Best Information Technology Invoice Template for IT Services

Running a successful IT business requires not only delivering top-quality services but also managing finances effectively. One of the key components of this process is ensuring that your clients receive clear, professional documentation for the work you’ve completed. A well-structured document for payment requests can save time, avoid confusion, and enhance your business’s reputation.

Clear and organized financial records are crucial for maintaining good client relationships and ensuring prompt payments. By using a customizable document format, businesses can easily adjust the layout and details to meet their needs, while keeping everything consistent and professional. This flexibility helps businesses focus more on their services and less on administrative tasks.

In this guide, we will explore the essential components and advantages of using a formal billing format designed specifically for IT professionals. By following best practices and understanding the necessary sections, you can create a smooth payment process and avoid common pitfalls in the financial aspect of your business.

Information Technology Invoice Template Overview

In the world of IT services, having a professional document to request payment is essential for smooth business operations. A well-organized billing sheet not only ensures clarity but also reflects positively on the professionalism of your services. Such a document helps both the service provider and client maintain transparency regarding the work completed and the amount due.

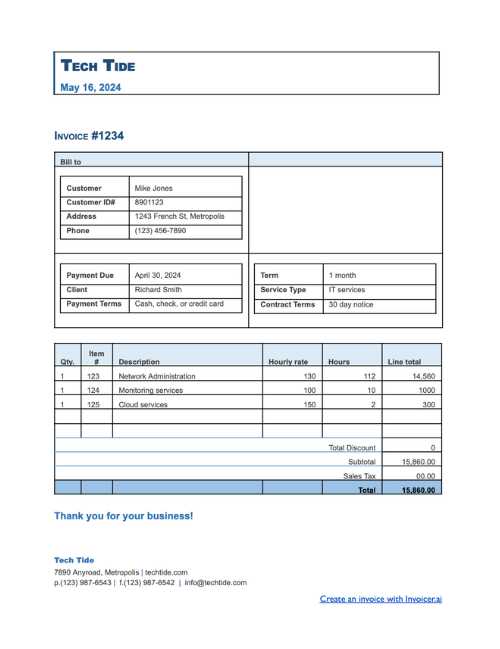

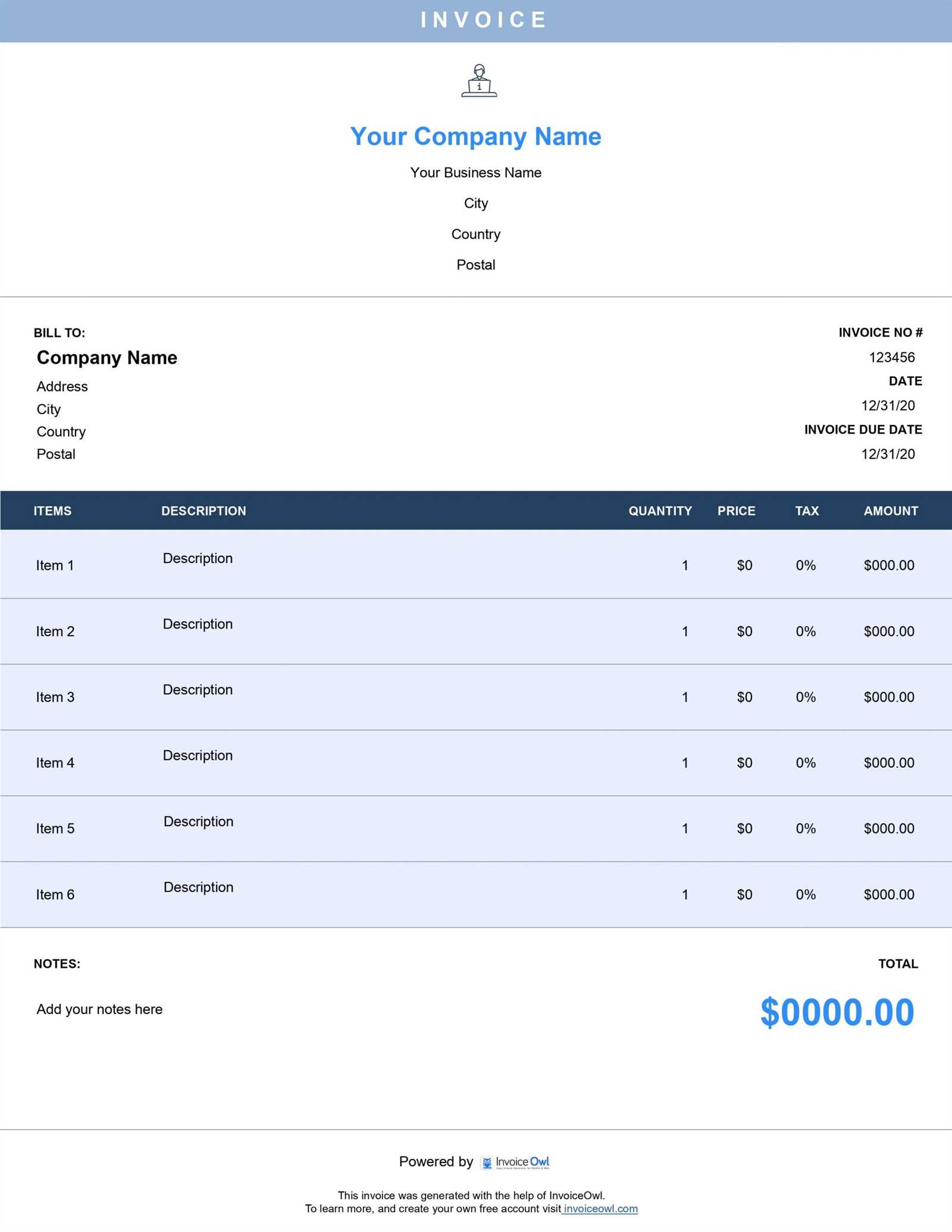

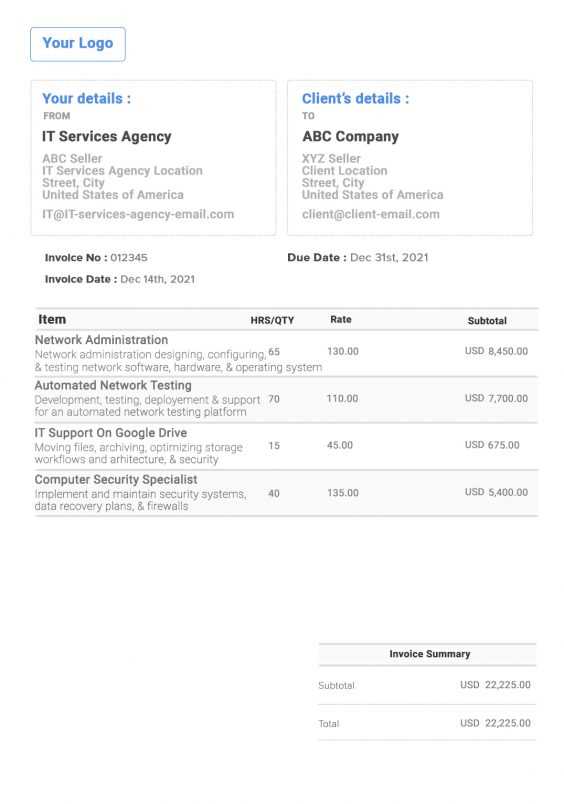

This type of billing document is designed to include all the necessary details to make the payment process as clear and efficient as possible. It typically features sections for contact information, service descriptions, dates, rates, and total amounts due. Having a standardized format can greatly reduce errors and improve communication with clients.

Key Components of a Standard Billing Document

- Contact Information: Both parties’ names, addresses, and communication details.

- Work Description: A clear breakdown of the services provided or tasks completed.

- Payment Terms: Information on due dates, late fees, and accepted payment methods.

- Total Amount: A precise total that includes applicable taxes, discounts, and any additional charges.

- Dates: The start and end dates of the services rendered, along with the issue date of the document.

Benefits of Using a Structured Billing Document

- Clarity: Both you and the client can easily understand the details of the services provided and the payment expectations.

- Time-Saving: A pre-designed document format speeds up the billing process, leaving more time for your core tasks.

