Hotel Booking Invoice Template for Easy Customization and Use

When managing accommodation services, accurate and professional documentation is essential for smooth financial transactions. Providing clients with clear and detailed receipts ensures transparency and fosters trust. A well-structured payment document is not only a legal requirement but also helps maintain a positive relationship with guests, enhancing their experience from check-in to checkout.

Designing effective financial records is key to ensuring smooth operations. These documents should outline the services provided, include all necessary details, and offer a simple format that both the business and the client can easily reference. Whether you’re running a small guesthouse or a large resort, having the right structure in place can save time and reduce errors.

Customization is another important factor. Tailoring your records to reflect your unique offerings, from additional amenities to special rates, will ensure accuracy and professionalism. By using the right tools and formats, you can streamline the process and make sure everything is clearly presented, minimizing misunderstandings with guests.

Hotel Booking Invoice Template Overview

For any accommodation provider, creating detailed and well-organized financial records is crucial to ensure both clarity and accuracy. These records serve as a formal acknowledgment of the services provided and help manage transactions smoothly. Whether for a single-night stay or an extended visit, clear documentation is essential for both business and client satisfaction.

Purpose and Importance

The primary function of such a document is to confirm the exchange of services for payment. It provides a clear breakdown of costs, including any additional fees, discounts, or taxes applied. This transparency helps avoid disputes and ensures both parties understand the terms of the transaction.

Key Features to Include

A well-structured document should include essential details such as guest information, dates of service, a full list of charges, and payment methods. By incorporating these elements, businesses can easily track financial records and simplify accounting tasks. Customizable fields can also allow providers to add specific notes or special requests, offering flexibility while maintaining professionalism.

Why You Need an Invoice Template

Having a structured document to record payments and services is essential for any accommodation provider. It not only helps ensure that financial transactions are properly documented but also offers a professional way to present charges to clients. Without such a framework, errors can occur, and tracking payments may become cumbersome.

Here are several reasons why utilizing a standardized document format is beneficial:

- Consistency: A predefined layout ensures that all essential details are included every time, reducing the risk of missing key information.

- Efficiency: With a set structure, you can quickly generate and issue records, saving time on administrative tasks.

- Accuracy: By using a standard format, calculations, tax rates, and charges are easier to manage, helping to avoid mistakes.

- Professionalism: A well-organized document enhances your image as a reliable and transparent service provider.

- Customization: Templates allow you to easily adapt the document to your unique pricing structure and service offerings.

Ultimately, adopting a standardized document helps streamline your operations, ensures clarity for clients, and keeps your financial records organized and accurate.

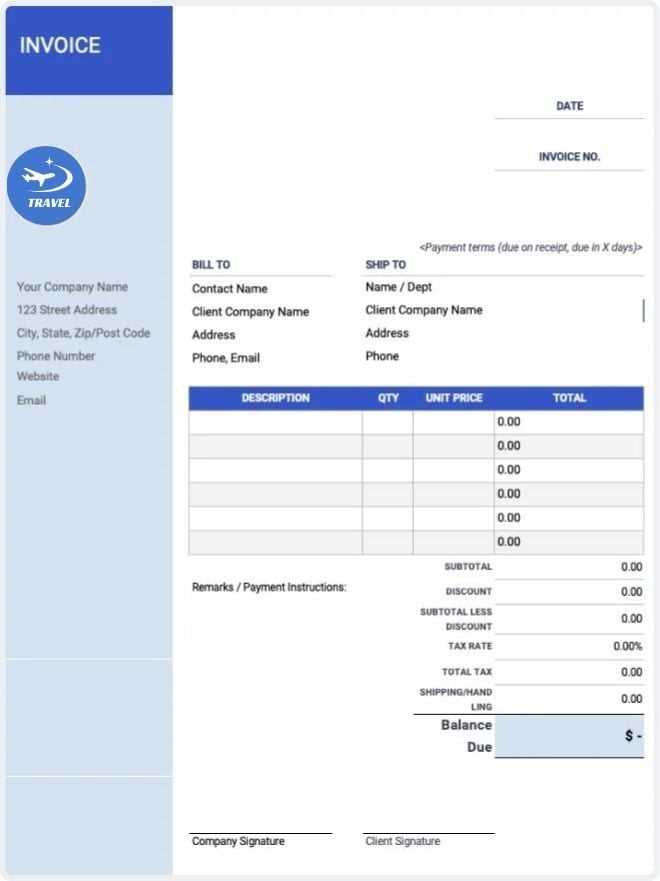

How to Create a Hotel Invoice

Creating a detailed and accurate payment receipt is a vital part of any accommodation service. This document should clearly outline the charges for services rendered, ensuring both the provider and the guest have a transparent record of the transaction. Here is a step-by-step guide to creating a professional document that covers all necessary details.

