Best Buy Invoice Template for Streamlined Billing and Easy Payments

Managing financial transactions efficiently is essential for any business. Whether you’re a freelancer, small business owner, or part of a larger organization, having a streamlined process for documenting payments is key. The right tools can simplify this task, ensuring accuracy, clarity, and prompt payments.

Creating a reliable billing document is more than just a formality–it’s a vital part of maintaining smooth operations. By using a well-structured and easy-to-understand document, businesses can minimize errors, reduce misunderstandings with clients, and ensure timely settlements. This approach not only saves time but also enhances professionalism.

Customizing your financial records to reflect the specific needs of your business and clients allows for greater flexibility. From payment terms to itemized lists, these documents provide all the necessary details to avoid confusion. Whether you are looking for a simple layout or a more comprehensive option, selecting the right solution can improve your billing process significantly.

Best Buy Invoice Template for Quick Billing

Efficient billing is essential for maintaining cash flow and ensuring that businesses receive payments promptly. A well-organized document designed for rapid processing can significantly reduce the time spent on this task. By utilizing a pre-designed structure, companies can easily input necessary details and generate accurate statements with minimal effort.

Streamlining Your Billing Process

When the format is already set, the process of issuing financial records becomes much quicker. Rather than manually formatting each document from scratch, you can simply adjust the figures, client information, and services provided. This not only saves time but also eliminates the risk of common errors, making the process more reliable.

Customizing for Specific Needs

Although these tools offer standardized designs, they also provide flexibility for customization. You can tailor fields for your business model, whether it’s adding unique service descriptions, adjusting tax rates, or including discounts. The ability to modify the layout to fit your specific needs enhances both efficiency and professionalism.

