Printable Invoice Templates for Easy Business Billing

Managing payments and transactions efficiently is crucial for any business. One of the key components in this process is having the right tools to generate clear and accurate billing documents. These documents not only serve as records of sales but also reflect your professionalism and attention to detail. By using pre-designed formats, businesses can save time and ensure consistency across all transactions.

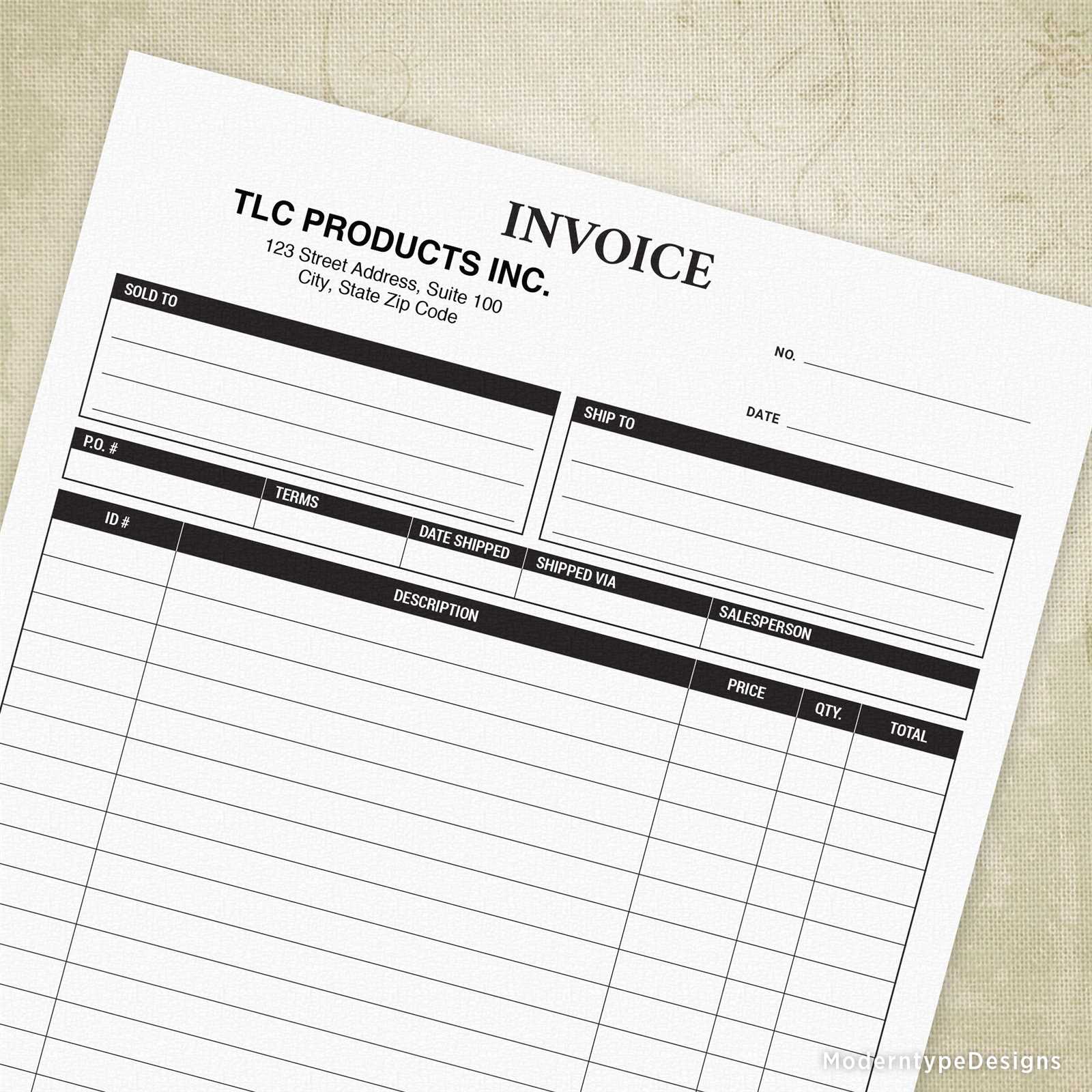

Customizable formats allow you to personalize your financial records, adding company logos, client details, and payment terms. This makes the billing process smoother for both the sender and the recipient. With the right document structure, you can ensure clarity, avoid errors, and make sure all necessary information is included.

