Security Company Invoice Template for Easy Billing

Managing financial transactions efficiently is crucial for any business, especially for those offering specialized services. Ensuring that clients receive clear and accurate statements not only promotes professionalism but also helps in maintaining smooth cash flow.

In this guide, we will explore the importance of using structured documents for payment requests. These documents serve as an essential tool to outline the services rendered, payment terms, and contact details, helping businesses stay organized and transparent in their dealings.

By following a streamlined approach, it becomes easier to create personalized records that meet the specific needs of each client. This not only ensures clarity but also fosters trust and reliability in professional relationships.

Importance of Professional Invoicing for Security Services

Accurate and clear financial documentation is essential for any service provider. It helps establish trust between businesses and their clients while ensuring smooth financial transactions. By utilizing well-structured billing records, companies can avoid misunderstandings and improve payment collection efficiency.

For those offering specialized protection or monitoring services, it is particularly important to present professional payment requests. These documents not only detail the work performed but also outline payment terms, deadlines, and contact information, making the process transparent for both parties.

A well-prepared billing statement also reflects the reliability and professionalism of the service provider. Clients are more likely to pay promptly when they receive clear, organized, and accurate statements that leave no room for confusion.

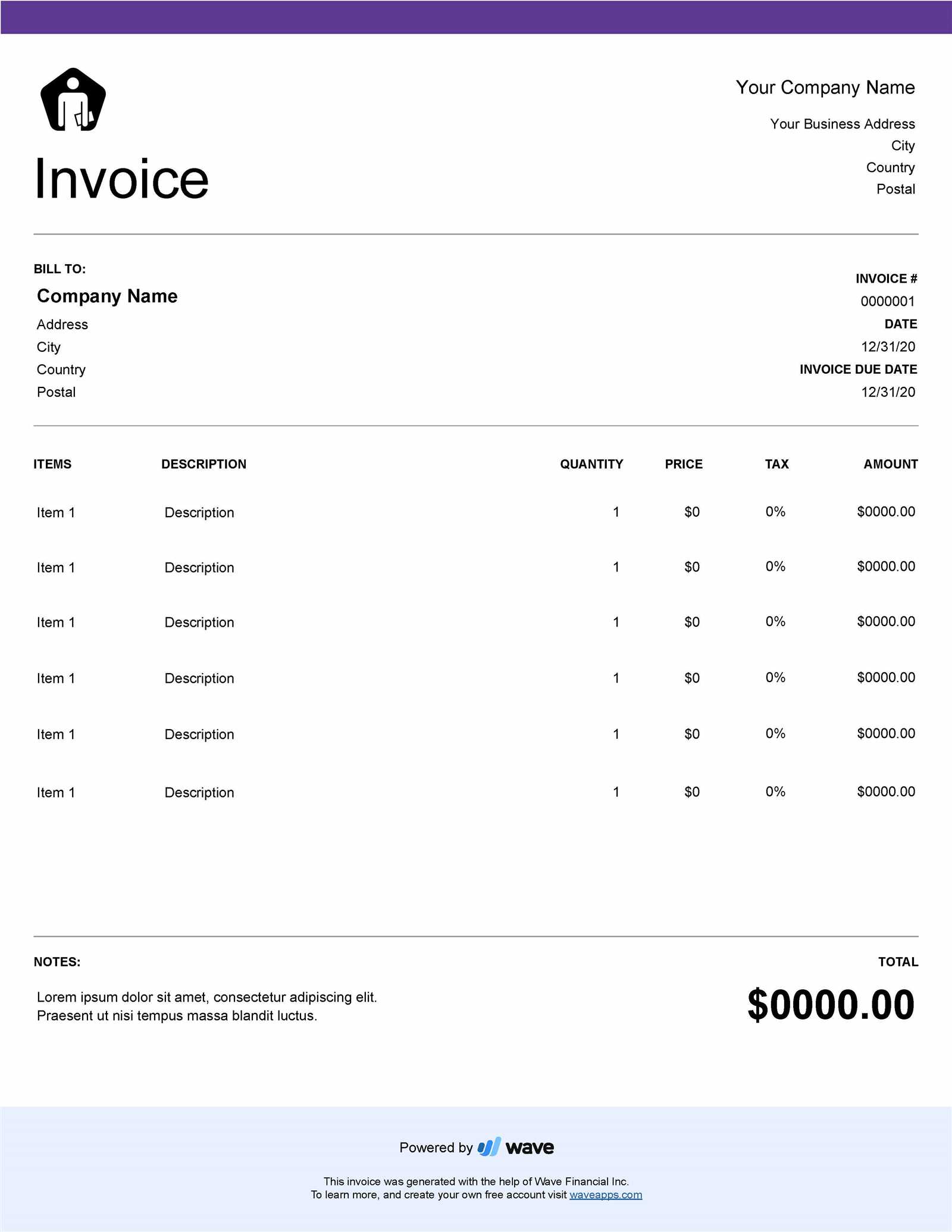

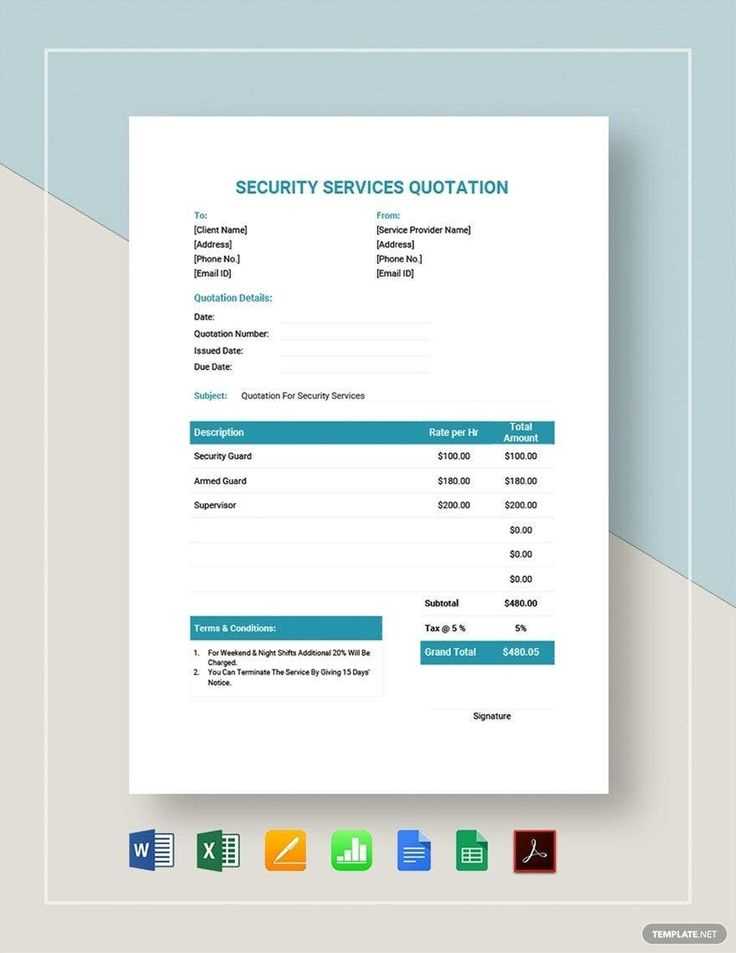

How to Create a Customizable Invoice Template

Creating a flexible document for billing purposes allows businesses to tailor their financial statements to suit the specific needs of each client. A customizable format ensures that all the relevant details are included, while also offering the freedom to adjust layout, design, and content as necessary.

To begin designing a flexible billing record, follow these key steps:

