How to Use and Customize a PayPal Invoice Template

Creating professional documents for requesting payments is a crucial part of any business transaction. With the right tools, you can simplify the process and ensure accuracy in your financial dealings. One of the most effective ways to manage this is by using customizable forms that align with your branding and payment terms.

These customizable forms not only save time but also enhance professionalism. Whether you’re an entrepreneur, freelancer, or small business owner, having the right system in place can make your operations smoother and help you get paid faster. In this guide, we’ll explore the best practices for creating and sending payment requests, making sure you are fully prepared for efficient financial management.

PayPal Invoice Template Overview

When managing payments for your products or services, it’s essential to present clear and organized requests that reflect your professionalism. A well-structured payment request document can simplify communication and ensure that your clients have all the necessary information to process payments efficiently. These customizable documents can be tailored to meet specific needs, saving time and reducing errors.

Using a pre-made form for billing allows you to maintain consistency and avoid repetitive manual entry. It also ensures that each detail is captured correctly, from the payment amount to the terms and due dates. This process streamlines the way you handle payments and enhances the overall client experience.

Key Features of a Payment Request Document

- Customizable Layout: Easily modify details to match your business needs.

- Clear Payment Information: Includes the total amount due, due date, and payment instructions.

- Professional Design: Creates a clean and polished look for your documents.

- Record-Keeping: Helps maintain a clear financial history for both parties.

Why Use Customizable Forms?

- Time Efficiency: No need to create new documents from scratch every time.

- Reduced Errors: Predefined fields minimize the chances of making mistakes.

- Consistency: Maintain uniformity across all your business transactions.

Why Use PayPal Invoices for Payments

Utilizing a digital payment request system provides businesses with a reliable and efficient way to handle transactions. By choosing an established platform that integrates seamlessly with various payment methods, you can ensure both security and ease of use for both you and your clients. The ability to customize and automate this process also saves time and reduces the chances of errors.

These payment request documents offer clear, professional communication that fosters trust and transparency between you and your customers. With built-in tracking features, you can monitor payment status, send reminders, and streamline your financial operations, all from one centralized platform.

- Security: Provides a safe environment for financial transactions, reducing the risk of fraud.

- Global Reach: Supports international payments, allowing businesses to work with clients worldwide.

- Ease of Use: Simple setup and easy-to-follow steps for creating and sending requests.

- Payment Tracking: Real-time updates on payment status, helping you stay organized.

- Professional Appearance: Clean, branded forms create a positive impression for your clients.

How to Create a PayPal Invoice

Creating a payment request document involves several simple steps that ensure clarity and accuracy. By using an online platform designed for such transactions, you can quickly generate a professional form tailored to your needs. This process allows you to include all essential details, such as item descriptions, payment terms, and contact information, while maintaining a polished appearance.

To get started, it’s important to gather all the necessary information before you begin. This includes the recipient’s details, the goods or services provided, and the agreed-upon payment amount. Once you have everything prepared, you can begin entering the data into the system, customize the format, and send the document with just a few clicks.

Step-by-Step Process

- Step 1: Log in to your account and locate the payment request section.

- Step 2: Select the option to create a new form or document.

- Step 3: Enter the client’s name, email, and payment details.

- Step 4: Customize the layout and add any specific notes or terms.

- Step 5: Review the document for accuracy and send it to your client.

Tips for Customizing Your Payment Request

- Include a Personal Touch: Add your logo and branding to make the form feel more professional.

- Be Clear and Precise: Specify the payment deadline and any additional instructions.

- Use Consistent Formatting: Ensure all information is easy to read and well-organized.