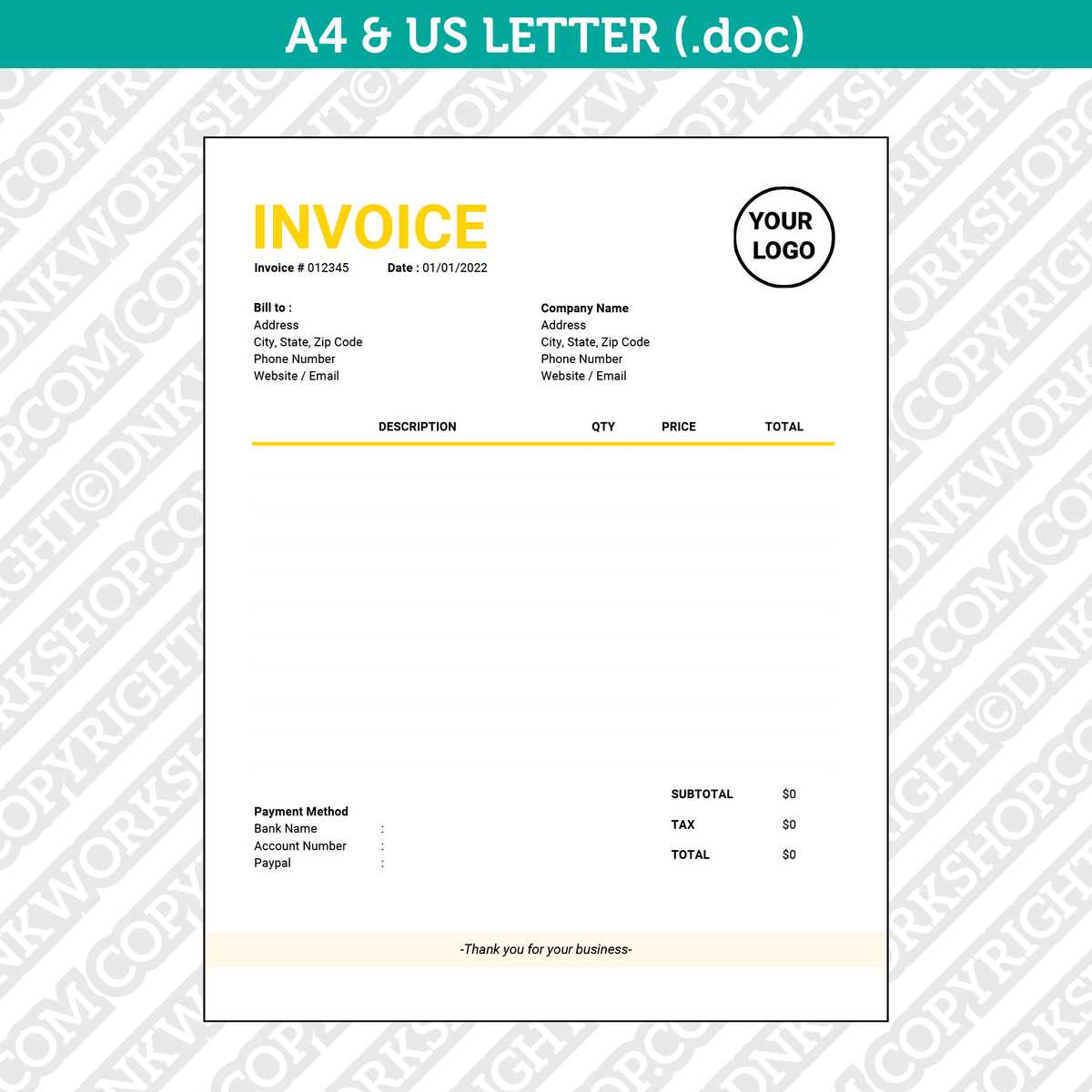

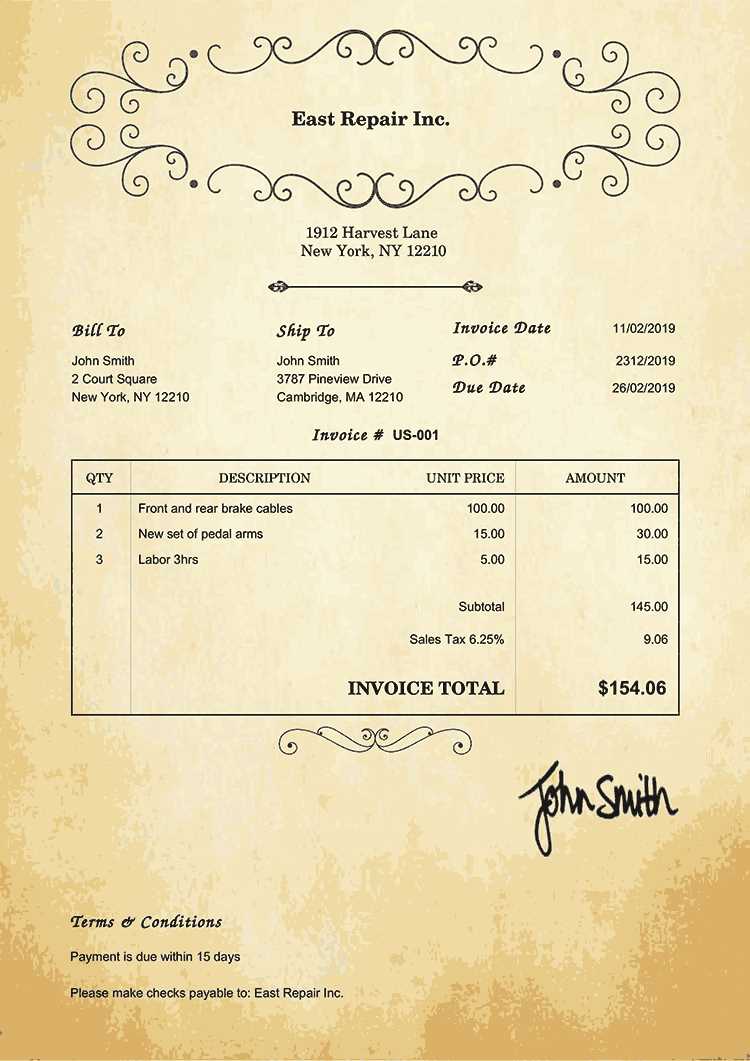

How to Create an Invoice Template

Designing a professional billing document doesn’t have to be a complicated task. With the right approach, you can create a structured layout that suits your business needs while maintaining clarity and ease of use. Here’s a simple guide to help you build an efficient record-keeping format.