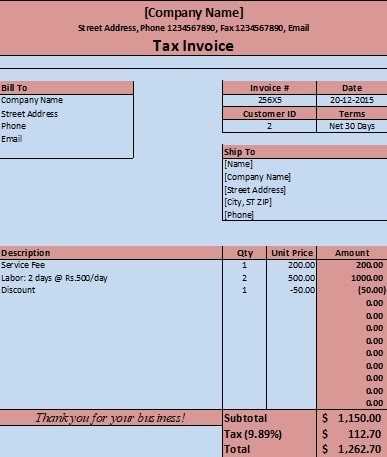

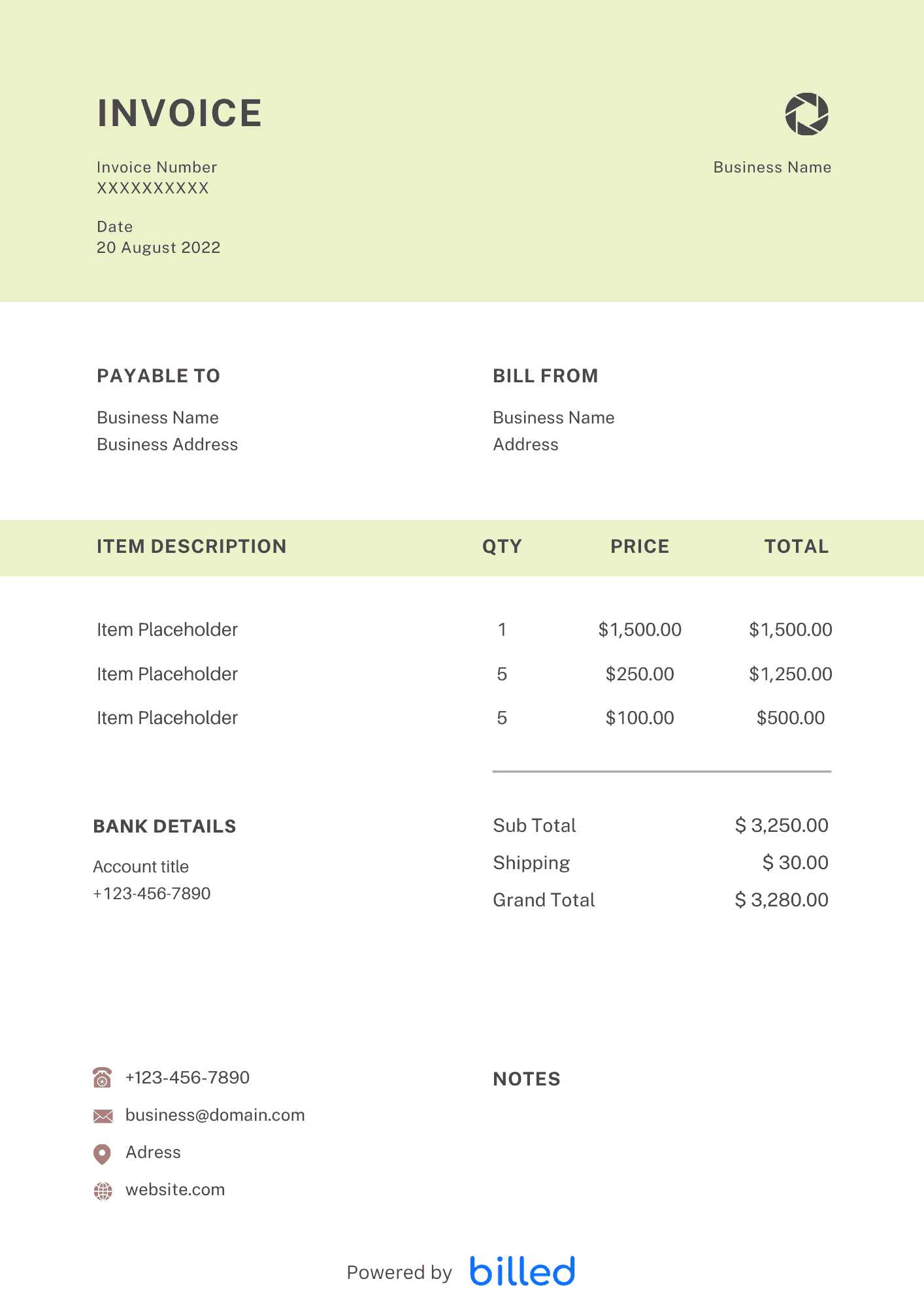

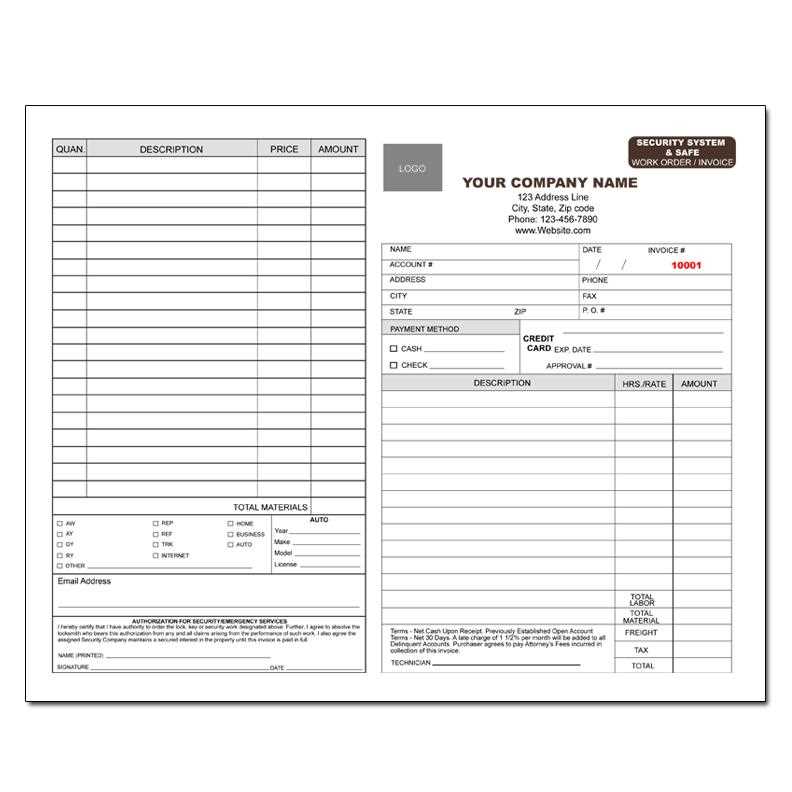

- Start with Basic Information: Include essential details such as the service provider’s name, address, and contact information, as well as the client’s information.

- Outline Services Rendered: Clearly list all services provided, including dates, descriptions, and any applicable rates or fees.

- Set Payment Terms: Specify payment deadlines, accepted methods, and any penalties for late payments.

- Include Itemized Costs: Break down the costs associated with each service, ensuring transparency for the client.

- Design a Clean Layout: Use simple, easy-to-read fonts and consistent spacing to ensure the document is visually appealing and professional.

- Save as a Customizable File: Save your document in an editable format, such as a Word or Excel file, to easily adjust for future use.

With these elements in place, you can create a functional and professional record that can be modified to fit any job or client. Whether you need to add or remove sections, update pricing, or change due dates, a customizable design ensures your documents remain adaptable.

