Free Self Employed Invoice Template for Word

Creating professional documents for clients is essential for freelancers and small business owners. Whether you’re providing services or selling products, ensuring timely and clear communication of your charges is crucial for smooth transactions. A well-structured document not only reflects professionalism but also helps you keep track of your income and payments.

Customizable billing documents can save you time and effort. Instead of drafting each one from scratch, you can use ready-made formats that allow you to simply fill in the necessary details. This approach ensures that your documents are always consistent, reducing the chances of errors and misunderstandings with clients.

With convenient options available for editing and formatting, these tools can be tailored to your specific needs. Whether you need to include payment terms, tax information, or itemized services, these pre-made layouts are flexible enough to accommodate various business models.

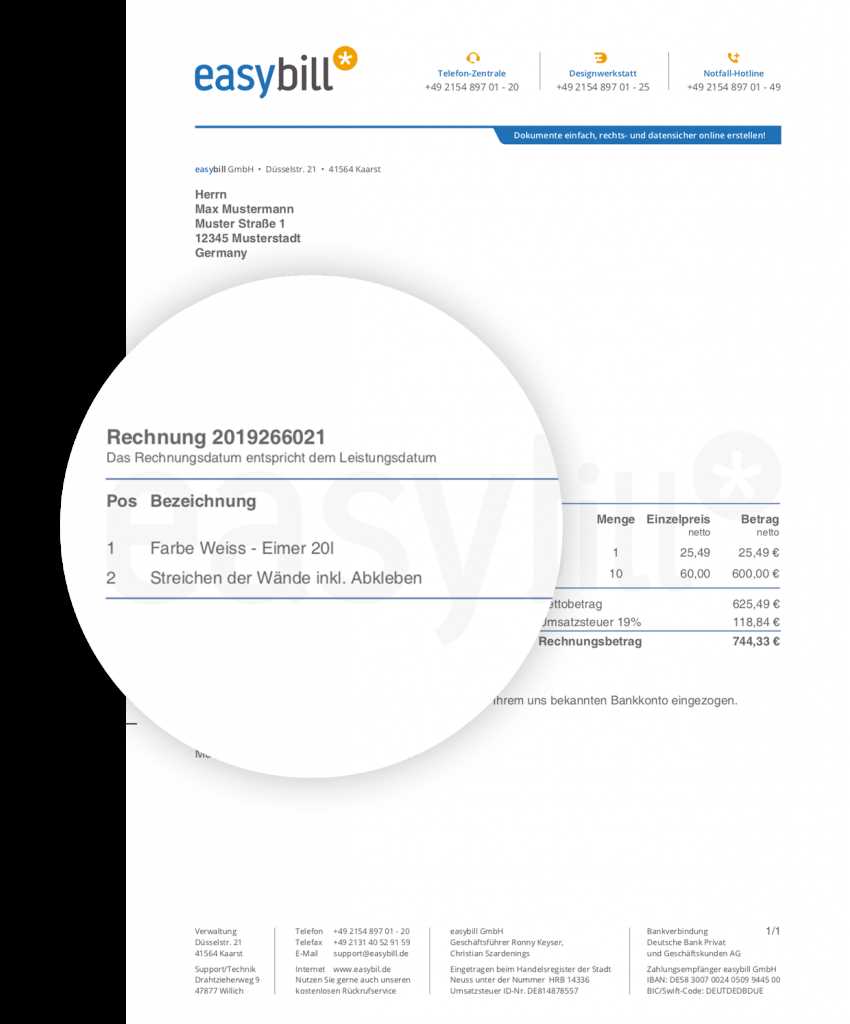

Free Self Employed Invoice Template Word

Managing your billing process efficiently is an essential part of any small business or freelance operation. Using a pre-designed document format can help streamline the process, ensuring consistency and professionalism in all your client communications. With these formats, you can focus on your work while knowing that your billing paperwork is handled quickly and accurately.

Why Choose Pre-Made Billing Formats

Using an existing format provides a structured layout where you only need to insert the relevant details. This eliminates the risk of missing important information or making formatting mistakes. Whether it’s tracking time, adding product descriptions, or listing payment terms, having a standardized design ensures you never forget a key element of the billing process.

How to Customize for Your Needs

One of the key advantages of using these formats is their flexibility. You can adjust them to match your specific business needs. Whether you are a graphic designer, consultant, or contractor, these pre-made documents can be tailored to reflect the unique services you offer and the way you work with clients. Add your business logo, update payment methods, or change the layout to suit your style.

