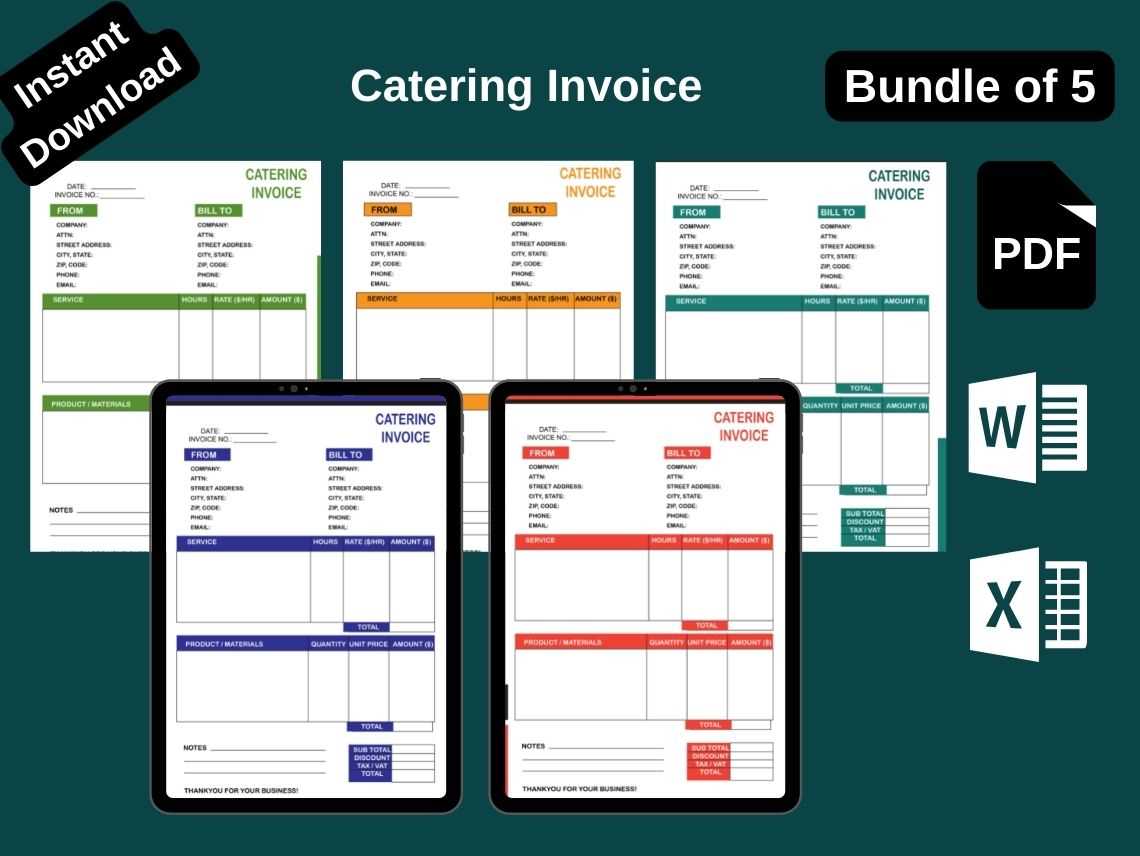

Free Artist Invoice Template for Word Download and Customization

In any creative field, having a clear and professional way to bill clients is essential for managing payments and maintaining trust. The process of issuing payment requests should be simple, efficient, and ensure that all necessary details are included. Whether you’re a freelancer or working with a steady client base, it’s important to have a reliable method for documenting your transactions.

Customizable billing formats are a great tool for achieving this goal. They allow you to quickly generate clear, professional records that are easy to modify for each project. This makes it easier to stay organized and on top of your finances, without the hassle of creating documents from scratch every time.

In this article, we will explore how to make the most of digital billing formats that can be tailored to suit your needs, making your payment requests seamless and helping you maintain professionalism in every transaction.

Why You Need a Billing Document Format

For any creative professional, managing financial transactions smoothly and professionally is crucial. A well-structured document not only ensures clarity but also helps avoid misunderstandings with clients. Having a pre-designed, customizable format for generating payment requests can save time and improve the overall experience for both parties involved.

Using a consistent and clear structure for documenting your services is vital for establishing credibility. It shows that you take your work seriously and are committed to transparent business practices. With a reliable document design, you can ensure that all necessary details are included every time, avoiding any confusion or delays in the payment process.

The following table outlines some of the key advantages of using a professional billing format:

| Benefit | Description |

|---|---|

| Time Efficiency | Generate documents quickly without needing to create new ones from scratch for each project. |

| Clarity | Ensure all essential details, like services provided, payment terms, and contact information, are clearly presented. |

| Professionalism | Present a polished and organized image to clients, helping you stand out in the marketplace. |

| Consistency | Maintain a uniform structure for all financial documentation, which fosters trust and reliability. |

| Customization | Easily adjust the format to fit specific needs for different projects or clients. |

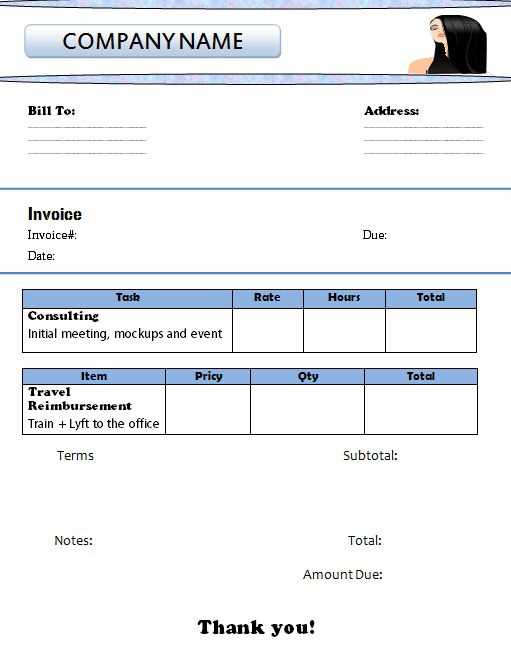

How to Customize Billing Documents in Word

Personalizing your financial documents allows you to maintain a professional appearance while tailoring each record to specific project details. By customizing your format, you can adjust the layout, add unique elements, and ensure that all required information is present. This level of flexibility makes it easier to adapt documents for different clients and projects without reinventing the wheel each time.

To get started with customizing your payment records in a word processor, follow these essential steps:

- Choose a Layout – Begin by selecting a basic layout that suits your needs. You can opt for a clean, minimal design or something more detailed with logos and color accents.

- Add Personal Information – Make sure to include your name, business details, and contact information in the header or footer, ensuring clients can easily reach you.

- Include Service Details – List the services or items provided in a clear, organized manner. This section should include descriptions, quantities, and rates to avoid confusion.

- Set Payment Terms – Clearly state payment expectations, including due dates, late fees, and accepted payment methods.

- Insert Unique Client Information – Customize the document for each client by including their name, address, and any specific instructions or requirements they have provided.

- Adjust the Design – You can modify fonts, colors, and even add your business logo to make the document more personalized and branded.

After making these adjustments, save the file and ensure it’s easy to modify for future use. This way, you’ll be able to quickly generate accurate and personalized records for all your transactions.

