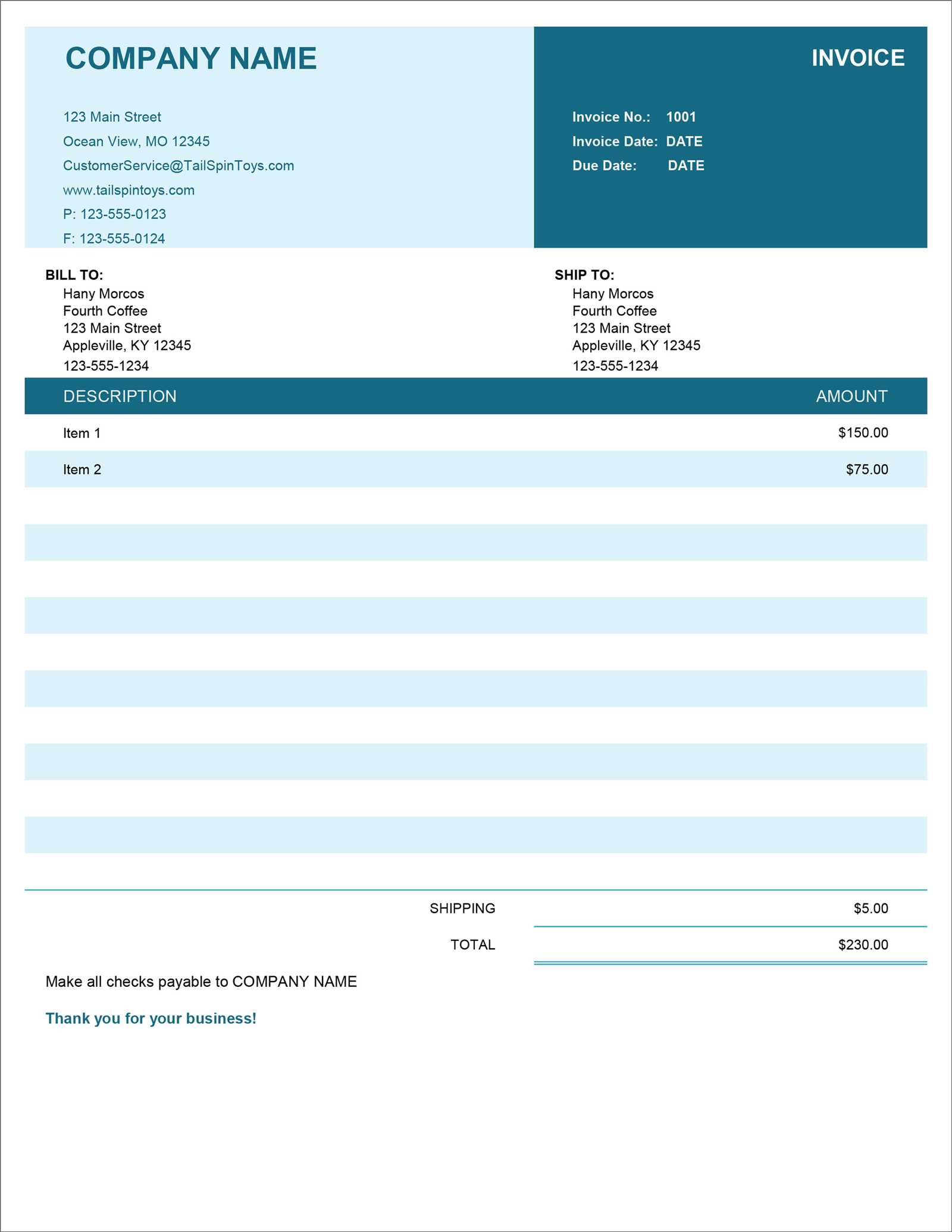

Simple and Customizable Basic Sales Invoice Template

Managing financial transactions efficiently is crucial for any business. A well-organized document that outlines the details of each sale can save time and reduce errors in your accounting process. Whether you’re a freelancer or a large corporation, using a consistent and professional approach to track payments is essential for smooth operations.

Designing a structured document that includes all necessary details–such as buyer information, product descriptions, amounts, and terms–can simplify your workflow and provide clarity for both parties involved. With the right layout, this record helps maintain transparency and can be easily modified to meet various business needs.

Customization plays a key role in tailoring this document to fit your unique needs. By adjusting specific fields and layouts, you ensure that it reflects your business practices while maintaining a professional standard. Incorporating these elements can enhance the efficiency and accuracy of your record-keeping system.

