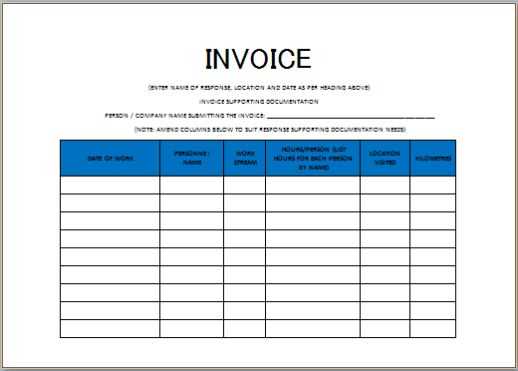

Self Employed Independent Contractor Invoice Template for Quick and Easy Invoicing

For those managing their own business, clear and organized financial documentation is crucial. It simplifies the payment process and helps maintain professionalism when dealing with clients. Crafting such documents ensures smooth transactions, helping both parties understand the terms of service, costs, and deadlines.

In today’s fast-paced digital world, having a well-structured method for charging clients is essential. With the right format, you can quickly communicate all necessary details, from work descriptions to payment methods, ensuring transparency. Whether you’re using software or a simple form, a customized solution makes it easier to manage your financial interactions efficiently.

Understanding what elements to include, how to personalize your approach, and ensuring all legal aspects are covered will give you the confidence to handle client payments seamlessly. This guide explores the best practices and key elements to keep in mind for streamlined billing.

Best Practices for Creating Contractor Invoices

When it comes to billing for services, having a well-structured and clear format is essential. It not only ensures that payments are made on time, but it also helps avoid any confusion regarding the work done and the amounts due. Following key principles in designing your documents can enhance both professionalism and efficiency in your financial dealings with clients.

