How to Use an Interest Invoice Template

Managing payments and ensuring that additional charges are properly accounted for can be a complex task for many businesses. Having a clear and organized method to document these extra fees helps maintain transparency and smoothen the billing process. This section explores a straightforward approach to creating documents that reflect additional costs for delayed payments or services rendered beyond the agreed terms.

By using a well-structured format, you can ensure that all necessary details are included, preventing misunderstandings and disputes. Creating a professional document that outlines these charges not only improves your credibility but also aids in maintaining consistent financial records. Whether you are a freelancer, a small business owner, or part of a larger company, having the right system in place is essential.

Properly formatting these documents and automating their creation whenever possible can save you time and effort. With the right tools, it’s easier than ever to streamline the billing process and ensure all parties are clear on what is owed.

Understanding Billing Documents for Additional Charges

In business transactions, ensuring that extra fees are properly documented and communicated is crucial. When a payment is overdue or services extend beyond the initial agreement, it’s essential to have a clear method to reflect these additional costs. This section explains the concept behind structured billing documents that outline extra charges for such situations, helping both parties stay on the same page.

Why These Documents Are Important

Using a well-organized approach to list additional charges ensures that customers clearly understand the fees they are being charged. It also serves as a reminder of payment obligations, preventing confusion and promoting timely payments. A comprehensive format, which includes all necessary details like amounts, dates, and explanations, minimizes the risk of disputes.

Key Elements of a Properly Structured Document

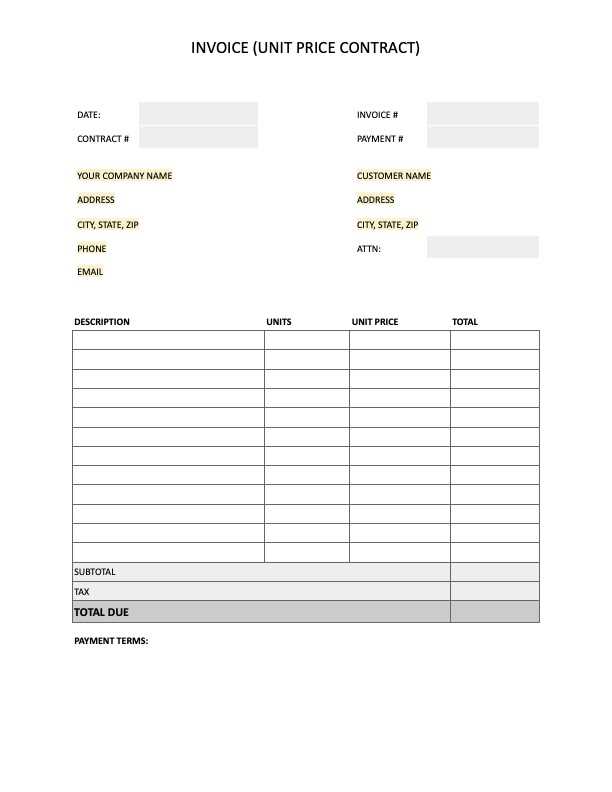

A correctly formatted document should include essential components that outline the extra charges in a clear and transparent manner. Below is an example of a basic structure that businesses often use to ensure all required details are presented:

| Item | Description | Amount | Due Date |

|---|---|---|---|

| Late Payment Fee | Charge for overdue payment beyond the agreed period | $50.00 | 2024-11-10 |

| Service Extension Fee | Charge for additional hours of service rendered | $30.00 | 2024-11-05 |

This table illustrates how a simple breakdown of extra charges, descriptions, amounts, and deadlines can help in keeping transactions clear and organized.

Why Use a Billing Document for Additional Charges

Managing extra fees effectively is crucial for maintaining accurate financial records and ensuring a smooth transaction process. Without a standardized approach, it can be easy to overlook important details or miscommunicate charges to customers. Using a well-structured billing document provides clarity, consistency, and helps streamline the entire process of documenting additional fees.

Consistency and Professionalism

A consistent format for outlining additional costs reflects professionalism and attention to detail. By using a pre-designed structure, businesses can ensure that all necessary components are included in each document, reducing the chances of mistakes. It also promotes a uniform appearance, which is essential for maintaining a trustworthy reputation with clients and partners.

Time and Efficiency Savings

Instead of creating a new document from scratch every time, using a standardized form allows for quicker generation and reduces the effort required to prepare each billing statement. Whether you’re handling a large number of transactions or just a few, automating the creation of these documents helps save valuable time and ensures greater accuracy in calculations.

