Free Self-Employed Cleaner Invoice Template Download

Managing financial transactions is a crucial part of running your own business. For those offering cleaning services on an individual basis, creating clear and organized records is key to maintaining professionalism and ensuring timely payments. Having an effective system in place not only simplifies the process but also boosts credibility with clients.

One essential tool for managing payments is a properly structured document that outlines the services rendered, payment terms, and any applicable charges. This type of document helps avoid confusion and ensures both parties are on the same page when it comes to financial expectations.

In this section, we explore how to create and use a document that makes the billing process straightforward and efficient. By following the guidelines, you can create a document that suits your business needs while saving time and effort. With the right approach, you’ll be able to present a professional image to clients and streamline your payment collection process.

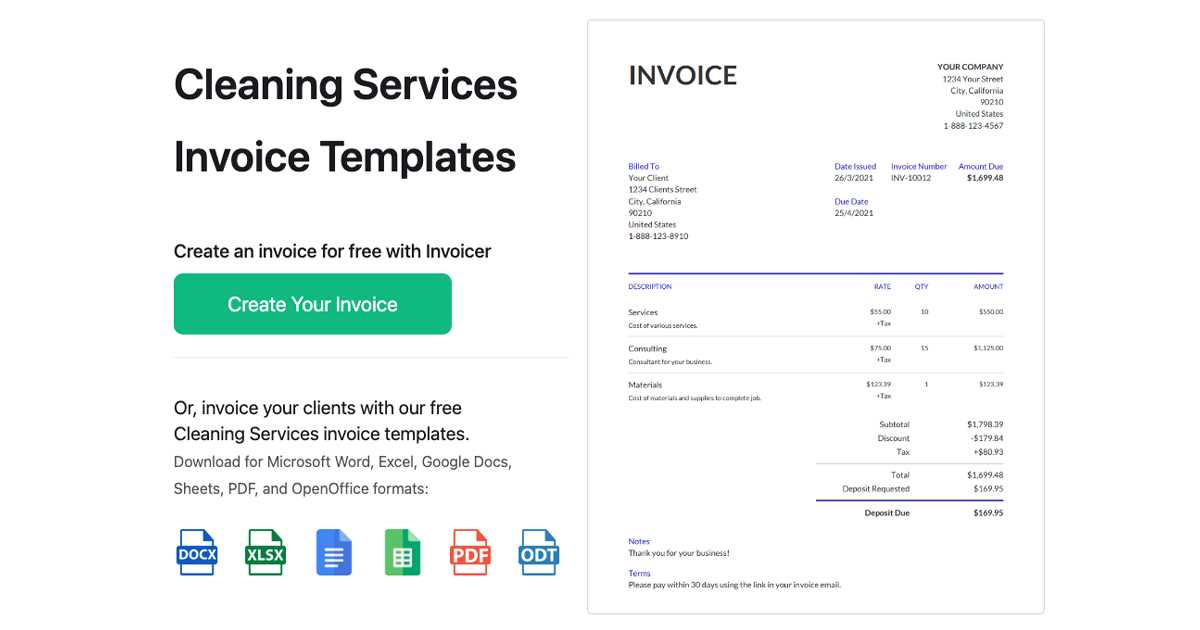

Free Invoice Template for Cleaners

For independent service providers, having a professional document to record payment details is essential. It ensures clarity for both the business owner and the client, helping to avoid misunderstandings and disputes. By using a structured form, you can quickly detail the services provided, the agreed rates, and payment terms.

