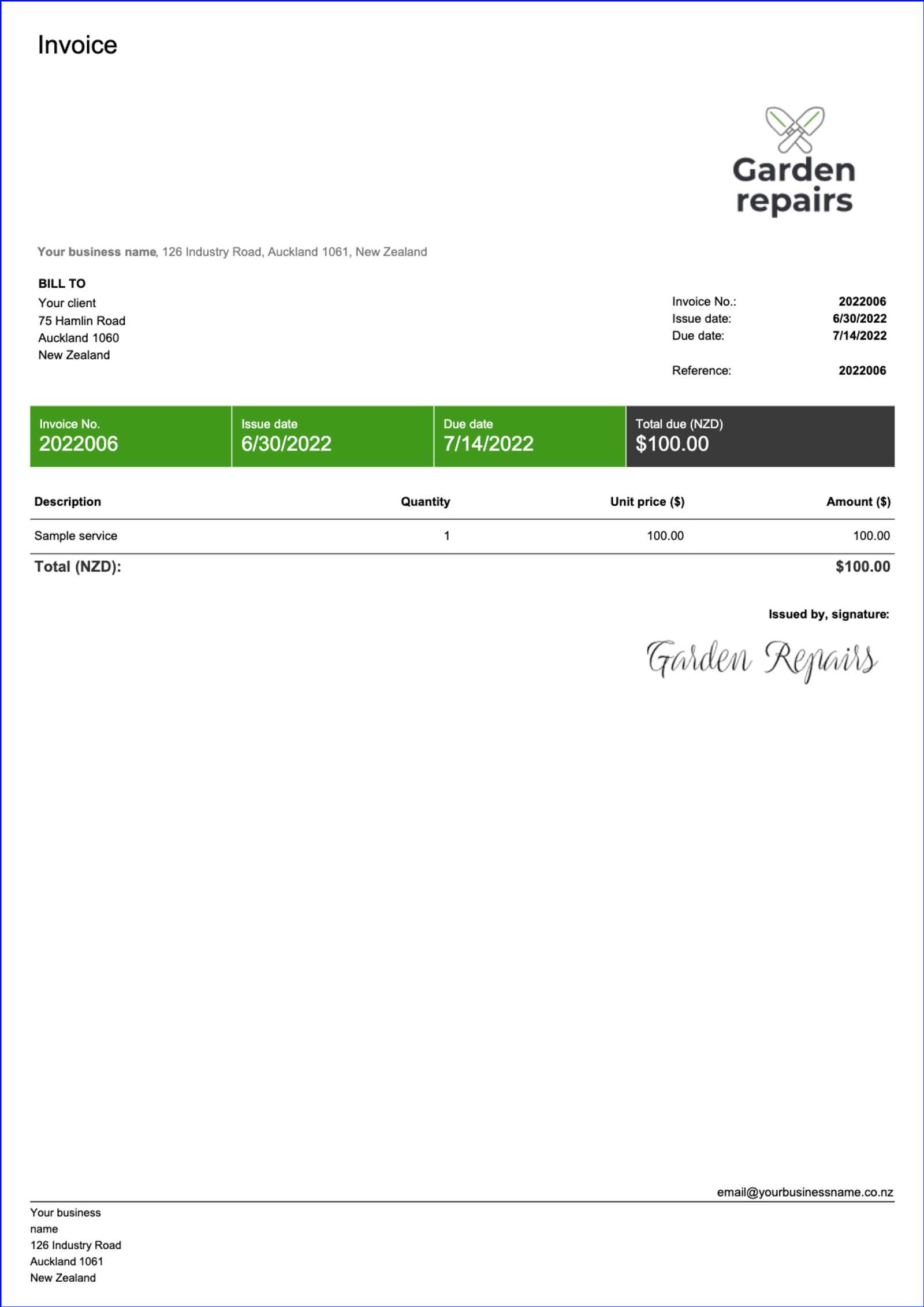

How to Use an Invoice Generator Excel Template for Effortless Billing

Efficiently managing payments and keeping track of financial transactions is a crucial part of running any business. A simple and organized approach to creating and sending invoices can save valuable time and reduce errors. With the right tools, generating professional billing documents becomes a seamless task, even for those without extensive accounting experience.

There are powerful solutions available that allow you to easily customize and automate your billing process. These tools are designed to make it simple to calculate totals, apply taxes, and ensure that each document is correctly formatted for your clients. Whether you’re a freelancer or a small business owner, having a structured system for invoicing can improve cash flow and enhance your credibility.

By using digital solutions, you can easily keep track of issued documents, manage payments, and maintain clear financial records. The flexibility of these tools means that they can be adapted to fit the unique needs of your business, while helping to maintain a professional image with every transaction. The following guide will walk you through the process of using a versatile billing solution to simplify your financial workflow.

What is an Invoice Generator Excel Template

Managing financial documentation can often be time-consuming, especially when it comes to preparing statements for clients. An efficient solution for automating the creation of these documents can significantly streamline the process. A tool designed for building and customizing billing forms allows users to quickly generate professional documents, ensuring accuracy and consistency every time. These solutions are often integrated with built-in formulas, making it easier to calculate totals, taxes, and discounts without manual effort.

Key Features of Such Tools

Such tools are typically designed with flexibility in mind, offering a variety of customizable fields. Users can easily adjust them according to the specific needs of their business. Whether it’s adjusting currency, adding payment terms, or listing items, these platforms allow for a high level of personalization.

| Feature | Benefit |

|---|---|

| Customizable Fields | Allows businesses to adjust the format and content to fit their needs |

| Automated Calculations | Reduces errors by automatically calculating totals, taxes, and discounts |

| Professional Design | Ensures a polished, business-ready appearance |

| Reusable Format | Offers the ability to reuse and modify the document for multiple transactions |

How This Tool Can Save Time

Rather than manually entering information each time a document is needed, users can input details into a pre-built structure, instantly creating a professional-looking document with minimal effort. This approach saves significant time and reduces the chances of errors that could arise from creating such documents from scratch. It also makes it easier to track and store your records, ensuring a smooth workflow and effective management of fin

Benefits of Using Excel for Invoicing

Using a spreadsheet application to manage billing processes offers numerous advantages for businesses of all sizes. These solutions provide an easy and efficient way to track transactions, calculate totals, and create professional documents quickly. With a variety of built-in features, users can automate many aspects of their financial workflow, reducing the time spent on manual tasks and minimizing errors. The flexibility of such tools allows for custom configurations to match individual business needs, making them an ideal choice for invoicing tasks.

Cost-Effectiveness and Accessibility

One of the main reasons businesses turn to spreadsheet software is its cost-effectiveness. Most users already have access to spreadsheet applications, meaning there is no additional investment required for invoicing tools. Additionally, these programs are user-friendly, even for those with limited experience in accounting or finance. This accessibility allows business owners to manage their documentation without needing specialized software or hiring external services.

Automation and Accuracy

Automating key calculations such as totals, taxes, and discounts is another significant benefit. With built-in formulas, the chances of human error are minimized, and the process becomes faster and more efficient. This level of automation ensures that documents are accurate and consistent, giving business owners peace of mind when handling financial records.

By using pre-set formulas and customizable fields, users can tailor their system to meet the specific needs of their business. This flexibility means that businesses can easily adjust their billing processes as they grow or change, keeping everything organized and up to date with minimal effort.

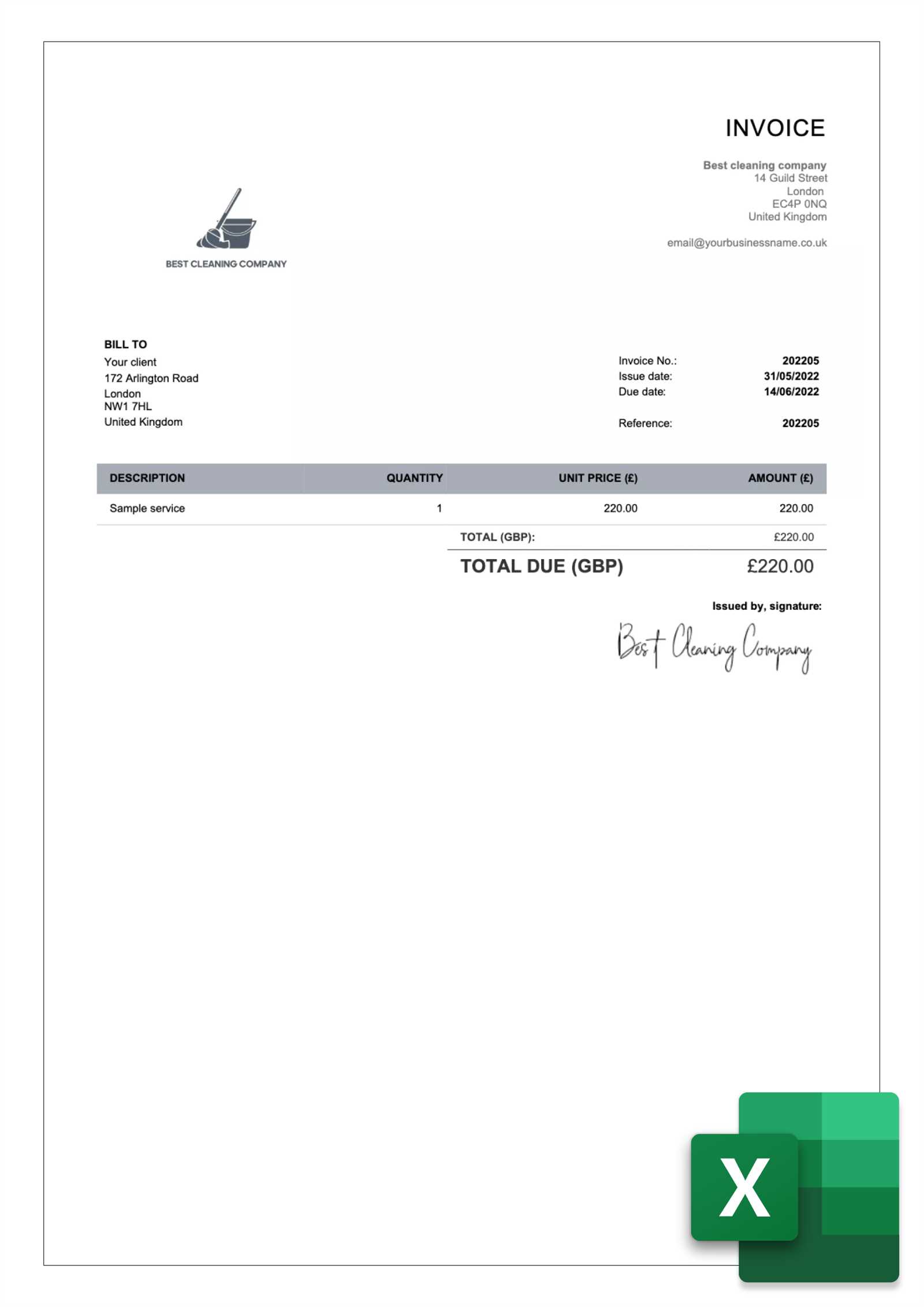

How to Download an Invoice Template

Finding the right tool to manage your billing process is a simple and efficient way to streamline administrative tasks. Downloading a pre-designed solution can save time, providing a ready-made structure to quickly input your details and generate documents. These ready-to-use files are designed to help you get started with minimal setup, ensuring that you can create professional-looking forms right away.

Where to Find Reliable Files

There are many reputable websites that offer free and paid solutions for businesses looking to automate their documentation. Some platforms provide downloadable files that are easy to modify and suit various industries. It’s important to ensure that the source is trustworthy and that the file formats are compatible with your system to avoid any issues during download or use.

Steps to Download and Install

Once you have found a suitable solution, downloading the file is usually a straightforward process. Most providers will offer a simple button or link to initiate the download. After the file is saved to your computer, open it in your preferred software to start customizing the fields. Many tools are designed to be compatible with common programs, making it easy to get started with minimal effort.

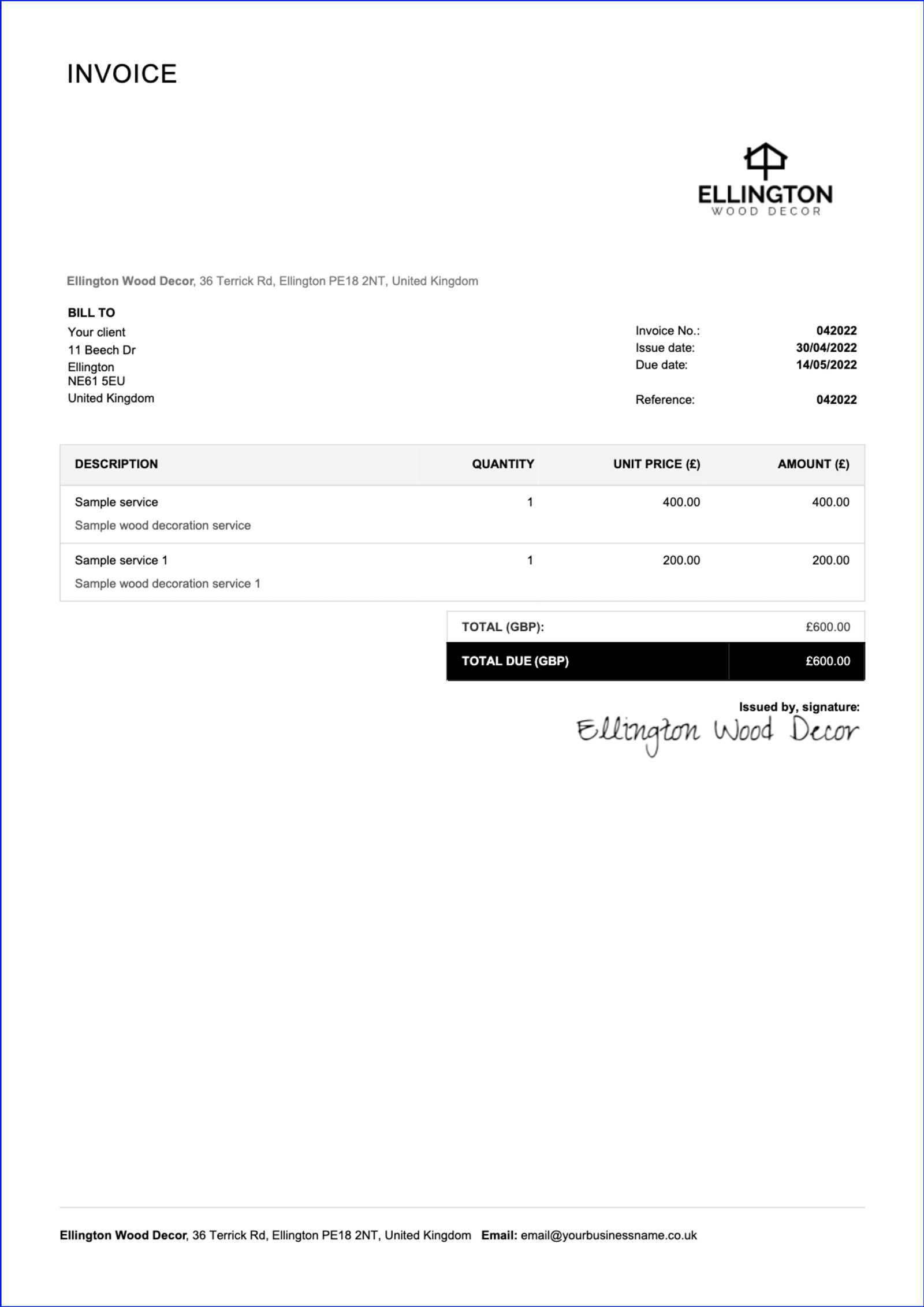

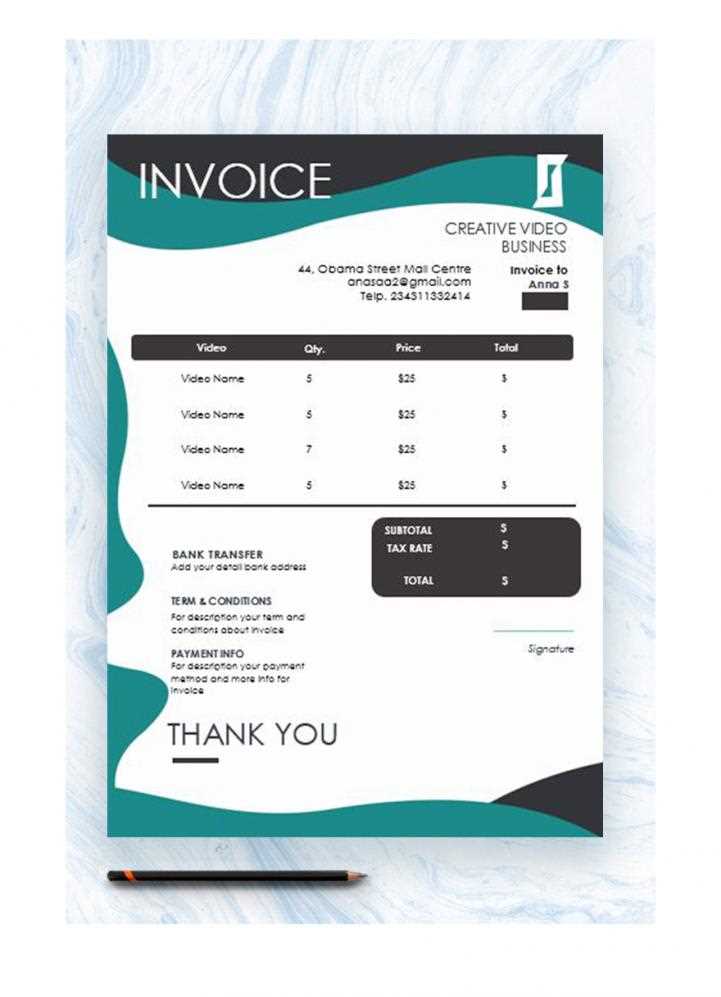

Customizing Your Billing Document in Excel

Tailoring your billing document to suit your business needs ensures that each generated file reflects your brand and includes all the necessary information. Customizing these files can be done easily within spreadsheet applications, allowing for adjustments to design, structure, and content. This way, you can create a personalized document that is both functional and professional.

Adjusting the Layout and Design

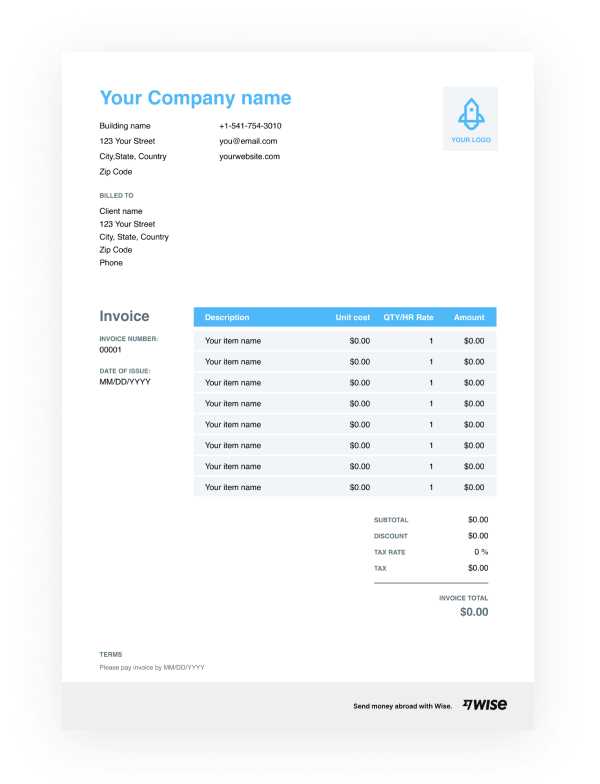

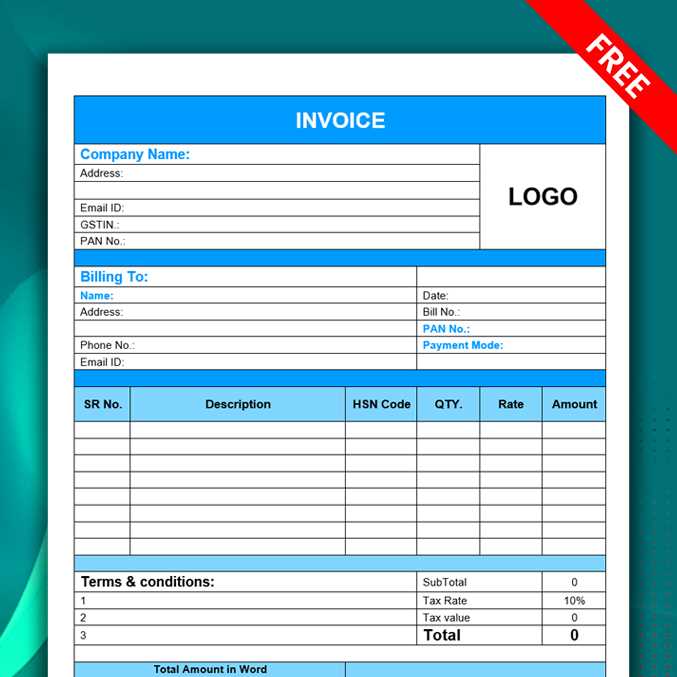

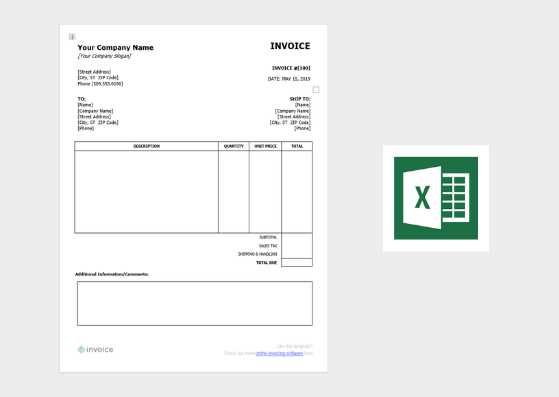

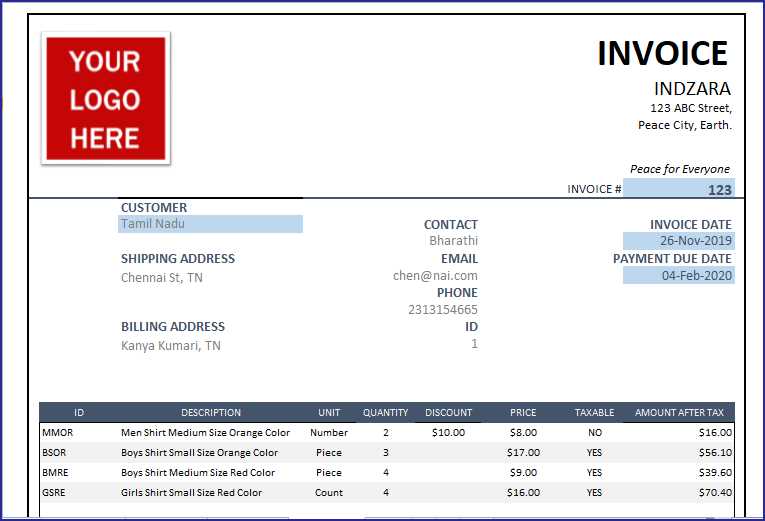

One of the first steps in customizing a billing form is modifying its layout. You can change fonts, colors, and alignment to match your company’s branding. Additionally, adding or removing columns for specific data–such as item descriptions or payment terms–helps ensure the document is tailored to your specific business needs. Customizing these visual elements creates a cohesive and professional appearance that clients will recognize.

Adding Custom Fields and Formulas

Another important customization is adjusting the fields to reflect your unique business processes. You may want to include fields for custom discounts, delivery charges, or different payment methods. You can also incorporate formulas to automate calculations, ensuring totals, taxes, and discounts are calculated automatically. This customization reduces manual errors and speeds up the document creation process.

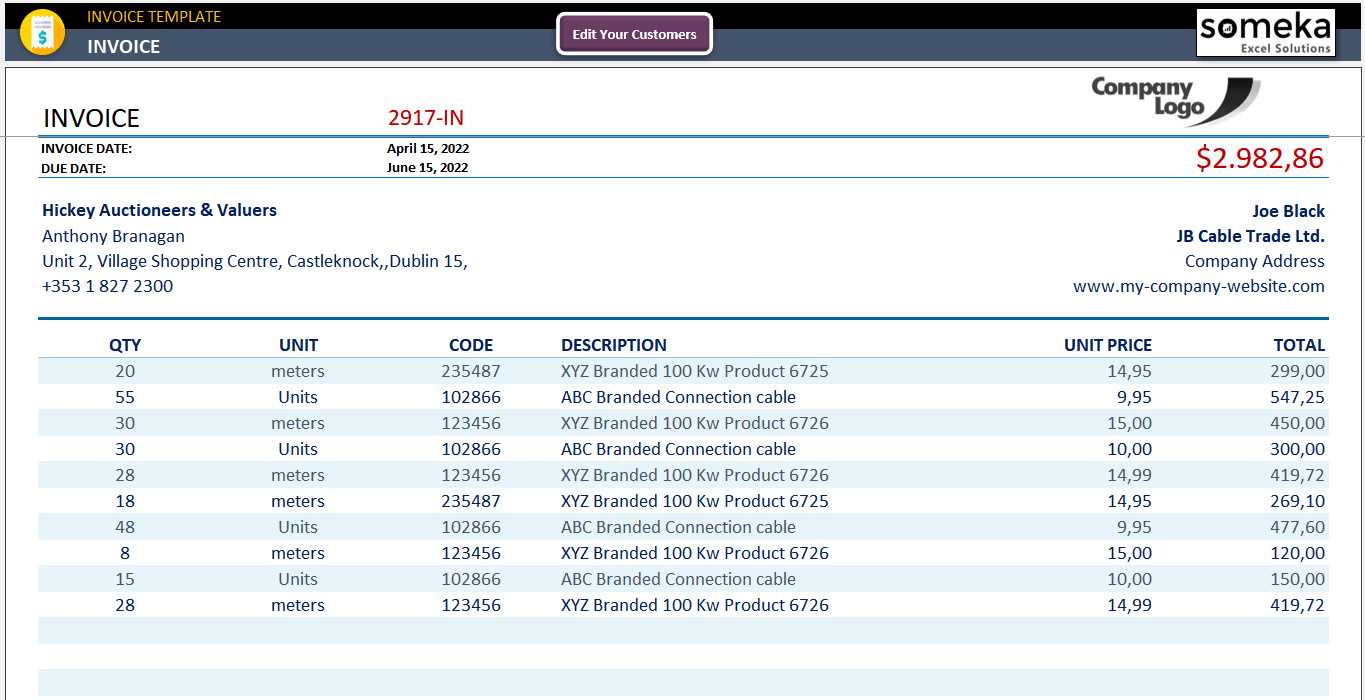

Step-by-Step Guide to Creating Invoices

Creating professional documents for clients doesn’t have to be a complex process. With the right approach, you can quickly produce accurate and well-organized statements for every transaction. This step-by-step guide will walk you through the essential elements needed to create a polished and functional document for your business needs.

Step 1: Open Your Document and Set Up the Layout

Start by opening your chosen file and setting up the basic structure. Begin with the header, where you should include your business name, logo, and contact information. Be sure to leave space for the recipient’s details, including their name, address, and contact number. This section should be neat and clearly defined to give your document a professional appearance. Ensure the layout is clean and organized, making it easy for the client to read the important details.

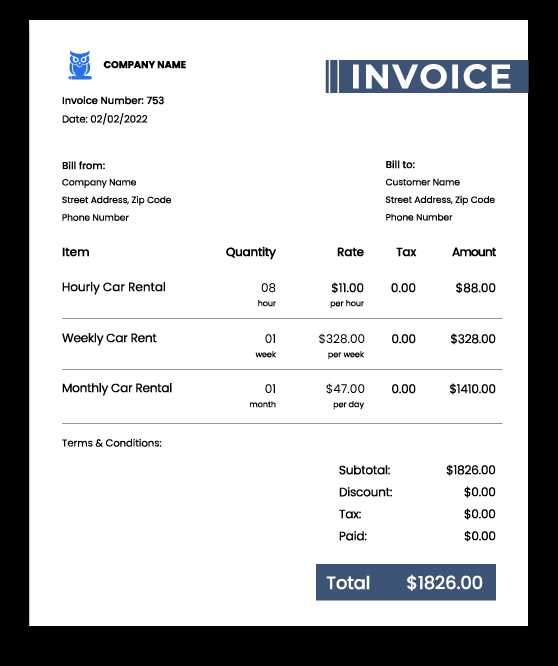

Step 2: Input Transaction Details and Calculate Totals

Next, enter the details of the transaction, such as the services or products provided, quantities, unit prices, and any additional fees. It’s essential to double-check this information for accuracy. Once the data is entered, use automated formulas to calculate totals, including taxes, discounts, and the final amount due. Automation at this stage reduces the risk of errors and ensures your document is correct every time.

Step 3: Review and Finalize

After entering all the necessary information, carefully review the document to ensure all details are accurate and clearly presented. This includes checking for correct spelling, ensuring that calculations are accurate, and confirming that all client information is correctly listed. Once you are satisfied with the details, save the document and prepare it for delivery, whether through email or print.

How to Calculate Totals Automatically

Automating the calculation of totals in your financial documents is a great way to save time and avoid errors. By setting up the right formulas, you can ensure that all amounts, including taxes, discounts, and totals, are computed automatically. This reduces the manual work involved and guarantees accuracy in every document you create.

Setting Up Basic Calculations

The most common calculations you’ll need are for the subtotal, taxes, and final amount due. Here’s how you can set them up:

- Subtotal: Multiply the quantity of each item by its price and sum up all the results.

- Tax Calculation: Apply the appropriate tax rate to the subtotal to calculate the tax amount.

- Final Amount: Add the subtotal and tax to get the final amount that needs to be paid.

Using Built-In Formulas

Spreadsheets offer built-in formulas that can handle these calculations for you:

- SUM Function: Use the SUM formula to add up item costs or other values in a range of cells.

- PRODUCT Function: Multiply item quantity by unit price using the PRODUCT formula.

- TAX Function: Multiply the subtotal by the applicable tax rate to calculate the tax amount automatically.

- SUMIF Function: Apply conditional sums if you want to calculate totals based on specific criteria (e.g., certain categories or items).

By using these formulas, you can ensure that your calculations are always accurate and up to date, no matter how many items or adjustments you have to make. Simply entering the necessary data into the document will trigger the formulas and produce the correct totals each time.

Best Features of Invoice Generator Templates

When it comes to automating and streamlining the billing process, using a ready-made solution can provide significant advantages. The right set of features in a billing document can save time, reduce errors, and improve overall professionalism. Here are some of the most valuable features that make such tools stand out for businesses of all sizes.

Customizable Layout and Design

One of the most important aspects of a billing solution is its flexibility in design. A well-designed document helps create a strong professional impression. Key customizable features include:

- Branding: The ability to add your business logo, color scheme, and contact details to ensure the document reflects your brand identity.

- Adjustable Fields: Easily modify sections like product descriptions, quantities, and pricing to suit your needs.

- Fonts and Layouts: Customize fonts, alignments, and cell sizes to create a clean and readable structure.

Automated Calculations and Totals

Manual calculations are time-consuming and prone to errors. One of the best features of these solutions is the ability to:

- Auto-Calculate Totals: Automatically sum up item costs, taxes, and apply discounts based on preset formulas.

- Tax and Discount Integration: Easily add tax rates and apply discounts to the total amount based on your business rules.

- Dynamic Updates: When item quantities or prices change, totals are updated instantly without any manual intervention.

Professional Design and Usability

A good billing document doesn’t just need to be accurate; it should also be user-friendly and professional-looking. The key features here include:

- Pre-built Structure: These documents typically come with a well-organized structure that requires little to no setup.

- Clear Sections: Clear labels for all necessary details like sender information, recipient details, payment terms, and due dates.

- Easy to Edit: Users can modify or add fields as

Why Choose Excel Over Other Tools

When it comes to managing financial documents, many tools are available, each offering unique advantages. However, some solutions stand out for their versatility, ease of use, and powerful features. A popular choice for many businesses is using spreadsheet software, which offers a combination of flexibility, customizability, and robust functionalities. Here are some reasons why this option is preferred over others.

Cost-Effectiveness and Accessibility

One of the biggest advantages of using spreadsheet software is its cost-efficiency. Most users already have access to this type of application, eliminating the need for additional software purchases or subscriptions. The accessibility of these tools, combined with a low learning curve, makes them an ideal option for small businesses or individuals who need an affordable yet reliable solution.

Customizability and Flexibility

Flexibility is key when it comes to handling diverse business needs. With spreadsheets, you can tailor your documents to suit the specific requirements of your industry, whether it’s adding extra fields, modifying calculations, or adjusting the layout. Unlike other tools that may have limited customization options, spreadsheet programs allow for extensive modifications, letting users create documents that perfectly match their workflow and style.

Automation and Integration

Another significant benefit of using spreadsheet software is the ability to automate complex calculations. From adding up totals to applying taxes and discounts, built-in functions can do the heavy lifting for you, reducing errors and speeding up the process. Furthermore, spreadsheets integrate well with other software, such as accounting platforms, enabling seamless data transfer and better overall management of financial records.

Ease of Use and Familiarity

Most business owners and professionals are already familiar with spreadsheet tools, which makes the transition to using them for managing financial documents smooth and intuitive. The user interface is simple, with drag-and-drop functionality, easy navigation, and the ability to instantly preview your work. This familiarity minimizes the time spent learning new software and allows you to focus on what matters most–your business.

Wide Availability of Resources

Unlike other specialized software that may require constant updates or support, spreadsheets offer a vast range of tutorials, forums, and templates available online. Whether you’re a beginne

Creating Professional Invoices with Excel

Creating high-quality, professional billing documents is essential for maintaining a strong relationship with clients and ensuring timely payments. With the right approach, you can design polished and accurate statements that not only reflect your brand but also provide clear and concise information. Spreadsheet software offers a powerful platform for achieving this, providing both flexibility and ease of use for business owners and freelancers alike.

Customizing the Layout for a Professional Look

Start by designing a clean, organized structure that highlights key information such as business details, client information, and payment terms. A professional layout should include clearly labeled sections and consistent formatting to make the document easy to read and understand. Adding your company logo and using branded colors will further enhance the document’s appearance and help build your brand identity. Make sure to include spaces for the recipient’s details, such as name, address, and contact information, along with the date and due date for clarity.

Automating Calculations for Accuracy

Using built-in formulas to automate calculations not only speeds up the process but also reduces the risk of human error. You can easily set up formulas for calculating item totals, taxes, discounts, and the final amount due. This automation ensures that the document is always accurate, no matter how many line items are added. Formula-driven totals also make it easier to adjust prices or quantities without having to manually update every field, saving you valuable time.

By combining a clean layout with automated calculations, you can create professional, error-free documents that enhance your business’s image and improve overall workflow.

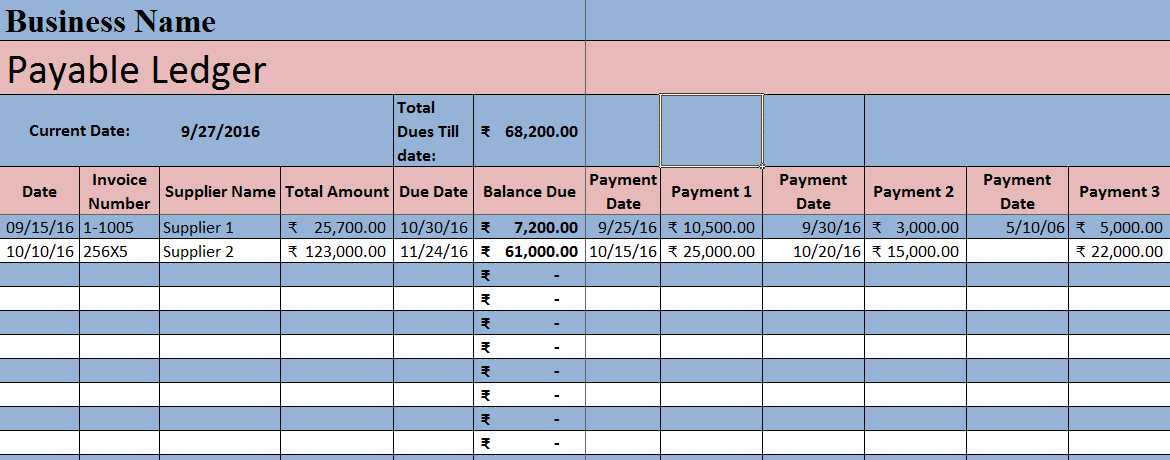

Managing Multiple Invoices in One File

Handling multiple billing documents can become cumbersome if each one is stored separately. A more efficient approach is to manage several statements within a single file. This allows for easy tracking, editing, and retrieval of documents, while keeping everything organized in one central location. By using simple organization strategies, you can manage many transactions without the need for multiple files or complex systems.

Using Separate Sheets for Each Document

One of the most straightforward ways to manage several billing statements in a single file is by using separate sheets for each transaction. This method allows you to:

- Organize Each Transaction: Create a unique sheet for every new client or project, keeping information separated and easy to find.

- Quickly Access Documents: Navigate through tabs at the bottom of the file to switch between different billing statements.

- Maintain a Master Record: Keep a summary sheet with links to each individual transaction for faster reference.

Tracking Payments and Due Dates

In addition to organizing your documents by client or project, it’s essential to track the status of each payment. You can add columns in your master sheet to monitor due dates, payment statuses, and any outstanding balances. Key steps include:

- Payment Status: Add a column to mark whether a payment has been received, is pending, or is overdue.

- Due Dates: Include a column for the due date of each transaction to stay on top of upcoming payments.

- Filtering by Status: Use filtering options to quickly sort and find overdue or unpaid transactions.

By organizing your transactions this way, you ensure that all your billing information is readily accessible, reducing the risk of missing payments or losing track of documents.

Free vs Paid Invoice Excel Templates

When it comes to managing billing documents, one of the decisions businesses often face is whether to use free or paid solutions. While both options offer a way to streamline the process, there are notable differences in terms of functionality, customization, and support. Understanding these differences can help you choose the best solution for your needs, whether you’re a small business owner, freelancer, or large enterprise.

Advantages of Free Solutions

Free options are widely accessible and offer basic functionality that can meet the needs of many businesses. Here are some of the key benefits:

- Cost-Effective: The primary advantage of free tools is that they come with no upfront cost, making them ideal for businesses with limited budgets.

- Easy Access: Free resources are often readily available online, meaning you can start using them immediately without any purchase process.

- Basic Features: Free options often cover the essentials, such as creating simple documents and performing basic calculations.

Benefits of Paid Solutions

While free tools can be helpful, paid options generally offer additional features and support. Here are some advantages of opting for a paid solution:

- Advanced Customization: Paid solutions often allow for more in-depth customization, including advanced design options and tailored fields specific to your business needs.

- More Features: You’ll often find additional features in paid tools, such as automated reminders, customizable templates, or integration with accounting software.

- Customer Support: With paid solutions, you typically have access to dedicated customer support, ensuring you can get help when needed.

- Security and Updates: Paid options often come with regular updates and better security features, ensuring that your data is protected and the software remains up-to-date.

While free tools are a great option for startups or smaller businesses with minimal requirements, paid solutions are often worth the investment for those looking for greater flexibility, enhanced fe

Common Mistakes to Avoid with Excel Invoices

When creating financial documents, small errors can lead to misunderstandings or delays in payments. It’s important to be vigilant about common mistakes that can affect the clarity and accuracy of your records. By understanding and avoiding these issues, you can ensure that your documents are both professional and precise, helping to maintain smooth transactions with clients and partners.

Incorrect Calculation of Totals

One of the most frequent mistakes in creating financial statements is incorrect calculations, whether due to human error or formula issues. Here’s how to avoid them:

- Double-Check Formulas: Always review your formulas to ensure they are correctly applied, especially for totals, taxes, and discounts.

- Manual vs. Automatic Calculations: Avoid manually entering totals when a simple formula can handle it, reducing the chance of miscalculation.

- Accurate Tax Rates: Ensure that tax rates are up-to-date and correctly applied to the appropriate sections of the document.

Missing or Incorrect Client Details

Incomplete or inaccurate client information can cause confusion or delays in payments. To prevent this, always check the following:

- Correct Contact Information: Make sure the client’s name, address, and other contact details are accurate and up-to-date.

- Accurate Dates: Ensure that both the issue date and due date are clearly listed and correct to avoid misunderstandings regarding payment deadlines.

- Clarity in Terms: Double-check that the payment terms (such as net 30, net 60, or specific due dates) are clearly stated and understood by both parties.

Unclear or Inconsistent Formatting

A poorly formatted document can create confusion for both you and your client. Avoid the following formatting issues:

- Inconsistent Font Styles: Keep font choices uniform to make the document easier to read and more professional.

- Poor Alignment: Ensure that the text, numbers, and labels are properly aligned so that all details are easy to locate and read.

- Too Much Information: Avoid overloading the document with unnecessary details. Stick to what’s essential

How to Automate Invoice Generation

Automating the process of creating billing documents can save businesses significant time and effort. By setting up systems that automatically generate these documents based on predefined rules, you can reduce manual entry, avoid errors, and speed up your workflow. This guide will walk you through the key steps and tools that can help you automate the creation of billing records effectively.

Using Built-in Functions for Automation

Many software tools, including spreadsheet applications, have built-in functions that can automatically calculate totals, taxes, and discounts. By setting up formulas to automate these processes, you can ensure accuracy while saving time on manual data entry.

- Use Formulas for Calculations: Apply basic formulas to automatically add up item costs, calculate taxes, and determine the final total.

- Set Up Conditional Formatting: Use conditional rules to highlight overdue payments or unpaid amounts, ensuring that these are easily visible.

- Dynamic Fields: Set up fields that automatically pull client information, dates, or payment terms from a master sheet or database to eliminate repetitive tasks.

Integrating with Other Software

For more advanced automation, integrating your billing document system with other software solutions can streamline the entire process. By connecting your billing tool to accounting, CRM, or payment systems, you can automate data input and document creation, further reducing the time spent on manual work.

- Accounting Software Integration: Link your billing system with accounting software so that payments and transaction details are automatically updated in your financial records.

- CRM System Sync: Integrate with your customer relationship management (CRM) system to automatically pull client details and track their payment history.

- Payment Gateway Link: Set up a connection with payment processors to automatically track when payments are made, updating the status of your records instantly.

By using built-in tools and integrating with other systems, you can automate the creation of billing documents, making the process faster, more accurate, and less prone to error. This level of automation ensures that your workflow is efficient, your records are up-to-date, and your clients are invoiced on time.

Integrating Your Excel Template with Accounting Software

Integrating your financial documents with accounting software can greatly improve your workflow by automating the transfer of data between systems. This seamless connection reduces the need for manual entry, helps maintain accuracy, and keeps all your financial information up to date in real-time. By linking your spreadsheet-based documents to your accounting software, you can streamline both the creation and tracking of transactions, saving valuable time and minimizing errors.

Benefits of Integration

Integrating your financial record system with accounting software offers several advantages, particularly when it comes to consistency and efficiency. Here are some key benefits:

- Eliminates Double Entry: Data is automatically transferred from your documents to your accounting system, reducing the need to enter the same information twice.

- Real-Time Updates: Any changes made in your document are reflected instantly in your accounting software, keeping your records current and accurate.

- Improved Accuracy: Automation reduces the risk of human error, ensuring that figures, such as totals, taxes, and discounts, are consistent across all systems.

- Faster Reporting: With integrated systems, you can generate reports with ease, pulling data directly from your financial records without manual input.

Steps to Integrate with Accounting Tools

Integrating your documents with accounting software involves a few essential steps. Here’s how you can get started:

- Select Compatible Accounting Software: Ensure that your accounting software can import and export data from your financial document files, such as .CSV, .XLSX, or .PDF formats.

- Connect Data Fields: Map the fields in your document (such as client name, transaction amount, and date) to the corresponding fields in your accounting software.

- Use Import/Export Features: Many accounting tools allow you to import transaction data directly from spreadsheets or export to them. Set up these features to automate the transfer of in

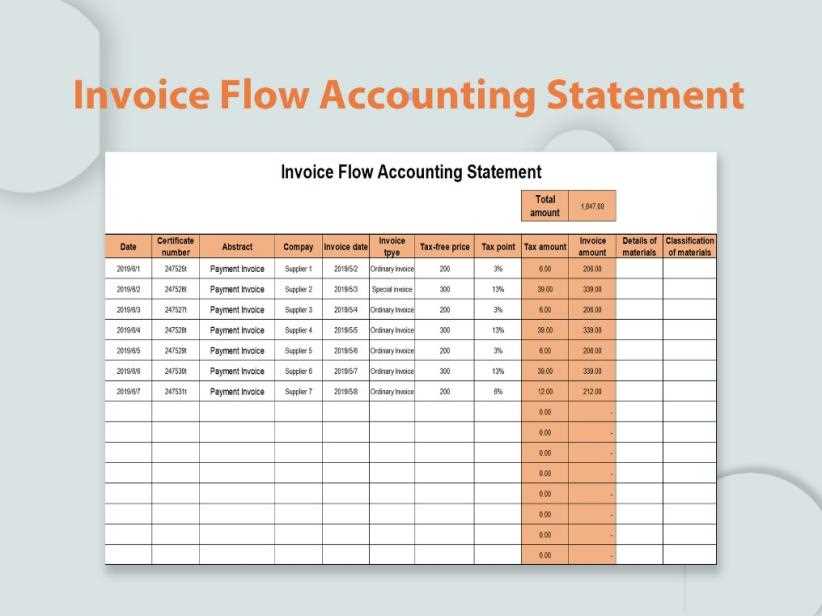

Ensuring Accurate Tax Calculations in Excel

Accurate tax calculations are crucial for maintaining proper financial records and ensuring compliance with tax regulations. When creating financial documents, the ability to calculate taxes correctly can save time and prevent costly errors. With the right formulas and tools, you can automate tax calculations and eliminate the need for manual updates. This section explores how to ensure your tax figures are accurate in a spreadsheet-based system.

Setting Up Tax Rates and Formulas

To ensure correct tax calculations, you need to set up the appropriate formulas and tax rates in your document. Here’s how to do it:

- Input Tax Rates: Make sure your tax rate is entered correctly in a fixed cell so that it can be referenced in all related calculations.

- Use Consistent Formulas: Create formulas that automatically calculate tax amounts based on the subtotal or item cost. For example, use the formula: Item Price * Tax Rate.

- Consider Multiple Tax Rates: If your region has different tax rates based on location or product type, set up separate formulas or use conditional logic to apply the correct rate.

Common Pitfalls to Avoid

While setting up tax calculations, there are several common mistakes to watch for. Avoiding these errors will help you maintain accurate financial records:

- Incorrect Tax Rate Application: Ensure that tax rates are applied correctly to taxable items. Double-check that items not subject to tax are excluded from the calculation.

- Rounding Issues: Depending on your location, tax rates may require rounding to a specific decimal place. Ensure that your formulas account for rounding correctly to avoid discrepancies in totals.

- Manual Adjustments: Avoid manually changing tax amounts after calculations. Instead, adjust the formula or the tax rate if changes are needed.

By set