How to Create and Customize an Invoice Template for Your Business

In today’s fast-paced business world, managing payments efficiently is essential for smooth operations. One of the key tools for achieving this is a well-structured payment request that ensures clarity and professionalism. Having a document that reflects your brand’s identity while conveying all necessary details can significantly improve communication with clients.

Building a functional payment document involves understanding key elements that need to be included, such as payment terms, service descriptions, and contact information. Customizing these documents to fit your specific needs can make a considerable difference in how your business is perceived.

Whether you’re a freelancer or a small business owner, mastering the art of crafting clear and organized billing forms is crucial. In this guide, we’ll walk you through the process, from setting up essential components to ensuring your document is both professional and easy to navigate.

How to Create an Invoice Template

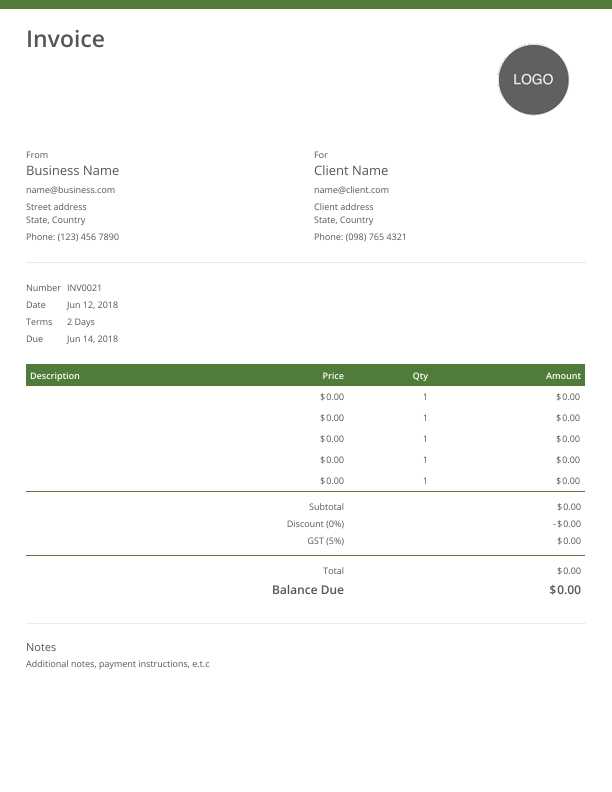

Designing a billing document involves organizing key information in a clear, concise format. The goal is to ensure that clients can easily understand the terms, amounts, and other relevant details. A well-structured form can streamline payment processing and reduce misunderstandings, ensuring a smooth transaction process for both parties.

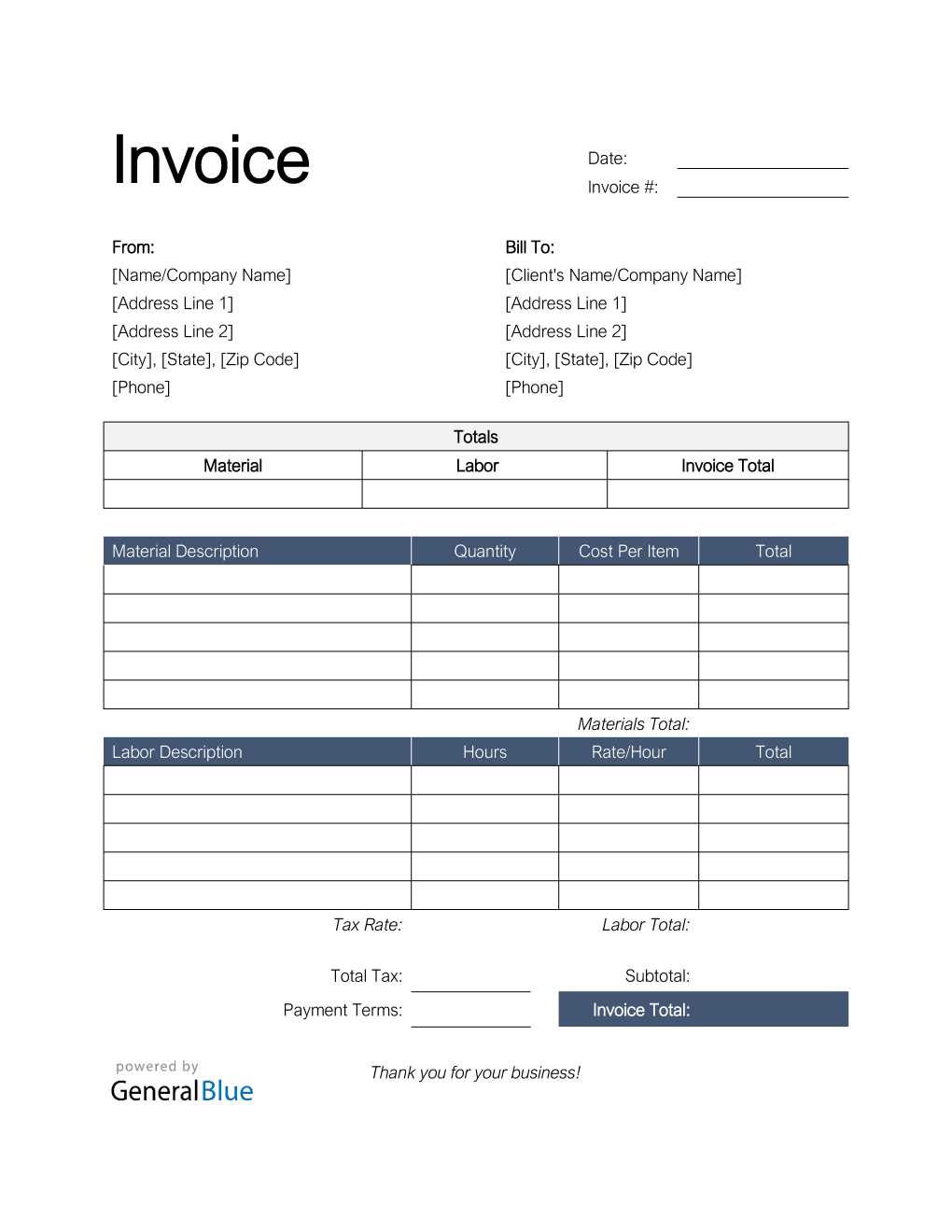

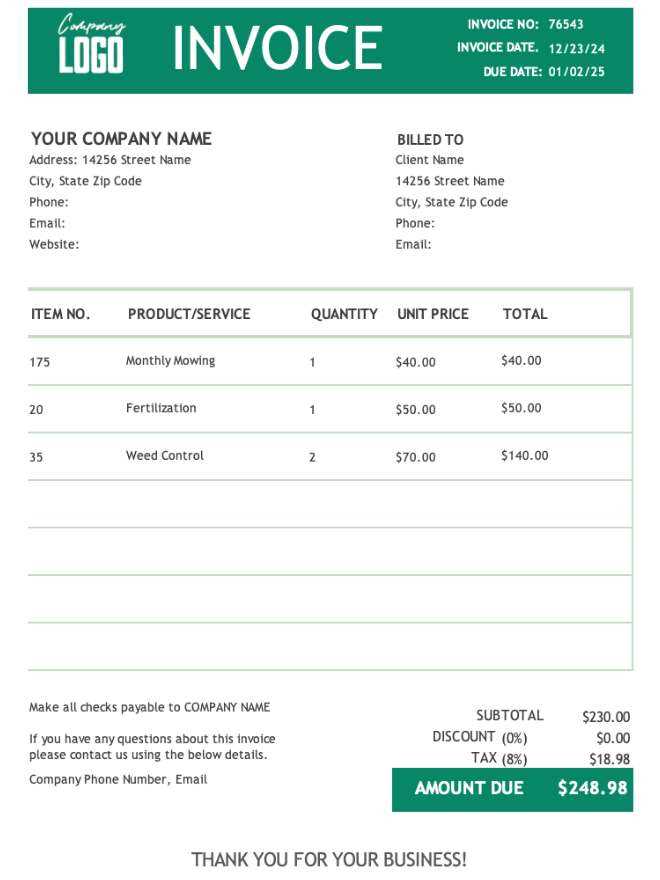

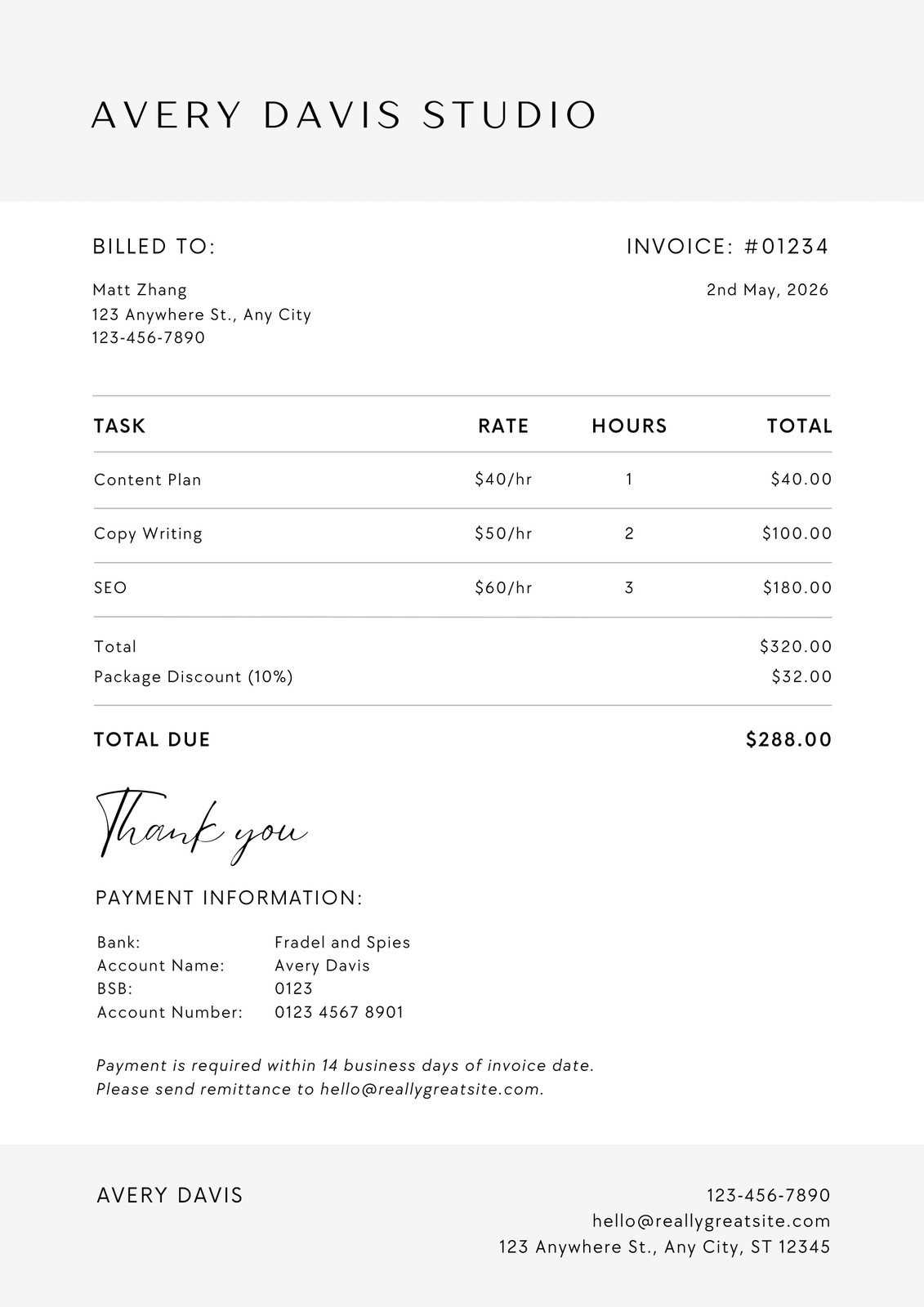

Start by including essential components such as the recipient’s name, your business details, a breakdown of products or services, and the total amount due. Make sure that each section is clearly labeled to avoid any confusion. This basic structure serves as a foundation for crafting professional documents tailored to your specific needs.

Once the fundamental information is in place, focus on customizing the design to reflect your brand’s identity. Choose fonts, colors, and layouts that align with your business style while maintaining readability and professionalism. The final document should not only serve as a functional tool but also leave a positive impression on your clients.

Benefits of Using Custom Invoice Templates

Utilizing a personalized billing document offers several advantages that can enhance both your business operations and client relationships. When designed to fit your specific needs, such a form can help ensure accuracy, improve efficiency, and present a professional image to your customers.

One of the primary benefits is the ability to streamline the payment process. With a consistent structure, clients can quickly review important details, such as the amount owed, the payment terms, and due dates. This reduces the chance of errors and delays, helping you get paid faster.

Another key advantage is brand consistency. By incorporating your business logo, colors, and contact information, you reinforce your brand identity with every transaction. This not only improves recognition but also conveys a sense of professionalism, helping you build trust with clients.

Lastly, customizing your billing documents makes it easier to track financial records. You can include unique numbering systems, categorize services or products, and even adjust payment terms as your business evolves. This level of flexibility simplifies both the administrative and accounting sides of your operations.

Essential Elements of an Invoice

To ensure smooth transactions, it’s crucial to include key details in your billing document. These elements help both you and your clients quickly identify necessary information and prevent any misunderstandings. Whether you’re sending a single request or handling multiple clients, consistency and clarity are essential.

Key Information to Include

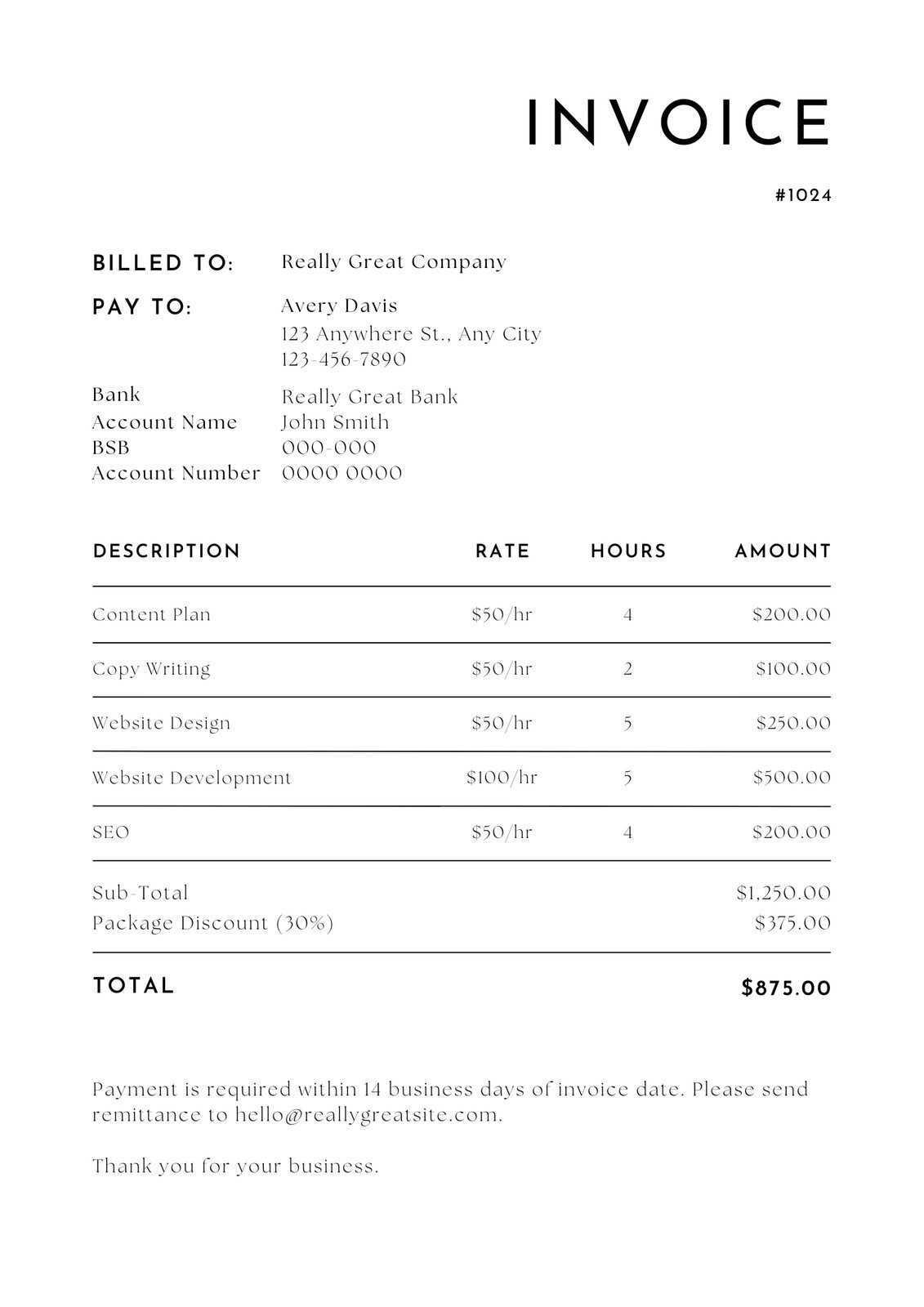

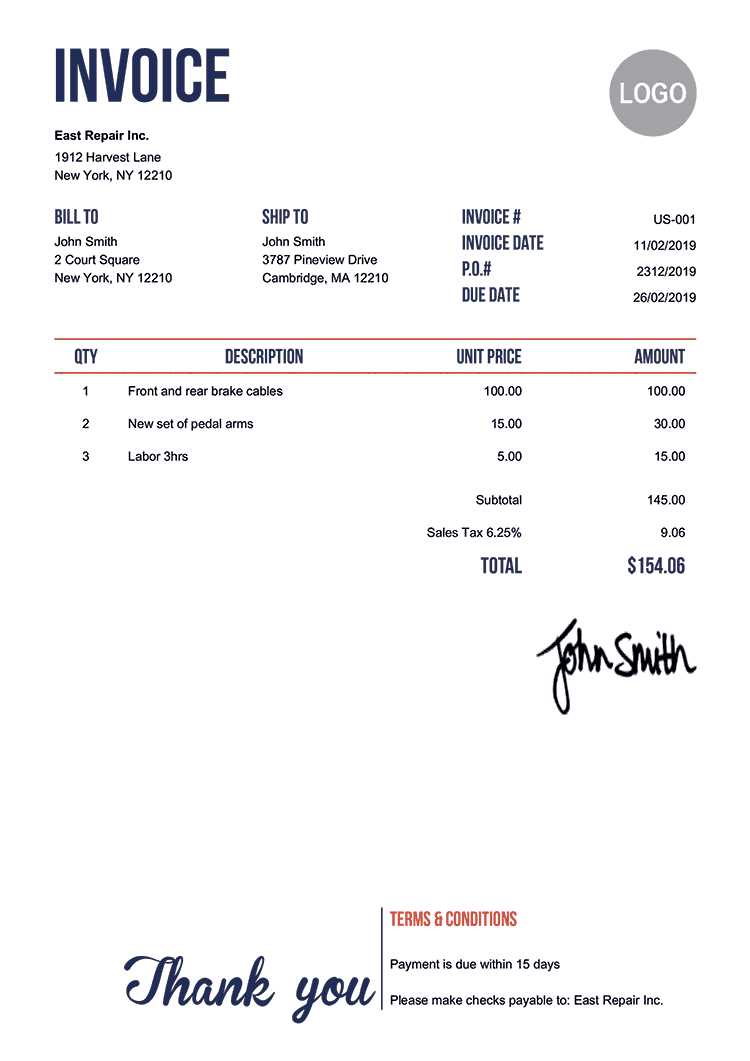

- Sender’s Details: Your business name, address, contact information, and tax identification number.

- Recipient’s Details: Client name, address, and contact information.

- Unique Reference Number: A unique identification code for tracking the document.

- Issue Date: The date the billing document is generated.

- Due Date: The deadline for payment.

- Description of Services/Products: A breakdown of the services rendered or items sold.

- Total Amount Due: A clear figure reflecting the amount the client owes, including any taxes or additional fees.

Optional but Useful Details

- Payment Terms: Include any specific conditions such as late fees, installment options, or discounts for early payment.

- Payment Methods: Indicate the acceptable ways clients can settle the amount (e.g., bank transfer, credit card, online payment).

- Notes or Messages: Additional space for personalized messages or reminders.

Choosing the Right Invoice Design

The appearance of your billing document plays a significant role in creating a professional image and enhancing client experience. A well-designed form is not just functional but also reflects your brand’s identity, making it easier for clients to process payments and build trust in your business. Selecting the right layout can help improve clarity, reduce errors, and streamline communication.

Factors to Consider

- Brand Identity: Use colors, fonts, and logos that align with your brand. Consistency in design strengthens recognition and reinforces your business’s professionalism.

- Clarity and Simplicity: Ensure the layout is easy to follow. A clutter-free design helps clients quickly identify key information like amounts, terms, and payment details.

- Readability: Choose fonts and text sizes that are legible both on screen and in print. Make sure the most important details stand out without overwhelming the reader.

- Adaptability: The design should be versatile, whether sent via email or printed out. It should look good on both desktop and mobile devices.

Popular Design Styles

- Minimalist: A clean, simple layout with plenty of white space, focusing on essential information only.

- Modern: Bold typography and graphics, often using colorful accents, that reflect a contemporary and dynamic business.

- Classic: A more traditional style, with formal fonts and a straightforward structure, suitable for established industries.

Step-by-Step Guide to Making Invoices

Designing a payment request document can seem overwhelming at first, but by breaking it down into manageable steps, the process becomes much simpler. With a structured approach, you can ensure that each section is properly completed, saving you time while ensuring your clients have all the details they need to process payments.

Essential Steps in the Process

- Include Your Business Information: Start with your company name, address, and contact details. You may also need your tax identification number, depending on your location.

- Add Client Information: Include the name, address, and contact details of the person or business you are billing.

- Assign a Unique Reference Number: Every payment request should have a unique identification code. This helps both you and the client track payments and records.

- Detail the Products or Services: List each item or service provided, including quantities, rates, and individual costs. Be clear and specific to avoid any confusion.

- State the Total Amount Due: Add up the costs for each product or service, and include any applicable taxes, discounts, or additional fees.

- Specify Payment Terms: Include the due date, accepted payment methods, and any terms regarding late fees or early payment discounts.

Example Breakdown

| Description | Quantity | Rate | Total | |||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Web Design Service | 1 | $500 | $500 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Monthly Hosting Fee | 1 | $30 | $30 |

| Description | Amount | Tax Rate | Tax Amount | |||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Consulting Service | $500 | 10% | $50 | |||||||||||||||||||||||||||||||||

| Subtotal | $500 | $50 | ||||||||||||||||||||||||||||||||||

| Total Amount Due | $500 |

While designing a billing document may seem straightforward, there are several common mistakes that can lead to confusion, delayed payments, or even disputes with clients. It’s important to pay attention to the details and ensure that your document is accurate, clear, and professional. Avoiding these mistakes will help maintain good business relationships and ensure smooth financial transactions. Here are some of the most frequent errors to be aware of when preparing a payment request:

By being mindful of these common errors, you can ensure that your billing documents are clear, professional, and error-free, which will ultimately help streamline your payment process. Free Tools for Designing InvoicesDesigning a professional billing document doesn’t have to be a complicated or expensive process. Several free tools are available that allow you to create well-structured, visually appealing forms without requiring advanced design skills. These platforms often offer customizable options, templates, and features that cater to various business needs. Here are some of the best free tools that can help you craft professional payment requests quickly and easily: Top Free Platforms for Designing Billing Documents

Each of these tools offers unique features th How to Create Invoices in WordUsing Microsoft Word to design a payment request document can be a simple and effective way to produce professional-looking forms without needing specialized software. Word offers flexibility, allowing you to customize the layout, fonts, and content to suit your business style. With a few basic steps, you can generate a clear, organized billing statement ready to be sent to clients. Step-by-Step Guide to Making a Billing Document in Word

Formatting Tips for Professional Appearance

|