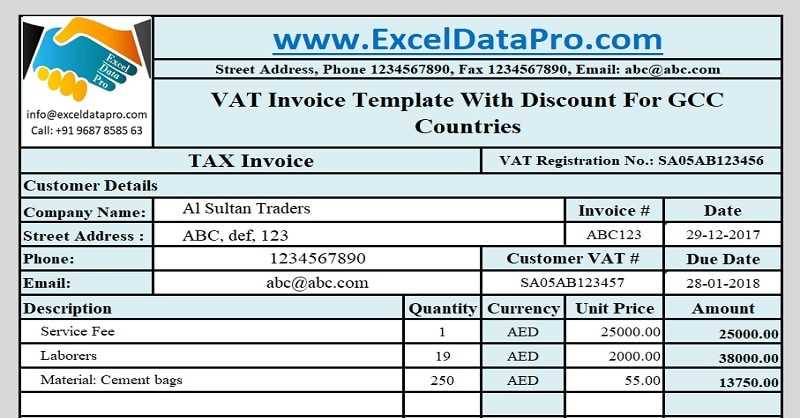

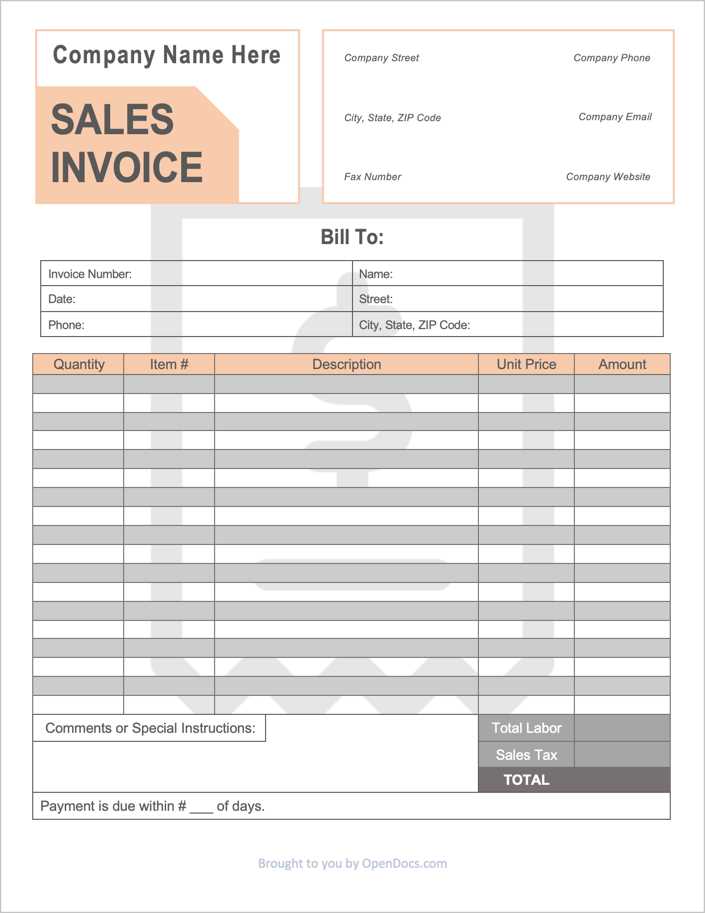

Basic Sales Invoice Template Overview

When it comes to documenting transactions between buyers and sellers, having a clear and organized record is essential. A well-structured document serves as both proof of purchase and a tool for managing payment terms. It ensures that both parties are on the same page regarding the specifics of the transaction, including the agreed-upon amounts, delivery terms, and contact information.

Having a reliable document to capture these details is crucial for maintaining an efficient accounting process. The key elements of such a document include transaction dates, a description of goods or services, payment terms, and a unique reference number. Customizing this document to fit your business’s specific needs can greatly improve record keeping and overall transaction management.

Core Components

Each document should feature essential fields such as the buyer and seller’s contact information, itemized list of products or services, and pricing details. Including this information ensures that there is no ambiguity when it comes to the agreed terms. Additionally, clear payment instructions or methods should be specified to prevent any confusion.

Why Standardization Matters

Using a consistent format for all your transactions can help streamline business operations. It ensures that no important information is overlooked and reduces the likelihood of errors. This standardization also makes it easier for businesses to automate processes and integrate the documents with accounting or inventory systems, creating a more efficient workflow.

Why You Need an Invoice Template

Maintaining a professional and consistent approach to documenting transactions is crucial for any business. A structured document that clearly outlines the terms of an exchange not only helps maintain accuracy but also builds trust with clients and customers. Without a standardized system, there is a higher risk of errors, missed payments, and confusion.

Having a pre-designed document ready for use can save significant time and effort. It ensures that you don’t have to start from scratch with each transaction, reducing the chances of forgetting important details. Here are a few key reasons why this is important:

- Efficiency: Using a ready-made format speeds up the billing process, allowing you to focus on other important tasks.

- Professionalism: A consistent layout projects a more organized and trustworthy image to your clients, which can improve your brand reputation.

- Accuracy: Having fixed fields ensures that all essential information, such as dates, prices, and contact details, is included, minimizing errors.

- Clarity: A clear and simple structure prevents any misunderstandings regarding the transaction terms, reducing the chance of disputes.

- Tracking: Templates often include tracking features that make it easier to monitor payments, due dates, and outstanding balances.