Steps to Create a Payment Receipt

- Include Your Business Information: At the top, list your name, address, contact details, and any relevant identification number. This helps the guest easily recognize the source of the document.

- Guest Details: Include the guest’s full name, address, and contact information. This ensures that the document is properly linked to the individual staying at your property.

- Service Dates: Clearly state the check-in and check-out dates, including any specific timeframes for additional services provided, such as late check-out or early check-in.

- Breakdown of Charges: List all services and amenities provided with their respective prices. Include the base rate, any additional charges (e.g., room service, parking), and applicable taxes.

- Payments Made: Specify any deposits or advance payments made by the guest, as well as the method of payment (credit card, cash, etc.).

- Total Amount Due: Provide the final total that the guest is required to pay, including all applicable fees and taxes.

- Payment Terms: State the due date for the remaining balance, along with acceptable payment methods, if applicable.

Final Touches

- Personalize the Document: Add any special notes, such as discounts or additional charges, that apply to the guest’s stay.

- Proofread: Before sending or handing over the document, double-check all information for accuracy.

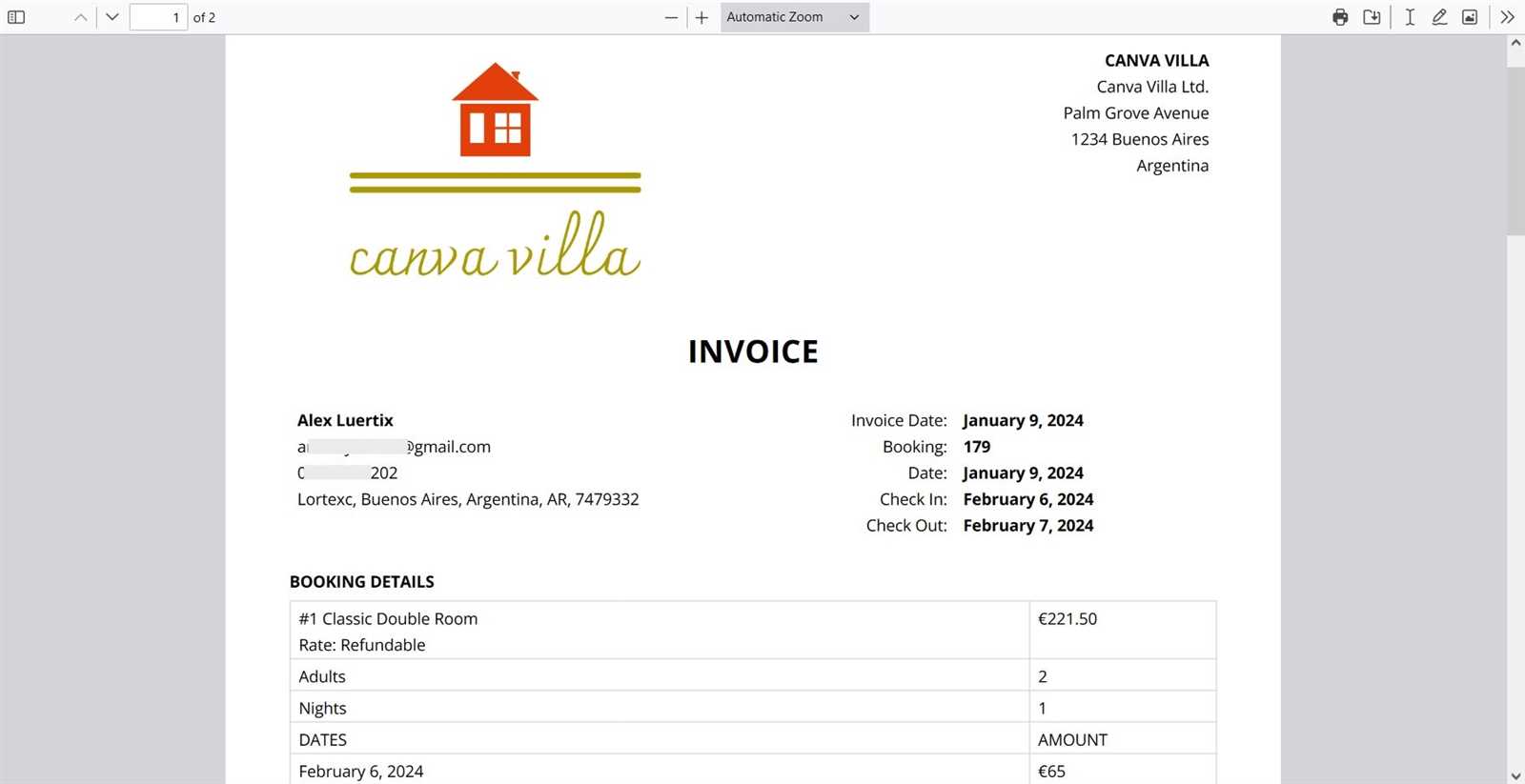

- Key Elements of a Hotel Invoice

To ensure that your financial documents are clear, accurate, and professional, it’s crucial to include all the necessary components. These essential details help both the guest and the service provider understand the breakdown of charges and ensure that no critical information is overlooked. Below are the key elements that should be present in every receipt issued for accommodation services.

- Business Information: Always include the name, address, and contact details of your establishment. This helps identify the source of the document and provides guests with a way to contact you for future inquiries or issues.

- Guest Details: The guest’s full name and contact information should be clearly listed to avoid confusion, especially when dealing with multiple bookings or clients.

- Stay Dates: Include the check-in and check-out dates, along with any other relevant dates such as late check-out or additional services provided.

- Service Breakdown: List the individual services provided, such as room charges, additional amenities, or extra services like transportation, meals, or spa treatments. Each service should have a clear cost associated with it.

- Tax and Fees: Clearly indicate any applicable taxes or service fees, including the percentage or fixed amount. This helps guests understand the full cost of their stay.

- Payments Made: Document any payments that have already been made, such as deposits or prepayments. This provides transparency and ensures that both parties are clear on the balance due.

- Total Amount: The final amount to be paid should be clearly highlighted, showing a sum of all charges minus any prepayments, taxes, or additional fees.

- Payment Terms: Include details regarding the payment method (e.g., credit card, cash) and the due date for any remaining balance, if applicable.