Why Use an Invoice Template

Efficient billing is a cornerstone of managing any business, especially when working independently. Using a pre-designed document to record payments and charges ensures consistency and accuracy, saving valuable time. By relying on a structured format, you can focus more on your work while keeping financial records organized and professional.

Save Time and Effort

Creating a new billing document from scratch each time can be tedious and time-consuming. With a standardized design, you can quickly fill in the relevant details, reducing the amount of time spent on paperwork. This allows you to focus on your core tasks, whether you’re delivering a service or managing client relationships.

Ensure Accuracy and Professionalism

Using a pre-made format minimizes the risk of errors, such as forgetting key information like payment terms, dates, or amounts. Additionally, these documents often include professional layouts, giving your communications a polished and cohesive appearance. This enhances your credibility and helps maintain a positive impression with clients.

Benefits of Using Word for Invoices

When managing billing, the software you choose plays a crucial role in the efficiency and professionalism of your documents. One of the most commonly used tools for creating financial records is a word processor. It offers a range of advantages that make the process quicker and simpler, while also providing flexibility in formatting and customization.

Key Advantages of Using a Word Processor

- Easy to Use: Word processors are intuitive and familiar to most users, making them ideal for creating structured documents without a steep learning curve.

- Customizable Layouts: You can adjust fonts, colors, logos, and even layout details, allowing you to create a unique design that fits your brand or personal style.

- Formatting Flexibility: Whether you need to align text, insert tables, or add images, a word processor provides the necessary tools to ensure that your documents look professional and clear.

- Accessibility: These tools are widely available on most devices, making it easy to create and edit documents from anywhere, whether at home or on the go.

Time-Saving Features

- Pre-built Styles: Many word processors come with pre-made layouts for various types of documents, which can be adapted to suit your specific needs.

- Save and Reuse: Once you create a standard format, you can save it and use it for future projects, minimizing the need to start from scratch each time.

- Automatic Calculations: Although not as advanced as specialized software, some word processors allow basic math functions, which can help you quickly calculate totals or taxes.

How to Customize Your Invoice

Adapting a billing document to meet your specific needs ensures that all important details are included and presented in a way that reflects your business’s unique style. Customization allows you to highlight key information, set clear payment terms, and create a polished, professional appearance that builds trust with clients. Here’s how you can modify the layout and content to suit your business.

Essential Elements to Include

- Business Information: Make sure to include your company name, address, and contact details. This establishes your identity and makes it easier for clients to reach you if needed.

- Client Details: Always add the client’s name, company name (if applicable), and contact information for clarity.

- Services or Products: List the services rendered or products sold with detailed descriptions and corresponding amounts. Be specific to avoid any confusion.

- Payment Terms: Clearly outline your payment policies, such as due dates, accepted payment methods, and late fees if applicable.

Design Customization Options

- Logo and Branding: Incorporate your business logo and brand colors to maintain a consistent visual identity.

- Text Formatting: Adjust fonts, text sizes, and alignments to enhance readability and emphasize important information like totals or due dates.

- Layout Adjustments: Modify the structure of the document, such as column widths, spacing, and positioning, to suit the amount of information you need to present.

- Additional Sections: Add sections for taxes, discounts, or notes as needed to fully capture the scope of your transaction.

