Essential Services Invoice Template for Streamlined Billing

Effective billing is a crucial part of running any business, ensuring that you get paid accurately and on time for the work you provide. Whether you’re an independent contractor, small business owner, or part of a larger company, having a well-organized system for generating payment requests can save you time and prevent costly errors.

Creating structured and clear payment requests is vital for maintaining a professional image and facilitating smooth transactions. This process goes beyond just filling out a form–it’s about ensuring that all necessary information is included, formatted properly, and easy for the recipient to understand. When done correctly, it can enhance communication and reduce confusion between both parties.

In this guide, we will explore how to craft efficient billing documents that reflect your professionalism and streamline your financial operations. By focusing on key details and customization, you can ensure that your requests are both legally compliant and tailored to the unique needs of your business or service. Whether you’re new to billing or looking for ways to improve your current system, this resource will help you develop a straightforward approach that works for you.

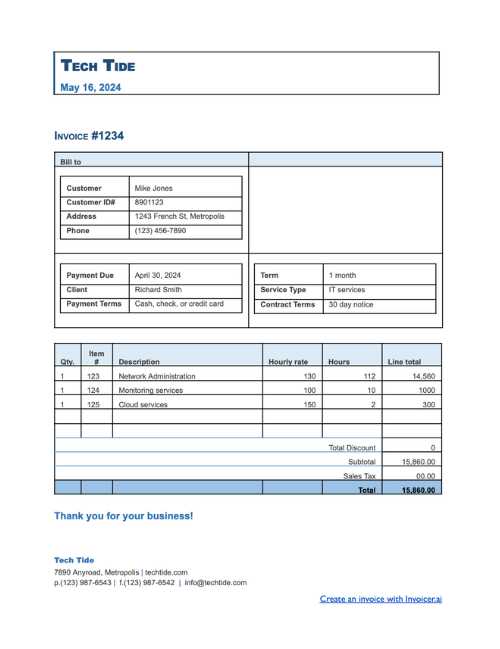

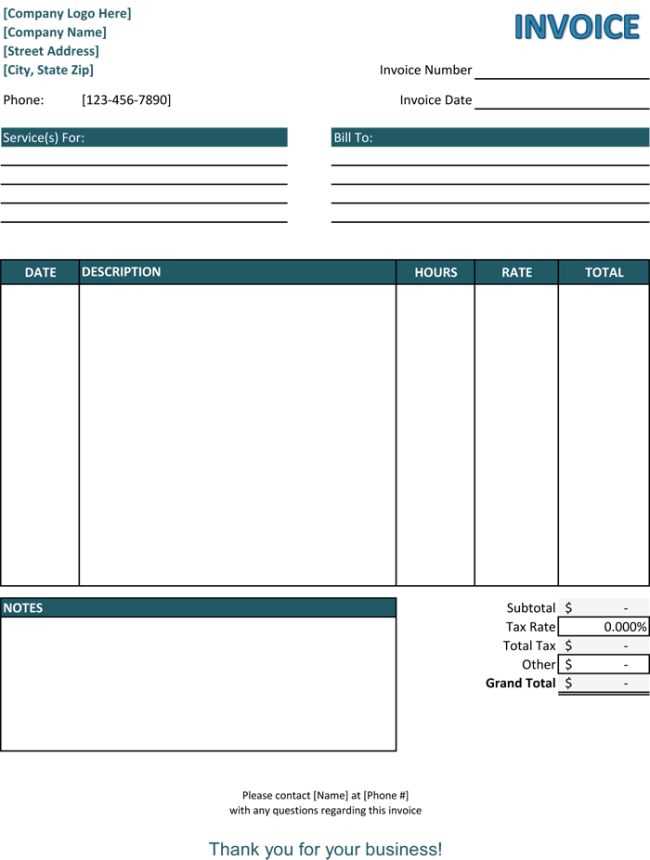

Services Invoice Template Overview

When requesting payment for work completed, it’s essential to have a structured document that clearly outlines the terms of the transaction. This document helps ensure transparency, professionalism, and smooth communication between the service provider and the client. By using an organized format, both parties can easily refer to the same details, reducing misunderstandings and speeding up the payment process.

What Makes a Well-Designed Billing Document?

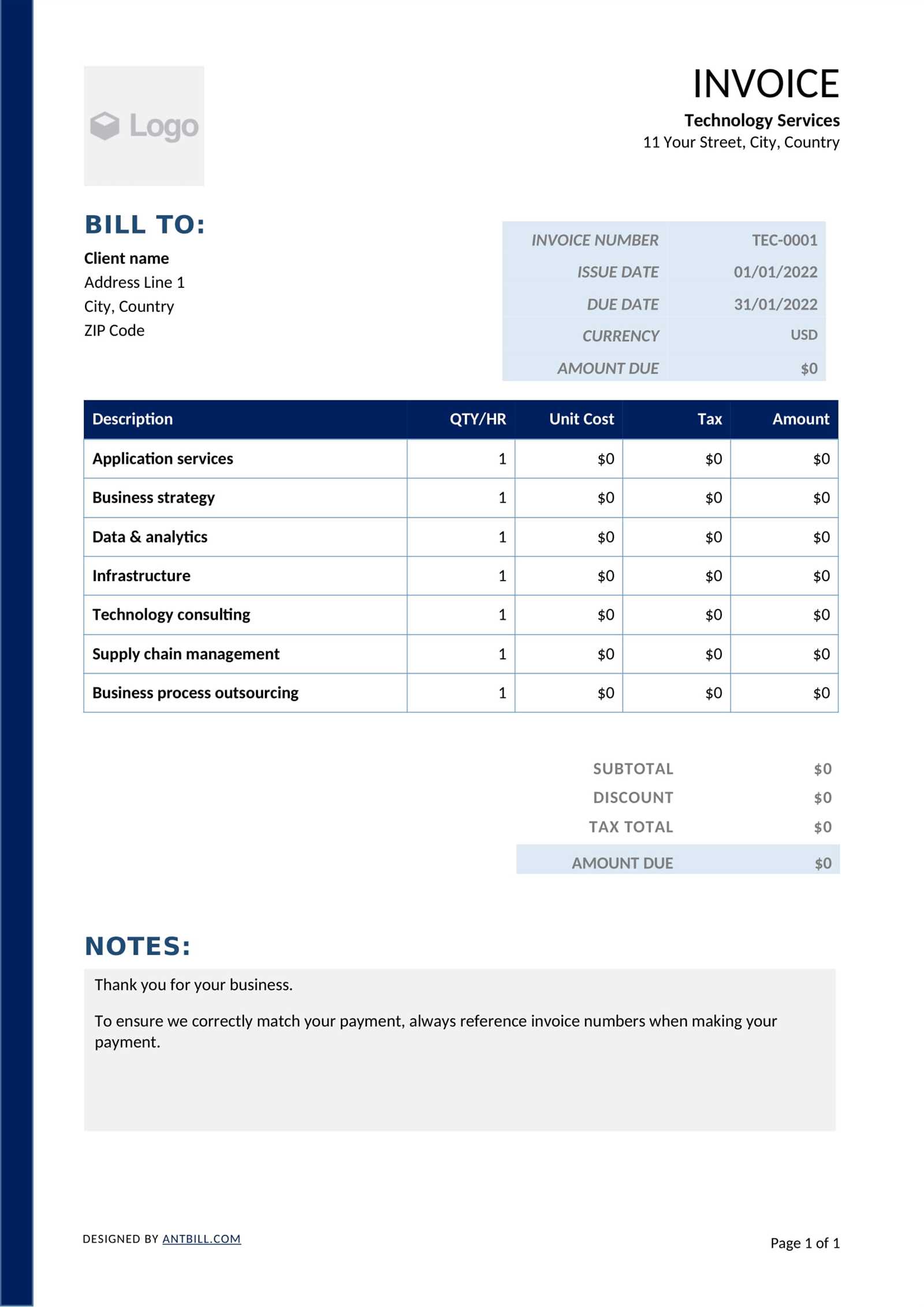

A well-crafted payment request should contain several key elements to ensure that all necessary information is conveyed clearly. These include:

- Client Details: Clear identification of both the provider and the customer.