- Professionalism: A clean, well-organized bill fosters trust and enhances the client experience.

- Error Reduction: Standardized formats minimize the risk of overlooking essential details.

Why Use an IT Invoice Template

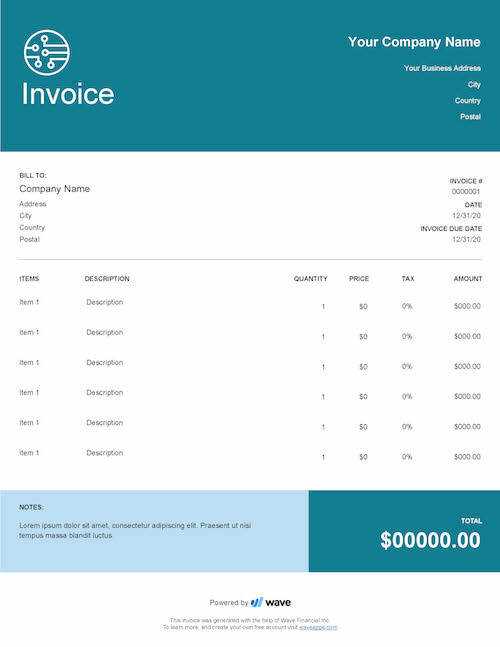

For businesses offering professional services, having a structured format to request payment is crucial for maintaining consistency and professionalism. A well-organized billing document ensures that both parties are on the same page regarding the details of the work completed and the amount due. Using a predefined layout makes the entire process smoother and more efficient.

One of the main reasons for utilizing a set format is to avoid errors. Manually creating each billing document from scratch can lead to inconsistencies or missed information. With a standard format, every essential detail is included, reducing the likelihood of mistakes and making the document easier to understand for both the service provider and the client.

Advantages of Using a Standardized Billing Format

- Time Efficiency: Streamlining the billing process saves valuable time, allowing professionals to focus on their core work.

- Clarity: A structured document presents all necessary information clearly, reducing the risk of misunderstandings or disputes.

- Professional Appearance: Consistent formatting enhances the business’s credibility and shows attention to detail.

- Accuracy: A standardized format ensures that all required sections are included, minimizing the chance of missing important information.

Key Information to Include in Every Billing Sheet

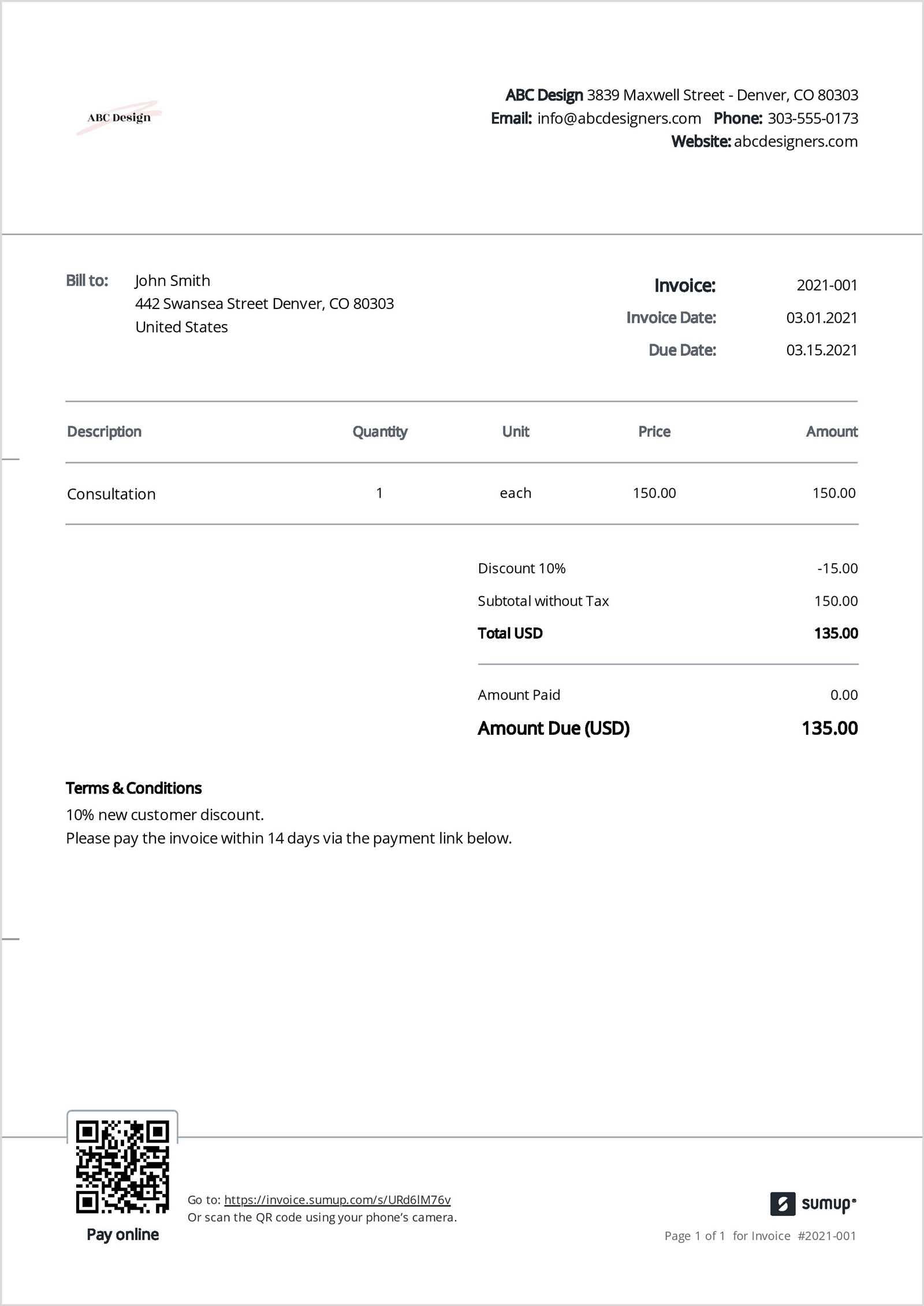

| Section | Description | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Contact Details | Both parties’ names, addresses, and communication information for easy reference. | |||||||||||||||||||||||

| Work Summary | A detailed description of the tasks performed, including time spent and any deliverables. | |||||||||||||||||||||||

| Payment Terms | Clear instructions on due dates, payment methods, and any penalties for late payment. | |||||||||||||||||||||||

| Total Amount | The total cost of the services, including taxes and any additional charges.Key Features of IT Invoices