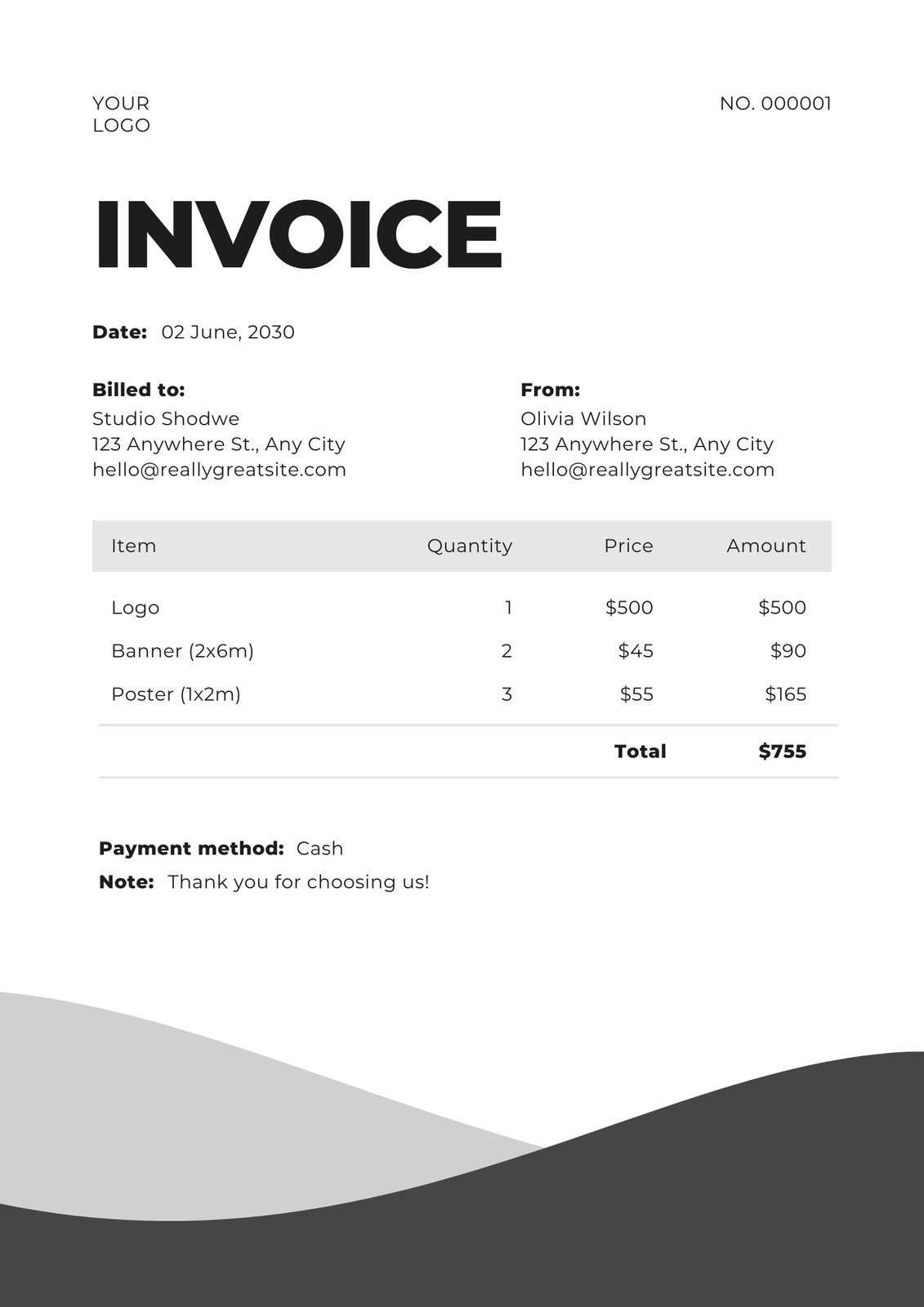

Simple Steps to Create Invoices

Creating a billing document doesn’t have to be complicated. By following a few simple steps, you can ensure that all the necessary information is included, and the layout is clean and professional. Streamlining the process allows you to spend less time on paperwork and more on growing your business.

Step-by-Step Guide

- Choose a Layout: Start by selecting a format that suits your needs. A simple design with clear sections is often best for clarity and ease of understanding.

- Insert Your Business Information: Include your company name, address, phone number, and email. If you have a website, add that as well.

- Client Details: List the client’s full name or business name along with their contact information for easy reference.

- Describe the Services or Products: Be detailed when describing what was provided. Include quantities, prices, and a brief description for each item or service.

- Calculate Total Amount: Ensure all charges are totaled correctly, including taxes, discounts, or additional fees.

- Set Payment Terms: Indicate the payment due date, methods accepted, and any late fees if applicable.

Final Touches

- Check for Accuracy: Verify that all information is correct before sending the document.

- Include a Thank You Note: Add a polite note of appreciation for your client’s business. It’s a small touch that leaves a positive impression.

- Save and Send: Once you’re satisfied with the document, save it and send it via email or through your preferred method of communication.

Free Invoice Templates for Freelancers

Freelancers often juggle multiple projects and clients, making efficient billing a key part of their daily routine. Using pre-designed document formats can significantly reduce the time spent on creating financial records. With the right layout, freelancers can quickly generate professional-looking bills without starting from scratch every time. These formats are easily customizable, helping to maintain a consistent appearance and tone in all communications with clients.