By adopting a standardized document for each exchange, businesses can streamline operations and create a smoother process for managing payments, invoicing, and customer relations. This system can also be tailored to suit specific needs, making it even more beneficial for various industries.

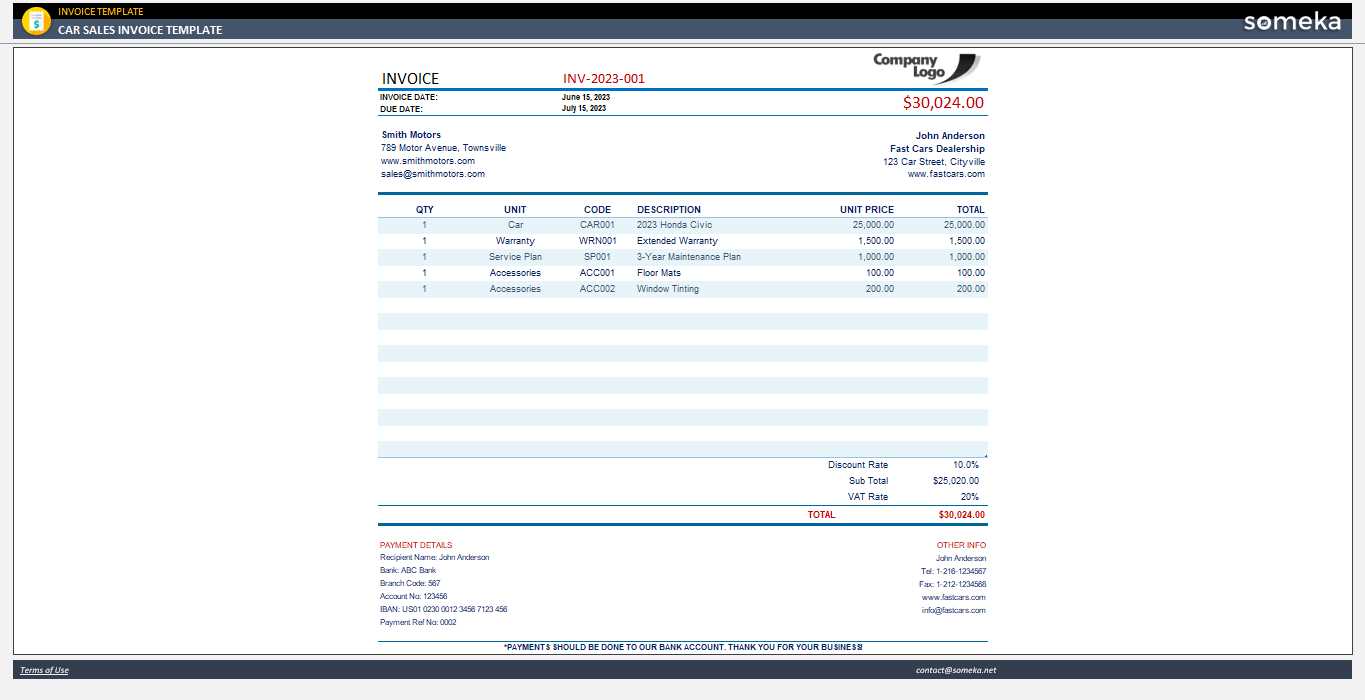

Key Features of Sales Invoices

An effective document for recording transactions should contain specific elements that ensure clarity and accuracy for both the buyer and the seller. These key features help avoid confusion, maintain transparency, and provide a clear record for accounting and legal purposes. Understanding these essential components can streamline the process and create a more professional experience for all parties involved.

Essential Elements

The foundation of a well-structured document includes the following key components:

- Unique Identification Number: A reference code or number for easy tracking and referencing of each transaction.

- Parties Involved: Clear identification of both the buyer and the seller, including contact information such as names, addresses, and phone numbers.

- Itemized List: A detailed description of products or services, including quantity, unit price, and total amount.

- Payment Terms: Clear terms that outline when payment is due and what methods are accepted.

- Tax Information: Any applicable taxes or additional fees, including tax identification numbers if required by law.

- Dates: The date of the transaction, as well as the date payment is due, to avoid confusion about timing.

Additional Features

Beyond the basic elements, there are other features that can add value and improve the document’s functionality:

- Discounts and Offers: If applicable, discounts or special offers should be clearly mentioned, showing the reduced amount.

- Shipping and Handling: Including shipping costs or delivery fees, if relevant, can help avoid any misunderstandings.

- Terms and Conditions: A section to outline the legal terms or specific conditions related to the sale.

Including these components ensures that the transaction is well-documented, helping both businesses and customers maintain an accurate and transparent record of exchanges.