Key Features of a Billing Document for Additional Charges

When documenting extra fees, it is important to include specific elements that ensure transparency and clarity. These key components not only help both parties understand the charges but also provide a professional and organized approach to managing financial transactions. Below are the essential features that should be included in any billing document that addresses added costs.

| Feature | Description |

|---|---|

| Clear Breakdown of Charges | Each additional cost should be itemized with a detailed description of the reason for the charge. |

| Due Date | Clearly state the date by which payment is expected, ensuring there is no confusion regarding deadlines. |

| Payment Terms | Define the payment terms, such as accepted methods and whether any penalties will apply for late payments. |

| Total Amount | Provide a clear total that includes all charges and fees, ensuring the final amount is easily identifiable. |

| Contact Information | Include clear contact details for any queries related to the charges or payment process. |

These features not only ensure the document’s effectiveness in communicating the required details but also help prevent any misunderstandings between the involved parties.

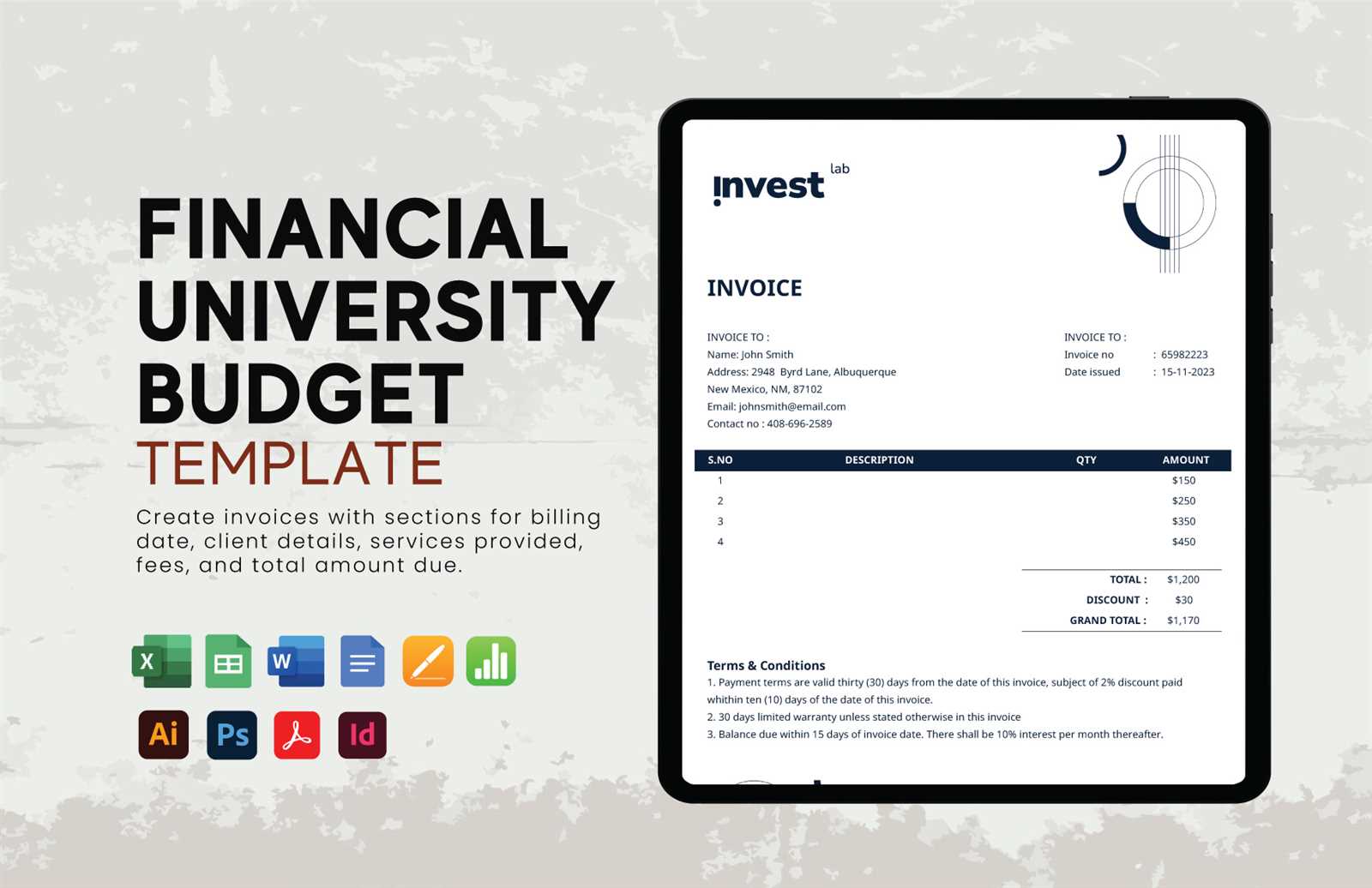

How to Customize Your Billing Document

Tailoring your document to meet specific needs is essential for ensuring that it fits your business requirements and communicates the necessary information clearly. Customizing the structure allows you to include the relevant details for each situation, making the document both functional and professional. Below are steps to personalize your document for better accuracy and clarity.

