How to Use a Timesheet Invoice Template for Efficient Billing

For freelancers, small businesses, and contractors, keeping accurate records of worked hours is crucial for smooth financial operations. Having a well-organized system for tracking time and creating clear, professional invoices ensures prompt payments and fosters trust between service providers and clients. Efficient time management paired with clear documentation eliminates confusion and reduces the risk of disputes.

One of the most effective ways to manage this process is by using a structured format that simplifies both time documentation and payment requests. By adopting a customizable structure, businesses can tailor the system to their needs, ensuring accuracy while saving time on repetitive tasks. With the right approach, time records and financial requests become much more than just a requirement–they turn into a tool for enhancing business operations.

Whether you’re new to the field or an experienced professional, optimizing how you track hours and present your billing details can significantly improve your workflow. This guide will explore methods to create, adapt, and utilize such systems to maximize efficiency and minimize errors.

Understanding the Importance of Time Tracking and Billing Records

Accurate documentation of worked hours and clear billing statements are fundamental to maintaining healthy business relationships and ensuring timely payments. For service-based professionals and companies, precise time records not only serve as a reliable reference but also prevent misunderstandings with clients regarding payment terms. When the details of work completed and the hours spent are transparently outlined, both parties can quickly agree on the final amount due without confusion.

Using a consistent method for presenting these records enhances professionalism and builds trust. It ensures that both the client and the service provider are on the same page, minimizing the risk of disputes over missing details or miscalculated amounts. Additionally, well-organized billing formats facilitate quicker processing of payments, which is crucial for maintaining steady cash flow, particularly for freelancers and small businesses.

By establishing a straightforward system for time tracking and invoicing, companies can improve their operational efficiency, reduce administrative overhead, and focus more on delivering quality service. This approach not only simplifies the administrative process but also strengthens client relationships, creating a more reliable and transparent billing cycle.

