include the name, address, and contact information of the recipient to ensure the document is accurately directed to the right person or organization.

- Document Number: Assign a unique reference number to each billing document. This allows both parties to easily track and reference specific transactions.

- Issue and Due Dates: Specify the date when the bill is issued and the due date for payment. This is essential for establishing the payment timeline and avoiding confusion about deadlines.

- Description of Products or Services: Provide a detailed list of what was sold, including quantities, unit prices, and total cost. This section should clearly outline what the client is paying for.

- Tax Information: In Australia, the Goods and Services Tax (GST) must be included if applicable. Indicate whether the price is inclusive or exclusive of tax, and calculate the GST accurately.

- Total Amount: Clearly state the total amount due, including any taxes and additional charges. This ensures transparency and makes it easy for the recipient to see the full cost.

By ensuring these elements are included, you can create a document that meets both legal requirements and professional standards, making the billing process smooth and straightforward for both parties.

Customizable Invoice Templates for Free

Having the ability to personalize your billing documents allows you to better reflect your brand and streamline your workflow. Many tools available online offer customizable formats that can be adapted to meet the specific needs of your business. These resources allow you to create professional and accurate records quickly, without the need for design expertise or expensive software.

Here are some benefits of using customizable solutions:

- Brand Personalization: You can add your business logo, adjust colors, and modify the layout to align with your company’s style. This helps make your documents look more professional and consistent with your branding.

- Easy Modifications: Customize fields to suit your services or products, including adding extra details like discounts, payment terms, and special instructions.

- Time Efficiency: With pre-designed structures, you can quickly fill in the required information, speeding up the process of generating accurate billing records.

- Compliance with Local Standards: Many customizable options come with built-in features to ensure compliance with tax regulations and legal requirements, such as GST calculations.

- Cost-Effective: You don’t need to pay for expensive software or hire a designer. Numerous tools are available without cost, providing all the essential features needed for creating professional documents.

Using a customizable solution gives you the flexibility to adapt your records according to your specific business needs while maintaining a polished and professional appearance. This simple approach ensures that all details are accurate, clear, and in line with best practices for financial documentation.

Why Choose a Free Invoice Template

Opting for a no-cost solution for creating your billing documents can be a smart decision for many small businesses and entrepreneurs. These tools provide essential functionality without requiring any investment, making them an ideal choice for businesses that need efficiency and affordability. The key advantages of using such a resource include accessibility, ease of use, and the ability to customize as needed.

Here are some reasons why this option might be right for you:

- Cost-Effective: The most obvious advantage is that you don’t need to spend money on software or design services. These tools are available without charge, helping businesses maintain a tight budget.

- Quick and Easy Setup: Setting up a billing document is simple and can be done in a matter of minutes. You don’t need to be a designer or have advanced technical skills to create a professional-looking record.

- Flexibility: Many options are customizable, allowing you to adjust layouts, colors, and fields according to your business needs. Whether you need to add your logo or modify the format, these tools make it easy to tailor the document to your preferences.

- Professional Appearance: Even though these resources are available at no cost, they are often designed with a polished and professional look. This helps ensure your documents are consistent with your company’s branding and standards.

- Compliance Assistance: Some tools automatically incorporate essential fields required for legal compliance, such as tax information and business registration numbers. This reduces the risk of making mistakes or overlooking important details.

By choosing an accessible and efficient solution, you can save time, reduce costs, and still produce high-quality documents that reflect well on your business.

How to Download an Invoice Template

Getting started with creating billing documents can be easy, thanks to various online tools that allow you to download ready-made resources. These documents are designed to simplify the process of record-keeping and can be customized to fit your specific business needs. The steps to access these resources are simple and straightforward, ensuring that even those with limited technical skills can quickly start generating professional records.

Steps to Download

To begin, follow these easy steps:

- Search for Reliable Platforms: Look for websites or platforms that offer customizable billing solutions. Many are available online with no cost, and some might also offer premium features if you need additional customization.

- Select the Right Format: Choose a format that suits your needs. Most sites provide documents in various formats, such as PDF, Excel, or Word. Pick the one that works best with your workflow.