Why Freelancers Need a Professional Document

As a freelancer, maintaining a professional image is essential for building trust and credibility with clients. A well-structured billing document can showcase your attention to detail, helping you stand out from competitors. It also ensures that all necessary information is included, such as service descriptions, payment terms, and due dates, minimizing the chance of disputes or confusion.

Where to Find Customizable Formats

There are numerous resources available online where you can access ready-made formats tailored specifically for freelancers. These options allow you to personalize the document with your business name, logo, and specific payment terms. Most of these designs are easy to edit and adapt to your unique needs, whether you’re offering consulting, design, writing, or other freelance services.

Choosing the Right Invoice Template

Selecting the right billing format is crucial for any business or freelancer. The document you choose will not only reflect your professionalism but also ensure that you include all necessary details for smooth transactions. A well-organized design can help you present your charges clearly and make it easier for clients to understand the payment process.

Key Factors to Consider

- Clarity and Simplicity: Choose a format that is clean and easy to read. Avoid overly complex designs that might confuse the client. A straightforward layout helps ensure all essential information is highlighted clearly.

- Customization Options: Select a layout that allows for easy edits, whether it’s adjusting fonts, adding logos, or inserting payment terms. Flexibility is important to match the format with your specific needs.

- Professional Appearance: Ensure the design you choose aligns with the tone of your business. A polished and cohesive document will make a positive impression on your clients.

- Inclusion of Essential Information: Look for a format that includes sections for all the necessary details, such as service descriptions, payment terms, totals, and contact information.

Where to Find Suitable Formats

- Online Resources: Many websites offer customizable options tailored for different industries and business types. Browse these platforms to find a layout that fits your business style.

- Pre-Built Solutions in Software: Some word processors and business management tools include ready-made formats that can be edited to suit your needs. These often come with automated calculations and easy formatting.

- Customizable Designs from Freelancers: If you have specific branding requirements, you can hire a designer to create a unique layout that reflects your business identity while meeting all invoicing standards.

Essential Elements of an Invoice

For any business or freelance work, a properly structured billing document is essential to ensure smooth transactions and clear communication with clients. Each section of the document serves a specific purpose, making it easier for both you and your clients to track payments and manage financial records. Understanding the necessary components helps to create a complete and professional document every time.

Key Components of a Billing Document

- Business Information: This includes your company name, address, contact details, and tax identification number. It’s important for clients to easily identify who is issuing the document.

- Client Information: List your client’s full name, company name (if applicable), and their contact information. This ensures that the document is directed to the correct recipient.

- Unique Document Number: Assign a unique reference number to each document. This helps both parties keep track of different transactions and simplifies record-keeping.

- Dates: Include the issue date (when the document is created) and the due date (when payment should be received). This helps clarify the payment timeline.

- Description of Goods or Services: Clearly outline what products or services were provided. Include itemized details like quantities, rates, and any additional notes about the work done.

- Pricing and Totals: Specify the cost for each product or service. Include any applicable taxes, discounts, or additional fees, followed by the total amount due.

- Payment Terms: State the methods of payment you accept, your bank details (if necessary), and any late fees or interest charges for overdue payments.

- Notes or Additional Information: You can use this section to include any extra information or a polite thank-you message for the client’s business.

Why These Elements Matter

- Clear Communication: Having all necessary details ensures that there is no confusion regarding services, payment schedules, or any other terms.

- Professionalism: A well-organized document shows clients that you take your business seriously and helps build trust.

- Legal Protection: Including all necessary details helps

Best Practices for Self Employed Invoices

When creating billing documents for your business or freelance work, following best practices ensures that you maintain professionalism and avoid any misunderstandings with your clients. Properly formatted documents with clear terms can help streamline the payment process and improve cash flow. By implementing a few key strategies, you can make the billing process smoother and more efficient.

Key Tips for Effective Billing

- Ensure Accuracy: Double-check all figures, dates, and client details to avoid errors. Accurate information prevents delays and disputes over charges.

- Use a Clear and Professional Layout: A clean and organized design makes the document easier to read and navigate, improving client experience and reducing the chance of overlooked details.

- Set Clear Payment Terms: Always specify due dates, accepted payment methods, and penalties for late payments. This sets clear expectations and encourages timely payments.

