Best Invoice and Statement Templates for Business Efficiency

In the fast-paced world of business, managing financial records efficiently is essential for maintaining smooth operations. Properly formatted documents help ensure clear communication between companies and their clients, facilitating timely payments and reducing confusion. Creating uniform, professional-looking files can greatly enhance your business’s credibility and organization.

Whether you’re a freelancer, a small business owner, or managing a large corporation, having the right structure for billing and financial reporting can save both time and resources. Pre-designed formats are an invaluable tool for ensuring consistency and accuracy, enabling you to focus on other important aspects of your business. These tools offer flexibility and can be customized to suit your unique needs, ensuring a streamlined process from start to finish.

By adopting the right format, you can easily track transactions, keep your clients informed, and maintain clear records for future reference. Embracing digital solutions for these essential documents can further improve efficiency, reducing the manual work involved in generating or editing files. With the right approach, you’ll be equipped to handle any financial situation with professionalism and ease.

Invoice and Statement Templates for Businesses

Efficient financial documentation plays a crucial role in ensuring smooth business operations. Having well-organized, consistent documents for tracking payments, summarizing transactions, and managing client interactions can greatly improve overall efficiency. For any business, utilizing pre-designed formats can help simplify the process and reduce errors, making it easier to maintain accurate records and communicate effectively with clients.

Why Businesses Need Structured Documents

Without a standardized approach, managing finances becomes a cumbersome and error-prone task. By adopting a clear structure, businesses can minimize confusion, ensure compliance, and improve cash flow management. Having a uniform design for all financial records not only enhances the company’s professionalism but also saves valuable time that would otherwise be spent on creating documents from scratch.

Benefits of Pre-designed Formats for Businesses

Consistency is key when it comes to managing financial paperwork. Using ready-made structures ensures that all essential details are included and presented clearly. Furthermore, these documents can be easily tailored to fit a company’s specific needs, whether it’s adjusting for different billing cycles or incorporating branding elements. Pre-designed solutions are especially useful for small and medium-sized businesses that need a simple yet professional way to handle daily transactions.

By relying on efficient, customizable formats, businesses can ensure they are always prepared, reducing administrative costs and allowing them to focus more on growth and development.

Why Templates Save Time and Effort

In any business, managing financial documents efficiently can take up a significant amount of time. The process of creating accurate, professional records from scratch for every transaction can be tedious and error-prone. Using pre-designed structures can help streamline this task, allowing businesses to save valuable time while maintaining consistency and accuracy across all their records.

Here are some ways these ready-made structures help reduce the time spent on document creation:

- Faster Setup: Pre-formatted documents eliminate the need to start from scratch, providing a structure that only requires minimal customization for each new entry.

- Reduced Errors: With established fields and categories, there’s less room for human error, ensuring all necessary information is included and correctly formatted.

- Increased Productivity: By automating the layout, users can focus more on content rather than design, allowing for faster processing and fewer distractions.

- Consistency Across Documents: Using the same structure for each record helps businesses maintain a professional, uniform appearance in all their communication, which is important for branding and trust.

Additionally, these structures can be easily stored and reused for future purposes, reducing the need to re-enter the same information repeatedly. The result is a significant reduction in the administrative workload, allowing businesses to redirect their focus toward more strategic tasks.

