Free Cake Invoice Template for Word Download and Customization

Running a bakery or any custom dessert business requires attention to detail, and one of the most essential elements is managing financial transactions. Having a structured, clear, and professional way to document payments ensures smooth communication with clients and helps maintain a trustworthy image for your business.

By using a digital document that can be easily customized, you streamline the process of issuing payments for your products. These documents are not only efficient but also give your brand a polished and organized look. Whether you’re offering a custom treat or a bulk order, a well-crafted document simplifies the process and minimizes errors.

In this guide, we’ll explore how to create, modify, and optimize such documents, providing you with everything you need to manage your financial interactions more effectively. From adding pricing details to setting payment terms, these resources will help you stay on top of your business’s invoicing needs.

How to Create a Billing Document in Word

Creating a professional billing document is essential for any small business, especially when dealing with custom orders or products. A well-structured document helps maintain clarity, ensures both parties are on the same page, and enhances the professional image of your business. The good news is that it’s easy to create this type of document using a simple word processing program.

To begin, open your word processor and start with a blank document. You can choose to start from scratch or make use of a pre-made layout, which will save time and effort. The goal is to customize it to fit your business’s specific needs, from the client’s details to the product description and pricing.

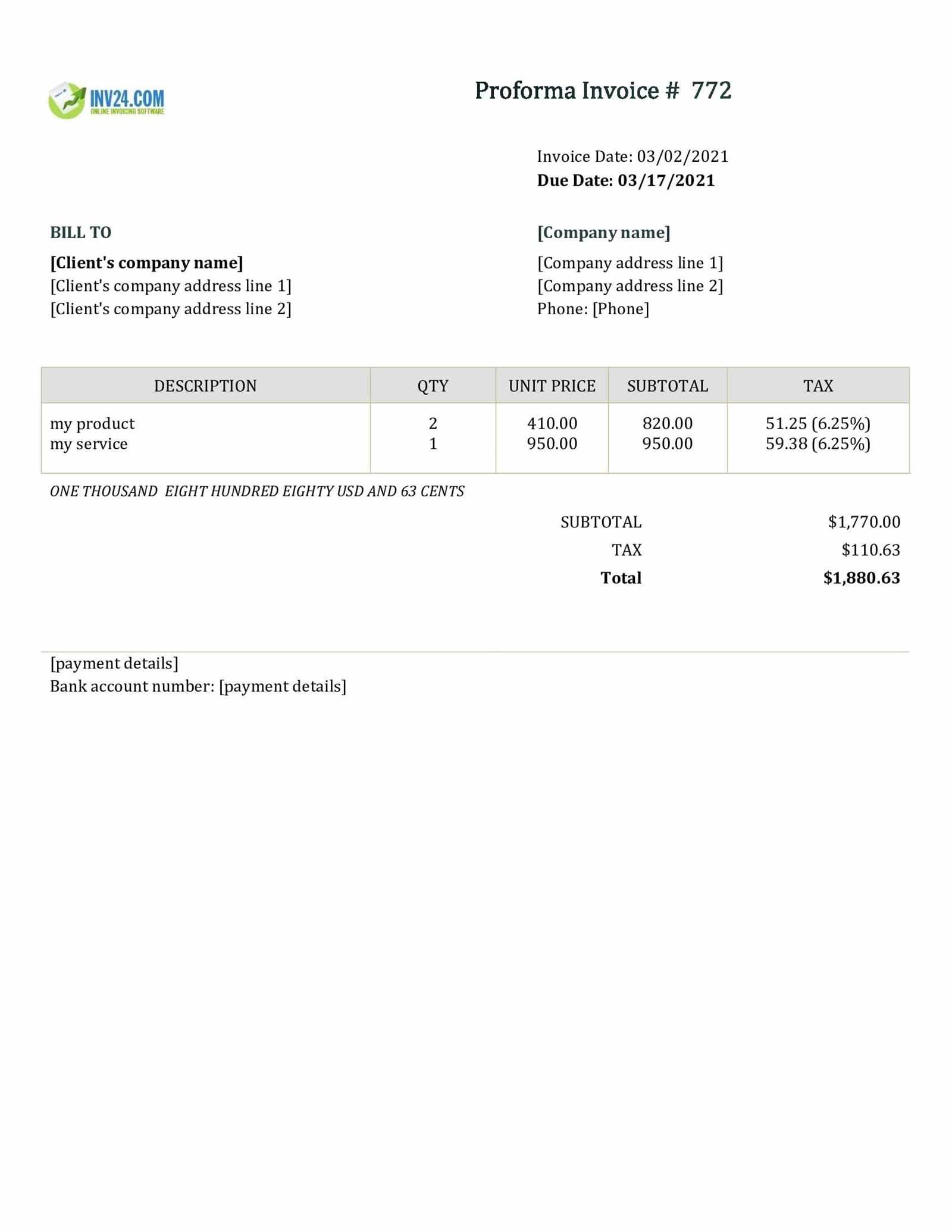

Start by adding your business name, contact information, and logo at the top. Then, include the client’s details, including their name, address, and contact information. After that, clearly list the products or services provided, along with prices, quantities, and any applicable taxes or discounts. Finally, include payment terms, such as due dates and methods of payment, to avoid any misunderstandings.

Once you’ve created your document, don’t forget to save it for future use. You can easily modify it for different clients, making it an efficient tool for managing your business transactions. With just a few adjustments, you’ll have a professional-looking document that supports your brand and streamlines your operations.

Why Choose Word for Billing Documents

When it comes to creating professional documents for your business, using a word processing program offers several advantages. These tools are not only user-friendly but also provide a high level of customization, making it easy to produce documents that align with your brand’s identity and specific needs. For small business owners and entrepreneurs, this simplicity and flexibility make it an ideal choice for managing financial records.

Ease of Use and Accessibility

One of the primary reasons for choosing this type of software is its ease of use. Most people are familiar with basic features such as adding text, tables, and images, making it quick to start. Additionally, these programs are widely accessible, and many small businesses already have them installed on their computers, reducing the need for additional investments in software.

Customization and Flexibility

Another key benefit is the ability to fully customize your documents. You can adjust fonts, colors, and layouts to match your business style, ensuring each document looks professional. Whether you are billing for custom orders or regular purchases, these programs allow you to easily update and save documents for future use. This flexibility also enables you to add relevant information such as payment terms, contact details, or personalized notes.

In conclusion, using a word processing program for your financial records ensures you maintain a polished, professional appearance while keeping your workflow simple and efficient. The ability to edit and store these documents with minimal effort provides long-term value for your business operations.

Benefits of Using Billing Templates

Using pre-designed billing documents provides a quick and efficient way to handle financial transactions, saving valuable time and effort for business owners. Instead of starting from scratch each time, these ready-made structures allow for faster customization, reducing the risk of errors and ensuring consistency across all customer interactions. Whether you’re managing a small shop or running a larger operation, these documents help streamline your administrative processes.

Time-Saving and Efficiency

One of the most significant advantages of using these resources is the amount of time saved. Instead of creating a new document every time a transaction occurs, you simply fill in the relevant details such as customer information, products or services, and payment terms. This eliminates the need to format or structure each document from the beginning, allowing you to focus on other important tasks in your business.

Consistency and Professionalism

By using pre-made designs, you ensure consistency across all your financial documents. This uniformity contributes to a professional image, which can build trust and credibility with your clients. A well-organized, easy-to-read document reflects positively on your brand, helping to create a sense of reliability and attention to detail that can set you apart from competitors.

In summary, utilizing ready-made document designs not only enhances the efficiency of your operations but also boosts the professionalism of your business communications, making it an essential tool for anyone managing multiple transactions or client relationships.

Customizing Your Billing Document

Personalizing your billing document is a key step in making it reflect your business’s unique style and professional standards. Customization allows you to add specific details that are relevant to your operations, making the document both functional and aligned with your brand identity. Whether it’s adjusting the layout, colors, or adding custom sections, these modifications help create a polished and cohesive appearance.

Start by adjusting the layout to suit your preferences. Most word processing programs offer a variety of layout options, such as adding tables to organize product details, quantities, prices, and total costs. You can also include a section for any special notes or terms that might apply to a particular transaction, such as delivery instructions or custom requests.