Incorporating these elements into your financial documents ensures that both you and your guests have a clear understanding of the charges and any remaining balance. This level of detail not only improves transparency but also helps maintain a professional image for your business.

Benefits of Using a Template

Adopting a standardized structure for your financial documents offers numerous advantages. With a pre-designed format, you can streamline the process, save time, and ensure consistency in all of your transactions. This approach provides clarity for both the service provider and the guest, reducing the likelihood of mistakes and misunderstandings.

- Time Efficiency: Using a pre-built format eliminates the need to create new records from scratch each time. This allows you to quickly fill in the details and focus on other important tasks.

- Consistency: A set structure ensures that each document contains the same key elements in the same order. This consistency helps maintain professionalism and makes it easier for guests to understand the charges every time.

- Accuracy: Pre-made formats often include fields for all necessary information, reducing the chance of forgetting essential details, such as taxes, fees, or payment methods.

- Customization: Even though the format is standardized, many options allow you to tailor the document to fit your unique services, pricing, and branding, ensuring it aligns with your business needs.

- Professional Image: A well-organized and polished document gives a professional impression to guests, enhancing their experience and trust in your services.

- Easy Tracking: Having a consistent format makes it easier to organize and track financial records. This can simplify accounting and help you stay on top of your financials.

By using a structured approach for your financial documentation, you can save time, ensure accuracy, and provide a higher level of service to your guests. This leads to a more efficient operation and a better overall experience for everyone involved.

Customizing Your Hotel Invoice

Personalizing your financial records ensures that they reflect your unique services and pricing structure. Tailoring your documents not only helps maintain a professional image but also provides guests with a clear breakdown of charges specific to their stay. Customization allows you to highlight special offers, add your branding, and adjust the format to suit your operational needs.

- Add Your Logo: Including your logo at the top of the document reinforces your brand identity and makes the receipt look more polished.

- Adjust Layout and Design: Modify the layout to include your preferred fonts, colors, and positioning of key elements. A clean and easy-to-read design enhances the guest’s experience and avoids confusion.

- Include Special Services: If you offer unique amenities or additional services such as spa treatments, excursions, or meals, make sure they are clearly listed with corresponding charges.

- Adjust Tax and Fee Calculations: Customize the fields to automatically calculate local taxes or service charges based on your location and pricing policies.

- Personalized Notes or Discounts: Add specific notes to the document, such as discounts, special offers, or customized messages to guests. This adds a personal touch and shows you value their business.

- Multiple Payment Methods: Customize the payment section to include all available payment options, such as credit card, bank transfer, or online payment systems.

Customizing your payment documents allows you to provide guests with a more tailored experience while ensuring that all important details are covered. This flexibility also ensures that your documents are perfectly aligned with your business practices, making them both functional and professional.

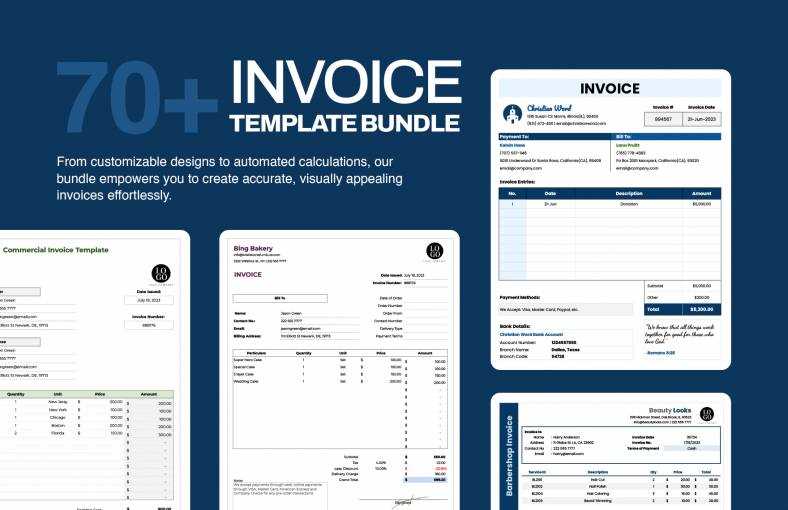

Free vs Paid Invoice Templates

When choosing a format for your financial documents, one of the key decisions is whether to opt for a free or paid solution. Both options offer their own set of advantages and limitations, and the right choice depends on your business needs, budget, and the level of customization you require. Below, we compare the features of both free and paid options to help you make an informed decision.

Free Options

Free formats are widely available and can be a great starting point for smaller businesses or those just beginning to streamline their operations. These solutions typically offer basic features, and in many cases, you can download them with minimal effort.

- Cost: As expected, free formats come at no cost, which is ideal for businesses on a tight budget.

- Basic Features: Free solutions usually include essential elements like guest details, service breakdown, and total charges.

- Limited Customization: Free versions tend to offer fewer options for personalization, which may be a drawback for businesses wanting to add branding or special pricing options.

- Limited Support: Most free formats don’t offer customer support, so troubleshooting or customization might be challenging if issues arise.

Paid Options

Paid solutions provide more advanced features and a higher level of customization, making them a better option for businesses that require a more professional appearance or specific functionalities.

- Customization: Paid formats often allow for greater flexibility, such as custom fields, personalized branding, and the ability to adjust layout and design according to your business’s needs.

- Advanced Features: These may include automated calculations, integrated payment gateways, and the ability to manage multiple payment methods.

- Support: Paid options usually come with customer service or technical support, ensuring that any issues or questions are addressed promptly.

- Regular Updates: Many paid solutions provide regular updates to keep your documents in line with the latest regulations and best practices.

Ultimately, the decision between free and paid formats depends on the complexity of your business requirements. Free formats can serve basic needs, but if you’re looking for more flexibility, professional appearance, and additional features, investing in a paid solution might be th

Best Software for Invoice Templates

When creating professional and well-organized payment records, using the right software can significantly improve efficiency and accuracy. The right program not only simplifies document creation but also helps manage your finances, track payments, and streamline the entire process. Below are some of the best software solutions that offer great features for generating and customizing financial documents.

Top Software Options for Financial Records

- FreshBooks: FreshBooks is a popular accounting and invoicing software that offers customizable financial documents, automation for recurring charges, and integration with various payment gateways. It’s ideal for small businesses looking for an easy-to-use solution with a wide range of features.

- QuickBooks: QuickBooks is a comprehensive accounting software that includes customizable document creation, expense tracking, and reporting. It’s perfect for businesses that need more than just basic document generation but also want to manage payroll, taxes, and invoices in one place.

- Zoho Invoice: Zoho Invoice provides a powerful yet affordable solution for creating professional payment records. It offers customization options, time tracking, and integrates with other Zoho apps, making it a great choice for businesses that need flexibility and scalability.

- Wave: Wave is a free software that helps create and send customizable payment receipts. It’s an excellent option for freelancers or small businesses on a tight budget, offering features like online payments, expense tracking, and receipt scanning without a subscription fee.

- Invoicely: Invoicely offers both free and paid plans and is a great tool for businesses that need multi-currency support and recurring billing. Its simple interface allows users to create and send customized financial documents quickly and easily.

Choosing the Right Software for Your Needs

- Consider Your Budget: If you’re a small business or freelancer, free solutions like Wave or Invoicely may be sufficient. For businesses that need more advanced features, paid options like FreshBooks or QuickBooks might be better.

- Integration with Other Tools: Look for software that integrates well with your existing accounting or business tools, especially if you need to track expenses, manage taxes, or create detailed reports.

- Ease of Use: Choose a solution that fits your technical expertise. If you prefer a simple and intuitive interface, look for software with easy-to-use customization options.

Ultimately, the right software for generating payment records will depend on your specific needs. Whether y

Common Mistakes to Avoid in Invoices

Creating payment records may seem straightforward, but small errors can lead to confusion, delays, and even disputes. It’s crucial to ensure that all the details are accurate and clear. Avoiding common mistakes when generating these documents will help maintain professionalism and ensure smooth transactions with your clients.

Key Errors to Watch Out For

- Missing or Incorrect Contact Information: Failing to include the correct details for both the guest and the service provider can lead to misunderstandings and delays in payment. Always double-check names, addresses, and contact numbers.

- Omitting Key Charges: If any services or fees are left off the document, it could lead to confusion and payment issues. Ensure that all charges, including taxes, extra services, or additional amenities, are clearly listed.

- Incorrect Calculations: Errors in adding up charges or calculating taxes can lead to discrepancies between the agreed amount and the final total. Always verify calculations and use automated tools when possible.

- Not Including Payment Terms: It’s important to clearly state the payment due date, methods of payment, and any late fees. Failing to do so can lead to delayed payments and misunderstandings.

- Unclear Service Descriptions: Avoid vague descriptions of services or charges. Be specific about the services rendered, the dates, and the rates to avoid confusion and ensure transparency.

- Failure to Proofread: Even small spelling or grammatical errors can hurt your professional image. Always review your documents before sending them out to ensure they are clear and accurate.

How to Ensure Accuracy

- Double-check all information: Before finalizing a document, make sure all the details are correct, including dates, charges, and contact information.

- Use automated tools: Many invoicing systems offer automatic calculations and pre-filled fields to reduce the chances of errors.

- Keep a checklist: Maintain a standard checklist to ensure that every essential component is included in your payment documents.

How to Format Your Hotel Invoice

Proper formatting is key to creating clear and professional financial records. A well-organized document makes it easier for clients to understand charges and for businesses to keep track of payments. The right format ensures that all essential details are included, easy to read, and properly structured, enhancing both functionality and presentation.

Steps to Format Your Financial Document

- Start with Your Business Information: At the top of the document, include your company name, address, contact details, and any relevant registration numbers. This helps identify the source of the document and ensures your business’s legitimacy.

- Add Client Information: Clearly list the guest’s name, contact details, and address. This ensures that the record is associated with the correct individual or organization.

- Include the Date of Issue: Always specify the date the document is created. This helps both parties reference the record accurately in case of any future communication.

- List Service Details: Include a clear breakdown of all services provided during the guest’s stay, such as room rates, extra amenities, and additional charges. For each service, list the date, description, and price to ensure transparency.

- Show Applicable Taxes and Fees: Make sure to include any taxes, service charges, or additional fees, specifying their percentage or amount. This ensures the client understands the full cost.

- Provide Total Charges: Clearly show the final amount due, including all charges, taxes, and deductions, such as prepayments or deposits. The total should be easily distinguishable from the other details.

- Payment Terms and Methods: State the accepted methods of payment and any due dates or late payment fees. This helps avoid any confusion or delays in payment.

Best Practices for Clear Layout

- Use Consistent Fonts: Stick to professional, easy-to-read fonts like Arial or Times New Roman. Avoid using too many different styles or sizes, which can make the document look cluttered.

- Align Information Properly: Ensure that all details are neatly aligned. Service descriptions, dates, and prices should line up for easy reading.

- H

Adding Tax and Fees to Invoices

Incorporating taxes and service fees into your financial records is essential for ensuring accuracy and compliance with local regulations. These additional charges not only affect the total amount due but also help provide transparency to your clients. Properly listing and calculating taxes and fees can prevent misunderstandings and ensure that both parties are on the same page regarding the final payment.

How to Calculate and Add Taxes

- Understand Local Tax Laws: Different locations have varying tax rates, so it’s important to stay updated on local regulations. This may include sales tax, value-added tax (VAT), or other applicable charges based on your region.

- Specify Tax Rate: Clearly list the applicable tax rate on your document. If the tax rate differs for various services, ensure that each rate is specified next to the respective charge.

- Calculate the Tax Amount: Multiply the price of each service by the tax rate to calculate the tax amount. Add these amounts together to get the total tax due.

- Show Tax Breakdown: List each service or charge separately, showing both the price and the tax applied to it. This adds clarity for your clients and helps them understand how the final amount is calculated.

Handling Service Fees and Additional Charges

- List All Applicable Fees: Include any additional fees, such as cleaning, security, or processing fees. Make sure these charges are explained and listed separately to avoid confusion.

- Provide Clear Descriptions: Clearly describe each fee on your document, including the reason for the charge. For example, instead of just listing “service fee,” specify “Cleaning Fee” or “Late Checkout Fee” to provide more context.

- Ensure Consistent Formatting: Make sure that all taxes and fees are clearly distinguished from the base charges. Using a different font style or highlighting key details can help clients easily spot these additional costs.

Accurate tax and fee calculations are essential for maintaining transparency and building trust with your clients. By carefully adding these details to your financial documents, you ensure that both parties have a clear understanding of the total amount due and avoid potential disputes over pricing.

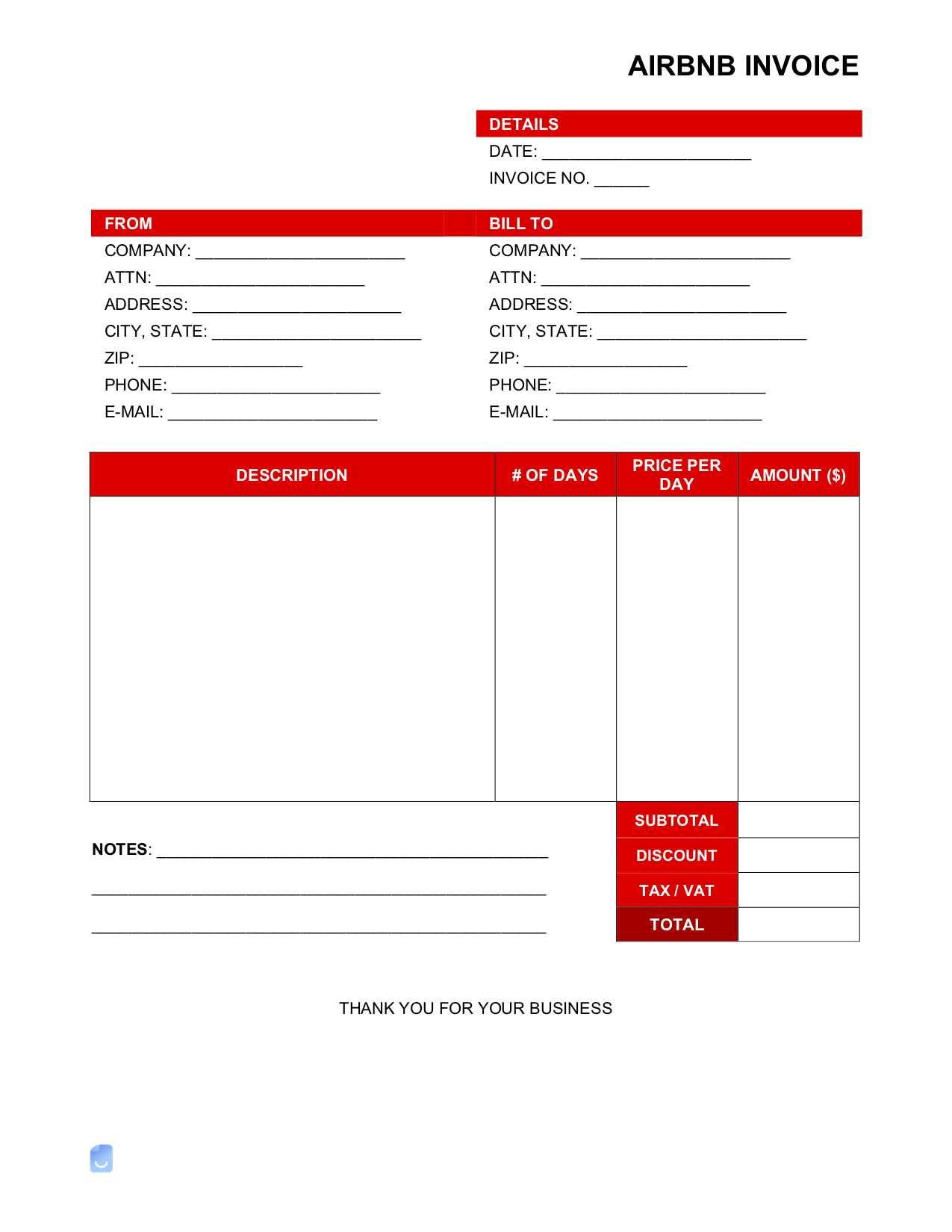

Invoice Template for Large Properties

For large establishments that offer a variety of services and amenities, creating detailed financial documents is essential to managing guest accounts effectively. The complexity of pricing structures, multiple charges, and diverse offerings requires a robust format that clearly breaks down each service, fee, and applicable taxes. An effective format for large properties will ensure accuracy, prevent confusion, and provide transparency for both guests and business owners.

Key Features for Large Properties

- Multiple Service Listings: Large properties often offer a variety of amenities, from rooms to events, dining, and additional services. A well-structured document should list each service separately, along with corresponding charges.

- Detailed Breakdown of Charges: Guests should be able to see exactly what they are being charged for, including taxes, service fees, and any additional charges. This breakdown ensures transparency and avoids disputes.

- Multiple Payment Methods: Large properties often handle a range of payment options. It’s important to clearly state how payments can be made, whether by card, bank transfer, or other methods.

- Itemized Services: Clearly itemize all services and fees, such as room rental, food and beverage charges, event services, and any other extras, to ensure clarity.

Example Format for Large Property Financial Documents

Service Description Quantity Unit Price Total Room Rent (Luxury Suite) 1 $250.00 $250.00 Breakfast Buffet 2 $30.00 $60.00 Spa Services 1 $100.00 $100.00 Event Hall Rental How to Send Hotel Invoices Professionally

Sending payment records professionally is crucial for maintaining positive relationships with your clients and ensuring smooth financial transactions. A well-presented document, delivered promptly and with the right approach, demonstrates your business’s commitment to clear communication and professionalism. How you send these documents can be as important as the content itself, as it affects your image and efficiency in dealing with payments.

Best Practices for Sending Payment Records

- Choose the Right Delivery Method: The most common and efficient way to send payment records is via email. Ensure that the document is in a universally accessible format like PDF to preserve its formatting and prevent tampering. Alternatively, secure cloud links can also be used for added safety and ease of access.

- Use Professional Email Language: Craft a clear, polite, and professional email to accompany your financial document. Mention the document’s purpose, the amount due, the payment terms, and a clear call to action, such as confirming receipt or initiating payment.

- Include Clear Subject Lines: The subject line should make the purpose of the email immediately apparent. Use specific language, like “Payment Record for Your Recent Stay,” to avoid ambiguity and ensure that the recipient knows exactly what to expect.

- Attach a Personalized Message: Always include a brief message with the attached document, thanking the recipient for their business and clearly stating any next steps or payment deadlines. A personalized tone can make the communication feel more thoughtful and professional.

- Double-Check Accuracy: Before sending any financial document, verify that all the information is correct, from the service details to the amounts and contact details. Mistakes can harm your credibility and create confusion, so it’s essential to ensure the accuracy of every element.

Ensure Timely Follow-Ups

- Set Reminders for Payment Due Dates: Always track the due date and set reminders for yourself. If payment is not received on time, follow up promptly with a polite reminder email. Include a copy of the original document, the due amount, and the payment instruction

Tracking Payments with Hotel Invoices

Efficiently tracking payments is an essential aspect of managing financial records. By keeping a clear record of all transactions, businesses can ensure that payments are received on time and that any discrepancies are quickly addressed. Proper tracking helps maintain cash flow, prevents missed payments, and supports accurate financial reporting.

Steps to Effectively Track Payments

- Assign Unique Reference Numbers: Give each financial record a unique reference or identification number. This helps you easily track and match payments with the correct accounts, avoiding confusion and errors.

- Monitor Payment Dates: Track the due dates and payment dates for all financial documents. Keeping an eye on overdue payments allows you to follow up with clients promptly, ensuring timely settlement of accounts.

- Use Payment Status Indicators: Indicate the payment status on your document, such as “Paid,” “Pending,” or “Overdue.” This provides a quick visual reference and allows for better organization when managing multiple transactions.

- Record Payment Methods: Always note the method of payment–whether it’s by card, bank transfer, cash, or another option. Tracking payment methods can provide valuable insights into payment trends and customer preferences.

- Update Your Records Regularly: As soon as a payment is received, update your financial system or ledger. This ensures your records remain accurate and reflects the most current information available.

Tools and Techniques for Payment Tracking

- Use Accounting Software: Invest in reliable accounting software that allows you to track payments, create reports, and manage multiple transactions. Many tools also provide automated reminders for overdue payments.

- Create a Payment Tracker Spreadsheet: For businesses looking for a low-cost solution, a well-organized spreadsheet can help track payments, record dates, amounts, and payment methods.

- Leverage Online Payment Systems: Use online payment systems with integrated tracking features to streamline the payment process and ensure you have a real-time view of incoming payments.

By following these methods and using the right tools, businesses can easily manage payment tracking, ensuring timely payments, fewer administrative errors, and a better overall financial workflow.

Automating Your Payment Record Process

Automation can significantly streamline financial tasks, reducing manual errors and saving valuable time. By implementing automated systems, businesses can quickly generate, send, and track payment records, ensuring accuracy and efficiency. Automation not only speeds up the process but also enhances customer experience by providing fast, consistent, and error-free documents.

Benefits of Automating Your Process

- Increased Efficiency: Automated systems can handle repetitive tasks, such as generating payment records and sending reminders, freeing up time for more strategic business activities.

- Improved Accuracy: Reducing manual input decreases the likelihood of mistakes. Automated systems use predefined templates, ensuring consistent and accurate entries.

- Faster Processing: With automation, you can instantly generate payment documents, speeding up the time it takes to complete each transaction.

- Better Organization: Automated systems help maintain a structured and organized financial record, making it easier to track payments, resolve disputes, and retrieve past records when needed.

How to Automate Your Payment Process

- Implement Accounting Software: Use specialized accounting software that automates the creation and delivery of payment records. Many solutions integrate with payment processors and offer features like automatic updates for received payments.

- Use Online Payment Solutions: Online payment platforms often include automatic invoicing features, enabling businesses to instantly issue financial documents when a payment is made.

- Set Up Email Automation: Automated email systems can send payment records and reminders at specific intervals, ensuring timely communication without requiring manual intervention.

- Integrate with CRM Tools: Customer relationship management (CRM) tools can be integrated with accounting systems, automatically triggering payment record creation after a service is rendered or booking is completed.

By automating your financial documentation processes, you can ensure that your payment records are accurate, timely, and efficiently managed, allowing you to focus on growing your business and enhancing customer satisfaction.

Legal Considerations in Payment Records

When creating financial documents for customers, it is essential to understand the legal obligations and considerations that come into play. These records are not only tools for managing transactions but also important legal documents that may be used for dispute resolution, tax reporting, or compliance with local regulations. Properly handling these records ensures your business remains compliant and reduces the risk of legal complications.

Key Legal Aspects to Consider

- Accuracy and Transparency: All charges, fees, and taxes should be clearly outlined and accurate. Misleading or unclear information could result in disputes or legal issues. Transparency ensures that customers understand exactly what they are paying for and prevents confusion.

- Inclusion of Required Information: Many jurisdictions have specific legal requirements for what must be included in financial documents. This can include business name, address, contact information, tax ID, payment due dates, and details of services rendered. Failing to provide this information could lead to penalties or legal challenges.

- Tax Compliance: Ensure that the correct tax rates are applied to services, and that tax calculations are accurate. This is crucial for compliance with tax authorities and avoiding potential audits or fines.

- Retention of Records: In many countries, businesses are legally required to retain financial records for a specified period. Make sure that all documents are stored securely and in compliance with local record-keeping laws.

- Terms and Conditions: Clearly state the payment terms, including deadlines, late fees, and cancellation policies. This helps to avoid disputes and provides a legal framework for both parties in case of payment delays or cancellations.

Best Practices for Legal Compliance

- Consult with a Legal Professional: To ensure full compliance with local regulations, it’s always a good idea to consult with a lawyer who specializes in business law or financial documentation.

- Update Regularly: Laws and regulations may change over time, so it’s important to stay updated on any new legal requirements that may impact your financial documents. Periodically reviewing your processes will help you stay compliant.

- Use Reliable Accounting Systems: Automated accounting tools often include built-in compliance checks and generate legally compliant documents. These tools