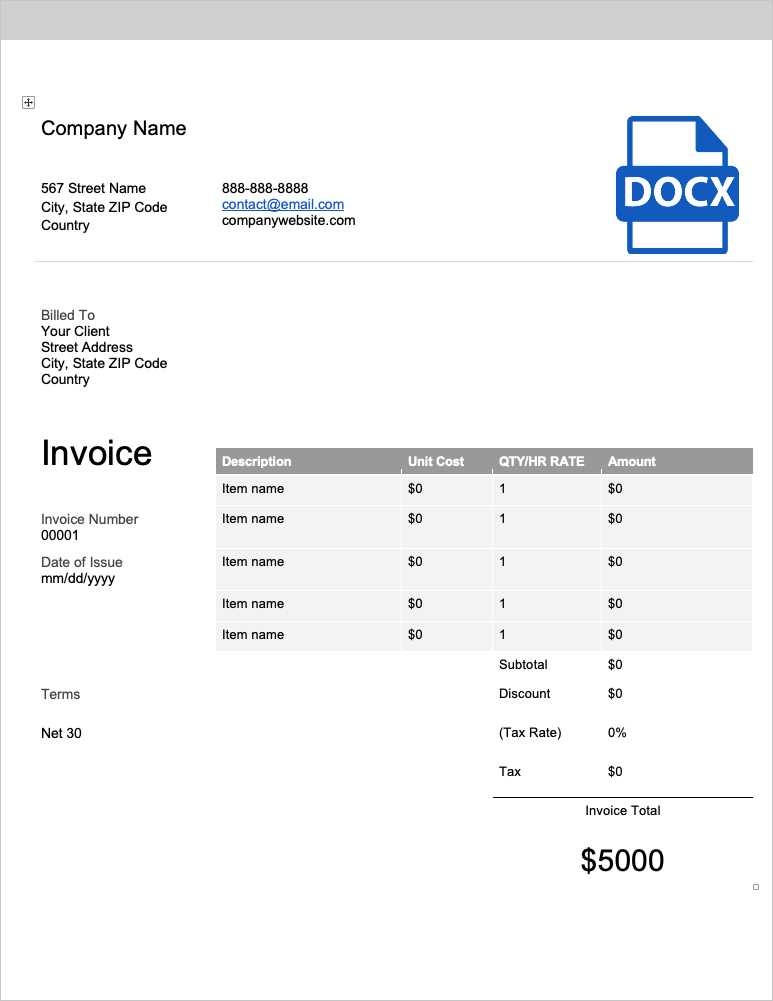

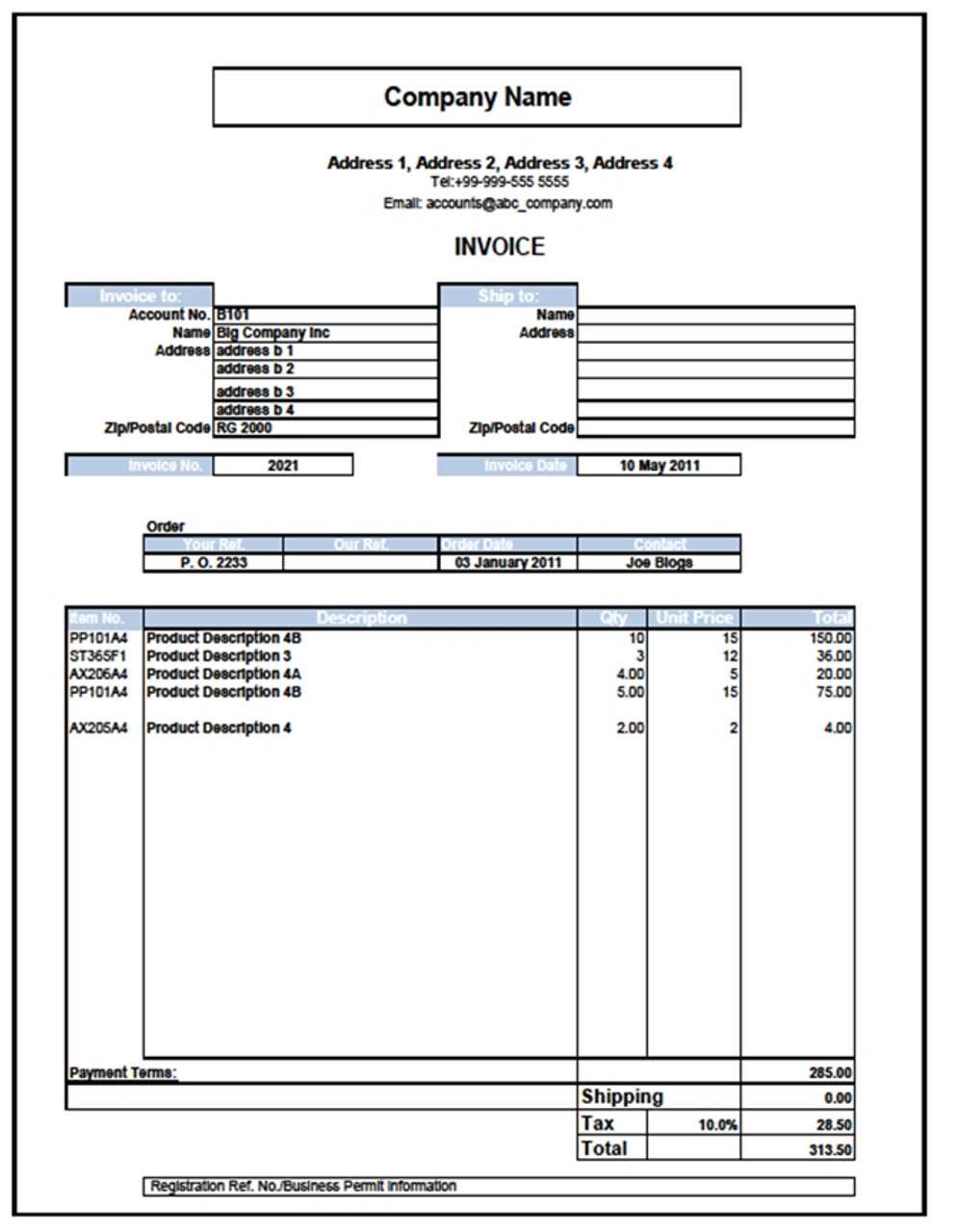

How to Create an Invoice Template

Designing a well-organized document for recording transactions is essential for keeping track of business exchanges. A properly structured document ensures that all the necessary information is captured, saving time and avoiding errors. With the right approach, you can create a document that suits your business needs while maintaining professionalism and clarity.

Step-by-Step Process

Follow these steps to create an effective document layout:

- Choose a format: Start by selecting a format that suits your needs. You can create a simple table layout or use specialized software for more advanced features.

- Define key sections: Identify the core information that needs to be included, such as the transaction details, buyer and seller information, and pricing.

- Keep it organized: Ensure that each section is clearly labeled and logically organized for easy reading.

- Design for readability: Use clear fonts, appropriate spacing, and consistent formatting to make the document easy to understand.

Suggested Layout

A sample layout for your document might include the following sections:

| Section | Description | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Include your business logo, name, and contact information at the top. | ||||||||||||||||||||||||||

| Transaction Details | Provide a summary of the products or services, including quantity, price, and total cost. | ||||||||||||||||||||||||||

| Buyer/Seller Information | Include both the buyer’s and seller’s names, addresses, and contact details. | ||||||||||||||||||||||||||

| Payment Terms | Specify due dates, accepted payment methods, and any late fee details. | ||||||||||||||||||||||||||

| Footer | Optionally, add any additional information, such as terms and conditions or a tha

