Easy to Use Printable Invoice Templates

Managing financial transactions efficiently is crucial for any business. One of the key elements in maintaining smooth operations is having a clear and consistent method of documenting payments and requests. Using pre-designed forms can help simplify the process, ensuring that all necessary information is included and formatted properly.

Customized formats offer a professional approach that can be tailored to meet specific business needs. These tools provide flexibility, enabling quick adjustments while maintaining a polished appearance. Whether you’re a freelancer, a small business owner, or working in a larger organization, having ready-made solutions saves valuable time and reduces errors.

In this guide, we’ll explore how to choose and effectively use these resources to streamline your financial documentation tasks. By utilizing these organized systems, you can focus more on growing your business while leaving the administrative tasks to well-structured and easy-to-use formats.

Benefits of Using Printable Invoice Templates

Utilizing pre-designed forms for billing offers numerous advantages, particularly in terms of efficiency and professionalism. By relying on ready-made solutions, businesses can reduce the time spent on creating documents from scratch while ensuring accuracy and consistency in their records.

One major benefit is time-saving. Rather than spending time designing a new format every time a payment needs to be requested, users can simply choose a suitable layout and fill in the necessary details. This minimizes the effort involved and allows for faster processing.

Another key advantage is professional appearance. Ready-to-use formats often come with clean, well-organized structures that give the document a polished look. This can help businesses maintain a credible image with clients, making the process of financial transactions more seamless.

Additionally, these tools can ensure accuracy. By following a standardized format, the risk of missing important information, such as payment terms or contact details, is significantly reduced. This not only improves the clarity of communications but also helps prevent misunderstandings or delays in payments.

Why Printable Invoices Save Time

Using pre-designed forms for billing significantly streamlines the documentation process, allowing businesses to operate more efficiently. These ready-made solutions eliminate the need to create each payment request from scratch, enabling faster turnaround and reducing manual work.

Quick Setup and Easy Customization

With structured formats, businesses can quickly input the required information and send it without having to worry about formatting or layout. These tools come with predefined sections, making it easy to adjust the details without losing time on design adjustments.

Minimized Errors and Improved Accuracy

Pre-designed layouts also help reduce human error. With a standardized structure, the chances of omitting important fields like payment deadlines or client details are minimized, saving time spent on corrections and follow-ups.

Types of Invoice Templates Available

There are various formats available for creating billing documents, each designed to suit different business needs and preferences. Depending on the type of transaction or the industry, users can choose from a range of pre-structured designs that cater to specific requirements. Understanding the different options helps in selecting the most appropriate one for smooth business operations.