Whether you’re a freelancer, a small business owner, or managing a larger enterprise, having easy access to well-organized, user-friendly billing formats can streamline your workflow. These resources help maintain a professional appearance while reducing the time spent on manual calculations and layouts.

Benefits of Using Printable Invoice Templates

Using pre-designed billing documents offers a range of advantages for businesses of all sizes. These tools simplify the financial aspect of operations by providing an organized and consistent approach to managing payments. By relying on structured formats, businesses can reduce human error and ensure that all necessary details are included in every transaction.

Time Efficiency and Convenience

One of the primary benefits of using such documents is the significant amount of time saved. Instead of manually creating each new record from scratch, users can easily customize an existing layout with the required information. This allows for quicker processing of transactions and minimizes the time spent on administrative tasks.

Professional Appearance and Accuracy

Consistency is key when maintaining a professional image, and using standardized billing formats ensures that every document is neat and well-organized. Clients are more likely to trust businesses that present clear, easy-to-read records. Additionally, automated fields and pre-set calculations help eliminate mistakes that might occur with manual entries, ensuring the accuracy of financial data.

How to Customize Your Invoice Template

Customizing your billing documents allows you to make them more aligned with your business branding and requirements. By adjusting elements like company logos, contact details, and payment terms, you can create professional-looking records that represent your business effectively. This process helps ensure clarity and reduces the risk of misunderstandings with clients.

Steps to Personalize Your Document

To get started, follow these simple steps to modify a standard document layout for your business needs:

- Add Your Business Logo: Include your company logo at the top for a personalized touch.

- Enter Contact Information: Ensure that your business address, phone number, and email are correctly listed for easy communication.

- Set Payment Terms: Customize the payment due date and any late fees, if applicable.

- Include Custom Fields: Add specific information relevant to your business, such as project codes or reference numbers.

Design Tips for a Professional Look

While customization is important, maintaining a clean and professional design is equally crucial. Here are some tips to ensure your document looks polished:

- Use Clear Fonts: Opt for legible fonts that are easy to read on both printed and digital formats.

- Keep the Layout Simple: Avoid clutter; ensure there is enough white space around each section.

- Highlight Key Information: Use bold or underlined text to emphasize important details, like payment amounts or due dates.

Top Features to Look for in Invoice Templates

When choosing a document layout for your billing needs, it’s important to select one with features that ensure both clarity and professionalism. The right structure can make transactions smoother, reduce errors, and present your business in the best light. Key elements in an effective layout help ensure that all necessary details are included while keeping the design simple and user-friendly.

Key Elements for an Effective Layout

Here are some essential features that every well-designed document should have:

- Customizable Fields: The ability to modify sections like item descriptions, amounts, and terms is critical for flexibility.

- Clear Payment Terms: Clearly stating due dates, payment methods, and any late fees ensures there are no misunderstandings.

- Automated Calculations: Built-in formulas that automatically calculate totals and taxes save time and reduce errors.

- Professional Design: A clean, modern layout that aligns with your brand helps maintain a professional image.

Additional Features for Added Convenience

Some additional features can further enhance the user experience and streamline your workflow:

- Multiple Currency Options: If you deal with international clients, having support for different currencies can be helpful.

- Client Information Storage: The ability to save and reuse client details for faster processing is a valuable time-saving feature.

- Online Integration: Templates that integrate with accounting or payment software simplify the entire financial process.