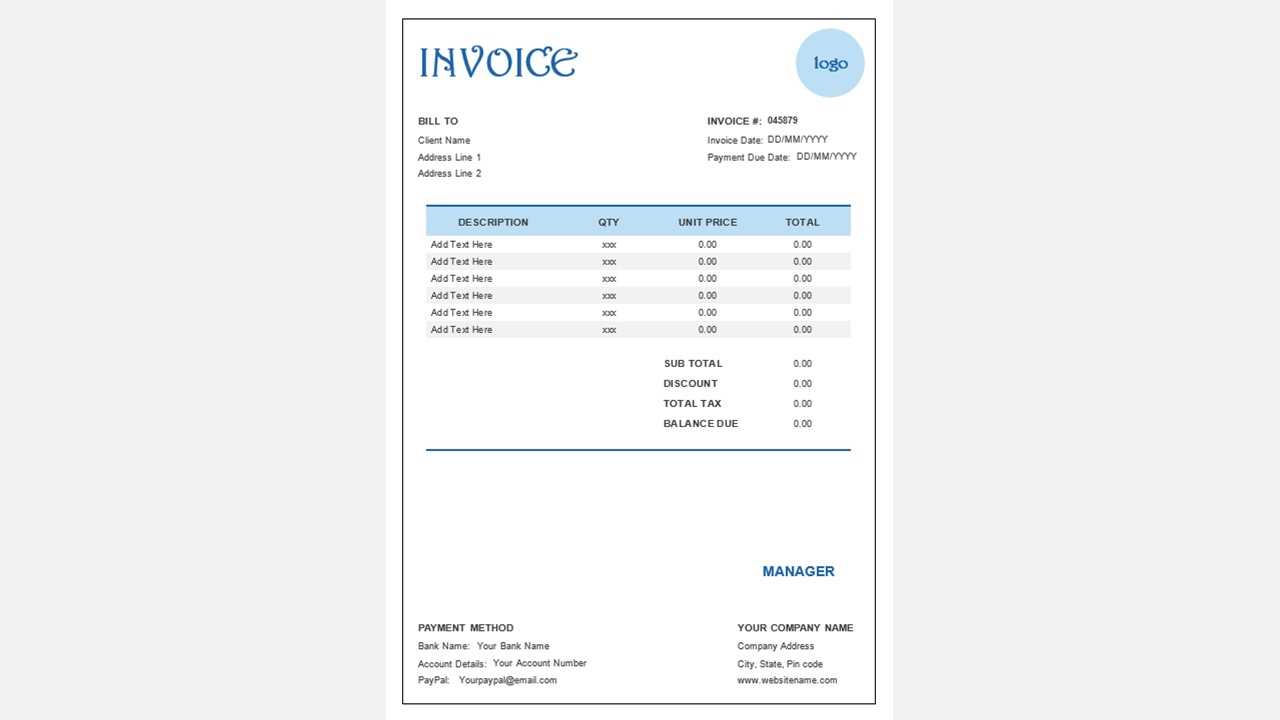

Essential Elements of a PayPal Invoice

When creating a payment request document, there are several key components that must be included to ensure it is clear, professional, and comprehensive. These elements not only help in providing all necessary details but also facilitate easy payment processing for your clients. Including the right information minimizes confusion and ensures that both parties are on the same page.

Below are the fundamental elements that should be present in every payment request document:

| Element | Description |

|---|---|

| Sender and Recipient Information | Include your business details, such as name, address, and contact information, as well as the recipient’s details. |

| Unique Reference Number | Assign a unique number for each document to track and manage payments easily. |

| Itemized List of Goods or Services | Clearly describe the products or services provided, including quantities and individual costs. |

| Total Amount Due | Display the total amount the client needs to pay, including taxes or discounts, if applicable. |

| Payment Terms | Specify due dates, late fees, and accepted payment methods. |

| Notes or Special Instructions | Include any additional information, such as terms of service or other important details. |

By including these essential elements, you ensure that your payment request documents are both effective and professional, helping to facilitate smoother transactions and better communication with your clients.