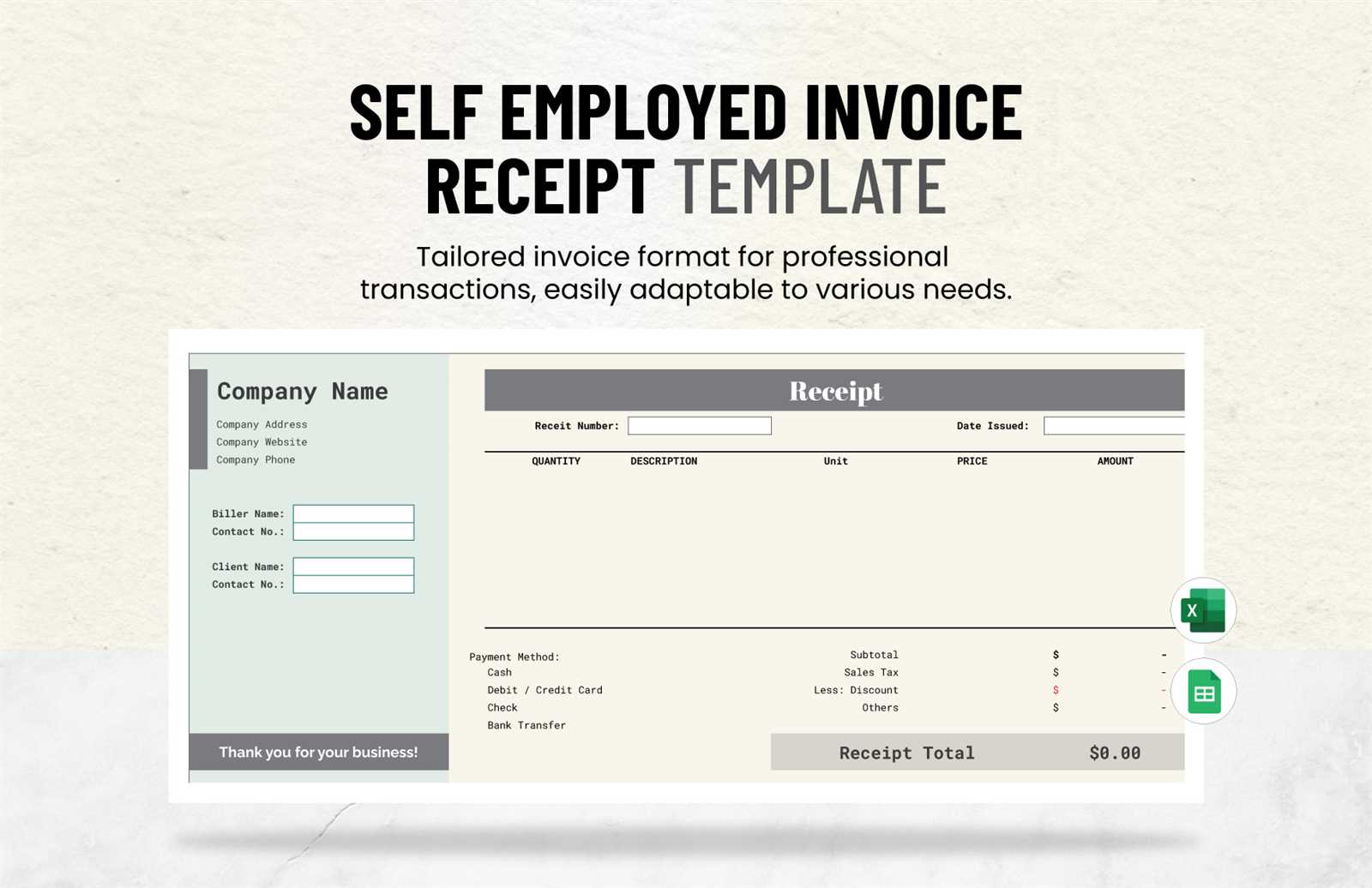

Many small business owners opt for a simple, pre-designed document that they can easily fill out after each job. This saves time, ensures consistency, and reduces the chance of errors. A well-organized form can also add a level of professionalism to your business, reinforcing your reliability in the eyes of your clients.

There are many resources available for downloading such forms, offering them at no cost. These templates can be customized to suit your specific needs and preferences, ensuring that each transaction is properly documented. With just a few adjustments, you can tailor the document to reflect your branding, services, and pricing structure.

How to Create Your Own Invoice

Creating a document to record payments for services provided is an important step for any independent business. It ensures that both parties are clear on the terms of the transaction and helps keep your finances organized. A well-structured bill not only outlines what was done but also presents a professional image to your clients.