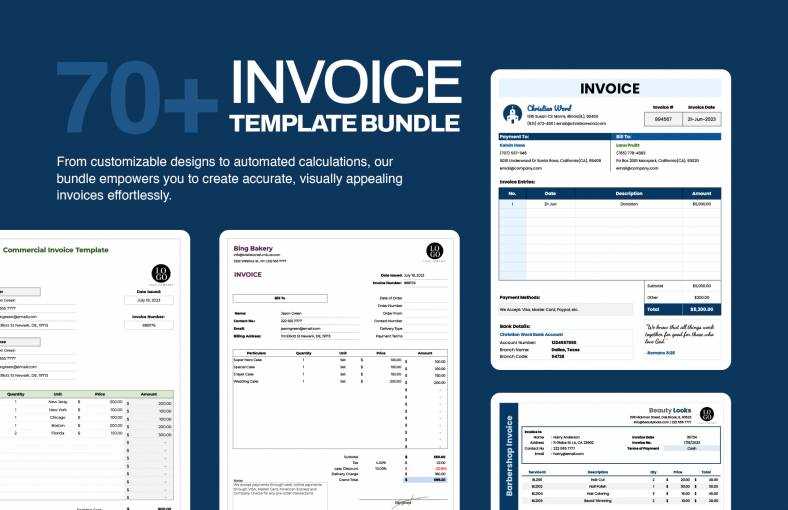

Free vs Paid Printable Invoice Templates

When choosing a document layout for your billing needs, businesses often face the decision between free and paid options. Both have their advantages, but the right choice depends on the specific needs of your business. Free options are widely available and may suit small businesses or freelancers with simple requirements, while paid options tend to offer more advanced features and customization options for larger or more complex operations.

Advantages of Free Options

Free billing documents are a great option for businesses just starting out or those with basic needs. Here are some benefits of using free formats:

- No Cost: Free options are, of course, available at no charge, making them ideal for startups or small businesses with tight budgets.

- Easy Access: Most free layouts are easy to find online and can be quickly downloaded or accessed through various platforms.

- Basic Functionality: For simple transactions, free formats often include all the necessary fields for creating clear and accurate documents.

Benefits of Paid Options

Paid layouts offer a range of advanced features that can be particularly useful for businesses with more specific needs or higher volumes of transactions. Some key benefits include:

- Customization: Paid documents often allow for greater flexibility in design, enabling you to add custom fields, logos, and brand elements.

- Advanced Features: Paid layouts may include automated calculations, integration with accounting software, or multi-currency support, streamlining your billing process.

- Customer Support: Many paid services provide access to support teams, helping resolve any issues quickly and ensuring you’re using the system to its full potential.

Where to Find Reliable Invoice Templates

Finding a trustworthy source for your billing documents is essential to ensure that you’re using accurate, professional, and easy-to-customize formats. Whether you need a simple layout or a more advanced design, there are numerous places where you can find high-quality options, both free and paid. The right resource can save you time and help you maintain consistency across all transactions.

Online Platforms and Websites

There are many online platforms where you can find reliable and customizable document layouts for your business. Here are some common sources:

- Document Creation Websites: Sites like Canva and Microsoft Office Templates offer a wide selection of easy-to-edit designs that can be tailored to your needs.

- Freelancer Platforms: Freelance marketplaces such as Fiverr and Upwork have professionals who can create a custom document for your business, ensuring it meets your specific requirements.

- Online Accounting Tools: Accounting software like QuickBooks and FreshBooks often provide built-in, customizable billing formats that integrate seamlessly with your business operations.

Design Marketplaces and Paid Services

If you’re looking for more advanced or specialized layouts, paid services and design marketplaces may be a better fit. Here are some options to consider:

- Template Marketplaces: Websites such as Envato Elements and Creative Market offer high-quality, professionally designed layouts for purchase.