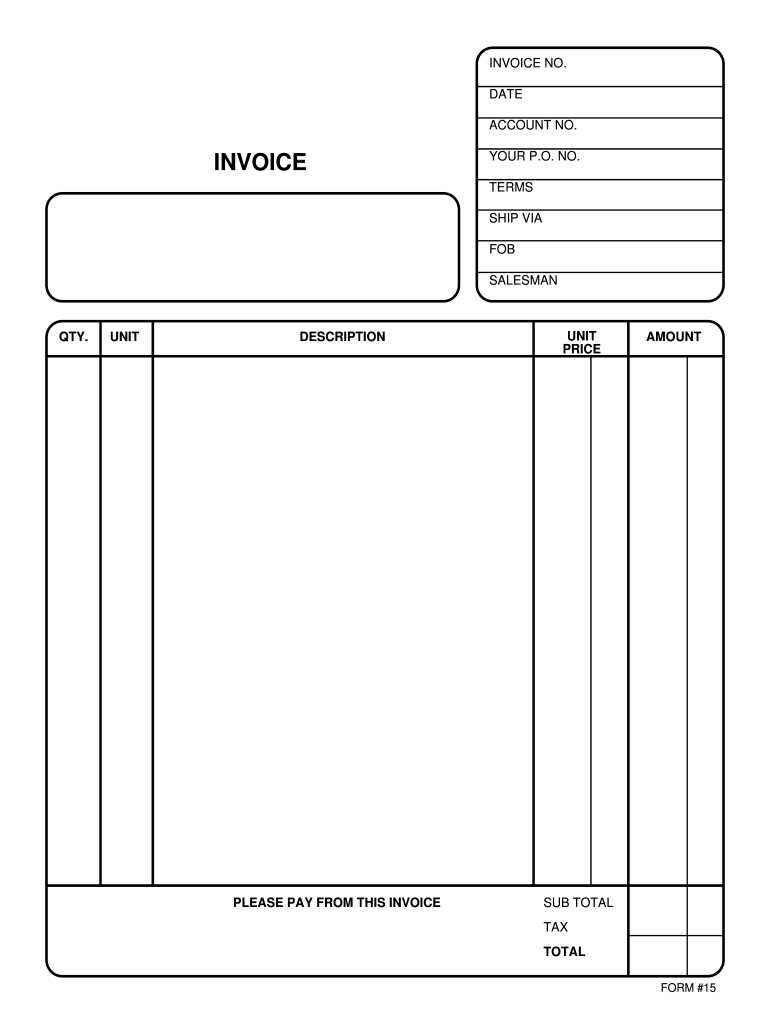

Basic Billing Forms

These simple and straightforward layouts are ideal for businesses that require minimal information. They typically include only essential fields such as:

- Client name and contact details

- Itemized list of services or products

- Total amount due

- Payment terms and due date

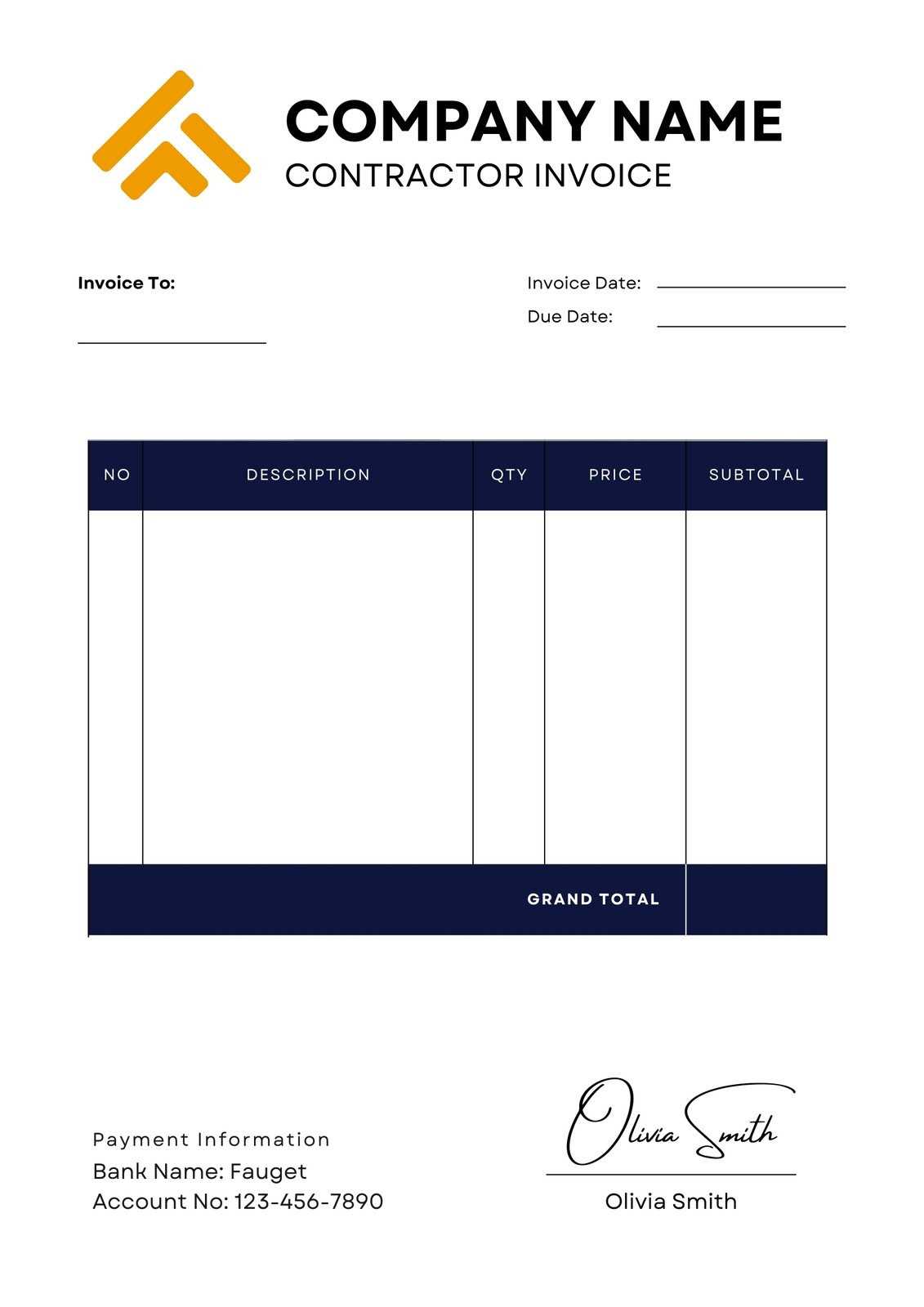

Professional and Detailed Formats

For businesses that need to present more comprehensive information, such as multiple payment terms, taxes, or detailed service descriptions, more advanced layouts are available. These forms often feature sections for:

- Company logo and branding

- Payment methods and bank account details

- Discounts, taxes, and shipping costs

- Terms and conditions

These formats help to maintain a polished and professional appearance while ensuring all necessary details are included.

How to Customize Your Invoice Template

Personalizing your billing document layout allows you to reflect your business’s unique branding and meet specific operational needs. Customization not only makes the document look professional but also ensures that it contains all the essential information your clients expect. By adjusting certain fields and sections, you can create a more tailored experience for both you and your customers.

Adjusting Key Fields

Start by modifying the basic sections to suit your business. Essential fields to customize include:

- Business Information: Add your company name, logo, contact details, and business registration information.

- Client Details: Ensure accurate client names, addresses, and contact information are included.

- Services or Products: Customize the list of goods or services provided, along with the associated prices, quantities, and total amounts.

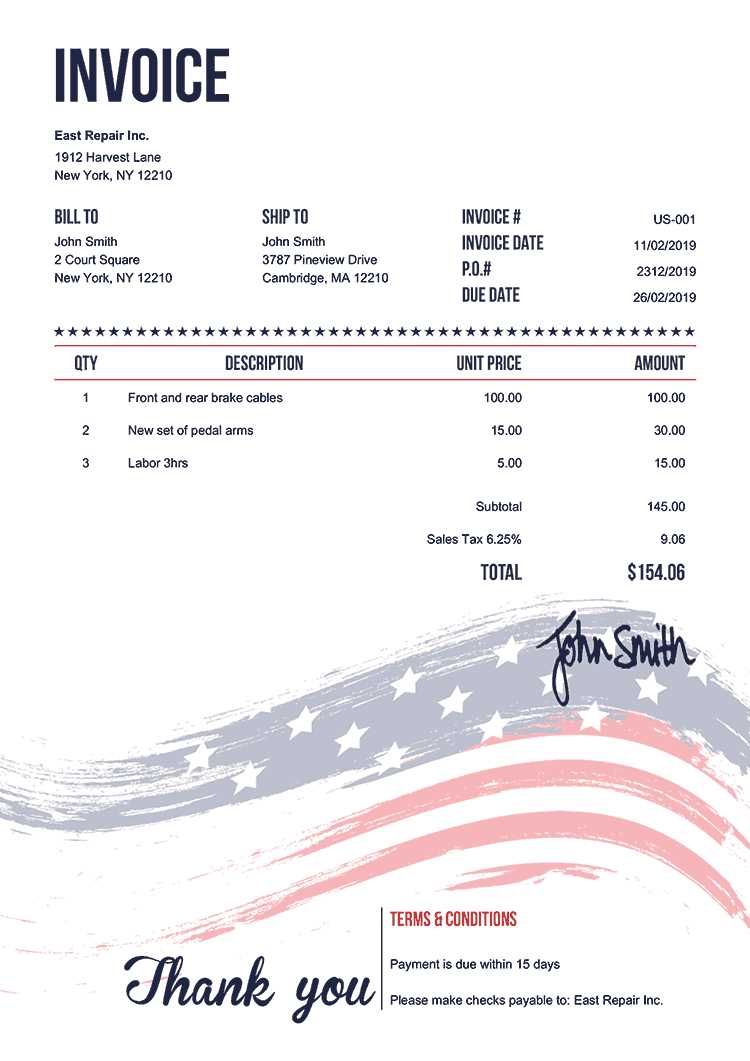

Branding and Aesthetic Choices

Incorporating your brand elements, such as logos, color schemes, and fonts, can make the document feel more professional. Choose a layout that matches your company’s image, whether you prefer a modern, minimalist design or something more traditional. Ensure that the document remains easy to read by maintaining a clear and organized structure.

Customizing your document layout helps reinforce your brand identity and builds trust with clients, making your billing process more seamless.

Common Mistakes in Invoice Creation

When creating billing documents, there are several common errors that can lead to confusion or delays in payment. These mistakes often stem from oversights or miscommunications, and they can have a negative impact on both the business and the client. Recognizing and avoiding these errors is essential for maintaining smooth and efficient transactions.

Here are some of the most frequent mistakes made during the process:

| Common Mistake | Impact | How to Avoid |

|---|---|---|

| Missing Client Information | Leads to delays in communication and payment. | Ensure all client contact details are correct before sending. |

| Incorrect or Omitted Payment Terms | Causes confusion regarding due dates and payment conditions. | Double-check the payment terms, including deadlines and late fees. |

| Failure to Include Taxes or Discounts | Results in incomplete or incorrect amounts being charged. | Ensure all applicable taxes, fees, and discounts are included and clearly listed. |

| Unclear Descriptions of Products or Services | May lead to disputes or misunderstandings about the work provided. | Provide clear and detailed descriptions for each item or service. |

By paying attention to these common mistakes, businesses can ensure that their billing documents are accurate and professional, leading to smoother financial transactions.

Top Features to Look for in Templates

When selecting a pre-designed layout for your billing documents, it’s essential to consider the key features that will make the process more efficient and professional. The right layout not only improves the visual appeal but also ensures that all necessary information is easily accessible and clearly presented. Focusing on these important elements can help streamline your workflow and avoid common issues.

Customization Options

Flexibility is one of the most important features to look for in a billing form. The ability to adjust sections such as company logos, payment terms, or service descriptions ensures that the layout fits your unique needs. A customizable design allows you to make updates whenever necessary without starting from scratch.

Clear Structure and Readability

A well-organized layout is critical for clear communication. Choose a design that prioritizes easy readability, with logical groupings for essential information. Important details like client names, payment deadlines, and itemized charges should be easy to locate, minimizing the chance of errors or misunderstandings. Clarity is key for ensuring your clients can quickly understand their obligations.

Best Printable Invoices for Small Businesses

For small businesses, selecting the right layout for billing documents is crucial to ensure smooth transactions and maintain a professional image. Simple, yet effective, designs can make a big difference by streamlining the process and reducing errors. Here are some of the best options that cater specifically to the needs of small business owners.

- Basic Billing Format: Ideal for businesses that offer a small range of products or services. These formats focus on essential information and are easy to fill out.

- Service-Based Layout: Designed for service providers, this option includes sections for detailed descriptions of the work performed, including hourly rates or project milestones.

- Product Sales Model: Best for businesses selling physical goods, this layout provides space for an itemized list, quantities, and prices, as well as total costs and taxes.

- Minimalist Style: Perfect for businesses that prefer a clean, modern look. This layout reduces clutter and highlights the most important details, keeping the document professional and straightforward.

- Branded Templates: For small businesses looking to maintain a strong brand presence, this style allows customization with company logos, colors, and fonts to align with your brand identity.

Choosing the right format depends on your business type and how you want to present your services. These options help create professional, clear, and consistent billing documents that can make managing finances easier and more efficient.

How to Format Your Invoice Correctly

Properly formatting your billing document is essential for clear communication with clients and ensuring that all necessary details are included. A well-structured layout not only prevents confusion but also presents your business in a professional light. Following a logical flow and ensuring all required information is easy to find will help avoid payment delays and disputes.

Include Essential Information

First and foremost, make sure your document contains all the key details that your client needs to understand the charges. These include:

- Business Name and Contact Information: Clearly display your business name, address, and phone number at the top.

- Client Information: Include the client’s name, address, and any relevant contact details.

- Payment Terms and Due Date: Specify when the payment is due, including any late fees or discounts for early payment.

- Detailed List of Goods or Services: Itemize what was provided, along with quantities and prices for each item or service.

- Total Amount Due: Make sure the total is clearly marked, including any applicable taxes and fees.

Keep the Layout Clean and Simple

Clarity is essential in any billing document. A clean, simple layout with clearly separated sections helps clients easily identify important information. Ensure that there is enough white space between sections, and use bold or underlined text to highlight key details like totals or due dates. Avoid clutter by limiting unnecessary graphics or complex fonts, as they can distract from the main content.

By following these formatting guidelines, you ensure your document is not only professional but also easy to read and understand, making the payment process smoother for both you and your client.

Integrating Your Invoice with Accounting Software

Connecting your billing system to accounting software can streamline your financial processes, reduce errors, and save time. Automation allows you to easily track payments, generate financial reports, and maintain accurate records without manually inputting data. This integration simplifies bookkeeping and ensures consistency across all your financial documentation.

Benefits of Integration

Integrating your billing system with accounting software provides several key advantages:

- Time Efficiency: Automatically sync transaction data between your billing records and accounting system, eliminating the need for manual entry.

- Accuracy: Minimize the risk of human error by allowing the software to handle calculations, such as taxes or discounts.

- Real-Time Updates: Ensure that your records are always up to date, with payments tracked and accounted for immediately after transactions occur.

How to Connect Your Billing System

To integrate your billing process with accounting software, follow these steps:

- Choose Compatible Software: Ensure the accounting platform you use supports integration with your chosen billing tool.

- Link the Systems: Most accounting software providers offer simple instructions or integration options to connect your billing platform. This could involve entering API keys or logging into both systems simultaneously.

- Sync Data: Once connected, you can configure the software to automatically sync transaction details, from customer information to payment status.

Integrating your financial systems can greatly enhance efficiency and ensure your business’s financial data is organized and easy to access, ultimately supporting better decision-making and smoother operations.

How to Add Payment Terms to Invoices

Including clear payment terms in your billing documents is essential for setting expectations with clients and ensuring timely payments. These terms outline when the payment is due, any applicable late fees, and the methods of payment accepted. Properly stating payment conditions helps avoid confusion and fosters better financial management.

To ensure your payment terms are easily understood, follow these guidelines:

- State the Due Date: Clearly indicate the payment deadline. Use phrases like “Due upon receipt” for immediate payments or specify a specific date (e.g., “Due within 30 days”).

- Include Late Fees: If applicable, mention any penalties for late payments, such as a percentage of the total amount after a set period (e.g., “2% late fee after 30 days”).

- Specify Accepted Payment Methods: List the payment methods you accept, whether it’s credit card, bank transfer, PayPal, or other methods. This helps clients understand how to pay.

- Offer Discounts for Early Payment: If you provide early payment discounts, make sure to highlight these incentives (e.g., “5% discount if paid within 10 days”).

By including these details, you create a clear agreement between you and your clients, reducing misunderstandings and ensuring that payments are made according to the agreed-upon terms.

Legal Considerations for Invoicing

When creating billing documents, it’s important to understand the legal aspects that ensure compliance with tax laws and business regulations. Properly formatted and detailed payment requests can prevent disputes and provide protection for both parties involved in the transaction. Whether you are a small business owner or a freelancer, knowing the legal requirements is crucial to avoid potential complications.

Key Legal Requirements

Here are the essential elements to include to meet legal standards when preparing a billing document:

- Business Information: Always include your full business name, legal address, and tax identification number (TIN). This is necessary for tax purposes and to verify your legitimacy.

- Client’s Details: Ensure the client’s full name and address are listed, especially if you are working with large organizations or other businesses that need this information for their records.

- Itemized List: Clearly detail the services provided or goods sold, including quantities, unit prices, and any applicable taxes. This transparency helps avoid disputes.

- Tax Information: Be sure to include the correct tax rates for your region or country. For businesses that deal with international clients, it’s vital to understand VAT (Value Added Tax) or other tax structures.

- Legal Disclaimers: If applicable, include any terms regarding payment delays, interest charges, or refund policies. These clauses can protect your business in case of payment issues.

Keeping Records

Maintaining accurate records of all transactions is not only vital for your own financial management but is also required for legal compliance. Make sure to keep copies of all your billing documents, as these can be used as evidence in case of disputes or audits. Many countries require businesses to retain records for a specified number of years, so proper filing is essential.

By following these legal considerations, you ensure that your financial practices are in line with the law, which ultimately builds trust with clients and protects your business from potential legal issues.

Free Printable Invoice Templates for Download

Many businesses and freelancers are often looking for accessible and easy-to-use billing forms. Fortunately, there are a variety of free resources available online that allow you to download customizable forms for professional transactions. These documents can be quickly filled in and used for requesting payments, making it simple to stay organized and ensure smooth financial operations.

Benefits of Using Free Templates

Free billing forms offer a range of advantages, making them an excellent choice for small businesses and entrepreneurs:

- Cost-Effective: Downloading free documents means you don’t need to invest in expensive software or custom designs, saving you money on operational costs.

- Quick Setup: These forms are ready to use, allowing you to create professional-looking payment requests in no time, with minimal effort required.

- Customizable: Many downloadable forms come in various formats, such as Word, Excel, or PDF, which can be easily customized to suit your brand and specific needs.

- Variety of Designs: Free resources offer a wide range of designs, from simple to more elaborate options, enabling you to choose one that best represents your business.

How to Download Free Forms

To find and download free billing forms, follow these steps:

- Search Online: Look for reputable websites offering free downloads. Be sure to choose websites that provide safe and secure files.

- Choose Your Preferred Style: Browse through different styles to find a layout that fits your business’s needs and aesthetic.

- Download and Save: After selecting the right form, download it to your computer or cloud storage and make any necessary customizations.

- Fill In Your Details: After downloading, input the required information, such as business details, payment terms, and transaction specifics.

By taking advantage of free downloadable forms, you can simplify the billing process and maintain a professional standard without additional expenses.

Design Tips for Professional Invoices

Creating a well-structured and visually appealing payment request is crucial for leaving a positive impression on your clients. A clean, professional layout not only enhances the clarity of your details but also builds trust with your customers. By following a few simple design tips, you can ensure your financial documents are both functional and aesthetically pleasing.

Keep the Layout Simple and Organized

One of the keys to a professional document is simplicity. Avoid cluttering your payment request with unnecessary information or excessive graphics. Stick to a clear, easy-to-read format that prioritizes the essentials, such as:

- Client Information: Include their name, address, and contact details at the top.

- Service or Product Breakdown: Clearly list the services or items provided, along with prices and quantities.

- Clear Total: The total amount due should be prominently displayed so it’s easy to locate.

Choose Professional Fonts and Colors

Font style and color choices play a significant role in the overall tone of your document. For a professional look, consider the following:

- Font: Use clean, sans-serif fonts like Arial or Helvetica for better readability.

- Font Size: Make sure headings and totals stand out by using larger text, but avoid making everything the same size.

- Colors: Stick to neutral or corporate colors like black, gray, or blue. Too many bright or clashing colors can look unprofessional.

By adhering to these design guidelines, you ensure that your financial documents not only look polished but also convey the professionalism of your business.

Printable Invoice Templates for Different Industries

Every business, regardless of the sector, requires an efficient way to request payments and maintain financial records. Different industries often have unique needs when it comes to documenting transactions, which is why tailored forms are essential. By using the right structure, you can ensure that your documents meet the expectations of your clients and align with the standards of your industry.

Creative Services and Freelancers

For professionals in creative fields, such as designers, writers, or consultants, the format should focus on clear descriptions of services rendered, including rates and deadlines. It’s also important to account for any additional terms, such as licensing rights or revisions. A minimalistic, sleek design that reflects the creative nature of the work can help reinforce the brand image.

- Clear Service Descriptions: Ensure clients understand exactly what was provided.

- Project-Based Billing: Include milestones or phases for payment tracking.

- Due Dates and Payment Terms: Specify clear terms for when payments are due.

Retail and Wholesale

In the retail and wholesale sectors, the focus is often on the volume of products sold. These documents should clearly outline the quantities, unit prices, and total amounts. The format should be simple, with a table layout for easy reading. It’s also important to list product descriptions and any discounts or taxes applied.

- Itemized Lists: Include each product or service along with the corresponding prices.

- Quantity Breakdown: Ensure the total number of units sold is clear.

- Tax and Discount Details: Display any taxes or discounts separately for clarity.

By customizing your documents based on industry needs, you can make your transaction records more efficient, clear, and professional, ensuring smooth business operations and client satisfaction.

How to Track Payments with Invoices

Effectively managing your payment records is essential for maintaining a healthy cash flow and ensuring your financial processes are organized. Tracking payments accurately helps you stay on top of outstanding balances, reduces errors, and ensures you can quickly follow up on overdue amounts. By incorporating the right details into your documents, you can easily monitor the status of each payment.

Include Clear Payment Details

Start by ensuring your financial documents contain all the necessary information to track payments easily. This includes:

- Unique Invoice Number: Assign a distinct number to each payment request for easy identification.

- Payment Due Date: Clearly state when payment is expected to avoid confusion.

- Payment Methods: List accepted payment options, such as bank transfer, credit card, or online payment systems.

Monitor Payment Status

Keeping track of payment statuses is vital for staying organized and maintaining professional communication. You can track payments by:

- Marking Paid Amounts: Indicate when a payment has been made, including the amount and payment method used.

- Record Partial Payments: For larger amounts, mark partial payments to avoid confusion and ensure accuracy.

- Follow-Up Notifications: Set reminders or automated notifications for overdue payments.

By including detailed payment terms and tracking progress, you create a seamless process for both you and your clients. This ensures financial clarity and reduces the risk of missed or delayed payments.

Printing and Sending Your Invoices Efficiently

Ensuring your financial documents reach the right person promptly and in a professional manner is critical for maintaining smooth transactions. Efficient printing and delivery help reduce delays in payment and enhance communication with your clients. Whether you’re handling paper-based or digital correspondence, adopting best practices can save time and improve your overall workflow.

Streamlining the Printing Process

To optimize the printing of your documents, follow these simple tips:

- Use Standard Paper Sizes: Stick to standard sizes like A4 or Letter to avoid wasting resources and to ensure compatibility with printers.

- Double-Check Formatting: Ensure that all essential details–such as payment terms, dates, and itemized lists–are well-organized and readable before printing.

- Print in Bulk: If you’re sending multiple documents, batch them together for a more efficient printing process and save time on setup.

Choosing the Best Delivery Method

Selecting the appropriate method for sending your documents is equally important. Here are some options:

- Electronic Delivery: For quicker service, email your documents as PDFs, or use secure online payment platforms with integrated invoicing systems.

- Postal Service: For clients who prefer physical copies, make sure to use tracked services to ensure safe and timely delivery.

- Automated Reminders: For digital communication, set up automatic reminders for clients to prevent delays in payments and maintain a professional image.

By streamlining both the printing and sending processes, you not only improve your efficiency but also create a more reliable experience for your clients, which can positively impact your cash flow and business reputation.

Maintaining Accurate Invoice Records

Keeping precise records of your financial documents is crucial for tracking business transactions, ensuring tax compliance, and maintaining a clear overview of your cash flow. Accurate record-keeping helps prevent errors, minimizes disputes, and provides an easy reference when you need to review past transactions. Establishing an organized system for managing these documents can save valuable time and resources in the long run.

Organize Your Documents Effectively

To maintain accuracy, it is essential to implement a consistent filing system. This can be done through both physical and digital methods, depending on your business needs. Here are a few tips:

- Use Clear Labeling: Each record should be labeled with the client’s name, transaction date, and a unique identifier for easy retrieval.

- Keep Separate Folders: Separate your financial documents by year, month, or client to reduce clutter and simplify searching.

- Backup Your Records: Regularly back up your digital files in cloud storage or external drives to prevent loss due to hardware failures.

Regular Review and Reconciliation

Performing regular checks on your financial records helps ensure accuracy. Schedule periodic reviews to ensure that all documents are accounted for and match your bank statements. This will help identify any discrepancies early on, which could prevent larger issues down the road.

- Compare With Bank Statements: Reconcile your financial records with your bank’s statements to verify that all payments and receipts are properly documented.

- Audit for Errors: Regularly audit your records for mistakes, such as incorrect totals or missing entries, to maintain up-to-date and reliable documents.

Maintaining precise records is not just about staying organized; it’s about creating a foundation for smoother business operations and avoiding potential legal or financial issues. Whether managing physical or digital records, ensure that your system is robust and efficient.