Chauffeur Invoice Template for Easy and Professional Billing

In any service-oriented profession, accurate and efficient billing is crucial for maintaining a smooth workflow and ensuring timely payments. For those offering personal transportation services, creating clear and well-organized billing documents is essential to convey professionalism and avoid misunderstandings with clients.

By utilizing structured documents that outline services rendered, pricing, and payment terms, individuals can ensure transparency in their financial dealings. These documents help establish trust and serve as a legal record for both service providers and clients. Adopting a consistent method of tracking and presenting payment requests simplifies the process and reduces administrative time.

Effective billing management requires more than just a simple list of charges. The right approach incorporates clear details, personalized adjustments, and well-defined payment schedules. This not only ensures a smooth transaction but also strengthens the reputation of the service provider.

Understanding Chauffeur Invoice Templates

Effective billing is an essential part of any professional transportation service. A well-organized document that details the services provided, associated costs, and payment terms ensures clear communication between the provider and client. These records not only serve as a reminder of the service but also act as an official statement for transactions, making it easier for both parties to track payments and manage finances.

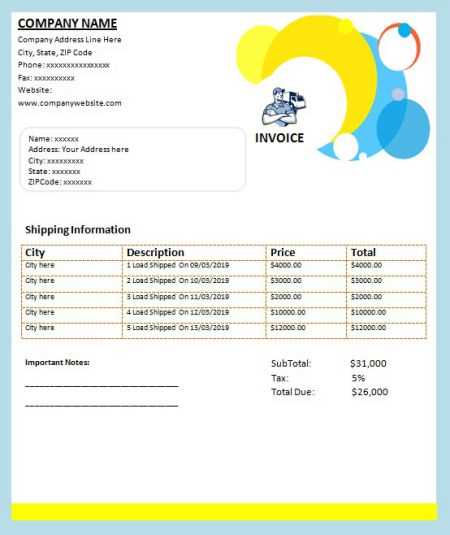

When creating such documents, it’s important to include specific sections that highlight important details like service descriptions, hours worked, and applicable taxes. Customization is key, as each job might require different information depending on the type of service offered or client preferences. An efficient structure allows for easy adjustments and consistency across multiple transactions.

Organization plays a critical role in keeping the process simple and transparent. Proper categorization of services, pricing, and clear payment instructions can help avoid confusion and ensure timely payments. By using a standardized format, professionals can quickly generate these documents, saving time while maintaining a high level of professionalism.

Why Chauffeurs Need Invoice Templates

For professionals in the personal transportation industry, having a standardized way to document services provided is essential for maintaining clear financial records and fostering trust with clients. Structured documents that outline the details of services, charges, and payment terms ensure transparency and consistency. These tools are invaluable for simplifying administrative tasks and speeding up the billing process.

Benefits of Using Structured Billing Documents

Utilizing a pre-made document allows service providers to reduce errors, save time, and ensure they don’t miss important information. Here are some key advantages:

| Advantage | Description |

|---|---|

| Efficiency | Filling out a pre-defined document is faster and reduces the time spent on creating each statement from scratch. |

| Accuracy | A standard layout minimizes the chances of omitting important details, such as service descriptions or charges. |

| Professionalism | A well-designed document makes a good impression and conveys a high level of professionalism to clients. |

| Legal Protection | Accurate and thorough records help protect both parties in case of disputes or legal matters. |

Streamlining Payment Processes

Another reason professionals rely on these structured documents is to ensure prompt payment. By clearly stating the services provided, pricing, and terms, it becomes easier for clients to understand their financial obligations. This not only helps in reducing delays but also avoids confusion regarding charges.