Step 1: Adjusting the Layout

Start by modifying the layout to match your branding and business style. This includes adjusting fonts, colors, and the arrangement of sections. You can also add your company logo or other identifying elements to make the document look more professional and aligned with your business identity.

Step 2: Adding or Removing Sections

Depending on the nature of the additional charges, you may need to add or remove certain sections. For example, you could include a section for discounts, taxes, or payment instructions. Alternatively, you might remove unnecessary details if they don’t apply to the current transaction.

| Section | Customizable Option |

|---|---|

| Header | Add business name, logo, and contact details. |

| Charge Description | Modify to reflect specific charges such as late fees or service extensions. |

| Payment Instructions | Specify preferred payment methods and terms. |

| Footer | Include legal disclaimers, return policies, or other relevant notes. |

By adjusting these sections, you ensure the document reflects your needs and maintains accuracy in each transaction.

Essential Elements of a Billing Document for Additional Charges

When creating a document to reflect additional fees, it’s important to include several key components that ensure clarity and accuracy. These elements not only help to break down the charges in a comprehensible way but also provide all the necessary information for both the business and the customer. Below are the essential parts that should always be included in such documents.

1. Clear Description of Charges: Each fee should be clearly explained, including the reason for the charge and how it was calculated. This helps avoid confusion and provides transparency.

2. Due Date: Including a specific deadline for when the payment is due ensures there is no ambiguity about the expected timeframe for settling the account.

3. Payment Terms: Clearly state the terms for payment, such as acceptable payment methods, any penalties for late payments, or conditions for discounts if paid early.

4. Total Amount: The total sum should include all charges and be easy to locate. This allows the recipient to quickly understand the full amount due.

5. Contact Information: Ensure that contact details are provided in case the recipient has any questions or concerns about the charges.

How to Calculate Additional Charges for Late Payments

When payments are delayed, businesses often charge extra fees to compensate for the time value of money. Calculating these additional charges requires a clear understanding of the rate to apply, the time period involved, and the amount overdue. Below is a guide to help you determine how to calculate these fees accurately and fairly.

Step 1: Determine the Charge Rate

The first step in calculating late fees is to determine the rate at which the charges will accrue. This rate is often specified in the agreement or contract and may be a percentage of the total amount due, calculated either daily, monthly, or annually. For example, a 1% per month fee would add 1% of the outstanding balance each month the payment is overdue.

Step 2: Calculate the Time Period

Next, you need to determine the time that the payment has been overdue. This is the number of days, weeks, or months the payment has been delayed beyond the original due date. A simple formula is:

Time Period = Overdue Date – Original Due Date

Step 3: Apply the Formula

Once you have the rate and the overdue period, apply the calculation. For example, if the total amount due is $1,000 and the charge rate is 1% per month, and the payment is 2 months late, the calculation would be:

Additional Fee = Total Amount Due × Rate × Number of Periods

In this case:

Additional Fee = $1,000 × 0.01 × 2 = $20

Thus, the total amount due would increase by $20 due to the late payment.