Key Elements to Include

A well-crafted document should contain all the necessary information for a clear and transparent transaction. Make sure your document includes the following details:

- Business Information: Company name, address, phone number, and email.

- Client Details: Name, address, and contact information.

- Transaction Date: The date the document is issued.

- Unique Reference Number: A specific identifier for tracking purposes.

- Itemized List of Products/Services: Description, quantity, unit price, and total cost.

- Payment Terms: Due date, payment method, and any late fees or discounts.

Design and Customization Tips

Once you’ve included all necessary information, focus on the layout and design to make the document easy to read and professional-looking. Here are a few tips:

- Use clear headings: Bold each section for better readability.

- Ensure alignment: Keep text and figures aligned for a clean, organized appearance.

- Incorporate your branding: Add your logo, brand colors, and fonts to personalize the format.

- Leave enough white space: Avoid overcrowding and allow space between sections to improve visual clarity.

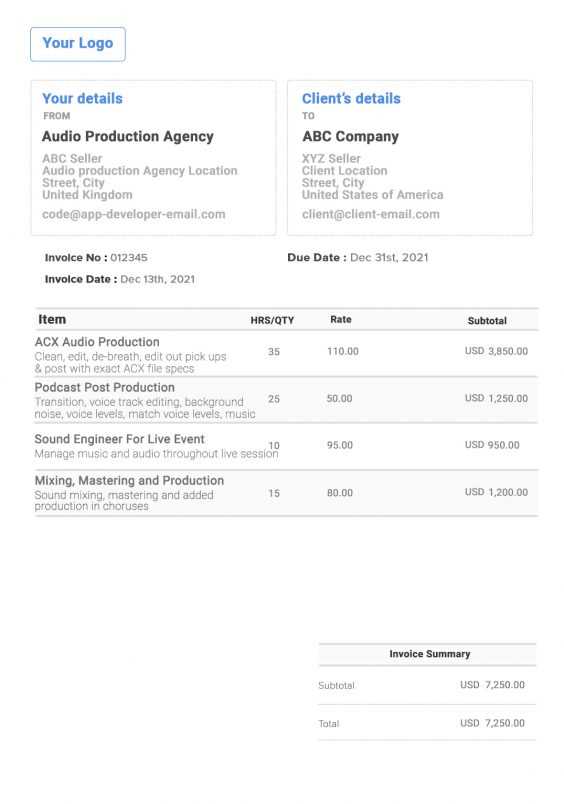

Top Features of an Invoice Template

When it comes to generating accurate and professional documents for billing purposes, certain features can make the process much more efficient. These essential characteristics ensure that the records are clear, well-organized, and legally compliant. A well-constructed document can also save time and reduce the likelihood of errors.

Essential Fields for Accuracy

A well-structured document must include specific fields that ensure all necessary details are captured correctly. Some of the most important features include:

- Client Information: Name, address, and contact details for accurate communication.

- Clear Breakdown of Charges: A detailed list of products or services provided, with unit costs and totals for transparency.

- Due Date and Payment Terms: Including payment due dates and terms helps set clear expectations with clients.

- Tax Calculations: Automatic tax inclusion ensures compliance with local tax laws and avoids discrepancies.

Design and Customization Options

Aside from functional aspects, the visual design of your billing document can also improve the client’s experience. Customizable design features include:

- Professional Layout: A clean, organized structure with bold headings and proper spacing enhances readability.