Benefits of Using a Time Tracking and Billing System

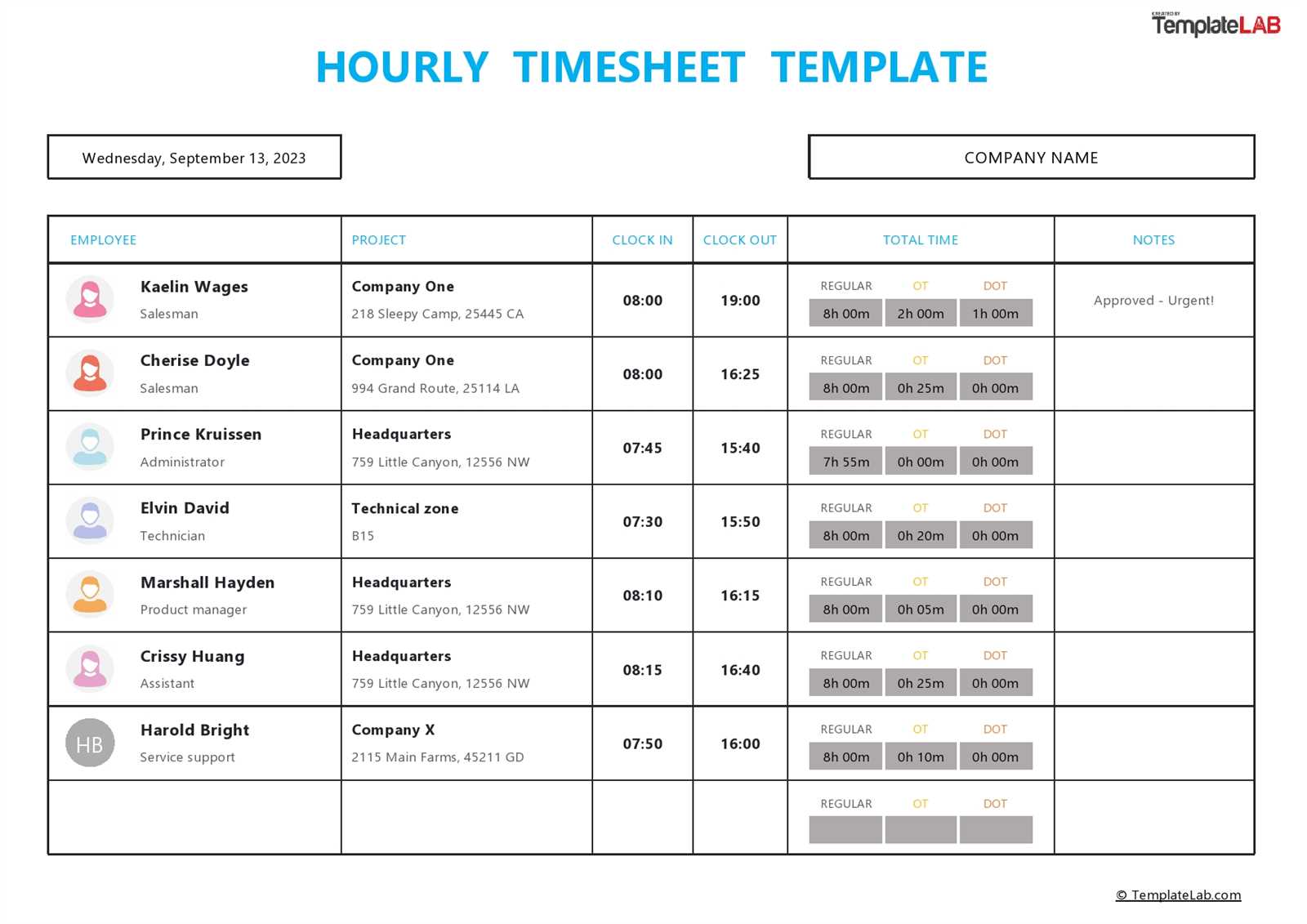

Implementing a structured system for tracking work hours and generating payment requests brings a range of advantages to both service providers and clients. A well-designed format simplifies the entire process, reducing errors, saving time, and increasing overall efficiency. Instead of manually calculating hours or dealing with complex spreadsheets, using a pre-designed framework streamlines the task and ensures all important details are included.

One of the main benefits is consistency. With a uniform approach, the information presented is always clear and easy to understand, which helps in avoiding confusion and disputes. It also reduces the chances of mistakes in calculations or missed entries, ensuring that every hour worked is accounted for. Below are some of the key benefits of using such a system:

| Benefit | Description |

|---|---|

| Time Efficiency | Automated entry fields and easy-to-fill-out formats save time on manual tracking and calculations. |

| Improved Accuracy | Pre-built fields and organized structure reduce the likelihood of errors in reporting hours worked. |

| Professional Presentation | A polished and uniform document conveys professionalism and boosts client confidence. |

| Faster Payments | Clear and transparent documentation accelerates the payment process, ensuring timely receipts. |

| Customization | These systems can be tailored to different industries and needs, providing flexibility for various businesses. |

By using a standardized approach, businesses can focus on their core services rather than spending excessive time on administrative tasks. This leads to improved customer satisfaction, better cash flow management, and a smoother workflow overall.

How to Create a Custom Time Tracking and Billing Document

Creating a personalized structure for documenting worked hours and requesting payment is a straightforward process that can be tailored to suit the needs of any business or freelancer. The key is to ensure that all necessary information is clearly organized, easy to understand, and fully customizable. By following a few simple steps, you can design a document that not only meets your specific needs but also enhances your professionalism when dealing with clients.