Include Detailed Service Descriptions

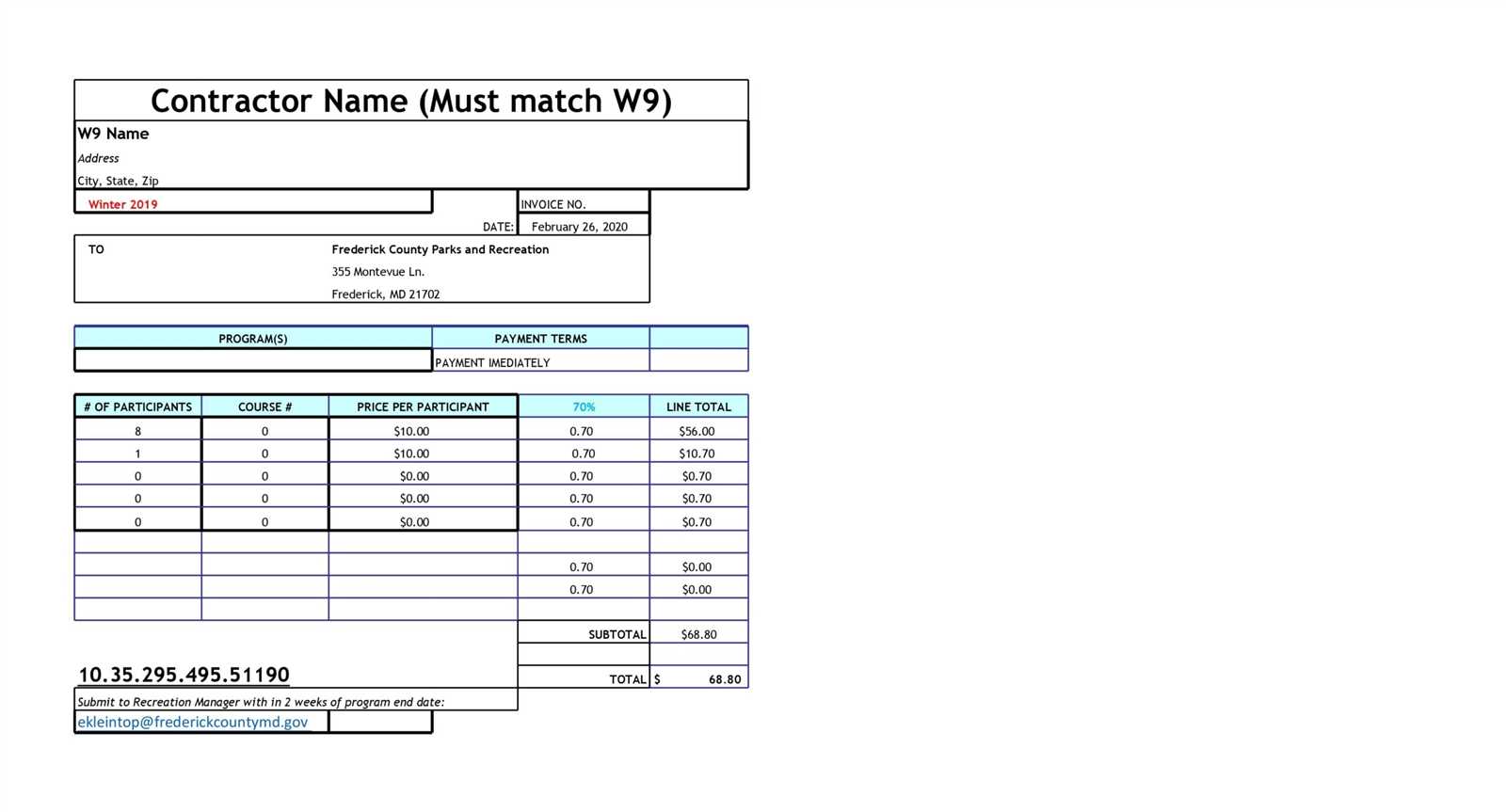

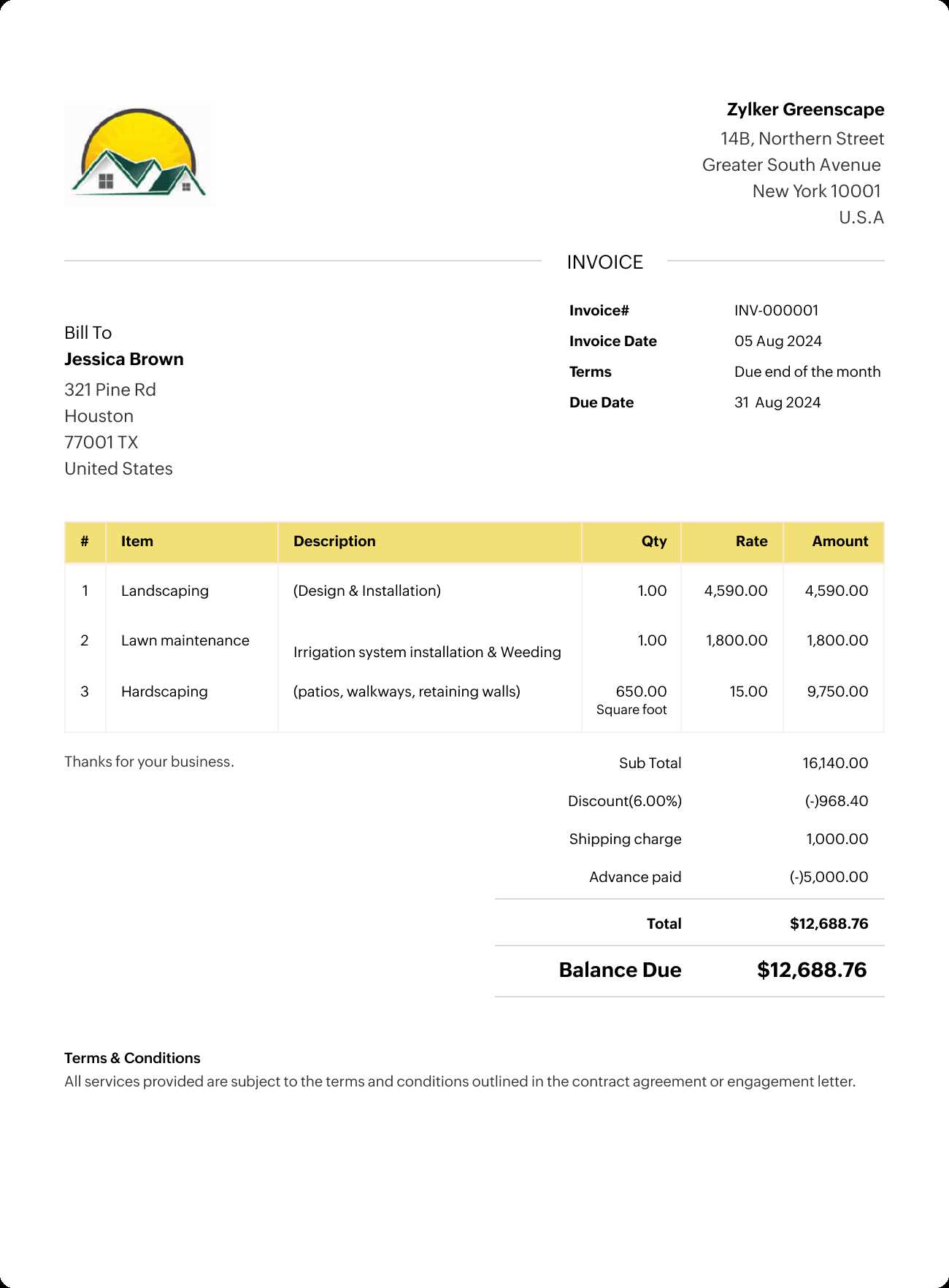

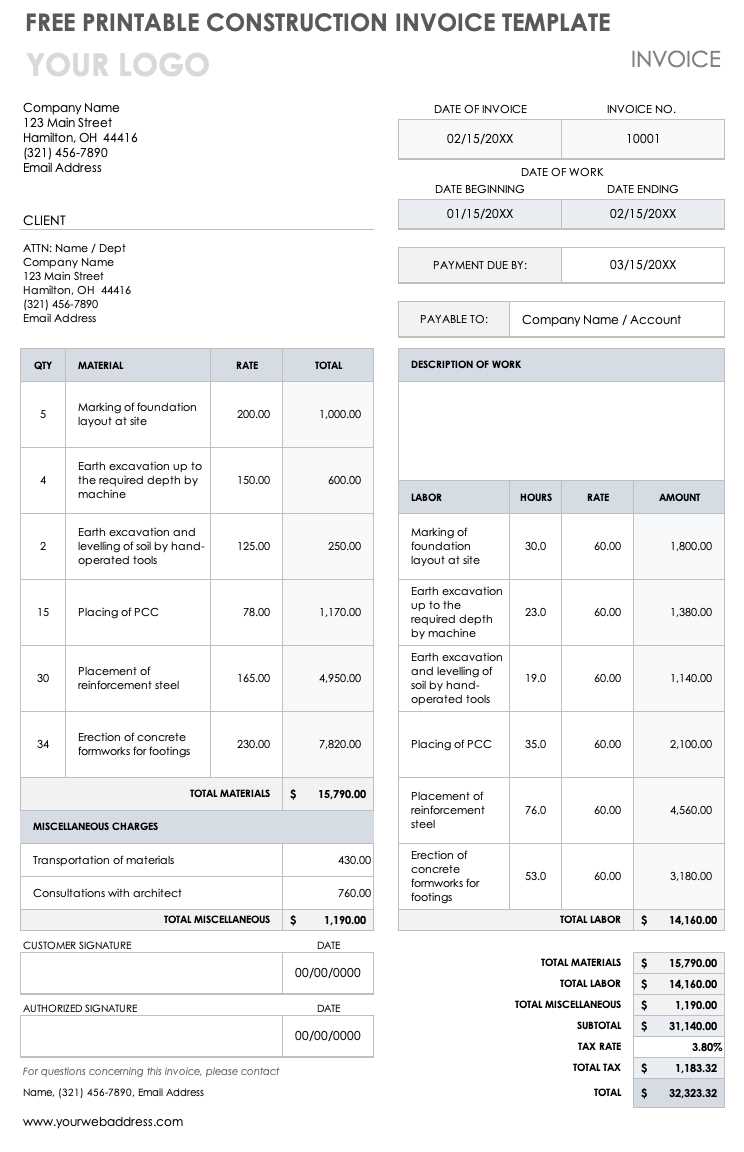

One of the most important elements is providing a detailed breakdown of the work completed. By outlining each task or service with a clear description, you make it easier for clients to understand exactly what they are paying for. This transparency helps build trust and reduces the likelihood of disputes. Be sure to include dates, quantities, and rates where applicable.

Clearly Define Payment Terms

Another crucial aspect is setting clear expectations around payment. Indicate due dates, preferred payment methods, and any penalties for late payments. Including this information upfront ensures both parties are on the same page and helps you manage your cash flow effectively. Terms such as net 30 or due upon receipt are commonly used, but you should

Essential Elements of an Independent Contractor Invoice

Creating a thorough and professional document for billing purposes is crucial for ensuring smooth transactions and clear communication with clients. A well-constructed form includes several key elements that provide all necessary details, making it easy for clients to process payments without confusion. These components not only streamline the payment process but also help protect your business by providing a record of services and amounts due.

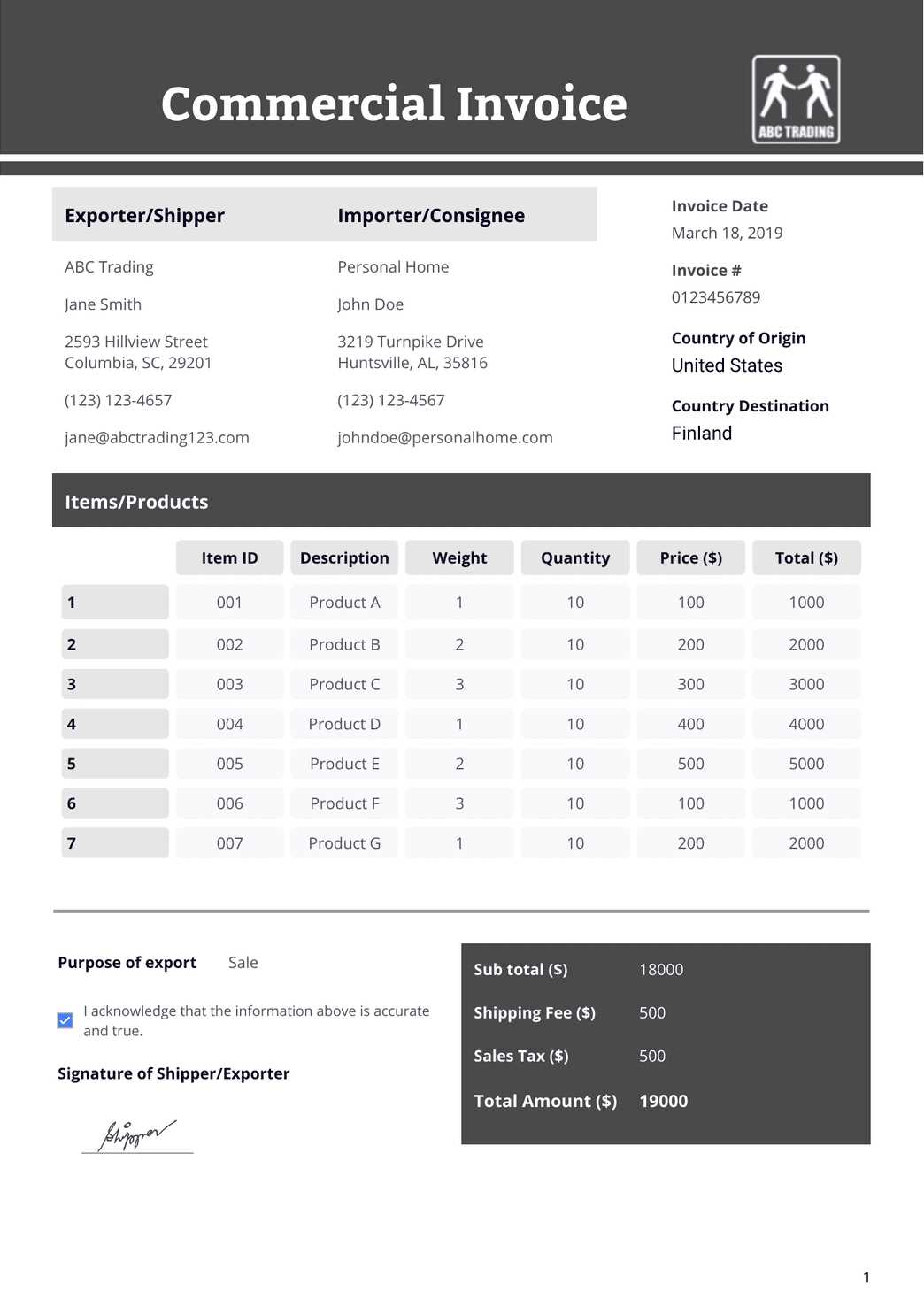

The first essential piece of information is contact details. Include both your information and the client’s to ensure everything is properly documented. This typically involves names, addresses, phone numbers, and email contacts. Having this upfront ensures both parties can easily reach each other if any questions arise.

Next, ensure that the document includes a clear description of the services provided. Each task or project should be broken down into specific line items, with details like dates, rates, and quantities. This allows the client to understand exactly what they are being billed for, minimizing the risk of disputes.

Lastly, be sure to incorporate payment terms. Clearly outline due dates, accepted payment methods, and any late fees or discounts for early payments. These terms set expectations from the beginning and help ensure timely payment. Including this information prominently helps avoid misunderstandings and keeps the transaction process transparent.

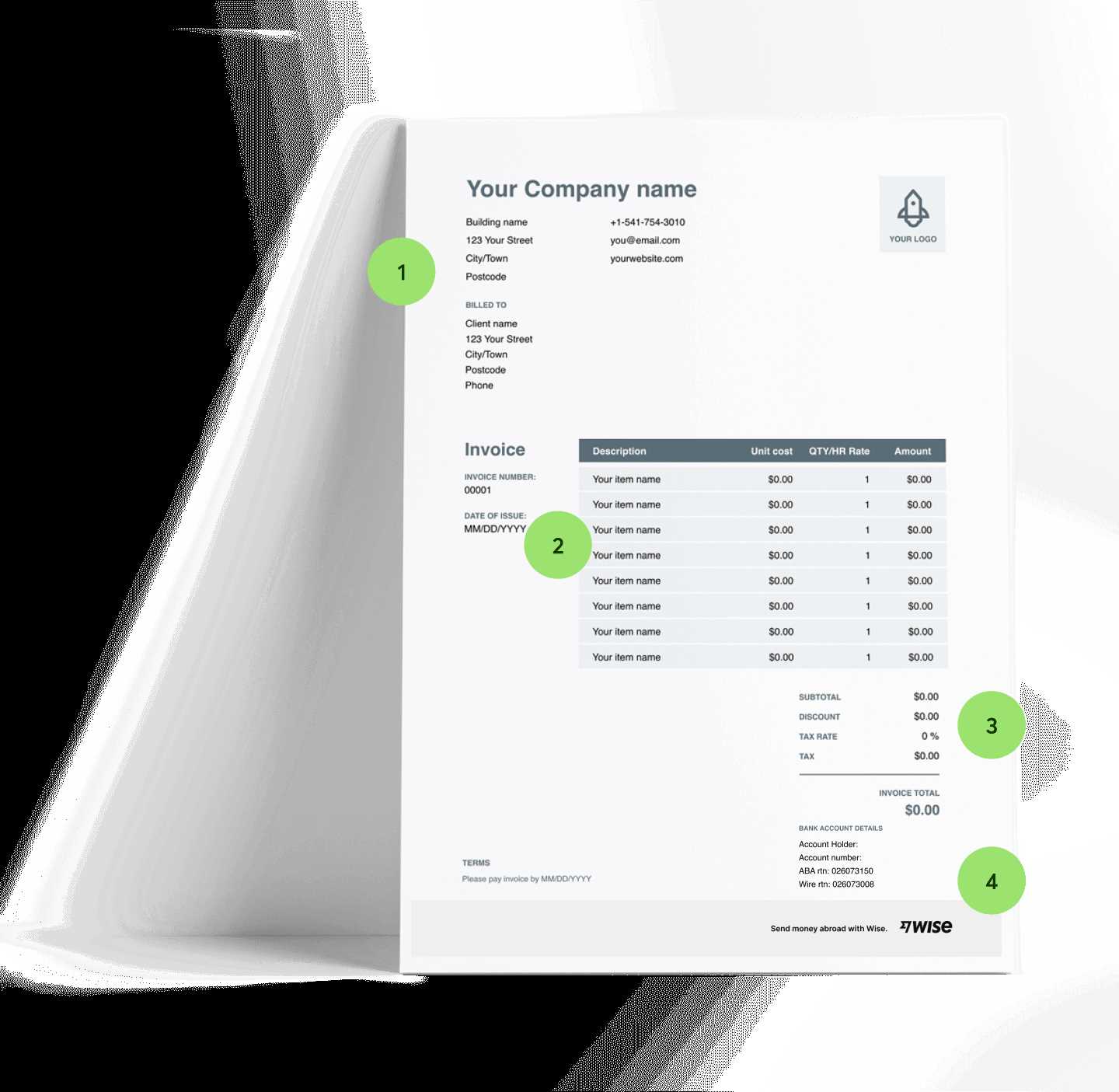

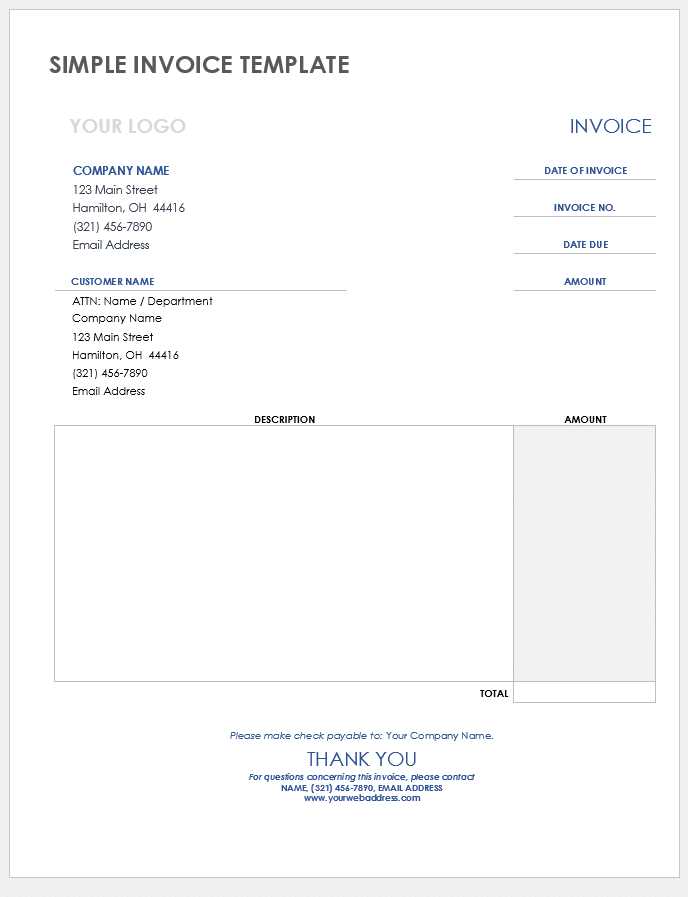

How to Customize Your Invoice Template

Personalizing your billing format is a smart way to reflect your brand and make the payment process easier for both you and your clients. A customized document not only enhances your professional image but also allows you to include specific details that match the nature of your work. Adjusting the structure and layout ensures that all important information is clearly presented, making it simple for clients to understand.

The first step in tailoring your format is to incorporate your business logo and colors. Branding adds a personal touch and helps your document stand out. It also reinforces your professional identity, making a strong impression on clients. Whether you opt for a minimalist design or something more elaborate, consistency in branding is key.

Next, consider modifying the layout to highlight the most important details, such as service descriptions and payment terms. You might want to rearrange sections or add custom fields that apply to your specific line of work. For instance, if you offer multiple services, include distinct categories that make the breakdown of costs easier to follow.

Lastly, don’t forget to save your customized version as a reusable format. This saves time and ensures consistency across all your documents. With a personalized approach, you create a professional yet unique impression that benefits both you and your clients.

Streamline Your Payment Process with Invoices

Efficient payment handling is essential for maintaining a healthy cash flow and fostering strong client relationships. By optimizing your billing method, you can significantly reduce the time spent on administrative tasks and ensure timely payments. A well-organized approach to managing transactions also minimizes errors and keeps financial records accurate.

One of the best ways to simplify your payment system is by using a standardized format for all your billing documents. This consistency not only reduces confusion but also speeds up the process for both you and your clients. When everything is clearly laid out, from service descriptions to payment terms, clients are more likely to respond promptly.

Incorporating digital solutions can further enhance efficiency. Utilizing automated invoicing tools or software allows you to send documents instantly and track their status. These tools often provide features like reminders for overdue payments, which can be especially useful in keeping your cash flow steady. Additionally, by integrating payment gateways, clients can make quick and secure transactions, making the entire process smoother and faster.

By adopting these strategies, you ensure that your billing system remains organized, professional, and efficient, leading to faster payments and better financial management.

Top Mistakes to Avoid on Contractor Invoices

While creating billing documents may seem straightforward, there are several common errors that can lead to confusion, delays in payment, or even disputes. Ensuring that your documents are accurate and professional is crucial for maintaining a smooth financial workflow and building trust with clients. By avoiding some of the most frequent mistakes, you can streamline your billing process and improve your chances of getting paid on time.

Forgetting Key Information

- Missing contact details: Always include both your and the client’s full contact information. This ensures easy communication if any issues arise.

- No service description: Vague or missing descriptions of the work completed can lead to confusion or disputes. Be clear and detailed to avoid misunderstandings.

- Omitting payment terms: Failing to include due dates or payment methods can delay payments. Specify terms such as net 30 or due on receipt clearly.

- Time-saving: Automated solutions can drastically reduce the time spent on creating, formatting, and sending documents, enabling you to allocate your time more effectively.

- Customization: Many software options offer customizable features, allowing you to tailor documents to reflect your brand identity with logos, colors, and specific layouts.

- Accuracy: Digital tools minimize the risk of errors in calculations and data entry, ensuring that all amounts and totals are correct.

- Record keeping: Most applications provide tracking features, which help you manage outstanding payments and maintain organized financial records.

- User-friendly interface: Look for software that is intuitive and easy to navigate, enabling you to create documents quickly without extensive training.

- Integration capabilities: Ensure that the chosen tool can integrate with other systems you use, such as accounting software or payment processors, for seamless operations.

- Customer support: Reliable customer service can be invaluable, especially when you encounter technical issues or have questions about features.

- Business Expenses: Costs directly related to your services, including materials, tools, and software, can often be deducted.

- Home Office Deduction: If you use a portion of your residence for work purposes, you may be eligible for deductions based on the space utilized.

- Travel Expenses: Expenses incurred while traveling for business, including transportation, lodging, and meals, may also be deductible.

- Use Accounting Software: Consider utilizing accounting programs that offer payment tracking features. These tools can automate the process, providing real-time updates on outstanding payments.

- Create a Payment Schedule: Establish a timeline for when payments are due and set reminders to follow up with clients as necessary. This proactive approach can help reduce delays in receiving funds.

- Maintain Detailed Records: Keep meticulous records of all transactions, including dates, amounts, and payment methods. This information will be invaluable for your financial statements and tax preparation.

- Send Payment Reminders: Regularly remind clients of upcoming payment deadlines to encourage timely submissions.

- Be Transparent: Clearly outline payment terms and conditions in your initial agreements to avoid misunderstandings later on.

- Encourage Prompt Payments: Consider offering incentives for early payments, such as discounts or rewards, to motivate clients to settle their bills faster.

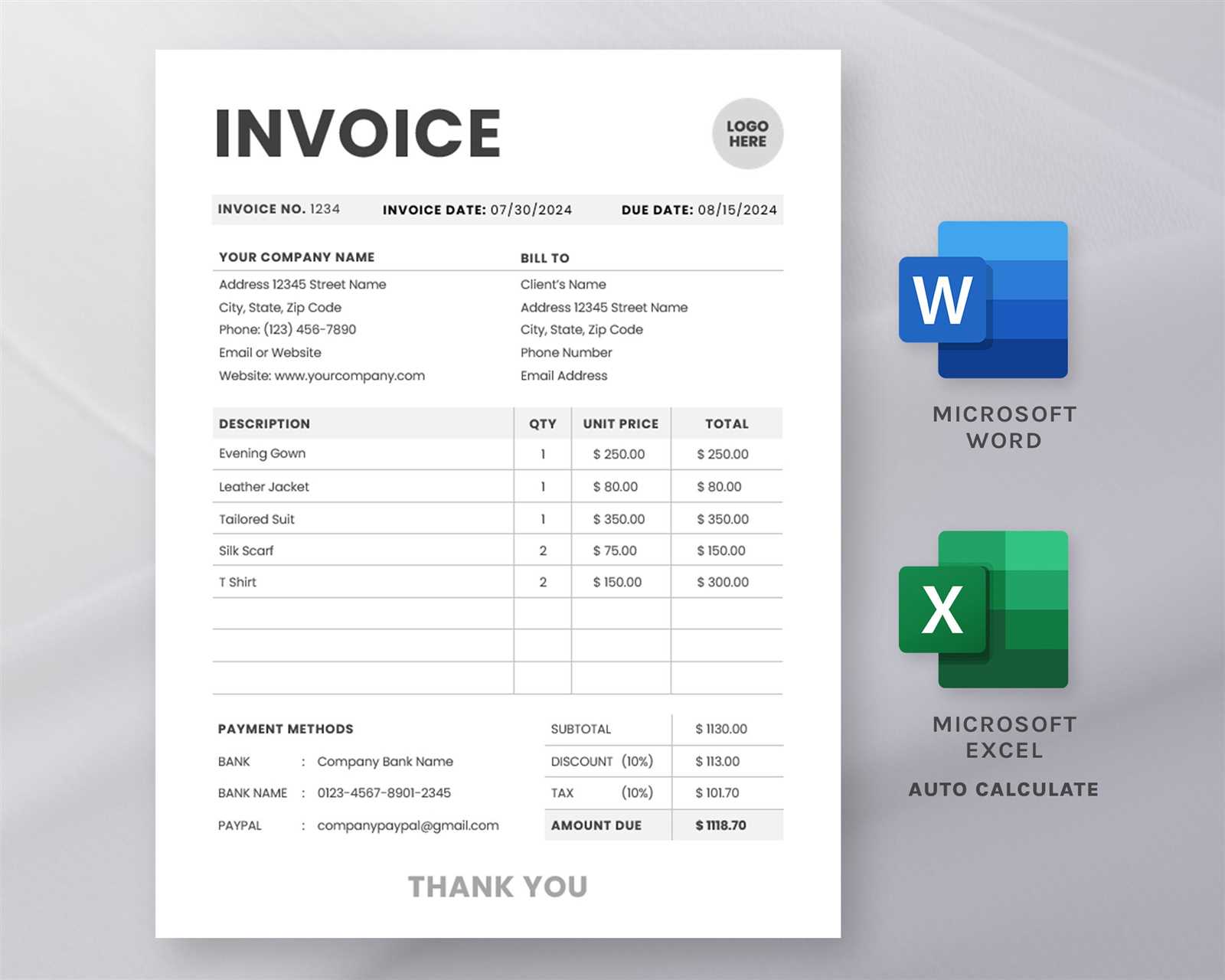

- Your Business Information: Include your name or company name, address, phone number, and email. This helps the client easily identify who is providing the services.

- Client Information: Clearly state the client’s name, address, and contact information. This personalization helps to build a stronger business relationship.

- Unique Invoice Number: Assign a specific identification number to each billing document for tracking purposes. This helps both you and the client manage records efficiently.

- Date of Issue: Include the date when the billing document is issued. This provides a clear timeline for payment expectations.

- Description of Services: Provide a detailed description of the services provided, including specific tasks completed and the duration of each service. This transparency helps clients understand the value of what they are paying for.

- Rates and Charges: Clearly outline the charges associated with each service, including hourly rates, flat fees, or any other pricing structures used.

- Subtotal and Total Amount: Calculate the subtotal for the services rendered, then include any applicable taxes or fees to arrive at the total amount due.

- Payment Terms: Specify the payment methods accepted, due dates, and any late fees that may apply if payment is not received on time.

- Notes or Additional Information: Use this section for any relevant information, such as thank-you notes, reminders about future work, or terms and conditions.

Using Software to Generate Professional Invoices

Utilizing digital tools for creating billing documents can significantly enhance efficiency and professionalism in your financial processes. Software designed for generating these records simplifies the entire workflow, allowing you to focus on delivering quality services rather than getting bogged down by administrative tasks. By leveraging technology, you can ensure accuracy, consistency, and a polished appearance for your documents.