- Download the File: Once you’ve selected the format, click the download button. The file will typically be saved to your computer, ready to be filled out and used immediately.

- Customize Your Document: After downloading, open the document in the appropriate software (Word, Excel, etc.) and modify the necessary fields, such as business name, contact info, and item descriptions.

Where to Find Downloadable Resources

There are a number of trustworthy websites where you can find these resources. Some offer simple downloads, while others might require creating an account. Make sure to choose reputable sources to ensure that you’re getting high-quality, professional documents.

- Business Resource Websites: Many sites dedicated to small businesses or startups offer downloadable documents as part of their services.

- Financial Tools Providers: Companies that offer accounting software often include downloadable resources to complement their paid products.

- Freelancer Platforms: Platforms that cater to freelancers may also offer these resources for their users, making it easy for them to manage their financial transactions.

Downloading and customizin

Common Invoice Mistakes to Avoid

When preparing billing documents, small errors can lead to misunderstandings, delayed payments, or even legal complications. It’s important to ensure that every detail is correct and consistent. Avoiding common mistakes helps maintain professionalism and ensures smooth transactions between you and your clients. Below are some of the most frequent errors and how to prevent them.

Top Mistakes to Watch For

Here are the most common mistakes when preparing billing documents and how to fix them:

| Common Mistake | How to Avoid |

|---|---|

| Missing or Incorrect Contact Details | Ensure that both your business and client’s details are accurately listed, including addresses, phone numbers, and email addresses. Double-check spelling and accuracy. |

| Incorrect or Missing Payment Terms | Clearly define payment terms, including due date, late fees, and accepted payment methods. This helps prevent confusion later. |

| Omitting Tax Information | If applicable, include tax details such as the Goods and Services Tax (GST), and ensure it is calculated correctly. Indicate if amounts are tax-inclusive or exclusive. |

| Not Including a Unique Reference Number | Assign a unique reference number for each transaction to keep track of payments and avoid errors in accounting. |

| Failure to Itemize Services or Products | Always provide a clear breakdown of what the client is being charged for, including quantities, rates, and total costs. This ensures transparency. |

Other Potential Pitfalls

In addition to the mistakes listed above, it’s important to check the following:

- Incorrect Date Formats: Ensure consistency in date formats (e.g., DD/MM/YYYY) and make sure the issue and due dates are correct.

- Errors in Total Calculations: Always double-check math, especially if you’re offering discounts or applying taxes.

- Lack of Professionalism: Avoid using informal language or inconsistent fonts. Your documents sh

Free Invoice Templates vs. Paid Versions

When it comes to creating billing records, businesses often face the decision between using no-cost solutions or investing in paid options. Both choices offer distinct advantages, but the right option depends on the unique needs of the business. Understanding the differences between free and paid resources can help you make an informed decision, ensuring that you select the best option for your workflow and budget.

Advantages of Free Options

Free resources are often the first choice for businesses that are just starting out or for those with a limited budget. These tools typically offer all the basic features needed for creating simple and effective billing records. Some of the benefits include:

- Cost Savings: As the name suggests, free resources come at no cost, making them ideal for small businesses or individuals who need to keep expenses low.

- Ease of Use: Many no-cost tools are designed for simplicity, allowing users to generate documents quickly without a steep learning curve.

- Basic Functionality: For businesses with straightforward needs, free options provide all the essential features required for clear and professional documentation.

Benefits of Paid Solutions

While free tools are sufficient for basic tasks, paid options offer a broader range of features and customization. These solutions are often used by businesses that require more advanced functionality or a higher level of professionalism in their documents. Here are some of the key advantages of paid versions:

- Advanced Features: Paid options often come with extra functionalities, such as automated calculations, multi-currency support, or integration with accounting software, which can save time and improve accuracy.

- Customization: Many paid solutions allow for more extensive customization, from advanced layout changes to the ability to add custom fields or branding elements, ensuring the documents align with your company’s image.

- Better Support: Paid versions typically come with customer support, providing assistance in case of any issues or technical difficulties.