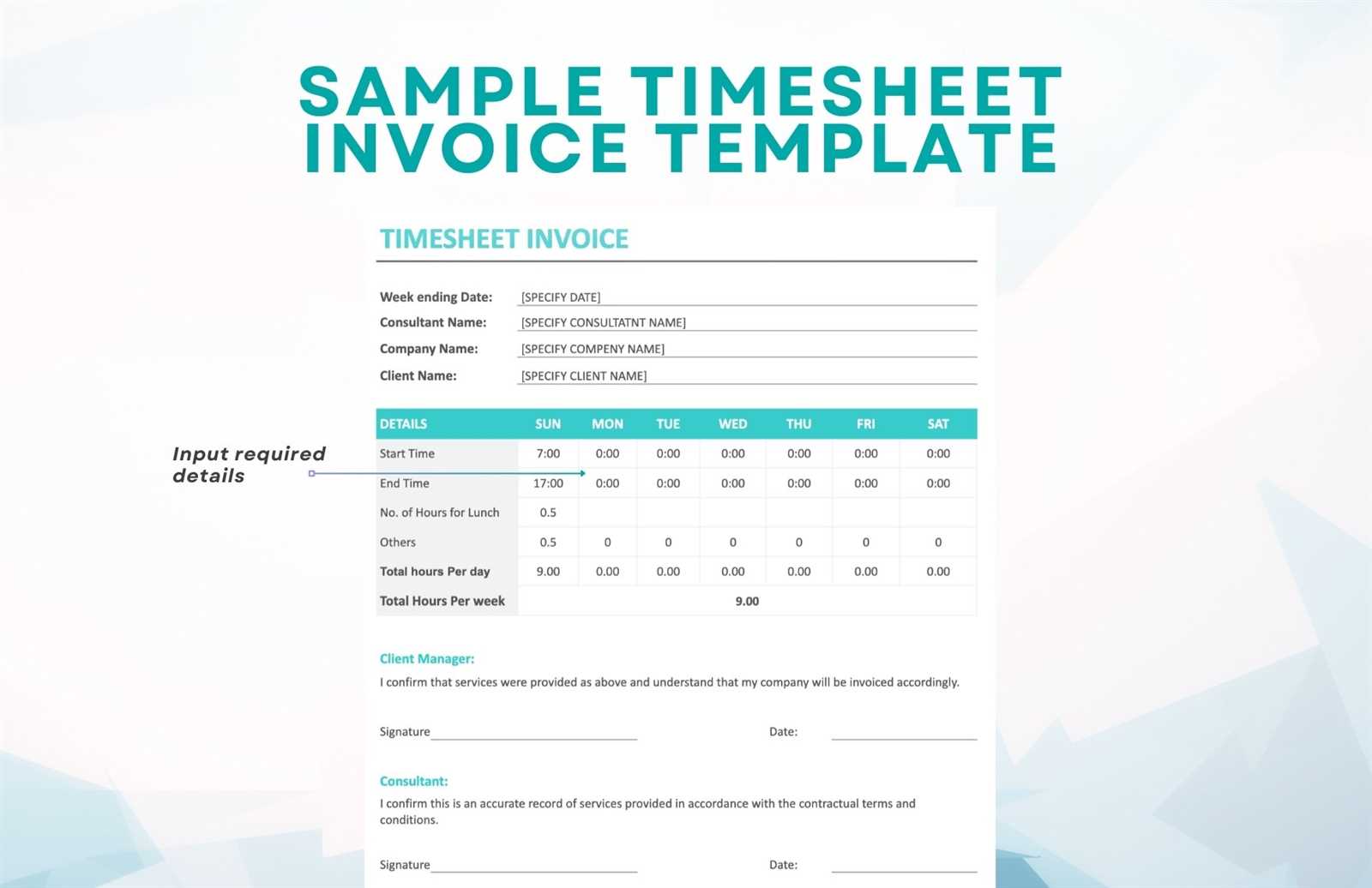

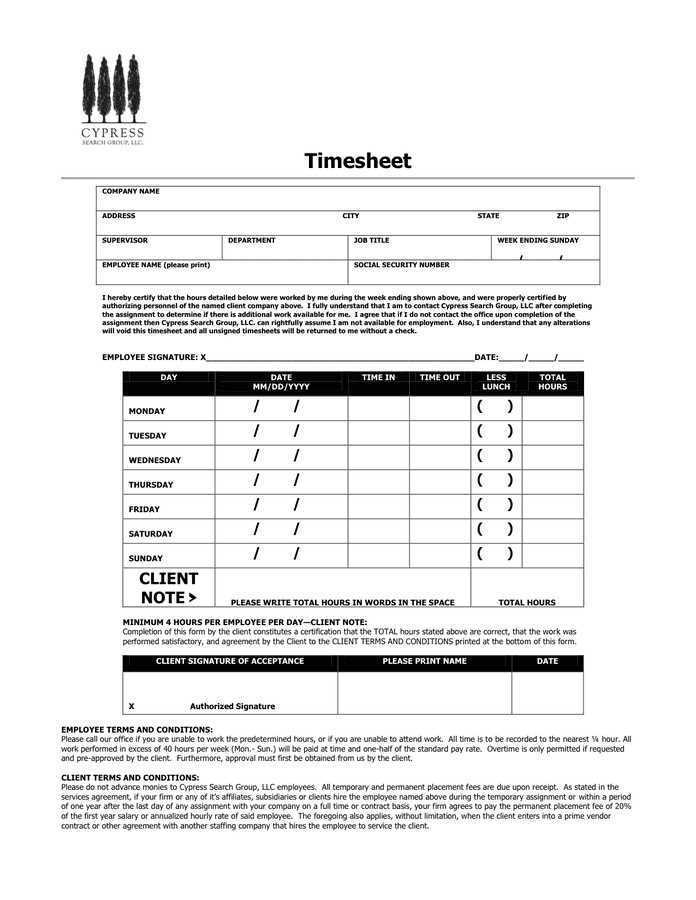

Start by including the basic details that should be present in every document: the client’s information, the dates of work performed, and a clear breakdown of hours worked for each task. You can further enhance the document by adding fields for hourly rates, any additional charges (such as for overtime), and a section for payment terms. This ensures that clients have all the information they need to process payments quickly and without confusion.

Next, choose a format that works best for your business. Whether you prefer to use a spreadsheet, a word processing tool, or an online platform, the goal is to create a consistent and organized layout. Be sure to design the document with flexibility in mind, allowing for easy modifications should work hours or payment details change. With this approach, you can quickly generate accurate billing records tailored to each client, saving time and avoiding potential errors.

Essential Elements of a Time Tracking and Billing Document

To create a comprehensive and professional billing record, there are several key components that must be included. These elements ensure that the document is clear, accurate, and complete, reducing the chances of misunderstandings and delays in payment. Each part serves a specific purpose, from identifying the client to detailing the work performed and calculating the total amount due.

Key Information to Include

Here are the critical pieces of information that should be present in every document:

- Client Details: Always include the full name, address, and contact information of the client to whom the billing is directed.

- Service Provider Information: Clearly list your name, company name (if applicable), address, and contact details.

- Work Period: Specify the dates or time range during which the work was completed.

- Task Description: Include a brief description of the tasks or services provided during the billed period.

- Hours Worked: Provide a detailed breakdown of the hours worked for each task, making it easy for the client to verify.

- Rate of Payment: Indicate your hourly rate, flat fee, or any other applicable pricing structure used for the billing.