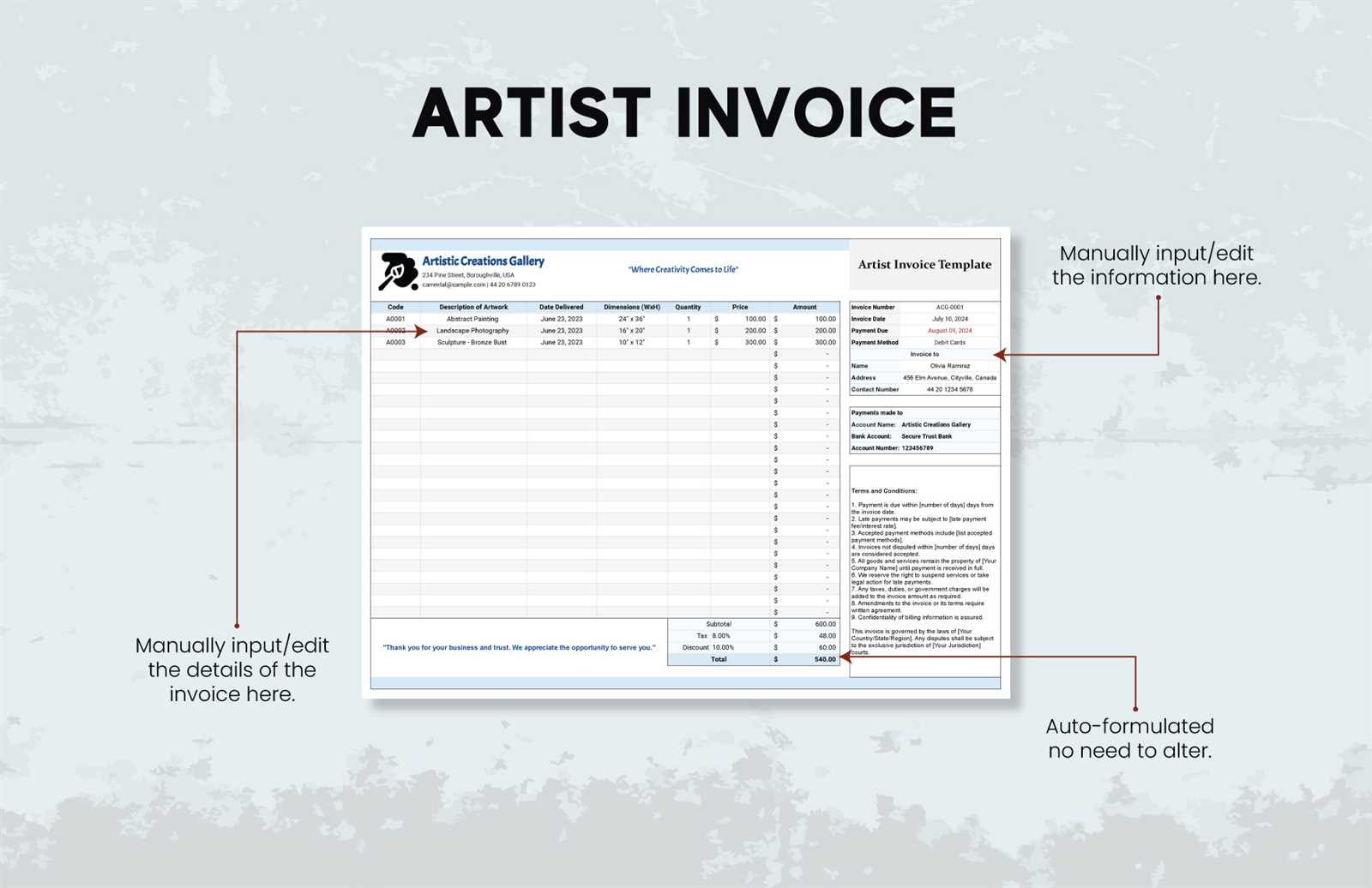

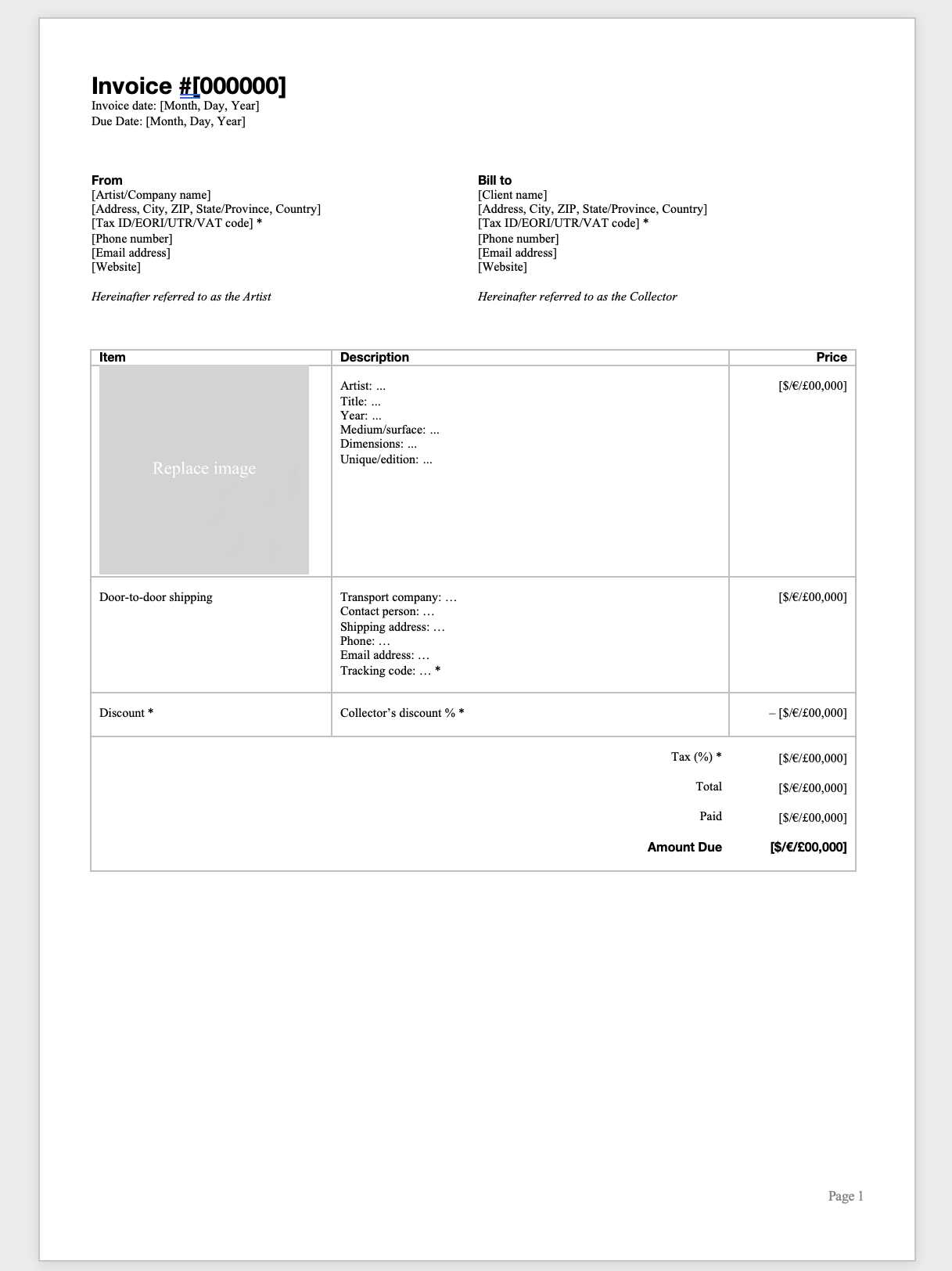

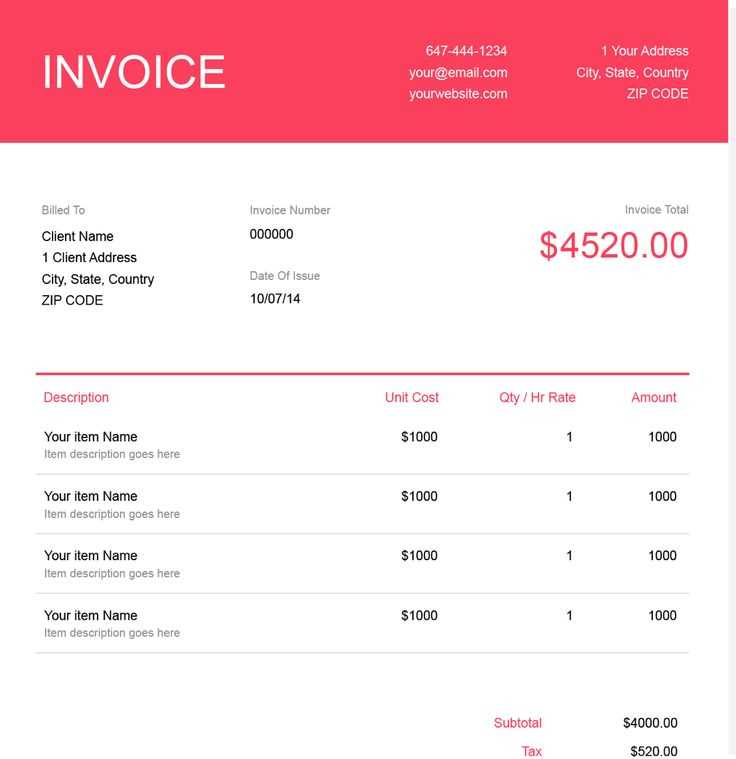

Key Elements of a Billing Document

When creating a payment request, it’s essential to include all the necessary components to ensure clarity and professionalism. Each section should be designed to provide both you and your client with a clear understanding of the work completed, the amount due, and the terms of payment. The following are some key elements to include when preparing your financial record:

Contact Information and Header

The first section of your document should include both your details and the client’s. This includes full names, business names (if applicable), addresses, phone numbers, and email addresses. It’s essential to provide clear contact details in case any follow-up is necessary.

Service Description and Charges

One of the most critical sections is the list of services or products provided. This should be detailed enough to avoid confusion. For each item or service, include:

- Item/Service Name – A clear description of the service or product provided.

- Quantity – If applicable, specify the quantity or hours worked.

- Rate – The cost per unit, hour, or item.

- Total – The total cost for each service or item.

Additionally, it’s important to include any taxes or discounts applied to the total amount, ensuring complete transparency regarding the final amount due.

Payment Terms and Due Date

Clearly define the payment terms, including the due date and any penalties for late payments. This section sets expectations for both parties and helps to prevent misunderstandings later. Make sure to specify the following:

- Payment Method – Indicate the preferred method of payment, such as bank transfer, PayPal, or check.

- Late Fees – Outline any late fees that will apply if payment is not received by the due date.

- Discounts – If applicable, note any discounts given for early payment or other conditions.

By ensuring these elements are clearly outlined, you cre

Benefits of Using a Digital Billing Document

Adopting digital formats for managing financial records offers several advantages over traditional paper-based methods. Digital documents not only streamline the process but also help save time, reduce errors, and provide enhanced flexibility. By leveraging digital tools, you can improve the efficiency and professionalism of your financial transactions.

Time and Cost Efficiency

One of the most significant benefits of using digital records is the time saved compared to manual entry and printing. With a digital document, you can create, modify, and send your financial records instantly. Additionally, there are no printing costs or physical storage concerns.

- Instant Creation and Customization: Quickly generate and personalize records as needed, saving valuable time.

- Elimination of Printing Costs: Save money by reducing the need for paper, ink, and physical storage.

- Reduced Mailing Delays: Send records electronically, ensuring faster delivery without relying on postal services.

Accuracy and Error Reduction

Manual calculations or data entry are more prone to human error. With a digital format, these risks are minimized through automated calculations and easy-to-check details. You can also keep track of changes and ensure accuracy without the need for complex adjustments.

- Automated Calculations: Many digital formats automatically calculate totals, taxes, and discounts, reducing the likelihood of mistakes.

- Easy Editing: Easily correct errors or make adjustments without starting from scratch.

- Version Control: Keep track of document revisions and ensure that you always send the correct version to your clients.

Increased Organization and Accessibility

Digital records allow for easy storage, organization, and retrieval, meaning you no longer have to sift through stacks of paper. You can categorize, search, and access your records from anywhere, helping you stay on top of your finances.

- Centralized Storage: Keep all records in one secure digital folder or cloud storage service.

- Instant Access: Access your documents from multiple devices, whether at home, in the office, or on the go.

- Searchability: Quickly search through past records to find specific details or transactions without the hassle of manual filing.

By utilizing digital formats for your financial documentation, you can save time, reduce errors, and stay organized, all while enhancing the professionalism of your business operations.

How to Save Time with Billing Templates

Using pre-designed formats for generating financial records can significantly cut down on the time spent creating documents from scratch. With a consistent structure already in place, you only need to input project-specific details, saving you the effort of formatting each time you need to send a payment request. This streamlined process helps you stay organized and focused on your work, rather than getting bogged down in administrative tasks.

Here are some key ways to save time with these ready-made structures:

- Quick Customization: Instead of manually adjusting the layout or adding necessary fields, you can instantly update client information, services rendered, and amounts due with minimal effort.

- Consistent Design: With a pre-built structure, you maintain a uniform and professional look across all your financial records, eliminating the need to repeatedly adjust font sizes, margins, or headings.

- Pre-filled Fields: Many formats include fields that automatically calculate totals, taxes, and discounts, reducing manual entry and the risk of errors.

- Time-Saving Shortcuts: If you use the same payment methods or services for multiple clients, you can create a standard layout with these details already included, saving you from retyping common information.

By using a streamlined approach to creating your financial documents, you free up valuable time to focus on the work you love, while ensuring your payment requests remain clear, professional, and accurate.

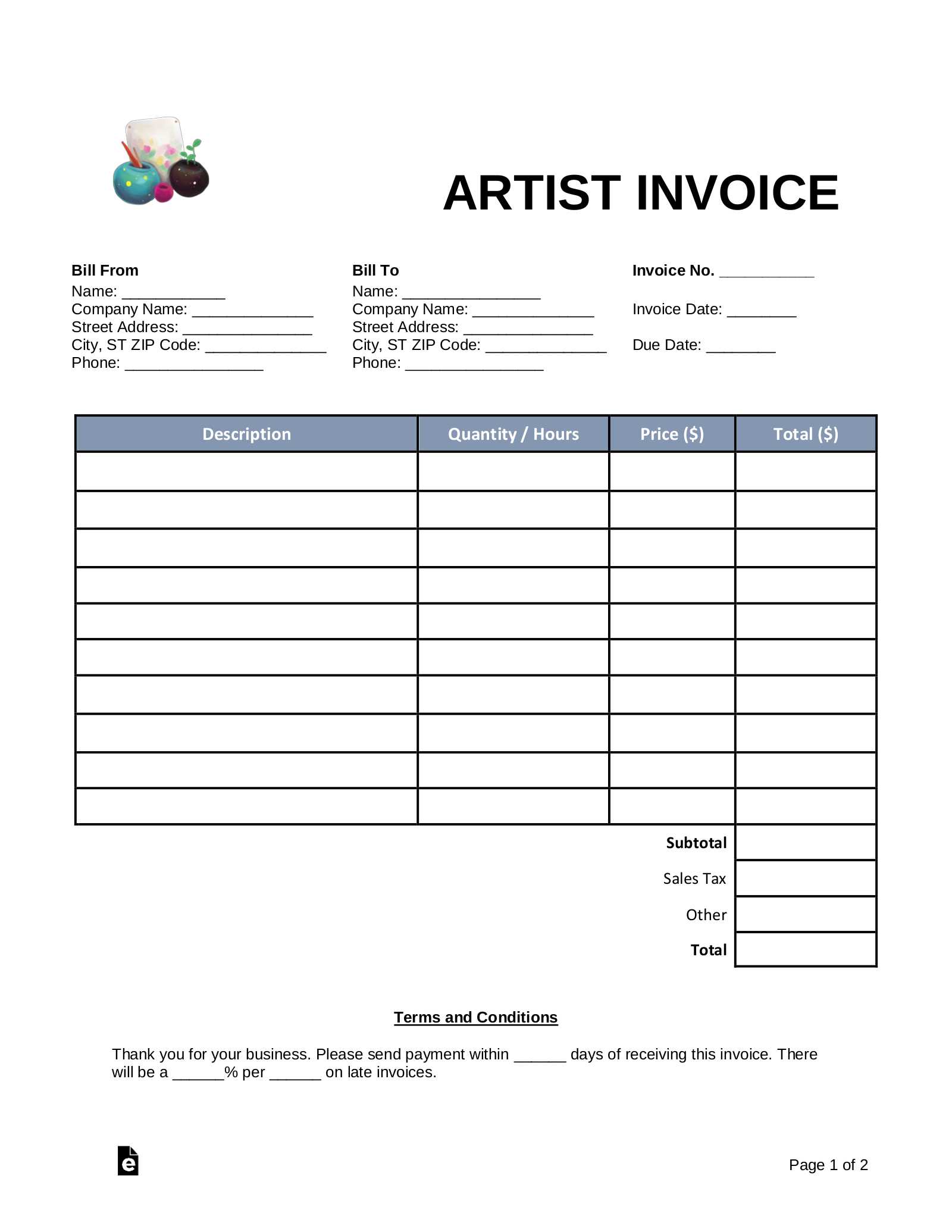

Choosing the Best Billing Document Format for Creative Professionals

Selecting the right format for your financial records is essential for maintaining a professional image and ensuring clarity in your business transactions. A well-designed layout not only saves time but also helps you present your services in a clear and organized way. When choosing a structure, it’s important to consider your specific needs, the nature of your work, and the level of customization required for each project.

Key Features to Look For

When evaluating different billing formats, certain features are critical for ensuring that your documents are both professional and easy to use. Here are some important aspects to consider:

- Clear Service Breakdown: Choose a format that allows you to list individual tasks or services with corresponding details (such as hours worked or quantities).

- Customizable Fields: Look for a format with easily adjustable fields for client names, contact info, dates, and payment terms.

- Tax and Discount Options: Ensure the structure includes sections to apply taxes, discounts, or special rates.

- Professional Aesthetic: Pick a design that aligns with your business branding, including options for logos, colors, and fonts that reflect your creative style.

Comparing Different Options

To help you make an informed decision, here’s a comparison of different format types based on their features and suitability for creative professionals:

| Format Type | Key Features | Best For |

|---|---|---|

| Minimalistic | Sleek design with clear sections and minimal distraction | Freelancers looking for a clean, straightforward layout |

| Creative/Branded | Customizable colors, fonts, and space for logos | Professionals wanting to showcase their brand alongside financial details |

| Detailed | Sections for hours worked, project phases, taxes, and discounts | Service-based businesses with long-term or ongoing projects |

| Simple and Compact | Basic layout, quick to fill out and send | One-time projects or quick billing with less detail |

By considering the nature of your work and what features are most important to you, you can choose the best format that ensures both efficiency and professionalism in your financial documentation.

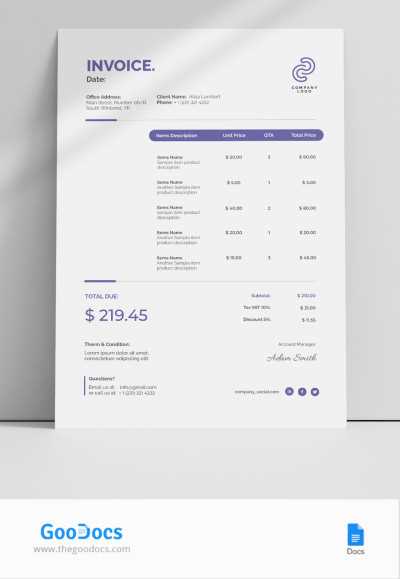

Setting Payment Terms on Your Billing Document

Clearly defined payment terms are crucial for ensuring smooth financial transactions between you and your clients. By specifying when and how payments are due, you can avoid misunderstandings and delays. Properly communicating your payment expectations helps set a professional tone and ensures that both parties are on the same page regarding deadlines, fees, and accepted payment methods.

Key Elements of Payment Terms

When outlining payment terms, it’s important to include the following elements to ensure clarity and avoid confusion:

- Due Date: Clearly state the date by which the client must make the payment. This sets expectations and helps you track when payments are overdue.

- Late Fees: Specify any penalties or interest charges that will apply if the payment is not received on time. This encourages clients to pay promptly.

- Accepted Payment Methods: Outline the methods of payment you accept, such as bank transfers, credit cards, or online payment systems.

- Discounts for Early Payment: If applicable, offer a discount for early payments to incentivize faster transactions.

Examples of Common Payment Terms

Here are some common payment term structures that you can use or modify to fit your needs:

| Term | Description | Best For | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Net 30 | Payment is due within 30 days from the issue date. | Service providers who offer ongoing work with flexible payment periods. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due on Receipt | Payment is due immediately upon receiving the document. | One-time projects or short-term services where immediate payment is expected. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 50% Upfront | Clients pay 50% of the total cost upfront, with the balance due upon completion. | Large projects or custom work where upfront investment is required. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net 15 | Payment is due within 15 days of the issue date. | Businesses t

Design Tips for Creating Professional Billing DocumentsWhen creating a payment request document, the design plays a vital role in ensuring that your records are both functional and visually appealing. A well-organized layout not only makes the document easier to read but also reinforces your professionalism. By balancing creativity with clarity, you can create a financial record that is not only informative but also reflects your unique style. Key Design ConsiderationsHere are some important design elements to consider when crafting your financial documents:

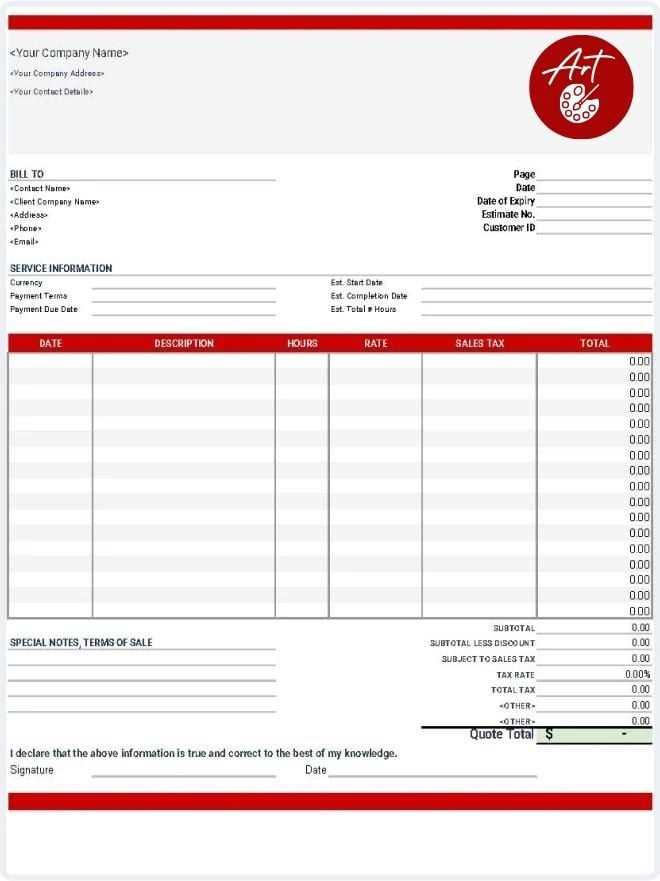

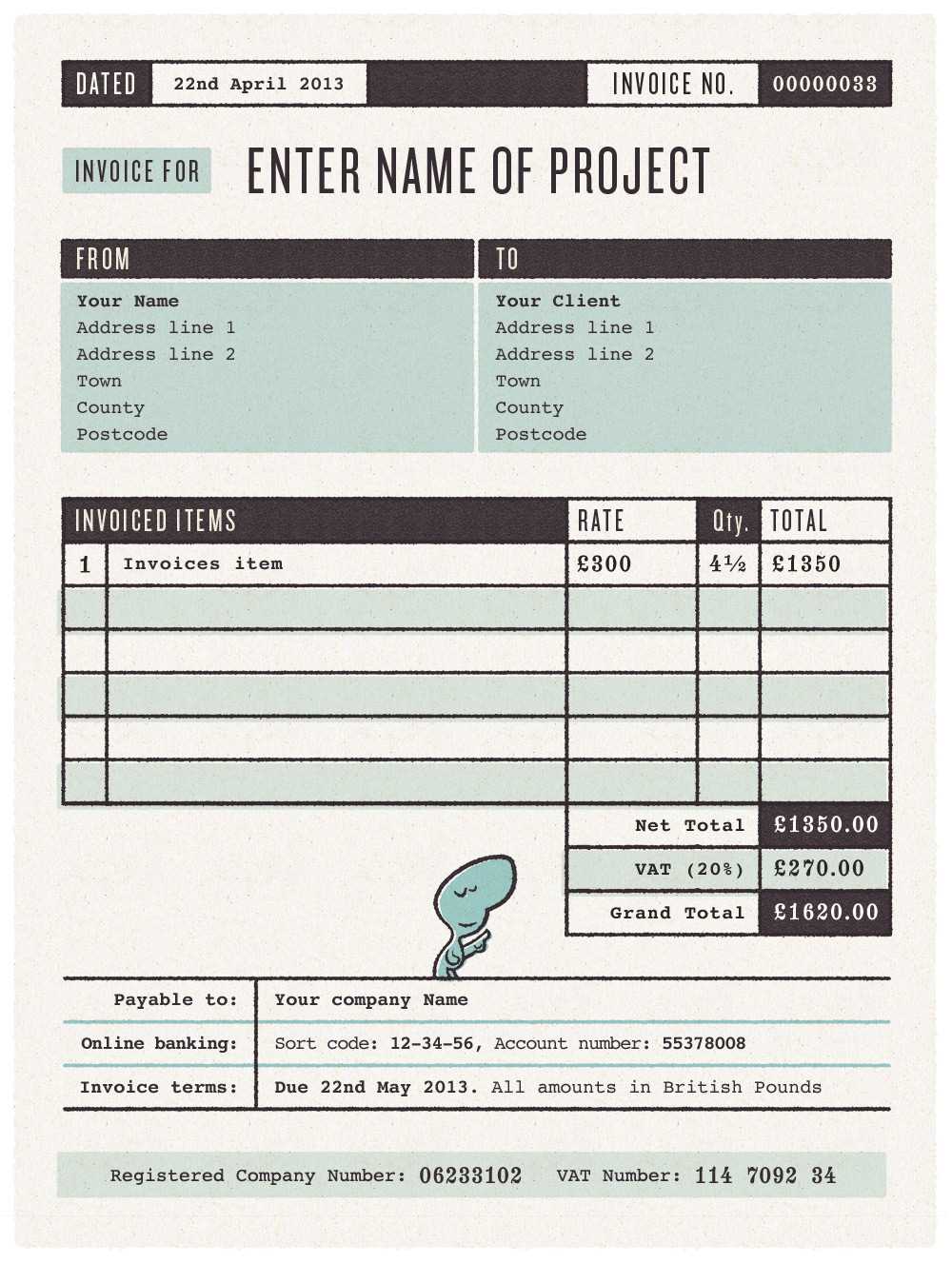

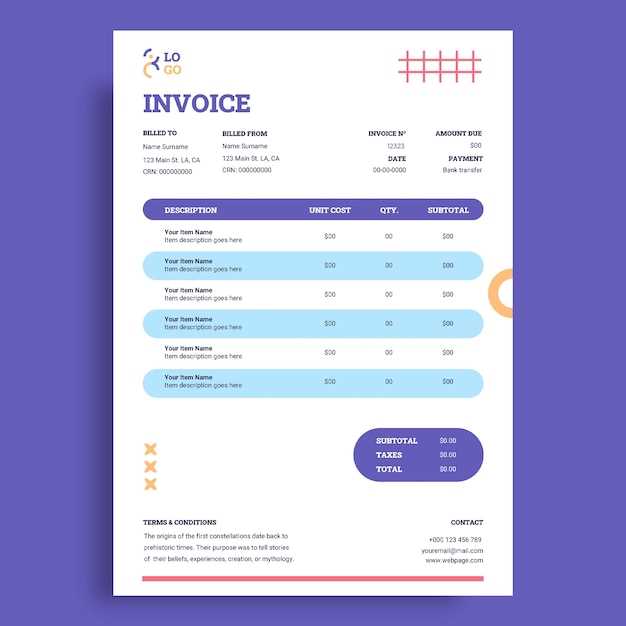

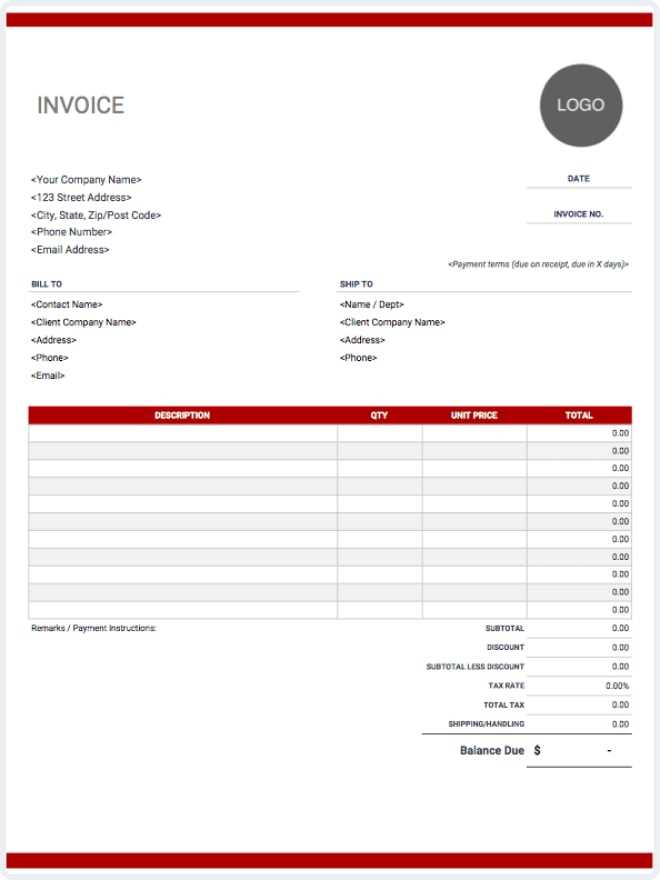

Choosing the Right FormatThe structure of your document is just as important as the design. Depending on your needs, you can choose a simple format or something more detailed. Below are examples of different design options to consider:

|