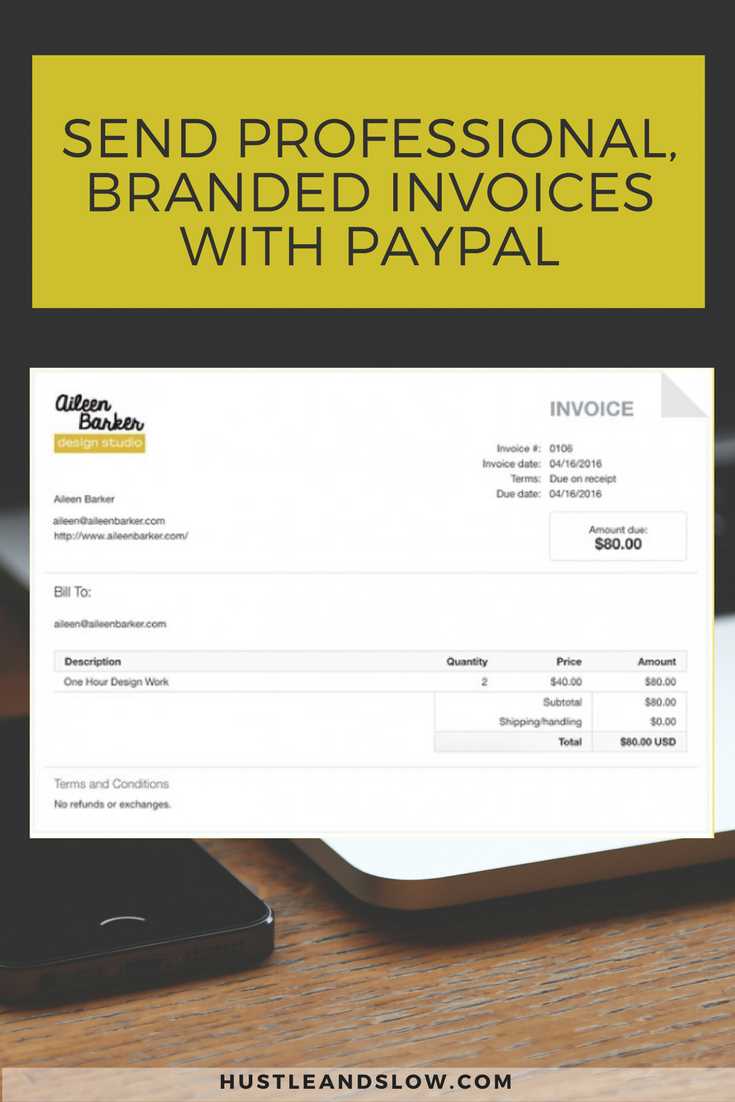

Customizing Your PayPal Invoice Template

Personalizing your payment request forms is an essential step in ensuring that they align with your brand and effectively communicate the necessary details. Customization allows you to add your business identity, adjust the layout, and include any specific terms that are important for each transaction. By tailoring the design and content, you can create a more professional and consistent experience for your clients.

Customization not only improves the aesthetics of the document but also enhances its functionality, making it easier for both parties to track payments and understand the terms clearly. Here are some key areas where customization can make a significant impact:

Key Customization Options

- Branding: Add your logo, business colors, and fonts to match your brand’s identity.

- Payment Terms: Adjust payment deadlines, late fees, and other conditions based on the client or project.

- Additional Fields: Include custom fields for more detailed information like shipping addresses or project-specific terms.

- Message to Client: Personalize the message section to provide special instructions or express gratitude.

Steps to Customize Your Payment Request Document

- Step 1: Choose a design that best fits your business’s style.

- Step 2: Add your logo and adjust the colors to match your branding.

- Step 3: Update the payment terms to reflect specific client agreements.

- Step 4: Input any additional information or notes that may be necessary for the client.

- Step 5: Review the form for accuracy before sending it out.