- Total Amount Due: Sum up the charges for all tasks and hours worked, including any additional costs like taxes or fees.

- Payment Terms: Clearly outline the payment deadlines, accepted payment methods, and any penalties for late payment.

Optional but Helpful Additions

Including additional details can make the billing document even more effective:

- Purchase Order Number: If the client has issued a purchase order, include it for easy reference.

- Notes or Special Instructions: This section can be used to clarify any special terms or to add notes about the work provided.

- Discounts or Adjustments: If applicable, include any discounts offered or adjustments made to the standard pricing.

By ensur

Best Time Tracking and Billing Documents for Freelancers

Freelancers often face unique challenges when it comes to managing their work hours and billing clients. Having an efficient and professional system for tracking time and presenting payment requests can make a significant difference in terms of organization and promptness. The right structure not only saves time but also helps maintain a professional image, ensuring smooth communication with clients and reducing the risk of disputes.

For freelancers, there are several highly effective, customizable solutions available that simplify the process of creating detailed billing records. Whether you prefer a minimalistic layout or a more detailed breakdown, the following options cater to different preferences and needs:

- Simple and Clean Layouts: These are ideal for freelancers who prefer a straightforward approach. They typically include sections for client details, work description, and payment terms, with minimal design elements. Their simplicity ensures that clients can quickly understand the billing details.

- Time and Rate Breakdown: These formats are perfect for those who charge hourly rates. They allow freelancers to break down the time worked on each specific task, making it easier for clients to verify the charges and ensuring that all hours are accounted for.

- Comprehensive Service Records: If you offer a variety of services, this format allows you to list each service separately, along with the corresponding hours worked and costs. This is ideal for freelancers who provide multiple types of work for a single client.