- Include a Detailed Description: Ensure you provide a thorough breakdown of services or products, including rates, quantities, and the scope of work completed. This makes it clear what clients are paying for.

- Send Timely and Consistent Invoices: Send invoices promptly after completing work or delivering goods. Consistency in your billing practices builds credibility and ensures regular payments.

Sample Billing Document Layout

Section Details Business Information Your company name, address, phone number, and email Client Information Client’s name, business name, address, and contact details Unique Document Number Assign a unique reference number for tracking purposes Date Issued The date when the document is created Payment Due Date Clearly state when the payment is due Service Description Detailed list of services provided or products sold Amount and Total Itemized pricing, taxes, and any discounts or fees Payment Methods Indicate acceptable payment methods (bank transfer, PayP Common Mistakes to Avoid in Invoices

Creating accurate and clear billing documents is essential for smooth business transactions. Even minor errors can lead to delays in payments or confusion with clients. It’s crucial to be aware of the most common mistakes that can undermine the professionalism of your documents and make sure to avoid them. Below are some common pitfalls and how to prevent them.

Key Mistakes to Watch Out For

- Missing or Incorrect Client Details: Not including the correct client name, address, or contact information can delay payments and cause confusion. Always double-check these details before sending.

- Failure to Include a Unique Document Number: Without a unique reference number, both you and your client may find it difficult to track transactions. This is especially important for record-keeping purposes.

- Unclear Service Descriptions: Vague descriptions can lead to misunderstandings about what was provided. Be specific about the products or services delivered, including quantities and rates.

- Incorrect Pricing or Totals: Ensure that your pricing is accurate and that all calculations are correct. This includes taxes, discounts, and any additional charges.

- Missing Payment Terms: Not specifying the payment due date or methods of payment can lead to confusion. Clearly state when payment is expected and how it should be made.

- Ignoring Late Payment Fees: If you have terms for late payment penalties, make sure they are clearly mentioned. This encourages timely payments from clients.

Example of Potential Mistakes

Error Consequence How to Fix Missing Client Information Delays in communication and payments Double-check the client’s contact details before sending Incorrect Calculations Disputes over pricing and payment amounts Use a calculator or automatic tools to verify totals No Payment Terms Confusion about when and how to pay Always include clear payment terms and methods Unclear Service Description Misunderstanding of what was delivered Provide detailed descriptions of all items or services By being aware of these common errors and taking steps to prevent them, you can ensure that your billing process is both efficient and professional, leading to smoother transactions and better relationships with your clients.

How to Save Time with Templates

Creating a new billing document from scratch every time can be time-consuming and repetitive. By utilizing pre-designed structures, you can significantly reduce the amount of time spent on administrative tasks. These ready-made formats allow you to focus more on your actual work rather than on formatting or entering the same information repeatedly. With the right structure, you can easily customize and send professional documents in just a few minutes.

How Templates Simplify the Process

Using a pre-built layout eliminates the need to start from scratch each time you need to send a bill. With the key sections already laid out–such as client details, service descriptions, and payment terms–you only need to fill in the unique aspects of each transaction. This reduces errors and ensures consistency across all your documents.

Benefits of Using Pre-Formatted Documents

- Faster Turnaround: With a structure already in place, you can complete each document more quickly, allowing you to send it immediately after completing the work.

- Consistency: Every billing document will look the same, helping to maintain a professional appearance and reducing the chances of missing important information.

- Customization: While templates are standardized, they are also flexible, allowing you to easily modify details like client information, pricing, and service descriptions.

- Reduced Mistakes: Since the main structure is already set up, there is less chance for errors, helping to avoid misunderstandings with clients.

By incorporating pre-designed structures into your routine, you streamline your workflow and minimize time spent on administrative tasks, giving you more time to focus on your core business activities.

Understanding Numbering Systems for Billing Documents

Having a clear and organized numbering system for your billing documents is crucial for both tracking and accounting purposes. A well-structured numbering system ensures that each document is unique, easy to reference, and can be organized in a logical sequence. Whether you’re managing a small business or handling multiple clients, an effective system helps prevent confusion, errors, and potential delays in payments.

Why Numbering Is Important

Each document should have a unique number to distinguish it from others. A consistent numbering system allows you to quickly locate a specific document, verify payments, and maintain accurate financial records. It also provides a clear audit trail, which can be important for tax purposes or if a dispute arises.