With these customization options, you can create paym

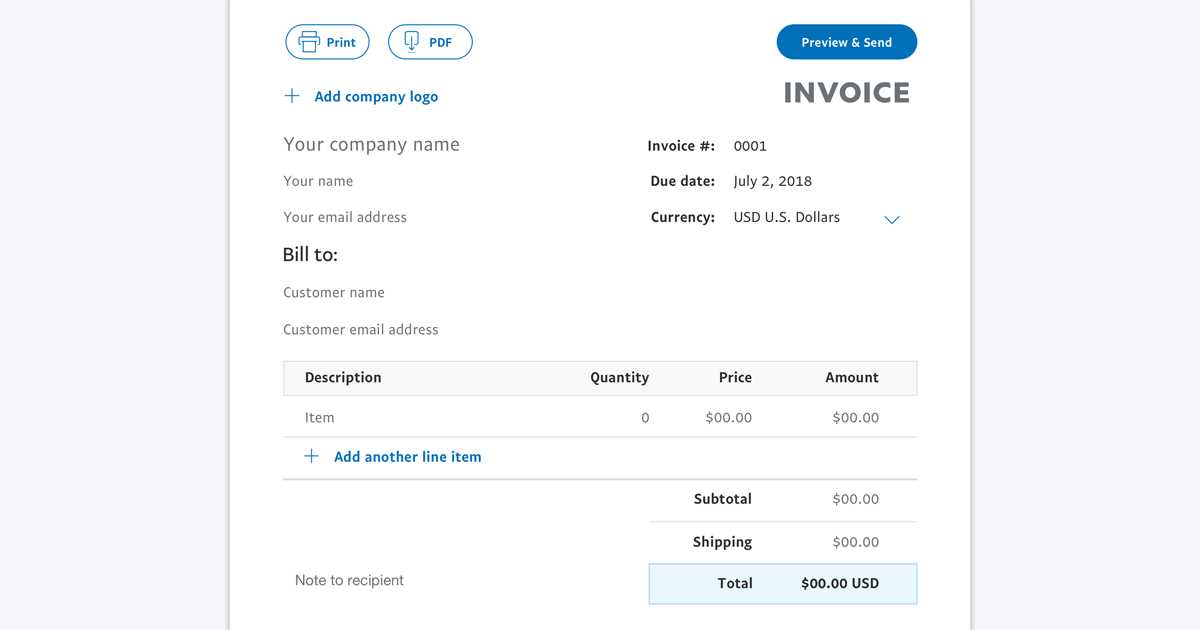

Step-by-Step Guide to PayPal Invoices

Creating a professional payment request document can be a simple and quick process when you follow the right steps. By using an online platform designed for handling financial transactions, you can efficiently generate a well-structured document that includes all the necessary details. This guide will walk you through the entire process, from setting up the form to sending it to your client.

Step 1: Set Up Your Account

Before you can create and send payment requests, you need to set up an account with the platform you’re using. This includes entering your business details, linking your payment methods, and adjusting your preferences for how you want to handle transactions.

Step 2: Create a New Payment Request Document

Once your account is ready, navigate to the section where you can create a new document. This is typically found under a “Billing” or “Transactions” tab. Once there, select the option to generate a new form or request. You will be prompted to enter basic details such as:

- Recipient Information: The name, email, and address of the client.

- Transaction Details: A description of the products or services being billed.

- Amount: The total amount to be paid, including any taxes or discounts.

Step 3: Customize the Document

After entering the basic details, customize the form to include any additional information you deem necessary. You can add specific terms and conditions, adjust the layout, or include personalized messages for your client. Be sure to check for accuracy, including the payment deadline and any agreed-upon terms.

Step 4: Review and Send

Once you’ve filled in all the required information and made any customizations, take a moment to review the document carefully. Ensure all details are correct, from the client’s contact information to the final payment amount. When everything looks good, simply click “Send” to deliver the payment request to your client via email or another communication method.

By following these steps, you can easily create and send professional payment requests, helping you streamline your billing process and maintain a smooth flow of transactions.