- Specialized Services: Paid platforms like Invoicely and Zoho Invoice provide customizable solutions with additional features like automated reminders and integration with payment gateways.

- Design Agencies: If you need a fully customized solution, you can hire a design agency to create a unique layout tailored specifically to your business needs.

How to Ensure Accurate Invoice Details

Ensuring that all the details on your billing documents are accurate is crucial for maintaining professionalism and avoiding potential issues with clients. A well-detailed document not only helps in smooth financial transactions but also builds trust and credibility. Proper attention to every element, from item descriptions to payment terms, can prevent costly errors and ensure your business is paid promptly.

To guarantee accuracy, it’s essential to follow a few key practices when creating and reviewing your records:

- Double-check Client Information: Make sure the client’s name, address, and contact details are correct. This is especially important for large transactions or international clients where errors can cause delays.

- Verify Product or Service Details: Ensure that the descriptions, quantities, and prices are accurate. Mistakes in this area can lead to confusion or disputes over charges.

- Review Dates and Terms: Always confirm that the issue date, due date, and payment terms are clearly stated. This includes checking for any discounts, taxes, or additional fees.

- Cross-check Totals and Calculations: Manually or automatically calculate all totals to ensure there are no discrepancies between item costs, tax rates, and the final amount due.

- Use Clear, Consistent Formatting: A consistent format reduces the risk of errors and helps make the document easy to read and understand, minimizing the chance of misinterpretation.

Common Mistakes to Avoid in Invoices

Creating billing documents requires attention to detail, as even minor mistakes can lead to confusion, payment delays, or client dissatisfaction. It’s crucial to be aware of common errors that can occur when generating financial records. By avoiding these pitfalls, you ensure smooth transactions and maintain a professional reputation with your clients.

Here are some of the most common mistakes to watch out for:

- Incorrect Client Information: Always double-check the recipient’s name, address, and contact details. Mistakes here can delay payment or cause confusion over the billing process.

- Missing or Inaccurate Dates: Failing to include the issue date or the due date, or listing them incorrectly, can create misunderstandings about payment terms and deadlines.

- Unclear Payment Terms: Vague or incomplete payment instructions, such as unclear due dates or payment methods, can cause delays or disputes over when and how payment should be made.

- Mathematical Errors: Even small errors in calculations, like incorrect totals, tax rates, or discount percentages, can make the billing document look unprofessional and cause confusion for both you and your client.

- Missing Important Details: Forgetting to include critical information such as item descriptions, quantities, or unit prices can make it difficult for the client to understand the charges and might lead to delayed payments.

- Inconsistent Formatting: A disorganized layout can make it difficult for clients to quickly find the information they need, leading to frustration and delays in processing your payment.

Best Software for Editing Invoice Templates

When creating and customizing billing documents, having the right software can make a significant difference in both the efficiency and professionalism of your work. The right tool should allow you to easily edit and personalize every aspect of the document, from layout design to calculations. Whether you’re a freelancer, small business owner, or part of a larger company, using the right editing software ensures that your financial records are accurate and well-presented.

Top Tools for Customizing Billing Documents

Here are some of the best software solutions for editing and creating professional billing records:

- Microsoft Word: A widely-used word processor with customizable document layouts, offering flexibility for businesses that need a simple, easy-to-edit design without extra complexity.

- Canva: Known for its drag-and-drop interface, Canva makes it easy to design professional billing records, offering a variety of templates that can be customized with logos, colors, and text.

- QuickBooks: This accounting software includes built-in tools for generating and customizing detailed financial documents. It also integrates with accounting and payment systems, making it ideal for businesses managing larger volumes of transactions.

- Zoho Invoice: A cloud-based service designed specifically for invoicing, Zoho provides a wide range of customization options, from personalized branding to automated billing features. It’s perfect for businesses that need an all-in-one solution for managing client payments.