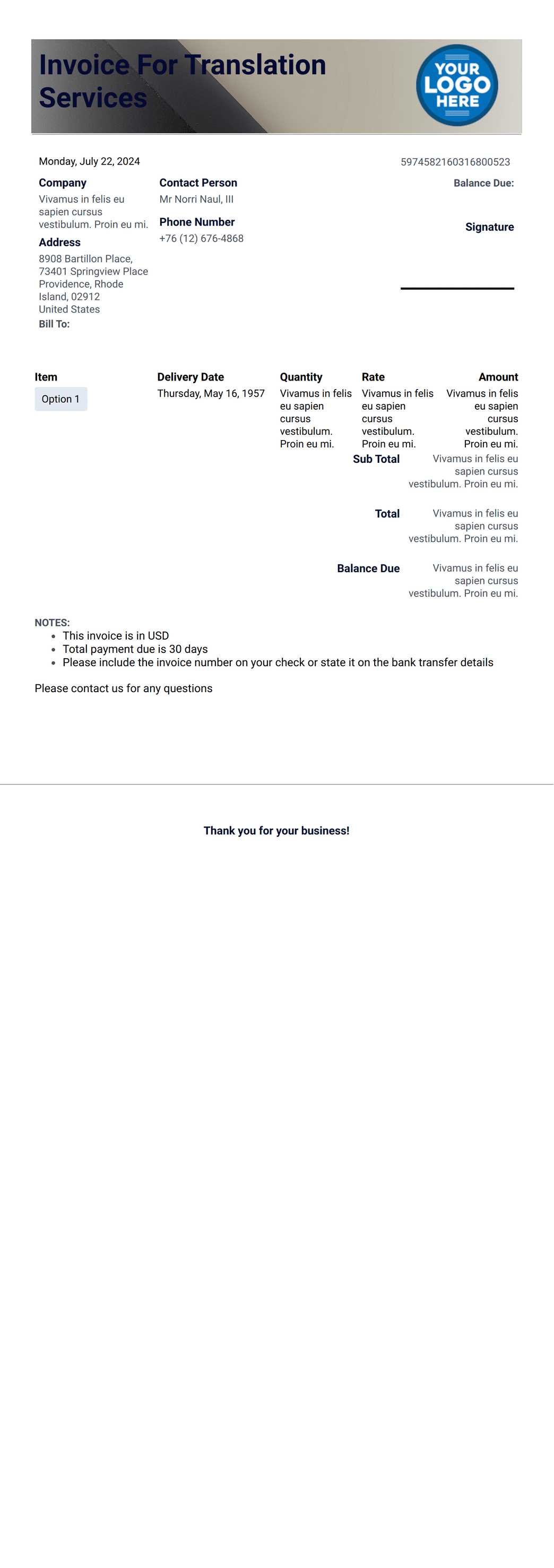

For any business providing professional services, creating a clear and accurate document for requesting payment is essential. These documents should be designed to highlight important information, ensure transparency, and help both parties avoid confusion. A well-constructed billing sheet includes several key elements that make the payment process more straightforward and professional. One of the most important aspects of a billing document is the ability to easily identify the services provided and the total amount due. In addition to that, it should offer details such as payment terms, dates, and any applicable taxes or additional charges. All these features together create a document that serves as both a record of work completed and a formal request for compensation. Below are some of the key components that every billing document should include to ensure clarity and accuracy:

How to Customize Your Template

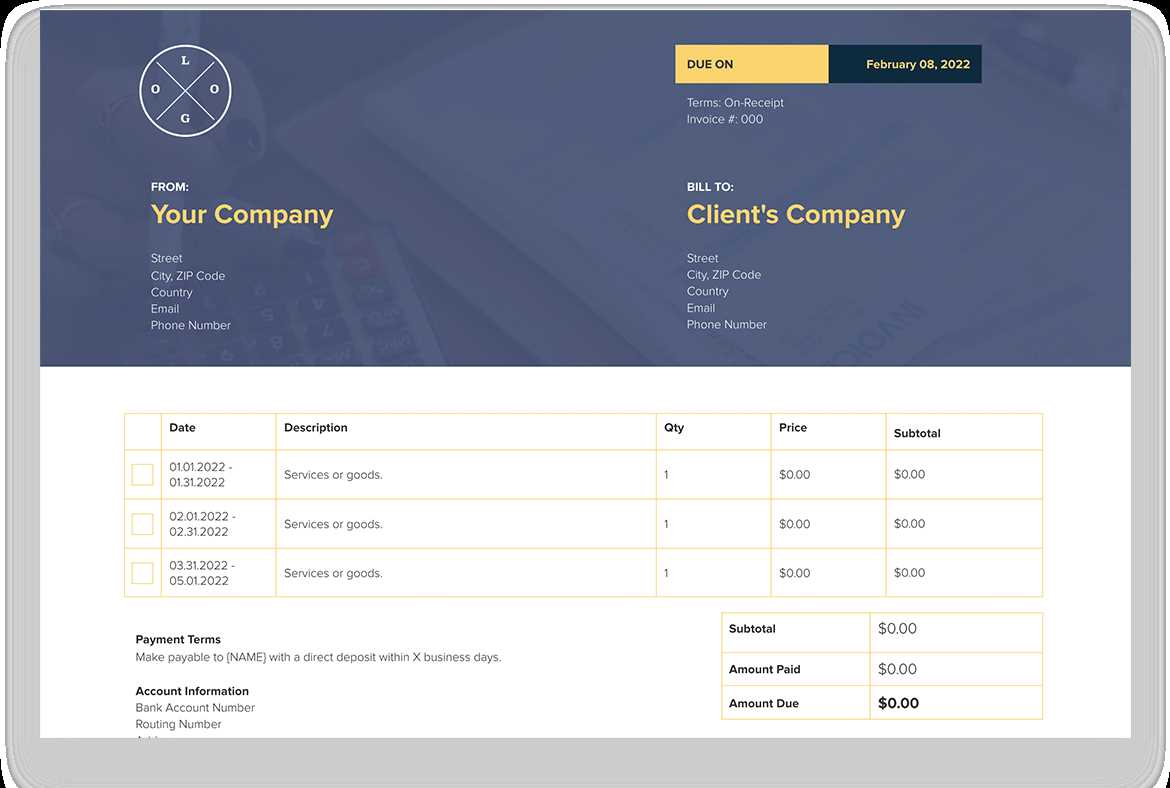

Personalizing your billing document is essential to reflect your business’s unique style and meet specific client needs. A customizable format allows you to adjust sections such as service descriptions, payment terms, and branding elements, ensuring that each document accurately represents your work and is aligned with your company’s professional image. By making simple changes to a pre-designed layout, you can add your logo, adjust fonts, or modify sections to match the scope of your services. Customization not only helps your document look more professional but also ensures that all necessary details are presented clearly, making it easier for your clients to understand and process payments. Here are some tips on how to effectively customize your document for maximum impact:

By following these steps, you can create a personalized, clear, and professional document that streamlines the billing process and enhances your overall client experience. Benefits of Streamlined Billing in ITEfficient billing processes are essential for businesses providing IT-related services. A streamlined approach to managing payments not only reduces administrative workload but also ensures that clients are invoiced accurately and on time. By simplifying the steps involved in requesting payment, businesses can enhance their cash flow, improve client relationships, and reduce the risk of errors or disputes. When the billing process is smooth and automated, it minimizes delays in payments and provides clear communication between the service provider and the client. This efficiency fosters trust, as clients know what to expect and when to expect it, which can lead to quicker settlements and fewer misunderstandings. Here are some of the main advantages of adopting a streamlined payment system:

By embracing a streamlined approach to billing, businesses can create a more efficient, professional, and client-friendly environment, ultimately improving overall business performance and client retention. Essential Elements of IT Service InvoicesFor any IT service provider, having a clear and comprehensive document for requesting payment is key to ensuring smooth transactions and professional interactions with clients. A well-crafted billing document includes specific details that outline the services provided, payment terms, and other crucial information that helps both parties understand their financial obligations. In the case of IT services, the document should go beyond simply listing the cost. It must include precise breakdowns of the work performed, timelines, and any other pertinent factors that contribute to the final amount. Without these key components, it can be difficult to track services or resolve disputes should they arise. The following elements are essential in every billing sheet for IT services:

Including these key details in every billing document ensures that all parties are clear on the financial aspects of the services rendered, which can help avoid misunderstandings and improve the efficiency of payment collection. Common Mistakes in IT Invoicing

Creating a billing document for IT services may seem straightforward, but there are several common mistakes that can complicate the payment process. These errors not only affect your cash flow but also may lead to misunderstandings with clients or even delay payments. Avoiding these mistakes is essential for maintaining a smooth and professional billing system. From omitting essential details to miscalculating fees, these issues can quickly become obstacles in your payment cycle. Identifying and correcting these errors early can save you time, improve client relations, and ensure timely payments. Common Errors in Service Breakdown

Payment and Administrative Errors

By addressing these common mistakes, you can create a more efficient and professional billing process, minimizing issues and ensuring that both you and your clients are on the same page. Choosing the Right Template for Your BusinessSelecting the right billing document format is crucial for maintaining a professional image and streamlining the payment process in your business. The right format not only ensures accuracy but also helps reflect your brand identity and meets the specific needs of your clients. A good format can save you time, reduce errors, and improve communication, ultimately contributing to smoother transactions and better client relationships. When choosing a document design, consider factors such as the complexity of your services, the types of clients you work with, and the level of detail required in the billing process. It’s important to select a format that is both easy to use and comprehensive enough to cover all the necessary details without overwhelming your client. Factors to Consider When Choosing a Document Design

Choosing Between Pre-Designed and Custom Formats

|