- Service Description: Detailed breakdown of the work or products delivered.

- Payment Terms: Clear instructions on how and when to pay.

- Pricing Structure: Transparent costs with itemized rates, including any taxes or additional fees.

- Due Date: Specific date when payment is expected.

Why Use a Pre-Formatted Document?

Using a pre-designed document helps eliminate errors and ensures consistency across all payment requests. It also saves time, as you don’t need to recreate a new document for each transaction. Customizing a standard format can help you maintain a professional appearance and ensure that all important details are included in every communication.

Whether you’re a freelancer, consultant, or business owner, leveraging this type of document not only simplifies the billing process but also helps maintain a smooth relationship with clients by demonstrating organization and reliability.

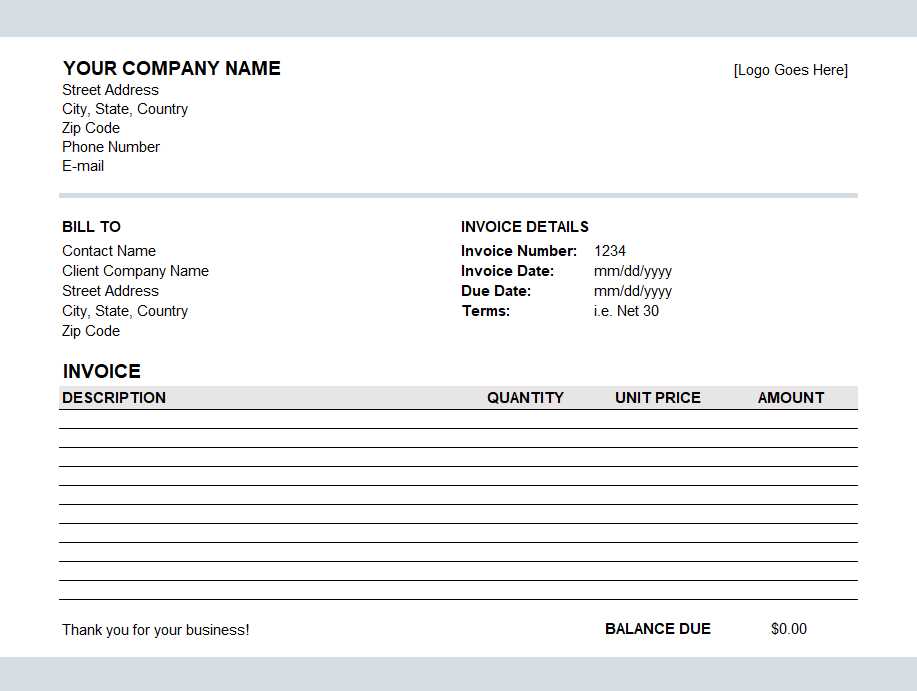

How to Create a Professional Invoice

Creating a professional billing document requires attention to detail and a clear structure to ensure that both parties involved in the transaction have a mutual understanding of the terms. A well-organized request for payment reflects positively on your business and encourages timely payments. To create a document that is both functional and professional, certain elements must be included and formatted correctly.

Step-by-Step Process for Crafting a Payment Request

Follow these steps to develop a polished document that will effectively communicate all necessary payment details:

- Include Contact Information: At the top of the document, list your business name, address, email, and phone number, as well as the client’s details. This ensures that both parties can easily identify who the request is coming from and where to direct questions.

- Provide a Unique Reference Number: Assign a unique number or code to each request. This helps both you and your client track the document and simplifies your record-keeping system.

- Clearly Outline the Work Done: Provide a detailed description of the work, products, or deliverables. Be specific about the scope, quantity, and any other relevant information to avoid confusion.

- State the Payment Terms: Define the payment deadline and acceptable methods of payment. Be clear about any late fees, early payment discounts, or installment options if applicable.

- Break Down Costs: Itemize all charges with clear explanations and corresponding prices. This transparency helps prevent disputes and fosters trust between both parties.

- Include Tax Information: If applicable, add any taxes or additional fees. This is particularly important for businesses that operate in areas where taxes are required on transactions.

Design Tips for a Professional Appearance

In addition to the content, the appearance of your billing document plays a key role in i

Benefits of Using an Invoice Template

Utilizing a pre-designed document for payment requests offers numerous advantages for businesses and freelancers alike. Rather than starting from scratch each time you need to create a new billing statement, a well-organized format streamlines the process, helping you save time and reduce errors. Whether you’re managing a large number of transactions or just a few, a structured approach enhances the efficiency and professionalism of your operations.

Time-Saving and Efficiency

One of the primary benefits of using a pre-made format is the time it saves. Rather than manually setting up a new document each time, you simply input the specific details of the current transaction. This consistency allows you to focus on other important tasks, rather than spending time designing or formatting a payment request.

- Faster Turnaround: Quickly generate a new document without having to start from scratch.

- Easy to Reuse: Keep a master version to duplicate and customize for each new transaction.

- Reduces Administrative Work: Cut down on the time spent creating, revising, and sending out payment requests.

Improved Professionalism

Using a well-structured document gives a polished and professional impression to clients. It shows that you take your business seriously and have established systems in place to manage transactions efficiently. The format ensures that all necessary details are included in a clear and readable way, leaving no room for ambiguity.

- Consistency: Maintain a uniform appearance across all your payment requests.

- Brand Identity: Customizable layouts allow you to incorporate your logo, colors, and fonts.

- Clear Communication: The standard format reduces the likelihood of missing or confusing information.

Ultimately, adopting a standardized approach to creating payment documents helps you stay organized, ensures compliance with industry standards, and projects a professional image to clients, leading to better business relationships and smoother financial transactions.

Key Elements of a Service Invoice

When creating a document to request payment for completed work, it’s essential to include several important details. A well-structured request ensures that both you and your client understand the terms of the transaction, including the work performed, payment terms, and any additional fees. Including all relevant information in a clear and concise format helps prevent confusion and ensures smooth processing of payments.

Essential Information for a Complete Billing Statement

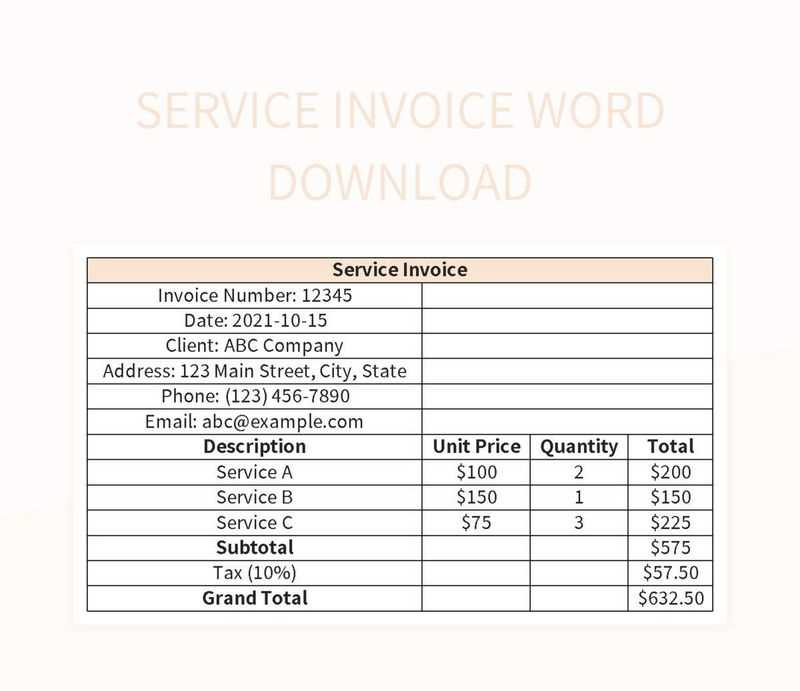

Here are the key components that should be included in every document to ensure transparency and clarity:

| Element | Description |

|---|---|

| Contact Information | Details of both the service provider and the client, including names, addresses, and contact numbers. |

| Unique Identifier | A reference number for tracking purposes. This helps both parties refer to the document easily. |

| Service Description | A detailed breakdown of the work performed, including the type of service, time spent, or products delivered. |

| Pricing Details | Itemized costs for each service or product, along with unit prices and quantities. Include applicable taxes and fees. |

| Payment Terms | Clear instructions on the payment method, due date, and any penalties for late payment. |

| Total Amount Due | The final sum to be paid, including all fees, taxes, and discounts, if applicable. |

Formatting for Clarity

For the document to be easily readable and professional, proper formatting is key. Use clear headings, organized sections, and a logical flow of information. The layout should allow the recipient to quickly find key details such as t

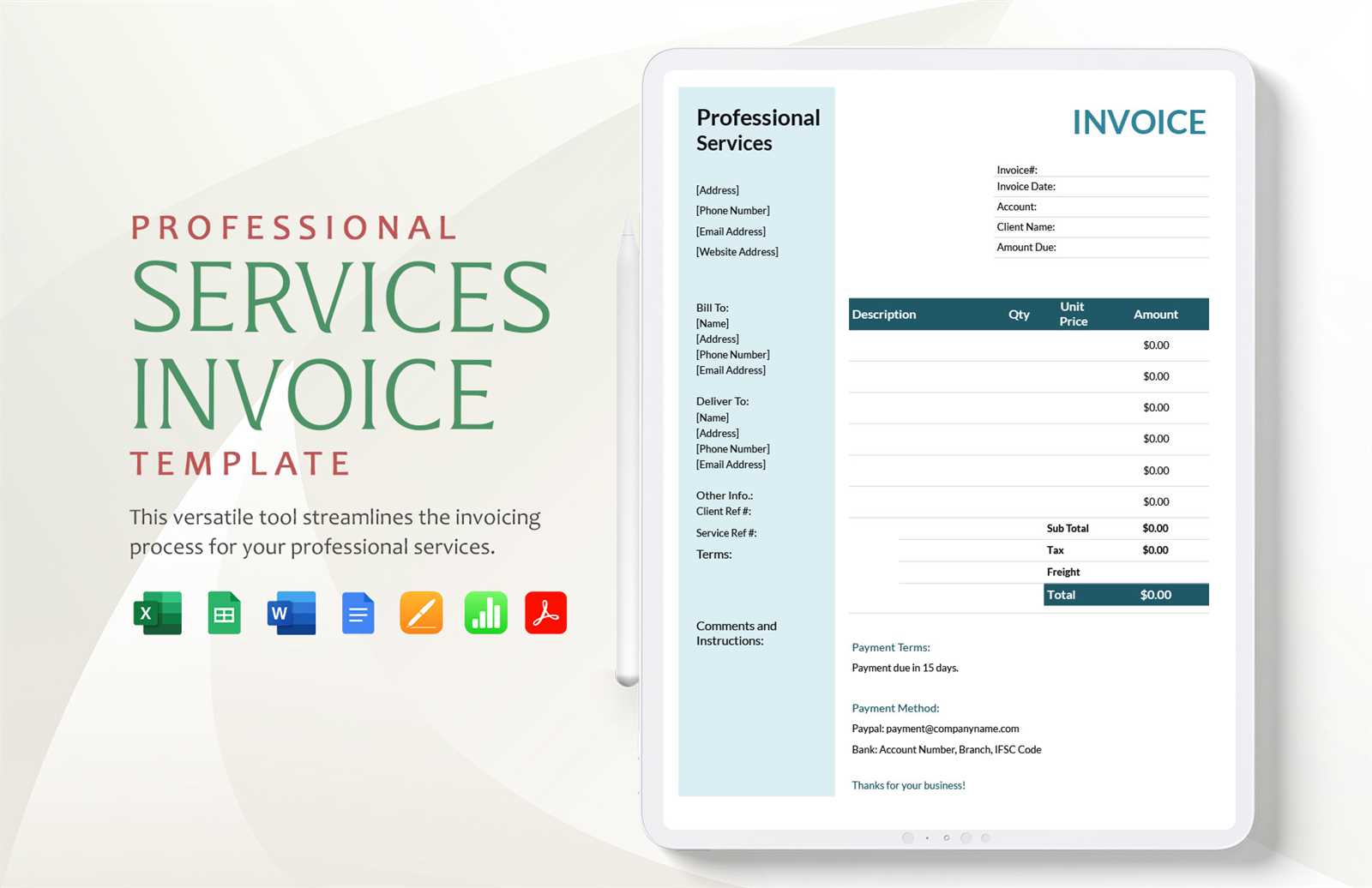

Customizing Your Invoice for Clients

Tailoring your billing document to meet the specific needs of each client can help build stronger relationships and ensure clear communication. A customized approach not only reflects professionalism but also shows that you value each client’s individual requirements. By adjusting details like payment terms, service descriptions, and branding, you can create a more personalized experience that fosters trust and efficiency in your business dealings.

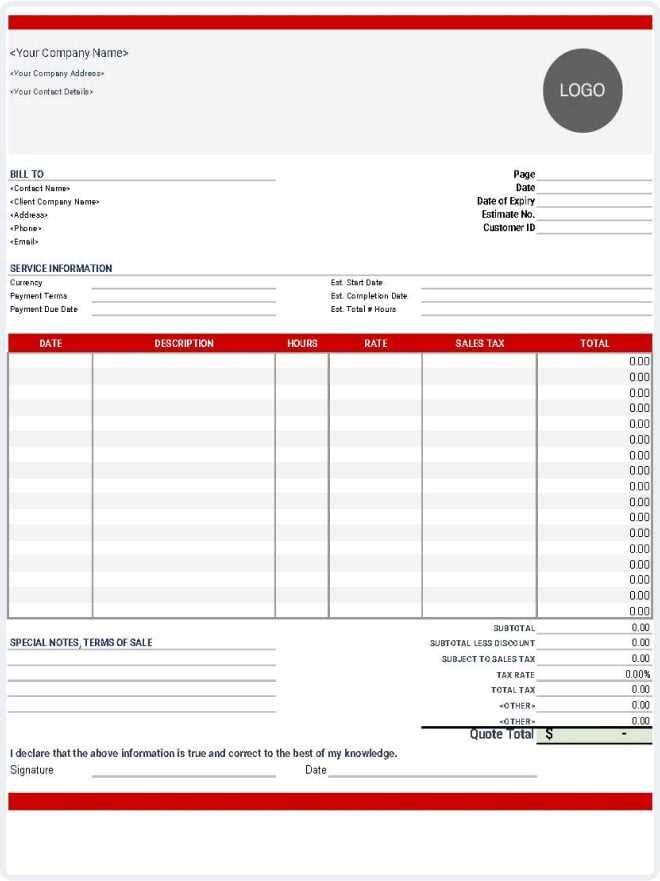

Personalizing the Document

To make your request for payment stand out, consider incorporating client-specific details that show your attention to their unique needs. This can include:

- Client’s Business Information: Include the client’s company name, contact details, and any reference number specific to the transaction.

- Customized Service Descriptions: Adjust the description of the work based on the project specifics, addressing the client’s needs in clear, relevant terms.

- Flexible Payment Terms: Adapt the due date or payment method depending on the client’s preferences or agreed terms.

Branding for Professionalism

Incorporating your business branding into the billing document can enhance your professional image and make your documents feel cohesive. Elements to consider include:

- Logo and Brand Colors: Adding your logo and using consistent colors throughout the document reinforces your brand identity.

- Personalized Notes: Including a brief thank-you note or special message can make the experience feel more personal and appreciative.

- Customized Layout: Adjust the layout to reflect your business style, using professional fonts and organized sections that are easy for your client to navigate.

By customizing your billing documents, you demonstrate that you are not only detail-oriented but also adaptable to your client’s needs, leading to stronger, long-lasting business relationships.

Common Mistakes to Avoid in Invoicing

Even small errors in your payment requests can lead to confusion, delays, or misunderstandings with clients. Ensuring accuracy and clarity in every document is essential for maintaining professional relationships and ensuring timely payments. Below are some of the most common mistakes businesses make when preparing payment requests and how to avoid them.

Key Errors to Watch Out For

Pay attention to these common mistakes to ensure your payment requests are clear and effective:

- Missing or Incorrect Contact Information: Double-check that all client and business details are correct. Errors in contact information can delay communication and payment processing.

- Unclear Service Descriptions: Vague descriptions can cause confusion. Always provide a detailed breakdown of the work completed, with clear terms and definitions.

- Failure to Include a Payment Due Date: Without a clear due date, clients may delay payment. Always specify the exact date by which the payment should be received.

- Incorrect Pricing or Calculation Errors: Ensure all rates, quantities, and totals are correct. Mathematical errors or incorrect pricing can damage your credibility and cause disputes.

- Not Accounting for Taxes or Fees: If applicable, make sure to include taxes, fees, or other charges. Omitting them can lead to confusion or clients refusing to pay the full amount.

- Overlooking Terms and Conditions: Failing to mention late fees, payment methods, or other critical terms can create confusion down the line.

How to Avoid These Mistakes

By taking the following steps, you can minimize errors and ensure your payment requests are professional and efficient:

- Double-Check All Information: Before sending, review every detail, from client contact info to the pricing breakdown, to ensure accuracy.

- Use a Standardized Format: A consistent layout helps you avoid missing important details and ensures clarity every time.

- Include Clear Instructions: Be explicit about how and when

Top Tools for Invoice Creation

Creating accurate and professional payment requests is essential for smooth business operations. While manual creation can be time-consuming and prone to errors, using specialized software can significantly streamline the process. These tools not only simplify the design and calculation of your documents but also ensure that you remain consistent and efficient across all transactions.

There are many tools available that can help you generate well-organized and customized payment documents. Below are some of the top options that can make the billing process quicker, easier, and more reliable:

Best Tools for Efficient Billing

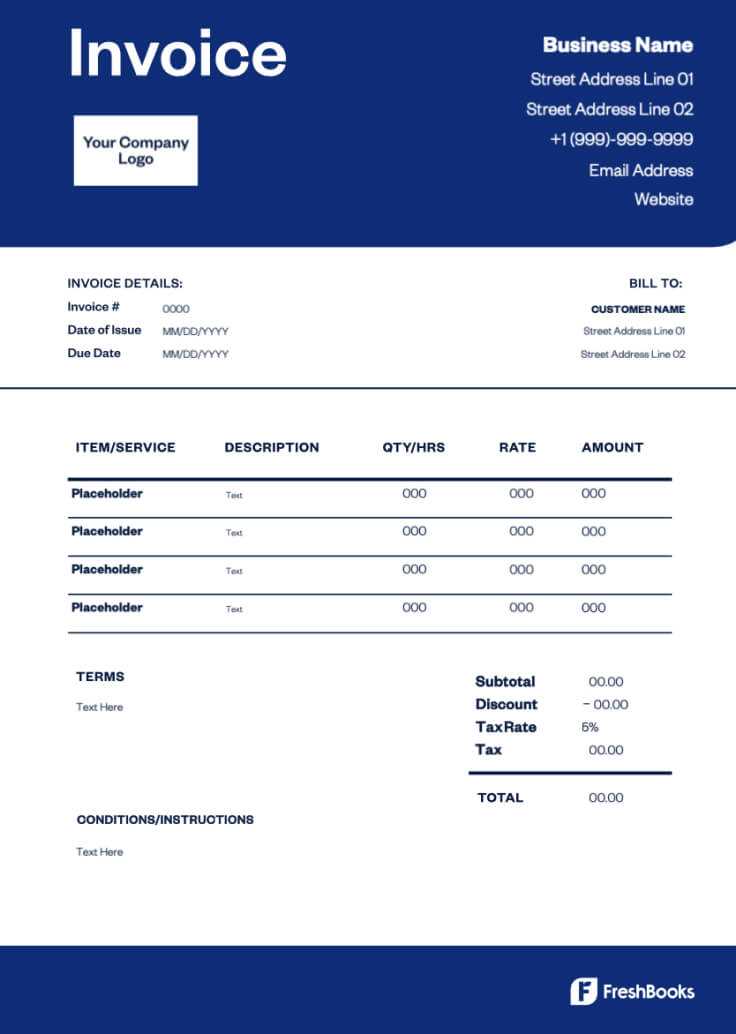

- FreshBooks: This cloud-based software is ideal for freelancers and small businesses, allowing users to create, send, and track payment requests with ease. It also integrates time tracking and expense management, making it a comprehensive solution.

- QuickBooks: Known for its accounting features, QuickBooks also offers simple yet customizable billing options. It’s perfect for businesses that need to manage both payments and financial records in one place.

- Zoho Invoice: Zoho provides a user-friendly interface with customizable features, such as recurring billing and automated reminders. It’s an excellent option for businesses looking to streamline their billing process without sacrificing personalization.

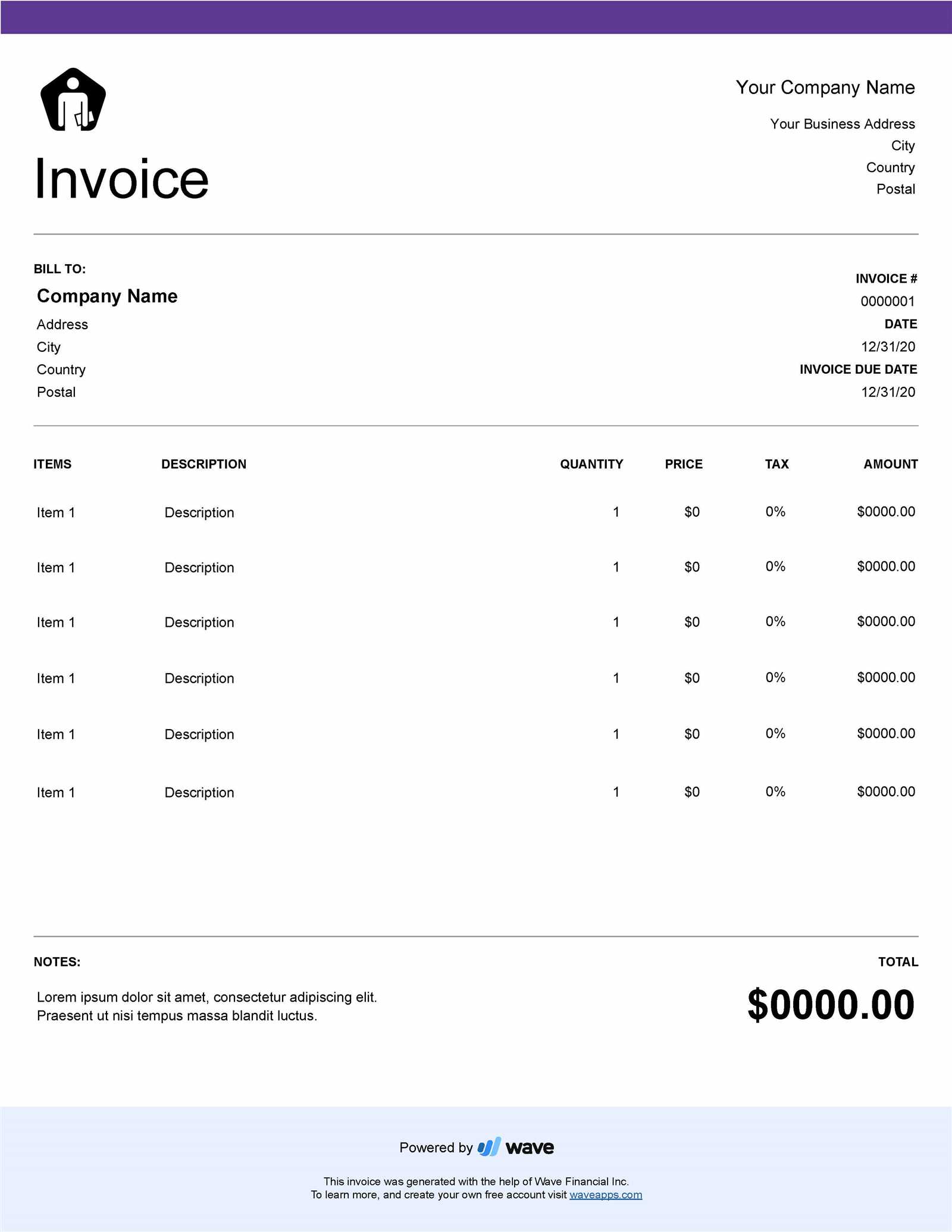

- Wave: Wave is a free tool with powerful invoicing features, allowing you to send unlimited professional-looking payment requests. It also includes features for accounting, making it a great option for small businesses with budget constraints.

- Bill.com: This tool specializes in automating accounts payable and receivable. It allows users to create and manage payment requests efficiently, reducing administrative time and ensuring faster payments.

Additional Features to Consider

When choosing a tool for creating billing documents, consider features that will enhance your workflow, such as:

- Automation: Tools with automation features can send reminders, follow-up emails, and even automatically generate new documents based on past transactions.

- Customization Options: Choose software that allows you to personalize the document with your logo, colors, and payment terms to reflect your business’s branding.

- Payment Integration: Some tools allow you to integrate payment g

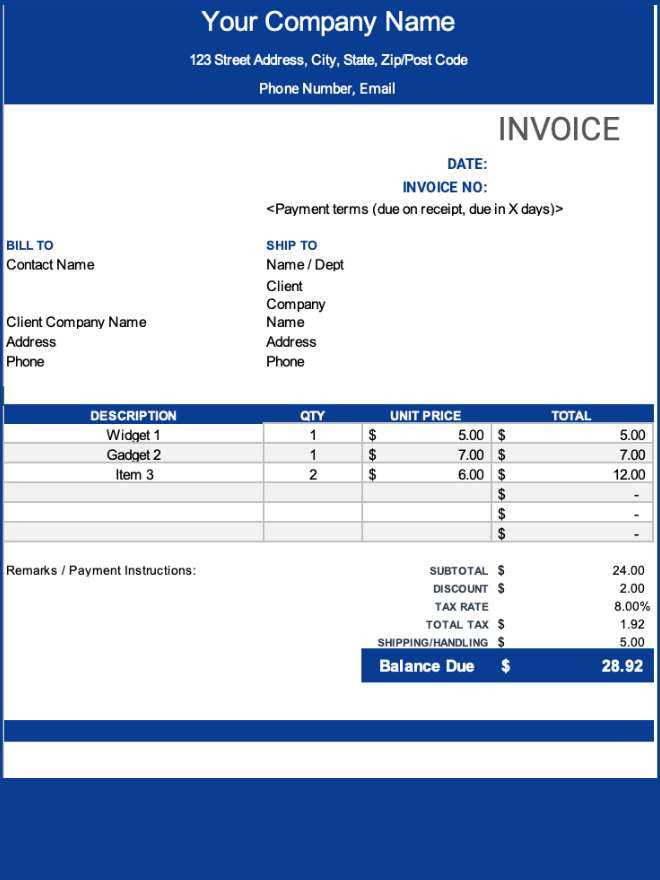

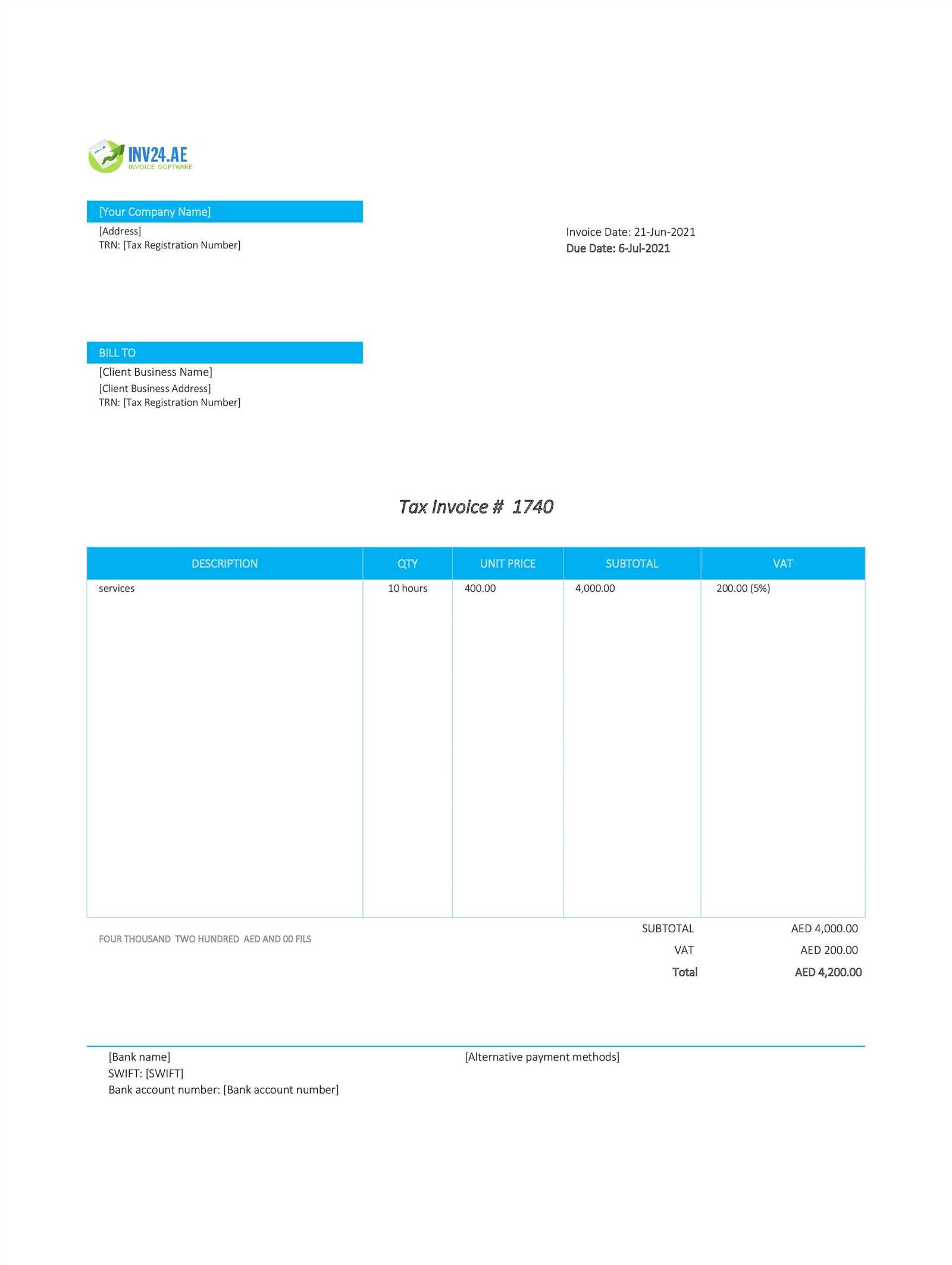

How to Calculate Service Fees on Invoices

Accurately calculating the charges for your work is essential to ensure fair compensation for the time and effort you’ve invested. Whether you’re charging by the hour, per project, or based on other factors, it’s important to break down the pricing clearly for your clients. Understanding how to calculate and present fees can help avoid confusion and prevent disputes, ensuring a smooth transaction.

There are different methods for calculating fees, depending on your pricing structure. Below are the most common approaches to determine the amount your clients will owe:

Pricing Models for Billing

Pricing Model Description How to Calculate Hourly Rate You charge for the time spent working on a task or project. Hourly Rate x Total Hours Worked = Total Fee Flat Fee You charge a fixed price for the entire job, regardless of time or materials. Agreed Flat Rate = Total Fee Per Unit Rate You charge based on the number of items, services, or tasks completed. Unit Price x Number of Units = Total Fee Retainer Fee A set amount paid upfront for ongoing work over a specified period. Agreed Retainer Fee = Total Fee Commission-Based You charge based on a percentage of the revenue or value generated from the work. Commission Percentage x Total Revenue = Total Fee Additional Factors to Consider

In addition to the basic pricing structure, you may also need to account for other costs or adjustments:

- Materials and Supplies: If you incur costs for materials while completing a task, ensure that these are included in the total fee.

- Travel or Add

Choosing the Right Template for Your Business

Selecting the appropriate document format for billing is crucial for maintaining a professional appearance and ensuring smooth transactions. The right structure not only makes the payment process more efficient but also helps build trust with your clients. Whether you’re a freelancer, a small business owner, or managing a larger company, using a format that suits your business model can make all the difference in managing finances and client relationships.

There are several factors to consider when choosing a layout for your payment requests. Below are some key aspects that will help you decide which approach is best for your needs:

Key Considerations When Selecting a Billing Document

Factor Description Business Size and Type A freelancer or small business may prefer a simple layout, while larger companies may need more complex formats with additional sections for detailed pricing and terms. Branding Requirements If branding is important to you, select a structure that allows you to easily customize colors, fonts, and logos to reflect your company’s identity. Payment Method Integration For ease of payment, choose a format that supports integrating payment methods, such as PayPal links or bank transfer details, to allow clients to pay directly from the document. Recurring vs One-Time Billing If you have clients who require regular billing, look for a layout that supports recurring charges and automatic reminders for overdue payments. Customization Options Choose a format that allows for flexibility in terms of ad How to Send an Invoice to Clients

Once you’ve created a payment request, it’s essential to send it to your clients in a timely and professional manner. How you deliver your document can influence the speed and accuracy of the payment. Ensuring the right format, clear communication, and convenient payment options can help speed up the process and improve your relationship with clients.

There are several methods for sending a payment request, each with its own advantages. Below are some of the best practices for delivering your documents effectively:

Methods for Sending Payment Requests

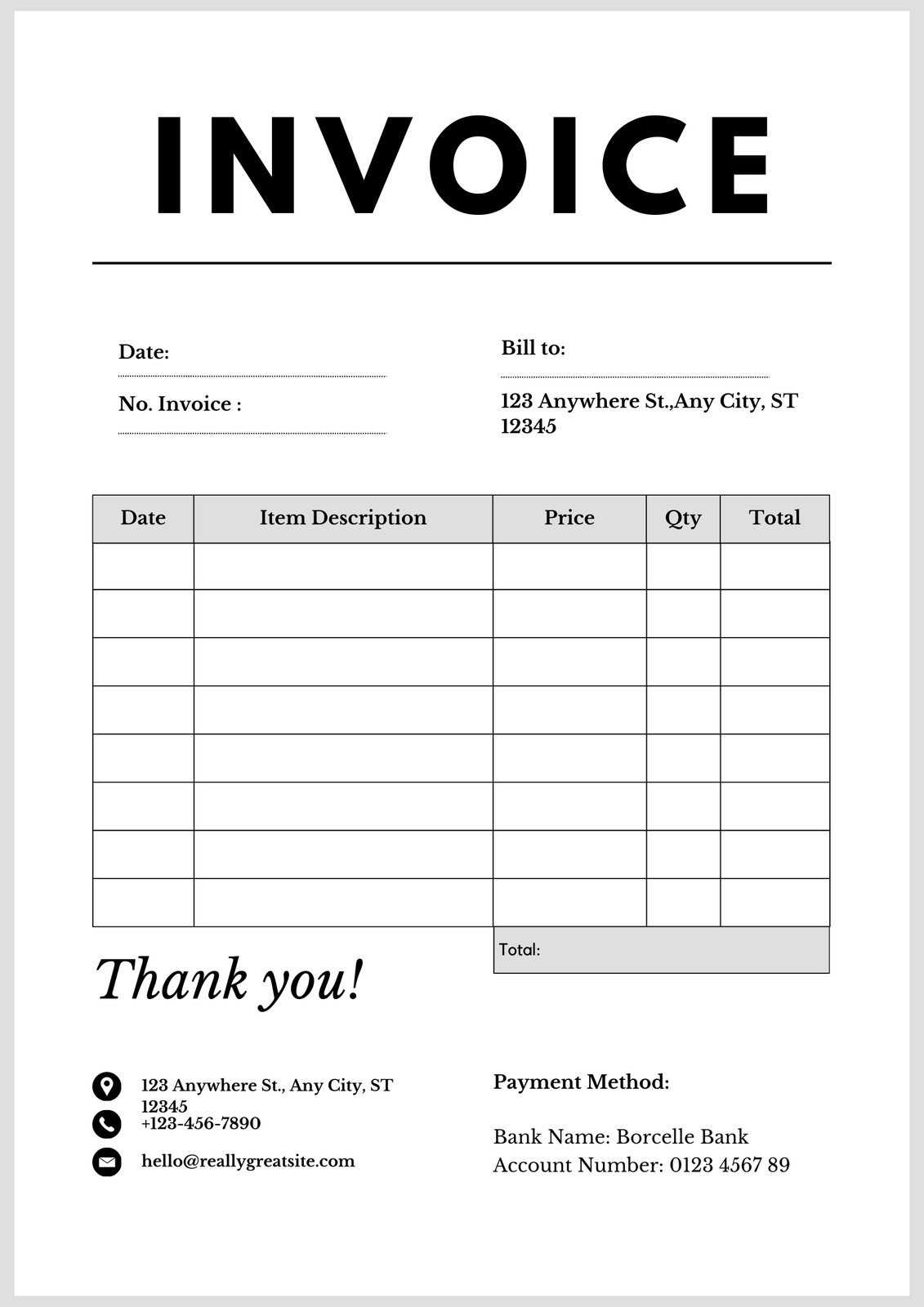

- Email: Sending the document as a PDF attachment is one of the most common methods. It’s quick, secure, and allows you to include any personalized messages or reminders about payment terms.

- Online Billing Platforms: Using specialized platforms (such as FreshBooks, QuickBooks, or PayPal) enables you to send requests directly to clients, track their status, and even accept payments online.

- Postal Mail: If your client prefers hard copies or operates in an area where digital communication is limited, sending a printed document via postal mail ensures delivery. This method is typically slower but may be required in certain situations.

Tips for Effective Delivery

- Use a Professional Email Address: Ensure that the email address from which you send the request is clearly associated with your business. Avoid using personal or generic email accounts.

- Include a Clear Subject Line: The subject should clearly state that the email contains a payment request. For example: “Payment Request for [Your Company Name] – [Invoice Number].”

- Provide Payment Instructions: Include all the details your client needs to make the payment, such as bank account numbers, online payment links, or instructions for checks.

- Set Expectations for Response Time: Let the client know when to expect a follow-up

Legal Requirements for Service Invoices

When creating a payment request, it’s essential to ensure that all necessary legal requirements are met. Failing to include the proper details or not adhering to local regulations can lead to delays in payment or even legal disputes. Different regions and industries have specific rules about what needs to be included in billing documents, and understanding these requirements is crucial for smooth business operations.

These legal obligations can vary depending on your location, the nature of your business, and the size of the transaction. Below are the common elements that need to be included to comply with legal standards when creating a payment request:

Essential Information for Legal Compliance

Required Element Description Business Identification Details Include the legal name of your business, business address, and contact information. Depending on your country, you may also need to include your business registration number or tax identification number (TIN). Client Information Ensure that your client’s name, address, and contact details are accurate. Some jurisdictions may require their business registration or VAT number. Unique Reference Number A unique sequential number should be assigned to each document for identification purposes. This helps track and organize payments. Description of Goods or Work Clearly list what has been provided, including a breakdown of services, dates, and quantities. This ensures transparency and helps avoid disputes. Payment Terms Specify the payment due date, any discounts, and applicable late fees. This ensures both parties understand when payment is expected and the consequences of delays. Tax Information If applicable, include any sales tax or VAT rates. Make sure that the appropriate tax amount is clearly shown and legally compliant with your jurisdiction’s tax regulations. Legal Disclaimers Some regions may require specific terms related to payment, refunds, or late charges. Check local laws for required disclaimers Managing Payments After Sending Invoices

Once you’ve sent out your payment requests, the next step is to effectively manage the process until the client settles the amount due. Timely and accurate follow-ups are essential to ensure that you receive payment on time and maintain positive relationships with your clients. Monitoring the status of each transaction and being proactive in handling any issues can make a significant difference in your cash flow and overall business success.

There are several strategies for managing the payment process effectively. Below are some key practices and tools to help you stay organized and ensure timely payments:

Best Practices for Payment Management

Action Description Track Payment Deadlines Set reminders for payment due dates to ensure that you can follow up with clients before the payment is late. This helps avoid delays and keeps things on schedule. Send Payment Reminders If a payment isn’t received by the due date, send a polite reminder email or message. You can also set up automated reminder emails through billing software. Offer Multiple Payment Methods Make it easy for clients to pay by offering a variety of payment options, such as bank transfers, credit card payments, or online payment platforms. Communicate Clearly Maintain open communication with clients in case of any delays or disputes. Be clear about your payment terms and the consequences of late payments. Provide Payment Plans If clients are unable to pay the full amount at once, offer flexible payment plans to make it easier for them to fulfill their obligations over time. Tools for Managing Payment Status

- Accounting Software: Platforms like QuickBooks, FreshBooks, and Zoho allow you to track the status of payments, generate reports, and send automatic reminders.

- Payment Gateway Integration: Using platforms like PayPal or Stripe helps clients make payments dire

How to Track Outstanding Invoices

Managing unpaid payments is a critical aspect of running a business, as it directly affects your cash flow and overall financial health. It’s important to have an organized system for tracking overdue balances to ensure that you follow up promptly and maintain smooth financial operations. Without proper tracking, overdue payments can accumulate, leading to financial strain and unnecessary stress.

There are several methods for keeping tabs on outstanding balances. Whether you prefer digital tools or manual systems, setting up an efficient tracking system can help ensure that you address overdue payments promptly and maintain a professional approach with your clients.

Methods for Tracking Unpaid Balances

Method Description Accounting Software Using accounting platforms like QuickBooks, Xero, or FreshBooks helps automate the tracking process. These tools can generate reports and send reminders, keeping everything organized. Manual Ledger If you prefer a more hands-on approach, maintaining a spreadsheet or physical ledger allows you to track payments, due dates, and balances on a client-by-client basis. Payment Gateway Integration Online payment platforms like PayPal or Stripe provide real-time tracking and automatically mark transactions as paid when clients settle their bills. They also notify you of any failed transactions. CRM (Customer Relationship Management) Tools CRM systems like HubSpot or Zoho can help track communication history and payment status, allowing you to manage follow-ups with overdue payments more efficiently. Key Tracking Information to Monitor

- Client Name: Keep track of which clients have outstanding balances and prioritize follow-ups based on their payment history or the size of the amount due.

- Amount Due: Ensure that the exact amount outstanding is clearly recorded, along with the original agreed-upon amount.

- Due Date: Monitor when payments were due to identify o

How to Handle Disputes Over Invoices

Disputes over payment requests are a common challenge in business, but addressing them promptly and professionally can help maintain positive client relationships and ensure a timely resolution. When clients contest charges or the terms of payment, it’s important to remain calm, listen carefully, and approach the situation with a clear, methodical strategy. Effectively handling these disputes can lead to better communication, clearer agreements, and ultimately, more successful business transactions.

To resolve issues effectively, start by thoroughly reviewing the details of the payment request and the client’s concerns. Understanding the root cause of the disagreement allows you to find a fair and efficient solution. Here are some steps to follow when managing disputes:

Steps to Resolve Payment Disputes

- Review the Details: Double-check the terms, pricing, and any relevant agreements to ensure that everything in the payment request is accurate. This helps to avoid misunderstandings from both parties.

- Communicate Clearly: Reach out to your client promptly to discuss the issue. Use clear, polite language, and aim for a solution that is fair for both parties.

- Provide Supporting Documentation: If necessary, provide any contracts, signed agreements, or additional documentation that can help clarify the situation and support your position.

- Negotiate a Compromise: If the client’s concern is valid, consider negotiating a solution. This could include adjusting the payment amount, extending the payment terms, or offering a discount.

- Put Agreements in Writing: Once an agreement is reached, make sure it’s documented. Send a follow-up email summarizing the new terms or any changes to the payment arrangement to avoid future confusion.

By taking a proactive and professional approach to resolving disputes, you can ensure that the situation is handled efficiently and that the client continues to feel valued. Keep communication open and transparent to prevent future misunderstandings, and aim to reach a resolution that both parties can agree on.

Invoice Templates for Different Industries

Each industry has unique requirements when it comes to documenting transactions and collecting payments. Whether you’re in consulting, retail, construction, or another field, your payment request should reflect the specific needs of your business and comply with industry standards. Customizing your document ensures that all the necessary details are included, helping to avoid confusion and delays in the payment process.

While the core components of a payment request remain largely the same–such as the client’s information, payment terms, and a description of the provided goods or work–the format and content may vary depending on the industry. Below, we explore how different industries can tailor their documents for greater clarity and effectiveness:

Industry-Specific Payment Request Customizations

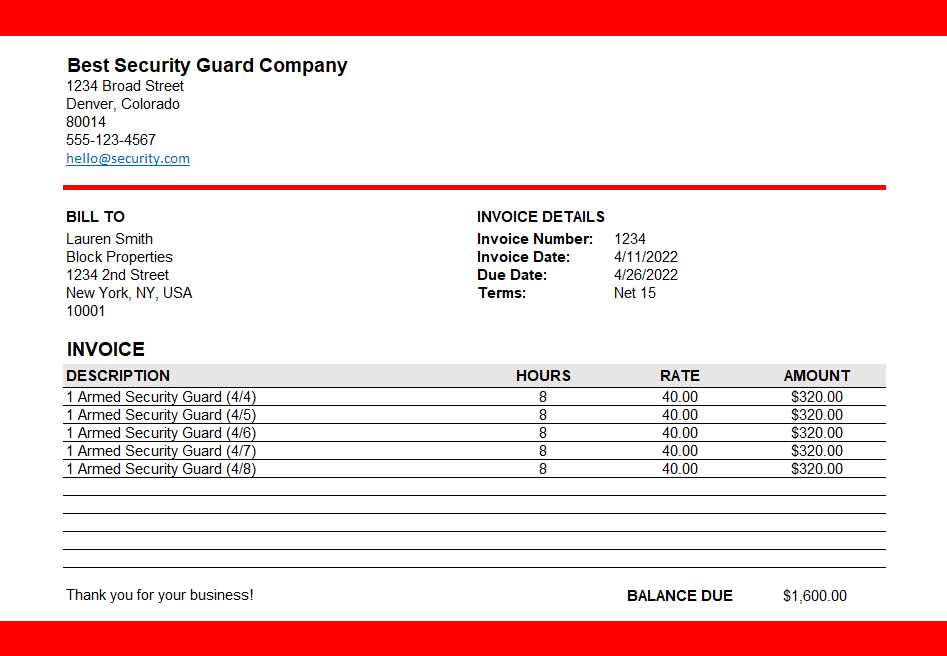

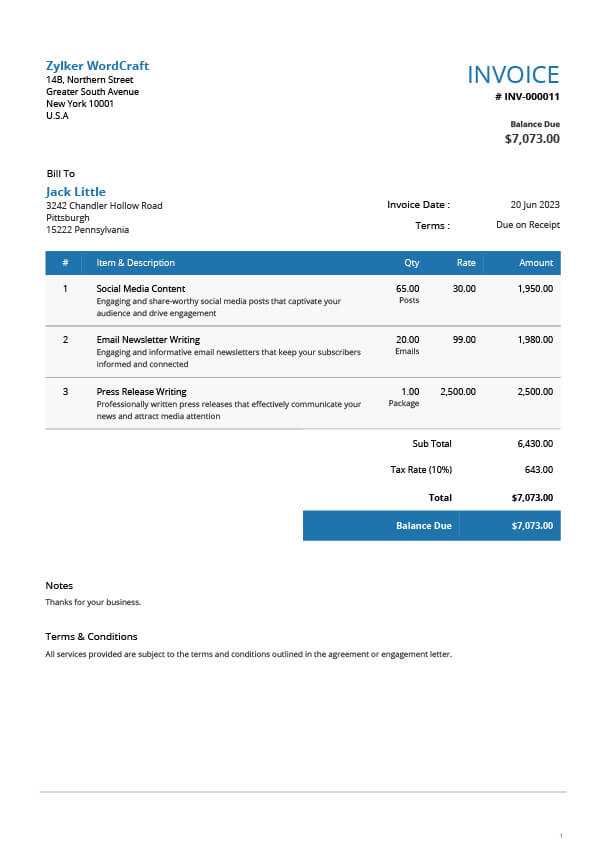

- Freelancers and Consultants: Professionals in fields such as writing, design, and marketing may require a simpler format with clear hourly rates, project milestones, and payment terms. These documents often include a section for outlining the scope of work and any applicable taxes.

- Retailers: Retail businesses typically use documents that list product names, quantities, unit prices, and total amounts. It’s essential for the payment request to break down sales tax, discounts, and shipping charges if applicable.

- Construction and Contractors: For those in construction, building, or repair work, it’s crucial to include detailed descriptions of labor, materials, and job phases. Contractors often issue progress payments or request deposits, so including payment schedules is a key consideration.

- Healthcare Providers: Healthcare professionals, such as doctors and therapists, often need a payment request format that includes insurance information, patient details, services rendered, and the corresponding charges. Payment requests for medical services should also consider billing codes and regulations.

- Event Planners: Event planning businesses typically issue documents with multiple line items covering venue rental, catering, decoration, entertainment, and other services. Clear breakdowns of these charges, along with any deposits or final payments, are essential.

Adapting Documents for Global Business

- Currency and Tax Rates: If you’re working with international clients, be sure to include the appropriate currency, tax rates, and payment methods specific to the region.

- Payment Methods: Different industries may prefer different payment methods. Retailers may use online payment systems, while consultants may prefer bank transfers or checks.

- Legal Requirements:

Best Practices for Timely Invoicing

Ensuring that payment requests are sent out in a timely manner is crucial for maintaining healthy cash flow in any business. Delays in sending these documents can lead to late payments, which could disrupt your financial planning and operations. Establishing a set process for generating and sending payment requests helps minimize errors and reduces the time between service delivery and payment collection. By following best practices, you can improve your chances of getting paid on time and avoid potential conflicts with clients.

Here are some best practices that can help ensure your payment requests are sent out promptly and efficiently:

Steps to Ensure Timely Billing

- Set Clear Terms: Clearly define payment terms with your clients upfront. Specify the due date, late fees, and accepted payment methods so that everyone is aware of the expectations from the start.

- Automate the Process: Use accounting or billing software to automate the creation and sending of payment requests. Many platforms allow you to set up recurring billing cycles and automatic reminders, ensuring you never miss a due date.

- Send Payment Requests Immediately: After completing a project or delivering goods, send the payment request as soon as possible. Delaying this step can lead to delayed payments, as clients may forget or lose track of their financial obligations.

- Be Consistent: Establish a routine for issuing requests. Whether you send them weekly, bi-weekly, or monthly, consistency in timing helps clients plan and pay their balances on time.

- Double-Check for Accuracy: Before sending, verify that all details in the payment request are correct. Incorrect amounts, missing client information, or overlooked terms can delay the process, leading to disputes or payment delays.

Effective Follow-Up Strategies

- Send Reminders: Set up reminders to be sent a few days before the due date. This proactive approach will increase the likelihood of receiving payment on time.

- Follow Up on Overdue Payments: If a payment is not received by the due date, follow up immediately. Be polite but firm in your communication, reminding the client of the original payment terms and any late fees that may apply.

- Offer Easy Payment Options: Make it easy for clients to pay by offering multiple payment methods such as credit cards, bank transfers, or online payment platforms. The more convenient the process, the quicker the payment will l