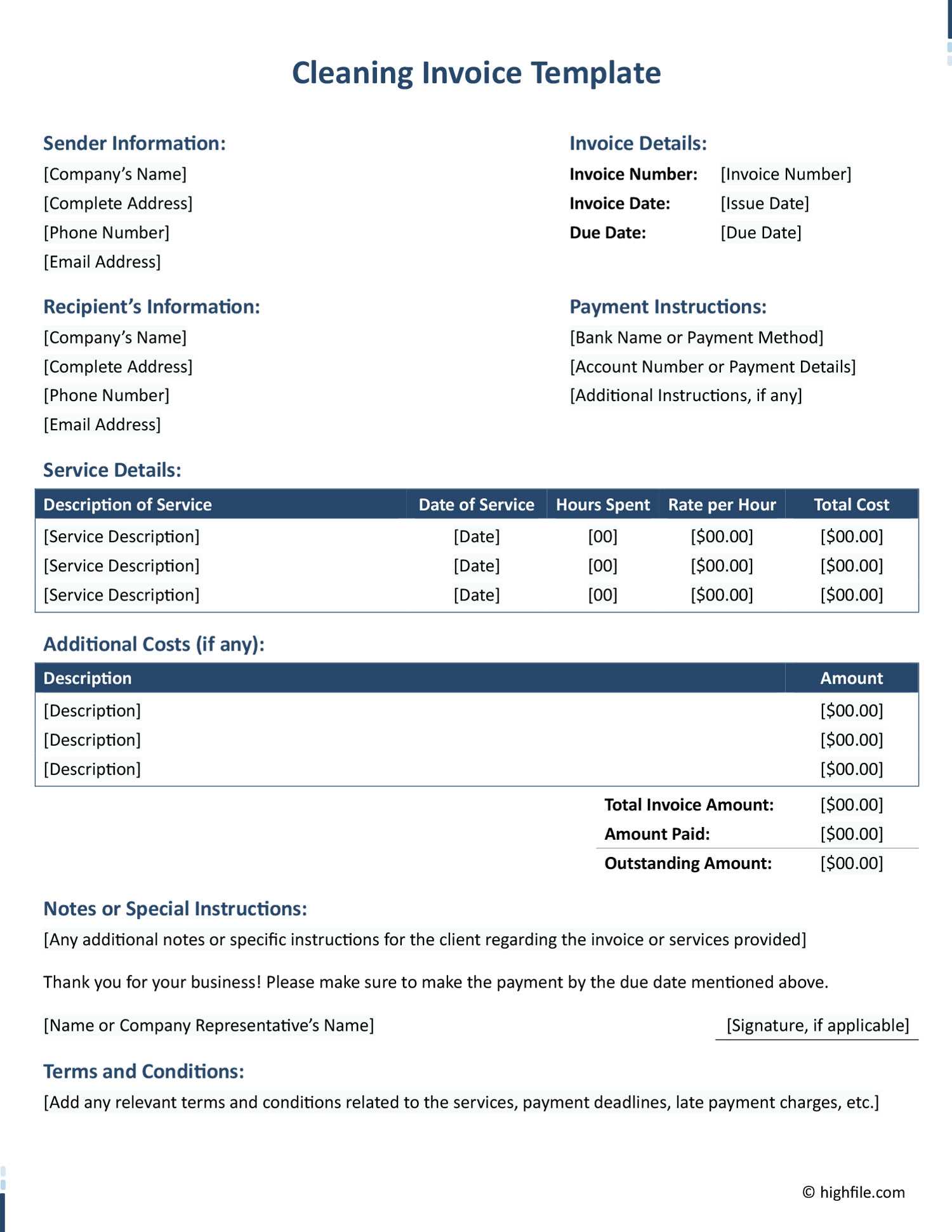

Essential Elements of a Billing Document

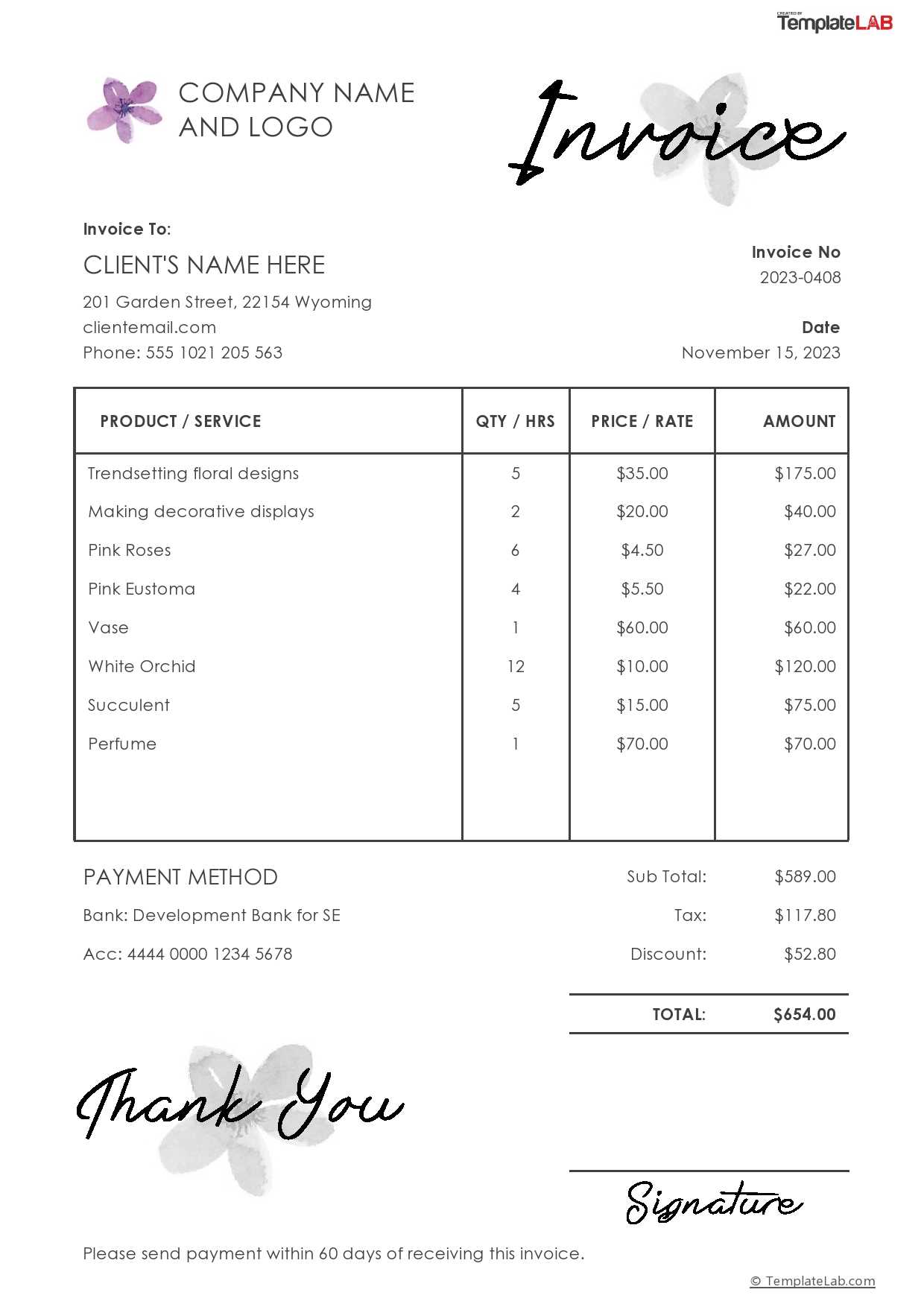

To start, ensure that your document includes key details such as the date, client information, a description of the work performed, and the agreed-upon costs. Include any applicable taxes or discounts and make it clear when the payment is due. These elements make the transaction transparent and reduce the risk of disputes.