Benefits of Using Software

Choosing the Right Software

When selecting a software solution, consider the following factors:

By adopting software solutions for generating billing documents, you can streamline your financial processes and present a more professional image to your clients.

Understanding Tax Deductions on Contractor Invoices

Navigating the complexities of taxation can be challenging, particularly when it comes to the financial records you submit for your work. A thorough understanding of applicable deductions is essential for managing your finances effectively and maximizing your potential savings. Properly accounting for these deductions not only reduces your taxable income but also enhances your overall profitability.

One crucial aspect to consider is the range of expenses that may qualify for deductions. These can encompass various categories such as:

It’s important to keep meticulous records of all relevant expenses and retain supporting documentation, as this will facilitate the process during tax season. Consulting with a tax professional can also provide valuable insights into maximizing your deductions and ensuring compliance with regulations.

By understanding and effectively utilizing available deductions, you can significantly impact your financial health and streamline your business operations.

How to Track Invoice Payments Efficiently

Keeping track of payments received for your services is crucial for maintaining a healthy cash flow and ensuring your financial records are accurate. An organized approach to monitoring these transactions not only helps you manage your income but also improves your professional image and client relationships. By implementing effective strategies, you can simplify the tracking process and stay on top of your finances.

Establish a System for Tracking

Communicate with Clients

Effective communication can significantly enhance your payment tracking efforts. Here are a few tips to consider:

By establishing a robust tracking system and maintaining open lines of communication with your clients, you can ensure efficient management of payments and foster a positive working relationship.

Benefits of Using a Digital Invoice Template

Utilizing a digital document for billing purposes presents numerous advantages that can enhance efficiency and professionalism. The transition from traditional methods to a more modern approach streamlines the entire process, allowing for quicker turnaround times and improved accuracy. Below are some of the key benefits associated with employing a digital format for billing communications.

| Benefit | Description |

|---|---|

| Time Efficiency | Digital formats can be easily created and customized, significantly reducing the time spent on preparing documents. |

| Enhanced Accuracy | Using automated systems minimizes the risk of human errors, ensuring that all calculations are correct and details are accurately represented. |

| Professional Appearance | A well-designed digital document conveys a sense of professionalism, enhancing your brand image and credibility. |

| Easy Record Keeping | Digital files can be easily organized, stored, and retrieved, making it simple to track your billing history and client payments. |

| Environmental Benefits | Reducing paper usage contributes to sustainability efforts, allowing you to promote eco-friendly practices in your business. |

| Accessibility | Digital documents can be accessed from anywhere, providing flexibility for both you and your clients when managing billing matters. |

Incorporating a digital approach not only enhances operational efficiency but also improves overall client satisfaction. By embracing technology in your billing practices, you can create a more streamlined and effective process that benefits both your business and your clients.

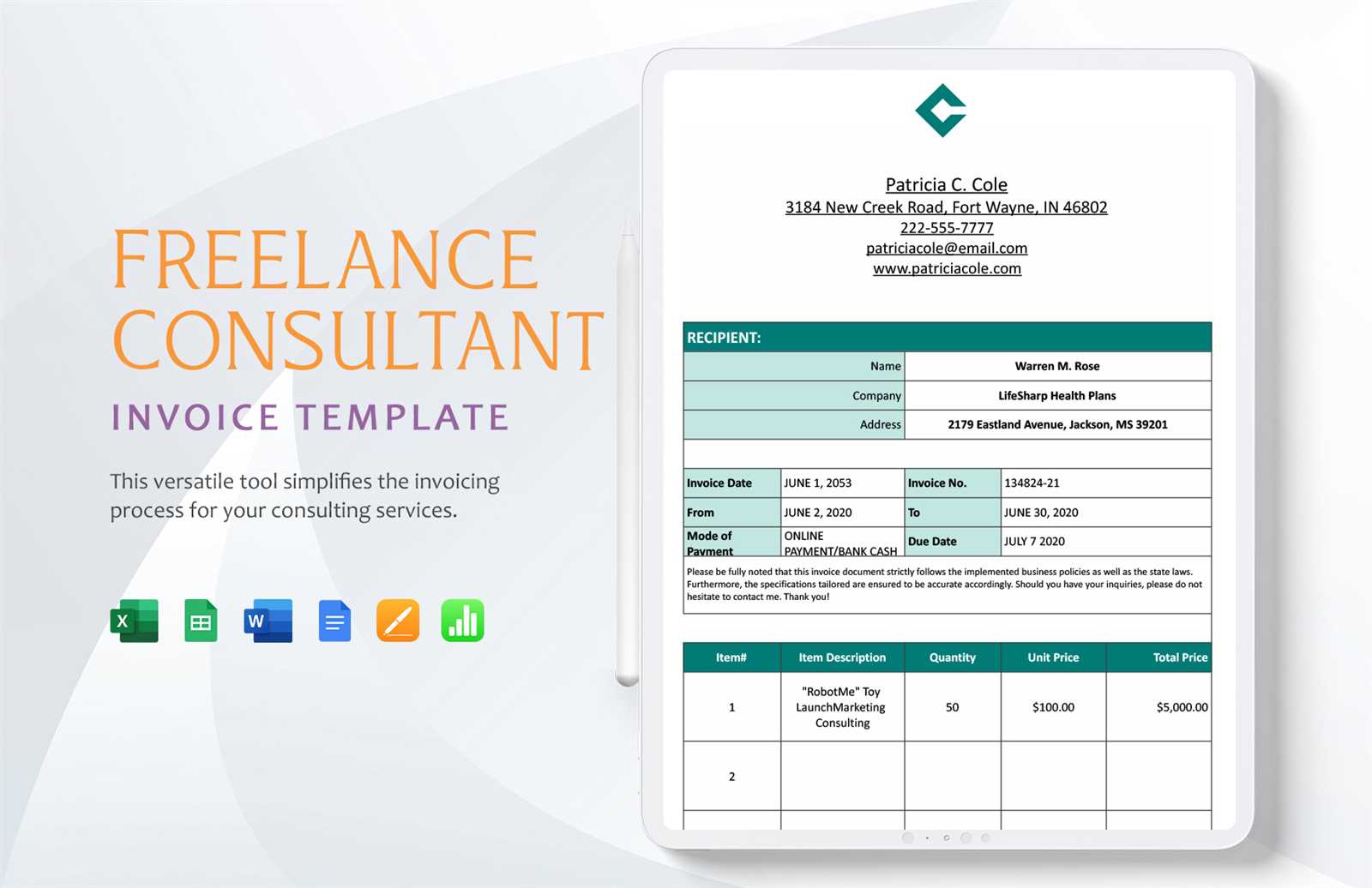

Key Differences Between Freelance and Contractor Invoices

Understanding the distinctions between various billing documents is crucial for professionals operating in diverse environments. While both types of billing statements serve the same fundamental purpose of requesting payment for services rendered, they can differ significantly in structure, terminology, and the specifics of the information included. Recognizing these differences helps ensure that clients receive accurate and professional communications, which in turn fosters better business relationships.

Freelance statements typically emphasize a more personalized approach, reflecting the unique nature of one-off projects or short-term engagements. They may include detailed descriptions of the services provided, including time spent on tasks or specific milestones achieved. On the other hand, billing documents for ongoing engagements often adopt a more standardized format, reflecting a regular flow of work and consistent payment schedules.

Additionally, the layout and design of these documents may vary. Freelance communications may incorporate more creative elements that align with the individual’s branding, while standard forms tend to prioritize clarity and conciseness. This awareness of the unique requirements and expectations for each type of document can help professionals present their work effectively and ensure prompt payment.

What to Include in a Service-Based Invoice

Creating a comprehensive billing document is essential for ensuring clarity and professionalism when requesting payment for services rendered. A well-structured statement not only facilitates timely payment but also provides a clear record of the transaction for both parties. When preparing such a document, it’s important to include several key elements to ensure that all necessary information is conveyed effectively.

Including these essential components in a service-based billing document ensures that clients have all the information they need to process payments promptly and accurately, contributing to a smoother financial transaction experience.

Invoicing Tips for New Independent Contractors

Effective billing practices are crucial for maintaining a steady cash flow and ensuring that you get paid on time for your services. For those just starting their journey in providing services, mastering the art of billing can be challenging but rewarding. Here are some valuable tips to help streamline the process and enhance professionalism in your financial communications.

1. Create Clear and Detailed Statements

Ensure that every billing document you produce is clear and detailed. Include all relevant information such as your contact details, the recipient’s information, and a breakdown of the services provided. This clarity not only helps clients understand what they are paying for but also reduces the chances of disputes regarding charges.

2. Establish Payment Terms Upfront

Before starting any work, communicate your payment terms clearly to clients. Specify due dates, acceptable payment methods, and any penalties for late payments. This transparency fosters trust and helps prevent misunderstandings later on.

By following these tips, newcomers can establish a solid foundation for effective billing practices, ultimately leading to a more successful and sustainable service-oriented business.

How to Set Payment Terms for Invoices

Establishing clear payment conditions is vital for ensuring timely compensation for services rendered. By outlining specific guidelines regarding payment expectations, you can minimize confusion and foster a smoother financial relationship with clients. This section will explore effective strategies for defining and communicating payment terms.

1. Determine Your Payment Schedule

Decide whether you will require payment upfront, upon completion, or on a specific schedule. Common options include net 30, net 60, or milestone payments for long-term projects. Each method has its advantages, so consider what aligns best with your business model and cash flow needs.

2. Clearly Outline Accepted Payment Methods

Communicate which payment methods you accept, such as bank transfers, credit cards, or digital wallets. Providing various options can make it easier for clients to fulfill their obligations promptly.

3. Include Late Fees for Delayed Payments

To encourage timely payments, consider implementing a late fee policy. Clearly state the amount or percentage that will be charged for late payments, along with when it will take effect. This can motivate clients to adhere to the agreed-upon payment terms.

By thoughtfully establishing payment conditions, you can create a clear framework that promotes timely payments and strengthens client relationships.

Legal Considerations When Sending Contractor Invoices

When issuing billing statements for services provided, it is crucial to be aware of the legal aspects that can impact the transaction. Understanding your rights and obligations can help avoid disputes and ensure compliance with applicable laws. This section will outline key legal considerations to keep in mind.

| Consideration | Description |

|---|---|

| Contractual Agreement | Ensure that there is a clear written agreement outlining the terms of service, including pricing and payment conditions. This document serves as a legal foundation in case of disputes. |

| Tax Compliance | Be aware of tax obligations related to your earnings. Different jurisdictions may have varying requirements for reporting income and collecting sales tax. |

| Privacy Regulations | Protect client information by complying with data privacy laws. Avoid including sensitive personal data on billing documents unless necessary. |

| Payment Terms | Clearly define payment terms to mitigate misunderstandings. Ensure that late fees or interest charges comply with local regulations. |

By considering these legal factors, you can navigate the complexities of the billing process more effectively and maintain professional relationships with your clients.