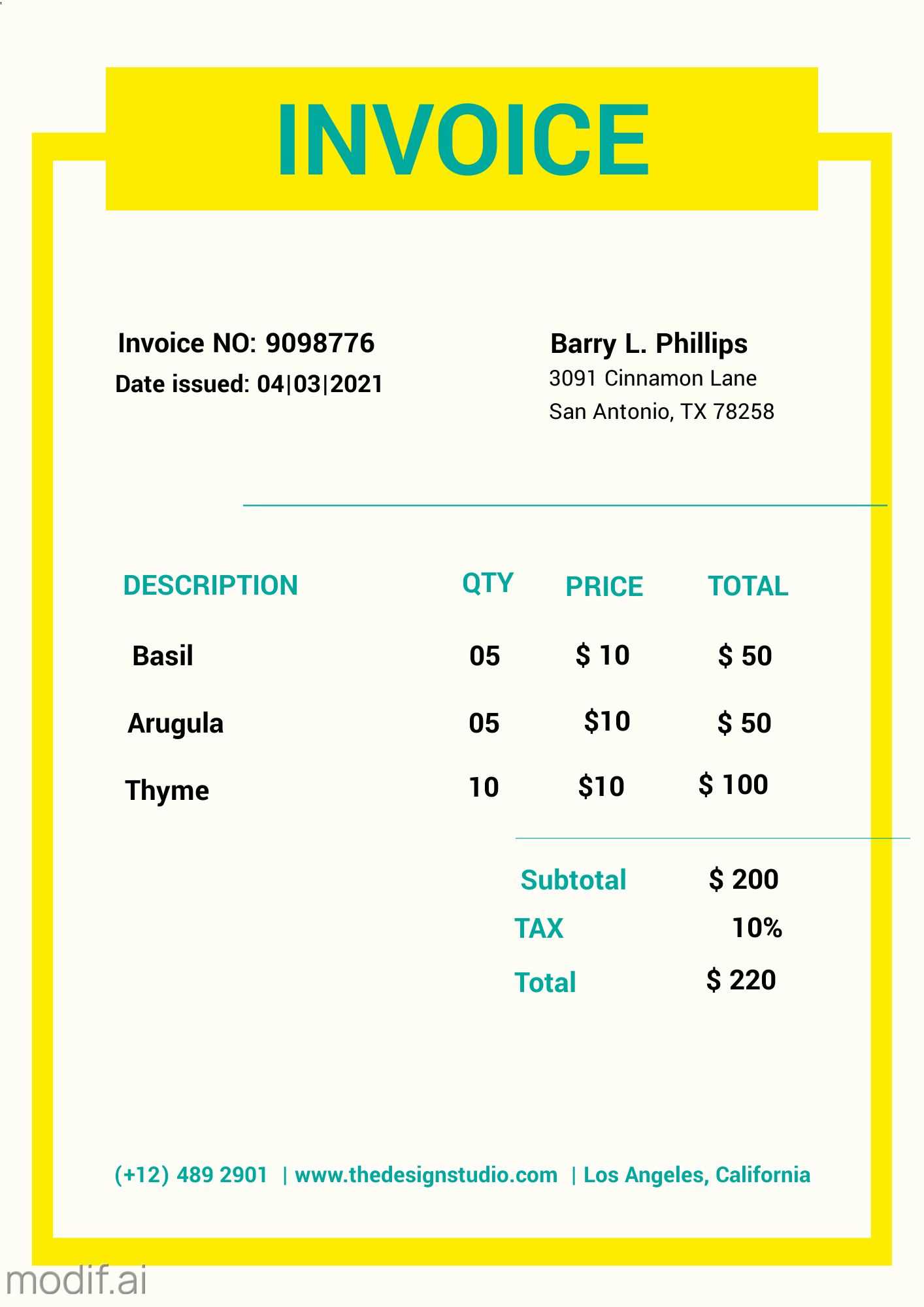

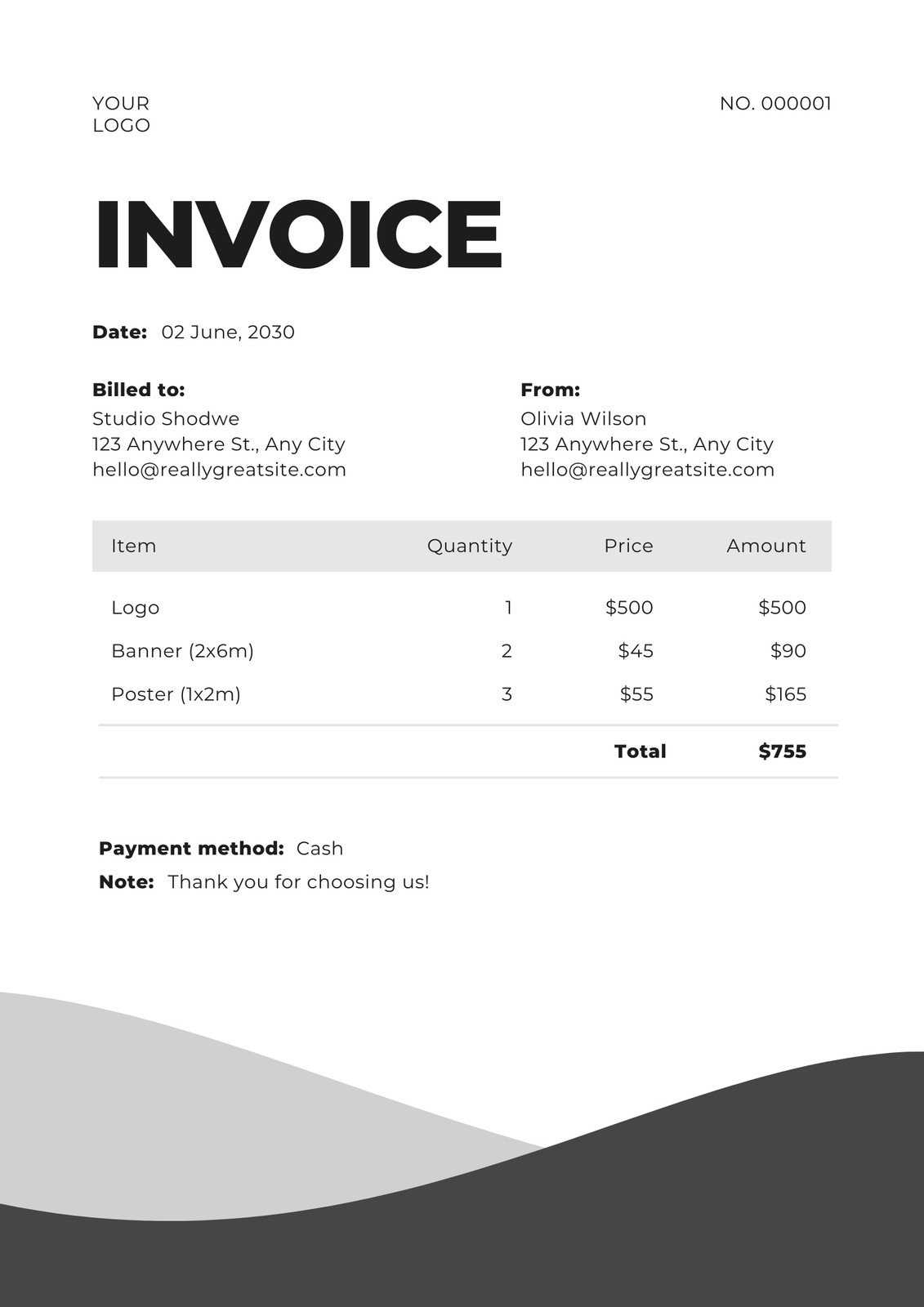

Customizing Your Invoice LayoutPersonalizing the structure of your transaction record is essential for ensuring it aligns with your business’s unique needs. A well-tailored document not only looks professional but also ensures that all relevant details are included in a clear and easy-to-understand manner. By customizing the layout, you can enhance readability, improve user experience, and reflect your brand identity. When customizing, focus on the following key elements to make the document functional and visually appealing:

While customization is important, make sure not to overcomplicate the layout. Keep the design clean and simple so that it remains professional and effective. A document that’s both functional and aligned with your business’s branding can make a significant impact on customer relationships and streamline your workflow. Essential Information on Sales InvoicesFor any transaction document to be effective, it must include the necessary details that clearly outline the terms of the exchange. These critical pieces of information ensure both parties understand the specifics of the agreement and can serve as an official record for accounting purposes. Without the right details, misunderstandings and discrepancies can arise, leading to potential disputes or missed payments. Here are the key elements that should be included in your document to ensure its effectiveness:

Including these key details ensures that the document is comprehensive, transparent, and useful for both financial records and legal purposes. By capturing all necessary information in a well-organized format, businesses can maintain clear and accurate transaction records, facilitating smoother operations. Free Templates vs Paid TemplatesWhen selecting a pre-designed structure for documenting transactions, businesses often face the choice between free and paid options. Both options come with their own set of advantages and drawbacks, and understanding the differences can help you decide which best suits your needs. While free designs may seem appealing due to their zero-cost benefit, paid versions often offer more customization and advanced features that could improve your workflow. Free options are widely available and can be a good starting point for small businesses or individuals who are just beginning. These templates typically cover the basic requirements but may lack advanced customization features. Additionally, they might not always offer the level of support or professional design that paid alternatives provide. On the other hand, paid designs often offer a higher level of customization, more professional layouts, and additional features like automated calculations, integrated payment options, and better customer support. These advantages can save businesses time and reduce the likelihood of errors, making them a good investment for those looking to streamline their processes. Common Mistakes to AvoidCreating a structured document for transactions can be straightforward, but there are several common pitfalls that individuals and businesses often encounter. Avoiding these mistakes is crucial to ensure clarity and professionalism, as well as to maintain accurate financial records. Being aware of potential errors can save time and prevent misunderstandings.