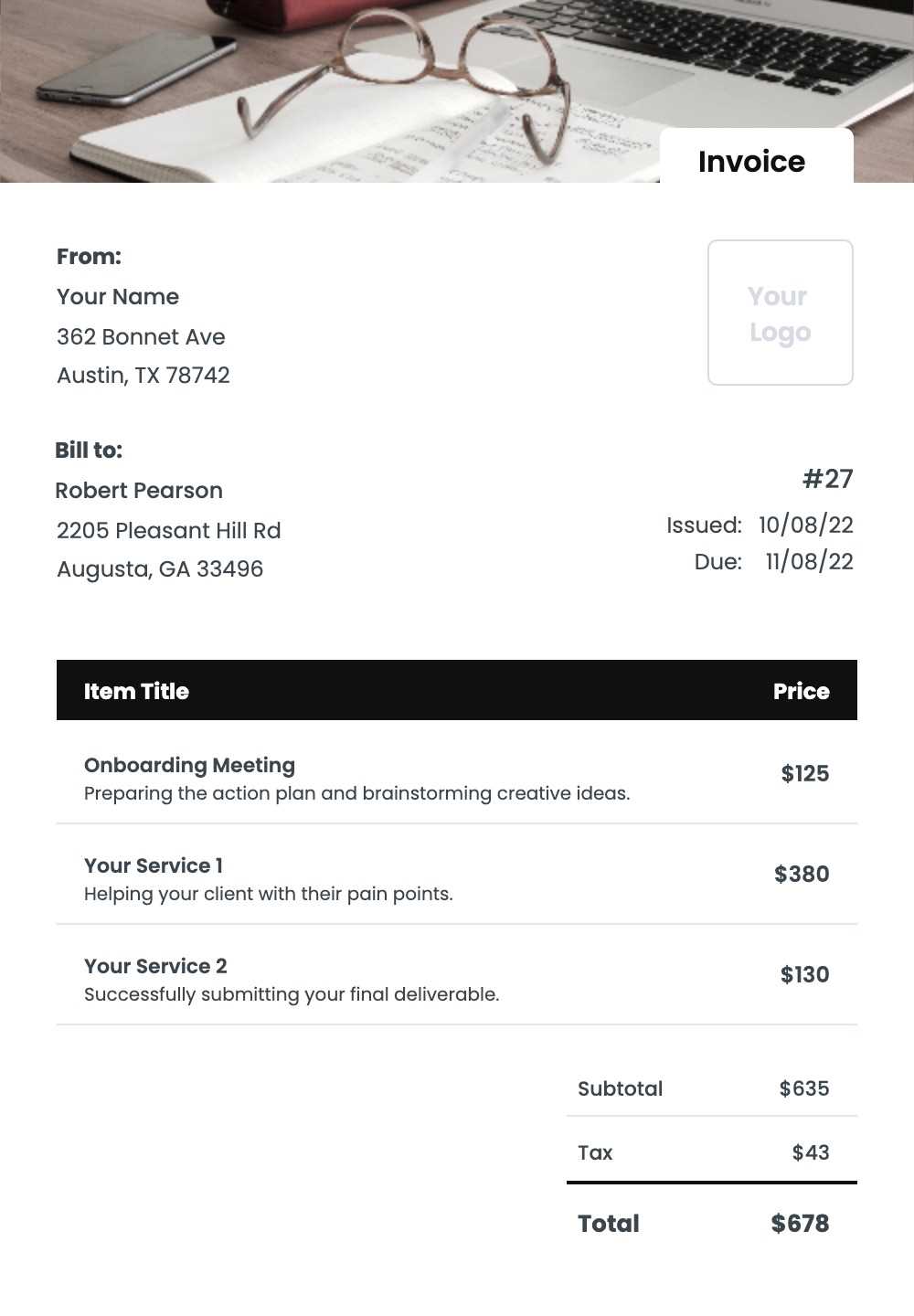

Designing a Professional Layout

The appearance of your billing document plays a role in the perception of your business. Use a clean, easy-to-read layout with clear headings and sections. You can include your logo or contact details at the top to personalize it and make it easy for clients to reach out. Keep the font simple and professional, ensuring the document is easy to read and understand.

By following these steps, you can create a billing document that is both functional and polished, helping you manage your transactions with confidence.

Benefits of Using an Invoice Template

Having a pre-designed document to manage financial transactions offers numerous advantages for any service provider. It simplifies the process of tracking payments, improves consistency, and enhances professionalism. By utilizing such a tool, you save time and ensure that each billing is accurate and clear.

Time Efficiency

One of the most significant benefits is the time saved by not having to create a new document from scratch every time you need to issue a bill. A ready-made format allows you to quickly fill in the necessary details, speeding up the billing process. This lets you focus on other aspects of your business while still ensuring accurate records.

Professional Appearance

Using a structured form presents a more polished and organized image to clients. A clear, easy-to-read document helps establish trust and conveys a sense of professionalism. Clients are more likely to feel confident in your services when they see that you have a reliable system for documenting and managing transactions.

- Consistency: Each document follows the same format, reducing errors and ensuring uniformity across all transactions.

- Accuracy: A well-organized layout reduces the chance of missing important details or making mistakes in calculations.

- Customization: You can adjust the document to reflect your unique services, rates, and payment terms while maintaining a professional structure.

- Legal Compliance: Some regions require specific details to be included in billing documents. Using a structured format helps you stay compliant with local regulations.

Overall, using a pre-designed document makes it easier to maintain a high standard of efficiency, professionalism, and accuracy in your business operations.

Why Service Providers Need Professional Invoices

For anyone offering services on an individual basis, maintaining a clear and organized billing system is crucial. A well-crafted document not only ensures accurate payments but also helps to establish credibility with clients. It provides a record of transactions, which can be vital for both financial tracking and legal purposes.

Building Trust with Clients

Clients expect transparency when it comes to costs and payment terms. Providing a professionally written bill demonstrates reliability and attention to detail. It shows that you value your work and respect the agreement made with the client, which can foster long-term relationships and encourage repeat business.

Financial Organization and Record Keeping

A well-structured billing system helps you track earnings, manage expenses, and organize your finances more effectively. It provides a clear record of all transactions, which is important not only for keeping your business running smoothly but also for tax purposes. By maintaining a professional system, you make it easier to file taxes and prepare financial reports.

In addition, having a documented record of services provided can protect you in case of disputes. Should any issues arise regarding payment or services rendered, a clear and professional record can serve as evidence to resolve the situation swiftly and fairly.

Essential Information for Cleaner Invoices

When providing services, it is crucial to ensure that all important details are clearly communicated in the documentation provided to clients. This helps in maintaining transparency and prevents any confusion regarding payments. A well-organized record not only facilitates easy transactions but also establishes professionalism and trust with customers.

Key Elements to Include

The document should feature several key components that outline the specifics of the work completed and the agreed-upon terms. These details typically include the service provider’s contact information, a breakdown of services rendered, the total cost, and payment terms. Below is a list of the most important aspects to include:

| Details | Description |

|---|---|

| Service Provider Information | Full name, business name (if applicable), contact details such as phone number and email address. |

| Client Information | Client’s name, address, and any other relevant contact details. |

| Work Description | A clear description of the tasks performed, including the time spent and any special requirements. |

| Charges | The total amount for services rendered, including any applicable taxes or additional costs. |

| Payment Terms | The payment method, due date, and any penalties for late payments. |

Why These Details Matter

Including all relevant details ensures both parties are on the same page and helps to avoid disputes in the future. The more precise the document is, the easier it becomes for clients to understand what they are being charged for and how the process will proceed. This level of clarity is beneficial for both the client and the service provider.