- Online Tools and Software: Many freelancers benefit from using online platforms that automatically track time and generate professional billing records. These tools often come with integrated features like automatic tax calculations, payment reminders, and export options to make the entire process seamless.

- Customizable Spreadsheets: For freelancers who prefer more control over the layout, customizable spreadsheet formats are a great choice. With spreadsheet programs, you can design a document that fits your ex

Why Accurate Time Tracking Matters for Billing

For freelancers and businesses that charge based on hours worked, precise tracking is essential for both transparency and fairness. Incorrect or vague records can lead to disputes, delays in payment, and even the loss of clients. Ensuring that every hour is accurately logged not only protects your revenue but also builds trust with clients, demonstrating professionalism and accountability.

Accurate time records are the foundation of reliable billing and efficient payment processing. Here are some reasons why it is crucial:

- Prevents Disputes: Accurate documentation ensures that clients can easily verify the hours worked, reducing the chances of disagreements over payment amounts.

- Enhances Professionalism: A well-documented breakdown of hours shows clients that you are organized and transparent, which can lead to stronger long-term relationships.

- Improves Cash Flow: Clear and accurate records help speed up the billing process, leading to faster payments and more predictable cash flow.

- Protects Against Underpayment: Without accurate tracking, you may miss out on compensation for work completed, especially if there’s no clear record of hours or tasks.

- Supports Tax Filing: Accurate time logs provide reliable data for tax purposes, helping you to report earnings correctly and avoid issues with tax authorities.

In summary, keeping detailed and accurate records of time worked not only ensures you are compensated fairly but also enhances the overall business process. It prevents misunderstandings, streamlines payment, and strengthens client trust–all of which are crucial to long-term success.

Automating Time Tracking and Billing

Automation can drastically simplify the process of recording work hours and generating payment requests, allowing businesses and freelancers to save time and reduce human error. By integrating tools that automatically track time and create payment documents, you can focus more on the work itself rather than the administrative tasks. This shift not only increases efficiency but also improves the accuracy of the data collected, ensuring timely and correct payments.

There are several benefits to automating these processes:

- Increased Accuracy: Automated systems eliminate the risk of manual errors, ensuring that the number of hours worked is recorded accurately every time.

- Time-Saving: With automatic tracking, you no longer need to manually log hours or format billing documents, which reduces the time spent on administrative tasks.

- Real-Time Tracking: Many automated tools provide real-time data on work completed, allowing you to monitor progress and adjust billing as needed.

- Seamless Integration: Automation can integrate with other business tools like project management software and accounting platforms, making the entire process more cohesive and efficient.

- Consistency: Automated systems follow the same structure and rules for each task, ensuring uniformity in all reports and billing statements.

By using automated solutions, freelancers and businesses can ensure they are spending less time on administrative work and more time on growth and client satisfaction. The ease and accuracy of automation make it a valuable investment for anyone looking to streamline their operations.

Common Mistakes in Time Tracking and Billing

When it comes to tracking work hours and generating payment requests, even small mistakes can have significant consequences. From miscalculating hours to failing to include essential details, errors can lead to disputes, delayed payments, and frustrated clients. By understanding the most common mistakes in this process, you can take steps to avoid them and ensure a smoother, more efficient billing cycle.

Here are some of the most frequent errors made when documenting time and generating billing records:

- Inaccurate Hour Tracking: Not recording every hour worked or forgetting to update logs can lead to underbilling, where you lose compensation for hours completed.

- Omitting Task Details: Failing to specify the work done for each task can confuse clients and lead to misunderstandings about what they’re being charged for.

- Not Including Proper Rates: Sometimes, professionals forget to update hourly rates, leading to inconsistencies in the final payment or undercharging clients.

- Unclear Payment Terms: If the payment terms (such as due dates, penalties, or accepted methods) are vague or missing, clients may delay payments or question the billing process.

- Failure to Review Before Submission: Sending out billing records without reviewing them can result in mistakes like incorrect totals, missing information, or even typos that may affect the professionalism of the document.

- Not Tracking Overtime or Extra Costs: Forgetting to include extra charges for overtime, travel, or other additional services can cause confusion and may result in lost income.

- Lack of Consistency: Inconsistent formats or irregular document structures can make it difficult for clients to understand and process the payment request, leading to delays.