- Compliance Assistance: Paid options may also include built-in compliance features, helping ensure your documents meet legal and tax

How to Add Tax Information on Invoices

Including accurate tax details in your billing documents is essential for both legal compliance and clarity with clients. Properly detailing taxes ensures that your records are transparent and meet the requirements set by local tax authorities. Whether you’re dealing with sales tax, value-added tax (VAT), or other forms of taxation, knowing how to properly add this information is crucial for maintaining smooth business operations.

Here’s how to effectively incorporate tax information into your billing documents:

- Clearly Label Tax Components: Indicate the type of tax being applied, such as GST (Goods and Services Tax), VAT, or any other applicable tax. This ensures that both parties know exactly what tax is being charged and how it affects the total amount.

- Specify Tax Rates: List the exact tax rate being applied to the total amount of goods or services provided. For example, in countries with a GST, make sure to show the specific percentage (e.g., 10%) next to the tax amount.

- Indicate Taxable and Non-Taxable Items: If your business deals with a mixture of taxable and non-taxable goods or services, be sure to list them separately. This ensures clear understanding for both you and your client about which items are subject to tax and which are exempt.

- Show Total Tax Amount: After calculating the tax on each line item or service, provide a subtotal of the tax amounts and display it clearly in the final section of the document. This helps the recipient see how much tax they are paying in total.

- Include Business Registration Number: For businesses that are registered for tax purposes, include your tax registration number on the document. This is often a legal requirement and can help your clients validate your tax status.

By including the correct tax details, you not only comply with tax regulations but also avoid confusion with clients. Ensuring that all information is clearly stated and accurate will help maintain professionalism a

Design Tips for Professional Invoices

Creating well-designed billing documents not only improves the visual appeal of your business communications but also enhances clarity and professionalism. A clean, structured design can make it easier for your clients to understand the details of the transaction, reducing the likelihood of errors or confusion. With a few simple design principles, you can ensure that your documents stand out and make a lasting impression.

Essential Design Elements

Here are some key design tips to ensure your billing records look polished and professional:

- Use a Consistent Layout: Keep your layout simple and organized. A structured, easy-to-read design makes it easier for your clients to find key information quickly. Avoid clutter and focus on essential details like payment terms, amounts, and business contact information.

- Prioritize Readability: Choose legible fonts with a professional tone. Stick to a maximum of two or three font types, and avoid overly decorative fonts that may distract from the important details.

- Include Your Branding: Adding your business logo, colors, and fonts reinforces your brand’s identity. This makes your documents instantly recognizable and helps establish credibility with clients.

- Use Clear Headings and Sections: Organize the information into clearly defined sections with headings for each part of the document, such as “Item Description,” “Total Amount,” and “Tax Information.” This guides the reader through the document and makes key details easy to locate.

- Incorporate Adequate White Space: Ensure there is enough space around text and between sections to prevent the document from looking crowded. White space enhances readability and gives the page a cleaner, more professional look.

Additional Tips for Enhancing Your Design

- Use Grids for Alignment: A well-aligned design looks more organized and professional. Use grids or tables to align text and data, especially when listing items and amounts.

- Highlight Important Information: Make key details stand out by using bold or larger fonts for headings, total amounts, or due dates. This helps clients focus on the most important

How to Organize Your Invoices

Efficiently organizing your billing records is essential for maintaining accurate financial records, ensuring timely payments, and simplifying your accounting process. A well-structured system for managing these documents helps you stay on top of your business’s cash flow and provides easy access to important information when needed. Whether you are using digital tools or physical files, a consistent and methodical approach is key to smooth operations.

Tips for Effective Organization

To keep your documents properly organized, follow these practical strategies:

- Implement a Clear Naming Convention: Establish a consistent naming system for your files, such as including the date and client name in the file name. For example, “2024-10-15_ClientName”. This makes it easier to locate specific documents later.

- Use Folders and Subfolders: Create main folders categorized by year or client, and use subfolders for individual transactions or specific periods. This will help you easily sort and access all related documents.

- Track Due Dates: Keep a separate record of due dates for payments. You can set reminders or use a tracking system to follow up on overdue payments, ensuring that nothing slips through the cracks.

- Digitize and Back Up Documents: If you are working with paper records, consider scanning and saving your documents digitally. This reduces clutter and allows for easy backup to prevent the loss of important files.