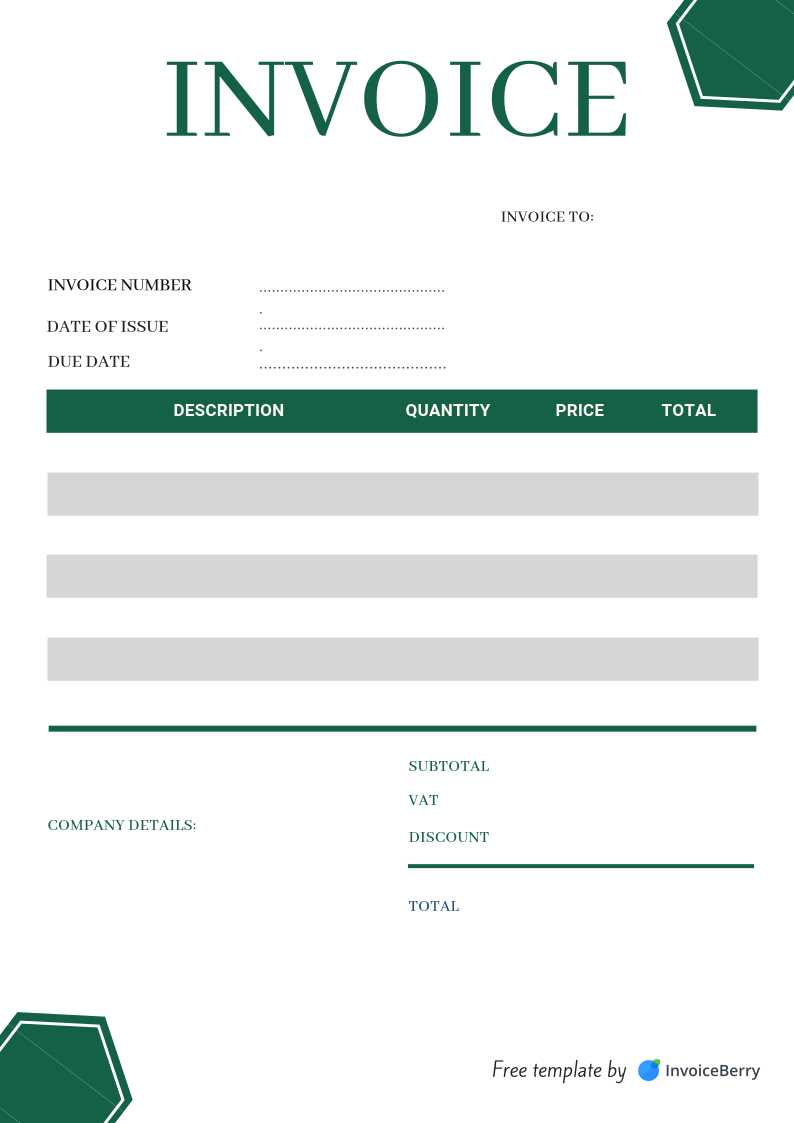

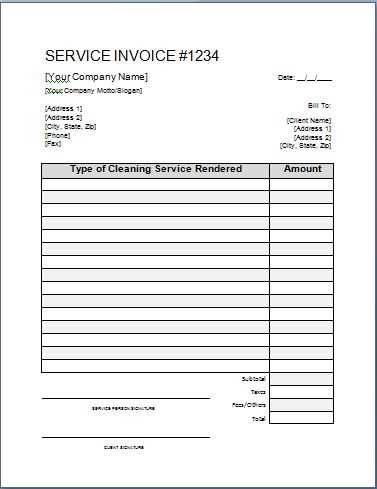

Simple Steps to Customize Your Invoice

Personalizing your service record is an essential step in ensuring that your business transactions are professional and clear. By tailoring the document to suit your specific needs, you can ensure that all necessary details are included, while also reflecting your brand identity. Below are easy-to-follow steps that will guide you through the process of customizing your document.