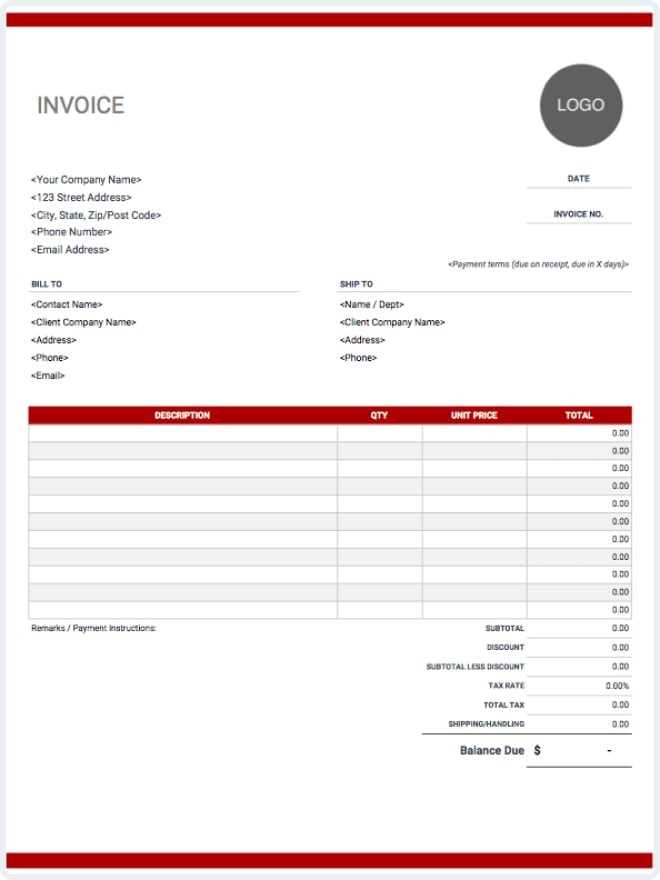

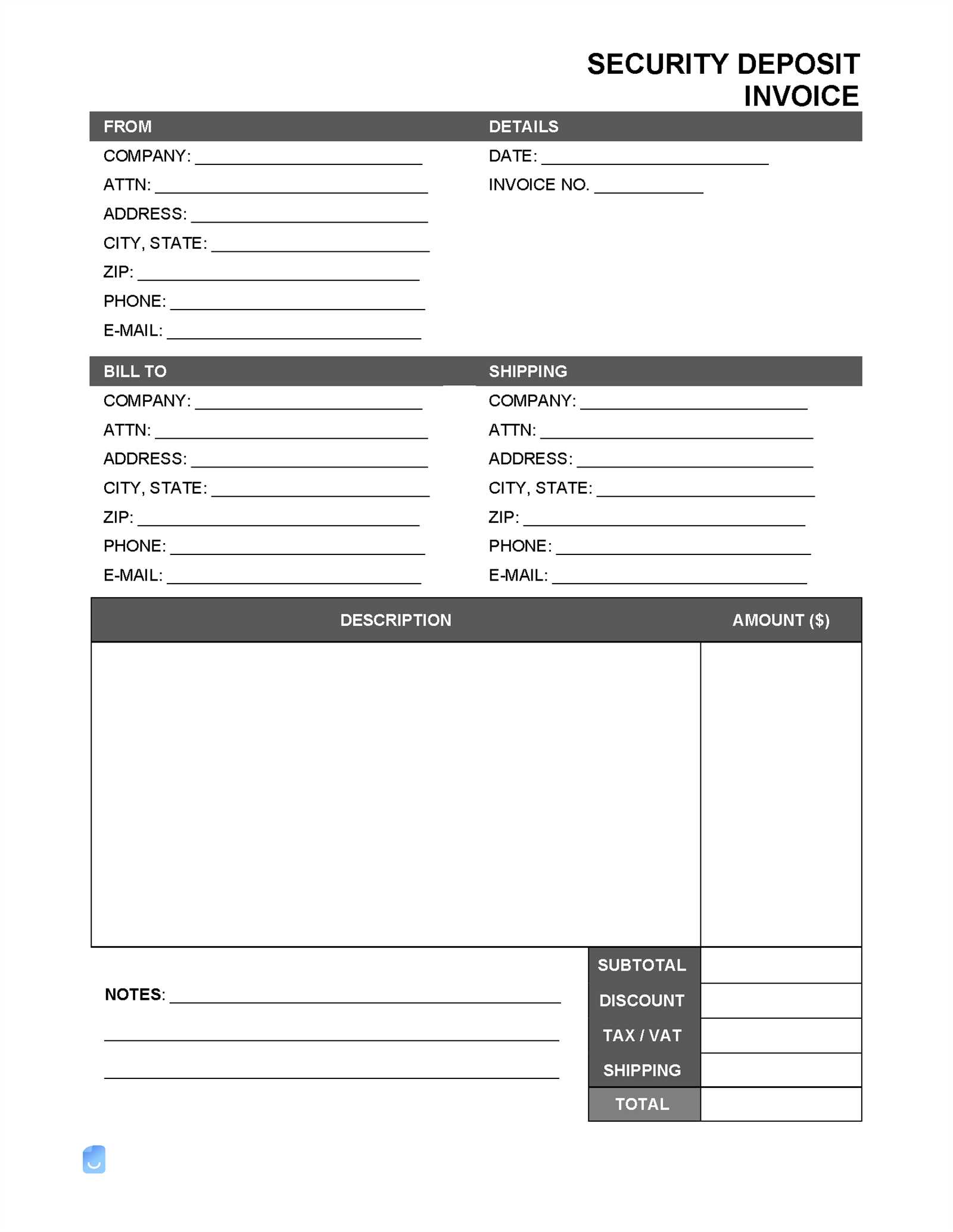

Key Elements to Include in an Invoice

For any service-based business, creating a clear and professional payment record is essential. It serves as a formal request for payment, providing all the necessary details for both the service provider and the client. Ensuring that this document contains the right information can prevent confusion and expedite the payment process.

The following are key elements that should be included in every billing statement:

- Provider’s Information: Include the full name, business name (if applicable), contact details, and address of the service provider.

- Client’s Information: Clearly list the client’s name, address, and contact information to ensure the bill reaches the correct person.

- Unique Reference Number: Assign a distinct identification number for each document to track payments and keep records organized.

- Service Description: Provide a detailed breakdown of the services rendered, including dates, hours worked, and any relevant notes.

- Cost Breakdown: List the price for each service or item, making it easy to understand how the total was calculated.

- Payment Terms: Include the due date, accepted payment methods, and any penalties for late payments.

- Additional Fees: Mention any extra charges, such as travel or equipment fees, if applicable.

- Legal Information: Add any necessary tax identification numbers or registration details, if required by local law.

By including all these key elements, the document will not only appear professional but will also help in reducing misunderstandings and improving the chances of timely payments.

Using Templates to Save Time and Effort

Creating financial documents from scratch for every client can be time-consuming and repetitive. Instead, using pre-designed formats allows businesses to quickly generate accurate records without having to start from the ground up each time. This approach not only saves valuable time but also ensures consistency across all communications.

By utilizing a reusable structure, service providers can easily modify key details such as client information, services provided, and payment amounts, while maintaining a professional appearance. The document layout remains intact, so there’s no need to reformat or reorganize with each new bill.

Additionally, using ready-made layouts reduces the risk of errors and omissions, as the format is already tested and designed to include all essential elements. This streamlines the billing process, allowing businesses to focus more on delivering quality services rather than spending time on administrative tasks.