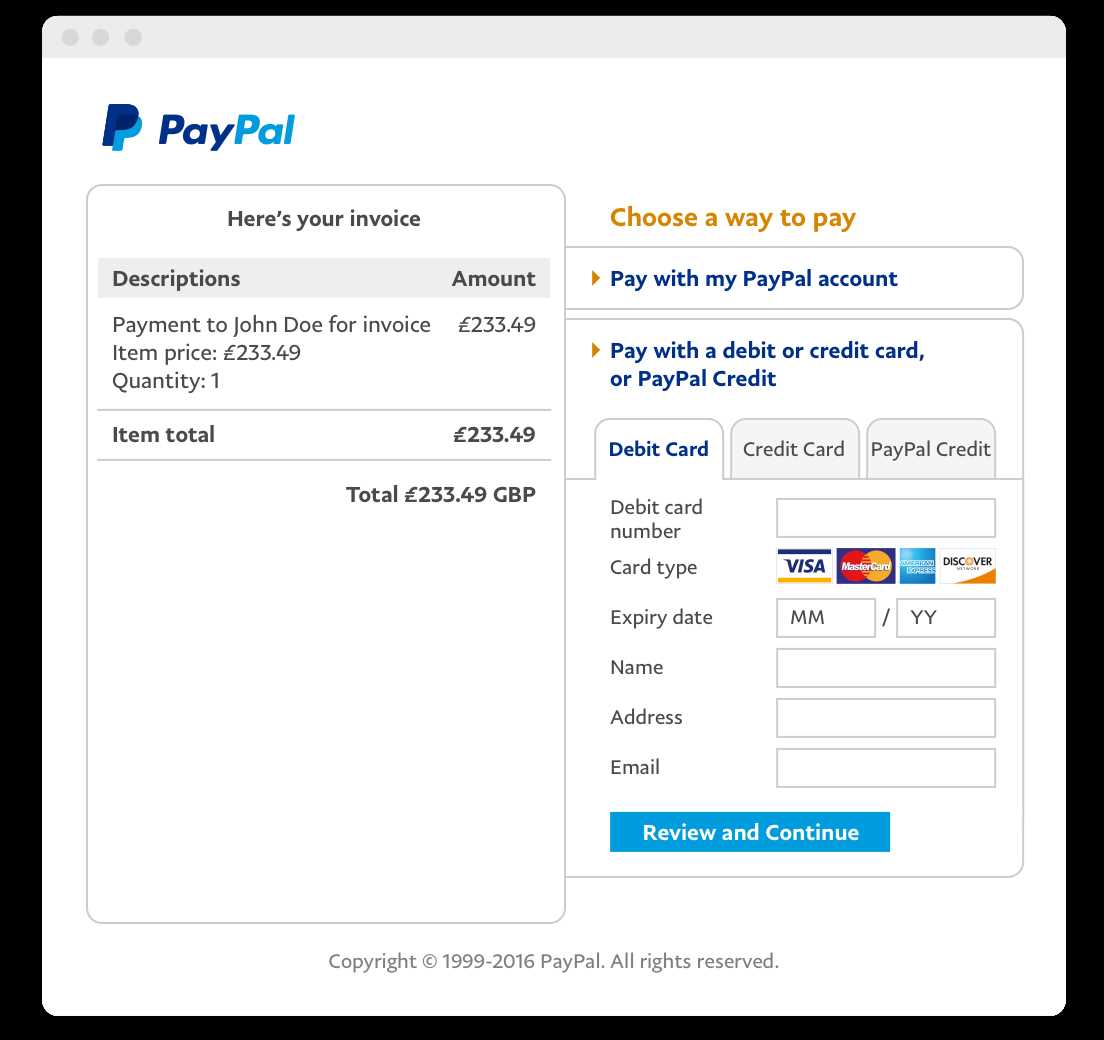

Understanding PayPal Invoice Fees

When using an online platform to generate and send payment requests, it’s important to be aware of any associated fees. These charges can vary depending on the payment method, the location of your business, and the type of transaction being processed. Understanding these fees can help you make informed decisions about which payment solutions to use, as well as how to manage your business finances effectively.

Most platforms charge a fee for processing payments made through credit or debit cards, which is typically a percentage of the total amount. Additional fees may apply if you are sending money internationally or if the transaction involves currency conversion. It’s crucial to account for these costs when setting prices for your products or services, as they can impact your overall revenue.

Be sure to check the fee structure outlined by the platform you’re using and factor these costs into your financial planning. In some cases, you may have the option to pass the fee onto the customer, while in other cases, you may need to absorb the cost yourself. Understanding how these charges work will help you maintain profitability while offering a convenient payment solution for your clients.

How to Send a PayPal Invoice

Sending a payment request is a crucial step in the billing process. Once you’ve created the document with all the necessary details, the next task is to send it to your client efficiently. The platform you’re using will typically offer various methods to ensure the document reaches the intended recipient, whether through email or direct link. Understanding the steps involved ensures you can deliver a seamless and professional experience for both you and your client.

Steps to Send a Payment Request

- Step 1: Log in to your account and navigate to the section for payment requests or billing.

- Step 2: Find the document you wish to send, or create a new one if you haven’t done so already.

- Step 3: Enter the recipient’s email address or select their contact from your client list.

- Step 4: Review the details to ensure accuracy, including the amount due, payment terms, and any specific instructions.

- Step 5: Click the “Send” button to deliver the request directly to your client’s inbox or as a shareable link.

Additional Options for Sending

- Email: The most common method, sending the document directly to the recipient’s email address with all payment details.

- Link Sharing: Generate a secure link to the payment request that can be shared via email, messaging apps, or even embedded on a website.

- Downloadable Document: Some platforms allow you to generate a downloadable version of the payment request that can be sent manually or attached to emails.

By following these simple steps, you can ensure your clients receive the necessary information promptly, making the payment process faster and more efficient.

Tracking Payments with PayPal Invoices

Monitoring the status of your payment requests is a crucial part of managing your business transactions. Keeping track of which payments have been made and which are still outstanding allows you to stay organized and follow up with clients as needed. Most platforms provide features that allow you to track payment statuses in real time, helping you stay on top of your finances.

By tracking payments efficiently, you can ensure that your cash flow remains consistent and address any issues before they become problems. Payment tracking tools also provide valuable insight into your business’s financial health, allowing you to make informed decisions about future operations.

How to Track Payment Status

- Payment Notifications: Most platforms will send automatic notifications when a payment is made or when the payment status changes.

- Transaction History: You can access a detailed transaction history, showing all payments sent and received, including dates and amounts.

- Status Updates: Each payment request will have a status indicator (e.g., “Paid,” “Unpaid,” “Pending”), so you can easily see which transactions need attention.

- Automated Reminders: Some platforms allow you to set up automated reminders to notify clients of overdue payments.

Why Payment Tracking is Important

- Timely Follow-ups: It helps you follow up on outstanding payments without delay, improving cash flow.

- Accurate Financial Records: Keeping track of every transaction ensures that your financial records are accurate and up-to-date.

- Improved Client Communication: Having clear information about payment statuses allows you to communicate effectively with clients about their payment schedules.

Using these tracking features allows you to take control of your financial management, reducing stress and ensuring timely payments for your services or products.

Common Issues with PayPal Invoices

While digital payment requests provide an efficient way to manage transactions, they are not without their challenges. From incorrect details to technical glitches, various issues can arise that may cause confusion for both the sender and the recipient. Identifying and addressing these common problems early on can help prevent delays in payments and ensure smoother financial operations.

In this section, we will explore some of the most frequent issues that users face when creating or sending payment requests and offer solutions to address them.

Common Issues with Payment Requests

- Incorrect Payment Amount: One of the most common mistakes is entering the wrong amount due. Always double-check the total, including taxes, discounts, or additional fees, before sending the document.

- Missing or Incorrect Client Details: If the recipient’s contact information is incorrect or missing, the payment request may not reach the right person. Ensure that the email address and name are accurate.

- Unclear Payment Terms: Sometimes, the terms regarding due dates, late fees, or accepted payment methods are not clearly stated, leading to confusion and delays. Always specify these details clearly to avoid misunderstandings.

- Payment Not Received or Processed: Technical issues, such as network errors or server problems, may prevent the payment from being processed. If this happens, check your payment platform’s status page or contact support for assistance.

- Currency Conversion Issues: International transactions may experience discrepancies due to currency conversion. Be aware of any conversion fees or potential discrepancies between the quoted amount and what the client pays.

How to Address These Issues

- Double-check all entries: Verify the recipient’s details, payment amount, and terms before sending the document.

- Confirm payment status: If payment isn’t received, check the platform’s payment tracking system to confirm the transaction’s status and resolve any issues with the payment provider.

- Communicate with the client: If there’s any confusion or a mistake,

How to Adjust Payment Terms in PayPal

Adjusting payment terms is an important aspect of managing transactions with clients. It allows you to set clear expectations regarding when payments are due, what payment methods are accepted, and any penalties for late payments. Customizing these terms helps ensure smoother financial transactions and reduces the risk of misunderstandings.

Most online platforms allow you to modify the payment conditions within the payment request document, giving you flexibility in tailoring the terms to suit your business needs or specific client agreements. Whether you need to offer extended deadlines, apply late fees, or define installment plans, adjusting these settings is simple and can be done quickly.

Steps to Adjust Payment Terms

- Step 1: Log into your account and navigate to the section where you can create or manage payment requests.

- Step 2: Select the document you wish to edit, or create a new one if needed.

- Step 3: In the payment terms section, specify the due date, late fee policies, or any discounts you may be offering for early payments.

- Step 4: Adjust payment methods to include options such as credit cards, bank transfers, or other digital payment methods.

- Step 5: Save the changes and review the document to ensure that all terms are clear and accurate.

Things to Consider When Setting Payment Terms

- Due Dates: Set a clear due date that is reasonable for both parties. Avoid making it too short, which may cause unnecessary pressure on the client.

- Late Fees: If you plan to charge late fees, clearly state the fee structure and how it will be applied to overdue payments.

- Accepted Payment Methods: Specify which payment methods you accept, and consider offering flexibility to accommodate your client’s preferences.

- Installment Options: If you offer payment plans, be sure to define the payment schedule, amounts, and any interest or fees for installments.

By adjusting your payment terms, you can create a more

Integrating PayPal Invoices with Your Business

Integrating payment request systems into your business operations streamlines your billing process, enhances efficiency, and helps maintain consistency across all financial transactions. By incorporating digital payment solutions, you can automate much of the invoicing process, reduce administrative tasks, and offer a professional experience to your clients. This integration can help you save time and avoid errors, ensuring that payments are processed smoothly.

Whether you run a small business or a large enterprise, using a centralized platform to manage all your transactions can improve cash flow management, reduce late payments, and simplify financial reporting. Below are some ways to effectively integrate payment request systems into your daily operations:

How to Integrate Payment Requests into Your Business

- Automated Billing: Set up automatic recurring requests for subscription-based services or regular clients to ensure timely payments without manual intervention.

- Custom Branding: Personalize payment documents with your business logo, colors, and fonts to maintain a cohesive brand image throughout all communications.

- Accounting Software Integration: Link your payment system to accounting tools to automatically update your financial records, track income, and generate reports.

- Client Management: Maintain a client database that allows you to easily send payment requests, follow up on outstanding balances, and customize communications based on the client’s history.

Benefits of Integration

Benefit Description Efficiency Automates much of the billing process, saving time and reducing manual errors. Improved Cash Flow Ensures timely payments, reducing the chances of late fees and improving financial liquidity. Consistency Maintains a professional and consistent experience for clients, enhancing brand perception. Scalability Allows businesses to easily scale their operations without increasing administrative workload. By integrating payment request systems with your business operations, you not only save time but also create a more reliable and professional workflow. The ability to automate and customize billing ensures that you can focus on growing your business while maintaining strong client relationships.

Advantages of Using PayPal for Invoicing

Using a digital payment system to manage billing and payment requests offers a variety of benefits for businesses, ranging from convenience and efficiency to enhanced security. Leveraging a trusted online platform simplifies the entire payment collection process, making it easier to generate, send, and track financial documents. With built-in features designed to help businesses handle transactions seamlessly, this system is a valuable tool for both small businesses and large enterprises.

When it comes to handling payments, there are several key advantages to using an online platform that specializes in payment processing. Here are some of the most significant benefits:

Key Benefits of Using an Online Payment System

- Speed and Efficiency: Digital platforms streamline the entire process of creating and sending payment requests, allowing businesses to save time and reduce administrative tasks.

- Global Reach: You can easily send payment requests to clients anywhere in the world, supporting multiple currencies and offering a range of payment methods, including credit cards and bank transfers.

- Security: Online platforms offer robust security measures, such as encryption and fraud protection, ensuring that both you and your clients are protected from potential threats.

- Professional Appearance: Payment documents can be customized with your business logo, colors, and branding, helping you maintain a professional image with clients.

- Automatic Payment Tracking: Many platforms automatically track the status of payments, providing you with real-time updates on whether the payment has been made, is pending, or overdue.

- Convenience: Clients can easily make payments online, reducing the need for physical checks or bank transfers and increasing the likelihood of timely payments.

- Integration with Accounting Tools: Many platforms can integrate with accounting software, automatically updating your financial records and simplifying tax reporting.

By adopting an efficient and secure payment system, businesses can streamline their billing process, reduce errors, and improve cash flow. The combination of ease of use, security, and flexibility makes it a top choice for businesses seeking to optimize their financial management and create a better experience for their clients.

How to Add Taxes to PayPal Invoices

When creating payment requests, it’s often necessary to include applicable taxes to ensure that both you and your clients comply with local regulations. Many digital payment systems provide tools to automatically calculate and apply tax rates based on your location and business type. This can save you time and help maintain accuracy in your billing process. By adding taxes to your payment documents, you ensure that the correct amount is billed to your clients, avoiding any surprises or discrepancies during the payment process.

Here’s a step-by-step guide on how to add taxes to your payment request documents using a popular payment system:

Steps to Add Taxes

- Step 1: Log into your account and navigate to the section where you create or edit payment requests.