Avoiding these common mistakes requires attention to detail and a systematic approach to time tracking and billing. By staying organized, double-checking your records, and maintaining clear communication with your clients, you can minimize errors and ensure that payments are processed smoothly and promptly.

Choosing the Right Time Tracking Format

Selecting the right format for documenting work hours and generating payment requests is crucial for accuracy and efficiency. The format you choose will depend on several factors, such as the complexity of the services provided, the number of clients, and the frequency of billing. An effective format will not only save time but also ensure clarity and transparency, making the process smoother for both you and your clients.

Factors to Consider When Choosing a Format

Here are some important considerations when deciding which structure is best for your needs:

- Ease of Use: The format should be simple to use and require minimal effort to update. A complex system can lead to errors or delays in the billing process.

- Client Requirements: Some clients may prefer detailed breakdowns, while others may only need high-level summaries. Understand your client’s preferences to ensure the format aligns with their expectations.

- Service Complexity: If you offer multiple services or bill for different types of work, choose a format that allows you to easily separate and categorize tasks. This ensures that clients can easily understand what they are paying for.

- Frequency of Billing: For frequent billing, a streamlined and automated format may be best. For less frequent or project-based work, a more detailed approach might be necessary.

Popular Formats to Consider

Here are some of the most commonly used formats for time tracking and billing:

- Spreadsheet-Based Formats: These are highly customizable and offer great flexibility. They can be tailored to suit any type of work and can include detailed breakdowns of hours, tasks, and rates.

- Online Tools and Software: Many time-tracking tools are designed to automate both the tracking and billing process. These platforms often provide integration with other business tools and can generate professional, ready-to-send documents.

- Manual Logs: Some businesses still rely on manual tracking methods, such as handwritten logs or simple text documents. While this format may work for very small operations, it can become inefficient as the business grows.

- Pre-Designed Digital Forms: Pre-made forms can save time by automatically generating calculations and summaries based on the data entered. These formats are especially useful for businesses that require a quick turnaround.

By carefully considering your specific needs and client preferences, you can select the most suitable format that enhances your time track

Integrating Time Tracking Documents with Accounting Tools

Efficient integration between time tracking records and accounting tools can streamline business operations, reduce manual errors, and ensure accurate financial reporting. By linking the documentation of work hours and service details with accounting platforms, you can automate processes such as billing, payroll, and expense tracking, ultimately saving time and effort in managing finances. This seamless flow of information helps businesses maintain consistent and up-to-date financial records.

Here are some key benefits of integrating time tracking records with accounting software:

- Automated Data Entry: Automatically transferring data from your time tracking system to your accounting software reduces the need for manual entry, minimizing the risk of mistakes and saving time.

- Faster Invoicing: Integration allows for quicker generation of payment requests, as work hours and services are already documented and easily accessible. This leads to faster processing and timely payments.

- Improved Accuracy: By eliminating the need to manually input time worked or calculate totals, the integration ensures that all data is correct and aligned with your accounting records.

- Better Financial Insights: Integrating time tracking with accounting tools provides real-time financial data, helping you track project costs, monitor cash flow, and make informed decisions.

- Simplified Payroll: For businesses with employees or contractors, linking time records with payroll systems automates salary calculations, deductions, and tax filing, reducing administrative overhead.

- Consistent Reporting: The integration ensures that all financial reports, including profit and loss statements, tax filings, and project budgets, are based on accurate, real-time data.

To get the most out of this integration, choose accounting software that offers built-in compatibility with your time tracking system or provides easy ways to import data from external tools. Many modern accounting platforms, such as QuickBooks, Xero, and FreshBooks, support direct integrations with popular time tracking apps, making the process even more efficient.

Incorporating time tracking and accounting tools together creates a more efficient and accurate workflow, improving overall business management and financial transparency.

How Time Tracking Documents Improve Payment Efficiency

Clear and detailed work records are essential for speeding up the payment process and ensuring that businesses receive timely compensation. By using structured documents that outline the hours worked, services provided, and the agreed-upon rates, businesses can eliminate confusion, reduce the back-and-forth between parties, and streamline the entire payment procedure. When everything is documented accurately, it makes it easier for clients to understand what they are paying for and process payments more quickly.