Understanding Payment Terms and Deadlines

Clear and concise payment conditions are essential to ensure timely and accurate financial transactions. Establishing when payments are due and outlining the expectations for both parties helps avoid confusion and disputes. Properly defining these terms sets a professional tone and promotes smooth business operations.

It is important to clearly state the payment due date, whether it’s a specific number of days after the service is provided or a fixed date each month. Providing multiple payment options can also help clients make payments easily and on time. Additionally, including details about late fees or interest charges for overdue payments encourages prompt settlement.

By clearly outlining these terms in each billing statement, businesses can minimize the likelihood of payment delays and ensure better financial stability. Transparency in payment deadlines and conditions fosters trust and improves client relationships.

Service Billing Practices Explained

When offering specialized services, establishing clear billing practices is essential to ensure transparency and avoid misunderstandings. A well-structured billing approach helps both service providers and clients understand how charges are calculated and what to expect when it comes time for payment.

Hourly vs. Flat Rate Charges

There are two common methods for calculating service fees: hourly rates and flat fees. Hourly billing involves charging for the actual time spent performing the service, while flat-rate billing sets a fixed price for a specific service, regardless of the time spent. Each method has its advantages depending on the nature of the work, with hourly rates providing more flexibility and flat rates offering predictable costs.

Additional Costs and Markups

Sometimes, additional expenses like equipment rentals, travel costs, or emergency response charges may be included in the final bill. It is important to clearly outline these extra fees in the billing statement to prevent any confusion. Service providers should ensure that clients are aware of any additional costs before the work begins to maintain transparency and trust.

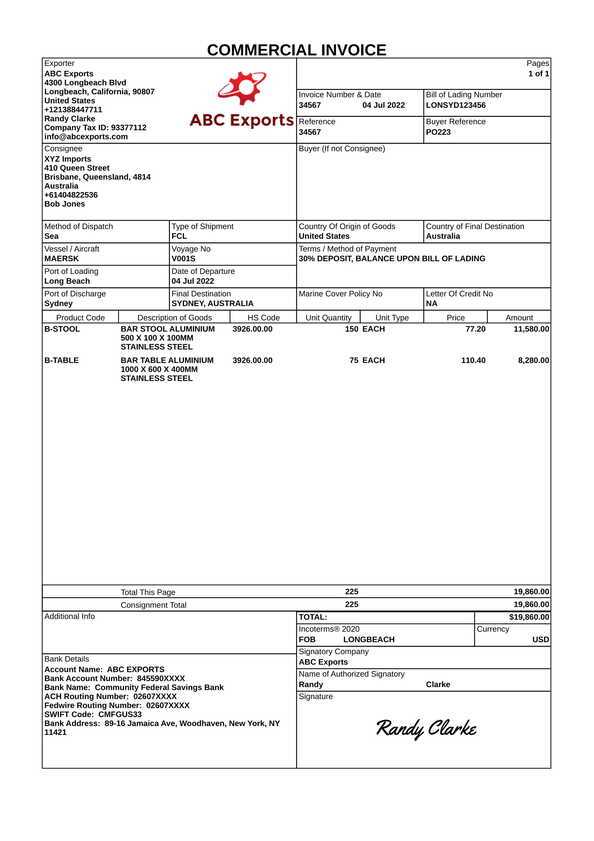

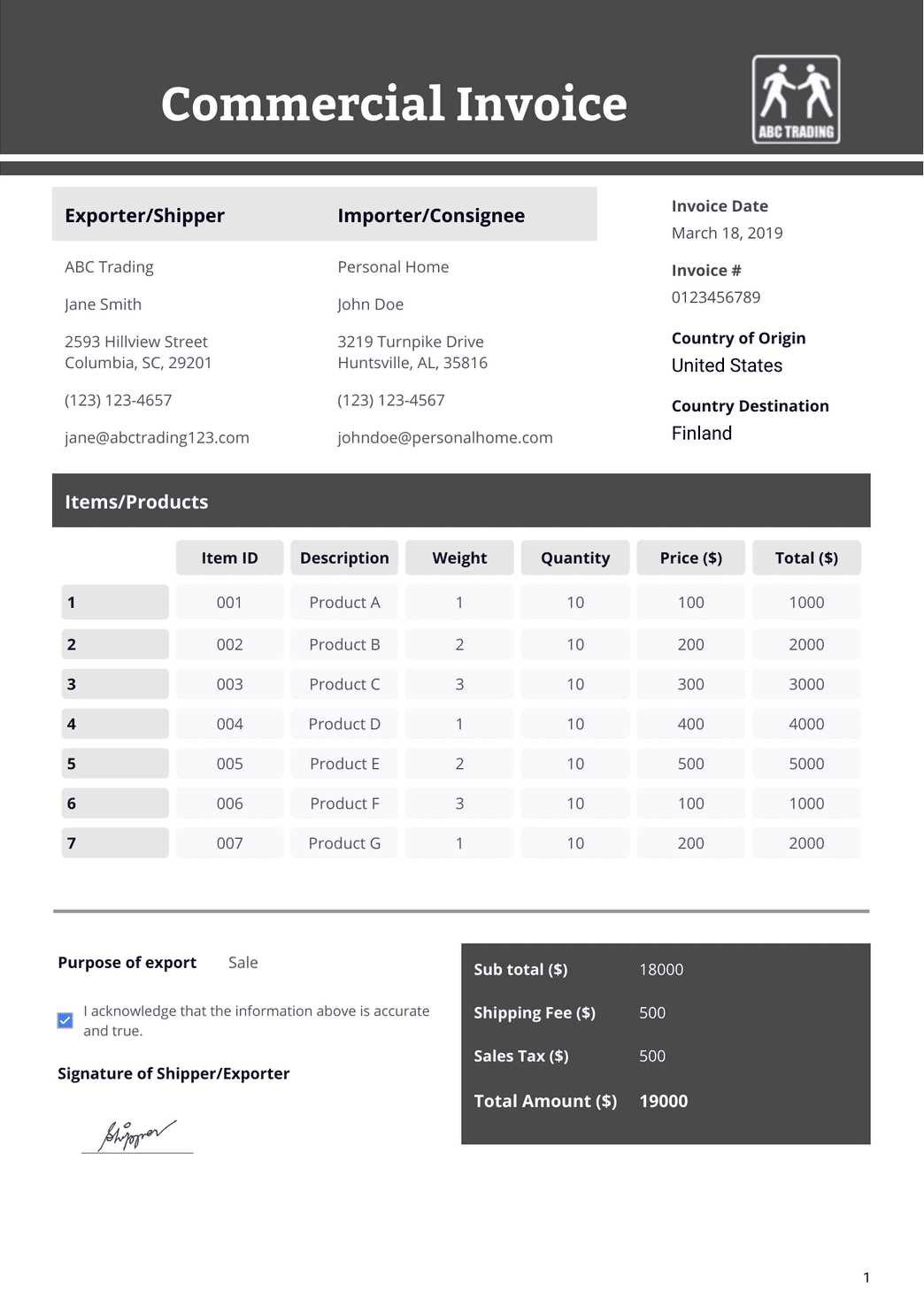

How to Calculate Charges for Security Work

Accurately determining the cost of specialized services is crucial for both the service provider and the client. Properly calculating charges ensures that businesses are compensated fairly for their work while offering clients a transparent and clear breakdown of the costs involved.

Factors to Consider When Setting Rates

There are several elements that should be taken into account when calculating fees for services rendered. These include:

- Time Spent: The amount of time spent on the task is one of the most common factors influencing the final charge. This could be based on hourly, daily, or even weekly rates.

- Complexity of the Task: More complex or high-risk tasks often justify higher charges. For example, specialized services may require a premium rate.

- Resources Used: The use of equipment, technology, or additional personnel can impact the overall cost of the job. This may include transportation costs or the use of specific tools and resources.

- Client Location: Travel costs or geographic location may affect the final price, especially if services are being provided outside of the local area.

Calculating the Final Amount

Once all the necessary factors are considered, the service provider can calculate the final amount by:

- Multiplying the hourly rate by the total number of hours worked (if billed hourly).

- Adding any extra fees for materials, equipment, or transportation.

- Including applicable taxes or regulatory charges.

By carefully accounting for each factor and providing a detailed breakdown, businesses can ensure that the billing is accurate, fair, and understandable to clients.

Best Software Tools for Invoice Creation

Choosing the right software for generating financial documents can significantly improve efficiency and reduce errors. With the right tool, businesses can easily create professional and accurate records, customize them as needed, and streamline the billing process. There are numerous options available, each offering unique features tailored to different business needs.

Top Software Options for Billing

The following table highlights some of the best software tools for creating billing documents:

| Software Name | Key Features | Pricing |

|---|---|---|