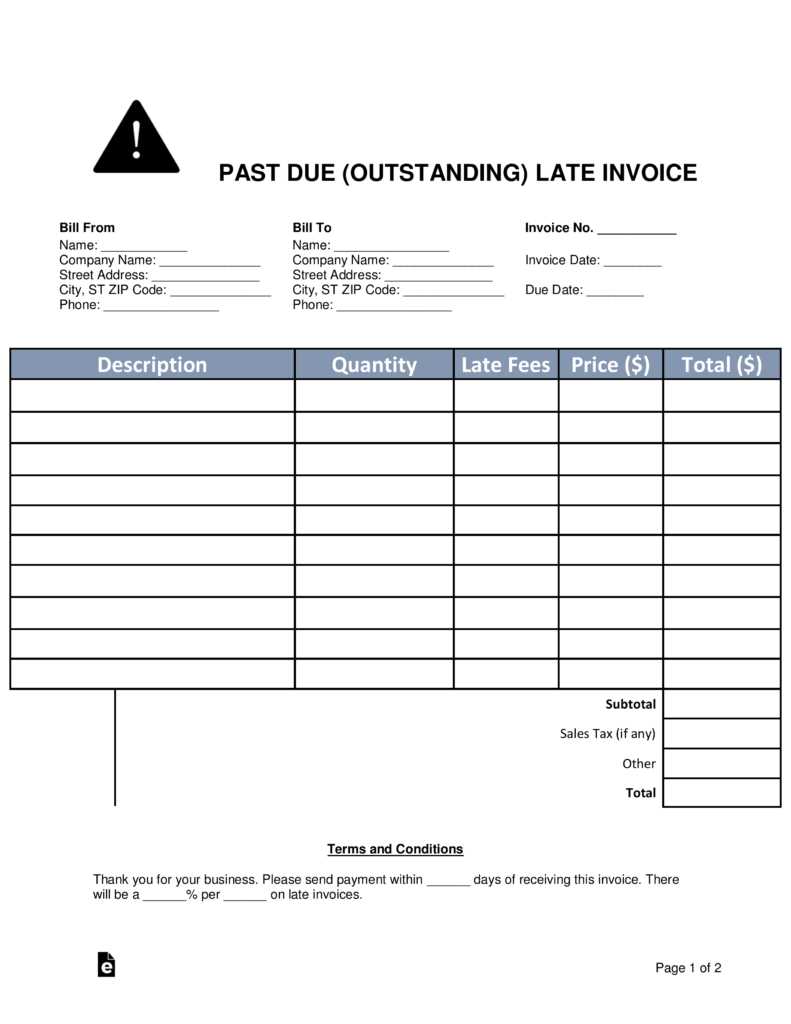

Different Types of Billing Documents for Added Charges

There are various types of billing documents that reflect additional fees, each suited to different scenarios and payment terms. These documents can vary depending on the nature of the charges, the time period involved, and the specific agreement between the business and the customer. Understanding the different types can help businesses select the right format for each situation.

Late Payment Charges

One of the most common types of documents for added fees is related to late payments. These documents typically outline the charges incurred due to overdue balances and often include a fixed percentage added to the outstanding amount for each period the payment is delayed. The document will specify the amount due, the original due date, and any additional fees based on the duration of the delay.

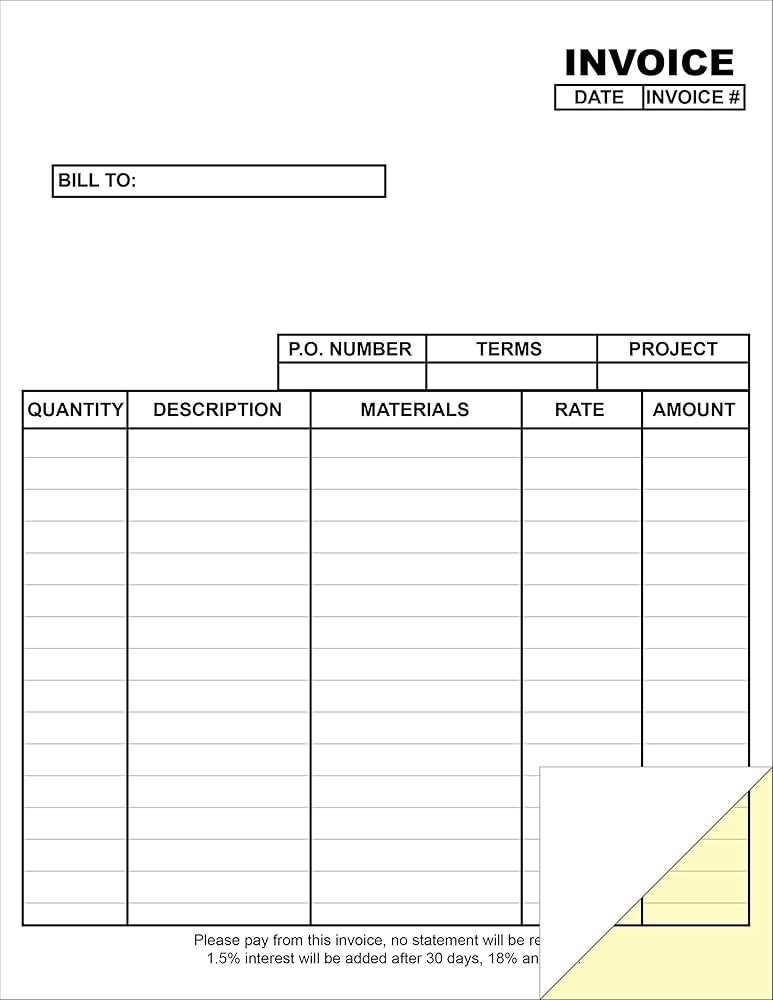

Extended Service Charges

Another common type of document is one that outlines charges for services rendered beyond the initial agreement. These documents specify the additional cost for extra hours worked or services provided outside of the original scope. It is essential to clearly outline the extra charges in this type of document, ensuring that the client understands the reason behind the increased fees.