- Step 2: In the document creation screen, locate the tax section or the option to add tax.

- Step 3: Enter the tax rate. This could be a flat rate or a percentage, depending on your local regulations. You may also have the option to apply different rates based on the item or service being provided.

- Step 4: If applicable, select the correct tax type (e.g., sales tax, VAT, GST) based on your region.

- Step 5: Verify the total amount with the tax applied before finalizing the payment request.

Additional Tips

- Automate Tax Calculations: Some systems can automatically calculate taxes based on your business location and the buyer’s location. Make sure your account settings are configured to use these features.

- Tax Exemptions: If your products or services are tax-exempt, you can manually adjust the tax rate or remove it entirely for specific clients or transactions.

- Review Tax Regulations: Ensure that the tax rates applied are correct by staying up to date with any changes in your local tax laws.

Adding taxes to your payment requests ensures that your billing is compliant and transparent, giving clients a clear breakdown of charges and preventing any confusion during the payment process.

Managing Multiple Invoices in PayPal

Managing multiple payment requests efficiently is essential for businesses that deal with several clients or ongoing projects. With the right system in place, you can streamline the process of sending, tracking, and organizing your payment documents. The ability to manage several requests at once allows you to stay organized, reduce errors, and ensure timely follow-ups. Using a central platform for these tasks helps you stay on top of your finances and maintain professionalism in your communications.

Here’s how to manage multiple payment requests effectively in your account:

Steps to Manage Multiple Payment Requests

- Step 1: Use the dashboard or management section of your platform to view all active and past requests. This overview allows you to track which payments have been made and which are still pending.

- Step 2: Organize your requests by categories such as due dates, client names, or project types. This can help you prioritize and focus on the most urgent tasks.

- Step 3: Set reminders or automated notifications for upcoming due dates or overdue payments to ensure nothing slips through the cracks.

- Step 4: If you need to issue multiple requests for the same client or project, consider creating a recurring billing setup to save time on future transactions.

- Step 5: Track payment status in real-time, reviewing any unpaid or partially paid requests so you can follow up promptly.

Managing Multiple Requests Efficiently

Task Action Organizing Requests Use tags or categories to group requests based on due dates, clients, or other criteria. Tracking Payments Monitor the status of each request to ensure timely follow-ups on overdue or unpaid amounts. Automating Reminders Alternatives to PayPal Invoice Templates

While digital platforms offer a convenient way to manage payment requests, there are several other tools and methods available for businesses looking for alternatives. These options provide various features that can cater to different business needs, whether it’s custom branding, more detailed financial reporting, or integration with existing accounting systems. Choosing the right solution depends on factors like ease of use, cost, and the specific needs of your business.

Here are some alternatives to traditional online payment request systems that can help you manage transactions and billing more effectively:

Popular Alternatives for Billing and Payment Requests

- Accounting Software: Platforms like QuickBooks, Xero, and FreshBooks offer comprehensive accounting features, including automated payment requests, tax calculations, and client management. These tools are ideal for businesses that require detailed financial records and reports.

- Standalone Billing Solutions: Services like Zoho Invoice and Invoice2go allow you to create and manage payment requests easily, often with customizable templates and the ability to accept various payment methods, including credit cards and bank transfers.

- Cloud-Based Financial Platforms: Tools like Stripe and Square provide invoicing features as part of their broader payment processing services. These solutions are well-suited for businesses that need an integrated system for both payment processing and billing.

- Manual Methods: For those who prefer a more hands-on approach, creating invoices using spreadsheet tools like Microsoft Excel or Google Sheets can provide full control over formatting and content. However, this method requires more time and attention to detail.

- Custom-Built Solutions: Some businesses prefer to create their own billing system using website builders or CMS platforms like WordPress, which offer plugins or extensions designed for invoicing and payment tracking. This option requires more technical knowledge but provides full customization.

Considerations When Choosing an Alternative

- Ease of Use: Ensure that the solution you choose is user-friendly and aligns with your level of expertise, so you can quickly adapt without steep learning curves.

- Cost: Compare the pricing models of different platforms. Some may offer free basic versions, while others charge based on usage or features.

- Integration: Consider whether the tool can integrate with your existing accounting or CRM software to streamline data management and reduce manual input.