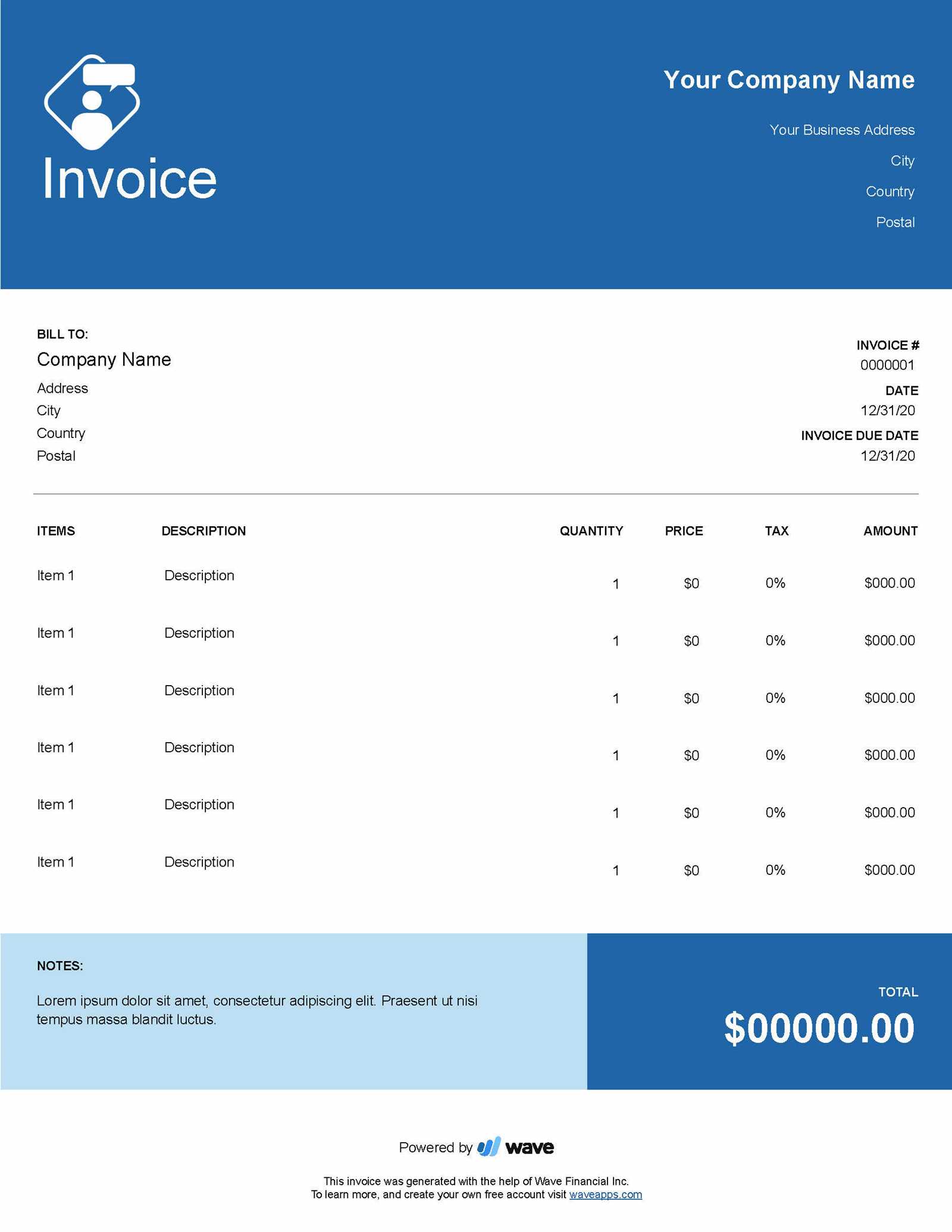

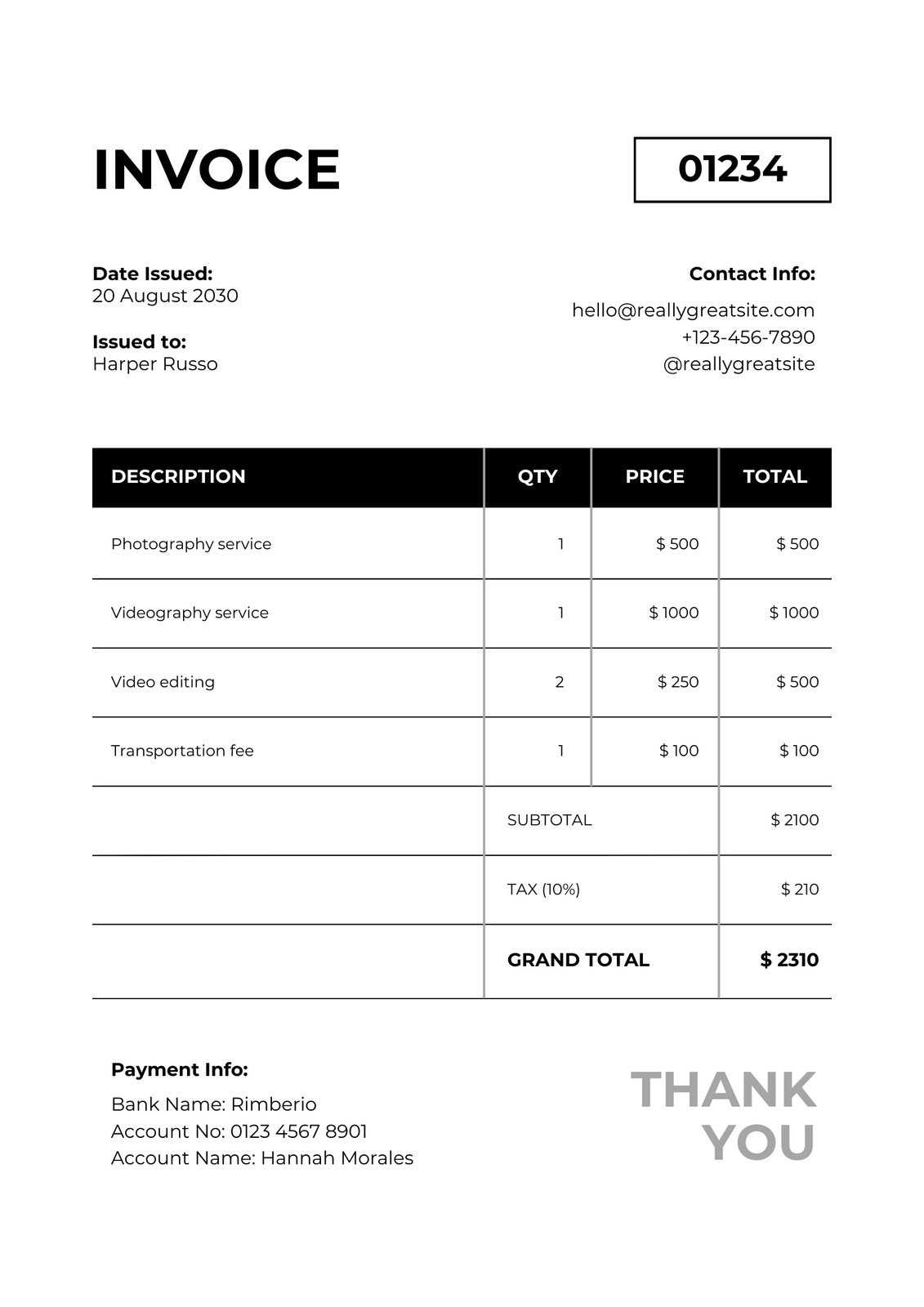

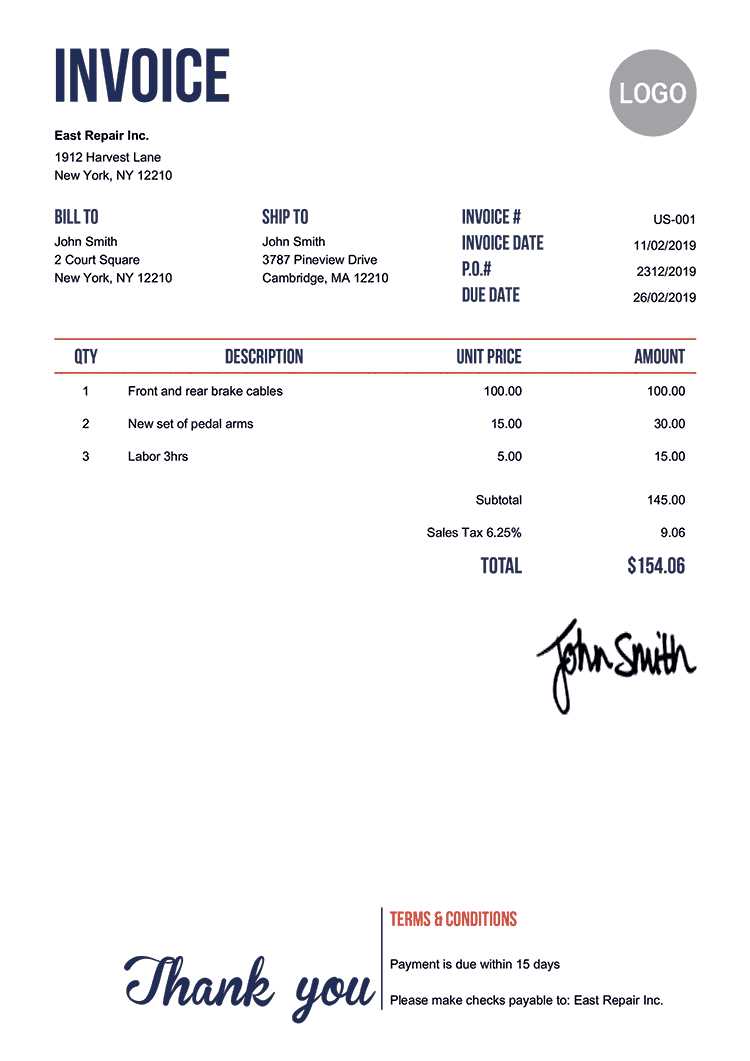

Essential Features of an Invoice Template

For any business, creating clear, accurate, and professional documents is crucial for maintaining smooth financial operations. The right structure for these records ensures that all necessary details are included, reducing confusion and minimizing errors. A well-designed document format includes specific components that make the process of billing or transaction tracking efficient and effective.

Here are the core elements that every properly designed document should include:

- Contact Information: Clear details about both the business and the client, including names, addresses, phone numbers, and email addresses, are essential for proper communication.

- Unique Reference Number: A distinct identification number ensures easy tracking and reference for future communications or inquiries.

- Service or Product Details: A concise list of the services provided or products sold, along with their corresponding quantities, unit prices, and any applicable discounts.

- Total Amount Due: A final, clear sum of money owed, including taxes, shipping, or any additional charges, ensures there’s no confusion about the balance that needs to be settled.

- Payment Terms: Clear instructions on how and when payment should be made, including accepted payment methods and due dates, help avoid any delays or misunderstandings.

- Business Branding: Including company logos, color schemes, and other branding elements creates a professional image and reinforces brand identity.

By including these essential features, businesses can create professional, accurate documents that facilitate smooth transactions and help build trust with clients.

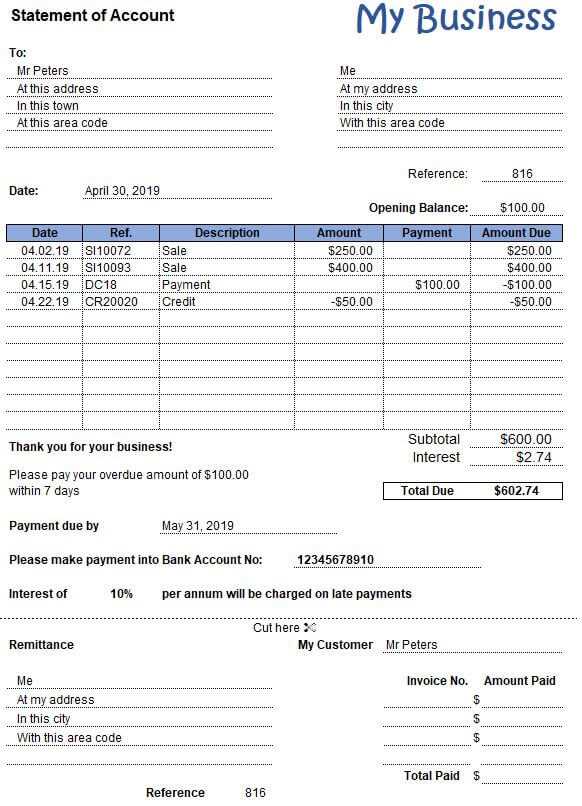

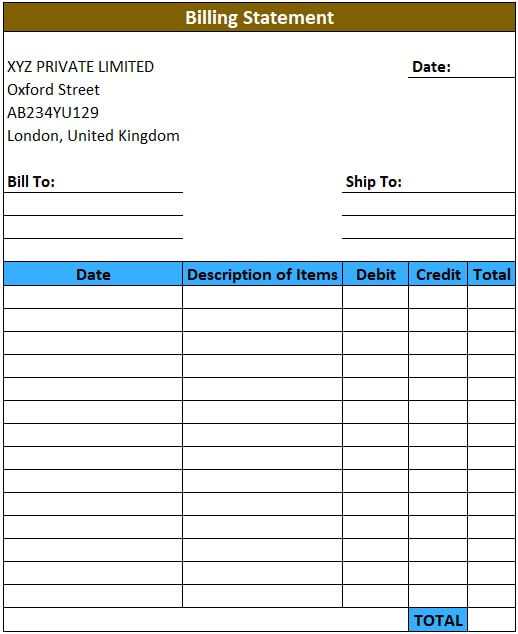

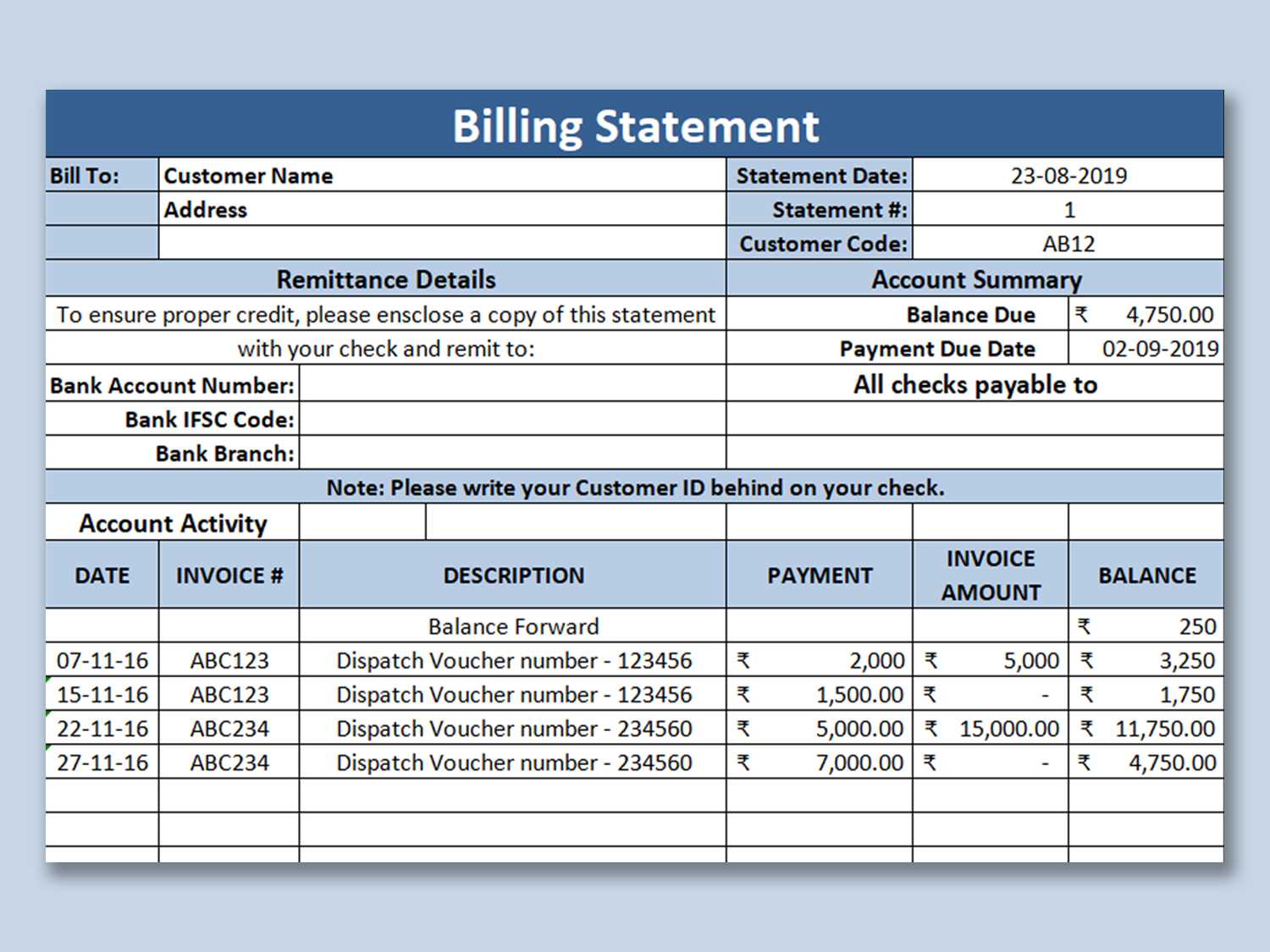

How Statement Templates Simplify Reporting

Accurate financial reporting is essential for tracking a company’s performance, understanding cash flow, and making informed business decisions. Having a consistent format for summarizing transactions makes it easier to compile, analyze, and share data. With ready-made structures, this process becomes more streamlined, reducing the time and effort needed to generate reports while ensuring they remain clear and organized.

Using pre-structured documents to summarize financial activity provides several key advantages:

- Consistency: A fixed format ensures that all relevant information is included, making it easier to compare different periods or accounts.

- Reduced Errors: With predefined fields, the risk of omitting important details or making mistakes in calculations is minimized, leading to more accurate reports.

- Time Savings: Ready-to-use structures save businesses the trouble of starting from scratch every time a report is needed, allowing more time for analysis and decision-making.

- Improved Clarity: A well-organized format enhances readability, making it easier for stakeholders to quickly grasp key financial details.

- Efficient Data Management: These formats can be easily updated or customized, allowing businesses to adjust for changes such as new clients, services, or accounting periods.

By implementing a standardized system for summarizing financial data, companies can ensure that reports are not only easy to generate but also insightful, helping to improve financial oversight and strategic planning.

Customizing Templates for Your Brand

Maintaining a consistent brand image across all business communications is essential for building trust and recognition. When creating essential financial records, tailoring the design to reflect your company’s identity not only adds a professional touch but also strengthens brand visibility. Customizing these essential documents ensures they align with your overall branding strategy, making your company stand out in every interaction.

Key Elements for Brand Customization

To effectively customize financial documents for your brand, consider the following elements:

| Element | Customization Tips |

|---|---|

| Logo | Place your company logo at the top of the document to increase brand recognition. |

| Color Scheme | Use your brand’s colors for headings, borders, or backgrounds to reinforce your visual identity. |

| Font Style | Choose fonts that are consistent with your company’s brand guide, ensuring readability and a professional appearance. |

| Contact Information | Highlight your business’s contact details in a way that aligns with your brand’s tone and style. |

Benefits of Customization

Customizing financial documents not only ensures your brand’s aesthetic is present but also helps in creating a cohesive and professional experience for your clients. Well-branded records enhance your credibility, showcase attention to detail, and can even make clients feel more connected to your business. By reflecting your unique identity in every document, you create a lasting impression while maintaining clarity and professionalism in your communications.

Free vs Paid Invoice Template Options

When it comes to choosing the right design for financial documents, businesses often face the decision between free or premium options. Both have their advantages, but the choice largely depends on the complexity of your needs, your budget, and the level of customization required. Understanding the differences between free and paid solutions can help you make an informed decision about which option best suits your business.

Advantages of Free Solutions

Free document formats are an excellent choice for businesses just starting or those with minimal financial management needs. These options typically offer the basic structure necessary for billing and tracking, making them quick and easy to implement. Some key benefits include:

- No Initial Cost: As the name suggests, free solutions come at no cost, making them an appealing option for small businesses or freelancers.

- Ease of Use: Simple and straightforward designs often require little to no training or technical skills to use effectively.

- Quick Setup: Free formats can be downloaded or accessed immediately, allowing for fast implementation and usage.

Benefits of Paid Solutions

While free options are useful, premium solutions offer more advanced features and customization, making them ideal for businesses with more complex needs. Paid services typically provide enhanced functionality, such as:

- Customization: Premium options often allow for greater design flexibility, letting businesses incorporate logos, color schemes, and specific branding elements.

- Advanced Features: Paid formats may include automated calculations, integration with accounting software, or enhanced reporting capabilities.

- Ongoing Support: With a paid solution, businesses usually have access to customer support, ensuring issues are resolved quickly.

Ultimately, the choice between free or paid options depends on the specific needs of your business, whether you’re looking for simplicity and affordability or advanced features and a more professional look.

Top Tools for Creating Templates

When it comes to designing professional documents for tracking transactions or managing payments, having the right tools can make all the difference. Various platforms and software offer powerful features that help streamline the process of creating, customizing, and automating these essential records. From simple drag-and-drop interfaces to more advanced design capabilities, these tools cater to businesses of all sizes and needs.

Here are some of the most popular tools for creating efficient, professional documents:

| Tool | Key Features | Best For |

|---|---|---|

| Canva | Easy-to-use, customizable designs with drag-and-drop functionality. Offers a range of templates. | Small businesses and freelancers looking for quick, visually appealing solutions. |

| Microsoft Word | Offers templates with advanced formatting options. Integrates well with other Microsoft tools. | Businesses needing highly customizable documents with a familiar interface. |

| Google Docs | Collaborative platform with simple, accessible document creation. Cloud-based for easy sharing. | Small teams or startups that need quick document generation and cloud access. |

| Zoho Invoice | Specialized tool for creating professional, customizable financial records. Includes automation features. | Businesses that need automated solutions and integration with accounting software. |

| FreshBooks | Cloud-based platform with templates tailored for small businesses. Offers invoicing, reporting, and time tracking. | Freelancers or small business owners looking for a comprehensive invoicing solution. |

Each tool provides unique advantages depending on the level of customization, automation, and integration your business requires. Choosing the right one can save significant time and effort, ensuring your financial records are both professional and easy to manage.

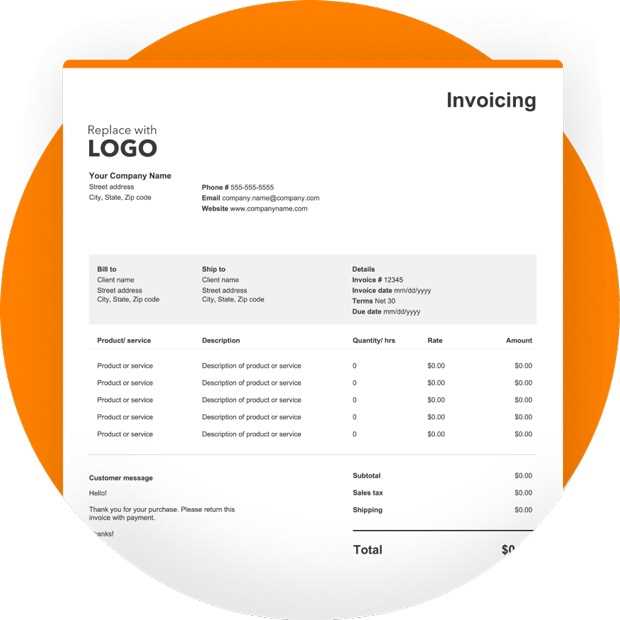

Design Tips for Professional Invoices

Creating polished, professional-looking financial documents not only ensures clarity but also enhances your business’s credibility. A well-designed format can make it easier for clients to understand the details of their transactions while conveying a sense of professionalism. By focusing on key design elements, you can create documents that are both functional and visually appealing.

Key Elements to Include

- Company Branding: Incorporate your logo, brand colors, and font choices to ensure consistency with your business’s identity.

- Clear Layout: Use a structured, easy-to-read layout with sufficient spacing. Important details like payment terms and amounts due should be prominent.

- Itemized List: Break down the services or products provided into clear, itemized sections with descriptions, quantities, and prices.

- Contact Information: Display your company’s contact details–such as address, phone number, and email–clearly at the top or bottom of the document.

- Legal Information: Ensure you include any necessary legal terms, tax information, or disclaimers that may apply to the transaction.

Design Tips for a Professional Appearance

- Use White Space: Don’t overcrowd the document. Adequate white space improves readability and gives the document a clean, uncluttered look.

- Consistent Fonts: Stick to 1-2 fonts. Choose easy-to-read options like Arial, Helvetica, or Times New Roman, and use different font weights (bold, regular) to create hierarchy.

- Highlight Key Information: Use bold text or colored highlights for important information, such as the total amount due or payment due dates.

- Minimal Design Elements: Keep graphic elements to a minimum to avoid distraction. Simple lines, borders, or icons can help to emphasize sections without overwhelming the reader.

- Align Text Properly: Ensure all text is aligned consistently, especially numeric data (like totals or dates), for a neat, professional finish.

- Choose the Right Software: Select a platform that integrates seamlessly with your accounting system. Look for tools that support automated generation, calculation, and delivery of records.

- Set Up Recurring Transactions: Many automated platforms allow you to set up recurring billing schedules for regular clients or subscription-based services, eliminating the need to create new records manually every time.

- Customize Reminders: Set up automated reminders to notify clients of upcoming payments or overdue balances, ensuring timely collection without needing manual follow-ups.

- Integrate Payment Systems: Connect payment gateways to allow clients to pay directly through the generated records, which can automatically update your system when payments are made.

- Automate Reports: Set up automated reporting to generate summaries of transactions or outstanding balances on a regular basis. This allows you to monitor cash flow with minimal effort.

- Time Savings: Reduces the time spent on manual data entry and administrative tasks.

- Consistency: Ensures that all records are created with the same format and accurate details, minimizing errors.

- Improved Cash Flow: Automated reminders and payment tracking help ensure faster payments and fewer overdue balances.Improving Cash Flow with Statements

Effective management of cash flow is essential for maintaining a healthy business. One of the most critical aspects of cash flow management is ensuring timely payments from clients. Regularly updating financial records that summarize outstanding balances can help identify issues early and improve the likelihood of receiving payments on time. By providing clear, detailed overviews of amounts due, businesses can prompt clients to settle their balances efficiently.

How Financial Summaries Help Improve Cash Flow

Financial records that detail outstanding payments offer several advantages when it comes to managing cash flow. Here are some key ways they help:

- Prompt Payments: Regularly sending clear, professional documents helps remind clients of their obligations, encouraging timely payments and reducing delays.

- Tracking Outstanding Balances: Financial overviews allow businesses to track which clients owe money and which payments are overdue, making it easier to follow up on delinquent accounts.

- Accurate Records for Better Forecasting: Regular updates of financial records help businesses predict cash flow more accurately, allowing for better financial planning and budgeting.

- Professionalism and Trust: Well-structured documents contribute to a professional image and build trust with clients, who may be more willing to settle debts promptly when they feel confident in the business’s operations.

Key Tips for Using Financial Summaries Effectively

To make the most of financial documents for cash flow management, businesses should follow these best practices:

- Send Regular Updates: Providing consistent updates ensures clients are always aware of their current balances and payment deadlines.

- Use Clear Payment Terms: Make it easy for clients to understand when payments are due, including any late fees or penalties for overdue amounts.

- Follow Up Promptly: If a payment becomes overdue, use these summaries as a tool to follow up quickly, showing clients the outstanding balance and reminding them of payment terms.

- Offer Multiple Payment Options: The easier you make it for clients to pay, the more likely they are to settle their balances quickly.

By effectively using these documents to stay on top of outstanding balances, businesses can improve their cash flow, minimize the risk of bad debt, and ensure smoother financial operations overall.

Benefits of Using Digital Invoice Templates

In today’s fast-paced business environment, digital solutions are becoming increasingly essential for streamlining administrative tasks. Using electronic formats for creating billing records can save time, reduce errors, and enhance efficiency. Digital documents not only improve the speed at which transactions are processed but also offer several other key advantages over traditional paper-based methods.

Here are some of the main benefits:

- Time Efficiency: Digital records can be created, edited, and sent in a matter of minutes. Automation features such as recurring schedules or pre-filled client information further reduce the time spent on creating each new document.

- Cost Savings: By eliminating the need for paper, ink, and postage, businesses can significantly reduce operational costs. The use of online platforms also often eliminates subscription or maintenance fees associated with traditional software.

- Accuracy: Automation helps eliminate common human errors such as incorrect calculations or missing details, ensuring that all records are accurate and professional.

- Easy Customization: Digital formats allow businesses to tailor documents to reflect their unique branding, from logo placement to color schemes, creating a cohesive and professional presentation.

- Environmentally Friendly: Reducing the reliance on paper helps lower your company’s carbon footprint, contributing to environmental sustainability.

- Accessibility: Digital records can be stored and accessed from anywhere with an internet connection. This flexibility allows for easier tracking, sharing, and retrieval of important financial information.

- Security: Electronic documents can be encrypted or password-protected, providing enhanced security over paper records, which are more susceptible to loss or theft.

By leveraging digital solutions, businesses can not only streamline their internal processes but also improve client experiences and contribute to a more sustainable future.

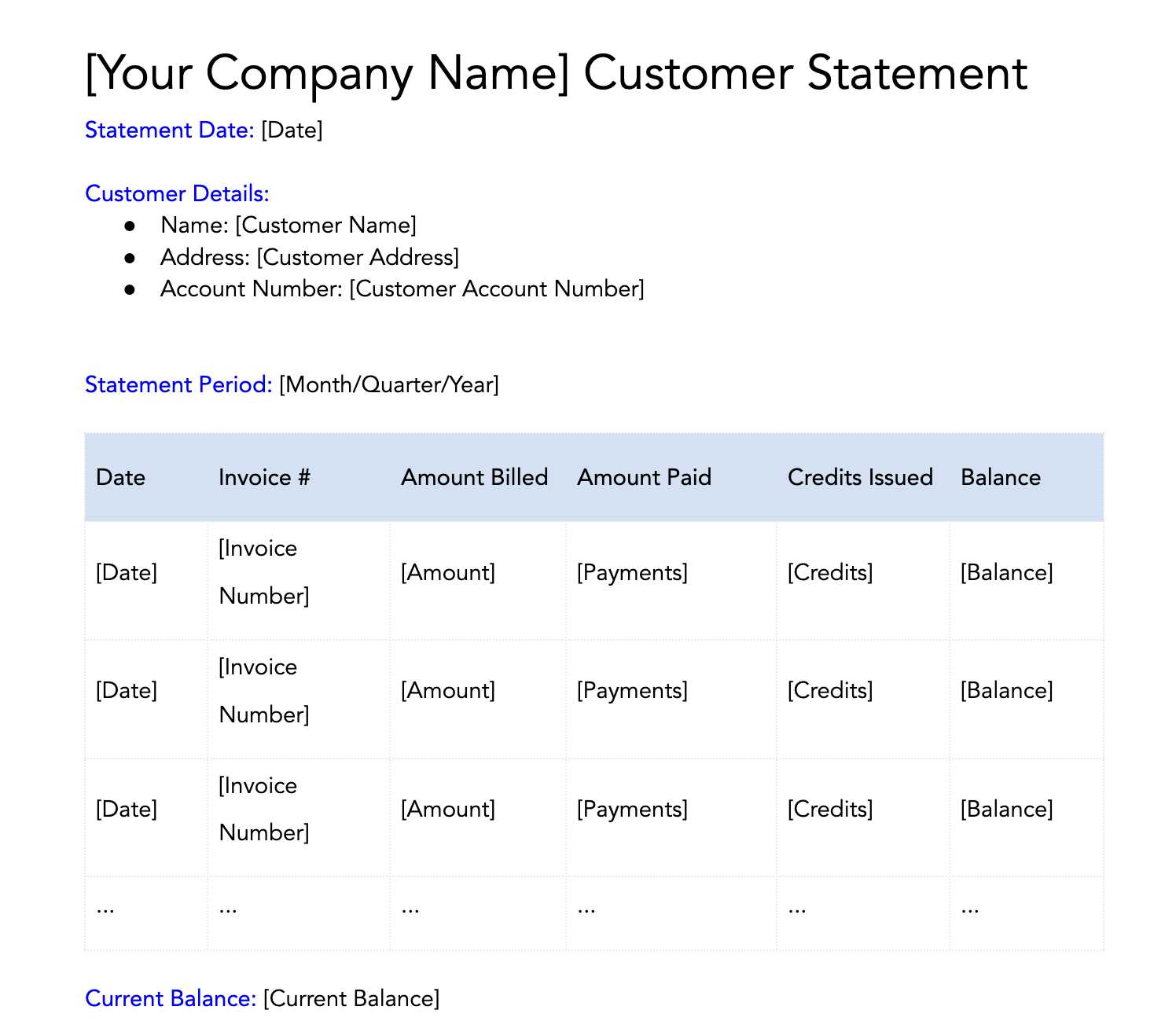

Key Differences Between Invoices and Statements

While both financial documents play a crucial role in tracking payments and outstanding balances, they serve different purposes in the business world. Understanding the distinctions between these documents helps businesses maintain clear communication with clients and ensures that payments are processed efficiently. Each document is designed to convey specific information about a transaction or a series of transactions, and knowing when to use each can improve cash flow management and customer relations.

Here are the main differences:

- Purpose: A financial record that requests payment is issued when a product or service is delivered. It details the specific amount owed and outlines payment terms. In contrast, a financial overview is typically sent periodically, summarizing all recent transactions between a business and a client, providing a broader picture of the relationship.

- Frequency: A payment request is usually sent after each individual transaction, typically when payment is due. On the other hand, an account overview is sent regularly, such as monthly or quarterly, to provide an update on the client’s total balance and any outstanding amounts.

- Content: A payment request is itemized, listing products, services, and amounts due for each item. A financial overview, however, is a summary document, listing only the total outstanding balance and providing a snapshot of the client’s account over a specific period.

- Timing: A request for payment is issued immediately following the completion of a transaction, while an account overview may include multiple transactions and is often issued at regular intervals.

- Action Required: The primary function of a payment request is to prompt immediate payment, with clear instructions on how and when to pay. A financial overview, however, serves more as a reminder, with no direct request for immediate payment, though it may include details on overdue amounts.

By understanding these key differences, businesses can use both documents effectively to manage their finances, ensure timely payments, and maintain accurate records.

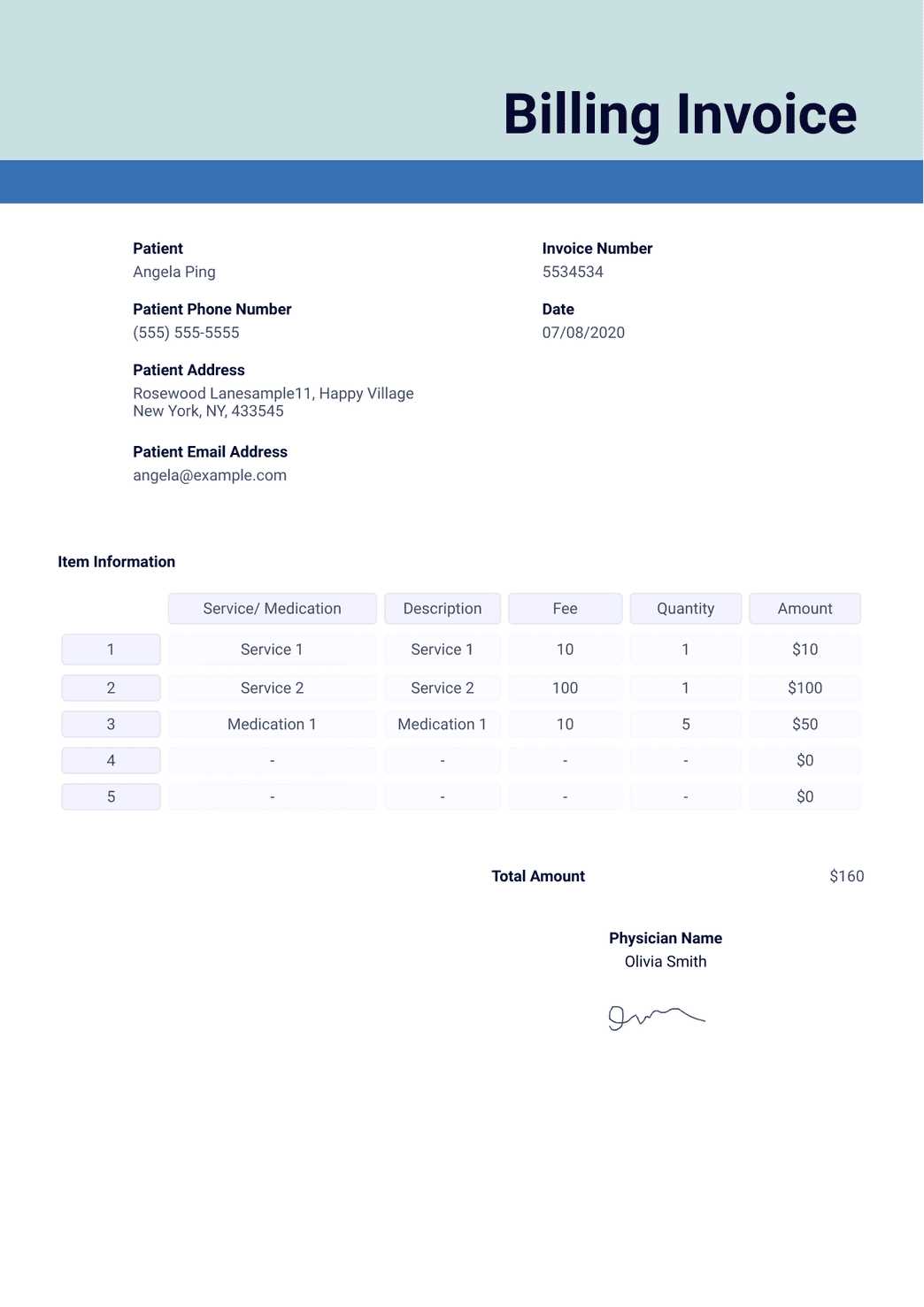

Templates for Different Business Types

Every business operates differently, with varying needs for managing transactions and client communications. Customizing documents to suit the specific nature of your business can significantly improve efficiency and client satisfaction. The structure, design, and content of financial records should align with the type of services or products you offer, as well as how you interact with your clients.

Here are some common business types and the ideal approaches for creating tailored financial records:

Freelancers and Contractors

Freelancers and independent contractors typically provide specialized services. Their billing records should reflect the project-based nature of their work. A simple, clear layout is essential, with detailed descriptions of tasks, hourly rates, or project milestones. Payment terms should also be flexible, as freelancers often require deposits or partial payments before work is completed.

- Include: Clear descriptions of services, hourly rates or project fees, and agreed-upon deadlines.

- Consider: Adding a section for partial payments or deposits to ensure timely compensation during long-term projects.

Small Businesses and Startups

Small businesses often deal with a wide range of clients and need to manage diverse transactions. They require documents that can handle both one-off and recurring payments. It’s essential to maintain a balance between professionalism and simplicity, as these businesses may not have large administrative teams. Clear itemization of products or services sold, along with terms for recurring billing, is important for keeping track of sales and payments.

- Include: Itemized lists of products or services, total amounts, and taxes. A section for payment methods and due dates should be prominently displayed.

- Consider: Adding a section for discounts or promotions if applicable, and a reminder about any return or refund policies.

E-commerce and Online Retailers

For e-commerce businesses, digital transactions are the norm, and records should be adapted

Ensuring Legal Compliance in Your Templates

Maintaining legal compliance in financial documentation is essential for protecting both your business and your clients. A properly structured document not only ensures clarity and professionalism but also helps you meet various legal requirements related to taxation, contracts, and consumer protection laws. Failing to include required details or using incorrect formats could result in disputes, penalties, or loss of reputation.

Here are some key considerations for ensuring that your financial records comply with legal standards:

- Include Required Information: Depending on your location and the nature of your business, specific details must be included in every document. Common requirements include business registration numbers, tax identification numbers (TIN), payment terms, and a clear breakdown of products or services provided.

- Comply with Local Tax Laws: Tax regulations can vary significantly between regions. Ensure that your records contain the correct tax rates, are formatted according to local laws, and include applicable tax amounts. Keeping updated on tax rules is critical to avoid penalties.

- Clear Payment Terms: Ensure your documents specify payment due dates, late payment fees, and accepted methods of payment. Clearly defined terms reduce the risk of misunderstandings and potential legal disputes with clients.

- Adhere to Consumer Protection Laws: In many jurisdictions, businesses must provide specific protections for consumers. This could include refund policies, guarantees, or dispute resolution procedures. Including these terms in your documents ensures you meet consumer rights regulations.

- Maintain Record Keeping: Legally, you may be required to keep financial records for a certain period. Using consistent, organized formats makes it easier to store, retrieve, and present documentation if necessary, whether for audits or disputes.

By ensuring that your documents meet legal standards, you protect your business from compliance risks, maintain trust with clients, and contribute to the smooth operation of your financial processes.

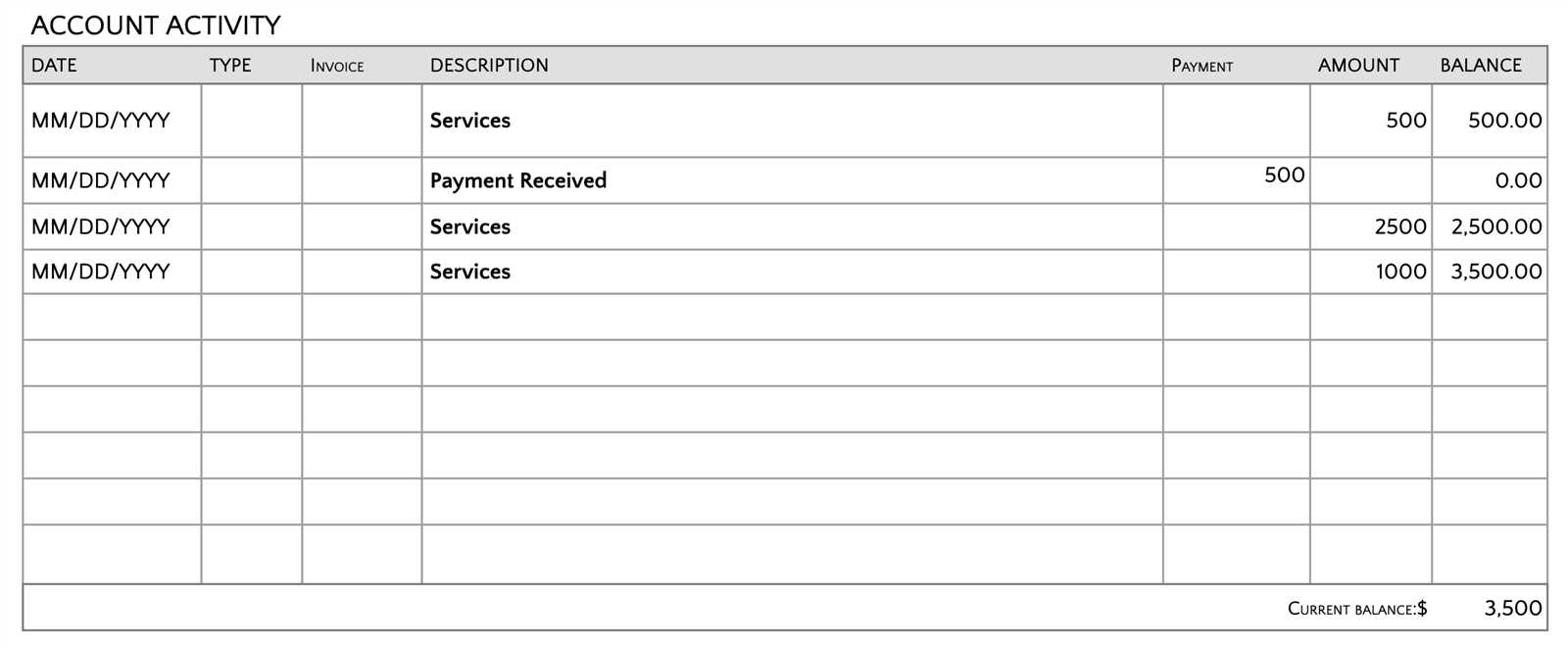

How to Track Payments with Statements

Tracking payments is a critical aspect of financial management for any business. Using well-organized financial summaries allows companies to stay on top of incoming payments, monitor overdue balances, and identify potential issues in cash flow. Regularly updating these summaries ensures that all transactions are documented clearly and that both businesses and clients have a clear record of payment history.

Steps to Effectively Track Payments

To make the most out of financial overviews for payment tracking, businesses should follow these key steps:

- Maintain Detailed Records: Include the client’s name, the amount due, payment date, method of payment, and any discounts or adjustments applied. This comprehensive information helps in easily identifying any discrepancies or missed payments.

- Update Regularly: Ensure that financial summaries are updated regularly, ideally after each transaction. This keeps the information current and helps prevent errors or omissions.

- Track Partial Payments: For clients who make partial payments, clearly mark the amounts paid and the remaining balance. This avoids confusion and ensures that clients are aware of what they still owe.

- Set Payment Deadlines: Clearly define payment deadlines in each record. This makes it easier to track overdue payments and follow up accordingly.

- Use a Consistent Format: Keep a consistent format across all records, making it easier to compare payments over time and identify patterns in a client’s payment behavior.

Tools for Efficient Payment Tracking

To simplify the process of tracking payments, businesses can leverage various tools and software that automate much of the work. These tools help maintain accurate records and reduce the risk of errors. Some features to look for include:

- Automatic Payment Reminders: Set up automatic notifications for clients when a payment is due or overdue, ensuring that follow-ups are timely.

- Payment History Tracking: Maintain a log of all payments made, including amounts, dates, and methods, so that you can easily review past transactions.Best Practices for Template Maintenance

Maintaining well-structured financial documents is essential for any business to ensure consistent communication with clients and smooth internal operations. Regularly updating and refining these documents helps prevent errors, keeps the information accurate, and ensures compliance with legal and regulatory requirements. Proper maintenance practices also contribute to professionalism and make it easier for both businesses and clients to track financial transactions efficiently.

Key Practices for Effective Document Maintenance

Adhering to the following best practices can streamline the process of maintaining financial documents and improve overall business operations:

- Regular Updates: Ensure that your documents are updated frequently to reflect any changes in pricing, terms, or tax laws. This includes adding new fields, modifying existing ones, or even removing outdated sections to keep everything relevant.

- Consistent Formatting: Standardize the design and layout of your documents. Use consistent fonts, colors, and logos so that each document maintains a professional appearance. This helps create brand recognition and avoids confusion for clients.

- Version Control: Keep track of different versions of your financial records to ensure that you always use the most up-to-date version. Implementing version control helps you quickly identify changes and ensures accuracy when dealing with clients or team members.

- Backup Copies: Regularly back up your records to avoid data loss. Store digital copies securely on cloud platforms or external drives to prevent losing important files in case of technical failures.

- Legal Compliance: Periodically review your documents to ensure that they meet local laws and tax regulations. This may involve consulting with a legal expert or accountant to verify that all necessary information is included, such as tax rates, payment terms, and refund policies.

Streamlining Template Maintenance

To make the maintenance process more efficient, consider implementing the following strategies:

- Automate Updates: Use software tools that can automate many of the maintenance tasks, such as applying tax rate updates or generating customized records based on new pricing information.

- Centralized Storage: Store all versions of your documents in a centralized location, such as a cloud service or file management system. This ensures easy access and organization, preventing confusion and potential errors when retrieving documents.

- Feedback Loops: Create a system for gathering feedback from your clients or team members to identify areas where

Integrating Invoice Templates with Accounting Software

Integrating financial documents with accounting software can streamline business operations, reduce errors, and save time. By automating the process of generating and managing payment records, businesses can ensure greater accuracy and efficiency in their financial reporting. With the right integration, companies can easily track transactions, monitor cash flow, and generate reports without the need for manual data entry or multiple software systems.

Benefits of Integration

When financial records are integrated with accounting software, businesses enjoy several advantages:

- Automated Data Transfer: Integration ensures that information entered in one system automatically updates in the other, reducing the need for manual data entry and minimizing errors.

- Faster Processing: By automating the creation and processing of financial documents, businesses can handle a higher volume of transactions without delays.

- Improved Accuracy: Automatic synchronization between your documents and accounting software ensures that financial data is consistent and up-to-date, reducing the chances of discrepancies.

- Better Financial Reporting: Integration enables businesses to generate real-time financial reports, which improves decision-making and financial planning.

How to Integrate Financial Documents with Accounting Software

Integrating your financial records with accounting software is often a simple process, though it may vary depending on the software or platform you use. Here are the basic steps:

- Choose Compatible Software: Select an accounting platform that supports integration with the software you’re using to create financial records. Popular options include QuickBooks, Xero, and FreshBooks.

- Link Accounts: Most accounting software offers features to link your financial management system with invoicing or payment platforms. Set up a connection between your accounts for smooth data transfer.

- Map Fields: Ensure that fields in your financial records correspond to the relevant categories in the accounting software. This may involve setting up mapping rules to match details like amounts, client names, payment dates, etc.

- Test the Integration: Before fully relying on the integration, run a few tests to ensure the data flows correctly between both systems. This helps identify potential issues and ensures accurate synchronization.

Key Integration Features to Look For

When choosing a solution, consider the followi

Common Errors to Avoid in Invoices

Creating financial documents that are both accurate and clear is crucial for maintaining healthy business relationships. Even small mistakes can lead to confusion, delays in payments, or even disputes with clients. By understanding the common errors that occur in these records, businesses can take proactive steps to avoid them and ensure smooth transactions.

Frequent Mistakes to Watch Out For

| Error | Impact | How to Avoid |

|---|---|---|

| Missing Contact Information | Clients may not know how to reach you for questions or clarifications. | Always include your business name, address, phone number, and email address. |

| Incorrect or Missing Dates | Confusion over when the payment is due can cause delays or missed payments. | Ensure that the date of issue and the payment due date are clearly stated. |

| Unclear Payment Terms | Clients might be unsure about how and when to pay, which can lead to payment delays. | Specify accepted payment methods, due dates, and any late fees clearly. |

| Calculation Errors | Incorrect totals can undermine your credibility and cause payment issues. | Double-check all calculations before sending, or use automated systems to ensure accuracy. |

| Omitting Details of Products or Services | Missing or vague descriptions can cause confusion and disagreements over charges. | List all products or services in detail, including quantities, rates, and descriptions. |

Additional Considerations

Even after correcting the common mistakes listed above, it’s important to pay attention to the overall clarity and organization of the document. Avoid clutter by using simple language, appropriate fonts, and clear section headings. A well-organized, accurate document not only improves communication with clients but also helps avoid unnecessary delays and issues down the line.

How to Automate Your Invoicing Process

Managing financial records manually can be time-consuming and prone to errors. Automating this process can streamline your workflow, reduce human error, and ensure timely transactions. By using automated systems, you can set up recurring transactions, track payments more efficiently, and focus more on growing your business.

Steps to Automate Your Financial Record Creation

Automating your financial documentation process involves integrating the right tools and setting up systems that handle repetitive tasks. Here’s how to get started:

Benefits of Automation

Automating your financial processes offers several advantages, including: