Free UK Invoice Template for Professional Billing

Running a business requires clear and professional documentation, especially when it comes to financial transactions. One of the most essential documents in business dealings is the request for payment, which serves as a formal record of services or goods provided. Crafting this document with precision not only ensures that all necessary details are included but also helps in maintaining a professional image.

For business owners in the UK, understanding the key components and layout of a well-structured request is crucial. Whether you’re a freelancer or a small business owner, having an organized, legally-compliant format can streamline your operations. This article will guide you through creating and using the right documents to ensure prompt and accurate payments.

Understanding UK Invoice Requirements

When requesting payment for goods or services in the UK, it’s essential to follow specific guidelines to ensure the document meets legal and business standards. This ensures clarity for both parties and avoids any confusion or delays in payment. Understanding what needs to be included and how it should be structured is key to maintaining professionalism and compliance with UK regulations.

Key Elements of a Payment Request

A well-prepared payment request should contain certain fundamental details. These are crucial for providing a clear record of the transaction and for ensuring the document is legally valid. The key elements to include are:

- Business Information: Include the name, address, and contact details of both the service provider and the recipient.

- Unique Reference Number: A distinctive reference number for tracking purposes.

- Transaction Date: The date the goods or services were provided, or the date the request is issued.

- Detailed Description: A clear description of the goods or services provided, including quantities, prices, and any applicable rates.

- Payment Terms: Specify the due date, accepted payment methods, and any late fees or discounts offered for early payment.

- VAT Information: If applicable, provide the VAT number and include VAT calculations, especially for businesses that are VAT-registered.

Legal Considerations

In the UK, a properly formatted request not only aids in smoother transactions but also ensures compliance with tax and business laws. If your business is VAT-registered, you must follow the regulations set by HMRC, including accurate VAT calculations and appropriate formatting. Failing to include required details may lead to delays in payment processing or even legal issues.

By understanding and following these requirements, you ensure that your payment requests are both professional and legally compliant, reducing the chances of disputes and improving cash flow management.

How to Create a UK Invoice

Creating a proper document for requesting payment is essential for ensuring clear communication between businesses and clients. Whether you’re an individual contractor or a large company, the document you generate must include all the necessary details for processing the payment smoothly. Follow these simple steps to craft an effective and professional payment request.

Step-by-Step Process

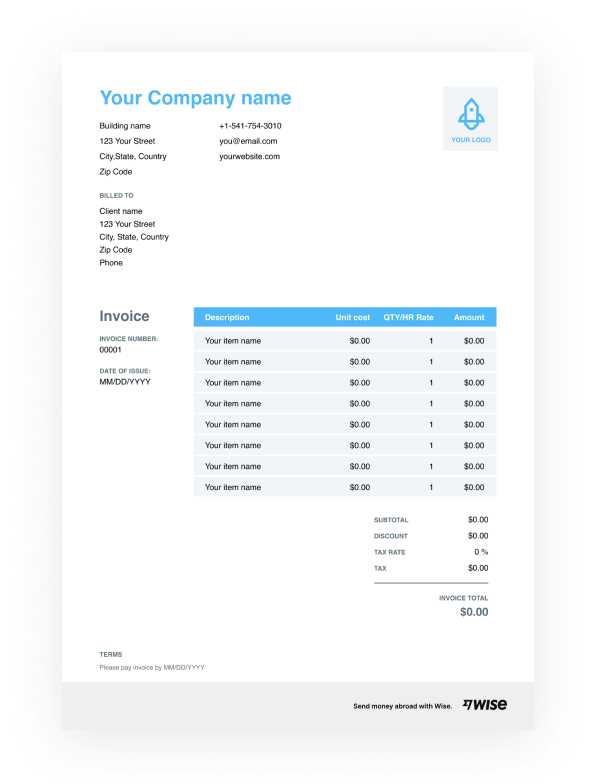

To create a complete and accurate payment request, you need to include specific sections and details. Below is an easy-to-follow outline to help you structure the document correctly:

| Step | Details |

|---|---|

| 1. Add Your Business Information | Include your business name, address, contact information, and VAT registration number (if applicable). |

| 2. Provide Client Details | Make sure the recipient’s name, address, and contact details are listed correctly. |

| 3. Assign a Unique Reference Number | Give the document a unique identifier for tracking purposes. |

| 4. Specify the Date | State the date the payment request is issued, as well as the due date for payment. |

| 5. List Services or Goods Provided | Describe each item or service, including quantity, price, and any additional fees. |

| 6. Calculate Payment Amount | Provide a clear breakdown of the total amount due, including any applicable taxes or discounts. |

| 7. Payment Terms | Outline the terms for payment, such as due date, accepted methods, and late fees. |

Formatting Tips

When creating the payment request, ensure the layout is clean and easy to read. Use clear headings for each section and avoid cluttering the document with unnecessary details. A professional and organized appearance increases the likelihood that your request will be processed quickly and accurately.

By following

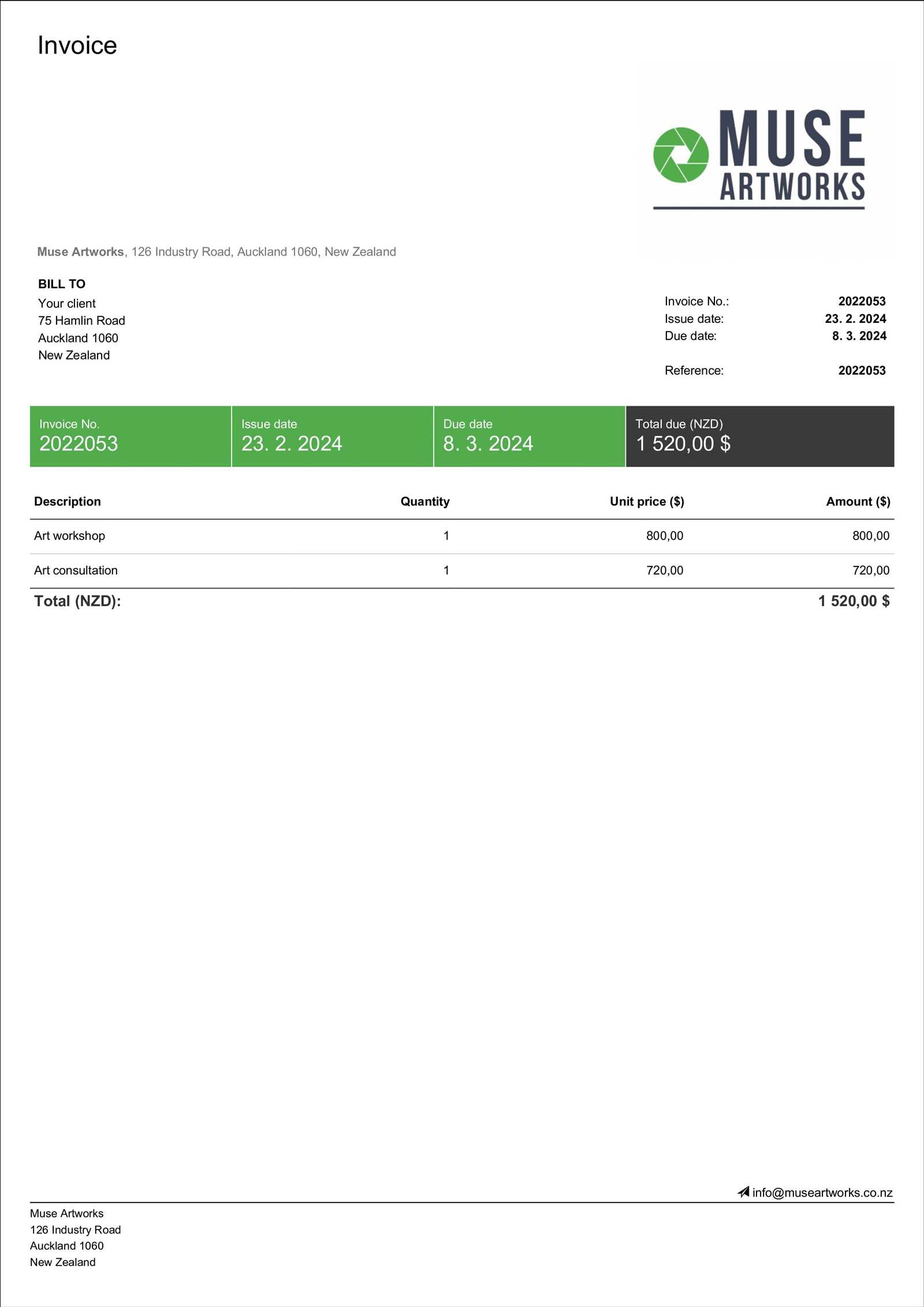

Essential Elements of a UK Invoice

To ensure a smooth and efficient payment process, it’s important to include all the required information in your payment request. Each element serves a distinct purpose, ensuring both clarity and compliance with UK regulations. Whether you’re working with clients in the UK or abroad, including these essential details helps protect both parties and promotes timely payment.

Key Components to Include

For a payment document to be effective and professional, it should contain several crucial elements. These elements not only help maintain a clear record of the transaction but also ensure that the recipient has all the information needed to process the payment without delay.

- Contact Information: Include the names, addresses, and contact details of both the payer and payee. This establishes clear communication channels and allows for easy identification of the parties involved.

- Unique Identification Number: Each document should have a unique reference number for record-keeping and tracking purposes. This helps you easily locate and reference the payment request in the future.

- Issue and Due Dates: Clearly state the date the document was issued and the due date for payment. This provides a timeline for when payment should be made and helps prevent confusion over deadlines.

- Detailed Breakdown of Charges: List all goods or services provided, along with quantities, individual prices, and any additional charges or discounts. This ensures transparency and helps the recipient understand what they are paying for.

- Payment Terms: Include clear terms about when payment is expected, preferred methods of payment, and any late fees or penalties for overdue amounts. This helps avoid misunderstandings about payment expectations.

- VAT Information (if applicable): If your business is VAT-registered, be sure to include your VAT number and clearly indicate any VAT charges. This ensures compliance with UK tax regulations.

Ensuring Clarity and Accuracy

Accuracy and clarity are paramount when preparing a payment request. Each element should be clearly laid out and easy to read, with no ambiguity about the amount due or the services provided. The recipient should have no trouble understanding the details of the transaction, which minimizes the risk of disputes or delays.

By including these key components, you ensure that your document is legally sound, easy to process, and ready for payment. Following these guidelines helps maintain professionalism and efficiency in your business dealings.

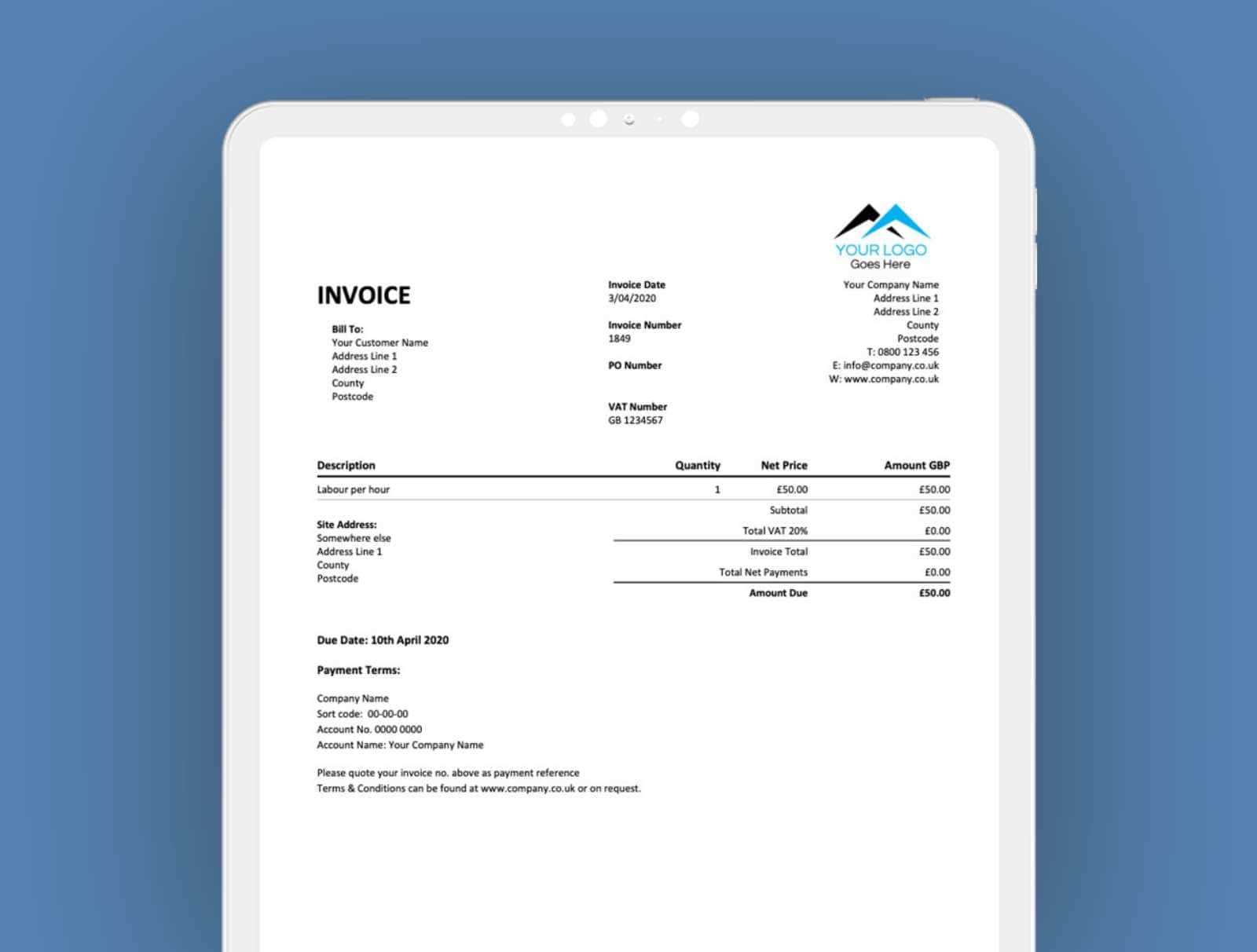

Customizing Your UK Invoice Template

Personalizing your payment request document can help reinforce your brand identity and ensure consistency in your business communications. Customization allows you to tailor the structure, design, and content to better suit your business needs while adhering to UK regulations. By adjusting key details and visual elements, you can create a more professional and polished look that reflects your business values.

Here are some tips for customizing your payment documents:

- Branding: Add your business logo, color scheme, and fonts to make the document visually align with your brand. This adds a level of professionalism and makes your documents instantly recognizable.

- Flexible Layout: Choose a layout that works best for your business. Depending on the complexity of your services or products, you may prefer a more detailed breakdown or a simple format. Adjust sections like item descriptions, prices, or additional charges to match your workflow.

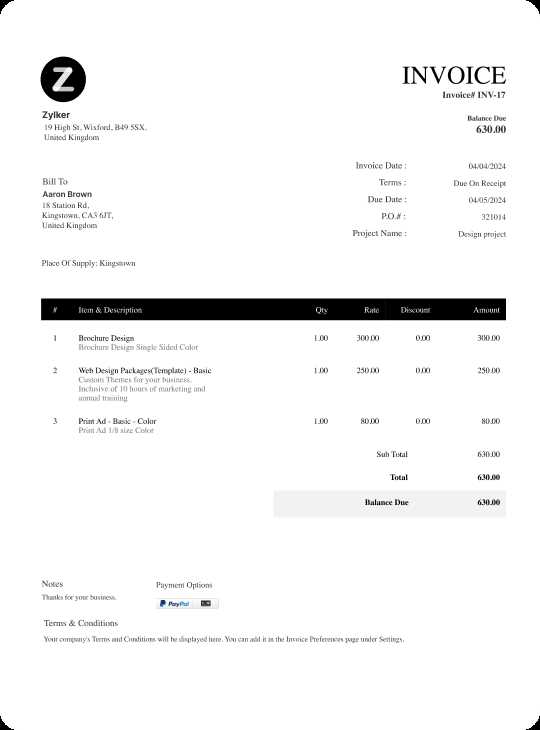

- Custom Fields: Depending on your industry, you might want to add extra fields. For example, you could include a “Project Name” or “Purchase Order Number” to track specific projects or orders. Tailor your document to fit your specific business requirements.

- Payment Methods: Include your preferred payment methods and account details, whether it’s bank transfer, PayPal, or another method. Clear instructions on how to make the payment will reduce confusion and encourage faster processing.

- Terms and Conditions: Customize the terms and conditions section to reflect your payment policies. Whether you offer early payment discounts, penalties for late payments, or specific return policies, make sure your terms are clearly outlined and tailored to your business practices.

By customizing your payment request, you not only make it more efficient and relevant to your specific needs but also present your business in a more professional and coherent manner. Keep the layout clear and easy to follow, ensuring that every section is organized and that the content is easy to understand. This personalization can improve communication and enhance your business relationships.

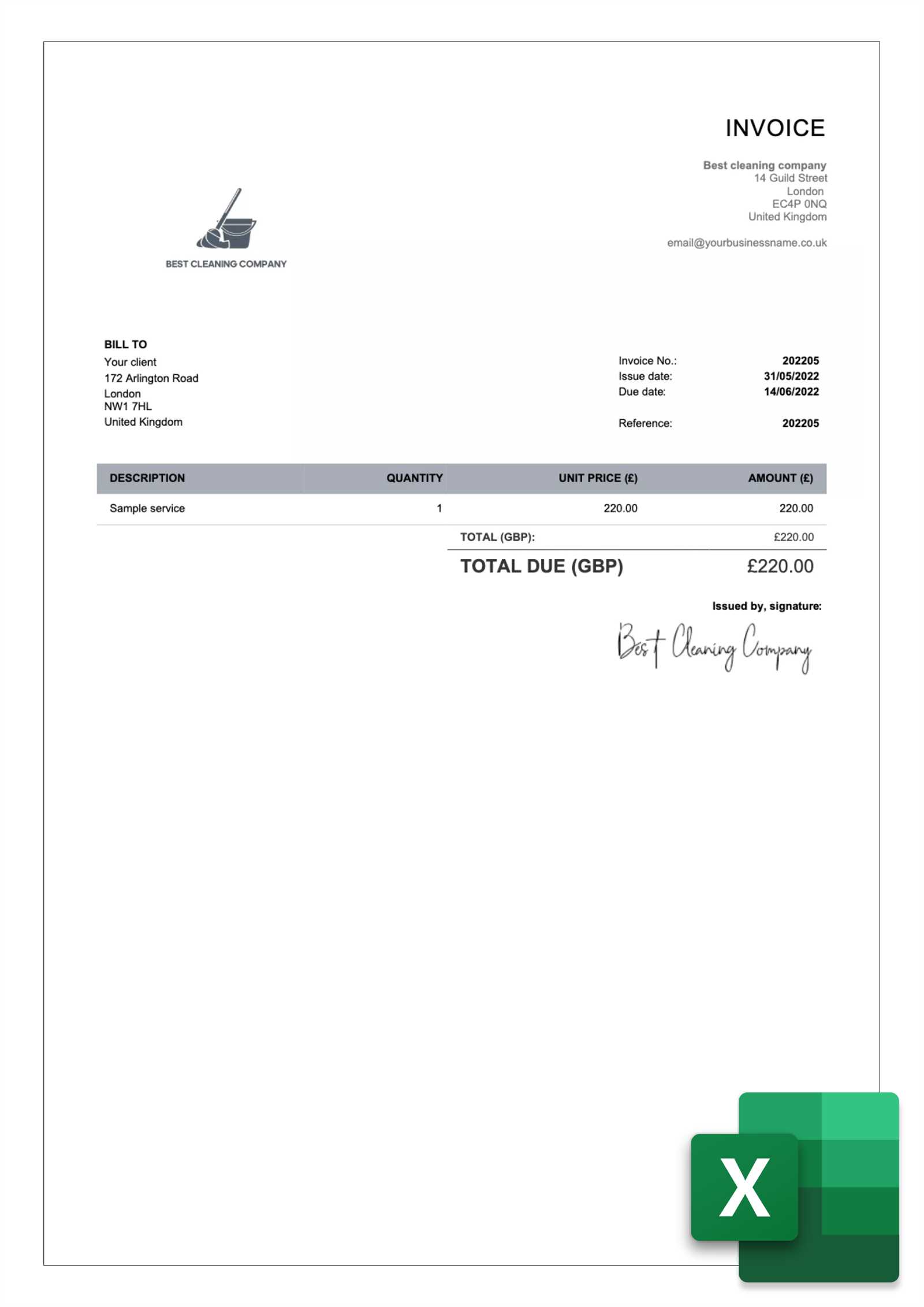

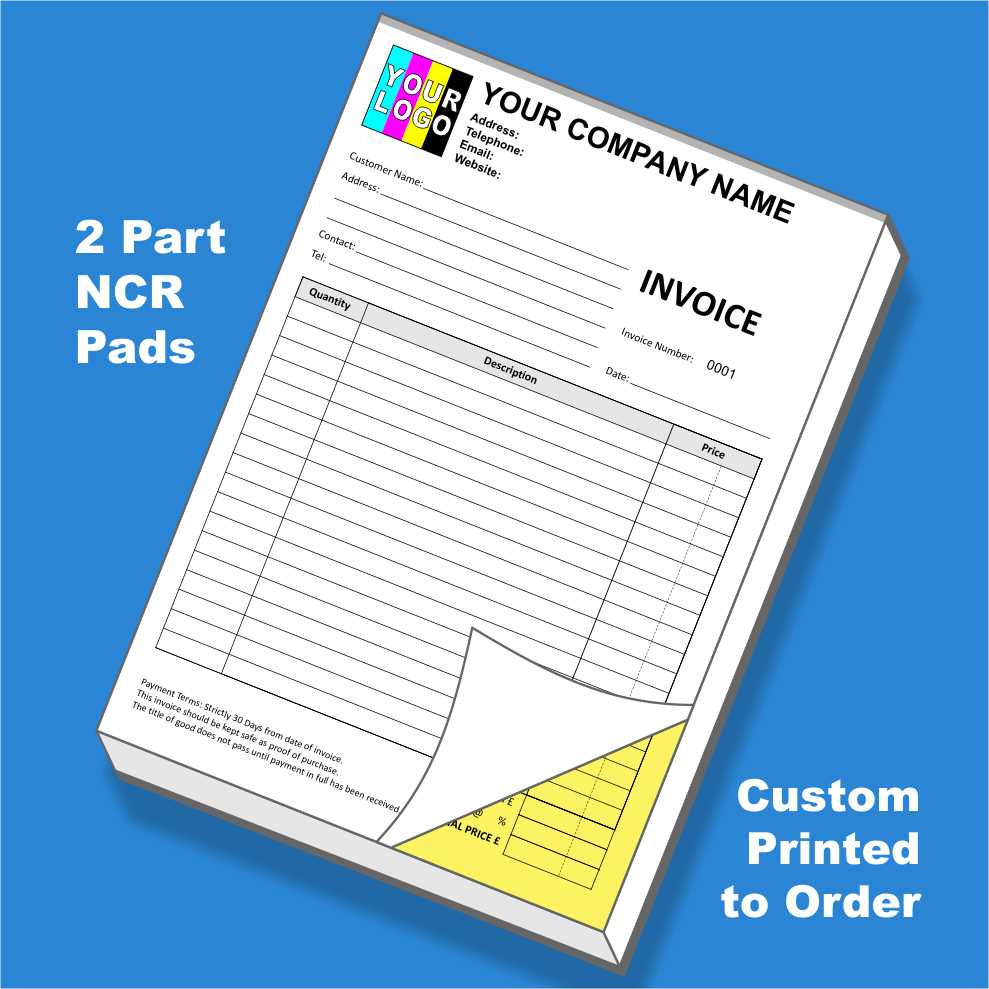

Top UK Invoice Template Options

There are numerous ways to create a professional payment request, and selecting the right option for your business can make a significant difference in how quickly and efficiently payments are processed. The ideal option should reflect your business needs, offer a user-friendly design, and include all necessary elements to meet UK regulations. Here are some of the top choices to consider when choosing a document format for your payment requests.

- Online Invoice Generators: Many businesses turn to online tools that allow you to create and send documents quickly. These platforms often come with pre-built designs and can be customized to fit your specific requirements. They also provide the convenience of saving and sending requests directly from the platform.

- Spreadsheet Templates: For businesses comfortable with Excel or Google Sheets, spreadsheets can be a great way to generate detailed payment requests. These tools allow full customization, from adding taxes and discounts to creating complex breakdowns of goods or services provided.

- Word Processor Documents: If you prefer working with Microsoft Word or Google Docs, using a document processor is a simple option. With the ability to add logos, adjust fonts, and create clean layouts, word processors offer flexibility, though manual calculations for totals and taxes may be required.

- Accounting Software: For businesses with regular financial transactions, investing in accounting software can streamline the entire process. Many accounting platforms provide built-in options for generating payment requests with all necessary details and legal compliance built in. These systems can also automate the tracking of payments, overdue amounts, and even tax calculations.

- Customizable PDF Forms: If you’re looking for a document that is both professional and easy to share, customizable PDF forms might be a good option. Many platforms offer free or paid PDF templates, allowing you to fill in your details, save the document, and send it securely to clients.

Each of these options comes with its own set of benefits, depending on the size of your business and the complexity of your payment process. Choose a method that aligns with your workflow and ensures that all necessary elements are included for legal and professional purposes. Whether you prefer simplicity or advanced features, there’s a solution to fit your needs.

Common Mistakes in UK Invoices

Despite the simplicity of creating a payment request document, several common errors can lead to confusion, delays, or even legal complications. These mistakes often arise from overlooking important details or misinterpreting legal requirements. By understanding the most frequent issues, businesses can ensure that their payment requests are both accurate and compliant with UK regulations.

Frequent Errors to Avoid

Here are some of the most common mistakes businesses make when preparing payment requests, along with tips to help you avoid them:

| Common Mistake | How to Avoid It |

|---|---|

| Missing Business Information | Always include your full business name, address, and contact details, as well as the recipient’s information, to avoid confusion. |

| Incorrect or Missing Dates | Ensure that both the issue date and payment due date are clearly stated and accurate to prevent disputes over deadlines. |

| Omitting VAT Information | If VAT is applicable, make sure to include your VAT registration number and clearly show the tax calculation. |

| Unclear Payment Terms | Specify the accepted payment methods, due date, and late payment fees to avoid confusion and delays. |

| Not Including a Unique Reference Number | Assign a unique reference number to each payment request to make tracking and future reference easier. |

| Inconsistent Descriptions or Prices | Provide clear, accurate descriptions of the goods or services offered and ensure pricing is correct to avoid disputes. |

Impact of Mistakes

Even small errors can lead to significant consequences, such as delayed payments or confusion regarding the amount due. Inaccurate or missing information can also raise questions about the legitimacy of your business and impact your professional reputation. By double-checking all details and avoiding common mistakes, you can ensure that your payment requests are processed smoothly and efficiently.

Taking the time to review you

How to Include VAT on Invoices

Incorporating VAT into your payment request is essential for businesses registered with HMRC. The Value Added Tax is a consumption tax added to goods and services, and it’s vital to include the correct details on your payment requests to ensure compliance with UK tax laws. Failure to do so can lead to issues with HMRC, including penalties or delayed payments. Here’s how to correctly show VAT on your payment requests.

Steps to Include VAT

Follow these steps to ensure that VAT is properly included in your payment request:

- Check Your VAT Registration Status: Before charging VAT, verify that your business is VAT-registered with HMRC. Only VAT-registered businesses are allowed to charge VAT to their customers.

- State Your VAT Number: Include your VAT registration number on the payment request. This lets your client know that you are VAT-registered and allows them to claim back VAT if applicable.

- Clearly Indicate VAT Rate: Specify the applicable VAT rate. In the UK, the standard rate is 20%, but reduced rates or exemptions may apply depending on the nature of your goods or services.

- Show VAT Amount Separately: Break down the VAT charge separately from the total amount for clarity. This helps the client easily identify how much VAT they are being charged.

- Include VAT in Total Amount: Ensure the final amount due includes the VAT charge, so the client knows exactly what they need to pay in total.

Example Breakdown

Here’s an example of how to show VAT on a payment request:

| Description | Amount | VAT Rate | VAT Amount | Total | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Prod

Invoice Format for Freelancers in the UKFor freelancers in the UK, creating a clear and professional payment request document is essential for maintaining good business practices and ensuring timely payments. A well-structured document not only helps clients understand the charges but also ensures compliance with tax regulations. Whether you’re working on short-term projects or long-term contracts, the right structure can streamline your billing process and improve your cash flow. Key Elements of a Freelancer Payment Request

Here are the essential components to include in your payment request as a freelancer:

Example Structure for FreelancersHere’s an example of how your payment request might be structured:

In this example, the document clearly outlines the services provided, the costs associated with each, and the applicable VAT. The total amount due is clearly displayed, making it easy for both the business and the client to track the payment. This type of format is easy to adapt for various types of small businesses, whether you’re offering consulting, creative services, or product sales. By using a consistent and professional layout, small businesses can foster trust with clients and ensure timely payments, which is key to business growth and sustainability. Why Use a UK Invoice TemplateFor businesses in the UK, having a structured and standardized method for creating payment requests is essential for ensuring clarity, accuracy, and compliance. A consistent approach helps to avoid confusion and mistakes, which could result in delayed payments or disputes. By using a predefined format, businesses can streamline the billing process, save time, and maintain professionalism, all of which are crucial for maintaining healthy cash flow and customer relationships. Benefits of Using a Structured FormatUsing a well-organized structure for your billing documents offers numerous advantages:

How It Helps with Accuracy and EfficiencyBy using a pre-designed format, the chances of making errors–such as omitting key details or miscalculating totals–are significantly reduced. It also helps ensure that all necessary information, such as your business and client details, payment terms, and services rendered, is included without overlooking any important aspects. Ultimately, utilizing a well-organized structure for your payment requests contributes to a smoother, more efficient business operation, fostering trust with your clients and helping to avoid potential issues down the line. Choosing the Right Invoice StyleSelecting the appropriate design for your payment request documents is an important aspect of maintaining a professional image for your business. The style of your billing documents not only affects how your business is perceived by clients but also impacts the clarity and ease with which they can process the payment. Whether you’re a freelancer, a small business owner, or a larger enterprise, understanding the different options and their applications can help you choose the style that best suits your needs. Factors to Consider When Selecting a StyleWhen choosing the design for your billing documents, several factors should be taken into account:

Types of Styles to Choose FromThere are several design approaches you can choose from, depending on your business and client needs:

Choosing the right style for your payment request document not only enhances your professional image but also ensures that your clients can easily understand and process your payment terms. It’s essential to find a balance between creativity and clarity to suit both your business and your clients’ expectations. Tips for Clear Invoice DesignDesigning a clear and easy-to-read payment document is essential for ensuring smooth transactions and preventing misunderstandings between businesses and clients. A well-organized layout enhances readability, reduces confusion, and ensures that all necessary details are easy to find. By following a few simple design tips, you can create documents that are both functional and professional, improving your business’s communication and efficiency. Here are some important tips for creating a well-structured and visually appealing payment request document:

By following these tips, you can create a well-structured and visually appealing document that not only communicates important details clearly but also builds trust with your clients, ensuring smooth and timely payments. Managing Multiple Invoices with TemplatesWhen handling numerous payment requests, organization becomes key. Managing multiple documents efficiently ensures that you maintain professionalism and stay on top of your financial records. By using well-organized formats, you can streamline the process, reduce errors, and ensure that every detail is correct and consistent across all requests. Implementing a standardized structure not only saves time but also enhances accuracy and reduces the risk of missing important information. Benefits of Using Predefined FormatsPredefined structures allow you to quickly generate multiple requests while maintaining consistency and clarity. Here are some advantages:

Tips for Managing Multiple RequestsTo effectively manage several payment requests, consider the following strategies:

By implementing standardized formats and efficient processes, managing multiple payment requests becomes a streamlined task. This ensures your business operations run smoothly and professionally, enabling you to focus on more important aspects of your work. When to Send an Invoice in the UKKnowing the right time to issue a payment request is crucial for maintaining positive cash flow and avoiding delays. Sending such documents at the right moment helps establish clear expectations with clients, encourages timely payments, and reduces confusion. Understanding the appropriate timing can significantly improve your financial management and ensure smoother transactions. Factors to Consider When Deciding the TimingSeveral factors play a role in determining the best time to send a request for payment:

Best Practices for TimingTo ensure prompt payment, follow these best practices:

By understanding when to issue a payment request and aligning with both your business practices and client expectations, you can ensure timely payments and maintain smooth operations. Legal Considerations for UK InvoicesWhen preparing a payment request, it is essential to ensure that all legal requirements are met. This not only helps in maintaining a professional relationship with clients but also protects your business in case of disputes. Understanding the legal framework surrounding such documents in the UK is crucial for compliance, accuracy, and transparency. In the UK, certain information must be included to ensure that the document is legally binding and fulfills tax requirements. Failure to comply with these regulations can result in delays or complications with payments, or even legal consequences. Therefore, understanding the basic legal obligations is key to safeguarding your business interests. Key Legal RequirementsTo avoid potential legal issues, make sure to include the following elements in your documents:

Important ConsiderationsAside from the key legal requirements, there are additional points to keep in mind to avoid legal complications:

By following these legal considerations, you can ensure that your payment requests are not only professional but also compliant with UK law, which helps protect your business interests in the long run. Free Resources for UK Invoice Templates

For small businesses, freelancers, or anyone managing payments, having access to free tools to create payment requests is a valuable resource. The availability of various online platforms can simplify the process of designing professional-looking documents that adhere to legal standards, while also saving time and money. These free resources are ideal for those who don’t want to invest in expensive software or don’t need a highly customized solution. Many online services offer easy-to-use designs that can be customized for individual needs, allowing users to quickly generate the documents they require. These resources often come with additional features like automatic calculations, customizable sections, and downloadable formats that make sending and managing payment requests more efficient. Top Free ResourcesHere are some of the top platforms providing free options to create professional payment requests:

Why Choose Free ToolsFree resources can be particularly helpful for those just starting out or those with minimal business expenses. While premium solutions offer more advanced features, these free tools are often sufficient for basic needs:

Using these free tools allows you to focus on other aspects of running your business while ensuring your payment requests are clear, professional, and legally compliant. |