Here are some ways in which precise tracking and billing documentation can enhance payment efficiency:

- Clarity for Clients: By including all the relevant details–such as work descriptions, hours worked, and rates–clients can easily verify the charges, reducing the likelihood of questions or disputes.

- Faster Processing: With clear documentation in place, clients can quickly review and approve the payment request, speeding up the approval and payment process.

- Reduced Errors: Accurate records minimize the risk of mistakes in calculations or missing details, ensuring that businesses are paid the correct amount without the need for adjustments.

- Automated Reminders: Many time tracking systems and platforms can send automated reminders when payments are due, prompting clients to settle invoices on time and reducing delays.

- Streamlined Approval Workflow: By integrating time tracking documents into accounting or project management software, the approval process becomes more seamless. Managers and clients can easily approve work logs and payment requests without unnecessary back-and-forth.

- Reduced Backlog: With everything organized and easily accessible, there is less chance of backlogs in the payment process. Clients can process requests more quickly, leading to faster cash flow for businesses.

By ensuring that work details are accurately captured and presented, time tracking and billing documents help businesses get paid faster, improve client relationships, and avoid unnecessary delays in their payment cycles.

Customizing Time Tracking Documents for Different Industries

Each industry has its unique requirements when it comes to documenting work hours and billing clients. Customizing time records to reflect the specific needs of a business or profession can improve accuracy, efficiency, and clarity. Whether you’re in construction, consulting, or creative services, tailoring your documentation ensures that you capture all the relevant details necessary for smooth project management and client communication.

Key Customization Considerations

When adjusting your time-tracking documents for a particular industry, consider the following factors:

- Work Complexity: Some industries, like consulting or legal services, may require more detailed descriptions of the work done, while others, such as retail or manufacturing, may focus more on total hours worked or specific tasks completed.

- Billing Structure: Different industries often use different billing models. For example, freelancers may charge hourly, while some industries may work on a project-based or retainer model. The structure of your record should align with your business model.

- Task Breakdown: Certain fields require more detailed breakdowns of tasks or milestones. For example, a creative agency might need to list stages of a design project, while a construction company may need to track hours worked on specific construction phases.

- Compliance Needs: Some industries, particularly those that deal with government contracts or regulatory requirements, may need to track specific information for compliance purposes, such as billable hours for different types of work or subcontractor hours.

Examples of Industry-Specific Customization

Here are some examples of how time tracking documents can be tailored for specific industries:

Industry Customization Focus Construction Track hours worked on specific projects or stages of construction, material costs, equipment usage, and subcontractor hours. Creative Services Break down hours by different project phases such as brainstorming, design, revisions, and final delivery. Include notes on client feedback and milestones. Consulting Detail How to Handle Overtime in Time Tracking and Billing

When employees or contractors work beyond their regular hours, it’s essential to accurately account for overtime in the billing process. Properly handling these additional hours ensures that you are compensated fairly and that your clients are aware of any extra charges. Clear documentation of overtime hours helps avoid misunderstandings and ensures transparency in your payment requests.

Calculating Overtime Hours

Overtime hours are typically billed at a higher rate than regular working hours. To ensure accuracy, it’s important to clearly differentiate between standard hours and overtime hours. Here’s how to handle this:

- Track Regular and Overtime Hours Separately: Use separate columns or fields in your time records to list standard hours and overtime hours. This makes it easy for clients to see the breakdown and understand the additional charges.

- Apply the Correct Overtime Rate: Ensure that overtime is billed at the appropriate rate, which may be 1.5x, 2x, or another agreed-upon multiplier, depending on the terms set with the client.

- Clarify the Terms: Be clear about what constitutes overtime in your agreement. For instance, overtime may apply after 40 hours a week or after a specific number of hours worked in a day.

Including Overtime Charges in Your Payment Request

When preparing a payment request, it’s important to include the overtime charges in a clear and detailed manner:

- Label Overtime Hours Clearly: Use clear labels such as “Overtime,” “Weekend Work,” or “After-Hours” to distinguish overtime hours from regular hours.

- Provide a Breakdown of Charges: Include the total number of overtime hours worked and the applicable rate. For example, “10 hours of overtime at $45/hour” makes it easy for clients to verify the charges.