- Branding Elements: Incorporating your logo, color scheme, and font choices allows the document to reflect your company’s identity.

- Editable Fields: A customizable format enables quick adjustments for different clients and projects.

Why Choose a Buy Invoice Template

Opting for a structured billing solution offers several advantages, particularly when it comes to maintaining efficiency and professionalism in financial transactions. A pre-designed format can save time, reduce errors, and ensure that all necessary details are included in every document. Whether you’re a small business or a large enterprise, having the right tool simplifies the process of managing payments.

Time-Saving Benefits

By using a ready-made document structure, you can significantly reduce the time spent creating and formatting each record. Some key time-saving benefits include:

- Quick Setup: Easily fill in relevant information without having to design a new format every time.

- Efficient Reuse: Save your customized version and reuse it for multiple clients or projects.

- Reduced Errors: With a pre-built structure, you’re less likely to miss important details or make formatting mistakes.

Enhanced Professionalism

Consistently using a well-designed document for all transactions helps maintain a professional appearance and ensures clarity with your clients. Additional benefits include:

- Consistency: Every document follows the same clean and organized layout, strengthening your brand’s image.

- Clarity: Clients can easily review the details of the transaction, which leads to fewer misunderstandings.

- Legal Compliance: Many templates come with built-in legal and tax-related sections, ensuring your documents are compliant with local regulations.

Benefits of Using Professional Templates

Using a professionally designed structure for managing financial transactions offers several advantages that can streamline your business operations. From ensuring consistency to improving client trust, opting for a high-quality solution helps businesses maintain accuracy and professionalism. These tools simplify the process of generating records and improve overall efficiency.

Consistency and Accuracy

One of the primary benefits of using a professionally created document layout is the consistency it brings to your billing process. By adopting a standardized format, you ensure that each record looks the same and contains all necessary details. This can reduce errors and omissions, leading to more accurate documentation. Key benefits include:

- Uniform Layout: Every record follows the same structure, making it easier to review and compare transactions.

- Complete Information: All necessary fields are included, reducing the chance of leaving out important details.

- Reduced Mistakes: The risk of errors is minimized because the document is pre-structured and easy to fill out.

Enhanced Professionalism and Client Trust

A clean, polished layout not only improves the readability of your records but also builds trust with clients. By presenting your billing documents in a professional way, you show clients that you are organized and serious about your business. Other advantages include:

- Brand Identity: Incorporate your company’s logo, colors, and design elements to reinforce your brand.

- Clear Communication: Easy-to-read documents help clients understand the breakdown of charges and payment terms, leading to fewer disputes.

- Time Efficiency: Using a pre-designed solution saves time, allowing you to focus on other aspects of your business while ensuring accuracy in your records.

Customizing Your Invoice Template

Personalizing your billing documents ensures they reflect your unique business needs while maintaining a professional appearance. Customization allows you to tailor the format to your specific services, client preferences, and branding guidelines. By adjusting various elements, you can create a more functional and visually appealing record-keeping tool.

Adjusting Key Information

One of the main advantages of using a flexible structure is the ability to modify the details that are most relevant to your business. Some common elements you might customize include:

- Business Branding: Incorporate your logo, company colors, and fonts to create a cohesive look.

- Service Descriptions: Adjust the descriptions of products or services to match your offerings.

- Tax Rates: Set the correct tax percentage depending on your location or industry standards.

- Payment Terms: Specify your preferred payment methods, due dates, and any late fees or discounts.

Design and Layout Customization

In addition to modifying the content, you can enhance the document’s overall design to improve readability and client experience. Some options for customizing the layout include:

- Section Arrangement: Change the order of sections to highlight the most important details first.

- Font and Color Scheme: Adjust fonts and colors to align with your branding and ensure easy readability.

- Adding Extra Fields: If necessary, include additional fields such as project numbers, client references, or shipping details.