How to Format a Billing Document for Additional Charges

Creating a well-organized billing document for added fees is essential to ensure clarity and transparency in financial transactions. Proper formatting not only helps the recipient understand the breakdown of charges but also ensures that all relevant details are easily accessible. Below are key steps to format such a document effectively.

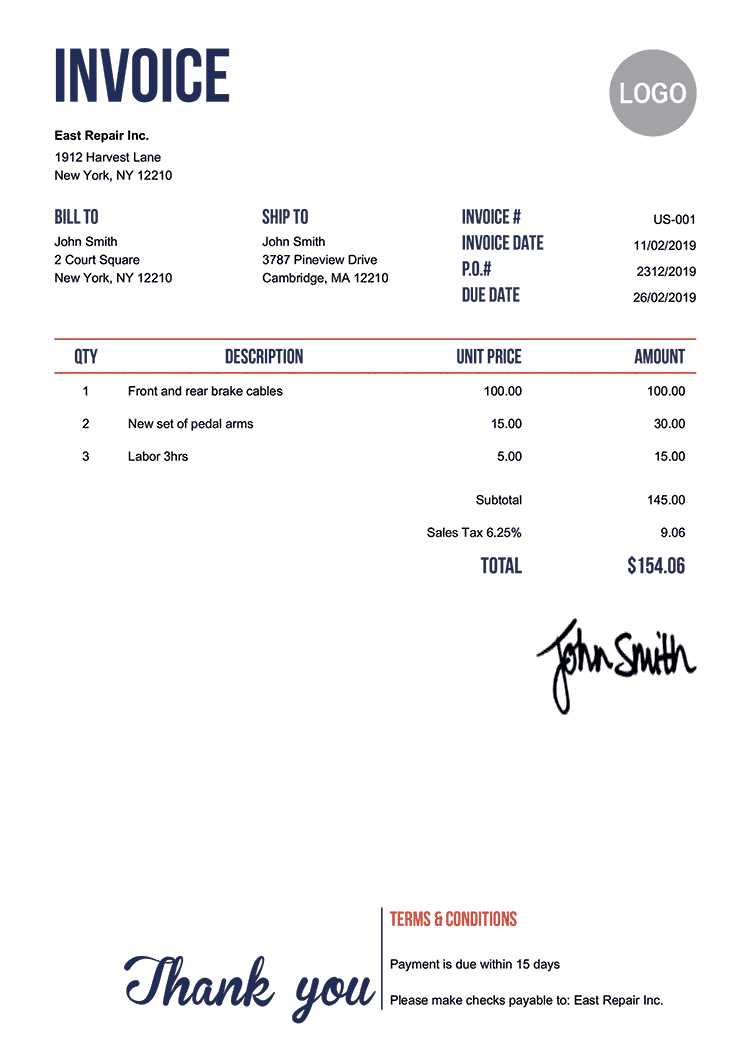

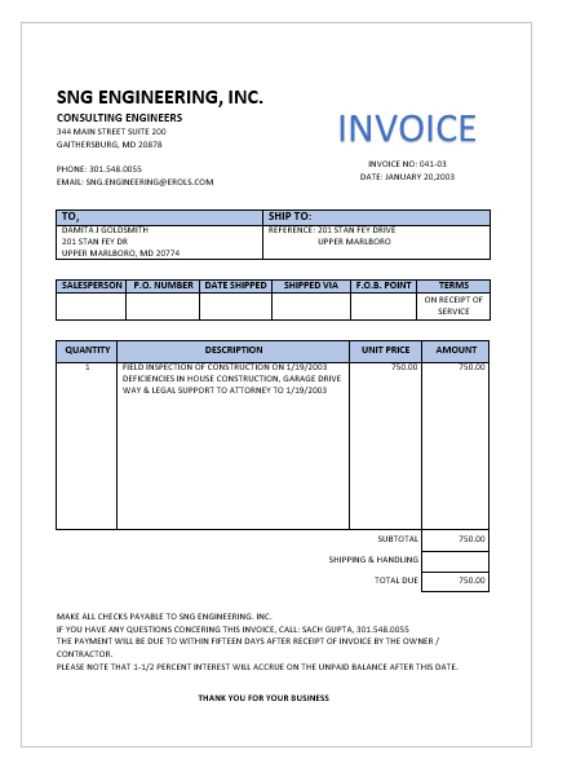

1. Include the Necessary Header Information

The first section of your document should include key information about your business and the recipient. This includes your company’s name, address, and contact information, along with the recipient’s details. This section helps establish a clear point of contact for any questions regarding the charges. Don’t forget to include the document number and the date for future reference.

2. Break Down the Charges Clearly

The most important part of the document is the breakdown of the additional charges. Each fee should be listed separately with a clear description, such as the reason for the charge and the amount. Use a table format for easy readability, ensuring that each entry is clearly labeled and easy to understand.

| Description | Amount |

|---|---|

| Late Payment Fee | $25 |

| Service Extension Fee | $50 |

| Tax | $5 |

3. Clearly State the Total Amount Due

Once the individual charges are listed, include a total section that sums up all the fees. This should be easy to locate and should highlight the final amount due, ensuring there is no confusion about the total payment expected.

4. Provide Payment Instructions

Conclude the document by including clear instructions on how the recipient can pay the outstanding amount. Specify acceptable payment methods, payment deadlines, and any applicable late payment penalties if the payment is not made within the specified timeframe.

Benefits of Using Preformatted Documents for Billing

Using pre-designed documents for billing provides a wide range of benefits for businesses. These ready-made structures help streamline the process, reduce errors, and ensure consistency across all communications with clients. By utilizing such formats, businesses can save valuable time and maintain a professional appearance in their financial dealings.

1. Time Efficiency

One of the key advantages of using preformatted documents is the significant amount of time saved. Instead of starting from scratch with each new bill, you can simply fill in the necessary details. This approach not only speeds up the billing process but also eliminates the need to reformat each document individually, allowing for quicker processing and fewer delays.

2. Consistency and Professionalism

Maintaining a consistent format across all billing documents is crucial for professionalism. Using pre-designed formats ensures that each document looks uniform and polished, reflecting positively on your business. It also helps to present a clear and organized structure, making it easier for recipients to understand and process the charges.

Common Mistakes When Creating Billing Documents for Added Charges

Creating accurate and clear billing documents for additional charges is essential to maintaining healthy business relationships. However, several common mistakes can occur during the process, leading to confusion or disputes. These errors can be avoided by understanding the potential pitfalls and ensuring that each document is correctly formatted and transparent.

- Failure to Include Clear Terms: One of the most frequent mistakes is not specifying the terms of the additional charges, such as the interest rate, payment deadlines, or late fees. Without these details, clients may be confused about how the charges are calculated and what is expected of them.

- Incorrect Calculation of Charges: Errors in calculating the added fees can result in incorrect amounts being charged. Whether it’s a mistake in applying the rate or an oversight in the time period, incorrect calculations can cause disputes and undermine trust.

- Lack of Transparency: Not providing a breakdown of the charges can leave clients feeling uncertain about what they are paying for. Clear explanations of each fee and its calculation are essential for maintaining transparency.

- Missing Contact Information: Failing to include the right contact details can create confusion if clients have questions or need clarification regarding the charges. Ensure that your business’s contact information is always included.

- Not Specifying Payment Methods: Omitting details about acceptable payment methods can delay the process. Be sure to list all payment options clearly, so customers know how they can settle the balance.

By avoiding these common mistakes, businesses can create clear, accurate, and professional documents that ensure both parties are aligned and avoid unnecessary conflicts or delays.

Legal Considerations for Charging Additional Fees in Billing Documents

When including added fees in billing documents, it is crucial to consider the legal aspects to ensure compliance with regulations and avoid potential legal disputes. Different regions and jurisdictions have specific rules regarding the calculation, disclosure, and collection of these extra charges. Failing to adhere to these rules can result in legal penalties or damaged relationships with clients. Understanding the legal framework is essential for businesses to protect themselves and maintain transparent financial practices.

1. Compliance with Local Laws

The first legal consideration when applying additional charges is ensuring that your practices comply with the laws of the jurisdiction in which your business operates. Many regions have specific regulations that govern how and when these fees can be applied. For example, interest or late payment charges might be capped at a certain percentage or require specific disclosures.

2. Clear Terms and Conditions

To avoid any potential conflicts, it is essential to clearly outline the terms under which extra fees are applied in your contract or service agreement. This ensures that both parties are aware of the terms before any charges are incurred. Failing to disclose these terms in advance can lead to accusations of unfair practices or breaches of contract.

| Fee Type | Legal Limitation |

|---|---|

| Late Payment Charges | Must comply with local interest rate regulations. |

| Service Extension Fees | Should be clearly outlined in service agreement. |

| Penalty Fees | Must be reasonable and non-excessive. |

3. Avoiding Unconscionable Terms

Another important legal consideration is to ensure that the terms applied to additional charges are not unconscionable. Charging excessive fees or imposing unreasonable terms could lead to the charges being deemed unenforceable in a court of law. It is crucial to strike a balance between fair compensation for services and maintaining fair business practices.

By addressing these legal considerations, businesses can ensure that they are compliant with regulations, maintain transparency with clients, and avoid any legal issues that may arise from improperly applied charges.

Tips for Automating Billing Document Creation with Added Charges

Automating the process of creating billing documents for added charges can significantly improve efficiency, reduce errors, and save time. By leveraging the right tools and software, businesses can streamline their billing process and ensure accuracy while focusing on other important tasks. Implementing automation in this area allows for consistency and smoother operations across multiple transactions.

1. Choose the Right Software

To automate the process effectively, it’s essential to select billing software that aligns with your business needs. Look for platforms that offer customizable features, such as automatic calculation of additional charges, easy template creation, and integrations with accounting systems. These tools can automate much of the manual work, including applying the correct fees and generating the necessary documents instantly.

2. Set Up Clear Rules and Parameters

Automation is only effective when the rules are clearly defined. Set up specific parameters for the calculation of additional fees, such as interest rates, payment deadlines, and applicable penalties for late payments. By establishing these parameters within your software, you ensure that the calculations are done consistently and in line with your business policies.

3. Implement Scheduling Features

One of the advantages of automation is the ability to schedule billing documents to be generated automatically on a regular basis. By setting up recurring billing cycles, you can ensure that clients receive timely updates regarding any outstanding charges. This reduces the need for manual tracking and ensures that the billing process remains consistent each month or cycle.

4. Integrate with Other Systems

To further streamline the process, integrate your billing software with other business systems such as CRM platforms, payment gateways, or accounting software. This integration helps you track client transactions in real-time, apply accurate charges, and automatically update records when payments are made. A seamless flow of data between systems minimizes the risk of errors and enhances operational efficiency.

By adopting these strategies and leveraging automation tools, businesses can significantly reduce the time spent on billing tasks while ensuring accuracy and professionalism in their operations.

How to Track Payment Deadlines

Tracking payment deadlines is a crucial part of managing business transactions. Ensuring that clients meet their payment obligations on time can prevent cash flow issues and maintain a smooth financial operation. By implementing the right systems and practices, you can easily monitor due dates, send timely reminders, and ensure that your accounts stay on track.

One of the most effective ways to track payment deadlines is by using digital tools or software that allow you to input due dates and automatically alert you when they are approaching. These tools can integrate with your financial systems to provide real-time updates on the status of payments, giving you an overview of which invoices are pending and which ones have been paid.

Additionally, it’s important to establish a clear and consistent process for tracking due dates. For instance, setting reminders for a few days before the deadline will allow enough time to reach out to clients if needed. Moreover, keeping organized records of past due dates and payments can help you spot trends and address potential issues early on.

1. Utilize Reminder Systems

Many accounting software platforms offer built-in reminder systems that notify you when payments are due or overdue. These systems can be customized to send alerts at various intervals, such as a week before the due date, on the due date itself, and after the deadline has passed. Automated reminders can save you time and reduce the risk of forgetting about important payment deadlines.

2. Set Clear Payment Terms

Clear communication with your clients about payment deadlines is essential. Make sure that payment terms are specified in the contract or agreement, including the exact due date, any grace periods, and the consequences of late payments. By being transparent from the beginning, you set clear expectations, which helps reduce delays and misunderstandings.

With these practices in place, you can effectively manage and track payment deadlines, ensuring that your business remains financially stable and that clients understand their responsibilities.

Integrating Billing Documents with Accounting Software

Integrating billing documents with accounting systems is a powerful way to streamline financial management. This process allows businesses to automate the flow of financial data between systems, ensuring that all transactions are recorded accurately and efficiently. By linking the two, you can eliminate manual data entry, reduce the risk of errors, and save valuable time.

1. Benefits of Integration

When billing documents are connected to accounting software, every transaction is automatically reflected in the financial records. This real-time data synchronization helps maintain consistency between the accounts receivable ledger and the financial statements. Integration also simplifies the tracking of payments, making it easier to generate reports and monitor cash flow.

Moreover, this integration can automate the calculation of any additional charges, such as penalties or fees for overdue payments, ensuring they are applied consistently across all transactions. By streamlining these processes, businesses can focus on more strategic tasks rather than manual bookkeeping.

2. How to Set Up Integration

Setting up an integration between billing documents and accounting software usually involves connecting the two platforms using an API (Application Programming Interface) or other integration tools. Many modern accounting software solutions offer native integrations with popular billing systems, which makes the process straightforward. If direct integration is not available, third-party tools can often bridge the gap between the two systems.

Key steps include:

- Choose accounting software with robust integration capabilities.

- Link the billing system to the accounting platform through secure API connections.

- Test the integration to ensure data is transferring correctly.

- Set up automation rules for syncing data, such as payment updates and overdue fees.

By integrating these two systems, businesses can achieve a higher level of efficiency, reduce errors, and gain better visibility into their financial health.

Best Practices for Sending Billing Statements

Sending billing statements is an essential part of managing your financial operations. To ensure timely payments and maintain strong customer relationships, it’s important to follow a set of best practices. These practices help communicate expectations clearly, minimize confusion, and avoid delays. A well-organized and professional approach to sending these documents enhances the overall customer experience.

1. Ensure Clarity and Accuracy

Before sending any documents, double-check all details to ensure accuracy. This includes verifying the amounts due, the payment terms, and any applicable fees. Clear and precise information helps prevent misunderstandings and reduces the likelihood of disputes. Additionally, clearly outline the due date and any penalties for late payments, so the client knows exactly what to expect.

It’s also a good idea to include an itemized list of the charges, showing a breakdown of services or goods provided. This level of transparency can improve trust and lead to smoother transactions.

2. Send Invoices Promptly

Timeliness is key when sending billing statements. The sooner you send them after a service or product delivery, the easier it will be for your clients to make timely payments. Consider setting up automated systems that generate and send these documents as soon as they are needed. This reduces the chances of forgetting to send them and helps maintain a consistent schedule for both you and your clients.

Sending reminders ahead of the payment due date or offering early-bird discounts can also encourage prompt payments, benefiting both parties.

Best practices include:

- Check all details before sending, ensuring accuracy and clarity.

- Send billing statements promptly after services are rendered or goods delivered.

- Offer multiple payment methods to make it easier for clients to pay.

- Provide clear contact information in case there are questions or concerns.

By following these best practices, you can streamline the billing process, minimize disputes, and improve cash flow management.

Ensuring Accuracy in Interest Calculations

Accurate calculations are critical when it comes to adding extra charges or fees to financial statements. Mistakes in these calculations can lead to confusion, disputes, and potential financial discrepancies. To avoid such issues, it’s essential to follow a systematic approach, use reliable tools, and double-check every figure. By ensuring that your calculations are precise, you can foster trust with clients and maintain smooth business operations.

1. Understand the Calculation Method

Before making any calculations, make sure you fully understand the method being used. There are several ways to calculate additional charges, such as simple interest, compound interest, or a flat fee structure. Each method has its own set of rules and formulas, so be clear on which one applies to your situation.

- Simple Interest: Typically used for straightforward calculations based on a fixed percentage over a specific time period.

- Compound Interest: Used when interest is calculated on the initial amount as well as any accumulated interest from previous periods.

- Flat Fees: Applied as a fixed fee added on top of the total amount due, regardless of the payment period.

Understanding which method to use ensures that you apply the correct formula and avoid overcharging or undercharging your clients.

2. Double-Check for Errors

One of the simplest yet most effective ways to ensure accuracy is to double-check all your calculations. Even a small mistake, such as an incorrectly typed number, can lead to significant discrepancies. Make use of automated tools or calculators that handle these computations for you to minimize human error.

Additionally, reviewing the details of the transaction, including the amount due, payment terms, and any adjustments, can help identify any potential mistakes before the final statement is sent out.

3. Use Automated Tools

Many accounting or financial management tools offer built-in calculation features that help streamline the process and reduce the risk of mistakes. These tools often come with preset formulas, ensuring that the calculations are performed consistently and accurately every time. Automation not only saves time but also increases the reliability of your statements.

Key tips for ensuring accuracy:

- Familiarize yourself with the calculation methods and use them correctly.

- Always double-check the numbers before finalizing any document.

- Take advantage of automated tools to streamline and safeguard calculations.

- Maintain clear records and track all adjustments to avoid confusion later on.

By following t