Popular Numbering Methods

- Sequential Numbering: This is the simplest and most common system, where each document is assigned a consecutive number. For example, the first document might be #001, the second #002, and so on.

- Yearly or Monthly Prefixes: Some businesses use prefixes based on the year or month for easier tracking. For example, a document issued in 2024 could be numbered as “2024-001”, or “01-2024-001” for January.

- Client-Based Numbers: Another approach involves incorporating the client name or code into the numbering system. For example, “Client001-2024-001” could refer to the first document for a particular client in 2024.

- Alphanumeric Systems: Combining numbers and letters can help create a more unique system. For example, “A-001”, “B-001”, etc., where each letter represents a different project or client group.

Choosing the right system depends on your needs, the size of your business, and how many documents you generate. The key is to ensure consistency, simplicity, and ease of use,

Managing Payments with Billing Documents

Effectively managing payments is a critical part of maintaining smooth financial operations. By using a structured document format for your transactions, you can ensure timely payments, clear communication, and proper record-keeping. A well-organized billing document not only helps clients understand the charges but also makes it easier for you to track outstanding payments and follow up when necessary.

How Structured Documents Help with Payment Management

Using a pre-designed format for each transaction ensures consistency, reducing the risk of errors that could delay payments. By detailing the payment terms, due dates, and accepted payment methods upfront, both parties have a clear understanding of expectations. Additionally, including a unique reference number for each document makes tracking payments and following up on overdue balances simpler.

Key Strategies for Managing Payments

- Set Clear Payment Terms: Clearly state when the payment is due and the acceptable methods (e.g., bank transfer, credit card, PayPal). This removes any ambiguity and helps avoid delays.

- Offer Multiple Payment Options: Allow clients to choose their preferred payment method. The easier it is for them to pay, the more likely they will do so promptly.

- Use a Reminder System: If a payment is overdue, a polite reminder can go a long way. Include a section in your document that outlines late fees or interest charges for overdue payments.

- Track Outstanding Balances: Keep a record of all payments made and any remaining balances. This will help you stay organized and follow up on any outstanding amounts.

- Automate Recurring Payments: For clients with regular billing, automating the payment process through subscription or direct debit can help ensure timely payments.

By using a structured approach to managing payments, you can streamline the billing process, reduce payment delays, and build stronger relationships with your clients.

How to Send Invoices Effectively

Sending billing documents efficiently is essential for ensuring timely payments and maintaining a professional relationship with clients. The process should be straightforward and clear, reducing the chances of confusion or delays. By following a few key practices, you can improve the way you send these documents and increase the likelihood of prompt payment.

Steps to Streamline the Sending Process

- Choose the Right Delivery Method: Determine whether email or physical delivery is more appropriate for each client. Email is typically faster and more efficient, but some clients may prefer printed copies for their records.

- Use Clear and Professional Communication: When sending your document, include a brief and polite message that specifies the amount due, the payment due date, and any relevant terms. Ensure your tone is respectful and professional to foster positive relations.

- Send Promptly: Aim to send your billing documents as soon as the work is completed or the goods are delivered. This shows that you are organized and helps to initiate the payment process quickly.

- Follow Up if Necessary: If a payment is not received by the due date, it’s important to follow up politely. Send a reminder email or make a phone call to ensure that the client is aware of the outstanding balance.

- Keep Track of Sent Documents: Maintain a record of all documents sent, including dates and methods of delivery. This helps you stay organized and provides you with documentation in case you need to reference it in the future.

Best Practices for Delivery

- File Formats: When sending electronically, ensure that the document is in a universally accessible format, such as PDF. This helps avoid any issues with file compatibility.

- Use a Professional Email Address: Send billing documents from a business email address rather than a personal one. This adds a layer of professionalism to your communication.

- Confirmation of Receipt: Ask clients to confirm receipt of the document. This ensures that they have received

Tracking Payments and Due Dates

Keeping track of payments and deadlines is an essential part of managing any business. Without a system to monitor outstanding balances and due dates, it becomes easy to lose track of what has been paid and what is still pending. A good tracking method not only ensures that payments are received on time but also helps in maintaining organized financial records, reducing stress and preventing unnecessary delays.

To stay on top of payments, it’s important to maintain a clear record of when each transaction is due and what has been paid. Regularly updating this information ensures that you can take prompt action if any payments are overdue, and it helps to build trust with clients by showing that you are organized and professional in your dealings.