- Time Zone Differences: With remote workers located in different time zones, it can be difficult to standardize the hours worked or track when specific tasks were completed.

- Proving Work Hours: Without direct supervision, remote workers may need to provide additional proof of work done, such as activity logs or task reports, to justify the hours billed.

- Non-traditional Work Hours: Many remote workers have flexible schedules, which can make it difficult to track hours based on a standard 9-5 workday.

- Use Digital Tools: Leverage time tracking software or apps that allow remote workers to l

Tips for Designing Professional Time Billing Documents

Creating well-structured and professional time billing documents is crucial for ensuring that clients understand the work completed and the charges associated with it. A clean, organized design not only makes the billing process smoother but also helps reinforce your professionalism and attention to detail. A well-designed document can facilitate faster payments and improve client relationships.

Key Design Principles for Time Billing Documents

Here are some key tips for designing documents that clearly communicate the necessary information and look professional:

- Keep It Simple: Avoid clutter by using a clean layout with clear sections. Stick to essential information and keep the design minimalistic. This ensures that clients can easily navigate through the document without confusion.

- Use Clear Headings: Organize the content with headings for each section (e.g., “Hours Worked,” “Total Cost,” “Client Information”). This helps break the document into digestible parts and makes it easier for clients to find what they need quickly.

- Choose Professional Fonts: Select clean, readable fonts such as Arial, Helvetica, or Times New Roman. Avoid using overly stylized fonts that can detract from the clarity of the document.

- Include a Logo: Adding your company logo to the top of the document helps reinforce your brand identity and adds a professional touch. It also makes the document look more official and polished.

- Maintain Consistent Formatting: Use consistent font sizes, colors, and styles throughout the document. This helps ensure that the document feels cohesive and professional.

- Provide Clear Itemization: List all the services or tasks performed along with the corresponding hours worked and rates charged. This ensures transparency and reduces the likelihood of disputes.

- Highlight Key Information: Bold or highlight the most important elements, such as total charges, payment due date, or client information. This draws the client’s attention to crucial details.

- Include Payment Terms: Clearly state payment terms and conditions. For example, specify the payment due date, late fees, and acceptable payment me

Saving Time with Digital Time Tracking Documents

Using digital time tracking documents can greatly streamline the process of recording work hours and preparing payment requests. These tools eliminate the need for manual calculations and paperwork, enabling you to quickly capture, organize, and send all relevant information. Whether you’re managing a team or working independently, digital solutions can help reduce errors, speed up the process, and make record-keeping far more efficient.

Advantages of Using Digital Tools for Time Tracking

Here are some key benefits of switching to digital tools for tracking work hours and generating billing documents:

- Automatic Calculations: Digital tools often come with built-in features that automatically calculate total hours worked, overtime, and billing amounts. This eliminates manual math errors and saves time.

- Real-time Tracking: Digital systems allow workers to track their hours as they go, ensuring that no time is forgotten or misreported. This is especially helpful for teams working on multiple projects simultaneously.

- Easy Customization: Digital time tracking systems can be customized to fit your needs, allowing you to easily adjust for different billing rates, work conditions, and job-specific requirements.

- Increased Accuracy: With fewer manual inputs and automated systems, digital solutions reduce the risk of mistakes and discrepancies in the final bill.

- Improved Record Keeping: Digital tools allow you to store records securely in the cloud, making them easily accessible for audits, tax preparation, or future reference.

Example of Digital Time Tracking Record

Here is an example of how digital tools can streamline time tracking and billing for services rendered:

Task Date Hours Worked Rate Total Design Project 2024-11-01 6 hours $40/hr $240

Time Tracking and Billing for Remote Workers

Managing the hours worked and billing for remote workers requires clear, accurate, and reliable documentation. Since remote employees or contractors typically work outside of a traditional office setting, it can be more challenging to track their work hours effectively. Proper systems and processes for recording work time and generating payment requests ensure both transparency and timely compensation for remote workers, while also providing clients with a clear breakdown of services rendered.

Challenges in Managing Remote Work Billing

Remote work often comes with unique challenges in time tracking and invoicing. Here are some common issues that arise:

Best Practices for Remote Worker Billing

To ensure accurate billing for remote workers, the following best practices should be followed: