How to Create the Perfect Decorating Invoice Template

In the world of service-based businesses, having a clear and well-structured billing document is essential for ensuring smooth transactions and maintaining professionalism. Whether you’re offering interior design, home improvement, or other creative services, a properly formatted bill helps both you and your clients stay organized and avoid misunderstandings. A good billing document not only outlines the services provided but also details payment terms and timelines to ensure clarity for both parties.

For those in the creative industry, crafting an efficient billing solution can make a big difference in managing finances and enhancing customer satisfaction. With the right structure, you can easily track payments, provide transparency, and project a professional image. The key is to design a document that reflects the nature of your services while being easy to understand and use. Customization and attention to detail are crucial for tailoring this document to your unique business needs.

By developing a comprehensive and intuitive billing solution, you’ll streamline your operations and make the payment process smoother for everyone involved. In the following sections, we’ll explore the important elements to consider when creating such a document, from the necessary information to include to tips for keeping it polished and professional.

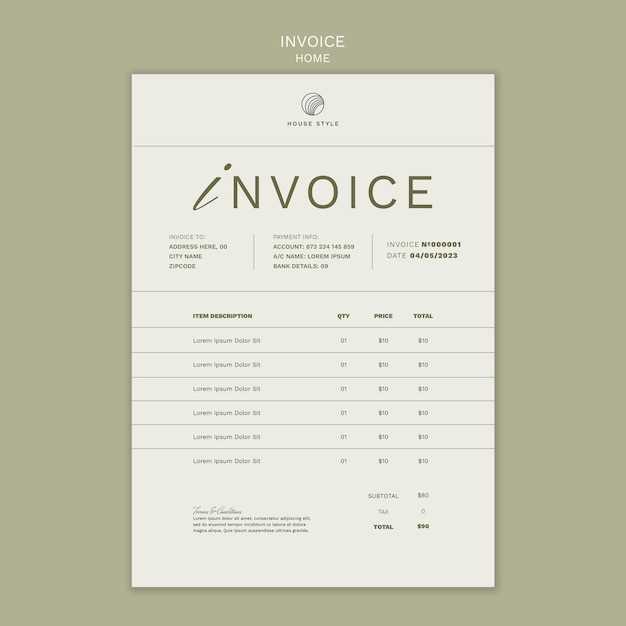

Essential Elements of a Billing Document

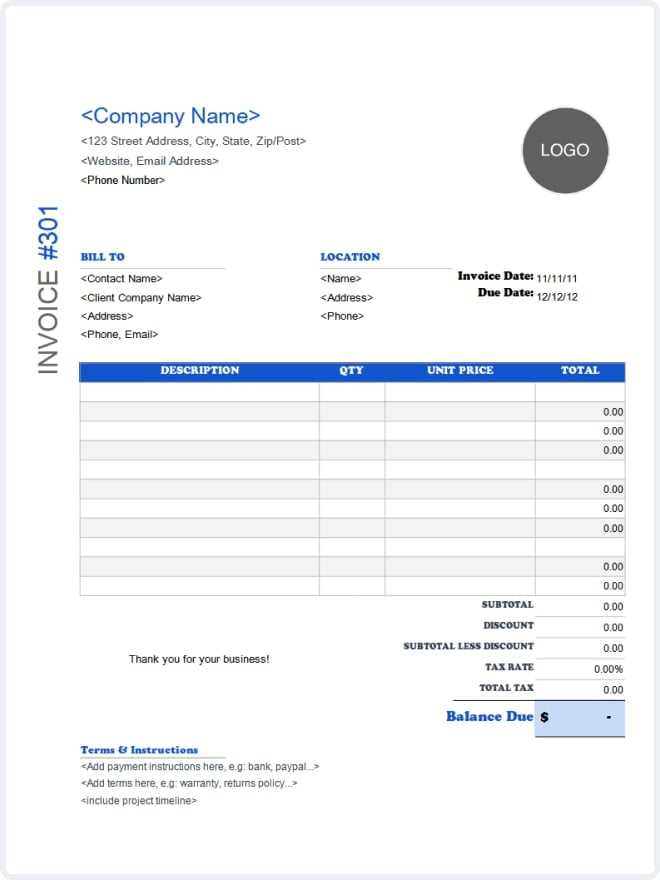

When creating a professional billing document for your services, it is crucial to include all the necessary details to ensure clarity and prevent misunderstandings. A well-structured document not only ensures timely payments but also demonstrates professionalism to your clients. The following are the key elements you should include in any billing document for your projects.

Key Information to Include

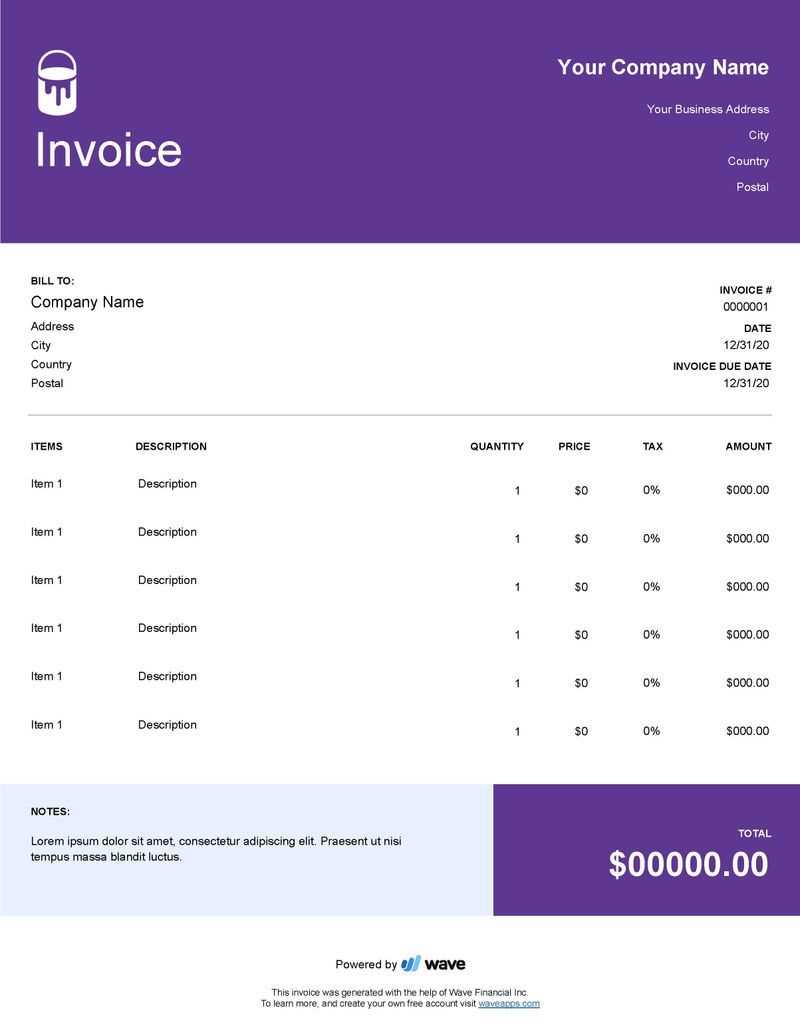

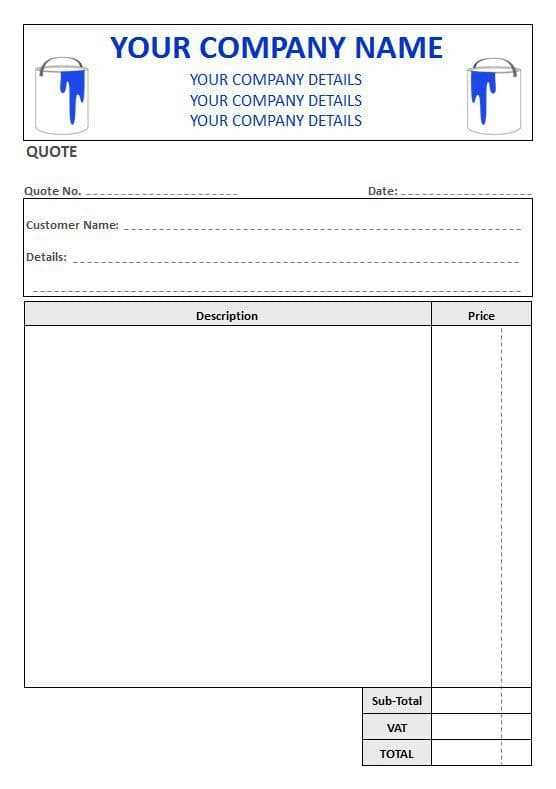

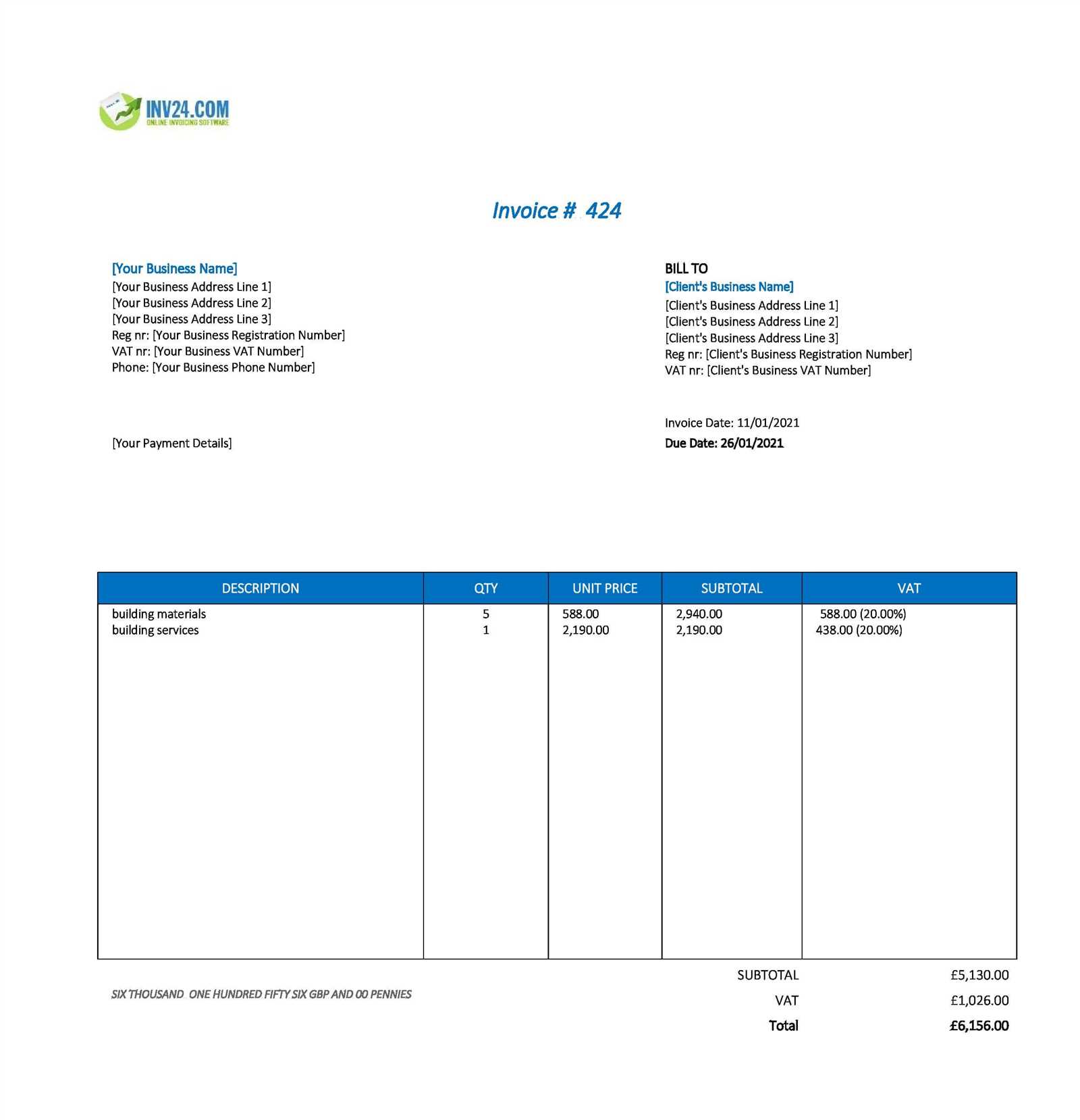

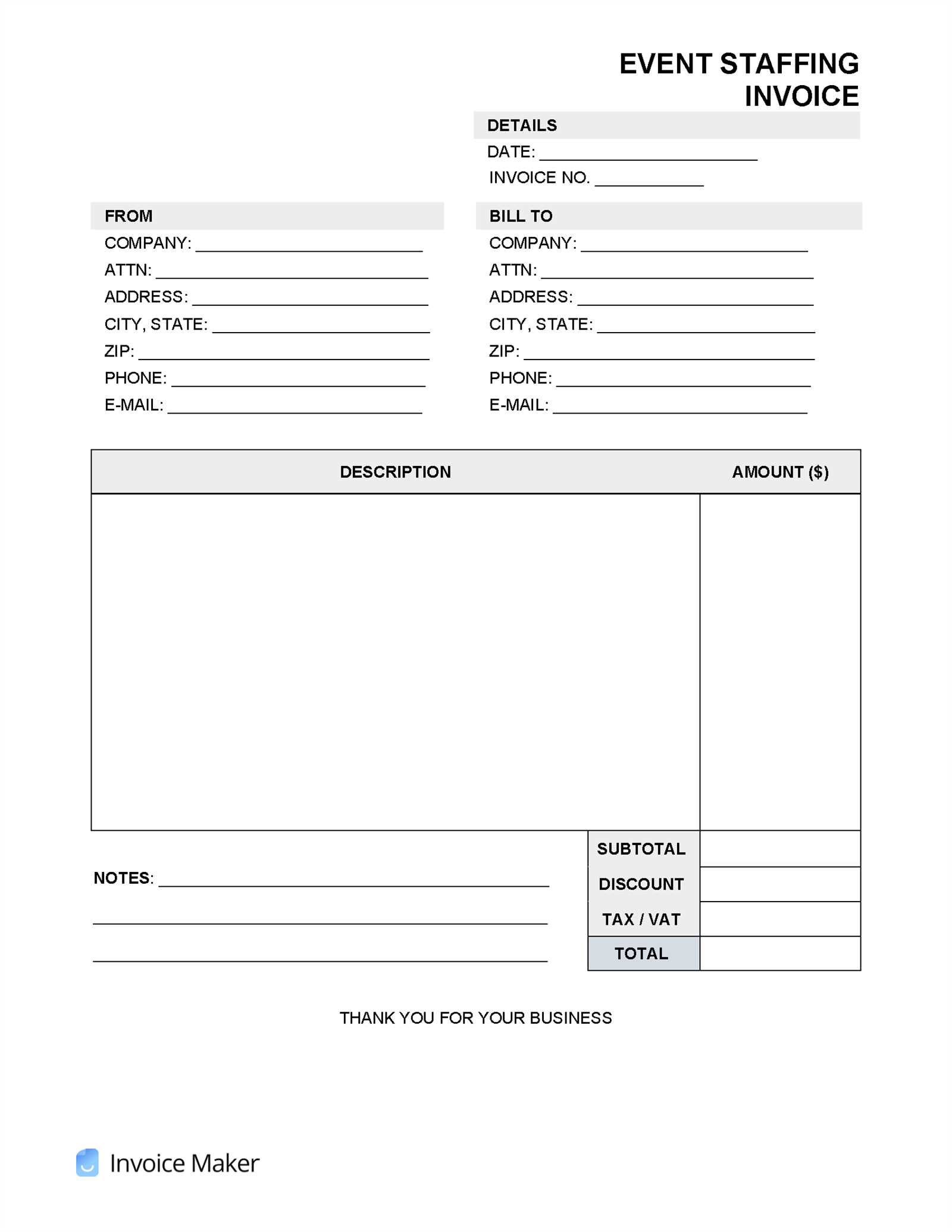

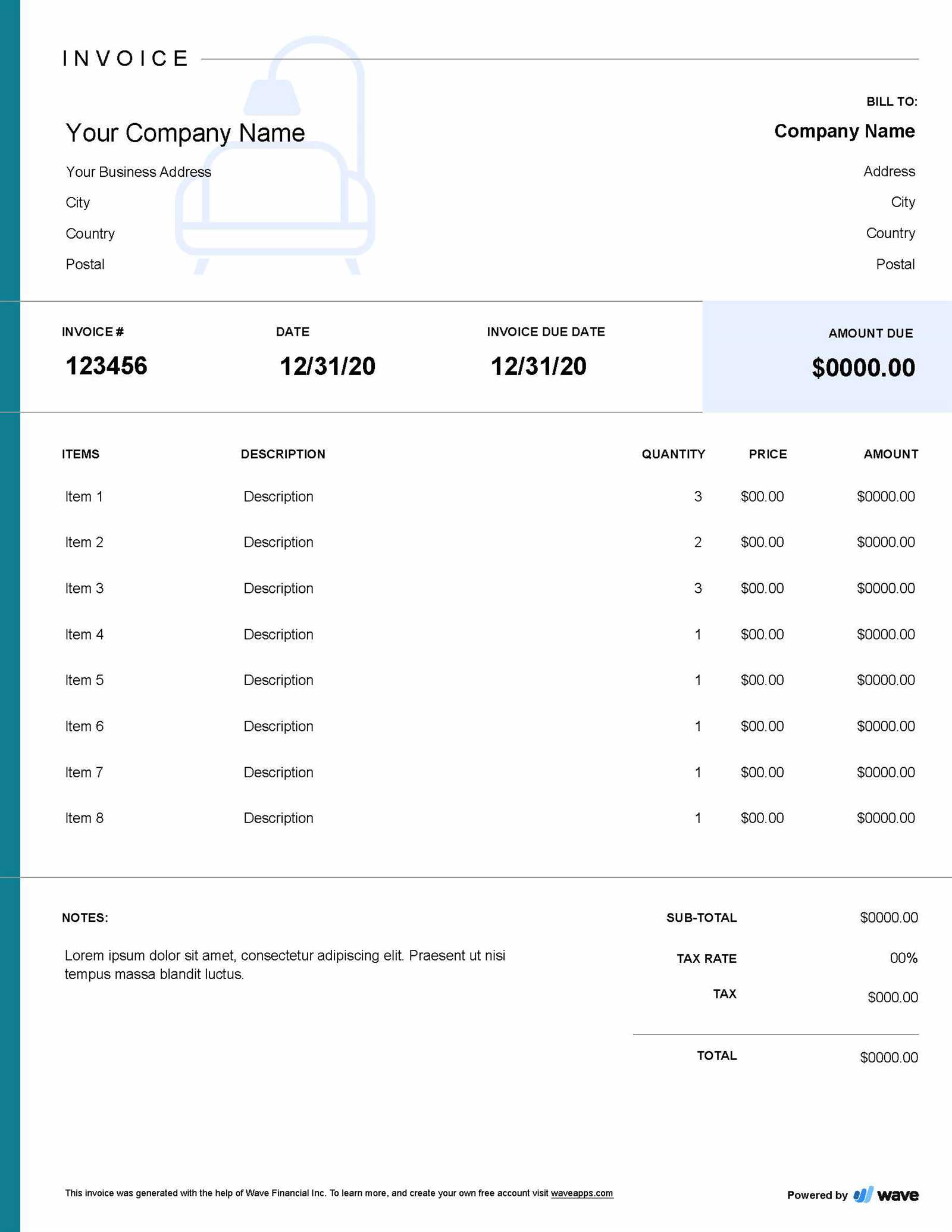

- Service Provider Details: Your name, business name, contact information, and address should be clearly listed at the top. This allows the client to easily identify who provided the service.

- Client Information: Similarly, include the client’s name, address, and contact details for reference.

- Document Number: Assigning a unique identifier to each document is crucial for tracking and record-keeping purposes.

- Date of Service: Specify when the work was completed or when the billing is due to ensure both parties are on the same page.

- Itemized List of Services: Break down the work performed in detail, including quantities, rates, and descriptions. This ensures transparency and helps the client understand exactly what they are paying for.

- Payment Terms: State the terms clearly, including due dates, late fees (if any), and acceptable payment methods.

- Total Amount: Summarize the total cost of all services, including any taxes or discounts applied.

Additional Considerations

- Project References: If applicable, include project numbers, reference codes, or specific details related to the work that will help both you and your client remember the scope of the project.

- Notes or Terms and Conditions: Add any additional terms such as warranty information, return policies, or special agreements made during the project.

Incorporating all of these elements will not only make your document comprehensive but also give your client the confidence that they are working with a professional. Be sure to review the document before sending to ensure accuracy and completeness.

Why Use a Professional Billing Document Format

Utilizing a standardized format for your billing documents offers numerous benefits, especially for service-based businesses. A consistent structure not only streamlines your workflow but also enhances client satisfaction and ensures that all essential details are included every time. Whether you’re managing small or large projects, having a pre-designed structure helps you maintain clarity, avoid errors, and present a polished image to your clients.

One of the main advantages of using a pre-designed format is the time saved on document creation. Instead of starting from scratch each time, you can simply plug in the relevant information and quickly generate a professional document. This eliminates the need for manual formatting, allowing you to focus on your core business activities. Furthermore, with a reliable structure, you reduce the risk of forgetting key details, such as payment terms or specific service descriptions.

Standardization plays a key role in maintaining professionalism. When clients receive consistent, well-organized documents, it reassures them of your reliability and attention to detail. This consistency also helps with record-keeping, making it easier to track payments and projects over time. Additionally, a well-structured format can be customized to suit different types of projects, providing flexibility while maintaining a professional appearance.

Finally, using a ready-made format ensures that you comply with any legal or industry-specific requirements, such as including tax information, project references, or certain payment conditions. This makes it easier to stay organized and avoid potential issues related to billing accuracy or regulatory compliance.

Benefits of Customizing Your Billing Document

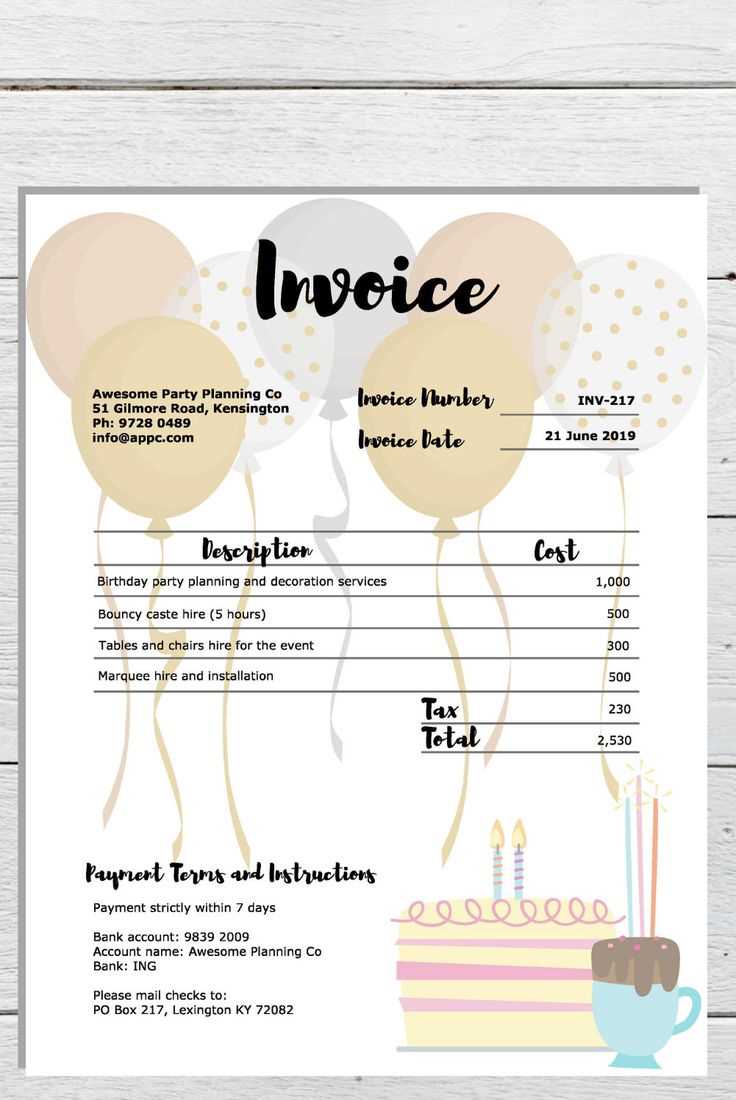

Customizing your billing document allows you to better reflect your unique business style, improve client communication, and ensure that all necessary details are included. A personalized layout offers several advantages that can positively impact your professionalism and efficiency, ensuring both you and your clients are satisfied throughout the transaction process.

- Professional Appearance: Tailoring your billing documents to match your branding helps create a cohesive, professional look. This includes adding your company logo, using brand colors, and incorporating consistent fonts. A well-designed document communicates reliability and strengthens your brand identity.

- Enhanced Client Trust: A customized document demonstrates attention to detail and dedication to providing a quality experience. When clients see a polished, personalized document, they are more likely to perceive your services as reliable and trustworthy.

- Clearer Information: Customization allows you to prioritize the information that matters most to you and your clients. You can adjust sections to include specific project references, service descriptions, or payment instructions tailored to your business model, ensuring clarity for both parties.

- Flexibility for Different Projects: A personalized billing format can be adapted for various project types, whether it’s a small consultation or a large-scale renovation. You can create multiple versions of your document to suit different types of services while maintaining a professional and consistent presentation.

- Better Record Keeping: When you customize your documents, you can incorporate useful features such as unique reference numbers or date fields, which makes tracking payments and managing records easier and more efficient.

By customizing your billing documents, you ensure a more organized, professional, and client-focused approach to handling payments. This not only enhances your operational efficiency but also reinforces the trust and confidence your clients place in your services.

Key Information to Include in a Billing Document

To ensure that your billing documents are clear, accurate, and professional, it’s essential to include all the necessary information. A well-detailed document helps avoid confusion, ensures that both you and your client are on the same page, and facilitates timely payment. Below are the critical elements that should always be included in a billing document to maintain transparency and professionalism.

- Business Details: Include your full business name, address, phone number, and email address. This allows the client to easily identify who issued the document and how to contact you if needed.

- Client Information: The client’s name, address, and contact details should also be clearly listed to avoid any confusion about who the bill is addressed to.

- Document Reference Number: Assign a unique reference or invoice number to each document. This is essential for tracking purposes, helping both parties to reference and organize billing records easily.

- Issue Date and Payment Due Date: Clearly state the date the document was issued and the date by which payment is due. This helps avoid misunderstandings about deadlines and ensures that payment terms are clear from the outset.

- Detailed List of Services: Break down the work completed in a clear, itemized list. Include descriptions, quantities, hourly rates (if applicable), and the cost for each individual service. This adds transparency and gives the client a clear understanding of what they are being charged for.

- Subtotal and Total Amount Due: Provide a breakdown of the costs, including taxes, discounts, or additional fees, to give the client a clear picture of how the total amount was calculated. Be sure to highlight the total amount due clearly at the bottom.

- Payment Instructions: Include clear instructions on how the client can make payment. This may include payment methods accepted, account details, or online payment options, as well as any late fees or penalties for overdue payments.

Including these essential elements in your billing document will ensure that both you and your client have a clear understanding of the transaction. This level of detail helps prevent disputes, promotes tru

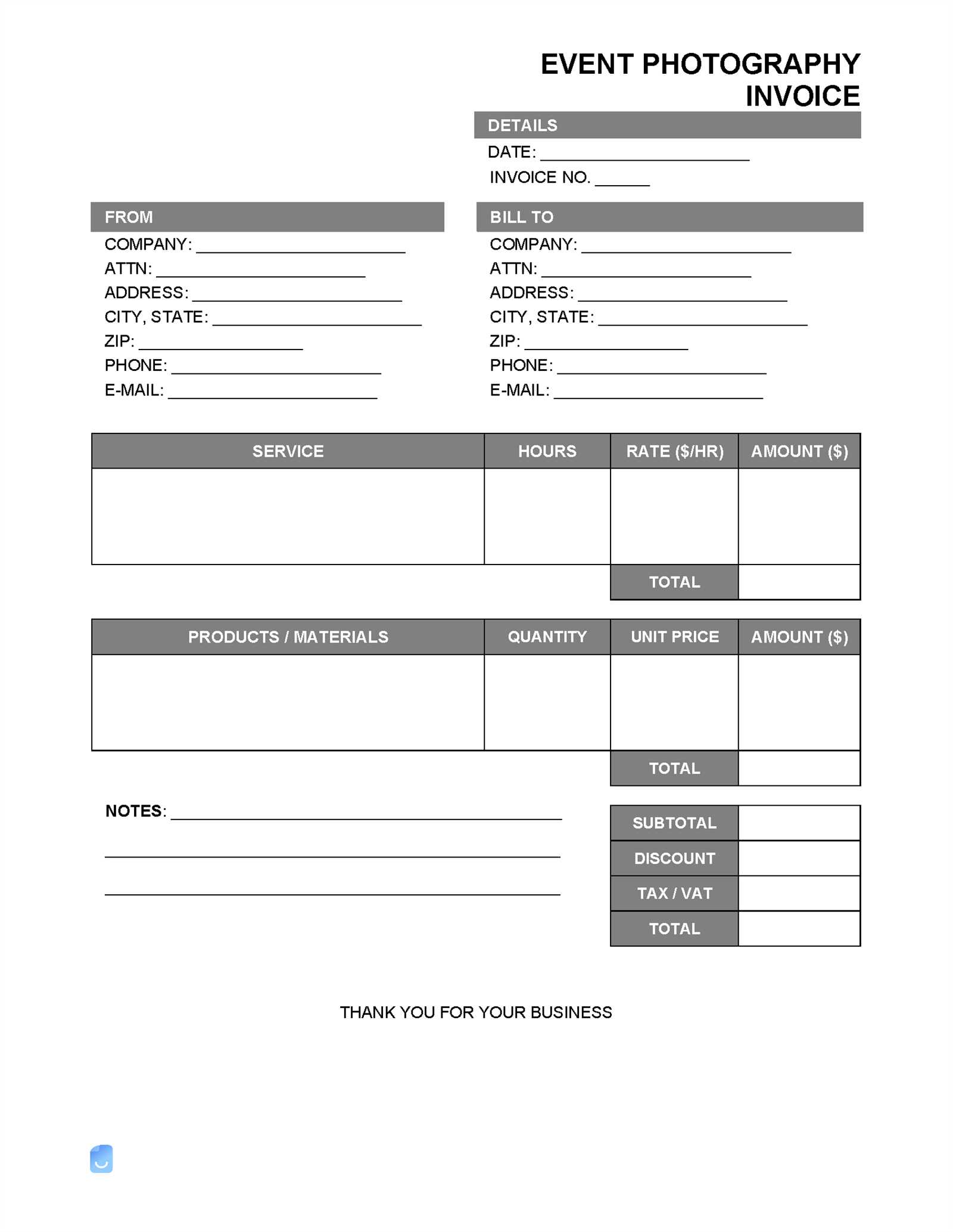

How to Choose the Right Billing Format

Selecting the appropriate format for your billing documents is essential for ensuring clarity, efficiency, and professionalism. The format you choose can impact the way clients perceive your business and how smoothly the payment process goes. A well-chosen layout can streamline the creation of documents, help you maintain organization, and make the billing process much easier for both parties involved. Here are some factors to consider when deciding on the right structure for your billing needs.

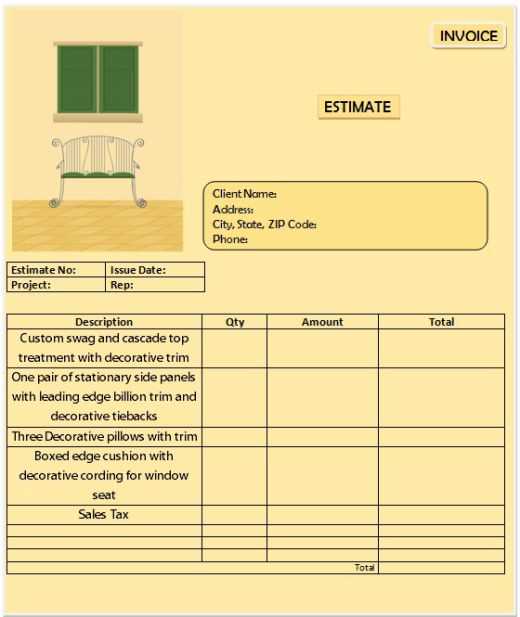

- Consider Your Business Needs: Choose a format that suits the scale and type of services you offer. For example, a simple format might work for small jobs or consultations, while a more detailed layout may be required for larger, multi-phase projects.

- Flexibility and Customization: Opt for a format that allows easy adjustments. If your projects vary in scope or pricing, look for a layout that lets you customize the content easily. This ensures you can accommodate any unique elements specific to each job without much hassle.

- Clarity and Simplicity: The format should be clean and easy to read. Avoid overly complex layouts that could confuse clients. Clear headings, itemized lists, and logical sections will help your clients quickly understand the charges and details.

- Professional Appearance: A polished, well-organized layout contributes to the overall impression of your business. Select a format that looks professional and aligns with your branding, making sure it enhances your credibility and trustworthiness.

- Digital vs. Print: Consider whether your billing documents will be sent digitally or in print. If you are working with digital formats, ensure the design is compatible with various devices and email systems. For printed documents, ensure the layout is suitable for physical copies and is easy to read on paper.

- Compliance Requirements: Make sure the format includes all the necessary legal and regulatory information. This could include tax details, business registration numbers, or other industry-specific requirements that need to be visible on your billing documents.

By taking these factors into account, you can choose a format that best suits your business and improves your clients’ experience. A well-thought-out structure will help ensure that your documents are easy to understand, professional, and aligned with your business goals.

Tips for Designing a Professional Billing Document

Creating a billing document that looks both polished and professional is essential for leaving a positive impression on your clients. A well-designed document not only ensures that the payment process runs smoothly, but also enhances your credibility and reflects your attention to detail. Here are some key tips for designing a billing document that stands out and maintains professionalism.

Focus on Clarity and Readability

One of the most important aspects of any billing document is clarity. Your clients should be able to quickly understand the charges, terms, and details without confusion. Use clean, legible fonts and ensure there’s adequate spacing between sections. Make sure the following elements are easy to identify:

- Headings and Subheadings: Clearly distinguish sections such as “Client Information,” “Services Rendered,” and “Payment Terms” to help clients navigate the document easily.

- Itemized Lists: Break down services with bullet points or numbered lists for better clarity. Each service should have a corresponding cost, and the overall total should be easy to locate.

- Legible Fonts: Choose easy-to-read fonts for both headings and body text. Avoid decorative fonts that may be hard to read, especially in small print.

Maintain Consistency and Branding

Your billing documents should reflect your business’s branding and maintain a consistent appearance. This includes using your business logo, color scheme, and any other brand elements. Consistency in design will help reinforce your business identity and create a cohesive experience for your clients. Here’s how to ensure your document aligns with your brand:

- Logo and Business Information: Position your logo at the top of the document and ensure your business contact details are easy to find.

- Colors and Style: Use your brand colors for headings, borders, and accent elements to keep the design aligned with your overall visual identity.

- Uniform Layout: Stick to a consistent layout for each document. Reuse the same structure for every bill to create a sense of professionalism and reliability.

By prioritizing clarity and branding consistency, you can de

Common Mistakes to Avoid in Billing Documents

Even a small error in your billing document can lead to confusion, delayed payments, or a lack of professionalism in the eyes of your clients. To avoid these issues, it’s important to be mindful of common mistakes when creating your documents. Below are several key mistakes to watch out for and tips on how to prevent them.

- Missing or Incorrect Client Details: One of the most common mistakes is not properly including the client’s full name, address, or contact information. Always double-check these details to ensure the document is accurate and addressed correctly.

- Unclear Service Descriptions: Vague or incomplete descriptions of the services provided can lead to confusion or disputes. Be specific about what was done, how it was done, and the amount charged for each service. This ensures the client knows exactly what they’re paying for.

- Failing to Include a Payment Due Date: Omitting a clear payment due date can cause delays in payments. Always specify when the payment is due and include any late fees or penalties for overdue amounts. This helps set clear expectations and encourages timely payments.

- Incorrect Calculations: Mistakes in the math, such as incorrect totals or miscalculated taxes, are not only unprofessional but can lead to significant payment disputes. Always double-check your calculations before sending out any documents, and consider using an automated system to reduce the risk of errors.

- Lack of a Unique Reference Number: Every document should have a unique identifier or reference number. Failing to include one makes it difficult to track payments, resolve disputes, or keep organized records. Ensure that each document is numbered sequentially for easy reference.

- Not Including Clear Payment Instructions: Make it easy for your client to pay by clearly outlining acceptable payment methods and providing the necessary details (such as bank account information, online payment links, or payment platform details). Leaving this out can create unnecessary confusion and delays.

- Ignoring Legal Requirements: Depending on your industry, there may be specific legal requirements for your billing documents, such as tax identification numbers, business registration details, or specific tax rates. Failing to include these can result in complications or even legal issues down the line.

By avoiding these common pitfalls, you can ensure that your billing documents are accurate, professional, and conducive to a smooth transaction process. A clear and error-free docu

Incorporating Your Branding in Billing Documents

Incorporating your brand identity into your billing documents is a powerful way to maintain a consistent professional image across all client interactions. Your documents are not just for tracking payments; they also reflect your business’s personality, values, and professionalism. By adding brand elements, you ensure that each communication feels cohesive and reinforces your brand every time a client receives a document from you.

Key Brand Elements to Include

When personalizing your billing documents, consider including the following brand features to create a unified experience for your clients:

- Logo: Place your company’s logo at the top of the document. It’s the first thing clients see, and it instantly establishes your business’s identity.

- Brand Colors: Use your brand’s color palette for headings, borders, or accents. This subtle touch can make the document feel more polished and aligned with your brand’s visual identity.

- Typography: Select fonts that match your brand’s style. Whether you use modern, sleek fonts or something more classic, consistency in typography across all documents strengthens your visual presence.

Why Branding Matters

Branding isn’t just about making your documents look good; it’s about creating trust and recognition. When clients see a document that’s aligned with your other business materials, it boosts confidence in your professionalism. It also helps your clients easily recognize your documents in their inbox or on their desk, reducing confusion and fostering a sense of familiarity with your brand.

Moreover, consistent branding across all documents, from billing to contracts and proposals, reinforces your business identity. Over time, this contributes to building a strong brand presence, which can ultimately lead to repeat business and positive word-of-mouth.

Legal Requirements for Billing Documents

When creating a billing document, it’s important to ensure that it complies with local laws and regulations. Depending on the type of services you offer and your location, there may be specific legal requirements that need to be included. These requirements help protect both your business and your clients, ensuring that all transactions are clear, transparent, and in line with tax and legal standards.

At a minimum, your billing documents should include certain details to meet legal standards and provide clear records for both parties involved. Missing or incorrect information could lead to compliance issues, legal disputes, or delays in payment. Below are the most common legal requirements to keep in mind when creating your billing documents.

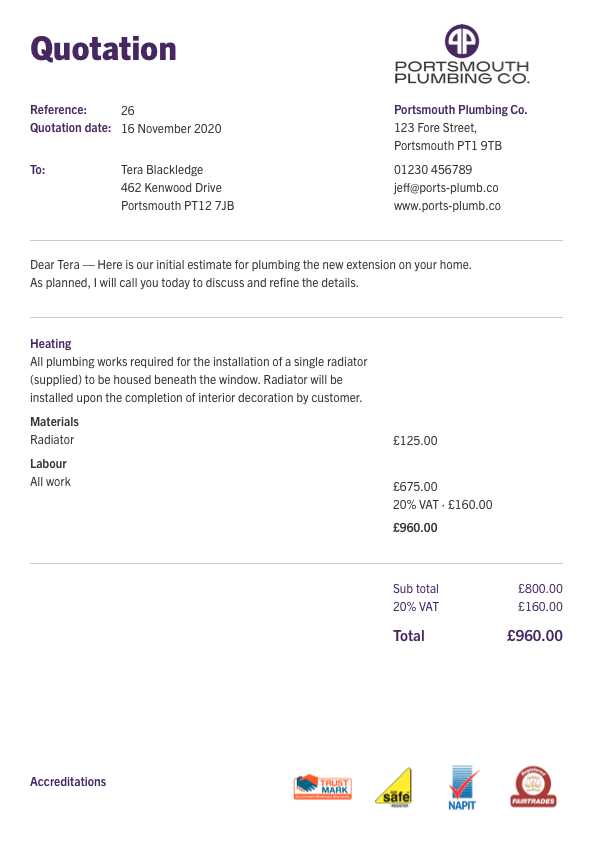

- Business Information: In many jurisdictions, it is required to include your business name, address, and tax identification number (TIN). This ensures that your client can verify the legitimacy of your business and also helps with record-keeping for tax purposes.

- Client Information: Some regions require the client’s full name and address to be included on the document. This helps establish a clear contract between both parties and may be needed for audit or tax purposes.

- Tax Information: If your business is required to charge sales tax, it’s important to list the applicable tax rate and the total tax amount on the billing document. You may also need to specify your VAT (Value Added Tax) number, depending on the jurisdiction.

- Payment Terms: Legal requirements may stipulate that you include clear payment terms, such as the due date for payment, accepted payment methods, and any late fees or penalties for overdue payments. This ensures both parties understand the expectations around payment.

- Unique Reference Number: Many legal systems require each billing document to be numbered sequentially for easy tracking and reference. This helps avoid disputes and ensures proper record-keep

How to Calculate Charges on Your Billing Document

Accurately calculating charges on your billing documents is essential to ensure transparency, prevent disputes, and guarantee that you are compensated fairly for the work you’ve done. The process may vary depending on the type of services provided, but understanding the basic components and how to calculate them is crucial for every business. Below are the steps and tips to help you correctly determine the charges for your services and avoid common mistakes.

Breakdown of Charges

Before calculating the total amount due, it’s important to break down the services or products you’ve provided. This helps both you and your client understand exactly what is being charged. Here’s how you can organize and calculate the charges:

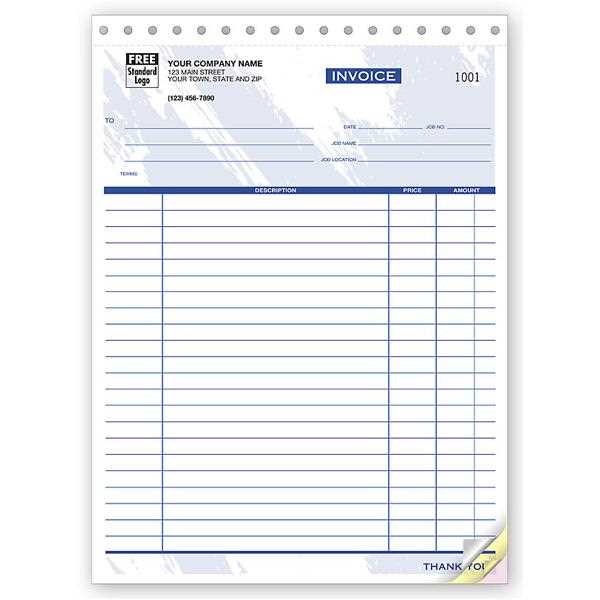

- Hourly Rate: If you charge by the hour, multiply the number of hours worked by your hourly rate. Ensure that the hours are accurately recorded to avoid discrepancies.

- Flat Fees: For fixed-price services, simply include the agreed-upon amount for each service or product delivered. Be sure to list all items or tasks individually to avoid confusion.

- Materials or Supplies: If your work involves the purchase of materials or supplies, make sure to add the cost of these items separately. Provide a clear description of each material used and its cost.

- Additional Costs: Include any extra charges that may apply, such as travel fees, rush fees, or equipment rental costs. Specify what these charges are for to maintain clarity.

Adding Taxes and Discounts

After calculating the basic charges, you need to factor in any applicable taxes or discounts that might apply. This will ensure that your billing document reflects the full and accurate amount due.

- Sales Tax: Calculate the sales tax based on the local tax rate for your area or industry. Add the appropriate percentage to the total amount before calculating the final amount due.

- Discounts: If you offer discounts (for example, for early payment or repeat business), subtract the discount amount from the total charges. Ensure that the discount is clearly indicated on the document to avoid misunderstandings.

By following these steps and accurately calculating each component, you can ensure that your billing document reflects the true value of your work. This not only helps maintain transparency with your clients but also ensures that you are compensated fairly for the services and products you provide.

Managing Payment Terms and Deadlines

Clear and well-defined payment terms are essential for maintaining a smooth financial relationship with your clients. Establishing the right deadlines and conditions ensures that both you and your client are on the same page regarding expectations for payment. Effective management of these terms can help avoid delays, misunderstandings, and disputes. Below, we will explore how to set payment terms and manage deadlines effectively in your billing documents.

To begin, it’s important to clearly communicate when payment is due and under what conditions. Common practices include setting a fixed deadline (e.g., 30 days from the billing date), offering early payment discounts, or outlining penalties for late payments. Make sure these terms are easy to understand and are prominently displayed on your document.

Key Elements of Payment Terms

Here are the main components that should be included in your payment terms:

Payment Term Description Due Date Specify the exact date by which payment should be made. A clear deadline helps clients understand when their payment is expected. Late Payment Penalty State any additional fees or interest charges that will apply if payment is not received by the due date. This encourages timely payments. Early Payment Discount Offer a discount to clients who pay early. This incentivizes prompt payments and strengthens client relationships. Accepted Payment Methods List the payment options available to your clients (e.g., bank transfer, credit card, online payments) to ensure there are no issues with how they can pay. Partial Payments If applicable, outline any conditions for partial payments, such as installment plans or deposit requirements. By defining and communicating these terms clearly, you can avoid confusion and ensure that both you and your client have the same expectations regarding payment deadlines and conditions. A well-structured payment pl

Using Online Tools for Billing Document Creation

Creating professional billing documents can be time-consuming if done manually, but using online tools can significantly streamline the process. These tools offer pre-designed structures, automated calculations, and customization options, allowing you to generate accurate and polished documents quickly. Whether you are a small business owner or a freelancer, leveraging online tools can save you time and improve your workflow.

Many online platforms provide user-friendly interfaces that make document creation straightforward, even for those with limited design experience. Additionally, these tools often integrate with accounting or payment systems, making it easier to track financial transactions and send documents directly to clients. Here are some key benefits of using online tools for generating your billing documents:

Benefits of Online Tools

- Ease of Use: Online platforms often feature drag-and-drop interfaces and pre-built sections, making it easy to add or remove elements based on your needs.

- Customization: You can personalize the document with your branding, such as adding your logo, adjusting colors, and modifying the layout to align with your business style.

- Automated Calculations: Many online tools automatically calculate totals, taxes, and discounts, reducing the risk of human error and saving time.

- Cloud Storage: Documents can be saved securely in the cloud, allowing you to access them from any device and keep your records organized.

- Instant Delivery: Most platforms allow you to send your documents directly to clients via email or through integrated payment gateways, speeding up the billing process.

Popular Online Platforms for Document Creation

Several online tools can help you create and manage billing documents with ease. Below are some popular options to consider:

- FreshBooks: Known for its user-friendly interface and accounting features, FreshBooks allows you to create, send, and track billing documents while integrating with various payment systems.

- QuickBooks: A trusted name in small business accounting, QuickBooks offers customizable document creation, along with features to manage taxes, expenses, and reports.

- Zoho Invoice: With Zoho, you can generate professional documents, set up recurring billing, and automate payment reminders, all while staying organized.

- Wave: A free tool with robust features for creating and sending billing documents, Wave also integrates with accounting and payment services for seamless management.

By utilizing online tools for your billing documents, you can reduce manual effort, ensure accuracy, and provide your clients with profess

How to Handle Multiple Projects on One Billing Document

When working on several projects for a single client, it can be efficient to consolidate the charges for all of them into one document. This approach helps to simplify your client’s payment process while allowing you to track everything in a single record. However, it’s important to clearly separate each project’s details to avoid confusion and ensure that each task is accounted for properly. Below are key strategies for handling multiple projects on one document.

To begin, organize the document in a way that makes it easy for your client to see what they are being charged for each specific project. Break down the charges and services for each project separately, while ensuring the total amount due is clearly visible. This will prevent any misunderstandings and provide a transparent overview of the work completed.

- List Each Project Separately: For clarity, separate each project by a distinct section or table. Include the project name, description of work, and the amount charged for each individual task.

- Use Itemized Charges: Under each project, list out the specific services or items you provided, along with their respective costs. This makes it easier for your client to understand exactly what they are paying for.

- Include Project Deadlines: Mention any deadlines or milestones associated with each project, if relevant. This reinforces the context for the charges and helps your client track progress.

- Provide a Total for Each Project: Include subtotals for each project, so your client can see the cost breakdown for each section before the final total is presented.

- Clear Total Amount: At the bottom of the document, clearly show the combined total for all projects. This ensures the client can easily understand the total amount due without confusion.

By organizing multiple projects on one document in a clear, structured way, you help your client easily navigate the charges and keep everything transparent. This approach not only saves time but also helps maintain a professional appearance and strengthens your business-client relationship.

Best Practices for Sending Billing Documents

Sending billing documents correctly is just as important as creating them. The way you send these documents affects not only how quickly you receive payment but also your professional reputation. Whether you’re sending documents via email or post, following best practices ensures clarity, professionalism, and prompt payment. Below are the essential steps for effectively sending your billing documents to clients.

Key Steps to Ensure Professional Delivery

- Use a Professional Email Address: Always send billing documents from a business email address, not a personal one. This reinforces your professionalism and makes it easier for clients to recognize the sender.

- Include a Clear Subject Line: Your subject line should be concise and to the point, such as “Billing for [Project Name] – [Due Date]”. This helps the client immediately understand the purpose of the email.

- Attach Documents Properly: Attach the document in a widely accepted format (e.g., PDF). Ensure the file name is professional and easy to identify, such as “Billing_[ProjectName]_[ClientName]_[Date].pdf”.

- Provide a Brief Message: In the body of your email, include a polite message explaining the contents of the document and the due date for payment. This adds a personal touch and reinforces the importance of timely payment.

- Double-Check Contact Information: Verify that the recipient’s email address is correct and up to date. This prevents miscommunication and ensures the document reaches the intended person.

Additional Tips for Sending Billing Documents

- Send a Payment Reminder: If payment is due soon or overdue, consider sending a friendly reminder email a few days before or after the due date. This can encourage timely payments without being pushy.

- Offer Multiple Payment Options: Make it easy for your client to pay by offering several payment methods (e.g., bank transfer, credit card, PayPal). Be sure to include all necessary payment details in the document or email.

- Follow Up If Neces

Automating Billing Documents for Efficiency

Automating the creation and sending of your billing documents can save you time, reduce errors, and ensure that your clients receive timely and accurate charges. By leveraging automation tools, you can eliminate the need for manual input while improving consistency and speed in your financial processes. Below, we’ll explore how automation can streamline your billing workflow and increase overall efficiency.

Benefits of Automating Billing Processes

Using automation for your billing documents can help in several key areas:

Benefit Description Time Savings By automating repetitive tasks such as document creation and email sending, you free up time to focus on other important business functions. Accuracy Automation reduces the risk of human error in calculations, ensuring that all charges and totals are correct every time. Consistency Automation ensures that your billing documents follow a consistent format, helping to maintain a professional appearance across all communications. Faster Payment Processing By setting up automated reminders and due dates, clients are more likely to make timely payments, improving your cash flow. How to Automate Your Billing Documents

There are several ways to automate the creation, sending, and tracking of billing documents. Consider these options:

- Use Billing Software: Many accounting and invoicing platforms, such as QuickBooks, FreshBooks, or Zoho Invoice, offer automation features that allow you to set up recurring billing, send documents automatically, and track payments.

- Set Up Recurring Billing: For clients with ongoing projects or subscriptions, automate the generation and delivery of regular billing documents on a specific date each month or after a defined period.

- Automate Payment Reminders: Most billing platforms allow you to send automatic reminders for unpaid or overdue balances. This reduces the need for manual follow-ups and encourages timely payments.

- Integrate Payment Gateways: Linking your automated billing documents to payme

Tracking Payments with Your Billing Document

Efficient payment tracking is essential for maintaining a healthy cash flow and ensuring that clients settle their accounts in a timely manner. When managing multiple projects or clients, it’s important to have a clear and organized way to track payments against each charge. By incorporating payment tracking into your billing documents, you can easily monitor which payments have been received and which are still outstanding. Below are effective strategies for managing this process.

How to Track Payments Effectively

Integrating payment tracking directly into your billing document helps you stay organized and on top of your receivables. Consider the following methods:

- Include a Payment Status Column: Add a section on your document where you can mark the status of each payment (e.g., “Paid,” “Pending,” or “Overdue”). This gives both you and your client a clear view of payment progress.

- List Payment Methods: Specify the payment method used for each transaction (e.g., bank transfer, credit card, PayPal). This helps you quickly identify and verify payments.

- Track Partial Payments: If your clients make partial payments, update your document accordingly, showing the amount received and the balance due. This ensures transparency and prevents misunderstandings.

- Include Payment Dates: Record the date when a payment was received. This allows you to easily track overdue payments and follow up if necessary.

Tools for Tracking Payments

There are several tools and methods you can use to track payments more efficiently:

- Billing Software: Many billing platforms, such as QuickBooks, FreshBooks, and Wave, automatically track payments and update your records when a payment is received, making it easy to stay organized.

- Spreadsheets: For those who prefer a more hands-on approach, using spreadsheet software like Excel or Google Sheets allows you to manually track payments, providing flexibility and control over the process.

- Payment Gateways: Integration with payment processors like PayPal, Stripe, or Square often provides real-time updates on payment status, ensuring that your records stay current without a

Maintaining Professionalism in Billing

Maintaining a high level of professionalism in your billing process is essential for building trust with clients and ensuring timely payments. A well-structured, clear, and respectful approach to billing reflects positively on your business and fosters long-term relationships. By consistently applying professional practices in your financial communications, you demonstrate your commitment to quality service and reliability. Below are some key practices to ensure your billing process remains professional.

Key Practices for Professional Billing

- Clear and Concise Information: Always provide clear details about the services provided, the charges associated with each item, and the total amount due. Ambiguity can cause confusion and delay payments.

- Timely Delivery: Send your billing documents promptly upon completion of a service or project. Delaying invoices may create the impression of disorganization or lack of professionalism.

- Consistent Formatting: Use a consistent layout for all your billing documents. A clean, organized format with easy-to-read sections promotes professionalism and ensures that your clients understand the charges quickly.

- Polite and Respectful Language: Even when communicating about overdue payments, always use polite and professional language. Maintain a positive tone to ensure client relationships remain strong.

- Accurate Records: Ensure all information, including dates, prices, and client details, is correct before sending. Mistakes or discrepancies can undermine your credibility.

Additional Tips for Professionalism

- Custom Branding: Include your logo, brand colors, and contact details in your billing documents. This reinforces your brand identity and adds a personalized touch.

- Follow-Up Reminders: If payments are overdue, send gentle reminders in a professional manner. Offer assistance if there are any issues with the payment process, demonstrating your willingness to resolve any concerns.

- Offer Multiple Payment Methods: Make it easy for clients to settle their balance by offering various payment options, such as bank transfers, credit cards, or online payment systems.

By following these best practices, you ensure that your billing process is smooth, professional, and efficient. This not only encourages timely payments but also strengthens your reputation as a trustwor