Additional Options for Specialized Needs

If you’re looking for more advanced functionality or specialized features, consider the following options:

- FreshBooks: This accounting software is focused on small businesses and freelancers, providing an easy-to-use interface with customizable templates and automated billing tools.

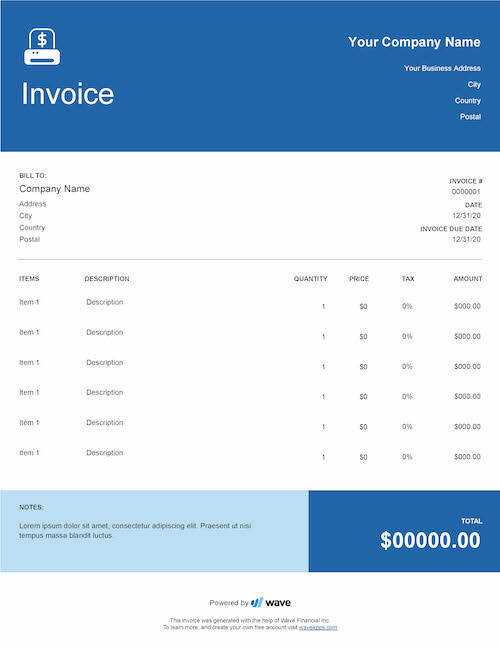

- Wave: A free cloud-based accounting tool, Wave offers robust invoicing features, including the ability to create and customize professional-looking financial documents with ease.

- Excel or Google Sheets: For users who prefer working with spreadsheets, both Excel and Google Sheets allow you to create detailed records with custom formulas, giving you full control over the calculations and layout.

How Printable Invoices Save Time

Streamlining the billing process is essential for any business, as it directly impacts cash flow and operational efficiency. Using ready-to-use billing documents can significantly reduce the time spent on creating, organizing, and managing financial records. These tools eliminate the need for repetitive manual work, allowing businesses to focus on their core tasks while ensuring accuracy and consistency in each transaction.

Efficiency Gains Through Pre-designed Layouts

One of the biggest time-saving benefits comes from using pre-made designs that are easy to customize. Here are a few ways these resources help save time:

- Quick Customization: Instead of starting from scratch, businesses can input key information like client details, item descriptions, and prices directly into an existing format, reducing the time spent on document creation.

- Automated Calculations: Many billing formats come with built-in formulas that automatically calculate totals, taxes, and discounts, eliminating manual calculations and reducing the risk of errors.

- Standardized Format: Using a consistent design for all your financial records ensures uniformity, so there’s no need to adjust layouts or formatting every time you generate a new document.

Time Savings with Streamlined Distribution

Not only does using ready-made designs speed up the creation process, but it also helps businesses distribute their records more efficiently:

- Digital Delivery: Many tools allow you to save and send your documents electronically, cutting down on mailing time and ensuring faster receipt by clients.

- Templates for Recurring Clients: If you work with repeat customers, you can easily reuse their information from previous transactions, speeding up the process even further.

- Integrated Systems: Some software tools integrate directly with payment processors, allowing clients to pay immediately after receiving their documents, which accelerates

Creating Professional Invoices with Templates

Maintaining a professional appearance in financial documents is essential for building trust and credibility with clients. By using well-designed layouts, businesses can present clear, organized records that convey reliability and attention to detail. These pre-structured formats allow for easy customization while ensuring that all the necessary details are included, making it simple to create polished, professional documents every time.

Customizability is one of the key advantages when using pre-made designs. You can personalize the document with your company’s branding, including logos, color schemes, and specific terms. This not only enhances the document’s professionalism but also reinforces your brand’s identity with every transaction.

Consistency in your financial records is vital. With a standardized format, every document you create will follow the same structure, making it easier for clients to understand and process your charges. This consistency also reduces the chances of errors, ensuring that the right details are always included and properly formatted.

Additionally, many tools that offer these layouts include automated features like pre-filled fields for client information, itemized lists for services or products, and automated tax calculations, all of which save time and improve accuracy. With the right layout, businesses can confidently send out professional, error-free documents that reflect their commitment to quality and efficiency.

How to Use Templates for Small Businesses

For small businesses, managing administrative tasks efficiently is key to growth and sustainability. Using pre-designed documents for financial transactions can simplify many aspects of business operations, from creating accurate records to ensuring timely payments. By leveraging customizable layouts, small business owners can create professional documents quickly, saving valuable time and minimizing the risk of errors.

One of the main benefits of using pre-structured designs is the time savings. Instead of manually creating a new document for each transaction, you can simply input the relevant information into a ready-made layout. This allows for faster generation of records, which is especially important for small businesses with frequent client interactions and regular billing cycles.

Consistency is another advantage. With a pre-designed format, all your records will follow the same structure, ensuring that clients always receive clear and well-organized documents. This consistency helps to maintain a professional image, which is important for building trust with clients and partners.

Customization options also allow small businesses to tailor documents to their specific needs. Whether you need to add company logos, adjust payment terms, or include special discounts or fees, a customizable layout ensures you can personalize your documents without starting from scratch each time. Additionally, many platforms offer features such as automated calculations for taxes and totals, further improving accuracy and reducing manual work.

By using these pre-structured solutions, small businesses can streamline their billing processes, avoid mistakes, and present a polished, professional image to clients. This efficiency helps maintain a smooth cash flow and strengthens client relationships, key factors for any small business to thrive.

Integrating Invoice Templates with Accounting Software

Integrating your billing documents with accounting software offers significant advantages, particularly when it comes to efficiency and accuracy. By connecting your records with a financial management system, you can streamline the process of tracking payments, generating reports, and maintaining a seamless workflow. This integration allows for automated data transfer between systems, reducing manual input and minimizing errors in both billing and accounting.

Automation is one of the main benefits of integrating your billing documents with accounting software. When you use a system that can automatically populate details from previous transactions, or even calculate totals and taxes, it drastically reduces the time spent on each task. This not only saves time but also ensures that your records are accurate, without the risk of manual mistakes.

Additionally, integration ensures that all your financial data is stored in one centralized location, making it easier to manage your accounts, track payments, and generate reports. Many accounting systems allow you to customize the format of the documents you create, so you can maintain consistency in your business’s financial records while also taking advantage of the software’s more advanced features.

Real-time Updates are another important feature. When payment information is entered, the system can update both the financial records and any outstanding balances instantly. This helps small business owners stay on top of their cash flow, quickly identifying overdue payments and reconciling accounts without needing to manually cross-check multiple sources of data.

By integrating your billing solutions with accounting tools, you not only improve your workflow but also ensure that your financial management remains organized, consistent, and efficient. Whether you’re handling a few transactions or managing large volumes, this integration supports a more streamlined, error-free process that helps your business run more smoothly.