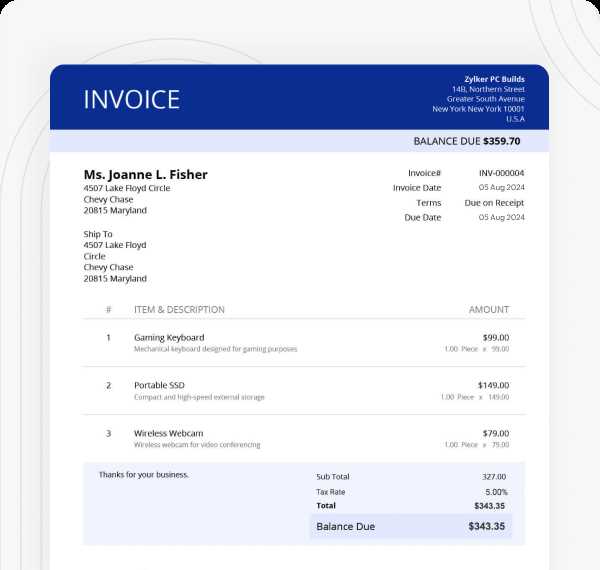

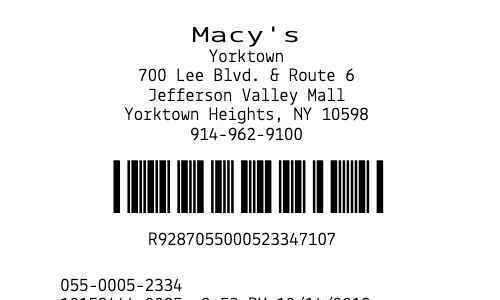

Understanding Invoice Numbering and Formats

Properly organizing and numbering your financial records is crucial for tracking transactions, maintaining order, and ensuring compliance. A well-structured numbering system helps you stay organized and easily retrieve any record when needed. Additionally, understanding different formatting conventions can make your billing process more professional and efficient.

Importance of Numbering

Each record should have a unique identifier, often referred to as a reference number, that allows both you and your clients to easily track and refer to specific transactions. A systematic approach to numbering helps prevent duplication and confusion. Consider these key points:

- Sequential Numbering: A simple, continuous numbering system ensures every record is unique.

- Yearly or Monthly Prefix: Adding a date-based prefix (e.g., 2024-001) helps organize records by time period.

- Custom Prefixes: Some businesses include project numbers, client codes, or specific product categories to organize records further.

Choosing the Right Format

The format of your financial documents should be clear and easy to understand. Below is an example of a common structure used by many businesses:

| Format | Description |

|---|---|

| #### | A simple sequential number (e.g., 0001, 0002, 0003). |

| YYYY-#### | Year-first format, often used for tracking by year (e.g., 2024-0001). |

| ###-### | A format including a mix of categories or projects (e.g., 123-456 for specific projects). |

| Customer ID-#### | Includes a client-specific identifier (e.g., C1001-0001). |

Choosing the appropriate format will depend on your business structure, industry standards, and personal preferences. The key is to ensure that the numbering is consistent, logical, and easy to follow for b

Free vs Paid Invoice Templates: Which to Choose

When it comes to managing your financial records, choosing the right document design is crucial. Whether you opt for a free or paid solution depends on the specific needs of your business, the level of customization you require, and your budget. Both options offer distinct advantages, but it’s important to weigh the pros and cons before making a decision.

Advantages of Free Options

Free document designs can be a great choice for startups, small businesses, or individuals just starting out. They offer a simple solution with minimal investment. Key benefits include:

- No Cost: Free designs allow you to create and send billing documents without any upfront expense.

- Basic Features: Many free options provide all the essential fields needed to generate standard records.

- Quick Setup: Free layouts are usually easy to access and use, requiring little time to get started.