- Regularly Update Your System: Make it a habit to organize and update your records regularly. At the end of each week or month, go through your files to ensure that everything is correctly categorized and that no documents are missing.

Choosing the Right Tool for Organization

Depending on your business size and preferences, there are several tools you can use to keep your documents organized:

- Accounting Software: Many accounting platforms offer built-in features for organizing and storing records. They allow you to track payments, store documents digitally, and generate reports at the click of a button.

- Cloud Storage: Cloud-based solutions like Google Drive or Dropbox provide easy access and sharing options for your documents, while also offering the benefit of secure off-site storage.

- Physical Filing Systems: For businesses that prefer paper, consider using a filing cabinet with labeled folders for different categories. Ensure documents are kept in an orderly manner and are easy to access when needed.

By adopting a consistent organizational method, you ensure that your billing records are easily retrievable and up-to-date. This not only saves time but also helps maintain accuracy in your financial management, leading to smoother business operations.

Best Free Invoice Templates for Australian Freelancers

For freelancers, creating professional billing records is essential for ensuring timely payments and maintaining a professional image. Many online resources offer no-cost solutions that are perfectly suited for Australian independent workers. These solutions provide basic structures that can be easily customized to meet individual business needs while saving both time and money.

Here, we have compiled a list of some of the best options available to help you create well-structured and clear documents. These solutions offer simplicity, ease of use, and flexibility to suit a variety of industries.

Top Solutions for Freelancers

Platform Features Best For Wave Easy to use, customizable design, tracks payments, includes tax features Freelancers looking for a simple, all-in-one tool with automated tracking Zoho Invoice Customizable, multiple language support, easy client management, time tracking Freelancers working with international clients or those offering time-based services PayPal Invoicing Easy to create, direct PayPal payment links, automated reminders Freelancers who use PayPal as their primary payment method Invoicely Simple interface, recurring billing, multiple currencies Freelancers with clients in different time zones or who offer subscription services FreshBooks Customizable, detailed reports, time-tracking, automated follow-ups Freelancers who need in-depth financial tracking and reporting C

How to Send Invoices Efficiently

Sending billing documents in a timely and organized manner is key to maintaining healthy cash flow and fostering strong client relationships. A streamlined process helps ensure that clients receive accurate records, can easily process payments, and that your business remains on top of its finances. Efficient communication and clear delivery methods can save time and reduce the risk of errors or delays in payment.

Steps to Optimize the Sending Process

To improve efficiency in sending billing documents, consider these steps:

- Use Digital Delivery: Sending documents via email or cloud storage platforms speeds up delivery time and eliminates the need for paper handling. It also ensures that clients can easily access and save the records for future reference.

- Automate the Process: Use accounting software or invoicing tools to automatically send out records based on preset conditions, such as upon project completion or at regular intervals. This minimizes manual effort and ensures no bills are overlooked.

- Provide Multiple Payment Options: Make it easier for clients to pay by offering various payment methods, such as bank transfers, credit cards, or online payment systems like PayPal. Clearly state the payment details on the document to avoid confusion.

- Set Reminders and Follow-ups: Schedule automatic reminders for clients when the payment due date approaches. Automated follow-up emails can help reduce delays without requiring constant manual intervention.

- Keep Records Organized: Maintain a systematic approach for tracking sent documents. Use software that keeps a history of sent records and their statuses, ensuring that you can easily refer back to previous communications if needed.

Best Practices for a Professional Touch

- Personalize the Message: While automation is key, a personal touch is always appreciated. Include a brief message with each document, thanking your client for their business and clarifying any important details.

- Set Clear Terms: Be sure to include clear payment terms, due dates, and any late fees in your communication. This reduces the likelihood of misunderstandings and helps your clients know exactly what to expect.

- Double-Check Details: Before

Invoice Software vs Manual Creation

When it comes to preparing and managing billing records, business owners and freelancers often face the decision between using specialized software or creating their documents manually. Each method has its own set of benefits and challenges. The choice ultimately depends on the scale of operations, the complexity of transactions, and personal preference. Understanding the pros and cons of each approach can help determine which option is the most efficient for your business needs.