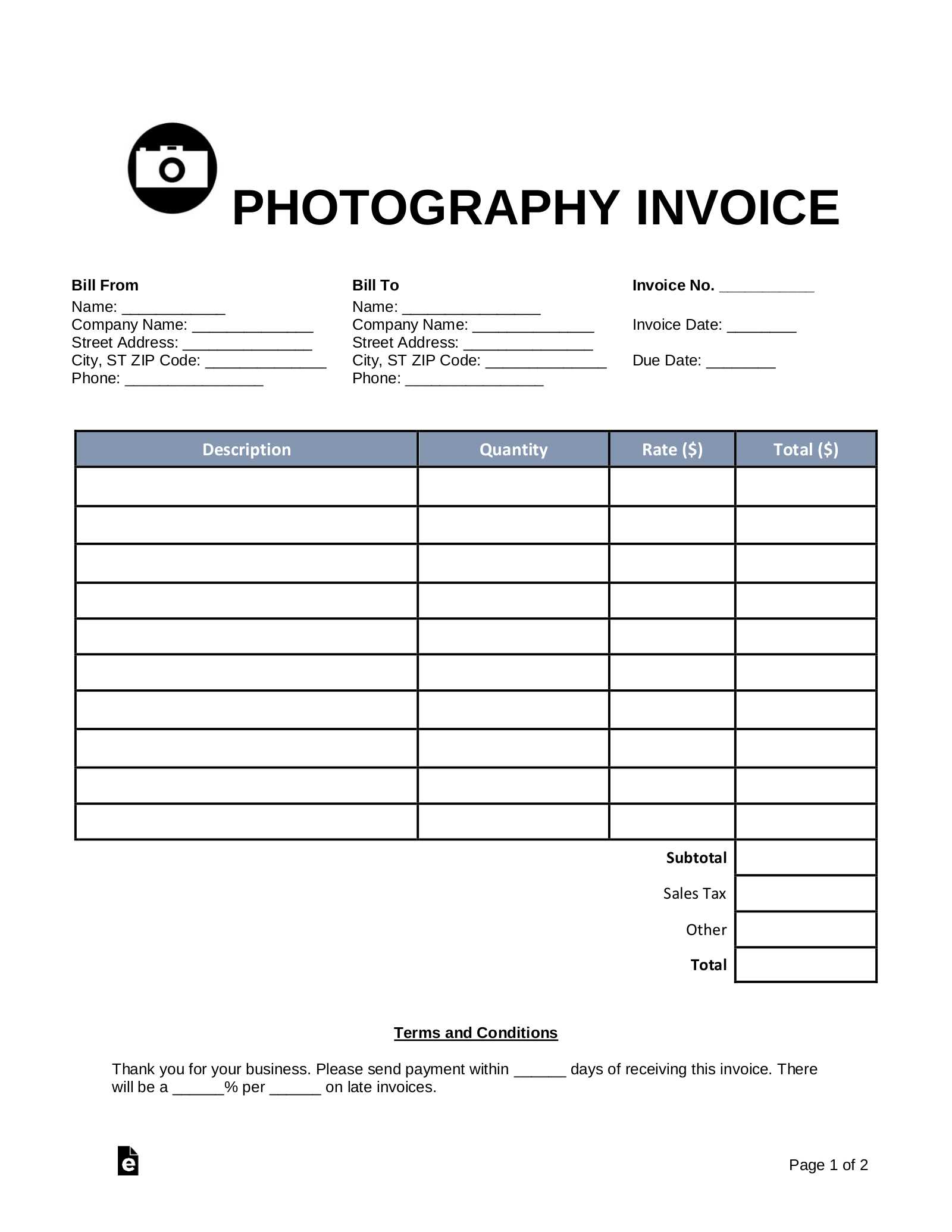

Printable Invoice Templates for Freelancers

Freelancers often juggle multiple projects, deadlines, and clients, making it essential to maintain an organized and professional approach to financial transactions. Using structured documents for billing helps ensure that payments are clear, timely, and free of disputes. Ready-made designs specifically suited for freelancers offer a convenient and effective way to streamline this process, allowing for consistent and professional record-keeping.

When choosing billing documents, freelancers should look for layouts that meet their specific needs. These designs typically include sections for client information, project details, hours worked, and payment terms, making it easier to customize for each individual job. Some of the key features to look for include:

- Customizable Fields: The ability to quickly update client names, project descriptions, and payment amounts is crucial for freelancers managing multiple clients and projects simultaneously.

- Clear Payment Terms: Freelancers often work on varied payment schedules, so clear terms for due dates, late fees, and hourly rates are essential to avoid confusion.

- Professional Design: A clean, easy-to-read layout helps reinforce credibility and professionalism, which is vital when dealing with clients who may not be familiar with your work style.

- Tax Calculations: Many freelancers are required to apply taxes to their services, so using a design that includes automatic tax calculations can save time and reduce errors.