Advantages of Paid Solutions

While free options can work well in the early stages, paid designs often offer more advanced features and customization. These options are suited for businesses that require more flexibility and professional-level functionality. Benefits include:

- Customization: Paid solutions often provide more customization options, allowing you to modify the layout, color scheme, and branding elements.

- Advanced Features: Some premium layouts include automatic tax calculations, payment tracking, and integration with accounting software.

- Support and Updates: With paid options, you typically get access to customer support and regular updates, ensuring the tool remains functional and up-to-date with current laws.

Ultimately, the choice between free and paid options depends on your specific business needs and resources. If you’re just starting out and need something simple, a free design may be sufficient. However, if you’re looking for a more tailored and p

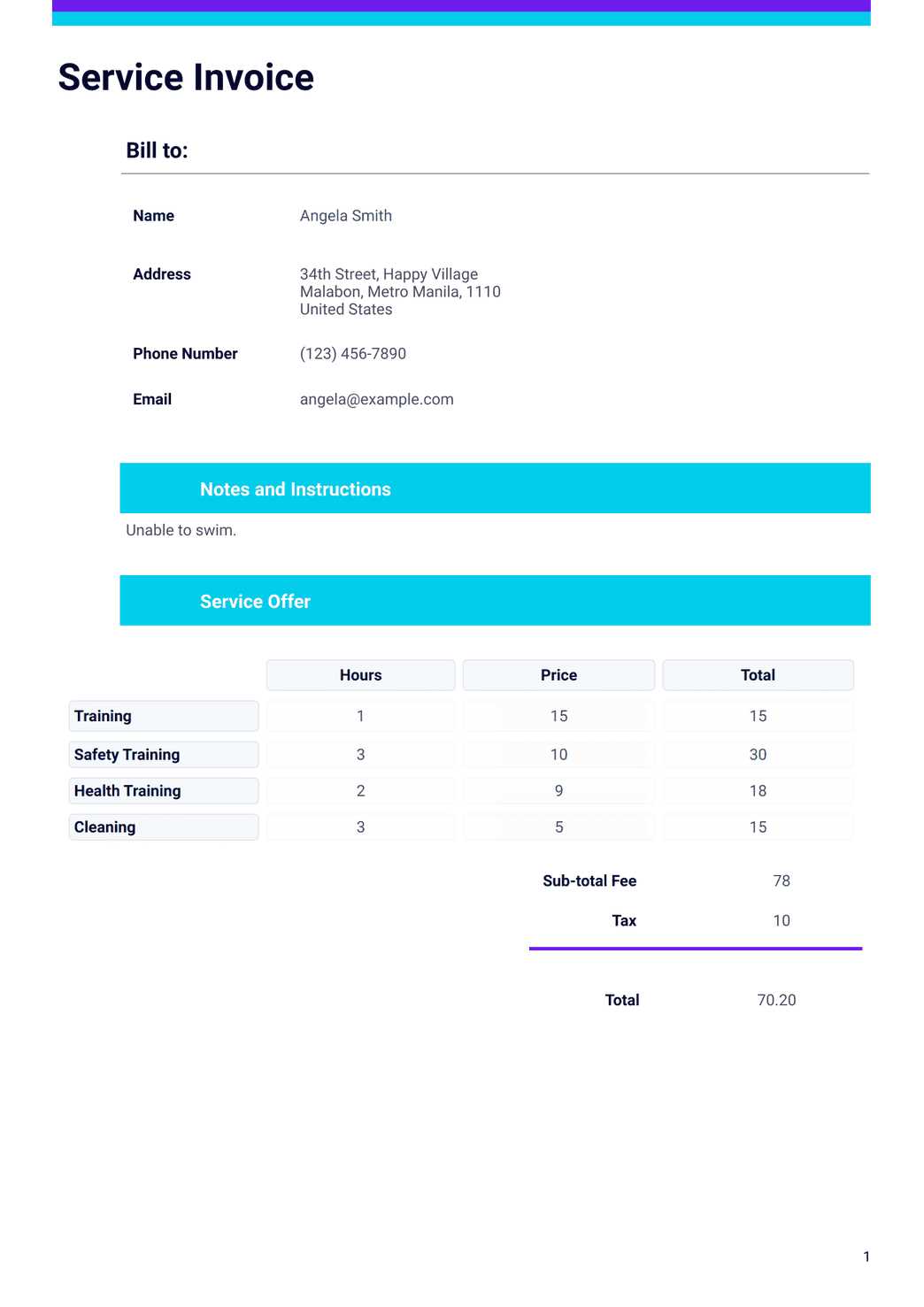

Invoice Template for Small Businesses

For small businesses, maintaining a professional image while keeping operational costs low is crucial. A well-structured billing document can help streamline payment processes, improve cash flow, and enhance customer relationships. With a simple yet effective design, small businesses can manage their transactions smoothly without the need for expensive software or complicated systems.

When selecting a billing solution for a small business, it’s essential to focus on simplicity, clarity, and functionality. The goal is to create a document that is easy to generate, accurate, and ensures all necessary information is presented to clients in a clear and organized way. A properly designed format not only speeds up payment collection but also fosters trust with clients by showing professionalism.

For businesses with fewer transactions or those just getting started, a basic, customizable structure can offer everything needed. Features such as automatic calculations, payment terms, and easy-to-read layouts ensure that each document meets the needs of both the business owner and their clients.

How to Add Payment Terms to Invoices

Including clear payment terms in your billing documents is essential for ensuring that both parties understand the expectations regarding payment deadlines, methods, and conditions. These terms help prevent confusion, promote timely payments, and set the right tone for a professional relationship. By outlining your payment expectations upfront, you minimize the risk of delayed payments and disputes.

Key Payment Term Components

When adding payment terms, it’s important to include several key elements that make the process clear and unambiguous. Here are the main components to consider:

- Due Date: Specify the exact date by which payment should be made, such as “Due within 30 days of receipt.”

- Payment Methods: Indicate the accepted methods of payment, such as bank transfers, credit cards, or PayPal.

- Late Fees: Clarify any penalties or interest charges for overdue payments, such as “A late fee of 5% will be applied after 30 days.”

- Discounts: Include any discounts for early payment, such as “2% discount if paid within 10 days.”

Sample Payment Terms Table

Here is an example of how to present payment terms clearly in your billing documents:

| Payment Term | Description | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Due Date | Payment is due 30 days from the date of the document. | |||||||||||||||||

| Payment Methods | We accept payments via bank transfer, credit card, or PayPal. | |||||||||||||||||

| Late Fee | A 5% late fee will be applied after 30 days. | |||||||||||||||||

| Early Payment Discount |

| Mistake | Consequences | Solution |

|---|---|---|

| Missing Client Information | Can cause confusion or delays in payments, especially if there’s no way to contact the client. | Ensure that the client’s full name, address, and contact information are included. |

| Incorrect Dates | Leads to confusion regarding payment deadlines, affecting cash flow and client trust. | Double-check the issue and due dates to avoid any discrepancies. |

| Unclear Payment Terms | Can result in misunderstandings about when and how payments should be made. | Clearly define payment methods, due dates, and penalties for late payments. |

| Inaccurate Amounts | May cause disputes or delays in payment if the amounts charged are incorrect. | Verify all calculations, including taxes, discounts, and totals, before sending the document. |

| Lack of Unique Identification | Without a unique reference number, it becomes difficult to track and match payments with specific records. | Always assign a unique number to each record to improve tracking and reference. |

By avoiding these common mistakes, you can ensure that your financial documents are clear, professional, and acc

How to Design a User-Friendly Template

Designing an effective and user-friendly document layout is essential for ensuring that both you and your clients can easily understand the information presented. A well-structured format not only enhances readability but also speeds up the process of creating and processing records. Whether you are handling one-time transactions or recurring billing, having a clear, intuitive design can make a significant difference in efficiency and professionalism.

When designing a layout, the key is to balance simplicity with functionality. Each section should be organized logically, ensuring that essential details are easy to find, while the overall appearance remains clean and uncluttered. Here are some tips to consider when creating an accessible and effective design:

Prioritize Clarity and Simplicity

The main goal of a well-designed layout is to present information in a clear and easily digestible manner. Some important principles to follow include:

- Minimal Text: Avoid excessive text or jargon. Stick to concise descriptions and clear instructions.

- Logical Flow: Organize the sections logically, placing the most important information (like client details and amounts) at the top.

- Readable Fonts: Use standard fonts that are easy to read, and make sure the text size is large enough to be legible on both desktop and mobile devices.

Enhance Visual Appeal

Aesthetics play an important role in making the document feel professional and easy to navigate. A clean and simple design is more likely to make a positive impression. Consider the following tips for visual appeal:

- Use White Space: Adequate spacing between sections and text helps reduce clutter and makes the document easier to scan.

- Consistent Alignment: Align text and numbers consistently to create a more organized and structured appearance.

- Branding: Incorporate your logo and brand colors to create a personalized touch without overwhelming the document.

By focusing on clarity, simplicity, and visual appeal, you can design a document that not only looks professional but is also easy for clients to understand and for you to manage.

Automating Invoices with Templates

Automating the creation and management of billing documents can save businesses significant time and effort, allowing for quicker processing and fewer errors. By using pre-designed layouts, businesses can streamline the entire process, from generating documents to sending them to clients. This not only speeds up workflow but also ensures consistency in the way transactions are recorded.

How Automation Improves Efficiency

Automating the process of generating billing records offers several advantages that can help a business operate more smoothly:

- Time Savings: Once the structure is set, generating a new document becomes a simple task, requiring minimal manual input.

- Consistency: Automation ensures that each record follows the same format, reducing the risk of errors and omissions.

- Scalability: As the volume of transactions grows, automated systems can handle increased workloads without compromising speed or accuracy.

Key Features for Automation

To fully benefit from automation, certain features should be incorporated into your system. These can include:

- Custom Fields: Automatically populate fields such as customer details, service descriptions, and amounts from an existing database.

- Recurring Billing: Set up automatic generation of documents for regular payments, such as subscriptions or monthly services.

- Payment Integration: Connect the billing system with payment gateways to track and update payment status in real time.

By integrating automation into your document management system, you can ensure smoother, more efficient business operations while maintaining professionalism and accuracy in every transaction.

Ensuring Legal Compliance with Invoices

When creating billing documents, it is essential to ensure that they meet all necessary legal requirements. A well-constructed record not only helps maintain professional relationships with clients but also safeguards your business from legal complications. Each jurisdiction may have specific regulations regarding what needs to be included in these documents, and failing to comply could lead to fines or disputes.

To guarantee that your documents are legally sound, it’s important to incorporate essential details and adhere to local tax and business laws. In this section, we’ll outline the key components that should always be included in your records to ensure they are compliant with legal standards.

Key Legal Requirements for Billing Documents

- Accurate Date Information: Include the date of issue and, if applicable, the due date to clearly define payment expectations.

- Unique Reference Number: Assign a unique identifier to each record for tracking and reference purposes.

- Seller and Buyer Details: Clearly state both the business’s and client’s name, address, and contact information.

- Tax Information: Include relevant tax identification numbers and tax rates, especially if your business operates in regions with specific tax laws.

- Clear Payment Terms: Outline payment methods, due dates, and any penalties for late payments to avoid potential legal issues over financial transactions.

Ensuring Compliance with Local Laws

Different countries and regions have varying rules about what must be included in financial documents. To ensure compliance:

- Research Local Laws: Stay informed about the legal requirements in your operating ju