| QuickBooks | Customizable templates, automatic payment reminders, integration with accounting tools | Subscription-based, starting at $25/month |

| FreshBooks | Simple invoicing, time tracking, online payments | Subscription-based, starting at $15/month |

| Zoho Invoice | Multiple currencies, recurring billing, customizable designs | Free plan available, paid plans starting at $9/month |

| Wave | Free invoicing, accounting, and receipt scanning | Free |

| Invoice Ninja | Unlimited invoicing, proposals, client management | Free plan available, paid plans starting at $10/month |

Choosing the Right Tool

When selecting software, it’s important to consider the specific needs of your business, such as the volume of invoices, the complexity of your billing structure, and your budget. Many of these tools offer free trials, allowing you to test them before committing to a subscription plan.

Handling Discounts and Special Offers in Invoices

Offering discounts and special promotions is a common practice to encourage customer loyalty and attract new business. However, it is essential to properly reflect these reductions in billing records to maintain transparency and avoid misunderstandings. Clear communication of discounts helps clients understand the value of the offer and ensures that they are applied correctly.

When applying discounts or special offers, there are a few key steps to follow:

- Clearly State the Offer: Specify the type of discount being offered, such as a percentage off or a fixed amount, and include any conditions, like a minimum purchase amount or limited-time availability.

- Apply the Discount Properly: Ensure that the discount is deducted from the correct item or total, and reflect it as a separate line item on the billing document for transparency.

- Indicate the Total After Discount: Clearly show the original amount, the discount applied, and the final total. This helps the client see exactly how the discount affects the overall charge.

- Use Promo Codes (If Applicable): If using a promo code or voucher, include the code on the billing document to allow easy reference in case of queries or disputes.

- Specify Expiration Dates: If the discount is time-sensitive, include an expiration date to avoid confusion or misuse of the offer after it’s no longer valid.

By properly documenting discounts and special offers, businesses can improve customer satisfaction, maintain transparency, and avoid any issues related to pricing or miscommunication.

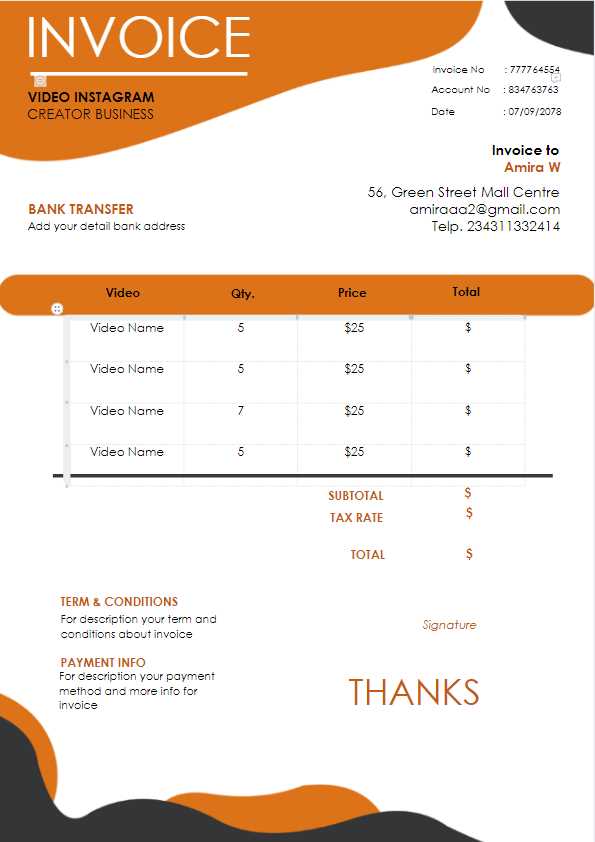

Managing Multiple Invoice Types for Clients

When working with different clients, it’s essential to tailor billing methods to suit various needs. Each client may require a unique approach depending on the nature of the services provided, payment frequency, or specific agreements. Managing multiple types of financial records effectively ensures smooth transactions and enhances client satisfaction.

To streamline the process of handling various billing formats, businesses can implement a few key strategies:

- Identify Client Preferences: Determine how each client prefers to receive their billing documents–whether it’s a detailed breakdown, a summary, or a recurring charge statement. Understanding these preferences early on can improve efficiency.

- Utilize Different Billing Structures: Some clients may prefer one-time payments, while others may have ongoing agreements with monthly or annual billing cycles. Adapt the structure to the client’s needs to avoid confusion.

- Automate Where Possible: Use software tools to automate the creation of various billing formats. This reduces the chances of error and ensures consistency across different client accounts.

- Clearly Label Different Types: If multiple billing formats are in use, make sure that each document is clearly labeled to avoid any confusion. For example, use terms like “Recurring Charge,” “One-time Payment,” or “Custom Agreement” to clearly distinguish between types.

- Maintain Detailed Records: Keep accurate records of the terms agreed upon with each client so that invoices can be customized accordingly. This includes tracking payment schedules, discounts, and any special terms.

By organizing and adapting to the diverse needs of clients, businesses can foster long-term relationships and ensure a seamless and professional billing process.

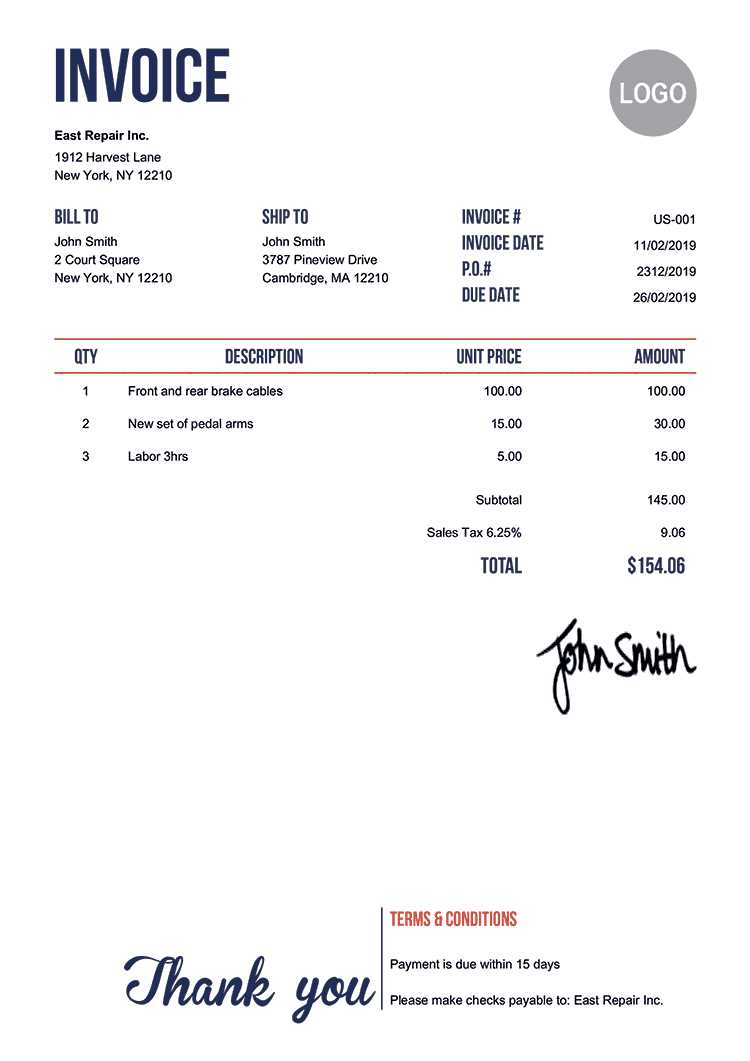

How to Keep Your Invoices Professional

Maintaining a professional appearance in all financial records is essential for building trust with clients and ensuring smooth business operations. A well-designed, clear, and accurate document reflects positively on your business and helps establish credibility. Regardless of the service provided, consistency and attention to detail are key to presenting a polished image.

Essential Elements of a Professional Record

A professional document should include several key elements to ensure clarity and efficiency. Below is a table outlining the most important components:

| Element | Purpose |

|---|---|

| Company/Business Name | Clearly identify your business or organization for easy reference. |

| Client Information | Include accurate client contact details to ensure the document reaches the right person. |

| Document Number | A unique identifier for tracking and record-keeping purposes. |

| Service Details | Clearly describe the services rendered, including dates, quantities, and specific tasks. |

| Total Amount | Show the amount owed, including taxes, fees, and any applicable discounts. |

| Payment Instructions | Provide clear and concise information on how payments should be made (e.g., bank account details, online payment links). |

Best Practices for a Professional Appearance

In addition to the necessary components, following these best practices will help maintain a high standard:

- Consistency: Use the same format for all your documents, ensuring that fonts, colors, and layout are uniform.

- Accuracy: Double-check all the details to avoid errors in the billing amount or client information.

- Clarity: Make sure that the document is easy to read, with clear headings, bullet points, and a logical flow.

- Timeliness: Always issue your records promptly and within the agreed-upon time frame to demonstrate professionalism.

By ensuring that each record meets these standards, you’ll not only maintain a professional appearance but also foster better relationships with your clients.

Common Mistakes to Avoid in Billing Documents

Creating accurate financial records is essential for maintaining professionalism and avoiding misunderstandings with clients. However, there are several common errors that businesses may make when drafting these documents. These mistakes can cause confusion, delays in payments, or even damage relationships with clients. By understanding and addressing these issues, businesses can ensure that their billing practices are as smooth and efficient as possible.

Key Mistakes to Avoid

Below is a table highlighting common mistakes and their potential impact on your financial records:

| Mistake | Impact |

|---|---|

| Incorrect Client Information | Failure to include the correct client name or contact details can result in documents not reaching the right person or department. |

| Missing or Inaccurate Service Details | Not clearly detailing the work performed or omitting key information can lead to disputes over the services provided and the associated costs. |

| Unclear Payment Terms | Vague or missing payment instructions can lead to delays or confusion regarding the due date or method of payment. |

| Failing to Include Taxes or Fees | Omitting taxes or additional charges can cause problems when the client realizes they owe more than expected, damaging trust. |

| Inconsistent Formatting | Disorganized or inconsistent formatting can make the document harder to read and create a perception of unprofessionalism. |

How to Avoid These Mistakes

To prevent these issues, consider the following steps:

- Double-check all details: Always verify client information, service descriptions, and amounts before sending out a document.

- Clearly state payment terms: Ensure that all payment instructions, due dates, and any penalties for late payment are prominently displayed.

- Maintain consistency: Use a consistent layout, format, and font across all financial records to create a professional appearance.

- Use automation tools: Leveraging software or tools can help reduce human errors and ensure

When to Send an Invoice for Services Rendered

Knowing the right time to issue a payment request is crucial for maintaining smooth cash flow and managing client expectations. The timing of when to send a billing statement can affect payment speed, client relationships, and even the perception of your business. It’s important to consider various factors before deciding on the optimal time to submit a payment request.

Factors to Consider

The timing of your billing will depend on the type of service provided, the agreement made with the client, and any specific conditions that may apply. Below are some key considerations:

- Completion of Work: Typically, payment requests should be sent once the service has been fully rendered. This ensures that all agreed-upon tasks have been completed, and there is no confusion over what the client is paying for.

- Contract Terms: Review any contractual agreements made with the client regarding payment schedules. Some clients may require invoices at specific intervals, such as weekly, monthly, or upon completion of milestones.

- Project Duration: For long-term projects or ongoing services, consider sending invoices periodically (e.g., bi-weekly or monthly) to keep the cash flow steady and maintain financial stability.

- Client Preferences: In some cases, clients may prefer a particular timing for receiving financial statements. Understanding and accommodating these preferences can help build a better relationship.

Best Practices for Timing

Here are some best practices to keep in mind:

- Immediate Billing After Completion: For one-time services, issue the payment request as soon as the work is completed, ensuring the client knows that the service has been concluded and payment is due.

- Prepayment or Deposits: In certain situations, especially for large or ongoing projects, you may require a deposit before work begins. This provides security and ensures commitment from the client.

- Timely Reminders: If payment is due but hasn’t been made, it’s important to follow up promptly. Gentle reminders can help avoid delays and encourage timely settlement.

By aligning your billing schedule with these best practices, you can help ensure prompt

Legal Considerations for Billing Statements

When it comes to requesting payment for services rendered, it is essential to be aware of the legal requirements involved in creating and issuing financial statements. These legal considerations ensure that your payment requests comply with applicable laws and regulations, protecting both your business and your clients. A clear understanding of these rules can help avoid disputes and maintain professional standards.

Key Legal Aspects to Consider

There are several legal aspects to take into account when preparing financial documentation:

- Accurate Information: All payment requests must contain correct details about the work performed, the total cost, and payment terms. Misleading or inaccurate information can lead to legal complications and undermine your credibility.

- Clear Terms and Conditions: It is crucial to include clear payment terms, including the due date, any late fees, and any applicable taxes. These terms should align with the agreement made with the client and be compliant with local laws.

- Tax Compliance: Ensure that your financial statements include the necessary tax information, such as tax identification numbers and VAT, if applicable. Failure to comply with tax regulations can result in penalties or legal issues.

- Proper Record-Keeping: Legally, businesses must keep accurate records of all transactions, including issued payment requests. This helps ensure that you can provide proof of work done and payments received if disputes arise in the future.

Contracts and Agreements

Before issuing a billing request, it is essential to have a legally binding agreement in place that outlines the terms of service and payment. The contract should clearly define:

- Scope of Work: The specific services to be provided, ensuring both parties understand the expectations.

- Payment Schedule: The timeline for payment, including due dates and any agreed-upon milestones for long-term projects.

- Late Payment Penalties: Any agreed-upon late fees for overdue payments, which should be clearly stated in the contract.