By using ready-made solutions, freelancers can not only improve their workflow but also focus more on delivering high-quality work to clients, knowing their financial paperwork is handled efficiently and professionally. These designs help build a reliable, consistent approach to billing, ensuring that freelancers are paid on time and with minimal hassle.

Design Tips for a Clear Invoice Layout

A clear and well-organized design is crucial for ensuring that your financial records are easily understood by clients. A cluttered or difficult-to-read document can lead to confusion, payment delays, and a lack of professionalism. By following a few simple design principles, you can create documents that not only look polished but also make it easy for clients to find all the necessary details quickly and efficiently.

Key Elements of a Clear Layout

When designing your billing documents, focus on the following elements to create a layout that is both functional and aesthetically pleasing:

- Simple, Clean Design: Avoid excessive graphics, complex fonts, or unnecessary information. A straightforward, minimalist design ensures that the document is easy to read and doesn’t overwhelm the recipient.

- Logical Structure: Arrange the information in a logical flow. Start with the basics, such as your company name and contact details, followed by the client’s information, the services provided, and the amount due. This makes it easier for the reader to follow.

- Use of Space: Proper use of white space around text and sections helps reduce clutter. Make sure each section is clearly separated, allowing the reader to easily distinguish between different pieces of information.

- Clear Headers and Subheadings: Use bold or larger text for headings to draw attention to key sections such as payment terms, due date, and totals. This ensures that important details are not overlooked.

Additional Design Enhancements

While clarity is the primary goal, there are a few additional design elements that can further enhance your document’s usability:

- Consistent Fonts and Colors: Stick to one or two complementary fonts, and use color sparingly to highlight important areas like the total amount due or payment instructions.

- Readable Font Size: Choose a font size that is large enough to read comfortably, but not so large that it wastes space. Typically, a font size between 10-12 points is ideal for the body text.

- Alignment: Ensure that text is aligned properly, especially numbers. Align monetary amounts to the right and descriptions to the left for easier reading.

By following these design tips, you’ll create professional-looking records that are easy for clients to navigate. A clear, organized layout will help ensure that your clients can quickly find the details they need, leading to

How to Print and Distribute Invoices Efficiently

Efficiently managing the distribution of your financial documents can save you time and ensure timely payments. Whether you prefer physical or digital delivery, having a streamlined process for both printing and sending these records is crucial for maintaining good client relationships and managing your cash flow. By adopting the right strategies, you can speed up the distribution process while keeping everything organized and professional.

Printing Documents for Physical Delivery

If you need to send hard copies, it’s important to ensure that your printed documents are clear, professional, and easy to read. Here are a few tips for printing efficiently:

- Use Quality Paper: Always print your records on high-quality paper to ensure they look professional. Standard letter-sized paper (8.5 x 11 inches) is usually ideal for business documents.

- Set Up Print Settings: Adjust your printer settings to ensure that the document is centered on the page and the text is sharp and clear. Double-check the margins and alignment before printing.

- Batch Printing: If you have multiple records to send out, batch printing can save you time. Ensure all documents are ready and formatted before printing to minimize errors and paper waste.

Distributing Documents Quickly and Securely

Once your records are printed or ready in digital format, the next step is to distribute them. Here’s how to manage distribution effectively:

- Digital Distribution: For faster delivery, consider sending your documents via email. Make sure the document is in a universally accessible format, like PDF, and that the file name is clear and professional (e.g., “Invoice_1234_YourCompany”).

- Automated Systems: Using accounting software that integrates email features can automate the sending of records. Set up automated reminders to send out payment due dates and follow-up emails for overdue payments.

- Physical Mail: If you’re mailing hard copies, make sure to use a reliable postal service. For added security, consider using tracking services to ensure the documents reach their destination safely.

By optimizing both the printing and distribution processes, you can ensure that your financial documents are delivered quickly and professionally, minimizing