Next, incorporate your business’s branding elements. This could include your logo, brand colors, and font choices that match your website or marketing materials. Consistent branding across all business documents enhances your professional image and makes your communications instantly recognizable to clients.

Additionally, ensure that all relevant legal or financial information is present, such as tax rates, payment methods, and due dates. Customizing these aspects allows you to cater to specific customer needs while keeping everything clear and organized.

Once you’ve made your adjustments, save the modified version for future use. With just a few tweaks, you’ll have a billing document that not only looks great but also meets all of your business’s operational needs.

Step-by-Step Guide to Edit Billing Document

Editing a billing document can be a straightforward process, especially when you have a clear and organized structure to follow. With just a few adjustments, you can tailor the document to suit each transaction while maintaining consistency and professionalism. This guide will walk you through the essential steps needed to modify the document effectively.

Step 1: Open Your Document

Start by opening the document in your preferred word processing software. If you’re working with a pre-designed structure, it should already include placeholders for key details like customer information, product descriptions, pricing, and payment terms. If not, you can add these sections yourself by using tables or text fields to organize the information.

Step 2: Update Customer and Product Information

The next step is to update the customer’s information and the details of the products or services provided. Replace any placeholder text with the client’s name, address, contact details, and any other relevant information. For the items or services provided, ensure that the descriptions, quantities, prices, and total amounts are accurate. If necessary, adjust tax rates or add any applicable discounts or additional charges.

Once the customer and product information is updated, double-check for accuracy. Small mistakes can lead to confusion or delays in payment, so take the time to review the entire document carefully.

Step 3: Customize Payment Terms and Finalize

Next, update the payment terms to reflect your business practices. This may include specifying due dates, payment methods (such as credit card or bank transfer), and any late fees or penalties for overdue payments. Be clear about expectations to avoid misunderstandings.

Finally, review the document to ensure everything is in place. Make any necessary final adjustments, such as adding a logo or changing font styles to match your branding. Once the document looks polished and complete, save it and send it to your client with confidence.

Top Features of a Billing Document

When creating a professional document to track payments, certain features can significantly improve both the functionality and appearance of the file. These key elements ensure that the document is not only organized but also clearly communicates all necessary details to clients. Here are some of the top features to consider when customizing your business’s billing records.

- Clear Client Information: A well-organized section for customer details, including name, address, and contact information, ensures that each document is easily traceable and personal to the client.

- Itemized List of Products or Services: Providing a detailed breakdown of the goods or services provided, along with their prices, quantities, and totals, helps eliminate confusion and creates a transparent record of the transaction.

- Tax and Discount Calculations: Automated fields for taxes or discounts ensure accuracy and help clients quickly understand the final amount due without having to manually calculate these adjustments.

- Payment Terms: Clearly defined payment terms, such as the due date and accepted payment methods, ensure that clients know when and how to pay, minimizing delays and misunderstandings.

- Professional Branding: Including your business logo, custom colors, and consistent fonts adds a professional touch that enhances your brand image and helps clients recognize your business easily.

- Due Date and Late Fees: Highlighting the payment due date along with any late fee policies encourages timely payments and sets clear expectations regarding overdue balances.

- Clear Formatting and Layout: Using tables, bold headings, and appropriate spacing makes the document easier to read and ensures that all important information is easy to find at a glance.

Incorporating these features into your billing documents not only ensures a smoother workflow but also enhances your business’s professional image, making the transaction process clear and efficient for both you and your clients.

Best Practices for Document Design

Creating a well-structured and visually appealing document is essential for ensuring that your communication with clients is clear and professional. A good design not only enhances the document’s readability but also reflects positively on your business. Following a few key design principles can make all the difference in delivering a polished, functional document that leaves a lasting impression.

1. Keep It Simple and Organized

Avoid cluttering your document with too much text or unnecessary elements. Use clear headings and logical sections, such as a customer information section, a product list, and a payment summary. A clean layout makes it easier for clients to locate important details quickly, such as due dates and total amounts.

2. Use Readable Fonts

Choose fonts that are easy to read and professional. Stick to classic, simple fonts like Arial or Times New Roman, and avoid overly decorative styles. Consistent font sizes and types across the document help maintain a uniform and organized appearance.

3. Include Clear Payment Instructions

Make payment instructions obvious and easy to find. Ensure that payment terms, such as due dates and acceptable payment methods, are highlighted in a prominent section. This reduces the chance of confusion and encourages prompt payments.

4. Incorporate Your Branding

Add your business logo and color scheme to personalize the document and reinforce your brand. Using consistent branding elements across all your documents helps build a recognizable identity and enhances the professional image of your business.

5. Use Tables for Clarity

Tables are an effective way to organize information in a structured, easy-to-read format. Use them to break down the product or service details, including prices, quantities, and totals. This ensures your clients can quickly understand the charges and review the document without any confusion.

6. Proofread for Accuracy

Before finalizing any document, always proofread for errors in spelling, numbers, or calculations. An accurate document reflects attention to detail and professionalism, while mistakes can lead to misunderstandings or loss of trust with clients.

By following these best practices, you can create a functional and attractive document that not only conveys all the necessary information but also enhances your business’s

How to Add Tax and Discounts

Incorporating tax rates and discounts into your financial documents is crucial for ensuring accuracy and transparency in pricing. By clearly outlining these adjustments, you can help clients understand the final price, reducing confusion and fostering trust. The process involves calculating the correct percentages and placing them in the appropriate sections of the document.

Adding Tax

Tax rates vary depending on your location and the type of products or services you provide. To ensure you are charging the correct amount, follow these steps:

- Determine the applicable tax rate: Check your local tax laws to identify the correct percentage. This might differ based on your location or the type of goods you offer.

- Calculate the tax amount: Multiply the subtotal (the sum of all products or services) by the tax rate. For example, if the subtotal is $100 and the tax rate is 10%, the tax would be $10.

- Add the tax to the total: After calculating the tax, add it to the subtotal to determine the total amount due. The final price will be the sum of the products, services, and tax.

Applying Discounts

Discounts can be a great way to reward loyal customers or promote special offers. Here’s how to apply them correctly:

- Determine the discount type: Discounts can be either a fixed amount (e.g., $10 off) or a percentage (e.g., 15% off). Choose the type based on the offer you are providing.

- Calculate the discount: For a percentage discount, multiply the total price by the discount percentage. For example, if the total is $200 and the discount is 10%, the discount amount would be $20.

- Subtract the discount from the total: Once you’ve calculated the discount, subtract it from the

Including Payment Terms in Your Document

Clear and concise payment terms are essential for ensuring that both you and your client understand the expectations surrounding payment. Including these terms in your business documents helps set clear guidelines on when and how payment should be made, reducing the likelihood of misunderstandings or delayed payments. Properly outlined terms also promote professionalism and instill confidence in your clients.

1. Specify the Due Date

Always include a clear due date for payment. This should be a specific calendar day, not just a vague “net 30” or “due upon receipt.” By specifying the exact date, you provide a clear timeline for the client to follow, helping them manage their finances and avoid late payments.

2. Define Accepted Payment Methods

Clearly outline the methods of payment you accept. Whether it’s credit card, bank transfer, online payment platforms, or checks, specifying the available payment methods reduces confusion and ensures that the client knows how to proceed. If you have multiple options, list them to provide flexibility.

3. Mention Late Fees or Penalties

Including information about late fees or penalties for overdue payments is a good practice. This helps encourage timely payments by setting expectations for any additional charges incurred if payment is delayed. Specify the percentage or flat fee that will be added after the due date has passed, along with the timeframe in which it will be applied.

4. Offer Discounts for Early Payment

Incentivizing early payments with a discount can encourage clients to pay ahead of schedule. If you offer this option, be sure to include it in the payment terms. For example, you could offer a 5% discount if the bill is paid within 7 days of receipt. This provides an incentive for clients to prioritize their payment and helps you manage cash flow.

5. Include Payment Instructions

Make it easy for your clients to know exactly how to submit payment. Provide clear instructions for each payment method, including bank account details, payment links, or specific address information for checks. The easier you make the payment process, the more likely your clients are to pay promptly.

By thoroughly outlining the payment terms, you not only set clear expectations but also help streamline your business’s financial operations. Well-structured payment terms minimize disputes, encourage on-time payments, and ensure that your transactions are transparent and professional.

Using Professional Fonts and Layouts

The appearance of your business documents plays a significant role in how your company is perceived. Choosing the right fonts and organizing the layout effectively not only makes the document easier to read but also enhances your professional image. A well-designed layout with clear, readable text can leave a positive impression on your clients and help ensure that your document communicates its message with clarity and authority.

Choosing the Right Fonts

Fonts are more than just decoration; they convey the tone and professionalism of your business. For business documents, it’s essential to choose fonts that are both clear and professional. Here are some tips for selecting the right fonts:

- Stick to Classic Fonts: Opt for classic, legible fonts such as Arial, Calibri, or Times New Roman. These fonts are widely accepted and easy to read on both digital and printed copies.

- Avoid Decorative Fonts: While decorative fonts may look appealing, they can be hard to read, especially in formal documents. Keep the design simple to ensure your message is clear.

- Use Font Sizes Wisely: Use larger fonts for headings or section titles, and smaller fonts for the body text. This creates a hierarchy and makes it easier for the reader to navigate the document.

Effective Layouts for Clarity

The layout of your document should be well-structured, with sections clearly separated and easy to follow. A good layout enhances readability and ensures that key information is easily accessible. Consider the following best practices when designing your layout:

- Use Headings and Subheadings: Organize the document into distinct sections with clear headings and subheadings. This helps break up the content and allows readers to quickly find the information they need.

- Maintain Consistent Margins: Consistent margins around the edges of the document ensure that the text doesn’t feel cramped or cluttered. This improves the overall appearance and readability.

- Incorporate Whitespace: Don

Saving and Storing Your Billing Documents

Properly saving and organizing your billing documents is essential for maintaining an efficient workflow and ensuring that you can quickly access past records when needed. Whether you are managing client transactions, tracking payments, or ensuring that you have all the required information for tax purposes, knowing how to save and store your files securely will help keep your operations running smoothly. In this section, we’ll explore best practices for saving and storing your financial documents.

Choosing the Right File Format

When saving your document, it’s important to select the right format for both easy access and long-term storage. Here are some common formats to consider:

- PDF: PDF is a popular format for business documents because it preserves the layout and ensures the document appears the same across all devices. It’s ideal for sharing with clients or archiving documents securely.

- Editable Formats: If you need to make future edits or reuse the document for multiple clients, save the file in an editable format like DOCX or a cloud-based tool such as Google Docs. This allows for quick changes without starting from scratch.

Organizing Your Files

To maintain an organized system, it’s important to create a structured file management system. Consider the following strategies:

- Folder Structure: Create folders for each client or transaction type to help you easily find specific documents. For example, you could have a “2024 Clients” folder, and within it, subfolders for each client’s records.

- Consistent Naming Conventions: Use consistent and descriptive file names, such as “ClientName_BillingDate” (e.g., “JohnDoe_2024March”). This makes it easier to locate specific documents later.

- Version Control: If you make frequent updates to your documents, consider adding version numbers or dates to the file names. For example, “ClientName_Invoice_v1” or “ClientName_Invoic

How to Bill Clients for Custom Orders

When offering personalized products or services, accurately billing clients is essential to ensure that both parties understand the pricing structure and expectations. Creating a clear and detailed bill for custom orders not only helps maintain transparency but also establishes a professional standard for your business. In this section, we’ll walk through the key steps to properly bill clients for custom orders, ensuring that all aspects of the transaction are addressed and documented.

1. Itemize Each Custom Request

Custom orders often involve unique specifications, so it’s important to clearly break down the cost of each element involved. Here’s how to handle the itemization:

- List each product or service: Provide a detailed description of the custom product or service you are offering, including the materials, size, design, or any other unique specifications requested by the client.

- Include pricing for individual elements: If the custom order includes several components or steps, such as design work or specific materials, list each element separately with its corresponding price.

- Specify any additional fees: Include any additional fees, such as delivery, rush fees, or consultation charges, that apply to the custom order.

2. Apply Taxes and Discounts

Once you’ve itemized the custom order, it’s time to account for taxes and any applicable discounts:

- Tax rates: Depending on your location, tax may need to be added to the total amount. Specify the tax rate clearly on the bill, and calculate the tax based on the subtotal of the custom order.

- Discounts: If you offer discounts for repeat clients, early payments, or bulk orders, be sure t

Automating Billing Documents with Word

Automating the process of creating financial records can save you time and effort, especially when dealing with frequent transactions. By utilizing built-in features in document editing software, you can streamline the process of generating professional and accurate records without having to start from scratch each time. This not only enhances efficiency but also reduces the chances of human error, ensuring that every document is consistent and correct.

Using Fields for Dynamic Content

One of the most powerful features for automating your documents is the use of fields. Fields allow you to insert dynamic content that updates automatically based on the information you provide. For instance, you can set up fields for dates, names, or prices that will automatically update when the document is generated or modified. This eliminates the need for manual entry every time a new document is created.

- Date Fields: Set a field for the current date so that every time you generate a new document, the date will be automatically inserted without any extra effort.

- Client Details: Create fields for client names, addresses, or other personal details that can be quickly updated or pulled from a database, making the document generation faster.

- Amount Calculations: Use fields to insert automatic calculations, such as totals, taxes, and discounts, ensuring that all financial data is accurate and up to date.

Saving and Reusing Custom Layouts

Another way to automate your documents is by saving custom layouts and formatting. Once you’ve designed the layout for your document, you can save it as a reusable file. This allows you to maintain a consistent structure without having to recreate the format for each new document. By simply inputting the necessary information, you can generate a fully formatted document in minutes.

- Custom Styles: Save specific font styles, headings, and section layouts that you use regularly. This ensures that every document you generate looks professional and maintains the same appearance.

- Saved Sections: If your documents include recurring sections, such as terms and conditions or product descriptions, save these sections as reusable blocks that can be easily inserted into new

Free vs Premium Billing Document Templates

When creating financial records for your business, you’ll often encounter two main options for design resources: free and premium templates. Both have their advantages, but the choice between them largely depends on your specific needs, budget, and the level of customization you require. This section explores the key differences between free and premium design resources, helping you make an informed decision on which is best suited for your business operations.

Free Templates

Free templates are often an appealing option for small businesses or individuals who are just starting out. They provide basic functionality at no cost, making them a great choice for those on a tight budget. However, there are some limitations to be aware of:

- Limited Design Options: Free resources often have basic designs that may not fully represent the professional image you want to project. Customization options may also be limited.

- Basic Features: Free templates usually come with fewer features. You might not find advanced fields for automatic calculations or dynamic content integration, which can result in more manual work.

- Generic Appearance: Free templates are often widely used and may lack unique elements that help your business stand out.

- Less Support: Since free templates are typically community-driven or provided by non-commercial sources, support may be minimal or unavailable when you encounter issues.

Premium Templates

Premium templates offer a wider range of features, flexibility, and support. They are typically designed by professionals to meet the needs of businesses looking for high-quality, customized solutions. Here are some of the advantages:

- Advanced Features: Premium designs often include advanced features like automatic tax calculations, customizable fields, and client management integration, reducing the time and effort needed to complete each document.

- Unique and Professional Designs: With premium resources, you’ll find high-quality, unique designs tailored to present your business in the best light. These templates often include modern, stylish layouts that are customizable to reflect your brand’s identity.

- Customer Support: Premium template providers typically offer dedicated support, ensuring you can get help whenever needed. This is a valuable resource, especially for those who may not be tech-savvy.

- More Customization Options: Premium templates usually offer greater flexibility in terms of layout and design. You can adjust colors, fonts, and fields to suit your specific requirements, creating a more personalized experience for your clients.

Which Option is Right for You?

The decision between free and premium templates depends on your specific business needs. Here are some questions to consider:

- What is your budget? If you are just starting out or have limited funds, free templates can be a good place to begin. However, if you have a larger budget and want a more polished, professional look, premium templates are worth the investment.

- Do you need customization? If you require a high degree of customization or advanced features like automated calculations, premium templates will likely offer a better solution.

- What’s your long-term goal? If you plan to scale your business and need to project a more professional image, investing in a premium option might be the right choice.

Ultimately, both free and premium templates can serve your business well, depending on your priorities. Free templates are a great starting point, while premium templates provide more robust options for businesses looking to elevate their documentation process.

Common Mistakes to Avoid in Billing Documents

Creating accurate and professional financial documents is essential for maintaining clear communication with clients and ensuring timely payments. However, there are several common mistakes that can lead to confusion, delays, and even disputes. Understanding these pitfalls and knowing how to avoid them will help you streamline your billing process and present a more polished image to your clients. Here are some key mistakes to watch out for:

1. Missing or Incorrect Client Information

One of the most critical elements in any billing document is the client’s details. Missing or incorrect information can delay payments or cause confusion. Ensure that you have the correct name, address, and contact information for each client before finalizing your document.

- Incorrect spelling of the client’s name: This may seem minor, but it can cause confusion, especially if you are dealing with legal documents or contracts.

- Wrong contact information: Ensure that phone numbers and email addresses are accurate, so clients can reach you easily for clarification or payment inquiries.

2. Lack of Detailed Descriptions

Vague descriptions of the products or services provided can lead to misunderstandings. Always provide clear and detailed descriptions of what the client is being charged for. This is especially important for custom orders, where the client may not know exactly what to expect in terms of pricing.

- General terms: Using general terms like “services” or “items” instead of specifying the exact nature of the product or service makes it harder for clients to understand what they are paying for.

- Omitting quantities: If you’re providing multiple items or services, always list the quantity, unit price, and total price for each to avoid confusion.

3. Incorrect Pricing and Calculations

Errors in pricing or calculations can result in overcharging or undercharging a client. This can lead to disputes or delayed payments. Double-check your math and ensure that the prices match your agreed terms with the client.

- Miscalculating totals: Ensure that the subtotal, taxes, and discounts are calculated accurately before presenting the final amount.

- Inconsistent pricing: Avoid price discrepancies between what was initially quoted and what is reflected in the final document. Consistency is key to maintaining trust.

4. Missing Payment Terms

Fa

Legal Considerations for Billing Documents

When preparing financial documents for your clients, it’s essential to understand the legal aspects involved to avoid potential disputes or misunderstandings. These documents not only serve as a record of the transaction but also protect both parties’ rights. Properly structured documents can help establish clear terms, outline responsibilities, and ensure compliance with local laws. Here are some key legal considerations to keep in mind when creating your business documents.

Clear Terms and Conditions

One of the most important legal aspects of a financial document is the inclusion of clear terms and conditions. These terms should outline the expectations for both parties, including payment deadlines, refund policies, and responsibilities. A well-defined contract helps avoid confusion and provides a legal framework in case of disputes.

- Payment Deadlines: Clearly state when the payment is due and what the penalties are for late payments. This can help ensure timely transactions and avoid misunderstandings about deadlines.

- Refund and Cancellation Policies: Be transparent about your policies regarding refunds and cancellations. This protects you and your clients in case of any changes or issues with the order.

- Additional Fees: If there are extra charges (for rush orders, custom designs, etc.), make sure to include these in the terms. Transparency in pricing can prevent future disputes.

Taxation and Compliance

Another critical consideration is ensuring that your documents comply with local tax laws and regulations. Different regions have varying rules for tax collection, and it is important to correctly apply the appropriate rates to the services or products you provide. Failure to include the correct tax rates or not accounting for taxes in your billing documents could result in legal complications.

- Sales Tax: Depending on your location and the nature of the services or goods you provide, you may need to charge sales tax. Ensure the correct percentage is applied and clearly stated on the document.

- Tax Exemptions: If your business or certain products are eligible for tax exemptions, make sure these are documented appropriately to avoid issues with tax authorities.

- Local Regulations: Keep up to date with local regulations regarding business transactions, including requirements for tax reporting and record-keeping. Failing to comply can result in fines or penalties.

By addressing these legal considerations, you ensure that your financial documents are not only pro