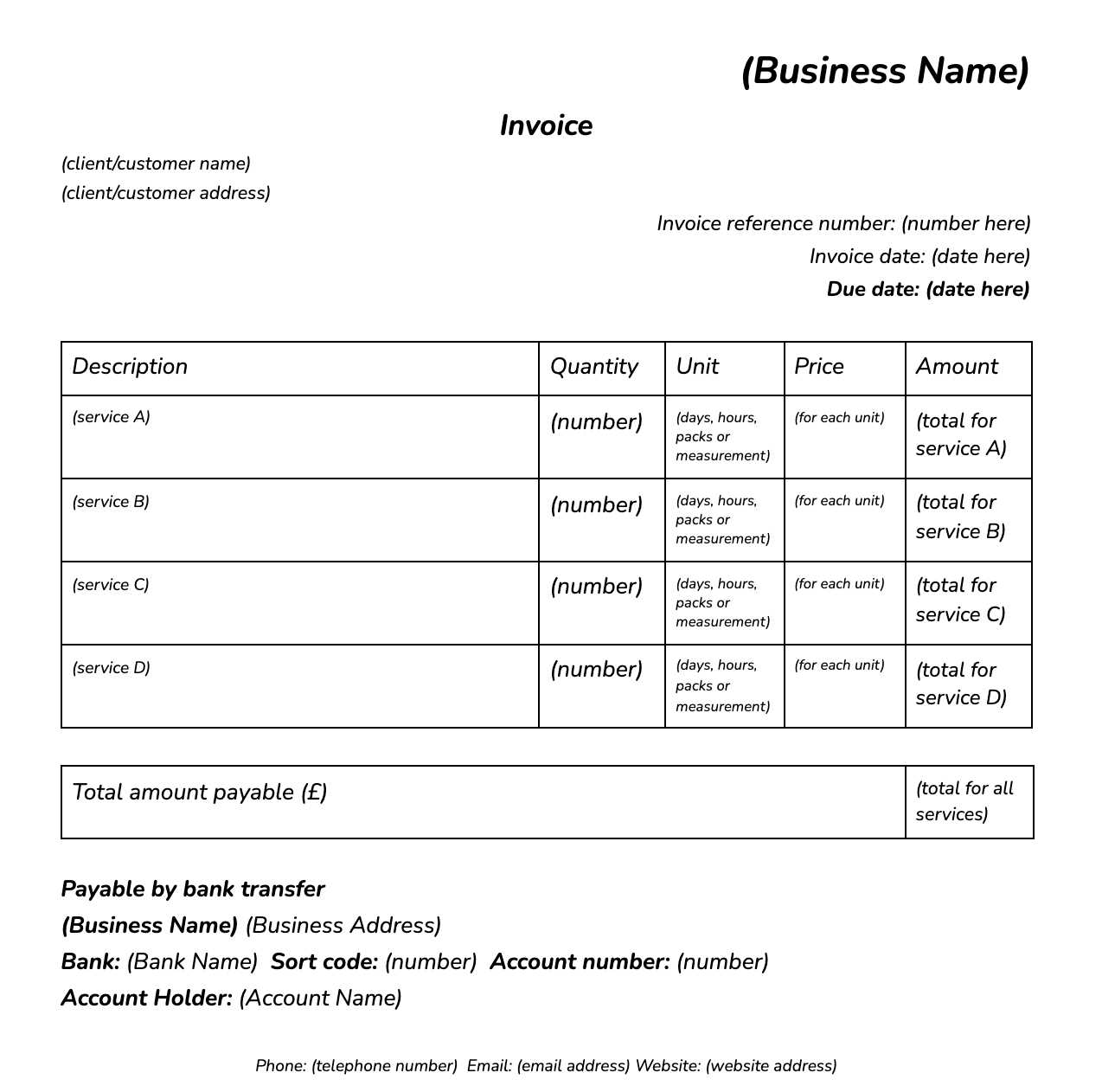

Step-by-Step Customization Process

Customizing your record involves a few key actions that can make a significant impact. From adding your business logo to adjusting the layout and content to suit your specific services, each element plays a role in making your document both professional and user-friendly. Here are the primary actions you should take:

| Step | Description | |||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Add Your Branding | Include your logo, business name, and contact information at the top of the document to give it a professional look. | |||||||||||||||||||||||||||||||||||||

| 2. Specify Service Details | Provide a detailed description of the services provided, along with the date and time the work was completed. | |||||||||||||||||||||||||||||||||||||

| 3. Adjust Pricing and Charges | Customize the pricing structure according to the type of services provided. Be sure to include any taxes or additional fees if applicable. | |||||||||||||||||||||||||||||||||||||

| 4. Set Payment Terms |

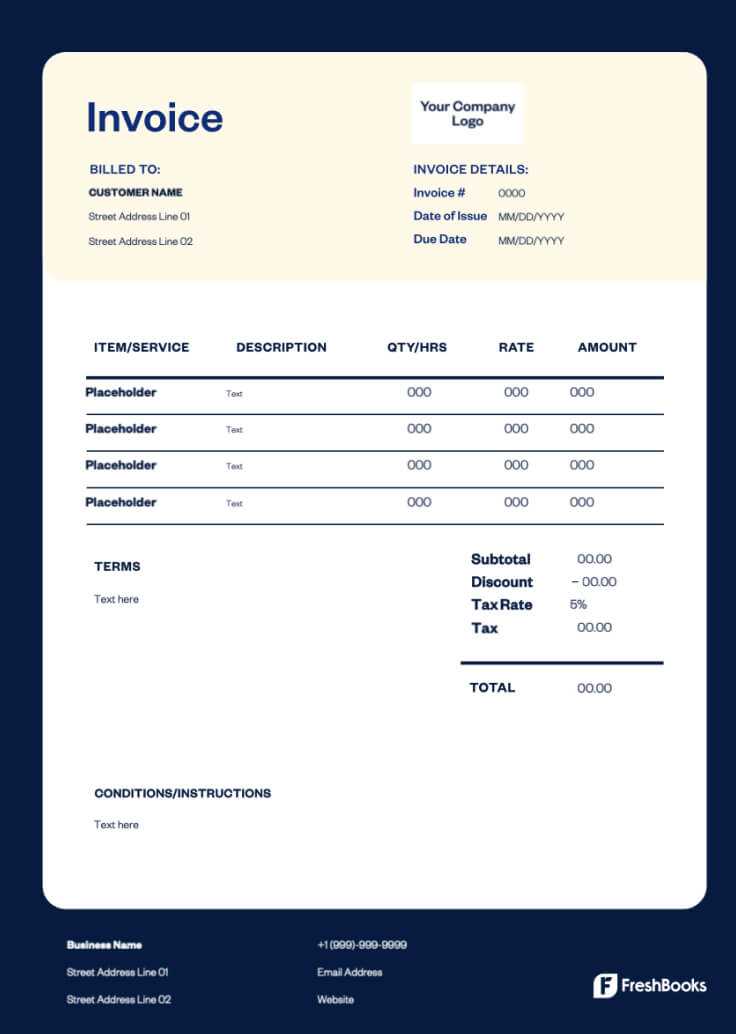

| Factor | Consideration |

|---|---|

| Service Complexity | If the services are straightforward, a simple layout will suffice. For more complex tasks, a detailed format with separate sections may be necessary. |

| Client Preferences | Some clients prefer a minimalist design, while others might require more information to be laid out clearly. It’s useful to know their preferences before choosing a format. |

| Frequency of Use | If you are providing services regularly, choosing a reusable and easy-to-update format will save time and effort in the future. |

| Visual Appeal | A clean and professional appearance is key. Avoid overly complex designs and opt for clear, easy-to-read fonts and organized sections. |

Common Mistakes to Avoid in Invoices

Creating clear and accurate documents is crucial for maintaining smooth business transactions. However, there are several common errors that can occur during this process, leading to confusion, delayed payments, or even disputes. Avoiding these mistakes ensures professionalism and helps in establishing trust with clients.