There are a variety of tools and methods you can use to track due dates and payments effectively, ranging from simple spreadsheets to more advanced accounting software. The key is to find a method that fits your business needs and ensures that you can easily follow up when necessary.

Using Word for Professional Invoices

Creating professional documents is an important part of any business, and using a widely accessible software can help ensure your documents look polished and consistent. By using a popular word processing program, you can easily design and customize billing documents that meet the expectations of your clients. With the right layout, you can quickly generate clear, readable, and professional-looking records that reflect your business’ attention to detail.

Why Use a Word Processor for Billing?

- Ease of Use: Most people are already familiar with word processing software, making it a quick and easy tool to generate documents without needing special design skills.

- Customizability: You can fully customize the document to match your branding and business needs. Fonts, colors, and layout can be adjusted to create a unique and professional look.

- Standardized Format: Word processors offer simple ways to create a consistent structure across all your records, ensuring every document looks the same and maintains a high level of professionalism.

- Accessibility: Documents created in word processing programs can be easily saved, edited, and shared electronically, making it convenient for both you and your clients to access and manage them.

Tips for Professional Design

- Include Essential Information: Make sure to add your business name, address, contact information, as well as your client’s details, and a breakdown of services or products provided.

- Organize Layout Clearly: Use headers and bullet points to make information easy to read. A clean, organized layout will leave a positive impression and ensure clarity for your clients.

- Set Payment Terms: Clearly specify payment deadlines and accepted methods to avoid confusion or delays.

- Use Professional Fonts: Stick with easy-to-read fonts like Arial or Times New Roman, and avoid using too many different styles that can make the document look cluttered.

Using a word processing program for your billing documents allows you to combine professionalism with convenience. With a few simple adjustments, you can produce documents that not only look great but also help ensure smooth financial transactions with your clients.

Where to Find Free Billing Document Formats

When running a business, it’s essential to have professional, well-structured documents for transactions. Fortunately, there are many places where you can find pre-made formats for your billing needs without having to start from scratch. These resources provide ready-to-use designs that are both practical and customizable, making it easier to maintain an organized financial system.

Top Resources for Downloading Free Billing Formats

Here are some reliable places where you can find free templates for your business documents:

Resource Description Website Microsoft Office Offers a variety of pre-built designs for different types of documents, including billing records, which can be easily edited in your preferred software. templates.office.com Google Docs Provides simple, cloud-based formats that you can access from anywhere, making it easy to create and share your billing documents instantly. docs.google.com Canva Known for its customizable designs, Canva lets you create visually appealing billing documents with a user-friendly drag-and-drop interface. canva.com Zoho Provides a range of customizable formats and tools for generating billing records, including automated features for recurring payments. zoho.com FreshBooks While primarily an accounting software, FreshBooks offers free bi Tips for Ensuring Document Accuracy

Accurate billing documents are essential for maintaining a professional image and ensuring that payments are processed without delay. Errors in pricing, client details, or services provided can lead to confusion and payment disputes. By following a few key tips, you can ensure that your financial records are precise and error-free, making the process smoother for both you and your clients.

Steps to Improve Document Accuracy

- Double-Check Client Information: Always verify that the client’s name, address, and contact details are correct before sending a document. This reduces the risk of miscommunication or delayed payments.

- Review Service or Product Details: Ensure that all the services or products listed are accurate and match the agreed terms. This includes quantities, prices, and any special conditions or discounts that were discussed.

- Verify Payment Terms: Clearly define the payment due date, method, and any additional charges such as late fees. Misunderstandings about payment terms can lead to unnecessary delays or disputes.

- Check Calculation Accuracy: Ensure that all numbers, such as totals, taxes, and discounts, are calculated correctly. Double-check the math to avoid any discrepancies that could delay payment or affect client trust.

- Use Consistent Formats: Maintain consistency in formatting, especially with numbers, dates, and amounts. This makes it easier for both you and your client to quickly read and understand the document.

Tools for Accuracy

- Use Accounting Software: Tools like accounting programs can help automate calculations, track hours worked, and generate standardized documents, reducing the risk of human error.

- Use Spell Check: Always use a spell-checking tool to ensure there are no typos in the client’s name, your business name, or other important details.

- Proofread: Before sending any document, take the time to proofread it. A second set of eyes can often spot mistakes you may have missed.

By following these practices, you can minimize mistakes, create more reliable documents, and maintain a smooth billing process, ultimately lea