Advantages of Using Software

Invoice creation software offers a variety of features designed to save time and reduce the likelihood of errors. Here are some key benefits:

- Automation: Software can automate many tasks, such as calculating totals, taxes, and generating unique reference numbers for each record. This streamlines the process and minimizes human error.

- Professional Design: Many software solutions come with pre-designed, customizable formats that give your documents a polished, professional look, which can enhance your business image.

- Tracking and Reminders: Invoices can be automatically tracked, and payment reminders can be sent out, reducing the administrative burden on business owners.

- Cloud Storage: Cloud-based systems allow for secure storage, easy access, and backup of all documents, reducing the risk of lost files.

- Integration with Other Tools: Many invoicing platforms integrate with accounting, payment, and CRM tools, allowing for seamless data flow across your business processes.

Advantages of Manual Creation

On the other hand, manually creating each document has its own set of benefits that some businesses may prefer, particularly in smaller operations or for those with minimal technological needs:

- Control and Customization:

How to Personalize Your Invoice Template

Customizing your billing documents is an excellent way to make them reflect your brand and stand out in the eyes of your clients. A personalized document not only provides essential information but also adds a professional touch that can improve your business’s image. Whether you’re using software or designing your records manually, there are several ways to make them uniquely yours while ensuring that they remain clear and effective.

Key Elements to Personalize

To give your billing documents a more personalized and polished look, focus on the following key areas:

- Logo and Brand Colors: Incorporating your business logo and using your brand colors helps create a cohesive look and feel. This makes the document look more official and aligned with your marketing materials.

- Custom Header: Include a custom header that displays your company’s name, tagline, and contact information. This makes your documents instantly recognizable and provides clients with easy access to your details.

- Personalized Greeting: A simple greeting such as “Thank you for your business” or “It was a pleasure working with you” adds a personal touch. This can make clients feel valued and build a stronger business relationship.

- Custom Payment Terms: Tailor the payment terms to suit your business needs. You can specify due dates, late fees, and available payment methods in a way that makes sense for your operations.

- Notes and Additional Information: Including a section for notes allows you to add relevant comments or details for each transaction. This could be project-specific information, a thank-you message, or even reminders for future services.

Tips for Maintaining Professionalism

While personalizing your documents is important, maintaining professionalism is equally critical. Follow these tips to ensure your billing records remain clear and professional:

- Keep the Layout Clean: Avoid clutter and unnecessary elements. A clean, well-organized layout makes your documents easy to read and ensures that the essential details are highlighted.

- Use Clear Language: Be concise and clear with your wording. Avoid jargon and make sure the payment details and terms are easy to understand.

- Proofread

Free Invoice Templates for Small Businesses

For small business owners, managing billing and payment records efficiently is crucial to maintaining smooth operations and cash flow. Having access to customizable and easy-to-use tools for creating professional billing documents can save time and reduce errors. There are many options available that cater to different business needs, allowing entrepreneurs to streamline their processes without the need for expensive software or complicated systems.

Benefits of Using Ready-Made Billing Documents

Ready-to-use, customizable billing records can provide several advantages for small business owners:

- Cost-Effective: Many solutions are available at no cost, making them an affordable option for businesses on a tight budget.

- Ease of Use: Most tools are designed to be user-friendly, so you can generate professional-looking documents with minimal effort and without requiring technical knowledge.

- Time-Saving: Ready-made solutions allow you to quickly create accurate billing records without having to start from scratch each time.

- Customization: These tools often offer basic customization options, letting you add your company logo, contact information, and specific payment terms, helping your business maintain a professional appearance.

Where to Find Templates for Your Business

There are numerous resources where small business owners can find quality and customizable billing records, such as:

- Online Tools: Websites offering downloadable formats that are compatible with popular document software like Microsoft Word, Excel, and Google Docs.

- Accounting Platforms: Some online accounting software providers offer free document generation features as part of their basic packages.

- Template Marketplaces: Websites like Canva or Etsy often feature customizable billing records created by professionals that you can easily modify for your business.

By using these tools, small business owners can simplify their billing process, improve their workflow, and maintain a professional approach to managing payments without incurring unnecessary costs.