By being mindful of these common mistakes, you can enhance the effectiveness of your transaction documents, ensuring that they are clear, accurate, and convey professionalism. This attention to detail not only fosters trust with clients but also contributes to the smooth operation of your business. How to Use an Invoice Template EffectivelyUsing a pre-designed document for recording transactions can significantly streamline your workflow and reduce errors. However, simply filling out a template isn’t enough to ensure its effectiveness. To maximize its potential, it’s important to follow a few best practices that enhance clarity, organization, and professionalism. Here are some key steps for using a document layout effectively:

Key Information to IncludeEach transaction document should clearly present the following details:

By following these guidelines, you can ensure that your transaction records are clear, accurate, and professional, making them easier to manage and track over time. Legal Requirements for Sales InvoicesWhen creating a document to record financial transactions, it’s crucial to ensure compliance with local laws and regulations. These legal requirements not only help maintain transparency but also protect both the buyer and seller in case of disputes. Understanding what is legally mandated can help businesses avoid penalties and ensure smooth financial operations. Each country or region has specific rules for what needs to be included in a transaction record. However, there are common elements that are generally required across most jurisdictions. These include details about the buyer, seller, transaction amounts, and applicable taxes. Essential Legal InformationEnsure that your document includes the following mandatory details:

Staying Compliant with Local RegulationsIn addition to these standard requirements, businesses should be aware of any specific regulations in their area. For example, some countries require that certain legal disclaimers be included, while others may have specific rules about how digital documents should be stored. It’s important to research local regulations or consult with a legal expert to ensure full compliance. By meeting these legal requirements, businesses can maintain professional, legally sound transaction records, protecting both their operations and their customers. Choosing the Right Invoice FormatSelecting the proper layout for documenting financial transactions is crucial for clarity and professionalism. The format you choose not only affects how easy it is to record and track transactions but also plays a role in how your business is perceived by clients. A well-organized, easy-to-read structure can enhance communication and ensure that all the necessary details are included. There are several factors to consider when deciding on the most suitable structure for your documents:

To make the process easier, many businesses rely on pre-designed structures that can be customized as needed. However, the key is to strike a balance between simplicity and thoroughness, ensuring that all necessary details are present while keeping the document easy to understand and process. How to Save Time with TemplatesUsing pre-designed documents can significantly streamline administrative tasks, reducing the time spent on repetitive work. With a well-structured layout, you can avoid starting from scratch each time a new transaction occurs. This allows you to focus on other critical aspects of your business while ensuring consistency and accuracy in your records. Here are some ways templates can help you save valuable time:

Incorporating ready-to-use documents into your workflow helps save time, reduces manual effort, and ensures that you maintain professional standards without unnecessary delays. By adopting such practices, businesses can become more efficient while staying organized and consistent. Tips for Organizing Your Invoices

Efficiently managing financial records is essential for maintaining smooth business operations. Proper organization helps ensure that you can quickly retrieve information when needed, track payments, and stay on top of outstanding balances. Implementing a clear system not only boosts productivity but also provides peace of mind when it comes to financial audits or client queries. Here are some useful tips for organizing your financial documents effectively:

By adopting these strategies, you can ensure that your financial documentation remains organized, accessible, and up-to-date, making your business processes more efficient and reducing the risk of errors or missed payments. Using Templates for Different IndustriesPre-designed documents can be customized to suit the specific needs of various industries, helping streamline business operations and improve efficiency. Whether you’re in construction, retail, or services, having a structured approach to managing transactions can save time and reduce errors. By adapting standard layouts to match industry requirements, businesses can maintain consistency and professionalism across all dealings. Common Industries and Their Specific Needs

Benefits of Industry-Specific Templates

By utilizing tailored documents, businesses in various sectors can optimize their administrative processes, maintain professionalism, and ensure accurate record-keeping across all transactions. Incorporating Branding into Your InvoicesIncluding your company’s branding on official documents not only reinforces your brand identity but also ensures that every interaction with your clients reflects professionalism and consistency. A well-branded document provides more than just a functional purpose–it becomes a part of your overall marketing strategy. By incorporating your unique style into these essential papers, you enhance the customer experience and reinforce your brand’s message. Elements to Include for a Strong Brand Identity

Additional Tips for Effective Branding

By integrating these elements, your documents not only serve a functional purpose but also contribute to building a lasting, recognizable brand image that leaves a positive impression on every client interaction. Automating Document Generation with TemplatesAutomating the process of creating business documents can significantly streamline your workflow and save valuable time. By using pre-designed structures that require minimal manual input, you can quickly generate accurate and professional papers without the need to start from scratch each time. This level of efficiency is especially beneficial for businesses that handle large volumes of transactions or need to issue documents on a regular basis. Benefits of Automation

How to Implement Automation

Implementing an automated document generation system involves selecting the right software or tool that suits your business needs. Many modern platforms integrate with other business systems, such as accounting software or customer relationship management (CRM) tools, to pull relevant data directly into the document. This integration minimizes the risk of human error and ensures that your documents are generated accurately and quickly.

By automating document generation, businesses can improve efficiency, maintain consistency, and reduce the chances of errors, all while saving time a How to Handle Document Discrepancies

When discrepancies arise in business documents, it can create confusion and delay the transaction process. Whether it’s an error in pricing, quantity, or other important details, addressing discrepancies quickly and professionally is crucial to maintaining good relationships with clients and partners. This section will guide you through the steps to identify, resolve, and prevent such issues from affecting your business operations. Steps to Address Discrepancies

Preventing Future DiscrepanciesProactive measures can help minimize discrepancies in the future. Using automated systems, integrating data from your accounting software, and regularly reviewing your processes can significantly reduce the chances of errors occurring. Additionally, setting clear communication expectations with clients and partners from the outset can prevent misunderstandings that might lead to issues down the line.

By following these steps, you can effectively manage document discrepancies, ensuring smoother transactions and stronger business relationships. Updating Your Document Layout Regularly

To ensure that your business operations remain smooth and compliant, it’s essential to keep your document formats up-to-date. Over time, requirements and best practices may change, and your documentation should reflect these shifts. Regular updates help streamline your processes, improve accuracy, and maintain professional standards in your transactions. Stay Current with Legal and Tax Changes One of the main reasons to update your document layout is to comply with changes in legal or tax regulations. New laws or guidelines may require modifications to the way you present certain information. Failing to keep your documents current could result in penalties or confusion for both you and your clients. Always stay informed about any legal requirements that may affect how you present financial or transactional data. Adapt to Business Growth As your business grows, the needs of your customers and the complexity of your offerings may evolve. Updating your documentation allows you to tailor it to reflect new products, services, or pricing structures. Whether it’s adding new sections, adjusting your payment terms, or modifying the way you categorize charges, adapting your document format ensures it always meets the current needs of your business. Improving Professionalism and Efficiency Regular updates also present an opportunity to enhance the professional appearance of your documents. Streamlining the layout, optimizing font choices, and ensuring that all essential information is clearly visible can improve both the user experience and your company’s image. By investing in quality document design, you improve efficiency and ensure that clients can quickly understand the details of the transaction. Tips for Regular Updates

By dedicating time to regularly updating your document format, you ensure that your processes remain efficient, compliant, and professional, helping your business |