Common Pitfalls to Watch Out For

Below are some frequent mistakes that can affect the quality and effectiveness of your service record. Being aware of these can help you improve the accuracy of your documentation and reduce the risk of misunderstandings.

| Mistake | How to Avoid | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Missing Contact Information | Always include full details such as your business name, address, phone number, and email. This ensures clients know how to reach you if needed. | ||||||||||||||||||||

| Vague Service Descriptions | Clearly outline the services provided, specifying tasks performed and any special conditions. This helps avoid confusion about what was actually delivered. | ||||||||||||||||||||

| Details | Description |

|---|---|

| Service Provider Information | Full name, business name (if applicable), contact details such as phone number and email address. |

| Client Information | Client’s name, address, and any other relevant contact details. |

| Work Description | A clear description of the tasks performed, including the time spent and any special requirements. |

| Charges | The total amount for services rendered, including any applicable taxes or additional costs. |

| Payment Terms | The payment method, due date, and any penalties for late payments. |

Why These Details Matter

Including all relevant details ensures both parties are on the same page and helps to avoid disputes in the future. The more precise the document is, the easier it becomes for clients to understand what they are being charged for and how the process will proceed. This level of clarity is beneficial for both the client and the service provider.

Free Invoice Tools for Self-Employed Cleaners

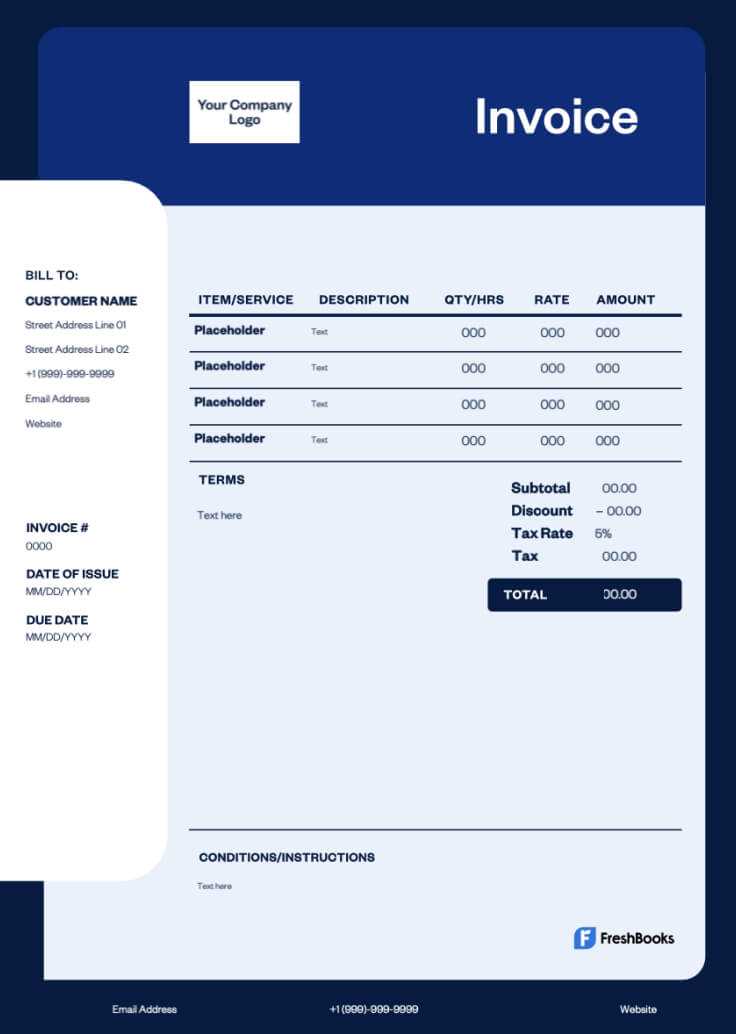

Managing payment records effectively is a key component of running any service-based business. Fortunately, there are numerous tools available that can assist in creating and managing your transaction documents without the need for expensive software. These tools offer customizable options and are designed to streamline the process, allowing you to focus on the services you provide.

Several online platforms offer simple, intuitive solutions that help generate professional documents, track payments, and ensure that you stay organized. Whether you need to create a one-time document or manage multiple transactions, these options can save you valuable time.

Popular Options to Consider

Here are some popular tools that can help you create and manage your service records efficiently:

| Tool | Features |

|---|---|

| Wave | Wave offers a fully customizable system for generating payment documents. It’s ideal for small businesses and provides features like recurring billing and payment tracking, all at no cost. |

| Zoho Invoice | Zoho Invoice is a versatile tool that includes invoicing, expense tracking, and client management. It’s designed for simplicity, offering a range of templates to suit your needs. |

| PayPal Invoicing | PayPal allows you to create, send, and track payment records directly from your account. It’s particularly useful if you already use PayPal for transactions, providing easy payment options for clients. |

| Invoicely | Invoicely provides a simple platform to create, send, and manage records. The free version includes basic features such as customization and multi-currency support. |

Why Use These Tools?

These online platforms offer significant advantages

How to Track Payments and Due Dates

Keeping track of payments and due dates is crucial for maintaining a healthy cash flow in any service-based business. Without a system in place, it can be easy to lose track of what’s been paid and what still needs attention. By implementing a clear process for tracking payments and setting up reminders for upcoming due dates, you ensure that you get paid on time and can avoid unnecessary delays.

Here are some methods and tools that can help you stay organized and on top of your financial commitments:

Methods for Tracking Payments

There are various ways to monitor payments and due dates. Whether you prefer a digital or manual approach, consistency is key to keeping your records up to date. Below are some effective strategies:

- Use Payment Management Software: Many online tools offer built-in features to track payments automatically. These tools can send you notifications when payments are due and help you maintain accurate records.

- Set Up a Spreadsheet: For a more hands-on approach, you can create a spreadsheet that lists each transaction, payment amount, and due date. This allows you to quickly see any outstanding balances and follow up accordingly.

- Manual Logs: If you prefer a paper-based system, keeping a physical log of payments and due dates can still be effective. Just ensure you regularly update it to avoid missing important details.

Setting Up Payment Reminders

Having a system for setting up reminders is essential for staying ahead of payment deadlines. Here are a few ways you can set reminders:

- Calendar Alerts: Use digital calendars like Google Calendar to set reminders for upcoming due dates. You can receive notifications before the due date to ensure timely follow-ups.

- Automated Email Reminders: M

Understanding Payment Terms

Clear and well-defined payment terms are essential for any service-based business to ensure smooth transactions. Establishing these terms upfront helps prevent misunderstandings between you and your clients and ensures that both parties are on the same page regarding when and how payments should be made. Understanding key aspects of payment terms will also help you manage your cash flow effectively and maintain professionalism.

Key Elements of Payment Terms

When setting payment terms for your services, it’s important to include the following elements to avoid confusion and ensure prompt payments:

- Due Date: Specify when payment is expected. Common due dates include “due upon receipt,” “net 7,” “net 30,” or other time frames that are mutually agreed upon.

- Late Fees: Clearly state any fees that will be applied if payment is not made on time. This serves as an incentive for clients to pay promptly and ensures that late payments do not disrupt your business.

- Payment Methods: Indicate the payment methods you accept, such as bank transfer, credit card, PayPal, or checks. Make it easy for clients to choose a convenient method.

- Discounts for Early Payment: Some businesses offer discounts for early payments as an incentive. For example, you might offer a 2% discount for payments made within 10 days.

Common Payment Terms Practices

There are various common practices that can be applied to payment terms, depending on the nature of the work and the relationship with the client. Here are a few examples:

Tips for Professional Invoice Design A well-designed document is an essential part of your business communications. It not only ensures clarity but also reinforces your professionalism. A visually appealing and well-structured document makes it easier for clients to read and understand the details of the transaction, and it helps establish trust in your services. Below are some key design tips that will enhance the look and functionality of your business records.

Key Design Elements to Consider

When designing your service record, it’s important to focus on the following elements to ensure it looks professional and is easy to follow:

- Consistent Branding: Use your company logo, brand colors, and fonts consistently across all business documents. This creates a unified look and reinforces brand recognition.

- Clear Layout: Organize the content in a clean, easy-to-follow structure. Divide the document into clearly labeled sections, such as services provided, charges, and payment terms. Avoid cluttering the page with unnecessary information or graphics.

- Readable Fonts: Choose a font that is easy to read. Stick with standard fonts like Arial, Helvetica, or Times New Roman, and make sure the text size is appropriate for readability.

- Whitespace: Ensure there is enough whitespace around each section to make the document feel less crowded. Proper spacing makes the information easier to digest and adds to the overall professional appearance.

Practical Design Tips for Better User Experience

In addition to the basic elements, here are some design tips that improve the user experience and increase the likelihood of timely payments:

- Highlight Key Information:

Automating Your Invoice Process

Streamlining your billing process can save valuable time and reduce human error. By automating certain aspects of creating and sending service records, you can eliminate repetitive tasks and focus on delivering high-quality service to your clients. Automation also helps ensure that you stay on top of payments and deadlines, improving cash flow and overall efficiency.

Benefits of Automation

Automating your billing system comes with several advantages that can significantly enhance your business operations:

- Time Savings: Once you set up an automated system, you won’t need to manually create records for each transaction. The system can generate them automatically based on pre-set rules, saving you considerable time.

- Consistency: Automation ensures that all documents follow the same format and include the correct information, reducing the likelihood of errors and inconsistencies.

- Improved Cash Flow: With automated reminders and due date tracking, you can ensure that payments are made on time, reducing late fees and helping maintain a steady flow of income.

- Reduced Administrative Work: By automating follow-ups, you can minimize the effort required to chase overdue payments, allowing you to focus on other aspects of your business.

How to Automate Your Billing Process

There are various tools and software options available to help you automate your service record creation and payment tracking. Here are a few ways to get started:

- Use Billing Software: Many platforms allow you to set up automatic billing cycles, send reminders, and track payments. Tools like Wave, Zoho I

Legal Aspects of Cleaner Invoices

When providing cleaning services, it’s crucial to understand the legal implications of documenting payments. These records not only serve as proof of the work completed but also ensure both parties are protected under the law. Proper documentation helps in resolving disputes, complying with tax regulations, and maintaining clear financial records. Therefore, understanding the essentials of creating and managing these documents can significantly contribute to smooth business operations.

Key Legal Requirements

Regardless of the service provided, every professional must adhere to specific legal requirements when requesting payment. These include offering detailed descriptions of the services performed, outlining payment terms, and including necessary identifiers such as tax numbers. Additionally, the document must comply with local taxation rules to avoid potential fines or issues with authorities. Ensuring accuracy in these records is a basic yet vital part of operating lawfully and preventing misunderstandings.

Tax Considerations and Compliance

Another important aspect is adhering to tax regulations. Depending on the jurisdiction, individuals may be required to charge VAT or other applicable taxes. It’s essential to clearly indicate these charges in the documents issued to clients. Failure to account for taxes correctly could result in penalties or financial liabilities. Maintaining proper records will also facilitate smooth tax filing and support any audits conducted by tax authorities.