Self Employed Invoice Template for Ireland Easy to Download and Use

For freelancers and independent contractors, managing financial transactions efficiently is essential for maintaining a successful business. One of the most important tasks is generating well-structured billing documents that clearly communicate the services provided and the amount due. These records not only ensure that clients understand the charges but also help maintain a professional image while keeping your accounting in order.

Crafting a comprehensive and accurate document can be straightforward with the right tools. By using pre-designed formats, independent workers can save time, avoid errors, and ensure they meet legal and tax obligations. This approach reduces the risk of miscommunication with clients and helps ensure prompt payments.

In this guide, we will explore the key elements that should be included in your billing documents, how to customize them for different services, and the benefits of using digital solutions. Whether you’re just starting or looking to improve your existing process, mastering this aspect of your business will make financial management more efficient and less stressful.

Essential Guide to Self-Employed Invoices in Ireland

For independent workers, generating clear and accurate billing documents is crucial to maintaining a smooth workflow and ensuring timely payments. Whether you’re offering services as a freelancer, consultant, or tradesperson, proper documentation is essential not only for professional appearance but also for legal and tax purposes. A well-organized billing process helps establish trust with clients and prevents any misunderstandings regarding payment terms.

In this guide, we’ll explore the key elements that make up an effective billing record. Understanding what information needs to be included, from personal details to payment instructions, will streamline your operations and help keep your finances in order. Moreover, knowing how to adapt the structure of your documents for different types of clients and projects can save valuable time and ensure accuracy.

By following best practices and utilizing the right tools, you can ensure that your financial transactions are transparent, professional, and compliant with local regulations. A comprehensive approach to billing will not only support your cash flow but also enhance your reputation as a reliable and responsible professional.

Understanding Invoices for Self-Employed Workers

For independent professionals, creating proper financial documentation is a critical step in ensuring smooth business operations. These documents serve as formal records of the work completed, detailing the amount due for services rendered. Beyond serving as a request for payment, they also provide essential information for tracking earnings and staying compliant with tax regulations. A clear and concise document not only helps in securing timely payments but also reinforces professionalism in client relationships.

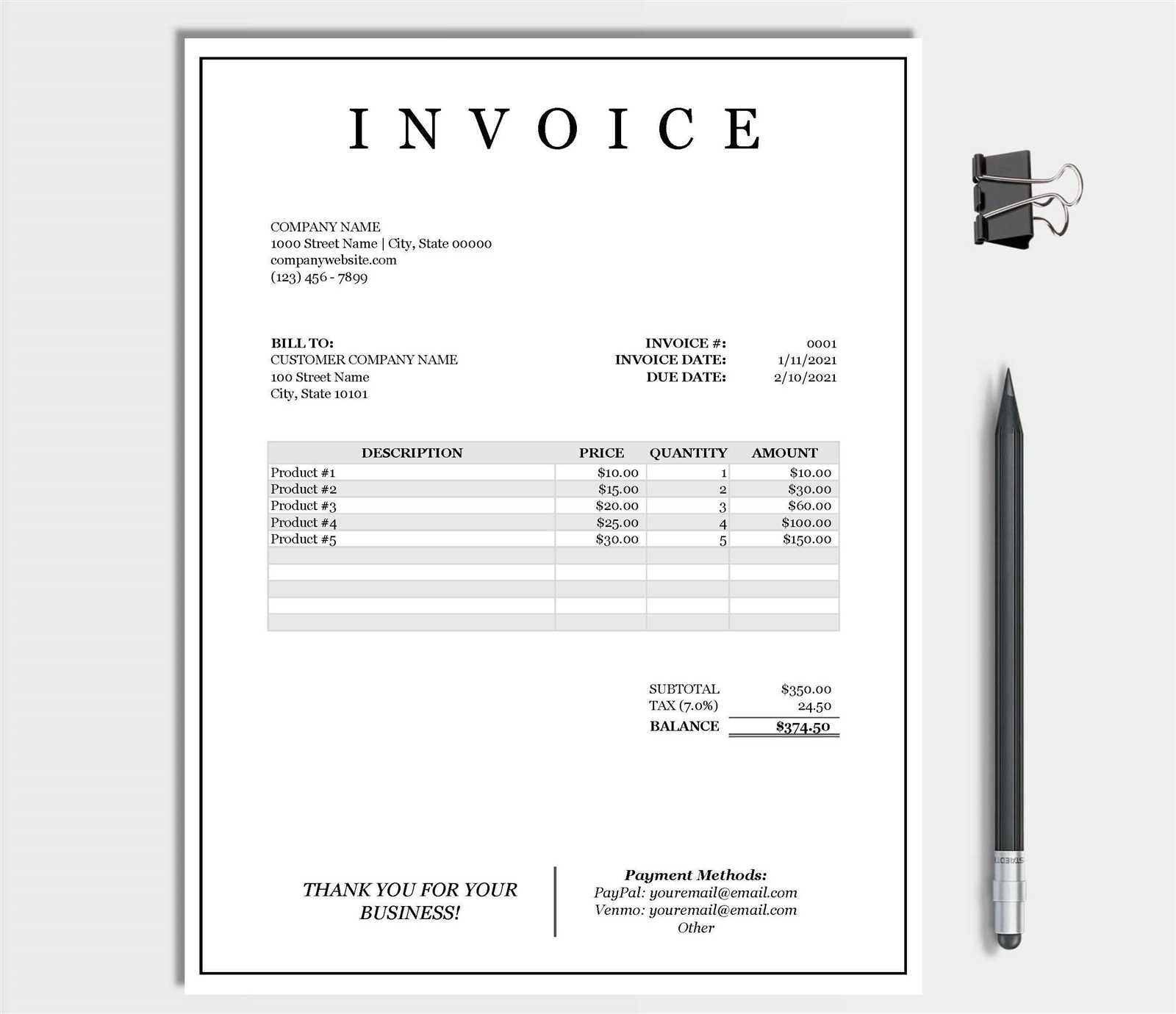

Key Elements of a Billing Document

A well-crafted record should contain specific details that ensure clarity and transparency. These details include information about the services provided, payment terms, and the dates of work or delivery. Additionally, correct formatting and layout can make it easier for clients to understand the charges and for the worker to keep accurate financial records.

| Element | Description |

|---|---|

| Client Information | Includes the name, address, and contact details of the person or company being billed. |

| Service Description | A clear outline of the work completed, including any relevant dates, hours, or quantities. |

| Payment Terms | Details the total amount due, payment method, and any applicable taxes or discounts. |

| Due Date | The date by which the payment should be received, often tied to a specific payment term (e.g., 30 days). |

| Unique Reference Number | A specific identifier for each document, helping to track payments and avoid confusion. |

Why Accurate Financial Documents Matter

Accurate and detailed financial records help reduce misunderstandings with clients and ensure that payments are processed efficiently. These documents also serve as an important tool for tax filing, providing a clear record of income. By maintaining professionalism in these records, independent professionals can protect themselves against potential disputes and foster trust with their clients.

Key Components of a Self-Employed Invoice

Creating a professional billing document requires attention to detail, ensuring that all necessary information is clearly presented. Each element serves a specific purpose, from identifying the work completed to outlining payment expectations. A well-structured document not only helps with client communication but also ensures compliance with financial regulations. Understanding the key components of such records is essential for independent workers who want to streamline their financial management and enhance their professional image.

At a minimum, a complete billing document should contain the following sections:

- Business Information: Include your full name or company name, address, and contact details. If applicable, add your tax identification number.

- Client Details: Clearly state the name, address, and contact information of the individual or company being billed.

- Description of Services: Provide a detailed breakdown of the services rendered, including dates, hours worked, or quantities provided. This section helps clients understand what they are being charged for.

- Amount Due: Specify the total amount owed, including any applicable taxes, discounts, or additional fees.

- Payment Terms: Clearly define when payment is due, acceptable methods of payment, and any late fees that may apply.

- Unique Reference Number: This helps both you and your client track the document for future reference.

By incorporating these components into your billing documents, you ensure that your financial communications are clear, professional, and legally compliant. Such consistency not only reduces misunderstandings but also improves your cash flow by setting clear expectations for payment timelines.

How to Create a Professional Invoice

To establish a professional image and ensure timely payments, independent workers must create well-organized and clear billing documents. A well-designed document not only helps in communicating the work completed and payment due but also minimizes any potential confusion. By following a structured approach, you can produce a document that is both easy to understand and legally sound, streamlining the payment process for both you and your clients.

Steps to Create a Clear Billing Document

Creating a professional record is straightforward when following these essential steps:

- Start with Your Business Information: Include your name or business name, contact details, and tax number if applicable. This helps clients identify you easily and serves as a reference for your professional identity.

- Add Client Details: Clearly list the client’s name, company name (if applicable), address, and contact information. This ensures the document is directed to the correct recipient.

- Provide a Service Description: Describe the work performed or products delivered. Include specific details such as dates, hours worked, quantities, and rates to avoid any confusion.

- List the Amount Due: Clearly state the total cost for the services rendered. Include any taxes or discounts, if relevant, and ensure that the calculation is accurate.

- Specify Payment Terms: Indicate when payment is due and outline accepted payment methods (e.g., bank transfer, cheque, etc.). If you apply late fees, mention them here as well.

- Include a Reference Number: Assign a unique identification number to each document. This makes it easier to track payments and manage your records effectively.

Designing a Legible and Professional Layout

How your billing document looks is just as important as the information it contains. A clean, organized layout not only enhances readability but also reflects professionalism. Here are some tips to ensure your document is easy to follow:

- Use Clear Headings: Break the document into sections with bold, clear headings for each part (e.g., “Service Details,” “Amount Due”).

- Keep the Format Simple:

Importance of Invoice Numbering for Self-Employed

For independent workers, tracking financial transactions accurately is essential for maintaining proper records and ensuring smooth business operations. One of the most important aspects of this process is the use of a unique numbering system for each billing document. A well-structured numbering system not only helps with organization but also ensures clarity in both internal record-keeping and client communications. It provides a simple and effective way to track payments, identify specific transactions, and maintain a professional appearance.

Invoice numbers serve several purposes, including simplifying the tracking of financial documents, assisting with tax reporting, and preventing confusion between clients. Moreover, having a unique reference for each document helps reduce the risk of duplication, errors, or lost payments.

Reason for Numbering Benefit Tracking Payments Each unique number makes it easy to identify when and what has been paid, preventing confusion. Tax Reporting A clear numbering system ensures your financial records are organized and easily accessible for tax filing. Professionalism Using a consistent numbering method signals professionalism and enhances your credibility with clients. Preventing Duplicates A unique number for every transaction reduces the chance of sending multiple bills for the same service. In addition to helping with organization, invoice numbering also supports compliance with business regulations. Maintaining a sequential and logical order of numbers is often required for accurate financial tracking, and it can be essential for audits or reviews. As such, incorporating a numbering system into your billing process is an essential step for maintaining accuracy and professionalism in your business transactions.

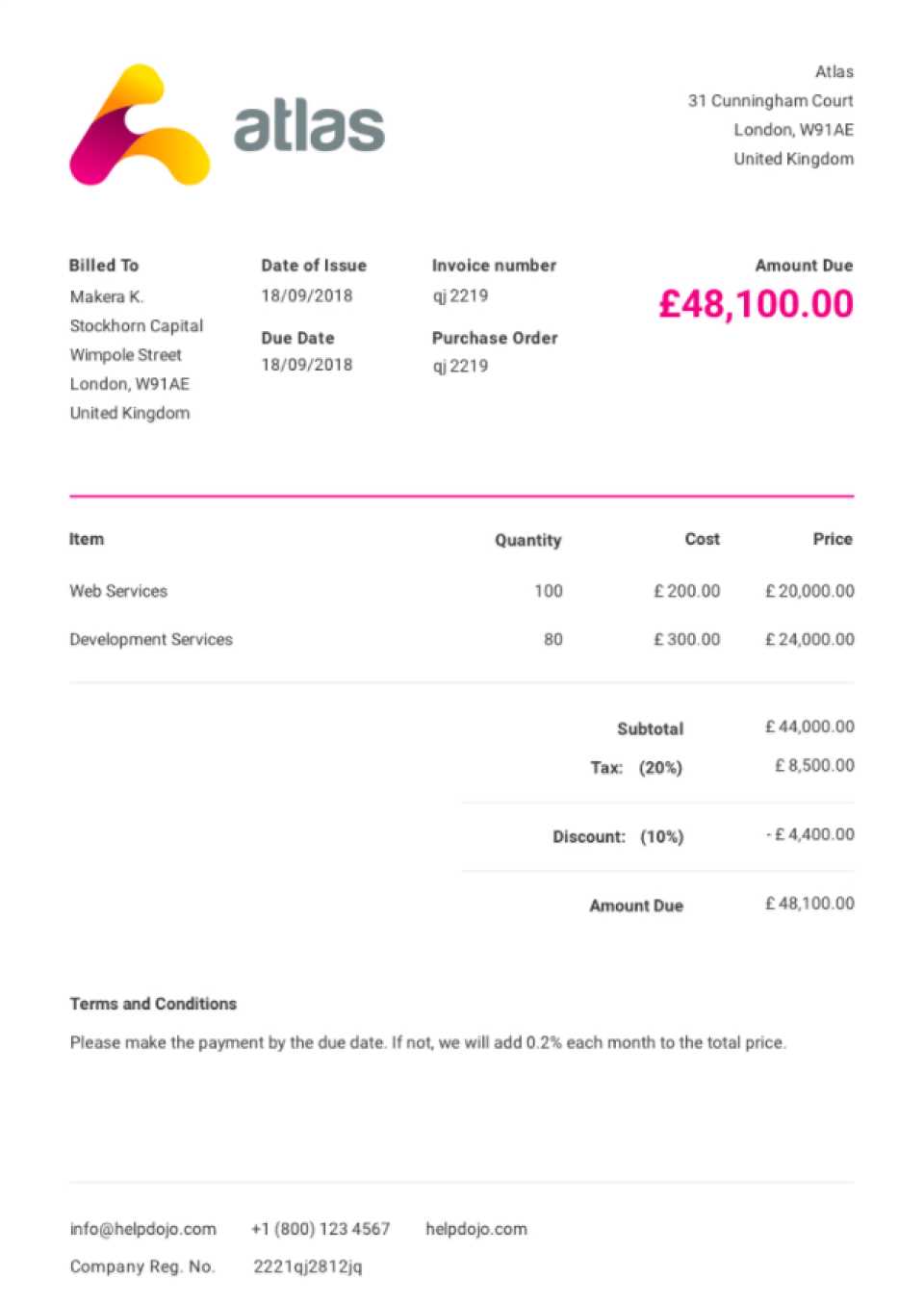

Tax Considerations When Sending Invoices

When providing services and requesting payment, it’s essential to consider the tax implications of your transactions. Properly documenting the amount charged, including any applicable taxes, ensures compliance with local tax laws and helps you avoid costly errors. For independent workers, understanding the key tax elements to include in billing documents is crucial for maintaining financial transparency and staying organized throughout the year. Proper tax handling not only benefits your business but also helps build trust with clients.

There are several tax-related factors to keep in mind when preparing your billing documents:

Tax Element Explanation VAT (Value Added Tax) If your services are subject to VAT, include the VAT rate and the total tax amount separately. You must also indicate whether the price is inclusive or exclusive of VAT. Tax Identification Number (TIN) Ensure your tax identification number is visible on the document if required by local tax authorities. This helps verify your business status and tax compliance. Taxable Amount Clearly separate the taxable services from non-taxable items if applicable, so clients understand what they are paying for. Payment Terms and Deadlines Clearly state the date by which payments should be made. Late payments may be subject to additional taxes or penalties under certain tax laws. Record Keeping Ensure you keep accurate records of all transactions and taxes collected, as this is necessary for tax reporting and future audits. Accurate tax information in your billing documents ensures that you remain compliant with legal requirements and helps you manage your financial obligations efficiently. Failing to account for tax properly can lead to penalties, missed deductions, and a loss of credibility with clients and tax authorities.

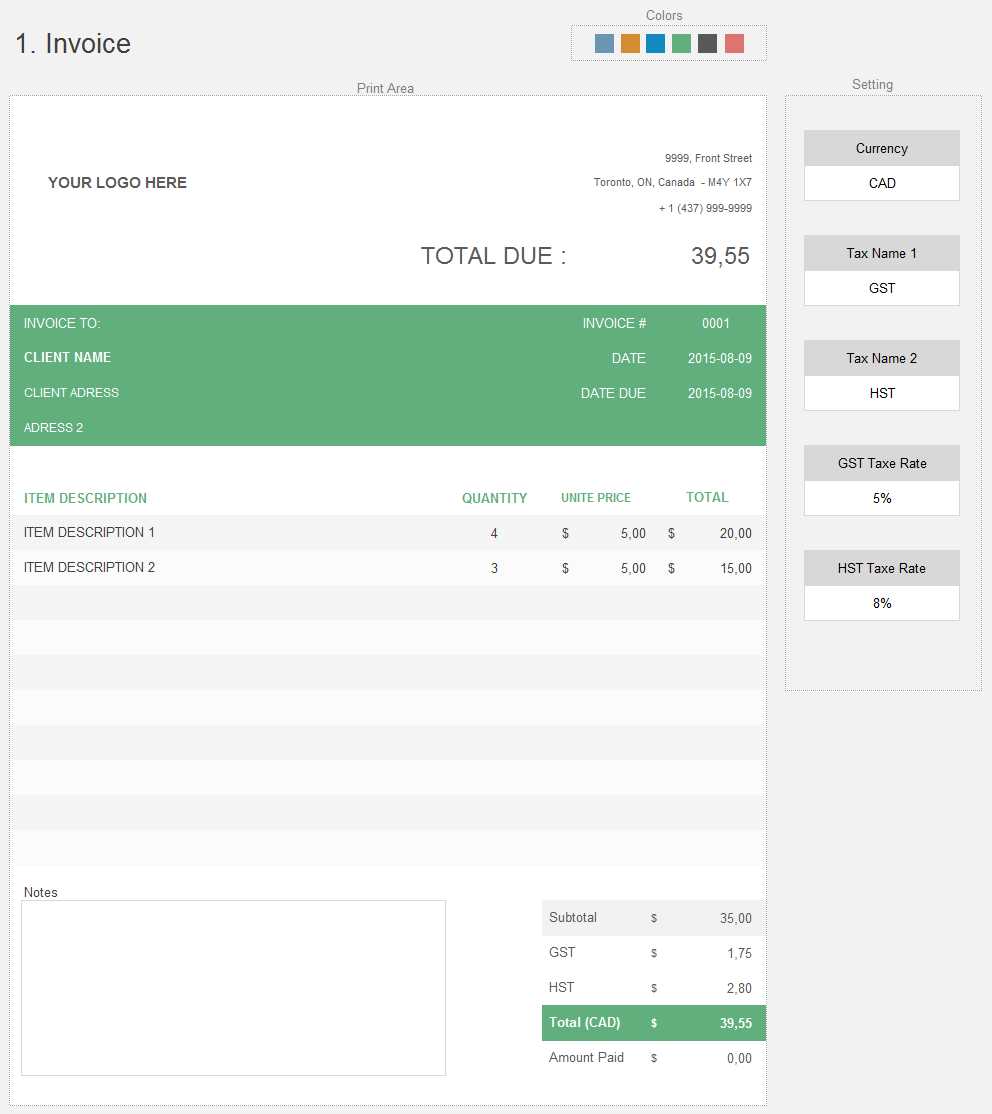

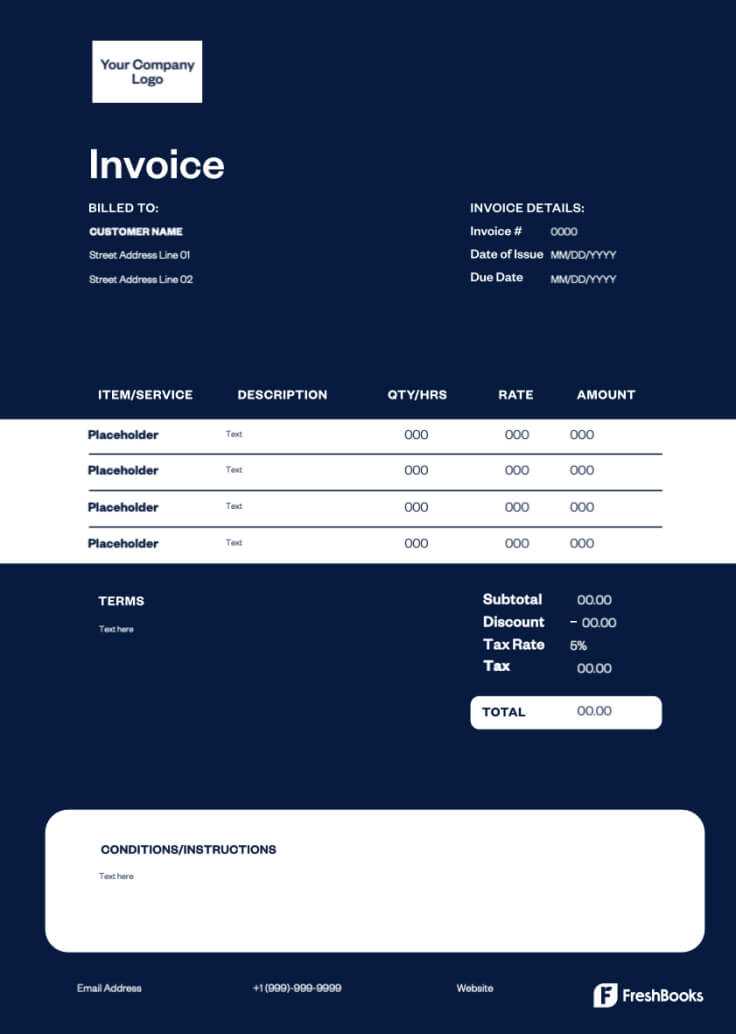

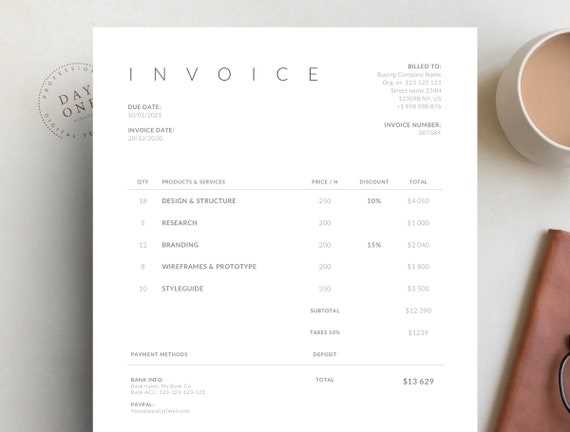

Choosing the Right Invoice Template for Ireland

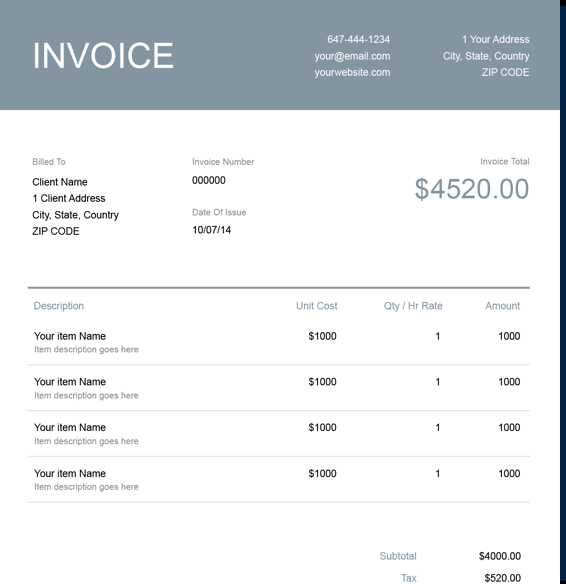

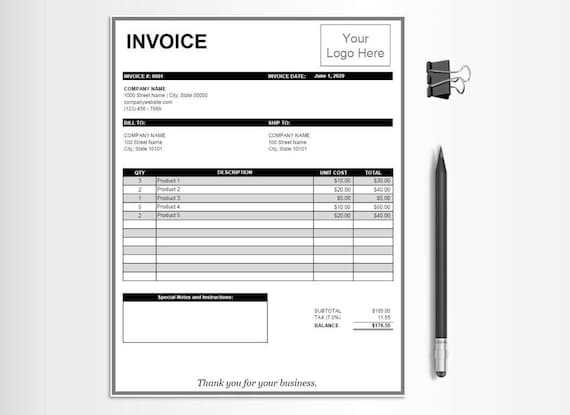

Selecting the appropriate format for your billing documents is an important step in ensuring smooth financial transactions. The right design can help communicate professionalism, improve payment clarity, and ensure you remain compliant with local regulations. For independent workers in any field, choosing the correct layout that suits the type of service provided and meets legal requirements is essential for maintaining effective business operations.

When choosing a suitable format for your billing documents, consider the following factors:

- Compliance with Local Regulations: Ensure that your format aligns with the tax laws and business practices in your region. This includes VAT information, tax identification numbers, and correct breakdowns of charges.

- Clear Structure: A well-organized document is crucial. The template should allow for easy identification of the client, service details, and payment terms. Clients should be able to quickly see the amount owed and how it was calculated.

- Customization Options: Choose a format that can be tailored to fit your specific needs. For example, it should allow you to add different types of services or adjust pricing structures easily.

- Professional Design: The appearance of your document matters. A clean, polished design gives the impression of reliability and attention to detail, which can have a positive impact on client relationships.

- Digital Accessibility: In today’s digital world, opting for an electronic version that can be easily edited and shared is important. This makes invoicing faster and more efficient.

By focusing on these aspects, you can select the best format that ensures both clarity and professionalism. A well-chosen layout not only streamlines the billing process but also supports better financial management, helping you stay organized and focused on growing your business.

Common Mistakes to Avoid in Invoices

Creating accurate and professional billing documents is essential for maintaining smooth business operations. However, even small errors can lead to confusion, delays in payment, and issues with tax reporting. Understanding and avoiding common mistakes when preparing these documents can save time, protect your reputation, and ensure timely compensation for your work. Below are some of the most frequent pitfalls to watch out for.

Some common mistakes to avoid include:

- Incorrect Client Details: Always double-check the recipient’s information, including the name, address, and contact details. Mistakes here can delay payment and cause confusion for both parties.

- Missing or Incorrect Dates: Ensure that both the issue date and the due date are clearly stated. Failure to include these dates can lead to misunderstandings about payment timelines.

- Unclear Service Descriptions: Be specific about the work done or products delivered. Vague or incomplete descriptions can create confusion and lead to disputes over the charges.

- Not Including Payment Terms: Always state the payment due date and any penalties for late payments. This ensures that both you and your client understand when and how payment should be made.

- Incorrect Calculation of Charges: Double-check all numbers, including hourly rates, quantities, taxes, and discounts. Simple errors in calculations can lead to serious issues with clients and impact your cash flow.

- Not Including a Unique Reference Number: Each billing document should have a unique number for easy tracking and to avoid confusion between different transactions.

- Failing to Include Tax Information: If applicable, make sure to add the correct tax rate, whether it’s VAT or another type of tax. Not including this can cause tax-related issues for both you and your clients.

By avoiding these common mistakes, you can ensure that your financial records remain accurate and that your clients have a clear understanding of their obligations. This can significantly reduce the chance of payment delays and help foster a professional, transparent relationship with those you work with.

How to Customize Your Invoice Template

Adapting your billing document to suit your unique business needs is an essential part of streamlining your financial process. Customization allows you to create a document that reflects your brand, provides clarity for clients, and includes all necessary details to avoid misunderstandings. Whether you need to add your company logo, adjust the layout, or include specific terms, personalizing your billing record is a simple yet effective way to maintain professionalism and ensure accuracy.

Here are several ways you can tailor your billing documents to meet your needs:

- Add Your Brand Identity: Incorporating your company logo, color scheme, and contact details at the top of the document can make it look more professional and reinforce your brand identity.

- Adjust Layout and Design: Customize the layout to ensure that the document is clear and easy to follow. You can organize the sections in a way that suits your workflow, such as grouping the service description, charges, and payment details in distinct areas.

- Include Additional Information: Depending on your industry, you may want to add extra fields such as purchase order numbers, project codes, or service-specific terms. These details help clarify the scope of the work and avoid disputes.

- Set Payment Terms: Personalize the payment section by specifying the due date, acceptable payment methods, and any late fees or discounts for early payment. This ensures that both you and your client are clear on the payment expectations.

- Provide Clear Itemization: Customize the service description section to include any specific notes related to the work or products provided. This can include hourly rates, quantities, or even a brief summary of the work done, ensuring there is no confusion about what the charges are for.

Customizing your billing document not only helps improve clarity and communication with clients but also reflects your attention to detail and professionalism. By tailoring your document to your needs, you ensure that each transaction is recorded accurately and in a way that suits your business style.

Best Practices for Invoice Submission in Ireland

Submitting your financial documents in a timely and organized manner is essential to maintaining smooth business relationships and ensuring timely payments. Following the right procedures not only helps you stay compliant with local regulations but also shows your professionalism. A well-structured approach to submitting your records can minimize confusion, reduce delays, and foster trust with your clients. Whether you’re submitting documents electronically or in person, there are key practices to follow that can streamline the process.

Timely Submission and Delivery

Sending your billing document promptly is crucial to maintaining cash flow and avoiding unnecessary delays. Make sure you adhere to agreed-upon timelines and avoid waiting until the last minute. Providing the document early can give your client enough time to process it, especially in larger organizations with multiple approval steps. It’s also a good practice to follow up after submission to confirm receipt and clarify any outstanding details.

- Send Soon After Completion: Ideally, submit your financial document shortly after completing the work or delivering the service. This keeps your record-keeping accurate and improves the chances of receiving payment on time.

- Use Reliable Channels: Whether you’re sending via email, a professional portal, or postal mail, ensure you use a method that guarantees delivery and can be tracked. Digital submission via email or secure platforms is often faster and more reliable.

- Confirm Receipt: Always confirm that the client has received your document, especially if you’re submitting through email or online platforms. A quick follow-up ensures there are no misunderstandings.

Clarity and Organization

Ensure your document is clear and well-organized to avoid confusion on both sides. Double-check that all sections are filled out correctly, including the service description, amounts, payment terms, and due dates. A neat, professional layout will help your clients quickly understand the charges and make payment processing easier for them.

- Check for Accuracy: Always verify the amounts, calculations, and client information before submission. Accuracy prevents delays and disputes over payment.

- Clear Communication: Include any necessary instructions, payment methods, and references to ensure your client knows exactly how to proceed with payment.

By following these best practices, you

How to Track Your Payments Effectively

Tracking payments accurately is essential for managing your cash flow and maintaining financial clarity. Proper tracking allows you to monitor what has been paid, what is still due, and identify any discrepancies quickly. Whether you are running a small business or working as an independent professional, having an effective system in place ensures that you stay on top of your financial records and can follow up with clients when necessary.

Key Strategies for Tracking Payments

There are several approaches you can take to track payments efficiently, depending on your preferences and the tools available to you:

- Use a Spreadsheet: A simple yet effective method is creating a dedicated spreadsheet where you can record each payment, including the date received, amount, and method of payment. You can also track overdue payments in the same sheet to follow up on them.

- Accounting Software: Consider using accounting software or apps specifically designed to track financial transactions. These tools can automate much of the process, helping you stay organized and save time.

- Manual Ledger: For those who prefer traditional methods, maintaining a manual ledger to track incoming payments is still a viable option. Keep a written record of each transaction, noting key details such as client name, payment amount, and payment method.

Creating a Payment Tracking System

Regardless of the tool you choose, a clear system will help you monitor incoming payments and follow up on overdue balances. Below is an example of how to organize a payment tracking table:

Payment Date Client Name Amount Due Amount Paid Payment Method Balance Due Status 2024-10-01 John Doe $500 $500 Bank Transfer $0 Paid 2024-10-10 ABC Corp $1,000 $500 Credit Card $500 Partial Payment 2024-10-15 Jane Smith $200 $0 Cash $200 Unpaid By setting up a table like this, you can easily track payments, follow up on overdue balances, and quickly identify discrepancies. A well-organized tracking system helps you stay on top of your finances and ensures that payments are processed smoothly.

Ensuring Compliance with Irish Tax Laws

Understanding and adhering to tax regulations is critical for any business or individual involved in providing services or selling goods. Compliance with local tax laws not only helps you avoid penalties but also ensures that you are correctly accounting for taxes and contributing to the proper authorities. In Ireland, businesses are required to follow specific guidelines when it comes to taxation, whether you’re collecting VAT, keeping records for income tax purposes, or fulfilling other obligations.

Key Tax Considerations for Businesses

There are several important aspects of Irish tax law that need to be addressed when preparing and managing your business finances:

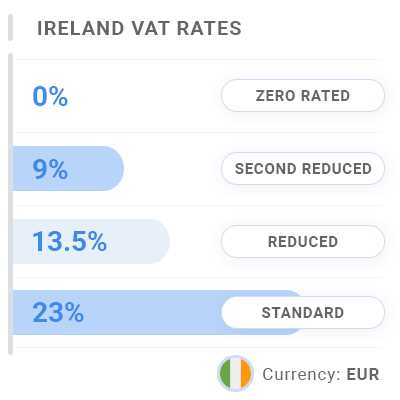

- VAT Registration: If your turnover exceeds the VAT registration threshold, you must register for VAT and charge VAT on taxable goods and services. Ensure that VAT is properly indicated on your financial documents and that you keep accurate records of all VAT transactions.

- Income Tax and PAYE: All income generated from services or sales must be declared to the Irish Revenue Commissioners. You may also need to register for PAYE if you have employees or contractors working for you.

- Tax Deductions: There are various tax deductions available, such as those for business expenses or capital allowances. Familiarize yourself with these deductions to ensure you are minimizing your taxable income and reducing your tax liability.

- Record Keeping: Maintaining accurate records of your financial transactions is essential for tax compliance. Ensure you keep receipts, bank statements, and financial documents for the appropriate length of time, as required by Irish tax law.

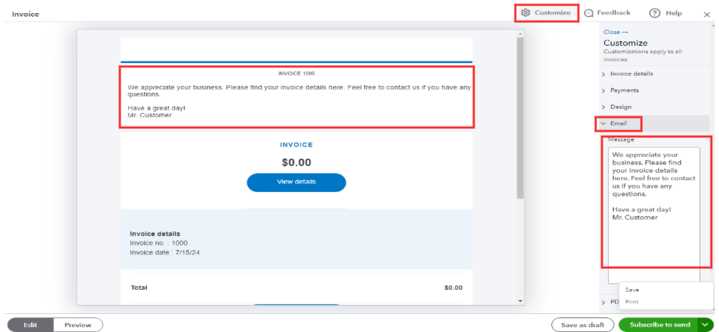

- Using Accounting Software for Invoicing

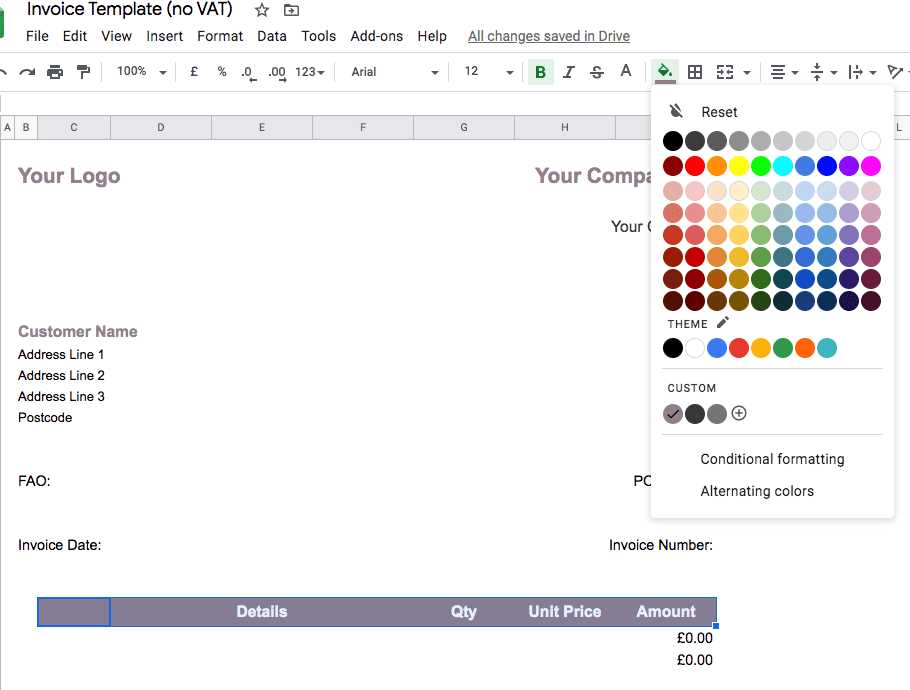

Leveraging accounting software can significantly simplify the process of creating and managing your financial records. With automated tools at your disposal, you can quickly generate professional billing documents, track payments, and maintain accurate financial records without the risk of manual errors. These platforms are designed to save you time, improve accuracy, and ensure that you stay organized throughout the billing process. Whether you’re working with a small business or managing personal projects, using the right software can streamline your entire workflow.

Benefits of Accounting Software for Billing

Accounting tools offer numerous advantages when it comes to generating and tracking financial documents. Below are some key benefits of incorporating accounting software into your business practices:

- Automation of Routine Tasks: Accounting software can automate many aspects of the financial record-keeping process, including the generation of billing statements, calculations, and reminders for overdue payments. This reduces the need for manual input and minimizes the risk of human error.

- Professional Document Generation: The software allows you to create professional-looking billing statements with customizable layouts, helping you present a polished image to clients while keeping all the necessary details intact.

- Real-Time Tracking: With accounting software, you can track payments and outstanding balances in real-time. This provides you with an up-to-date overview of your financial situation, enabling you to act quickly on overdue payments and manage your cash flow effectively.

- Easy Access and Security: Many modern accounting tools store your data securely in the cloud, providing easy access from anywhere. Cloud-based systems also offer data backup options, reducing the risk of losing critical financial records.

Choosing the Right Accounting Software

When selecting accounting software for managing your billing and financial records, it’s important to consider your specific needs and business requirements. Some factors to consider include:

- User-Friendly Interface: Choose a platform that is easy to navigate, with intuitive features that allow you to manage your finances with minimal effort.

- Customization Options: Look for software that offers flexibility in customizing billing documents, allowing you to include your company logo, adjust the layout, and tailor the content to your preferences.

- Integration with Other Tools: Many accounting platforms can integrat

How to Handle Late Payments on Invoices

Late payments are a common issue faced by many businesses and independent professionals, and they can have a significant impact on cash flow. Delayed payments can disrupt your financial planning, create stress, and affect your ability to meet obligations. It’s important to have a clear strategy in place for addressing overdue payments, both to protect your business interests and to maintain healthy client relationships. A well-thought-out approach can encourage timely payments while allowing you to take necessary steps when things go off track.

Steps to Take When Payments Are Late

When payments are delayed, it’s crucial to remain professional and handle the situation calmly. Here are some steps to follow:

- Send a Reminder: The first step is often sending a polite reminder to your client. Mistakes or oversights happen, so providing a gentle nudge can prompt the client to pay without feeling pressured. Include the due date, amount owed, and payment details in your reminder.

- Follow Up with a Formal Request: If there is still no response, follow up with a more formal communication. This should reiterate the details of the outstanding payment, including any previous reminders you’ve sent, and request immediate payment or explain the consequences of further delay.

- Offer Payment Options: In some cases, clients may have cash flow problems or difficulties with the payment method. Offering flexible payment options, such as installment plans, can help resolve the issue without losing the client.

- Charge Late Fees: To incentivize timely payments, it may be necessary to include late fees as part of your payment terms. If the situation calls for it, applying these fees will show your clients that you are serious about getting paid on time and may encourage them to settle their accounts sooner.

- Legal Action: As a last resort, if payment remains unresolved after multiple attempts, you may need to consider legal action or involving a collections agency. Before taking this step, ensure that your terms and conditions are clear about late payments and potential legal consequences.

Preventing Future Late Payments

While handling late payments is essential, preventing them from occurring in the first place can save you time and hassle. Here are some proactive strategies to help avoid overdue balances:

- Set Clear Payment Terms: From the outset, make sure your payment terms are clearly defined. Specify the due date, the accepted methods of payment, and any penalties for late payments in your agreements.

- Send Documents Promptly: Ensure that all billing documents are sent as soon as the work or service is completed. The sooner you send the documentation, the sooner the client can process it and make payment.

- Establish an Early Payment Discount: Offer incentives for clients to pay early, such as a small discount on the total amount due. This can encourage prompt payment and reduce the risk of late fees.

Effectively managing late payments is crucial for maintaining healthy cash flow and protecting your financial stability. By following a clear, professional process and taking proactive steps to pr

Why Digital Invoices Are Beneficial for Self-Employed

In today’s digital age, shifting from traditional paper-based billing to electronic documents offers a wide range of advantages. Digital documents streamline the entire process, making it more efficient, secure, and environmentally friendly. For individuals running their own business or working independently, embracing this method can significantly improve workflow, reduce administrative overhead, and enhance professionalism in client interactions.

Key Advantages of Digital Billing

Switching to digital formats for your billing system brings several benefits that can positively impact your business operations:

- Efficiency and Time-Saving: Creating, sending, and tracking electronic documents is much faster compared to paper-based methods. This allows you to focus on your work rather than spending time on administrative tasks, speeding up the entire billing cycle.

- Reduced Risk of Errors: With automated systems, there is less risk of making mistakes in calculations or missing essential information. This reduces the likelihood of disputes with clients over inaccuracies and helps maintain smooth financial transactions.

- Easy Record-Keeping: Storing digital files is far more organized and space-efficient than keeping physical copies. You can easily search, retrieve, and back up your documents to ensure that you have quick access to your financial records at any time.

- Faster Payments: Digital documents are often linked to online payment gateways, allowing clients to make payments directly through the document itself. This simplifies the payment process and speeds up transactions, helping to improve your cash flow.

- Professional Appearance: Digital documents can be customized to reflect your brand, including your logo and contact information. This enhances the professionalism of your business and leaves a lasting impression on clients.

Environmental Impact and Cost Savings

Using electronic billing also has a positive impact on the environment. By reducing the need for paper, ink, and postage, you contribute to sustainability efforts while lowering operational costs.

- Lower Costs: By eliminating the need for physical materials and postage, digital documentation can help reduce the overhead costs associated with traditional billing.

- Environm

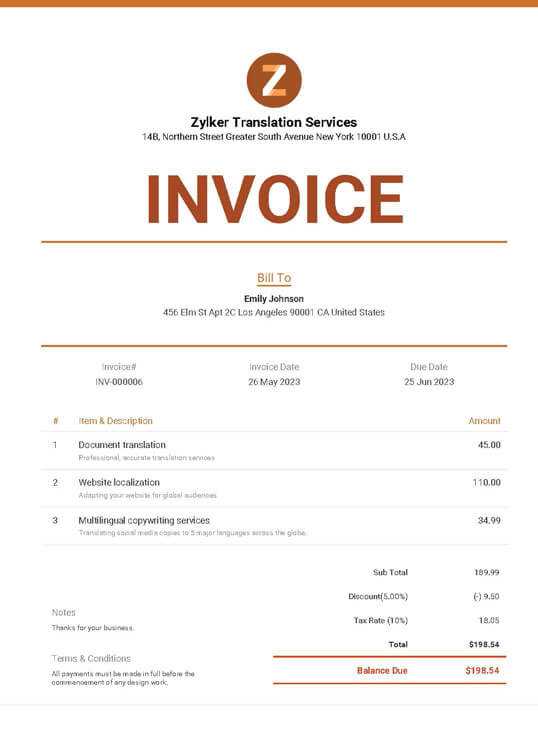

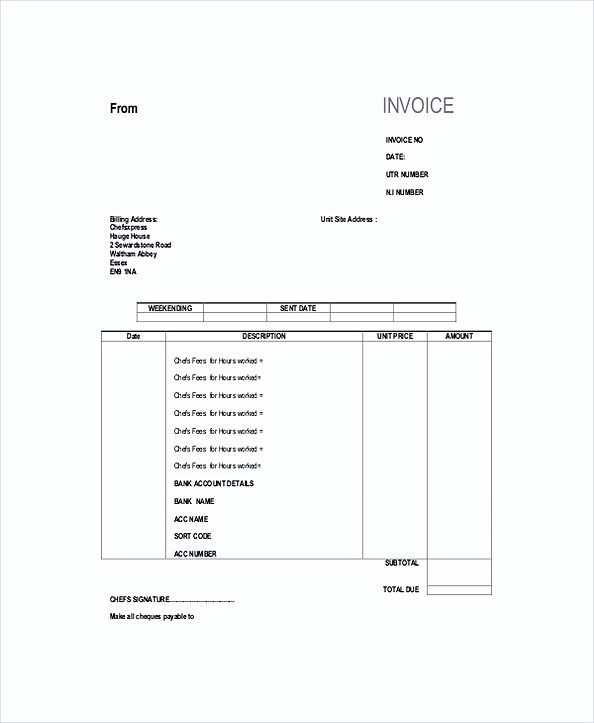

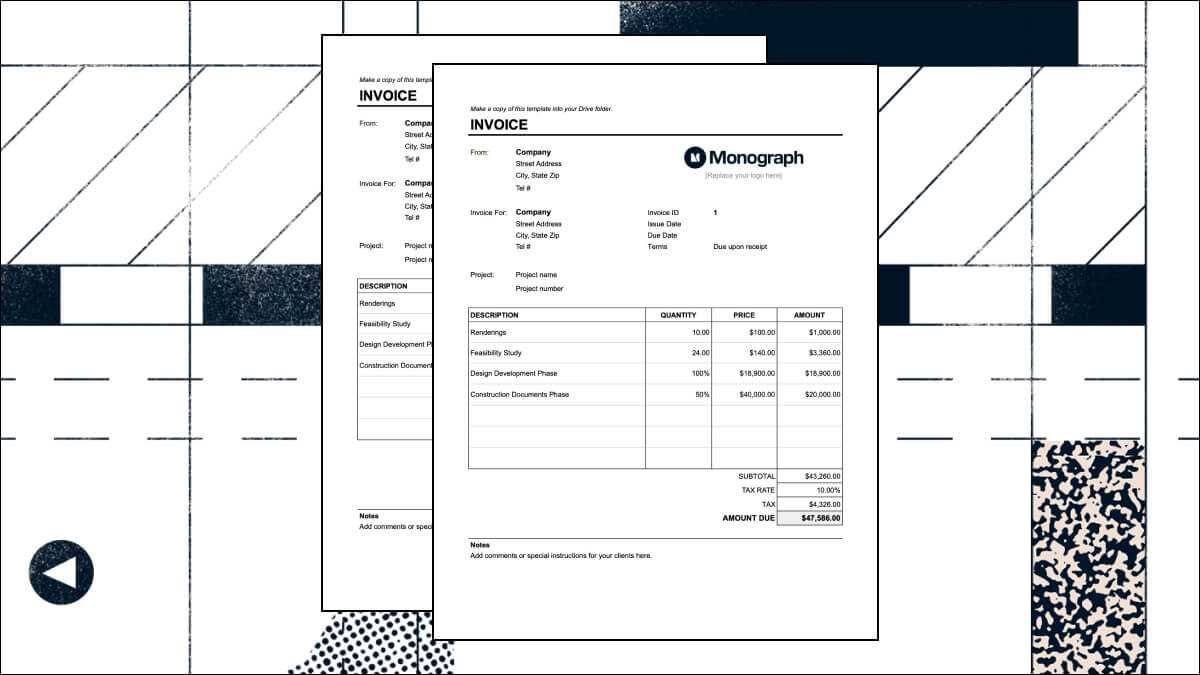

Free Invoice Templates for Irish Freelancers

Freelancers in Ireland, like those in many other countries, need simple yet professional tools to manage payments and maintain financial organization. One of the most effective ways to do this is by using ready-made billing documents that can be customized to fit your specific needs. Free document templates can save time, eliminate the need for design or formatting work, and ensure that all necessary information is included in every transaction.

Using free billing templates offers an affordable and efficient solution for freelancers. These documents are often designed with clear sections for essential information such as payment terms, contact details, itemized services, and amounts due. Many of these resources are available online and can be easily downloaded, allowing freelancers to start managing their finances right away without additional costs.

Moreover, using professionally designed templates ensures that your documents are not only clear and concise but also reflect your business in a polished, trustworthy manner. This can help strengthen client relationships and provide a sense of professionalism. Whether you’re a writer, designer, developer, or consultant, these free tools can make invoicing simpler and more effective.