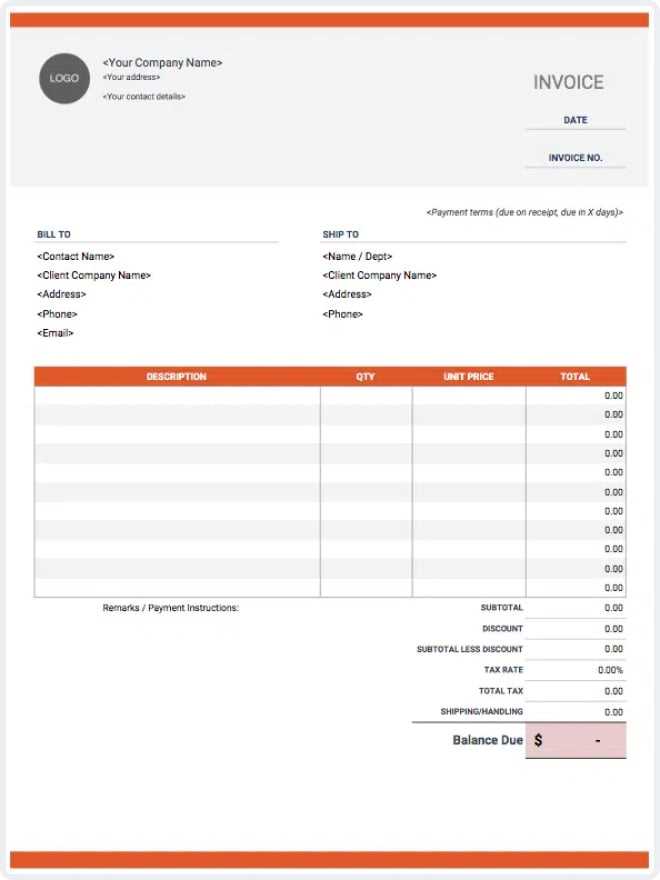

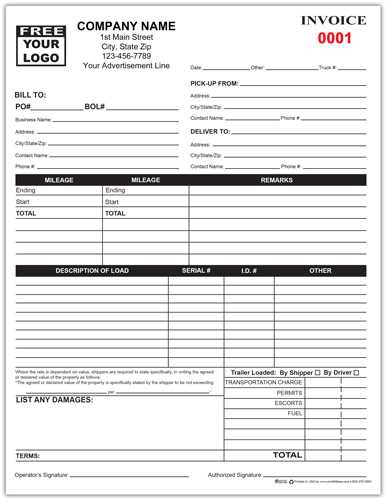

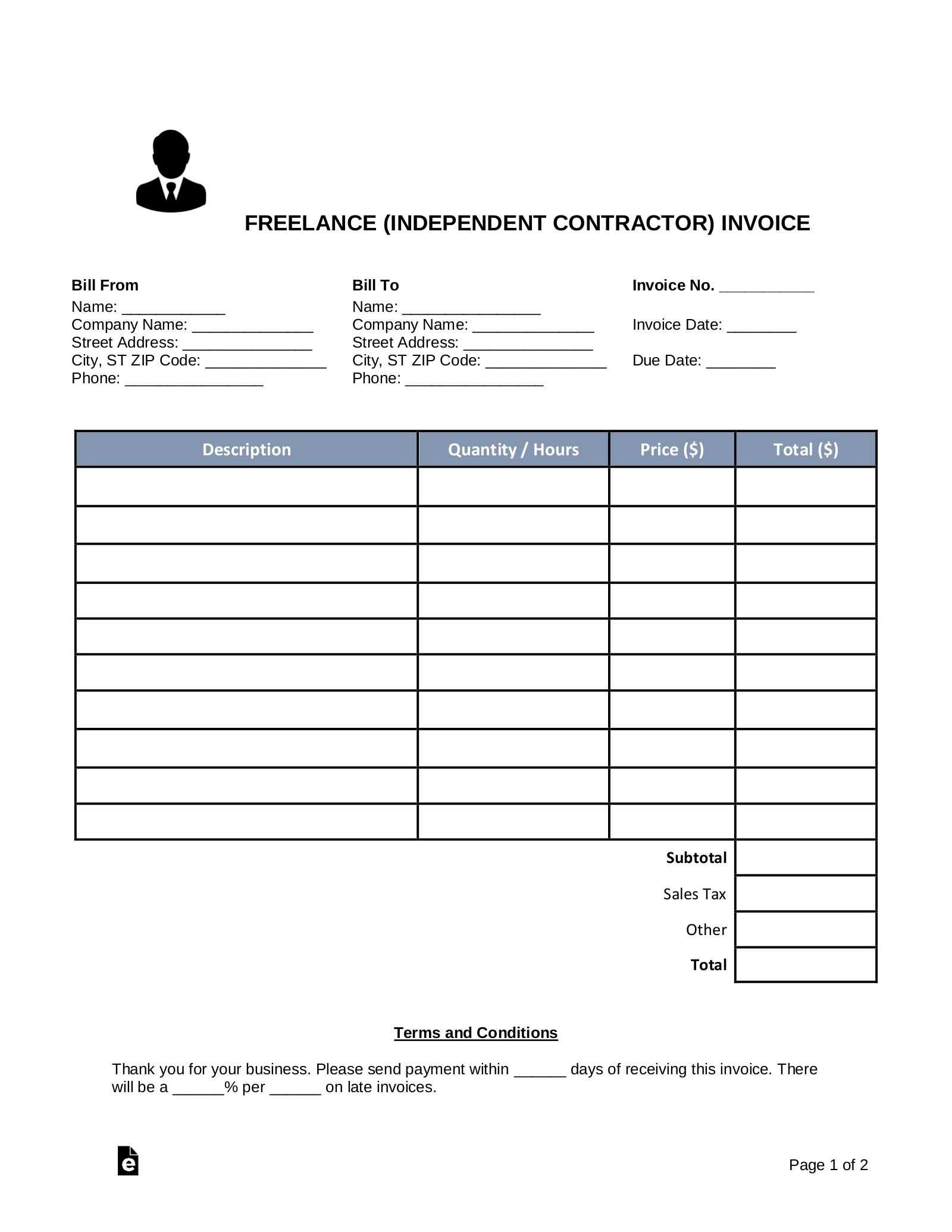

Key Elements of a Chauffeur Invoice

For any transportation service provider, it is essential to include specific details in a billing document to ensure clarity and avoid disputes. A well-structured document not only outlines the services rendered but also provides transparency on costs, terms, and other vital information. The following elements are crucial for a comprehensive and professional financial statement.

| Element | Description |

|---|---|

| Service Description | Clearly outline the nature of the service provided, including the duration, destinations, or any special requirements fulfilled. |

| Date and Time | Include the date(s) of service, as well as the start and end times to ensure accuracy in billing. |

| Pricing and Charges | Break down the charges, including hourly rates, flat fees, or additional costs such as taxes, parking, or tolls. |

| Payment Terms | Specify the payment due date, accepted methods of payment, and any penalties for late payments. |

| Contact Information | Provide both the service provider’s and the client’s contact details to facilitate any future communication. |

| Invoice Number | Assign a unique reference number to each statement for easy tracking and record-keeping. |

Including these key elements ensures that both the service provider and client have a clear understanding of the transaction. This structure helps to avoid confusion, streamlines payment processes, and reinforces a professional image.

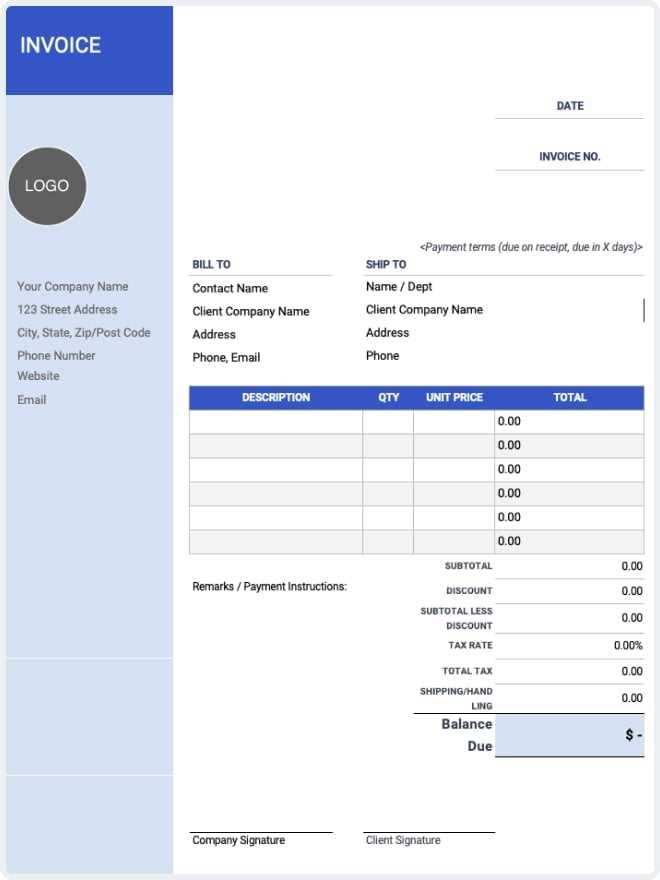

How to Create a Chauffeur Invoice

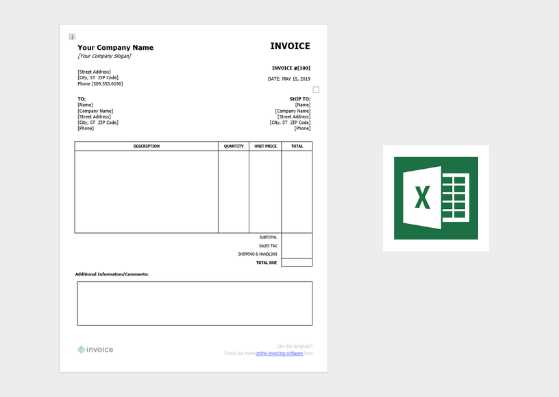

Creating a professional document for your transportation services is a straightforward process that ensures clarity and promotes trust with clients. By following a simple step-by-step guide, you can easily generate a document that outlines all relevant details, making the billing process smooth and efficient.

Step-by-Step Guide to Creating Your Document

Follow these simple steps to create a professional and effective record of services provided:

- Include Contact Information – Make sure to list both your details and your client’s details at the top of the document. This includes names, phone numbers, and addresses.

- Define the Services Rendered – Clearly outline what services were provided, including specifics such as the time, dates, and any special requirements or requests made by the client.

- List Pricing Details – Break down the pricing for each service. Include any additional fees such as tolls, parking, or other incidental charges.

- Provide Payment Terms – Specify the total amount due, the due date, and accepted payment methods. If applicable, mention any late fees or discounts for early payment.

- Assign an Invoice Number – For organizational purposes, include a unique identifier for each document to easily reference past transactions.

- Additional Notes – Use this section for any extra information, such as thank-you notes, terms and conditions, or special instructions regarding the service.

Using Tools for Quick Creation

While it’s possible to manually create these documents, using digital tools like word processors or specialized software can help save time and ensure consistency across all transactions. Many tools also offer pre-designed formats that can be easily customized according to your needs.

By following these steps and using the right tools, creating a billing document becomes a simple task that enhances your business operations and keeps everything organized.

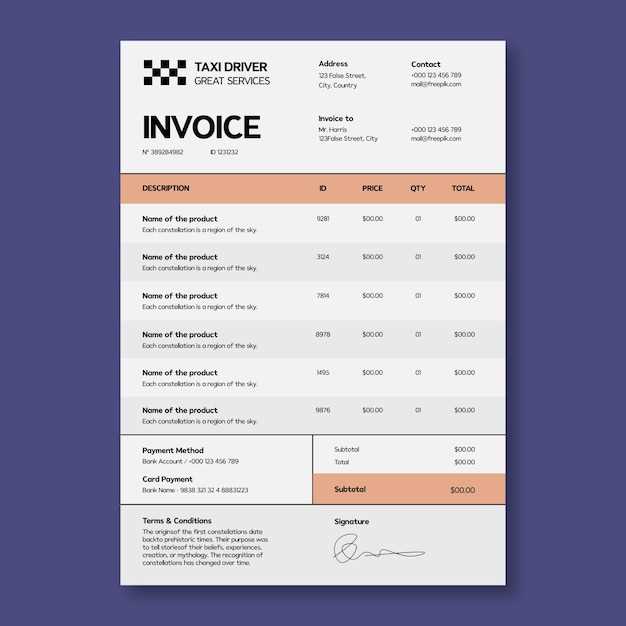

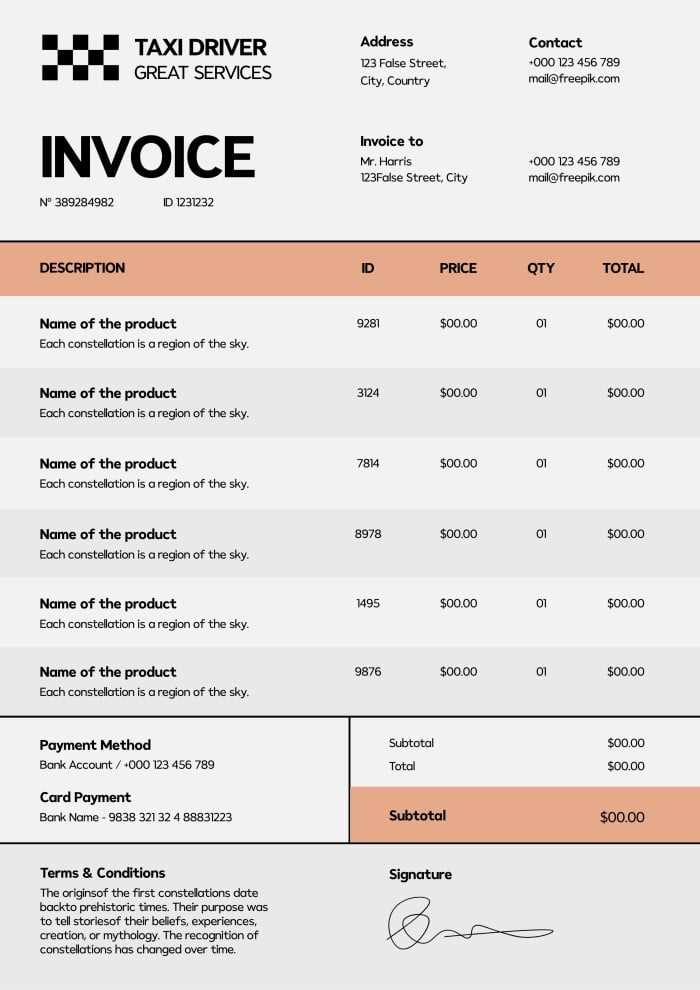

Customizing Your Chauffeur Invoice Template

Tailoring your billing document to suit your specific needs can help create a more personalized and professional experience for your clients. Customization allows you to add or remove sections, adjust the layout, and include any additional details that are unique to your services. This ensures that every transaction is accurately represented, with all relevant information clearly communicated.

Personalization can include elements such as your business logo, a custom color scheme, or specific service descriptions that reflect the nature of your work. It also means you can adjust the layout to prioritize certain information, such as payment terms or service details, depending on what you believe is most important for your clients to see.

In addition to design changes, it’s important to customize the legal and payment terms sections to match your business practices. For instance, you can adjust payment due dates, penalties for late payments, or accepted methods of payment based on your preferences.

By personalizing your document, you not only enhance your professional appearance but also make the billing process smoother for both you and your clients. Customization makes your service stand out and ensures that each transaction is clear, transparent, and in line with your specific business operations.

Best Practices for Billing as a Chauffeur

For professionals in the personal transportation industry, establishing clear and consistent billing practices is essential for maintaining good relationships with clients and ensuring timely payments. By adhering to best practices, you can streamline your billing process, reduce errors, and enhance the overall experience for both you and your clients.

Key Billing Strategies

Here are some important strategies to consider when managing your financial transactions:

- Provide Clear Service Descriptions – Always be specific about the services you provide, including any special requests or changes made during the trip. This helps clients understand exactly what they are paying for.

- Set Transparent Pricing – Ensure that your pricing structure is easy to understand. Avoid hidden fees and be upfront about any additional charges, such as fuel costs, waiting time, or parking fees.

- Establish Payment Terms – Clearly outline the payment due date and acceptable methods of payment. Consider offering various options, such as credit card payments, bank transfers, or mobile payments, to accommodate your clients.

- Send Invoices Promptly – Issue payment requests as soon as possible after the service has been provided. This reduces the chance of delays and ensures that both you and your client are on the same page regarding payment expectations.

- Offer Professional Follow-ups – If a payment is overdue, follow up with a polite reminder. Having a system in place for reminders can help avoid misunderstandings and delays.

Maintaining a Professional Image

Maintaining professionalism throughout the billing process enhances your reputation and encourages repeat business. Ensure that your documents are neatly formatted, free of errors, and easy for your clients to read. Timely, transparent billing reflects well on your services and fosters trust with your clients.

Common Mistakes to Avoid in Invoices

When creating billing statements for your services, small errors can lead to confusion, payment delays, and even disputes. Avoiding common mistakes ensures that the transaction process is smooth, professional, and free from misunderstandings. Proper attention to detail helps maintain a strong relationship with clients and ensures timely payment for your work.

One of the most frequent mistakes is failing to include clear and complete service details. Not specifying the services provided, the duration, or any additional costs can lead to clients questioning the charges. Similarly, not providing an accurate payment due date or accepting payment methods can cause unnecessary delays.

Another common issue is forgetting to include the appropriate tax or additional fees. If clients are surprised by extra costs, it may result in delayed payments or even disputes. To prevent this, always ensure that taxes, parking fees, and other incidental charges are clearly outlined.

It’s also important to assign unique reference numbers for each billing statement. Without this, it becomes difficult to track payments or resolve any issues that may arise. Lastly, inconsistent formatting or missing contact information can make a statement look unprofessional and harder for clients to process.

Legal Requirements for Chauffeur Invoices

When providing services and generating billing documents, it is essential to adhere to certain legal standards and regulations to ensure compliance and avoid any potential legal issues. Different regions and jurisdictions may have specific requirements, but there are some universal elements that must be included to ensure your financial records are legally sound.

Failure to comply with legal requirements can result in disputes, penalties, or delayed payments. To avoid this, make sure that all relevant details are accurately reflected in your documents. Here are the key legal considerations to keep in mind:

- Business Information – Always include your legal business name, address, and registration number. This identifies you as a legitimate service provider and ensures your documents are legally recognized.

- Tax Information – If applicable, include your tax identification number (TIN) or VAT number. This is essential for tax purposes and ensures that both parties are clear on any tax obligations.

- Clear Service Descriptions – Accurately describe the services rendered, including specific details such as dates, times, and any additional charges. This helps prevent any confusion or legal disputes later on.

- Payment Terms – Clearly outline the payment due date, the amount to be paid, and accepted payment methods. This helps avoid misunderstandings regarding when and how payments should be made.

- Legal Clauses – If necessary, include terms and conditions that clarify the agreement between the service provider and the client. This could include cancellation policies, late fees, and any other terms that are legally required in your jurisdiction.

- Record Keeping – Ensure that all documents are stored securely and are accessible for any future reference or audits. This is not only essential for your business but also to comply with accounting and tax regulations.

By meeting these legal requirements, you ensure that your documents are not only professional but also legally compliant, protecting both you and your clients from potential issues down the road.

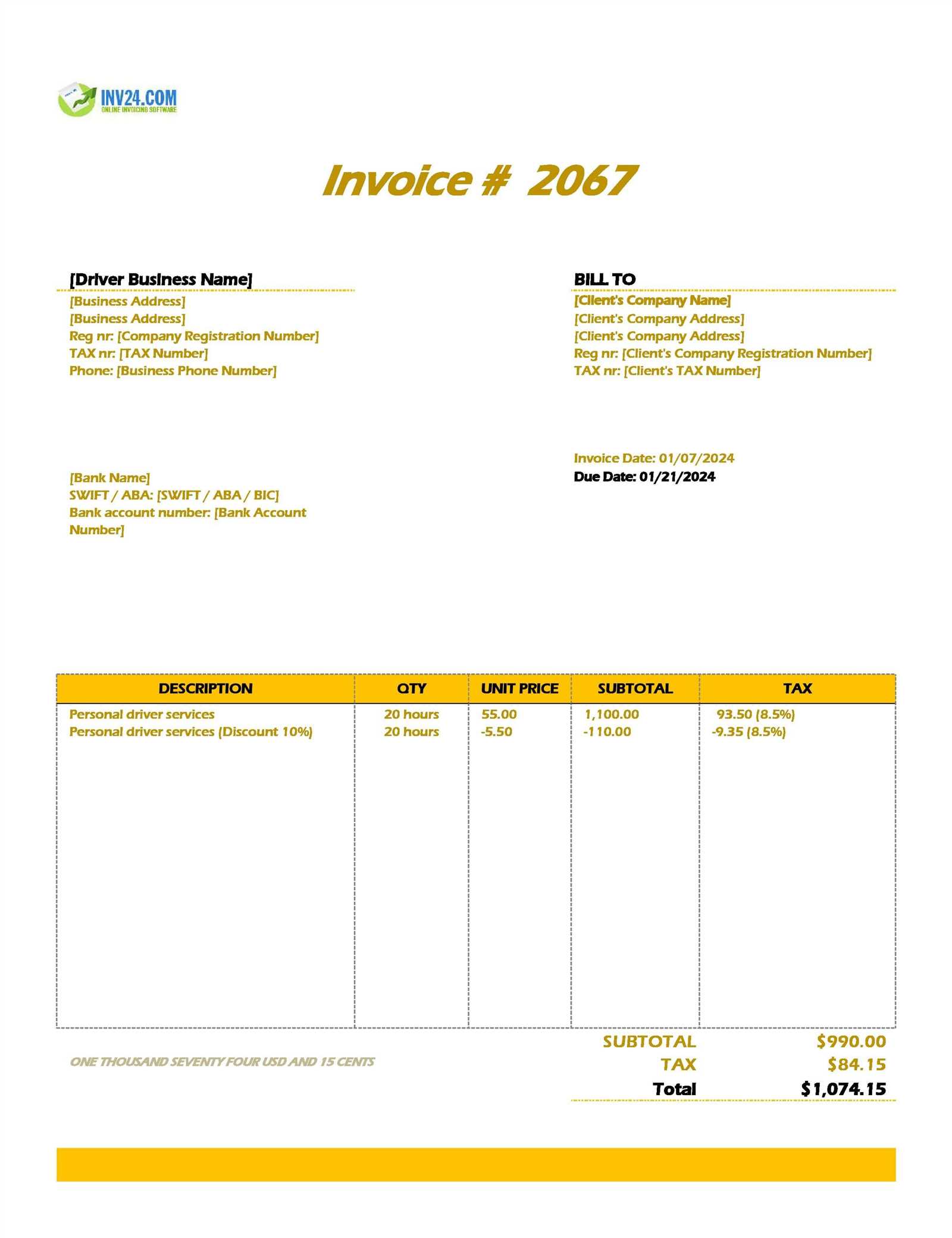

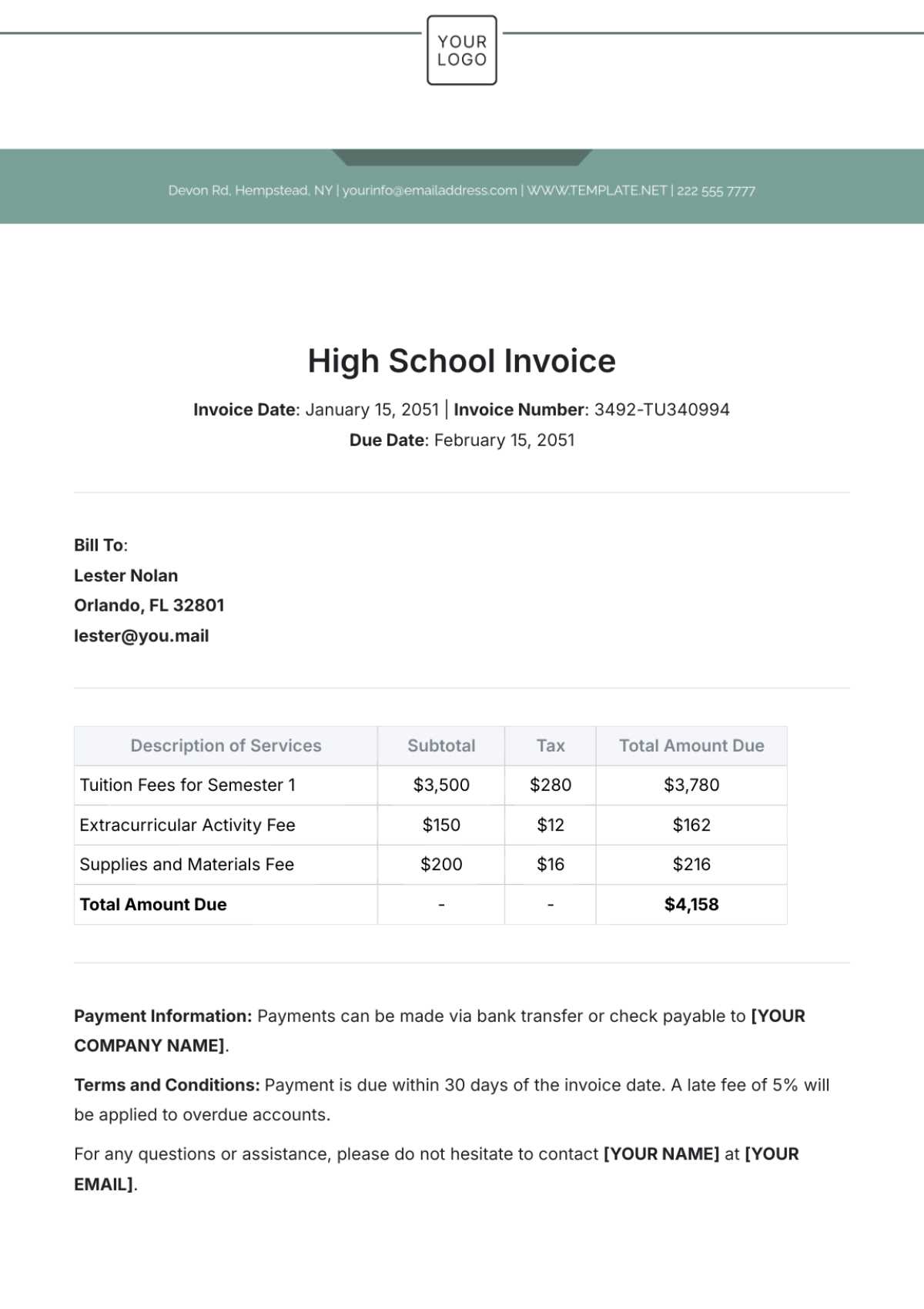

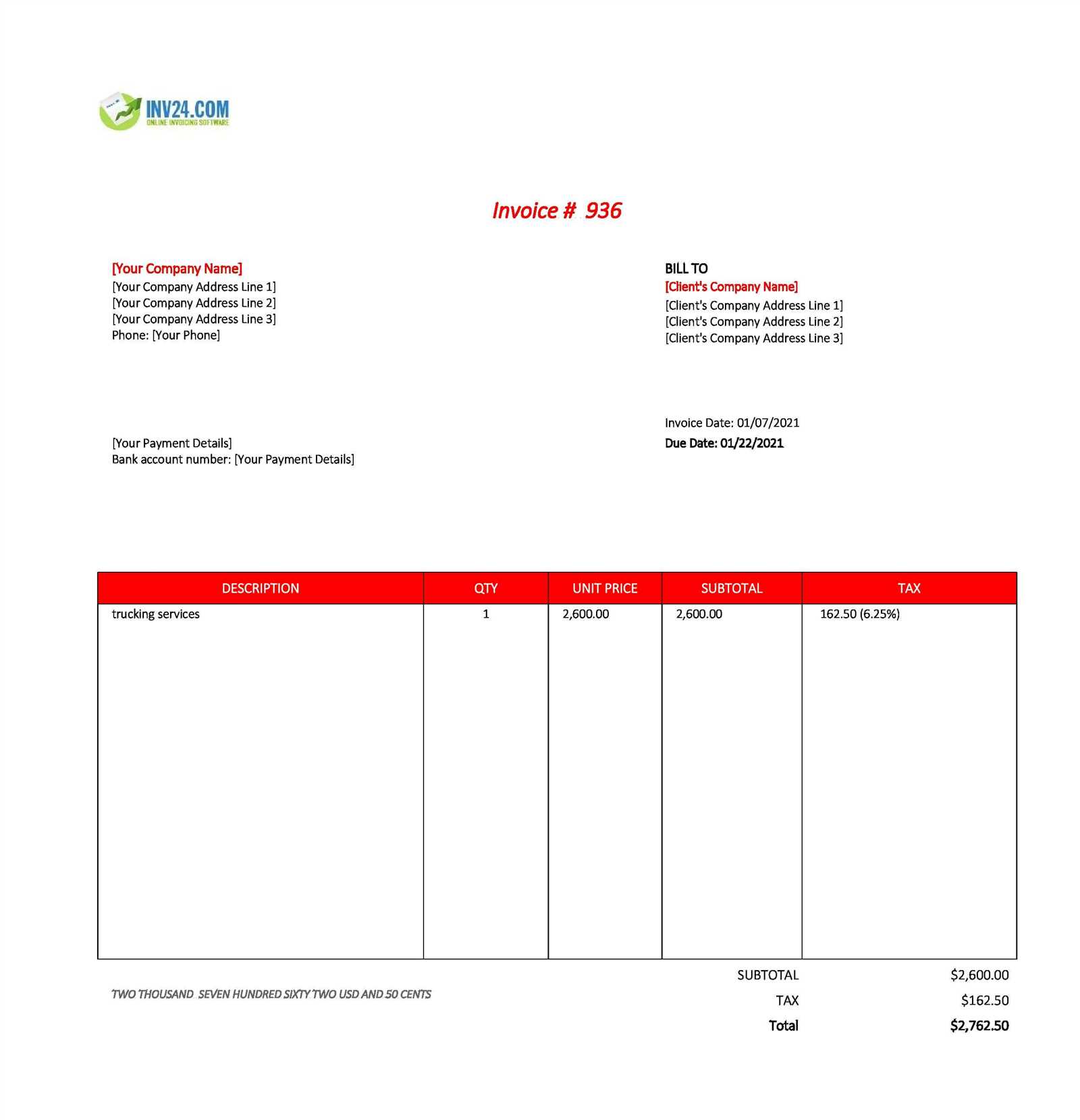

How to Add Tax Information on Invoices

Adding tax information to billing documents is a crucial step in maintaining compliance with local tax laws. It ensures that both you and your clients are clear about any tax obligations and prevents any future misunderstandings or legal issues. Properly including tax details also helps in accurate accounting and smooth transactions.

Steps to Include Tax Information

Follow these steps to make sure the tax details are correctly included in your billing records:

- Specify Tax Rates – Clearly state the applicable tax rate for your services. This can vary depending on the location and the type of service provided, so ensure it aligns with local tax regulations.

- Provide Tax Identification Number – If you are registered for tax purposes, include your tax ID number. This is required in many regions and adds legitimacy to your financial documents.

- Itemize Tax Amount – Break down the tax amount separately on the document. This helps the client understand how much of their total charge is attributed to taxes.

- Include Total Taxable Amount – Before adding the tax, list the total taxable amount of services provided. The tax is usually calculated based on this figure, so make sure it is clear and easy to find.

Example of Tax Information on a Billing Document

Here’s an example of how you might structure tax details:

- Service Total: $100

- Tax Rate: 10%

- Tax Amount: $10

- Total Due: $110

By properly including tax information, you make the billing process transparent for your clients and ensure that you are fully compliant with applicable tax laws.

Automating Your Chauffeur Invoicing Process

Automating the process of creating and sending billing statements can save time, reduce errors, and improve efficiency. By integrating technology into your financial operations, you can streamline the process, allowing you to focus more on providing excellent service to your clients. Automation ensures that all necessary information is included, calculations are accurate, and documents are sent on time.

There are several ways to automate your billing process, from using software tools to setting up recurring payment schedules. Many digital solutions offer customizable features, allowing you to input specific business details and generate documents in just a few clicks. These systems can also track payments and remind clients of overdue bills, reducing the need for manual follow-ups.

Implementing automation not only increases productivity but also ensures consistency across all your financial documentation. As a result, you can maintain a professional image while ensuring timely payments and smoother operations.

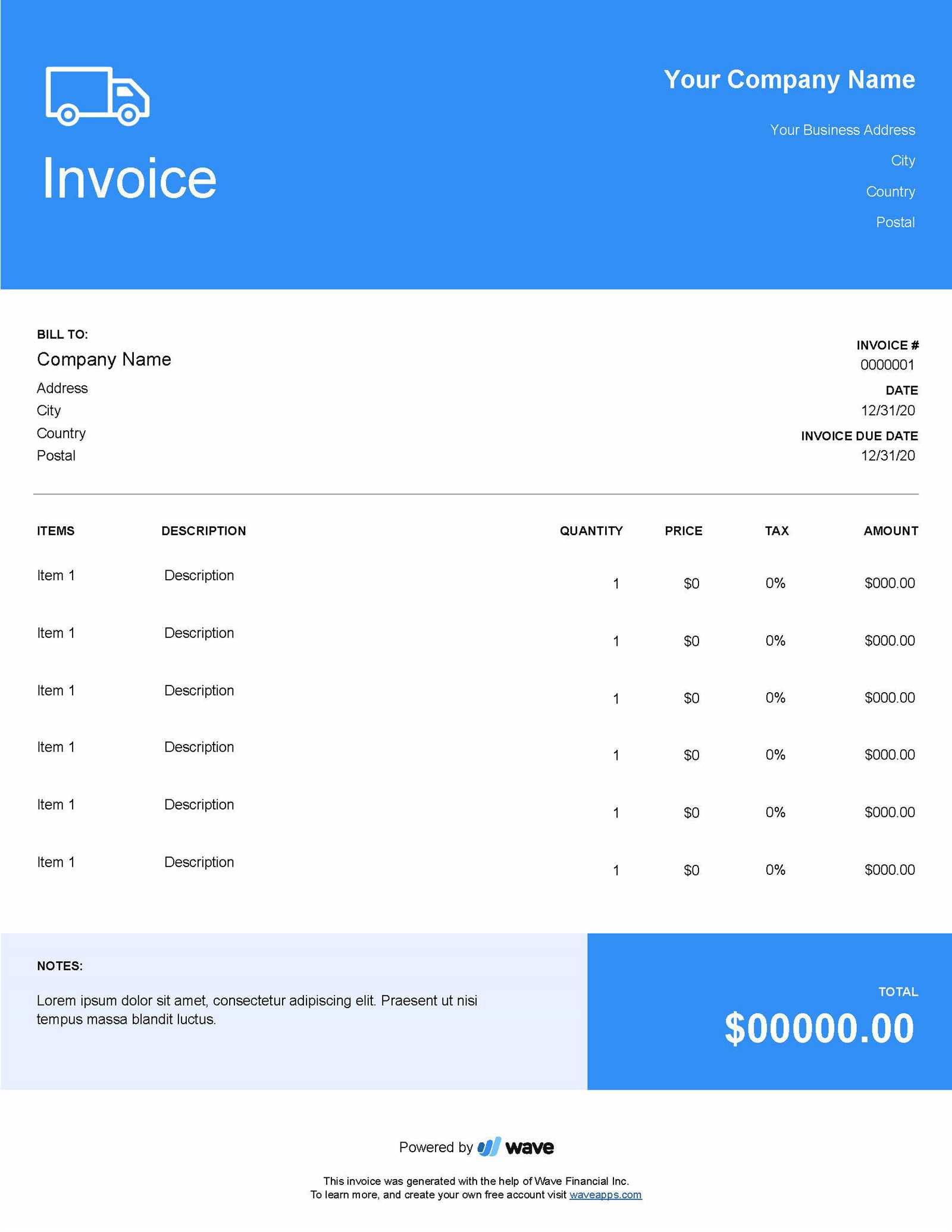

Free vs Paid Chauffeur Invoice Templates

When choosing a solution for creating billing documents, you have the option of using free or paid resources. Each choice offers distinct advantages and limitations, depending on your specific needs and business scale. Understanding the differences between these options can help you make the right decision based on your requirements and budget.

Advantages of Free Resources

Free resources often serve as a great starting point for small businesses or those just getting started. Many platforms offer basic features that cover essential needs without any upfront cost. These options are especially helpful if you’re looking to generate simple and straightforward documents without a lot of customization.

- No Initial Cost – Free tools are budget-friendly, which is ideal for businesses with limited financial resources.

- Quick and Easy Access – Most free resources are accessible immediately, requiring no subscriptions or commitments.

- Simple Design – Basic templates can be sufficient for businesses that don’t need advanced features.

Advantages of Paid Resources

Paid tools, on the other hand, offer enhanced features and greater customization. If your business requires a more professional and polished appearance or if you need advanced functionalities like automated calculations or recurring billing, a paid solution may be the right choice. Paid options often come with customer support and regular updates, which can be crucial for maintaining a smooth billing process.

- Customization – Paid solutions often allow for greater flexibility in design and functionality, giving you the ability to match your branding and specific business needs.

- Advanced Features – Many paid services offer automation, integration with accounting software, and other time-saving tools.

- Customer Support – Paid platforms typically provide customer service, ensuring that any issues or questions can be addressed promptly.

Ultimately, the choice between free and paid solutions depends on the complexity of your needs, the volume of transactions, and the level of customization you require. Free tools may suffice for simple billing, but for businesses that demand more robust features and professional support, paid options offer greater long-term value.

Choosing the Right Invoice Software

Selecting the right software for managing your billing process can significantly impact the efficiency and accuracy of your business operations. With various options available, it’s essential to choose a platform that meets your specific needs and supports your workflow. The right software can streamline tasks, reduce human error, and save valuable time.

When evaluating different software solutions, consider factors such as ease of use, customization options, pricing, and the ability to integrate with other tools you may already be using. Whether you need basic functionalities or more advanced features, there are options for every type of business, from freelancers to large enterprises.

Make sure the software you choose aligns with your business size, the complexity of your transactions, and your long-term growth goals. A well-suited solution will not only simplify billing but also improve client relations and keep your financial records organized and up-to-date.

How to Track Payments Effectively

Keeping track of payments is crucial for maintaining cash flow and ensuring the financial health of your business. Whether you are managing one-time transactions or recurring payments, having a reliable system in place helps you stay organized and ensures that no payment is missed. Efficient tracking also minimizes disputes and improves the overall client experience.

Methods for Effective Payment Tracking

There are several ways to manage and track incoming payments, ranging from simple manual methods to more automated systems. Here are some of the most effective approaches:

- Use Accounting Software – Automated accounting systems help track payments, update balances, and send reminders for overdue payments.

- Maintain Clear Payment Records – Keep detailed records of each transaction, including payment dates, amounts, and payment methods, for easy reference.

- Set Payment Reminders – Utilize tools that send automatic reminders to clients before or after a payment is due, reducing the chance of late payments.

Best Practices for Payment Tracking

In addition to using the right tools, adopting best practices can improve the accuracy and timeliness of your payment tracking:

- Record Payments Immediately – Enter payment details as soon as they are received to prevent missing or incorrect entries.

- Reconcile Accounts Regularly – Regularly compare your payment records with bank statements to ensure everything matches and no discrepancies exist.

- Provide Multiple Payment Options – Offering various payment methods can speed up the payment process and make it easier for clients to pay on time.

By tracking payments effectively, you can avoid unnecessary delays and keep your financial records accurate. Implementing the right tracking system ensures that you are always on top of your business’s finances and can focus on growth and client satisfaction.

Importance of Clear Payment Terms

Establishing clear and concise payment expectations is essential for fostering strong client relationships and ensuring smooth business operations. When both parties are on the same page regarding payment procedures, it reduces confusion, enhances trust, and minimizes the risk of late or missed payments. Setting out well-defined terms from the start helps avoid misunderstandings that can lead to delays or disputes.

Benefits of Clear Payment Terms

Having transparent and straightforward payment terms offers numerous advantages for businesses, including:

- Improved Cash Flow – Clear terms set expectations for timely payments, which helps ensure a consistent flow of income for your business.

- Reduced Disputes – When both parties understand the agreed-upon payment structure, it minimizes the likelihood of disagreements regarding billing.

- Professionalism – Clear and precise payment conditions reflect professionalism, reinforcing your credibility with clients.

Essential Elements of Payment Terms

For payment terms to be effective, they should include the following key details:

- Payment Due Date – Specify the exact date by which the payment should be made, or establish a clear timeline (e.g., 30 days from the service date).

- Accepted Payment Methods – List the payment methods you accept (e.g., credit card, bank transfer, online payment systems).

- Late Fees – Outline any late payment penalties to encourage timely payment and discourage delays.

- Discounts for Early Payment – Offering small discounts for early settlement can be an incentive for clients to pay promptly.

By establishing clear payment expectations upfront, you promote transparency and reduce the chances of payment-related issues down the road. Clear terms also contribute to a more organized and efficient billing process, ultimately benefiting both you and your clients.

How to Handle Late Payments

Dealing with delayed payments is an unfortunate but common aspect of running a business. While it’s important to maintain professional relationships with clients, it’s equally essential to ensure that payments are made on time. Having a clear strategy for addressing late payments can help you manage cash flow, protect your business, and avoid unnecessary stress.

Steps to Take When Payments Are Delayed

If a payment hasn’t been received by the due date, it’s important to address the issue quickly and professionally. Below are steps you can follow to manage overdue payments:

- Send a Reminder – Politely remind the client that the payment is overdue, including the original payment terms and the amount due.

- Contact the Client – If a reminder doesn’t resolve the issue, contact the client directly via phone or email to inquire about the delay.

- Negotiate a Payment Plan – In some cases, clients may be facing financial difficulties. Offer to set up a payment plan that works for both parties.

- Apply Late Fees – If your terms include penalties for overdue payments, it’s important to apply them consistently to encourage timely payments.

How to Prevent Late Payments in the Future

While it’s not always possible to prevent delays, you can take steps to minimize the risk:

- Set Clear Payment Terms – Make sure your payment expectations are clear from the start, including due dates, accepted methods, and any late fees.

- Invoice Promptly – Send invoices as soon as services are completed or goods are delivered, rather than waiting for an extended period.

- Offer Multiple Payment Options – Make it easy for clients to pay by offering various payment methods, such as credit cards, bank transfers, and online payment platforms.

Late Payment Charges Example

Here’s an example table showing how late fees might be applied based on the payment delay:

| Days Late | Late Fee |

|---|---|